IPO investors tried to unload while they could.

By Wolf Richter for WOLF STREET.

Lyft started trading today as a public company. It had lost $911 million last year. Investors have been subsidizing every ride. Outside of burning the money that its investors have handed it, Lyft does not seem to have a sustainable business model. To reduce the burn rate, it has cut the pay of its drivers. And hundreds of those drivers were protesting and went on strike today in Los Angeles, San Diego, and San Francisco to draw attention to their pay.

On Thursday, Lyft priced the IPO offering shares at $72 and sold 32.5 million shares at this price to IPO investors, which raised about $2.3 billion in new money from those investors. Now Lyft has more cash that it can burn.

But this morning, it took hours to get everything lined up. Trading in Lyft shares finally opened a few minutes before noon because that’s how long it took to manipulate the levers to create that “pop” at the start that would make all the headlines within minutes of the “pop.”

And sure enough, minutes later, headlines like “Lyft pops 20% in trading debut…” started making the rounds. That’s all that really mattered. And that’s all anyone remembered.

That “pop” is the amount that shares opened over the already over-inflated IPO offering price of $72 a share, established on Thursday. And so the opening price today of $87.24 represented a beautiful 21% pop for those IPO investors if they could have gotten out at that price. And some were able to.

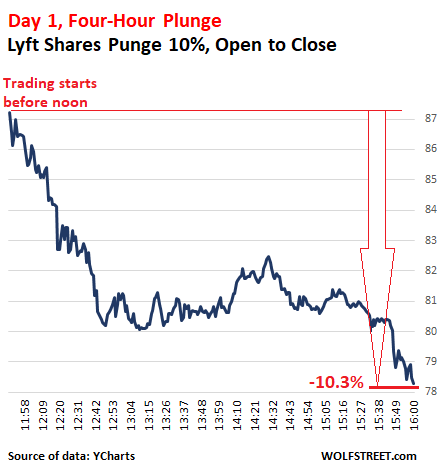

This pop gave Lyft a market cap of about $30 billion for just one minute, just before high noon, so to speak. And that was as far as the hype managed to drive these shares. And then the selling by those IPO investors started. It was relentless – despite the hype among retail investors to get in on the ground floor of the next miracle. Four hours later, shares closed at $78.29, down 10.3% from the first trade, with the sell-off speeding up at the end of the day (stock price data via YCharts):

There is no telling how this crazy stock will do in a world where making money is uncouth for these companies, and where burning investors’ cash year after year in huge quantities is a perfectly noble business model even for companies that have been around for years and have thousands of employees and billions in revenues.

And these cash-burn business models are rewarded with ludicrously huge valuations that have been surgically removed from all reality. Each of these companies comes up with its own home-made metrics that it tells fawning analysts to watch, to distract from irrelevant details such as “net losses.” And as long as these home-made metrics show an upward trend, regardless of how much money the company loses, it is a raging success in the eyes of those analysts. Historically, this works until it suddenly doesn’t.

The financial world has gone nuts. Read… How Can a Company with $1.8 Billion in Revenue Lose $1.9 Billion? WeWork Shows How

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

At $2.3 bil and 0.911 bil a year burn rate, Lyft now has a supply of firewood that will last about 2.5 years. Unless they throw logs on the fire at an even faster rate. :)

———————-

So, you can pump even before the trading officially opens? Interesting. I notice that even at the close, any original IPO buyers who still want to get out with their shirt can do so. But, in this crazy world, the price will probably shoot up on Monday.

————–

I can almost understand a corp like Netflix burning money to build a library of films that they can sell for years afterwards. But expecting a company like Lyft to make money at its core business when it never has before just seems crazy. Thus, the stock will likely shoot up. :) I guess I’m just an old fogey expecting a company to prove they can make money before they go public.

Just came from CNBC site; they have really gone off the deep end with calls for the Fed to feed their bubble. The Lyft debut debacle won’t help.

Cramer of course doesn’t really count as a constant voice for helicopter money; more comic relief like a kid wanting ice cream. He describes the tiny baby steps toward normal rates as a ‘rookie mistake.’

But now WH economic adviser Larry Kudlow is calling for two cuts ‘immediately’. Does he mean together, a cut of 50% ?

How about declaring a national emergency because the FAANGS might not return double digit returns in 2019? The ones who apart from Amazon employ very few compared to their market cap. Whatever Facebook is,it is NOT the economy. How did we end up with the Federal Reserve being beholden to social media?

In a column a day or so ago I believe WR said if we enter a recession it will be the first time it happens with low Fed rates and high deficits.

