How far can QT go? Quite a bit further.

By Wolf Richter for WOLF STREET.

When Powell was asked at the post-meeting press conference today about QT while the Fed is cutting rates, it triggered a discussion, which he started out with: “We’re not talking about altering the pace of QT right now, just to get that out of the way.”

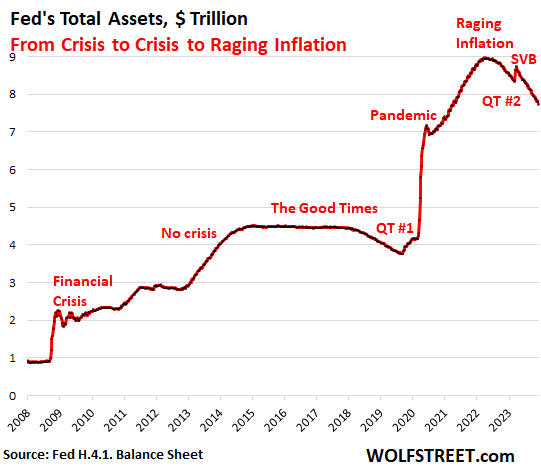

The question arose because the Fed said in its policy statement today that QT would continue on autopilot, even as the median projections by FOMC participants saw three rate cuts in 2024. QT has already reduced the balance sheet by $1.2 trillion, and Wall Street hates QT. It wants QT to stop.

And so the hope is that by the first rate cut, the Fed will have ended QT because QT is a mechanism to tighten, while cutting rates is a mechanism to loosen monetary policy, and continuing with QT while cutting rates would bring these two mechanisms into conflict, and that therefore the Fed would stop QT before it starts cutting rates. That’s the hope.

QT while cutting rates.

“They’re on independent tracks,” Powell said. Whether the Fed can keep QT going while also cutting rates, or whether it would end QT before it cuts rates, comes down to why the Fed is cutting rates, he said:

If the Fed is cutting rates in order to go “back to normal,” with the economy growing but inflation low, a scenario that the Fed’s Summary of Economic Projections today projected, the Fed could keep QT going while cutting rates at the same time.

If the Fed is cutting rates because the economy is “really weak,” as Powell put it, the Fed could halt QT while cutting rates.

“So, you can imagine, you have to know what the reason is, to know whether it would be appropriate to do those two things [QT and rate cuts] at the same time,” he said.

How far can the balance sheet drop? RRPs and Reserves.

“The balance sheet seems to be working pretty much as expected,” Powell said. “What we’ve been seeing is that we’re allowing runoff each month. That’s adding up. I think we’re close to $1.2 trillion now. That’s showing up….”

Yes, it is showing up, as we discussed last week:

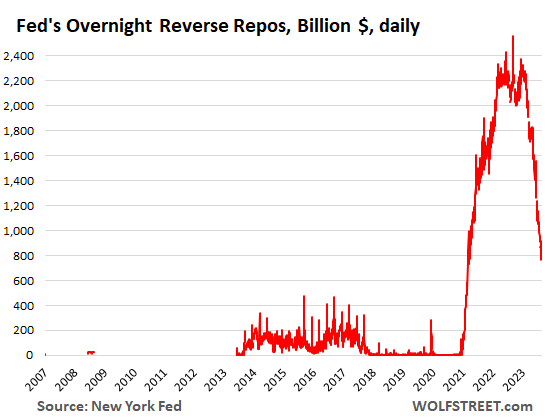

“The reverse repo facility [RRPs] has been coming down quickly,” he said. “At a certain point, there won’t be any more to come out of, or there will be a level where the reverse repo facility levels out, and at that point, reserves will start to come down.”

With these overnight reserve repos (ON RRPs or short RRPs), which are a liability on the Fed’s balance sheet, not an asset, the Fed takes in cash mostly from money market funds and pays interest of 5.3% (we explained it here).

The balances of RRPs have dropped as money market funds have pulled out their cash and bought Treasury bills with them, of which the government is issuing a huge amount, and which pay more than RRPs, around 5.5% for maturities of four months or less, which are the maturities that money market funds primarily buy.

The normal amounts of ON RRPs is close to zero. Balances surge only under excess liquidity during the latter phases of QE. But then under QT, they drop and go back to their normal state.

That’s what Powell meant when he said, “At a certain point, there won’t be any more to come out of [RRPs because they’ll be at zero], or there will be a level where the reverse repo facility levels out.” Going back down toward the zero line is their normal state:

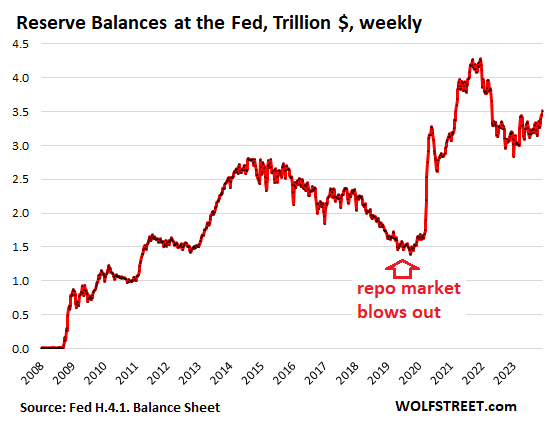

“And reserves have been either moving up as a result or holding steady,” he said. Reserves or reserve balances are cash that banks put on deposit at the Fed to earn 5.4% interest. They’re a liability on the Fed’s balance sheet, not an asset.

“At a certain point, there won’t be any more to come out of [the RRPs], or there will be a level where the reverse repo facility levels out, and at that point, reserves will start to come down,” he said.

Reserves jumped to $3.51 trillion on the Fed’s balance sheet, released last Thursday. They represent excess liquidity in the banking system. After RRPs have been run down to about zero or have stabilized at low levels, according to Powell, QT will then begin to draw down reserves further:

“We intend to reduce our securities holdings until we judge that the quantitative reserve balance has reached a level somewhat above what is consistent with ample reserves,” he said, a reference to the Fed’s “ample reserves” regime that it coined following the repo market blowout in late 2019, when reserve balances had fallen so low that banks weren’t lending to the repo market any longer, which had caused repo rates to spike and contagion to break out, triggering the Fed’s bailout of the repo market.

Back then, the repo market blew out when reserves had dropped to below $1.5 trillion. The “ample reserves” regime attempts to keep them above that magic line in the sand. As everything has grown since the end of 2019, the magic line in the sand has likely moved up some and by 2026 might be around $2 trillion.

“When reserve balances are somewhat above the level judged to be consistent with ample reserves,” the Fed will “slow and then stop the decline in size of the balance sheet,” he said today.

“We’re not at those levels, with reserves close to $3.5 trillion,” he said. “We’re watching it carefully. And you know, so far, it’s working pretty much as expected, we think,” he said.

So I’m just putting two and two together: There are $823 billion left in RRPs as of today that can come out via QT. Then reserves can be drawn down to the magic line in the sand of “ample reserves.” If this occurs in 2026, with QT on autopilot, the line in the sand might have moved to $2 trillion, and the Fed could until then draw down the reserves by another $1.5 trillion (from $3.5 trillion now), which would amount to roughly an additional $2.3 trillion in QT, on top of the $1.2 trillion in QT already under the belt, for a total of about $3.5 trillion in QT, knock on wood.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The FED’s balance sheet ain’t EVER going back to normal, and QT will stop well short of ever returning to pre-pandemic levels. You can be assured of that. Anybody who believes otherwise is delusional.

Bernanke and his greedy, filthy experiment, with the blessing of CONgress, has permanently altered the course of the USA, and turned it into a giant graft racket for the wealthy who get to fleece the rest of society in order to enjoy lives of opulence almost unheard of in human history.

So I take it you didn’t get an invite to Bernanke’s birthday party which is today.

He wasn’t invited.

And with good reason. DC obviously has no training as an economist and just likes spouting nonsense.

The Fed are just PEOPLE doing the best they can with the information they have. They don’t own working crystal balls, you know. They’ve done well at keeping the GFC from become Great Depression II and the economy from tanking in the pandemic.

Now we’re paying the cost of that but it seems to me that this cost is worth paying for the pain we avoided.

Of course they could have done better. But isn’t that true for all of us on every important decision we’ve made in our lives? Such things are only obvious in hindsight.

