Fifth deal croaked in August. Moody’s has a cow over Ancestry.com’s deal. Deals had to be sweetened to find buyers. Retail investors bail out.

Despite the Fed’s warnings over the years about leveraged loans – including in its Financial Stability Report and in the minutes of its July meeting – the leveraged loan market has only gotten bigger and riskier and has ballooned to $1.3 trillion globally by a narrow definition, or to $3.2 trillion by a broader definition. But first signs are appearing that it’s getting rougher.

Ancestry.com, a heavily indebted, junk rated DNA-tester – owned by private-equity firms Silver Lake Partners and Spectrum Partners and by Singapore’s sovereign wealth fund – was able to complete a $1.385 billion leveraged loan, according to “sources” cited today by LCD of S&P Global Market intelligence. The loan’s primary purpose was to fund what was supposed to have been one of the largest special dividends back to its owners. But the way the loan was originally pitched ran into a wall of resistance, forcing the company to make concessions.

Five other leveraged loan deals have gotten pulled in August because they failed to find reception in the market. For now, it’s just the beginning of a crack. In total, $28 billion in leveraged loans have been priced in August, according to Bloomberg, and those five loans that got pulled so far amounted to only $1.3 billion. But it’s a sign that investors are starting to open their eyes a teeny-weeny bit.

The way the Ancestry loan was originally pitched, the special dividend back to its private equity owners was supposed to be $912 million. In addition, the PE firms were trying to get creditors’ consent for a clause in the debt covenant that would allow it to extract another $150 million in special dividends by the end of the year.

So the already heavily leveraged company was going to be loaded up with an additional $1.15 billion in debt and use $387 million in cash on hand to allow its PE firm owners to strip out $1.06 billion in cash. The remaining proceeds of the loan would be used repay some existing debt.

Moody’s had a cow.

Moody’s credit rating for Ancestry is already a highly speculative B2, which is five notches into junk (my plain-English cheat sheet for the corporate credit rating scales by Moody’s Fitch, and S&P)

So on August 8, Moody’s announced that, based on the size of the debt-funded dividend and some other factors, it would change its outlook for Ancestry to “negative,” from “stable,” putting another credit downgrade on the table. It also withdrew its Speculative Grade Liquidity Rating of SGL-2.

“The dividend is a clear step-up in the aggressiveness of the company’s financial policy,” Moody’s wrote. “Recent declines in DNA kit sales and subscribers have made future prospects more uncertain, making this an inopportune time to raise leverage aggressively.”

“Given our expectation for little to no earnings growth, debt-to-EBITDA leverage is likely to remain elevated above 7.0x while free cash flow could quickly deteriorate should subscriber weakness continue, hence the negative outlook,” Moody’s wrote.

And the market too balked.

When the loan was being shopped, potential investors’ reluctance was palpable. So by August 15, the dividend was reduced by $200 million to $712 million. The pricing of the loan was increased from the original Libor plus 400 basis points to Libor plus 425 basis points, according to LCD. And some protections for creditors were added into the covenant, which is still “cov lite” and leaves creditors exposed. And the loan size was increased to fund a larger repayment of part of an existing loan.

Those new terms soothed Moody’s, which on August 19 changed its outlook back to “stable,” from “negative.” But it added that “the debt-funded dividend remains aggressive.” So that deal got done, as of today.

But five other leveraged loan deals got scrapped in August.

So far in August, five loan deals were pulled, for a total of $1.3 billion – the last one being a leveraged loan proffered by streaming-service provider Vewd Softare, according to Bloomberg today. Vewd is owned by New York-based PE firm, Moore Frères & Company.

The other four deals that were pulled in August include leverage loans by marketing firm Golden Hippo, Glass Mountain Pipeline Holdings, power generator Chief Power Finance, and fitness-center builder Life Time Inc.

Other deals had to be sweetened to become palatable, including the $367 million leveraged loan by Total Safety Inc. The provider of industrial safety services is owned by PE firm Littlejohn & Co. It needed the money to fund the acquisition of Sprint Safety. The deal got done only after it was priced at 93 cents on the dollar.

