There’s no need to still pay a “loyalty tax” to the banks.

By Wolf Richter for WOLF STREET.

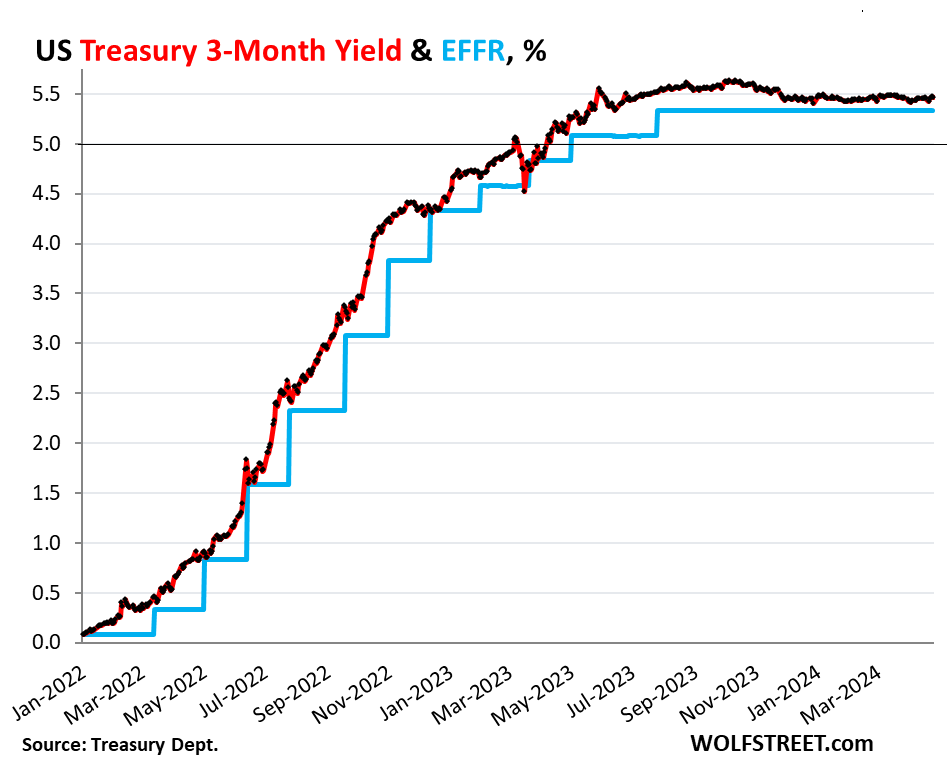

It’s sort of an anniversary: Treasury bills of three months or shorter have been selling at auction with yields over 5% since mid-April 2023. And since mid-May 2023, they have been selling with yields in the 5.2% to 5.6% range. Money market funds and CDs followed. These were finally reasonable returns, up from the ridiculous near-0% that had been in effect until January 2022.

Yields on low-risk short-term investments have come a long way since March 2022, when the Fed’s rate hikes started, and they have stayed over 5% for a year, and it looks like they’re going to stay there for longer, as Rate-Cut Mania has been obviated by resurging inflation.

The three-month Treasury yield closed at 5.48% on Friday. The effective federal funds rate (EFFR), which the Fed targets with its headline policy rate, has been at 5.33% since the last rate hike in July 2023. These used to be normal-ish yields two decades ago, and would have been considered low for many years before then, but here they are again. For a lot of investors, it’s the first time in their investing lives that they’re seeing those yields.

Those yields are not a gift from God, but a result of resurging inflation that has been eating into everything, and that finally belatedly forced the Fed’s hand.

Americans hate, hate, hate inflation. But they’re liking the 5%-plus yields on their cash, and put a lot of cash to work by yanking it out of their bank accounts and putting it in 5%-plus T-bills, money market funds, and “brokered CDs” that they bought through their brokerage accounts.

And that has forced banks to compete for deposits, to keep deposits from fleeing, and to attract new deposits to replace those that did flee, by offering attractive interest rates. And Americans have flocked to those CDs too, and they are switching back and forth, arbitraging rate differences, thereby keeping banks on their toes.