@Brian,

DC is largely correct, and you have bought into the propaganda. There’s no such thing as a free lunch. This money that the Fed spent on QE will have to be paid back, and there will be hell to pay. We somehow survived more than 200 years of recession and growth without the Fed doing QE, and it has opened Pandora’s box to the current inflation.

Happy1, agree.

Stealing 25% from people’s savings to prevent a minor crisis is not “doing the best they can”

Did either of you even read what I wrote? I didn’t say there wasn’t a cost and I didn’t say things couldn’t have been done better. I said that the cost may be worth the gain (of no GD2 & no pandemic economic crash).

I also said that all of this is only visible in hindsight. And you’re completely discounting what would have happened had they acted differently (because that isn’t included with hindsight).

@Brian, the Fed really messed up big time when missing the boat on inflation in 2022 and insisting it was “transitory”, while pouring more QE fuel on the fire. It was either shear incompetence or evil planning. I’ll give them the benefit of the doubt and call them criminal idiots. Either way, they all deserve to get fired.

I am omnipotent. People really believe my “soft landing” story.

Everyone is busy either justifying / celebrating my actions, or giving reason to whatever I pull out of my a**.

maybe if lucky someday the derivatives market could blow up

but I doubt it given

TBTF fed

And yet there are no signs of a recessions…

Warren, if you do not see signs of recession try walking around San Francisco. Check out Embarcadero shopping center, or any mall or whatever.

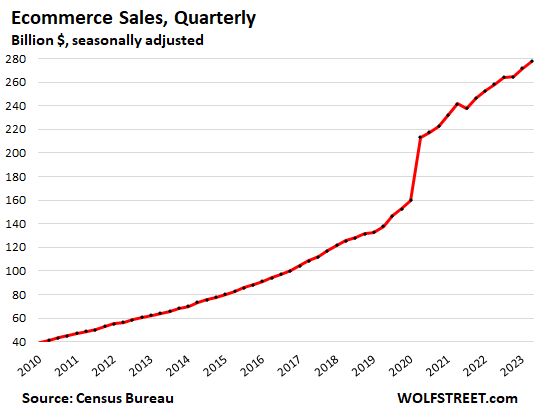

LOL. The US Brick and mortar meltdown, so called by yours truly starting in 2016 when ecommerce started killing brick and mortar retail around the US, from Sears on down. Did you miss all that? This has been a standing feature of this site for 7 years.

Google the phase: brick and mortar meltdown

Or you can go straight to here and get the whole series of 7 years:

https://wolfstreet.com/tag/brick-and-mortar-meltdown/

Here are department store retail sales:

And here are ecommerce retail sales:

“The FED’s balance sheet ain’t EVER going back to normal,…”

What’s “normal” for you? Zero? $800 billion as in 2008? Nope, cannot happen because of the liabilities on the Fed’s balance sheet: Cash in circulation, reserves, RRPs, and the TGA (the government’s checking account.

I wrote this about 15 months ago to explain the relationship between these liabilities and the assets, and it still holds: The total absolute floor would be $5.2 trillion in 2022 figures and higher in 2026. So around $6 trillion would be about “normal.”

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

I don’t know the name of the derivative/instrument but just like federal funds futures, Bloomberg has a chart of Wall Street’s forward expectations for balance sheet runoff. There is currently a 0.00000% chance QT ever gets the balance sheet down to $6 trillion. Just like how federal funds futures predict that rate cuts are a certainty next year. Wall Street is expecting QT to end some time in 2024.

Yes, and Powell quashed that today.

To be fair to those saying that amount of QT will never happen, it’s hard to imagine getting through 2026, with continued autopilot QT, without recession, war, pandemic, or some black swan to derail it. But short of that, fingers crossed the fed sticks with it. Why wouldn’t they?

Ben R, yes. My issue is that “recession” should not be reason to derail it, as the balance sheet excess should be withdrawn even if it does cause a recession. Otherwise, printed money becomes structural debt, and it shouldn’t

Fully agree with your assessment on this one. Fed assumed lender of last resort a while ago and they’re going to have a balance sheet that looks like it. 6-7 is the number I’ve concluded on because I just imagine they roll-off slower as they work their way through the shorter duration assets. It’s been impressive to see how quickly they are shrinking the assets.

“It’s been impressive to see how quickly they are shrinking the assets.”

It really has been impressive, this another reason to doubt any pivot-monger talk and why there’s a good case the Fed really is still leaning in a hawkish direction. There were too many headlines about the interest rates (and even that unchanged) when the QT push is the most interesting and significant. Especially the way the Fed’s duties have extended, the fact the asset and liquidity reduction has been so fast and continues at the quick pace is really significant.

I’ve had my criticisms before with Fed policy and the pandemic hyper-looseness with the MBS purchases really was short sighted but credit where it’s due, because central banks have been all over with their policies on steps since then to counter the liquidity excess. Ours in the US at least is still well aware of the danger the asset bubbles posing and how inflation could roar right back, and they understand the broader risk to Americans if they fail to continue pushing back against it. There’s still a long way to go, but they absolutely have not gone soft here.

6 trillion normal, I assume you mean in the context of easy money expectations

Nope… 6 is normal normal. Follow Wolf’s link above, but VERY broadly… 2 in Cash, 2 in Reserves, 1 in TGA (Treasuries checking account), and 1 for my VERY liberal rounding and inflation between now and 2026.

No, read the article I linked.

I fully agree with your reasoning, but don’t have to like it.

TGA going from an inflation adjusted $8 billion pre-2008 to persistent growth with a recent peak to trough average of around $500 billion (low of $103b) is mind blowing. We’re essentially carrying nearly a billion dollars in interest expense every month to hedge against Congressional malfeasance.

Reserves and RRPs, I’m not at all bothered that the Fed has stepped up to ensure liquidity, but keeping the rate spread so narrow where their is ZERO risk feels like unnecessary welfare to me. 5.5% vs 5.4% on reserves and 5.5% vs 5.3% on overnight repos doesn’t provide much room for markets to price risk in any kind of natural way.

Cash in circulation is just plain confusing. Who are these people and how many inches/feet have they added to their mattress heights? I have family overseas that hoard dollars and understand the impulse to a degree, but on an inflation basis we’ve re-stabilized at a level that is almost twice as high as pre-2008. It’s double crazy when factoring in inflation and increasing reliance on revolving credit card debt that Wolf often mentions, cash in circulation should be going down, right? maybe? I recently transitioned back to keeping/using cash to better manage out household budget, but imagine I must be an anecdotal outlier in that respect. Is it a reflection of growing grey/black markets? Domestically/Abroad?

Thanks to Wolf, I understand the reasons why normal has to be higher, but the reasons behind the reasons are awfully questionable.

“TGA going from an inflation adjusted $8 billion pre-2008 to persistent growth…”

Now wait a minute. Before the Financial Crisis in 2008, the US government had its main checking accounts at JPM and a few other banks. In 2008, during the Financial Crisis, with banks teetering, it shut those accounts down and moved all its cash to the Federal Reserve Bank of New York, where the TGA today is. This move dramatically increased the liabilities of the Fed, and therefore in equal amounts the assets. It has nothing to do with QE but with the 2008 fear of a banking collapse that would have caused the US government to not be able to pay its obligations.

With such a high floor on the balance sheet, who really cares if QT is happening?

We’ve had the worst inflation in decades and FED seems to be calling premature victory with rate cut projections. The only other lever to fix the GROSS financial inequalities in the system is QT. We’ve dug ourselves into such a large hole that our new normal is a fictional floor with trillions in unwarranted stimulus that’s never going away.

So, really, who cares at this point? I say bring the rate cuts and QE back so we can all be rich. The only sinister thing happening is that the rules of the game are obscured and the FED is pretending they are trying to do the right thing. Remove the mask and let the markets eat.

People are so upset they can’t even think anymore.

There were dozens of comments here calling for bloodshed and revolutions because the Fed added “any” to the statement and added a rate hike to the projections for 2024.

