Unlike the defaults during the Financial Crisis, this default cycle is structural, in addition to being financial.

By Wolf Richter for WOLF STREET.

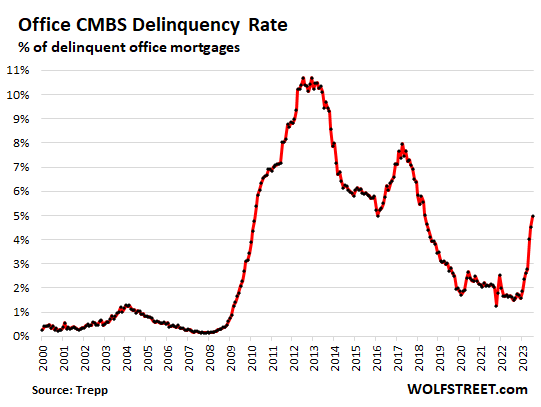

The delinquency rate of commercial real estate mortgages on office properties that had been securitized into Commercial Mortgage-Backed Securities (CMBS) spiked to 5.0% by loan balance in July, up from a delinquency rate of 2.8% in April, having now spiked by 2.2 percentage points in three months, by far the biggest three-month spike in the data going back to 2000, and by 3.4 percentage points so far this year, by far the biggest seven-month spike, according to Trepp, which tracks and analyzes CMBS.

This office-mortgage default cycle is outrunning the cycle during the Financial Crisis with ease, and it just started. The cycle during the Financial Crisis, as horrible as it was, started more slowly and proceeded more slowly than this cycle; it eventually topped out four years later with a delinquency rate of over 10% in 2012 and 2013. We’re already halfway there in seven months, on mortgages that were mostly written in 2014 and later.

Unlike the massive default cycle during the Financial Crisis, this default cycle is structural, in addition to being financial: No one knows what to do with all this vacant office space in older office towers. And cutting the rents to fill the properties – if it’s even possible to fill older office towers – won’t work because those much lower rents wouldn’t pay for the mortgage payments and expenses.

The default cycle is also financial in that CRE mortgage rates have more than doubled, which is a killer when on variable-rate mortgages and/or when a maturing mortgage needs to be refinanced. And at these mortgage payments, older office towers with a high vacancy rate doesn’t make economic sense anymore.

We have watched with fascination how mortgages on big office properties became delinquent, how landlords – giant landlords such as private equity firm Blackstone and private equity firm Brookfield – walked away from properties to let lenders take the losses, and this is happening from Houston to Chicago, from San Francisco to Manhattan, and all over the middle of the country.

And we have watched with amazement how the office market has un-frozen a little, finally, and some older office towers had actually sold, at huge discounts of 50% in Manhattan, of over 70% in San Francisco, of over 80% in Houston, and in one case, the largest office tower in St. Louis, it sold for so little in a foreclosure sale that all the proceeds were eaten up by fees and expenses, and lenders got zilch.

What all these big cases that came across our desk over the past 18 months had in common was that banks were not the lenders, that banks were not on the hook for losses on these big CRE loans, but that global investors ate those losses, because banks had securitized the mortgages and sold the CMBS to investors, or had sold the loans directly to private lenders, commercial mortgage REITs, and others.

This has espoused a perfectly logical theory around here that banks had kept the less risky office mortgages on their books, and sold their riskiest stuff to investors, and that smaller banks that piled into CRE lending mostly stayed away from refinancing big older office towers since 2014 – the kind that is now causing these mega-problems. The theory is that bank-held office loans would also face delinquencies and losses, but maybe not as badly as the stuff investors ended up with.

So some initial data on bank-held office loans going bad. The delinquency rate of bank-held office loans has also been rising since late last year: In Q4 2022, the delinquency rate of bank-held office loans reached 2.2%; and in Q1 2023 it rose to 2.7%.

This is according to Trepp’s analysis of Trepp’s Anonymized Loan-Level Repository data set, which is based on a sample of $160 billion in diverse bank loans from multiple banks. So this is a limited sample of the enormous size of the loan market, but it points at the direction this is going.

The data is quarterly. The delinquency rate of 2.7% in Q1, the last data point, is roughly equal to the March delinquency rate of office CMBS. So there’s that.

If this sample is broadly representative of all bank-held office mortgages, what we still don’t know is how big the loans are – they could be smaller office properties – and what the loss ratios will be if and when the properties are sold.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: Trouble in paradise as Sell signs are popping up across the stock markets…

As has been the case since the turn of the century into the 2000s, the single most distressed area of CRE remains shopping malls with the delinquencies and closures now at record highs.

I’m floored by the St. Louis foreclosure that sold for $4.1 million. How could no one have wanted a 1.4 million square foot building for even a little more than that? They must have been convinced that rents they could have gotten wouldn’t even cover the cost of operation (including taxes, insurance, etc.), given that the building itself was basically free.

I thought it was maybe a dump or something and went on Street View to see it.

That’s a freaking skyscraper for $4.1 in downtown.

Dang. Makes me feel justified in calling someone’s 500K house the 89K crapshack it is.

