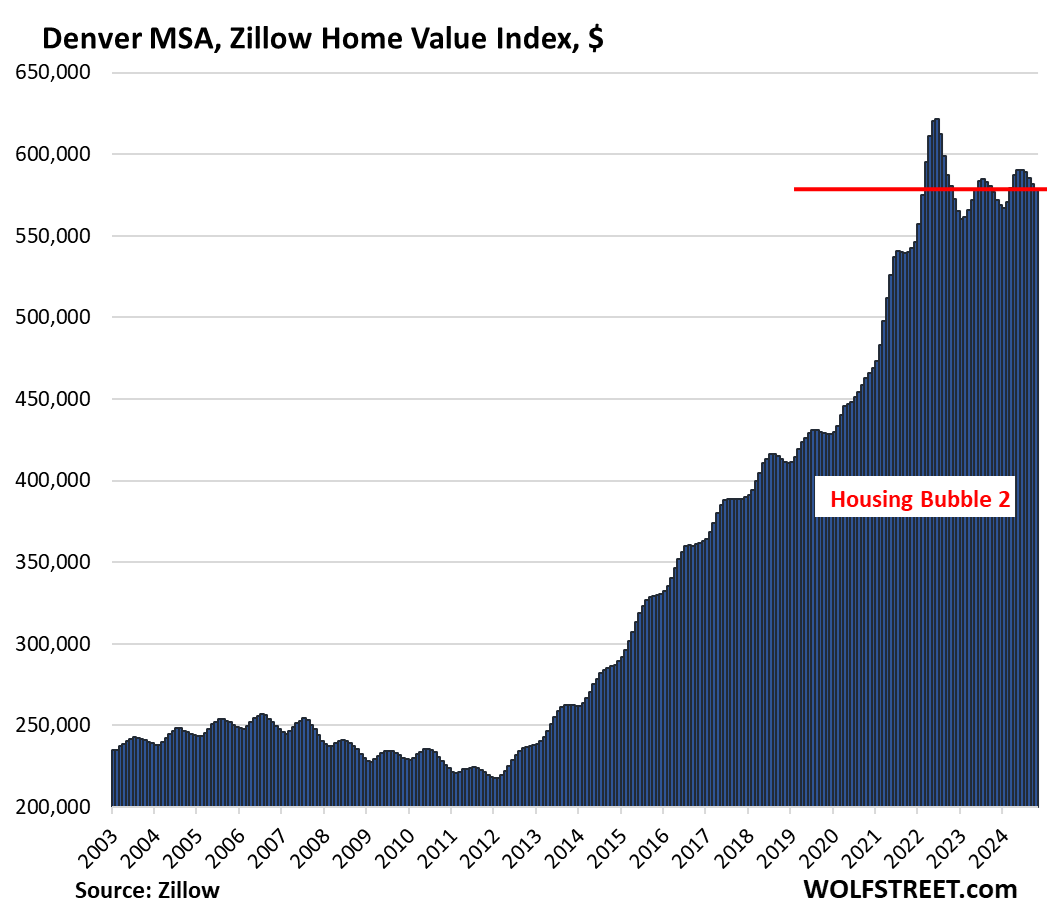

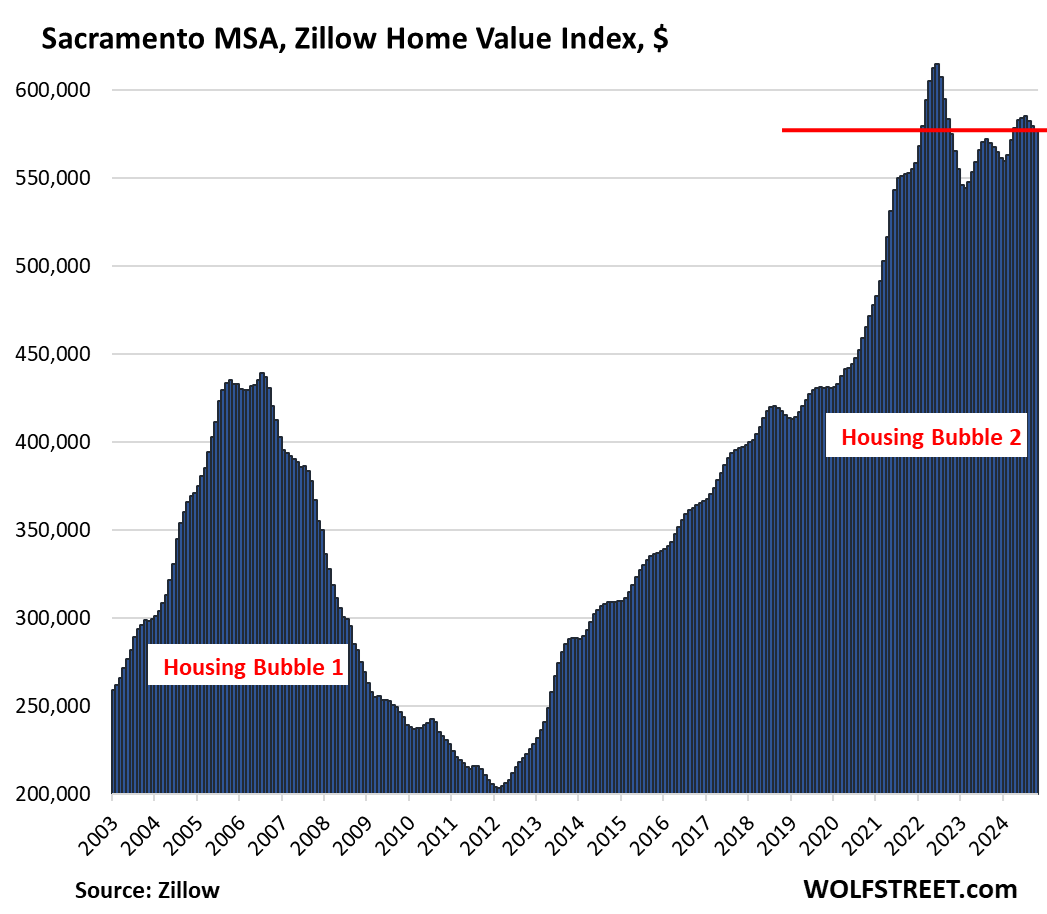

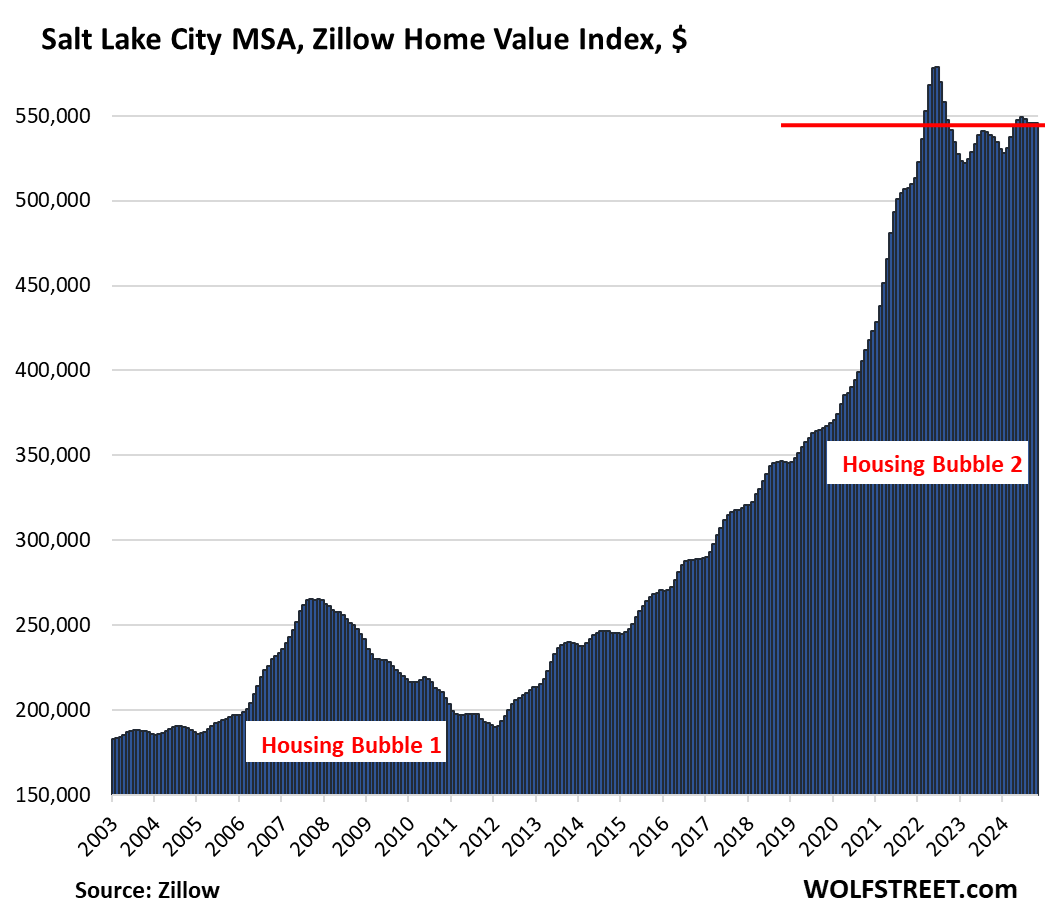

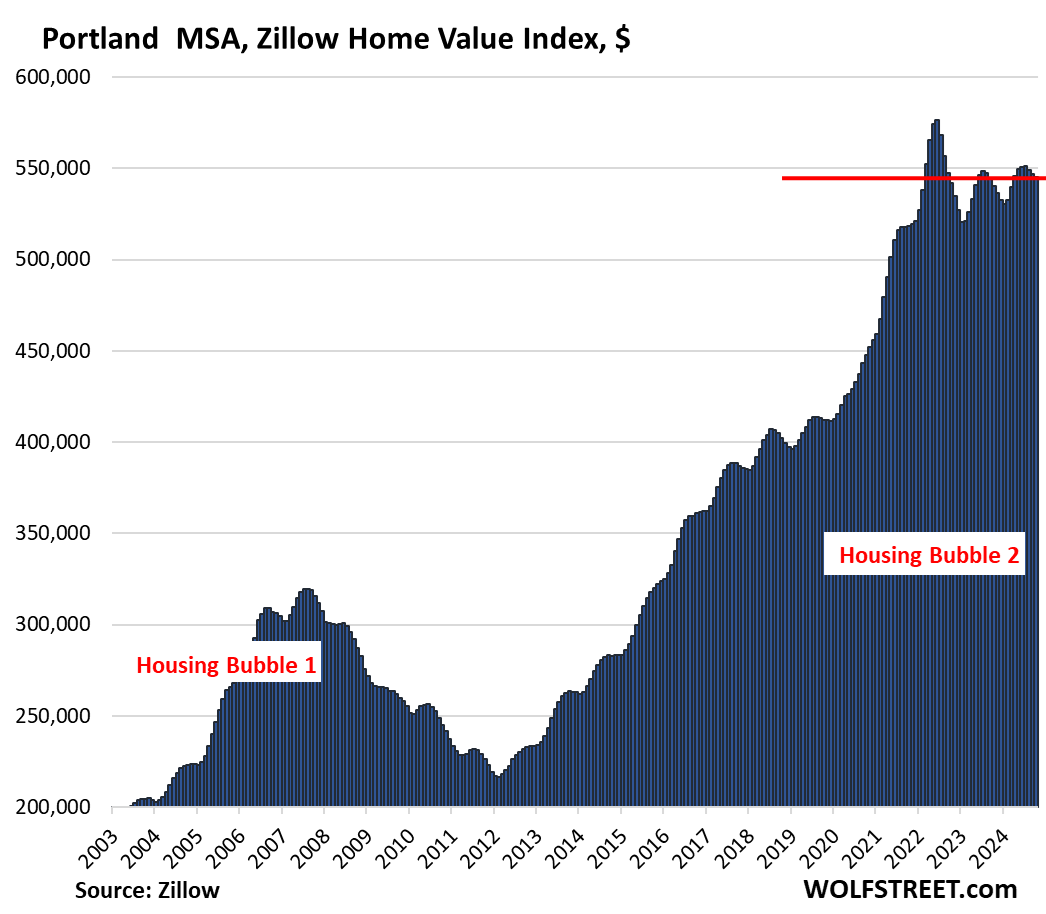

19 are below their 2022 peaks: Austin -20%, San Francisco -10%, Phoenix -8%, San Antonio -7%, Denver -7%, Salt Lake City -6%, Sacramento -6%, Portland -5%, Dallas -5%, Seattle -5%, Honolulu -4%…

By Wolf Richter for WOLF STREET.

The mix that drives the housing market now: Lowest demand since 1995 and surging supply of existing homes, as buyers are on strike because prices are too high. Active listings have been surging all year in just about every major market, including in formerly hot markets such as Florida and in Texas where they reached the highest level since at least 2016. In addition, since the first rate cut, mortgage rates have risen back to around 7%.

Homebuilders have been taking market share from sales of existing homes by lowering their price points, buying down mortgage rates, and throwing incentives into the mix, to where payments on a new house are below payments on an equivalent existing house. And facing ballooning inventories of unsold houses, they continue to aggressively price their inventory and motivate buyers with big incentives. They’re making deals and are absorbing demand that would have gone to existing home sellers, and their sales have held up.

And renting has become a far cheaper solution than buying in recent years, after the spike in prices and the surge in mortgage rates, homeowners’ insurance, property taxes, and maintenance expenses. More and more people who could buy are renting, or are planning to rent when they move the next time; they’re profiting from an arbitrage between two similar products with very different prices, in some metros saving thousands of dollars a month by renting an equivalent home. And this too contributes to the large-scale decline in demand in the purchase market.

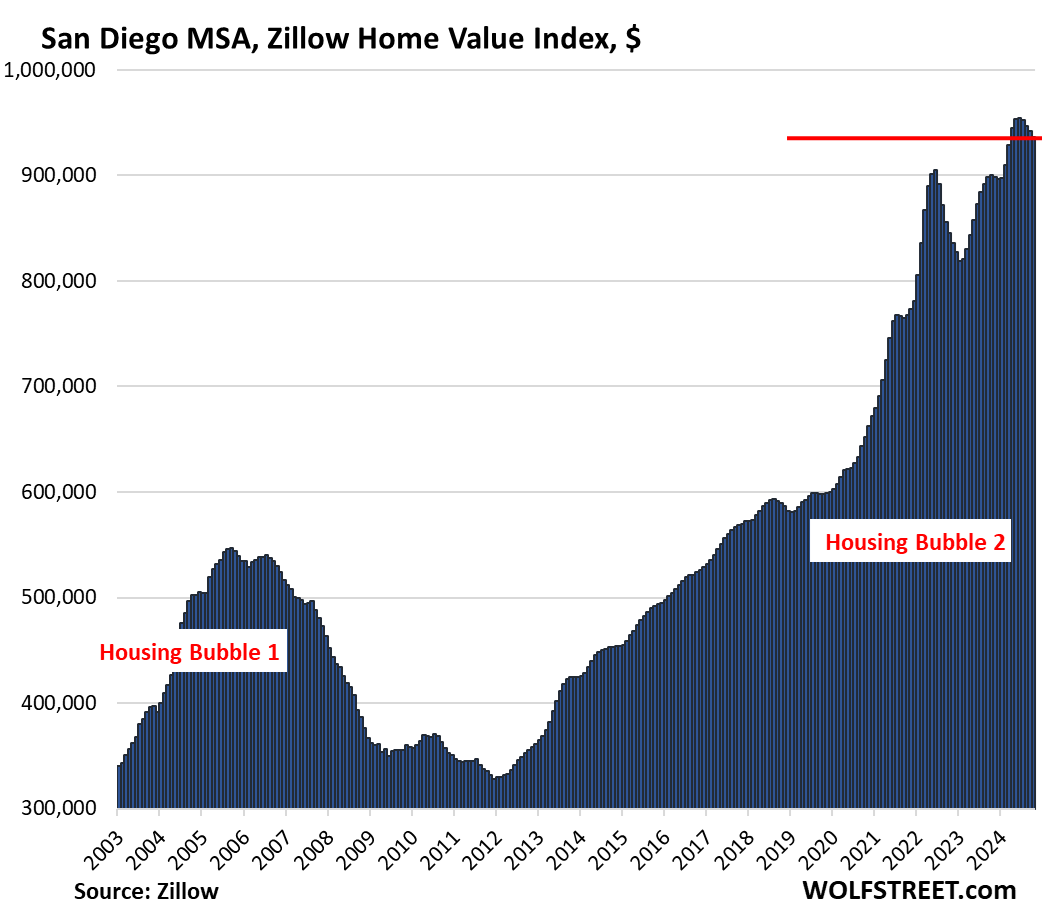

With these dynamics, prices in many major metros, even in markets such as San Diego, have started to sag.

