Prices of New Houses v. Existing Houses: Price cuts and mortgage-rate buydowns make new houses more attractive.

By Wolf Richter for WOLF STREET.

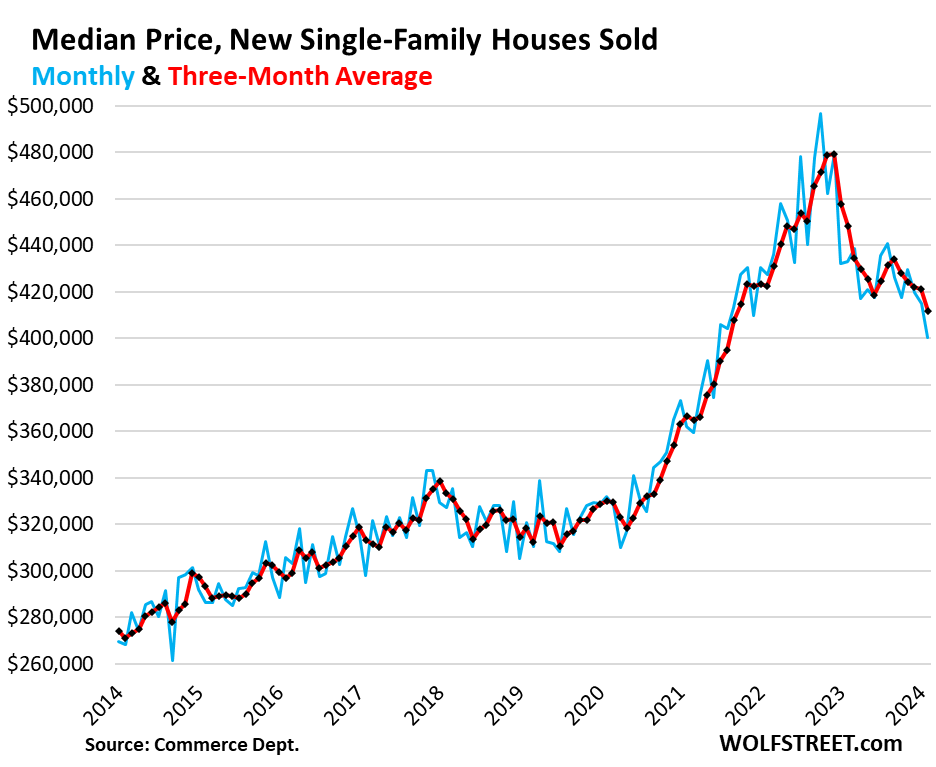

The median price of new single-family houses that were sold in February fell to $400,500, the lowest since June 2021, down by 7.6% from February 2023 and down by 6.3% from February 2022, according to data from the Census Bureau today (blue in the chart). Compared to the peak in October 2022, the median price has dropped by 19.4%.

The three-month moving average, which irons out some of the monthly ups and downs, fell to $411,700, the lowest since September 2021 (red).

The prices here do not include the substantial costs of mortgage-rate buydowns that homebuilders use to stimulate sales in this market where sales of existing homes have plunged. Mortgage-rate buydowns lower the monthly payment but do not lower the contract price of the house. Prices here also don’t include other incentives, such as free upgrades. These contract prices show that homebuilders are building smaller homes with less expensive amenities at lower price points, and then they’re throwing mortgage-rate buydowns and other incentives on top of it to make deals.

Lower the price and they will come.

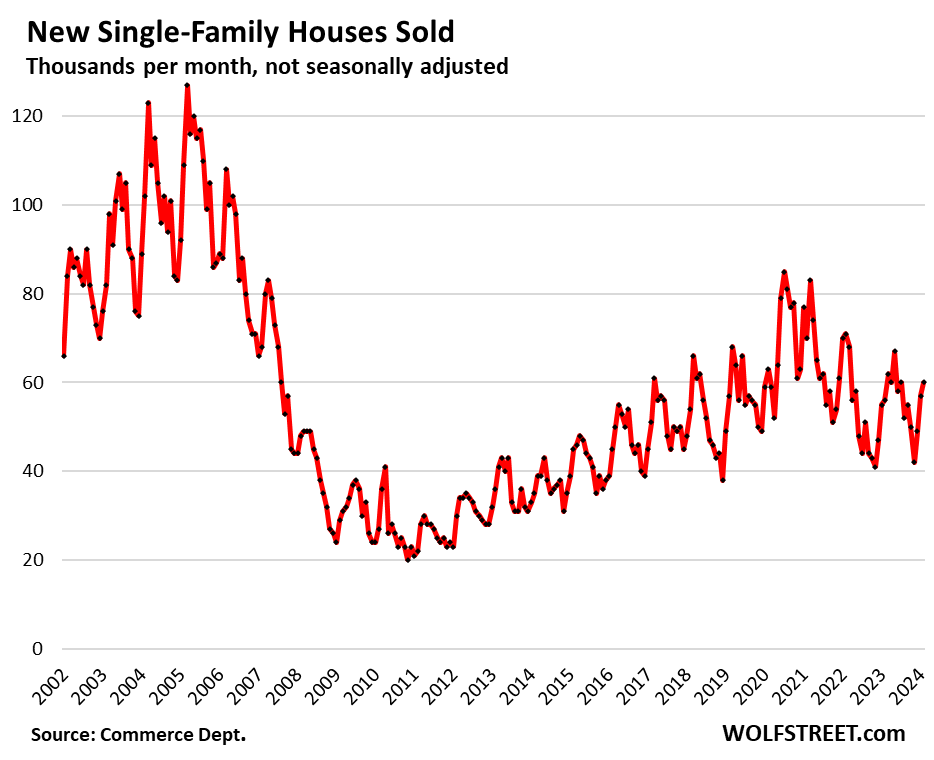

Homebuilders sold 60,000 new houses in February, not seasonally adjusted, up a tad from January, and up by 7.1% from a year ago.

Compared to February 2019, sales were down only 4.8%, despite the 7% mortgage rates, while sales of existing (resale) homes plunged by 19% compared to February 2019.

The fact that sales of new houses are hanging in there despite 7% mortgage rates shows that homebuilders have figured out this market, and they’re running circles around homeowners trying to sell. Homebuilders are competing directly with resale homes. They’re in the business of building homes, and they cannot try to outwait this market, as many potential home sellers are trying to do.