Leveraged loans are too risky for banks to keep on their balance sheet. So they repackage them into Collateralized Loan Obligations (CLOs) and sell them to the credit markets or they repackage the loans and sell them to loan funds and other institutional investors that then sell them to retail investors.

But retail investors bail out.

Loan mutual funds and loan ETFs used to be popular – especially with retail investors. Leveraged loans normally have floating rates. For example, Ancestry’s loan was issued at a rate of Libor plus 425 basis points. In a rising interest-rate environment, such as 2018, the interest rate on those loans adjusts, and so the yield rises, but the price of the loan remains roughly stable. Bonds on the other hand experience falling prices as yields rise.

But the market got the jitters late last year. Leveraged loans are notoriously slow to sell, creating a potentially treacherous liquidity mismatch in a fund that allows for daily withdrawals. Fear of the liquidity mismatch, and the potential for a run on the fund, caused investors to try to get out the door first.

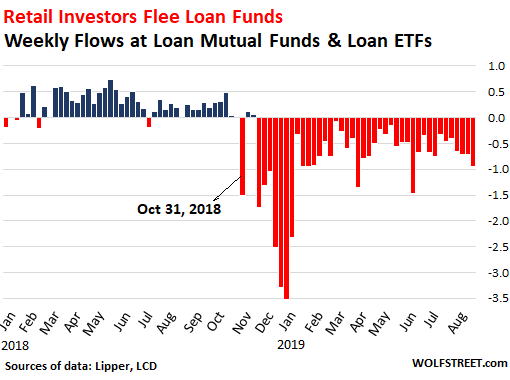

And this year, markets figured that interest rates would fall, instead of rise, and more investors withdrew their money from loan funds, leading to 40 weeks in a row of net withdrawals, now totaling about $36 billion (data via LCD, citing Lipper):

However, CLOs have remained popular. After a blistering record of new issuance in 2018, the year 2019 started out with even more issuance: Through mid-July, $77 billion in CLOs were issued, according to LSTA, up from $57 billion from the same time in 2018. But there are now doubts that this pace of issuance will continue.

Who holds these CLOs? According to a Bank of England’s most recent Financial Stability Report, banks are big holders of A or higher rated tranches, including US banks ($160 billion), European Banks ($32 billion), and Japanese banks ($96 billion). Insurance companies hold $160 billion of CLOs, and hedge funds $96 billion.

But there is murk everywhere. There isn’t even an agreement what “leveraged loans” are. And banks are not off the hook. They hold 57% of these instruments in various forms, the Bank of England found. Read… Who Holds the $3.2 Trillion in “Leveraged Loans” and CLOs?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Insurance companies have enticed our politicians into making it mandatory to have in so many areas.

@Joe – read beyond the title… the word is “Issue-ance”, not “Insurance”?

@Wolf – I can’t wait until NIRP reaches CovLite Junk Leveraged Loans, and investors line up to pay interest to outfits like Ancestry.com for the privilege of lending them money so the insiders at Ancestry.com (or wherever) can issue themselves special dividends, and then charge it off over time to their poor customers.

Ancestry.com is doomed, because they failed to work for their customers (delivering better service at lower prices), and instead they now have to overcharge just to meet their debt-service costs. All it takes now is a disruptive startup, funded at NIRP (no debt service), to invest a little in an improved product and destroy Ancestry.com’s line of business with competitive pricing.

Wisdom Seeker,

“…can’t wait until NIRP reaches CovLite Junk Leveraged Loans, and investors line up to pay interest to outfits like Ancestry.com for the privilege of lending them money…”

In that scenario, WOLF STREET is going to then issue a $1 billion leveraged loan and I’m going to retire on the negative yield the investors are earning on it :-]

This negative yield stuff gives me headaches, it’s so twisted.

You better not retire anytime soon, we need your wisdom.

So you’ll have a billion dollars in cash or gold or something under your bed costing you no interest. Where do you live?