These people were sick to their stomach and threw up all over the comments, and I had to go in behind them last night and mop up the mess. I deleted dozens of comments to that effect, people were going nuts on me. Today is a little better, but there’s still lots of vomiting.

just FYI: per Bill Dudley: “If one assumes — consistent with the most recent report on the Fed’s open market operations — that 8% of GDP would be a suitable cushion of reserves, and that the Fed won’t slow the rate of quantitative tightening until reserves fall to 10% of GDP, there’s still a long way to go.”

that’s ~$3 trillion, roughly half your figure!

kiers,

I think there is some confusion here about what he referred to. I didn’t read Dudley’s editorial, but it seems he is talking about “reserves” (“reserve balances,” officially) — meaning the cash that banks have on deposit at the Fed, and that the Fed is paying them 5.4% interest on.

These “reserves” are $3.5 trillion right now.

So nominal GDP (not adjusted for inflation) = $27.6 trillion annual rate. 8% = $2.2 trillion for reserves.

I said $2 trillion” for reserves in 2026, which would bring the total balance sheet down to $6 trillion.

Dudley says $2.2 trillion. So his figure and my figure are very close.

edit: ah…sorry: you are talking “assets”; you are correct on the asset side, with reserves 2-3 trn.

Yes, I just saw this #2 comment belatedly and already replied to your #1.

The real question is what happens to demand for treasuries when RRPs dry up? What happens to demand when reserves draw down towards $1.5%. Given the amount of treasuries to be auctioned by the end of Q1, that’s about the time RRPs will go away. The balance has been dropping like a rock since May ’23.

I have no idea what the Fed would consider appropriate for it’s balance sheet given the new MMT paradigm we live in.

My prediction is that we’ve formed a trough in core PCE inflation and it will SLOWLY rise next year, putting the Fed is a big pickle. Add to this all of it’s QE induced liquidity drying up my mid-year, and things get really interesting.

And the biggest question of all is how much longer does the labor market hold up?

The stock market is certainly doing its part to inflation the top 40%’s wealth effect.

At the same time, demand for Treasuries world wide is declining as US diplomacy angers much of the world. Countries like China, and Saudi Arabia who used to be customers for Treasuries are now decreasing purchases. US sanctions, and the theft of assets, are also giving would be investors reason to avoid putting money in US controlled investments. Another issue is money destruction, which is happening as a result of CRE losses, loan defaults, and banks cashing in long term Treasuries at a loss to pay back depositor’s who are withdrawing funds at an increasing rate. All these factors have an effect on liquidity, which will effect interest rates going forward. Fed jawboning does not carry the same weight when liquidity dries up…

Two thumbs up Depth Charge!

I dont think this FED has any spine. When 10 year went up by 75BP FED said Market is doing FED’s job of Financial conditions tightening. So no hike needed. Now it has dropped more than 100 BP from peak. Can we say Financial conditions loosened up 20%? Just dancing to the tune of Wall St.

All press conference crony journalists asking rate cuts questions and when to stop QT.

The Tayor rule, if implement in Fed policy, would put the Fed funds rate at 6.99% given the current employment and inflation data. The Fed has already given up their fight against inflation before they even got started. They see an election year and want to keep their jobs and keep all those in power staying put for another 4 years.

Howdy Folks. I wonder if Powell will be like Greenspan ????

Maestro Part 2???? Years to go, before we know…………

So almost 2x the amount of QT we’ve had to date? I’d be so excited about that! 🙏🏽🙏🏽🙏🏽

Almost 2x more to go, that is.

Yeah I feel like that’s the main tell the Fed is NOT pivoting, at best going neutral to still mild hawkish. Admittedly, JPow on the surface seemed on the fence about some things today so can understand people getting confused. The usual pivot-monger squawkers were out in force earlier but already some of the headlines are pulling back, even on the WSJ that’s been pushing the pivot talk for over a year (and they’re admitting there’s a serious yield curve problem). It sounds more hawkish when you look at the action and words in the official statements–talk about rate cuts but no commitment or agreement, higher for longer is now official policy and Powell and rest of the Fed not ruling out even a rate hike when they clearly had that option.

On one hand, some arguing the “dovish” side based on how hard the US dollar plunged today, falling to worst since August ’23 in one day. If there’d been real confidence in the USD outside of Fed support, the talk goes, then it shouldn’t take a nose dive that hard even on a sharp rate cut much less on a Fed hold. That’s about the only argument the “Fed went totally dovish” side really has but even that I feel like it’s mixing up the chicken and the egg. It probably does show there’s concern about USD purchase power without Fed supporting higher rates and the level of debt surging in the US (household even more than public), but that doesn’t mean the Fed is turning more dovish–it could even be the opposite. If the dollar is really that fragile, then the dollar tanking means more expensive imports and inflation heats up again, then the Fed is in a pickle and right back to hiking like Volcker. Americans simply cannot tolerate even more increases in basic goods, rent and food when we have record homelessness and US cost of living getting worse, that’s how you get a country torn apart in social unrest.

On other hand I feel like the main argument for the Fed being at least mild hawkish is what JPow said and did on QT. If the Fed was really going dovish it would of at least slowed quantitative tightening, but it’s full speed ahead and that may matter even more than the short term rates. In fact being cautious about the interest rates actually leaves MORE room to keep chugging and even speed up QT which may be the real message here. Goldman-Sachs was talking recently about central bank liquidity with the bank reserves despite QT, not sure how much to believe that but the bond and T-bill guidelines go against that in January, and if the Fed really wanted to pivot, they’d at least have reduced the QT to prevent the liquidity from really pulling back. But they didn’t–QT is in full force.

Would just double-down on that last point, doesn’t it seem like the Fed’s full force push with QT IS the main point of where they were going today, in other words the main thing they wanted to communicate? The QE effect once covid hit has been a lot more important than short term rates for pumping up the housing bubble and all the other asset bubbles. It really was one of the biggest pandemic stimulus right along with the PPP and other programs (and all the fraud that went with them), whether or not the G-S guys are right, it was going to be some months and a year or two anyway before that liquidity drained out.

But going hard on QT to reverse the QE and draw down the liquidity is the thing that really pops the Everything Bubble and “wealth effect” more than anything with short term rates. And again the part of how keeping the interest rates basically sideways leaves MORE freedom to go aggressive with QT. So a real pivot would’ve meant at the very least, taking the foot off the accelerator for QT–didn’t happen. Maybe that’s why despite the equities markets today, volume was so light. Actual investors (not the algos) know deep down the Fed is still prioritizing more price stability, a big part of that is finally popping these dumb asset bubbles and valuations–you can’t support a modern economy like that for long without everything falling apart, capital gets too badly mis-allocated. And right along with QT there’s a ramp up in the prosecution of the PPP fraud, and heavier tax collection of the billionaires who’ve been able to dodge for so long.

So that excess stimulus indulgency from the pandemic, both the monetary and fiscal side that’s the main cause of all this inflation and overdone liquidity to start with, it gets mopped up. There should be more on the fiscal side, but the QT is a powerful monetary tool for that, much more important than short term rates and JPow is ramping it up even more. That is NOT a pivot, if anything it seems like going MORE hawkish on the monetary policy that actually matters for the asset bubbles driving the price increases and stupid valuations to start with. And coming to think about it, not even Volcker as hawkish as he got by the early 80’s, had tools like QT at this level at his disposal to drain away the liquidity and tighten like this. That’s why I feel like ultimately the Fed was in reality a lot more hawkish today than first reactions thought, why the volume in the equities rally was so low and JPow is actually re-doubling on what’s really pulling back on the over-stimulus from the pandemic. The sideways interest rates just make it easier as policy to push forward with the real tightening from the QT and go full throttle without pulling back on it.

Miller,

Very good point, I agree with you.

Yet interest rates have a psychological effect on the market.

If the dot plot is stating 3 rate cuts next year, it’s not dovish, it’s capitulation to Mr market, at best, Powell is talking out of both sides of his mouth. this makes sense if he wants to achieve plausible deniability against being seen as hawkish if we get a downturn in real economy or a market plunge. Main goal is keeping his job, so he’s human & minimally principled re: his duties. But, he’s getting bullied by markets and the statements of his fomc counterparts.

Yea well, you know shit happens. Your expholiant phrase was contained in your first sentence: ” Yeah I feel like that’s the main tell the Fed is NOT pivoting, at best going neutral to still mild hawkish. “. Revealed your persona.

On the first chart QT #1 is around $4 Trillion. QT #2 is closer to $8 Trillion. Naturally QT #3 should take us to approx. $16 Trillion.

You can always hope and pray. Try a rain dance maybe?