Price declines from prior month: Prices of single-family houses, condos, and co-ops fell in October from September in 29 of the 30 large metros here.

Seasonal, you say? The charts below for each of the 30 markets show that in many markets, there has been nothing seasonal for years – seasonal price changes must happen in a similar way the same months every year, or they’re not seasonal. But in some markets, there is clearly some seasonality.

By Metropolitan Statistical Area (MSA), the top month-to-month price declines:

- Austin: -1.0%

- San Francisco: -0.6%

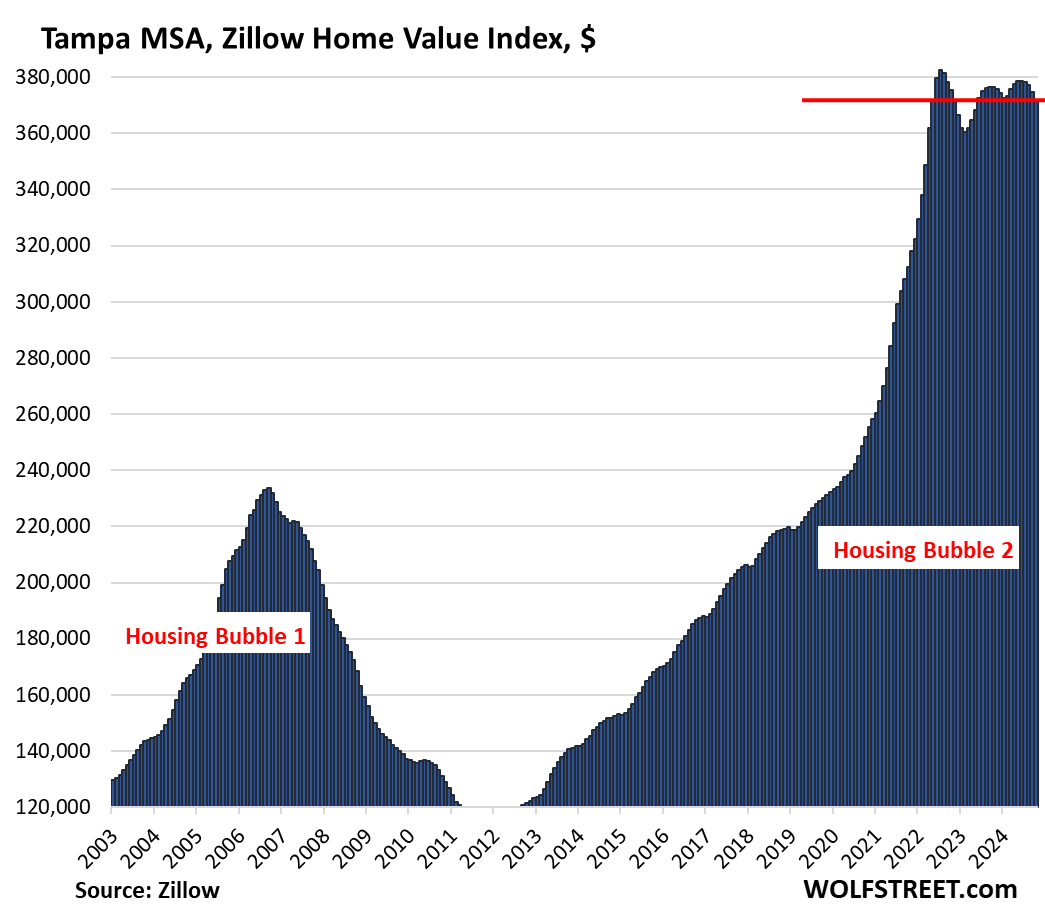

- Tampa: -0.7%

- San Antonio: -0.7%

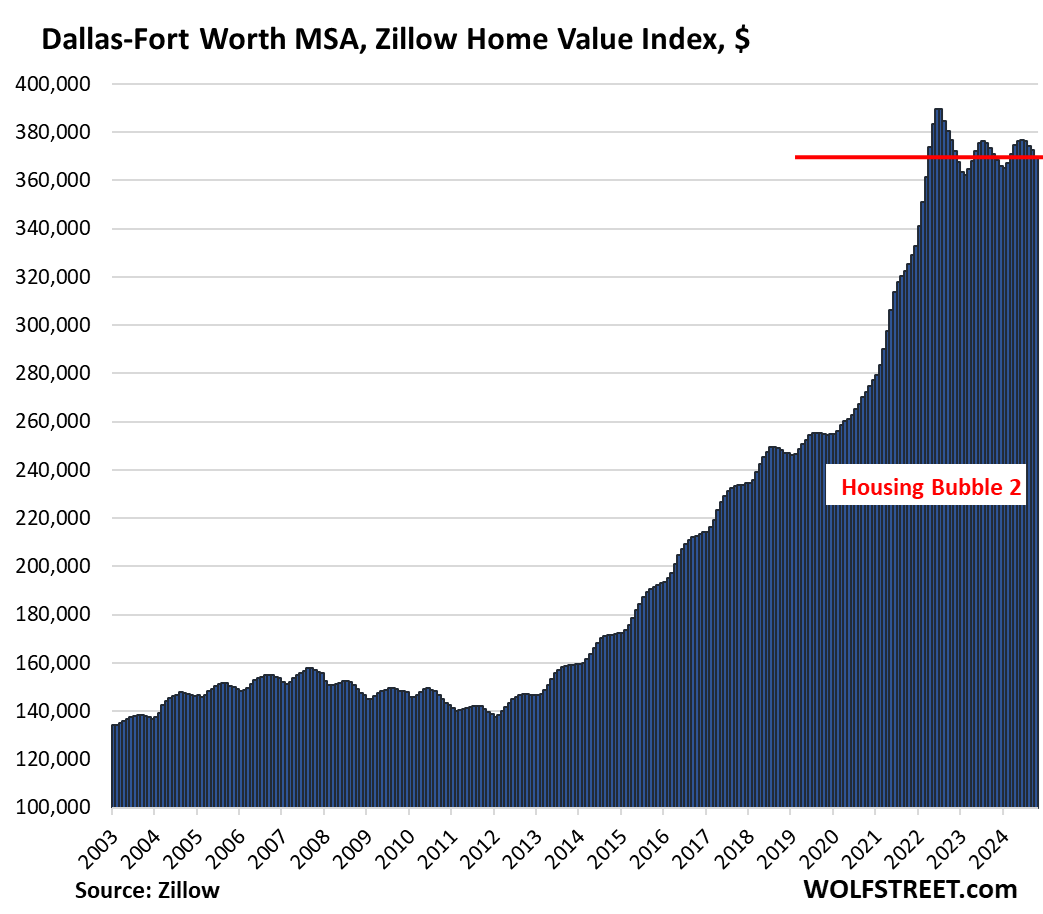

- Dallas: -0.7%

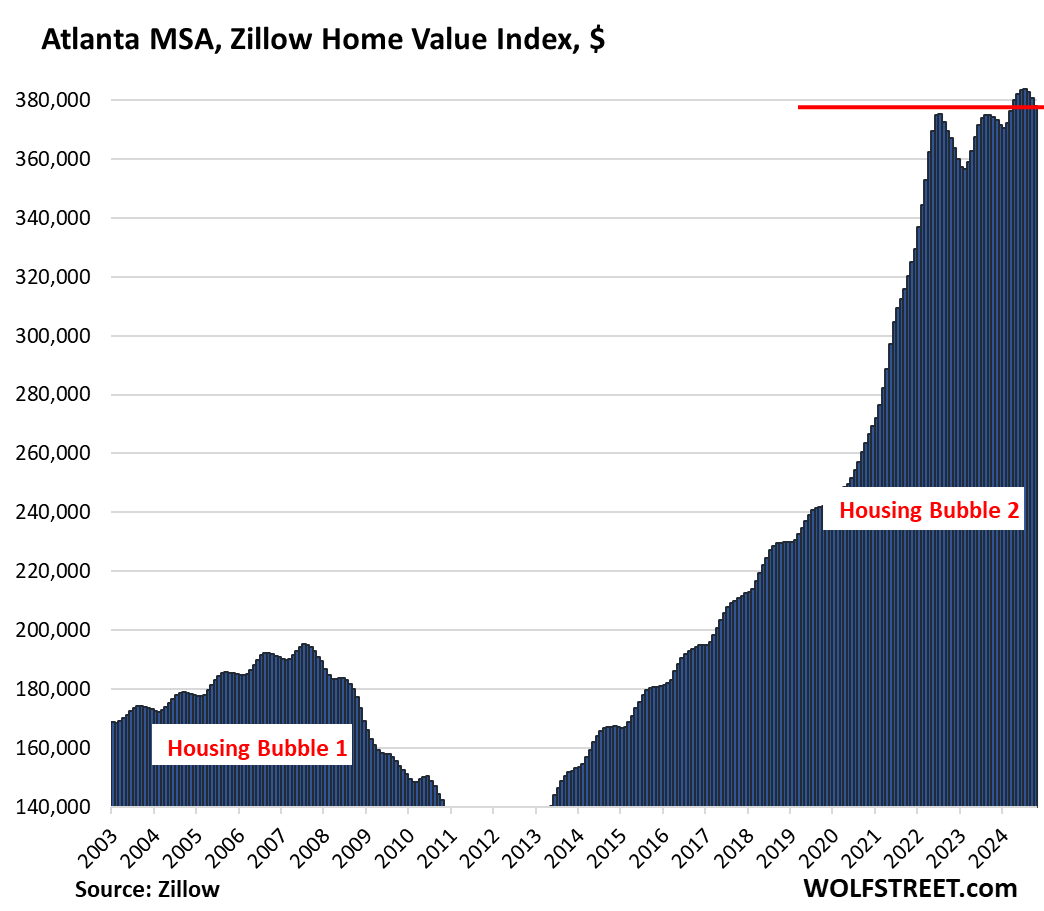

