Nope, the Fed dumped. But there was huge demand elsewhere.

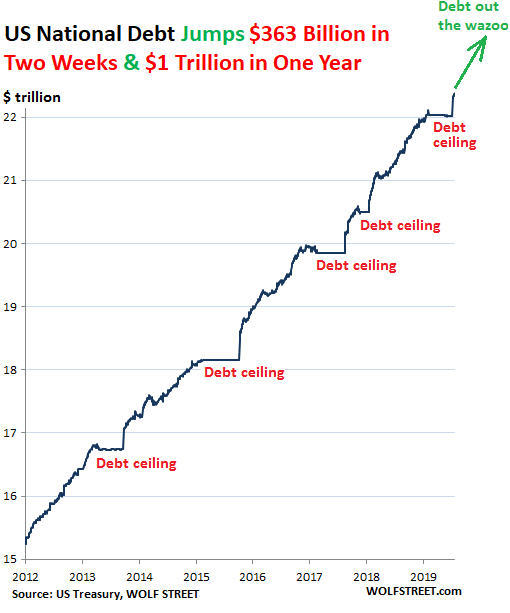

The US Gross National Debt has jumped by $363 billion in the two weeks since President Trump signed the law that suspended the debt ceiling. This surge pushed the total debt to $22.39 trillion. That’s up by $1.01 trillion from 12 months ago. And these are the good times. Watch this debt balloon during an economic downturn! Whoopee! Note the technical term at the top right of the chart:

The question, “Who the heck is buying all this debt” – because every dime has to be bought by some entity – is becoming increasingly nerve-wracking, particularly as the trade war with China puts the possibility out there that Chinese entities might dump their US Treasury securities, much like Russia has already done. But Russia was only a small-ish holder. China is – or rather was – the largest one.

So we got some answers on Thursday when the Treasury Department disclosed in its TIC data how much of this debt was held, bought, and dumped by foreign investors through June.

Foreign investors bought hand-over-fist. But not the Chinese!

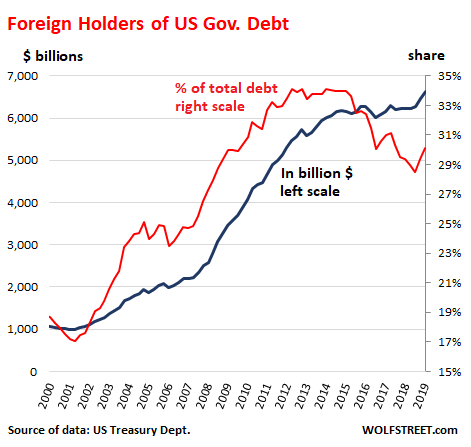

All foreign investors combined – so “foreign official” holders, such as central banks, and foreign private-sector investors such as banks and Mexican billionaires – held $6.64 trillion in US Treasury bonds and bills, having raised their holdings in the month of June by $97 billion, and over the 12-month period by $411 billion, all of it driven by frantic buying over the past seven months.

In dollar terms, this $6.64 trillion held by foreign investors is a record (blue line). In terms of the percentage share (red line) of total debt, it’s a far cry from the record maintained from July 2012 through May 2015, when it maxed out at 34.1% of total Treasury debt. The share dropped to 28.5% at the end of last year. Under the recent surge in buying, it has ticked up to 30.1%:

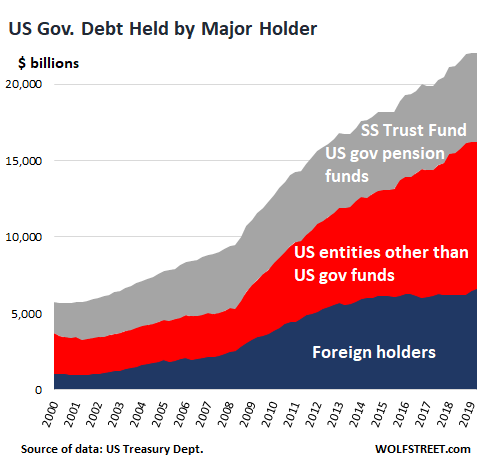

About $5.9 trillion of US Treasury securities are held by various funds administered by the US Government, including the Social Security Trust Fund and pension funds for government employees and military personnel. This “debt held internally” is an asset that belongs to the beneficiaries of those funds and is a true debt of the US government. In terms of the funds, they invested their beneficiaries’ money in what is generally considered one of the most conservative investments in the world, US Treasury securities.

But those $5.9 trillion in Treasury securities are not traded in the market and thus are free from the moment-by-moment price fluctuations of marketable securities.

The chart below shows those three big groups of holders of US Treasury securities through June: US government-administered funds, such as the Social Security Trust Fund and US government pension funds (gray), US individuals and entities other than the government (red), and foreign holders (blue):

The Big Two Foreign Creditors of the US.