I can’t remember whether he also mentioned the trillions still on the Feds balance sheet from 2008, but this would be the first recession with that also.

That’s the fate these gibbering market shills have prepared for us: the next emergency may see a Fed with most of its dry powder gone.

When will CNBC start criticizing fiscal policy (spending) and the 22 trillion dollar debt?

The Fed is like the money manager of a spend- thrift rock star (or reality TV star) No amount of financial engineering can keep him solvent forever.

“How about declaring a national emergency because the FAANGS might not return double digit returns in 2019?”

Hilarious. Love it!

Today’s joke is tomorrow’s policy.

Thanks. Guess everyone knows ‘cut of 50% should be .5 %’

Ha, completely missed that one. A mixup of “50 basis points” v “50%” is both easy to do, and easy to overlook, especially since everyone knew what was meant.

Don’t worry. The Fed will just start buying products from Amazon and ad space from Facebook. Why should it stop at MBS, Treasuries and stocks?

Or, the Fed will just start to buy Amazon and Facebook stocks.

…then BitCoin and eventually Beanie Babies

=>Or, the Fed will just start to buy Amazon and Facebook stocks.

Inefficient. They could just tax you and give them the money.

Better yet, just let them tax you. They need the money. Yours will do fine.

Why not stop at just ad space on Facebook and Amazon products? Buy space on the Microsoft Cloud, or maybe the ad space for an entire TV season from one of the networks. Seriously though, I think if Amazon is receiving help from the Fed, the company would be destroyed overnight and have to be liquidated.

As for the original topic, you would have to wonder if the Fed and the media are going to try to bring down the economy so that President Trump isn’t reelected. It doesn’t matter if you love or hate him, the same thing happened to Bush 41.

On the contrary, looks like the Fed and the financial media are trying to pump up Wall Street in aid of Trump’s argument that a stratospheric stock market equals good times for all. Thanks to the Donald we’re gonna be so rich we won’t even believe it!

=>you would have to wonder if the Fed and the media are going to try to bring down the economy

That would create a ‘national emergency’ so dire there would be ‘no choice’ but to suspend ‘elections’.

Numerous other ‘national emergencies’ have already been engineered just in case. Select your brackets and place your bets.

I find it ironic that WWII internet camp fencing is being recycled for the border wall and kiddie concentration camps. Don’t you?

“I find it ironic that WWII internet camp fencing is being recycled for the border wall and kiddie concentration camps. Don’t you?”

Unamused, i find your typo slip of “INTERNET” camp fencing delightfully un-ironic and right on point.

“I find it ironic that WWII internet camp fencing is being recycled for the border wall and kiddie concentration camps. Don’t you?”

Actually, that concertina wire is gleaming new and top-quality, which is why enterprising Mexican thieves are already re-purposing it.

Unamused and Kitten Lopez,

I don’t think President Trump is going to suspend elections anytime soon. If anything, he might go ahead and cancel the national emergencies started by President Obama.

And those kiddie concentration camps? Those camps were started by previous administrations. The press only hit those kiddie camps on the current President because they don’t like him.

Been doing it for old tech like Oracle, Cisco, Microsoft, IBM for years. Who knew the Soviets actually knew what the heck they were doing.

The New brave world of the Cash Burning Machines brought to you by the lax and half asleep “ Securities and Exchange Commission “. With the really ( rapidly balding Eagle)! .

Thank you Wolf , the article is oozing choice words that few ( Economic reporting bots) in the MSM needs to learn,

Uh , that and the scrutiny that is so lacking in our institutions.

Keep up the good work.

=>Cash Burning Machines brought to you by the lax and half asleep “Securities and Exchange Commission “

You have it backwards. The SEC is sponsored by half-asleep CBMs. They were up late celebrating.

Privatisation works.

I remember when an IPO had a thirty day lockup period, and you couldn’t short the stock either for thirty days.

My guess is that you’ve never written any billion-euro options.

Our captured, complicit regulators and enforcers aren’t “lax and half asleep,” or criminally negligent like some would suppose. They exist for the sole purpose of giving these fraudulent markets an unearned veneer of legitimacy to make it easier for the Wall Street grifters to separate the retail investor muppets from their wealth and assets.

Point taken, but if you’re gullible enough to take a gamble on a money-losing ‘unicorn’ well, you got it coming.

I’m gradually coming to the belief that these unicorns without any future hope of profitability are not a fluke, they are intentional.

– Trillions are spent by VC, PE.

– This money keeps employment and salaries up (for Tech at least).

– It also keeps the stock market and real estate market going.