You make a joke, but isn’t that exactly what wall street does when they wait with baited breath for what the fed will say? Like letting the oracle of Delphi get high off the gas coming from the crack under her chair and letting her ramble nonsense and calling it prophecy.

Now wait a minute, your claiming that the Oracle of Delphi was female ?

Now who was the Oracle of Delphi, exactly.

Hahaha,

that hope dies last

Wolf-

In an “ample reserve” regime you referenced in the article, won’t he Fed balance sheet (alternately emphasizing asset growth or liability growth) grow to whatever size needed to quell the disaster of the day. If that is what Andy meant to imply, then his statement seems directionally logical to me. Not sure what your reply meant on this important subject…

“Ample Reserves” sounds much like the famous 2012 Mario Dragi line: “We will do whatever it takes.” Doesn’t whatever-it-takes in an ample reserve regime imply an ever-growing tool chest of both asset and liability tools? I.e. a bigger or MUCH bigger balance sheet

Did you do an article on the shift to an “ample reserve” regime?

Thanks for interpreting Powell’s presser.

John H

The Fed revived its “Standing Repo Facility” in the summer of 2021 (just before it announced the end of QE), that it had killed in 2009 with QE. So disasters will be dealt with that way, meaning short-term (overnight!) liquidity injections that then go away when things settle down, and they don’t stick on the balance sheet. The Fed has traditionally done this including after 9/11 when the markets froze up. And after a few weeks they were gone and the dotcom bust continued.

Thank you, Wolf. Sounds sort of like a magic bullet.

What’s the downside to this method of support?

Is there a limit as to how large a facility the Fed can practically apply?

Is there an additional element of moral hazard: either encouraging risky behavior, forgiving bad banking, or price discovery malfunctions, etc.?

Milton Friedman always said there’s no such thing as a free lunch. The next time they use overnight standing repo facility, what’s it gonna cost us?

Sorry to be so dense on this… I feel like you’ve discussed it enough so that it should make more sense to me.

I had a question about the definition of ample reserves, also.

My understanding of a central bank monetary policy was either the age old fractional reserve system and the current excess reserve system.

Settling on the excess reserve system will eventually fail.

@Andy: Are you talking QE1, QE2, and potential future QE3 amounts and not QT1,2,3…?

The US national debt is already exploding at an unsustainable rate. The national debt increased from $31 to $34 trillion this year, and interest payments on that debt is soon to become the biggest spending item besides SS & Medicare.

Even though the Federal Reserve is technically apolitical, a majority of rate-setting voting members are appointed by the President & confirmed by the Senate. No politician is ever going to want to appoint a fiscal & monetary hawk.

So QE will happen again to service that exploding debt. It’s only a matter of when & not if.

“So QE will happen again to service that exploding debt. It’s only a matter of when & not if.”

What will keep QE locked up in the safe is inflation. If inflation sticks around, no one is going to do QE because everyone see the plight that Argentina is in, and no one wants that.

If inflation is 0-2%%, they can do whatever they want. But those 0%-2% years seem to be over, even in Japan.

“IF inflation sticks around…” ?

i think its clear that it IS sticking around, and WILL stick around for some time..

you yourself have written articles on how entrenched inflation in services has become, and how difficult it is to root out.

n0b0dy,

Yes, I’m in that camp, and we had signals in the last CPI of that. If that continues for a few months and moves to PCE, and pushes up Core PCE, the dot-plot rate cuts will get pushed out further, like they were in 2022.

It doesn’t only stick but often bounces up and down…

So The Fed gets information before the public. Powell knew yesterday that unemployment was going to come in below expectations today. Powell knew that retail sales were going to come in above expectations today. So with some inlfation reaccelerating and no signs of a recession even from the hot off the press data that he has in his hands why does he not tamp down expectations for rate cuts. He also knows exactly how the main stream media is going to interpret this new dot plot. I hope there is some long game strategy in this that is good for the whole country and not just the very wealthy. Include me in the camp that is very skeptical of The Fed’s true motivations.

Aren’t the deals in the aftermath of the UPS and UAW strikes essentially locking in 5% wage increases for the next four years? I don’t see how services can escape there resulting inflationary pressure.

Blame it on the Fed,

I see lots of similar things, not just wages, that tell me that core services will stay high and maybe go higher in 2024. But that’s not guaranteed. Like I said, if services inflation begins to push up core, and durable goods deflation halts, which would further push up core, those dot-plot rate cuts are off the table.

On this your just wrong, the market wants QE and the fed will give it

So with potential interest rate cuts it would still seem logical that treasury yields could do well. Seems they still need to attract buyers.

Exactly. Supply of treasuries will be *structurally* higher over the coming years because a) the increasing fiscal deficits that need funding, and b) the Fed is no longer a buyer.

Agree!

For the moment i see Powell under the market pressure.

He had to be dovish to avoid a harsh market reaction.

No one want’s to see a crash in a pre-election year.

he had to?

why did he have to..?

sticking to the plan of slaying the inflation beast would not have caused a ‘crash’ as you suggest.

if anything, there is alot more chance now of a major destabilizing event happening since the wall street money knows the fed wont dare do anything substantial to reign in their shenanigans.

as it should be then.

masters of kicking the can down the road is all these people are.

He had too otherwise the treasury market would have fallen a cliff.

Treasury market is very sick,they just needed some relief.

You cannot let them fall in an election year.

“masters of kicking the can down the road is all these people are.”

I agree ,but once you are started you can’t exit!

Nobody would be ok with their retirement plans and life insurance leaning to zero.

Even if it is the real value.

The Treasury would like to attract investments from citizens who believe in the long term story, going forward, of America. Personally, given the current interest rate structure, I’m not feeling it.

What I thought Wolf said was this ain’t grandads economy .

A football team wins when the environment empowers every position, too work together to accomplish a common goal.

Think the market and Pow Pow are both on autopilot. One is on autopilot to continue to say QT is on going and rate will stay higher, while the other is on autopilot to ignore everything daddy Pow Pow say and autopilot the market and asset price to the moon….

Wonder when reality will crash this party….not holding my breath for that anytime soon.

I think the expectation is moderate but lower GDP growth of around 1.5% for 2024 and lowering inflation so slight uptick in unemployment. My advisor doesn’t expect 2024 to be an incredible stock year but he admits his firm totally was off on the last round of predictions. I am in that tricky window of too early just to go income based but close enough to retirement that an extended downturn would be a problem. From my perspective seems like the markets fairly safe barring any major events.

The nice thing is: right now, you can get paid to wait and see how this all plays out. 26 week treasuries still have the highest yields, and MMFs aren’t paying much below that right now.

This situation where we’re paid to stay out of duration is abnormal and can’t last forever.

It’s hard to know how much to believe this but on the stock market’s confusing moves in 2023 despite interest rates and QT, Marketwatch had an article quoting Goldman-Sachs there was a lot of liquidity injection since Oct. 2022 from central banks due to the higher bank reserves (and draining of the reverse repos). They said this was the only thing explaining the increases that seemed to go against the trend of tightening, because there so much extra liquidity that had to go somewhere. Hate the term but they even called it “QE”-like.

I have my doubts but even if that’s true, lower down in the article the G-S guys were saying that changes totally in Jan 2024 with the new guidelines in the bond and T-bill issues. That’s where the Fed action today sounds more hawkish than a lot of the financial press is making it, because if indeed there’s been this liquidity pump going on, then it was basically delaying effects of QT, and that little cushion is going to be gone in January.

If the Fed really did want to pivot or “go dovish” then even more than the interest rates, they’d be pulling back on QT. But they didn’t, JPow made clear they’re going full speed ahead there. It’s also why I have my doubts about the rally today and all the dumb pivot talk in general. The market volume today really wasn’t that high despite the index gains. The Fed is still sounding on about going higher than longer, and the QT was the big tell that whatever happens with the short term rates sounding like sideways at best, the push to tighten liquidity and pop the asset bubbles is where the main Fed action is.

Glen,

The markets are not safe at all.

We are likely approaching a blow off top from a 100 year bull cycle. Next up will be a extended bear market.

Not saying this to scare and deff not saying get out now but safe is not an accurate description of this market.

Best thing you can do is SET STOPS and keep raising them! If your advisor can’t or doesn’t understand why then get a new advisor.

Good luck!

Everybody knows that FED balance is inflated forever and will never return even near the prepandemic levels, which was already overinflated.