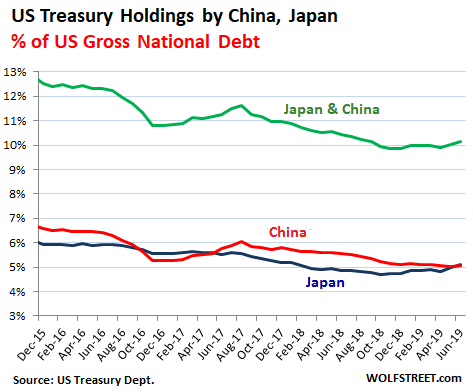

China had been the largest foreign creditor of the US, but it has shed $66 billion in Treasuries over the 12 months through June, and with holdings of $1.11 trillion, dropped to second position, behind Japan.

Japan became once again the largest foreign creditor of the US, having added $92 billion in Treasury securities to its holdings over the 12 months, driven by an 8-month buying binge starting in November totaling $104 billion. Its holdings now at $1.12 trillion are still down from the $1.24 trillion at the peak 2014:

The importance of Japan and China as creditors to the US has been diminishing for years, as their combined holdings have fallen while the US gross national debt has ballooned. But the recent buying binge by Japan brought the combined share from 9.9% late last year to 10.1% in June:

Other Major Foreign Creditors of the US

No country comes close to Japan and China. The third largest foreign holder is the UK with $341 billion in Treasuries, followed by a gaggle of others. Most of the entries in the list are tax havens for corporate or individual entities. Belgium is home to Euroclear, which handles large amounts in fiduciary accounts (in parenthesis, Treasury holdings in June 2018):

- UK (“City of London” financial center): $341 billion ($274 billion)

- Brazil: $312 billion ($300 billion)

- Ireland: $262 billion ($301 billion)

- Switzerland: $233 billion ($235 billion)

- Luxembourg: $231 billion ($220 billion)

- Cayman Islands: $227 billion ($191 billion).

- Hong Kong: $216 billion ($196 billion)

- Belgium: $203 billion ($155 billion)

- Saudi Arabia: $180 billion ($164 billion)

Other than foreign investors, who else is there?

The TIC data covered holdings through June. So over the 12-month period through June, the US gross national debt, having bumped into the debt ceiling in January, remained stuck at $22.0 trillion, up $828 billion from a year earlier.

Foreign investors, as we have seen above, bought $411 billion of this new debt. Leaves $417 billion that other non-foreign entities must have bought.

Not the Fed. It got rid of $265 billion in Treasury securities over the 12 months, reducing its holdings to $2.1 trillion at the end of June.

So other US entities must have bought the $265 billion the Fed dumped, plus the $417 billion in new debt that foreign entities did not buy, for a total of $682 billion. But who?

US government entities bought $106 billion in Treasury securities over the 12 months, bringing their total holdings to $5.83 trillion. This “debt held internally,” when seen from the other side, are assets in funds such as the Social Security Trust Fund and government pension funds.

So over those 12 months, the government added $828 billion to its debt. Foreign investors bought $411 billion of it; the Fed dumped $265 billion; and US government funds acquired $106 billion. Leaves $576 billion that someone must have bought. Who?

The only one left.

American institutions and individuals added $576 billion of Treasuries to their holdings, bringing them to $7.46 trillion. US banks were large buyers of Treasuries. According to the FDIC, in the first quarter, the latest data available, banks added $55 billion in Treasuries to their holdings, “the largest quarterly dollar increase since fourth quarter 2014,” the FDIC said.

Other large US institutional holders include bond funds, pension funds, hedge funds, businesses with cash balances that they don’t want to keep in a bank, and private equity firms sitting on their “dry powder.” Individuals are also large holders, via their accounts at Treasury or at their broker. All combined, American institutions and individuals held 34% of the US gross national debt.

Data destroys the myth of tariffs being a “tax on consumers.” Here is where inflation runs hot – and it’s not imported consumer goods. Read... Inflation Data Shows Tariffs Are Not a Tax on Consumers but on Foreign & US Corporations

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Ireland??? They are more indebted than the USA. How are they doing this? As they world whistles by the graveyard….

Trinacria,

Corporate America with mailbox entities in Dublin where their “overseas” cash is registered. This “cash” is usually a combination of bonds, including US Treasury securities.

Apple is a very large factor in this Ireland scenario.

Wolf I can not visit your sight with out getting virus notifications on my iPhone. Google notice. My phone is constantly updated. This has been going on for a couple of weeks. I am not clicking on them because a google search says that they are fraudulent Malware. I can not be the only person have you had other complaints. Saw this article referenced on Market Watch.

Denise Hartman,

I have no idea what you’re seeing. I go to my site on my iPhone all the time, and NEVER get a warning. I just clicked on a few of the links on MarketWatch to my site, and there is no problem and no warning. I just checked: There is no virus warning when I search for my site on Google; My Google Search Console says everything is clear. I use it to monitor my site’s search traffic and to fix issues as they arise with Google; so this would be the first place where Google would have notified me of a problem. My Google Webmaster says everything is clear. Below is a screenshot of one of the my server’s firewalls, Sucuri, showing that my site is not blacklisted by any search engine due to malware problems:

I would restart my iPhone {or any other smart phone) IN SAFE MODE.

