Job growth bounces back some, hourly earnings jump, unemployment dips, but job growth is too slow to absorb the massive influx of immigrants.

By Wolf Richter for WOLF STREET.

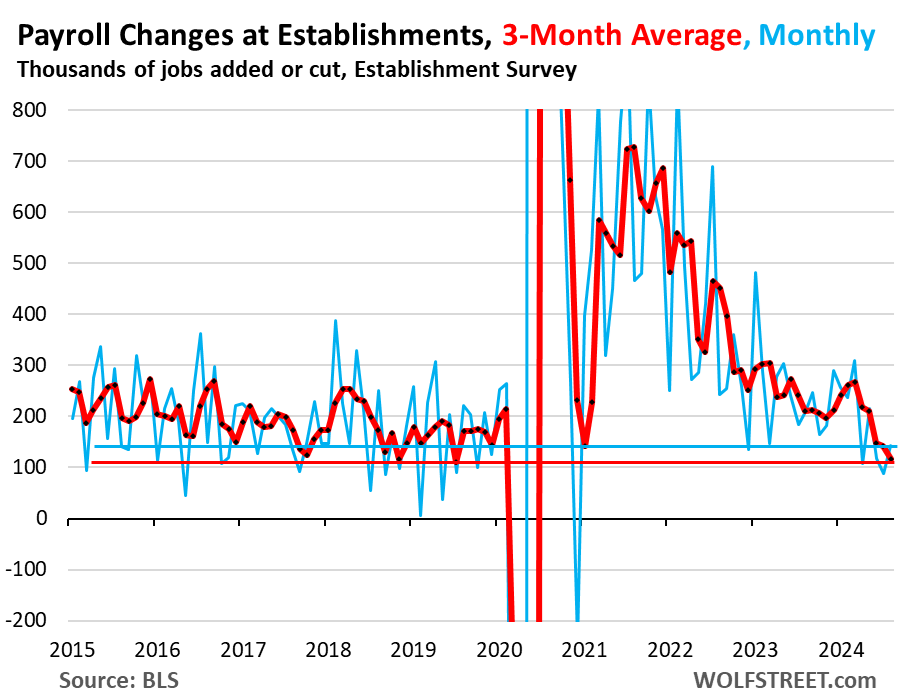

Payrolls at employers rose by 142,000 jobs in August, the most since May, and a bounce-back from July, which was revised down to 89,000 new jobs (may have been affected by the bad weather across a big part of Texas due to Hurricane Beryl), and from June, which was revised down to 118,000, according to the Bureau of Labor Statistics today (blue in the chart).

The three-month average — which includes the revisions and irons out the month-to-month squiggles — declined to 116,000 jobs, dragged down by the July report, and at the very low end of the three-month averages in 2018 and 2019 (red).

A month ago, the three-month average for July was 170,000 as reported then, which was decent compared to 2018 and 2019. But that drop of the three-month average from 170,000 a month ago to 116,000 now took it from decent to weak.

The Fed’s rates are high, inflation has dropped, and the labor market could use some juicing up.

Clearly, the growth in new jobs has slowed from the frenetic pace of rehiring in 2021-2023 after the mass-layoffs during the early phases of the pandemic that had then triggered labor shortages.

Job creation has now dropped to the lower end of the range in 2018 and 2019, making it more difficult for the massive waves of immigrants – 6 million in 2022 and 2023, plus those arriving this year, according to the Congressional Budget Office – to find work, which has been putting upward pressure on the unemployment rate.

But layoffs remain very low. It’s not that companies in aggregate are shedding jobs as they would during a recession – but they’ve slowed adding jobs.

The Fed’s policy rates are high and, at 5.25% to 5.5%, well above all inflation rates, and double the annual core PCE price index (2.6%), which the Fed uses for its 2% target. This puts policy rates into fairly restrictive territory, and the labor market has started to show the effects.

So inflation is still above target, and it ticked up in July, which was perhaps just one of the squiggles on the way down, or one of the squiggles that indicated a change in direction. Either way, there is now room to cut. And job creation has now slowed to where cuts would be appropriate in order to not further reduce momentum in the labor market.

If inflation resurges, and refuses to go back down on its own, the Fed can always hike again. Rate cuts are not permanent.

A recession in the US (which are called out by the NBER) generally includes actual declines in payrolls (but they’re still growing), a surge in the unemployment rate (but it remains historically low and dipped in August), a surge in initial unemployment insurance claims (which remain historically low and fell further in recent weeks), and quarter-to-quarter declines in GDP (but in Q2, GDP grew 3.0%, much faster than the 10-year average, picking up steam from the more sluggish growth in Q1).

So a rate cut in September wouldn’t be because there’s a recession, but because the Fed has room to cut, with inflation being half its policy rates; and because the labor market now has trouble growing fast enough, with interest rates this high, to absorb the massive influx of immigrants that are looking for work.

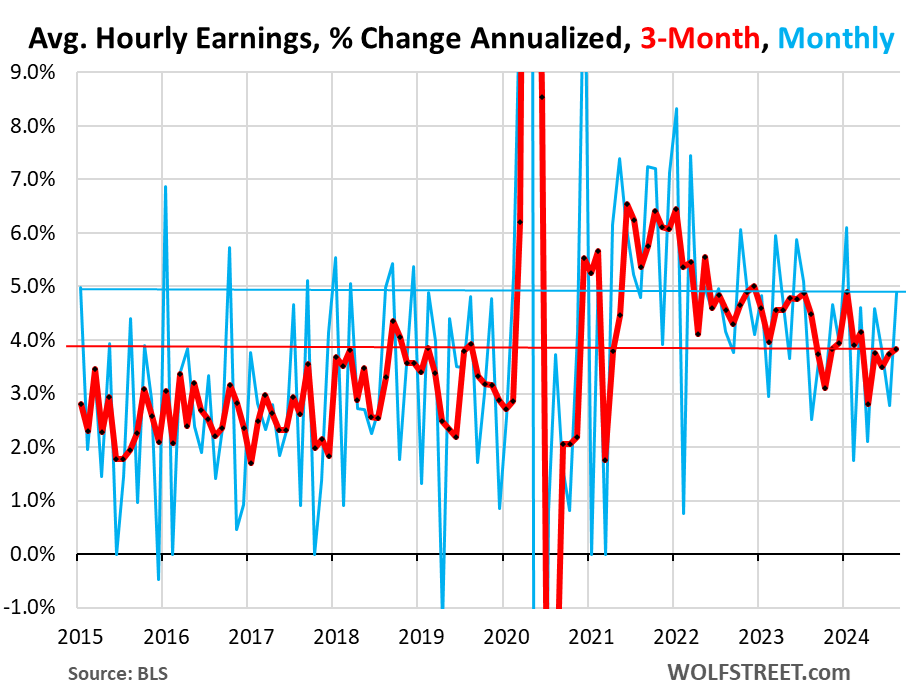

Average hourly earnings jumped by 0.4% (4.9% annualized) in August from July, the biggest increase since January (blue in the chart below).

The three-month average, which includes revisions and irons out some of the month-to-month squiggles, accelerated to 0.31% (3.8% annualized), the biggest increase since March, the second month in a row of increases, and at the very high end of the range in the years before the pandemic (red).

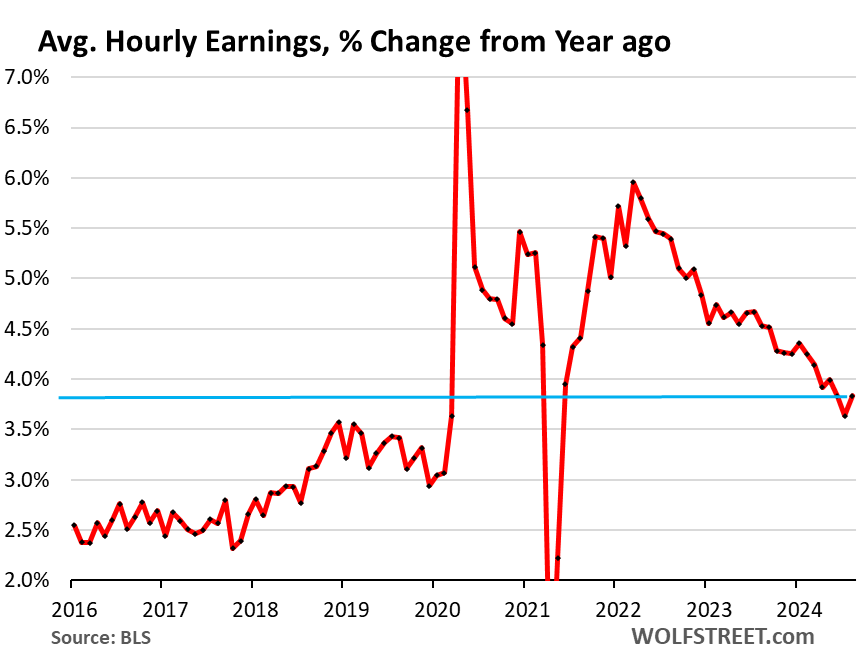

The 12-month rate rose to 3.8%, well above the peaks of the 2017-2019 period.

