Biggest Drunken Sailors of all. Average interest rate on the Treasury debt spiked but is still only half of what it was in 2001.

By Wolf Richter for WOLF STREET.

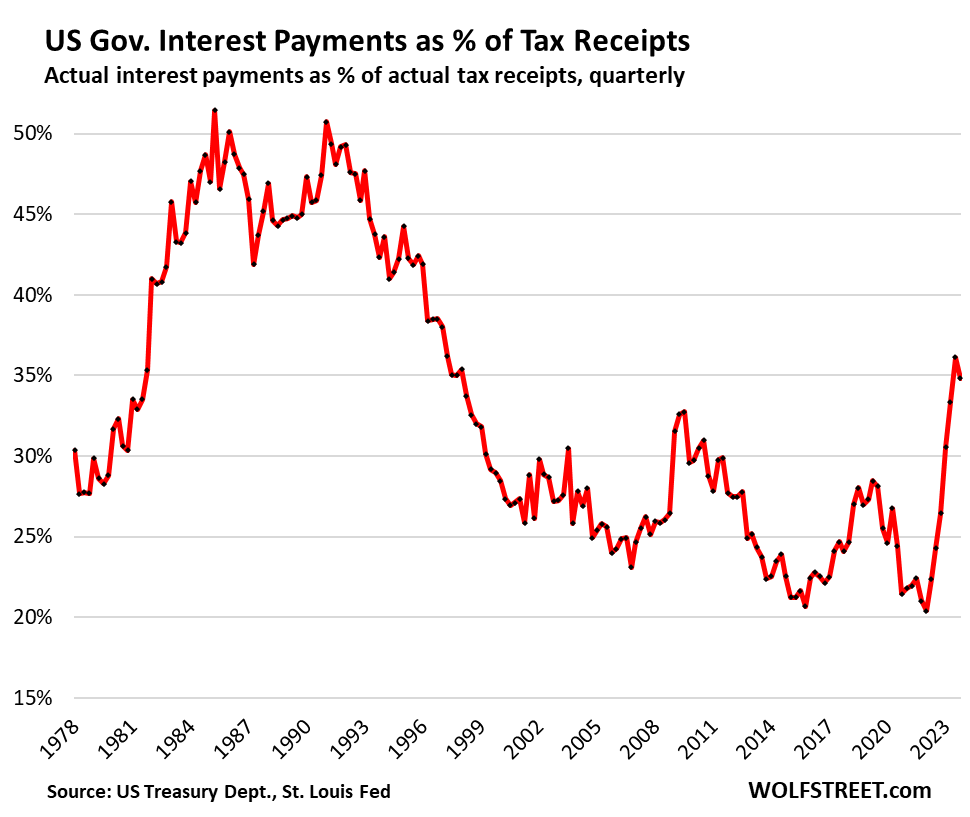

Interest payments as a percent of tax receipts is the primary measure of the burden of the national debt on government finances – to what extent interest expense is eating into the national income. So the ballooning national debt, now at $34.6 trillion, comes together with rising interest rates on that debt. Interest rates have risen because inflation has roared back after decades of slumber. But inflation also inflates tax receipts over the longer term.

So higher inflation is now the third element in the mix – ballooning debt, higher interest rates, and higher inflation. In Q4, 2023:

- Interest payments spiked to $256 billion, up by $11 billion from Q3

- But tax receipts jumped to $736 billion, up by $57 billion from Q3

And interest payments as a percent of tax receipts dipped to 34.8% in Q4, from 36.1% in Q3, which had been the highest since 1997

Some salient points:

- The ratio of interest payments as percent of tax receipts was 20.4% in Q1 2022, the lowest since 1969, driven by ever lower interest rates, including nearly free short-term debt.

- In the 15 years between 1982 and 1997, the ratio was higher than today.

- In the 10 years between 1983 and 1993, the ratio ranged from 45% to 52%.

Back then, Congress eventually got serious about dealing with the ballooning deficit when interest payments hit 50% of tax receipts.

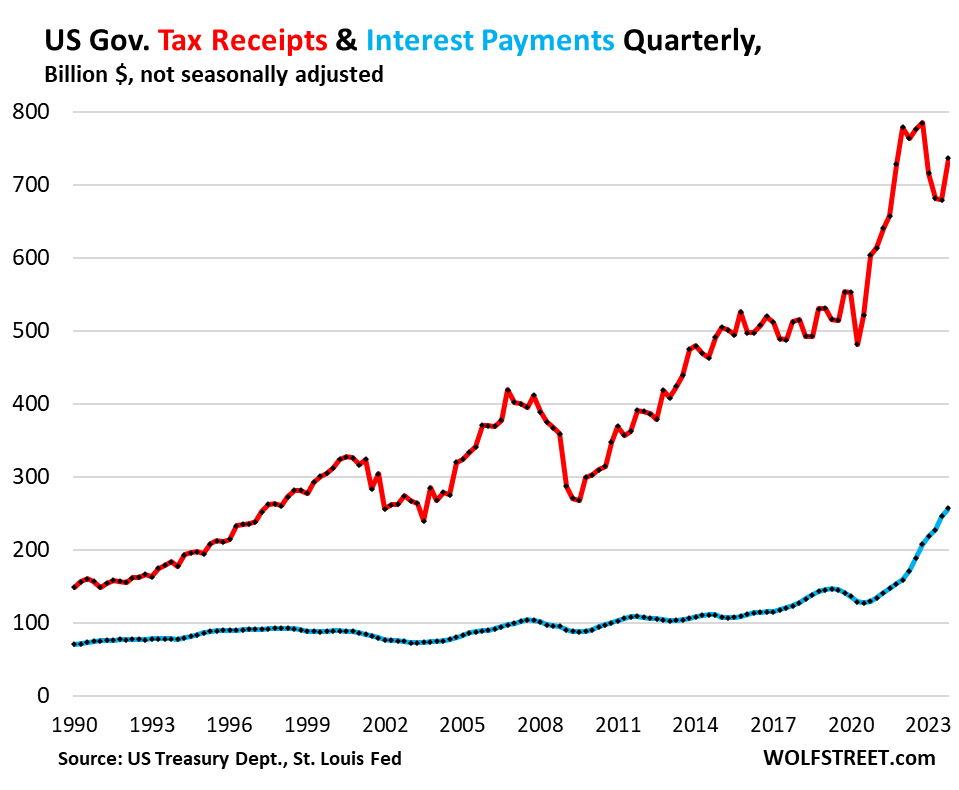

In terms of dollars, interest payments barely rose in the 20 years between 1995 and 2015 despite the debt that never stopped ballooning. The reason was simple: Average interest rates of these Treasury securities kept falling during these 20 years. Interest payments in blue, tax receipts in red.

Tax receipts (red in the chart above).

The measure of tax receipts here is what’s available to pay for regular government expenditures, including interest payments: total tax receipts minus contributions to Social Security and other social insurance, that are paid specifically by contributors into those programs and are not available to pay for general expenditures. This data of tax receipts was released on March 28 by the Bureau of Economic Analysis as part of its GDP revision.

This measure of tax receipts jumped to $736 billion in Q4, as some capital gains taxes made their way into estimated taxes, after the massive returns in stocks, cryptos, and some other investments in 2023.

Tax receipts will also jump in Q1 and Q2 2024, as April 15 is the day by which folks have to send in their big capital gains taxes for the tax year 2023.

But capital gains tax receipts had plunged in Q1 and Q2 2023, following the crappy year 2022 for stocks, bonds, cryptos, and other investments. That plunge in the capital gains taxes in Q1 and Q2 2023 was off the spike in capital gains taxes that had followed the Fed-fueled asset-price spike in 2020 and 2021.

Receipts from regular income taxes will continue to move higher due to growing wages and salaries (wage inflation) and growing employment.

Interest payments (green in the chart above).

Interest payments have spiked for two reasons: the higher interest rates and the ballooning debt.

Inflation is back in a big way for the first time in decades, and higher interest rates are working themselves back into the debt as new debt with higher interest rates is added, and as maturing debt with lower interest rates is being replaced by new debt with higher interest rates.

The government on Thursday sold 28-day T-bills at an investment yield of 5.38% and 56-day T-bills at an investment yield of 5.39%. Both issues combined totaled a monstrous $155 billion.

Yields are still lower in longer-term debt. For example, earlier in March, the government sold $39 billion in 10-year notes at a high yield of 4.17%.

