American Homes 4 Rent and Invitation Homes sold over 3,000 older single-family houses in 2023.

By Wolf Richter for WOLF STREET.

Building professionally managed communities of single-family houses for rent, with their own leasing and maintenance office, is the hottest trend in new house construction.

“Build-to-rent” has attracted homebuilders, from the biggest on down. And it has attracted the biggest single-family landlords that, instead of buying houses scattered all over the place to be rented out, are buying entire build-to-rent communities from homebuilders; and some also have their own build-to-rent construction programs where they buy the land and build these communities and lease them out.

Having entire communities of new build-to-rent houses with their own leasing and maintenance offices is more efficient for the landlord than older houses with more maintenance requirements scattered all over the place.

And the biggest landlords have begun selling thousands of older houses scattered all over the place, given their higher management costs and the sky-high prices they bring in this overpriced market.

These are the same landlords — American Homes 4 Rent and Invitation Homes — that were formed in 2012 at the end of the Housing Bust to buy these houses for cents on the dollar out of foreclosure. They know what they’re doing.

For example…

American Homes 4 Rent [AMH] began adding build-to-rent single-family developments in 2017 and is now largely “focused,” as it said, on adding build-to-rent single-family properties through its own homebuilding division, AMH Development Program, for communities of rentals. In addition, it is buying some build-to-rent houses from third-party homebuilders. It’s no longer buying individual existing homes, but has started selling them – more in a moment.

In 2023, it built rental developments with 2,317 newly constructed single-family houses: 1,838 houses for its own operations, and 479 houses for its unconsolidated joint ventures. It only purchased 47 houses from third-party homebuilders.

“We typically incur costs between $250,000 and $450,000 to acquire and develop land and build a rental home,” American Homes 4 Rent said in its annual report.

Invitation Homes [INVH] acquired 1,789 single-family houses from homebuilders in 2023, at an average estimated cost basis of $390,000. Of those houses, 760 are scheduled to be delivered in 2024, the remainder in future years. These houses are in communities of rentals.

These two landlords sold over 3,000 older houses combined in 2023, having become big sellers of single-family houses they’d bought years ago here and there.

“Our properties held for sale were identified based on submarket analysis, as well as individual property-level operational review,” American Homes 4 Rent said in its annual report.

In 2023 it sold 1,546 houses and held another 862 houses for sale. “We will continue to evaluate our properties for potential disposition going forward as a normal course of business,” it said.

Invitation Homes sold 1,489 houses in 2023 for $547 million, for an average sales price of $367,000.

Combined, American Homes 4 Rent and Invitation Homes sold 3,035 older single-family houses into this overpriced housing market while they can still get top dollars, even as they expand their stock of build-to-rent houses.

Homebuilders are chasing after single-family build-to-rent. D.R. Horton [DHI] reported that as of March 31, it carried $3.1 billion in investments in rental properties, up from $2.7 billion six months earlier. During the 12-month period through March 31, it sold 6,248 single-family build-to-rent houses, about 7% of its total unit sales (in addition, it also built and sold a bunch of multifamily units).