Wall Street always wins. We will live with inflated asset prices forever. The wealth of next generations is permanently transferred to the baby boomer generation by the FED during the pandemic.

It CANNOT return to “prepandemic levels” because of the liabilities on the Fed’s balance sheet: Cash in circulation, reserves, RRPs, and the TGA (the government’s checking account.

I explained this about 15 months ago — the relationship between these liabilities and the assets — and it still holds: The total absolute floor would be $5.2 trillion in 2022 figures, and higher in 2026. So around $6 trillion might be about “normal” by 2026.

Here is my explanation. Everyone needs to read this:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

And it’s an absolute outrage that we are to the point that the floor is 5.2 trillion.

Why? Serious question.

ChS

That the liabilities are that huge. They have created a monster. Think about what that means.

ChS, because it was nearly all printed money. Even to the extent that there’s more cash in circulation, the Fed could withdraw it if it wanted.

It could also force the banks over time to move their reserves elsewhere.

I also am outraged by this new floor.

How can:

– lender-of-last-resort policies by the Fed,

– combined with the power to produce currency,

– in a highly indebted financial system

Not lead to larger and larger interventions, backed by a progressively larger Fed balance sheet?

For context, I believe the federal government should be as small as possible, while also understanding the federal government provides some necessary functions. Before I go getting mad about something, I like to a least understand it, and I, admittedly, do not fully understand what functions of the FED are truly necessary.

In reference to the 5.2 trillion number, I am not understanding the outrage, but that could be entirely due to my ignorance.

Bank Reserves: If this drops to the “ample reserves” number, why is that outrageous? The reserves do have a function.

$ in circulation: this seems more driven by the economy and is more a by product of that than a manipulated number.

RRP’s: if this goes to $0, sounds good to me!

Government checking account: now the outrage on this I get, the federal government spends too much money! But it will never be zero and it isn’t the biggest component to the FED balance sheet.

So please enlighten me. Which of the aforementioned should I be completely pissed off about?

ChS-

Not sure if you’re addressing me, but I’d like to clarify why I’m so concerned about the Fed’s balance sheet.

James Grant wrote an article about the weekly H.4.1 on November 10, 2023 entitled “Onward and upward with the H.4.1.”. In it he wrote:

”The H.4.1 dated Nov. 4, 1983 ran to four pages only. It showed total assets of $191.2 billion, which corresponded to 5.3% of 1983 GDP. Unobtrusive Treasury bills, maturing in a year or less, constituted 43.4% of the U.S. government securities portfolio. Bonds falling due in more than 10 years made up just 14%. Federal-agency obligations summed to $8.7 billion. It would be fair to say that the Fed had little or no direct presence in the U.S. housing market.”

He continues: “Forty years on, the H.4.1. Form runs to 11 pages. It shows total assets of $7.9 trillion, which corresponds to 28.6% of annualized third-quarter GDP. Treasury bills, maturing in a year or less, constitute just 4.7% of of the U.S. treasury securities portfolio. Bonds maturing in more than 10 years make up 31%. Mortgage-backed securities sum to $2.5 trillion, compared with Treasury holdings of $4.9 trillion. It would be fair to say that the Federal Reserve stands over the residential real estate market like a Goliath.”

In a couple of short paragraphs, Grant summarizes 40 years of Fed scope-creep and portfolio degradation (both duration and quality). In actuality, scope-creep has been happening since the Fed’s inception before our entry into WWI.

If, as you say, that you believe “the federal government should be as small as possible” (and I have no reason to believe you don’t), how could you NOT be concerned about the growth of such a federally funded institution.

The forgoing argument doesn’t get into several other avenues of concern, including:

– Moral hazards of socializing banking risk

– Picking winners and losers (think Lehman/Bear Stearns, or uninsured SVB depositors

– Distortion of the price signals sent to projectors and producers, thus creating gluts and shortages

– Enabling federal deficits and debt growth through rate suppression

The $5.2 trillion number is a guess, and is not the issue. It’s the sprawling growth and mission creep that are the problem, along with an overly broad mandate (more thoughts on that if you are interested…)

Hope this helps. All IMHO

Respectfully submitted.

John H.,

Thank you for your response. I agree with all of your concerns. I am “outraged” by deficit spending/ national debt, FED purchase of MBS, and QE.

Prior to the GFC, The Fed balance sheet was about 6% of GDP, using Q1 2023 GDP of 26.5 T and the 5.2 T theoretical balance sheet, that’s about 19.6 %. So, I get the general concern, just not the specific issue when the numbers are broken down.

Bank reserves ultimately belong to the banks. So those aren’t the same as the FED printing $ to purchase treasuries and MBS. Right?

Cash in circulation isn’t something the FED prints without a demand in the economy and doesn’t directly influence interest rates. Right?

Or do I have it wrong?

ChS-

Mine is a general concern, as you’ve noted.

I agree that the reserves are an asset of the commercial bank depositors, and are immediately subject to a request for withdrawal. The Fed currently pays IOR on bank reserves. The reserves are part of the package (discussed in the article) that supports the Fed’s balance sheet assets. I’m not sure how to respond to your assertion about “printing $” but maybe someone else can. But, overall, reserves are not my issue.

Currency in circulation (“cash,” as you called it) is a bank liability, but if it is presented for redemption, my understanding is that it is to be paid off in currency, so a redeemer would only be exchanging dollars for dollars. (In the early days of the Fed, an individual could redeem paper dollars for specie, and thus retire from the whole damned fiat money system, but those days are long gone.) Currency in circulation is also not my issue.

The specific issue troubling me is the concept that the Fed’s balance sheet which, in total, acts as a stimulant to all lending in the commercial banking system, has grown to become a disproportionately dominant piece of the US (and world) economy. This stimulus magnifies the boom/bust cycle, and leads to bouts of inflation exactly as we are experiencing now.

The problem isn’t the composition of the liabilities that fund the balance sheet assets — its the fact that the assets have grown from 5.3% to that 28% of GDP. Sure, that 28% will come down — has come down with QT — perhaps even to 19% as you say, or maybe even lower. But I (and I believe other commenters too) fear that during the next foul-weather period, the can-kicking drill will include an even larger surge in assets on the Feds books. If that occurs, the Fed’s balance sheet footprint will advance to progressively higher highs. An unwinding of this progression will be even more forceful as the proportional size of the Fed’s balance sheet increases.

I would love to be disabused of these fears with an argument that I’m misunderstanding the growth of the Fed’s scope and balance sheet over the last 110 years, or by being convinced that some realistic reforms that limit future growth in the Fed’s mandate and balance sheet will occur.

Just my take. Open to corrections.

you should have a quiz that people must answer based on this in order to post. Have it pop up after pressing “post comment”

Seems like one of the big changes in Fed liabilities since 2008 is reserves. There were none at the Fed in 2008. Is that because the banks held their reserves themselves? Why does the Fed hold reserves now? Is it pooling risk? So the huge increase in the floor of Fed liabilities is due to an accounting gimmick?

They started paying interest on reserves- that was the big change.

Reserves are cash that banks have that they put on deposit at the Fed. So the Fed owes the banks this money (just like my bank owes me the money I deposit into my account).

Before 2020, there were “required reserves” that the banks had to keep at the Fed based on a 10% reserve requirement; and there were the “excess reserves.” The reserve requirement was moved to 0% and so now there are no required reserves. Just reserves. So if you check “required reserves,” there were some before 2008, but they were small.

The reason why reserves piled up is because the Fed started paying bank interest on their reserve balances during the financial crisis, today 5.4%. Reserves are a risk-free instantly liquid investment for banks.

Wolf-

If the Fed lowered reserve requirements to 0% (meaning banks can loan as much as they want without holding any reserves), then why can’t the reserve balance go to zero as well, with minimal effect on loan availability?

I understand banks still need to meet capitalization requirements, etc. but that capitalization no longer needs reserves parked at the Fed, so, especially if the Fed finally eliminates the interest they pay on reserves (which is also an anomaly of the post-GFC era), banks won’t hold them any longer.

To look at it another way, if reserves aren’t required to make loans, what’s the reason for having a line in the sand? What’s the unwanted macroeconomic effect if these unnecessary reserves drop below that line?