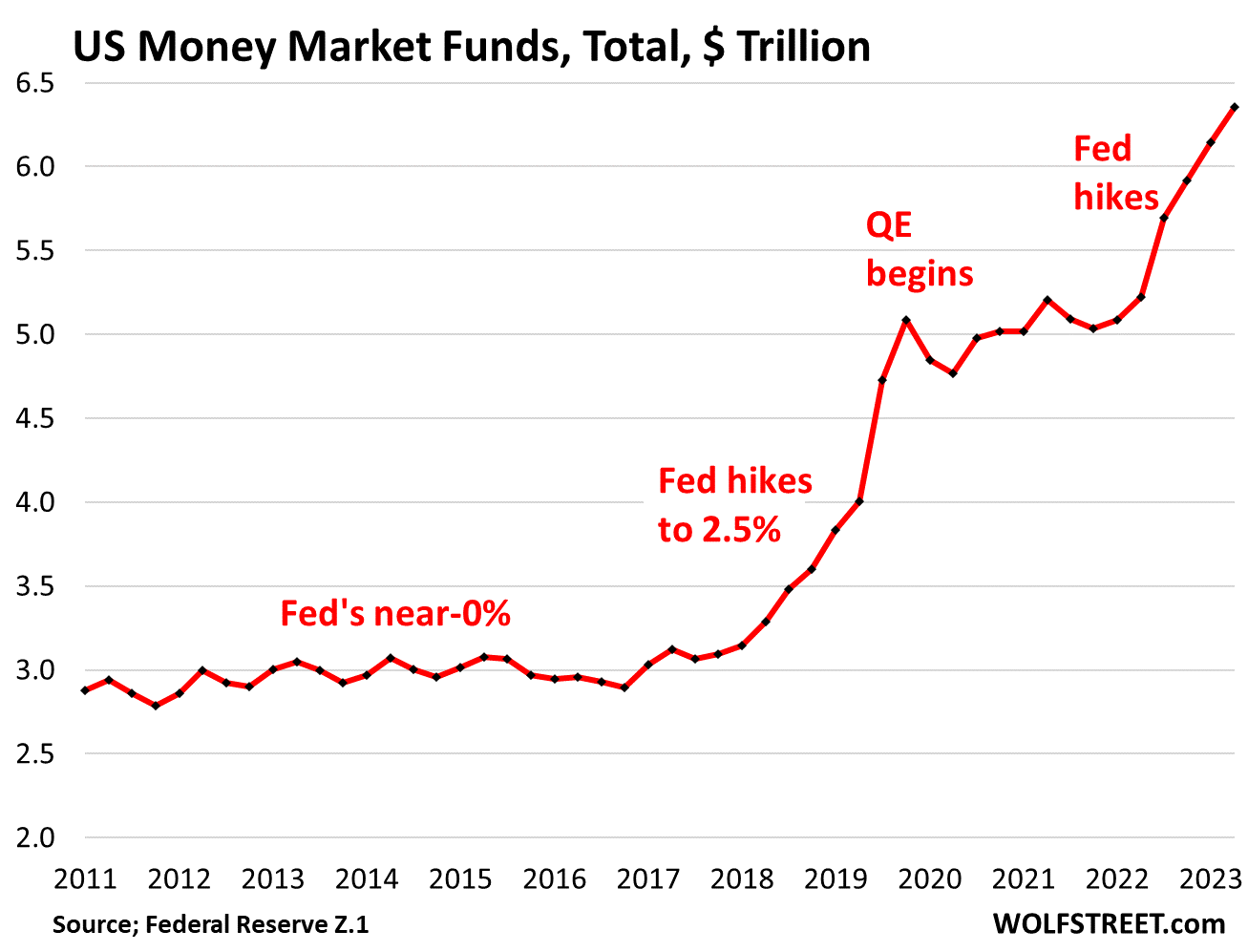

Money market funds (MMFs) that are tagged “retail” had swollen to $2.43 trillion as of April 3, but then there was a $300 billion dip around April 15 Tax Day when taxpayers withdrew cash to pay taxes. By April 24, the balance was down to $2.40 trillion, according to the weekly measure by ICI (Investment Company Institute).

This includes MMFs that invest in government instruments, such as T-bills; MMFs that invest in tax-exempt securities; and MMFs that invest in non-Treasury assets.

MMFs held by Households: A broader measure of MMF balances held by households, released by the Fed as part of its quarterly Z1 Financial Accounts, jumped to $3.6 trillion at the end of Q4, up from $2.6 trillion during the 0% pandemic era, and up from $1.6 trillion before the rate-hike cycle of 2017-2018.

Households are indirectly among the holders of institutional funds because the institutions include employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.

MMFs are mutual funds that invest in relatively safe short-term securities, such as Treasury bills, repos in the repo market, repos with the Fed – what the Fed calls “Overnight Reverse Repos” (ON RRPs) – high-grade commercial paper, and high-grade asset-backed commercial paper, all of them with short maturities.

Total MMFs held by households and institutions spiked to $6.36 trillion by the end of Q4, according to the Fed’s data.

Banks have to compete with T-bills and MMFs.

Deposits are loans from customers to the banks and form the backbone of bank funding. When depositors yank their cash out, banks can collapse, and do collapse, see Silvergate Capital, Silicon Valley Bank, Signature Bank, and First Republic. When customers yank their money out because the bank’s interest rates on CDs or savings aren’t high enough, banks attempt to offer more attractive rates, but not across the board – that would be far too expensive – but to new money, and this initially happens with brokered CDs. That’s the first phase of banks reacting to T-bills and MMFs.

But as customers are starting to flee in larger numbers, it becomes imperative to retain the cash from existing customers by offering them competitive rates on cash they already have at the bank, and that’s the second phase, which started last year.

And so banks are offering CDs that yield 4% or 5% and more, even to their existing customers, and people have flocked to them. For banks, CDs (“time deposits”) provide funding that is more stable than savings or checking accounts whose cash can be yanked out instantly via electronic fund transfers.

Large Time-Deposits (CDs of $100,000 or more) surged by nearly $1 trillion since the Fed began its rate hikes, to $2.37 trillion by the end of February 2024, up from $1.40 trillion in March 2022. Last month, they dipped a hair to $2.36 trillion in preparation for Tax Day, according to Federal Reserve data released this week.

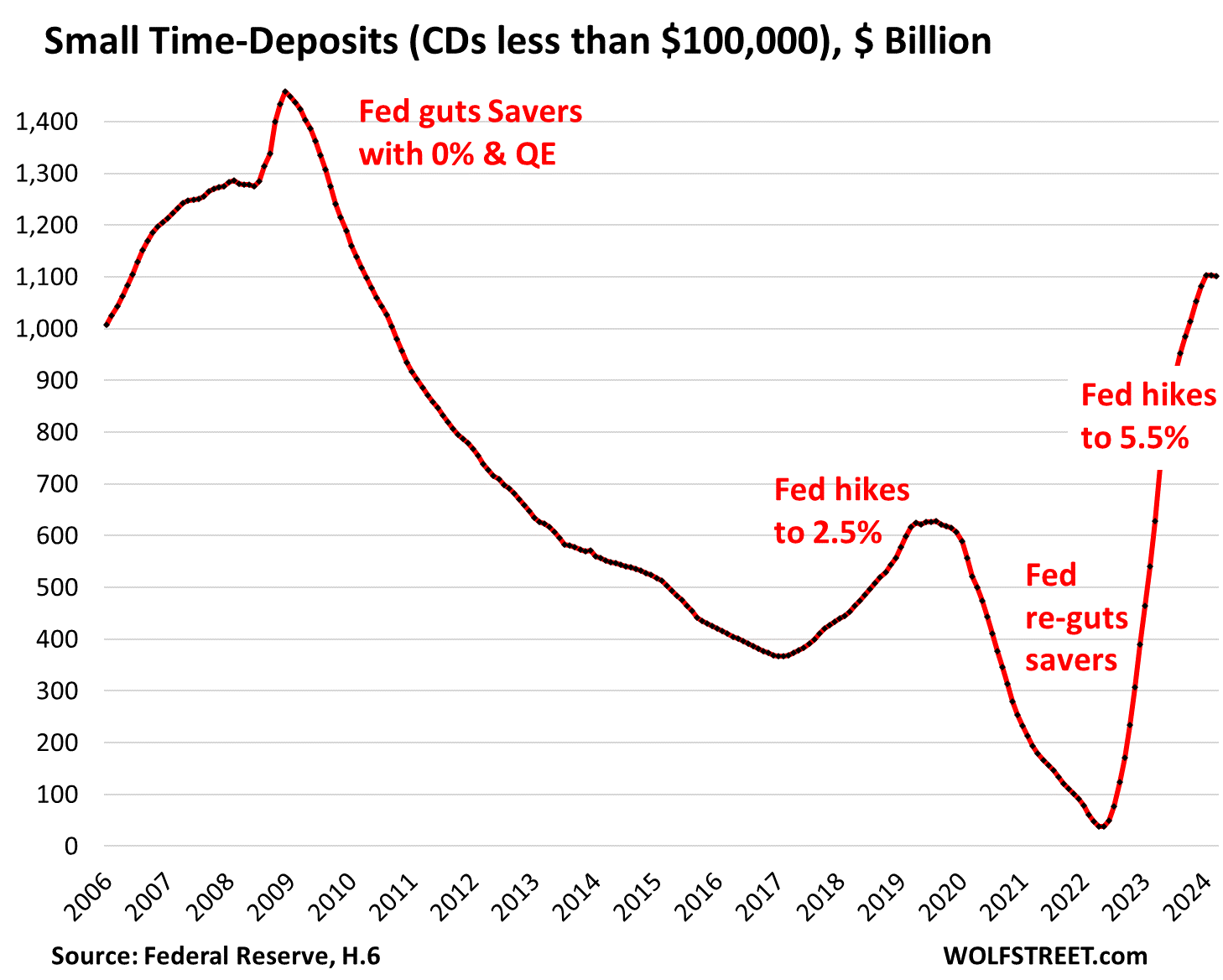

The Fed’s interest rate repression during the Financial Crisis caused banks to slash the interest rates on CDs to near-0%. The cashflow of yield investors, such as savers, was sacrificed at the altar of asset-price inflation. And CD balances plunged, as deposits mostly reverted to other types of bank accounts that paid nothing and whose balances continue to swell.