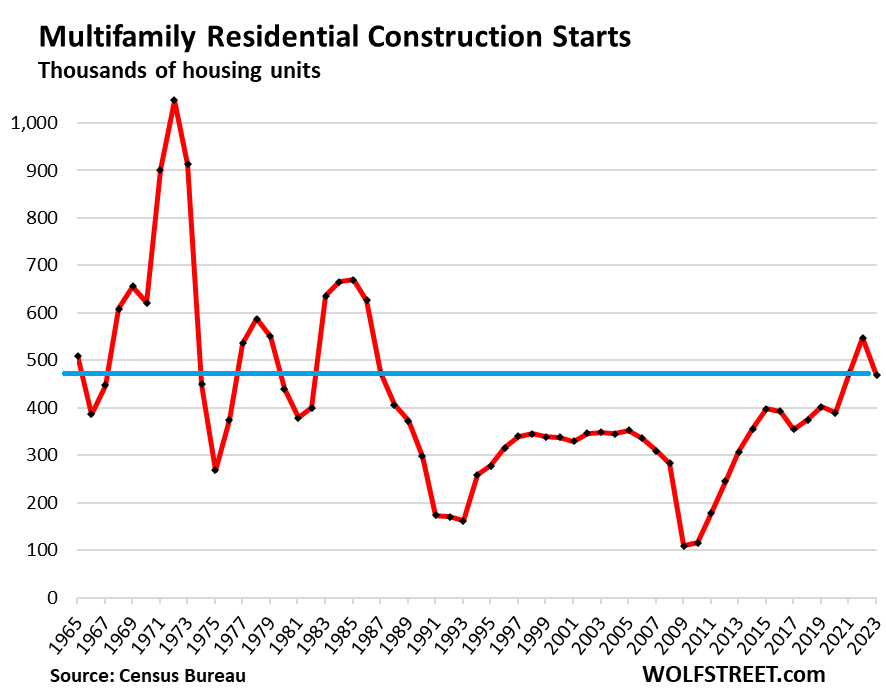

Additional competition from the multifamily construction boom.

Over the past few years, multifamily building construction – condos and apartments, mostly at the higher end – has started to put a large number of units on the market. In 2022 and even in 2023, multifamily construction starts were at the highest since the 1980s.

This plays into the trend of population growth. As cities get larger, they get denser as some people choose to live in larger buildings at the core of the city with shorter commutes. Time is money. And money is money too, because people can save money on a monthly basis. People are doing this calculus, and they’re making choices.

This is the competition for single-family houses, both new and resale, and people are arbitraging the cost differences:

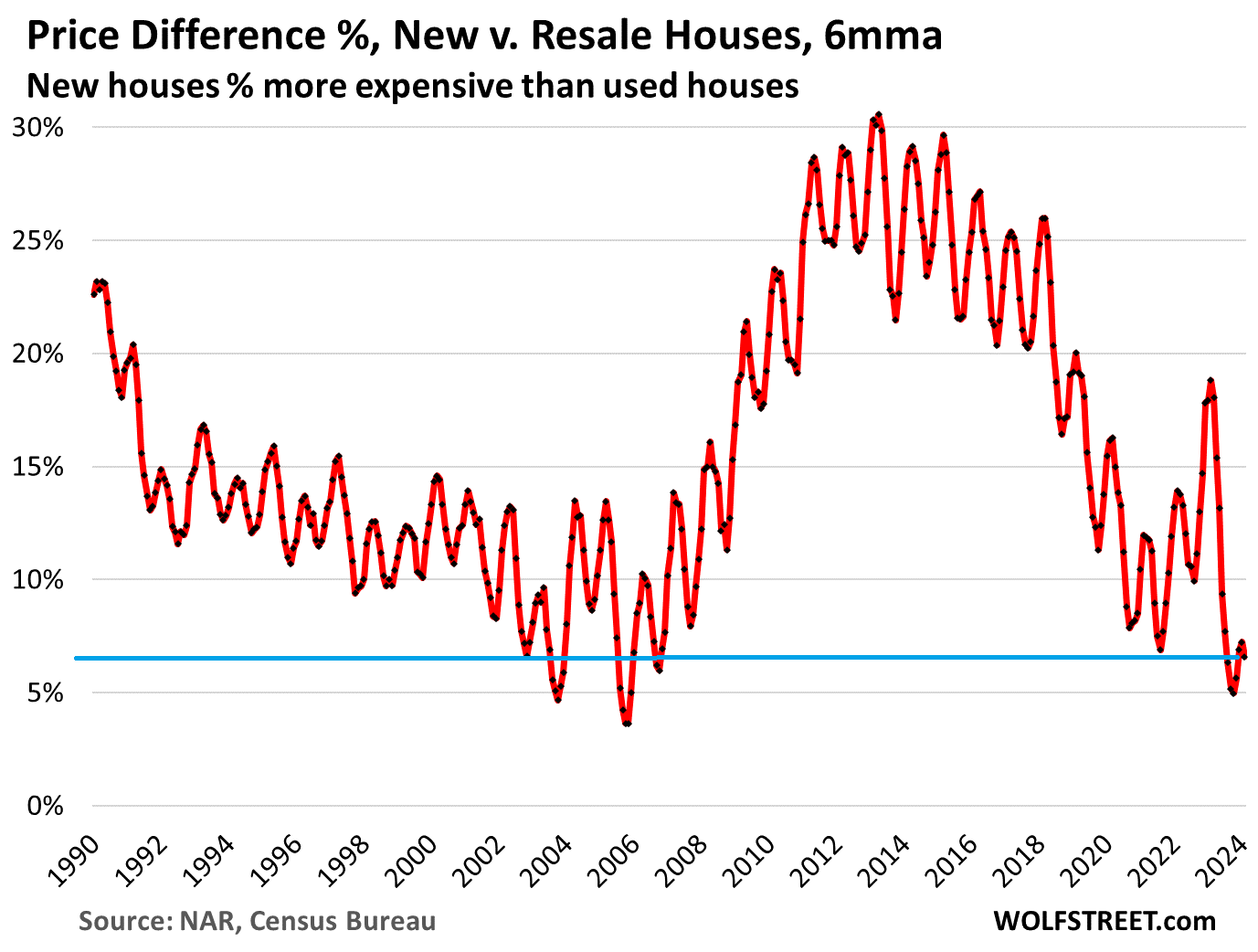

Price difference between new and resale houses.