Then I would load and run a GOOD virus killer. DO NOT waste your time running a antivirus program that is currently on the machine as it may be comprised. LOAD A FRESH ANTIVIRUS PROGRAM AND RUN IT.

(I am NOT a iPhone user – but I do understand how to control viruses on most phones and computers…)

Actually, when you consider that notional outstanding in shadow shadow finance is in the quadrillions, these numbers are tiny. This is why all the central banks and governments combined, have no control. The eurodollar rules, nothing else. When credit freezes, nothing anyone can do will be able to unfreeze it.

Treasuries are not purchased for safe haven purposes. They are purchased for their liquidity. Don’t think money, think liquidity. It’s all that matters.

Distinguish between safe haven and liquidity.

Re comment below. Safe haven is a false concept. The myth is that those bonds sit on a shelf and nothing is done with them. There is no money without circulation. And of course, the facts show it. Bonds are collateral, hedged against–in short, they never leave the world of the Eurodollar. Just read Jeff Snider’s Eurodollar university series. Step out of the world of 1850s economics.

That is the mother of all mistakes

I’d say the full faith and credit of a big entity with the powers to tax, to make laws, and to wage war, among others, constitutes a safe haven. And more high net worth individuals ($50m +++++) residing in said entity than in any other entity in the world help to prove my point.

Even if it is getting more f’d up by said high net wealth individuals, and the stupid wannabes, (who don’t yet realize they are NOT going along for the ride, and in fact are next on the menu, just like the vanishing middle class, if the agenda continues)

Prediction only good for my lifetime, and my betting ends when my currently organized bunch atoms go back to the smallish ball in space they last came from.

Chinas economy is joined at the hip to the US$.

The federal debt was $5.65 trillion in 1999. It is over $22 trillion today. Bill Clinton was the last president to pass a balanced budget.

I believe, if I recall correctly, the balanced budget was the result of pressure and oversight by the republican controlled congress – specifically Gingrich as speaker.

@Trinacria

You recollection is incorrect. The Clinton fiscal policy was implemented by the enactment of the Omnibus Budget Reconciliation Act of 1993, which passed the House despite every single Republican including Gingrich (who at the time was the Republican Whip) voting no. In the Senate, all Republicans also voted no and there were enough Democrats who joined them that the deciding vote was cast by Vice President Gore. The Republicans opposed the bill because it increased taxes as well as cutting spending.

The 1993 act went way beyond balancing the budget, resulting in surpluses starting in FY 1998 that grew to $236 billion in FY 2000 and were projected to reach $489 billion in FY 2010. It was projected that by sometime between the start of FY 2007 and the end of FY 2009, the Treasury would have enough cash on hand to pay off all of the debt held by the public but because some of the debt had terms that did not permit its being paid off (for example 30 year 8.125% bonds issued in August 1989 that didn’t mature until last week) the Treasury would have been investing the accumulated surplus in the private sector.

The Republicans took control of the House and Senate in 1995, but it was not until they also occupied the White House in 2001 that they were able to reverse the Clinton budget policy and return to deficit spending with the enactment of the 2001 and 2003 tax cuts.

Dink Singer,

“The 1993 act went way beyond balancing the budget, resulting in surpluses starting in FY 1998 that grew to $236 billion in FY 2000 and were projected to reach…”

Yes, but… the national debt INCREASED every year during that time, showing that the government spent more than it took in, resulting in more debt every year during the “surplus” years. There was not a single year when this “surplus” reduced the national debt.

So where is the chart of revenues?

Wrong! the fiscal surpluses were a result of the high economic growth caused by th tech bubble of the late-1990’s (in the interest of full and fair disclosure our family benefited and continues to benefit from it).

per Dr. Dean Baker the CBO projected a U.S. deficit of 2.3 % for 2000 in 1996. However, due to the tech bubble 1.0 caused high economy growth ( 4% growth for 4 years: ‘ 96 4.47 %; ‘ 97 4.49 % ; ’98 4.88; ’99 4.81 %. ), caused the budge surpluses.

So with was a fake balanced budget based on the ponzi scheme (tech bubble!)…

No surprise there!

Wow! Pressure and oversight on deficits from the GOP! Those were the days.

There’s only ‘Pressure and oversight’ when a Democrat is in the White House; a Repuglican president may do as he pleases.

Clinton and the Republican Congress had a few years of “budget surpluses” but even in those years, the actual Federal debt increased by up to 130 billion annually. Figure that out!!

The last time there was no debt added in a fiscal year was sometime in the Eisenhower administration.

Clinton’s “balanced budget” was strictly smoke and mirrors. If it were actually balanced the total debt would decrease (or at least not grow). Instead the total debt grew.

The last balanced budget was back in ’57 when Congress misjudged how fast the recession recovery was going to be and did not spend as much as they could.

