The CDK cyberattack wreaked havoc on processing and reporting deliveries by nearly 15,000 dealers.

By Wolf Richter for WOLF STREET.

The ransomware attack on CDK’s cloud-based dealership management system, which on June 19 had cut off nearly 15,000 dealers from the software that was running every aspect of their operation, wreaked havoc on processing and reporting sales by the end of June. The large publicly traded auto dealers, including AutoNation, warned about it last week. The work had to be done by hand. As of July 2, “substantially all” of the nearly 15,000 dealerships were back on the core system, according to CDK. But by then it was too late, in terms of catching up with processing and reporting to their manufacturers those deliveries that had been made since June 19.

Those deliveries that didn’t make it into Q2, will get picked up in July and Q3. Several automakers made reference in their press releases today to this “industry crisis.”

Despite this mayhem at the worst possible moment toward the end of the quarter, total new vehicle sales – deliveries by dealers or automakers to their end-users – rose by 9.1% from Q1, to 4.08 million vehicles, down just 0.4% year-over-year, according to the Bureau of Economic Analysis today.

As the chart shows, new vehicle sales have been a no-growth business since the 1980s, and only price increases and more expensive models kept revenues growing for automakers. But now the opposite is happening, after the huge price spikes in 2021 and 2022: New vehicle prices have started to edge down as automakers and dealers are piling on incentives and discounts.

Average incentives per vehicle sold rose 51% year-over-year to $2,625, or 5.3% of MSRP, according to J.D. Power estimates.

But automakers and dealers are still slow to react to this market, and to the large-scale build in inventories, and they’re letting go of their big-fat pandemic-era profit margins only very slowly. During periods in 2019, as inventories were also piling up, incentives ran over 10% of MSRP.

The average transaction price – including all incentives, discounts, and odious addendum stickers – fell 3% year-over-year to $44,857 in June, according to J.D. Power, on rising incentives by manufacturers, declining gross profit margins by dealers, and increased inventories of lower-priced vehicles that automakers had deprioritized during the era of shortages, in favor of high-dollar vehicles.

The ATP had spiked by 36% during the pandemic, from $34,900 in December 2019 to $47,300 in December 2022. Since that peak, the ATP has dropped by 5.2%. New vehicle prices are sticky on the way down, as everyone in the industry is trying to keep them from going down, while still maintaining sales momentum.

But the erstwhile shortage of vehicles has turned into what for some brands is a full-blown glut, and the vehicles must be sold and deals must be made, and to do that, the price spike is finally getting whittled down – but not nearly as fast as used vehicle prices that have dropped in a historic manner.

The biggest automakers in the US in Q2.

General Motors, #1: Sales of all its brands in the US rose 0.6% year-over-year, to 696,086 vehicles in Q2. All the growth was in EVs, whose sales surged by 40% year-over-year to 21,930 vehicles. Sales of vehicles with internal combustion engines (ICE) fell 0.3%:

| General Motors sales | Q2 2024 | Q2 2023 | YoY |

| Total | 696,086 | 691,978 | 0.6% |

| EV | 21,930 | 15,652 | 40% |

| All ICE vehicles | 674,156 | 676,326 | -0.3% |

GM killed its long-running EV, the Bolt and Bolt EUV, at the end of last year, and Bolt sales have become a trickle. But it has a slew of new EV models now on the market, including a full-size truck, though ramping up production of models with all-new powertrains and platforms is tough, and the numbers are still painfully small, but they’re coming up. GM is struggling with the problems every automaker has run into in setting up EV supply chains, from Tesla on down, and like all of them, has been dogged by quality issues of early production models.

Toyota, #2: Sales of Toyota and Lexus brands combined in the US rose 9.2% year-over-year in Q2, to 621,549 vehicles.

EV sales, staring to: Sales of its pure EVs multiplied by four to 11,607 vehicles.

Ford, #3: Sales by Ford and Lincoln brands rose 0.8% year-over-year in Q2 to 536,050.

The sales growth was all in EVs (+61% yoy), while sales of vehicles with internal combustion engines (ICE) fell (-0.9% yoy), and sales of ICE vehicles without hybrid powertrains fell 5.0% (yoy).

Hybrids are ICE vehicles with an auxiliary electric drive as part of the powertrain. They’re more efficient, but usually somewhat more expensive, than the equivalent non-hybrid ICE model. Plug-in hybrids have larger batteries and more powerful electric motors than regular hybrids, but still have a gasoline engine. Most of the hybrids sold are regular hybrids.

Ford offers hybrid powertrain options on many of its models, including its F-150 pickup, and they’re popular. Hybrid sales are now eating into non-hybrid ICE sales which dropped 5% year-over-year:

| Ford Motor Sales | Q2 2024 | Q2 2023 | YoY % |

| Total | 536,050 | 531,662 | +0.8% |

| EVs | 23,957 | 14,843 | +61.4% |

| All ICE vehicles | 512,093 | 516,819 | -0.9% |

| Non-hybrid ICE | 458,271 | 482,230 | -5.0% |

Hyundai-Kia, #4: Hyundai is the parent company of Kia, with Hyundai holding a 33.9% stake in Kia, and Kia holding stakes in Hyundai subsidiaries. And they share vehicle platforms. They report US sales separately, but for our purposes, we look at them as one automaker with two brands.

Combined sales edged up 0.2% year-over-year in Q2 to 421,558 vehicles (Hyundai +2.2%, Kia -1.6%).