– And those who held stock before the IPO generally do well, as long as they get out early. And the only reason investors are pressing for IPO is so that they can beat a hasty exit.

The only losers are those who buy the stock after IPO.

Do you think there was any price manipulation going on during the first day of the Lyft IPO? If so, they should be ashamed of themselves.

Maybe it’s time for Hillary to go “talk to those guys” on Wall Street again.

Bobber

The whole market is a concoction of manipulation forces, ( we know that)!

The hedge funds , the pension funds ( overseas ones and local) , various large investment banks, investment funds, ( every one who play the current market games is supposed to know that at least).

What I am trying to speak to here is :

( fantasy and conspiracy theories aside)

is one part of the government regulator , the part tasked with overseeing the process of facilitating new companies entrance to the market ( IPO) ,

should be more scrupulous and wary of the compounding damage that market is left with when ( ill structured regulation is used to vet the process of entry to the prospectant company) .

In essence what this does and is doing is undermining the confidence of retail investors and paving the road to the Mayhems that lies ahead.

Over the last three decades the government/s have basically given up their role and we’ve reached a point where the damage to the economy will have far reaching consequences for (every citizen of your country) .

The Bubble created by the Federal Reserve, and the clear collusion between the various interests to continue the lies and deception will shortly leave unbearable consequences and dare I say

( POLITICAL INSTABILITY) to the mix , this No fancy or scaremongering Statement, it is the clear lesson learned from the near and far history,

Economic Instability begets Political Instability.

This is one thing we could all do without in this shrinking world of ours. The big Economic Blocks needs to be reminded that they’re Not an isolated ( Japan).

Anything that happens in your neighborhood have major effects on the world markets, and this time the size of the problem will be unmatched and unmanageable.

Every day, every hour we stray into this we’re digging ourselves deeper and deeper into the hole. Extricating ourselves from will require super human efforts.

and a lot of pain.

On the other hand we could joke about it and just pretend it is not happening.or maybe ( call Hillary to sort the mess out!)

Remember NO NATION is immune to implosion.

We have a free choice.

Who’s joking about anything? When Hillary received a question about the last banking crisis during the presidential election, she said she “talked” to those guys on Wall Street about curbing behavior, as if a scolding was a good replacement for regulation. That’s a fact, and it exemplifies the “hands off” attitude politicians have had when it comes to regulating Wall Street.

It was priced at $72 and closed at $78. Spin all you want, that ain’t no 10% drop my bearish friend.

That’s not how an IPO works. Unless you bought on Thursday as IPO buyer, you didn’t buy at the IPO price. That wasn’t a public price. It was a price set by the company and the underwriters. The publicly traded price started after the first trade, at $87.24 on Friday, just before noon. That’s the moment when Lyft became a publicly traded stock. So spin all you want, as publicly traded company, the stock started trading at $87.24 and plunged 10% in four hours.

Leave the explanation on how IPOs work (you’re Not going to convince the “believers “)! :)

Now Wolf, my opinion in the price of Lyft is this,

In all likelihood the Bankers and the ( big stake holders) will keep the price of Lyft artificially inflated to get the “ Boober” IPO from going Tits up!

Once that “ dog’s breakfast “ is served hot , all hell will break loose as the whole “menagerie “ stampede to the doors to save their “ tender “ hide from the harsh reality’s Sun!!

What your take on this?

Media is helping story last night on how Bay Area flight shuttles appeal to those who have $500 and want to reduce a 2 hour drive to ten minutes. Uber is in on the ground floor, haha.

√

how long to find out how much of the selling was done by original founder stock holders?

The ones that run like Forest.

We have a company that burns through money like water through a strainer and the “ company and underwriters” set the IPO price? They must have used common core math to arrive at such an inflated price, or is it pure manipulation? Sounds like it should have been a penny stock.

It is definitely down now… price hasn’t been above the official IPO fix of $72 since that first day. But it’s only down to $70 as of today’s close, and anything can happen.

I am less pessimistic about this one than Wolf is. Most stock IPOs go through a price drop period before some become good stocks to own. But where the value investors will set the floor? No clue.

Uber had better hurry with their IPO before Lyft cashes too far.

Yes, the IPO prices could “SNAP” at any time.

I don’t know about that … SNAP has been rebounding nicely the last few weeks. New highs soon?

gary,

Snap would have to nearly triple to set a new high :-]

Selling concrete ,boring, 10% margins on building useful products,why do it. Burning thru VC and investor Cash using a internet interface , now we are cooking on gas. Performance does not matter in our fiat system. We are in a casino culture and only a disaster will correct it . For a while.The tesla roadster out in space optics is worth another 100b. Telling a lowlife les miserable that you got one on order is sweet. I love this country,we are interesting .