This still relatively high wage growth is way down from the pace in 2022 and 2023. As Powell said at the press conferences, it likely no longer provides significant fuel for inflation.

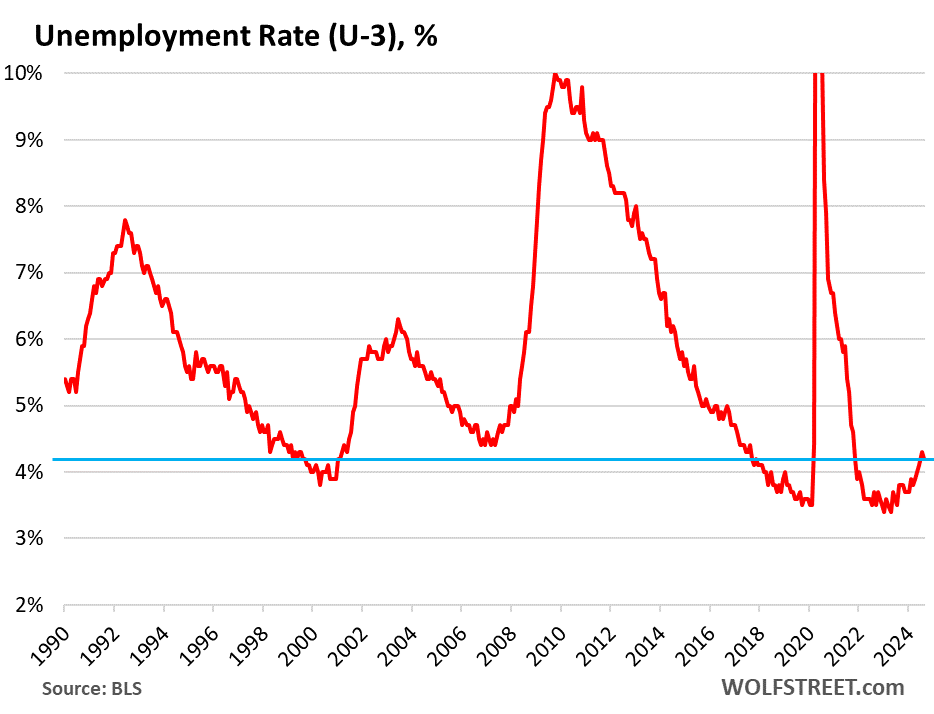

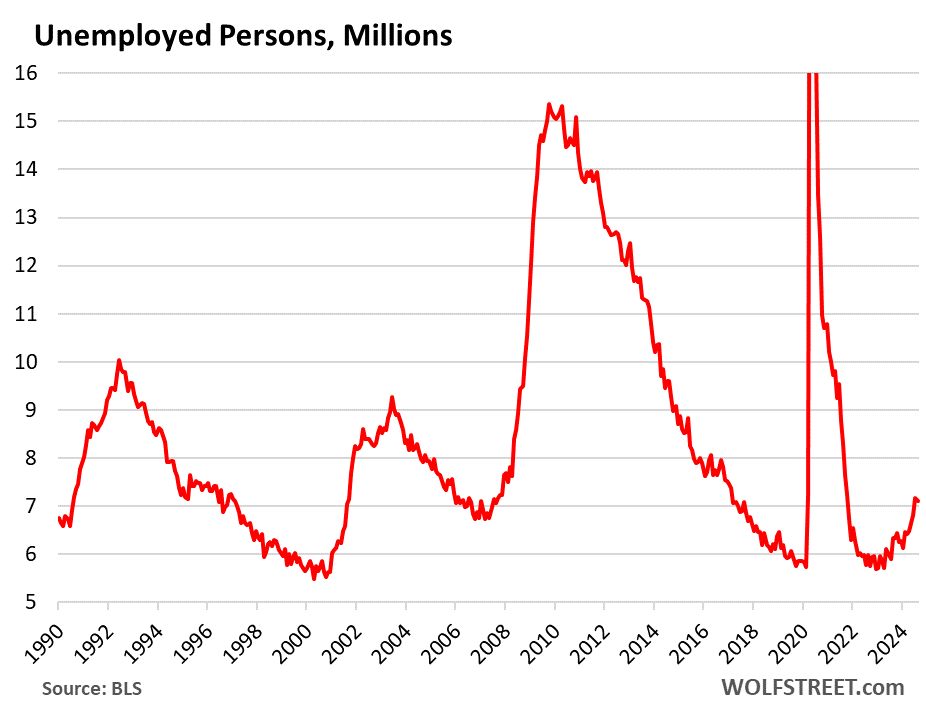

The headline unemployment rate (U-3) dipped to 4.2% (from 4.3% in July), which is still historically low, but is up sharply from the period of the labor shortages in 2022.

The unemployment rate now sits smack-dab on the Fed’s 4.2% “longer run” median projection for the unemployment rate, according to the Fed’s last Summary of Economic Projections.

The unemployment rate is also where the massive influx of immigrants over the past two years – estimated at 6 million in 2022 and 2023 by the Congressional Budget Office – shows up: Those that are looking for a job but have not yet found a job count as unemployed. And their influx into the labor force has caused the unemployment rate to rise.

An increase in the unemployment rate due to a surge in the supply of labor is a different dynamic than a rise in the unemployment rate caused by job cuts (reduction in demand for labor), as we would see during a recession:

The number of unemployed people looking for a job dipped to 7.11 million. At the low point during the labor shortages, the number of unemployed had dropped to 5.8 million.

The unemployment rate (above) accounts for the large-scale growth in the labor force over the decades; this metric here of the number of unemployed does not take into account the growth in the labor force.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Has the Fed ever started cutting rates with stock prices and housing prices at all time high (give or take)?

Well, they’re now coming down belatedly, even as we speak.

At the moment, the Nasdaq Composite is down 5.5% this week.

😬

It’s not like the stock market has only had one negative month since last October 😏 That one month being April 2024, driven by tax-loss selling.

Quick, rates need to be lowered to zero! Wall Street billionaires can’t afford for stocks to go down!

The Nasdaq is up by only 5% from Nov 2021 — nearly 3 years ago. Most stocks have stalled or are down over this period. It’s just a few gigantic stocks that have pushed overall indices higher — and that’s related to the AI bubble.

Wolf,

Sure, the soaring of asset prices was blunted (somewhat) by unZIRP, but the valuation metrics (PE ratios for Mag 7, incomes-to-rent-or SFH-prices, etc.) are still ZIRP-era unreasonable (which I’m sure shocked the hell out of the macro-economy-as-digital-microwave Fed).

I also understand that the Fed wants to salvage employment…but that was the same rationale that led to essentially 20 years of ZIRP and its related, profound pathologies.

If the Fed acts very incrementally, perhaps the worst can be averted, but we are already hearing from the CNBC-deflation-is-the-debil, shock-and-awe-rate-cut inflationistas.

On a semi-related note, here is one of the best ever takedowns of the “permanently high, permanent high” mindset….

“Is the “Everything Bubble” about to pop? Let’s start with what we’re told: there is no bubble, all the assets soaring to unprecedented heights are reasonably priced at a “permanently high plateau” because of AI, scarcity of housing, scarcity of Ferraris, interest rates trending down, the Fed waving dead chickens around the campfire, people buying toothpaste, and so on: you name it, it’s a reason for assets to drift higher.”

That’s from the Of Two Minds blog.

Can’t vouch for anything else there but that quote does capture the grifter-adjacent mindset that has led to where we are.

Why would there be significant tax-loss selling in April 2024? Unless you’re an entity on a fiscal year, losses in April 2024 are not reported until filing your tax return in 2025. The losses won’t help on 2023 returns filed in April 2024. My understanding is tax-loss selling occurs predominantly toward the end of the tax year when investors have a better understanding of their winners and losers for the tax year.

Sorry, not tax loss selling – what was I saying 🤦

Selling winners to pay capital gains taxes.

https://markets.businessinsider.com/news/stocks/stocks-market-selloff-weakness-april15-tax-day-impact-capital-gains-2024-4

If the market is going to tank, it will tank…regardless of what the Fed does.

it will tank relative to the continual 10-20% ANNUAL devaluation of fiat $dollar

1% need to put it somewhere

the 99% get to spend more fiat $dollars for less value items(ie living)

I’m seeing slower(10%) price increases with MANY industries saying they’ll keep it DOWN TO 10%

so NO WE DO NOT NEED TO LOWER RATES but RAISE THEM another 100 basis points

Wolf,

How is it that we fail to realize that this administration has added more red tape than any administration. ZIRP is for heroin addicts that now trade for fentanyl. This will only end in two forms: Argentina or Japan. Get tough or loose everything.