Mel,

I’ll have $1 billion in debt that is EARNING me interest. That’s what negative interest is. I can spend, waste, burn, or otherwise destroy and dispose of this $1 billion in cash that I borrowed, because it doesn’t matter what I do with the money. That’s the cash side of this deal.

Then there is the liability side of the deal. I will live off the debt that I owe, and will collect the amount that investors are paying me (negative interest) to owe them this money. I will make this a 50-year debt, so I will have passed on by the time this debt is due. And then when the debt is due and I’m gone, and the money is gone, investors are relieved to know that they won’t get their money back because over all these years they kept paying me to hold this money for them, and now the expense stops and the money is finally gone and stops being such a financial burden on them.

That’s the absurdity of negative interest rates. It’s truly absurd once you think your way through this to the bitter end.

Wolf,

Your description of this insanity is so apt that even a 10 year old can understand it. It’s a pity that our so called financial experts are so uneducated, or perhaps they are over educated.

I can easily make the case that US as a society does not value education. Just look on TV, all you get is how student loan debts are bad, people go to school to be swindled and don’t get a job in return. Then who are the heroes on the TV? Sports stars, actors, and media personalities. But definitely not your scientists or engineers… ok, may be your financial engineers.

But where to store the money borrowed? Every financial institution will be charging interest.

Dale,

As I wrote: “I can spend, waste, burn, or otherwise destroy and dispose of this $1 billion in cash that I borrowed,…”

You have to realize that with negative interest rates, money becomes a financial burden and is something to get rid of!

WS, I think you’re correct. I was a member of Ancestry for a year and used it to take the DNA test as well as track the family tree. But I balked at the annual fee of $100. I got the information I needed, and then stopped. But as you mention, if someone else can offer something similar for a lower price, I’ll consider it.

Considering these DNA companies sell your data to insurance companies and law enforcement, they should be paying you every time you are a statistical match.

A test done in Canada of identical twins, using several of these “ancestry” kits, showed that there is a good deal of discrepancy between different tests. As well, there is a wildly inconsistancy within one of the tests that showed one twin with “ancestry” in one place and the other twin with no such “ancestry”.

Personally, I go with the geneticists who argue that these types of genetic testing are at best anecdotal, at worst, bogus!

Ancestry was MADE to be doomed, and actually just a much larger version of all the flashlites, special sun glasses, food cooking/preparing, etc, junk you see on longish TV ads, just shorter term money makers.

They simply use a modern day DNA data base and the cheapest of commercial DNA analyzing machines. My sister was sucked in, but I set it from 10% to 90% certainty, and out popped the generic NW European, and the 4% or so “unknown” which is figured (or said) to be Neanderthal, which is likely true.

It was NOT because of bad customer service or any other damn business term. It was simply a very crude use of DNA tech. Trust me, I understand most of this stuff. If you REALLY want to know your ancestry, you are better off chasing old records and grave sites. If you have ENOUGH Native American, Asian, African, Latin American ancestry, etc, etc, for these gross level tests, you likely already know it. They just use well blended modern populations for comparison and DO NOT go into the detail DNA tech is capable of…that is BIG BUCKS STUFF. You think they are out digging like the anthropology guys? Come on.

As for the financial rip-off part, SOMEBODY passed financial laws allowing this crapp, and they have been chipping away at these “laws” for a long long time. Remember Liz’s shit fit? After yet another “little derivative law” was passed, WRITTEN entirely by Citibank, as very few congress critters understand that financial legal game and chipping away at it like she does.

Just like the detail people push (inform) new drugs to bio chem ignorant docs, lobbyists “inform” congress critters about needed new “adjustments” to laws.

May you live in interesting times.

PS: Neanderthal is pretty much in all Europeans, even found pretty far into Asia and the ME by the physical Anthropology guys. In fact, there is a growing consensus the actually evolved in Europe, from earlier hominids who migrated there.

There was NOT just one migration out of Africa, there were many, some going both ways. We just don’t have enough sites yet, to use what DNA can tell us.