$39,000 is a more realistic price with true value for most all of these $500K crapshacks in America these days.

This happened to Dallas in the 1990s and 2000s. Entire Class A office towers built in oil-rich 80’s were selling for land value.

Anyone who bought them made an absolute killing in a couple of years. You always buy when fear is the greatest.

This is not about fundamentals it’s about financing and lemming-mentality. IMHO

Owning real estate has a cost whether you are getting rents or not. Just assume tax, insurance and maintenance is some fixed cost per square foot, say $20. The building can be worth less than zero. Sometimes the land is owned by somebody else and leased to building owner.

Understood, I’m just amazed that there is so little demand for office space in St. Louis that even for basically a free building, no one wants to operate it.

To be fair, I haven’t been to St. Louis in many years, so I can’t assess what the other commenters have said about safety.

Visit downtown St. Louis and you’ll know why the bid was so low. I’m from Buffalo and it’s been interesting to watch how Buffalo has slowly begun the process of rebuilding while St. Louis has fallen apart. Many businesses have been acquired and HQ moved to other cities and the downtown district has to deal with crime, infrastructure issues, a city commuter tax and compete with slightly nicer suburban CBDs such as Clayton- the political hub for the metro area.

Real estate is cyclical.

Wasn’t that many years ago NYC almost went bankrupt and everyone wrote off real estate there.

Hippies moved to San Francisco in the 1960’s because it was so inexpensive to live there.

Correct on all accounts A:

Friends in SF in late sixties were paying $50 for 2 bedroom flats, although to be sure, these were not modern rehabs, just the opposite.

I was paying same for a spacious studio in Berzerkeley, and thought I had a real deal until I visited those friends.

Now days, likely in the $3500-$5K range for those flats, eh

In the 60s we were on the gold standard, overseas residential real estate “investors” weren’t a thing and MBS didn’t exist.

Available credit sets prices.

VintageVNvet – that’s because under unlimited fiat the cost is the answer to the question “how much of your monthly income are you willing to sacrifice”.

Plus now they deliberately restrict supply below demand to force a bidding scenario.

I took a taxi from Lambart Airport to downtown St Louis and witnessed 15 miles of slums the likes of which I have never seen.

St louis? Didn’t a football team leave there for Phoenix decades ago?

The city of St. Louis (not the surrounding county) has lost about 2/3 of its population since 1950 and has one of the highest homicide rates in the country. I agree with Buffalo Bill.

Yes Buffalo has built back thanks to Covid cash, etc,,

See how long it lasts…no where has the population declined so much yet building continues as if nothing is wrong anywhere..

there is a youtube video, “Why America Gave Up on This Town”.

Only matter time before Fed starts a new program like BFTP

No question this will be backstopped. The only question is how opaque they are going to have to make it this time around.

Again, world opinion of the US largess is not favorable. What they might have pulled off in 08/09, optics-wise, they’ll have to be more careful this go around.

But, no question, the problem will not be allowed to grow.

LOL, we got ourselves another drive-by line of “Fed backstop” BS. Never fails. You people are funny.

Wolf, to be fair, the Fed has a long, long, long, long way to go in clearing that balance sheet. Like it or not, that balance sheet is a backstop. At one point they had an 8.9 trillion dollar balance sheet. They are at 8.2 trillion now. Gee wiz, they clear a whole 0.7 trillion or 0.7/8.9*100= 7%. Wow, a whole 7%! Wake me when they clear it entirely.

Not to mention the Fed proxies that have been buying while they are selling. Seems to me the Fed is rather good at rewarding bad behavior. This has consequences, like it or not…

Also to be more fair…

Would you like to comment on the Fed’s Bank Term Funding Program? Is that not a “backstop” or some new type of “capitalism”? Can my business use this facility? Again, to say the Fed isn’t backstopping at all or playing favorites is being a tad disingenuous.

WB,

Good Lordy, more Fed BS.

This falls into the same category of BS I have seen here for 18 months: the Fed will never end QE and hike rates, and when it ended QE and began hiking rates, they said the Fed will cut rates and restart QE, and when the Fed started QT, they said the Fed wasn’t doing QT at all, and with each rate hike, they said the next move would be a rate cut, and now rates are up by 525 basis points, the most in 40 years, and the balance sheet has dropped by $750 billion in a year, the most ever, and I got this swarm of goofballs/trolls in the comments that say that the $750 billion is nothing, and that the Fed will restart QE anytime when an auto loan goes bad or whatever….

When you look at this BS for 18 months, day after day, by different commenters or the same commenters under different screennames, this BS gets really old.

As I have explained in my articles a gazillion times:

1. The Fed did not bail out the banks. Three regional banks collapsed and one was forced to shut down, four total. Investors got wiped out.

2. The Fed funded the FDIC to bail out the uninsured DEPOSITORS of the failed banks. It didn’t backstop the banks, but the depositors. The banks failed. Why is this so hard to get?

