Our drunken sailors in Congress better head to the detox.

By Wolf Richter for WOLF STREET.

The magnificently ballooning US government debt is rapidly approaching $34 trillion (now at $33.84 trillion), up from $33 trillion in mid-September, and up from $32 trillion in mid-June, amid a tsunami of issuance of Treasury securities to fund the stunning government deficits.

But inflation has broken out on a massive scale in early 2021, and the Fed has hiked its policy rates to 5.5% at the top end, and it has unloaded $1.1 trillion from its balance sheet under its QT program, which is pushing up long-term yields. And so the interest rates that the Treasury Department has to pay to be able to sell these mountains of Treasury securities every week has risen, with T-bills selling at yields of around 5.5% and longer-term securities selling at yields in the 4.3% to 4.7% range, after going over 5% a month ago.

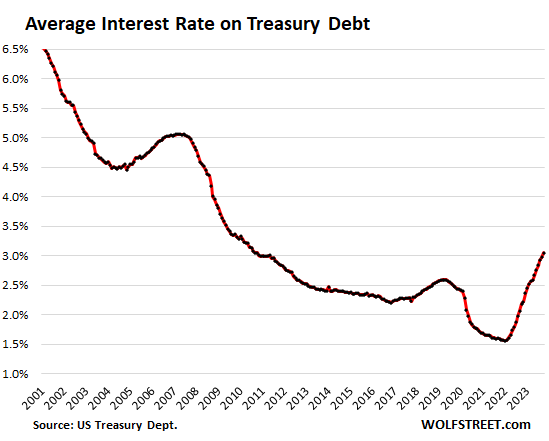

So the average interest rate that the government is paying on all its interest-bearing debt – much of it issued years ago with much lower coupon interest rates than now – has been rising from the historic low of 1.57% in February 2022 to 3.05% in October, according to data from the Treasury Dept.

This average interest rate will continue to rise as new securities with higher interest rates replace maturing lower-interest rate securities that were issued often years ago, and as all the newly added debt is piled on at the current higher interest rates.

The securities issued recently will cost the government whatever coupon interest they came with until they mature. The $40 billion of 10-year Treasury notes that were sold at the November 8 auction with a yield of 4.52% will cost the government 4.5% in coupon interest payments for the next 10 years, no matter what happens to interest rates.

The interest burden gets heavier. How heavy?

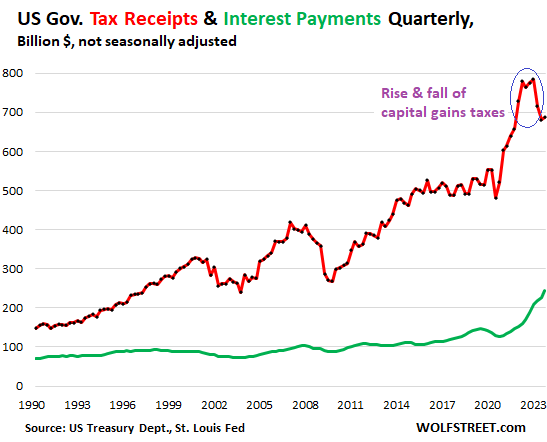

Interest payments reached $245 billion (not seasonally adjusted) in Q3, having doubled since 2018. But the economy has grown a lot, employment has grown, a record number of people are working, and they’re earning record amounts of money, and they have received the highest pay increases in 40 years, and inflation has taken off, and corporate profits have ballooned, and there were huge capital gains in 2020 and 2021, all of which triggered massive amounts of tax receipts.

In 2022, markets handed investors a crappy deal, and capital-gains tax receipts in Q1 and Q2 this year for the tax year 2022 plunged, even as other income taxes continued to surge. And these tax revenues have to be used to pay for the interest on the debt.

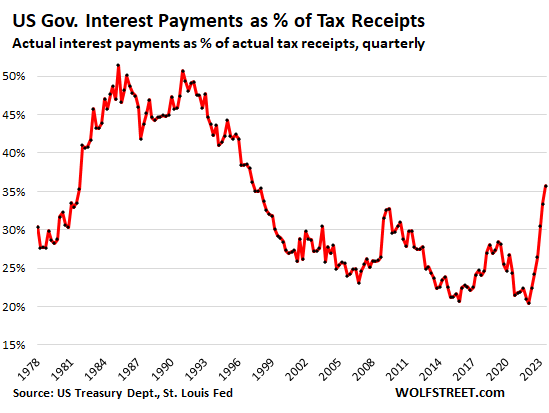

Interest payments as % of tax revenues is the primary measure of the burden of the national debt on government finances. This measure of tax revenues – total tax revenues minus contributions to Social Security, other social insurance, and some other factors – was released today by the Bureau of Economic Analysis as part of its GDP revision. This portion of the tax revenues is what’s available to pay for regular government expenditures, including interest expense.