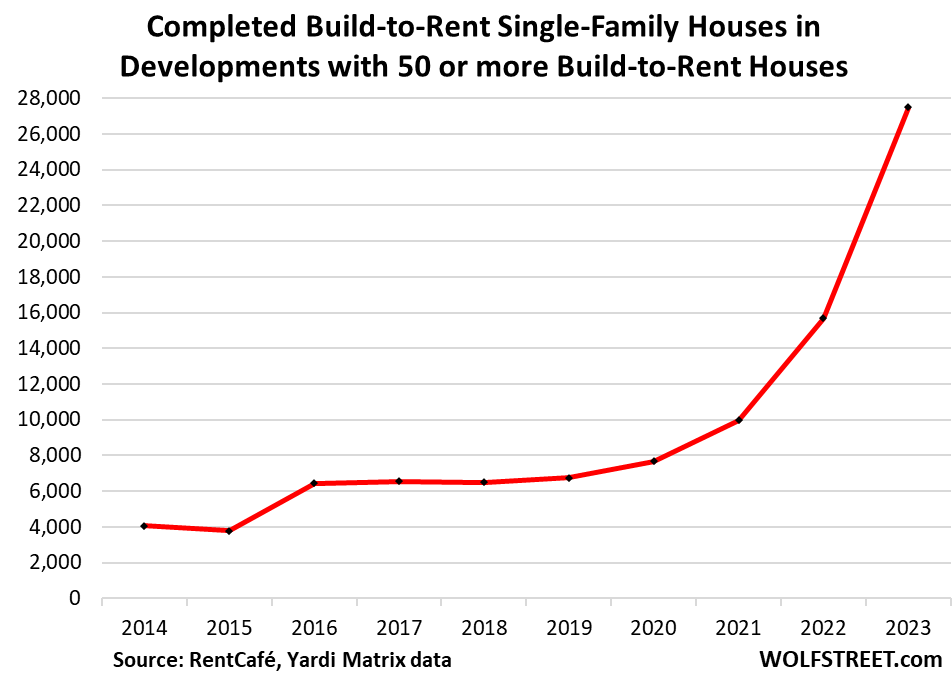

Build-to-rent single-family houses in communities with 50-plus rentals.

Last year, 27,495 build-to-rent single-family houses were completed in professionally managed communities with at least 50 single-family rental houses in markets covered by Yardi Matrix research, according to an analysis by RentCafé, based on data from Yardi Matrix. Up by 75% from 2022!

It does not include single-family rentals that are not located in build-to-rent communities or in smaller build-to-rent developments.

And more supply is coming: Another 45,400 build-to-rent single-family houses were under construction in professionally managed communities of 50-plus single-family rental houses.

This represents new supply of single-family houses on the rental market, which is great news for people not willing to play the crazy games of the grossly overpriced purchase market, even as the biggest landlords have been selling older houses into this market to cash in on the crazy prices and focus on more efficient-to-manage build-to-rent communities.

Renting a house can be substantially cheaper on a monthly-payment basis than buying an equivalent house these days, after the crazy price spikes in recent years and the 7%-plus mortgage rates now, and this arbitrage may be a good option for many people, which is why there’s strong demand for nice rental houses, which is why there is this sudden surge of supply.

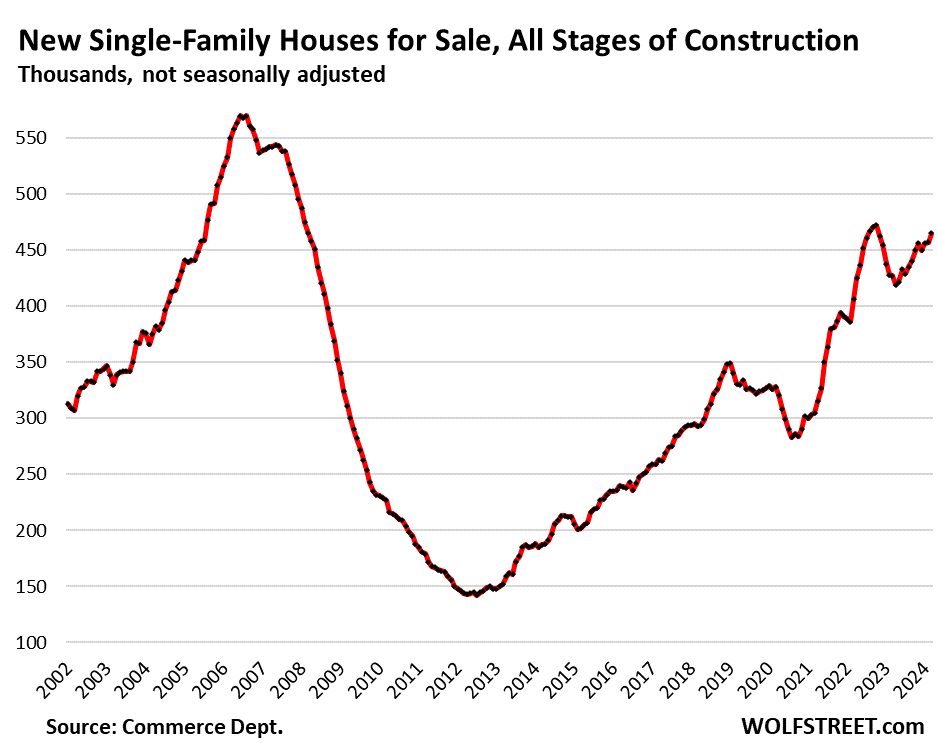

Sales of all single-family houses have been purring along at near-pre-pandemic levels. Prices of new houses have come down, and homebuilders are buying down mortgage rates to stimulate demand, in a market where sales of existing houses have plunged.

