The impact on homebuyers and the market, in dollars and cents.

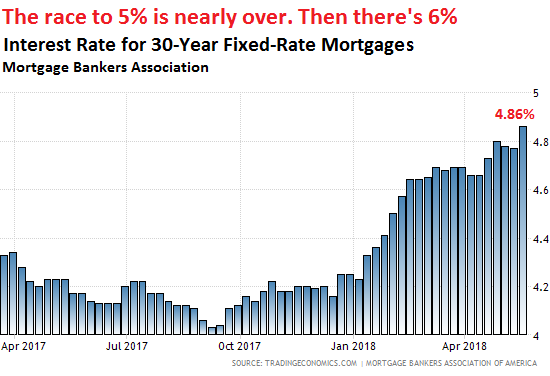

The average interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) and a 20% down-payment jumped to 4.86% for the week ending May 18, the Mortgage Bankers Association (MBA) reported this morning. This is up from 4.73% a month ago (chart via Trading Economics, red marks added). On the way to 5%:

The MBA obtains this data from weekly surveys of over 75% of all US retail residential mortgage applications handled by mortgage bankers, commercial banks, and thrifts.

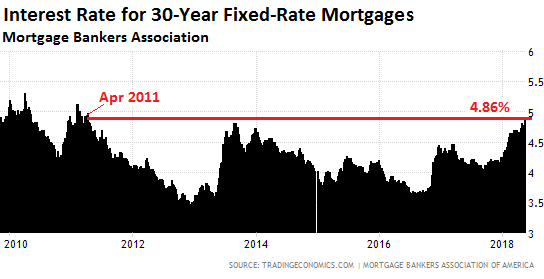

This average 30-year fixed rate of 4.86% was the highest rate since April 2011, now exceeding for the first time the spike during the Taper Tantrum in 2013. In 2018 so far, this measure of the average mortgage rate has risen by nearly 60 basis points (chart via Trading Economics):

The MBA reported more mortgage achievements in the race to 5%:

- The average interest rate for 30-year fixed-rate mortgages backed by the FHA rose to 4.90%, the highest since May 2011.

- The average interest rate for 15-year fixed-rate mortgages rose to 4.31%, the highest since February 2011.

“Points” – upfront fees, such as the lender’s origination fee, often rolled into the mortgage balance – are rising too:

- On 30-year fixed-rate mortgages with 20% down, average points rose to 0.52% of the mortgage balance.

- On FHA-backed mortgages, average points rose to 0.85% of the mortgage balance.

- On 15-year fixed-rate mortgages, average points rose to 0.56% of the mortgage balance.

At 4.86%, the average 30-year fixed-rate is tantalizingly close to 5%. At 5.2%, it will hit the highest level since 2010, at 5.5%, the highest level since 2008. The housing market will likely be able to digest these rates, though there will be some ruffles. But 6%?

While still historically low, 6% would face an entirely different environment this time around: Since 2008, the last time this measure of mortgage rates was 6%, home prices that have surged – in some of the hottest markets by over 50%, according to the Case-Shiller Home Price Index. This price surge was made possible in part by plunging mortgage rates.

Will rising mortgage rates unwind some of those price gains? And what’s the impact on home buyers?

We can look at rising mortgage rates in terms of how they would bump up the monthly mortgage payment on a given home price. In other words: How much more would the household have to pay a month to buy the same home at a higher rate?

More realistically, most households have budgets for housing. They can spend up to a certain amount a month and no more. Given these budget constraints for many households, higher mortgage rates translate into buying lower-priced homes: How much cheaper would the home have to be so that the household can afford it at the higher mortgage rate?

In other words, how far would they have to climb down the ladder of their dream-home aspirations when mortgage rates are rising? A very realistic question for homebuyers – and a potentially brutal question for the market.

I got started on this train of thought by David in Texas who sent me a model to test different mortgage rates and budgets (to simplify, we will ignore the thorny issue of down payments).

Example 1: Household budget for mortgage payment is $1,200 a month. With a 30-year fixed rate mortgage:

- At 3.5%, they can afford a $267,000 home.

- At the current 4.86%, they have to slash their aspirations by $40,000 because the mortgage they can afford at a $1,200 payment drops to $227,000

- At 6%, they have to climb down to a $200,000 home. They’re going from above the national median price ($250,000) to something at the lower end of the spectrum.

Example 2: Household budget for mortgage payment is $3,500 a month. With a 30-year fixed rate mortgage:

- At 3.5%, they can afford a $779,000 home

- At 4.86%, what they can afford drops by $117,000 to $662,000

- At 6%, it drops by $195,000 from their original aspirations to $584,000.

Example 3, for cities like San Francisco, where this reflects the median home price: Household budget for mortgage payment is $6,000 a month. With a 30-year fixed rate mortgage:

- At 3.5%, they can afford a $1.336 million home – a decent two-bedroom condo.

- At 4.86%, they have to lower their aspirations by $200,000 to $1.136 million.

- At 6%, they have to slash their original aspirations by $336,000 to $1.0 million.

Via this transfer mechanism – the fact that most homebuyers have budgets they cannot exceed – higher mortgage rates push down home prices if it is allowed to run long enough. This is why I think a 30-year rate of 5.5% will create some ruffles in the market, and 6% will cause pain.

But nothing is quite that simple. As rates are rising, homebuyers are trying to lock in current rates before they rise further, and demand for mortgages continues to be strong. The MBA’s Purchase Index, which tracks the number of mortgages taken out to purchase a home (as opposed to refis), increased 3% compared to the same week a year ago and has been consistently higher so far this year compared to the same time last year.

In San Francisco, there are plenty of homes for sale, at ludicrous prices for what you get. But asking prices are now getting “reduced.” Read… Graphic Details of the Crazy Housing Bubble in San Francisco, According to Zillow

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So in other words, housing prices should have dropped ~15% since rates have gone up from 3.5% (per my mental math). Where I am, they’ve only gone down 3-4%. No dice! (I calculated the same type of scenario yesterday).

You have to add in price stickiness – people may be unwilling to lower the asking price. Plus, a “now or never” attitude among home buyers could prop up prices: people may be willing to overpay now to avoid being forced into a less desirable home by higher interest rates.

I expect it’ll be a while before the interest rate hikes significantly affect home prices – but it’ll have to happen. After all, incomes are fairly flat.

“At 5.2%, it will hit the highest level since 2010, at 5.5%, the highest level since 2008”

Don’t count your chickens before they have hatched. I will make the gentleman’s bet that the Fed will not allow mortgage rates to get above 5.00% (and I will be quite pleased if I lose the bet).

Still more rhetoric out from the minutes of the last Fed meeting about letting inflation run hot to make up for years of low inflation. From where I sit (housing going from under 300K to over 1000K) inflation is off the charts not low but I guess if the Fed decides by decree that inflation is low then it is low (no matter how high it is).