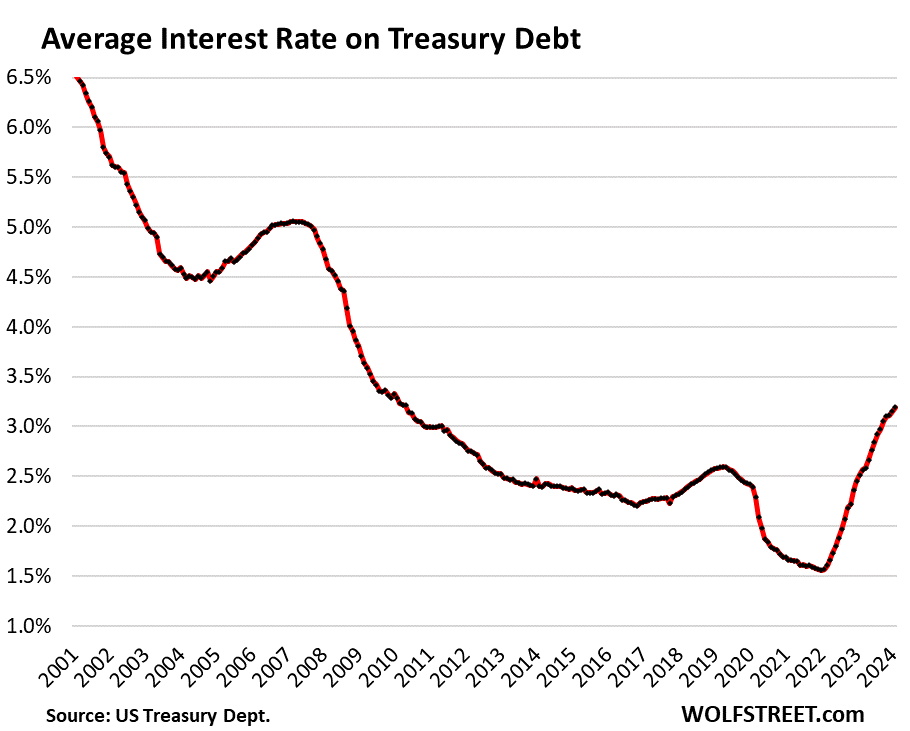

The average interest rate on Treasury debt.

The average interest rate that the government is paying on all its interest-bearing debt – much of it issued years ago with much lower interest rates than now – has been rising ever since it hit the historic low of 1.57% in February 2022.

In February this year, the average interest rate on national debt rose to 3.20%, according to data from the Treasury Department. This was the highest since 2010.

But obviously, in a historical context, and given the magnitude of inflation currently, 3.20% is still a very low rate, it’s less than half of what it was in 2001. But it will keep moving higher inexorably as old debt gets replaced with new debt, and as additional new debt is being added to fund the deficits:

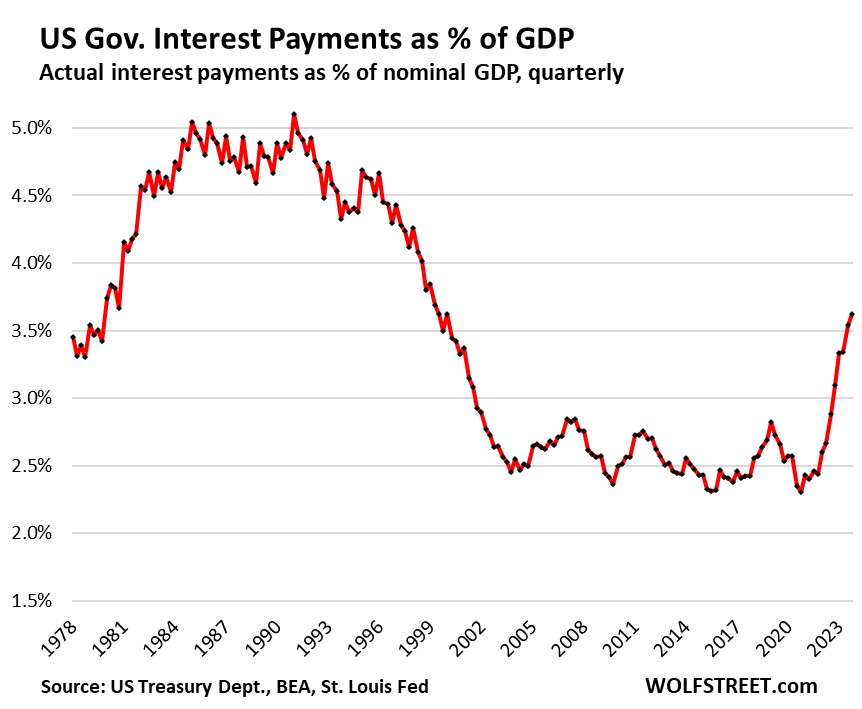

Interest payments as % of GDP: The burden of interest payments on the economy.

Interest payments as percent of GDP rose to 3.6% in Q4, the highest since 2000, based on today’s revised nominal GDP for Q4.

(The ratio is figured on an apples-to-apples basis: quarterly interest expense in current dollars, not adjusted for inflation, not seasonally adjusted, not annual rate; divided by quarterly nominal GDP of $6.93 trillion in current dollars, not adjusted for inflation, not seasonally adjusted, not annual rate).

So, this is a spike off very low levels, and it’s still quite a bit from the nightmare levels of the 1980s. But it’s decidedly heading in the wrong direction at a very fast pace:

Inflation…

Inflation also inflates nominal GDP (not adjusted for inflation). Nominal GDP in Q4 was up by 5.7% from a year earlier. Inflation inflates wages and salaries. Average hourly earnings at the end of 2023 were up by 4.5% from a year earlier. Inflation also inflates pre-tax business profits, as we have seen. And all these and other factors inflated tax receipts.

By inflating tax receipts, inflation helps servicing the debt; and it devalues the purchasing power of the existing debt; when the debt matures, holders will be paid off with devalued dollars. In this way, enough inflation over the longer term reduces the burden of the debt, even as higher interest rates over the term cause interest payments to rise.

It’s not interest payments that matter in a vacuum, but interest payments as a percent of tax receipts.

So we know where this reckless fiscal policy of today is going: higher inflation and higher interest rates for years to come.

Yield solves demand problems – but it’s costly.

The government is selling unspeakable amounts of new debt every week. Just on Thursday before markets closed for the Easter Weekend, it sold $155 billion in 28-day and 56-day T-bills. Someone has to buy this debt, and when interest wanes at the current yield, new buyers emerge at a higher yield, and when those buyers bought all they wanted, and no buyers at that yield materialize, then the yield rises further until more buyers emerge.

As we have seen, when the 10-year yield got closer to 5% last October, huge demand emerged, and that demand pushed the yield back down. That’s what yield is for, that’s its function, and it does that effectively: it makes sure there’s demand.

So it’s not an issue of there not being enough buyers – there will be enough buyers because the yield will rise to attract them until every last one of the Treasury securities is sold. But it’s an issue of those higher yields causing interest payments to shoot higher.

The curse of easy money.

The Fed’s interest rate repression from 2008 until 2022, obtained via near-0% policy rates and years of QE, caused borrowing for the government to be nearly free, with T-bill yields being close to 0% and longer-term yields falling to very low levels. Low interest rates encourage borrowing – everyone loves free money, and no one loves free money more than Congress. And then, debt really didn’t matter because interest payments were so low. But now the huge pile of debt does matter.

This debt binge by Congress was a result of the Fed’s reckless easy-money policies starting in 2008 with interest rate repression and QE. But now, easy money has turned into a curse of the worst inflation in decades, and a massive debt problem that won’t go away.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wait till these money losing tech companies start going belly up. Investors don’t want 0-yield tech at 5%. (Yeah, I’ve heard of AI, but there are many, many, billion dollar tech co’s not in the MAG7 with lousy earnings.) Good luck replacing that 6-figure salary. You’re not walking down to a local manufacturer.

The death knell of the tech mgmt executive was spoken before, during the great Dot Com Bust. Yet here we are again, with tech stocks booming and being paraded around at many times earnings. I think after every bust, a few years will pass while the dust clears, and tech just will come back stronger than ever.

Money blinds people from past screw ups. After the next bubble busts, people will forget again once the next bubble blowing trend starts…

It’s like childbirth….hurts like hell, you think you’ll never, ever do it again, but suddenly it’s over, you feel fine, forget about it and it’s off to the races again….

Or like flying spirit airlines. I’ll always say I will never do that again, then I see the price and just can’t resist booking another….

That’s Schumpeter’s “creative destruction.”

Repetitive, painful, and necessary (or at least healthy, in a systemic and Darwinian way)

I’ve come to see it that way too.

It won’t be long before minimum wage is a six figure salary. I give it 5 years. Currently ‘in my area’ it’s 20/hr. Just needs to double from here; actual employer cost will easily exceed 100k per employee. For a burger flipper that hasn’t increased productivity since the 1970’s.

Nah. Double 20 bucks an hour – assuming full-time work – doesn’t quite get you to six figures.

But who cares anyway? Id say “burger flipping” seems like hard, greasy, thankless work and the target of ready derision, and so compensation might should be commensurate with the drear & the hazards of the gig. A 20 dollar bill for every sixty minutes in a kitchen seems not outrageous to me. Take it out of the C suite’s bonuses.

Yeah who cares. /s

Naive to think it’s coming out of the C-suites bonuses. Lol.

“Take it out of the c-suites bonuses”

This is the big lie they told in Venzuela.

Now,

“A UN expert today urged Venezuela to address root causes of hunger and malnutrition, citing reports that nearly 82 per cent of Venezuelans live in poverty and 53 per cent in extreme poverty, with incomes insufficient to access a basic food basket.”

If being considered seriously is even a passing concern, don’t ever drag a comparison of the US economy to the Venezuelan economy into any discourse about inflation, wealth disparity or wage growth. Venezuela is not a harbinger of anything to come in this country in yours or any of your great great grandchildren’s lifetimes.