3. The Fed has ALWAYS lent to banks. That’s part of its job. Banks borrow to lend. And they have always been able to borrow from the Fed at the Discount Window. But that’s expensive money and the collateral requirements are strict, and as Powell said at the press conference, the system is “clunky.” So the Fed came up with the BTFP to lend to banks. It’s similar to the Discount Window, but with a slightly lower interest rates, less stringent collateral requirements, and more flexible terms. Lending to banks is what a central bank does, whether it’s called “Discount Window” or “BTFP.”

4. I comment on the BTFP every time I discuss the Fed’s assets including later today. The fact that you didn’t read these articles doesn’t mean I didn’t write them.

Nobody asked the Fed to buy MBS.

There was *zero* public pressure.

They bought MBS.

Watching Wolf lose his patience is a guilty pleasure. I feel bad for the guy, but it’s weirdly entertaining and I usually learn something.

this for Captive:

there’s a difference between being angry and ”losing one’s temper”

sometimes that difference can be fatal

other times it can COST a TON of ”money” or honey, eh

The Federal Reserve’s balance sheet graph speaks for itself (Bonds + MBS).

1. Looking at only the very top of the graph, the roll off looks impressive, but even that was interrupted to come up with the money to cover wealthy, super wealthy depositors. The same rich who should be able to read the “little people” are protected big stenciling on the front door ($250,000 …). Look at the slow rolled roll off rate, it isn’t even at the rate they bought it at; MBS forget about it.

2. Looking at the Federal Reserve restarting QE for more inflation is exactly what happened for today’s disaster. Janet Yellen was rolling off the balance sheet ever so slightly, got a bond “temper tantrum” (pressure for higher interest rates) and off the Fed went. Liquidity is easy to understand, have a lousy price (high) and no one opens their wallet to buy it, mystery solved.

3. This isn’t ancient history, only 15 years ago or less. Now with new bonds who is going to buy them at the lousy price the Federal Reserve’s self interest desires? There is a good chance that it would be considered a “taper tantrum” or “liquidity,” rather than “non suppressed free market unattractive interest rates.”

4. People in the USA have no homes, cannot move and all the personal domestic strife, because the Federal Reserve decided to boost housing prices by buying MBS on homes valued at any price as long as some Federal chartered institution signed off on it. Unknown if the Federal Reserve even bothered to get a sign off from any Federal housing agency, although HUD is a Presidential cabinet level position.

Fed Balance Sheet QT: -$91 Billion in July, -$759 Billion from Peak, Biggest Drop Ever, to $8.2 Trillion, Lowest since July 2021.

The Fed has now shed 22.3% of the Treasury securities it bought during pandemic QE.

https://wolfstreet.com/2023/08/03/fed-balance-sheet-qt-update-91-billion-in-july-759-billion-from-peak-biggest-drop-ever-to-8-2-trillion-lowest-since-july-2021/

The simple fact is that the Fed via their new facility is backstopping those banks with large UNREALIZED losses on bonds . This is completely separate from bailing out uninsured depositors via the FDIC and is in a completely different category from previous lending to banks via the discount window . In many instances the collateral that is backing these loans is so far underwater that many of these banks with large unrealized losses would be insolvent by banking standards . And the collateral is diminishing as long term rates move towards 5% .

The simple fact is that the Fed has created the huge inversion in the yield curve by letting maturities run off , without selling any of their longer term securities which they accumulated during the QE of 2020-2021.

Jcohn,

1. Your paragraph #1 is nonsense. The BTFP has nothing to do with unrealized losses, but with lending to banks that experience DEPOSIT FLIGHT.

Every single bank in the $17-trillion US banking system has unrealized losses. Yet out of the 4,400 banks, only a few borrow from the Fed, and only minuscule amounts: $105 billion in BTFP loans = 0.6% of total bank liabilities. The banks that are borrowing under the BTFP don’t want to pay customers enough to keep their deposits at the bank, and they don’t want to offer enough to attract new cash to replace the uninsured deposits they might have lost. This is all about replacing deposits.

your paragraph #2: The inversion has gotten a lot less steep today and yesterday. Markets were just fighting the Fed.

So “bailing out uninsured depositors” (your words Wolf) is okay?!?!?!? What the hell Wolf? Why do I have to see my dollar buy less because of someone else’s counter-party risk? FU!!

YOU took the risk of uninsured deposits YOU should suffer! That’s capitalism FFS!

Sorry, again, the fed is indirectly and directly rewarding bad behavior and backstopping banks. maybe this is semantics to you, but real productive people and savers are being crushed by the fed’s actions.

WB,

You’re changing the topic. I didn’t say it was OK to bail out uninsured depositors. I told you what the Fed actually did to correct these falsehoods. The Fed did NOT bail out the banks and investors. They went under. It helped bail out uninsured depositors. That’s all I said.

Nope.

Hope

Dope

…Or BTFB?

Remote work has been increasing since I started working in IT about 25 years ago. I image that employers will need newer, flashy digs if they want to attract talent willing to commute.