ZIRP has made our economy addicted to cheap money without any consequence. Cut rates and the little guy suffers. Raise rates and everyone suffers. Quite frankly, if you want to see a financial future not like Argentina, then raise rates to stop crappy spending. Deregulate.

I find it amazing that the crazies are completely unable to tell the difference between the Argentinan economy and the U.S. economy.

There are huge differences that have to be willfully ignored to think they are on the same path. Willful ignorance is the poorest form of argument.

Well, the CPI is up 22-24% since the year 2020, overall. That is an average annual increase of at least 5%. I would think that short rates should still be around 5%. Why then should the Fed lower rates?

The current rate of inflation is low lower than 5%. If you talk averages, then use the average inflation over the past 10 years, or the average inflation in the 1980s or whatever. None of that matters today. What matters today is inflation today, meaning price changes now, not three years ago.

I don’t agree with Wolf on this one. I think a lot of people today realize that, despite recent reductions in the ‘rate’ of inflation, we’re still facing grocery and other prices that are much higher than they were in 2020.

And those people could care less about slight current reductions in the CPI’s rate of change, they realize that when they go to the store, prices are staying well above what they were 4 years ago…

Dave,

You are arguing for deflation. That will not be allowed to happen.

Dave,

What are you asking for is deflation and economic depression.

No central bank is going to that to an otherwise (relatively) healthy economy.

You need to find a new job that pays you market rate.

The Fed should fix interest rates based on the real economy and not capital markets. So rate cuts should be expected.

But what we observe in the capital markets is an outcome of repeated Fed and Fiscal intervention. The market throws a tantrum on every withdrawal symptom demanding looser monetary policy or fiscal spending to keep rates low and profits elevated.

But if the markets get even a whiff that previous interventionism will not be repeated then I would expect we will see a quick and dramatic 30-40% drop in stock prices and a recession soon following it.

What we see in stock markets is moral hazard and will likely take a while to readjust. One way or the other these valuations will not hold.

A reversion to the mean of PE of spx from current estimates of PE 23 to maybe 18 is a 20 percent drop . Wolf says markets do what they do . They can stay irrational a long time or flat til economy catches up . As documented by Wolf we have an ever changing economy with tech becoming the real world economic changer . Offices becoming smaller (buildings not needed) Mobil technology, EV reducing need for gasoline , the rise of high speed internet with gaming and streaming content becoming the norm . Who knows what comes next maybe a medical treatment change due to tech. My point is people will adapt and I don’t want inflation or a return to ZIRP. I would love a cut to below the 10 year myself and given the past few experiences with inflation 50 basis points followed by 2 more gets us to 4 percent

“then I would expect we will see a quick and dramatic 30-40% drop in stock prices and a recession soon following it.”

Agreed…and I think it might be closer to 50-60%.

(Although valuation metrics have remained nuts since about 2015/2016 or so, unmoored from actual earnings – which are heavily massaged themselves).

I’m pretty sure the TTM SP 500 PE is something like 28/29…with unZiRP historical norms usually about 15.

And since the Mag 7 is so over-weight, it is useful to look at their PEs standing alone.

Apple and Microsoft are like 33 and 35. But they already have sold to the planet – PEs promising double the growth rate of global GDP under those conditions might be easiest done by finding a duplicate Earth to sell to. Or convincing people that an iPhone can *only* be properly operated by another iPhone.

Which brings us to Nvidia…and the fact that its rocket-ship revenues and 42 PE overwhelmingly come from the likes of…other Mag 7 companies.

So it isn’t like the Mag 7 aren’t dangerously correlated. If MS takes a hit, maybe it gets sick of spending $7-$10 *billion* per year to make Co-Pilot a thing. Even Zuck dialed back the billions trying to make the *Metaverse* a thing.

(The Metaverse – 2021’s AI. It is amazing how quickly/shamelessly an overvalued mkt can churn out hype cycles).

@Cas127,

All the big cloud providers are “sick of spending” billions on

NVIDIA hardware.

Since NVIDIA doesn’t produce hardware, only design it, all the big cloud players are working on their own in-house designs that they can have produced for far less.

With those purchases representing ~75% of NVIDIA’s current revenue, well… guess what happens as that shifts.

When I was young and foolish I bought a house and payed 14,5% interest rate because inflation was out of control and I didn’t want to rent.

The current house was paid for at 7.5 pct mortgage rate. Which was normal for the time. Kinda lays a question whether the interest rates are too high.

Ignorant of the gymnastics that Fed performed to save the American aristocracy. The rest of you can pay for it.

Exactly. They couldn’t give two shts about the rest of us.

This Fed Put’s timing is different from those in the past. This one is to prop up people’s lifestyles based on overextended spending beyond their mean, not so much the stock market. The timing of the September cut is absolutely perfect, that being the goal.

@andy

ADJUSTED FOR INFLATION, housing prices are not at their all-time high.

When you consider that the price level has increased something like 20% since January, 2020 (since COVID), the current low demand caused by high nominal mortgage rates means that real housing prices are actually something like 25% below the peak.

This sort of calculation is why inflation is so bad for economic policy: If you can’t even figure out what is going on, then you won’t be able to figure out what needs to happen.

The FED doesn’t (and shouldn’t) take into account things like stock or housing prices when the decide to increase or decrease rates.

The focus on inflation and employment.

However, crazy conspiracy theorists often pretend otherwise.

I recently listened to a podcast about tipping being everywhere and how that is a subsidy for biz owners for instead having to increaee salaries. It prompted me to Google if tips are included in the BLS for avg hr earnings. The answer was no for hourly workers, from what I can find. Also excluded for hourly workers are overtime and commissions. Tipping is a hidden source of inflation, most of which has happened already but still continues to grow in prevalence in more shops as well as default min % tip growing from 10% to 20% now. The no tip button has become harder to find as well. Lol, if Biden had removed tipping screens by executive mandate, my guess is that many people would magically feel better about the job he has done.

I’m not convinced there’s anything “wrong” with the job market to warrant deep rate cuts – in fact, a case could be made for no cuts at all.

The 3.4% unemployment rates were artificially low, due to artificial labor shortages. Many voluntarily dropped out of the labor force, citing fear of Covid while living on stimulus checks & boosted UI payouts. Now that the free money spigots have ended in even the bluest states, they’ve had no choice but re-enter the workforce, pushing up the unemployment rate.

The recent surge in immigration also expanded the labor force at a rate faster than new jobs could be created.

Meanwhile, the high monthly NFP job gains of the last few years were artificially inflated by jobs recovered by Covid reopenings, not newly-created jobs.

It’s normal for monthly job growth to slow as the labor market approaches full employment. There were multiple months with negative job growth & high layoffs in the 2009-2020 expansion, and the economy never fell into recession.

All other economic metrics (GDP, consumer spending-retail sales, etc.) remain exceptionally strong.

“… to warrant deep rate cuts”

I agree with you. “Deep” rate cuts would be inappropriate.

Any rate cuts are inappropriate right now and clearly politically motivated. The bond curve is ridiculously inverted and therefore easy from 2s on out. The Fed has intentionally kept lots of liquidity in the system as witnessed by the anemic QT initiative.So lets cut rates to employ a host of illegal immigrants? Right, perfect. Who cares if inflation picks back up again because it only harms lower and middle income Americans. Sorry Wolf but the logic is flawed on its face. What is a good unemployment number for U3? 2%? Best we see the equity market at 8000 on the S&P and house prices doubling in 4 years. Giddy up right? The conclusion is that the implicit inflation rate we are supposed to accept is over 3%. That sir warrants a yield curve repricing the likes of which we haven’t seen in quite awhile.

Historically, NAIRU (the non-inflationary unemp. rate) for the US economy has been estimated at around 5%.

However, the FOMC, which has been overtaken by progressives & labor economists, keeps moving the goalposts. They saw the 2019 economy with 3.5% unemployment & 1.7% PCE inflation and think that kind of goldilocks economy can be replicated at any time.

Inflation is still above-target today and has been for the last 3.5 years. It would appear the “neutral” unemployment rate consistent with 2% inflation would still be a little higher than it is now, maybe 4.5-4.7%.

John yes you’re right. This site went from “no way the fed will cut rates, anyone who thinks they will is a fool”, to “of course they’re cutting rates” overnight. The intellectual change is quite stunning really

Ronaldo

“This site went from “no way the fed will cut rates, anyone who thinks they will is a fool”, to “of course they’re cutting rates” overnight.”