EV sales are hot: Hyundai EV sales jumped 15% year-over-year in Q2; Kia’s EV sales in Q2 exceeded 15,000 vehicles, it said without disclosing further details, and in the first half soared by 112% to 29,392 vehicles.

In its press release, Hyundai made reference to the CDK fiasco: “Once again in the face of yet another industry crisis the Hyundai dealers showed their resiliency by closing Q2 with a 2.2% increase in total sales.”

Honda, #5: sales rose 2.7% in Q2 year-over-year, to 356,457 units, “despite the software cyberattack impacting auto dealers nationwide,” it said in its press release.

Stellantis (FCA) #6: FCA sales plunged 21% year-over-year in Q2, to 344,993 vehicles. It dropped to the #6 spot for the first time ever, behind Honda, from the #5 spot it still had teetered on last year. And of course, they’re no EVs here.

Ram, Jeep, and Dodge dealers are sitting on 150 days’ supply, the worst of any brands, and Chrysler dealers on 140 days’ supply. Dropping sales and a glut of inventory call for all-out huge profit-margin-gobbling incentives and dealer discounts to move the vehicles. We’re still waiting if they’re going to get the message someday.

Nissan, #7: Sales of its brands Nissan and Infiniti combined fell 3.1% in Q2 year-over-year, to 236,721 vehicles.

Sales of its all-electric Ariya crossover jumped by 123% to 5,203 units. At least something is growing.

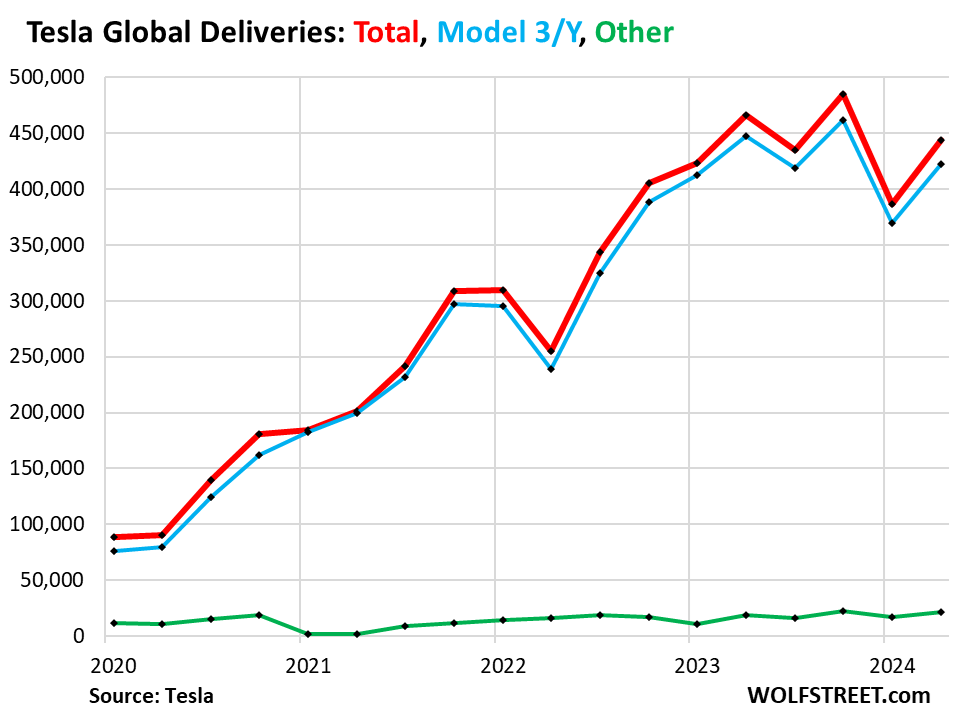

Tesla doesn’t disclose US sales. It only discloses global sales. For Q2, it reported 443,956 deliveries globally, up 14.8% from its extra-gloomy Q1 deliveries but still down 4.8% year-over-year. Tesla reports its Model S, Model X, and Cybertruck under the category, “Other.” It sold 21,551 of “other.” And it sold 422,405 Model Y and Model 3. In the US, Model Y was again the #2 bestseller in Q1 by registrations, behind only Toyota’s RAV4.

Because there was some confusing reporting in the media of Tesla’s deliveries, we’ll just post our chart here, though it doesn’t really fit because those are global sales, and we’re discussing US sales:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The quality issues that Wolf refers to aren’t just technical; they’re managerial, too. The North American car industry simply doesn’t have the management chops to oversee production properly. The top rank minds don’t go into motorcars; they go into computers and movies. Even Tesla had to ransack the legacy producers to get a half-decent team of performers, and that was a limited success.

Movies?

Ha ha retreads of 1970s and 1980s TV shows and 675 comic book movies, AI could generate better content.

To some degree this is on purpose. I went to a top engineering school back in the early 80’s. Senior year the big manufacturing companies would come to campus to interview and hire new engineers. Ford would hire students from the top of the class, but for its finance department, not manufacturing. And GM would hire students from the bottom of the class because it was said what they wanted was loyalty and not brilliance.

Well those are the folks who are in charge of GM today and it shows.

The managerial issues in the US are widespread. A big part is a lack of general knowledge and understanding (technically, culturally , you name it).

Management has become (and always has been to some extent) a club: high society (and aspirational folk)/ “big thinkers” who often can’t even be bothered to know how their products are made and delivered.