Amazon is the black hole that is sucking every common sense and reason that are trying to reach this constellation of money burning ventures. These companies, their venture capital backers and individual investors all have the Amazon story in mind.

” These companies, their venture capital backers and individual investors all have the Amazon story in mind.”

Then the ‘plan’ should be to wait until the unicorn falls to $7–like, IIRC, Amazon did circa 2008–and back up the truck; not before.

Yes, this is the dysfunction of our economy/business practices today. The ability to float/finance enormous money-losing organizations is a huge change from the past.

Is it fiat money? I don’t know, but without the “belief” that these businesses will somehow return a capital gain to certain investors, it couldn’t happen. The insiders are basically guaranteed their fortunes, so they have no incentive to change this. It will take some systemic melt-down.

Ahhh yes. TSLA. My favorite stock to watch during market hours. It got beaten down to 259 give or take last week and has a stoic fan club that buys each time the obscenely overpriced stock falls below 270-ish. But LYFT? It’s a frickin’ taxi service. How much is a share of HTZ? 40 bucks give or take. CNBS stooped to a new low with its loud and endless crowing of the LYFT IPO. They sounded desparate talking SF taxi service all day.

Around March, 2000, 3Com spun off its Palm subsidiary which produced personal digital assistants, the big thing before smart phones. At the end of its first day of trading, Palm had a market value of $50 billion. Then came the Dot.com bust in which Palm lost most of its value and never recovered.

Oh man, you are showing your age with that comment. What is 3com? And what the heck is Palm?

Next you’ll be telling me that there is a company named US Robotics. But it didn’t make actual robots.

Bah, all this manufacturing stuff is old school, we are in the Information Age, where data is everything. Couple that with the sharing economy, who needs manufacturing, let the people in Asia do those kinds of low wage, low skilled things.

Sorry, feeling just a little sarcastic today.

Yep – you only need to look at the disaster of the Chinese economy for the last 30 years to see how ‘old hat’ manufacturing is; we do ‘talking’ now, it’s much easier than having to clean grime out from under one’s fingernails (yeww!).

Those Chinese really do need to keep up with our burgeoning tattoo parlors and coffee shops here in the decadent west – they should knock down a few of those silly ‘factories’ (LOL!) to make some space.

@MD

Kind of funny you should mention how brilliant the Chinese are with their substantially larger ponzi finance scheme. Not that I disagree with your conclusions about the modern US tech industry, it is very much about pump and dump schemes. But it’s a far more global and systematic issue than I think many realize.

Yeah, and it’s also “funny” to think of how often the first generation of those “silly’ Factories'” in China were filled with machines shipped piece-by-piece from the United States.

Not so “funny” to think of the economic, social and political consequences for the average American, though.

So MD, assuming you had to invest $1M long-term (say, 10 years) in one and only one country (spread any way you want in that country’s businesses), would you invest in the USA or China?

Anyone remember Netscape Communications Corp?

“On August 9, 1995, Netscape made an extremely successful IPO. The stock was set to be offered at US$14 per share, but a last-minute decision doubled the initial offering to US$28 per share. The stock’s value soared to US$75 during the first day of trading, nearly a record for first-day gain. The stock closed at US$58.25, which gave Netscape a market value of US$2.9 billion. While it was somewhat unusual for a company to go public prior to becoming profitable, Netscape’s revenues had, in fact, doubled every quarter in 1995.[25] The success of this IPO subsequently inspired the use of the term “Netscape moment” to describe a high-visibility IPO that signals the dawn of a new industry.[26][27]” Taken from Wikipedia page on “Netscape Communications Corp”

Both that Wikipedia page and the one about the Netscape browser are worth reading…IMHO.

Sure we remember Netscape. Mosaic/Netscape browser writer Marc Andreesen is a principal of Andreesen Horowitz, one of the VCs underwriting a lot of unicorns (apparently not involved in Lyft, though).

Netscape, the company, is now Mozilla Firefox.

Netscape the stock, is i think now mostly a part of TimeWarner cable

Would say that both are successful.

Pssst.. don’t tell anyone, but I still have my Palm Pilot stuck in a drawer, and with new batteries it still works!! It will still store names and addresses that I have to manually input. I just trust that it will reappear as a viable device some time soon…..just like I believe my $87 Lyft investment will generate huge profits some time soon………

At $87, at least it isn’t a big risk… heck, you could have splurged and bought two shares.

Speaking of Palm, I have this old thing from HP from way back called the iPaq, remember those. If they only changed the name, they could have charged Apple a bikini for the naming rights.