Politicians will always spend every dime they have plus a little extra to get elected.

Balanced,,, you really believe that nonsense…

Yeah, he borrowed money from the Social Security system to balance the budget…

That would be similiar to you saying, “Honey I balanced our budget, nothing to worry about.” by borrowing from your 401k.

That would make you a good liar, just like Clinton, but not a very good good businessman.

@Top-GUN

Without inclusion of Social Security and other “off-budget” programs, the Clinton fiscal policy resulted in “on-budget” surpluses of $1.9 billion in FY 1999 and $86.4 billion in FY 2000 and they would have continued to grow rapidly had the Republicans not cut taxes and increased spending in 2001.

The dotcom bubble popped as soon as Clinton left office. That had nothing to with Republicans or Bush.

You really need to look at the Treasury’s public debt to the penny.

President Clinton had no such surplus.

Wow. If Clinton was that terrible, how do we even judge Bush II, Obama, and Trump?

Clinton removed Glass Steagle, the rules put in place after greate depression to make sure those who make mortgagors can NOT securitize and sell them to somebody else. I won’t argue which administration spent more. What I am saying is Clinton changed the law, the game rules of the financial system. That will have impact for decades until it is reinstantiated.

All true about the Clinton+(R) congress non-“surplus”. The only reason it even appears that way is du to the Dot.com bubble.

Others, like Bush, Clinton, Obama and Trump? They all ballooned the deficit- BUT most of the budget is entitlements- and getting more so as time passes.

There is an actuarial reckoning coming. When and what will crater? That’s the big question.

it was Lyndon Johnson’s idea to consolidate the annual surpluses in the FICA funds with the rest of the Federal government’s annual deficits. The consolidation made the costs of the Viet Nam war look smaller than they actually were.

Interesting comments….so, to sum it up it seems that all comes down to the old saying “figures lie and liars figure” .

BINGO

I well remember my dyed in the wool businessman Italian stepfather yelling very loudly at Reagan every single time he saw him on tv, “Balance the budget you dummy”, and never bothering to listen to anything else he said, and changed channels or went to another tv and watched sports. Clintons perfected the game of tossing the lower classes a few bones, for votes.

PS: Wish I could get solid confirmation on the Vietnam war costing 2/3 of WW2 in today’s dollars. But I did and still do know a lot of people who got really really rich off it.

Anyway, that put us in an economic hole that ended our super post WW2 advantage, and put us in the same hole most other countries are in.

All that Capex, just blown to hell, along with a lot of my pals.

A fundamental error for many responding to this thread.

Budget surplus/deficit are income statement terms. Debt is a balance sheet term. Surplus/Deficit compares what I made (revenues) vs what I spent (expenditures) in a specific time frame. Just because I’m making more money than I am spending in a certain period does not mean I am going to use the extra money to pay off debt. Surplus just means I have extra funds.

In terms of the US Government, the surplus (extra funds) can be used to do other things like fund the military and existing programs like Medicare or SS.

So in short, having a surplus and continually increasing debt is not “smoke and mirrors”. Let’s use some numbers on a personal level.

Let’s say every year for 10 years so far I make 100K, but I also spend 110K. For each of those 10 years I have been in a DEFICIT (spend more than earn). Let’s also say the only way I’ve been able to do that every year is to borrow the additional 10K from somewhere. So in this simple scenario, my debt has been growing at a consistent 10K per year. I now have a total of 100K in debt and for each year that I’m borrowing 10K I’ve had to pay interest.

One year I decide enough is enough. I’m going to cut all the excess fat and stop spending where I don’t need to spend. The year that I do this, I budget to spend only 80K while still bringing in 100K. Included in that 80K of budgeted spending is $500 total in interest payments on the 100K of debt I have. I look at this budget and think wow, if I keep this up and I choose to tackle my debt, I can pay off my 100K of debt (10K for 10 years) in just 5 years with the extra 20K I’m not spending. The year starts and things are chugging along as planned but then something crops up that I need to devote money to. I know I have 20K wiggle room (SURPLUS) in my budget but instead of using my 20K, I borrow 20K at 10% interest. That’s an additinal 2K I’m spending on debt so by the end of the year my new money situation (budget) looks like this:

100K income (although I borrowed money during the year, I didn’t earn it).

2500 debt expense (500 plus new 2K interest)

82K total expenditure (80k original spend plus new 2K interest spend).

120K debt (100K before plus new 20K)

In this new scenario, I’m still in surplus. I’m bringing in 100K but I’m only spending 82K so that’s an 18K SURPLUS. At the same time though, my debt has increased from 100K to 120K. My budget doesn’t come back to being a DEFICIT until I spend more than I earn in a given time frame.

So in short, you can balance the budget, get a surplus, and still increase debt. If you truly want to reduce the debt balance you have to stop borrowing and continue to pay off what you already owe. To stop borrowing you would have to make sure that new expenditures don’t come up next year. If they do, you can only pay for it by making more money. As far as the government in concerned, the way to make money is taxes and tarriffs. So pick your poison.