- Atlanta: -0.7%

- Denver: -0.6%

- San Diego: -0.6%

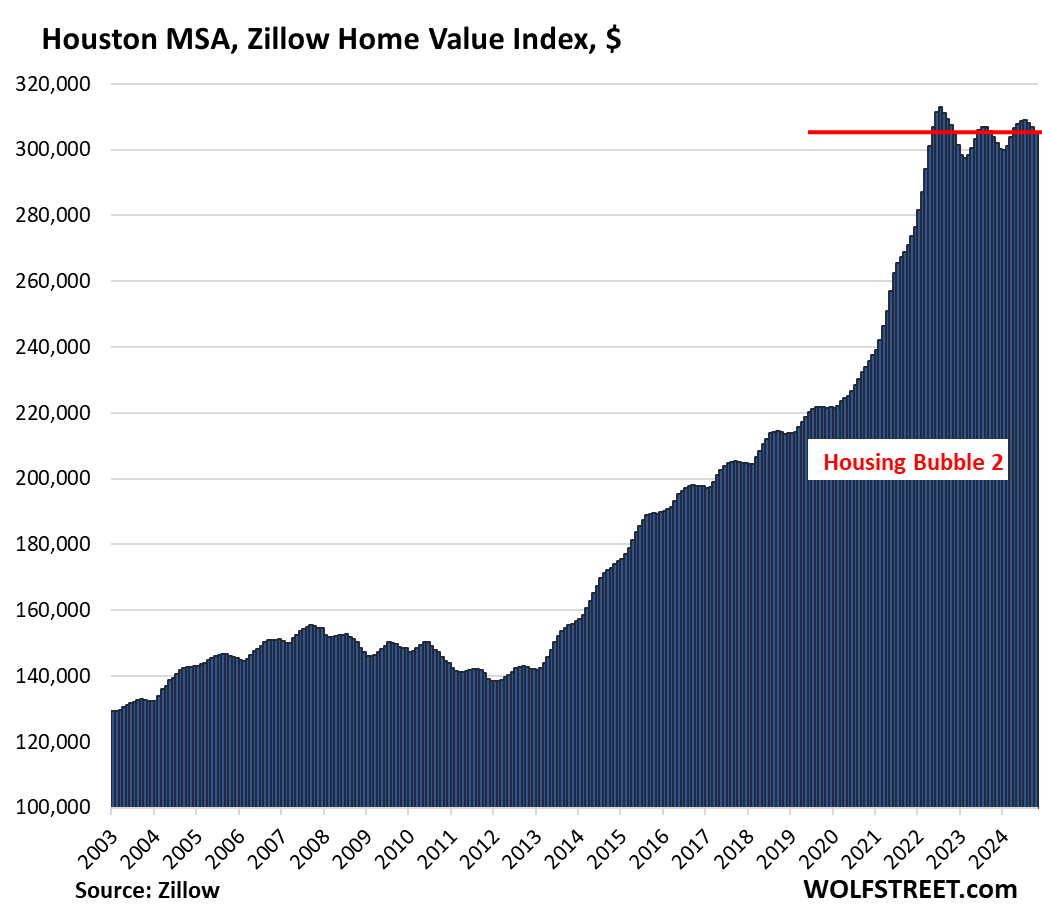

- Houston: -0.6%

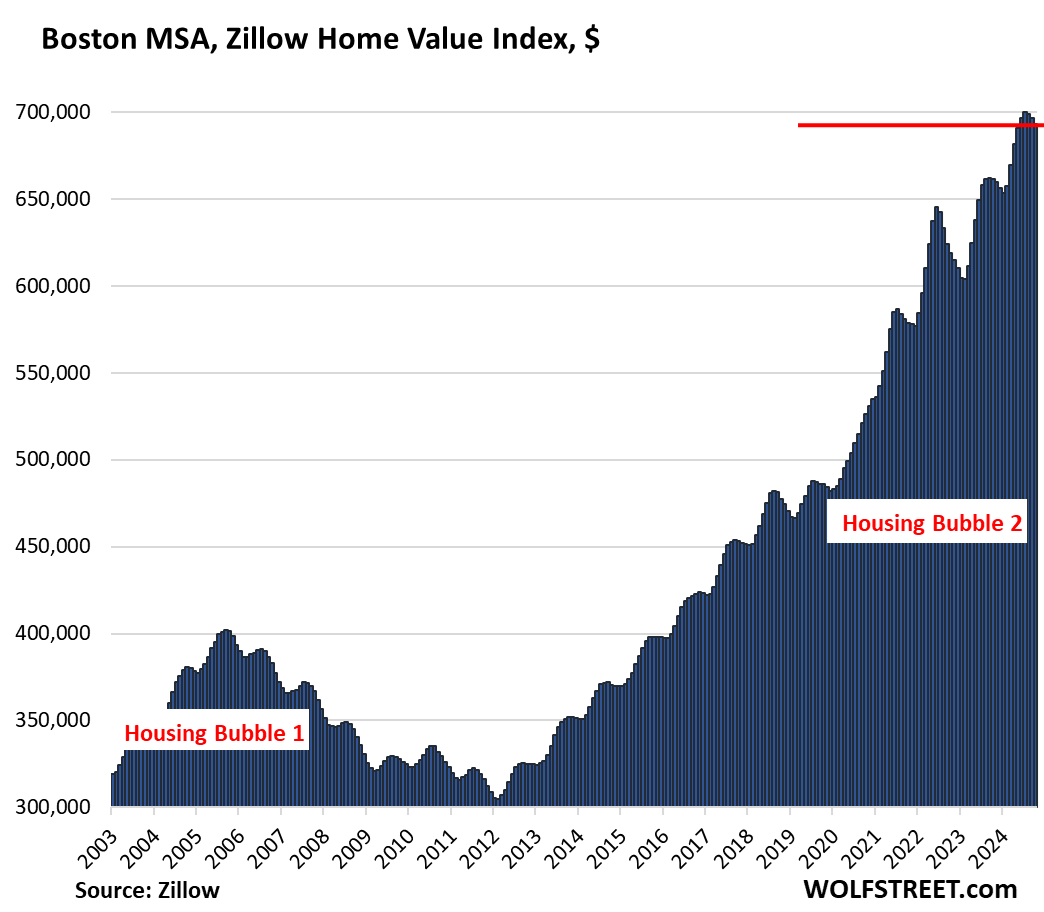

- Boston: -0.5%

- Phoenix: -0.4%

- Sacramento: -0.4%

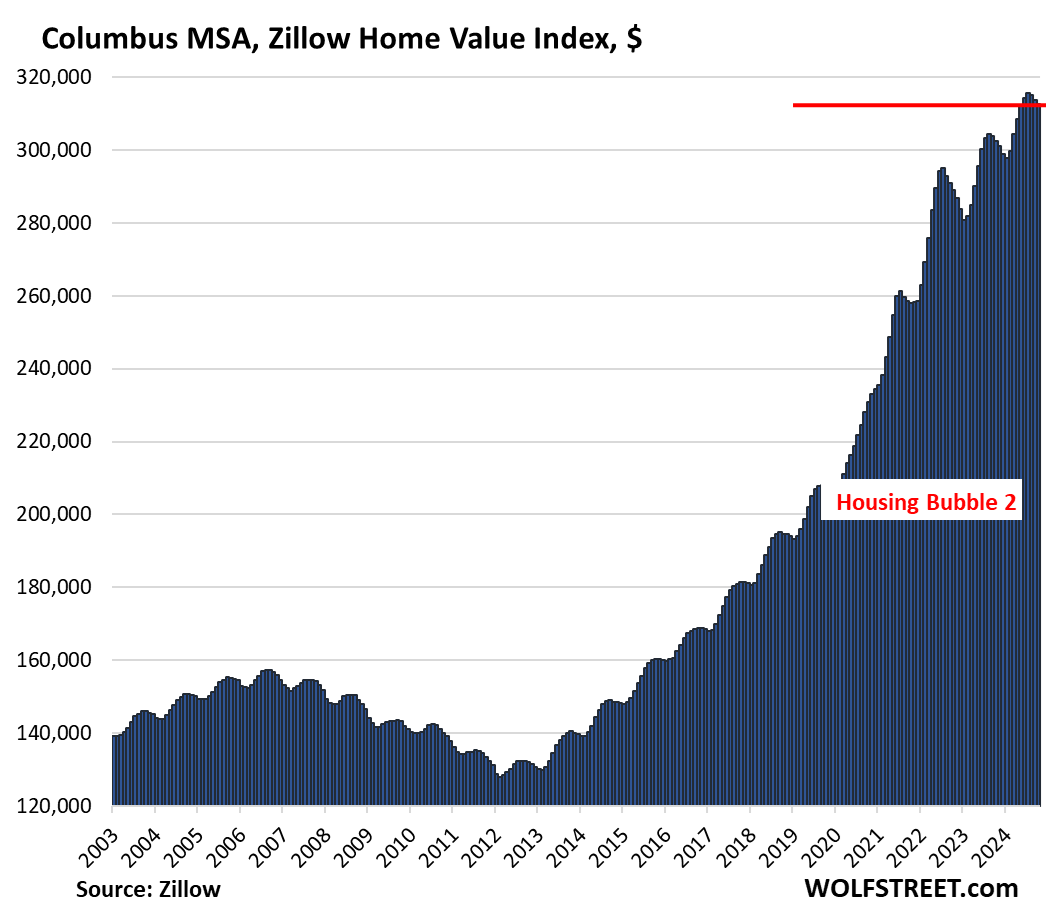

- Columbus: -0.4%

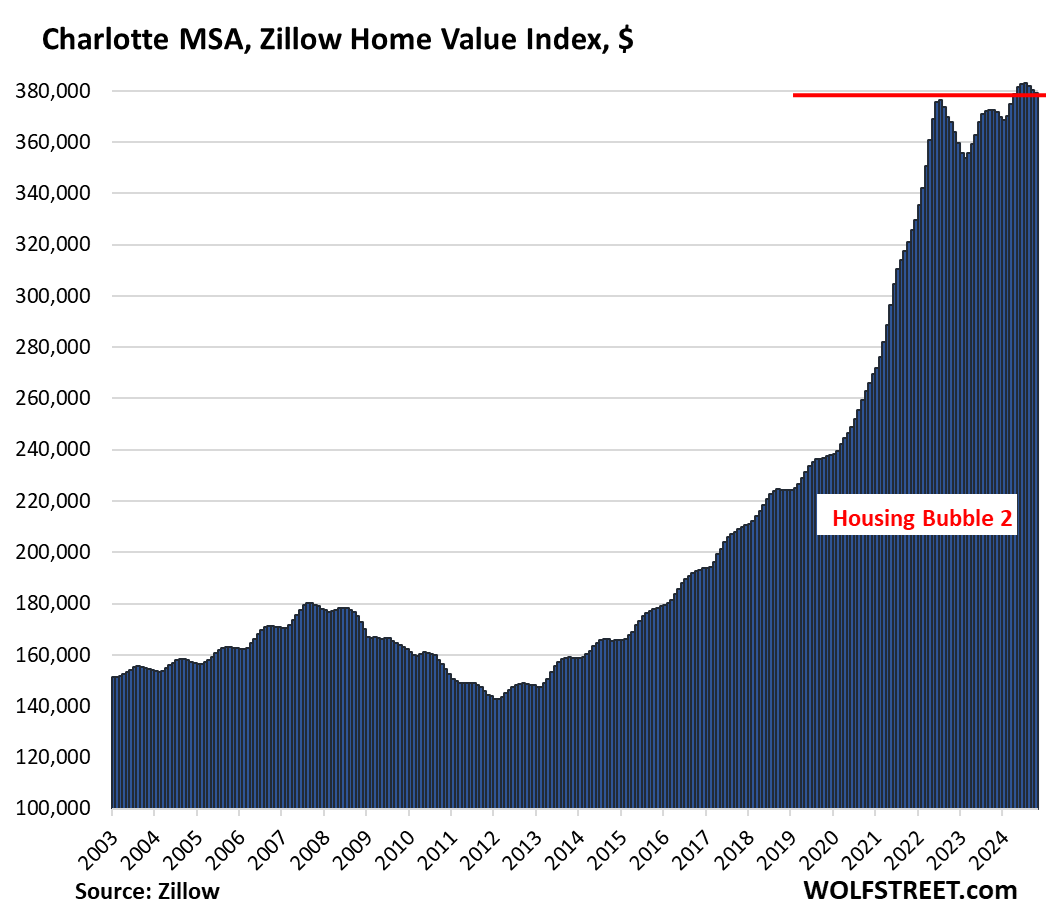

- Charlotte: -0.4%

- Portland: -0.3%

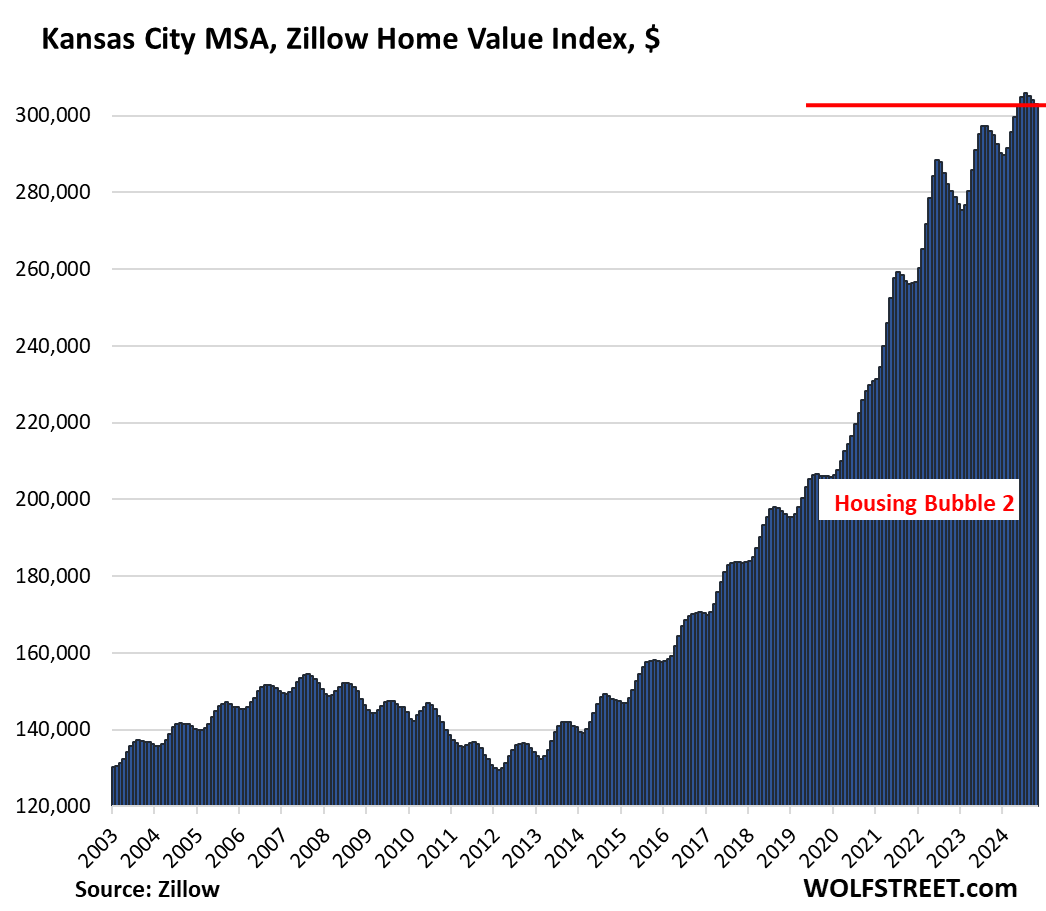

- Kansas City: -0.3%

- Miami: -0.3%

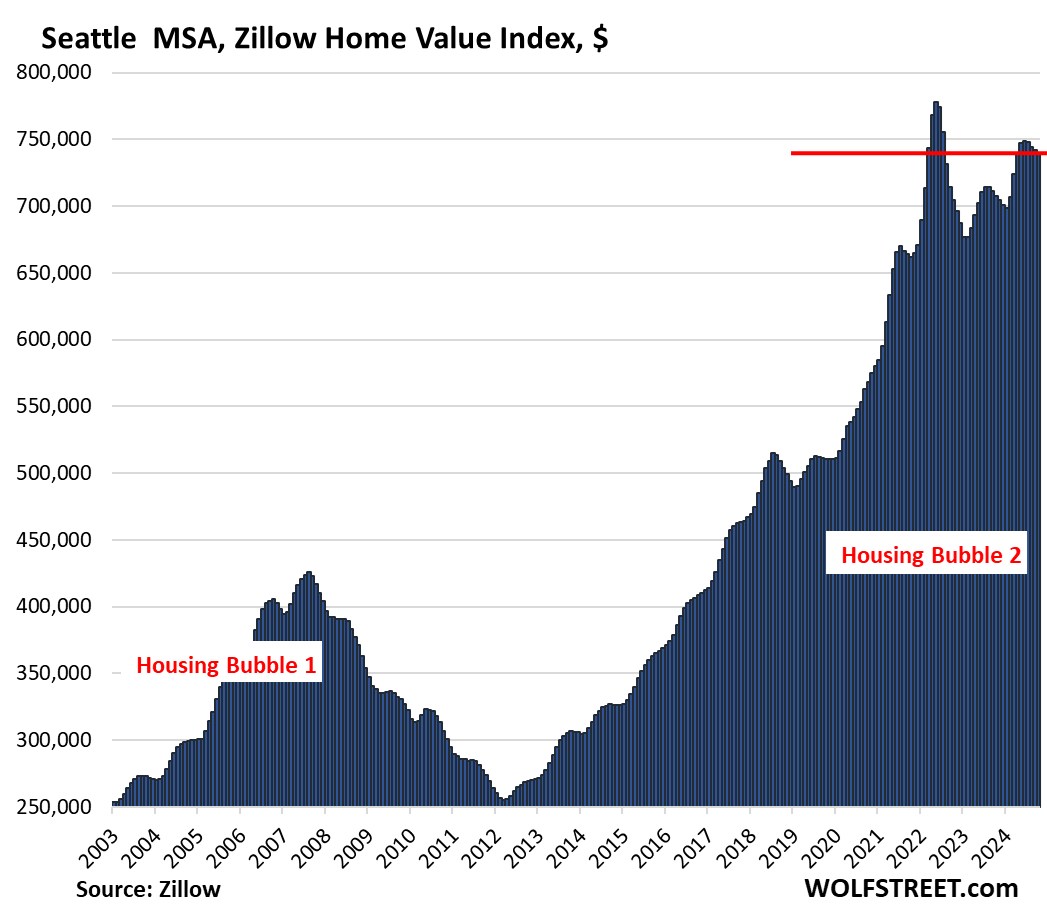

- Seattle: -0.3%

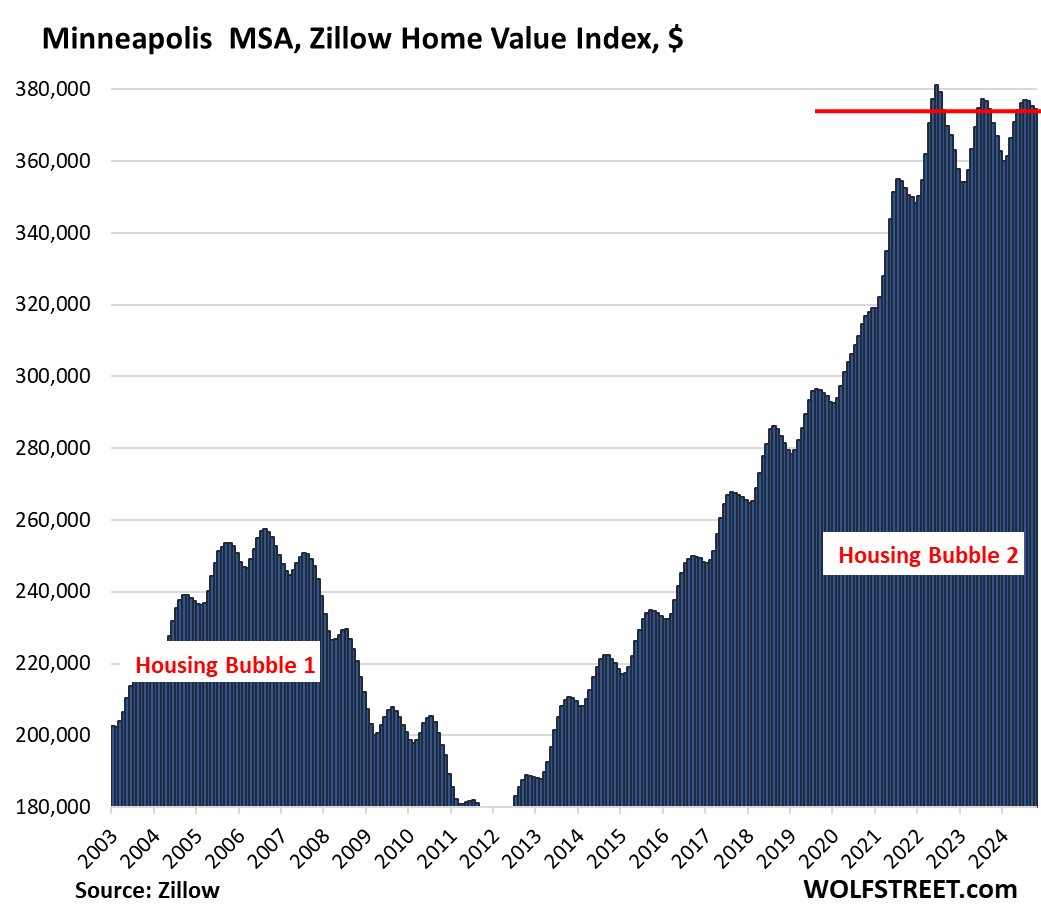

- Minneapolis: -0.3%

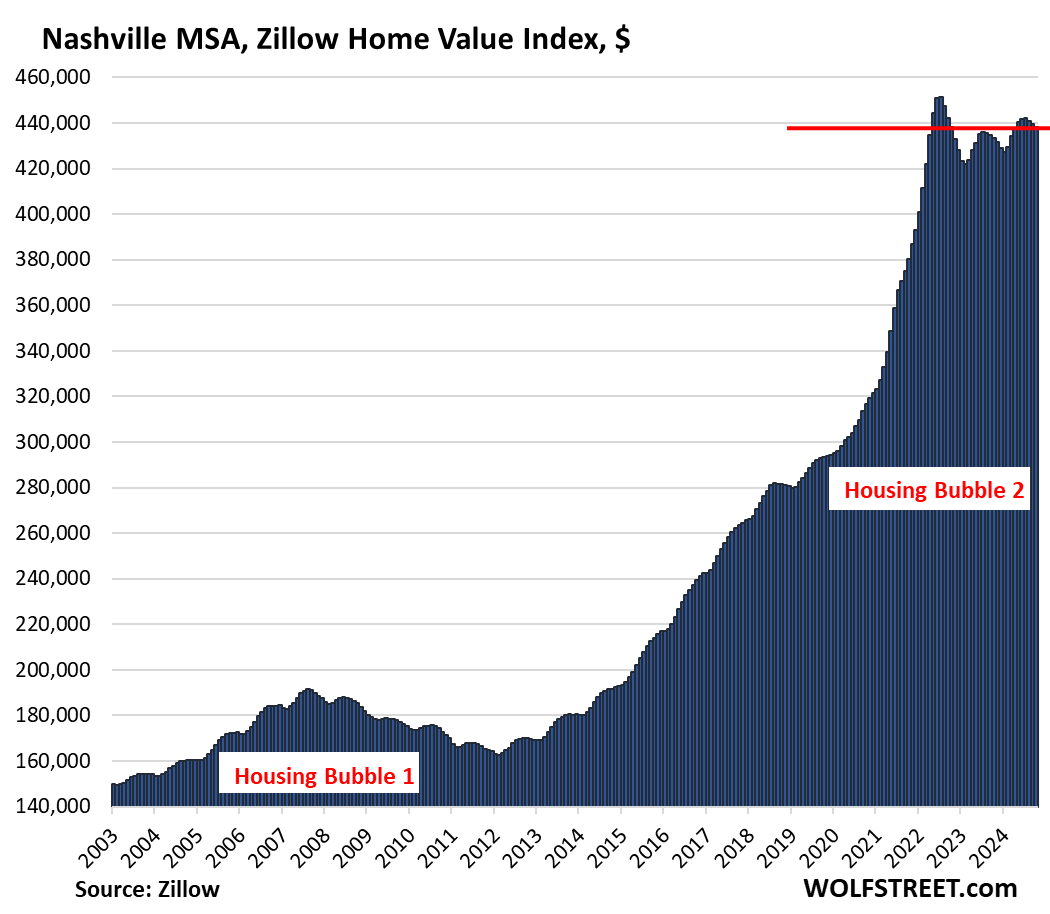

- Nashville: -0.3%

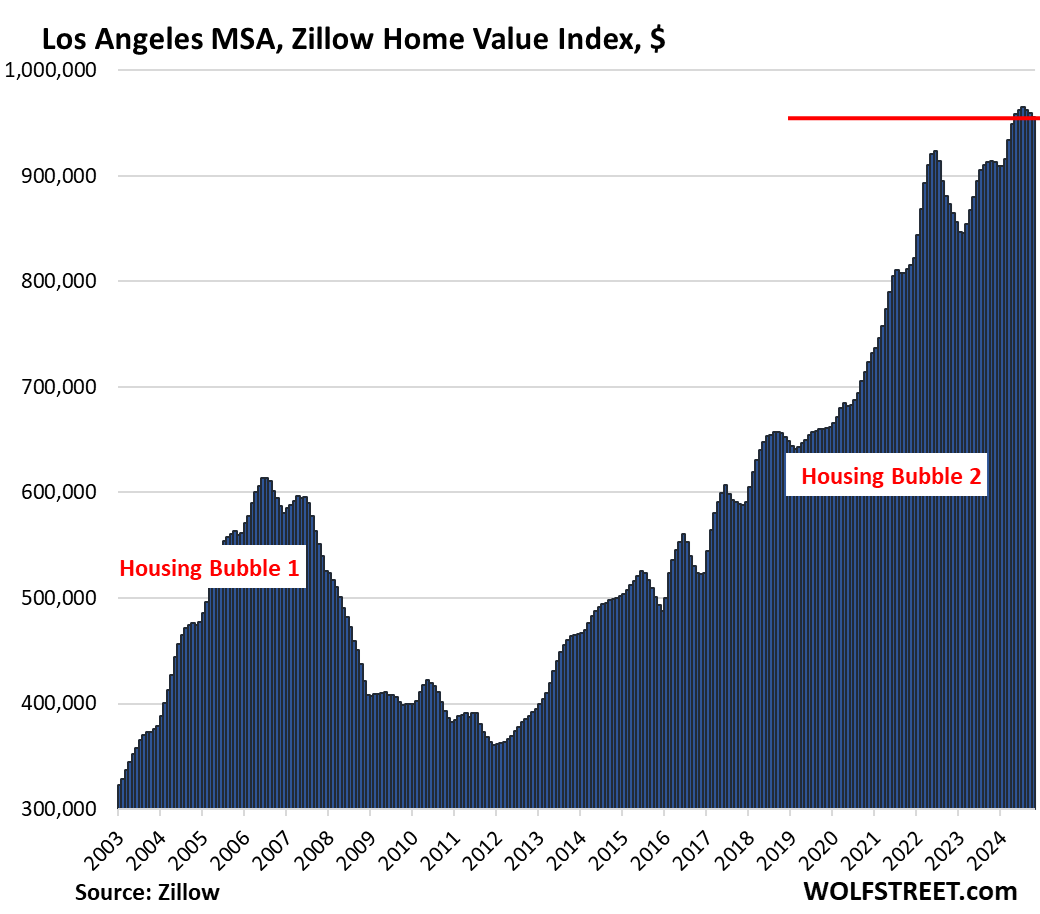

- Los Angeles: -0.3%

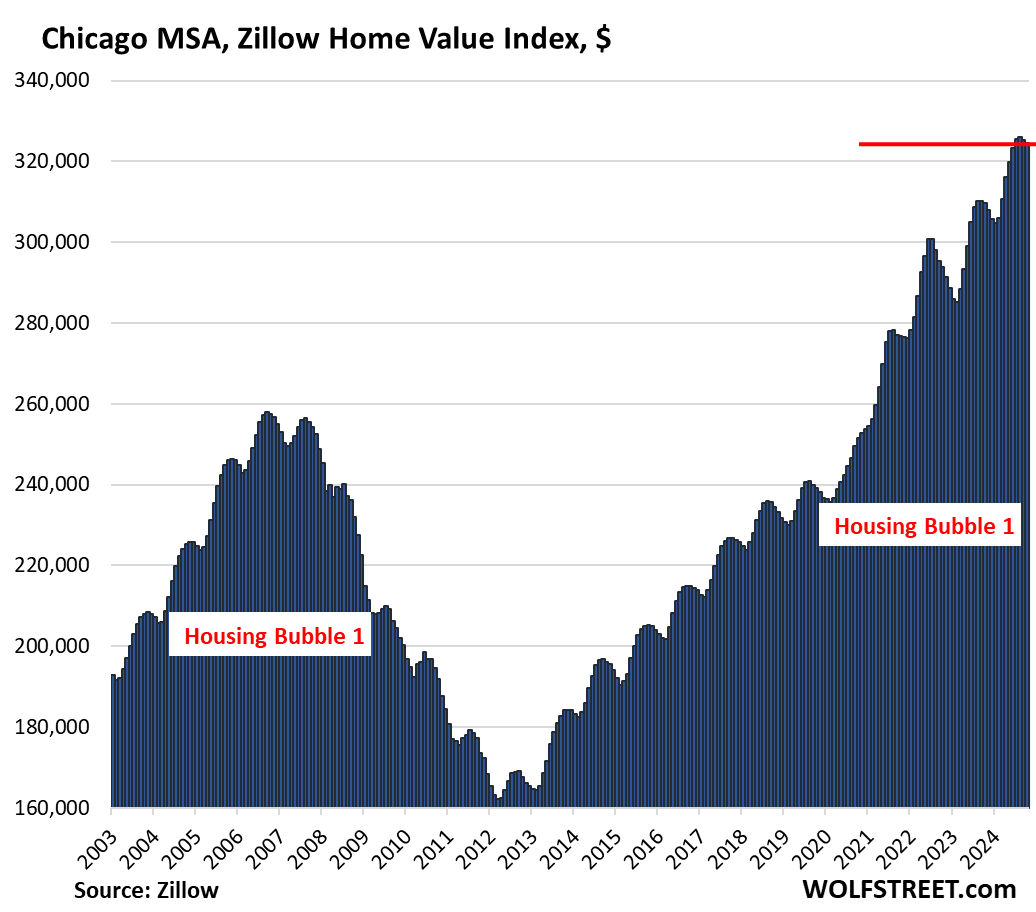