Small Time-Deposits (CDs of less than $100,000) surged from just $36 billion in May 2022 to $1.1 trillion in January and have stayed there through March, according to Fed data.

These small CDs reflect what regular folks are doing with their savings, and they too are now finally earning some income on their investments:

Treasury bills: There are currently $6 trillion of T-bills outstanding, and the pile keeps growing amid huge T-bill auctions. We don’t know the amounts of T-bills that households have stashed away, but it’s significant.

T-bills have terms of one year or less. At auction, they’re sold at a discount, and they’re redeemed at face value. The amount of the discount represents the interest earned over the entire period. They have become attractive instruments for yield investors and savers. They buy them through their broker or directly from the government at TreasuryDirect. They can set them up on auto-rollover so that maturing T-bills are replaced automatically with new T-bills purchased at auction. As settlement dates line up, cash doesn’t sit there unused.

Dodging the loyalty tax. For banks, deposits are the primary source of funding. Higher deposit rates raise the cost of funds for banks, and so they’re loathe to raise interest rates they pay on deposits, and they will raise only the minimum necessary to retain deposits, and they will offer higher rates to get new deposits. They love customers who don’t compare or who don’t pay attention or who feel stuck earning nearly nothing on their savings accounts and checking accounts. It’s free money for banks.

And there are still trillions of dollars in bank deposits that are earning nearly nothing. Some is inevitable, such as with transaction accounts. But other deposits should be moved somewhere else if the bank fails to offer competitive interest rates. There are lots of options today to dodge this loyalty tax. And the 5% interest rates are much-needed compensation for the loss of purchasing power due to inflation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Have recently discovered brokered

CD’s and am an investor.

Bought 2 yr Citibank CD at 5% yiel

Try getting this CD at one of their branches,not happening.

There’s no need to lock your funds up for 2 years to get 5%. Personally I think there will be better-yielding opportunities within 2 years and don’t want my money tied up that long.

At several banks (not Citi) you can get 5% interest on an online savings account.

The major money-market funds also pay 5%+.

Among investment brokerages, 5+%-yielding money market funds are the default core positions at Fidelity and Vanguard. Interactive Brokers yields 4.7%. Most of the other brokerages want to make money off the interest they earn on your idle cash by NOT paying meaningful amounts of interest.

My one quibble with Wolf’s recent articles is that for a lot of us with other earned income, the federal + state + sales + other taxes shrivel up nearly half of that 5% yield. With inflation back in the 3% range, after taxes and inflation, our savings are only treading water. I’m glad other savers in lower tax brackets are finally getting a bit of a boon here, but it’s a huge mistake to spend all your interest in an inflationary environment!

I also don’t see how the inflation will be halted without a substantial further change in both actual policies and policymakers’ mindsets. The Fed is already behind the curve again. And on the fiscal side, Congress isn’t going to let up on the gas pedal until there’s a budget crisis. Which is already unfolding but won’t get mainstream media airtime until after the election, so they can pin it on the lame duck president. (Note that either Trump or Biden will be a lame duck.)

You can add Charles Schwab to that list of brokers that offer 5%+ MMFs.

In order to combat the taxes on the higher interest rates, I have started contributing more to retirement accounts and then using the interest for more living expenses. It’s a 0 sum game in terms of disposable income, but it reduces the bite of the taxes, so I can keep more of what I earn.

Yes, but…Schwab only pays a miserly 0.45% on the brokerage cash balance, and they lost my IRA and Roth accounts to fidelity because of that fact

Yep, Schwab’s absurdly low rate on brokerage accounts is forcing me to pull money as well. Really shady on the company’s part.

You just have to buy their MMF, SWVXX, running about 5.2%. Unfortunately it’s not a sweep. But T bills are better anyway–higher yield, liquid, no state income tax.

Like CH said, just buy SWVXX. Through Schwab, you have to buy Tbills in $1000 increments. I throw the resulting “table scraps” into SWVXX that I can buy in $1 increments. Each of my accounts have less than $1 in cash sitting there.

GOOD comment BG:

We are one of the families now earning 5+% on our savings, and loving that return on our savings, small as they are, compared with the 0.01 we had been getting.

With all due respect for the banksters, etc., I am one who can remember grandma getting and living well in her own owned house on the 6% on her various fixed investments while encouraging me to invest or save my income from my paper route, lawn mowing, etc…

IMHO after watching this ”financialization” of the savings and ”trust” industry for the last 70 years or so:

”Absolutely get rid of the FRB, now clearly a well recognized pawn/puppet of the banksters, in favor of a USA bank actually working to retain and increase the value of the savings of WE the People/Peons…

Otherwise, WE the People might as well be in the serf/servant class as has always been the case in the ”Old World” where most Europeans immigrants were when they came to USA, as well as most recent immigrants who come to USA to do better than possible in SO many other places.

And, to be clear, I welcome every one coming to USA who wants to WORK, so similar to my ancestors…

We the people might like to receive higher wages for our work, rather than competing with an onslaught of newcomers ……

I’m holding out for a free toaster.

I suspect S & H Green Stamp books will make a comeback soon!

Family?…. gomez Adams, unkle fester, lurch and “black”Morticia, cousin ‘It, pugsley and wednesday.

And I think their is a grandma in this tale as well,

Adams family. Cemetery lane…USA

Crazy comment from the home toad.

Our grammar school had a bank book program. Teller wrote depo and balance/interest in by HAND.

But I stayed with my cigar box inside my small locked wood cabinet along with ALL my other “valuables” like marbles, battery-less crystal radio, etc. (always shared a bedroom with a generally evil brother) Old man got sick of sorting out beefs, so if there was one, we both got it, which was just fine by brother.

Interactive Brokers has conditions on the interest, no interest paid on first $10k afaik

In Canada the brokerage houses act as a middleman and take a cut making the paid interest rate less than buying from the source itself. Canada also has GIC brokers but anyone with money is just limited to the Manitoba credit unions for insurance protection.

Well, if I read Wolfs article correctly, it exposed the uncertainty, the fragility of the financial markets, which are exploring new horizons.

Since 8/23….Treasury Direct T-Bills…finally saving a little $$$

Howdy Mike. Saving some of your $$$$. Most will tell you DON T. Welcome to the squirrels world. Congrats.

My own commentary is the entire yield curve is an artifact of the Federal Reserve policy.