Grimp,

It is responses like this that I do not understand. Initially you complained about minimum wage rising. Why?

I know the masters behind many of the news sources you use try to get their viewers angry at minimum wage increases in order to distract from the out of control C-Suite pay (especially including stock options).

Why let them by continuing to use those sources?

6 figure salary is $50/hour. There’s a long way to go with Min wage.

Min wage at $20/hour is 40K/year but only in CA. Try to rent a 1Bd house/apartment or a room for less than the recommended 13K/year or 1.1K/month. You need to stack up the renters with multiple people per room to make Min wage work. Hopefully, higher end job salaries will float higher.

The rest of the country has it worse. 7.25 Federal min wage is 15K/year. Try to share a rent or rent a room at at the recommended $500/month. It is not possible except for VERY few areas.

Low wage renters are hurting all over the US. Red or Blue.

Government average interest now at 3.2%. Well that is the lowest for now and going forward, much higher. The thing is with higher rate hikes the spending would stop much faster with the price of money eating up expenditures. So I wonder about the FED independence and responsibilities. It’s almost like a game of chicken between the Fed and congress. Thanks Wolf.

It might be a temporary game of chicken but in the end they are on the same team. I hardly see a paradigm shift coming to address this but more likely a game of kick the can for a few more decades.

Even in CA we are seeing continued insanity. We had one great surplus year so massive spending happened which honestly on the surface hard to see how any of it helped. Over last decade per capital spending doubled and for example spending per prisoner ($133,000) increased despite a drop in population. Not suggesting there aren’t dangerous people that need to be locked up but imagine if a lot of this money went into the communities for real reform?

Slightly random post but my point is that current problems need to be looked at in new ways with fresh eyes. Not clear other than sound bites any of that will happen.

Dear John. The Govern ment would stop spending ? The Lone Wolf can correct me if I am wrong, but, did Govern ment ever even slow spending ever?

Debt-Free-Bubba,

Give the government credit where credit is due. They repealed most of the MHSA and who knows, they might continue on with different, but similar, legislation.

Howdy Glen Did they spend less or just cook the books? I continue reading Wolfs articles and do have trouble understanding how they add and subtract and the total looks cooked to me.

Debt-Free-Bubba,

My point was the landmark legislation intended to address Mental Health deficiencies was mostly cancelled. Those cost savings were simply redirected likely into things that tax cuts and other things. Oddly many consider Reagan a hero of sorts but I put him in same category as Thatcher, Albright, Kissinger, McCarthy(ism), and countless others. Reagan, perhaps because of my age, was the first President, whom represents the worst parts of hypocrisy and croynism, reducing tax rates the lowest since 1925. Reaganomics was a disaster, tripling the deficit in 8 years reducing debt as a percent of GDP that occurred post WW2.

Howdy Glen I do not want to get into too many posting violations with the Lone Wolf. So I will keep this post limited.

Govern ment BAD

Individuals. GOOD

Debt-Free-Bubba,

I think generalizations can be bad but I get your point. A government is simply individuals responsible for implementing a system. I am a proponent of a strong central government for the people. I want safe medication and food as well as institutions that can respond to things like pandemics(among other things).

“Of the people, by the people, for the people” is not a bad goal, but of course those are just words!

‘Give the government credit where credit is due’

Therein lies the problem. Govt does not wait for credit to be given, it simply takes it through taxation, manipulated low interest rates, debt monetisation and now taxation by stealth i.e inflation enabling it to pay back its debt with devalued dollars.

Glen,

My friend was in a government union, and they lterally told him to slow his work output down. The issue was not safety or quality, but that he was producing too efficiently. I think Bubba’s point is that when the government spends Other People’s Money, they don’t care deeply about how it gets spent, just that it gets spent. If you were paying people with your own money to work on your house, you definitely wouldn’t tell them to slow productivity.

JeffD,

Don’t disagree as that is certainly the experience here. I am poking fun but also point out the strange nationalist belief that we are the greatest democracy and people are fiercely proud of that. Politicians after all are both citizens and tax payers and serve at people’s will. If not, then perhaps the Declaration can serve as a guide as to what the responsibility of the people is.

Higher rates the would. With higher rates and the price of money, they would. When it was zirp it was pretty much free money.

Cut spending is probably a better way of saying it. The Inflation Reduction Act is doing just the opposite of what it implies.

Most legislation does the exact opposite of its name.

Exhibit 1: “The Affordable Care Act”

Grimp,

You really need to get better sources of information. Your ignorance is getting taken advantage of. Uses sources that inform and educate you, not reinforce your biases.

Wolf, this seems like it will not end well. Will we see stagflation? Seems like the Fed is trapped from its own making with inflation and rates. Shouldn’t they just hike and get it all over with? Pausing and pretending is not too confident.

I am with you John….

They could and should have hiked, really as far back as 2009. That would have caused general economic pain for sure, but that’s the idea when businesses and banks get it wrong. Would many banks going bust? I suspect so. Would the Dollar have continued to have world reserve status? (Possibly.) Would Obama’s, then fairly recent government, have survived? One more than likely thing is the collapse of asset values. Meaning quite large falls in the values of CRE and Residential RE. That is the assets which provide collateral for bank lending. Chances are much of the lending in the 5 years prior to 2008 , would have gone underwater relative to collateral. One other reason for banks going bust. Their assets were worthless (suddenly, non-performing) and the collateral wouldn’t have cleared the borrowing. Sadly for the rest of us Congress totally lacked any moral courage and they agreed to bailouts and QE and then did too much.

CON gressors of all and every stripes were bought then, as always, since at least the time when Andrew Jackson tried to get the best of the banksters about 200 years ago Chris…

And, to be sure, the banksters did their best to ensure the survival of the ”allies” during and after WW2,,, but also be sure you understand that was in their direct interests to do so.

I like the tax receipts versus interest payments and percent paid. The GDP comparison has always been too abstract for me me, not because it is hard to understand, but hard to relate to on a pragmatic level given the sheer mass and diversity of what it measures.

I agree something has to be done but the landscape of the 80s is very different than today. My totally unresearched guess is that while Congress took action it also benefitted from the .com era which followed not to long after. My guess is while AI could be considered the next great wave that spurns growth, I see most of that benefitting a smaller group of people and far smaller impact than the previous technology wave. Sure, lots of gains and booms and busts with this but even if transformational, not clear it will be an overall positive and without significant side effects. It is inevitable however.

AI is projected to make millions of middle, upper middle class jobs obsolete. Gonna be interesting.

—-

As inflation, have you seen the price of chocolate or coffee lately? Climate change is taking hold, we are in thr new normal. Oh yea, bird flu is detected in US Dairy cattle, so far….no sign of direct cow to cow transmittion, but no doubt worrying.

It’s time to start stockpiling pinto beans and toilet paper. Go vegan, and all you need is love. Slogans are coming. Give it a break.

The price of cocoa is due more to the fact that the governments of the main cocoa producing countries in west Africa pay a fixed amount to the farmers. The price may go up, but the farmers don’t benefit. If they did, we’d see cocoa out the wazoo. This is not climate change, but bad economic policy at work.

You know what coming after this. Lower interest lol over the long term. So easy to see it in th charts. Staying too biased to inflation for too long might get it all distorted.

I have two thoughts on inflation. Drill baby drill or hike rates and clean everything out of the system. The low price of oil would help combat inflation. Hiking rates would too. QT would be helped also with rate hikes. It’s time to start getting their tax receipts for 24.

Times have changed.

We now live in the Debt Age.

Investors are much more comfortable with state and corporate debt.

It would not be a surprise to see US national debt rising from $35T in 2024 to over $100T by 2050.

Don’t think that level of debt would be a major problem. The US is (culturally) leaning ever more left with every passing decade. The US today has a low tax burden (by international comparison), and there’s plenty of economic and socio-cultural scope for the US to raise tax by 50-100% over the next half-century.

On average, government debt doubles every ten years. Your estimate is likely way too low.

Debt never feel a worry when things are well but just one big black swan, can do what black swans always do.

I believe the US Treasury is fearful of failing demand for longer termed bond auctions and is running away from that; selling a lot more short-term bills instead. It’s a significant policy change. Higher forever?

I think they’re afraid of long term rates blowing up causing asset devaluation in an election year but they might get more inflation. What’s worse for votes is the only question they care about… We already know what’s worse for donors

No, it’s not afraid of falling demand, but it is afraid of higher long-term yields, which would then increase the deficit further.

Hit the nail on the head Wolf. The less attractive these treasuries become to buyers both local and internationally the higher the yields will become and the bigger the debt interest bill. Between a rock and a very hard place and none of the elite appear to care.

So you(all) think the Congress will act again when it hits 50% of tax receipts? If the previous wave is echoed we have another 10 years of interesting times in front of us.

Demand for bills is elastic since they are equivalent to cash, so the UST can skew new issuance away from coupon debt and into bills without short-term rates going up – at least to some extent.

So in effect, theyre inadvertently helping the fed by issuing more short term debt and keeping short term rates higher.