For a proper comparison to understand how the world has changed, how telecommunications and digital technology has adjusted how people go about their lives, you don’t have to go back too far. No mobile phones, digital watches where that chunky look was obligatory, international phone calls with seconds of delay each way. In those days everything was about the person, about being there, it all counted. Now? Now it is all faster, but somewhere else and more trivial, platformed where everyone is starring in something they know little about beyond being provided a reflection of themselves that seems attractive. Even those that use this technology for maximum effect are often like insecure radio operators directing a platoon into a void. No wonder so many are pegged to their screen waiting for some kind of result, or tied to their phones so as not to miss the detail that could explain it all and justify their own behaviour.

regarding: “Bah, all this manufacturing stuff is old school, we are in the Information Age, where data is everything.”

I was having a chat with my son yesterday about this very topic. We were also talking about kids apparently declaring themselves trans gender in grade 4, self – declaring what bathroom you should use, self driving cars, etc. I am currently re-reading several books on life in the late 1700s and early 1800s, when society was rigid, corrupt, and there was no chance for social mobility. Yet, many people knew latin and studied classics because there was not much else printed. 12 year old midshipmen learned astronomy and trig. My mother learned latin in high school in a very poor New Brunswick farm village, (1930s). We compared to modern youth of the ‘Information Age”, who with every electronic iteration are dumbing further and further down until they have finally reached the point of not being able to ‘grok’ an analogue clock face or make change with real money.

Our conclusion/question. It’s now all ones and zeros. It’s all done with a simple on/off switch. Such is data. If this continues people will be living lives of pupae. Why?

Some kind of reset is coming. Unfortunately, it will most like be preceeded with a rapid and automated war.

Now, off to let out the chickens and toss them their scratch; open the night time elk gate. Today, we are going on a picnic and hike will indentify some birds and look for bears on the estuary. Bah humbug data and consumerism. :-)

Today there is an “App” for all those that you mentioned….LOL!!

Today life is all about the “distracted human”………..stumbling onto streets and down stairs, killing others on the highways…..Yes, today there are “apps” for too many things……We are rapidly loosing our humanity.

As for the “markets” they are now totally dysfunctional, disoriented and headed for the abyss……….

I have grandchildren living in the Bay Area and use Lyft/Uber all the time……I may not agree with the concept but, it is working for many.

I can’t let the trans gender remark go without comment. It appears it is now a fad and cool to be doing this and it is starting in grade and middle school. We have seen some crazy fads in the past, but this may be the mother of all fads.

=>My mother learned latin in high school

Cogito ergo doleo. I think, therefore I am depressed.

=>Some kind of reset is coming.

Reboot it this time and it’s likely to just beep at you and shut down.

In the 60s rebellion meant long hair

In the 80s it was purple hair and nose rings

In the 00s it was tattoos

Now in the 2010s, there’s nothing left to shock parents or society. Purple hair, tattos and 28 piercings? Meh. So kids have to push teh envelope more and more. And declaring yourself a boy/girl when you’re actually a girl/boy is the new rebellion for today’s kids.

I could care less if someone proclaims themselves gay or straight but cornering kids at a young age and pushing them to decide which they are…when hetero is the norm and how we evolved…makes me just a little pissed. let kids be kids.

Option 1:

China makes socks, trinkets and cheap plastics. We make Google, Amazon, Microsoft, Netflix, Salesforce.

Option 2: We make socks, trinkets, cheap plastics

Why do so many people want Option 2? It’s mind boggling.

How many socks and trinkets do you need?

But option 2 doesn’t exclude keeping GoMaCroNetSales, maybe some would prefer that the original companies kept to what they were good at though, instead of acting as cash funnelling social fixes.

JSRG,

Au contraire.

China manufactures almost all the cellphones, including those thousand dollar iPhones, and most of the solar panels manufactured on planet Earth

The vast majority of TVs and laptops and server/desktop computer parts are manufactured in China.

China is a major supplier of strategic metals like titanium (which the US NEVER developed a manufacturing capacity for, choosing to secretly buy it from the Soviets during the Cold War), as well as numerous rare earths essential for the electronics industry

Within the next five years, esp if Tesla goes belly up, China will be the dominant world manufacturer of electric cars.

No, the US chose to de-industrialize and allow Wall Street profits and political vote buying to drive decisions about which industries to pursue and keep.

China made different, more long term strategic choices

JSRG,

…. continuing this line of thought, did you know that the US is the THIRD largest producer of COTTON in the world? We even export cotton to China! Or did, before the trade war anyway.