Here is an excerpt from a recent McKinsey’s American Opportunity Survey:

“The most striking figure to emerge from this research is 58 percent. That’s the number of Americans who reported having the opportunity to work from home at least one day a week. Thirty-five percent of respondents report having the option to work from home five days a week. What makes these numbers particularly notable is that respondents work in all kinds of jobs, in every part of the country and sector of the economy, including traditionally labeled “blue collar” jobs that might be expected to demand on-site labor as well as “white collar” professions.”

I don’t think it’s so much “flashy” and more “a place people actually want to come to work.” Part of that is going to be about culture. When people like their coworkers, they’re going to be much more likely to want to go into an office to interact with them (obviously!).

Another is making it seem that the employer actually cares if you’re happy. I’m not saying you need five course meals the way Facebook used to provide, but having coffee, a bowl of fresh fruit, snacks, etc. does wonders for making people want to come in, and it doesn’t really cost that much.

I think for a place like downtown Seattle people are going to have to feel safe before they will go back downtown.

I don’t see that happening unless/until someone cleans it up.

or until people like you and Fox News stop beating those dead, false horses

Sure …. IT workers making $450K per year will be rewarded for their 2 hr daily commute with something they could not afford on their own … … coffee, a bowl of fresh fruit, snacks, etc.

$450 K per year? To write code? No wonder these jobs are moving to India!

Only a 2HR “daily” commute….? One could only wish… Maybe a 2Hr each way commute….

First, most office workers period (including IT workers) are not making anywhere near $450k a year. That’s an absurd generalization. Second, it’s not about not being able to afford it, but just having it there. If you’re working from home and you want something to eat, you go to your cupboard. If you’re at the office, it’s nice to have the same optionality without having to remember to brings things in or buy it during a break.

Affordable/safe childcare.

Until the day that pig flies, many of us will be clutching onto our home offices with a kung fu grip.

And yes, both my productivity AND attendance has dramatically improved with WFH. Kids aren’t getting hurt/sick at after school care/camp, and I’m not coming down with every plague the lil petri dishes bring home. Off the bus, do their thing/don’t interrupt, and unlike latch key kids we were growing up, they are on my sonar.

Creating happy, well nourished kids.

Exactly the kind of thing capitalism has no ledger entry for.

“…. including traditionally labeled “blue collar” jobs that might be expected to demand on-site labor. ”

Hmm.. I wonder what professions these are and how many of them exist. As of this writing in mine we still don’t have a way to install 12″ pipe from my home 1000km away, I still need to get on a plane and do it myself. Probably a good thing because I don’t know how to do anything else when iRobot hops in there to do it, maybe those collars are some extremely light shade of blue.

Yeah, that line set off my BS alarm as well. Blue collar work almost definitionally can’t be done from “home” (the gym, the coffee shop…) unless maybe they’re talking about supervisory work, e.g. a shop foreman watching and directing work via camera.

I will head down to my local watering hole where all the pipe fitters from Intel hang out, and ask how many of them are able to work from home.

Since the source is McKinsey, the purveyors of bad management practices, I’m not surprised.

This argument is that the problem w/ office is supply. Businesses will always need office space. And in markets where remote work has created supply you will have rent crashes and defaults. But this is cyclical and supply surpluses will eventually get absorbed.

This is not a forever problem. This is a temporary dislocation of bad investments and bad loans finding a reset.

“This is not a forever problem.”

Correct because these older office towers will either be torn down or converted into residential (where possible). And then the problem is over.

Office space has been successfully converted into storage also.

https://www.insideselfstorage.com/conversions/converting-old-office-buildings-outstanding-self-storage-facilities

Yes, a wide relatively low building of the type the article shows (2 story?) in an area where land value is small.

In a central business district, a land values are high (Houston, Dallas, San Francisco, Manhattan, Chicago, etc.) a wide low building like this will be purchased for land value, torn down, and replaced by a high-rise (residential now). While they go through the any legal issues, and the planning, permitting, and funding process (which can take years), they might make some cash flow on the property by using it self-storage. Others tear it down and turn it into a parking lot for cash flow, until construction starts. In a place like San Francisco downtown, parking is very expensive.

Good dev are working from home to avoid the commute, but also because they *are* good, they work on harder problems and they want to concentrate.

Most firms have moved to open-office. What could be more absurd.

> we want you to work on this complex task

> we want it to be robust, maintainable and fast

> we want you to do this within earshot of 15 people talking

Most companies don’t even care about the work anymore.

The drop in ability in my firm in 12 years has been precipitous.

We are talking going from 40 year old men who know a heck of a lot about networking as a by-product of better I/O in c++ to today, where I have to keep telling people in their early 20s the cmd to tell if a port is open.

We are at a point where most people can’t understand what is happening.

Agreed and many younger dont seem eager to learn outside of their specific interests.

Another factor I see for WFH is that if companies have a lot of very valuable IP than theyre going to want to lock that information up very securely. WFH makes that a bit harder, although some companies seem to have figured it out fairly well.

…inflection point where the ‘parts changers’ outnumber the ‘mechanics’…

may we all find a better day.

Sears / Willis Tower in Chicago can be converted to residential and, at 400 square feet per person, house 11,000. That’s just one building.