A regional manager in my organization oversees the worst run property in the brand and somehow earned a promotion for it. He has the “look” and an “air” about him that someone absolutely gobbles up.

Skillset? Null

Nothing has changed. When I worked in software development for a financial conglomerate, it was well known that the entire management chain was composed of brain dead idiots. In fact the standing joke was if you weren’t stupid enough, a lobotomy was required before you could go into management.

How about first time managers? As in first time in a family to have a manager in them. Psychological studies have shown they make the worst and most dictatorial type of managers.

…give some poorly-prepped folks a hammer and suddenly their surrounding environment begins to resemble a nail…

may we all find a better day.

IBM is managing itself out of business whie the club rakes in cash bonuses and stock grants etc … Arvind is on his thrid or forth hailmary with AI while he rotates jobs out of the US to a new India excellence center… and everyone is asleep at the switch.

Hi ol’ silver, away…

The horse and buggy will be coming back soon so I wouldn’t put to much into the car scene.

It’s true…the horse doesn’t need gas, it doesn’t need to be charged up. Just let the horse eat some grass and get a drink, then you can ride silver to work.

It eats energy and shits out exhaust and gets up on the wrong side of the bed more than I like.. I am done with Fords

It eats energy and poops out exhaust and gets up on the wrong side of the bed more than I like.. I am done with Fords

apologies, sometime a joke needs to be told twice.

And sometimes, not at all…

; )

HT – …kept/used a lot of horses in the past, have we? (I do see your tongue firmly cheek-planted, but if one has issues with the considerable availability/price/garage-maintenance/emissions costs of kwts/gasoline or diesel-fueled transport, you’ll find quite the rearrangement of your daily life just beginning when you go equine/ox!… Best).

may we all find a better day.

Few days ago I read the Ford boss saying that future of mass EVs adoption are small cars. I agree. Was shocked hearing this from him, he missed the ICE for that approach.

What you need is an EV that can recharge without waiting. Either thru Solar or battery exchanges.

NIO already doing five minute waiting time battery exchange-but I don’t see Chinese people mass adopting this technology!

someone in India already homemade a totally solar powered car covered with panels

seems to me that will be able to be mass produced soon, and since most cars sit most of the time, make perfect sense

fundamental research in physics should be majorly financed and SOONER

That’s a joke. You cannot get enough power out of solar cells that fit onto a car to power a real automobile. You can power experimental devices with huge solar panels and skinny bicycle wheels with one person sitting in it and rolling a long at relatively low speeds.

So under perfect conditions in the midday sun, one square foot of solar panel produces about 20 watts of power. The Bolt, a lower-end EV, has an electric motor that is rated at 147 kilowatts = 147,000 watts. So how many square feet of solar panels does it take to power the Bolt under full acceleration? OK, forget that. How many square feet of solar panels does it take to maintain highway cruising speeds that require 12 KW = 12,000 watts. It would take 600 square feet, so an array of solar panels of 60 feet by 10 feet.

But you can power the AC in a car with solar panels in the middle of the day. And you can help charge the battery a little tiny bit when the car is parked in the sun. But it’s not economical to make this work in a car.

Homes use relatively little electricity, and have relatively big roofs, so that’s a good match for solar panels, and then you can use those big solar panels on the roof to top off the battery in your EV in the middle of the day, and people do that, and it works.

Small cars? Ford? Do you mean that they’re going to move past lobbying for the chicken tax and inexpensive foreign EVs? Or are they actually starting to see the beginning of an internal trend where F-150 profit margins are slowing down and he’s scared for the effects on his outsized compensation? Inquiring minds want to know.

He said it in context of EVs. To make them profitable (small battery) the cars should be smaller. For me personally, good cars of any type need to be light. Yes, he plans to produce smaller EVs in scale. A shocker to hear it from him.

https://www.autoguide.com/auto/auto-news/ford-says-selling-small-cars-is-the-move-years-after-selling-its-last-44611924

I think its more economics. The battery packs for the giant SUVs are too expensive.

No, because the “giant SUVs” bring the most money. Automakers sell giant ICE SUVs for $80k-plus, with HUGE profit margins for the automakers and dealers, so that’s an easy target to hit for EVs, but it’s a very limited market, not many of those giant ICE SUVs are sold.

The biggest sellers are mid-size and compact SUVs (crossovers that are more like hatchback cars). The Toyota RAV4 is in that category (#1 bestseller in the US in Q1). The Model Y is in that category (#2 bestseller in the US in Q1). But the missing model is the sub-$25k EV. The Bolt filled that niche, but the Bolt is gone. ICE vehicles in that price category are becoming scarce too, as all automakers have been upscaling all their models for decades. And the dollar-profit margins of $25K-cars are pretty slim. Ford Motor can make $20k in gross profit on a fully decked out 4×4 crew cab. But it had trouble making $1,000 on a Fusion (made in Mexico), when it still made them.

Toyota has actually shrunk the RAV4 over the years. It’s very slight but the driver and passenger are closer together in the vehicle. There is less glass in the windows and less headroom. The same has been done with the Highlander lately as well.

There was a larger Highlander you could order which was normal size but then most new ones nowadays are the smaller version. People really do not seem to complain to Toyota about this.

I notice it because I need the minimum amount of room the old versions of the vehicles offered. Safety in crashes and storage are my chief concerns.