The zirp policy was never meant to help the patriots to attain their modest goals.

It was rather a monster, designed to make Joe Lunch Bucket pay for the insolvency of the asset holders.

Something to keep in mind is that CDs are subject to state income tax, tbills are not.

This is a big factor in states with high income taxes, such as CA.

You can effectively move to Florida (for tax purposes) regardless of your state of residence.

Here in the 11570 its a blessing.

CDs are also less liquid than T-bills. When close enough to maturity, bills are equivalent to cash.

I have not yet reached the zen whereby the marginal interest on a CD would excite me.

I think that the Fed is feeding inflation not squelching it.

The TBTF banks (Chase, B of A, Wells) are still getting away with paying 0.01% APY on deposits, yet have no shortage of customers.

WF has been offering its own customers CDs with 5%-plus rates since last year.

B of A, too. I bet he is wrong on other two of big 4, also. They are all scared. It’s not much extra income to me, but sure beats a poke in the eye with a sharp stick. Even my real OLD “no risk” CD (like a checking account) pays 4%.

Anyone who thinks they will profit by lending currency back to a government practicing runaway inflation is stupid.

Q1: How many US Dollars exist today?

Q2: How many existed 10 years ago?

Q3: What rate of interest would be required to simply keep pace with the rate of growth of the supply of USD?*

Q4: What IRR would you have gotten investing in treasuries over that time period?

A1:~15T

A2:~32T

A3: ~8%

A4: LoL

I think you need to reread your first two questions and the corresponding answers.

With regard to the third question, part of the growth in the supply of USD is the result of economic and population growth, plus foreign demand for dollars. I don’t think you’re factoring this increased demand for more dollars into the 8% figure.

With regard to the fourth question, no one cares what treasuries paid 10 years ago unless you’re holding long-dated treasuries from that era. The pertinent question is what are treasuries paying me today relative to the alternatives.

Raging Texan,

You make your own decisions for yourself. But let me explain to you the single most important fundamental principle of finance:

Dollars (like any currency) are a unit of measure, such as miles or gallons or barrels. There are no “dollars” in existence. None. But there are assets and liabilities. And they’ve always been around, and new ones get created all the time, and old ones get destroyed, which is what humans do.

Today, those assets and liabilities in the US are denominated in dollars. Labor is denominated in dollars. In court, pain & suffering, fraud, etc. can be denominated in dollars. The list goes on. But they could be denominated in euros or pesos or whatever, it doesn’t matter — like you can express the distance on a highway in miles or kilometers or feet. In the old colonies, assets and liabilities were denominated in pounds, shillings, and pence. Some of those assets still exist, and today they’re denominated in dollars. Makes no difference. Dollars are just a unit of measure.

There are no “dollars.” just like there are no “miles” or “gallons.” They’re measurements in which something is denominated. The bank notes in your pocket are “Federal Reserve Notes,” and an asset for you and a liability for the Fed, which is why the Fed calls them “notes.” The cash in your bank account is money that the bank owes you, it’s an asset for you and a liability for the bank. In general, “cash” is an asset of some form for the holder (such as deposits, T-bills, bank notes, etc.) that is a liability for the issuers (they borrowed this money from you).

Very good one Wolf, it took me a long time to work that out. I used to think of it as being the beans or matches used when playing poker with friends, now it is just a black squiggle printed on a piece of paper, nothing more. If you have a lot of squiggles are you much happier than if you have a few? Success in life comes from doing something you enjoy and are very interested in, looking forward to going to work on Monday and keeping your life under control. Your line of squiggles will automatically extend across many pages. Thus endeth the lesson for the day.

“Dollars are a unit of measure, such as miles or gallons or barrels.”

It’s important to understand that the ‘measuring stick’ of Dollars changes with time.

A mile, gallon or barrel is the same quantity of the item they measure as they were a year ago.

Dollars are a measure of value, but their value is different from their value a year ago.

Excellent point!

This is a major difference between a gold standard and the current fiat dollar standard. The dollar was a fixed weight of gold, and conversely, an ounce of gold was “priced” at a fixed number of dollars. A federal reserve note is payable at a future date in a future dollar (whatever that might purchase!)

Under the old system, when one lost faith in the monetary or fiscal authorities, he could remove his (or her) deposits from the banking system and store it in the relative safety of an old sock.

Made for a heavy and uncomfortable sock, though!

Yes, and if a measuring stick changes over time, can it measure with accuracy?

Who would rely on a watch that tells inconsistent time? Similarly, who can rely on a dollar that provides an inconsistent measure of value?

I don’t think there is anything better than fiat to measure value, but current versions of fiat can be greatly improved. For example, the outlawing of QE would greatly increase its reliability.

Is the Fed a monopoly? When a monopoly gets too powerful, then what avenue is available to limit its power.

Is that what you’re getting at, Bobber ??

Which department of the federal government overseas “weights and measures?”

Wolf said: “There are no “dollars” in existence. None.”

———————————–

That’s really funny Wolf, because I possess a lot of them right now.

cb,

No, you don’t. The paper dollars in your pocket are “Federal Reserve Notes” (read what it says on them), meaning a loan from you to the Fed, an asset for you, and a liability for the Fed, denominated in dollars. The cash in your bank is a loan to your bank, and an asset for you that you can earn interest on, LOL, see article. You only own assets and have liabilities denominated in dollars, you don’t own dollars, just like your labor is denominated in dollars. You’ve been trolling this site with your goofball dollar-nonsense for years. Is it finally time to stop refusing to understand?

Notice how many terms used to describe dollars are also treasry lingo. You have a $100 bill in your pocket and you just bought a 13 week T-bill. The papers in your wallet say Federal Reserve Note and note is the term for 2-10 year treasuries.

Oversimplification, but dollars are just matured treasuries that no longer accrue interest.

Wolf’s point is deep, perhaps too subtle for some, but extremely important for anyone who wants to be genuinely wealthy.

A “dollar bill” isn’t “a dollar”, it’s a fancy piece of paper.

Mark’s point is equally important. It used to be that the dollar was 1/20th (later 1/35th) of an ounce of gold, or anything that could be converted to that. But nowadays the “dollar” is not a fixed unit of anything, it is an “elastic” currency unit.

Me, too. Many of mine are silver and say ONE DOLLAR.

Speaking of “refusing to understand”, here’s an issue almost everyone is purposefully blind to.

Either in the Upton Sinclair sense; “they make their money by NOT understanding it.”

Or, their religion tells them some diety gave Earth ONLY to THEM, to do whatever they want with.

Or a combo of both.

From a rights of nature perspective, most environmental laws of the twentieth century are based on an outmoded framework that considers nature to be composed of separate and independent parts, rather than components of a larger whole. A more significant criticism is that those laws tend to be subordinate to economic interests, and aim at reacting to and just partially mitigating economics-driven degradation, rather than placing nature’s right to thrive as the primary goal of those laws.

I think the management term is “putting out fires”, and not the long term goal it has to be.