- Chicago: -0.3%

Down from their 2022 peaks: Home prices in 19 of the 30 MSAs here were down from their respective peaks in mid-2022, so roughly from 27 to 28 months ago, led by these 14:

- Austin: -20.4%

- San Francisco: -10.0%

- Phoenix: -8.3%

- San Antonio: -7.5%

- Denver: -6.9%

- Sacramento: -6.0%

- Salt Lake City: -5.7%

- Portland: -5.4%

- Dallas: -5.0%

- Seattle: -4.9%

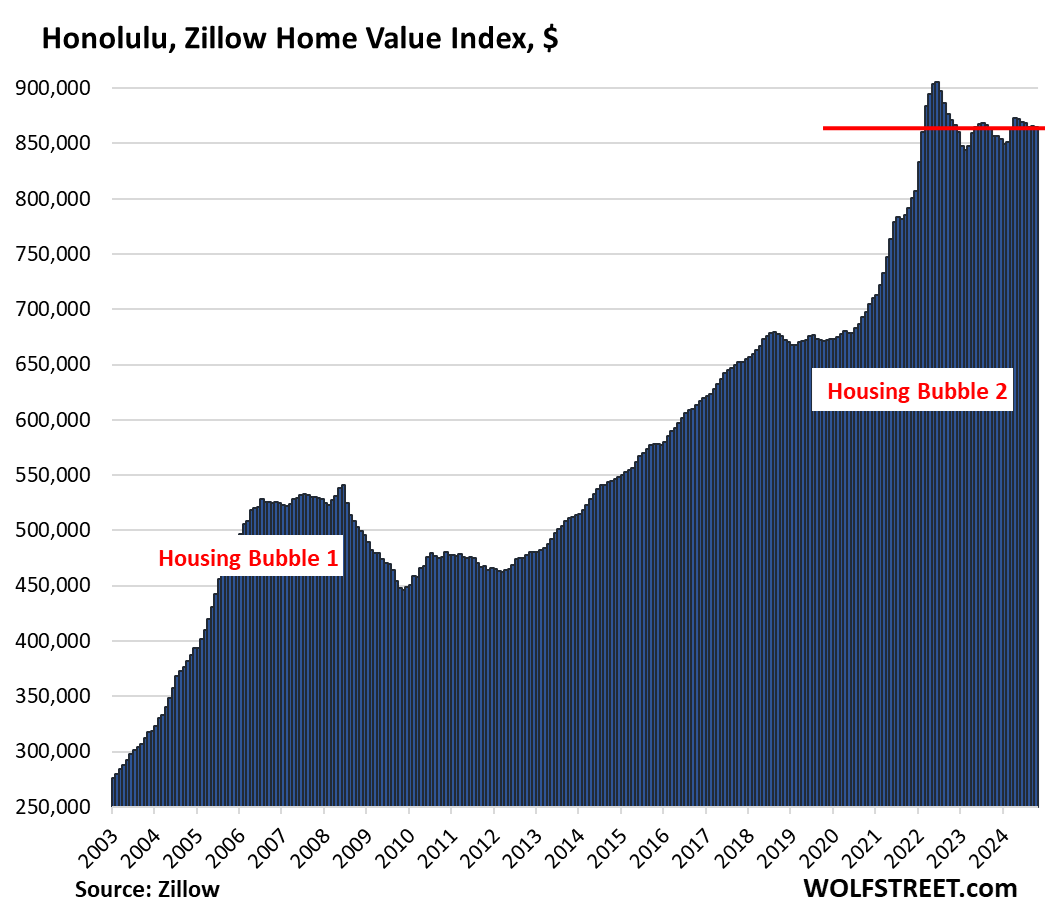

- Honolulu: -4.5%

- Tampa: -2.8%

- Nashville: -2.6%

- Houston: -2.4%

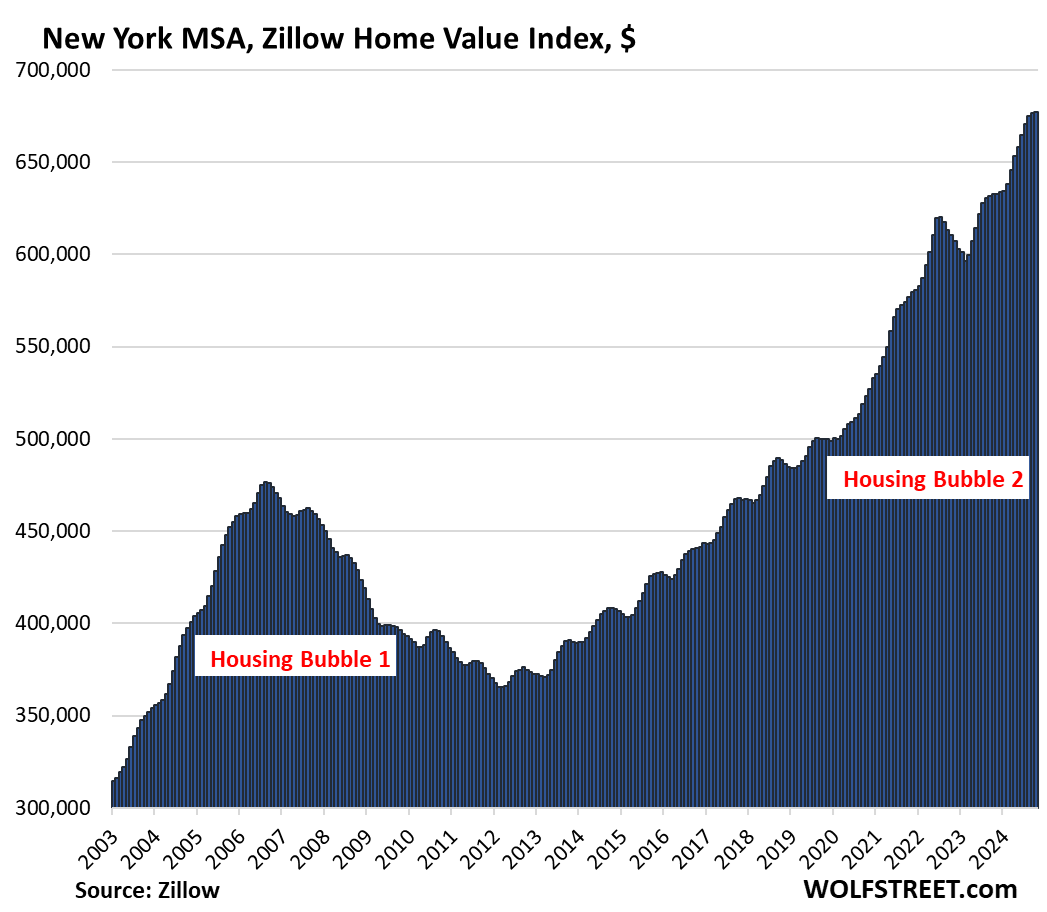

New highs: Prices in the New York City metro inched up by less than 0.1% and eked out a new high, the only metro of the 30 MSAs here to reach a new high in October.