The ratio of interest expense as percent of tax revenues spiked to 35.7% in Q3, up from 24.3% a year ago, and back where it had been in Q2 1997. But:

- The spike was from the 20.4% in Q1 2022, the lowest since 1969.

- In the 15 years between 1982 and 1997, the ratio was higher.

- In the 10 years between 1983 and 1993, the ratio ranged from 45% to 52%.

Tax revenues (minus contributions to Social Security, other social insurance, and some other factors) rose to $687 billion in Q3, after having dropped in Q1 and Q2 on plunging capital-gains tax revenues following the crappy year 2022 for stocks, bonds, cryptos, and other investments.

The plunge of the capital gains taxes was off the top of the Fed-fueled asset-price spike in 2020 and 2021 (red line in the chart below).

Interest payments jumped to $245 billion in Q3, on the ballooning debt funded with higher average interest rates (green).

This chart puts into perspective the interest payments and the tax revenues (minus contributions to Social Security, other social insurance, etc.) that are available to make those interest payments.

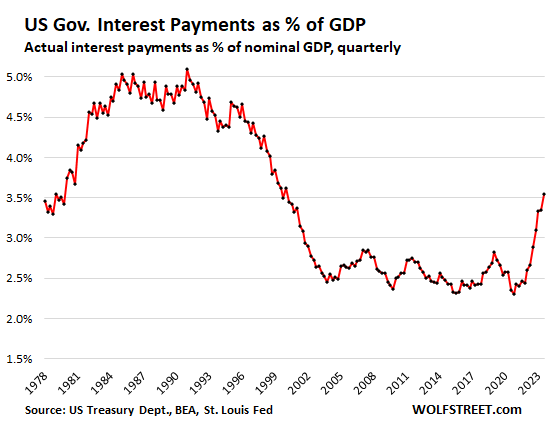

Interest payments as percent of GDP rose to 3.5% in Q3, based on today’s revised nominal GDP for Q3.

The ratio is figured on an apples-to-apples basis: quarterly interest expense not adjusted for inflation, not seasonally adjusted, not annual rate; divided by quarterly nominal GDP ($6.93 trillion in current dollars) not adjusted for inflation, not seasonally adjusted, not annual rate.

The ratio of 3.5% was the highest since 2000, but well below the range between 1979 and 2002, when it had peaked at over 5%, and stayed above 4.5% for nearly 15 years.

So, this is a gruesome spike, but off very low levels, and not yet in the nightmare territory of the 1980s. But at the current rate of progress, the spike might reach those nightmare levels in a couple of years.

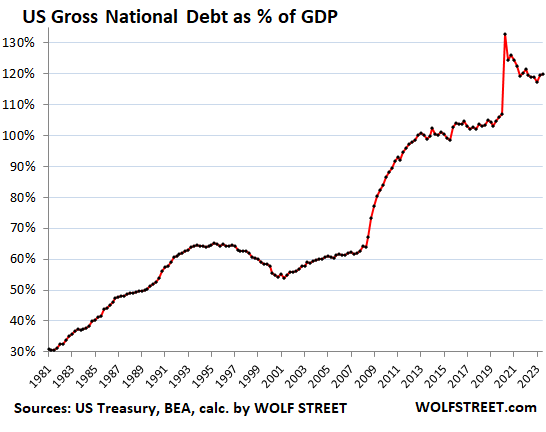

The US national debt-to-GDP ratio rose to 120% in Q3. So this measure is not impacted by interest payments or interest rates. This is the total gross national debt at the end of Q3 (not adjusted for inflation) divided by nominal GDP (seasonally adjusted annual rate, not adjusted for inflation).

The spike in Q2 2020 to 133% had occurred mostly because GDP had collapsed, and to a lesser extent because the debt had jumped.

If nominal GDP grows faster than the debt, the ratio declines, and therefore the burden of the debt declines, as it has done after Q2 2020.