“Overnight” only to you because you never read anything here.

However, today’s three-month average of nonfarm job creation dropped to 116,000 for August from 170,000 for July as reported a month ago. That 170,000 three-month average was a pretty decent long-term average figure. But that 116,000 three-month average today was low. And that came overnight. And it was caused by the big downward revisions of the prior two months. So today was a sign that nonfarm job creation as per three-month average has slowed quite a bit below long-term averages. So for me that was a clear indication that rates are pretty high and constraining the labor market.

When nonfarm jobs are revised down from 350,000 to 300,000, it really doesn’t make any difference. They’re both very strong numbers, so 50,000 give or take changes nothing. But to see the three-month average go from 170,000 in July to 116,000 in August was not good: it went over the magic line of being a decent labor market to being a labor market that has trouble creating enough jobs to absorb the new entrants into the labor force.

John Bridger,

“Anemic QT” LOL BS $1.8 trillion, most ever. Idiotic statement.

If the Fed were politically motivated, it would have cut six times this year already so that the rate cuts would have time to have some impact. Two months before the election, a single rate cut isn’t going to do any good. Now job creation is seriously slowing down, and rates are still at 5.5% with core PCE at half the Fed’s policy rates. To think that a single rate cut in September just two months before the election under these conditions is politically motivated is ridiculous.

The beginning of the cutting cycle has the potential to release “animal spirits” in the form of higher stock prices and euphoria spending. Greenspan called it “irrational exuberance”, which it is, but it is also a real mania phenomena. Three weeks of exhuberance into an election certainly would not hurt the incumbent’s prospects.

Not exactly. 2s 10s traded positive today for the first time in over 2 years. Rate cuts are going to lead to a steepening of the yield curve. I personally think that ling end yields should rise a bit even with Fed cuts absent a major reduction in inflation.

@John,

The curve is not inverted anymore. For the most common 2/10y indicator.

@Ronaldo

“This site went from “no way the fed will cut rates, anyone who thinks they will is a fool”, to “of course they’re cutting rates” overnight.”

I don’t think that this side was meant to be a cult bowing to no cut movement, where reality does not matter.

I think they should cut the short term rate by 25 bpts. Inflation is sleeping waiting for the chance to establish a higher price.

This is not over by any stretch of the imagination.

I know everybody says that prices of things like housing need to come down. Just a thought, but could wages go up?

Looking at an inverted rate curve is the same as reading the entrails of a sheep you just killed. Kind of outdated and no longer accepted by anyone with a clue.

@Jackson Y

Agree.

Most of the labor market problems are immigration-related, which means that cutting interest rates is unlikely to produce good results.

At the same time, real interest rates continue to be close to zero.

That makes no sense. Interst rates still have an effect in addition to immigration. There can be multiple forces at work at the same.

Also, real interest rates are no where near zero unless you are getting your information from bad sources.

Market still thinks 8 cuts in the next year or so. Seems ambitious.

Doesn’t seem like enough considering market will crash inside a year. And by market I mean the entire 7-stock market.

Lol! Get those cuts moving! Save the (soiled) bath water, not the baby!

For context, it may be a worthwhile exercise for interested people to reconnect with the demand and supply fundamentals of the bond market. Ever higher issuance in a lagged-in-effect QT environment.

Rising market rates seem more probable to me. Not in perpetuity of course but as documented in the next chapter.

Contemporaneous references to the “beginning of the rate cutting cycle” may be outdated as far as forward market rates are concerned. Let’s see.

If this happens expect asset prices to deflate significantly. That many lower rates implies some impactful economic shock.

I just hope rate cuts happen slowly and spread over enough time to allow the economy to adjust.

I agree the Fed *could* cut rates at the next meeting. They have wiggle room vis-a-vis the lower inflation readings as the article says.

I remain unconvinced that they *should* cut rates, however.

Over the last three months, job creation slowed down quite a bit. If it were 2018 or 2019, with rates already as low as they were back then, no biggie. But now rates are 5.25% to 5.5%, the core PCE price index is at 2.6%, and the influx into the labor force is huge and needs to be absorbed with strong growth in jobs, and that’s a good reason to cut, given the slowdown in growth.

But the Fed shouldn’t cut a lot, and it shouldn’t cut fast, unless the labor market deteriorates a lot. In August, the labor market picked up a little. If the labor market continues along the August lines, and picks up a little from there, the Fed should be very careful to not cut too far, or else it’ll have to hike rates again as inflation starts picking up steam.

i agree with you there. but waller came out implying that many cuts were justified, and that they should potentially be big cuts.

why is he jawboning? why not just stfu?

Because who would listen to him if he said

“hey guys let us wait and see…no one knows the future. I don’t freaking know, Powell doesn’t know….and over the last few years we have provided sufficient proof that we don’t know. But based on what we see some cuts are okay”

Who would pay him $$$ for such an interview or statement?

Maybe monetary policy makers should be disallowed from making public speeches and forward guidance should be banished.

“why is he jawboning? why not just stfu?”

The Fed has “the talking or reassuring markets disease”. The disease gets severe when the market falls.

To paraphrase Mike Tyson, the Fed had a plan to do QT and ZIRP (inflation is transitory) for ever till they got punched in the mouth by inflation.

That’s not accurate. He said he believed it was time for an adjustment in the policy rate in September and when it comes to the future, “If the data supports cuts at consecutive meetings, then I believe it will be appropriate to cut at consecutive meetings,” Waller said. “If the data suggests the need for larger cuts, then I will support that as well.”

So if it makes sense to do something I do it.

Wolf, I am dubious that this immigration wave is creating a rise in the “official” labor pool numbers. Most of that cohort are here illegally and cannot get a W-2 (at least not without submitting a fake SSN and hoping that their employer doesn’t use e-Verify.) Those folks wouldn’t even be counted in the BLS establishment survey.

The Household survey might be another matter. Mish and others have noted that the Household data and the Establishment data have diverged, so perhaps your theory is correct and there are tons of underground economy jobs out there.

If these folks can’t get jobs at all, they can ride government bennies or just go back home.

I wonder about this too, Chris. I don’t understand how we can talk about a surge of immigrants without data other than estimates. Estimates based on what?

In California at least, it’s against the law to request citizenship documentation for emergency medical treatment, but there is lots of chatter that “illegals” are a drain on our social services. How do you know that if you can’t ask their status?

I’m not trying to provoke anyone, I really want some sort of explanation for these estimates.

Chris from GA,

Neither the household survey nor the establishment survey ask for immigration status. The establishment survey asks the business how many employees and contractors it had working during the reference period. Lots of construction companies have workers without work permits. It doesn’t matter to the establishment survey. If they have 12 people working there, it’s 12 jobs.

Bongo,

“Estimates based on what?”

As I pointed out many times, the Congressional Budget Office used data from ICE (Homeland Security), from court proceedings, and the Census Bureau.

Few years back, working for large national company that E-verified everyone pre-employment, found out at least half the ”field forces” were illegals who had purchase all the bonafides needed for about $500.00 before crossing USA border. That was less than a week’s net pay at the time for field workers.

Office manager who did the E-verify work was very careful, following orders from headquarters, after company had been busted and fined for lack of testing previously.

Doubt this has changed???

Actually, most recent immigration isn’t illegal. It is refugee immigration. People here claiming refugee status from Central America.

Wolf, IMO What our labor force really needs is more skilled Labor, Welders, Mechanics, Electricians, not 6M+ more unskilled laborers trying to enter our workforce! I honestly don’t see the large number of immigrants who have entered our country in the last 3 years +, all being absorbed into our economy as quickly as you are assuming they will be.

Lot of the folx coming in ARE skilled, and perhaps more importantly ARE motivated to work diligently.

ALL the ones I have worked with in the construction industry over the past 5 decades have also been quick learners of new skills.

IMO USA needs to make it much more convenient for folx who WANT TO WORK to come here legally, and NOT have them forced to go through the Darien Gap and other terrible and deadly situations to get here.

Thank you VintageVNvet for stating the obvious.

People worry about declining birth rates in the US and in the next breath complain about immigration. It’s madness. The US has a HUGE resource in the young and motivated labor pool south of our border. It’s just a question of whether or not we can get the provincials among us to come to terms with people who have different skin colors than they do.

VintageVNet — would you be in support of revisiting something like the Bracero Program?

Phantastic,

“declining birth rates in the US” *are* a citizenry’s response to deteriorating US economic conditions – a response that is directly attacked by DC’s relentless commitment to continual mass human trafficking in direct contravention of US laws on the books.

If mass illegal immigration were an unalloyed, lock-cinch, economic win for almost everybody it is hard to see why that “desperately needed” foreign labor hasn’t helped to first construct the *housing* needed to well, account for their housing.