The 30 Most Splendid Housing Bubbles in America.

All data here is from the “raw” Zillow Home Value Index (ZHVI), released today. The ZHVI is based on millions of data points in Zillow’s “Database of All Homes,” including from public records (tax data), MLS, brokerages, local Realtor Associations, real-estate agents, and households across the US. It includes pricing data for off-market deals and for-sale-by-owner deals. Zillow’s Database of All Homes also has sales-pairs data.

We started The Most Splendid Housing Bubbles in America series in 2017 to document visually metro-by-metro the surge in home prices fueled by the Fed’s years of interest rate repression and QE. But since 2022, mortgage rates have risen and the Fed has shed $2 trillion in assets under its QT program, and little by little, metro-by-metro, the dynamics are changing.

To qualify for this list, the market must be one of the largest Metropolitan Statistical Areas (MSA) by population, and must have had a ZHVI of over $300,000 at the peak. The metros of New Orleans, Oklahoma City, Tulsa, Cincinnati, Pittsburgh, etc. don’t qualify for this list because their ZHVI has never reached $300,000, despite massive runups of home prices in recent years.

If these charts look absurd it’s because the housing market has become absurd. Housing market charts should never ever look like this. They’re documenting the crazy distortions triggered by the Fed’s monetary policies that then U-turned in 2022.

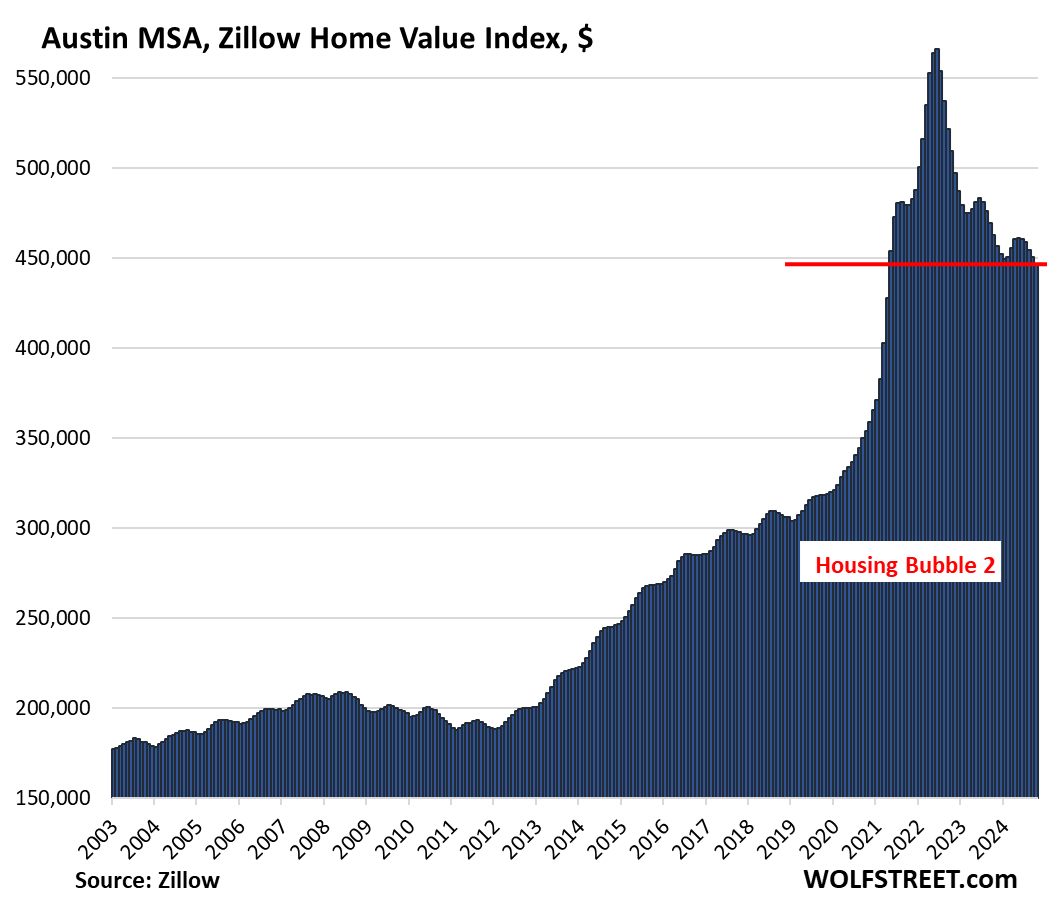

| Austin MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -20.4% | -1.0% | -3.5% | 161% |

Prices in Austin have dropped to the lowest level since April 2021.

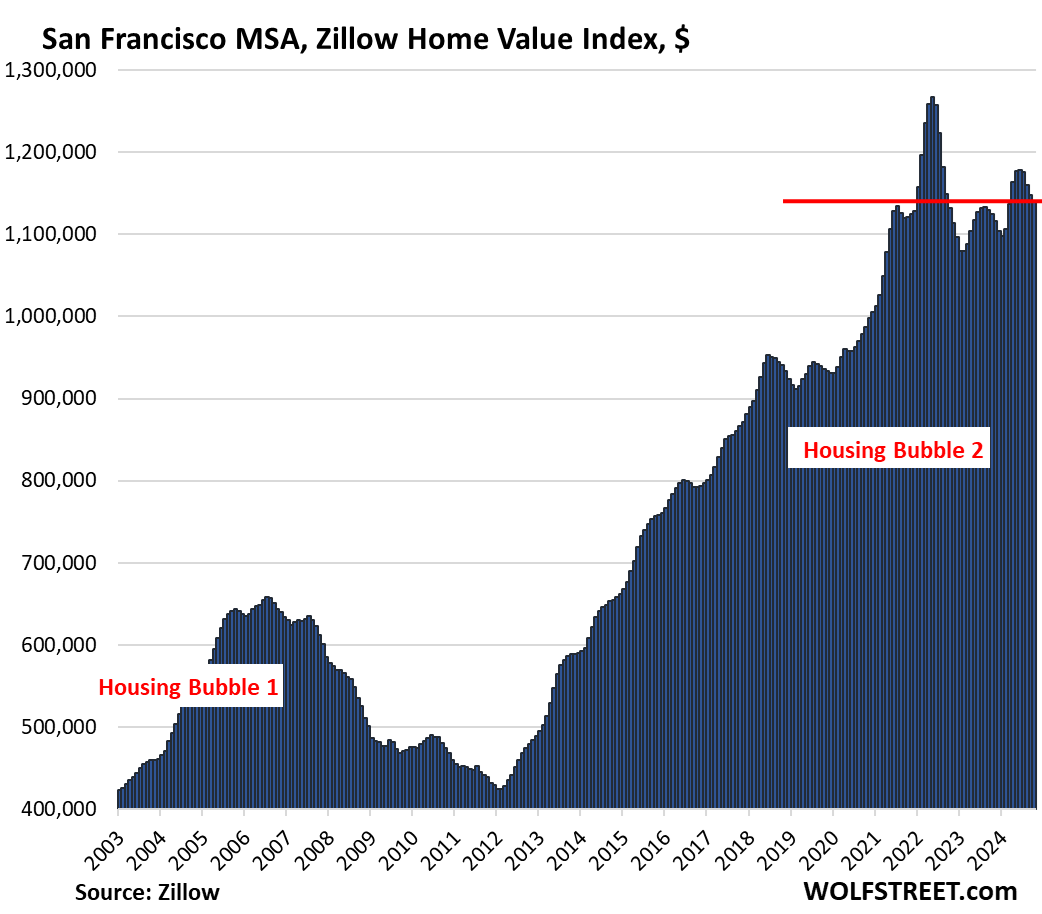

| San Francisco MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -10.0% | -0.6% | 1.4% | 292% |

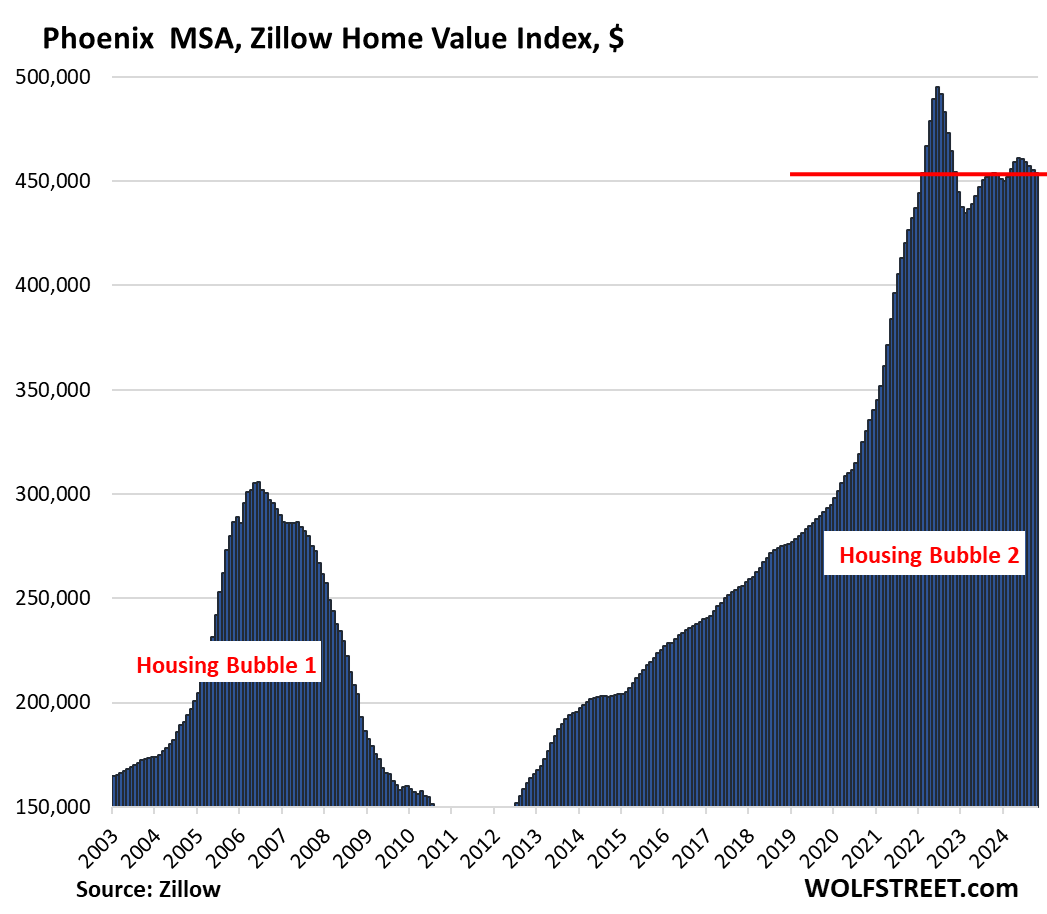

| Phoenix MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -8.3% | -0.4% | 0.0% | 222% |

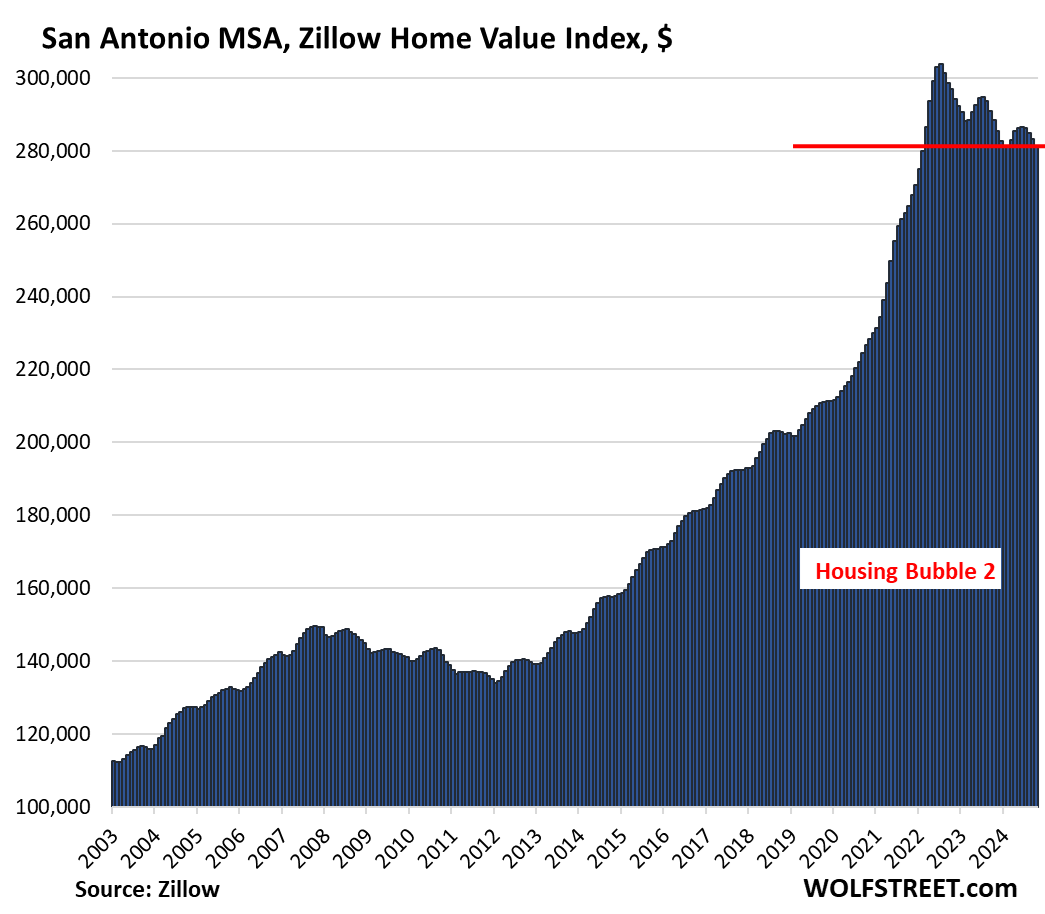

| San Antonio MSA, Home Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -7.5% | -0.7% | -2.5% | 150.7% |