This is because we have gianormous cotton harvester combines that allow one worker to do the work of 1,500 workers (yes I looked up the numbers) AND the USG subsidizes the industry with price insurance grants.

So THAT is where your tax money is going, and that’s why Small Town Rural America no longer has jobs for all those God fearing small town Americans, and that’s how meth and alcoholism and crime invaded once idyllic Mayberry RFD

“China is a major supplier of strategic metals like titanium (which the US NEVER developed a manufacturing capacity for, choosing to secretly buy it from the Soviets during the Cold War)”

True, but that was pretty damn smart. The Soviets had titanium but couldn’t find a use for it or how to use it; we invented new techniques and built the Blackbird. Who won that round?

My first contact with hi tech was an IBM 029 punch card machine. The computer language was Fortran IV and the mainframe computer that processed the program was an IBM 7094. The behemoth was kept in an air conditioned room and the turn around time was next day. How is that for ancient, at least by computer standards?

And do not ‘Fold, Spindle or Mutilate’ that card.

Might be time for LYFT to deploy there air bags. Is there any truth in the rumour that Penn and Tellar are company directors great illusionist that they are? Berny Madoff must watch this and cry how, easy to make a killing and not have to wear a pink jump suit.

It’s going to be b great sport watching govt / MSM damage control on this when it all comes apart.

For over a decade now there has been/ arisen an entire subculture / media infrastructure that not only saw IT coming, but has been explicitly documenting it every step of the way.

Thanks again Wolf

Lyft’s goal is to be bought out by Uber. Uber’s goal is to be bought out by Google. Google’s goal is for search ad revenue to subsidize a fleet of autonomously driven cars and trucks powered by their A.I., data, and satellites.

You’re not that far off.

My goal is to keep my 2002 dodge 2500 4X4 running another year way out here in the high mountain rockies God country and never, ever have to see either a lyft nor an uber. Deer, elk, cougar, black bear all are fine. Bobcat too. Even skunks. But Uber? I;d shoot it upon sight.

Why would GOOG buy LYFT? The whole ‘ride-sharing’ premise is based on autonomous cars replacing drivers–the main cost center for ‘ride sharing’–and Uber’s crashed and burned (I haven’t heard of LYFT even making an attempt). If anybody perfects autonomous vehicles, it will be GOOG; they can write their own apps to schedule the vehicles.

People waiting for true autonomous vehicles to save impossible business models are out of their collective minds.

I will gladly confess I am wrong and publicly change my opinion the moment I can get into a driverless car… that will get me through the center of Amsterdam on a rainy Friday afternoon and will go find itself a parking spot after having dropped me off in front of my home.

Until that time I consider all talk of autonomous cars as so much hype, more inspired by wishful thinking than technological awareness.

Agreed, My solution when I was in Amsterdam was Tram, Umbrella, walking. I think my approach will still be in use 20 years from now.

$30 billion dollar valuation for a company that lost over $900 million last year?

Rational thought and critical reasoning certainly have left the building. Would the last person out please turn off the lights?

We seem to be witnessing the return, in different form, of the irrationality which preceded 2008.

Back then, MBSs, ARMs, SPVs and the rest of the alphabet soup seemed normal, if not exactly rational. After the GFC, of course, everyone looked back and said “but that was crazy!….”

This time, the fashionable imbecilities are different, but at least as striking.

One such imbecility, obviously, is handing huge amounts of capital to cash-burners, even though everyone surely knows where this ends.

A second is using debt to eliminate equity – buy-backs may be fine for handing excess cash back to stockholders – but buy-backs to hand them debt?

A third imbecility is the assumed Fed rescue for every excess.

Are we seeing the first draft for the “told you so” books after GFC II?

You think stocks like Lyft are bad. Just wait until the Federal Reserve gets rights to buy equities. You’ll see a lot more pigs get dressed up for the Fed’s pen.

“ludicrously huge valuations that have been surgically removed from all reality.” I think you may have written the epitaph for the age. Everyone who has ever read a book about the Great Depression or other historic bubbles has come away with the notion that those people were stupid unlike us moderns secure in our rationality. When this Age of Debt ends it will take down all of the cash burners along with their delusional true believers.

The lack of vision here is astounding. Lyft is going to make a killing. Once the next downturn hits drivers will work for much much less than now and there will be no shortage of customers as so few will be able to afford a car. Then … presto – massive profits.

Plan B for if autonomous vehicles don’t quite make the grade, a chauffeured fleet where a subemployed society takes turns at driving for each other ?

