The trend is becoming clear.

Blame surging home prices that have outrun wage increases for years, mortgage rates that have risen to the highest level since 2011, the massive affordability issues that come with those factors, and now Wall Street’s resurging appetite for single-family homes that then appear on the rental market:

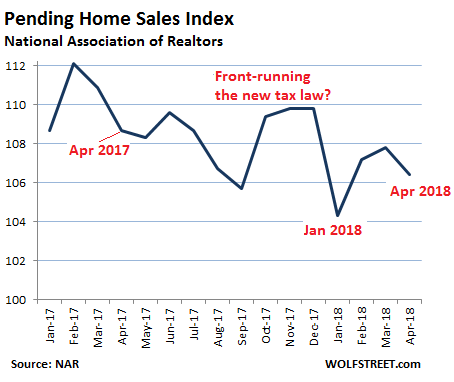

In April, pending home sales fell 2.1% from a year ago, according to the National Association of Realtors this morning. It was the fourth month in a row of year-over-year declines. The data is volatile, but the trend is starting to become clear:

The index, based on a national sample of the transactions handled by the NAR’s members, is a leading indicator for actual sales. It takes into account sales of existing homes, and not of new homes. A sale is listed as pending when the contract is signed but before the transaction closes, which usually happens within a month or two.

The Pending Home Sales Index fell in three regions and rose in one, compared to a year ago:

- Northeast: -2.1%

- Midwest: -5.1%

- South: +2.7%

- West: -4.6%.

The report blames inventory of existing homes listed for sale. “Feedback” from the NAR’s members indicated that “demand for buying a home is very robust,” the report said. But…

The unfortunate reality for many home shoppers is that reaching the market will remain challenging if supply stays at these dire levels.

However, it all comes down to overall supply. If more new and existing homes are listed for sale, it would allow home prices to moderate enough to stave off inflationary pressures and higher rates.”

“Supply” means supply of homes people can afford.

The plunge in January pending homes sales (chart above) was also blamed not only on supply but also for the first time on “the sudden increase in mortgage rates.” And mortgage rates have increased sharply since then. So this situation hasn’t gotten any better. But mortgage rates aren’t high enough yet to sink the market, they’re only high enough to keep some people out of the market.

So why are there seemingly so few homes for sale?

Even in the hottest markets, such as San Francisco, there is plenty of inventory for sale, but much of it is high-priced and difficult to reach for average buyers. But that doesn’t mean they aren’t trying.

Then there’s new construction, particularly of condos: New-construction inventory doesn’t show up in the inventory-for-sale data, which is based on MLS data, because condo developers have their own sales offices and normally don’t use MLS.

And Wall Street is once again scooping up single-family homes to put the on the rental market. Single-family home rentals are booming, and rents are rising, even as apartment rents have come under pressure in may major markets from an onslaught of multi-family supply.

Last year, Wall Street firms bought over 29,000 single-family homes, concentrated on a handful of markets, the most since 2014, Bloomberg reported earlier this month. This is a scheme that was launched in late 2011, with PE firms such as Blackstone Group using cheap funding and buying up homes out of foreclosure. These entities became the nation’s largest landlords that have by now mostly been spun off into publicly traded REITs. They developed a new structured security with which to fund their purchases: rent-backed securities. The peak year of purchases was 2013. Then purchases fell.

But now they’re rising again – in 2017 to the highest level since 2014. Among the largest buyers last year:

- Cerberus Capital Management bought an estimated 5,100 houses.

- Amherst, via its subsidiary, Main Street Renewal, bought about 4,900 houses.

- Tricon, the third-largest publicly traded single-family landlord behind Invitation Homes and American Homes 4 Rent, bought about 850 houses.

And this trend is continuing, fired up by strong rental demand for single-family homes and by cheap funding methods available only to large firms, including rent-backed securities and a still easy bond market. In investors’ minds – both, those that purchase the debt and those that purchase the shares of the REITs – the buy-to-rent scheme has turned into a proven global asset class, and this creates more demand for those investments. And the homes are pulled off the for-sale listings are appear on the for-rent listings.