P.S. Tax breaks are equivalent to increased expenditures to the government because they mean less money comes to the goverment. Using the personal example again, if my income decreases to 80K along with my new 82K debt, I’m immediately back in a deficit.

I think you are giving Clinton too much credit. He deserves some, but more goes to Newt Gingrich and the Republican Congress. A more credible statement would be “The last balanced budget was passed under Clinton’s.”

Wolf,

one has to wonder when the cleanest of the dirty shirt phenomenon will finally end. I would guess that treasuries are being purchased because it is still a safe haven, compared to places like Europe or Japan. NIRP land. And your article points out how good an idea it is to keep buying things like Argentinian bonds.

Isn’t this the reason technically that the equity in the US keeps floating, because the alternatives (equity wise) all suck. I mean technically Gold is a safe haven, as is all the cryptos because they are alternative investments. Although at some point, one who have to hope there is a reversion to normal. Where the economies of Europe and most of Asia starts humming again, and their equity market would go up instead of down.

Any prognostication on when that’ll happen?

Worldwide Institutions are buying UST cause they are the best collateral for money markets, and still positive yielding on a bull run…

If the euro was to collapse because Greece and Italy decide they’d be better off with the drachma and lira (ha ha) and Germany returned to the D-Mark, the US $ instantly becomes a second- tier currency.

In 1978 when the US $ nearly collapsed the D-Mark was the main currency alternative ( other non- currency havens were gold and silver.

I’m not Wolf, but heres $.02:

Sometime after they find a new cheaper energy source than what we currently use.

Sounds like just a tangled up mess of no substance printed paper. It’s too much for my tiny brain to fathom. Think I’ll just buy a few more ozs of silver this eve..

I just pulled a few more $100 bills from the ATM so I can sleep better. At least it’s not weightless and doesn’t come with a negative interest rate. I read a million is about 22 pounds but I’ll never prove it.

When NIRP countries borrow and then buy treasuries, is this essentially “free money” arbitrage? What is the end game / consequence to this type of behavior?

We know that certain *countries* are issuing bonds at negative interest rates (Germany in particular), but are these countries then buying USG bonds with the proceeds? I sort of doubt it. *Banks* *may* be buying USG bonds with their excess Euro-denominated reserves, but I doubt the Treasury of Germany is.

Oh, and by the way, if European banks really are buying USG bonds with Euro-denominated reserves, someone must be buying Euro bonds with USD-denominated reserves to be the other side of the transaction. Who is doing that? I can’t quite make logical sense of the original thesis of the @TheBenBernank.

The Germans are very smart- they are getting free money with NIRP bonds and using the proceeds to buy gold. The bad news is they are storing it at the N.Y. Fed.

I believe that the Germans repatriated much of their gold that was held abroad although I don’t know if they managed to get it all back under their control yet.

Anyone doing this has currency risk, i.e. the dollar could fall against the currency they are using. Hence the issues with carry trade. Using hedging against currency risk can pretty much negate the return, so anyone like a government wanting a safe return would tend to avoid it. Not to say they don’t benefit from it, but it is not the main purpose behind the purchases.

Observations from Wolf’s graphs:

1). Americans reduced their purchases of Treasuries as Powell’s U-Turn implemented interest rate suppression and rates fell.

2). Foreigners increased their purchases of US Treasuries as their central banks intensified domestic interest rate suppression and they sought rates higher than their central banks offered (which where usually negative interest rates).

Conclusion:

Interest rate suppression is increasing everywhere on Planet Earth. Every single central bank on Planet Earth is intensifying interest rate suppression.

Therefore, asset bubbles will increase based on current policy treads.

Don’t worry if China drops the debt. Luxembourg, Belgium, and the Caymans will magically pick up the slack. Without disclosure as to the actual buyers, it’s just a big shell game. Pun intended.

I don’t think China can drop it. China sells goods and gets paid in US$’s. The PBOC gives the manufacturer Yuan, takes the US $ and buys UST’s.

When the Chinese manufacturer needs raw products etc, he goes to the PBOC and they give him US$ which he then gives to Foreign entities to purchase what he needs.

The Chinese economy is linked to the US$, they may not like it but it is what it is. There appears to be very strong demand for UST’s.

China is not like Japan and Germany which are quasi under control of the US, hence the huge military bases in the countries, anyone ever ask why?

Supporting the currency is costing China lots of US$.

I think the Chinese have been using a bunch of dollars to pay for the BRI.

they will loot those countries as payback.

You mean as the IMF and World Bank have done for decades?

So I have heard theories that the US dollar could get much stronger because of the strong demand for treasuries, US stocks, and US dollars and assets in general from overseas. The stronger dollar will cause damage to other economies but also to the US as multinationals would be caught in the crosshairs thereby slowing down the US economy further. Does anyone have any thoughts on how that story may play out in terms of the impact to US real estate. Could the strong dollar cause an influx of money into real estate as foreign investors seek safer assets in the US as a way to preserve wealth in light of depreciating foreign currencies thereby further increasing the real estate bubble in the US OR could the strong dollar exacerbate the negative effects of the future recession thereby hurting real estate? I’m thinking the latter will play out but curious if I’m missing something. OR Could the US depreciate the dollar to offset this and then how will that impact real estate?