This topic of converting office towers to residential is recurring. The main argument against doing so is related to practical issues, such as retrofitting plumbing drain lines and egress windows. What if, instead of converting each floor into dozens of condos, each floor was instead converted to one condo, catering to the very top end of the market? Conversion would be much easier.

Except that in the St Louis example above the floors are each 30,000 sq.ft. even if you quartered it you would have a space 87 ft. x 87 ft. with windows on 2 walls you would have to add a huge airshaft in the center of the building to make most of that interior space usable and the engineering would be a daunting task.

Until recently I lived in a condo in a converted state office building in downtown Austin. The plumbing was not an issue at all. Just a matter of drilling holes in the concrete floors. However, metering water was not possible as the water for each vertical stack of units was fed by the same pressure line. (And the kitchens for each stack were fed by a different pressure line than the bathrooms.)

I think the issue with this would be that the lower you go floor wise the less attractive a proposition that becomes, you’d still have to pay whatever the price per sqft is in each region, I imagine the top end of the market would rather grab a penthouse suite elsewhere even if it isn’t as big instead of a giant midfloor unit. My guess anyway. Honestly I quite like city downtown cores so I hope some clever solutions come along for these towers, maybe they need to get cheap enough where a teardown becomes worthwhile.

I would do the math before concluding the Willis Tower can be converted. Office to residential conversions – particularly towers – generally are uneconomic. Often the conclusion is “tear it down, rebuild to suit residential…”

Why not have the federal government buy a few of these buildings and convert them into a low-tuition or no-tuition university or trade school campus that can compete with an overpriced state university? If they omit the football team and stadium, they can omit the multimillion dollar annual payment to the head coach. In time, tuition at state universities might return to some reasonable level.

Why the feds? Harvard, the other Ivies and similar have billions at their disposal. Classrooms and housing all colocated, no need to commute for many. Talk about going green!

Of course they’d never do that – too busy selling the country club lifestyle that they can charge a mint for.

The federal government has a history of involvement with higher education (Land-Grant Colleges and federal student loan programs). Setting up a few federal colleges to put downward pressure on tuition at state colleges and universities seems like a small step. Harvard and the other Ivies can put downward pressure on tuition at state colleges and universities by reducing their own tuition.

…wonder if disposing of Federal student loans might provide a lot of the desired ‘downward pricing pressure’ at many institutions of higher learning?…

may we all find a better day.

What’s that like a week of illegals crossing the border? That will be great, convert all the office towers to illegal towers, and screw all the landlords over. Hilarious!!

I think most readers realize the majority of the debt on these substantial office buildings are not owned by FDIC insured banks. The debt is held by pension funds, insurance companies and PE firms. I don’t think the Fed has any desire to bail out these type of entities.

You are assuming the fed is independent. I hope you are correct.

I think the FED is going to stay as far away from bailouts as they can. If we get a recession they can cut interest rates and that is a questionable if. Right now we are in a bull market with strong employment and moderating inflation.

Very informative article. As always, excellent analysis. The occurrence of of severe financial doom would materialize only in a purely market driven economy – one that allows investors to fail. However, as we became an economy substantially reliant on government interference at first sign of few large failures, financial support will come in some form of stimulus, bailout, tax abatement, direct purchase (yes – a shrinking government workforce always needs increasing amounts of resources, even real estate)

Consultant for banks on commercial loans. CMBS are 10Y FX debt w/ very high leverage. None of these can get taken out based on current valuations and current IRs.

Oh, and they are non-recourse so why would investors defend an upside down investment if the banks/remics have no way to force them to? It’s a systemic response to a very predictable market shift.

Bigger than CMBS are bank balance sheet loans aka “Bridge to a Sunny Day” loans. They are floating rate ST cash out loans where investors play musical balance sheets with banks, cashing out over and over and now bailing b/c refinance is not possible w/ current valuations and avail leverage terms.

“CMBS are 10Y FX debt”

This is not correct. CMBS mortgages can be any term, and some (click on the linked articles to see which) had terms of just a few years. Most of the CMBS mortgages that defaulted that I linked here were variable rate mortgages. Some defaulted on the payments because the rates doubled; others turned into repayment defaults when they matured, after having already defaulted on the payments.

What I find interesting is that the implosion of CRE during the great financial fraud (let’s start calling it what it was already) came after the market tanked. Here we are now, admittedly there is even less true price discovery, none the less, here we are, the economy appears to be cranking, people are still spending, the market has been positive etc., so what are we supposed to make of this? Is the CRE market suddenly a leading indicator? I don’t think so. Personally, I think that this is evolution (for a change). The work model is changing my friends.

CRE is certainty a leading indicator. So were bank failures So is crime and homelessness. What we have is a slow motion train wreck, one box car at a time. I heard a good analogy from an economist recently. Think of a brick dam with so much pressure(think debt) building up that all the bricks are straining and creaking and leaks start popping. The Fed puts its finger in a leak, then another and another. All the bricks are straining, but the pressure is going to blow and no one knows what brick will blow. When the brick blows fingers dont help the Dam blows. Thats when panic sets in. This is what we have now as I see it.

good analogy S: kinda sorta describing with the bricks and debt what HAS clearly happened before

question is, where to put the nest egg so it too doesn’t get destroyed when the dam blows out???

outside USA?

in a jar in the backyard?