Wolf – question, here, talking ‘small’ cars (recalling the early ’60’s, and their advent for the Big3 out of the all-ICE, ‘land-yacht’-era, then again into the late ’80’s/early ’90’s). D’you think GM ran into the same low-margin issues with the Bolt as Ford did with the Fusion leading to a similar misfires in longer-term strategic thinking?

may we all find a better day.

The Bolt was developed by GM Korea and largely based on an ICE platform that GM builds and sells in Korea. GM is big in Korea, manufactures there largely for the Korean market. So they quickly cobbled together an EV based on an existing ICE platform. The Bolt is assembled in the US, with many parts and components imported from Korea. So this car will never be as good as a blank-sheet EV. GM now has blank-sheet EVs on the market. And they’re good. The Bolt was designed to sell for over $30K when it came on the market in 2016. And it was designed without trying to maximize manufacturing cost efficiencies. They just wanted to get an EV on the road.

Bolt sales were completely crushed years ago by Tesla’s Model 3 which sold for nearly the same price but is a far better car. And Tesla is making money on it. GM halted production in 2021/22 due to battery problems, and then started production again in 2022, but cut the price of the Bolt by a lot. So in 2023, it had a successful EV because people paid something like $28K for the base version before rebates. But that price is probably substantially below its manufacturing costs.

An automaker will have to design a $25K EV with total focus on manufacturing efficiencies, like any vehicle in that price range, or else they will lose money. The US auto market requires a lot of safety and convenience stuff (thank God!) that adds expense. So its really tough to profitably build a $25k vehicle that Americans want to own and want to be seen with in large numbers – so not an econobox, but a nice large-enough a vehicle for five people with good performance and all the safety and convenience features that Americans now expect in a new vehicle. Tesla’s “Model 2” is supposed to hit that spot as Tesla is trying to design the vehicle and manufacturing process (including the one-piece rear portion of the vehicle done by giga-casting). But it keeps running into huge problems, and the project is delayed. So we’ll see.

Wolf – as always, many thanks for the background, and explanation for the tortured profitability path of the Bolt…

may we all find a better day.

It’s interesting to see how the market has reacted to Tesla’s second quarter delivery numbers which, as Wolf mentioned, were down year-over-year, but up from the first quarter. When the poor first quarter results were announced, the narrative seemed to change from Tesla being a car company to being a tech company. In other words, it didn’t matter that the delivery numbers were down because it’s no longer being priced as an auto stock.

However, based on the market’s reaction to an above expectations delivery number earlier this week, it obviously is being priced as a car company. Until of course it misses expectations, and the focus will once again be on Tesla as a tech company.

Given the company was promising almost exponetial growth a couple of years ago and the company’s shares were priced accordingly, it’s amazing to think it can actually record a decline in year-over-year sales and still have a market cap of $785b.

In every major city in the World they have “delivered” Teslas awaiting buyers, in vast numbers, while they sit and rot in the sun. In Australia 15% discounts are not even moving them and the Competition (Chinese) is eating them alive. But even then all EV sales are slowing to a crawl.

Not a Business I would want to be in. … Candle burning both ends does not end well

“In every major city in the World they have “delivered” Teslas awaiting buyers, in vast numbers, while they sit and rot in the sun.”

Ignorant stupid BS lies. “Deliveries” are when the end user (the customer) takes possession of the vehicle and the registration process has commenced. Any Tesla waiting to be sold are not “deliveries,” but are in Tesla’s “inventory.”

Deliveries are only deliveries when they become registrations (licensed and titled). The key indicator is retail registrations – which means John Q Public bought it. The sales numbers reported by the manufacturers can be manipulated very easily. Need some sales? Boom! Let’s replace some company cars and RDR them (Retail Delivery Record reported). At one time, I had multiple company cars (picked one up at one dealer in the AM and wholesaled it at a discount to another dealer after @500 miles (which is, IIRC, where most state motor vehicle laws dictate that a vehicle is now “used”) – which took about 3 days. Dealers will also “tombstone” cars to win incentive contests (bonuses paid on attaining sales objectives). The car’s not sold, but the RDR has been submitted and therefore is a “reported delivery”.

Another gimmick is service loaners. Retire the entire fleet of service loaners and replace them…. then move the retired units into their Certified Pre-Owned category (that’s where all those low mile units come from). Those often are plated and fall under “fleet” sales. Dealers don’t run them on dealer plates for liability purposes (loaners would be titled to another entity).

Figures don’t lie. Liars figure.

El Katz,

I generally like your generally insightful commentary on the auto industry, but this time… Your definition of a “delivery” is false. And your conclusion is BS.

A “delivery” in the US is when the dealer completes the deal (gets paid, delivers the vehicle to the customer, initiates the registration process, etc.), and the dealer’s computer system submits the data of the sale, including the customer data, to the manufacturer, and also submits the data to whoever funds the floorplan, and lots of money changes hands because the dealer gets paid for the unit (such as from the lender or the leasing company) and has to pay off the floorplan. Today, that’s very quick via electronic fund transfers. Back in my day, it was done by check. This triggers all sorts of things, including the warranty, etc. There is nothing to be played with.

There were incidences of FRAUD when FCA/Fiat-Chrysler was paying some dealers to falsify delivery data between 2012 and 2016 to pump up its own numbers. FCA got sued by other dealers, and was charged by agencies of the federal government, including the DOJ, the National Highway Traffic Safety Administration, and the SEC. It was also charged by the State of California. In 2019, FCA settled with the DOJ and the State of California for $800 million, the NHTSA for $110 million, and the SEC for $40 million. I don’t know how the private lawsuits turned out. But the whole thing was well over $1 billion. This was a huge scandal, and it was all over the news.