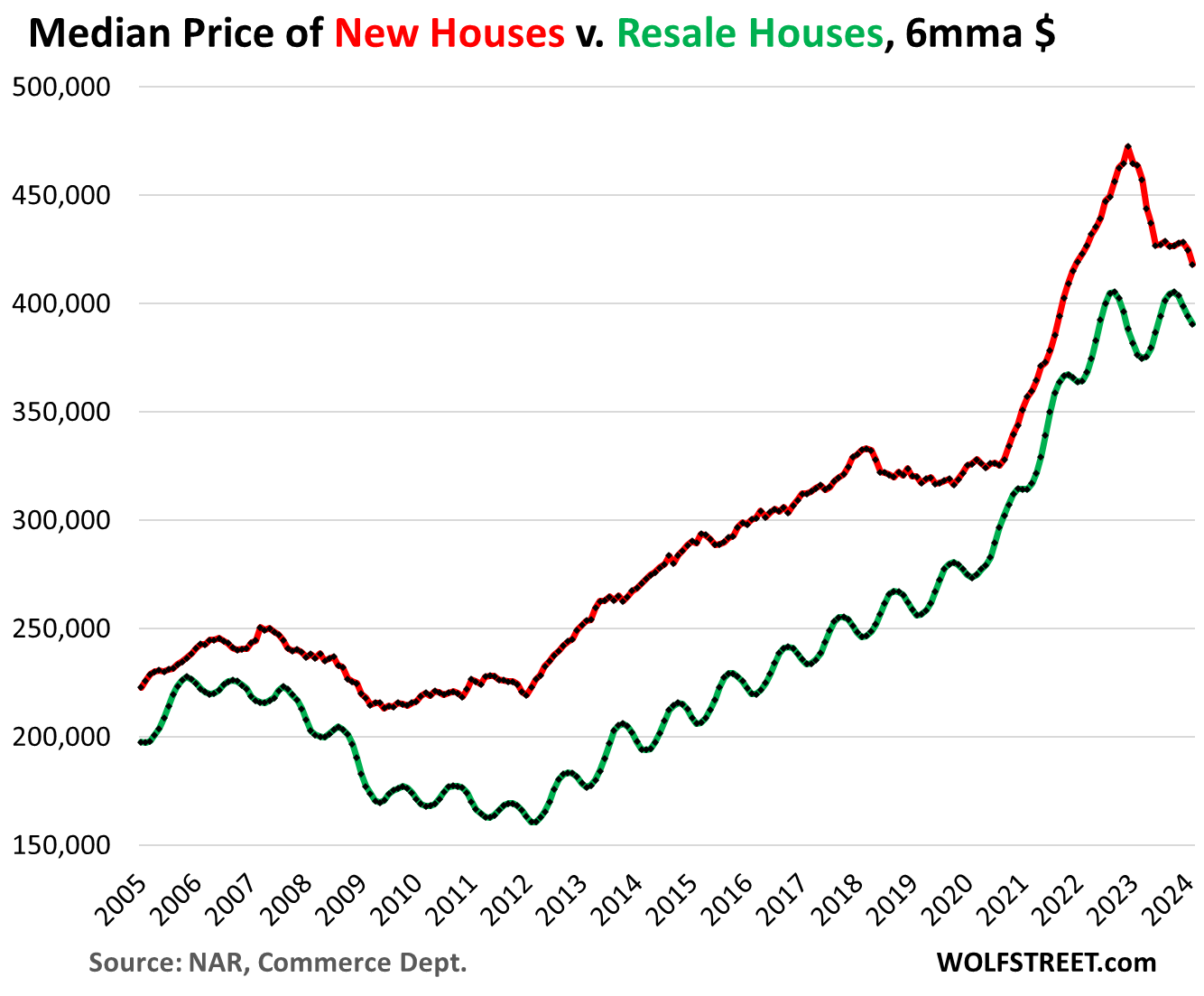

Homebuilders are aggressively taking sales away from homeowners, as the largest homebuilders have explained in their earnings calls. And the price difference between new and resale single-family houses has narrowed in a historic manner.

The national median price of new single-family houses (Census Bureau) has fallen faster and further than the national median price of resale single-family houses (National Association of Realtors).

We’re going to use 6-month moving averages in our comparison to smoothen out the strong seasonality of the median price of resale houses (seasonal high in June, seasonal low in January) and the volatile but not seasonal prices of new houses.

Red denotes the median price of new houses, green the median price of resale houses. We’re going to look at the percentage differences in a moment, which are even more illuminating.

In percentage terms, the median price (6-month moving average) of new houses is now only 6.6% higher than the median price of resale houses. The difference has been in the same range for the past nine months.

If you figure in the effects of mortgage-rate buydowns, the payments on a new house can be less than the payments on an equivalent resale house.

The unusual narrowing price difference – as homebuilders lower their prices more quickly than homeowners – also happened in the leadup to the Housing Bust and lasted well into the Housing Bust. Prices of resale homes eventually fell so much they became competitive with new houses again toward the end of the Housing Bust in 2012.

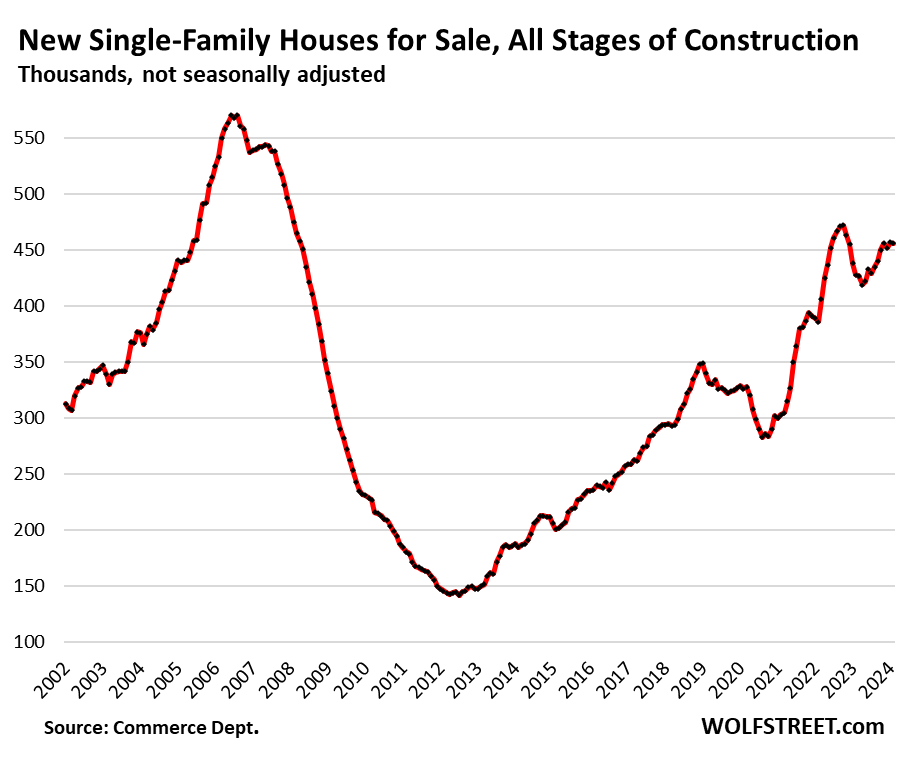

Inventory for sale is very ample.

In February, there were 456,000 new houses for sale at all stages of construction (not seasonally adjusted). Inventory has been in this very high range for months. In February, this inventory translated into 7.8 months of supply, which is more than ample, and a reminder that builders are very motivated to make deals:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

God, I wish this was the same story in Canada. Yes, prices are down 16% from peak but they’re still trading for many multiples of household income (8-10x in the major cities, 6-8x in minor cities. The historical average is 2-4x). Lower highs and lower lows, sure…for now…but if the BoC hits its aggressive QT target, and lowers rates, the Canadian RE insanity will re-emerge.