Pretty close to unprecedented 25%+ surges in housing costs really undercut the “illegal immigration” is an unalloyed good argument.

In fact it looks more like special pleading from a subsidized landlord class that is using illegals to build houses for $150k that the landlord class then sells for $450k.

Which is pretty much the story of the last 20 years.

(And let’s not pretend that the US doesn’t actually have a controllable *legal* immigration system that lets in a million a year – a fact studiously ignored by the proponents of sub rosa mass trafficking).

Who will pick Cali’s lettuce, strawberries etc. etc.

The latter btw is known by field workers as the crop from hell, real stoop labor. The Hispanics avoid it, with it often falling to Mestizo Indians based in Mexico. The land owner is almost never the direct employer, which would involve all kinds of gov oversight: an ethnic is made a business person, who hires the workers.

CAS: Very tactful and well-worded response. Especially about the part that the US has a legal immigration system that doesn’t seem to get used much.

Cas127,

You have it exactly backwards. Declining birthrates are sign of education and wealth. Poor, uneducated counties have high birthrate (having more children ups the odds one survive ms and thrives). In rich educated countries, birthrate drop.

Can’t argue with any of that.

I guess I feel that inflaction’s Act II is a bigger risk than unemployment spiking right now. Services inflation is still much too high and what happens when goods deflation stops pullif down the headline numbers?

Man I’ve been spoiled by 5.37% risk-free return.

Some people say the Phillips Curve is irrelevant to Fed policy during this AI revolution.

Apparently not!

Is business and industry so sensitive that interest rate cuts from a 5.5% base to 5 or even 4.5% make any significant difference?

Correct, a couple of cuts won’t make a lot of difference.

The Fed’s rates are short-term rates, and they impact variable rate bonds and leveraged loans that are pegged to SOFR. They also impact banks’ variable rate business loans, such as JPM might want to lend at JPM prime + 2 percentage points or whatever. All existing variable-rate debt would become more bearable, including in CRE! So that’s where the impact would be. But it’ll take more than a couple of cuts to make a real difference.

The long-term rates have already plunged as they have already priced in a bunch of rate cuts and 2% inflation for all years to come. So if there is a spike in inflation, long-term rates are likely to rise, regardless of what short-term rates do.

The Fed is always ahead of the curve when it comes to loosening, and behind the curve when it comes to tightening. Why would this be any different?

“The Fed is always behind when it comes to cutting rates” is what you’ve been reading in the financial papers for over a year. That the Fed has held out this long is almost a miracle, given the pressure it was under to cut.

LOL, it’s usually behind the curve when cutting, which is why there were so many recessions in the past century. Greenspan’s 1990s rate cut was one of the rare soft landings.

But this assumes the main objective should be to avoid recessions at all costs. Recessions are unpleasant for many people (and I’ve been laid off before) but they’re also an important part of the economic cycle, flushing out speculative excess & uncovering frauds (Enron & Madoff would never have been exposed if stocks only went up every year)

^^^ This if we always bail everything out it changes risk tolerance and increases speculative bubbles because people believe housing and stocks only go up (something I’ve heard a surprising amount of lately). And then even if a recession happens it will be fine, we’ll probably gets checks again and worst case I could always freeze my mortgage – if there were a recession the govt would intervene. This is from mainly Gen Z and younger millennials who graduated after 2012 and have known no other world.

But hey there’s a good chance they’re right. So bubbles will just keep inflating.

WTF!?!

LOL!

Not sure, I think that some commenters are just too deep in eating putin’s propaganda. USA is a shithole, collapse etc.

Is it not common knowledge (shouldn’t it be) that there is a huge number of people in St. Petersburg whose sole job it is to sow discontent and conflict in the US? Yes, they are employed by Uncle Vladimir, a man who is not your friend no matter what they say on certain “news” sources.

See ZH. Not just the comments. The articles from Burdensome are just like RT.

This article is the craziest, I like “crazy” but this one is my all time fave…now time for my meds.

Can’t post what I want or I’ll be disappeared….but this article really is cupcake crazy.

Looking in the only direction which is verifiable, i.e., to the past, I think Wolf’s good sense has never misled me. My frolics in the markets (many losses, though now out of sheer luck I am way up in the A.I. 7, for now) were generally in spite of what he was saying.

RTGDFA!!

Understand what you are saying Wolf, but rate cutting is pretty problematic with many asset classes (housing, Mag 7 equities, etc.) still at far-from-reasonable valuations (relative to metric measures used for decades prior to ZIRP).

The real problem is that a small rate cut will be used by those same asset class hucksters to drive the overvaluations to even less reasonable levels (either to entice bagholders or to keep the paint-huffing party going until the macro-economy collapses).

If those hucksters kept overvaluation alive with 30 months of empty pivot promises…imagine how they will behave with an actual pivot.

Call it CNBC disease.

Did you see the reaction in the stock market today. Rate cut cycles are rough on stocks.

Curious… why is rate cut cycle bad for stocks? Shouldn’t lower rates increase stock prices? Thanks!

Maybe when the Fed cuts, it’s because the economy weakens and revenues and profits will sink and everything will go to hell or whatever? “Why” is a funny thing with stocks.

It’s not uncommon for rate cuts after long periods of holding rates high to indicate recession or decline in stocks. In some cases the Fed is cutting because the labor market is deteriorating and recession or earnings hits are forthcoming. In other cases, markets may have more cuts priced in and realize the cuts may be slower. And sometimes markets don’t go down at all. But it’s clear to see that cuts often foreshadow market drops: https://en.macromicro.me/collections/9/us-market-relative/91/interest-rate-sp500

Why is indeed a “funny thing” with regards to equities…

(“Funny” in the irrational psycho killer sense of the word as opposed to “ha ha” funny..,).

It seems fairly difficult to argue that years and years of ZIRP (2012-2020) and prelude-to-a-ZIRP (2002-2006) didn’t cumulatively lead to,

1) turning the $150k cost median house of 2000 into the $450k cost median house of 2023 (through pretty fraud-y ZIRPian “affordability” improvements in contradiction of true underlying macroeconomic health) and

2) Turning historical-norm PE ratios of, say, 15, into today’s PE “norms” of say 30 to 45 (or worse, oh so much worse) (via ZIRPian impacts on discounted cashflow/net present value calculations, half ignorantly employed) – again in contradiction of many other indicators of true economic health.

So it is indeed “funny” that unZIRP has been damn slow to unwind the pretty gross mis-valuations. And “funnier” by the day (thoughts of the Fed and Frankenstein coming to mind…)

It depends on reasons to cut. If forced cut because of recession coming then stock down (most cases). But if reason is not out of panic ie just inflation going down (not common I guess) then stock can continue to go up, but not as much as before cuts.

Now we still have a hope for a soft landing. Who knows how this will play out.

Rate cut cycles aren’t bad for stocks in themselves. It is more of the reason rate cuts are happening that are bad for stocks. Rate cuts happen when employment starts to look iffy. Iffy employment is a sign of a weakening economy which is bad for stocks.

It is similar to how an increased use of air conditioning isn’t a cause of increased ice cream consumption. Instead they share the same cause. Summer increases air conditioning usage and ice cream consumption.

Iffy employment causes rate cuts and and a drop in stocks.

Fair enough.

The weakish jobs report did strengthen rate cut probability (back towards ZIRP) and yet the mkt did fall.

Perhaps the implications of a likely cut failed to sink in quickly (although that seems unlikely/impossible in the contemporary era).

And it is also strange that 30 months of unZIRP failed to unravel most of the overvaluations that 100 or so months of ZIRP wrought. It blunted the increases, but it didn’t unwind them.

A puzzlement.

We’ll see if anything changes next week.

(Another move possibly pregnant with possible import – Buffett dumping decent quantities of BoA. Maybe there are backchannel rumblings of near-term, widespread lender write-offs in the offing. I think lenders’ loan valuations are likely nowhere near actual market and at some point are going to have to be marked down/written off. That would explain mkt declines despite the approach of the long lusted for pivot).

“And it is also strange that 30 months of unZIRP failed to unravel most of the overvaluations that 100 or so months of ZIRP wrought. It blunted the increases, but it didn’t unwind them.

A puzzlement.”

There is no resistance to price increases from asset holders. There is gigantic resistance to price decreases from asset holder. Not all that puzzling.

Wolf, Well i think it could be more that the Stock Market Fell because the Jobs Report was not enough to push for a 50 Basis Interest Rate Cut ( 2 Cuts ). The Market is not satisfied with 1 Rate Cut in September.

In Actuality there should be No Rate Cuts. That reality is likely going to set in.

One thing matters only. When the FED starts cutting rates and keeps on going, all inflated asset prices will keep on deflating. With the QT on the automatic burner and lower interest rates, we have a double whammy on the economic growth going forward (and all assets that follow it).