Here’s the impact of rising mortgage rates on home buyers, and on the market, in dollars and cents. Read… What Will Surging Mortgage Rates Do to Housing Bubble 2?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I get lots of email from various housing auction vendors with listings from all around the country. It feels a lot like 2006. Is anyone else seeing that, and how does it rhyme with CalculatedRisk blog constantly claiming that the default rate and foreclosure rate are still dropping? Are these auctions not REO (meaning: already foreclosed) properties? Would love to see an investigation on what’s the back story on all these auctions. And what properties are Wall St buying? It can’t be properties listed on the open market, can it?

Here is the link to the CR foreclosure stats. I should mention that I have all but given up on CR, who seems now to be completely unable to spot any form of bubble. CR also closed down the comment section, so nobody can disagree.

http://www.calculatedriskblog.com/2018/05/mba-mortgage-delinquency-rate-decreased.html

I agree about CR losing credibility…the author there alsp let’s his anti-Trump bias seep into some of the articles

The Ben Jones Housing Bubble Blog has been chronicling Housing Bubble 2.0, and the comment section is always enlightening.

http://thehousingbubbleblog.com/index.html

I would be careful betting against McBride. He has lived and breathed housing trends for over 40 years.

Moreover, i remember when he was bearish for a long while against the grain, circa 2003-2007.

Unless you are actively shorting always better to be a early bear than a late one as long as you are not to early.

We blew the whistle on the US Market as untenable early 02 we were amazed they could keep NINJA flipping going as long as they did. But then when the SHTF we didn’t loose or need to bail out any banks either.

5 years is not far out when trying to predict where a Heavily Goosed Market will go and when .

> CR also closed down the comment section, so nobody can disagree.

CR closed down his comment section because it was taken over by Birchers and professional trolls.

In the first great depression they destroyed the family farm, the current depression will end the family home

Ambrose, Astute observation. In my area (San Diego) I see lots of homes on Zillow with the sale history indicating that these homes are often ‘back on the market’ meaning there are lots of buyers out there that can not qualify.

Most homes here are listing in the 600-800K range. Another bump or two in the Prime Rate will surely have a significant effect. For those that have been quietly waiting on the sideline it will be sorely welcomed.

A/C, I pulled title on recent purchases in Normal Heights, Golden Hill, North Park, a few other hip neighborhoods. The vast majority of loans (>90%) were <5% down, with the majority of those being 0% down VA loans… these are the easiest underwriting standards of any home mortgage product.

This high leverage doesn't usually end well, as these people have no skin in the game to fight for.

The Family Farm was mortgaged to the hilt going into the GD. My shrewd great grand father sold his ranch immediately after WWI and opened a machine shop because he knew what was coming. End of the war meant a return to low farm prices followed by farmers taking on increasing debt followed by bankruptcy.

The next one to fall is family because can you really have a family if you don’t have a “home”?

Gilfoyle from Silicon Valley said it best: “it’s a war of everyone against everyone.”

Ambrose, “they” didn’t destroy our family home or our farm.

We just went “outside the box” forty-one years ago, bought a mountain boundary in WV, built our house and have raised cattle, timber and other stuff on a small scale, ever since.

My son has done the same, starting about twenty-five years ago. Both of us have used off-farm income and/or retirement assets to supply liquidity.

It can be done today. You just have to be determined to do it.

You surely aren’t comparing your experience to the Great Depression?

Nope. I’m pretty sure Ambrose included a reference to the “current depression” and RDB responded accordingly, with his usual grace and honesty, and with clear reference to a period beginning four decades after the Great Depression.

And please don’t call him Shirley.

Blakeslee Thats called self sufficiency and old fashioned elbow grease I’m a big proponent of just that Keep up the good work sir

PS I bet your steaks are to die for

Yes anecdotally, though none of it reflects the social reality. Steinbeck said, “The tractor is no different than the tank when it drives people off their land.” There is nothing fundamentally wrong with the word “corporate”, it implies cooperation, and nothing wrong with finding your rock and standing on it, though it is not the same thing. The depression was an economic policy which destroyed the (global) social fabric, and led to the second war. The current economic policy is no different.

“The depression was an economic policy which destroyed the (global) social fabric, and led to the second war.”

The Depression started in the 1931 with the collapse of Credit-Anstalt. Before that it was a recession

WW II started in 1919 before the ink was dry on the Versailles Diktat.