Canada existing home prices — they had a crazy spike, and didn’t even reverse much during the GFC. But over the past two years, they’ve come down a lot more than US existing home prices. They look more like US new home prices.

https://wolfstreet.com/2024/03/18/the-most-splendid-housing-bubbles-in-canada-national-house-prices-flat-in-feb-16-from-peak-condos-drop-further-on-bank-of-canadas-5-massive-qt/

100%.

Both new and existing have come down a lot more than US, but we’re still well above historical norms for affordability, in part because we didn’t reverse much during the GFC, or during Powell’s last QT experiment (see 2017-2020 in your char). They only person more bullish/insistent on a Powell Pivot than a Wall money manager is a Canadian real-estate investor.

Cheap capital, as in Germany, Australia, Scandinavia, and others, have distorted long standing patterns of investment in RE. We can only hope that global QT will help to correct this malinvestment.

Thanks Wolf!

*Wall Street

Let’s give it some time, not everyone on a 5yr fixed rate mortgage has had to refinance yet. Prices will continue to fall, even if BOC at some point starts lowering we probably aren’t going to see the very low rates we used to have, if we do get them then we’ll be in a recession and homes aren’t going to bubble in that environment either.

Canada doesn’t have the 30 year fixed if I understand correctly so there is no cohort of low-rate locked in homeowners. More supply will come to the market as ARMs reset and people decide they aren’t happy with their home, and either trade up or down based on their finances.

I get low interest rates means inflation in housing prices and higher rates mean higher(increasingly more unaffordable- proportionately to income of course).. but is not the ultimate problem primarily from the usual…another yield scheme from out fascist traitorous elites?..why has housing accelerated so unnaturally relative to its typical 1.5(ish) percent annual appreciation since about the mid 90s?..housing became another source for wall street to sink its teeth into and suck the life out of it…THE LAWS OF CORRUPT CAPITALISTIC PHYSICS…INVESTMENT YIELD For them as action, HIGHER RENTS, HIGHER HOUSING PRICES for us, the EQUAL and OPPOSITE REACTION..

QT is ending in Canada starting next week. We’ll see who wins the battle the short sellers of the Canadian dollar or the Bank of Canada doing everything to prevent the dollar from falling.

The Real Tony,

Ignorant BS. The BOC just announced when and how they will end QT, and it’s not anywhere near.

The BOC lets roll off whatever matures that month. There are no caps. We know exactly what the BOC has on its balance sheet and when those bond issues mature and roll off:

A $23 billion bond issue matured April 1, and that will roll off on the first balance sheet after April 1 (Friday afternoon, April 5, and I will cover it). Then nothing matures until June 1, when $6 billion mature and roll off. Then nothing matures until September 1, when $10 billion mature and roll off. Then October 1, $4 billion mature and roll off. And then nothing matures until March 2025. By the end of 2024, the BOC will have shed about 70% of the assets it bought during pandemic QE, and about 55% of its total assets from peak. That’s a lot of QT, must faster than the Fed has been proceeding.

Wolf, is the % spread between existing homes and new homes similar for the 1st and 3rd quartiles as compared to the median?

Perhaps the trend is similar? I’ve seen lots of for sale signs along FL gulf-side ocean front (expensive) properties south of Tampa. I suspect rising insurance and taxes are mostly to blame. New homes are still being built in these same developments, just not directly oceanfront.

This was about national median prices and sales. If you want local prices and sales, go get your local prices and sales.

These are my favorite articles. I hope this trend continues for years.

There is a new builder from Arizona in my neighborhood (south of Seattle) snatching up vacant lot’s. He’s building high-quality small homes at prices that compare to older homes.

I’ve never seen this trend before. If it continues for long, I’ll consider selling my 60+ year old clunker in favor of new construction.

But whom will you sell it to?

It’s great to hear this, don’t get me wrong, but I’m a little concerned I won’t be able to sell my 1955 California ranch (small) for less than I paid for it in 2020. I’m even fine with not making much of a profit, I just hope it’s not a loss.

Think of that loss as the cost of having a roof over your head for 4 years now. Thats what renters do. And that’s the purpose of a house.

Oh I did and I’m grateful, and glad prices are dropping.

I understand why you sound condescending though. Many people think of a house as an ATM but I never did and still don’t. I would sooner sell a kidney that take out a HELOC.

My concern is not about profit but that the house needs work and since Covid plus inflation the cost of that work is insane. And paradoxically, also hard to find people who will do it!

Anyway, it will all work out in the end, and if it doesn’t it means it’s not the end.

Howdy Bongo. Congrats on paying down personal debt. HELOCs can be great $$$ makers if used for RE investments.

That’s pretty much what I do. I started off building small high quality rental houses. Renters loved getting high end features in a house that wasn’t 3000 sq.ft. I built a beautiful 1400 sq.ft. house in Friday Harbor and another with 1300 sq.ft. – 1 bedroom on the first floor and a 700 sq.ft. apartment on the second floor. I’m just finishing a fabulous 1300 sq.ft house in Tucson on 1.33 acres.

A Clunker is an old car. My sister owns a hse built about sixty years ago. I had a hse built in 2001 admittedly to a tight budget so spec grade. Her hse is much higher basic quality. For one big thing sixty years ago is pre-OSB. It existed but was not everywhere like now. It shouldn’t even be in the code for roof sheathing but almost all new houses here and even multi btw are OSB for walls and roof.

Her floors are ‘quarter sawn’ oak very nice to look at and way tougher than laminate. Lam will show wear over 10 depending on use. And oak floors can be refinished if scratched up.

One dated feature however: the liv room pic window does not have opening side windows and all windows are single pane.

You will get some modern diffs in a spec grade new hse but unlikely to get basic quality of sixty years ago, even if latter was spec. I don’t know if hers was. No one would have used OSB or laminate back then.

Nick,

You can still find fir sheathing homes being built in Campbell River. Most 4 story apt are being properly sheathed as well. I have never used OSB and still don’t, nor do I use Tyvek wrap in my non inspection home area. Houses are wrapped so tightly now that water vapour is trapped in framing and insulation which promotes condo disease. I use tar paper (60 minute) and sometimes two layers on southeast facing sides + perforated tar paper under cedar. Water vapour can simply adjust and move with temp changes and does not condense inside the walls or roof like it does with Tyvek. My brother built his own high end beach front home using the supposed best materials at the time, OSB and Tyvek. He had to replace the bottom 2′ of sheathing on his entire roof after just twenty years. It swelled and rotted. Plus, older homes often have first growth fir framing as opposed to bug-kill spruce found in most lumber yards.