There is plenty of supply of new single-family houses, with homebuilders’ inventory for sale rising to 465,000 houses, the highest since August-October 2022, and beyond that the highest since 2008. This amounts to 7 months of supply. Plenty of inventory for aspiring homeowners.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

They have brought back the Company Town, without the company.

As a renter-for-life, I’m happy to see this.

Peace and quiet and peace of mind is a good place to call home.

Maybe they’ll have a burger king close by.

Not a bad way to live if the neighbors are thoughtful, and considerate…

So they’re basically multifamily communities except the units are physically separate.

BS. They’re single-family houses that are rented out.

Just to make sure everyone is on the same page:

“multifamily” is a building type. It doesn’t mean “slumlord” or “poverty,” or whatever. It’s a building with multiple housing units in the same building.

“Multifamily” can be set up in two ways:

1. rental apartments

2. owned apartments, organized as condominium, co-op, or TIC.

There are 14 million single-family houses that are rented in the US, most of them owned by small landlords with 1-9 rentals:

https://wolfstreet.com/2024/04/09/the-biggest-landlords-of-single-family-rental-houses-and-multifamily-apartments-in-the-us/

My neighbor owns 6 houses plus the house he lives in.

Hi, will you help find a apartment or house to rent in Atlanta Ga .S.W. fo approximately $900.00 a month. I’m very clean, retired and get s.s. but I’m going back to work. Because everything is so costly now. Need to move now or within months . Thank You

I get that … it just struck me that the business model isn’t as new and different as it might first appear … that as they move away from scattered properties it’s a step in the direction of consolidated multifamily developments except with single family units.

“multifamily” is a building type. It’s a building with multiple housing units in the same building.

The build-to-rent single-family houses model isn’t new. It’s been around — see the chart above. But it has been very small. What’s new is that it’s suddenly getting huge.

It’s getting huge because it’s too expensive to buy existing homes at these crazy prices given the rents they can get. So:

1. The big landlords are selling at these crazy prices the individual houses they’d bought years ago.

2. And they’re building their own rental houses where costs and maintenance are lower.

No one should buy in a market where these big landlords have become sellers. These are the former PE firm guys that bought houses for cents on the dollar out of foreclosure in 2012. These people are the ultimate smart money. They understand this market. They know: buy low, sell high. This is a market to sell existing homes into, not to buy. Homebuyers today are the dumb money.

I agree with you no one should buy when smart money is selling. However the question is when will we actually get this price correction, if ever? There’s no guarantee if prices start to rapidly decline that our president and the other politicians won’t send everyone checks or freeze mortgage payments or something ridiculous or that the fed won’t immediately drop interest rates back to zero.

We should get a price noticeable correction based on the data/fundamentals but that doesn’t mean we will. My guess though is if we do it will be early to mid 2025 post election.

“These people are the ultimate smart money”

Wolf’s statement above is insightful, cautionary and useful. On the flip-side, it also brings to mind James Grant’s post GFC warning to “smart money” players:

“Mr. Market delights in smashing cream pies into the faces of the overly confident.”

— Grants Interest Rate Observer, Feb. 11, 2011.

Think Bear Stearns, Lehman Brothers… Enron, etc. before them… and LTCM before them.

Seems to me that if the Fed again drops rates to rescue the economy from some sudden and unexpected economic event, it will spur a new inflationary cycle shortly thereafter. And as this moral hazard gets repeated, it will instill the public’s conviction that inflation will have spurts, now and again, following each downturn, thereby building the “inflation expectation” that fuels greater inflation.

The rescue operations will ultimately build higher inflation into the economy on a permanent basis.

I know links are not allowed, but I will include this FRED link to see if it can be included in the conversation.

I’m not advocating that this will happen in North America, or that current events are similar, but am including it as an example of what happened to the Japanese housing market from 1990 to present.

Interesting prospective of what can happen to a highly industrialized modern economy when events turn south:

https://fred.stlouisfed.org/series/QJPN628BIS

“These people are the ultimate smart money. They understand this market. They know: buy low, sell high.”

Absolutely true!