It just took another 20 Years (not including Spain) for the shooting to start again.

And you must be willing to do something a lot of others are not these days. Work.

In our Town we would call you a queen street Farmer.

If there is good work in town you take it when there is no work if you looses your job, never mind, plenty to do at home.

The trick with that lifestyle is to not get into a situation where you MUST HAVE the outside income.

The reason the supply of homes for sale is small is simple: everyone that either bought in the last 3 years or refinanced in the last 3 years got a 3.50% 30 year fixed rate loan. Who is going to give up this fully amortized no balloon way below market rate loan? Thank you Fed officials for creating the lowest below market rate bubble in history. Unfortunately all the corporations that borrowed with these below market rates have variable rates, not 30 year fixed and they will have hell to pay. Again thanks to Bernanke and Yellen.

No, the folks who bought the rent-secured derivatives will take the losses – as will lower-level employees. The big shots will cash their bonus checks, found new companies, buy up the old company’s underwater houses at auction, and start back up.

When there is nothing else for wall street to generate returns, they will rent squeeze the working class. What saddens me is that even later on, when everything goes bust, like you said, the “investors” will take losses. What will be different that time is that the homes will no longer to sold on the market one by one. They will be bulk sold through the REITs to the likes of Warren Buffet. There will be NO real estate “retail” market. It will be “while sale” real estate market for residential like the commercials today. Financialization on everyday necessities and rent seeking.

From personal experience in my neighborhood many of the homeowners that do relocate keep their house and rent it out to take advantage of the loan mortgage rate on the property. Rentals in the neighborhood have more than tripled the past few years.

it’d take a wide scale recession and job loss for the home prices to go down.

I see thousands of homes available on airbnb even for a smallish city..

Hang on, then. With the trade war beginning today, China and India buying Iranian oil with petro yuan, Canada soon to be exporting oil from a west coast port to China… Russia and China stacking their ducks in a row, you might soon get that cheaper house coming available.

This is not going to end well for the US and the World economy. I see a real war on the horizon just in time for ‘allies’ to sit on their hands. I grew up on stories about the Great Depression and those stories had a great deal to do with how we built out our life, (much like RD). But there is now a big difference. When my folks went through the Depression they lived in a farming community and had lots of food. They had no debt. My Dad often remarked, “We always had lots to eat and do, we just didn’t have any money to buy anything”. I don’t think that applies these days to much of the population in any developed country.

The trade war and a NK talk collapse will start the snowball rolling. Surely, this insanity and lurching from one crisis to another cannot continue. It’s crazy.

note to self: fill oxy/acetylene tanks and buy more welding rod. renew stock of fasteners. buy a chunk of gill net. buy popcorn. need new bike tire. :-)

I work out of Santa Rosa ( ( I mostly handle country properties in West County) and although our office only closed 8 deals in the last week it was interesting to note that only two sold for the list price while 6 sold for 2-5% less than the list price.

This tend has been showing up for about 6 weeks as we enter the height of the selling season.

Tom, I’ve been following houses in the PHX area on Redfin since last fall. In the same time period you mention, the last 6 weeks or so, something shifted. That is about the time I started seeing the DOM increase, I started getting notifications of price reductions and I’m seeing an increase of homes back on the market after being in escrow. Prior to that the homes that I followed would sell in less than a week, often for more than asking and there were pretty much no reductions or back on the market listings.

Wolf what does the South got that’s the only place with positive numbers?

Are companies going south for better tax deals or what? Baby boomers retiring wanna move there? Or what?

Also the 00s generation, aka those born in 2000, are turning 18 this year. And their job prospects just suck.

Or what … better tax deals? In my home southern state it is no taxes. Boomers retiring wanna move there … you bet. Low price housing, good supply, property taxes so low they look like a typo. Move here from the Northeast and you property tax savings will pay a large chunk of your mortgage. Move here from California and it will look like you hit the mega jackpot. No taxes on defined benefit pensions and no taxes on social security earnings. Moderate climate = lower utility bills. The newcomers are moderating the red neck influences …..

Nice weather. Nice people. Available jobs. Lower home prices. Lower taxes.

These wall street outfits are pumping their own bubbles again???

They are IPO or hiving off and selling their reits the reinvesting the same capital rinse Etc.