Treasuries?

more dirt — paid for with cash?

bank accounts paying $0.01 per thousand?

If you are receiving $0.01per thousand, consider another bank.

sorry, but i dont see much panic yet. that is still in the future.

going from extreme greed to extreme panic. Its how the game works. Many names: equilibrium, business cycle, karma, yin yang, math, human nature, Greenspan/Bernanke/Yellin/Powell, Goldman Sachs…if you learn the game too well they can just change the sport. The game is called wealth transfer(inflation) and its your wealth to them. Just when you think youre good 1987 happens, again. Just when you think youre retired, GS says..nothing personal, its just business.

WB,

“the great financial fraud (let’s start calling it what it was already)”

We were all worth more than the big banks until they were bailed out.

I heard Jamie Diamond yesterday bitching about Basel 3 and how we have the strongest financial system in the world. I don’t know anything about Basel 3 but I got laid off when his bank failed. Muckety Mucks…

I agree with the rest of your comment too, there is change going on and we are still in a bull market. I think the fed is going to defend workers to the best of their ability.

The interest rate stocks are being sold because they are owned by the same sorts of people and funds that own long bonds. Too bad…

My poorly oil and metal dividend plays have been up the last 2 days.

It seems some balance sheet things eventually can be engineered by the Fed for banks that hold toxic waste, in theory, maybe time can be manipulated by TARP and BTFP, etc — but at some point, there’s the elephant in the room problem, of a tsunami is useless buildings and excessive worthless square feet.

Apparently, there’s a lot of vacant buildings in our future, and that has to impact the entire universe of investing, in terms of future valuations and risk.

This time is different

Allow me to summarize…

When you mis-allocate resources and capital, bad stuff happens.

There is some serious ‘bag-holding’ being done in the bond world as the fat guys fight each other through the door. Kind of tickles me because they always thought they were so smart, smarter than us equity guys.

The Federal Reserve had nothing whatsoever to do with TARP which was a Federal government program in which nearly all of the forced loans were repaid in full by the companies with interest.

There are way too many banks. Let’s convert some to apartments for the homeless. Get some value out of them.

Thomas Curtis

Wells Fargo has already started doing this. I ran into a homeless squatter in the lobby of the Rockville, MD branch.

A credit union in my town gives free lobby coffee to customers, but also gives free coffee to homeless who come and ask. So I became a customer. They are good people to do that. Not everyone can afford or enjoys the strange things done to good coffee these days.

rick m, yeah it’s all fun and games until one of the homeless guys assaults or rapes a customer (a lot of the homeless are mentally ill), and then sues the bank for encouraging the homeless to congregate there.

One thing I wonder about these commercial real estate mortgages is how was the money orginated when the loans was first issued? Was the money originated against the collateral?

Then, what happens when these CMR’s default? Do the money get destroyed or do they continue to circulate? In other terms, do the defaults dent the monetary supply?

I’m sure someone more knowledgeable can correct me, but it seems to me that a default on a loan removes the destruction on loan repayment, permanently increasing the money supply.

Would love to hear more thoughts on this.

Your loan is my asset.

Your rent payment is my cash flow.

A loan default doesn’t change the money supply because an asset of equal value and a cash-flow of equal get destroyed with it: The loan is an asset to the lender, and the lender loses the cash flow and ultimately part or all of the asset.

When a building owner/investor throws in the towel and gives the building to the bank, they are still profitable ententes with significant assets. Why don’t the banks go after the owners for some repayment? Seems to me they are still on the hook unless they went into bankruptcy protection. You or I would be hounded endlessly by debt collection agencies.

Most of the CRE mortgages are non-recourse, meaning the lender has a right only to the collateral and is not allowed to go after other assets.

Even if the CRE mortgage is recourse, the property will be in a special LLC with only the property in it, and so at the most, the lender can go after whatever is in the LLC, which is the property and an empty checking account.

Boston Consulting Group says 1.5 Billion square feet of office space could become obsolete, not counting the rate at which AI will be making people obsolete. Office space per employee is also declining.

Landlords don’t seem to like reducing rental rates and google searches on rental rate trends seem to come up sketchy, but that could be because I’m lame at it or should be looking elsewhere.

So, who is still building office towers in depressed markets? I seem to recall mention of that in earlier articles.

una – might be the ‘Wile E. Coyote runs off of the cliff while pursuing the Roadrunner’ effect…

may we all find a better day.

Bank reporting (10K, 10Q) will break down the exposure to various real estate collateral types. If you want to get a sense of the risk a particular bank has to this sector, look for the “office” collateral exposure in the real estate loans section of your favorite bank’s annual or quarterly report.