But these people are not many, because there is another truth that the mass of people buy at the peak and sell at the bottom

Back in 2006, one of my college professors basically said top of any economic cycle was marked by dumb money/retails investors buying at the top/aka the FOMO crowd. When everyone around you is a stock market expert (despite not working in the profession) and has a stock tip for you, it’s time to run. He made similar comments regarding other areas of investment like real estate as well. My question is when will the FOMO crowd run out of money?

How about we just drop this “smart money” BS and just say “The Controlling Money”……it can be pretty “dumb”, get part of a law changed, or buy more justice, and still “win”, now, if you haven’t noticed.

Oh yeah, GREAT article and RentCafe link was good too. Noticed Tucson was left out. When I lived down there ’09-’10, GF said they had expected 10 to 15 M people in Phoenix-Tucson corridor (permanent and some PT snowbirds from snow and cold country) and had to “prove” there was enough water for all + stinking golf courses……..

I think not.

Side note; Anyone ever get curious and drive out to California City in the Mojave? They had dirt golf courses, and plenty of cheap homes during time mentioned above. Interesting history, too, like Calico?

I think I see the metaphor you’re making… its like an apartment tower “tipped on its side” or something.

But, they attract a fundamentally different kind of tennant than apt towers do. Case in point: I was urged to buy a condo for my first home, but after living in an actual apartment tower, I had no desire to share any walls with other humans.

I’m sure many people don’t want to share a wall, but also don’t want to buy in this market in order to have that. Sfr solves that.

Spoiled in the USA with our villas . Most countries have multi family buildings when they don’t have cheap energy . That’s the driver we have inexpensive fuel and energy in the USA and can afford our villas with large overhead . I own one of them and never want 2 . Can’t take care of 1

I just want to play loud music without pissing off a neighbor…

Headphones.

Everyone in this 250 unit 3 story apt complex uses them for TV, music, except nice weather Sat, Sun afternoons when there is a live band pretty near me (not bad) and some other music.

No heavy metal or Rap…..over 62 mostly.

Excellent summary. I am in this market and you are correct the btr market is good for owners and tenants. It opens the possibilities of consumers living in a home that they would not be able to afford to buy. Thanks.

…Because they’re hideously mispriced.

If they were mispriced no one would buy/rent.

The really smart part is they treat the house as like a car. Buy it, rent it, and when maintenance costs cut into the profit, unload it.

Nah – people still heartily partake of all manner of stupidity, misadventure & vice for which the verdict has been in since time immemorial. In the case of housing – you gotta live somewhere. My point was that the smart money is renting since the price to buy the equivalent is still whack.

It opens the possibility to post-civil war, wage slavery with working people living in nice homes (with prices bid way up by, e.g., a big company that just lost its shirt in China (LOL)), they can only afford by working two jobs or long hours then getting kicked out when their working years end. Demand will decline sooner, rather than later: you can only squeeze so much blood from a corpse!

(At least, we will not be as bad as in China, where home prices plunged 40% and numbers of sales plunged 70% but somehow, real estate sales revenues only plunged 20% per CCP. Commie math! LOL)

Correction, that was in one area: CNN reported a 29.3% total plunge in first two months of 2024. (Math still does not compute! I guess basic math is not a strength of the CCP’s economists. LOL)

RH – basic Lysenkoism: ‘…the data ALWAYS confirms the state ideology…’ (or religion).

may we all find a better day.

The only real estate I own right now is income producing. We sold our home and most of our furniture and set sail 7 years ago. Now, that we are back on land, buying a home in this market doesn’t make sense. And we are enjoying the interest income from our house proceeds that more than covers our apartment. We our in Jacksonville in a 3BR 2.5 bath “carriage” apartment (no shared walls with a neighbor) with a 1 car garage for $2,049/month. Basic cable and utilities run another $100. Amenities include well equipped fitness center, large pool, game room, activities room, grill and fire pit area. I haven’t rented since my 20s about 40 years ago. I have to admit the turn key life is spoiling us. We definitely want to own a home but we are being patient.

I believe these newly built single family rental communities will thrive. I wonder if it will affect the multi-family projects down the road. Especially the older or outdated apartment buildings. Will they go the way of office buildings?