Prices in San Antonia have dropped to the lowest level since February 2022

| Denver MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -6.9% | -0.5% | 0.3% | 214% |

| Sacramento MSA, Home Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -6.0% | -0.4% | 1.7% | 247.3% |

| Salt Lake City MSA, Home Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -5.7% | 0.0% | 1.4% | 214% |

| Portland MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -5.4% | -0.3% | 0.9% | 219% |

| Dallas-Fort Worth MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -5.0% | -0.7% | -0.3% | 196% |

| Seattle MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -4.9% | -0.3% | 4.5% | 239% |

| Honolulu, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -4.5% | -0.1% | 1.0% | 282% |

| Tampa MSA, Home Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -2.3% | -0.5% | -0.4% | 214% |

| Nashville MSA, Home Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -2.6% | -0.3% | 1.1% | 218% |

| Houston MSA, Home Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -2.4% | -0.6% | 0.5% | 152% |

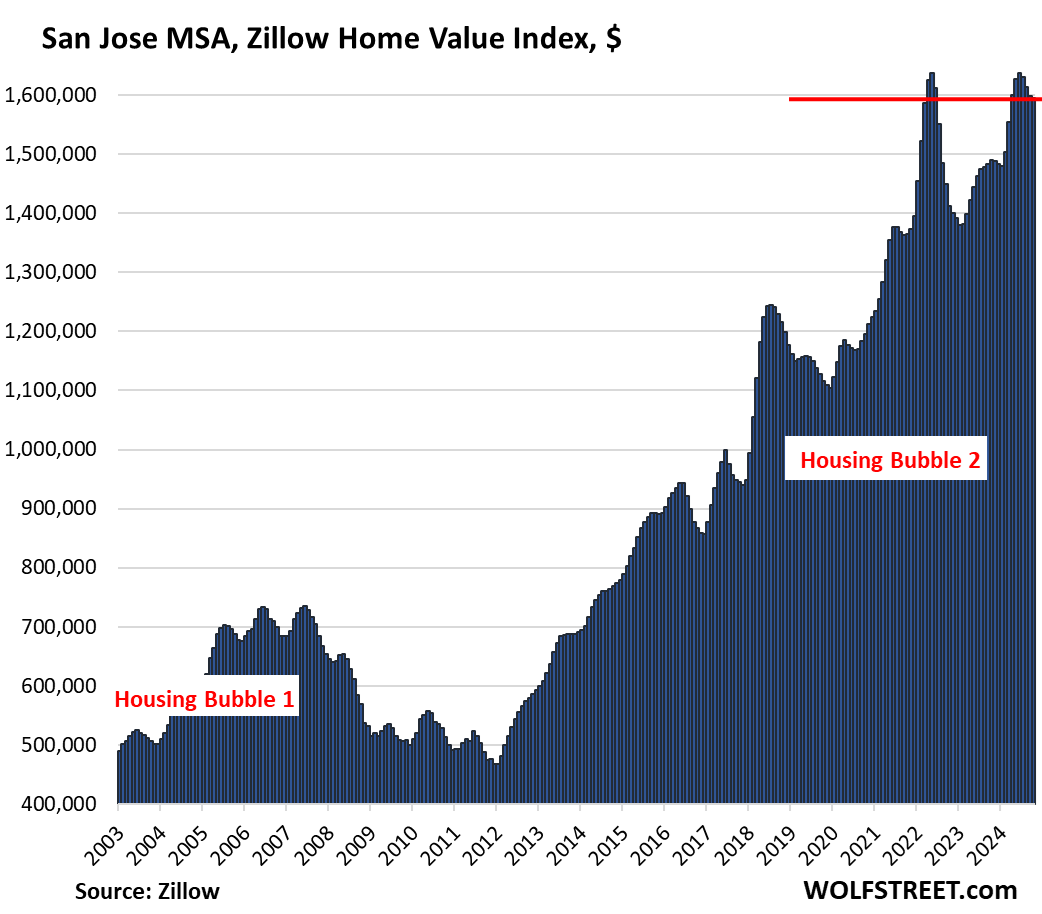

| San Jose MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -2.4% | -0.2% | 7.1% | 336% |

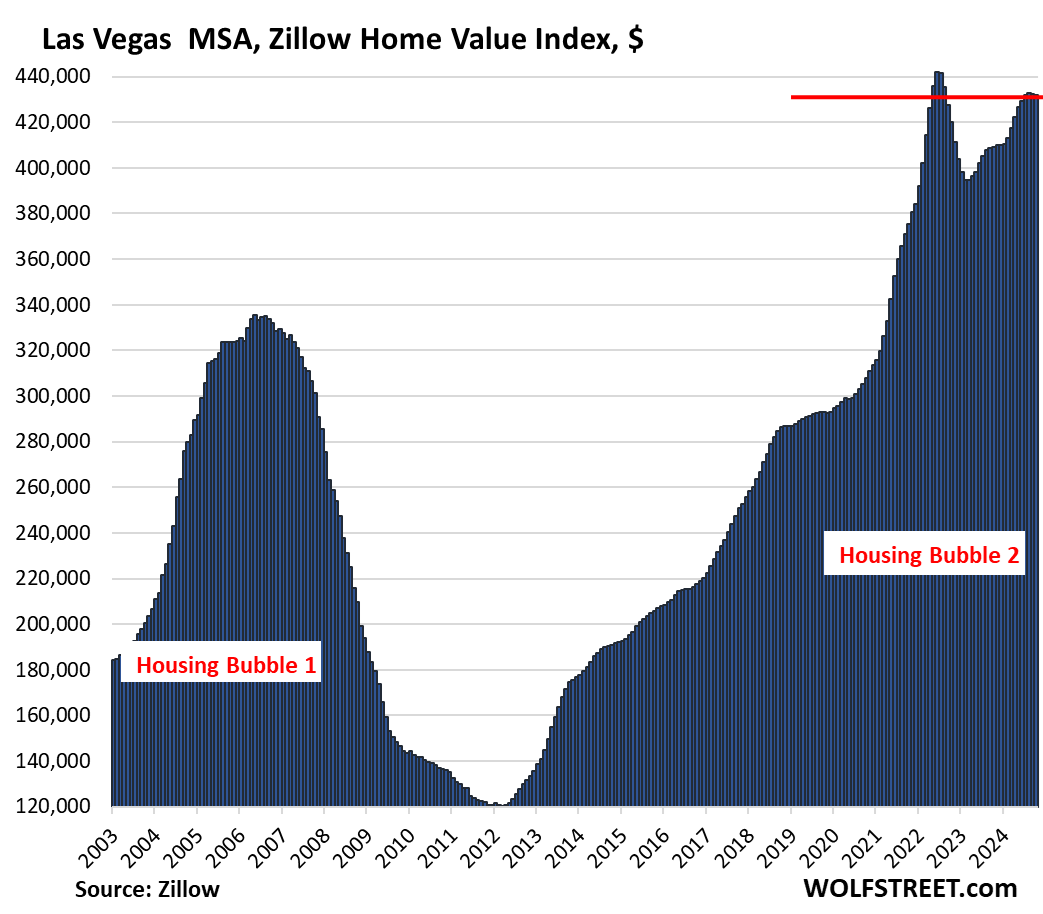

| Las Vegas MSA, Home Prices | |||

| From June 2022 peak | MoM | YoY | Since 2000 |

| -2.2% | -0.1% | 5.5% | 179% |

| Minneapolis MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -1.8% | -0.3% | 1.0% | 158% |

| Charlotte MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| -0.4% | 1.8% | 171.5% | |

| San Diego MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.6% | 3.9% | 335% |

| Los Angeles MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 4.6% | 331% |

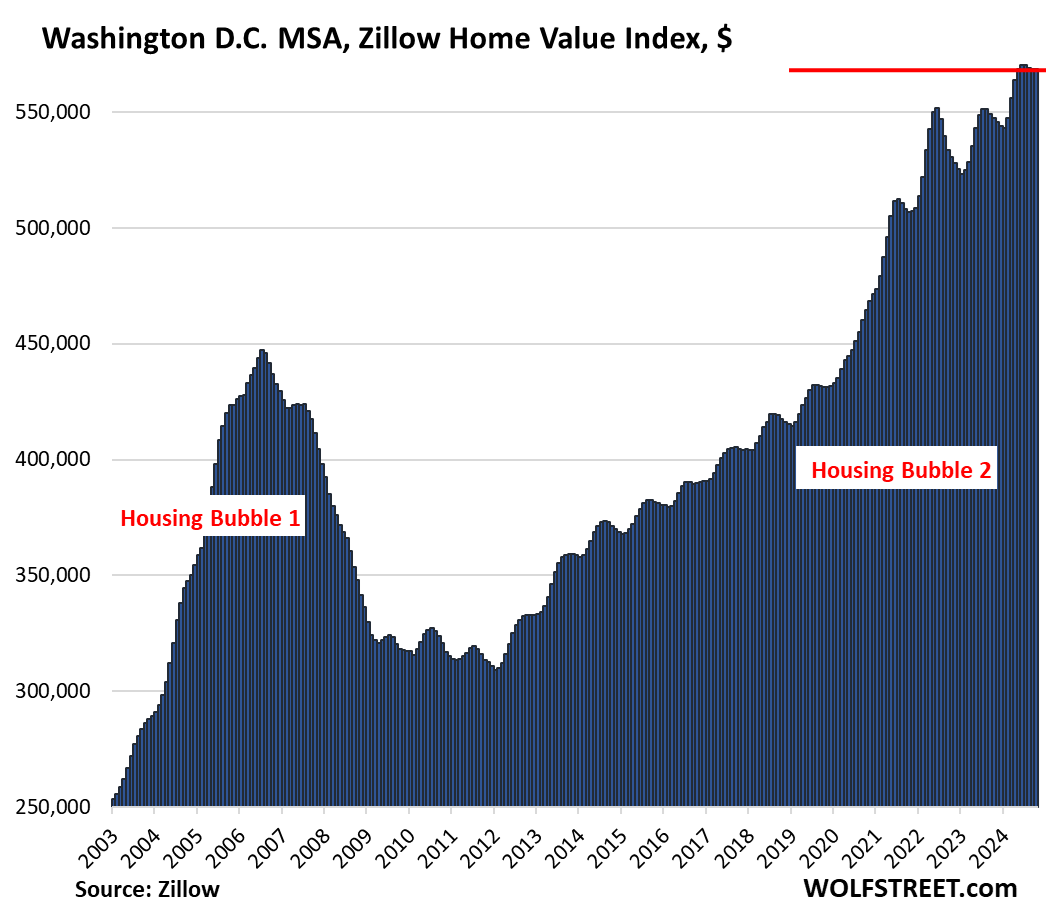

| Washington D.C. MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| 0.0% | 3.8% | 215% | |

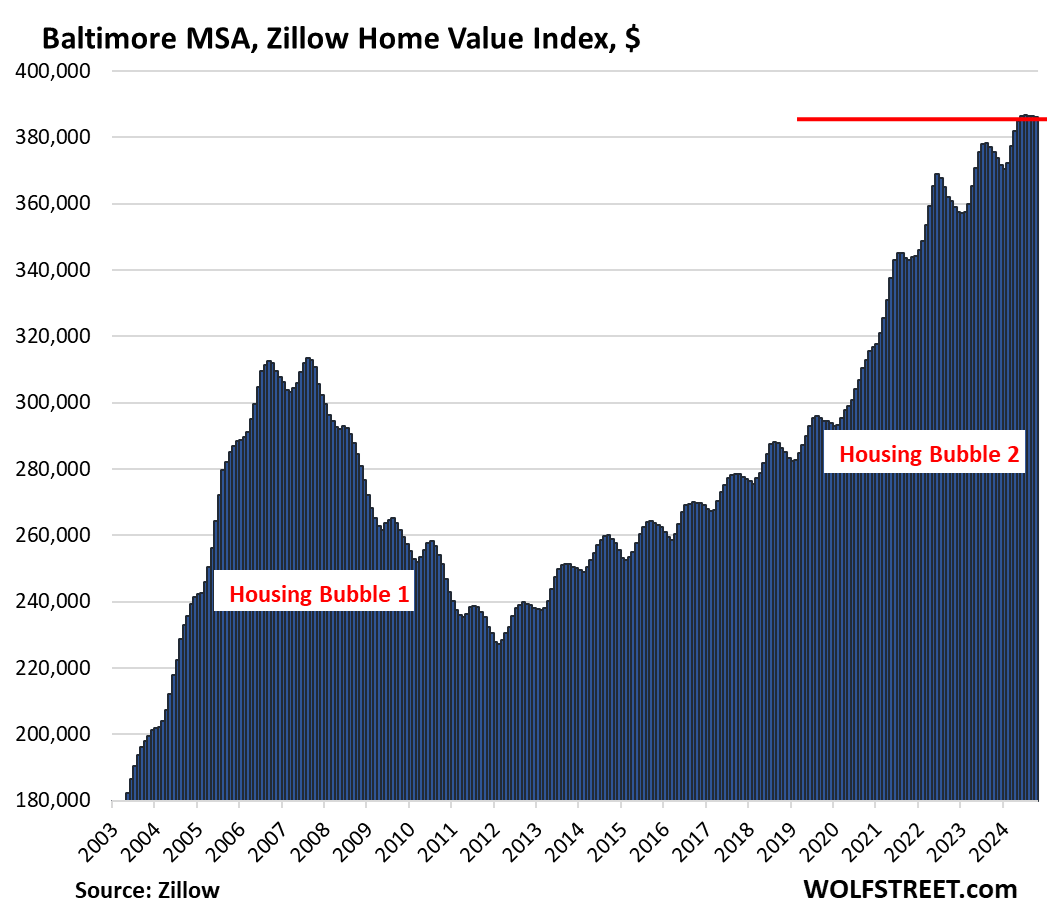

| Baltimore MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| -0.1% | 2.8% | 174% | |