What I find fascinating about the asset inflation scheme that Bernanke kicked off 10 years ago is the presumption that half the population can be made to “feel” wealthy without making the other half feel poor. How are the half that pay 60+% of income on housing supposed to feel wealthy? Well they aren’t supposed to feel wealthy they exist only to make the other half feel wealthy. Robbing the young to pay those who own everything is a corrupt scam. You can abuse a generation for only so long before they revolt.

I absolutely hope you are correct and the Fed is tightening for real but I’m afraid the current course is nothing more than a tiny, insignificant blip of a tightening dip before we resume on course with more massive and endless injections of easy money.

Afraid to own stocks or RE at Ben’s inflated prices? I think from here on out you can’t pay too much for any hard asset. From what I see currencies are in free fall and in nominal terms no asset will drop in value going forward. Central bankers have grabbed the monetary system by the neck and they are dragging behind the shed to shoot it in the temple – DO NOT HOLD CASH OR BONDS! Panic now and avoid the rush.

Building long-time equity in real estate is not necessarily “robbing the young”. It can be a strategy to accumulate inheritable wealth for one’s offspring.

I disagree. Housing ought to be treated like a boring utility, with a price that doesn’t change much over time. Instead we have turned it into a highly leveraged, volatile, investment vehicle that Americans expect to get rich owning over time.

Want great long term returns? Historically US stocks have been hands down the place to be, way outpacing gains in real estate. They’re also highly liquid, have minimal transaction fees, and they pay you dividends, rather than you paying property taxes…but it’s hard to build a big, fat index fund portfolio when you’re being forced to put 40%+ of your take home pay toward housing. I want a nice house, but I’d much rather have a nice portfolio…

“Housing ought to be treated like a boring utility, with a price that doesn’t change much over time.”

Mark, How would you value the house our family built for itself? Would it be just a money substitute?

In principle I agree housing laws need to swing us back more in the direction of a home is for families to live in an control rising rental cost by owning.

Housing as an investment with people flipping and owning rental properties and foreign investment has done great harm to the prospect of people trying to buy a primary residence.

We are so far down this path though you would have to annihilate a vast amount of private wealth to par down small and large real estate empires. I don’t give a shit about those investors but it still seems unfair to attempt to strip them of life times of wealth through government action.

Correct. Home prices going up for the sake of going up creates instability in the market. Americans have come to expect their home values to be their savior. But trees don’t grow to the sky. All home prices are limited by the income able to service the debt. If a higher percentage of your income is sacrificed for the home then you must give something up: saving for retirement. Then, in retirement, what investment do you live off of when you still have a mortgage on your home? No doubt the US is in a retirement savings crisis.

Home price appreciation not tied to income appreciation will eventually destabilize because of eating up too much of your monthly income and it prices out the first time buyer. No fish at the bottom of the food chain to eventually buy even the lowest priced house will eventually become a destabilizing force without dramatically reducing lending standards.

When the banking system (and the government) actually cared about maintaining standards in lending, you did not get a loan. My wife and I were approved for a loan 6.5 times our income which would have easily put our housing expenses above 45% of annual income. We would have had to give up saving for retirement to have a life outside the home. And WHEN the next recession happens, we would still have to shoulder that monthly nut. The crazy part was that everyone in the chain was encouraging us to take out a bigger loan. We resisted and still live in a smaller house than we would like.

I guess the “great leveler” (great book by Walter Sheidel btw) will be the next recession or a war that dramatically disrupts commerce.

If the public can’t get out of the housing hysteria themselves then the invisible hand of the market will eventually give them a shove.

I agree, RD.

This article made me think about my friend buying his first house. I told him about a great buy on a starter bungalow; excellent condition, across from a park/sportsplex, good school nearby, playing fields, greenspace, etc. The price would have been just under 2X his annual salary. It was a good family home. Our mutual boss talked him out of it. His advice was for friend to buy the most expensive home he could qualify for with his present salary. My friend took the bosses advice and waited to buy for another year, finally purchasing a slightly better home for 30% more. (I inspected both homes because I was also a carpenter). My friend could handle the payments, but barely.

I think the bosses concept was wrong in buying the ‘most’ vrs affordability. Over the years, as the RE market churned, the value increased and decreased with every cycle. The real difference was this. If he had bought my recommended house he could have paid it off in 15 years, or less. By buying the other home, plus building a shop, he never did pay it off and owed money at the time of his divorce. :-(

Pay the first house off. Save the mortgage payment by living the same lifestyle eventually using those accrued savings for a downpayment on a second home, ensuring rent will cover mortgage payment, insurance, and modest upkeep. Rinse and repeat.

This concept is not robbing from future generations as someone mentioned above thread. Rather, it is a way for working people of modest means to get ahead and find security.

Most importantly, a persons house needs to be a home first and foremost. It is something more than a simple investment or store of wealth. If first home-buying steps are done right it can set a person up for life and early retirement.

Where you are wrong is your co-worker friend had the opportunity to buy a home at 2x his annual salary. For the current generation homes cost 8x to 30x their annual salary. Your own example points out the inequity foisted onto the new generation.

Bernanke turned young people into rent slaves who must devote a huge percentage of their pay toward rent paid to someone who bought their place for “2x annual salary”. If this happened through some natural course of events or disaster it would be one thing, but to have a central banker decide one generation will reap huge rewards while another pays through the nose to enrich the first generation is corrupt. Ben Bernanke should not have been allowed to choose winners and losers, but even so he should have chosen the future not the past. What kind of society cares so little for the next generation – I think it’s unprecedented.

I’m not suggesting we give young people special privileges I only ask for a fair and level playing field and for bankers to take their thumbs of the scales.

van_down_by_the_river,

thanks for keeping it real. i don’t totally agree with everything you say here (it would be nitpicking), but these boomers have no idea. if i were in a worse mood, i’d write the ignorant (stupid, really) things my boomer parents have said about housing from their time vs. mine.

In my area (greater Minneapolis/St. Paul) most young people want to buy and/or rent in a few high-demand and expensive areas in the central core cities or very near in suburbs. Flippers/investors are busy–a couple houses down from me a small house is back on the market in less than a year, with fresh paint and a new kitchen (old kitchen was fine, just old) and a $250k price bump. First time buyers complain they can’t compete with all cash offers from contractors and developers for lower end houses, but these houses would also require some work and/or cash input which they generally don’t want to do.

Salaries are a little higher in the Twin Cities than other places in the Midwest, but not that much higher. I suspect these buyers are taking advantage of low/no interest rate loans from the bank of “Dear Old Dad” and this will continue for some time while interest rates adjust higher.

The buyers demands, the expandable budgets (Thanks Dad!!), the flippers all drive demand in a limited area and create a positive feedback loop that won’t end until it finally ends…how I’m not sure.