So fraud happens occasionally. But fraud is not business practice.

In terms of your BS about service loaners: We had a 500-vehicle rental fleet that we stocked with new vehicles that we ordered under a special rental program that gave us a better deal. The rental department was profitable and was a good business; it also provided the service loaners. We controlled the vehicles, and after a couple of years, we’d pull them out and sell them as used cars. When our rental department took delivery of the vehicle, that’s NO DIFFERENT than Hertz taking delivery of a whole bunch of vehicles. The dealer’s rental department is the end user of the new vehicle, the unit gets tagged and becomes a used vehicle. Same with service loaners.

Your allegation that this is a game is bullshit. The dealer is taking a new unit and is doing something with it to either make money renting it out or to service his customers, and it becomes a USED unit, and is sold as USED some time later.

“Certified pre-owned” = USED, and if the dealer tries to sell the loaner right away as used car, he can do that, but will take a hit because the unit will be priced like a low-mileage used vehicle (competing with auction cars) and not a new vehicle. And even then, it’s STILL an actual delivery because the unit is sold to a customer as used, and the unit is off the lot and in a customer’s garage. So what’s your problem?

Wolf:

One of the key elements that make your site a destination is that people feel they can exchange ideas and information freely and you welcome it. But that apparently comes with a cost.

If I understand your history correctly, your experience in the automobile business was at retail – Ford in OKC. Mine was manufacturers wholesale – from field rep to corporate exec – at two major volume manufacturer/distributors and nationwide experience. As a result, I have a different perspective than you and witnessed multiple things that dealers can and will do that you, during your tenure in retail, may not have even considered nor were they even available to you at that point in time.

Manufacturer and retail/consumer vernacular differs in some respects. The term “deliveries”, “sales”, “registrations” are often conflated into being the same. On the wholesale manufacturer side, the sales reporting screen is often called “Retail Delivery Report” or “Retail Delivery Record”. Ergo, it is often considered a “delivery” in manufacturer;s vernacular. In dealer vernacular, it’s when the paperwork is done, money exchanged, and the car’s busting bugs. Some dealer pre-report sales at month end to win a manufacturer sales contest or help their road guy hit his objective. If the deal busts out, those reported sales stick at the manufacturer level, but won’t show on the dealer financial statement as it was never finalized. Polk data rarely (if ever) matches manufacturer data as there’s a significant time lag between the events. The manufacturer still reports the “delivery” in their monthly PR releases. Rarely will it get reversed unless the dealer does.. and that reversal usually starts as a (-1) sale at the beginning of the next reporting month. Other parties report it as a “delivery” when it meets their criteria. Dealers when booked. DMV’s when processed. Polk when received from the DMV’s. However, DMV’s are notorious for being tardy in reporting to Polk… so you often end up with apples, oranges, and potatoes from the same sales month data due to how/when it’s reported/booked and by whom.

Manufacturer reported data is affected by a variety of processing decisions that are invisible to dealers. You, as a retailer, would never know. Without going on a diatribe, I could find thousands of sales at calendar year end if the need arose. Wasn’t rocket science. And perfectly legit. Nothing anyone would get their panties in a bunch about. We could also delay reporting some sales to the media by having an earlier cutoff to jumpstart the next sales year. Besides, with 6 time zones, sales cutoffs varied anyway. (Don’t forget AK and HI)

Regarding the certified used source of “sales”, here’s how it can work. Dealers are often compensated by the manufacturer for putting customer service loaners in service – which may include waiving the freight charges and ad association fees, a separate cash incentive for placing the vehicle in-service for a minimum of 60 days, and a monthly stipend if the vehicle is loaned at least once per month (we used 1% of MSRP as the stipend). Those units turn into future used inventory to feed the certified programs. The point I was trying to make is that the program can be a source of deliveries/RDR’s. FWIW, there’s no auction source for 500 mile current model year high demand vehicles. That’s a straw dog.

Any financial downside risk to the dealer is minimal, especially if turned quickly. That’s why you see certain hot current model year merchandise in the dealer certified inventory with 500 miles on them. Not BS. Fact. Customer gets a better warranty that they don’t have to pay for as a bonus, so they’re willing participants. In certain circumstances, the manufacturer rebates the certification fee to further encourage such behavior. Add that all up and it can quickly turn into multiple $1,000’s back of invoice – enough of a cushion on a desirable product. Also of note, the certified programs often have finance rates that are better than or equal to new. The CUC department was in my wheelhouse. I know it well.

Imagine if a manufacturer had 1,000 dealers and incentivized each to deploy x number of units based on their service RO count. It could easily turn into 1,000’s of “sales” per month if they all played ball. If titled, they turn into registrations for Polk purposes. To control day’s supply you change the vehicles that can participate in the program.

FCA? IIRC, they were willful participants in a scheme that impacted pricing. That was the part that blew them up. One dealer I know personally was at ground zero in that debacle.

However, if a dealer, as an independent businessman, wants to inaccurately report sales to the manufacturer, that’s his prerogative. I have seen instances where it was done to win sales contests, especially stair-steps. We would send auditors in… but they often dug a dry hole because the dealers knew their business better than the b-school bunch sent to guard the hen house. Another example of the natural divide between mfr wholesale and retail.