Wolf-

One thing to consider, with interest rates this high, could the cash in circulation component come down? when interest rates are low, there’s little opportunity cost to holding cash. But when they’re high, you have more incentive to get every last dollar into a bank and earning interest. I know personally, when interest was basically zero, having cash around the house was no big deal, and I preferred one big ATM withdrawal every few months. But now with the interest available, it’s worth it to go to the ATM every week instead and only withdraw what I need for the week.

Not to mention people in places like Europe where rates were negative. While they probably held their cash in mostly Euros, some of them probably also held some paper dollars too. Now that global interest rates are going up, could some of that cash in circulation start getting redeposited?

Squinting at the graph in your other article, it appears that if you drew a line upto 2007 and extended that slope to today, it would be ~$500bil lower than the actual number. So perhaps cash in circulation could decline by about that much if interest rates stay near where they are?

A large quantity of this physical currency is held in foreign countries by people who do not trust their local currency. To them, earning interest on these dollars is either not possible or not that important.

Take the case of Argentina. In order to flee the peso (nobody wants to hold pesos for more than a few days) they buy physical dollars. Even though they can deposit these dollars in dollar-denominated bank accounts, they do not do so because they distrust the banks (think about the 2002 corralito episode). So they end up with bundles of dollars that they store in their homes. Some of them even bury it into the walls of their home (emparedando dolares). In Argentina, a $100 dollar bill is considered better than gold. They even pay a premium if the $100 dollar bill is in great condition.

This large amount of currency outstanding provides the US a huge financial benefit. The US currency in circulation is basically a debt owed by the Federal reserve at 0%.

Lune,

“One thing to consider, with interest rates this high, could the cash in circulation component come down?”

Yes, and we’re already starting to see the first signs of it. Whatever amount it comes down means an equal reduction in the Fed’s assets, unrelated to QT. So if it comes down by $200 billion over time, it would mean a $200 billion lower asset level, in addition to whatever QT is doing.

So far, it’s down only about $20 billion since the peak in June (it’s at $2.3 trillion). If it drops enough to be visible, I’ll write about it, but we’ll have to see. Much of this cash is overseas, and folks there have their own reasons for hording and using these paper dollars, unrelated to interest rates.

“Much of this cash is overseas, and folks there have their own reasons for hording and using these paper dollars, unrelated to interest rates.”

Of course there is a reason.

The bank pays me 3 percent interest, tax free.

On euro accounts, the interest rate is 2 percent.

If it’s in the bank, it’s not “currency in circulation.” These are actually paper dollars, such as $100-bills which are very popular overseas. Holders of $100-bills do not receive any interest.

Currency has trended up since 1931.

We have a managed currency. The quantity of our currency is determined by the “needs of trade” (cash drain factor).

The volume issued may be influenced by the size of a federal deficit, but it is not determined in any way by the government’s needs for revenue. The collective demands of the public determine the absolute volume of currency held.

The volume of currency held by the public needs no specific regulation since it is impossible for the public to acquire more of a given type of currency without giving up other types of currency, or else bank deposits.

I.e., it is impossible for the public to add to the total money supply consequent to increasing its holdings of currency.

Spencer gets it — excellent explanation.

@ Wolf –

yes, the purchasing power of savers and those on fixed incomes was premanently transferred to asset holders and debtors ………….

Btw, if their dot plot for rate cut do materialize next year, kind of sucks for savers and people savvy enough to buy Tbills for the yield as finally we’re no longer in TINA environment and getting some decent return. Not to mention I doubt we will have much lower asset price, especially house prices by then, so double whammy we go again…

Savers would be screwed and speculators would-be/already being rewarded bigly.

Buckle up guys, QT is coming soon, matter of time.

If FED can project rate cuts in 2024, not 1 but 3, when inflation per WR’s article is still quite higher than target rate of 2%, then think what would happen when there is a small problem in economy. FED/Treasury would amplify this small problem to existential crisis, cut rates to zero and start QE.

Don’t believe me, just look at the data and loosening financial conditions.

What the hell is the matter with you people? The overall CPI is at 3.1%, thanks to the plunge in energy. So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.

If you think that overall inflation will rise again and sharply, once energy stops plunging, and durable goods stop dropping, and services pick up further, then this will show up in the CPI readings (and PCE readings), and they will head higher, and then the Fed will hike again, and we’ll get those higher rates and higher inflation.

The only thing that will push interest rates up is higher inflation. You don’t get short-term risk-free rates that are permanently 3% higher than CPI. That doesn’t happen. That’s just nonsense to expect it.

The Fed looks at core CPI, which is currently 4.0 percent YoY. Fed funds rate is historically about 1.0 percent above inflation. This gives an expected fed funds rate of 5.0 percent, which is about where we are now. If Powell wants 2 percent inflation, it seems he might need to hold for a while or even raise, depending on his often mentioned “lags of unknown length” and how “careful” he wants to be. He did not seem to emphasize being careful or data dependence, as he has done in the past.

It is pretty clear that as of today, the Fed is in Wall Street’s back pocket. It was not that clear even as of the last meeting.

Powell looked physically unusually haggard today, and thin. Maybe he has been ill, which might account for his lame, sell-out performance.

William Leake,

1. The recent core CPI numbers have been lower: 6-month annualized: 3.8%; 3-month annualized 3.4%.

2. “Fed funds rate is historically about 1.0 percent above inflation.” That’s not true. It’s all over the place. Here is the chart, see for yourself how restrictive rates (purple) are right now compared to core CPI (red):

3. If inflation keeps going down, fine. I have difficulties seeing that happen.

4. If inflation resurges, the future rate cuts get nixed again, like they got nixed in Dec 2022 for 2023, and we’re back to higher inflation and higher rates. Higher inflation seems like a plausible scenario to me, and if yes, the rates will stay higher or go even higher.

5. I have no idea why people are getting their brains tangled up like this over the dot plot.

This would be a perfect time for OPEC+ to get serious about their oil revenue. The oil prices cutting our inflation is lost sovereign wealth for the sheiks.

” I have no idea why people are getting their brains tangled up like this over the dot plot.”

Oh, maybe the 10 year going below 4 is a good reason.

Fed Up,

So really it’s the market’s reaction that is pissing you off so badly, and not the added “any” in the statement and the added dot-plot rate cuts?

Why are you saying that the Fed rate would need to be lower if inflation stays at 3%? Their goal is 2% and they’re still not there. Even if they were, I don’t understand the argument for needing lower rates. Rates are still historically low right now, the economy hasn’t broken under them yet, and it’s not clear that it ever will.

S,

If core inflation is 3%, then 4% rates are considered restrictive.

Last thing I want is for the economy to totally crater to where the Fed will cut to 0% and restart QE. I like the “careful” approach to get a decent economy, higher inflation with higher rates. I detest the 0% and QE, and what keeps them away is a growing economy and some inflation.

I think you need to cut your readers some slack :-) I’m not in “the sky is falling” mode but this is definitely an ever-so-slight pivot, and we know how markets react to that.

“if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%”

IOW, the majority of Fed governors expect inflation to stay at around 3%, which is why they expect a few rate cuts next year. And that’s I think where most readers (and you, based on your previous articles) would disagree with them.

Firstly, energy is volatile, so declaring victory on inflation due to a large drop in oil prices is pretty premature. Isn’t it curious that whenever inflation rises due to energy, the Fed always considers it “transitory” and does nothing, but when the volatility goes the other way, the Fed says “see, inflation is down! Time to ease off on interest rates!” The Fed can’t have it both ways: exclude energy and use “core” CPI when energy is high, then talk about the full CPI measure when energy goes low. Given that core CPI is currently at 4%, a Fed Funds rate of 5.5% is perfectly fine.

Secondly, Powell said essentially that he’s not sure where inflation is headed (could go higher, might continue to come down, will keep watching). That would argue for keeping interest rates where they are, which — to his credit — he did. But the dot plot doesn’t indicate that. It shows that the general consensus of the Fed governors is that inflation is tamed, and next year they’ll start dropping rates. Powell doesn’t set rates alone. He does have to listen to his board. So if the dot plot accurately reflects their opinions, then, regardless of whether Powell himself is still a hawk or a dove, his board will push him to be more dovish than he himself might be.