This is forcing the fed to keep rates higher, longer because we all know the fed follows the markets. It seldom if ever leads on interest rates.

The headline could also be

“the Curse of printing money against new government debt, rather than taxing the wealthy”

More “tax the wealthy” stuff. Let’s be more precise in how you’re saying that.

If by wealthy, you mean high income earners, consider how high income taxes already are. Top rate 37% (25% if cap gains) + Obamacare another 4%, plus if you’re in CA toss on another 13%. Virtually no useful deductions thanks to SALT limit and AMT. And yes, I know, tax geeks, this is generalization. High earners already take home less than 50% on the margin. And that sucks for younger workers who are actually trying to save up some wealth while they have good earnings.

Now, if by wealthy, you mean having lots of assets, different story. But a wealth tax is extremely difficult to design, for a lengthy list of reasons. It’s actually a “better” tax in terms of minimizing avoidance and unintended consequences, but still a real problem.

And to those thinking the answer lies in raising cap gains taxes, consider that those gains are not indexed for inflation. So while you may have a 50% gain when you sell an asset you’ve held for 8 years, your real gain is near 0%, yet the whole 50% is taxed….

I’m unclear on your wealth tax push back.

Are you saying it’s just too difficult, so we shouldn’t do it?

This country put a man on the moon. There’s very little that is ‘too difficult’ for the USA. It just needs to put on it’s “big boy pants” and kick the cowards, grifters, demagogues and pearl clutchers to the kerb.

Wealth tax is fundamentally unfair because it punishes savers and those who are balance sheet affluent.

Who do you think should pay more in taxes? The person who makes $150k/year, eats out all the time, and has a $800/mo car payment? Or the person who makes $30/hr, brings a homemade sandwhich to work for lunch, and gets there in a 10-year old car they bought with cash?

People who make a lot but blow all their money on an extravagant lifestyle, should be taxed more than, those who don’t make a lot but live a low-cost life in order to squirrel away every extra penny they make – in my opinion.

MM

Many things in this life are unfair. Often it comes down to a mere accident of birth.

I agree that we should strive to not exacerbate such inequities however, it’s a question of what we, the people, want for our society.

Multi-generational accumulation of wealth leads to oligarchy, a landed class and a permanent “us and them”. The larger the separation, the smaller probability of moving from one to the other.

Former civilisations instituted a debt jubilee on the change of a king – the writing off of all debts. They knew that huge accruals of imbalance were bad for society.

Now, I’m I’m not advocating elimination of debt, just the taxation of the of the obscenely* wealthy.

To address your specific example. I’m not targeting those high w-2 earners but those billionaires who seek to put themselves above the rest of us. After all, as you say, there are limited ways to game the system on a w-2.

* Yes, I know, “who decides what’s obscene?” From potter Stewart, “I’ll know it when I see it”. Unsatisfactory, I know.

A wealth tax is usually conceived as a way to tax unrealized capital gains. It’s a bad system because it removes productive capital from the economy and gives it to the government to spend inefficiently.

Also, it would be terrible in practice because you would have to give tax credits when there is a capital loss. Unrealized gains are just that, the value is only really established when the asset is sold, and that’s when capital gains taxes kick in.

Consumption taxes are a better idea. Also, ending double taxation of dividends would encourage more dividends to be paid which would then be taxed as ordinary income.

MM,

I agree with you. You shouldn’t be heavily wealth taxed if you buy a house or save for retirement.

We are wealth taxed today with property taxes. If you are not in CA or not in a state with no property taxes, you are very lucky (I feel sorry for Texans who pay up to 4% in wealth property taxes). Retirees and younger savers are being hit hard with the wealth property tax in other states. They may not have the money to pay it without having to sell their house at a mythical inflated assessed value.

I was never pro-Prop 13 before this year.

(Especially now after CA closed the blatant loopholes like allowing inheriting the current property tax on an inherited house and charging exorbitant rents). You should not be able to inherit wealth property taxes when they were depressed by Prop13.

My point is that there should be exclusions for the poor and middle to own a home and save for retirement without being taxed out of your primary home and your retirement wealth being heavily taxed.

There could be exclusions for a primary house and for a limit on retirement savings to make a wealth tax fair.

I think the most unfair exclusion for dynastic wealth is the stepped-up basis for inherited RE and stocks.

A wealthy person puts all of their unused wealth into stocks, RE, and art, and when they die, they pass on the assets to their heirs at the stepped up value of the assets when they die. Millions of capital gains are forgiven for the heirs.

I was amazed, grateful, and disgusted when my Mom’s house she purchased in the 1970’s for 50K sold for 800K. My 3 brothers and I declared a loss on our taxes due to RE commissions on the stepped up basis (now 800K). The government lost out on over 100K from just our poor mother (My mother was wealthy enough and saved by Prop 13 to not have to sell her house of 50 years before she died). Just think if I would have had 13M in assets that I could have stepped up to 0 in gains. Don’t blame me too much. I just followed the rules of the game of wealth preservation. I don’t agree with them but the wealthy heirs of the deceased are making a killing by not paying millions in taxes.

Bunter, when politicians talk about taxing the wealthy, they really, mean taxing wage earners, not billionaires. Wealth taxes aren’t “difficult”, they are unconstitutional, and more importantly, they have been tried and largely abandoned in Europe because they don’t work. Our politicians just need to rein in the spending. If the Federal budget were cut back to 2019 level, there would be no need for additional taxation, and I see almost no measurable benefit in the massive spending increase post 2020.

I don’t think it is smart to tax wealth. As mentioned already, that just punishes savers. What is better is to tax INCREASES in wealth.

We make it so easy for the extremely wealthy in this country to avoid paying taxes on the increases in their wealth.

If a working stiff works his ass off and works an average of 60+ hours a week for a whole year and makes lots of money in wages. He pays a huge portion of that in taxes, whether he saves it or spends it.

A billionaire earns much, much more than the working stiff working 60+ hours a week and will usually pay a far lower tax rate on the money simply because he can use all sorts of loopholes to avoid paying taxes on that money.

That isn’t right or fair.

Well said.

Also, a wealth tax would be irrelevant if we didn’t cause asset price inflation.

Newbie here. Enlighten me if a wealth tax is unfair, how fair it is to allow a RE owner to deduct interest expense from income but not allowing a renter their rent?

One of the many reasons it is cheaper to rent than own is deductible mortgage interest.

@Newbie,

I like where you are going with this, but likely, a lot of owners would find backdoors to rent to themselves (renting then subletting?), making the current bad situation even worse. The best solution would be to limit home related tax breaks to building only, and phase out *all* tax breaks related to home ownership over a four year period, including mortgage interest deductions. Active listings on the MLS would immediately explode in that case, and all the shadow inventory would come to market. Anyone under 40 could once again buy a home.

Forgot to say those tax changes are directed at Single Family Residences, only. Multi-family, multi-unit structures built specifically for commercial residential rental occupancy throughout, need the current tax breaks to remain in place.

Newbie: mortgage interest paid is deductible from your income, because bank CD and bond coupon interest payments are /added/ to your income. If you want to eliminate the mortgage interest deduction, you have to eliminate taxes on interest income too. Can’t have it both ways.

Wealth taxes already exist – they’re called municipal property taxes, excise vehicle taxes, etc.

I think there’s an argument to be made that if we allow homeowners to deduct interest, that renters should be allowed to deduct some portion as well. But determining what that portion would be will be impossible.

I’d rather eliminate the mortgage deduction in its entirety, and I wouldn’t even allow the $10k SALT

You guys are missing the point, the mortgage interest deduction helps both home owners and renters. It’s fine that you want to get rid of it, I hate social engineering through tax policy, but expect higher rent and no real net benefit to renters.

CHS, we’re talking about two things.

Interest that a landlord would pay on a mortgage is deductible either way, as it’s a business expense, no different than what he pays the gardener or for insurance.

We’re talking about the ability of a person living in his primary residence to deduct the interest.

Chs,

If you have a 3% mortgage rate, it is VERY hard to exceed the 27K std deduction (married). SALT tax deductions are capped at 10K so excessive property tax increases and state tax increases (wage increases) have actually hurt homeowners much harder. They can no longer deduct enough to exceed the 27K standard deduction. They’d have to have 17K in mortgage interest (above the 10K SALT) to deduct (or a 600K mortgage at 3%). This is not common for longer term homeowners.

Married renters have benefited from this higher std deduction. They take 27K off of their income. Before, it was 13K.

Most older homeowners cannot deduct enough to exceed 27K. They probably could have deducted SALT (Especially now with drastic property tax and State tax increases) before the new tax laws. This is hurting the poor and middle income homeowners.

This is changing with 7% mortgage rates and 1M houses. 7% of 1M (70K in first year interest) is easily deductible above the 27K standard deduction) but the higher property taxes (4% in some parts of Texas = 40K) is still capped at a 10K SALT deduction. A new homebuyer on CA coast is likely hit with up to a 20K-30K prop tax bill and a higher state tax bill but they are capped at a 10K limit deduction due to the SALT cap. Older homeowners in CA are protected with Prop 13 and don’t have enough taxes and interest to deduct with the 27K std deduction.