This CRE situation could the start of an enormous prosperous boom for Caterpillar whose equipment will be in high demand to tear down all of this CRE blighting the American landscape and return it to bucolic parks all around the country in the coming years! No wonder why CAT stock is soaring to near record highs!

c.40% sales are in construction

c.35% in energy & transportation

c.20% in resources

Nice markets to be in

From the Tax Foundation:

“Property taxes are the largest source of combined state and local tax revenue in the United States, responsible for 32.2 percent of collections across all state and local tax jurisdictions in fiscal year 2020 (the most recent year for which data are available). This is driven almost entirely by the predominance of property taxes in the local revenue toolkit, where they are responsible for 72.2 percent of all tax revenues.”

The WFH trend is going to increasingly add risk to various future real estate investments, and obviously cities that will be impacted by revenue challenges.

Eventually this will become increasingly polarizing with politics and social evolution, as WFH employees and RTO-employees battle over cultural divisions.

This wasn’t on a bingo card a few years ago.

And those property taxes are primarily spent or should I say wasted on a local primary and secondary educational system in big cities that has failed to provide a decent education for its students.

The results of the primary/secondary education system in many of the big cities in the USA are pathetic, disgusting, and show that there is no future for the products of those schools.

You do not need office space for workers that can not read, write, and do math at a high school or college level.

Nmae one other G7/G20 country that has an educational system and outcome as bad as the USA.

Ed – attend local school board meetings much???

may we all find a better day.

I work at a major US bank and in the past 3 months they’ve gone from:

– we’d like you to come into the office more

to

– if you don’t come in the company will implode

There is nothing to actually back up that scare tactic so I must conclude they have an ulterior motive.

All other major companies have also started saying the same thing at the exact same time. Tech workers are super scarce, if we had a real free market many companies would stay remote and grab all the better staff.

But we don’t appear to live in that world.

“There is nothing to actually back up that scare tactic so I must conclude they have an ulterior motive.”

They want you to feel like you belong so you won’t leave. But it may be more than that.

My experience is with operations other than banks. Employees tend to be more productive if they’re engaged and made to feel important. I kiss their asses and in return they knock themselves out for me. Remote work tends to sacrifice the interpersonal synergies.

Is that ulterior enough for you? Or is it considered manipulative these days to give people some sense of job satisfaction?

If the only part of your job that gives you satisfaction is having your ass kissed then yes, that is extremely manipulative and ulterior.

But hey, I’m a Nigerian Prince, so people kiss my ass whether or not I show up at the office/throneroom.

So I may have a notion of whats happening in your situation. I worked in a very lavish office for a Fortune 100 company and within a few months it was obvious we didnt need half the space. I kept asking, why are we paying so much for such a big footprint we’re not even using?

Turns out the big wigs that make those decisions about closing/consolidating offices didnt know the contract details – what kind of revenue that office is really generating and the source of those funds. We were doing work for programs located thousands of miles away and a knowledgeable person would have shut the office down and had the workers move to larger offices closer to the customer.

By stubbornly holding office space that wasnt really used for probably a decade when a local contract was held, the local manager had a great (but fake) story about how well the office was doing. I had already left by the time covid delivered its the death blow and everyone save for one employee left for greener pastures, not wanting to move.

So maybe its just a way for management to hold off the taking of their scalp.

That’s not my experience. There are still plenty of remote jobs out there, just a lot fewer than there were two years ago.

The fact is, a lot of people like coming into an office, so even if they are the “top talent,” they’re not necessarily going to gravitate to the WFH jobs.

I’m 100% WFH (my field has had that for a longtime now), but I’m thinking of going back to hybrid and onsite 2-3 days a week. Last 2.5 years I can feel the deconditioning from not walking as much as I did on-site even though I still exercise 5x a week. I basically sit 8-9 hours straight a day now.

Side note: Wolf, I clicked an ad on your site at the top of the page (Land Rover Defender, but it did it again on another) and instead of opening a new page/tab in my browser it just went to their webpage. I had to go back a lot to get to the original article. Other sites have their ads open a new tab (in Chrome at least). In case that’s something you may want to try so people aren’t moved off your site and can still read quickly where they left off.

I don’t control that. When it comes to ads, I control almost nothing, LOL

Z33, I thought you can set most browsers to “open in new tab”. Maybe I’m wrong.

In late June 2003 SFGate reported CRE vacancies in San Francisco were at 31% of available office space & climbing. I do not know if that counts ground-floor up, or if it conflates Retail with Office.

What I am confident of, having schlepped in offices in S.F. for nearly 30 years, is that there is not going to be a material recovery of use. Unlike the RRE crash of 2007-2009, there is no feasible re-use here. You tear them down or board them up. This is a sea change.

Many headwinds – remote working and meeting; saved transit time; saved parking $; far less inviting downtowns.

Respectfully submitted!

That 31% availability rate for office space tracks office space for lease as a % of total office space in the City. It does not include retail/restaurant space for lease in the same building. That’s a different category of CRE that is tracked separately.

Your paragraphs #2-4 nail it.

Random thought, but is there any reason that all retail/restaurant space has to be on the first floor? What if they reconfigured these buildings for the first two or three to be retail?