Perpetuating the bubble as they dont really care what they buy at, as long as they can profit in their time frame.

If they get caught in a big down move they can simply hold until they have written all the losses against tax whilst holding up rents.

It only becomes a problem, when housing is their only income stream.

is there a concurrent rise in property management companies? buying single family homes for rental is not exactly a slam dunk

Yes, there has been rise in property management companies.

Also, there has been dramatic rise in full service property management companies which can manage your property for short term rental e.g airbnb etc. Examples are: vacasa, turnkeyvr etc.

Equity Locusts from NY, MA, NJ and CT are helping to bring down the quality of life in my small state. There seems to be no end to the stupid money

Begbie Didnt they used to be called “ Carpetbaggers” ? I like “locusts” though

“locusts”

Was originally a term used by Hong Kongers, to describe CCP Mainlanders, who came on visitors permits, and brought all genuine luxury goods on Sight.

Dealing with a Busload of them, was a terrifying experience..

If I were a millennial shut out from the job market, housing, and straddled with the debts of boomers, I’d buy an RV and park it on the streets of a wealthy neighborhood, perhaps Janet Yellen’s neighborhood. You’d have to move it an inch every day to be legal in most cities.

Only do that if you want to discover what the inside of the local jail cells look like. The wealthy are not interested in having the hoi polloi cluttering up their neighborhoods. They have more than sufficient influence over their local police force to have you forcibly discouraged from parking on their street.

If you don’t take the hint, or the outright orders to move, you will be arrested and hauled away. Read “Animal Farm”….all animals are equal, but some are more equal than others.

I have a feeling that Wall Street is more interested in the (potential) capital gains from their residential real estate gambles and don’t desire to be in the landlording business for the long term. “Total return.”

I rented from a mega landlord in Florida for one year. It was hell. The house looked nice when we did the walk through but it had a multitude of problems, including known code violations. The reputations of these landlords are terrible. Just read the reviews online. I can confirm that most of the reviews are extremely believable. I would never rent from any of them again and I would definitely never buy one of these homes.

I think rent control is just around the corner for all these guys. I’m surprised that there hasn’t been a class action suit against them already.

Wall Street’s purchasing of single family houses has NOTHING to do with rental income and everything to do with keeping housing prices propped up. This is all Fed/Treasury manipulation of housing to keep it elevated. Similar activity in stocks, rest assured.

The fact that they are ruthless in renting is not surprising. But again, their buying houses in selected markets has everything to do with keeping prices up. The buying will increase and widen if housing stalls.

Sounds like a Netflix, Tesla, WeWork model. But if they want to keep it propped up, great! management firms and labour will gladly take their money; the socialist REIT/company , borrow from the fed and spend it. And as someone else pointed out, just LBO it, kill it and buy it back for cents. But its still lost capital! Which always spirals into “leaving the tax payer to foot the bill” Everyone, just trickledown!

I’m doing my part, living in my van in Seattle, I pay zero in rent while siphoning off the pay from one of the regions jobs – I buy only groceries and plan to spend, what is not stolen via inflation, in a Latin American country. Almost nothing I earn will be spent in this country, including social security if the clowns are still tossing that candy from the parade float by the time I retire. Cerberus can take their homes for rent and jam them up a black hole.

Hey Van Great plan by the way I’m collecting mine living on the SW coast of Turkey(Marmaris) and my total cost of housing with all utilities is under 200 dollars a month It’s a brand new two bedroom about a mile from the Med Living on east or west coast of US is so over rated In my opinion anyway

Some numbers from Oz in regards to RE in the mornings online newspapers:

1. Melbourne House prices

The median house price has grown by 98.5 per cent over the past 10 years, from $460,827 to $914,518, according to Domain Group data.

(Rate of return is about 7% a year before costs.)

2. Entry level luxury:

“The entry-level prestige market is roughly defined as being between $2.5 million to $3.5 million. ”

3. The best performing suburbs were near the expensive ones:

“….most of the suburbs that had seen strong growth from $500,000 in 2008 were “second choice suburbs” – those nearby to more blue chip areas.”

4. The highest growth suburb was actually out in the sticks, Narre Warren North:

“….had the highest growth of all suburbs with a median house price between $500,000 and $520,000 in 2008, increasing by 126.7 per cent to $1,170,000 over the decade.”