That explains the cash burn, nowadays you have to pay people to hitch-hike, before it cost nothing.

lack of “vision”???

next downturn will make drivers take even LESS of a cut and no one can afford cars and more CUSTOMERS for lyft???… presto.. “magic” profits…

ew….

A little sarcasm?

Almost all of the stock in IPOs are allocated to funds and large traders. Individual investors get a token amount if they are lucky, so if they want to participate they do so via buying the stock when it starts trading. In LYFTs case the stock opened above 87 and traded down all day.It was also down almost another dollar in the after market.And who is selling these individual investors stock?. The funds and large traders who received stock in the IPO at $72.And this is hardly the end of the selling. Insiders usually have to agree to a lockup period ( usually 6 months) before they can sell any of their stock. So watch out in Sept and beyond where more supply of stock will become available.

You must have gone long at $86 and change a share…..

“… few will be able to afford a car ..”

No problemo. 120-month car loans anybody?

There were two main reasons for the growth of Uber, LYFT and other ride sharing services.

The high cost of taxi rides and the delay and difficulty in getting a taxi.And what is a primary cause of both of these factors. The decision by cities to issue medallions to raise money and the associated decision to sharply limit the number of medallions issued. By sharply limiting the number of medallions, the city was guaranting that there would be delays in getting a taxi.By sharply limiting the number of medallions , the cities were creating a situation where medallions would become investment vehicles, resulting in speculation driving up the price of medallions . Because most of the actual tax drivers could not afford to buy a medallion, they were forced to lease their medallion, at prices that rose as high as $7,000/ month. Of course these lease payments were reflected in the price of taxi rides

Now the price of these medallions has crashed with the market for medallions frozen in San Francisco.

By limiting the granting of medallions back then, cities were also avoiding physical violence among starving drivers competing for fares, in markets over-saturated with supply.

That’s the actual origin of the taxi medallion system, an imperfect way to ameliorate the chaos that a “free market” guarantees.

It’s no accident that our current form of neoliberal capitalism would give rise to companies like Uber and Lyft: an explicit part of their business plan, like the system itself, is to eliminate regulation of monopoly interests.

The monopolies (taxi fleet owners then, Uber et. al. now) are still there, it’s just that increasingly no one even bothers to pretend to place some controls on them.

Your argument may be true when medallions started in the 1930s,but it holds no water in recent years. The medallion system resulted in a politically powerful lobbying group , who had/have a large incentive to artificially limit the number medallions , despite obvious evidence that consumers would be far better off with more medallions.

Perhaps, but it’s also true that Uber and its ilk seek to saturate the market and drive down wages (and destroy local mass transit, as well) so that they can eventually impose monopoly pricing.

Hopefully, na ga happen, but that’s the model…

And did you ever consider that workers are also consumers, so that by destroying drivers’ ability to make a halfway decent livelihood – possible then, out of the question now – “consumers” are ultimately screwed, as well?

Every single comment I read about Lyft on youtube before the fact was correct. Not one comment stated the stock would finish higher on IPO day.

Reminds me of the government, when they run out of other people’s money they raise taxes, again and again. The only difference is, when a company like this runs out of money, fools gladly give them money to keep the mucky mucks living lavishly.

Which government are we talking about here?

Because the US government will never run out of money. The USD is the American governments money, it is not “other peoples” money, that is obvious since only they can print it and not everyone else can.

Cutting all the way to first principles, Taxes exists not as a source to fund government expenses but instead to force people into working in order to acquire the USD issued by the US government to pay their taxes with.

Being the only currency to pay taxes in, is what makes the USD valuable.

That system is older than Jesus. No way that is going away soon.

re: lack of vision

The yuutes don’t drive anymore, since driving means being unglued from Twitter for more than 15 seconds. And I’m only exaggerating a little. But the general trends are showing young people don’t want to drive. Plus with the Green push toward getting rid of cars – or if not outright banning them, making them prohibitively expensive for the masses – Lyft and Uber will be printing money over the long run.

Seattle has embarked on a policy of making the city car free. This includes removing parking spaces, imposing congestion pricing, etc. And soon enough every major city will do the same. Paris and many other Euro cities have instituted bans on cars in the inner core.

The long game is to force people in urban areas to look for alternative forms of transportation to owning a car. And what company will be there to take advantage of it? Uber and Lyft using autonomous cars, that’s who.

$900M loss today is a pittance compared to what the future will bring for them.

That is a side to it that I notice as well, but for urban settings and society mostly. I am not sure that the effect of that would be enough to give these companies the valuation they expect though, for now how transport evolves or not involves a lot of speculation I think.