Here’s one proven one from a well researched site 40,000 years ago in Spain/S.France. They were baking flat bread on a flat rock using “flour” from some cattail like plant part. So much for the “paleo-diet”, har har. We can be sold ANYTHING!

(Thnx again for Bernays tip, Unamused)

“Loan mutual funds and loan ETFs used to be popular – especially with retail investors.”

Seeing that the supply of gullible investors is infinite, tomorrow I’ll set up an ETF from CLOs of junk-rated companies. I’ll call it: ‘I have a bridge to sell you ETF’.

Most investors are relatively more wealthy. Also, we’ve had weak economic growth the last decade even while swaths of unsustainable businesses provided jobs via their debt funded enterprises. The money is spent and can’t be earned back without a miracle, so basically these “investors” have willfully transferred their wealth to someone else to have a job at one of these businesses, they just don’t realize it yet. That’s not how the economy traditionally works though in theory or practice, which makes you wonder how much weaker the economy would have been if not for this insanity. Apparently we don’t need Andrew Yang as long as financial repression exists. How many people’s jobs in the last decade only existed because of “gullible investors?” Will they continue to be gullible next decade?

Petunia:

Yes! I also believe that all personal information used by the “business” community should be paying ALL those whose personal info has been used by them. Can u imagine all the money that would flow down the pike to even the homeless??????

Americans are way too tolerant with their relationship with business and how business uses them for profit.

What people really should have is the right to know how and when their data is used, sold, or accessed.

I really want to know who buys the lower rated CLO tranches. Anyone with that much money should have more sense than that. Like I couldn’t understand who bought those 100 year Argentinian bonds.

Ted,

It’s the yield. Everyone is chasing yield.

“You have to realize that with negative interest rates, money becomes a financial burden and is something to get rid of!”

Are the idiots behind this insanity actually trying to unwind some of their QE with this policy.

Making the money of the hated savers disappear by the year??

As always, Wolf thanks unmasking the PE firms that have the guts to fleece investors. In these times, both the investors and the rating agencies bare the blame. Ancestry is obviously a dying business(pun intended). I certainly wouldn’t loan them money at 6%.

Wolf,

a dumb question here. If I look at the bond funds in my 401K, a good number of them hold mortgage back securities as well as corporate bonds. Which explains their yields, this gets somewhat offset by the fact that they do hold varying percentages of US treasuries, or other forms of government bonds. Do these particular CLOs get repackaged and shoved into mutual funds as well or various bond funds and ETF types?

Because that would be a huge danger to a lot of these funds should bankruptcies suddenly occur in spades. And a lot of the prospectus don’t exactly have good transparency and the amount of turnover can get pretty high in some instances.

Should any normal person be worried about these bond funds sitting in 401K that they might actually implode? I’m starting to employ a strategy of getting only funds with most of their assets in US treasuries as a measure of safety.

Yes, I would be worried about these bond funds imploding.

MCH,

Generally: I like buying bonds outright when they’re priced right (which they’re not now). But I HATE open-end bond mutual funds. They’re convenient, but they’re super-risky.

Open-end bond mutual funds — which it sounds like you have — are subject to runs during rough times. When there is a run on a fund, the fund will have to sell the illiquid assets at fire-sale prices for cents on the dollar when no one really wants to buy. These funds can lose 50% or 60% of their principal in a rout – even when the underlying bonds don’t default!!! And that money doesn’t come back. First-mover has the advantage. You have to keep your eyes on it and get out when the first signs crop up.

If you have a fund that is well-run and is chock-full with Treasuries and A-rated corporate bonds, and some Agency MBS, you’re probably OK. The Treasuries provide liquidity and no one is worried about them. But the yield will be LOW.

If you earn a higher yield, there is all kinds of other stuff in the fund, such as that Argentine century bond… If you earn 6% or 7% on a bond fund these days, you’re sitting on dynamite. That’s OK too – until people get nervous and there’s a run on the fund. If you know what to look for, you may be able to get out in time. But these are just very risky instruments, and the risk of a run on the fund is not disclosed and is NOT priced in.