Furthermore, houses are so well wrapped these days Code now requires a constant fan circulation of outside air. My inlaws have to open a window to get their wood stove burning properly, (Pacific Energy wood fireplace).

The savings between OSB and standard fir sheathing isn’t that much these days. Builders with that sharp of pencil will be cutting back in other areas, too.

I worked building houses in my teens around Duncan and in Victoria, 50+ years ago. When I find our past projects they look as sharp as ever. My daughter has a 70 year old miners house in Ladysmith. Wonderful little place with sound framing and edge grain fir floors. All it has required was updating and some dolling up.

My new tract home I bought last year in south Texas is very tight. When they were building it, I noticed the fresh air intake duct install being laid in place and I asked about it as I had never seen that before. The answer was it’s code and these homes are so tight, make up air needs help.

How true, this rectangular 1,479 square foot box I live in is tight as a drum and elec/gas costs are very low compared to my last 25 year old home.

I think this is just a new form of shrink-flation. I could not find data for sales price per square foot, but for median listing price per square foot January 24 is only slightly off the all time high in June 2022(227 vs 224). Even though prices are coming down, what you are getting for that money is also coming down. While this data contains both new and existing homes, new construction home sizes have been trending lower now for several years.

Is there any data available that looks at prices on a square footage basis? Or are prices solely down because they’re building smaller houses?

Prices are down in every possible way a homebuilder can get the price down, and so homebuilder margins have shrunk (though they’re still fat) and houses have shrunk (though they’re still big).

You can see how aggressive their pricing is getting because they’re cutting into the gross margin.

So DR Horton, largest builder in the US, gave up 4.5 percentage points in gross margin over the past two years to make those sales:

Q4 2023: 22.9%

Q4 2022: 23.9%

Q4 2021: 27.4%

Note that the surge in constructions materials costs and costs due to delays and shortages was abating by mid-2022 and had mostly gone by the end of 2022.

Hmm…I wonder what Apple/Google/super high-tech margins look like compared to these home-building ones (home-building having been performed since time immemorial)…

Important to also note that DR Horton’s current gross margin is in line with pre-pandemic levels. It’s not like they’re giving up a lot to get these sales.

Q4 2019: 23.29%

Q4 2018: 21.82%

Then you have other builders like M/I ($MHO) that are killing it in today’s market.

Q3 2023: 26.92%

Q3 2022: 26.84%

Q3 2021: 25.12%

Q3 2020: 22.84%

Q3 2019: 20.54%

Well, yeah, prices are heading back to pre-pandemic levels too, it seems.

Nick Gerli had a good stream on X/Twitter about square footage. The difference in sqft in the median house is about 6% reduction since 2020 so in his opinion nearly negligible. He also mentioned that the standard financing rate is a 2% teaser for the first year and 5% fixed going out so that can almost add up to like $40k extra reduction in cost. That comes to a house near the cost prior to the run up.

Love Nick,

From his latest video:

“ Home builders like Lennar have cut prices on new houses substantially over the last several years. With the average selling price on a Lennar house in Q1 2024 being 16% below the peak in 2022. With prices in Texas dropping by even more, down 24%.”

Nick has a great YouTube channel and he has said some nice things about Wolfstreet in the past as well.

lol. Nick Gerli. The guy who definitively called the ‘top’ of the real estate market in June 2021. One of the biggest, data cherry-picking, click-bait crash bros out there. Can’t believe people watch his garbage. I can only believe it must just be selective bias from followers who desperately want or need the real estate market to ‘crash’ so they can buy a home. He is a renter who is one of those people who has been waiting to buy after the crash…for three or four years

Yes – but it’s not just price per square foot. Builders are cutting costs wherever they feel they can get away with it – without impacting consumer demand. Vinyl siding versus wood or brick. Vinyl windows versus wood or aluminum clad. Vinyl flooring versus wood or engineered. Quality of everything being stripped down… and then toss in a shiny new low-end refrigerator from Korea and as long as it has a stainless steel skin people don’t care. We’re renting in a “new” housing community while we build elsewhere, and our “new” refrigerator lasted less than 18 months. Our landlord simply paid to have a new one installed… the old one went to the landfill. So price is falling – but so is what you get for your dollar.

All appliances are like that anymore unless you drop a load of cash. Everything is disposable anymore. Kenmore is a thing of the past.

Existing Home Owners haven’t figured it out. Prices, even in SoCal, will drop. Only the well off can afford an SFR. Otherwise, you will have an inevitable housing crisis or nasty political situation earlier than expected. What’s amazing is an entire generation satisfied with renting forever.

Howdy 3% Prisoners. No point in you folks even reading another great Lone Wolf Article. Will the NEW loan have points added, origination fees, a teaser rate, balloon rate, and you may need a bridge loan too. Think before riding the New Home Wave Bubble. Boy, Youngins, you is gonna have ta download quite a few loan apps first….

Looks like my roommate at the sunshine mental home is missing.

Here at the home in bullhead city arizona.

Looking to purchase another house/ mobile to rehab. Slim Pickens, many others doing the same thing. Sometimes being lucky is better than being good. Prices seem stable, nothing notable. HA HA HE HE HO HO.

Two- things some commenters here frown upon are house rehabbers and those who think a house is just an investment. To those who feel this way, your right.

Howdy Home Toad. Competition was always fierce during my RE / rehab career. Only time the competition lessened, was during the beginning of housing bust 1. Rehabbing RE was the best fit for me and many others. Never found a non rehabber to ever agree with anything I say or type either. Just the way we like it?? HEE HEE.

Wants vs. Needs economy, insurance is up across the board, property taxes, and medical costs. In Denver the mayor has figured out that 50,000 additional migrants can bring down a city budget. I heard Austin, TX demand is in the tank. There are pockets of excellence all over the country. Gen Y and Z target should be within 2 hours of any major airport. Travel and enjoy your life, too much emphasis put on housing cost that now run 45% of your monthly salary. OMG if I hear or read one more complaint of how overcrowded or congested Florida has become I will scream.

I live in Florida. Lived here for 60 years. It is getting sooooo overcrowded and congested. Paradise lost.

Pretty decent objective measure is just to go to Wikipedia and get population density per state.

TL,DR…most states are still pretty damn empty…even those with better winter weather.

Florida is definitely growing…but unless hype-compelled to live in Miami…there are still plenty of more reasonably priced alternatives with good weather (Jacksonville, Ocala, Gainesville, the Panhandle, etc.).

And it is like humanity has lost knowledge of the existence of the southern 65% of fairly damn big Georgia. Apparently also lost knowledge of Google Maps.

Price spikes occur because absurd over-attention is paid to tiny areas…while ignoring adjacent areas.