This article may have answered my question.

https://wolfstreet.com/2019/07/18/us-home-purchases-by-chinese-other-foreigners-plunge-below-2012-level-chilling-chinese-reaction-from-juwei/

Predicting FX markets is one of the most difficult things out there with so many variables. What if the Fed is jawboned into a 50 basis point cut at the September meeting without the “mid-cycle adjustment” reasoning at the news conference. Everyone will assume that the we are on the border of going to a ZIRP and the dollar would/should react. Tricky stuff.

The USD$ has already been strong this whole year, up around 20% against many currencies, and many more in developing/emerging economies. It’s a good time to stacks of $$$.

The drop in foreign real estate investment over the past year indicates the latter is more likely to occur.

I am sadly old enough to remember when there was a fuss over Reagan’s first *annual* deficit of $200B. How quaint… now the debt increases by $363B in two weeks! That was “pent up” of course, but even so…

stealth stimulus. as long as it goes towards NatSec and Medicare, no one cares. but food stamps, the horror!

Haha. Wild.

I was born in 80. I remember asking my dad about the debt and him saying “we owe it to ourselves” and “you don’t run an economy like you do a household” …etc…etc

the next generation is gonna get “a little debt out the wazoo is good for you…” or “purchasing power kills…”

as for the article, see that even though foreigners bought, it was their private sectors that made the purchases. Most of the foreign officials that did buy are tax havens. The ‘For. Official’ line in the TIC link is the one to watch imho and it still hasn’t really budged for 6 years.

institutions and investors want it now. But when that demand turns will the governments of the world support the market? idk the answer but if it is ‘no’ then that is a big deal.

We owe our (debt) to ourselves. Really?

Hard to believe that more than half of Americans don’t have $400 bucks for an emergency.

One of the biggest problems today is that so many people do not understand the debt economy yet they have debt up to the wazoo.

1) Japan print, for free, buy UST for 2%, – before Fed cut rates, –

and get : 2% + capital gains. Once rates are cut, dump, before

the bond market get a Snake (river) bite.

2) On Jan 2018 saint JP moved, showed his scary face, trying to save the world from sinking deeper into the abyss.

3) The German 10Y bear market rally ended in Feb 2018, above water. It dropped for 7M, but since Oct 2018 the German 10Y lurch down into a vertical move, in divergence to US 10y. JP failed to save Germany & the European from the abyss.

4) The German 2Y underwater bear rally reached a high of

(-) 0.473 in Jan 2018. The 2Y was in a trading range til Jan 2019

at (-) 0.495.

This month it completed a 2.5y round trip, from Jan 2017

at (-) 0.964 to (-) 0.917.

5) Davos elite inverted the 2Y/10Y underwater, but the German

didn’t. The German 3M/10Y inversion, yes indeed.

6) To rectify US & German divergence, JP might throw a hint of a cut.

7) German rates get a Snake bite. They will bounce, move higher

towards the lower US rates :

a) Us govt will finance its high jumps debt, to prevent a recession in

election year.

– European rates short covering will raise inflation fears.

Oil will bounce lifting the most oppressed and hated sector. Oil co paying hyperinflation dividends, relative to Davos downhill, will rock, in a wild quadrilles.

8) Manipulated European bond investors, stabbed in the back, will

start a new flow, from fake underwater to the real deep water

energy co.

MICHAEL—we love you, you. are brilliant and we need your insight

But PLEASE stop the cryptic, staccato michigass…it doesn’t show any profundity…no one is impressed…you are not the Delphic Oracle….just keep it simple so that even those of us with pedestrian mentalities can understand…deliberate mystagoguery. went out with Gurdjieff and Madame Blavatsky….thanks Bro…keep on truckin…

1) Tiny tranquility candles above/ under a gap can hide volatility.

Full body candles cannot hide volatility.

2) Benoit Mandelbrot chaos prof : Volatility days are defined as days

with +/- 3% change.

They tend to cluster together. They appear in a downtrend and rallies.

They don’t predict trend.

They predict chaos and a major change.

3) Spx : after six month of tranquility, Aug 5th was a 3.8% day // Ndx was a 4.5% day.

4) US 10Y : Aug 1st & Aug 5th both were 5.9% days.

5) German : 10Y Aug 13 & 14 are very volatile days in vertical max.

6) Stay out of their way.

What is it with declining empires and massive debt? We are the Lannisters of real life.

What were the real reasons for the 2017-2018 rate HIKEs? They kept the US dollar high vis-a- vis foreign currencies. In my simple mind, this caused a huge carry trade at the same time repatriation of foreign income was encouraged.