Multi-family projects would work best if they were being sold to families that were friends with one another, and knew one another. Too much of suburbia is stranger-meets-stranger, and as I recall from my own childhood in the exurbs, we never knew our immediate neighbors, hardly even recognizing their faces. It was almost as bad a situation as a New York apartment building. Communities bond and are formed when there is commonality of purpose and a shared interpersonal history. Lacking this, there is only loneliness, atomization, and the Void.

Developing community relations starts with YOU

“Especially the older or outdated apartment buildings. Will they go the way of office buildings?”

I’d guess there will still be demand for multifamily. These build to rent subdivisions are in the suburbs, not downtown. Yet some people still want to live the city life; hi-rise living is an “experience” for many.

No thanks on the high rise……this FN society is making me more suicidal every day. But I still gotta know what’s going on…….if all there was were reality shows, poorly written and acted sitcoms, today’s movies, WWE, etc, I woulda checked out long ago.

We long since passed being busy getting what we need (mostly agriculture). But we still have to keep minds busy. Computer saved my invalid old ass…..for now.

What these comoanies are doing makes absolute sense. Theyre expanding into a new and growing industry. Theyre upgrading their properties and probably eliminating those with maintenance or structural problems or those that for whatever reason, underperform financially.

This is no different than rental car companies upgrading their fleets of vehicles. It’s not a statement about the existing home market being overpriced. IIt’s cheaper to build at wholesale prices than to buy individual houses at retail prices. Any good business would do the same in their industry. Its not rocket science.

As a rental property owner, I do the same thing – Sell some properties and buy others based on performance, demand, maintenance issues, etc.

I am doing the same thing, not because big companies are, but because I have come to the same conclusions. No more purchasing sfh. Buying land and building 10 new rentals in same place with access to my personal amenities. Building a community of like minded people to reduce costs and improve quality of life.

Yes, same philosophy for my rentals. Although, I admittedly developed near a University campus and require parents co-sign. I have a waiting list for these rentals. Word of mouth. Good duplexes in safe neighborhoods gets around. Affluent parents tell younger affluent parents that are sending their kids to the same institution.

However, finding new potential developments is getting harder, especially in municipalities with heavy pension promises and decreasing tax revenue.

You can be smart about development/investing, it’s not rocket science. However, future taxes should be a concern for everyone. Not having a balance budget and debt monetization (as the US has been doing) leads to hyperinflation eventually, every. single. time. To quote Wolf, I really hope that CONgress doesn’t go “full Argentina”.

Your situation is in many respects a function of the unusual housing market dynamics. I am glad you are able to take advantage of this. However, if things do return to prepandemic dynamics then this current setup might no longer work out as well at some point.

I am recalling a graph last year by Nick Gerli/Reventure that showed the buy vs. own calculation in Jacksonville was showing renting as about 10% higher than buying for like as far back as the stats went. However, in the past few years (and especially since interest rates shot up) the graph got completely turned on its head and was showing buying as 40% more expensive than renting (and I don’t even think he had maintenance as part of his calculation). This is a huge shift. So huge in fact, that one must wonder how sustainable it is in the long run.

Sorry, 2 BR, 2.5 baths w/garage.

I would like to know how they make money when one can earn 5%+ in a no risk investment. With apartment inventory increasing and leasing demand starting to wane, rental prices are more likely to hold steady or drop.

They’re making plenty of money. And they have reported still hefty rent increases, especially on renewals.

Note that these are single-family houses; they’re not apartments. Though people can and do arbitrage apartments and houses for rent, along with houses and condos to buy, depending on conditions of the market.

Also note that these landlords target households with above median incomes.

I wish I had had these options for rental communities in 1980. I was transferred 10 times in 20 years due to oil price collapse and lost up to 50 percent on my homes in Oklahoma Texas and Colorado . A rental community makes sense cost of moving drops considerably. Moving option has great value

Yep. That price collapse wasn’t limited to TX, OK and CO. It hit Arizona, Alaska, NM.

Long forgotten, if even known…

I wonder how many readers remember the farmland price collapse in the mid-80s. This after a price run-up in the 70s in which farm values doubled.

Wolf said: “Invitation Homes [INVH] acquired 1,789 single-family houses from homebuilders in 2023, at an average estimated cost basis of $390,000.”

————————————

Wonder what rents they are getting on these, and what return that produces? and what return flows through to the investor. sounds like a thin game to me. the big guys may in it for the fees.