Having gotten this off my chest: CLOs can be in a bond fund. You need to know that lower-rated tranches of a CLO take the first loss. So if you have an AA-rated tranche, it will be one of the last tranches to get hit. So if the recovery is 40%, you’ll likely be OK with an AA-rated CLO tranche. But generally you don’t know this if you have a bond fund that has CLOs in it unless the CLOs are one of the top positions, and then they show up on the list.

Thanks Wolf, it does bring up the question in terms of how much treasuries would be considered safe. Some of the bond funds have 30% in treasuries, others have more or less, depending. It is obvious once you know what to look for. The higher the yield, the fewer treasuries are involved.

For me, I have started to put all of the bond fund money into things that are overloaded with TIPS and just plain old low yield treasuries. Seems safer that way.

USG has serious revenue issues, while corporate America does not….

Wolf, you say at the top that you like “buying bonds outright”, when the price is acceptable.

You have, several times in your posts, covered general topics like buying bonds outright, and HOW TO do it. Another one: how to freeze your credit rating accounts.

These are quite useful, and the sort of topic that comes up again and again.

Have you considered posting a short list of HOW-TOs at the Home Page top, from which readers may link to your concise explanations of these, and a few other key how-tos?

If there’s more than one or two, listing them in alphabetical index form would be most helpful.

I know, we always want more. As usual, thx.

WSKJ,

I have thought about it. But I’m just one guy, so I have to choose my topics judiciously.

There are things I have learned the hard way, and things I have done professionally and know how to do, and I could write how-to articles periodically if I have something useful to say. But it would be outside of the bull’s eye in terms of topics for this site. “How to” is its own category in books — financial advice, personal advice, how to buy a used car, how to make the perfect cup of coffee, how to fall in love with the person you will never ever want to leave (ha, I figured that out 25 years ago)….

But who would want to read my ideas about this stuff?

Has nasty, legal financial advice issues, hanging off of it, also.

There might be some hope for this country when these private equity predators and parasites are indicted under the RICO statutes, given highly publicized perp walks, convicted, sent away to do hard time, and restitution made for their ill-gotten griftings.

Until then, it’s all reality TV and kayfabe.

How does Ancestry.com lose money (aside from idiotic owners stripping cash out)?

They don’t just do DNA, they have monthly fees for their genealogy offering (vast data sets that are largely unavailable elsewhere), and there are millions of paying subscribers whose data is essentially locked in. Genealogists will pay that bill before their food or electricity bill.

If that company goes belly up, Silver Lake will have a mob of angry elderly people outside their offices, waving pitchforks and black powder muskets. Possibly literally.

Ancestry has several competitors. 23andMe is quite popular.

23andme is a competitor for DNA analysis, not for genealogical sources. The largest corporate competitor on the genealogy side is MyHeritage, who also own Geni.com. There are also free resources, such as FamilySearch. Genealogists will often have paid accounts at several sites, as the data sets are different. In the case of Ancestry, this amounts to several million subscribers, paid on an annual basis, with a substantial retention number from year to year.

Are you saying there are millions of Genealogists?

And it does sound close to theft. The PE Pirates should be required to hold all funds stripped out in escrow, available for claw-backs for several years in case they do drive the company bankrupt.

If Ancestry fails, its productive assets will be assigned, and a new debt free Ancestry (with different owners) will continue the profitable businesses.

Sounds like some heavy competition for the elderly jewelry trinket scammers on home shopping networks. Had no idea it was so popular.

Check US non-performing loans percentages. It is the best of times and it is the worse of times; depending on individual circumstance.

It’s beginning to look like NIRP has forced European and Japanese banks into these highly speculative CLOs, among other high risk investments.

I suspect the next worldwide GFC will start with banking collapses there, with contagion spreading to the US

Maybe Ancestory can meet their obligations by selling Certificates of Genealogical Authenticity (CGA’s) of the strengths/weaknesses of all the generational data they have accumulated.