But in Q3, nominal GDP grew by 2.1% from the prior quarter (not annualized, not adjusted for inflation), while the debt grew by 3.5% over the same period (also not annualized, not adjusted for inflation). And so the burden of the debt grew. A similar thing happened in Q2.

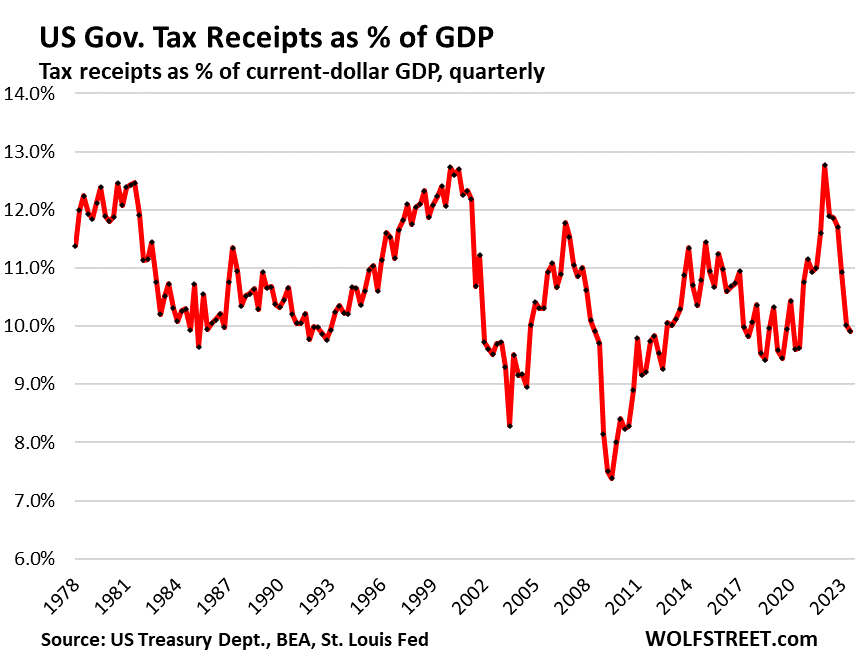

Tax receipts as a percent of GDP, at around 10%, is near the middle of the range over the past decades:

High interest burden might send Congress into Detox, but not yet. Back in the 1980s through early 1990s, the issue of interest expense eating half of the federal tax revenues (minus social insurance), while bond vigilantes were trotting around nervously, triggered a lot of handwringing in Congress and eventually forced Congress to begin grappling with reality. Eventually, they brought down the deficits.

High interest burden might be the only discipline left that can push our drunken sailors in Congress into detox to sober up. But it’s not happening yet. Our drunken sailors in Congress – “our” because we put them there, and we give them the booze – are still partying, and they’re brushing off the grandstanding about the debt in some corners.

The Fed’s role in this fiasco. With its reckless interest-rate repression from 2008 through 2021, via near-0% policy rates and trillions of dollars in QE, the Fed has encouraged Congress to go on an epic deficit-spending binge because the debt doesn’t really matter when the cost of borrowing is near zero. Now it suddenly matters, and it will matter a lot more going forward.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nothing goes to heck in a straight line….except?

This WOLF STREET dictum is going to get upwardly revised.

Kidding aside, the BEA did upwardly revise GDP and a bunch of related stuff today, and so, among other things, this ratio of “interest payments as % of tax revenues” doesn’t look quite as bad today as the unrevised ratio did in Q2.

Unrevised Q2: 36.2%

Today’s revised Q2: 33.4%

Today’s Q3: 35.7%

It’s still a straight line to heck, though.

Treasury yields dropped about 1% in the past month as Wall Street increasingly bets on rate cuts even in the absence of any recession signals. That will help the situation somewhat.

And even though the Federal Reserve is technically independent, the Board of Governors is nominated by the US President & confirmed by the US Senate, and if the national debt ever balloons to a point where it threatens national security, fiscal dominance will absolutely be a thing.

“Treasury yields dropped about 1% in the past month”

They’re volatile. They always drop after they spike. There have been much bigger retracements over the past two years, and before. It’s just a bunch of short-term bets, such as Ackman going out and promoting his latest bet, and the doofus reporters/bots at the WSJ, CNBC, Bloomberg, et al. are carrying his water, and after everyone jumped in, he cashes out. That’s what makes a market, and causes the volatility:

Waller running off at the mouth doesn’t help.