I don’t see this. There is a huge distortion from population grow that is not being counted, because the population is illegal, and doesn’t want to be counted. New adult-age bodies in the country means new money creation, not only by those adults, but by goverment (aka not adults) who will enact huge money creation for the infrastructure required to support all those new bodies (health care and housing subsides, for a start). I think people are really discounting the growth (and inflation) tied to this uncounted growing population. This money creation isn’t necessarily an overnight phenomenon, but will grow larger and larger each year as these people become more and more settled in their community. In other words the current growth scare is misdirected since growing massive loan amounts by and for these people are coming in the near future. I expect inflation to resurge within a year. Maybe I can finally buy those 5-yr Treasuries at 5.5% interest.

Could you share your data on the “huge” amount of this 6m of immigrants that are illegal? Curious to hear the source so I can better understand this.

I live near Santa Ana, California, a really expensive area with a (supposed) population of 308,000 in 2022. According to city data statistics from 2022, 76.6% of the population was hispanic, and that’s the “official” number. You can’t count people who don’t want to be counted, but you *can* pay attention to your surroundings. I went to very rural Logan Utah recently, and was amazed to see how many immigrants were living there from all over the world. If you haven’t seen or heard the evidence of increase in your community, you need to get out more. About a year and a half ago, Schumer acknowledged a floor of 11 illegal immigrants in the country. Do a Google search “AMNESTY For Undocumented Immigrants Is The Solution To US BIRTH RATE DECLINE: Chuck Schumer” on youtube.

JeffD, so you do not have evidence. You have cherry picked anecdotal stories that match your biases.

That you want to refer to nutty, YouTube videos to support your bias says a lot. Use better sources of information. Don’t just use sources that make you feel good about your views.

@JimL,

If you think Schumer is nutty, that’s your business, since the words come straight from him in the video. I don’t agree with you, though.

Wolf, help me understand the 6 million immigrants coming into the country to find work – are these immigrants that come through established channels, get Visas, etc and can legally work here, or are we counting the ones that sneak across the border and have no legal status here but also look for work?

Thanks.

Both. The unemployment survey doesn’t distinguish between legal & illegal immigration.

Also very interested in understanding more about this as I’ve heard it referenced a few times and seems like a major factor

The 6 million in 2022 and 2023 is total net immigration (those that came minus those that left): it includes those with work visas, green cards, H1b visas, etc. plus asylum seekers with and without work permits, plus illegals.

As soon as they’re actively looking for work, they’re considered in the labor force and count as unemployed – which increases the unemployment rate.

When they find a job, they count as employed. Some visa holders (H1b for example) already have a job lined up when they arrive and they don’t count as unemployed.

In the household survey (unemployment rate, labor force, etc.) there are known data problems with illegal immigrants since they’re less likely to respond to surveys.

In addition, there’s the issue in the household survey that the Census Bureau hasn’t updated its population estimates to include that wave of immigrants, and the BLS is extrapolating its figures to the un-updated population data, and therefor understates total employment, the labor force, etc.

The establishment survey (number of nonfarm jobs created, average hourly earnings, etc.) doesn’t have that issue. This is employer data, and they report who they have on their payrolls as employees or contractors, and they’re not asked about immigration status. So if a construction company has employees or contractors that don’t have work permits, it still reports these jobs, and it’s not an issue because the surveys don’t asked about immigration status.

Thank you. It’s clearer to me now.

When are people going to realize the FED is in charge of nothing. The more they tighten the more they ruin Main Street while the fiscal policy is where the wild inflation rise is coming from.l see the US entering a period of stagflation. The FED and Treasury like high asset prices because these assets capture inflation. (Think 1920s, Germany). Compared to the collective increases in money supply, stocks and especially bonds, have actually lost in comparison over time.

Oooh, Depth Charge will love this post!

Depth Charge has argued with me “vigorously” for months every time I said something to that effect in the comments (the Fed has room to cut, interest rates are high relative to inflation, the Fed will cut if the labor market weakens, etc…). I was trying to softly prepare him for it.

😂

I’ll start to pour one in Sept for the start of an eventual farewell to safe, risk free asset return…couple of cuts later, who knows, might force my money back in stock market again…blah, if that’s the case, just going to buy share in BRKA and call it a day or some high dividend stock like MO

You’re exaggerating. If the Fed cuts six times, 25 basis points each, it will bring the top end of the rates to 4.0% Which is still a pretty good risk-free return if inflation is in the 2-3% range. It’s risk-free, so you’re not losing 5.5% in the Nasdaq in one week, as we’re doing right now.

Not to mention while QT is still running at full speed. Bonds will still qualify for real competition against overvalued stocks.

QT is only running at half speed now.

ok, you got a point there. Regardless, IMHO still feels like a gut punch if it goes from 5.5 to 4.0 quickly, especially when certain assets like houses and cars are still well elevated in pricing and we’re still not at a steady 2.0% target…

But I get the point about 4% being risk-free. Besides the official number, inflation sure hasn’t felt like less than 4% for a long time.

A gut punch? Quite a sensitivity.

My home loan is at 3.375%. That’s the ground floor for me. If the dumpster fire is lit, I’ll shift my fixed investments into paying that off. I’m past the point where I can write off the interest payments.

The problem is markets will always demand more. So if the FOMC lowers rates by the 0.75-1.25% that markets are expecting in the near future, very soon markets will scream for MORE CUTS, regardless of economic fundamentals, or consideration of the lag time for rate moves to cascade through the economy.

Remember in Q3 2023 when the economy was growing at 5% and 500,000+ NFP jobs were being recovered or created every month. Every press conference question was a rephrased version of when are you going to cut.

Jackson Y is correct. It isn’t that a 25 bps cut in itself will be a disaster. It’s that politicians and Wall Street will see this as a capitulation and demand steady cuts from now on. Many have said they want a return to near ZIRP (which is negative in real terms assuming an inflationary environment). Also given that the Fed has succumbed to political pressure before, I think Wolf is understating the risk of this kind of mistake.

A few things are different this time.

Inflation is still running over the Fed target, despite their perennial massaging of the data, and price levels remain high in most sectors.

Government, corporate and consumer debt are very high.

The Fed usually panics in a downturn, but, the rock is getting bigger and the hard place is getting harder.

David Rosenberg makes a convincing case that we’re going into recession, but I don’t know how to game the Fed’s actions this time.

Will real rates still go negative? My best guess is that one way or another, that will happen again…. The rest is hard to predict!

Inflation is down to 2.6%, but in the pce/cpi articles you noted that it was mostly due to deflation in durable goods. If durable goods pick back up and inflation heads back above 3% is the right move to raise rates back again or just hold steady at something like 4.75%?

Inflation feels like it has slowed down some but it doesn’t feel “fixed” to me when I pay for something.

I am noticing some staples (that were still selling at reasonble prices in the last year or two) not going up in price but simply disappearing. Probably will see more of that with “inflation is down”.

Such as?

Here harder to get a good virgin olive oil.

I’ve noticed the EVOO issue too. I’ve taken to stockpiling from Mission Ranch Market in Mission Viejo when the have a sale of quality EVOO.

Are you guys slurping down the olive oil? Lay off the oil and try something a bit more healthy. Myself I have a moringa tree I chew on when feel my chakra is out of balance. The leaves, bark, branches are all edible.

I use the Virgin olive oil for shining and polishing the wooden banister leading up to my study…

:)

EVOO is v healthy. It produces the good cholesterol. I’m a monster for EVOO, nuts, seeds, good cheeses (countered by the EVOO).

And forgot the eggs, beens, and chicken.

I honestly don’t see how durable goods are going to continue staying down myself with an additional 10 million plus more immigrants(Consumers). More people chasing more goods…needing to purchase everything from Baby food to wheelchairs, ect..which in my opinion is why Consumer spending probably ticked up last month!

I raised this question in the previous article. Looking at the historical data, goods will always be slightly deflationary, according to the BLS, in normal times. The current goods deflation rate is similar to what it was before Covid hit.

This is largely due to quality adjustments, especially on technology.

It’s going to be very hard for the Fed to appear competent in the next “down” cycle.

I think their credibility could take a pretty hard hit. Harder than it has up until now.

This is history’s largest ever all-asset bubble. That’s going to unwind in the background….

Again you are too focused on inflation. If the labor market weakens more significantly deflationary spikes are more likely. This would solve many inflation problems that you speak of, but also create new issues.

Have a 26 week T-Bill and another ready for reinvestment….I think I will go to 52 weeks as it seems everything will be getting chopped…..

The 52-week yield has already priced in almost 6 cuts: currently trading at 4.1%. At last week’s auction, they sold at an investment yield of 4.34%. It’s hard to decide if this is a good deal because it’ll pay less for some time than a 2-month bill that rolls over every two months, but later it might pay more than a 2-month bill.