@van_down_by_the_river

I don’t dispute what you say. And there are certainly big differences in the financial means of various millennials. But I just don’t understand why they refuse to go where their budgets will allow them to get a good deal (e.g the suburbs). It seem to me that this particular group has an obsession with urban living and this demand is part of the problem.

“van_down_by_river”

Yes and no, true a good portion of Millennial’s have a much harder time buying a house than us baby boomers, but not everyone.

My nephew, age 36 (at the older end of the millennial’s) got married, had a kid, and in 2012 bought a 2 bedroom condo in San Ramon (S.F, Bay Area) for $300k sold it two years later for $470k. Bought a San Ramon townhouse in 2014 for $585k, three kids later, sold it for $775k in 2017. Moved to El Dorado Hills outside of Sacramento bought a home.

He is a police officer and she worked part time as an office clerk (not high paid techies). All his friends kept asking how he can afford San Ramon? Because his friends did not take the opportunity to buy in a downturn, like he did.

I bought my second house in Silicon Valley in 2008 when everyone was running for the hills! (Full disclosure, I had no idea it would increase in value 100%, thinking maybe 10%.)

The Bay Area in the last 40 years has cycled up and down, just more up (most notably this last time of course) than down. Both my first home(sold), and second home I bought in a downturn.

I remember in 1977, earning $4.50 an hour saying there is no way I am going to pay $60k for a house, that is insane!. I wish I did. I built my first house at age 32, wish I started earlier.

If at all possible try and wait for the next bust, it will come. Maybe where you live is different?

@lucky – it’s debatable whether or not your nephew is even a Millennial (he’d be the very oldest, in truth). he would have been 26 when the markets tanked. he would have been out of high school for 8 years working a job if he didn’t go to college(?), or 4 years on the job before all the layoffs took place. he’s not a typical Millennial. a lot of us graduated while the economy was losing 450k jobs a month (if my memory serves me right).

i’ll bet if he was out there in SF he had a nice “up”(?) on some of us in flyover country where $10-12 jobs are still de rigueur.

Michelle, let me

explain the millionials obsession about urban living. I think it is simple. Greenspan, Bernanke, Yellen has taught this generation a good lesson. Wealth creation is for sucker. Wealth transfer is for winners. If you leave urban, it is same as you leave IPO, house speculation, fat financial compensation of wall street firms, all of the wealth transfer mechanisms. That’s where FED showers money. If you go to low cost areas, you will have to grow crops, manufacture goods, have to do work to create wealth only to find it gets transferred away into the hands of urban people who are closer to financial system. Wealth transfer is the cause of the inequality, this is the cause of divide of 1% and 99%. The 99% want to be the 1%, live where they live, do what they do because if you are 99%, you are the sucker, loser, slave. So let’s all do transfer, and let others do the creation.

The key word there is “divorce”. Women pick the house and it makes perfect sense to get the most expensive one considering how family court usually works out.

Nothing wrong with that.

I was shocked to see President Trump talking about yet more tax cuts to try to buy the fall elections. Although I have been since 2007 a “deflation hawk” I am seeing, as the cook and shopper in the family, significant inflation for the first time over the past six months. The fixed budget I receive simply isn’t cutting it any more. It’s unmistakable, as is the rise in gasoline prices. I don’t know if this is a trend or not. The picture is too murky for me at this time to read, with too many contradictory indicators. But I am sure that inflation has finally “trickled down” from rich people’s assets to my grocery cart.

Although the Fed is indeed in control and will push all assets up in value long-term, I still expect market crashes in the meantime. The reason is that the main reason people buy is that prices are going up and attempts by the Fed to stop crashes will work as long as the novelty effect is in play, but eventually the market prices in the Fed, and then we are left with a market in which 50-60% crashes become just as likely as they were in the past.

The safest way to make money now is buying long-term bonds. When there is too much money, any interest is better than no interest, and long-term, interest rates are headed back toward zero. They’ll be closer to zero than where they are now before long (give it up to 3-4 years, though I’m expecting it sooner).

Hussman has pointed out that if the Fed tried to raise interest rates the conventional way through QT, it would have to cut its balance sheet by about half before we get off the zero bound. Not long ago, Kyle Bass said that the Fed will never be able to raise interest rates, except by maybe a “ceremonial” 25 basis points or maybe even 50 or 75.

I think they’ll be proven right in the end in that exponentially rising money and credit are needed to prevent an economic collapse, so the end game is zero percent interest rates (or NIRP) forever.

“From where I sit (housing going from under 300K to over 1000K) inflation is off the charts not low but I guess if the Fed decides by decree that inflation is low then it is low (no matter how high it is).”

The median home price in the US was $257,000 at the start of 2007. It’s currently $328,000. That’s a 2.2% annualized increase. San Francisco is not the rest of the country. It’s not even close to a rough approximation of housing markets in the rest of the country.

“From what I see currencies are in free fall”

Based on what, exactly?

“DO NOT HOLD CASH OR BONDS! Panic now and avoid the rush.”

If you are correct, and the Fed embarks on additional rounds of stimulus and QE, then this is terrible advice. Prior to Trump’s election and subsequent rate hikes, long dated bonds OUTPERFORMED the S&P 500 since 2008.

You’re entitled to your opinions, but they’re wrong.

With regard to home prices, if this current (bubble) price surge was made possible, in part, by plunging mortgage rates, wouldn’t rising mortgage rates correspondingly affect a downward pressure on home prices? In that case, new home buyers will still get the same house for the same money- higher mortgage rates, but on a lower home price.

What is worrisome is mortgage rates that aren’t fixed, in a rising rate environment- then these firm household budgets are so wrecked, even a small basis point move up in the rate would kill a budget. I wonder how widespread ARMs are this time around.

Higher rates = lower home prices yes.. but that also means lower property taxes. So there’s that benefit to the new buyers if prices drop even if on a monthly expense the mortgage remains the same due to higher rates.

Due respect, but hah!! The only way to get your assessment down is by affirmative legal process. Municipalities will keep the tax bill where it is by hook or crook. And if we’re in an inflationary environment then they’ll just increase the mill rates.

On another article IRIC, it was Dan that posted a house for sale in Minneapolis for around US$2 million.

The web site showed that the property taxes on that house were US$30,000 a year which had basically doubled since 2000.

At least here in Oz the RE taxes are sort of reasonable, but that being said, they have doubled in the last ten years or so.

The more established areas with high value homes near the CBD actually have lower property taxes as a % of value than the newer, growing areas. We really get ripped off in that respect.

Sydney with its super high property values has very reasonable property taxes in many areas.

For example, a house that had a market value of between $3 and $4 million had taxes of about A$3000 a year. So about 1/10 or less than the house in Minneapolis.

I think that many of pundits that talk about ‘high priced’ Australian property often overlook factors such as these when trying to compare property prices to the USA or other countries.

Here in Oz we don’t fund schools with RE taxes and there are seldom things such as specials. However, we do pay huge amounts of stamp duty on RE transactions.