Thanks for this chart Wolf. Comforting to see the uptrend still intact.

Thanks Wolf very informing!

+1 You would never guess that given what is being reported

Very important issue…far too little known.

(That “as percent of tax receipts” chart is a key one…the only way the G can “pay” for anything is via taxation (with incentive distortions, political blowback, and capital flight) or printing/inflation (with incentive distortions, political blowback, and capital flight)).

Conservatives have been screaming about DC’s 50 years of cultivated cancer – the relentlessly growing national debt (likely higher once everything is honestly included on the books – see Greece).

But the NYC/DC “Establishment” view in perpetual operation has been “don’t worry about it”.

For 50 years.

Well, the endgame is here.

What exactly is the Establishment’s long-promised “fix”? Where is it?

Because it certainly looks like they are checkmated between raising interest rates to strangle inflation (which DC created through printing) but then having to pay soaring interest payments on a grotesquely engorged national debt.

That box canyon is precisely why so many people/institutions believe the Fed *must* pivot – in order to save the DC way (make interest payments on National Debt) they will feed the other 95% of us into the volcano of soaring inflation (ie, DC will print to drop rates and therefore its interest payments on Treasuries…but your rents will go up another 50%).

I think Wolf had a post a while ago on how this needle could be threaded but the details need to be repeated more for them to sink in with me.

This paper offers some context, numbers and solutions. I was actually encouraged by it and I’m very, very concerned about the Fed finances.

I know interest rates were higher 85-95 but wow the debt to gdp was half as well. If debt is 2x that now aren’t we trapped into even higher than 85-95 debt service payment going forward of 50% or higher?

What other option is there but more QE and money printing? Seems like the horse has already left the barn, and getting religion about fiscal prudence is perhaps too late? The country is rapidly aging and hard to grow our way out?

We could revert the tax rate back to what it was in 1998 when there was no deficit.

Whoa whoa that sounds like communism, can’t have that in ‘Merica! /s

Hi Wolf,

Didn’t you criticize those who were indicating that the only way out of this debt mess was Inflation – or am I wrong ?

I believe you felt that higher Interest Rates for Treasuries was sustainable and that people would buy if the Rate was sufficiently attractive. Are you changing your view on the overall Government debt situation or am I misunderstanding ?

Regards

This is kind of a mishmash of what I didn’t say and what I said. So I’ll just repeat a few things that I did say:

1. Yield solves all demand problems. If demand drops, yields rise until there is enough demand. That’s how yield works.

2. At some point in the future, the yield required to sell the debt might be punitive, and things might get tough, see 1970s-1980s.

3. Inflation whittles away at the purchasing power of all assets, including bonds. So for debtors, it reduces the burden of that entire debt over the long term.

4. But the corollary is that interest rates rise with inflation, and this causes interest payments to rise. So it’s harder over the shorter term to pay for the debt, but over the longer term, the burden of the debt diminishes.

So just wondering, when does the government get to the point they can’t even make interest payments with their actual tax revenue?

Never. But they might get to the point where they cannot handle inflation any longer. See Argentina. Argentina has never defaulted on peso bonds; in only defaults on its foreign-currency bonds. A country cannot default on its own currency debt; it can always borrow more (by printing) to pay the interest. But it can destroy its currency, see Argentina.

Exactly. The Fed is saying to CONgress, “go ahead, I triple dog dare you”…

There will come a time (unpredictable) when it will be impossible for the government (federal) to collect enough in taxes to pay all of its expenses, including interest on the national debt. The Gov’t can of course borrow an indefinite amount through the Fed. (concealed green backing) given a few changes in existing law. But that would lead to hyperinflation – i.e., a collapse in the credit of the Gov’t.

So, the easy way, is the way the French did it in 1960. Simply say that beginning Jan 1 (or any other date), new dollars will be issued, and that each new dollar is worth 100 old dollars. Then follow that up with a largely state controlled economy.

In 1960, the French economist / mathematician Jacques Rueff, during Charles de Gaulle’s presidency, converted the old franc, to a nouveau franc, equal to 100 of the old franc. However, even with this substitution, inflation continued to erode the currency’s value, though at lower rates of change, in comparison to other countries. And this new franc equaled 20 cents to a U.S. dollar. The old rate was 5.00 to a dollar.