Thanks for the input, Wolf…..

I’m expecting a hard time for bond investors, too.

I blame the Fed for a decades-long asset explosion, which I expect to take years or decades to unwind.

My analysis is based on the secular trends thesis, which Peter Turchin, Michael Oliver and Marc Faber, among others, have advanced.

Oil prices below 70 usd/bbl also provides significant stimulus

“. Rate cuts are not permanent.” I don’t believe that. When was the last time they cut and then hiked within a 1 year period?

Market is expecting a cutting cycle. Not cut, cut, hike, hike. I don’t care if they have room to hike it’s potentially Powell’s Burns moment.

From a market perspective, I think this is 100% right on point, I don’t think they have any pricing target baked in we’ll be cutting then hike, they expect this to be cut, cut and cut…in their mind, inflation is a already over with, plus the only thing they can draw back to but it’s not a parallel comparison is the 2018 hike then cut pretty soon after and for a very long time..sure that was when official inflation was low and different dynamic but the market only remembers what they want to believe in.

I think the point of that paragraph is that if inflation starts to move too far in the wrong direction, and rest of the indicators like employment hot up again then rate hikes are on the table again.. but if your definition of permanent is under 1yr then you might turn out to be right

You really think that hikes will be back on the table? Or will they call it transitory and wait until it hits 7%+ again before they hike? So yes if inflation runs at 7%+ for months maybe they’ll eventually react. If it hits 4% I doubt they will.

Used short-side liquidity today to roll December puts into March and June. Same with Oct SOXS calls into January. Getting a feeling PPT will schedule face-ripping rally soon.

Probably. The economy is not bad. Corporate earnings are still growing. This is purely a pressure campaign from Wall St to the FOMC to ease by more than is economically justified. It’s happened many times…2015, 2018, 2020. If the FOMC caves to Wall St pressure, any market losses will be recovered EXTREMELY quickly.

DM: Dollar Tree CEO responds to outrage after company decided to drastically hike prices across stores

Customers had reacted angrily to news of a higher $7 price cap – with one saying: ‘So now it is Seven Dollar Tree, and they can up their prices.’

There are a lot of people who have never been in a Dollar Store, so they don’t understand the pricing model compared to other stores. Many items have smaller packaging to hit the lower price point. So instead of getting 6 oz of toothpaste, you might get 3.5 or 4 oz. Combine that with the overnight 25% price hikes, and it is now much cheaper to shop elsewhere.

I realized awhile ago even grocery stores have the same or lower unit prices vs dollar stores.

12:33 PM 9/6/2024

Dow 40,412.08 -343.67 -0.84%

S&P 500 5,419.85 -83.56 -1.52%

Nasdaq 16,743.49 -384.17 -2.24%

VIX 22.07 2.17 10.90%

Gold 2,523.70 -19.40 -0.76%

Oil 68.05 -1.10 -1.59%

To believe inflation is coming down enough to justify rate cuts, one would have to believe the CPI and PCE prints are reliable. I’m sure they are just as reliable as the jobs numbers that keep getting huge revisions. How can anyone trust the numbers coming out of this corrupt government anymore. No rate cuts are justified IMO.

Correct.

Agree, like totally DR:

Between the very likely political basis of any FF Rates changes of any direction AT THIS TIME; plus, more importantly, the actual increases in prices of ”good” FOODs, such as ”good” EV Olive Oil that is DOUBLE since 2020, and many other food similarly, the only saving grace has been the 5%+ returns of the T-Bills for those of us on fixed low incomes.

While it has gone up, SS has certainly NOT gone up as much as food and monopolistic public and private utilities.

Fortunately for some who made a good choice many years ago, the VA provides very satisfactory medical services with very low copays for needed meds.

Otherwise, and I read it is actually happening for some old folx, dog food for dinner, eh?

Just browse through your credit card history from 2019 and pick out a middle of the week grocery shopping entry. Compare that with one more recent. The eggs we always buy were $8.99 pre covid, now they are near $14. Looks like the “supply chain” issues never went away. Throw more cheap free money in the mix, what can go wrong? The poor can eat cake.

Our eggs — the ones that regular people buy — were $3.49 most recently. They were a lot more expensive (at which point we stopped buying), and they were a lot cheaper, and now they’ve risen again but are well below peak. I hope you enjoy your gold-plated eggs.

It seems many here are committing the logical fallacy of anchoring. They are comparing today’s prices to pre-pandemic prices and think that since today’s prices are higher that inflation is still out of control.

It is clear they don’t understand how it works.

^^^ This – all I know is prices for everything I buy continually seem more expensive each time. It does not feel like inflation is near 2% which would be unnoticeable to me.

Tin foil hat talk.

To think the numbers are unreliable means you think that there are literally thousands of lower level, non-partisan workers who are all in on the conspiracy to fudge the data.

All it would take is just one of them to make a discreet call to the Inspector General’s hotline that is posted in every government office every where. There would be tons of documents (emails, memos, etc.) coordinating the fudging of the numbers.

It is insane.

You make it clear you don’t understand why there are revisions to the jobs numbers despite the fact Wolf has explained the reasons. Instead of educating yourself on why the jobs numbers are constantly revised, you choose to remain in ignorance.

Then you proceed to use poor sources of information that manipulate you by taking advantage of your ignorance of the job numbers to make you angry over the “corrupt government”.

Instead of letting bad information sources take advantage of you and manipulate you to make you angry, why not instead use better sources of information and educate yourself?

You will do better in the long run.

Read more Wolf and listen when he explains the job number revisions and turn off the nutty information sources you currently use that take advantage of you by making you angry. Life will be so much better.

1:04 PM 9/6/2024

Dow 40,345.41 -410.34 -1.01%

S&P 500 5,408.42 -94.99 -1.73%

Nasdaq 16,690.83 -436.83 -2.55%

VIX 21.97 2.07 10.40%

Gold 2,525.70 -17.40 -0.68%

Oil 68.14 -1.01 -1.46%

Investors investing in stocks, say growth stock are accused of being greedy. And if they go down there is excitement/euforia around here. Sure, fair I guess.

Now, the real possibility of bills losing 1+% by some is considered end of the word. Why? The greed of the holders. This is my main interpretation now why some are so against cuts, they even ask for raises.

I don’t really see other interpretation.

No, far from greed on our part. I don’t believe rate cuts are justified and will only cause more inflation, especially when services inflation is still bad and worse than what they are reporting. It’s irresponsible to have let inflation get out of control the past few years which has now resulted in a huge permanent loss of purchasing power. Has nothing to do with greed. Savers have been hosed for decades in this disgusting country. But, yes, you stonk types are greedy.

I am interested in what source you are using as the basis for believing that service inflation is much worse that what is being reported.

Whatever it is, it is a poor source.

As a pre-empt, if you are going to say “your own experiences” then that just shows you don’t understand how inflation is calculated and are cherry picking numbers.

As for you saying it is “irresponsible” for letting inflation get out of control… is a bit of a disingenuous description. It completely ignores the fact that there was this little global pandemic that completely disrupted global supply chains and shut down factories (some permanently). As a result inflation came about.

You have it backwards. Bonds go *up* in value when rates are cut.

And bills specifically don’t move much due to the strong pull to par.

When your strategy is short bills then soon the strategy fails.

When they debauch currency like they do, the growth stocks won’t save you. The “investors” can’t get out of this bubble en mass.

The problem with the Fed’s dual mandate is that there is not a reliable enough relationship between interest rates and employment to consistently make effective policy. Best to focus on inflation where the Fed has at least a theoretical chance of getting things right.

$NDX in hell. PnF x1, 100 pts, Vol. Option #1 to July : 1,600 pts up. Option

#2 to May 31 : 2,900 pts up. Support held, but if breached it can get worse.

I’m in construction, and interest rates have definitely caught up. I’m seeing lot of unemployment in my local, and the people who are working are just doing punch list work, because there just isn’t much to do. This matches up with the data I read from the JOLTS report on ZH. Construction seems to be a blood bath.

I know this site has said construction has been booming as of late, but that is not what I am seeing anecdotally. Work is scant. 2 month project here, 3 month project there, but no big projects whatsoever.

I’ve been unemployed for 2 months, and am on the brink of bankruptcy lol. At some point I’ll have to leave my union, because we just can’t keep up with all the illegals and non-union contractors. I’ll just have to take the 10 dollar payout, even though I cant really afford a home of new car.

I do find it amazing in the States we are including all this illegal labor in the job statistics now. There is no more Sovereignty in America. It’s a global job market, where the low bidder gets priority. The unfair thing about the illegal labor is all the subsidies and charities that take care of their necessities, so they all can drive around in 95k Ford Raptors.