Only new homebuyers with high interest rates and renters have benefited with higher tax deductions. Older homeowners (outside of Prop 13 protected CA with state taxes) are paying more taxes.

ChS

As a personal example. I am a middle income homeowner. My income has risen over time so my state taxes have also risen. My property taxes have also risen.

The mortgage interest falls every year as I pay off the loan.

5 years ago, when the std deduction was 13K, my mortgage interest, plus property and state taxes easily exceeded this. There was no SALT cap back then.

Now, my property taxes and State taxes exceed the SALT cap so I am capped at a 10K deduction. My mortgage interest falls every years and the combined no longer exceeds the 27K std deduction. Paying a mortgage and property taxes on a house while working paying state taxes is no longer a tax deduction

My property taxes and state taxes keep going up but I am capped at 10K. My mortgage interest keeps going down.

At some point, my total (taxes (going up), interest paid (going down)) may exceed 27K, but due to the SALT cap, it prevents me from itemizing deductions.

Personally, and possibly greedily, I wish interest paid in mortgages would be directly deductible against interest earned in Tbills and CDs and THEN the 27K std deduction is applied.

I pay more in taxes since I cannot directly deduct my mortgage from my Tbill interest earned without exceeding the 27K std deduction that renters and paid off homes get. I pay more in interest than a renter, but I cannot deduct it from my interest income for taxes.

BobE, thanks for detailing your experience. It only furthers my point that there will be no net benefit to renters by eliminating the mortgage interest tax deduction for homeowners. In the case of a landlord renting out a home with significant interest to deduct, such as could be the case in California, eliminating the interest tax deduction will only result in higher rent for the renter.

Your example also details how, generally, both homeowner and renter benefit equally under the current tax law with the high standard deduction. Something to note with it potentially expiring for 2026.

As a side note, state taxes should NOT be deductible for anyone. Why should lower tax states subsidize higher tax states. If someone wants to live in a state with higher government “benefits” associated with higher taxes, that is their choice. Californians should have the option of living in a highly socialized state, and Wyoming citizens should have the option of living in a more libertarian state. That’s how the system is suppose to work. You should get what you vote for on a state level because state governments are more democratic.

“I wish interest paid in mortgages would be directly deductible against interest earned in Tbills and CDs”

I like this idea. You pay income tax on your net interest income (interest earned minus interest paid).

Einhal, fair point, currently you don’t have to set up a business to deduct the interest on a rental, but I can see how you would adjust the tax law to allow that specifically. Regardless, I think you and I agree there should be less special deductions in general.

Einhal, I decided to check myself and now realize I am a moron. Lol

Bingo.

Most of the asset wealthy don’t touch their assets directly, but take out low interest loans against their assets to fund their lavish lifestyles.

Tax these loans at normal income (which is what they are) and have them justify them on their taxes.

That’s ridiculous. A loan is not income unless it’s not paid back.

They could also tax any “income” received from HELOCs or cash-out refi’s, That is income received while pushing capital gains taxes out to when the home is sold.

It has been tax-free cash for many.

Two things.

The number of people who are wealthy enough to finance their lifestyle based on loans against assets they hold is so small as to to be almost ridiculous to talk about. There probably aren’t more than a thousand such households. In my entire life I have met one such person. You need to be in the hundred million plus category to even remotely have this make sense.

And the loans eventually have to be paid off. So there will be taxable income. So why do you care if they borrow money now and pay later?

And most importantly, you inadvertently highlight the real problem when say “low interest loans “. The Fed’s unnecessary and immoral interest rate policy fuels this behavior. If rates were normal, the interest for this type loan would be enough that it wouldn’t be financially viable.

Happy1,

“The Fed’s unnecessary and immoral interest rate policy fuels this behavior”

Good point.

If I were immoral, and had a crystal ball, I could have cash-out refi’d my house to the max when mortgage rates were at 3%. I could have put this cash in a TBill making 5.5% and paid off the refi with the spread in interest rates making a profit.

It would have worse than it seems with regards to taxes. You have to pay taxes on the TBill interest but due to the std deduction, I wouldn’t be able to deduct the interest paid for the refi.

In addition to Happy1’s great response, now that rates have gone up and those folks take their capital gains and pay off the loans, the borrowers have paid interest AND capital gains tax. Ending up worse than if they had just paid the capital gains. And the government received taxes on the interest and the capital gains. More wealth distribution. Isn’t that what you want?

It is amazing just how much people let blind ideology cloud their view.

Then there are those that are so clueless that they cannot even accurately describe their opponents views. They are completely and utterly incapable.

They think thise that want a more fair tax system are just looking to redistribute wealth. They are incapable of recognizing this due to their ideological blindness.

Here is a clue for the clueless. Wealth is already being redistributed through an unfair tax system.

Why are you defending Warren Buffett and Elon Musk paying taxes at a ridiculously lower rate than a working stiff?

Tax receipts look pretty healthy in the charts.

The bear went over the mountain and what he saw was very disturbing, 34 trillion in debt and rising fast, not a good sight.

I agree crazytown the tax receipts look healthy but our country is addicted to crack, “I’ve got to get more”. We could be at 100 trillion and our tax receipts could still look good… IMO

The bear family went south, smart.

Reminds me of Ollie North and turning a blind eye to drugs flooding inner cities funding the Contras.

Always good to consider where the bulk of the spending occurred and what it created or destroyed. One could argue from an American perspective much of it was simply burned but of course the cost was much higher.

Mm,

My numbers are valid but for humor let’s take your as a math lesson. If China has 2x the emissions but 4x the population who has the greatest per capita emissions?

A) US

B) China

C). Phone a friend

This is nonsense. The issue is not that the wealthy don’t pay enough. They do. The issue is that the “wealthy” have so many inflated assets due to poor monetary policies. Get rid of those and the problem won’t seem so bad.

Various arguments can be made but for example the top 1% create the emissions in one year that the bottom 10% create in 2 decades. Seems reasonable to have an extra 1% tax for example to fund things such as insulating houses for the harsh winters for the bottom 30% or so. Reality is that the planet hasn’t been destroyed by too many humans but contributions of a small percentage of them. Seems logical that should come with considerable cost. This phenomenal isn’t even casual to simply industrialization alone but the utilization of wealth.

If you’re that concerned about emmissions, tell China to stop burning so much damn coal.

You mean like those idiots who fly around the world in private jets to campaign against climate change?

MM,

Lol. China bad. You are following the script. Well done. Per capital emissions of China is almost half of US and that is factoring some of their emissions is for our consumer economy. China is also the world’s renewable energy leader. It is true they lead in current emissions rather than historical emissions but that is why their is relevance in per capita as China is over 4 times larger. The World as a whole likely won’t meet it climate change objectives but I clearly see China investing and beating us there. They are now creating inexpensive quality electric cars as well although we probably won’t see them in the US.

China is burning more coal than they ever have in history. Coal is one of the dirtiest forms of energy that exists.

A quick google search implies China emits 2x the CO2 that the USA does. i.e. the sites Our World In Data and WorldOMeter, which I assume are pretty accurate. Which data are you looking at and what is ‘per capital emissions’?

I shall now go to the river and throw myself in do my part. I realize my output of emissions is small but to help the planet… and so I jump.

Then I crawl out gasping for air and go home.

Really? Climate change as an argument for propping up government spending?

By what metric do you judge that the wealthy pay enough?

Buffett has oft stated that he pays a lower percentage in tax than his secretary.

That trope from Buffett is the height of dishonest. First, it’s very likely that an average secretary, especially if he or she has children, pays 0 federal income taxes. Sure, he might pay FICA, but I don’t even consider those taxes; those are more akin to Social Security and Medicare insurance premium payments.

If Buffett does pay a lower rate, it’s likely because he is getting his income from tax free municipal bonds (I remember during an analysis in 2012 it was discovered that Romney had a lot of his income that way), and you’re basically getting a much lower return in exchange for federal tax free treatment.

But when people call for “higher taxes on the rich,” it’s NEVER on the super wealthy like Buffett. It’s always just to raise the marginal tax rate on the “working rich” higher, such that a professional couple making $700k a year in W-2 income has to pay 60% (with state taxes included) instead of 45-50%.

The billionaire class is NEVER touched, and the “working rich” don’t have the availability of all of those new fangled loopholes I keep hearing about.

Unless you’re a business owner, there are very few loopholes available to you.

Buffet doesn’t have an “average secretary.” He has an executive assistant, and probably a whole team of them. Secretaries are sort of gone. There are executive assistants now, male and female, and the good ones that take care of big bosses make a lot of money and pay income taxes just fine, probably lots of it.

I expect Buffet also consumes less, percentage wise, also. And probably produces more value also. Seems like a good thing. Why punish efficiency?

ChS,

I am not that against necessary travel but I was referring to the wealthy Americans who take a 20 minute jet ride when it is a 40 minute drive. I would more be a fan of letting climate fighters go where they need to go and abolish the UN. That line specifically crafted for you.

LOL, you really do get me. Now add the WEF to the UN and we got a deal!

As an off topic side note. If we could electrify air travel and control point source pollution from power plants, of all energy sources, I think everyone should be able to fly rather than drive.

Chs,

If we can add IMF and forgive debts we got a deal. World bank optional.