In 1960, the French franc, which was one of the weakest currencies, overnight, became one of the strongest. Correcting policies included plans to 1) balance the budget, 2) stabilize the currency, and 3) eliminate currency controls.

The gold content of the franc increased 100%, & 1) foreign exchange rates, and 2) France’s internal prices, reflected the conversion overnight. Internally, prices dropped about 90 per cent, and the foreign exchange value rose from about 0.238 cents per franc, to about 20.389 cents per franc.

Domestically, France was on a managed paper standard; externally, on a modified gold bullion standard. With the new policies, France’s economy strengthened, and the franc became fully convertible @ approximately its gold par, into gold for foreign exchange and into foreign currencies.

With the introduction of the Euro, the franc in Jan. 1, 1999, was worth less than 1/8 of its Jan. 1, 1960 value.

What’s the impact on the deficit, over time, of having lowered incremental tax rates?

THIS is the ONLY thing that matters…

When I think about the relationship between the fed (monetary responsibilities) and CONgress (fiscal responsibilities) all I see is a scene from “Blazing Saddles”, but this time both entities are pointing a gun at the head of the taxpayer and threatening to pull the trigger.

Regarding the volatility in the treasury market, my hypothesis is that this is due to lack of demand (buyers, i.e. higher for longer). Do you agree?

We just need to setup a bunch of Gov. William J LePetomane tollbooths to pay the debt. Poblem solved.

But that ten cent toll has been affected by inflation. Now, somebody’s got to go back to town and get a sh!tload of quarters.

Note: In my comment above that should be a “lack of dependable buyers for treasuries”…

I agree that higher rates will solve this problem.

We need a balanced budget amendment with no exceptions, then a flat tax, then an invoice to every person in the USA to pay their prorate share of $100,000, if put into place today. Also, every immigrant should be handed an invoice for $100,000 upon entry.

Solved three problems at once.

Should your immigrant invoice be indexed for inflation from the time of your families arrival?

With the name I’d assume Irish descent I’d say we should add a 1000%+ increase to your immigrant bill as well, that’s based on a lenient immigration arrival date of 1940.

Of course you would easily agree with this, knowing that you care about a fair and flat system.

Not sure what reduced the late 90s interest as part of GDP. Perhaps the .dot era? Don’t feel like there is any magical things that will significantly increase GDP anywhere on the horizon however.

I *think* at bottom, the core of the G racket was the basic pitch that “so long as the GDP grows faster than the national debt, we “will” grow our way out of fiscal/macroeconomic disaster…yoo hoo!! free DC spending money!! YOLO, be-atches!!”

Of course, the debt has grown much (much) faster than the GDP…and has for decades…but that reality was never allowed to defeat the perpetual macro fantasy.

(Every annual deficit was in itself a refutation of the fantasy).

Because without the fantasy, DC would have had to make spending *choices* it never had the integrity or the brains to make.

In other words, the Titanic was a flawless ship, right up until the foreseeable iceberg.

AI. If not the big thing, at least it will figure out how to solve the problem. Hopefully it doesn’t just say “higher for longer, idiots.”

Wha…..a/i?…. that’s like crypto, right….?

Politicians buy votes. AI will never solve that problem.

That is democracy’s Achille heel. Someone wiser that me first stated that.

Seems like as the debt rises and as money is moved out of bonds and into stocks (like the last few days) or is used to buy over-priced houses, the Fed will have to keep the interest rate on T-bills at its current or fairly high levels. This assumes the amount of money used to buy stocks, houses, bonds, and bills is not infinite.

I meant to say “out of bonds and bills”.

If bonds and bills are being sold and those FRNs are buying stocks then yields should be rising proportionally with the rise in stocks.

That isn’t happening. I think the answer to this mystery is hidden in the relative strength of the dollar and the FX market, but it’s just a hypothesis, and I would very much appreciate an expert opinion.

Remember, the Fed, banks and anyone really can use dollars to buy other currencies. Might be an alternative way to fight inflation…

What about the idea that the treasury should have been selling a lot more longer term bonds while rates were so low?

Then even more banks would have collapsed by now, 😁.

Wall street is beginning the crying pressure via headlines:

–Bill Ackman openly predicting rate drop Q1 2024 or else….

–Novogratz sez (in effect) “Banks will put an end to QT on their own regardless what Fed thinks….”