Construction added 34,000 jobs in August, one of the best performing sectors. Over the past three months, construction added 64,000 jobs, which is big for a sector that isn’t that huge, with 8.3 million total employees. Job openings dropped because they were finally able to hire people and fill those job openings? Flood of immigrants as you pointed out? Which is why employment levels have risen.

There are some segments in construction where work has slowed a lot (office & multifamily construction, for example). But other segments of construction are trying to find workers. There are also regional differences.

Location Location Location is just as important in construction work as in RE in my experience Wolf.

Was trying to remember how many times I moved to find work or to find better paying work from first construction job in summer of ’62 until last one in summer of ’19, but I can’t.. LOL Suffice it to say 5 different states, some multiple times.

In other news ,, a new 49 story Waldorf-Astoria office, condo and retail project was just announced to add to the BOOM in construction in downtown Saint Petersburg. Pools, with Palm Trees are shown at several levels on the plans!

My company sells it’s product to the construction industry, all I keep hearing is the construction industry down and that these are tough economic times due to interest rates. Our market covers all the various types of construction (not just office and multifamily). Sure it might still be adding jobs but the type of jobs and the scope (size and $value) of the projects might have changed

Rates should be in restrictive territory, always. It’s about the only way for excess savings to be routed towards useful endeavors instead of corrupt ones.

Preach! And note they trot out the magic number of 6 million. They love their fairy tales while they had light us.

The CBO reports 6 million illegal immigrants, while Chuck Schumer reports 11 million. Schumer’s job depends on getting that number right, not so much so with workers at the CBO.

CBO did NOT report 6 million “illegal” immigrants. It reported a net increase of 6 million immigrants of all kinds, from green card holders to illegals.

Making the CBO numbers even more dubious.

Your failure to understand the numbers does not them dubious. It is your failure, not theirs.

The 6% GIC (CD term deposits) were good while it lasted.

Everyone and they’re dog is talking about $100,000+ a year price increases for Canadian real estate under the assumption that interest rates will be drastically cut in the near future again.

Interesting how tangentially related illegal immigration is to monetary policy decisions that will be made by the Fed. Maybe Wall Street sent them up for rate cuts.

MW: Nvidia shed $406 billion in market cap this week. What’s next for the stock?

Market cap has nothing to do with the price of Nvidia’s stock.

My take on ‘Dollar Stores’ — if you can get Walmart free delivery (i don’t know if this applies to rural areas) on a purchase of 40 bucks or more, why shop at the local Dollar store?

Wolf, as I said in my comment a couple of days ago, the Fed would be reasonable in doing a .25% rate case. Nothing more is needed yet – have to see if the job market loosens further or if inflation has just been giving the Fed a head fake. The Fed screwed up by thinking inflation was transitory, and they’re not going to make the same mistake here, thinking the slight slowdown is transitory. I realize, as some have said, this always seems to be a one-way street — too late to tighten, too quick to loosen — but a 0.25% cut now is reasonable. Now, the market may well think it is the first of 16 more cuts to come, but it will do what it will do, and hopefully the Fed will just do what it should do; take a cautious approach with only 0.25% cuts at any given time (unless the economy goes to hell in a handbasket) and don’t overdo it.

Economy and Labor Market is doing fine. We are back to normal periods where Job growth was not expected to super-duper. We had huge job numbers because people who stopped working had to start work as Stimulus/Savings/Health concerns got over. These are not negative Job numbers. Even Powell said those are not from Layoffs. FED has SOME room to cut rates now to dial down the restrictiveness.

September Meeting Statement and Presser will tell us if we will are rate cut cycle or rate normalization cycle. Both involve rate cuts but goal is different.

If FED wants to maintain credibility (whatever is left), Powell and FOMC Statement should clearly state they are cutting to normalize as Inflation has come down from high levels. But Inflation Job is NOT done. Powell should kill this rate cut mania in Press Conference. Also Powell should clearly state QT will go on. In past he said they are different and not connected. That should kill few liquidity junkies.

With the Fed buying back low coupon long term bonds, my bottom line is that our not so bright central bank is doing what it has been doing for a long time…………

…………..supporting and financing tens of trillions of federal deficit spending and expecting positive results.

Sorry folks; history paints a very ugly picture of the results.

b

PS. “Insanity: doing the same thing over and over again and expecting different results.”

Albert Einstein,

The “FED” isn’t buying back anything. The Treasury Dept is buying back bonds, and it has to raise the money to do so by selling new bonds.

READ THIS:

https://wolfstreet.com/2024/08/28/treasury-department-aggressively-pushes-down-long-term-interest-rates-via-shift-to-t-bill-issuance-and-bond-buybacks/

1) The civilian labor force is 168.5 million. In Nov 2023 it was 168.2 million. It didn’t jump by 6/8 millions. The illegal work in the Black Market. They are not reported by their employers.

2) Their footsteps are in consumer spending. The drunken sailor aren’t

drunk. Consumer spending is rising due to 5/8 millions in the black market. The actual GDP is higher. Gov Debt/GDP is lower.

3) The new immigrants are learning on the job or in tech schools. The

private sector is 132.4 millions. The illegals will start new businesses, or get a job in small companies. Small businesses, 1-49 workers, will grow from 58 millions to 63/65 millions within a few years. The arge co 500+ are only 23 millions.

4) Small businesses are smarter, flexible and more innovative.

Gen alpha is 30/40 million short. Demand for highly skilled workers will

rise. // 7 million unemployed. 132.4 million in the private sector. Their total is 139.5M. Gov jobs : 168.5M – 139.5M = 29 millions. 29/168.5 = 17%. If the gov stays put its size will shrink to 15%/16% within a few years. The gov will be able to cut debt fast if the Fed will cut rates. CL might drop, the Dow will rock !

I only read your first point.

This refers to the household survey. The BLS’s household survey has trouble accounting for the 6 million immigrants that came into this country in 2022 and 2023 since many don’t respond to surveys, many of whom are now working. The BLS also extrapolates the survey data to the Census Bureau’s population data, which still hasn’t been adjusted for the huge influx of immigrants, and so the total number of workers in the household survey is understated by several million workers. We’ve discussed this here endlessly.

BLS total civilian force and revisions don’t matter. U can skip on bullet points 1 to 4, fine with me.

Using a chart based on BLS data, blogger Kevin Drum states:

“For native born workers, the prime age participation rate is higher than it was before the pandemic and higher than it’s been since 2002. Nobody’s been pushed out of the labor force by foreign born workers.”

I’ll note that the same chart shows increased foreign-born LFP, too which would seem like the supply of workers increased to meet the demand since unemployment remains historically low.

Anyway, it would seem like a sign of intelligence is the ability to look at new or revised data and be willing to change one’s opinion. As someone whose asked for awhile now what criteria Wolf would use to be open to FED rate cuts, I’m delighted to see this re-evaluation of the data.

Here’s hoping the rabid Wolf pack follow their leader.

Everything hinges on the monetary cycle, doesn’t it?

Print baby print!

Looking forward to many more years of price appreciation for my gold coins.

Fed can cut all they want as long as Treasury can sell ever larger quantities of debt.

If the Fed does not have to buy the Treasuries debt offered at the Feds chosen rate, then the Fed has room to cut.

If the fed has to buy that debt because nobody else will at the desired rate then it tells us that the Fed does not have room to cut rates.

Why else would the Fed be working so hard to reduce it’s balance sheet ? It has to make room to buy Treasury debt in case the market won’t buy it at the rates offered.

FYI, the Fed’s balance sheet is not an 800 square foot condo where you have to “make room” for the new couch by throwing out the old couch. The Fed’s balance sheet is sort of unlimited. The problem it runs into with QE is the problem it ran into with QE, which it is now trying to resolve with QT and higher rates.

Guys, remember, todays markets are managed. From equities to bonds and everything in between. The only way is up (with a few deeper dips here and there). The fed is in a great place, with neutral rate rising, economy still growing and inflation expectations at the slightly elevated levels. Fed wants reasonably higher inflation, because in the last decade+ their loose policy failed to produce inflation and stimulate growth, therefore their monetary policy was loosing power and influence over the economy. What mainstream media, fed speakers are talking and day to day data we get is just short term noise. Dont be frustrated and angry with valuations and prices. Thats the economy we live in. It will somewhat adjust but longer term the only way is going to be up. Accept it, adjust to it and find way to take advantage of that environment

yes, in the long run. But in the long run, we’re all dead.

Here in Maine so many businesses would love to have a 5% unemployment rate, it would mean that we can even choose for the best candidates without lowering the bar, year after year.

Here, without the J1 students, the hospitality industry would stop in 48 hours.

In Boston, without the illegal (yes! Open your eyes, please) immigrants, the food retail industry would stop in 24 hours.

In New York City in 12 hours …