The short version is that we have forgotten we are just another large land mammal…….with certain environmental requirements to survive…..or is that too deep a concept?

I think you’re ignoring the barter value of the dollar, esp in foreign markets. Bob Prechter says that laws are written in such a way that bank deposits are considered “loans” to the bank. The law used to be written that in the event of a brokerage failure the depositor has to line up with all other obligators, stocks and options. The purpose of FDIC is to gloss over the problem of comingled assets by giving depositors head of the line privileges at the money printer and giving Goldman Sachs FDIC. Recall in 2008 if you held money in a general MMF the NAV busted, while Treasury MMFs did not. Small difference in rates, big difference in outcomes. So there’s a lot of talk here about rates, but not much about financial integrity and to be direct you probably won’t lose your capital if you MMF busts NAV but you will lose time value, and if that’s your entire nest egg, that could make a serious difference. Remember SVB went broke holding TREASURY bonds, and the Fed threw them under the bus. New generation of libertarian gunslingers like Peter Thiel can take apart your bank in one second from their smart phone. The rather unpleasant reality up until this point has been that the Treasury is paying depositors those high rates, through BTFP (ended) and RRPO, (winding down). High finance was always a Gentlemans agreement. Sure FDIC will save you, but how long will it take, and what will inflation look like when you finally get your money. Most of my cash is in MMFs (which are tradeable securities with stock symbols) and I do not sleep well.

The 4 meter in diameter giant round “stone money” that is used in the Yap Islands of Micronesia might help illustrate the fundamental basis for the Federal Reserve US dollar.

* best forum ever

* highly educational

And whatever you call it, I still declare it stupidity to invest “dollar denominated assets” into anything that pays interest measured in USD where the rate of interest is lower than the rate of growth (recent or predicted) of the USD monetary base.

“Anyone who thinks they will profit by lending currency back to a government practicing runaway inflation is stupid.”

I borrowed $1,000,000 against my principal residence w/a 30 year. It was adjustable. 7 yrs @2.5% then can adjust to a max of 6.5%. Current payment is $3,970 and half is going to principal every month. Paid off nearly 40k in 18 months. Zero closing costs.

4 week TD TBill rolling and yielding 5.39%(was up at 6 briefly). After Fed taxes I net 3.5%. Even though it costs me an extra 13k to make the payment annually, my principal is dropping about 24k per year and in Oct will be passing into the ‘more principal than interest’ zone each month.

Call me stupid for lending Janet money. The way I look at it, the US Treasury paying my mortgage is a great savings plan. 5.5 years from now I will have received a $172,000 discount on the principal and if my rate goes to 6.5% I can simply pay it off and the gov’t paid me $172,000 after tax for being a nice guy.

pay 91k over 7 years, get 172k with very little risk. My only real threat, per se, is Fed lowering rates.

I’m an expat here in Egypt. The government released t-bills with a yield of 31%…. fantastic you say. Until you realize they also devalued the currency by 55% and inflation is hovering around 38%. Imagine the pain felt by the ‘middle class’….well, what’s left of it. They also nearly doubled minimum wage. Things like property prices also ‘doubled’ in the same time span. It just goes to show, the numbers can always get bigger. In such a system however, the USD is king; and I can make purchases using dollars or euros, in local currency….and from that perspective, local prices have actually gone down after accounting for exchange rates. (of course there isn’t much to purchase as importers can’t afford to clear their goods at the ports). Oh yes, there was a point in the past few months the country ran out of US dollars because everyone was doing this.

If you could offer Americans advice, what should we buy to help guard against inflation?

Howdy B B. My advice is buy what you need and can afford. Save the rest. Debt Free and living within your means, and you will not be afraid of inflation.

“Anyone who thinks they will profit by lending currency back to a government practicing runaway inflation is stupid.”

i agree with what i believe your sentiment to be here.. but let me alter it slightly:

“anyone who thinks [its a good idea] lending currency back to a government practicing runaway [deficit spending] is:

[delusional]

[contributing to the inflation they’re trying to offset by said investment]

[sadly mistaken]

[(COMBINE ALL OF THE ABOVE.)]

the rest of your comment takes away from this essential theme which i believe you had to begin with…

5% is the risk free rate. If you want more yield, take more risk.

Plenty of funds out there with 10-20% distribution yields that far outpace the current inflation rate.

Ummm, 20% to 30%??? Do your due diligence first. There may be traps in very high yields. Decades ago I saw one company with 13% dividends, which looked very good until one looked at their financials and found that the dividends were based on a royalty stream which would halt in 4 or 5 years at which time the company would cease to exist. If you held on to the end you would get about 80% back. Why the lower yield than it should have been? Too many looked only at the 13% dividend and never looked at why it was 3x the dividend stocks at the time.

I’d be skeptical of anything claiming to yeld 30%. My highest yielding fund has a 19.5% ish TTM distribution, but most have yields in the 9-16% range.

I hold about 12 of these funds with varying assets & strategies for diversification. Some are covered call funds, others invest in sr secured loans, BDCs, HYG, CLOs, etc. Definitely not keeping all my eggs in one basket. I also have some shorts against HYG and TLT in case credit spreads blow up.

The one stock I own paid about 30% of its total share price in dividends last year – but half of those were special dividends paid out from asset sales. The share price fell accordingly since the company became smaller afterwards.

You’re absolutely correct that if its too good to be true, it probably is.

Which, in my mind, stay short and wait for the inevitable, revaluation of the price of a currently overpriced asset.

Bottom line.

1. Banks have huge amounts of money invested in 30yr Treasuries paying less than 1%.

2. When they are forced to sell those Treasuries, they take a huge loss.

3. When depositors withdraw their money from banks, they are forced to sell Treasuries.

4. Trying to compete with Treasury yields by paying 5% interest on CD’s while earning less that 1% on their Treasury holdings is a loosing proposition.

5. Commercial Real Estate Loans are delinquent and non performing at increasing frequency negating banks profits. Foreclosing on these loans forces banks to realize losses.

All of this adds up to tons of red ink, and ensures more bank failures going forward.

“Foreclosing on these loans forces banks to realize losses.”

Banks recognize the losses on CRE long before they foreclose on the property. They set up the losses in their loan loss reserves well ahead of time.

The new process is called CECL. That’s “Current Expected Credit Losses” and is a very good predictor of future losses. It is front end weighted and works well applying the future losses on a monthly basis (amortizing) to the income and balance statement.

Those reserves are estimates of future losses.

I wonder how accurate banks’ 2006/2007 loss reserves were for the years that followed.

Reserving for losses is of course a dynamic process and banks hiked reserves in subsequent years.

But banks are incentivized to lag (and lag badly) in this process, since adding to loss reserves hurts bank earnings.

in a ZIRP environment, banks make plenty of crappy loans (starved for yield) and they are (pretty) slow to reveal how actually crappy those loans are.