While we follow TICDATA monthly for foreign holdings of GOVERNMENT securities, there is another more revealing report each June for foreign Portfolio Holdings which include private foreign holdings and type of holdings.

You can see there that some large trading partners, do not hold the same proportion of US securities compared to others. Comparing balance of payments and trade to US securities holdings are quite fascinating. Comparing countries annual GDP to their US dollar securities is even more surprising. Another amazing study is tracking how much banks keep in their own balance sheets (H.8) through the years and the inventory of private dealers each Thursday (by NY Fed).

By looking at this data yourself, you get a big picture of something quite “unbelievable”.

In response to CoscoAB:

the jobs were real, the money did come int. Bush 43 failed He cut taxes to the wealthy and blew the money on the wars in Iraq and Afghanistan. Then, the economy crumpled under him toward the end his mal-administration. That is the source of our present problems.

F Irish Spitz.

Under R/R, an Irish, F fell from 16.11 to 8.58 on Oct 1987.

Mark it down, this is where we are.

Under Clinton, another Irish, F fell from in Apr 1998 @ 37.72 to

a swing point low of 22.20 and bounce back up, to all time high

on May 1999 @ 38.62.

From the peak F fell to 21.69 on Dec 2000 and up to LPSY

on Apr 2001 @ 31.42.

— Draw L2 line from 22.20 to 21.69, on linear chart.

— Draw L1 line from May 1999 @ 38.62 peak to July 2014(H)

@ 18.12.

F constricted between support , L1 & L2 form a spitz.

F under L1 is similar to the DOW baby bull/ bears under a resistance line from 1929 to 1946(H), til the 1949 jump. The jump sent the DOW all the way to 1,000 in 1966.

After 32 years, and 6Y accumulation phase, Ford have nowhere to go but up.

Ford hyperinflation div @ 6.7% will attracted the betrayed and humiliated European bond holders.

Short covering will force them to join the wild Irish dance, for wealth.

Thanks JP.

Nice writeup.

I can’t say that I believe in any real relationship between Irish descent Presidents and Ford’s stock market performance.

As for the technicals: technical analysis is very much like art. Not only is it in the eye of the beholder, the images can be made to look like whatever the writer wants to say. This doesn’t mean technical analysts have no skill, but it does mean the method itself isn’t the source.

It also doesn’t cover real world issues associated with a stock or the vertical said company is in.

Among other issues: all car makers are under severe pressure due to worldwide reductions in new car purchases. Lifetimes of cars on the road continue to increase as well, meaning at least part of the problem is secular.

“particularly as the trade war with China puts the possibility out there that Chinese entities might dump their US Treasury securities,”

I’ll start with what I know, and what has been asserted by others.

I know the Chinese government uses US treasuries to stabilize its currency. Hence any mass selling of US paper would send the Yuan/dollar ratio into the stratosphere. This would stimulate massive capital out-flows from China. Not a good idea when you’re in an economic down-turn. Also it might weaken the dollar, which according to many would be a net economic good.

What I’ve read elsewhere is that the USA can simply prevent China from selling its treasuries. Would they? I don’t know.

China and other central banks have not been net buyers of treasuries for many years Wolf. The USA is now largely dependent on domestic buyers of treasuries, which is bad for US stocks as people are liquidating their stock portfolios to buy treasuries.

T-bills and notes as an alternative to bank high yield savings products made good sense on an after tax yield in high tax states. Plus they are just as liquid as the online bank account, if you need to sell.

Or maybe some Americans figured that 3.0% yields were the high water mark and grabbed it while they could…

The 2yr10yr spread sure widened in a hurry!

You know I was always suspicious that there was a free lunch with central banks. It just doesn’t pass the smell test.

If a central bank can print money to soften a recession doesn’t that mean that people will take that into account and take more risk than they should. Seems a little like a resonance frequency that gets out of control.

My base case is governments know people will work for fiat so it’s easy to play games with the currency to facilitate government policy instead of honest money and honest tax discussion.

You’re talking about second order effects.

First order effect with a CB printing fiat currency is dilution of the value of every pre-existing fiat currency unit.

The economic objective is to get people to invest and work; the increased growth *can* offset the dilution (see China 1984-present), but won’t if the growth doesn’t occur (see US 1989-present).

Put another way: Let’s say China and the US both issue $1 trillion in fiat dilution. The US grows 2%, China grows 6%.

China GDP in absolute terms increases $816 billion vs. the $1 trillion in new debt (the 6% growth rate multiplied by 2018 GDP).

US GDP increases $410 billion vs. the $1 trillion in new debt.

This is already a problem.

But it gets worse: how much of the US and China growth would have occurred anyway? The US population increases 0.6% to 0.75% annually – GDP should be increasing by that much, automatically.

China’s population growth has been between 0.41% and 0.48%.

China may be “corrupt”, but its debt issuance has overwhelmingly results in GDP growth. The US’ debt issuance, on the other hand, not so much.