Much carping has begun.

Also, you forgot the obligatory point of net debt vs gross, NET debt (held by public) is “only” $27 Trillion (6.7 Trillion is intragovernmental non public debt).

Any chance the US war hawks pipe down? anyone? How come the US billionaire class NEVER tells the war hawks to zip it?

Ackman wants rates to drop because he probably bought some bonds.

Hi Wolf:

Your last sentence in the article, especially the second part is very intriguing. You said:

“Now it suddenly matters, and it will matter a lot more going forward.”

Given the widespread expectations of interest rate cuts occurring next year – assuming they do happen, “why would it matter a lot more going forward”?

Wouldn’t our politicians just heave a sigh of relief and continue with their merry drunken sailor ways?

The same “widespread” expectation, or pivot mongering, has been rampant for over a year and blatantly ignores the actual fundamentals.

As wolf has repeatedly said, just more Wallstreet crybabies trying to work their book.

I’m waiting for the real data to indicate a pivot is warranted, or something even bigger than price stability to break before I bet on the “just around the corner” pivot. Sort of like the recession that has been about to wash over us for about 2 years now. Don’t hold your breath.

Part of why I read this site constantly is to actually be in the know about what’s REALLY going on. MSM and financial gurus can’t be trusted, but wolf’s data is superb.

@Biorganic. I am completely with Wolf and you that the current going is good – high Fed rate till a pivot is warranted by real data.

However, having been fooled by the Fed since the 1990s with its unending bubble-blowing (zirp, wealth effect, Helicopter Ben and QE), I cannot shake off the nagging feeling as to when it is going to capitulate to Wall Street and the government.

I think both Wall Street and the government would like to keep the party going at all cots. As far as the government goes, both parties will be very happy to kick the can down the road – all they need to show is a facade of prosperity not sustainable growth which is not very glamorous.

Also, Wall Street knows who’s boss. The Federal Reserve has never been so afraid of “surprising” markets in its history as over the last 15 years. In the current cycle, the FOMC has done nothing but follow the bond market & FFR futures market, which had been pricing in a 2021-22 pivot to rate increases long before Powell officially announced it. Over this rate cycle, the markets consistently led the FOMC’s policy decisions.

Now the markets are pricing in 1.25% of rate cuts over the next year. If the Federal Reserve doesn’t follow through, there will be chaos in the markets. FOMC officials are more likely than not to obey their masters.

Inflation has come down a whole lot from the 9% range in 2022, and everyone at the Fed is acknowledging that. But is it on track to keep going down, or is this a head fake; that’s one question the Fed is struggling with. Another question is, with inflation now much lower, policy has become restrictive at current levels, theoretically, so that alone should put further downward pressure on inflation. So how long should rates be kept at that level. That’s another question the Fed heads are debating. There is a reasonable public discussion going on at the Fed. But people taking big bets on Wall Street aren’t interested in a reasonable discussion. They need hype and hoopla.

A reasonable Fed discussion would center around trying to average 2% inflation for the 2020’s decade as promised. A reasonable Fed would also be focused on achieving long-term sustainable growth, not the avoidance of short term recessionary pain.

But that’s wishful thinking. The Fed has been more than willing to support employment and growth via increasing long-term financial risks and moral hazards. That will work fine, until a small spark lights the powder keg.

The Fed’s $8T balance sheet continues to fuel inflation as we speak, even after the recent 20% inflationary price step-up. They should be talking about accelerating the reduction of that balance sheet, but it may be too late if the economy now depends on that large balance. When you leave stimulus in place long enough, it creates a new permanent price plateaus that cannot be reversed without recession.

Every FOMC member from Powell on down has expressed openness to lowering interest rates AT LEAST TO SOME DEGREE if inflation comes down, even in the absence of a recession. Because as they see it, lower inflation while holding rates steady = higher real rates = additional tightening.

I don’t completely agree with this view – if the economy is firing on all cylinders like right now, the neutral interest rate is almost certainly higher than 2.5% = inflation target + 0.5%. But it’s not clear officials are willing to entertain this idea. The notion of higher neutral rates doesn’t align with FOMC vice-chair John Williams’ published research.

Any rate cuts in the absence of a recession may not be as much or fast as Wall Street would like, but in 2019, a 0.75% lower FFR was enough to send the S&P 500 up 29%.