Done! I’ll make some calls

You are right. Your response is nonsense.

You didn’t need to post any more than that.

Warren Buffett, Elon Musk, or pays taxes at a far lower rate than someone turning a wrench 60 hours a week.

Why do you think this is ok? Why do you think any mention of it is “nonsense”?

Annualized interest expense per FRED was $1.025T at the END OF FY 2023. That’s now 2 quarters stale. Jeez, I wonder why it’s taking the Fed so long to update these numbers? How bad will they get when it’s all said and done?

With inflation slowly creeping up, I don’t think anyone should be surprised by these predictions for the next 12 months:

1) The FY ’24 budget deficit as predicted by Biden’s budget hits $2.15T which is on top of last year’s $1.7T. This is a lot of buoyancy for the labor market.

2) The unemployment rate tops out this CY at 4.2% due primarily to people trying to re-enter the work force.

3) Continuing un-employment claims move up to 2M from the current 1.8M, but still very non-recessionary which is closer to 2.5M.

4) A recession, if it arrives, is forestalled until ’25.

5) The Fed doesn’t lower interest rates this year.

6) The Fed raises rates in July by 25-basis points.

7) Once it’s reported deep into FY ’25, the annualized interest expense as of 4th Qtr FY ’24 is $1.35T.

8) CRE turns out to be a “clamoring for rate cuts” red herring, at least in CY ’24, meaning no bank failures.

9) Consumer debt climbs further and sets up a pullback sometime in CY ’25.

10) Oil pushes past $105$ a barrel due to the war in Ukraine continuing to knock out Russian oil exports along with tensions in the middle east.

Just to clarify your first paragraph: “annualized” interest expense means that you’re looking at the “seasonally adjusted annual rate” of interest expense, this is a “rate,” not actual dollars. It means, if the interest expense in the quarter continues at the current rate for all four quarters, total interest expense for the entire year will be $1 trillion. To get a feel for actual interest expense in a quarter, divide the “annual rate” by 4, which gets you closer. Don’t get hung up on “seasonally adjusted annual rates” of interest expense. I gave you the actual dollars in each quarter, not annualized, not seasonally adjusted, not annual rate.

I understand this fact, and I’m pretty sure that my #5 takes care of that consideration. I don’t expect the Fed to lower rates this year. Obviously, if they do, then it will affect the final real interest expense for the FY.

Like your quarterly graph’s trend shows, I fully expect the interest expense to continue to rise through the end of FY ’24. IF the Fed cuts rates, this is likely to occur in the final CY quarter, but again, I’m expecting this inflation head fake to continue through CY ’24.

I’m in the camp that firmly believes that the 2% core PCE target is no longer valid given all the potential inputs to maintaining higher inflation for longer. This is the 1970’s redux.

Like the 70’s, the only solution for this inflation spike is a recession, but the obscene levels of deficit spending that didn’t exist in the 70’s is the real game changer here.

But, your point is well noted though.

Question: Is your data 6 months old as well? When you reference Q4, you’re talking about FY, right?

Any idea why the FRED site is taking so long to publish the annualized data from FY Q1?

I will be happy if the Fed raises rates by 25 bps this July. Hope you’re right, but Fed seems to be way too slow with this “transitory” inflation. I guess if the earth has been around millions of years what’s a decade…a transitory blip lol.

How have they been too slow? They raised rates at a historically fast rate since that “transitory” comment came out.

Janet Yellen won’t sell longer term. It’s all rate manipulation in the curve.

They’re selling longer-term securities just fine. They’re selling a bunch of them. But proportionately not enough in terms of the huge deficits they have to finance. They’re selling more T-bills and fewer long-term securities than they should to maintain the balance. T-bills are now over 20% of the total debt, and that’s high.

Wolf, what’s the reason for the 20% rule when it comes to bill issuance? I.e. why can’t the Treasury just fund the whole debt with bills?

I’m wondering if eventually too much bill issuance would compete with bank deposits and cause a deposit drain even at large banks. Sure they could raise their CD rates well above the current bill rates, but that would also drain liquidity.

There are lots of reasons for limiting T-bills to 20%. But it’s not a rule. One reason is that T-bills mature quickly, and constantly have to be redeemed and new ones have to be sold at auction. So for example, if the government has a T-bill-only debt, there might be $10 trillion in 3-month T-bills outstanding, so it needs to sell $10 trillion at auctions spread over every three-month period just to replace maturing 3-month T-bills. So at every one of its weekly 3-month auctions, it would have to sell $770 billion in T-bills, which is about 10x the current already gigantic size. It would just be nuts.

Isn’t also to shift the federal debt to shorter duration so the can implement QE 2.0?

8T (1/4 of all) maturing debt needs to be rolled over during 2024 + 3T of deficit.

That will put the ratio of interest-to-receipts close to the all-time high of 45%, the last time seen during the peak of 1980s and that’s with a booming economy. Then wait for the recession to kick in, like it already did in Europe.

My bet 2025 is the year when interest will exceed the tax receipts.

This article is IMO the most important article Wolf has ever written.

Sadly, our fed, for the first time in a century, is in a box.

Lower rates and the dollar drops, inflation takes off like a rocket for demographic reasons etc etc. Raise rates and the debt interest goes out the wazoo while business receipts probably drop and the real estate mess turns into a disaster etc etc.

The DC gangsters have nearly driven us off a cliff trying to buy votes. Both parties are equally irresponsible.

So…..they just let inflation cook and pour liquidity in when a mess occurs and pray no black swan shows up. The problem is that I don’t like to pray about my kids future.

What a country.

Wolf did write many useful article-only this one struck a cord in many.

Currently the income percentage just to finance debt -it’s the most watched by many.

That’s why I’m on the belief the “Weimer Boy” will soon cut rate and go back to QE-otherwise the Treasury income will not be enough to service the debt.

I agree with both of these assessments of the problem – but disagree with the prediction that the Fed will go back to QE and dump liquidity onto the problem.

The Fed says its mandates are low employemt and stable prices. Many here claim its not-so-secret mandate is propping up asset prices. But its real priority, above all of these, is ensuing the smooth function of credit & dollar markets; specifically the market for Treasuries. The Treasury Bond market is literally the most important market in the world because Treasuries are considered the cleanest collateral – and its the Fed’s job to keep it that way.

Above all else, the Fed needs to make sure the world continues to buy Treasuries. And they’re certainly walking a tightrope right now. If rates go too high, the backlash & pressure will come from butthurt politicians and corp execs who want their free money back. But if they cut rates, they could spark a loss of confidence / return of the Bond Vigilantes, causing a sell off in bonds & rate blowout.

Look what happened in the early 1980s; multiple times when the Fed cut short rates, the 10-year rates rose sharply. I think Powell is genuinely concerned about losing control of the long end of the curve, and the way he’s doing that is by managing inflation expectations.

The Fed says it wants 2% inflation. Its secretly ok with 3-4% inflation, but it needs to say 2% is the goal to keep yields stable. If it says its ok with 3-4% inflation, then the 10-year yield would have to go up another 200bps. But as long as the belief that inflation will come down remains, and there’s demand for the 10-year at sub-5% rates, all is ok.

I’ve felt like Powell is overly optimistic about inflation coming down, but maybe he’s trying to make a self-fulfilling prophecy. Fake it till you create it, as they say.

I read Powell (and the FED) very differently than you. I see them very worried about inflation continuing in services while deflation is no longer present in durable goods. I think they are very worried.

I also think they see that much of the rest of the world is teetering on recession and they are worried about it infecting the U.S.

Furthermore, the last thing they want to do is fall for a head fake. They don’t want to lower rates to avoid the recession in the rest of the world, but then see inflation take off. Similarly, they do not want to raise rates to fight worrisome inflation only to see the rest of the world drag the U.S. into a recession.

They are walking a tight rope right now with some fairly large forces pushing in different directions. Raising or lower rates too soon and then having to backtrack makes their job even harder in the future because you never know which action the economy is acting on.

Tl;dr, the fed is right now specifically maneuvering to avoid a situation where it would later be forced to do QE. But if it really comes down to it, the fed will throw wall street under the bus in order to protect the treasury market.

Wolf,

This raises an interesting question. What do YOU think is your “most important” article? YOUR favorite? (Or your top 5-10 of each)

Oh goodness. I’ve written 6,970 articles since I started the predecessor cite, Testosterone Pit in 2011. I don’t rank them. I’ve written some that I thought were more important than others, and this quarterly series is one of them, but there are others. Later today, I will post one that I feel is equally important, about immigration, population growth, and how the wrong population data screws up part of the BLS employment data – but not in the way people want to have it. Some of the stuff I’m most proud of isn’t the most popular.

“In the 10 years between 1983 and 1993, the interest to income ratio ranged from 45% to 52%.”

Reagan and Bush Trickledown economics and Voodoo economics.

” Circa 2020 to 2021 and 2023: Tax receipts jump a lot”

The savvy cashing out and the peasants dig in for infinite AI gain! What to say about their real Intelligence!!

“From 1992 to 2008, % interest payments plunged”

We changed our way of calculating the inflation and fooled the whole world. PPT worked on the stock market side to increase the tax revenue.