Except Lyft, Uber, and the tech young people use today is likely a fad. Also, cities moving infrastructure from the inner core isn’t going to work in the long run because people will start to drive more in their own cars. They will have their own families and will need to transport their own kids.

Except a) Young people aren’t having kids anymore. The birth rate is plummeting. And in urban areas the birth rate is virtually non-existent. Try finding a kid in San Francisco. And b) there won’t be personal cars in big cities. The left, which controls cities is moving towards making driving a thing of the past. The Green New Deal will be a reality within a decade.

Other than my two urchins there has been only two other chilluns on my block since 1990. I called to my wife to note that I saw children two blocks down, but they never appeared again.

Please don’t confuse the real estate-dominated liberals who are elected in cities with actual Leftists.

The US hasn’t had a real Left in many years.

Yup. Apparently, the yutes are getting married and making babies. Ride-sharing is too unpredictable to get the kids to soccer practice reliably.

Get away from the Urban Nirvanas; everybody still drives everywhere.

That is the result of explicit government policies that encouraged suburbanization (initially just for white people, since early suburban projects like Levittown had racially exclusive sales covenants) and road-building, all at the urging/lobbying of “growth coalitions” made up of banks, realtors, the auto companies, civil works contractors, builders, etc.).

Not that we should expect it, but government could also enact policies that discourage low density development and automobile dependence, and instead facilitate mass transit.

If urban areas grow as you say, and people have less need for transportation, why does that help Uber/Lyft? Less transportation demand means a shrinking pie for all players in the industry.

Also, when things go autonomous, which everybody says will happen in less than 7 years, why would Uber/Lyft run the show as opposed to Google, Tesla, major auto companies, or the next rising star? The typical mistake made by start up investors is failing to appreciate future competition.

Did somebody say Uber/Lyft have only 10% of the market and therefore have huge growth potential? That doesn’t seem right to me. I can’t think of anybody who doesn’t use them in Seattle right now. I rarely even see a traditional cab anymore. I think they have lots of market share, and they still can’t make money.

I’m sure there’s some additional market share to be gained in retirement areas, like Florida and Arizona, where technology is shunned.

This latest IPO stage reminds me of the dot.com bubble. Overvaluation for crap companies. It must the end the this cycle as Wall Street pushes idiots to buy before the collapse.

So right. I was home for awhile this AM, had CNBS on and was laughing and groaning at the hype and glitter the talking heads were devoting their time to to dress up a pig snout SF based taxi service.

My suspicion is that it will get worse this time around as the percentage of money gone into passive index funds is much higher now. this means not may sellers aiding price discovery which in turn means bubbles will blowup higher and crash further.

A lot of the above comments reference the overall abstraction of our world now versus a generation or more in the past. I have always found the last chapter of Dostoyevsky “Notes from Underground” an appropriate harbinger of our current and future time:

“…and what

matters most, it all produces an unpleasant impression, for we are all

divorced from life, we are all cripples, every one of us, more or less.

We are so divorced from it that we feel at once a sort of loathing for

real life, and so cannot bear to be reminded of it. Why, we have come

almost to looking upon real life as an effort, almost as hard work, and

we are all privately agreed that it is better in books. And why do we

fuss and fume sometimes? Why are we perverse and ask for something

else? We don’t know what ourselves. It would be the worse for us if

our petulant prayers were answered. Come, try, give any one of us, for

instance, a little more independence, untie our hands, widen the

spheres of our activity, relax the control and we … yes, I assure you

… we should be begging to be under control again at once. I know

that you will very likely be angry with me for that, and will begin

shouting and stamping. Speak for yourself, you will say, and for your

miseries in your underground holes, and don’t dare to say all of

us–excuse me, gentlemen, I am not justifying myself with that “all of

us.” As for what concerns me in particular I have only in my life

carried to an extreme what you have not dared to carry halfway, and

what’s more, you have taken your cowardice for good sense, and have

found comfort in deceiving yourselves. So that perhaps, after all,

there is more life in me than in you. Look into it more carefully!

Why, we don’t even know what living means now, what it is, and what it

is called? Leave us alone without books and we shall be lost and in

confusion at once. We shall not know what to join on to, what to cling

to, what to love and what to hate, what to respect and what to despise.

We are oppressed at being men–men with a real individual body and

blood, we are ashamed of it, we think it a disgrace and try to contrive

to be some sort of impossible generalised man. We are stillborn, and

for generations past have been begotten, not by living fathers, and

that suits us better and better. We are developing a taste for it.

Soon we shall contrive to be born somehow from an idea. But enough; I

don’t want to write more from “Underground.””