From their website: ” our blended rent growth year-over-year at the end of the second quarter in 2022 was 11.8% “

Watch for big insider stock sales from these entities. That’ll probably be about the time that the tide on house prices turns.

They must be expecting a decent return. In the county I live in NC there are currently 6 of these neighborhoods that have been built in the last 4 years and they are all 200+ homes with asking rents of around $2000-2500/month. There are 2 more that I’m currently aware of going up currently.

What is missing here is “Pride in Ownership” which has helped neighborhood improvement.

“You will own nothing and be happy” is about power and control.

This is not “self-control,” and this “others control” is a cultural construct. It enables the continued financialization of life.

This is the business model: Middle-high income renters who demand a certain level of service and quality. The operation and maintenance of these communities is an income stream in itself.

Not only is rent allowed to increase as the market bares, but the services provided will also be included in these increases. This is perfect for a society that has no knowledge of how (non-digital/ AI fueled) things work.

I am regularly amazed by folks who have been able to accumulate 10s of millions in wealth and can barely wipe.

I imagine this may be an expanded service tier in the future. “Domestic upkeep services” including cooking, cleaning and… wiping?

All bundled into the rent/ protected by exclusive contracts so the Big Boys hold the keys to the service providers. This will be the cream, keeping the profits of the independent service providers at bay, while ensuring the fat pockets are kept fattening.

The corporatization of the world is at hand! Civility will ensue!

Ya think the Visiting Angels” should take pride in a good wipe? Or in a good swipe?

The latter would be my preferred source of pride.

The article notes the efficiency benefits of a landlord having all properties in the same neighborhood or subdivision. The cost savings to this business model could be substantial.

If all the units a particular landlord manages have the same appliances etc. I imagine it would reduce repair costs. Similar idea as say a delivery company owning a fleet of one single model of van.

Garage door opener breaks? “No problem, we keep a couple xtra on hand to swap out”

I expect they have different options, but probably a limited set. Same chance for reduced/expert maintenance applies to apartments. One of the things that make it cost effective. Also makes it easier to create a troubleshooting/maintenance sheet for tenants or handyman.

“1,838 houses for its own operations, and 479 houses for its our unconsolidated joint ventures.”

Wolf, I think the ‘our’ in this sentence might be a typo.

Yes, thanks

“These are the same landlords — American Homes 4 Rent and Invitation Homes — that were formed in 2012 at the end of the Housing Bust to buy these houses for cents on the dollar out of foreclosure.”

Fun fact: The FHFA pioneered the “REO To Rental” program back in 2012 to encourage larger investors to take large numbers of houses off its hands and rent them out: https://www.google.com/search?q=FHFA+reo+to+rental

There have been a variety of house price supports implemented by government at all levels, as well as the central bank. They seem to have worked extremely well. I think one side-effect reason is that they have helped the expectations of house price inflation to become “entrenched.”

That’s the model used by the Resolution Trust Corporation after the S & L bust. They needed to dispose of the commercial property and land that these “banks” foreclosed on.

But what do you do with collateral for a $100K S & L loan that guarantees a certain HS kid will sign with OU?

I just happened to be spending a lot of time in OK for that one….was many funny parts to it all…especially the graffiti and other signs.

All of my units in New England were built between 1850 and 1920. Up here, something from the 1980s is a spring chicken and 2019 is unaffordable to most. Can’t wait to get out of the old stock but can’t build the new at a price that makes sense. Eventually the construction industry will return to the Northeast. That will be bad for me if I stay still.

I had three rental properties in Northern New England, built in 1920, 1975 and 2000.

Decided that this year it was a good time to unload one with the silly prices. The 1920 was naturally the one to go. Old houses are charming, right? Not when you’re a landlord and you have to maintain them.

The money from that sale will go back into a new build for a rental (a duplex). My overhead is low (I’m a tradesmen and comfortable with carpentry even if it’s not my main trade because I’ve been around it long enough to know how to frame and finish). The prices of existing houses are too insane and any rentals I bring on line from here on out are going to be low maintenance. Putting my 30+ years of working age experience to good use.

For you young people looking to own rentals, the best advice I can offer on lower maintenance costs is to own homes or duplexes built on one level.

@Flashman I don’t notice any difference in the maintenances and repair cost per foot between one and two story properties I rent (other that one story homes have more roof to replace per rentable sf). What is it about two story homes that increases your costs?