Adjacently, for banks’ securities holdings (plenty of which are CMBS/RMBS assemblages of loans somebody else originated) even the regulators get in the game of “hide the (poisoned) salami” by not requiring mark-to-market in all cases.

there has been a push by the GAAP board to ‘force’ companies to take their reserve accounts to $0 at the end of every fiscal year – thus not dragging old dogs around for years

According to FRED, the 30yr treasury constant maturity was below 1% for exactly one day in March 2020. I don’t think “Banks have huge amounts of money invested in 30yr Treasuries paying less than 1%.” Did you mean the 10yr treasury?

I think he may be talking about the 10-year yield, which fell to 0.5% by Aug 2020, for a day. Even then, they didn’t stay below 1% for very long. So banks didn’t do a lot of loading up below 1%. But they kept loading up at yields below 2.5%, so in the broader range, there is some damage if they have to sell now.

But those securities with 10 years to run in 2020 are now 6-year yields (with 6 years left to run), and so their prices have already come back up, and the longer banks hold those securities, the more their prices will rise toward face value, and at maturity they’ll get face value and there won’t be a loss at all.

Well, actually, #1, is that you haven’t a clue of the universe, only the scent.

Banks hold you in the palm their hand whether you admit or not.

Sorry, totally off topic, but just saw in news UAW president is rising star of party. I wouldn’t think anyone affiliated with either of the major parties, who have not cut spending, which contributes to inflation, despite 34 trillion in US debt, would be a good rep or negotiator for workers.

Well one certainly agrees that president of a national union should be at the table where deals are cut. Unions cut their teeth on charismatic American characters.

With the gift or curse of empathy and love.

A 1-year GIC (CD) is about 5% at the online banks, but surprisingly no major difference at the Big 6 brick and mortar banks. It’s the long term yields which are lower and have variances.

B of A’s pathetic rates from their site:

7 Month

Account Balance Rate % APY %

Less than $10,000 4.65% 4.75%

$10,000 – $99,999 4.65% 4.75%

$100,000 – $999,999 4.65% 4.75%

$1,000,000 and over 4.65% 4.75%

10 Month

Account Balance Rate % APY %

Less than $10,000 0.05% 0.05%

$10,000 – $99,999 0.05% 0.05%

$100,000 – $999,999 0.05% 0.05%

$1,000,000 and over 0.05% 0.05%

13 Month

Account Balance Rate % APY %

Less than $10,000 4.22% 4.30%

$10,000 – $99,999 4.22% 4.30%

$100,000 – $999,999 4.22% 4.30%

$1,000,000 and over 4.22% 4.30%

25 Month

Account Balance Rate % APY %

Less than $10,000 3.15% 3.20%

$10,000 – $99,999 3.15% 3.20%

$100,000 – $999,999 3.15% 3.20%

$1,000,000 and over 3.15% 3.20%

i just bought one share of

1-3 Month T-Bill ETF (CLIP)

so i will see how this Fund works out for me

Interesting. Normally I stay away from bond funds, but the pull to par on a 1-3 month bill fund might be so strong that the NAV doesn’t go down much with rising rates.

So what your saying is don’t buy long term because the NAV is likely to go down. The long term is like a lever long enough to lift the world.

Sixteenth century wisdom.

Yep, when you can sell that beat up ⛏️ up for 8,000, the one you bought for the same price 7 years ago with less milage and less wear, times are good

My wife is from Brazil and they buy cars during times of inflation. Asset inflation feels like getting rich but it must not be. I imagine there was a guy in Zimbabwe who was elated to discover he was a billionaire only to realize a gallon of milk was a $100K.

The first thing that AI did was to weaken the first amendment rights, a necessary requirement. I assert that we have a Congress, whose salaries are paid by the tax payer while they actually work as a lobbyist being paid for their service.

The battle between are the California representatives of the representative government envisioned in the both the Constitution as well as the Declaration of Independence.

Talk about a society based on the magic that family connection made possible the elegance of both the documents cited above.

Americans don’t hate inflation, they are resigned to it. Best image is from the opening sequence of the Mary Tyler Moore show in the 70’s – when she looked at the price of the ground beef in the supermarket, and tossed it back with a “I can’t believe this price” look. If Americans hated inflation, they wouldn’t be investing in Treasuries, where the after tax return is well below the general increase in prices.

So they invest in stocks or real estate that can drop 50% in addition to getting eaten by inflation????

The Nasdaq composite is down 2% from the peak in Nov 2021, despite the huge rally in between. And the purchasing power of those stocks got whacked by inflation. People who bought T-bills in Nov 2021 are far better off than people who bought a fund that tracks the Nasdaq composite over the same period. And people who bought TSLA in Nov 2021 are totally screwed.

RISK.

She was renting her apartment in that Victorian from Phyllis and Laars.

Wolf said:

“Money market funds (MMFs) that are tagged “retail” had swollen to $2.43 trillion as of April 3, ……… according to the weekly measure by ICI (Investment Company Institute).

MMFs held by Households: A broader measure of MMF balances held by households, released by the Fed as part of its quarterly Z1 Financial Accounts, jumped to $3.6 trillion at the end of Q4 ….”

——————————————–

Huge difference in numbers. Why pay attention to the Investment Company Institue if it uses a narrow number? Can they be trusted at all?

Why did you stop reading???? Can’t you read an entire series of 4 paragraphs before you feel compelled to write a comment?

In that series of 4 paragraphs, you will also read what the difference is (so read those four paragraphs, for crying out loud):

“Households are indirectly among the holders of institutional funds because the institutions include employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.”

Wolf you may need to add a Test to access comments.

lol 😂

I’ve been in a money market, since selling my house in June 2022.

The main thing I like, is the compounding interest that keeps rolling forward. I never saw any advantage to other alternatives, like buying direct from Treasury.

I also like the ongoing nonstop spam I get from Fidelity and vanguard related to their AI services, which can help me burn up money on fees for speculating on investments that are excessively risky and IMHO, stupid ways to lose $.

I’ve pondered the idea of trying to use asset appreciation as a way to generate income, but for now, I’m far more comfortable earning monthly and annual income — versus hoping that the S&P will outperform the money market.

As rates stay higher and corporate earnings decrease, betting on stocks is a bit too risky today, but eventually, it’ll probably make sense to find a different investing balance. Obviously, long Treasury rates are still pointless, so right now, I’m getting paid to be patient — even with fees and taxes.

I’m not sure vanguard has ever had high fees on any of their successful products. And if a product is not successful, it shuts down after a while.

I would think putting all your money in a S&P backed fund would outpace the 5.5% everyone else is getting on return. But at a risk that might not be appealing.

I guess the Billion $ question is, where do people stash their cash once rates fall? 🤔

Suffering…

The thing I see, is a lot of sideways volatility in equities, especially all the doggy index funds that barely make any gains. The S&P has always been a reasonable way to play the market somewhat safe, but with the AI concentration, the risk seems enormous now.

The sideways returns don’t justify the risk lately and getting further out towards election, risk will increase.