Finally, about that dot plot. Yes, it’s not binding, and it’s revised all the time. But this is the first time this cycle that it’s been revised to be more dovish. From the time of Powell’s first rate hike, each revision to the dot plot was always more hawkish than the last. The fact that it is now turning more dovish is definitely a big deal. It shows that the mindset at the Fed is starting to turn, and just as hawkish changes to the dot plot indicated higher rates for longer, you can’t blame readers for assuming that dovish changes to the dot plot portend the opposite. There’s also a chance this was just noise, and the dot plot goes back to 2 cuts for the year next meeting, etc. but even if the dot plot stays around where it is, fluctuating a little here and there, that’s still a big change from the days when it consistently marched higher every meeting.

Anyway, like I said, I’m not grabbing my pitchfork just yet :-) But there *has* been a pivot to the dovish side, and given the Fed’s jawboning power, that’s going to do exactly what Powell keeps saying he doesn’t want: markets and the economy going back to irrational exuberance.

“So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.”

Wolf, I’m curious what you base your statement on. If the FED rate hasn’t historically followed CPI +1%, why should the rate be lower?

Nevermind sorry, posted prior to reading the following comments.

Wolf,

1. Sure, the start dates matter a lot when computing averages. But we have seen inflation drop many times recently, only to rise again.

2. From 1971 to 2022, the average core CPI was 3.90%, the average Fed Funds Rate was 4.86% (FRED). Curiously, not a whole lot different from today’s rates. Note that 4.86% minus 3.90% is .96%, very close to my 1%. Sure, there is a lot of volatility within both series, but an average is an average, just as the three month moving average you use in a lot of graphs is an average, and is often used to smooth out volatility.

3. and 4. Agreed.

5. I did not mention the dot plot. It is one of many predictions about future inflation by many so-called experts, which especially in economics, are not worth much. The Fed is often wrong, I need only mention the two words “transitory inflation”. Powell should be embarrassed to spend even a little time on the dot plot. To his credit he used to dismiss the dot plot as just individual guesses. After yesterday’s Fed capitulation, I have no idea what he thinks now.

With the somewhat startling dovish about-face by the Fed, the unintended longer term consequences might very well be higher inflation, especially within the background of a still tight labor market and a current 4% YoY core CPI (twice Powell’s often stated goal of 2%). It is amusing, because Powell used to say it is better to keep policy restrictive, than to loosen too early. As you can see in my Item 2, policy is pretty much neutral after being so loose for many years, and can in no way be seen as currently restrictive (based on historical data, which of course, can be useless, but it is all we have). Others may interpret the historical data differently, of course.

Well said. The less than celebratory feedback from the general public seems to suggest that they smell a rat. Which is probably the best bet. I think the whole drama around the Fed is orchestrated by the mob that’s running this country.

@Einhal Yes, the Federal Reserve Put is back in play again. It always is, once inflation is low enough that they could politically get away with it. Do you see how many FOMC members are actively trading their own investments – not just owning securities, but actively managing them alongside their “public service?” There was a brief uproar in 2021 and they set a new “ethics policy” that requires 45 days’ advance notice but still allows them to trade. Big policy pivots cause market trends that last much longer than 45 days, guaranteeing profits.

When did it go away? As soon as they bailed out depositors with over 250k in march you knew it never went away.

Someone laughed when I suggested “Santa Claus Rally” about a month ago.

Why would the Fed cut rates? Is 5.25% considered “restrictive” in these markets? The Fed has not done enough IMO.

Stacking 3% or 2% on top of the inflation that has occurred from 2021 leaves the drop in dollar value 20 to 25% over that time.

Acceptable? Fed victory?

The overall CPI is at 3.1%, thanks to the plunge in energy. So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.

If you think that overall inflation will rise again and sharply, once energy stops plunging, and durable goods stop dropping, and services pick up further, then this will show up in the CPI readings (and PCE readings), and they will head higher, and then the Fed will hike again, and we’ll get those higher rates and higher inflation.

The only thing that will push interest rates up is higher inflation. You don’t get short-term risk-free rates that are permanently 3% higher than CPI. That doesn’t happen. That’s just nonsense to expect it.

Is it your position that the Fed should NOT address the price rises of the past 3 years

or, is it your position they will NOT?

Reducing the rate does not undo the spike in prices now seemingly embedded.

The “spike” apparently stays, which seems to be the game of the Central Bankers. IMO

Does the dollar plummeting come into Fed decisions?

The past price rises in durable goods are actually being more or less slowly unwound. Used car prices have dropped sharply from their highs, electronics prices have dropped, furniture and appliance prices have dropped etc. Durable goods prices have been dropping for nearly two years. So that is happening, you’re actually re-gaining some of the purchasing power that you lost with these goods.

Gasoline prices have plunged, and you regained purchasing power with regards to gasoline.

Some food prices have dropped, others have risen and overall they’re still rising from very high levels.

The problem is in services. Some prices are being unwound. But that’s very tough to get rid of inflation in services.

Deflation — overall prices declining for a longer period, which is what you seem to demand — means that interest rates paid on savings, T-bills, CDs, etc. go to 0%, SS COLAs go to 0%, wages actually decline, etc. That stuff really pisses people off.

That said, we in the US never had deflation as measured by negative core PCE in my lifetime, and I’m not worried about it. The worry is inflation.

Wolf,

Given that you have so astutely pointed out in recent days in making remarks such as the following “The question is why would the Fed “pivot” to multiple rate cuts starting in Q1, with the labor market this strong, with wage growth re-accelerating, and with inflation in services – where two-thirds of consumer spending goes – running at 4.6% according to the PCE price index and at 5.5% according to CPI? Sure, energy prices plunged, and durable goods prices dropped off their spike, but the action is in services” and “Inflation in services accelerated in November for the second month in a row, to an annualized rate of 5.8%, driven by housing, healthcare, and insurance. Services is where about 65% of consumer spending goes, and it continues to be the driver of inflation” and “The acceleration of the three-month moving average in September, October, and November is very disconcerting” I simply don’t understand how you aren’t outraged by talk of possible rate cuts? Please explain for those of us who lack your insight. Thank you.

Under QE, when Fed purchased T-Bills (monetized US debt), bank reserves increased by the amount of that purchase. Under QT, if Fed sells those T-bills to a MMF that had parked cash in the RRP (inert money, not in bank reserves or a bank deposit liability. ), bank reserves are unaffected. The original Fed purchase remains in M-1, but now it’s (appropriately) been supplied by the private sector (the MMF). Nevertheless, QT will dampen future liquidity, since those RRP funds are no longer available to create fresh reserves, when the Treasury auctions new debt.

Wolf,

I am really fuzzy about what is meant by the money supply (various measures) and how QT and QE affect them? Can you talk about this sometime?

Why would Wall St hate QT when rates are dropping? Sounds like automatic profit to me. The Fed would sell bonds at rate X, and 25 bps basis points lower later, the owners would have a capital gain.

Good question. I would like to know that too, Wolf! Pretty please.

“The Fed would sell bonds at rate X, and 25 bps basis points lower later, the owners would have a capital gain.”

What are you talking about? The Fed doesn’t sell bonds. Under QT, the Fed holds the bonds until they mature, when it gets paid face value for them by the government, and then the bonds are gone, and then the Fed destroys the cash, just like it created the cash when it bought the bonds years ago.

Then I don’t really understand how the Fed could control the pace of QT. Let’s take the extreme example of the Fed rolling off everything in the next quarter, does that mean all the bonds would just mature then? How is the Fed controlling maturities?

They can’t roll off “everything” next quarter. They own a lot of securities that don’t mature for years. They have both short and long-term securities and they know when they will mature (aka the pace they mature). They can control the pace when it rolls off too quickly by buying more bonds that month so the net decline in the balance sheet is less than what it would have been. And for times when MBS don’t mature, it’s $0 roll off for that time period.

At any rate, not sure why the Fed would even suggest economy is slowing down. Also not sure why “analysts” had put in a negative retail sales expectation for Nov when holiday shopping in Nov blew out the prior year by a lot. Any rate cuts would be a mistake imo. But the Fed always gets it wrong so at least they would be consistent.

SocalJimObjects,

I’m not sure I understood your question because it’s twisted…

Bonds mature on their maturity date, and not when the Fed wants them to mature. I know the maturity dates of my bonds. If you buy a T-bill at the auction today you will see the maturity date, and it will mature on that date, and then you’ll get your money back (plus interest).

QT is on autopilot. You can look up the maturity schedule of the bonds the Fed has, and you see which ones mature on January 15 and which mature on January 31, and then on Feb 15, etc. all the way out.