A A$1 million house gets slapped with around A$50,000 in stamp duty paid by the buyer here in Victoria.

We also have another tax here on RE which is the land tax. This is on everything other than your principal place of residence and kicks in at some value. This tax is state by state so costs vary between states. As the tax is based on steps in value, the recent increase in property values has resulted in huge increases in tax in this area.

And Lou is right, property taxes never go down. When we had a small blip and prices fell or were steady here for a few years, the assessed ‘value’ actually increased!!

@Lee

Thanks for explaining the tax situation in Oz. It’s good to understand the various tax schemes other municipalities and countries use.

I don’t know what you’ve heard about the tax problems in Seattle, but long story short, their government has failed to manage the money well plus they have a huge problem with homelessness and affordable housing. Well Minneapolis is moving down the same path, thus the big tax increases. I suspect this is going to become a very big political deal when housing does enter a recession…but by then the smart politicos have usually moved onto fleece some new group of people. We’ll see…

My next door neighbor is on the Minneapolis City Council (12th Ward), and he’s one of the rare politicians that employs logic and common sense when voting on issues.

Our new mayor and many of the Council members are in favor of revising building ordinances to allow large four-plexes to be built on almost any residential property in the name providing affordable housing. In reality this will make starter homes on Minneapolis’ typical 40″ by 120″ lots more expensive as developers buy them to tear down and build rental properties. My neighbor (and friend, I should disclose) is against this proposal.

My property tax breakdown for 2018:

28% for Hennepin County

39% for Minneapolis

8% for Public School system

18% for ‘Other Local Levies’

My total property tax rate of ‘Estimated Market Value’ is 1.36%. This is not too bad I suppose, and my home is in the lower mill rate.

http://www.startribune.com/twin-cities-housing-market-gets-tighter-with-less-than-10-000-homes-on-sale/483346501/

And to Lee, actually the 2 million dollar home sits in St. Paul just down the river’s east side border of the two cities. It’s a damn nice piece of property though!

“With regard to home prices, if this current (bubble) price surge was made possible, in part, by plunging mortgage rates, wouldn’t rising mortgage rates correspondingly affect a downward pressure on home prices?”

Yes, ceteris parabis.

But everything is not equal– higher rates and higher expected future rates cause people to freak out and think we must buy now, because we won’t be able to afford that house at that price and a higher interest rate. You could say that it pulls demand in from the future.

It’s also (imo) a great example of how markets have this habit of making people do the exact wrong thing at the exact wrong time, i.e. selling stocks at the bottom of a crash, or frantically buying housing when it’s close to the top.

I personally prefer seeing rates going up. How are the variable rates looking in the USA these days? In Canada the fixed rate going up has caused the banks to turn to variable rate contracts and the prices on variable rates are down below 2.5% for some big name lenders. I think a lot of people are unable to qualify for the higher interest and higher stress tests. Which aren’t even that high yet, this is getting interesting to watch.

While I can’t speak to all big name lenders, you’d have to be pretty connected now or have a lot of money to get below 3% on a 5/1 ARM now(which still has a 30 year amortization). For reference, about a year ago, the lowest rate I heard about on a 10/1 ARM was 2.125%.

What if lenders start offering increased terms of 40+ years?

At least a few jumbo lenders do have a 40 year term. For government backed mortgages, the current max term is 30 years (barring a future law change).

They would have to charge much higher rates to compensate for the risks, unless they get government (GSE) backing.

But we already have interest-only loans. The thing is you have to refinance them at the end of the term. During good times, this is a breeze. During bad times, it’s really tough.

Wollf, wasn’t that similar to what the US had before 1932? Most housing was realtively short term , with huge payment at the end – presupposed refinancing. Of course, if timing was wrong, you were SRO.

Higher rates will certainly affect price, I have no doubt about that. I base this on the nature of typical consumer behavior and mortgage underwriting, which I think is captured well in this post. The speed with which this decline will happen depends on how psychologically sticky sellers are on the presumed price of their home, which we all know a lot of people have a hard time adjusting to. So it is more likely that we will see this downward pressure first pop up in new SFH and most likely, new condo deliveries.

People will spend as much money on a house as they can afford based on DTI guidelines for PITI. So the monthly payment influences the total allowed borrowing amount, which then influences what people will offer on a home. If more of the PITI is eaten up by interest, then the total amount that can be borrowed goes down and that decreases the price that buyers can offer. The other major variable here are income (which has been relatively stagnant for most people for a long time) and consumer debt (auto, student loans and credit card debt has been increasing).

The net result in my mind, if we follow this rate path for some time, will probably be a long period price stagnation on a nominal basis, with declining value in real terms.

However, I am not sure that there will be a major impact on the economy beyond that. Historic data shows that there is very little correlation, for example, between increases in mortgage rates and delinquencies/charge-offs.

https://fred.stlouisfed.org/graph/fredgraph.png?g=jWnK

So most likely, what I think (or hope) people will come to realize is that the current “housing affordability crisis” is not a housing supply crisis, as the current zeitgeist implies. But rather, it is an artifact of intentional macro rate policy decisions combined (or actually inter-correlated) with wage stagnation.

Then you have to factor in shrinking housing budget due to either feedback loop or extraneous recession and there will be even more pain

Some interesting patterns emerge when looking at the Case-Shiller National Home Price Index:

https://fred.stlouisfed.org/series/CSUSHPINSA

From the chart, it’s clear that the Fed and the government at large pulled out all the stops to halt the decline in house prices last time around. From the peak of Housing Bubble 1.0 in Jul-2006 to the bottom in Feb-2012 national prices only declined about 28%, taking them back to about Jun-2003 levels. From the peak, prices were on a noticeable down-trend by the time the S&P 500 peaked in Oct-2007. If we have any month-over-month price drops heading into this summer, it would appear to confirm a top. The last several years back to 2012 have seen strong price increases in the spring months through about August. In Bubble 1.0, 2006’s spring and summer selling season was much less exuberant than in prior years. Keep a close eye on enthusiasm this summer.

The Fed and government may have a harder time propping up house prices this time around. If prices revert to late-1990s levels prior to both bubbles 1.0 and 2.0, national average prices could drop as much as 55%.

No, you’re confusing real and nominal prices. The graph reflects nominal prices. Nominal median income is up more than 50% since the late 1990s, overall CPI even more.

There will probably be a drop in average house prices at some point in the future (say within 2-3 years) but probably more along the lines of 15%-25%, not 55%.