I’m somewhat optimistic that after the election, people will grind their way towards done acceptance, after several stages of grief — but, whatever party wins, I seriously don’t see good times ahead.

Bidenomics is fairly much a disaster, but wait until we get implementation of The Laffer Curve and tax cuts with inflation and probably a recession.

That does bring up the question as to how to play this as the clock counts down.

It’s an extremely bifurcated world which probably becomes even more polarized, so there’s going to be a weird mix of growth but also recessionary struggling, mixed with geopolitics and sticky inflation.

Not sure if we’ve seen this movie before.

I think ‘Bidenenomics’ is a joke to poke fun at people who are triggered by logic.

Seems to be working

Really good piece, Wolf. I guess we should calculate how much of total bank profit depends on continuing to cheat the savers. Best, Alex

Wolf said: “Americans hate, hate, hate inflation. ”

—————————–

Some Americans hate inflation. Some love it. It depends on what side of the asset bubble you are on.

The masters apparently love it as it has been continuous for decades and even the stated goal is 2%.

DM: America’s forgotten ‘doom loop’ city, where $205m skyscrapers are selling for $3.5m and the decaying downtown lies utterly deserted

St. Louis downtown has become a ghost town – with buildings boarded up and skyscrapers plummeting in value. Take, St Louis’s largest office building – its 44-story AT&T tower – for example. In 2006 this prime real estate sold for $205 million.

Major cities like San Francisco have hit headlines amid concerns their urban districts are in the grip of a doom loop – but a new report revealed the city where an even worse crisis is unfolding in its decaying downtown. Take the city’s largest office building for example. In 2006 this prime real estate sold for $205 million. But that same now vacant skyscraper recently sold for around $3.5 million – a shocking 98 percent drop in value in less than two decades, the outlet reported. The Railway Exchange Building, once the crown jewel of downtown, is also now an empty relic with peeling paint.

Are you talking about St. Louis?

Yes.

Hilarious that when rates were 0, the mantra was “low rates increase asset prices” so it’s justified. Now that rates are 5%+ the mantra is “high rates won’t have an effect on asset prices” so it’s justified. People out there really believe that asset prices will stay at the same level they were at 0% and nobody will be hurt!

Here’s the insight, smart money is moving out of overbought real estate and equities.

Where’s it moving to?

Bonds, i.e. debt.

Who IS the “smart money”

Also, as Howard Marks quipped: “Our industry is full of people who are famous for being right once in a row.”

Howdy Youngins. YEP, you have been imprisoned in your own homes and ZIRPed to stupidity. Never heard of Manufacturer discounts I bet?? Watch and Learn, it could be Boogie/Disco time again. If the FED ZIRP tool is used again???? Squirrels say go ahead and make our day. We just have to live long enough and will enjoy that too…..

Speaking of manufacturer discounts, I can envision a scenario where brand new pickup trucks are discounted by $30,000 off msrp just to move them. Ram in particular has an ugly inventory problem brewing. Those $100k trucks are just not selling. In fact, a $30k reduction might not do it.

Howdy DC. YEP, in the olden days, manufacturers would offer interest rate discounts, cash back offers. You could purchase a vehicle by signing your name, take the cash back or free interest rate.

Gold is money, everything else is credit. JP Morgan

JP Morgan got rich dealing in credit. That’s what banks do. So do you think that might have had something to do with him denigrating gold like this as mere money? Talking his book? Credit runs the world, and JP Morgan knew that.

JP Morgan is a fraud outfit, first and foremost. Just look at the fines they pay on the regular for their illegal doings. They should have been shut down long ago. Instead, Jamie Dimon is perhaps the most frequent visitor to the White House. The United States of Total Corruption.

JPMC is a superb bank, and my bank of choice where I am a Private Banking client and I am delighted with them.

I’ve always found knowing a good thief and having a dealer on the block does have its advantages.

While typing this a large black fly lands on my hand, as if adding inspiration to my message.

I have cds 5.05, 5.5, 5.7% and all for a year since last October. All of them are callable. The thing is if they’re callable I will find another one. Lately got a shorter duration 3 month one. Why? Because yields will be higher a long time. Years. I read Yellin wants to buy back treasuries with an extra 200 billion from taxes. Sounds like they have too many liabilities right now. They want those rates down and I’m counting on it not happening.

So everyone working and earning a salary are already -5% behind everyone retired who is investing all their money in a money market.

Is that a correct statement?

I work, but I did put money gradually into savings, in many ZIRP years, and now. I have money in a pretty modest money market account, I have fed into, and held onto, for years, when it was being eaten by inflation with zero return on it. I have had no raises in many years. I had to go without, to do this, just as I had to do that to make my home loan payments, through thick and thin (remember 2008?) with no assurance it would work out, for 30 years straight, now. It never even occurred to me to scan for someone to blame, who maybe was getting better returns than I was. I just did the right thing and kept doing it.

Am I now a bad guy, because the economy is temporarily doing what it is, and I wasn’t able to set aside freebies for you, that you seem to be implying I should?

sufferinsucatash,

People got the biggest raises in decades, especially at the lower end of the pay scales. This has been hugely documented. If you didn’t get a raise in this environment, try to get a new job.

People in the labor market, I’m told, have been getting raises. Retired people have not.

Most assets appreciate through capital gains or dividends/interest, and most pension plans have Cost Of Living Adjustments, including Social Security. I agree there is a very narrow group of retirees who got nothing but inflationary pain, but the vast majority have assets and income streams that have rolled with the punches.

Retired people get no raise?

After deliberation I find the old country bumpkin “should” get extra frosting on his pumpkin.

I’m a fan of helping out stupid people like me.

“Is that a correct statement?”

No. Not by a long shot. That’s some pretzel logic you have there.

Not by a long shot. I doubt most retired people have a great deal cash saved nor does it keep pace with real inflation.

If your waiting for rates to go back to nothing, if is not going to happen. The world has changed and few will hold dollars for nothing.

If I understand correctly, CDs of that amount do not. Additionally this differentiation is made without consideration of deposit term.

First question – can anyone speak to the logic of this differentiation? I’ve researched it to no avail.

Second question (with preamble) – the movement of funds discussed in this post, from low vield standard accounts toward higher yield cds, should result in a higher proportion of total funds in cd accounts of $100k (or more) and contribute to a reduction of M2.. Yet the decline of M2 halted in Oct-23 and is now inching up despite continuing QT etc. Why? Is it just an outgrowth of the pandemic money plug multiplying back onto itself?

Thanks in advance

Edit – first sentence should read

If I understand correctly, CDs that amount do not

Never mind, I guess I can’t edit

M2 money supply calculations distinguishe between CDs of less than 100k and CDs over 100k. Time deposits of $100k or less are included in M2 money supply; large time deposits (over $100k) are NOT included in M2, which I believe distorts M2.

There are other issues with what is included and what is NOT included in M2, which is why I think M2 is meaningless.