“The beginning of 2028 to 2020 looks eerily similar to 2023”

So, what can we expect?

We already used the QE magic trick of pulling a rabbit out of a hat. What else is left?

Or think what could be in store if the stock market bubble eventually pops?

“US Govt. interest payment as % of GDP = 3.5% now”

We can reduce this in our luckily 70% service-based GDP by increasing say Realtor fee to 10% (and they will buy Benz etc.), insurers can jack up the insurance cost by 100%, sell our homes at a dream price. Bingo, our GDP has grown much faster than the % interest payment!

If this is not enough, we can put sanctions on few countries that compete with us.

The government knows the longer term treasuries’ have low appeal and are purposely selling short term at high yields to give the impression there is demand for debt. They also see rates lowering soon and don’t want to be locked into high yields on long term debt. When and if rates turn down watch investors pile into 30 year debt.

“When and if rates turn down watch investors pile into 30 year debt.”

MJ — Maybe. 10+ year rates already imply future inflation will be low. So I kind of doubt the long end will rally much and drive yields down.

Exactly. People saying real estate will go up more when rates drop fail to see that mortgage rates are tied to long term rates, not short term rates. That drop has already been “priced in.”

10yr went from ~ 1.5% to 0.5% in Q1 2020.

Then from 0.5% to 4.5% in the subsequent years.

The markets can’t ‘see’ for toffee.

If they could, rates would have spiked in Q1 2020, not dipped.

Yes I know loads of debt would have been issued, but people still bought 0.5% at 10yrs… they’ll be crying into their cornflakes in 6 years when they redeem their principal.

They may as well have just flushed 50pc down the toilet.

But apparently this market can “see the future”

There is plenty of demand for long term debt, just not at 4.2%

I keep hearing that the Fed “has to” lower rates for all the $35.5 trillion reasons you detail above. Because without doing so bankrupts the government and we just can’t have that.

But if rates drop back down to 4.25 or 3.25 or 2.25 then inflation is just going to roar again. I’ve noticed gasoline is up 20% in the last month.

Maybe the Fed is going to have to face the reality that rates + inflation = 8% or more now. So where’s the pain going to be?

I think ultimately they’ll chose 5%+ inflation and 3% rates. And people will howl and vote the bastards out but prices will all but double again from here in a decade or so. Houses, oil, cars, food, insurance. All of it.

I think ultimately they’ll chose 5%+ inflation and 3% rates. !!!!

Rule 72 dictates that 5% inflation ( the tax you never see) will in a short 12 Years cut every bit of wealth you have accumulated in half.

Inflation eats everything, is voracious and should not be allowed, even at 1- 2%.

Powell needs to stop prancing around the ring and beat Inflation to a pulp with a short sharp recession to clear the dead and dying that are preventing the World from moving forward. After all, I know Wall street and they are out of aces to pump it up, after Ai runs and exhausts without a merit badge to show. If he does nothing then there apars to be a World wide, self induced ‘Mother of all recessions’ inflating around the entire World. He will reap that whirlwind if he does not prick the Bubbles

1% inflation would be phenomenal. Grandpa could buy the kids ice cream cones for about 1.5x what he paid when he was their age and tell funny stories about “back in my day”.

Unfortunately, the debt is so large now that anything LESS than probably 3% results in collapse, and 5-8% is likely necessary to stay ahead of it. This “2% target” is the Fed saying they’ll stop smoking- tomorrow. It’s BS, it’s ridiculous, and everyone knows it. But everyone pretends to believe. At 3.5% inflation the Fed is already signaling they are throwing in the towel.

It’s an exponential function now. The debt will be $36 trillion at the end of 2024, $50 T by 2030, $70 by 2035, and probably $100 trillion by 2040. From there just keep in going.

Grandpas are going to be telling stories of how the $20 bill that you need for a single ice cream cone used to put FOUR gallons of gas in the car..

5% inflation and 3% rates is impossible over the longer term because it will turn into 10%+ inflation quickly, and if the Fed doesn’t hike above 10%, it’ll lead to 20% inflation, etc. So over the longer term, you cannot have 5% inflation and 3% rates. You can have 3% rates, but much higher inflation will be the consequence.

And that’s what the Fed won’t tolerate, as we saw when it hiked by 525 basis point, the fastest pace in 40 years. They will keep rates high enough to keep inflation topped out at 5% or so, and to keep a lid on inflation, they need to keep the policy rate above the rate of inflation over the longer term.

What we will likely see over the next many years is inflation rising and falling and rising again as it typically does after it takes off, and we’ll see the Fed variously cutting and raising rates in response, as it did in the decades from 1970 through 2006, during which time it mostly kept its policy rates above the rate of inflation.

AGREE, like totally thunder!!!

The longer this bout of denial re the effects of easy money goes on, THE MORE THE damage, eventually.

NO way around the results,,, EVENTUALLY.

Some HOW, some WAY, WE, in this case the SAVER, etc., WE, have to make absolutely certain that ALL the ”puppets/politicians” come to not only understand the principles involved, but the very clear results for not only their constituents, but themselves.

WE can hope that happens sooner rather than later, ,,

but, based on my understanding of the state of the current ”education system” in USA, that is certainly not any kind of anything besides hope. ( Been a teacher in several USA High Schools. )

Inflation is the increase in asset prices. If you own inflating assets, 100% inflation doesn’t change their purchasing power.

It’s fiat currency that loses its purchasing power.

Yes, but you also get paid in inflated dollars. So for workers, their purchasing power should stay the same as well.

Rule of thumb is that short term rates have to be higher than inflation to properly control inflation long term. 5% rates and 3% inflation is more likely their target.

Excellent explanation, as always. Thank you Wolf.

Happy Easter

Looking off into the future, there’s a possibility that the tax picture will be modified, and of course GDP growth, real or nominal will fluctuate.

The current trend looks decent, but, not sure there’s clear sailing ahead.

I have no skin in the game, but think if rates stay higher and GDP decreases, this deficit game will just get worse.

“Net interest payments will climb to 3.1% of gross domestic product next year, the highest level in records going back to 1940, and then go on to hit 3.9% in 2034, the CBO said in its latest outlook for the federal budget.”

I don’t see anything problem. 1970s it was 55%, so 30% is nothing

If it goes back to 25%, it’s nothing. If it goes to 50% is not nothing 🤣

In the 70’s you had low government transfers, a kick ass home based economy and a proud Nation who believed in the dream – This is not the 70’s….. America is obviously without a Captain, a Rudder, an engine room and that Bridge pylon is like, coming up at 8 knots and hope and a prayer is NOT and option. Sanction all you want. Protectionism has never worked.

Time for an Ice bath

“Protectionism has never worked.”

Except for 19th Century America (heck, you guys invented this aspect of industrial development economics — so much so that it was called “the American System”) latter 19th Century Germany (see Franz List), and 20th Century Japan and Korea.

Excellent article as usual. By the way, if you are reading this comment, then I challenge you to send $50 to Wolf Street like I just did today. It is ridiculous that Wolf doesn’t charge for his valuable insights, and we should all feel guilty if we don’t at least send him some money from time to time.

At any rate, a few points about the article. While the issue of govt spending versus tax receipts is important, there are a few issues that should be emphasized here.

1) The government is running huge fiscal deficits. In other words, they are spending far more money than the taxes they collect. The deficit spending is unprecedented.

2) To make matters worse, the overall government debt load is at a historic high and going higher.

3) Comparing expenditures to tax receipts on a historical basis is very misleading. Due to the explosion of guaranteed expenditures for social transfer payments (Social Security, Medicare, Medicaid, free everything, etc) there is hardly any money left. This was not the case years ago. Social Security is bankrupt, due to: a) the money collected has already been spent (there is no trust fund), b) people are living much longer than ever anticipated when SS was first implemented, and c) insufficient current collections to match expenditures. In other words, Social Security is NOT “self funded”. It is running a massive deficit. So, what does this all mean? That, after transfer payments, there is virtually NO MONEY left. That is why these interest payments are crowding out all of the other government expenditures such as defense, education, etc.

4) When / if the stock market tanks, those tax receipts are going to plummet. People keep talking about the rich needing to pay their “fair share”, but the top 10% of earners in this country contribute 76% of all tax receipts. So, if the stock market tanks, or the economy goes into a recession, they we are screwed.

5) Which brings us back to the deficit-spending. The government typically runs a deficit during a recession, not during a strong economy. The current deficit spending during “good times” is unprecedented.

6) Yes, inflation makes it easier to pay the debt because the dollars are worth less and the inflation pushes people into higher tax brackets. But, investors are not stupid. And at some point, as Wolf points out, they are going to demand higher interest rates because they know they are being paid back in less valuable dollars.

None of this is to argue Wolf’s excellent points in his article. It’s just that things are much, much worse than that.

Thanks. So let me get busy…

Your #2: “To make matters worse, the overall government debt load is at a historic high and going higher.”

The debt in a vacuum is irrelevant, we’re having fun with it with my out-the-wazoo charts of the debt, but it’s irrelevant because it ignores population growth, economic growth, inflation, and tax receipts. This is precisely why I give you this data that is NOT in a vacuum.