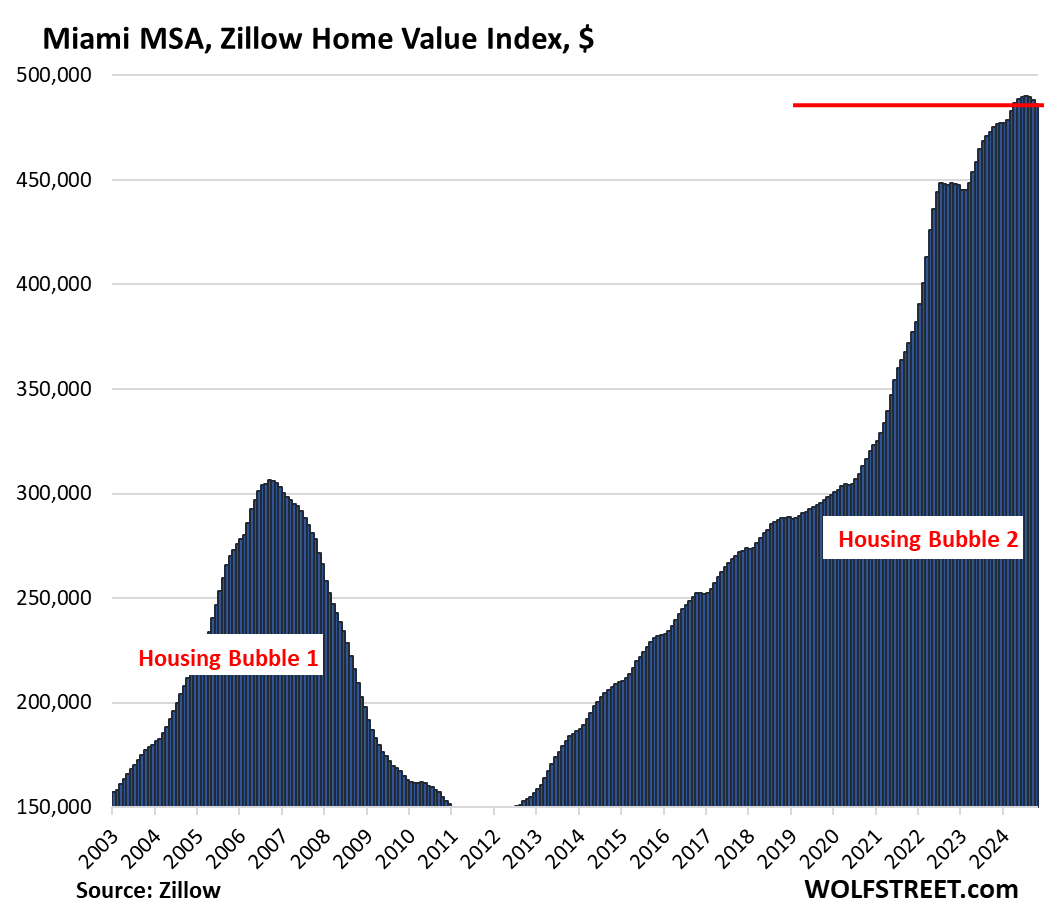

| Miami MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 2.3% | 333.4% |

| Atlanta MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.7% | 1.1% | 164% |

| Kansas City MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 2.7% | 177% |

| Columbus MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.4% | 3.3% | 154% |

| Boston MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.5% | 4.8% | 227% |

| Chicago MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 4.8% | 113% |

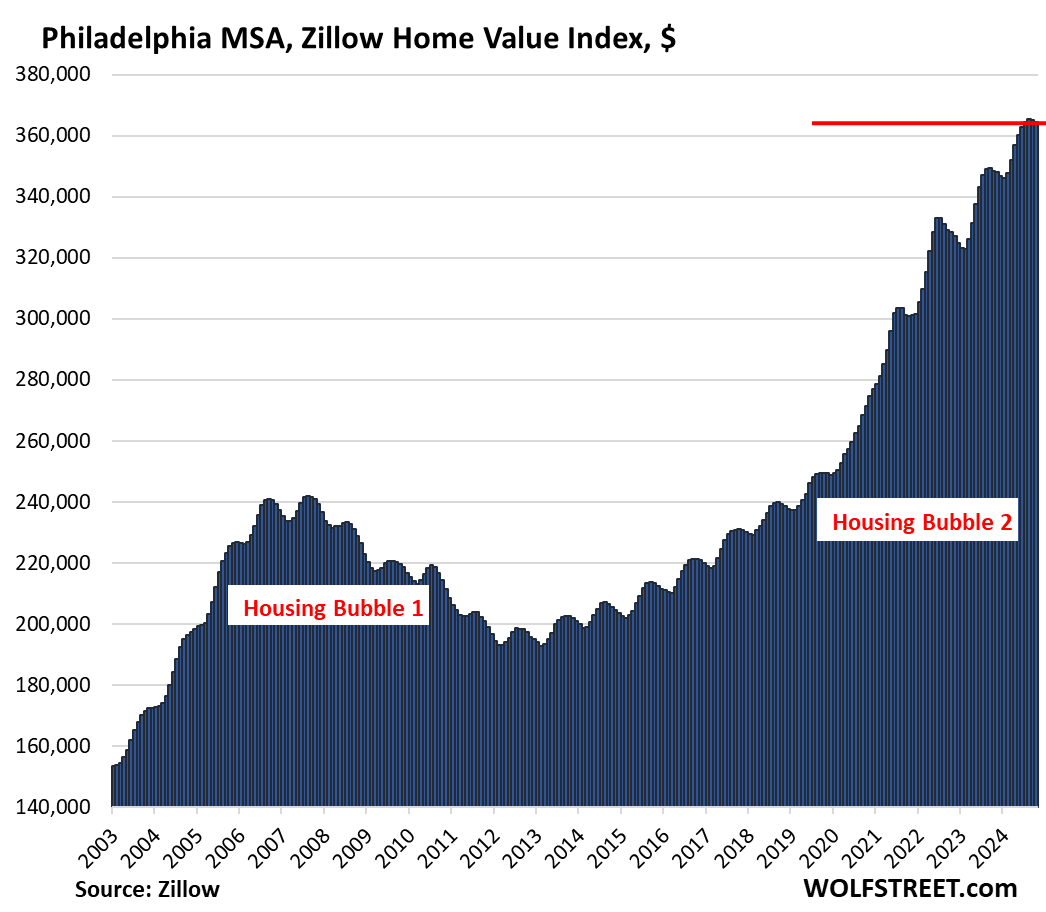

| Philadelphia MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.2% | 4.6% | 201% |

| New York MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| 0.1% | 7.0% | 212% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Please ensure your tray tables are stowed, seat backs are in the upright position, and seat belts are securely fastened.”

“Secure your own oxygen mask before assisting others.”

Does anyone remember the old days (the 1980’s) when they would also tell you to “extinguish cigaretes before putting oxegen mask on”?

“If you have two children traveling with you, decide which one you like more…”

Why did the airlines give us work?

Cmon.

signed, Larry David 😆

Oh my. Turbulence is ‘a comin.

Wolf street, I’m having a hard time finding the data that supports your analysis. Can you share where you go the data that shows peak sales price to current value for Austin, TX? I looked at the Zillow information and cannot find a peak to current value or -20%.

you have to download it from Zillow. How to do that is up to you to figure out.

We’re using Zillow’s “raw” (not seasonally adjusted, not smoothened) mid-tier data series for all homes.

You can get more details about Zillow’s data here, and why we chose it:

https://wolfstreet.com/2024/09/02/why-well-replace-the-case-shiller-home-price-index-for-our-series-the-most-splendid-housing-bubbles-in-america/

Thank you!

Housing sales are freezing up all around the country and very much so here in sunny Southern California.

I’m in South Texas I move a lot of land and cash buyers are still going strong.

Yep same here Santa Barbara county.

I hope and pray we don’t have a negative supply shock that increases inflation and interest rates.

If that were to happen we would be looking at a very very very serious recession given where all assets are right now.

The Fed’s nightmare scenario :)

What, like sharply higher tariffs and a trade war?

And deporting a good % of construction workers perhaps?

I hope he deports all 12 million of them and another 10 million follow them back. A drop in the nation’s population of 22 million would go a long way towards solving all our problems. I bet housing prices would drop like a rock along with rents.

The current fed was appointed by Trump, so there you go. Good job America!

Well with all those tariffs that are going to be coming up in the near future, we’re going to have high inflation.

The old trick of the past decades of putting off wage increases and setting off inflation by outsourcing to developing countries is over and done with. Doesn’t work anymore. China and other developing countries hit their birthrate collapse long ago. Korea, Malaysia, Japan, Taiwan are very old news. Thailand, Guatemala, etc. are now up against a wall between their own rising prices and trying to keep their domestic wages low.

So delaying the return of a healthy, diverse domestic economy with mostly domestic production and consumption won’t help. We can’t all be P/T real estate salespeople, flippers, physical trainers, uber drivers, and life-work balance therapists to each other indefinitely

And rebuild our destroyed manufacturing base that was devastated by cheap Chinese/foreign labor Thank Trump for trying to rebuild the working class that the liberal elite globalists eviscerated. Keep buying your drugs made in China my friend.

The working class will be eviscerated under Trump, even though they foolishly voted for him. Are you also a fool, or just joking?

Our manufacturing base needed to be outsourced to uneducated third world countries.

The problem is that we didn’t shift to manufacturing more sophisticated or high value items. Which is what was supposed to happen. So instead a lot of people were left with nothing.

We definitely need to manufacture things, but we need to also have workers who are qualified to do so. Modern manufacturing requires technological know how. We are not there yet.

In order for it to be a bubble, it has to pop and I don’t know what could cause that. First bubble was due to millions of home loans that were not qualified causing a flood of foreclosures. All these properties are well-qualified. The only thing I can think of is all the properties owned by investment firms going into auction if they go under.

No a bubble doesn’t have to go POP to be a bubble. That would be a bust. A bubble is on the way up. A bust is on the way down. Housing Bubble 1, Housing Bust 1. For the past many years. Housing Bubble 2. In Austin now, Housing Bust 2.

But a bubble can go POP

or it can go PFFFFFFFFFFFFFFFFFFFFFFFFF

Does a 20% drop in prices after such a huge run up really qualify as a bust? Seems like more of a normal pullback to me.

My guess is that nationally prices won’t drop more than 20% from the peek without a significant recession. Most will still have a lot of equity at those prices.

Locally YMMV

The last housing bust took five years to play out. Austin is just two years into it. You people are way too impatient. If it doesn’t collapse by 8 am tomorrow, it’s not a bust? I mean, crypto does that, not housing. Housing takes years.

What sound does the bubble make when: nominal prices stay stagnant / decline modestly over the next 10 years, while inflation eats away at the real price…?

In order for it to be a bubble, it has to pop? I always wonder if just before the great depression if people thought like this. We are fighting an economic war with nuclear China, we are fighting an actual war with nuclear Russia by proxy, we are fighting terrorist Iran (who can acquire nuclear weapons) by proxy. Terrorists could target our water supply, our power grid, our communications systems, our banking systems. We have been at full employment levels forever, what if the economy slows and all those “qualified” borrowers are not so qualified anymore?

I mean it’s comments like yours that tell me a bust cycle is on the way. House prices don’t just go up forever. And if the stock market takes a dump too, the same wall st buyers of properties that you rag on? You’ll WISH that they would buy properties instead of dump them to buy liquid equities at bargain basement discounts.

I think I read that some of those Wall Street landlords are already dumping some of their homes for a few reasons. They found that they couldn’t get as high of rents as they assumed they could and many are anticipating a drop in prices.

I know Blackstone is desperately trying to get rid of some of their commercial real estate. But knowing them, they’ll figure out a way to come out on top.

“Looks like we’re in for nasty weather”

“One eye is taken for an eye.”

It was interesting to see WolfStreet get referenced in October’s Housing Market Indicators report from the AEI Housing Center.

A part of me is happy to see Wolf get recognized like that. But a selfish side of me gets nervous.

This comment section is pretty decent. Intelligent insights and good questions are asked. For the most part there’s good back and forth. Once things take off, the riff raff show up and the comments section descends into chaos.

I think fondly of the Athletic’s comment section when it first came out. It was paradise. Intelligent discussions and people being pleasant to each other, even if they were rooting for different teams.

Now it’s just a cesspool of completely irrelevant political comments as well as juvenile name calling.

Keep up the good work monitoring these comments sections, Wolf. But also congratulations on getting some much earned recognition.

Seems like this might just be where things hang out until Spring. Doesn’t seem to be anything pointing to a change in the overall dynamics. Perhaps several interest rates cuts between now and March/April might change it up.

I think you’re right that prices more or less go sideways from here unless something big changes the dynamics.

Sacramento 6% should be -6% in the bold section under title of article.

yes, thank you. These small minus signs literally fall through the cracks in the paper.

When will it go POP is the question? Or will it keep going PFFFT?

It’ll go pfffff for like 6 months and then it will double in price so a 2 million in Cali will drop to 1.75M and then shoot to 3.50M!

Realtors: “we tried to tell you.”

So there is no demand right now for a $1.75 million dollar home, but six months from now there will be massive demand for that same house at $3.5 million?

With what magical money?

Haven’t you heard about the plans for QE3, Bro?

No this is off topic but is your username from the video game?

Pop or Pfft depends on the speed that the FED drains reserves, reaches the minimum level of “ample” reserves.

Does anyone know anyone who HAD to buy recently? Or perhaps wanted to?

What was that like?

I’m in western Washington and want to buy but, after having lived in Texas, Oklahoma, and Florida prior to moving here, every time I go look at a house I just end up shaking my head and wondering WTF is going on. $750k for a 1,500 sq ft fixer upper? No thanks. I’ll keep renting until things normalize or, if they don’t, I’ll move somewhere else.

Same here in Dallas, in the past you could get a nice brick home for about $150,000 in a nice area and now 350,000 minimum will get you some crappy home in a crappy neighborhood, I’m not paying that.

Exactly right. A POS house that I would not have paid

$150K a few years ago, I am now expected to pay $350K?

Oklahoma has unfortunately seen ridiculous price increases. Still cheap compared to other states though.

I got sick of waiting and waiting for prices to fall as they did nothing but shoot up for years

So the wife and I went and purchased a place still within our means

Got a decent rate with an assumable mortgage. So far so good I guess. Nice to be able to do what I want with the space and not worry about rent going up non stop

Congratulations! Those are fabulous reasons to own. Don’t let any of the Grouchies on here tell you otherwise.

I bought in May 2023. I was at a point where I almost had to do it. I bought much less than I could have a few years prior. I bought what I could easily afford. I know I overpaid, but I can also carry the costs with no issues. It is what it is. I made the call of the century by not buying when I moved to Florida in Sept 05. My timing was much worse this time.

I told my friends, “Be careful what you ask for,” regarding wanting to be the next president. It’s going to be a rough ride. Harris should be thankful she’s riding this storm out. Trump is in for some deep, deep turbulence.

As an Austinite and local homebuilder, I can tell you it’s been slow. You can hear crickets in the designer showrooms and supply houses. Austin, during the pandemic, was on Adderall, crack, and cousin Freddy’s Everclear punch.

The party is over, and the front yard is littered with red solo cups and White Claw cans. What goes up must go down. Spec houses and existing houses are sitting…and sitting. Nothing is genuinely moving.

When you have a car collision, the physical accident is over in seconds. Fixing the car may take weeks, maybe even months. That being said, the pandemic was a once-in-a-lifetime head-on collision. The time to fix the problem is an extreme multiple of the actual time it took to occur. We are all kidding ourselves if we think a new president (Republican or Democrat) is going to swoop in and make it better. No way.

Only time, night sweats, and cousin Freddy’s Everclear punch will make this feel better.

Lol love the analogy. Bloomberg is saying the same thing about stocks right now too; that the smart thing for an incoming president to do would be to remark that this market looks expensive and try NOT to own it. I suppose that’s a silver lining for the Dems; they don’t have to worry about it.

Washington D.C. is in second place next to NYC. That could change with the new administration coming to town. Musk (Government efficiency CZAR) wants to send 100,000 federal workers packing their bags in a major cost cutting move right out of the gate. Whole agencies (EPA) are being targeted to be moved to flyover country. Some like the Dept of Education to be eliminated altogether. Real Estate here could take a major hit. I couldn’t care less. Maybe my property taxes will stop going up at double digits every year.

Department of education in DC is less than 4000 people and if they completely eliminated the EPA that would impact DC some but they have lots of regional offices. Shutting down, combining, and creating agencies is not magic wand stuff and if even possible takes time and money. Not suggesting they won’t do their government efficiency stuff but feels like will be more attempts at reducing safeguards and perhaps even attempting privatization. To me it seems like mostly smoke and mirrors and sound bites. The government may collectively struggle to just pass continuing resolutions although could have record executive orders going on.

I have followed this site for years.

And most cheered WFH. In this era of technology

why does DC exist? There is no need for my congressman or senator

to have a home & office in DC.

Forestry & agriculture….in DC??!!

I wish Elon the best…..but it will take more than 4 years and a lot of tile

to drain.

Any theories as to why New York City is different from the rest and seems unaffected, i.e. there is a gradual increase vs any down movement?

The whole Mid-Atlantic region and further north has been rocketing higher until just the past few months. For example, Philadelphia and Baltimore kept hitting new highs until just recently. So now even New York’s price growth has been slowing month-to-month. In October, it was just a minuscule uptick. So it too might have run into resistance.

Looks to me like mid-Atlantic and NE have been more conservative, bubble-wise, than “trendy” cities, so less need/room to fall.

Also, I’ve been wondering when people will realize we barely get winters in MD anymore, and maybe some are realizing man wasn’t meant to live in the desert, the insane FL heat, or other natural disaster-prone places.

There’s less room to build here, so new construction is very limited. You don’t have entire subdivisions of 1500-2000 sqft homes popping up and adding pressure to existing home sales.

People generally want to live near cities, but all the undeveloped land is generally state forest or other protected conservation land. There’s lots of land in e.g. rural Maine, but no one wants to live there.