Let’s dig into the numbers a little further using the Case-Shiller chart at https://fred.stlouisfed.org/series/CSUSHPINSA and the CPI calculator at https://data.bls.gov/cgi-bin/cpicalc.pl

Starting with a reference point in January 1992 at 75.7 on the Case-Shiller chart, adjusting for CPI ($1 dollar in 1992 = $1.80 in 2018) would give an inflation-adjusted price of 136 in February 2018. The last data point on Case-Shiller is 197 in February 2018, so assuming prices revert to tracking inflation would imply a drop in price of 31% to revert to 1992 prices. But… If mania in markets can cause prices to exceed inflation-adjusted values by 45% (197/136=1.45) as they do now, then it is certainly possible that they could undershoot inflation-adjusted values as well. After the last downturn in housing there was only a brief period of a few months in early 2012 where prices approached inflation-adjusted prices using the January 1992 starting point. It required Herculean efforts like QE, 0% interest rates, Fed-monetized MBS, first-time home buyer grants, etc. to stop the decline.

Note that this does not include hedonic adjustments. Average house sizes are bigger than they were in 1992, which may be a liability depending on who owns the house. Ultimately, the value of a house is always the same: shelter from the elements. The elephant in the room that few people discuss is land prices. Land prices get grossly inflated by bank lending, while the cost of structures generally track the cost of labor and materials to build. I used January 1992 as the baseline since it is safe to assume that houses were fairly priced at that time, post S&L crisis and 1991 recession.

I in my reply I was referring to the original timesapn you spoke of (late 90s to now).

You can use early 90s and get different figures but then you can use other time points and probably get other numbers given that the slope of the Case Shiller index tends to change in different decades.

I think the imperative things to note is that real house prices are still not at the level they were before the last recession and as you mentioned, the housing drop then amounted to 28% and that was when we had a total meltdown of the housing market. Given this and the fact that mortgage underwriting standards have been much tighter since before the meltdown I find it difficult to believe that we will have a much greater crash coming up than what we had then (-28%) which is why I am forecasting a drop of 15-25% on average over the course of the next 2-3 years. Also, remember that we are talking averages here and there will be areas that will experience more, some less as real estate bubbles tends to vary greatly based on regions.

Housing was front and center in the last recession. Next time around equities and corporate credit is likely to take center stage given the extraordinary expansion of earnings multiples and leverage in those sectors. Housing will drop too, I just don’t think it will be the “main event” next time around.

“Nominal median income is up more than 50% since the late 1990s” Say what? In 2000, I was just out of college, and I was making more in term of dollars back then than right now. Take inflation into account, and my nominal income is way down despite the fact that my knowledge is probably 10 times what it was back in 2000.

״Take inflation into account, and my nominal income is way down״

Hmmm… You might want to look up the meaning of “nominal income”

“…and my nominal income is way down despite..”

You probably meant “real income” which means income adjusted for inflation.

Thanks Wolf for correcting me; yes, I meant real income.

Max Power: To summarize nominal income is down (except for minimum wage earners), and real income is way, way down. You had mentioned that “Nominal median income is up more than 50% since the late 1990s.”

R2D2: Your Information is totally incorrect. Nominal median household income in 1998 was about $40K. It’s about $60K in 2018. That’s a 50% increase. Real median income over this time period is flat (not “way, way down”).

Max Power: Stop posting fake numbers to support your real estate agenda:

“Since the turn of the century, the median household income has fallen by 6.6 percent, from $55,030 in 2000 to $51,371 in 2012. Thirty-five states have seen a statistically significant decrease in their median household income, the new Census figures show.

The average household in Michigan saw its income drop by a whopping 19.1 percent, from $57,963 a year in 2000 to $46,859 a year in 2012. In Mississippi, the median income plunged from $43,664 in 2000 to $37,095 in 2012, a 15 percent decrease. Household incomes fell by at least 10 percent in Georgia, Indiana, Tennessee, Nevada, Ohio, Florida, North Carolina and South Carolina.”

https://www.washingtonpost.com/blogs/govbeat/wp/2013/09/19/household-incomes-stabilize-but-still-below-2000-levels/?noredirect=on&utm_term=.7bfa8ea0a79a

R2D2 and Max Power,

Why don’t we hold that debate until September, when the Census will release the data for the annual American Community Survey (ACS). This has household and individual income data (inflation adjusted) going back many decades, and stratified in many ways, including gender. I always cover this. It’s always shocking.

R2D2: Sorry, but your claim is still completely wrong. Also, the data you are referring to is five years old.

Here is more recent data. It backs the numbers I have been quoting.

https://seekingalpha.com/article/4128903-october-2017-median-household-income

Wolf: Not sure why there is a need to wait. The most recently available stats clearly show that R2D2’s claims are completely unfounded. Also, based on how the economy is performing at this point there is no reason to believe the upcoming census update would change the overall picture.

Max Power

OK, I won’t wait till Sept :-]

When people are talking about declining real incomes, there is a lot of truth to it, but it’s not that simple. You have to scratch the surface. There is a lot that hides beneath the overall averages. From last year’s ACS data:

Real median earnings for men who worked full-time year-round in 2016 was $51,640, down 4.4% from the earnings peak in 1973 (inflation adjusted $54,030). That’s 43 years!

Over the same period, women’s real income increased 60% from $30,000 to $48,328 (adjusted for inflation). Thank god that women are getting paid more, but for men, it’s not a good situation.

And there is more:

For the top 5% of households, inflation-adjusted household income has soared by 112% since 1967. For the bottom 60% of households, incomes have inched up only very little with the bottom 20% gaining just $2,900 in household income over the past 50 years:

For the bottom 40% on the income scale of the households: income adjusted for inflation for the lowest quintile has dropped 9.5% since 1999; and for the second lowest quintile, household income has dropped 2.4% since 2000.

Households in the third lowest quintile (40% to 60% on the income scale, purple line) have now finally squeaked past their prior income peak in 2000, but by less than 0.5%.

OK, found the latest available figures:

1998 Median household income, nominal: $38,885

1998 Median household income, real: $57,248

2018 Median household income: $61,227

1998-2018 income growth, nominal: +57%

1998-2018 income growth, real: +7%

Obviously these numbers are not “down”, and certainly not “way, way down” (actually, they are the opposite of that).

Sources:

https://fred.stlouisfed.org/series/MEHOINUSA672N

https://fred.stlouisfed.org/series/MEHOINUSA646N

https://www.advisorperspectives.com/dshort/updates/2018/05/02/real-median-household-income-reintroduction-march-at-61-227

Not bothering with my calculator, but flat nominal prices over about 5 years with CPI at 2.2 (Fed is now saying the inflation target is “symmetrical”) would produce a decline in real terms in the range of 12-13%. Add a modest 1% YoY decline and now you have a proper price correction with very little experienced pain.

But, call me a heretic, but I don’t think that real estate outside of a select few areas, i.e. NYC and the Bay Area, is actually all that over priced generally speaking. Where I live, which is actually quite affluent (always listed in top-20 most affluent counties), median home prices in the county just achieved their pre-crisis peak eleven years after the crash. The mean, admittedly, is a bit skewed. But when looking at long-term returns, over say 30 years, prices where I live have only averaged YoY nominal increases of about 2.6% when CPI has averaged over that period about 3%.