This is a result of a couple of things:

a. The suburb is largely rural with big acreage blocks and

b. An influx of buyers from China, India, and Sri Lanka.

No doubt that over the next 10 to 20 years the bigger blocks will be sub-divided and sold off making the owners some very good profits.

Unfortunately there is no train station close by and very limited bus service. Shopping is a distance away too.

Examples of properties for sale there are:

https://www.realestate.com.au/property-house-vic-narre+warren+north-128240698

A$9 million

https://www.realestate.com.au/property-house-vic-narre+warren+north-128265650

A$2.6 million

And near the southern border much closer to ‘civilization’ on a smaller lot:

https://www.realestate.com.au/property-house-vic-narre+warren+north-128415614

A$780,000 – 820,000

650 square meters of land.

Wolf,

It’s actually pretty interesting, in one particular town in the valley, starts with Sunny and ends with Vale, what I’ve seen lately is a lot of inventory going on market, and what I’ve noticed is that there is a lot of price discovery, meaning, reduction in pricing happening after listing. I think it’s reaching a saturation point at least in parts of the valley.

One wonders, because given the prices in the valley now, I can’t imagine Wall Street investment types going after single family homes. The bill goes up really fast. And if the rental market turns, these guys could get caught on the wrong side. Seem very imprudent to me.

I’ve already commented that rents have dropped in the South Bay in comparison to 2 years ago, and there is a huge inventory of available apartments, but the property management companies do a great job of hiding the inventory. Go to any building that has posted property for rent and ask say you don’t like the apartment that they are showing you; they will show you multiple apartments to give you a choice. The point being that each building has multiple vacancies. 2 years ago you could hardly find decent apartments unless you were willing to pay over $2500.

I don’t care what numbers real estate industry tries to feed us, the reality on the ground is what is important. But rental business is probably still very profitable.

I’ve been following Zillow for Eastern North Carolina area and it seems to me that prices are dropping and houses are staying on the market for longer Raleigh is much hotter as it has the Capital, universities and the Research triangle( tech jobs) If you don’t need a job to survive you can pick up some great properties on the cheap and live near the Atlantic Ocean in places like Wilmington or New Bern

Great article! The 29,000 homes purchased by Wall St is, clearly, not that many. So any tale of that this keeps the market propped up, is malarky. When rets work they work. However, If things turn and they dont, they dont; businesses cant loose money forever. Reminds me of the dot com boom. All these companies had huge runways for profit lift off but they burned on the tarmack; albeit Amazon still gets fuel. The faucet is being turned off and normalization is the quit summer breez, before the winter Nor Easter.

Just had two houses I’m selling go into escrow this week. In the southwest. Both on the market about 4 weeks. No offers the first 3 weeks, then lowered the asking price on both about 5% and multiple offers came in immediately. The demand is still strong, but buyers seem very price sensitive. My original asking prices were a bit of reach as I was testing the market for higher prices. Many showings, but no offers. Both houses were total remodels and in great condition. One in the highest priced area and the other in a very working class area.

Rent-to-own is now on the rise in Pierce County, south of Seattle, an area hard-hit by foreclosures during the bust. All these ads now feature pics of a generic suburban mcmansion, and say the “broker” will match the renter/buyer with “investors.” It’s a little smelly.

Thanks Wolf, for answering my question from a previous post regarding high house prices coupled with low inventories.

1) Cerberus Capital Management

2) Amherst, via its subsidiary, Main Street Renewal,

3) Tricon

It’s look like any discussion of rising home prices is not complete without mentioning these handful of companies pouring money into the housing market. Today, these companies are making money. I wonder if rents start to fall across the country, the same companies could end up loosing a lot of money fairly quickly unloading a lot of their inventory in the process?

“Even in the hottest markets, such as San Francisco, there is plenty of inventory for sale, but much of it is high-priced and difficult to reach for average buyers. But that doesn’t mean they aren’t trying.”

In the suburbs around NYC, there is very little inventory at less than 500k. You should realize that ‘crack-shacks’ are not being marked up to ridiculous levels as in the bay area. There are just very few homes for sale. That is a very different situation than greedy home owners marking up their properties to soak techies or Chinese investors.