Perspective is far different that BS and lies.

FYI, Annual Reports and 10-K’s of publicly traded companies (Tesla) have sections called “Revenue Recognition Policies” that typically explain when a sale “occurs”. While I hae zero interest in Tesla or reading Tesla’s 10-K, one could spend a little time researching this and get some clarity on this matter.

Kile,

So I’ll help you with this. In the US, automakers recognize a sale for revenue purposes when they invoice the dealer, which happens before the vehicle leaves the factory, and well before the delivery to the end-user occurs. Dealers BUY the cars from the automakers (revenue for the automaker), and customers buy the cars from the dealers (revenues for the dealers). Dealers recognize the sale as revenue when they deliver the vehicle, which can be months after the automaker recognized the sale to the dealer of the same vehicle.

So you see, retail “deliveries” have nothing to do with automaker revenues, but with dealer revenues.

Automakers also sell directly to large fleets, such as rental fleets, and they recognize the revenue when the units are invoiced to the fleet before they leave the factory. But fleet “deliveries” directly to fleet customers occur later when the units are physically delivered to the fleet and the fleet takes possession of the units.

So with automakers, “deliveries” occur well AFTER revenue recognition from the sale.

Tesla doesn’t have dealers, but it manufactures in three different countries (US, China, Germany) for sale in those countries, and it exports from those factories to other countries. It also provides leases directly to its end-users whereby it retains ownership of the car while the end-user makes monthly lease payments. There are special accounting rules for revenue recognition on leases. But when a vehicle is leased and the end-user takes possession of it, it’s a “delivery.”

So revenue recognition is very complex. But a “delivery” is simple: it’s when the documents are signed and the end-user takes possession of the vehicle.

Where I live not enough Chinese drive a Tesla. Either everyone in Markham drives a Tesla or no one drives a Tesla that’s how things always work in Markham and will always work. So far virtually all the Chinese in Markham are still driving a white (black to a lesser extent as they only buy black or white the same with clothes) Mercedes Benz. They always buy the exact same phone and always have and the exact same cars.

Can ‘t wait until all cars are sold online with the assist of AI!

Who needs an asswipe salesperson who knows less than anyone doing a basic search.

Should save the dealers a bunch of money to upgrade their service departments.

Got my last car and never spoke to a human.

Might just be Colorado, but I’m noticing more and more post accident vehicles on the roads with bumpers dragging asphalt and mufflers literally on the ground. No tail lights at night are the absolute worst. I guess getting from point A to B by any means necessary has really taken toll on wallets. All my retired friends are now gainfully employed in mechanic work 6 days a week. Amazed at the amount of males driving around without a drop of mechanical aptitude.

That is a good recession indicator. No extra cash to shore up their rides. Bad sign

CO is a tale of two economies.

Much of the working class is willing to work for peanuts to get the lifestyle. Most of the owner class is Texas, California and the rest, with a huge bump in pandemic relocations.

The influx of Ca. Money especially pumped RE prices, as a sale of a multimillion dollar Ca. Home made a multimillion dollar CO home more reasonable (even if it’s incredibly overvalued).

It’s (always) getting tougher at the bottom. It’s more difficult to start out now than ever.

Some of the working class was attracted to CO for the legalized weed.

I thought people were leaving CA in droves?

Most of them came to where I’m at, Raleigh, NC. And phew they are crushing the roads with traffic. 😬

Apparantly the song hotel California was wrong. 😆

sufferin’ – welcome to what California has profited and suffered from, and yet endured for many decades (…check out the lyrics to the great Woody Guthrie’s ‘Do-Re-Mi’, referencing the Golden State in the ’30’s and forward, as long as we’re talking those carpetbaggin’ Eagles…). Best.

may we all find a better day.

Mechanical aptitude is gone. My son had a friend stop by, when he went to leave his battery was dead. He did not know how to open the hood. His dad checked the oil and washer fluid so he just drove the car and put gas in it. I heard of a parent driving 3 hours one way to help his son change a flat tire. People don’t even know how to change a tire on a bike and the labour rate for a bike mechanic here is $100/hr.

My mechanical aptitude sucks, but I can change a damn bike tire.

For those who can’t do that. I would hope they’d watch a YouTube video and try it themselves before they paid a bike mechanic for such a simple fix!

That’s the first thing I taught my girl when she learned to drive: how to change a tire. I also taught her to drive a stick shift. So there’s at least one Millenial out there who can drive those. ;-)

Boomer parents haven’t done their kids a lot of favors in stand on your feet department, seems like. I hope these stories I hear aren’t the end of the story. Figure they’ll learn but maybe a little later than they could have…

Flaming – think the aptitude is always there, but comes down to overcoming our society’s contemporary aversion/disdain for that which might dirty one’s hands and towards those willing to engage in same (…until it needs those ‘essential workers’, effusively praising them while denying them ‘combat pay’…).

may we all find a better day.

Depends on the age of the post-accident vehicles. On newer stock, the cost of replacement parts is absolutely goofy….. $1,000+ headlight assemblies , sensors out the wazoo (parking, cross traffic, ACC, backup cams). Paint cost is also outrageous. A gallon of automotive paint is in the multiple hundreds of dollars per… then there’s the additives… reducers….. and the good shops are backed up for months.