Even worse, if you look at Shiller’s entire dataset going back the 19th century, YoY nominal increases to present are only like 1.6%. So unless you are collecting rent, real estate is really about housing consumption and not a great investment. Which is astounding, considering that in the last 30 years, a significant amount of the nominal increase in prices is probably driven fictionalization through demand for “safe assets” to create collateral for repo and derivatives.

In my mind, the real crisis of “affordability” is the combination of student loan debt and low wages.

*financialization

“But, call me a heretic, but I don’t think that real estate outside of a select few areas, i.e. NYC and the Bay Area, is actually all that over priced generally speaking.”

No, you’re right.

According to Trulia last year, 2/3rds of US housing hadn’t recovered to pre-crisis peaks.

You can get a decent home in Wilmington, NC– a nice little city with a burgeoning economy– for about $200,000.

There’s a handful of metro markets that are blowing out of the water (SF, Seattle, NYC, Boston, to name some of the worst offenders), but really the vast majority of the country is not experiencing this.

I would say there are a bunch of rolling regional bubbles, as opposed to a national housing bubble.

Using the January 1992 baseline and adjusting for inflation, Case-Shiller national prices were up 66% in July 2006:

184.6/(75.7*1.47)=1.66

They are now up “only” 45%:

197/(75.7*1.80)=1.45

To equal the last inflation-adjusted bubble in 2006, national prices would need to be up to 226 on Case-Shiller, a 15% rise from here:

1.66*75.7*1.80=226

Can Housing Bubble 2.0 beat Housing Bubble 1.0?

@Debt Free – in absolute terms it would actually take more than a 15% rise becuase while prices catch up with the 15%, overall inflation would have risen as well. So if it takes say three more years to get there with the CPI at say 2.5%/year then the absolute rise will need to be about 22.5% in price adjusted terms to meet the 2006 top three years from now.

I strongly doubt that would happen. Like I said before, I would expect a 15-25% drop in prices instead over the same 3 year period.

If benchmark Interest Rates for Central Banks don’t go up in lockstep with Fed Balance Sheet normalization we can all assume that QE Infinity will soon be back with vengeance. If the CBs reinstate QE Infinity we can all assume that we turned into Japan somewhere over the last decade since Bernanke & Geithner manufactured Too-BIG-to-Fail, Nail, or Jail.

Systemically, the system is rigged to implode since 08 Lehman Chapter 11 bankruptcy. I suspect that Deutsche Bank & Wells Fargo are going to implode on the next downturn.

Complexity Theory posits total devastation given the bastardized fundamentals & econometrics. Fake News will not overcome that deleterious event, and propaganda cannot replace price discovery from occurring.

MOU

No snide intention, but, why can’t propaganda replace price discovery in a QE to infinity scenario? My wife is driven crazy by the fact that she is thrifty while so many people are profligate and live beyond their means. She is waiting for them to get their comeuppance. She’s been waiting for some people we know to get what she perceives as their just deserts for 20 years now. They’ve lived better than us on credit all that time, and they always seem to be able to extend and pretend. We struggle and worry while they take two vacations a year and drive new cars. We drive a 2001 Camry and a 2007 Focus and haven’t had a vacation in years. I no longer have faith that there are any automatic and autonomous processes that will redress the situation.

I was raised by a Chartered Accountant [Senior Rulings National Revenue CANADA Oil, Mines, & Resource Taxation], and you can tell your wife that she is right about the spendthrift type of individual that plays fast & loose with credit. They always get their comeuppance eventually unless they win the lottery and the Probability of that is astronomical. Professor Emeritus Albert Einstein always stated that the most powerful force that he was aware of in the universe was ‘compound interest’.

My CA father always told me never to borrow money for a car.

I drive a 1996 GM v-6 front wheel drive. And my last vacation was in 1969.

Mean Reversion is the autonomous process that you are looking for that will redress this situation. That you can bank on!

MOU

James, what you have and they don’t is a sense of freedom and honor. If freedom and honor collapses before seen/tangible material, then you join them. This is corruption.

Your 30 year FIXED rates in the USA are now a little higher than the published standard VARIABLE rates here in Australia.

Auction clearance rates are falling in both Sydney and Melbourne which indicates there is some pressure on the general market. High end homes and those in areas with higher demand have not suffered.

Areas that don’t usually go with auctions are difficult to find data for, but in my area good houses on good streets go fast and often for cash with some less than a week. Only three houses for sale within about 1.5 kilometers of where I live now.

Recent data out of good ole Oz suggests that the the RBA isn’t going to be increasing rates here any time soon as there is too much debt in the economy, retail sales are poor, and wages are not increasing very fast.

Housing starts are falling for condo/apartments reflecting the clamp down on interest only loans and higher taxes on foreign buyers. (Why do governments always shoot themselves in the foot and ruin markets for everybody by changing the rules n the middle of the game?)

Single family home starts are slowing down a little too. As the population growth hasn’t changed this will keep pressure on the demand side as well.

Really overblown average housing in Sydney is correcting a little.

Australia is a very interesting market and I would love it if Wolf or someone could cover it in a bit more detail.

I’m Sydney based and have definitely seen a slow down in prices and correction on properties sold in the eastern suburbs, even advertised prices have dropped slightly. I think its probably a bit like San Fran where Sydney is running out of people prepared to pay $1m for a crappy condo.

While the tax system is so heavily favoured towards owning investment properties I think this will continue to prop the market up in some shape or form. The big risk is 2019 when lots of interest only mortgages come up for renewal and the risk of a downturn by then.

“Why do governments always shoot themselves in the foot and ruin markets for everybody by changing the rules n the middle of the game?”

Because despite all their fake propaganda, they know the reality, and they see this huge mountain of debt in countries like Australia, Canada, and they know when this thing explodes, their economies will be in the toilet. So, they try to stop the bubble from getting even bigger; but alas, it is too late. These bubbles are gonna explode with the force of a dozen hydrogen bombs.

The 10 year rate is what the 30 year was when people were calling it a great deal (3.80% at my bank on a perfect scenario).

People will just pile into adjustables. Not necessarily a bad deal. Most people don’t stay in their house, specifically their first house, for 10 years.

Wolf, I think your 6 percent number is a good benchmark. When we hit that, I think you will see a shift in the market.

I’d like some advice here please if you fellas and fellaresses would like to chime in. Here in NZ I assume it’s similar to Australia in the sense that our housing market valuations are ridiculous to the extreme. But I’d like to know what happens going forward. The Fed raises rates. I’d say the NZ Reserve Bank doesn’t for the same reason as Lee above suggests. Just way too much private debt. So, then what happens? If NZ doesn’t raise rates but the US does: a) what does that do to the NZD and b) cross examine that with a shortage of housing and a government that thinks 67,000 extra immigrants per year is a good idea. What is to become of us? Already the exchange rate has gone from 72USc to a NZD to 67USc, which added to rising fuel prices means we’ve got high petrol prices at the moment compared to the last few years. And in NZ oil prices affect everything because we like importing things we don’t have. I can actually vouch for the ownership of gold because even though the price of gold has fallen lately, the weakening NZ dollar means it’s more expensive here in NZ. I fear bad inflationary things are coming. Somebody allay my fears!