If the Fed did that, they would have learned nothing the past decade. You can’t lower interest rates if asset price are high and going higher, even if current CPI inflation is low. High asset prices, particularly RE prices, are CPI inflation tinder. All you need is a spark.

The Fed should start viewing asset price increases as inflation that needs to be controlled with QT. If you wait until runaway perceived wealth hits the CPI, it’s too late to fight it.

In a static world, and the world of the U.S. past, higher yields might attract buyers of paper promises.

But I suggest the core of American Capitalism has been replaced by Financialization funded by the Fed to its friends and by Congress spending future taxpayer’s money, with no thought of repayment.

Unlike the past 2 decades of constantly rising prices of stocks and bonds, floated on fiscal and monetary insanity, the next 2 decades, sans an Industrial Base, might have a harder time selling Government, or any debt.

After all, if you were a lender to a Bankrupt, with a proven track record of squandering funds, the idea that the Bankrupt will pay you higher interest to put more funds at risk, seldom receives funds for future waste.

“Good Money chasing Bad.” comes to mind.

People who bought long bonds the past few years would likely agree with you. Hard to imagine anybody will buy a 1-2% long bond again, no matter how badly the Fed represses. The new floor, for the most accepting buyers, is likely around 3-4%, but for smart buyers, it’s in the 5-8% range and going higher as deficits grow.

Nobody was buying 1-2% bonds because they thought it was a good deal. The people buying those bonds were large banks, sovereign wealth funds, etc., who were required to buy the bonds either for regulatory reasons or to reduce their portfolio “risk” below some threshold.

In a hypothetical future with 1-2% long bonds, such buyers will presumably be required to hedge against rapid interest rate rises, but they’ll still exist.

Wolf – what time interval do the individual black dots in the charts represent?

quarters

Howdy Youngins The show is about to start………

Argentina has dodged the bullet of reality for decades. But Argentina does not have a world based reserve currency. The population in Argentina has grown from 20.5 in 1960 to 46 M now. More mouths to feed and no more land to grow food or new rivers to drain (actually there is a drought in Argentina). So the music continues for a while longer and no chairs have been pulled. Social chaos is minor. Many mistakes are not a problem until they are. Reality is a sly beast, creeping up on people who have dreamed big fantasies and foolish hopes.

Where are Tip and Ronnie when you need them?

Seriously, I am glad we passed the big bills last year. I think they were necessary (and I am willing to fight about it😉).

Roubini’s missive the other day talked quite a bit about government spending going up worldwide and how a lot of it will be pretty hard to avoid.

I joined the work of world in the 70s stagflation and now I have retired into the next stagflationary period! Oh Boy am I lucky!!!

Surprised Roubini isn’t too bearish for you.

The 80’s were when the debt game just began, its coming to an end now. You can’t compare apples and oranges. Me thinks the next ten years will be nothing like the last 50.

Sure you can compare apples and oranges. Apples are red, oranges are orange.

The 70s was stagflation and this will be too only worse because this will be for many decades or longer…. Homo sapien has to begin growing up.

Its already been stagflation Thomas, from 2008 thru 2019, now we’re on the next leg down my friend. Agree on the growing up part, but it ain’t gonna happen. Study history for why at 11!

GDP number is pretty meaningless when you are running record deficits. I like the compare to the tax receipts; more honest. Thank you for a great work, Wolf.

Ales Necas-

Please explain why GDP is irrelevant.

Because it is pumped by all the IOU government prints. FED might be tightening but congress is spending.

Grant’s Interest Rate Observer pointed out in a November 10th article that the H.4.1 (Fed weekly balance sheet) for 11/4/83 showed balance sheet assets at 5.3% of 1983 GPD. Today that ratio is 28.6% of 2023 annualized GDP.

A chart of Fed Assets as Percent of GDP might have fitted neatly into Wolf’s article between the chart showing Interest Payments as Percent of GDP, and the chart of US Gross National Debt as Percent of GDP.

A progressively more inflationary Fed has enabled/encouraged perennial deficit spending enacted nearly every year by our legislators.

The irony is that they deficit-spend in order to secure our votes…

GDP and tax revenue can go down (especially if we do realize a recession). Interest payments will continue to go up. The trend is not our friend!