Often, the flapping bumper covers can be re-attached by buying some inexpensive clips. Did that on my daughter’s *airport car* (RIP) a few years ago. Bought a bunch of plastic rivets for $10 (to hold down some garnish under the hood) from that Jungle website and got the genuine clips from a dealer as those usually don’t crack when you smack them into place. Total expense was probably $50 (the dealership clips were ‘spensive).

If all else fails, there’s always zip ties.

As far as mechanical aptitude, I wouldn’t let either of my kids get their license until they could change a tire, new how to check for proper tire inflation, check the oil, brake fluid, coolant, etc.. I also taught them to check their brake lights in a store front glass when backing towards it to make sure all bulbs were functional. Small spare parts kit in the trunk with bulbs, serpentine belt, fuses, and other stupid small bits that could leave you stuck in the boonies. My daughter still carries the portable compressor in her trunk (got rid of the space saver too…. no one ever checks the air in those).

GOOD advice EK: Similar story when my offspring wanted dirt bikes and me to fix ’em…

Told them I would be happy to hand them wrenches LOL.

Both do their own mech work, one even rebuilding his shocks after long trips into the vast deserts of the west.

Helped to ”let them” buy a fixer upper vehicle, but not drive it until all the proper safety equipment, etc., was working properly!

VVNv – had the similar experience with my (ex-)stepson wanting to race MX. What I found fascinating/frustrating (he was in his early ‘teens at this point) was his belief that I was ‘born’ naturally-knowing moto-mechanics. It took awhile to actually get him to listen to me when I said:

“…Sean, you have to realize the number of blowups and failures I have had to gain this knowledge is not only part of the mechanical and racing process, but of life. The best you can do is always realize every day is a valuable learning situation, and be open to that in order to keep those blowups and failures to a minimum over the longer term…”.

As stated, it took awhile, but he finally got it. Best.

may we all find a better day.

Q2 3023, lol.

Guess I’m being well prepared in advance.

America is car crazy and car stupid.

For most Americans, you’re not buying a car, you’re buying an image. Folks will pay a lot more for a cool image than they will for basic transportation.

People will often drive a vehicle beyond their means in order to impress people they don’t know. “I am somebody! Look at me!”.

Similar phenomena to the Louis Vuitton purses and other status symbols people display to affirm their station in life. Sadly, people are more frequently becoming robbery targets based on their flash. That’s why I prefer the “groomed hobo look” when out and about.

Grroommed hobo used to be called, ” shabby chic” back in the day when the rich folks figured out how much more fun we peed ons were havingEK!

Circa late sixties/early seventies in SF bay area and London for me,,, and no, I DON’T miss it, cause I got all of what I wanted then!

It’s incredible to me how the automobile industry has fallen off a cliff in such a short period, losing so many sales to light duty trucks. I really don’t get why automobiles are no longer attractive, especially given the shrinking family sizes. It’s so counterintuitive, it seems more like a supply conspiracy than a true demand problem.

They also don’t seem to be keeping track of the downsizing of the American garage and driveway. We live in a new subdivision of traditional single family houses with small yards and the now standard 20′ x 20′ double car garage, which will. not practically fit a full size pickup. More than half the houses in the subdivision are ” Alley Loaded” meaning the front of the house faces a park or greenway and the garage is on the back facing a narrow alley. In. most of these houses the length of the driveway is too short to park a car, let alone a full size pickup. As a result there are no pickups in the entire part of the subdivision with short or no driveways.

For the most part, people refuse to buy sedans. There are very few manufacturers still playing in that arena and most are import marques. It’s sort of the “chicken and egg” thing…. people can’t see around the “bro-dozers” when in a sedan or coupe, so they opt for a tall sedan (crossover) for their next car to improve their visibility.

Look at a 2000-ish BMW 5 Series. Those look tiny now in comparison to other sedans like a Camry or Accord. When I drive our 3-ers, I feel like I’m traveling in a tunnel surrounded by “high rises” with a eye level view of the surrounding vehicle’s tire valve stem.

Sedans have grown way overlarge, particularly BMW sedans during the past 20 years. The E39 5-Series sedans of 1997-2003 are the perfect size and one of the best cars ever produced. We have a magnificent 1997 540i and it is superb to drive, ride in, and to look at. It amazes me more with every passing day. And the E39 prices just keep rising on BAT with one M5 going for over $100,000 last week.

SoCalBeachDude,

“…magnificent 1997 540i and it is superb to drive,”

Personal question. I had a 1999 540i with the sports package (M5 wheels, steering wheel, etc.) and all the doodads, including traction control, for a couple of years back then. I agree with your assessment, but it had one huge flaw in intersections: when I stepped on the accelerator to get across the intersection or into traffic, the traction-control system kicked in and the car essentially stalled in the intersection, and I had to get off the gas and ease it out of the intersection. It was the most annoying thing, and I thought it was dangerous too. My theory is that the traction control system was configured for the 3.2L inline 6, and they just copied-and-pasted it over to the V-8 version, but the V-8 had so much more torque and needed a freer rein, that’s my theory.

Is that a problem you have encountered also? Your car might not have traction control – I would have considered myself lucky not having it.

Your 540i was a serious mechanical malfunction as that is not in any way typical of 8 cylinder E39 models.