I know that banks in many countries have to raise rates when the FED in US raise rates, but I don’t know the details of why they have to follow suit either. It would be great if someone could explain that.

If a country does not increase its interest rate while other countries do, its currency will lose value as its residents seek investments in other countries. The weak currency also leads to high inflation because imports now cost more. There’s nothing like inflation to upset a population.

Thanks Bobber for explaining that.

“The weak currency also leads to high inflation because imports now cost more. ”

Unless you are a commodity exporter.

NZ is a commodity exporter.

The NZ $ is also one of the most heavily traded and speculated currency’s in the world. (probably as the RBNZ does not have the money needed to intervene in it)

Just look at its charts and the obvious volatility.

That’s the way it is supposed to work in economic theory.

In reality it rarely does.

Prices are sticky and take time to adjust. Some prices never change.

Take a look at Japan. The yen under Abenomics fell like a rock, but inflation in Japan barely moved. Japan imports lots of energy, food, and raw materials.

Sure the price of gasoline changed a little and the price of electricity and NG went up – those last two already have a mechanism to reflect changes in NG and other energy generation costs.

The A$ is also stuck around the 75 cent area despite bad news out of China, poor retail sales here, poor wage growth, and poor construction activity along with a huge increase in interest rate differentials between US and Australian bonds.

For whatever the reason(s) it hasn’t gone down as much as one would expect………..

You also have a new government in NZ that has some whacky ideas – and it looks like that has impacted on business confidence there which IMO has impacted the NZ$.

They also want to limit or prevent foreign purchase of real estate and that will hit financial flows as well.

Nice country and I was lucky to have visited Christchurch before the big earthquakes.

“You also have a new government in NZ that has some whacky ideas”

Nothing wacky about here ideas in fact they dont go far enough.

We need to return to a regime where foreigners can not buy agricultural land and non resident non citicens can not buy houses.

Almost ever street in Auckland has at least 1 house in it, vacant, owned by an absentee non citicen speculator. Which is why we have a housing shortage.

This situation could be resolved with a municipal 100 % penalty vacant property tax and a 10% of valuation annual vacant property speculation tax, with draconian confiscation provisions for non payment. It is one of the few situations where a tax could solve the problem.

Our houses, should be for our people to live in, not for foreigners to make a profit on, whilst they are vacant, our peopel sleep in the streets.

Foreign speculators have made houses in Auckland completely unaforadble for workers. We are being driven back to the situation that existed in the 50’s where lowest income workers had to line up cap in hand and beg the government for social housing to get them off the streets.

In wellington central (where are the Politoicals work) they passed a bylaw making it illegal to sleep in vehicles on the street. Lets just solve the problem, by moving it alonga.

I don’t understand the rush to get into mortgages before interest rates go higher. These people could have bought a house a few years ago when interest rates and prices were lower, but they chose to wait. Now that interest rates and prices are much higher, they think it’s time to buy?

It appears some people are changing their mind about the market. They now have a fear of not being able to buy a home in the future. This kind of emotional buying doesn’t give me a lot of comfort with current price levels.

I would recommend buying now only if you are putting down 3%. You can just walk away from it if things turn sour. The Fed is begging you to do it.

Greedy boomers (who run the state of CA) really screw millennial on housing and many more fronts:

1. Prop 13 which basically freezes property taxes at what they are when you buy (they barely go up no matter how much the property appreciates), so boomers who bought houses 30 yrs ago pay say $3,000 in property taxes for a Coastal home vs, say $12,000 a year they should be paying, like most other states. This forces CA to have the highest state income tax in the country to get the revenue they need, which hammers milennials with high paying w-2 obs. And milennials mostly rent or are first time buyers, so they don;t get the advantage of the Prop 13 welfare boomers get. Prop 13 also prevents more housing supply coming on the market, as many retirees would sell if their property if taxes were $13k a year vs. $3k a year, and move to a cheaper state. Thus adding more supply for millenials to buy. But why ever sell when you have a paid off home on the coast and pay ridiculously low property taxes

2. NIMBY-ism. Boomers in CA (who run the city councils, state Gov’t, etc…) fight any housing development tooth and nail, and make if more difficult and expensive for builders to add supply faster.. This is great for them because it keeps their property value inflated and doesn’t hurt the view. But it screws millennials with astronomical rents and house prices due to demand outpacing supply in housing.

CA Boomers mindset: “I got mine so screw you millenials”

Prop 13 passed in the early 1980’s–more likely the generation before the boomers who controlled politics then. Anyway it was supposed to save older people who were being taxed out of their homes due to rapidly rising taxes.

But increases in government spending causes taxes to go up and CA doesn’t seem to be putting the brakes on spending–case in point: free college tuition.

Many if not most of the people benefiting from prop 13 though are boomers and older, not millenials. Pretty much every other state in the US re-asses property taxes to values on a regular basis, why should CA be the outlier? And because of the shortfall of property taxes due to prop 13, CA has to have a really huge state income tax, which punishes high income professionals.

Prop 13 helps to further distort the nutty CA housing market, along with NIMBY-ism . Both of these factors disproportionately hurt millenials trying to start families, get a reasonable rent or buy a house, and get ahead financially.

You mentioned Homelessness above. Thinking that issue could really expand if affordability becomes a lot worse.

And they are asking for more. Certified for the November ballot in California is a proposition that would allow 55 and older to transfer their grandfathered property tax rate into a new home purchase. The law currently allows for one of these in a lifetime; the proposition on the ballot in November would remove the “one time only” limit.

http://www.lao.ca.gov/ballot/2017/170501.pdf

“CA Boomers mindset: “I got mine so screw you millenials””

Should read

Early Boomers mindset: “I got mine so screw you all”

As one of the tailenders in the baby boom I can assure you. That is their mind set, and has been for a long time.

The tailenders suffer more than any other group, as they were made to pay through the nose for the front end and taught to expect the same, when it was their turn. Which was the greatest lie of them all.

Already retirement ages are rising and payouts are dropping. The tailenders are getting hammered on all sides. Cant get jobs. Cant get pensions. Cant afford taxes/rent.

I saw a cartoon. I think in Time, the other day.

“The generation that broke America, born 1946 1956”

Should have read “the generation that broke the western world” as they have.

This is a good ‘what if’ article, but the Fed spoke clearly today that they will not be doing 4 hikes (that’s what I took away from it) and rates plummeted across the board. No 6% rates on mortgages any time soon.

Interesting dynamic today – the dollar surged yet bond yields tanked. You would have thought that stocks would have jumped to the moon. Everything is priced in.