Just thinking. Interested in thoughts of others… If in the past, interest as % of revenue was much higher, that might have been less of a threat than today if spending on Entitlements + Defense was much lower than today. If Entitlements + Defense is much higher (I suspect it is, but I do not have this in front of me) then rising interest expense, even if a lower % of revenue, can still be a greater threat today, then historically. Moreover, today’s situation continues to deteriorate in real time as debt spirals up.

Take “entitlements” off this list. The biggest part is social insurance, including Social Security, and their huge tax receipts (contributions to SS, etc.) are NOT included in the tax revenues here because the funds collected from SS contributions go into the SS Trust fund and not into general spending.

This nonsense about cutting “entitlements” spending keeps willfully ignoring that SS, Disability, and Medicare are huge revenue generators and are self-funding. The deficit is NOT caused by them. SS has accumulated a surplus of $2.7 trillion.

“The “SS Trust fund” consists of U.S. treasuries. It is already spent.”

This is the stupid braindead ignorant idiotic propaganda shit I can no longer tolerate. I own Treasuries. They’re among the most conservative investments out there, and they now pay a nice yield. Where does this bullshit come from that Treasuries in the Trust Fund are worthless because they’re “already spent?” What kind of effing braindead shit are you spreading here? Do you people have maggots between your ears? Go post this shit on X. Adios.

Why doesn’t the government instruct the Fed on selling some of our assets to pay off debt? I believe we have a large reserve of precious metals that could take the edge off of our debt problem?

Bernanke said they hold gold because of tradition. Are you suggesting they mess with tradition?

so far, there is HUGE demand for this debt (Treasury securities), which is why yields are still low. For now, there is no reason to sell assets. They can just sell debt. The problem may arise later.

The key is now to reduce the deficits to slow down the growth of the debt.

Gabby – be careful what you wish for (…already happened under Reagan’s admin. when public bandwidth assets were sold off at what can be now seen by those not ‘in the know’, then, at less than fire-sale prices (…imagine the lease revenues to the Treasury that could have been generated, instead of being privatized for a pittance…)).

may we all find a better day.

Is there some limit to USA dept to GDP ratio?

Nothing goes to Hell in a straight line except the damned souls.

And, they already know who they are, whence they go.

Ghost 1990 = The Killer [our drunken sailors] Goes To Hell

“Interest payments as percent of GDP rose to 3.5% in Q3, based on today’s revised nominal GDP for Q3.”

The problem with comparing interest payments to GDP is that a large part of GDP is now made up of gov’t borrowing. If large deficits means trouble finding buyers and interest rates go up, on the long end, gov’t may be forced into austerity. Then GDP will go down. Of course they will probably try yield curve control first. But how will that affect buyers if deficits are really high?

That’s why the primary and first measure I gave you is interest payments as % of tax receipts.

If the US was in the middle of a recession, then the deficit wold not be so scary, because it would go down automatically when the recession ended and unemployment returned to a non-recessionary level.

But when you have very low unemployment and a huge deficit at the same time, that is what makes this situation a bit scary.

The only exit (aside from fiscal retrenchment – which doesn’t seem to be coming any time soon, and would probably trigger a recession if it did) would be the Fed lowering rates, but why would they when unemployment is at record lows and inflation is above their target rate – or even if inflation returned to the target rate.

It seems like eventually congress will have to rein in spending, that will trigger the long forecasted recession, and then the Fed will lower rates, and eventually the economy will recover. But that could be a painful journey, and the longer that congress keeps running huge deficits, the more painful it will have to be when the day comes.

Interest payments as % of tax revenues.

Of all the wonderful charts on Wolfstreet, this one continues to be the most breathtaking to me. Maybe we’re not hovering around 50% like we were in the 80s, but look how fast we’re getting there! “35.7% in Q3, up from 24.3%” in 1 year is nuts. It is the steepest rate of consistant rise on the graph by a large margin at this point. And there’s no sign that it will even slow down any time soon.

At this breakneck rate, it will be flirting with a record high by early 2025. Either politicians will start having to make unpopular cost cuts as receipts are eaten up by debt service, the Fed will blink (maybe forced to blink), or we’ll continue on with massive deficits until we hit a cliff of some sort. I have a feeling congress won’t make uncomfortable career-ending cuts. So either the Fed eventually breaks or we all get to find out what happens when 70%, 80% or more of our tax revenue goes to interest. The later 2020s could become a wild ride!

So what? Seriously — what is the supposed consequence?