Mr. Wolf writes: “But automakers and dealers are still slow to react to this market.” The automakers all received tariff based protection from the high quality inflation busting Chinese EVs. Chinese owned Volvo can bring in their EV because Volvo has a US factory, and should undercut Tesla.⁷

Tesla is living on borrowed time going forward in time profits can only fall. Their stock price is just another fine example of the fraud ponzi stock market that presently exists.

For once, I agree with you. I must be wrong.

…footnote ‘7’? (…a new commenting guideline I’ve missed, as well as the footnotes themselves?).

may we all find a better day.

I just had breakfast with a friend who works at an auto-industry supplier. He advised staying far, far away from anything Stellantis. He said that the U.S. portion of the company is being run dictatorially from abroad and things are going downhill fast, both from a quality and a morale standpoint.

That’s my impression too. A bunch of French people trying to tell Americans how to sell pickups 🤣

Even worse, A Bunch of French people trying to tell Americans how to make Pickups. The French had a brief burst of automotive greatness in the 1950’s with several brilliant Citroen designs, which were great as long as you lived in France and had a French Mechanic.

I had a Renault R17 back in the 70’s and it was a very weird car but ahead of its time. I only managed to keep it running because I found a French mechanic who worked out of a dilapidated shed down by the waterfront. He worked on Renaults, Citroens and Porsches but he hated the Porsches, cursing them up and down in his French Accent, wearing his Jacques Cousteau knit cap.

The big cheese of Stellantis is Portuguese.

El K: I have never had Portuguese cheese, but it’s fun to say!

…and here i thought FIAT (Italians) had more managerial HP in Stellantis than the French…

may we all find a better day.

Stellantis is comprised of 14 automotive brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram, and Vauxhall.

Saw my first left hand drive Lancia only yesterday. some Italian must have driven it over. It did stand out…….

Considering the French can’t even sell their cars in America, it’s bizarre to think they know anything about the US truck market. Ah, managerial arrogance…

I bought a Ford Maverick hybrid recently. Gets better mileage than my wife’s older RAV4 hybrid, carries 4 people in comfort, and is great for all the Home Depot runs I do. If they made a pure EV version, I would have bought that, but they don’t.

Wolf, I was not able to post on the comment above about the oyota Highlander. If you look at all the generations of the Highlander they keep getting bigger. The early ones, while claiming to be three row, were tiny.

I bought a 2024 Grand Highlander Hybrid AWD and it is quite large. I use it to Uber and I can put 3 adult males in the third seat and they don’t complain. It is AWD (which I need for the snow in CO), seats eight. I have 29,000 miles on it and get between 36 and 56 MPG depending on the mix of town and highway driving. It is the most amazing vehicle I have owned. My prior vehicle was a 2017 Camry Hybrid that I sold for 50% of what I paid for it new. In six year I put 187,000 miles on it, gave over 10,000 rideshare rides and got between 36 and 52 MPG. When sold except for one wear spot on the drivers seat the interior damn near looked like new as did the exterior. Oil changes every 10k, air filters at 20k, plugs at 100k and tires and wipers as needed. The most reliable and cheapest to operate vehicle I have ever owned, and at 73 that has been a lot of vehicles! As to GM, talk to folks that try to make a living in ridesahare using anything made by GM. The repair costs are deadly.

Stock market insanity bubble update:

As Mr. Richter mentioned, Tesla’s year over year sales declined by 4.8%–but they beat delivery estimates by about 5900 vehicles, and in the wacky stock market world, that apparently justifies a 2 day valuation increase of over $60,000,000,000, or more than TEN MILLION DOLLARS for every vehicle that beat the estimate (!!!##@@**???)

The S&P 500 market cap now exceeds $56 TRILLION–not all US equities, JUST THE S&P 500– and just the top four mega cap companies are valued at $12 TRILLION, or $1500 for every man, woman and child on the planet.

This is yet another historic bubble, and when the music stops, lookout below. You will see the SPY below 4500 again. It is a LOCK. Below 4000 is a very real possibility. The Nasdaq 100 (QQQ) will collapse like a house of cards, because that’s what it is.

…apparently justifies a 2 day valuation increase of over $60,000,000,000

Just a bit more then Tesla needs to pay Elon’s $50B pay package.

Coincidence?

You clowns have no idea.

My 2002 BMW touring Wagon pleases my wife, and it is the biggest piece of garbage that we have ever owned of our five vehicles.

The four computers have failed so many times, that I have trouble keeping up with the bureaucrats of the DMV.

That car cost me exactly $900.

I Have spent about $4,000 keeping it on the road.

But, my wife likes it.

Happy wife, piece of garbage car.

Here’s one of those things that is “BS and a lie”…… or not.

https://www.reuters.com/legal/litigation/lawsuit-accuses-hyundai-faking-us-sales-data-electric-cars-2024-07-08/

Fraud, yes, and I told you in my comment the story about the FCA fraud case in 2016 of faking deliveries, that FCA settled in 2019 for over $1 billion with the DOJ, the SEC, other agencies, the state of California, and other dealers.

I also said in the same comment of the FCA fraud case: “So fraud happens occasionally. But fraud is not business practice.”

https://wolfstreet.com/2024/07/03/new-vehicle-sales-q2-evs-surge-yoy-except-at-tesla-stellantis-drops-to-6-behind-honda-first-time-ever-gm-ford-ice-vehicles-dip-yoy-but-their-evs-spike/#comment-594366

But you didn’t read my comment and you didn’t read what I said in that comment about fraud because you were tangled up too much in rationalizing your own stuff.