I listened to a fellow, PhD, Masters, principal member of a rental community, SFR development, build and service company, spend a long half hour explaining why financing a home is a terrible investment, that the financial market is far better and one ought not consider a real estate investment until all the other investment buckets were filled. Renting is the way to go, he was very emphatic.

1) If owning real estate is such a bad investment why are you shoulders deep in just that?

2) If renting is such a good plan, how is it paying $1,300.00 a month for 2600 square feet of SFR on 11 acres of ground even considering the 20k roof I had installed last year a ‘bad deal’? Rent on the place would be $4,500.00 a month around here. If I hadn’t bought and ‘suffered’ my housing would be at straight market rate every day until my demise.

Obviously unstable people ought not get into longer term contracts, nor should those whose employment or income tends to be unstable. It seems that renting is a sucker’s game for most people long term though.

It works while inflation continues to erode away the value of the dollar. It doesn’t work when that’s in reverse. And it sometimes does go in reverse.

And what would your mortgage be on the place if you bought right now?

I suspect your comment boils down to “I’d be crazy to sell my house and give up my low mortgage rate – which is no longer available, and possibly won’t be for decades – just to rent instead.” And you’d be right. Otherwise, you live in a very unique market. I’d be curious to know where that is.

My probably flawed interpretation of this –

Current new home builders *still after price cuts and buydowns* have adapted and operate with a huge profit margin. So much so that landlords are also going to build for cheap and rent them out.

You say “50 plus” and I assume you mean communities of 50 or more houses and not communities for people over 50. That being said how many of these communities are age restricted? I’ve never seen a single family rental development that wasn’t for seniors, but real estate is local so others may see them all over.

Also will that growing inventory force builders to ease up on new starts or is it growing entirely due to an increase in total starts motivated by still high demand from buyers?

1. NOWHERE EVER did I say “50 plus” … that’s only in your imagination. The phrases I actually used were:

Bold in the subheading:

“Build-to-rent single-family houses in communities with 50-plus rentals.”

In the text:

“…professionally managed communities with at least 50 single-family rental houses

2. “I’ve never seen a single family rental development that wasn’t for seniors,”

What a pile of crap. Build-to-rent is for everyone, especially families with kids. What you’re talking about are 55+ communities (for seniors), which are an entirely different thing.

I live in a single-family neighborhood where everything was built in the 20s. Many old-timers in this hood are selling and getting out of Dodge (Oakland). My neighbor bought for 400k a while back, while some recent listings have been going for 800k. These are 1 to 2 bedrooms run down. I don’t see the worth of buying here when I could get into one of these communities. I’m finally remote working, too, which opens up my options. I’ve lived in CA my whole life. It’s hard to imagine living elsewhere.

Pilgrimage is all but ineluctable to being. Place and tense are important things to consider, but really, home is in your head, along with everything else.

Nietzsche’s idea: the virtue of the nomadic life on earth, continuous wandering.

Yes, also Nietzsche; God is dead…

Nothing new under the sun.

God is dead. – Nietzsche

Nietzsche is dead. – God

Interesting data. Well, this should keep materials cost high for everyone!

Lovely.

I’m curious how they make this work. If they’re using credit to build these things, surely they’re subject to the same economic constraint that’s providing their customers in the first place (renting is cheaper than mortgage)? Just looking at the hi-rise and mfh equivalents in our area, they “cheat” a little bit and build smaller units than a build-to-sell model while charging just about the same in rent as that larger unit would have fetched. It kind of works. We’ve had enough of a nightmare finding a private rental we’re considering one of these units, even though they’re 50-80% more on a per sq ft basis.

I suppose if they’re self-funding from the sale of their existing properties, it’s effectively swapping low yield housing stock for high yield, with the added benefit of lower maintenance costs?

Yes, all while ignoring the purchasing power of local wages…

Like it or not, all these financial wizards still refuse to believe the truth, which is that there hasn’t been any meaningful price discovery for a long time. Prices will reset, eventually. Thanks to The Fed, we can ignore reality for a long time. The consequences of ignoring reality is another thing altogether.