What we mean by “rolling off” is that the bonds mature and come off the balance sheet, and that the Fed does not replace them with new bonds.

Wolf, my question wasn’t twisted, not doing Operation Twister here. Quoting from your article “We’re not talking about altering the pace of QT right now, just to get that out of the way.”

Focusing on that “altering the pace of QT”, say they want to go faster OR slower, how would they do that? If what you are describing is true, then there’s no way they can do anything either of the above without going to the market in order to change the mixture of maturities they have in the portfolio, because what they have is what they have.

SocalJimObjects,

“…my question wasn’t twisted,”

That: “…the Fed rolling off everything in the next quarter, does that mean all the bonds would just mature then?” was twisted. It’s the opposite, as I explained. Bonds mature on their maturity date. The Fed has nothing to do with that. And THEN after they mature and the Fed got paid its money back, they “roll off.”

“Focusing on that ‘altering the pace of QT’, say they want to go faster OR slower, how would they do that?”

Using “faster” as the example: either raise the cap for rolloff (let more bonds mature every month without reinvesting them); or, if not enough bonds mature to meet the cap, sell bonds into the market.

The Fed, back when it was still posing as hawkish, had actually floated the idea of selling some of its mortgage-backed securities (MBS) into the market to speed up the pathetic pace* of the MBS rolloff. But as the Fed capitulates to the markets it has abandoned that idea, and any mention of it by reporters at FOMC press conferences is now tersely shot down by Powell.

*The pace of the MBS rolloff is pathetic because MBS usually get paid off before maturity, e.g. when a house is sold and the mortgage paid off, and there are constant passthrough payments as homeowners make their monthly payments, but the screwed up housing market has slowed the pace of both activities, so the MBS rolloff cap has not been reached even once during this tightening cycle. Often it’s not even close.

The bonds mature on the maturity date specified at their issue, paying face value.

Rolling over refers to the decision by the issuer whether to roll over the debt by offering new bonds, at the current market rate.

This is what amazes me about Fed speak. Every meeting or two there’s some new element that subsequently disappears. I remember the Fed being data dependent, now it’s Nostradmus pricing in cuts much to the cheers of the market. The current SEP seems inflationary to me, a 180 degree flip in just one meeting (literally less than a week if you consider Powell’s comments last Friday).

Jerome’Arthur Burns’ Powell.

Powell has finally caved in to the calls of his masters. Arthur Burns can hold his beer.

What the hell is the matter with you people? The overall CPI is at 3.1%, thanks to the plunge in energy.

So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.

If overall inflation rises again and sharply, once energy stops plunging, and durable goods stop dropping, and services pick up further, then this will show up in the CPI readings (and PCE readings), and they will head higher, and then the Fed will hike again, and we’ll get those higher rates and higher inflation.

The only thing that will push interest rates up is higher inflation. You don’t get short-term risk-free rates that are permanently 3% higher than CPI. That doesn’t happen. That’s just nonsense to expect it.

Of course not Wolf.

But was only 2 cycles ago when inflation + 2% was considered “neutral.” I remember getting a 1099-INT tax form in 2007 for the 5% bank interest I received, when inflation was 3%.

Of course, after 2008, the Federal Reserve lowered its r* estimate to only PCE + 0.5% because it was a convenient number that allowed them to justify endless ZIRP & QE.

There’s evidence to suggest the neutral rate may be higher, even if it’s lower than “CPI + 3%.” Yet it doesn’t seem like the Federal Reserve is even willing to entertain that possibility, with the longer-run dot stuck at 2.5% or lower for the last 15 years.

Jackson Y,

If inflation resurges, rates should not be cut and depending on how badly it resurges, they should be hiked. We have seen some upward pressures in the latest CPI report. If that repeats a couple of times and spreads into PCE readings, those dot-plot rate cuts will be pushed out again like they were already in 2022.

If inflation truly goes back down further, rate cuts should be implemented.

So I’m seeing the underlying upward pressures in inflation, but PCE was benign for October, and November hasn’t come out.

So it all comes down to inflation. Rates are not in a vacuum. And from what I’m seeing, inflation isn’t over yet, and we’ll get some nasty surprises, but that’s a guess, and inflation may be truly down and stay down.

Looks like Federal Reserve chairman Burns to my memory. Only thing different is no thick stack of increasing price tags on merchandise as it is all done electronically.

Interesting, then, how tied Fed policy — and asset prices — to oil prices.

Hope the lid stays on the mid-east cauldron…

I’ve read that 40 percent of the SPR was sold in the last year to help reduce energy costs.

That’s gaming the inflation numbers just a

little. When and if they decide to refill the reserve, will the resulting higher costs be

fully reflected in the CPI ?

Any resulting higher gasoline prices will be fully reflected in CPI.

They sold at very high prices, much of it over $90, $100 a barrel. They’re buying back in the $70 range.

Wolf,

Perhaps why everyone’s panties are in knots is because so many of us have been thinking higher for longer and weren’t expecting the equity and bond markets to capitulate in their minds. Perhaps some readers have set themselves up hoping higher for longer would realize sane or insane goals such as a:

1. Further 20% equity market drop instead of hitting new highs with inflated PEs

2. Higher mortgage rates hopefully leading to a housing bubble collapse, instead lower mortgage rates which could result in higher home prices

3. Fixed income investors looking for bond rates to be more attractive rather than collapsing

…you get the idea. People are hostile because they’re self interested and their perception of what was supposed to happens didn’t…at least not yet

Yes sir, and Powell lost any balls he had in an election year,

Bloomberg’s Michael McKee: “Mr. Chairman, you were, by your own admission, behind the curve in starting to raise rates to fight inflation, and you said earlier, again, the full effects of our tightening cycle have not yet been felt. How will you decide when to cut rates, and how will you ensure you’re not behind the curve there?”

Powell: “So we’re aware of the risk that we would hang on too long. We know that that’s a risk, and we’re very focused on not making that mistake.”

Wtf Ben

Actually, I think Powell is an incredible impersonator of an earnest man while explaining an obviously biased determination that the best economic accelerant is low cost cash.

What’s interesting is the economy ran just fine from 1995 to 2007 with a very small M1 money supply. During that period, velocity or turnover of M1 (defined as nominal GDP/M1) ranged from 6x to 11x.

After 2007, the Fed embarked on a campaign to sustain economic growth through a trickle down wealth effect. They implemented QE to put cash in the hands of asset holders, which prompted them to bid up stock, LT bond and RE prices, as intended. The Fed flooded the system with so much M1, the velocity of money declined from 11x in 2007 to just 1x in 2020. They’ve pulled only a small portion of that bloated M1 out of the system with QT, so the velocity is still a meager 1.4x today.

Question for Powell: The economy ran fine with a small money supply for many decades prior to 2007. Why is such an enormous money required to run the economy after 2007?

The answer, of course, is that today’s huge excess money supply (or ample “liquidity” regime) is deemed necessary to artificially prop up asset prices and create a wealth effect. The hope is that if enough wealth is dropped into the lap of wealth holders, some of that wealth might actually be spent and trickle down to everybody else.

It raises many questions.

If the economy ran fine without a wealth effect prior to 2007, why do we need a wealth effect today?

How fair is this type of government intervention, which uses a trickle down or reverse Robin-Hood approach to picking winners and losers?

Is wealth redistribution a legitimate policy goal of the Fed?

Exponential equations are a real bi%$h. So is entropy. The connection has to do with the resources and energy (consumable calories) that are required to provide a decent standard of living for 8 billion souls.

The wealth effect (a physiological feeling or illusion) worked because people still felt like they could participate fairly in the economy. Talk to the average Joe/Jane now.

Look, economics is a SOCIAL science, and the reality is that, in reality the laws of physics and thermodynamics rule. In the absence of fusion reactors coming online all over the world, we are going back to a feudal system, simply because that’s what we have the energy to support and it’s human nature. Hundreds of trillions of paper promises (markers if you will) are being called in, and the resources/energy to deliver the real goods (lifestyle) simply are not there.

Hedge accordingly.

WB,

Your words are frightful but shouldn’t be ignored. There are many many problems coming to the whole world and most of them are related to the carrying capacity of the planet and homo sapien’s lack of maturity, ability to get along.

There were 3.5 billion people on the planet when I was born and I may live to see 10 billion or more.