Your #3 “Comparing expenditures to tax receipts on a historical basis is very misleading…”

… is BS. All of it. So in two parts: 1. I’m comparing “interest payments,” not general “expenditures,” to tax receipts. 2. Your thing about Social Security is ignorant BS. You’re abusing my site to spread lies. READ THIS, I’m not going to repeat it here:

https://wolfstreet.com/2023/10/23/social-security-update-trust-fund-income-outgo-and-deficit-in-fiscal-2023/

Your #4: “When / if the stock market tanks, those tax receipts are going to plummet.”

Yes, and we already saw that a year ago. Capital gains taxes plunged in Q1 and Q2 2023 because 2022 was a shitty year. This will happen again, and maybe more next time. But markets don’t plunge every year. The magnitude of the plunge can be seen in the tax receipts chart (second chart from the top, red line). The plunge is not the end of the world, as you can tell if you look at the chart.

Your #5. yes, which is why we’re writing about it.

Your #6: yes.

How is defense spending being “crowded out” by interest payments? At $883.7B for FY 2024 there seems to be plenty of money for defense spending.

Yes, LOL, good point: NOTHING is getting crowded out. And that’s part of the problem. It all just gets funded with borrowed money. Have your cake and eat it too.

Is that to say that chronic deficits (aka “can kicking”) must either end, or lead to plummeting currency.

The former alternative appears unlikely.

I’m looking for hope…

All fiscal sins lead to inflation®

So, if one views inflation is a hidden tax, inflationary policy (condoned by congress, and executed by the Federal Reserve System and the banks) is the method by which we fool ourselves into believing that we pay less in taxes than we actually do.

Aside from being unsustainable in the long-term, that sure feels sleazy.

Yes.

Nothing gets “crowded out” because the entire premise is a fallacy outside of hard currency regimes. In fiat currency regimes government spending “crowds in” business investment — that’s what all this “de-risking” talk is ultimately about.

I see two issues with buying Treasury bonds (20 & 30 years), and maybe even 10-yr Treasury notes right now:

1) Being paid back with dollars that are inflation-devalued (as mentioned above) and,

2) Losing faith that the Government will even be in a position to pay out the full nominal value (credit risk) that far into the future – who really knows? The federal debt is giving me an uneasy Ponzi-like feeling…

As a frugal retiree, I’m pretty happy with 17-wk laddered T-Bills. I also picked up some 2-yr and 3-yr notes, back when the yields were in the 5% range. I sleep well at night.

Treasuries have less credit risk than any other fixed income product. If the USG really does full-scale default on bond payments, then you wouldn’t be able to redeem your T-bills, and probably wouldn’t be able to access your bank deposits either. At that point, the only safe asset would be physical gold that you personally hold.

Of course the issue with holding gold right now is that it doesn’t pay interest.

I have gone back to solid gold filling at the dentist. Figure with that and a pair of pliers I will be able to pay for groceries in the dystopian future.

Regarding your #3, how are transfer payments any different than they were 20 or 30 r even 40 or 50 years ago?

Social security, Medicare, and medicaid all existed at those times.

Also, it should be noted that depending when you measure, people don’t live too much longer than they did when social security was first started. Back when SS was first started, childhood deaths were a far bigger issue than they are today, so while average lifespans were shorter back then, most of the difference was because of extreme outliers like babies dying.

A person who was 25 years old when SS was first started could still expect to live almost as long as a 25 year old today. Not quite equal, but closer than you think.

It should also be noted than average life expectancy has recently been dropping in the U.S., especially among males.

Some of it was due to COVID, some of it was due to COVID idiocy (vaccine nuttery), some of it is due to a drop on overall vaccination rates for a variety of afflictions, some of it is due to opioid overdoses, some of it is due to our effed up healthcare system.

It has been worse in the U.S. than most other 1st world countries.

That should help SS.

I’m much more upset with the Treasury than the Fed. They had ample opportunity to sell a ton of long dated bonds with rates at hundreds year lows and blew it.

Apparently, they raise money on an as-needed basis, but a lot of people have brought up that question. Maybe it’s based on some legal requirements related to budgets.

This is what Wolf is for, even if it’s a holiday.

The Treasury might have wet their finger, put it in the air, and found they they were in the doldrums, to borrow a sailing term. I’m guessing the Treasury decided not to issue long term debt because they projected it would push long term interest rates, “too high”. Little did they know, at the time, the bout of inflation they were about to be in for.

The other possibility is that Yellen suspected inflation was coming, but since she had worked decades at the Federal Reserve, didn’t want banks to load up on long term debt, knowing that it would cause an imminent banking crisis.

I found this TBAC gobbledegook at Treasury, and it hints at Treasury portfolio composition. However, I recall reading before that they need to keep a weighted balance for term structure.

I lost my mind and forgot how this song goes:

“* Weighted Average Next Rate Reset (WANRR) is a “Weighted Average Maturity” metric that attempts to adjust for the floating

rate aspect of some Treasury debt. The WANRR is the average time until the outstanding debt’s interest rate is set to a new

interest rate. For bills and fixed rate notes and bonds, the next rate reset is equal to the maturity date.

In contrast, for floating rate obligations, the time between the next rate reset date or maturity date is examined and the shorter

period is used in the calculation.

The consolidated outstanding debt is defined as the private amount plus SOMA Treasury securities holdings less currency

amount. In this calculation, SOMA Treasury holdings greater than the level of currency outstanding is treated as if it is a daily rate

reset.”

I hear your point, but I think you have cause and effect backwards. If they had issued that much more than they did, rates would have had to rise.

It’s like people saying “I should have sold my house at the peak in early 2022.”

However, if EVERYONE had done that, prices would have plummeted.

Prices are set at the margins. Maybe long term rates were that low ONLY because there were few idiots willing to buy it.

Yes to all but the last paragraph. Long term rates were low because lots of people bought. Thus bidding down rates.

Wolf,

That was a truly excellent article. Bravo.

Do you have any thoughts on a potential defense spending catalyst?

Ray Dalio has been talking about China potentially trying to cause a third regional conflict (in addition to Ukraine and Middle East) in order to try to covertly get concessions from the Biden Administration.

This could easily cause a lot of unanticipated defense spending.

Do you think it would be easy to absorb with more debt? Or is there a magic number at which things would start to unravel (like last October when long term rates took off)?

We’ll just borrow it, LOL. That’s what they’re doing. $60 billion to the richest chipmakers, such as Intel, no problem, we’ll just borrow it. They’re still all under the delusion that debt doesn’t matter.

There is still huge demand for Treasury securities — that’s why longer-term yields are so low. I have no idea why anyone would buy a 10-year note with a 4.2% yield, but that’s what they’re doing.

Wolf,

I think you are in rare company in identifying this problem.

As soon as people start to realize that the US government is just borrowing money without a clue of how to pay it back, it will become clear to everyone that the solution is just to print more money.

There was a time when Argentina’s government bonds were considered safe investments (many years ago).

The US should take note of what happens when you lose that trust.

I think everyone knows that it will happen. The flaw in the thinking of most Americans who believe that we’re “exceptional” is that they think it’ll happen to gradually that we’ll have plenty of time to clean things up.

We won’t. gradually, then suddenly.

Except they do have an idea how to pay it back. Just inflate it away gradually. A few more years of 3-5% inflation will make that deficit a bit more insignificant.

$10 a gallon gas doesn’t hurt if you are making $120,000 working at McDonalds. As long as the numbers grow in proportion, it doesn’t matter how high they grow.

The only people who are hurt are those who don’t work and live off of accumulated assets that cannot keep up with inflation.

One USD currently represents about 3 KWH of energy to help keep us warm in winter. Same dollar will still get you a gram or so of silver.

The newer state of the art data-dollar represents many quadrillions of bytes of raw data.

This dollar data dynamo will keep accelerating until self-generative AI discards our species.

Excellent post Wolf – hitting several urgent fiscal matters. I see 300-plus comments coming on this one!

Thanks for taking time to share, even on Easter Sunday. Compelling journalism (and the NCAA tourney) keeps delivering.

2023 $4.4 Trillion revenue vs $6.2 trillion spending. -$1.8 Trillion deficit we keep spending like the true drunken sailors. Most corporations or small businesses go out of business running deficits unless the y have a Rich Uncle Who’s just got out the Poor House. “We call him Uncle Sam”. We need a good ole Boston Tea Party, I see the revolt coming soon from the bottom.

Government latest budget numbers 5 months into the fiscal year 1.1 trillion. The target for the whole year is 1.6 trillion. It looks like we will blow out the target number?

Compared to other countries, the US is in fairly good shape, I’d say…

That is true. It is the reason the dollar is so strong.

” inflation helps servicing the debt”

This a common claim, but false when debt is rising faster than inflation.

Or when the government portion of the GDP is rising faster than the total GDP.

When the yearly deficit goes from $600B to $1.6T, either $1T is cut from spending or another $1T is borrowed. Remember an additional $1.6T spending is 5-6% of the $28T GDP. So take GDP growth with a kilo of salt.

Of course, who has any idea what the correct numbers are.

Correct. It’s not personal, it’s just MATH. Debt has been increasing exponentially. Inflation has not, and tax receipts definitely have not been rising exponentially.