After all, they are using this data supporting cases in the legal system. Nothing is sacred it seems. Maybe the public is on to this, and thus the declining testing!

I was pissed when an immediate relative went on there. When you give them your DNA (paying to do so, no less!), you’re also giving away your relatives’ private information without their prior consent. To make matters worse, neither of you have control over that company or what they do with your information. DNA services should be anonymous.

This kind of naivety, ignorance, and apathy on the part of everyday people is why we have cell phones that track your location constantly, browsers that allow google and others to fingerprint users on most sites even when they aren’t logged in, backdoored hardware and firmware like black-box intel management engine and BIOS, spyware operating systems, and eavesdropping “smart speakers”. Oh, and fiat money.

When you give them your DNA (paying to do so, no less!), you’re also giving away your relatives’ private information without their prior consent.

That information is used to determine which diseases you may be prone to, and therefore what your future health care costs may be, and therefore what your health care and life insurance premiums should be, and whether you or your family or your relatives should be insured or hired at all.

And it can be used for other purposes. When you sell your genome to a corporation they can patent bits and pieces of you to slice and dice and splice and chimericate and repackage for license or sale as they please, and your legal rights to your own person are diminished where they are not actually extinguished. This has long been done with tissue samples.

What do the laws say about all this? Naturally, the laws say what corporations want them to say. And if you knew what they say you would be horrified.

Naturally, insurers, employers, and others want this information. It can be used against you and yours in ways you have no way to foresee. It is yet another way in which you and what you are can be dehumanised and converted into a commodity. It is yet another system of control.

Thoreau said “I was not born to be forced.”

You, on the other hand, were.

23andme or whatever it’s called was founded by Anne Wjcicki. Her husband co-founded Google. Google invested heavily in 23andme. Google’s motto was: Don’t be evil. So they must be the good guys, right?

And to think that people were paying companies like this to take their dna …and ours. Because everyone probably has a relative that is stupid enough to do it.

I personally wouldn’t care what they do with “my data”. I don’t harbor any illusions that I am personally so important that someone is going to try to harm me via my data.

To my knowledge, I’ve never worn a tinfoil hat on any occasion though so it’s pretty easy for me to say stuff like this.

In addition, I am not worried about anyone corrupting my precious bodily fluids.

@Zantetsu – I guess you wouldn’t mind having your family’s healthcare insurance premiums dictated by a combination of genetic risk score (ancestry.com) and whether you folks ate your vegetables (credit card history) and mental health score (google searches, text messages, facebook). That’s just for a nobody like you, as you say – now imagine the pressure that can now be brought to bear on “our” representatives in government when any past indiscretion or embarrassing piece of information can be leaked to the public if they don’t play nice with those with the information access.

re: Dawns comment,

My in-laws used to have a certificate on their den wall for a Moon building lot. Nothing is impossible. :-) Pet Rocks? Ancestory tracking? Reincarnation? Balanced budgets?

Seriously, NIRP and Bailouts are very very worrying for us. We have some dinero in the bank, actually Credit Union, which does not have Bail In. We have broken it up into different vehicles, so each carries its own insurance coverage. But….when yield is 0% Or lower? It is going to take some discipline not to buy stuff.

Of course there’s no inflation, so no losses……:-) (Sarcasm alert).

note to self: buy more vaseline.

Remember “Jump to conclusions” mat? Wonder if now is the time for part II.

LOL, Paulo

thinking about the Reincarnation thing….the Buddha wanted extinction, you know, just saying…

like no more coming back again and again having to deal with the likes of the central bankers…. all those newfangled nefarious economic constructs….

hope that doesn’t sound sacrilegious; it’s only meant as dark humor

Question:

I have an interest in a profitable 15 year old, private business with a long track record of generating annual profits of high 6, low 7 figures.