For example, tech companies correctly de-camp from Silicon valley due to insane RE prices…move to Texas as an absolute price haven (definitely correct pre-boom) but insist upon not only Austin (pricier than 90% of TX at this point) but moreover insist upon new-skyscraper *downtown* Austin and then wonder why they are only saving 20% off Silicon Valley.

Move 5 miles in essentially any direction and they could save 50%+ relative to SV.

CAS – isn’t this the longstanding nature of urban ‘sprawl’, whatever state one’s in? (Master Berra’s ‘it’s too-crowded’ axiom always at work…).

may we all find a better day.

Skilled workers are the natural resources of tech companies. You can’t just put headquarters in the middle of a ranch in redneck Texas and expect an army of skilled techies to follow you purely because living in the middle of nowhere is cheaper.

Austin has an ecosystem which is attractive to tech workers. And if anyone can afford to live in the top 10% most expensive areas of TX, they can.

I seriously doubt anyone has moved their company to Austin and then actually verbalized this “wonder” you speak of.

Re: “ The fact that sales of new houses are hanging in there despite 7% mortgage rates shows that homebuilders have figured out this market, and they’re running circles around homeowners trying to sell”

This is fascinating and a good example for a resilient post-pandemic economy and fits into the notion of innovative finance — and accounting.

It’s actually an interesting convergence of Airbnb mentality for flippers and new age entrepreneurs that are gumming up traditional home inventory, alongside Wall Street home speculation and this cross current of aggressive smart home builders.

Then of course toss in the tsunami of people with 3% mortgages who are insulted from Fed rates and a shadow generational wealth transfer, etc, etc. — it all adds up to a complicated big picture, which does make this seem, like this time is different.

Nonetheless, as rates stay higher for longer, the margins and cash burn are likely to become increasingly chaotic.

I grew up thinking apartments were mostly rentals and single family homes were all owned by the family living there (plus maybe the bank). I did learn condos were a thing long ago.

But with the discussion of corporations buying “all” the homes in America, I have tried to find data indicating what % of multifamily units are rentals and what % of SFH are rentals. And also who owns these tentals? Is it a person that has <25 units, a local company thay has a few hundred or national corporations with thousands of units? Does anyone have firm DATA? I have seen a broad spread of numbers and am not sure what to believe. I would like to see the data split between multifamily units vs SFHs. Perhaps I am just not searching correctly.

Some articles state this is a huge problem, others state it as a nonissue. Thoughts?

I am wondering if this is only occurring in a handful of areas in the nation – perhaps cities with the very highest cost of housing? Thanks

Same basic data on who owns the US housing stock:

There are 146 million housing units in the US:

Of the 132 million occupied housing units:

Of the 45 million rented housing units:

Of the 14 million single-family rentals:

(Data via John Burns Research & Consulting, based on its own data and data from the Census Bureau)

Howdy Lone Wolf. Incredible information you just posted. Looking forward to your article about New Home Construction in the coming months…

But, BlackRock!

Yes, I had fun with one:

Title: “No, Blackstone Didn’t “Buy 17,000 Houses” out from under Desperate Homebuyers. And BlackRock Didn’t “Buy a Whole Neighborhood.” But Built-to-Rent is a Huge Change”

Subtitle: “Internet BS made from twisted headlines is fun to spread. But reality is a lot more interesting.”

https://wolfstreet.com/2021/06/22/no-blackstone-didnt-buy-17000-houses-out-from-under-desperate-homebuyers-and-blackrock-didnt-buy-a-whole-neighborhood-but-built-to-rent-is-a-h/

Thank you!

I very much appreciate this information!

What will happen to modest homes in a beach area where there is no land and 2 million dollar houses are being torn down to make way for 5 million dollar houses? How will the availability of land effects prices?

1. Sell the home for $2 million and take this manna from heaven and go somewhere else.

2. Don’t sell and stay put and enjoy life.

I am hopeful that all of this is just beginning of a significant & continued downturn in ALL home sales. Prices across the board still have a long way to fall. The Fed lowered rates to the point that millions of households are locked into their homes. The REAL question is how many of those refi’s were 90% or at least significant enough to create continued lock-in if prices fall nationally by 15-20% over the next 18-24 months? The Fed has this data.

Whenever the Fed starts to lower rates, I will bet that the 30YFRM will fall an extra 25-basis points for every equal drop in the FFR over the first 100-basis points of cuts. If the Fed drops the FFR to 4.5%, the 30YFRM will easily drop to 5%. But, I don’t see the Fed dropping rates by more than 25-basis points unless it’s clear that a recession is looming.

Right now, there’s no such tea leaves pointing to this happening over the next 2-4 months. Later Q4 becomes a possibility. Looking forward to the March economic data. I don’t foresee any meaningful indicators popping up to the negative before late summer. The $2.12T in deficit spending continues to create legs for the labor market.

How would cutting FFR would bring mortgage rates down ?

It’s a sincere question.

FFR impacts short term rates.

FEDS QE and QT impacts long tern rates.

Mortgage rates are tied indirectly to 10 year yield

Unless fed starts buying 10 yr bond ..mortgage may not fall.

Also us govt is running record deficit and with no qe.. bond yields may go up when govt would need to sell bonds for deficit spending and Fed no more doing qe.

The FFR is connected to all rates in so far as the perception that the Fed is achieving its goals. QE & QT touches all maturities as the Treasuries roll off. Over the last 20 months, this has mostly been bills but also has been shorted dated notes. Ultimately, what really affects Treasuries is demand. Well, when the 10YT fell below 1% from the Fed’s lowering of the FFR to .25% and the buying of MBS, then those factors & others had a material impact on the 30YFRM. And again, I’m only talking about that first 100-basis point drop. From there, it will be a sliding scale of less & less effect on the 30YFRM.

If the Fed lowers by 75-100-basis points, then there will be clear signs of a deteriorating labor market / economy which will force the 10YT lower. Personally, I think the economy is going to continue to hold up well. At most, we’ll see one rate drop late this year.

At some point, the bond vigilantes are going to revolt due to our excessive debt. You and I believe that day is coming, but it’s not quite here yet. Personally, I believe $40T is the point at which the massive debt load starts to affect the Treasury bond auction market, whereby bond buyers demand higher yields. That’s about 2.5 years off.

One initial gut reaction to this housing sales is to ponder cannibalism.

The pandemic has altered our thoughts about what the housing pie looks like and how many slices it has.

Nonetheless, this aggressive reaction by builders to take advantage of unusual market conditions — probably is a matter of all these companies ending up — stealing market share from each other, as well as stealing shares from existing home owners.

Steal, is perhaps the wrong word, but essentially and theoretically, the pie probably can only be sliced into so many pieces.

Bottom line, we’ll see losers in this pie fight and this even smells a bit like a deflationary black swan, where the baby hatchlings don’t have a happy ending.

Howdy Redundant Also think in terms of a light and fluffy airy cake.