I believe we had a conversation about this when I said that I don’t like the way M2 is calculated, and why I don’t cover it. This came up because you were using M2 in your predictive model about used-vehicle residuals.

Exactly, thanks. This is the clarity I was after:

“There are other issues with what is included and what is NOT included in M2, which is why I think M2 is meaningless.”

There’s no meaningful difference in the liquidity of a $150k cd and a $50k cd, yet one counts toward M2 and the other does not. Time to flush that measure.

I think the distinction goes back to when FDIC insurance was capped at $100k before 2010 (when it was raised to $250k). So insured CDs vs. uninsured CDs. Maybe this was meaningful at the time. But today, as you said, it’s meaningless.

Add another “anniversary celebration” with the first (NOT last?) FDIC insured-bank of the year failing!

Republic First (not First Republic), also a shadowy “weekend bank failure.” The regulators may have to invest in a bigger rug in 2024 to keep the markets from getting spooked… before the election.

Someone mentioned CLIP, there’s also BIL.

I have been considering pulling out the majority of my savings from the paltry interest and buying more BIL.

Liquid and a 5% annualized yield (and rising?)

I have lot of.money in BIL and SGOV.

I doubt the yield would go higher as Fed won’t hike but wait and watch or even cut rates.

Finally. It’s a “small bank” — the 213th largest bank in the US, LOL — with $5.8 billion in assets and about $4 billion in deposits, that has been on the brink for years. Routine FDIC stuff. Investors will lose everything (the stockholders have already lost nearly everything), depositors will not notice the difference, except for a different bank name on their branch (now “Fulton Bank”).

There have been bank failures in nearly every year for many decades. That’s just normal.

This is what I said about “small banks” failing:

Small banks: 31% of their loans are CRE loans. These banks have between $1 billion to $10 billion in assets. There are about 700 of these banks. 31% of the loan book being CRE is huge exposure – with some banks being more exposed and others less exposed. CRE losses will likely pull the rug out from under some of those small banks over the next few years. And we’ll notice, but we’ll probably not write about it.

https://wolfstreet.com/2024/04/13/banks-exposure-to-cre-loans-by-bank-size/

The real rate on risk free short term deposits are now positive as they should be and historically usually were. The Fed choose to suppress rates across the curve to pump the values of RE, stocks and bonds-and of course bail out the TBTF (NOT!) banks. They decided trickle down economics was just the ticket. The asset inflation part worked and made the top 1% fabulously wealthy, but the process was paid for by the vast majority of investors getting zero return on risk free investments for years and the end of price discovery that risk taking markets and capitalism require.

Politics has entered the markets and the population came to measure the success of a politician by the value of their 401k and house. “What about my 401k!” could be heard across the land in 2008.

The piper is now getting paid via inflation and a new sensitivity to the rates being paid on risk free money. If enough depositors vote with their feet and move their deposits to higher yielding ST rates, the banks will face a major risk to their profitability and some cases their existence.

Capitalism and free markets generally work and the government needs to stop poking nose where it doesn’t belong.

If you think “markets” of any significance have ever been free of politics, then you are beyond help.

Surely banks don’t want to pay out more interest than they have to. But given their ability to invest in more risk/yield has been hamstrung by various regulations, is this also a contributing factor? I.e. Basel III requiring banks to keep more assets / higher quality capital on their books.

It makes sense that bank CDs would consistently yield less than equivalent-duration bills. Same reason you get a slightly higher rate buying treasuries at auction vs thru your broker – the latter is a middleman that needs to make a profit.

DM: Florida’s housing bubble has burst! Why prices are being slashed after booming during the pandemic

Its warm weather, low taxes and relatively affordable housing market attracted a surge of Americans to Florida during the Covid-19 pandemic. But as prices stagnate and supply soars in some parts of the state, it seems that Florida’s housing bubble may have burst.

It seems that extremely expensive, or unattainable home insurance is playing a part in this also. Thousands of dollars a year, if you can even get insurance tends to slow down sales I guess.

Depends on location in FL SCBD.

Two recent sales for ”tearer downers” , w demo, i.e., vacant lot,,, going from right at $300K 4 months ago to $325K 3 weeks ago in our ‘hood…

Location location location is NOT going away, yet.

From S&P Global, an interesting related tidbit, but probably not worth pondering:

“ Banks continue to offer higher rates on products such as one-year $10,000 CDs to retain core deposits. As of March 22, 734 banks offered an average rate of more than 4% on one-year $10,000 CDs, compared to 646 banks three months ago and 66 banks at the end of 2022, according to Market Intelligence data.”

Last Friday, 5-month T-bills were yielding ~5.35%. I think the minimum is $1K. So that bank’s 1 yr., 4% yield CD, which has a penalty for early withdrawal, and is fully taxable, is a stupidisimo investment.

6-month Treasury. Bad keystroke.

Howdy Youngins. Do not dispair if separating. A case has just been filed in court as to who gets custody of the 3 % Mortgage. HEE HEE

PRIMIS digital bank is offering 5% on their checking account…

EVERBank, done business with them for 20 yrs, they are a 100% online bank, now have a premium savings account offering a hair over 5%.

Both of these can be easily linked to other banks including your local hometown bank…

Wolf,

When do you think there will be a profitability hit to banks?

It seems at some point customers will demand to be paid interest, especially with competition from places like Fidelity plus online banks.

I would think that things would have to revert to pre-GFC type rates.

Is this another of these crazy lag effects, or is something else at play?

(Thinking excessive government support of banks…)

Banks are also charging more for loans. So what’s important is the spread — the net interest margin. With a few of the banks I have looked it, it has narrowed a little, but it’s still pretty wide.

Rising interest rates are generally not bad for the net interest margin because banks can increase their lending rates faster than they have to raise deposit rates to keep deposits.

Do you think that banks will have to raise deposit rates to compete for capital (outside of CDs)?

I would have expected that to happen already…

Many banks did raise deposit rates on savings accounts.

MW: Stocks risk a wild week with Big Tech earnings, Fed’s faceoff with inflation

While requesting a money transfer, the manager of my local bank asked me why I wasn’t taking advantage of their new 4% savings account. Where do they find these idiots? I simply showed him the current yields on T-bills. Maybe he doesn’t understand that 5 is greater than 4…

You can’t pay your mortgage or CC with a T-bill. The lower rate is the price of liquidity.

If the bank’s CD rates are far below bill rates of equivalent duration… then that’s indeed a ripoff.

I don’t quite understand your comment about paying a mortgage. First, I don’t have any mortgage, not sure where you got that. Second, the point is I don’t want to lock up my money for more than a couple months (which CDs require), and I still want a decent return, hence, the laddering of T-bills. Of course this is just the conservative portion of my portfolio. In addition, as others point out, you do not pay state tax on interest from T-bills.

As the FOMC meeting approaches, I have that old Mariah Carey song stuck in my head, slightly modified. “All I want for [Fed Day] is [Rate Hikes!], background singers: “… and QT!”