What I am wondering is would it be possible to do what PE firms do namely issue debt in as big a number a possible, with a yield of say 2%, service that debt using the company’s cash flow, retain say 10% of the inbound cash for ‘business development’ and pay myself and the other shareholders the remainder in a ‘special dividend’

Given that there are fools handing billions to Argentina and companies that have never made a red cent of profit and never will, I am wondering if there would be yield hungry funds lined up to subscribe this.

Envo:

Just wrap it all up in a jelly foll taco/ravioli CDO, CDetc….Label it, “Come and Get It!” and investors will break down your door to merchandise it! LOL!!

Edit reply to Envo above: “….jelly roll…..”

So many Wisconsin manufacturing companies were destroyed by the PE bullshit starting back in the mid 90s. That it continues to this day speaks to cronyism being in total control. Since bailouts will continue (they are cowards at heart), we will most likely get that hyperinflation at some point.

I just do not understand the mentality of modern investors. They’re in charge of “investing” billions of dollars and don’t seem to care if they lose it all. They obviously don’t get paid by the profit their fund makes because it doesn’t make a profit when it keeps losing money. Are they run by kids fresh out of college who have never seen bad economic times?

Various factors at play, which are mutually reinforcing. For example:

1. Other People’s Money + manager retirement horizon = short term focus. “Who cares? I’ll be gone by the time this blows up.”

2. Lots of new investment money coming in aka savings glut (actually a debt glut). According to PIMCO, demographics suggests this will more than completely reverse in the next few years.

3. Greater Fools. As proven by that fact that Uber has a non-zero stock price, there are still plenty of greater fools.

Ancestry.Com featured in a current WSJ article because their CEO agreed to turn over their customer’s dna with the alphabet agencies, e.g. FBI in this case.

Imagine this in their T&Cs: We reserve the right to take your money and then share your scientific essence, aka your dna, with the FBI and other govt agencies, 4th amendment be damned. I mean it was only the 4th amendment. In fact, we think 1-3 were misguided, so the 4th must be also. Not to worry, you can trust that they are the “good guys” simply chasing the “bad guys.

Are Leveraged CLOs happening anymore?

https://www.ft.com/content/2c7e2b06-f7b0-11e3-90fa-00144feabdc0

Search: “Trafin 2018-1”

Well, yeah, all our other records are stored and will be stored in the big warehouse by Salt Lake City, so why should DNA and ancestry records be any different.

Obamacare, as well, requires health records to transition to electronic availability, and certainly DNA records are part of our health records, and will be increasingly so as high-tech healthcare progresses.

Inroads on our rights to privacy look like superhighways, and reclaiming those rights looks like a very rough road.

Wow, now that’s some useful information. Being a silly fool, I keep trying to go to the bank and pitch them a solid business plan that shows I can make the money to pay back the relatively small loan I’d need. I never thought of simply walking into the bank and telling them that my business needed a loan just because I needed the business to pay me a special dividend. I’ll have to try that new approach next Monday!

Hey guys and gals, I have a house in Detroit, rented by a group of crack addicts. I’m selling equity shares in this fine investment.

The money I get is going to me so I can continue to live the great slumlord life I’ve become accustomed to and buy a yacht on the Riviera.

Don’t miss out!!!

Disclaimer:

The above statements are sarcasm, and is not an offer to sell securities.

Back to a comment I made above to which you replied, Wolf.

I was not actually proposing that you write a new How-To book, or major post. I just meant to propose a couple of links to posts you have already made, the 2 topics that seemed to me especially useful, being:

1) freezing one’s accounts at the big credit-rating agencies, the advisability of doing so, etc..

2) buying Treasuries directly, how easy it is, etc..

This would be links like the ones you already have at the top of the Home page. At blogs in general, these are often titled “Popular Posts”, or “Hall of Fame”, or something like that.

See, you’ve already done all the work, except for finding the space for the new heading, and posting the links. OK, that was sarc.; this would take plenty of time and energy; but you are clear and concise, and some of your best stuff can be hard to find amongst all the other great new stuff.

I don’t see how you find the time to do what you are already doing so well, so this is just a suggestion for some time when you have a few spare moments, and you feel like gilding the lily. Hope you are LOL !