Old school, you have put it in terms that I can understand…..ah, yes, where are the Shurrshees when you require the smell test ?

re the likes of Michael Engel comments, above, I like to think that several close readings would give me clarity re your points, but I only have limited time, so hope that you will consider in future, closing with a “tell them you told them” summary supported by those points.

OK, OK, we can understand “wild Irish dance”, and “Keep out of their way”; still, a little more elucidation of your finer points would be helpful.

Thx, as usual, for your efforts to keep your posts understandable, Wolf.

Craploads of bonds are used as hedging instruments by sophisticated traders, who on average by more than Ma & Pa’s

But Who Bought This Pile of Treasury Securities?

Tax evaders. They can afford it.

Remember the young hedge fund manager who bought UST in the secondary during the first China nuclear option. He got a personal audience with Bernanke, not sure who was calling who sir, both sides have an interest in contiguous policies, while the Trade Wars have absolved all parties and “sterilization” is dead. Treasuries are liquid? Be careful what you wish for.

You must have a decent allocation to hard assets that have a yield. That is your only protection against runaway govt debt that will have to be inflated away.

Given all the comments, questions, and explanations, this whole money thing seems like a tricky business.

Smart money is who is buying. They know it is now time to abandon equities.

TPTB are cashing out. They’ve discovered gravity. They know what’s coming. And they want everybody else to keep their blinkers on while they prepare for the End Game.

Please ignore my previous comment on F. F chart infested

with +/- 3% days, since Apr 26.

thank you for this series, Wolf. it is great to see the data spelled out like this after auction. I don’t see this anywhere else. I do not use an ad-blocker for this site and the ones I see are finally starting to appeal to what I actually use.

If anyone is using ad-blockers remember to give our host a tip for these great articles and respectful comment section.

Personally, I am surprised how much the Treasury curve rallied because the spread between the CDX IG and the CDX HY did not widen much. Makes me think the Treasury market is way overbought and there is no recession in the works.

June year-to-year (2018 to 2019) data suggests the Foreigners held 3.84% more US Treasury Securities. This supposed increase is a 15.28% decrease in T Bills and a 5.6% increase in Notes and Bonds.

How exactly are they VALUATING these securities? Do they use the face value of the security or the “market” value? We all know that long term notes and bonds rose in value (as their yields dropped), meaning their prices rose from 2018 to 2019.

Remember what this report data is named:

Monthly Holdings of U.S. Long-term Securities at Current Market Value by Foreign Residents.

Current market value!!!!!

May year over year the TLT etf value rose 8.75%.

The Laddered 1-30 yr Tys etf PLW rose 6.69%.

Therefore the value of L.T. Treasuries held by foreigners also rose.

These reports are “meaningless” unless they are in constant dollars.

TRANSACTIONS are probably a little better to look at. Who is accumulating and at what rate?

Market value is the same for everyone (except holders of non-marketable securities). So the portion of the total that each holder holds, and how that portion changes, eliminates the issue of market value.

What’s the calculus on Social Security Trust Fund and government pension funds? How much goes in and how much is withdrawn? The reason I ask is to gauge how much of this debt is “cancelable.” Let’s say I contribute $1 to the social security fund through my taxes, but I don’t use any of it because of a healthy financial life during retirement, then the debt is effectively “cancelled” right? Does that make sense? Is this possible?

Vimal,

The only way you can avoid drawing on your SS after the age of 69 is if you die. And yes, this is part of the calculus — many people die before they can draw a lot (or any) out of the fund. There are survivor benefits, but they’re smaller and don’t apply if there are no qualified “survivors.”

This is a number that actuaries calculate for pension funds and insurance companies all the time. But it doesn’t cancel the Treasury securities in the trust fund. It just shifts it to the other beneficiaries.

If everyone lived to 110, none of these plans would have a chance. The actuarial calculus assumes that some people die before they draw any benefits; that others die shortly after they start drawing benefits; and that others cling to life for decades and keep drawing benefits for longer than they worked and paid into the fund.

It should be made real clear that most of that deficit under the Trump Administration is interest. Obama was very kind to add $10 trillion with ZERO PERCENT interest for most of the time. $600 billion of Trump’s $1 trillion deficit is interest.

US Federal Reserve believe they have discovered the secret to perpetual prosperity by printing US Dollar toilet paper and force Japan to take it.

PetroDollar is supported by unique genius residing in the Ivy League universities such as Harvard, Yale, Princeton, etc. These highly intelligent super academic continue to write ambiguous economics and financials principles, using BOMBASTIC english words, in order to mislead ordinary people into believing their glorified high level financial PONZI scam, is the only way to improve their lives.

Fiat currencies are first and foremost a con game—a confidence game or scam. They will be accepted and used until that confidence is destroyed. Central banks are well on their way to destroying that confidence and, once gone, regaining it won’t be possible.

Financials and economics studies are the biggest con job designed by the super elite.

Why hide behind fancyfool name like financials engineering ?

Economy is just all about money printing. The one getting the hands out from printed money get all the goodies without working hard for it. If they fail, they will be bailed out for sure with more money printing.

So Economy = Money printing