Live outside Philly. Median hit new highs but the same home wouldn’t sell the same

$1 million-50 acres/3800 sq/ft…2 hrs north of nyc seems like a great deal..i didn’t know

Dear America,

We’re full here in Boston. Please stop trying to buy houses here. There’s no more room.

Sincerely,

Everyone who lives here (except realtors).

My neighbor’s one-year-out-of-college son recently moved to Boston for a job, putting the squeeze on you and giving us here a little more room to wriggle.

Hopefully renting!

@ShortTLT most kids “one-year-out-of-college” in the Boston area are renting unless they have a trust fund or super rich parents…

It was pretty early and I hadn’t finished my coffee yet…

Oh don’t you worry, the towns will still resist any new builds. Ours just shot one down.

Seems like Tampa would show a larger decline with all the hurricanes in the area and another one potentially on the way next week.

Bend, OR. New ATH last month. Just in case you were wondering, $800k.

Can’t move cause my kids are rooted here now, but lower prices everywhere makes me happy.

Be patient.

Bend OR too would fall.

Housing market is like a titanic..

Austin at one time uses to be a super hot housing market and now look at it..

Jerome, the Madman!

I think it is pretty wild that the only places that are seeing Year on Year declines are in Texas. It looked like every other metro area saw increases.

I am a little surprised that we aren’t seeing declines across the country. I did see am article that said that Americans were heading back to urban areas and suburbs so is that one of the reasons?

After moving out to small towns and rural areas during the pandemic are people realizing why those places were so empty in the first place? Or is it because so many companies are requiring workers to come back to work?

Seems like that experiment is coming to an end for a lot of people. Kind of a bummer really. Especially for accounting and auditing positions like mine. When I’m at work I put on headphones and plug away. I could easily do that at home. For creative or more collaborative environments, I could see the need for having people come into the office.

My company is calling people back to office mandatory 4 days a week like many other companies .

Btw.. this decline just started

Not all regions would see the decline at the same time.

If it has gone up crazy it’d come down.

It’s a supply issue. BUILD MORE HOUSES. More density is a must. Minnesota has done the best job of any state.

Minnesota is a big state…

I’m sure there’s issues of under supply in areas. As the linked article from a few weeks ago says: spec homes are piling up.

I saw a Lennar commercial the other day. I don’t know if I have ever seen a national home builder placing a TV ad before?

“All stages of completion” or whatever, but the language definitely reeked of desperation!

Sure, build more… But inventories of new houses are surging, along with inventories of existing houses, and there is starting to be a glut of multifamily (apartments and condos).

I don’t see this as supply issue or even high mortgage rate issue

The issue is very simple.. damn high home prices which are slowly coming down

In socal inland.. it takes 10k to own a home per month where the median household income is just 55k.

Hope we see the disconnect

How has Minnesota done the best job out of any states? Just curious why you say that.

I have a slightly contrarian question – everyone here seems to think the bubble is deflating and I WISH it was. Most places are down from their 2022 peak but still up year over year. Why so much certainty on the directionality? How do we know this isn’t just slightly increased seasonal weakness? If each winter we get 3% pull back but then it jumps 6% in spring, the net trend is up.

I get the increased supply makes decreases possible but so far that excess supply isn’t causing significant decreases. And we need significant decreases for it to matter. If we only got 1% decrease you, it would take 20 years for it to matter and we’d all be making more money by then. That seems to be JPows goal. A flat market until wages catch up and he’ll err to the side of more inflation/modest gains

Many cities peaked in 2022 and have made lower highs since.

Not all tho.

Right 2022 was weird, but in most cities 2024s peak was above 2023s, so if 2025s is above 2024s then we’re moving the wrong way. These are small declines and correspond with seasonality so I’m not seeing any indication that they won’t bounce back up in Spring. Maybe not above 2022 but above 2024 – my question is what evidence is there this more than just seasonal weakness?

I don’t know if the bubble would burst or not but can tell you it’s a bubble because of sheer affordability problem.

If everyone is earning a million dollar suddenly then it’s no longer a bubble.

About the directionaloty.. increasing inventory decreasing sales volume historically un affordability points to one direction

I have no idea how things would turn up though

Also can we really get housing deflation with the stock market at all time highs? People are getting richer which means they can afford more.

For now perhaps.

Yes, crypto and the market are both up to ATHs bigly, but look at gold (it is too early to tell, but I feel there is a flow out of gold ETFs and into crypto ETFs). Both are very frothy and are mainly based on hopium it seems.

Now what happens if there is a massive trade war (price inflation) and massive deportations (causing wage inflation) kicking inflation up and thus kicking mortgages up by another 1% to 3%+ and the GDP down by 1% to 3%+?

Yeah crypto bros are getting rich. Nothing makes sense anymore.

And yeah there’s the inflation risk but JPOW will let it run hot. I have zero confidence in the fed raising unless we get both core and headline above 5% again. Even that might just get a pause.

This is a rather myopic viewpoint. Ask yourself, what percentage of the population own any crypto? The Winklevoss twins (ultimate example of inherited wealth wall street insiders) were pimping bitcoin 15 years ago FFS. It’s pretty clear who truly benefiting from the rise of bitcoin as an “asset” class. Like many I have enjoyed the capital gains and will pay my taxes, BUT definitely taking something off the table and recognizing it for what it is…

Interesting times.

Jerome Powell with the Federal reserve said in a meeting that their framework does not include deflation.

Read that however you want.

You’re a little confused here. Powell is talking about CONSUMER PRICE deflation v Inflation, as measured by consumer prices, such as the Consumer Price Index. This has nothing to do with asset price inflation, such as home price inflation.

Housing Bust 1 (-25 to -50% declines in home prices = asset price deflation) occurred even as consumer price inflation continued at a normal rate.

Every time I see Wolf’s update of this data, it just underscores how much further prices need to drop. Especially as you get geographically closer to D.C.

On my day job commute there’s a for sale sign in front of a house I’ve oogled at. Been for sale for a month now. Out of curiosity I looked on zillow…

535k (after recent 11k price cut) for… wait for it… one 800 sqft unit in a duplex! Not even the whole house! It’s so small I didn’t even realize the house was two units till I looked at the listing.

$651/sqft… the listing claims it’s “steps away from” the local train station, although it’s actually more like a mile walk.

Well, they didn’t say *how many* steps… Realtors up to their usual games.

Unless you like sleeping with ear plugs you don’t want to be “steps” away from the train station…

Real Estate market takes years to react

This slowdown is hard to read because the price declines and rising inventory could be seasonality, worries about the election or the beginning of a downturn. I find it hard to believe that tariffs and deportations can do anything but cause inflation to ramp up/ which means higher interest rates and lower housing sales/prices. As they say /Time Will Tell.

I’m hoping prices drop enough to drive out investors and VRBO hosts. Homes should be owned by the people living in them and not by speculators. Unfortunately, the investors will most likely just rent the homes until prices rebound when the process starts all over again. The people who typically suffer in the busts are the ones that are forced to move for their jobs or lose employment and already have enough bad things going for them.

Tax laws need to be fixed so that pump and dump is no longer a viable strategy.

All re is local. Some red areas like mine will do well, now that we are back to drill baby drill!

Oil and gas production under Biden went from new high to new high. It has been drill baby drill all along.

Yes, and under Trump coal will come back online. DUK looking attractive again after AI capitulates and accepts coal-fired power plants…

LOL!

Interesting times.

Coal can no longer compete on cost with natural gas and wind. Coal has become a more expensive energy in the US since we have a glut of cheap natural gas and highly efficient combined cycle NG power plants with a thermal efficiency of about 65% compared to a coal plant of 35%. Think of all that expensive waste! And with wind, the “fuel” is free and delivered for free to the plant (not by train). If coal plants are being pulled out of retirement, it’s because of the sudden surge in demand for power from data centers, and it takes longer to build a new NG plant than to un-retire an existing coal plant. But high operating costs of old coal plants will see to it that they’re being replaced with new non-coal power plants. It’s not the government that decides that, but costs and the desire by power generators to maximize their profits.

Yes, it was a joke, although I believe DUK also delivers natural gas as well. AI needs energy, period.

But, but, but…populists want coal back. People that think global warming is a giant hoax want coal back just to spite the rest of us living happy lives. These people remember that Uncle Ted used to make $70 an hour mining coal and could do so without skills. In an effort to buy votes from those ignorant people (who don’t read any fake news, but instead watch videos by unknown sources), and to spite the rest of us living happy lives, and to generally just be horrible, someone may just direct coal mines to reopen everywhere.

(But thanks for the clarification on coal, because I was not certain of those facts)

Coal will never be able to compete with natty gas on price. In some parts of the country it is so cheap it’s nearly free.

We could build data centers in the Marcellus shale which have built-in CCGTs. Within the same building, natural gas comes in and data flows out.

Starting to think what’s more likely than housing declines is a flat or slightly down market until wages catch up to prices. Without some sort of event there’s nothing to cause a big 2008 style decline. Even declines of 2-3% annually do nothing to help most buyers.

Let’s not forget this is October, conventionally the start of “downturn months” every single year. Yes, things are a bit slower than usual, and there’s been a lot of election-related worry. But I wouldn’t go crying “wolf” just yet.

Inventory on the market normally trends down during this time. Actually, almost always. Now, it is rising.

Aaron,

lets not forget to read the article. What does is say? Here you go:

“Seasonal, you say? The charts below for each of the 30 markets show that in many markets, there has been nothing seasonal for years – seasonal price changes must happen in a similar way the same months every year, or they’re not seasonal. But in some markets, there is clearly some seasonality.”

Rate cut mania and the SVB bailout led to a mini boom for a bit. Now it looks like reality is truly setting in and rates in the sub 4% range will never come back.

I work with a number of people who said they were holding out to sell and move because rates were going to come back down soon. Guess that was a bad assumption.

Never say never. Given enough time (30 years) everything will happen.

From my prolonged experience with refi’ing, everything did happen.

I purchased my primary home in1995 at 8.5%. During the Dotcom crash in 2001, rates dropped to around 6%. I refi’d after 6 years.

Thanks to the Fed, after 2008, rates dropped to around 4.5% by 2012.

I refi’d then after another 10 years. I remember asking the mortgage broker if rates would fall further. He laughed and said we’d ALL be in trouble if they did. He was right.

Then it got interesting. The Fed kept lowering rates after 2012. A couple more refi’s during the next 10 years landed me at 3%. If I would have waited a few months longer, it would have been less than 3%.

26 years of waiting. Have patience. :-)

You refi’d a whole bunch of times during the same bond bull market, when rates trended down for nearly 40 years.

That won’t work so well if we’ve entered a new bond bear market, which brings multiple decades of rising rates.

One (small) observation of the goofiness/map blindness of America’s recent decades of RRE boom-bustery…

Austin at $450k (after(!) falling 20%).

San Antonio at $280k

Both are way over-priced relative to pre-2003, pre-ZIRP reality.

(And still far, far, far better than CA/NY pricing insanity).

That said…Austin and San Antonio are less than 90 miles apart on the endless flat plains of Texas – pretty much just down the frickin road.

You would think companies determining site re-location plans might make the observation that a tiny shift in site location would result in a 33% cost-of-housing savings for their employees (see, also, wage expense…).

Ditto home-builders – you’ve got 90 miles to play with, how about taking the foot off superannuated ZIRP exploitation and build a friggin development for somewhere between 280k and 450k per home (or lower, so much lower…)

The intermediate counties are growing (fast) but the very fact that a $450k/$280k home price differential ever existed less than 90 miles apart is just…goofy.

In the same way that nothing really justifies the $1.1 million to $450k SF-vs-Austin differential, nothing really justifies the $450k to $280k Austin-to-San Antonio differential.

And lets talk about 2003 to 2023 differentials relative to income-related macro metrics…

Everybody seems to be forgetting that we’re going to have a recession and our housing market bubble will change based on how bad that recession is. Everything else is just a guessing game. But we can never forget one thing, the fundamentals make no sense in this market. In other words the median income doesn’t equate to the medium cost of a house. Something has to give, when is anyone’s guess. The how I believe is a fat ass recession and it is coming down the pipeline sooner or later. We had a big boom we’re going to have big bust, because in the end everything corrects. That’s usually how it goes, but of course if we decide to pump up the economy again during the next inevitable recession that could put a delay or lesson the correction, but it also adds to our national debt which in my opinion can’t handle another stimulus.

And to those on here who are the naysayers of we can endlessly borrow. I’m always trying to figure out how that is and no one’s been able to explain it to me. So if anyone on here is one of those who believed the national debt is not an issue, please explain why we can borrow endlessly and create an endless deficit. And please explain it to me like I’m a 2-year-old child.

I’m writing this on my phone so also please excuse any writing challenges above.

“But we can never forget one thing, the fundamentals make no sense in this market. In other words the median income doesn’t equate to the medium cost of a house. Something has to give, when is anyone’s guess.”

Have a look at this:

https://fred.stlouisfed.org/graph/?g=1AZCf

The gap between the median house price and median household income has been widening for 20+ years at this point. I agree that it’s a trend that can’t continue forever, but I’m wondering if the new normal is this situation in which house prices are red-lined and will only ever correct down to some orange zone, if you will, after overheating, before red-lining again.

I bought one house and sold two properties in across two western states this year and negotiated several other deals that didn’t pan out. In short, I sold at 98% of list but bought just this month at 15% lower than list price.

Furthermore, two other failed deals (inspection items and seller stubbornness) were at over 15% off list price. Its hard to know what any of these homes “peak value” was in 2022 versus today. Nevertheless, the market is SOFT when you actually participle as a buyer but seller’s are incredibly stubborn.

I think that sold prices, especially in non-disclosure states, are far below peak (and maybe below the actual data)…likely even bigger discount than these stats reveal. Anecdotally the market I just purchased in has median sales volume and median list even with last year but the total $ sales volume is much higher…wealthy buyers are still buying 8 figure homes but the rest of the market appears very fragmented.

I’m not even sure I got a good deal on this recent purchase but it was low enough that I felt that downside is probably only another 10% after derisking at the 15% purchase price to list discount. Time will tell.

Non disclosure data is in the data. Wolf has addressed this several times.

1:04 PM 11/13/2024

Dow 43,958.19 47.21 0.11%

S&P 500 5,985.38 1.39 0.02%

Nasdaq 19,230.74 -50.66 -0.26%

VIX 14.14 -0.57 -3.87%

Gold 2,580.30 -26.00 -1.00%

Oil 67.97 -0.15 -0.22%

Barron’s: U.S. Posts Biggest October Deficit Since Pandemic…

Some interesting stats below from AEI. Keep in mind, if prices are falling and inflation is going up, then the price decline in real terms is even worse than realized. Many posters who say prices are still going up are probably looking at the low end tiered house prices.

———————————–

AEI divides home prices into 4 categories (Low, Low-Med, Med-High, High). Here is the price appreciation for September YOY based on these tiers

AVG = 4.2%

Low=6% (2.4 month supply)

Low-Med= 3.3% (3.8 month supply)

Med-High=3.3% (5 months supply)

High = 2.3% (8 months supply)

Taking into account September 2024’s 2.5% inflation rate, 30 of the largest 60 metros have YoY HPA rates that are negative in real price terms.

Preliminary numbers for September 2024 indicate that the low price tier leads the YoY change in tier home prices at 6.0% due to low months’ supply (2.6 months), low unemployment, and increasing demand promoted by agency credit easing (FHA, Fannie, Freddie).

• The med-high and high price tiers are generally not eligible for federal first-time buyer assistance, leaving them more dependent on the Fed’s monetary punchbowl. As a result, they had the largest slowdowns in YoY

HPA since March 2022.

This will all start right back up again now that the election is over. The only thing that will have a huge affect now is that the many soon to be deported will no longer be competing for housing. Granted, they weren’t home buyers, but it will have some affect as housing vacancies will go up