The fourth rate hike is not off the table. Same as before. The Fed said all it takes is a little more inflation….

just a comment as to how much things can change from generation to generation. I had a uncle in N.C. who bought a home in 1939 for 1500.00. I asked him if it was a new home and he said no it was built in 1923. I said wow it must have only cost 750.00 then. He looked at me kinda funny and said that new it was 2500.00. He said houses were like cars then and depreciated because you had to fix the( new roof, etc.). We’ve had 3 generations that have been fooled by this out of control fed and their credit cycles. When it ends is anybodys guess but end it will either through a massive bust or a currency collapse.

That’s true, houses are depreciable, especially given the inclination of most people to gut perfectly functioning kitchens and bathrooms because they are out of style. Houses have become more like clothing.

New roof? $30,000. New windows? $30,000. New kitchen. $30,000, or maybe $80,000. New furnace. $7000. Take a tree out $5000. New driveway. $15,000.

As real estate agents say… Location, Location, Location.

The house depreciates with age but the house and land location likely increases in value due to proximity to the center of the city.

My grandparents bought a new house in the 1930’s that was considered the boonies compared to the city center but by 1960, they were considered close in the city because public transportation, trains, buses, shopping all reached out to where they lived. Their house was actually flat in price for a long time since in the 1960’s and 1970’s, people were moving to the suburbs for more land and bigger houses. Now the house is increasing higher than inflation because people are moving back to the city .

Their house decreased in value but their location increased in value.

I suspect San Francisco is the same way. You can buy an older house for more in the city or move out to Sacramento and pay less.

There is no direct correlation of mortgage rates and home prices.

In many instances, home prices rise along with mortgage rates.

I am in san diego ca and home prices are still going up, off the roof.

I am curious to see how does this end …

Is this is not a sign that the top is in, read the whole article – this guy knows it is just a game and you have to make as much as you can before it pops again

https://www.bloomberg.com/news/features/2018-05-24/small-time-bankers-make-millions-peddling-mortgages-to-the-poor

Sorry Wolf, the minutes yesterday had the effect of dropping yields because the Fed said they would let inflation run hot. They knew the effect their comments would have. They are scared to death because they know what higher rates will do to their bubbles, and the glacial pace shows they are not serious. If the Fed was serious the minutes yesterday would not have had that language. I will believe it when I see it.

TrojanMan,

There was not a single word in the minutes about letting inflation run hot. I suggest you read the actual minutes and not just headlines in the media and hot-headed bloggers who just read headlines in the media. I don’t know why this nonsense spread like a wildfire.

Actually I know: market manipulation. Stock market players WANT the Fed to let inflation run “hot” and stop raising rates. That’s where this nonsense gets started.

Note the relatively new phrase (showed up this year for the first time): “symmetric 2 percent.” This means that they will no longer only try to push up inflation when it’s below target, but that they will try to push down inflation when it’s above target.

That is much more hawkish than anything we’ve seen in the past 10 years. Here are the minutes:

https://www.federalreserve.gov/monetarypolicy/fomcminutes20180502.htm

And below are some relevant excepts, if you don’t want to dig through the entire minutes:

In discussing the outlook for inflation, many participants emphasized that, after an extended period of low inflation, the Committee’s longer-run policy objective was to return inflation to its symmetric 2 percent goal on a sustained basis. Many saw tight resource utilization, the pickup in wage increases and nonlabor input costs, and stable inflation expectations as supporting their projections that inflation would remain near 2 percent over the medium term. But a few cautioned that, although market-based measures of inflation compensation had moved up over recent months, in their view these measures, as well as some survey-based measures, remained at levels somewhat below those that would be consistent with an expectation of sustained 2 percent inflation as measured by the PCE price index.

Participants commented that above-trend growth in real GDP in recent quarters, together with somewhat higher recent inflation readings, had increased their confidence that inflation on a 12-month basis would continue to run near the Committee’s longer-run 2 percent symmetric objective. That said, it was noted that it was premature to conclude that inflation would remain at levels around 2 percent, especially after several years in which inflation had persistently run below the Committee’s 2 percent objective. In light of subdued inflation over recent years, a few participants observed that adjustments in the stance of policy should take account of the possibility that longer-term inflation expectations have drifted a bit below levels consistent with the Committee’s 2 percent inflation objective. Most participants judged that if incoming information broadly confirmed their current economic outlook, it would likely soon be appropriate for the Committee to take another step in removing policy accommodation. Overall, participants agreed that the current stance of monetary policy remained accommodative, supporting strong labor market conditions and a return to 2 percent inflation on a sustained basis.

These participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and achieving the symmetric 2 percent inflation objective on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening. A few participants commented that recent news on inflation, against a background of continued prospects for a solid pace of economic growth, supported the view that inflation on a 12-month basis would likely move slightly above the Committee’s 2 percent objective for a time. It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee’s symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.

Participants indicated that the Committee, in making policy decisions over the next few years, should conduct policy with the aim of keeping inflation near its longer-run symmetric objective while sustaining the economic expansion and a strong labor market.

Members agreed that inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.

They noted that the stance of monetary policy remained accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

Members agreed that the timing and size of future adjustments to the target range for the federal funds rate would depend on their assessments of realized and expected economic conditions relative to the Committee’s objectives of maximum employment and 2 percent inflation.

Members expected that economic conditions would evolve in a manner that would warrant further gradual increases in the federal funds rate. Members agreed that the federal funds rate was likely to remain, for some time, below levels that they expected to prevail in the longer run. However, they noted that the actual path of the federal funds rate would depend on the economic outlook as informed by incoming data.

Wolf, thank you very much for your thorough and prompt reply. I read your site regulatory but that was my first post ever. I like in the heart of San Francisco with my wife. I’m borderline gen x, she is a millennial. We work all the time and still can’t afford a place in SF. We have a $150K saved for a down payment and it still isn’t enough for a basic 2 bedroom condo. It’s very frustrating. I would have no issue making the payment with higher interest, it’s getting together 20% down at these astronomical prices that’s proving challenging.

Give it some time (years). The market here might move your way :-]

Every RE pro I know here says in private that this feels like 1999 or worse. Starting in 2000, SF emptied out. This market is infamous for its booms and busts.

Fed would never do anything to burst asset bubble hence this so called gradual increase and that too so late.

The moment they see an adverse impact on asset pricing, I am sure they’d back down.

So far, despite their gradual increase in rates, there is virtually no impact to ever increasing asset bubble. if they see an adverse impact, they’d start QE an rate decrease!

People like Warren Buffet have unloaded most of their unwanted assets to the moppets, and are now sitting on huge piles of cash. Time to crash the market, and send the silly moppets who fancy themselves as investors to hell. Sorry Pal, the FED will continue the tightening.

Its just a stinking mess. The FED has screwed the market with their extended low rates and money pumping. Inflation is rampant especially in construction materials and labor.. They have massively overshot. Welcome to the 80k pickup and the 300k Boston Whaler and the debt binge..