“In February, there were 456,000 new houses for sale at all stages of construction”

Wolf, I know this article is about the nationwide “bigger picture” trend – but is there any geographic breakdown of this new homes data? I.e. the # of units by state or county.

You can look it up, if you’re interest in it.

Look at builder websites – DR Horton, Lennar, etc.

If only there was increased supply of new homes in the North East.

The Boston metro area has basically painted itself into a corner with too many single family homes and too few multifamily. This basically forces everyone to buy or rent an hour away (or more) from the city center.

And that lovely Boston commute is further complicated by the general absence of functional public transportation since few people in MA are interested in exchanging their fancy European luxury cars for a bus/train ride anyway.

The northeast is an analogy, as it’s too built up in my opinion for much more. Sure, you can build tons of multifamily, but then you have infrastructure problems.

Maybe it’s just not a great idea to shove 50 million people in a small area between Boston and Northern Virginia?

Might be more than 50 mil…NYC metro alone is 20 mil. Then there is Boston, CT, NJ (basically 70% NYC suburb), Philadelphia, Baltimore, and DC…and all the close-in cities.

Supposed to be *anomaly. Damn.

Not only that, but the open land that does exist is heavily forested. Just look at all the green on google maps between 128 and 495.

Large open areas that can accomodate a whole new subdivision don’t exist here. Perhaps that’s why Boston metro existing home prices have remained sticky – less competition from new houses.

“general absence of functional public transportation”

MBTA = Money Being Thrown Away

Anyone know why the homebuilder stocks are near record highs if sales prices are lower? Perhaps a shorting opportunity?

Anyone know why Nvidia is at $950, with a $2.4 trillion market cap? Look, stock prices do what they do because they do it 🤣

I was going to answer JustAGuy by saying that people believe homebuilders will do well when (if it happens of course) interest rates come down. But Wolf’s answer of “because they do” is probably better. 🤣

I don’t actually know of course, but my guess is it has to do with the thesis of this article. None of the people competing with DR Horton in my subdivision, for example, are actually selling their houses.

Howdy JustAGuy. Homebuilder stocks should soar for a few years. Millions of prisoners that cannot sell old houses, and all NAR realtors and agents lined up against buyers of old houses. Plus, what better way to keep the RE bubble from popping too fast. Pump more air????

Not the case in San Diego. Prices here went up 6% in one month and are holding at all time highs despite the high rates

San Diego too would fall as it is not immune to rates.

I have homes in socal but I don’t track the prices.

Thanks WR for the report.

Things are moving in right direction but median price does not mean a lot .

Case Schiller prices need to fall a lot .

I don’t see prices going down unless recession unemployment happens big time

So far this rate hikes has been proven to be a dud either when it comes to taming inflation or asset prices.

All we can do to protect our selves is to stay invested.

Usd has already lost 60 percent of its purchasing power in last 4 years when it comes to essentials of life for common Joe.

Jon, rate hikes have so far proven to be a dud in my opinion because the wealth in this country is so concentrated.

It seems that everyone who owns assets can hold off on selling, and thus, wait out this “blip” of higher rates until the glory days of ZIRP and QE are back.

In other words, people would be rushing to the door to sell stocks if they knew 5% FFR was permanent. But they think that ZIRP is right around the corner, so assets are priced for ZIRP. Nobody NEEDS to sell, so we’re in a stand off with no selling pressure.

This mentality is pushing over to housing as well. It’s not a recession that is needed, but for something to break the mentality that all assets only go up.

Anton:

1. RTGDFA, it was about new house prices falling, not resale prices. You’re talking about resale prices.

2. California Association of Realtors, resale prices — BTW, the two peaks aren’t seasonal, the first was in May 2022 and the second was in August 2023.

If I am given an option I’d always buy a new one and i intend to buy a new one in next few years .

SD has lot of inventory coming in in multi family homes and there is lot of pressure on pricing as monthly payments are at really absurd levels.

We need asset markets to fall big time for things to come back to normal.

“Time is money. And money is money too..”

But unfortunately money is never time. Doesn’t matter how much you have, you can never buy a single minute past your inevitable end.

I’ve made and lost and made again large sums investing over the last four decades. Honestly looking back I probably should have just bought a whole street of houses in a decent neighborhood in a Sunbelt city in the 80s and spent my time enjoying life.

Well…money is time when you hire somebody to do something you rather not waste time doing.

If only new construction grew fast enough in SoCal to diffuse some of the bubbles quickly. Despite all the zoning reforms at the state level outmaneuvering local nimby, does anyone know why CA isn’t building fast enough?

California, including southern California, has lost population in recent years, and home sales are way way way down from a few years ago. And there’s quite a bit of construction going on too including in Southern California. So your first line doesn’t make sense. In urban cores, nearly all of the construction is multifamily (condos and apartments mostly at the higher end). New single-family developments move further out. People choose based on their preferences.

just in the UK this is not happening…apparently

Build baby build!

Although many commenters here point out that their region is still at all-time highs and lacks new construction (mine included), more construction across the country could lead to people moving out of those ATH stagnate SFH construction regions, thus alleviating some pressure.

New building at reasonable sizes appropriately-discounted is becoming the only viable way to own in the US.

The dislocations are yawning and have quite a ways to go to close. I don’t know why any young couple or family would buy in the US if they can at all avoid it until prices sink 30-50% from here.

My wife and I have been looking and you can still get 2-4 sizeable estates almost anywhere in the Mediterranean (except the French Riviera) for what a terrible house in a generic US suburbs costs. Go and work remotely if you can!

There are still people around here doing the WFH thing if their career choice and personality supports it. My son in law started doing it several years before Covid. He starts work at 6:30am and only leaves his home office at regular break times. He finishes up around 3:00pm. He sets these hours to link the time changes as his cohort is spread across Canada. He could live anywhere as long as he has high speed with peace and quiet.

Otherwise, people have to live where their work is, pure and simple. If it’s in Boston, so be it.

Where I live a cheaply made new townhouse with no basement and no backyard starts around the 2 million dollar mark. As you move 5 miles west the same new townhouse starts around 2.5 million dollars. New home prices are out of reach for most Canadians.

Wolf,

Your esteemed and respected colleagues over at the financial(cough) web site starting with a Z have interpreted ( or made up) the data differently.

“US Home Prices Rose For 12th Straight Month In January, Despite Soaring Rates”

Wolf’s article is about NEW home prices.

The ZH article, which I haven’t read, is probably referring to today’s release of the Case-Shiller National Home price index, which reflects EXISTING home prices.

Hubberts Curve,

I assume what the ZH article references is the Case-Shiller which came out today, which are resale house prices, not new-house prices, and the 20-city index actually declined month to month but was up yoy because the index is not seasonal and the peaks and troughs are not lined up seasonally so yoy comparisons are skewed, and have been skewed up and down for the last two years. More in a little while. stay tuned.