@WB I don’t think that I have met anyone who does not say that the price of housing is out of whack but I don’t know if the price of housing will drop or if inflation will keep driving wages up (the starting minimum wage at a CA McDonalds has gone from $10/hr in 2015 to $20/hr today). I was just talking to a guy selling the home his Dad bought in SF for $12K in 1949. He said that his relatives who bought similar homes in SF before the war for $3K-$4K told his Dad that he was crazy to spend so much and that prices were sure to tank after the postwar bubble burst.

This is definitely NOT 1949, or even 1979. The issue, moving forward is DEBT/GDP and the availability of resources and energy.

The U.S. had abundant resources in the post-WWII world. We also had all the productive capacity (everyone else’s was destroyed). This is not the case now. We also had largely self-sufficient people who understood real work and were willing to work hard and sacrifice. Look around at the average Joe and Jane now…

Many, maybe most, Americans ignore reality. It’s almost impossible to find an American who doesn’t ignore reality.

Except for reality SHOWS….lotta hrs spent watching/pondering/discussing those.

And compared to ETERNAL bliss, I guess can I see how our short life spans can be ignored……kinda like rounding off numbers to significant digits.

Build To Rent is both a need and an opportunity. Our team is actively partnering with developers and investors on BTR projects and hope to expand in coming years.

GDP slows to 1.6%…

Spending cools…

10-year yield leaps…

7:14 AM 4/25/2024

Dow 37,805.22 -655.70 -1.70%

S&P 500 5,005.09 -66.54 -1.31%

Nasdaq 15,462.23 -250.52 -1.59%

VIX 17.36 1.39 8.70%

Gold 2,331.10 -7.30 -0.31%

Oil 82.31 -0.50 -0.60%

MW: 2-year Treasury yield pierces 5% after quarterly core PCE inflation comes in hot

Friend lives in one of these and loves it. Bad neighbors don’t last long and no five cars on the lawn. Lots of people have some money and they are still trash.

It is more than money, it is the freedom from all crap of fixing everything or finding someone who will.

@Bear Hunter: The only downside I see is that these corporate landlords will mercilessly raise rents from the second year onward taking full advantage of the normal headache, stress, and reluctance of every tenant to pick up everything and move.

I don’t know if there are any contractual clauses built in as to the permissible rate of increase every year.

This is evident from Wolf’s earlier articles as well as his comment above:

“They’re making plenty of money. And they have reported still hefty rent increases, especially on renewals.”

Rent strike. All renters nationwide need to lock arms and say… not gonna pay. Sorry. Then the model breaks.

We have a build to rent community named “Pillars” nearby. All detached single family… some one story… some two story. When driving through, the place is so tight that it’s claustrophobic.

Kind of reminds me of an upscale trailer park without the wheels.

Drive through a newly built for-sale community, smaller footprints, smaller lots, closer together. That’s the trick. In big cities it’s wall to wall. Density is key. There is a price to pay for population growth.

High density is more a result of sky-high building development and permitting fees.

In this era it is considered a good thing for humans.

Chickens & cattle…..frowned upon.

Probably safer in the coming severe climate events. Guy from OK swore to me a tornado will go out of it’s way if it spots a trailer park.

Older metal mobile homes heat up more causing updraft which feeds the tornado? Need some government grant to study it! :-)

MW: Dow skids 600 points as GDP reading and Meta results unsettle investors

BTR works until the original owner sells

and the next landlord cuts back on maintenance to recoup their investment.

All the while the tenants voter for every

bond issue because they know they don’t

have any skin in the game long term.

These rental Home communities are popping up all around Phoenix. Cookie cutter- Yes – but the communities look nice.

Young couples can’t come up with the down payment but want to raise the kids in a SF home. This is the answer……

No age limit on the renters. Whether 55+ or 25+ these people are looking for affordable SF homes. This is the answer.

Who wants to overpay? Where I am its $2000+ more a month to buy. If people would stop overpaying then prices would come down. I guess AI/LLM should wipe out a lot of jobs and fix that problem but could be a year or two off.

They will never penetrate more desirable locations. This seems to be way down the list of projects accessible through local planning commissions, and for consumers it seems like renting a Cadillac to take a business trip. Nobody does that. And it seems to ignore the problem with rising building costs. It costs me X dollars a sq foot, to build multifamily, X +1 to build SFR, but my profit margin is still based on multifamily consumers?

Do we know which markets / sub-markets are these big companies selling in? If they are the smart money, it will be fruitful for all of us to benefit from their smartness.