I enjoy things Melody Wright posts versus ZH stupidity:

“Case Shiller Home Price Index (Jan data includes closed, repeat sales for existing sales only from Nov-Jan)

-.10% Month-over-Month 📉

+6.03% Year-over-Year “

Comment from Melody Wright last month, which is far more believable than anything ZH can dream about:

Trouble in the Triangle

MELODY WRIGHT

MAR 10, 2024

I absolutely love learning. If I am not learning I am not happy. This is why I often find myself at the end of the road of one challenge looking for the next. What I love about learning most (while also hating it) is how you start the journey as if in a fog, drinking water from a fire hose. That feeling can be one of the most overwhelming and disorienting feelings humans experience. It’s the “freeze” that occurs before fight, flight or fawn where your instincts drown out reasoning. For some, that feeling alone keeps them from foraying into new territory, especially if they had impatient parents or teachers who stung or humiliated them as they were learning to learn.

But, if you can withstand those first moments of humiliation and terror, you will find small islands of comfort and little by little, you will feel the ground beneath you start to firm as you gain confidence through the repetition of knowledge consumption. One of my favorite phrases of all time captures this perfectly: Повторение мать учения, or repetition is the mother of learning.

And, once you find your confidence you are free to go diving far deeper into the intricacies and nuances of your chosen topic as you uncover missed understanding that occurred while you were drinking from the fire hose. Once you reach this stage you can again feel like a total moron, but also achieve a far greater knowledge which brings me to a discussion of home prices. Case Shiller came out last week as I was navigating a family move that involved multiple households and I had little time until now to digest the news. So, what did the media have to say about the data release?

Are home prices rising or falling? According to the seasonally adjusted Case Shiller Home Price Index, home prices rose, but the non-seasonally adjusted data shows a different picture. Additionally, Case Shiller is one index as we’ve discussed which only tracks existing homes (not new) and is a repeat sales index that uses quite a bit of data manipulation such as excluding “data related to homes that sell more than once within six months.” Additionally, the data is very delayed. We received December data on February 27th. If that’s not bad enough, the index uses a three-month moving average which includes sales from October, November and December. And, on top of that, many of our more populated counties (heavily weighted in this series) have serious recording delays – sometimes up to a year – meaning that the first look is likely missing key data.”

I’ve always been an existing home guy, but lately I’ve come to acknowledge the benefits of new homes. Fresh styling, no remodels or repairs needed, functional floor space (no wasted space). I like the character of some existing homes but I worry about styling being somewhat out of date or worse yet, getting out of date after a purchase. For example, what is going to be the status of those round Greek-looking pillars in 10 years?

Existing homes clearly have the better lots. The lots they build on nowadays are barely suitable for canine alleviation.

For me, I like old with charm (meaning pre-WW2), or I like new. I don’t like the “in between,” like the awful architecture of the 1950s and 1960s, with the cookie cutter raised ranches or split levels.

I am the same. I used to want to buy but now I figure I’ll be forced to build. I’ll get what I want and help resolve the shortage. With every cheap starter home grabbed by flippers there’s no way for a bargain there. I can build something reasonably sized and new, and in a way the allows me to expand if needed (or the next guy).

Nothing worse than getting a bad case of FOMO then paying top dollar for a marginal house during a hot market, then realizing it’s out of demand a couple years later when things aren’t so hot.

Even when the existing houses look good they often have expensive work that needs to be done (roofing, plumbing, heating, moisture issues, mold, electrical/lighting issues, etc.) if they were built more than 20 years ago. A lady at work just had her venting redone because rodents had chewed out the vent work underneath the house. How many inspector are going to check that out before purchase? Last time I bought a house, I had to twist the inspectors arm for him to look in the attic underneath the roofing.

Howdy Young Prisoners. Trying to uncuff those shackles? HELOC maybe???….. Become a small business owner??? Forced to move? Have the courage to own rentals?? Wanna purchase that new home maybe ???? ZIRPed and confused???? Continue reading the Lone Wolf Articles on New Residential Construction. Sure to be a Bubba Bubble Best in the coming years…. NO crash, Boogie time for inflation and disco dancing…….

DFB

Prisoners ?

Now that’s just silly.

No one is a prisoner of a low interest mortgage rate.

To follow your “logic”, homeowners with a paid off mortgage are prisoners as well.

Your concept is just silly. Like the rest of your posts…..

Howdy Outside The Box Years of ZIRP. Moving will cost more. The asset has gained in value but so has every one elses. ZIRPed to stupidity is what I like to call it….

DFB

Typical real estate sales mentality.

“Ya gotta move”

There are tons of homeowners who stay in their home for years and years and years. They stay because they like it where they are. These folks move out of their home directly into an urn.

People who want to move and move and move are overwhelmingly renters.

I get it. You made money because of churning RE sales.

That’s all YOU see. I see hordes of folks who remain in one place because they like a sense of place.

Howdy Outside. Divorce, jobs, death, lots of reasons to move. The average ownership of a house was 7 years during my RE career. ZIRPing and Govern ment created bubbles has my ire and took away Freedoms.

Finally, some sense. People with low mortgage rates are not locked in. But those who would need to borrow to buy a new home may be locked out by high rates and prices.

MW: California homeowners face an insurance crisis. What will it mean for home prices in the state?

Floridians face a similar crisis. Wildfires in California, hurricanes in Florida.

Howdy SoCalBeachDude. ZIRPing in the USA . Things will never be the same as far as I am concerned. Bubbles everywhere………

Bubbles everywhere, Bubba posts everywhere. Coincidence??

Howdy Dirty Work. Love to click. Bad back relief….

Wow. I was wondering if the $420k would hold and we dropped even lower. These graphs are very encouraging for future home buyers as prices are dropping. Most commodities are still dropping from their peak 2022 prices and are now back to 2021. Maybe still higher than pre-pandemic but they have dropped 30% to 40% from the peak. You would think restaurants would lower their prices now that some of their inputs have dropped 30% or 40% but labor and rent costs probably negated the drop in input food costs?

Anyway, falling real estate prices and commodities are good signs for and it appears the FED is taming inflation and they a plus is they quickly reversed the raging inflation of 2021 through 2023.

Anyway….home prices dropping is a positive.

Howdy ru82 and YEP, home prices normalizing will be wonderful. Makes me wish Govern ment would quit picking winners and losers….. NO more ZIRP for you???? HEE HEE

You would never know this to be the case according to CNN’s latest headline. They’re claiming prices have rose.

End of March update from my little slice of flyover.

Mild winter, no…or very limited frost, The spring rush started in February.

Phones finally slowed down this week. I would expect to see good numbers for March & April new builds.

We will see if the pace for new home builds holds up.

Very quite on existing homes.

Builders I work with have cut the dead weight from their crews.

The work when they want to are gone. Takes away the friction on the

jobsites.