Restaurant high-rises are common in big-city central entertainment areas in Japan, such as in Shibuya (Tokyo). You stand in front of an 8-story building, and it has nothing but restaurants in it. Pretty cool, often with great views from the windows.

But I believe these buildings were purpose-built for restaurants. In Japan, urban renewal is a common thing with entire multi-block areas torn down and replaced. I haven’t seen any conversions.

Brick and mortar retail is dying, it’s getting killed by ecommerce. Retail CRE is in even worse shape than office, and has been in terrible shape since 2017. So no one is converting anything to retail. Some segments still work, such as grocery stores, gas stations, auto dealers (they own their properties), and a few others.

Got it, thank you. Where I live, restaurants are still packed, so I guess I was thinking the market could accommodate more of them, but then at some point, they won’t all be packed LOL.

“2023” SFGate and please add “saved office space rent” to the headwind list.

If you are old enough to remember the 1974 recession, you might recall that it was also a bad year for real estate, both commercial and residential. REITs that invested in mortgages were among the worst performing segments of the market. The Nifty 50 also imploded.

Great article. Thanks!

What’s more interesting to me is who owns the CMBS? Is there a way of finding out which mReits or CEFs or other securities actually own them?

Another nail in the ‘soft landing’ or no landing or no recession narrative.

Sorry, but Commercial RE is not just another Bath and Beyond story. It’s not just malls, or office towers, or hotels.

It’s CMRE. It’s a pillar of US finance/debt/.

Why in trouble so fast? Variable rate mortgages with no recourse. The BIG swan in the coal mine.

Last week WS had a list of almost twenty hotel/motels that Ashford had handed back to the lender. Two or three Courtyards, which is the budget Marriot line.

Convert to residential? They are already. People can live there. No conversion needed. But they had variable rate mortgages and those doubled, so…bye.

How much clearer can Powell make it when he says of the even bigger story, housing: “house prices must come down so Americans can afford houses’

Or as Deutsche B puts it: ‘we are looking at the first policy induced recession in 40 years.’

Moving from the obvious to my POV: I think Powell is extra motivated to rip off this band-aid fast, to take the pain now, so he can cut in 2024 and hopefully avoid having the same Pres who in 2018 called him ‘worse than Xi’ for taking some baby steps on rates in 2018.

The bizarre resilience of stocks etc., in the face of the most overvalued market since 2000 or 1929 must drive him crazy. But.. there’s always more hikes in the locker.

PS: so what is keeping the plane aloft? Govt debt continuing to grow out the wazoo. Tens of billions in CRE disappear but are replaced by hundreds of billions in new govt debt. More debt added since the debt ceiling soap opera of a few weeks ago than the US incurred in its first 200 years. After paying for WWII etc.

Fitch, whose job is assessing credit, points out that this is unsustainable. Yellen, Dimon, etc. react like Fitch doing the math is like farting in church. But let’s face it, we’re all kind of in the ‘deficits don’t matter’ camp. It’s old news. We’ve adapted.

Another helpful nugget in the article. That being that securitization helps as a shield for what otherwise oils be considered bank debt

On Canada there is a further step back on that we still keep the capital market operational arms ie bank owned dealer brokers at a distance by claiming the jirisidictional oversight is not federal but provincial and sro even though post 2008 liguidity injections from the federal level amd also from the us fed reserve were used to inject liguidity to transfer debt from the dealer broker arms of our big banks until it had matured amd showed a profit because the earlier strategy to adjust the time frames when the debt had to be recognized did not provide adequate time

My thoughts are that had this covert operation not been undertaken despite the jurisiDictional divide our capital markets would have seized up for the primary and secondary capital markets and caused more than a few hiccups for fed prov and municipal ability to sell debt and also for others selling into the capital markets which would have triggered downgrades by ditch etc for our governments debt

Yes our banks didn’t go bankrupt but without the 114 debt injection tje functioning of our capital markets would have seized

But even though the supreme court of camada gave the final nod and deemed having a federal oversight body for Canada akin to the other G7 our capital markets project was shuttered shortly there after and the whole mess handed off to one provincial securities body. That being the Ont securities commission

And our banks reputations were preserved

And taxpayers wallets were spared since the osc is no longer funded by the public wallet and hasn’t been since the mid Two thousand and teens

Perhaps Mr Richter could correct me if the above is not correct

Solution?

More Casinos

Right?

CRE is starting to feel a little like the national shopping mall decline, although I can’t imaging anything like that continuing in CRE. As stated, hope this is just a cyclical thing.

BWAHAHAHAHAAAA!!! Back in 1996, when I wrote my landmark paper I titled What is Money?, I was telling people how the fiat currency system would implode one day, and now it looks like that day is almost here!! This one idiot I worked with, Roger, he read my paper and said that I didn’t know what I was talking about because I didn’t have a degree in economics from a major university!! Well, the ones who DO have those degrees from major universities, are the ones who made this problem a thousand times worse!! We are looking at a world wide financial system collapse, and it’s all because of some greedy little bastards thought that it is a good idea to create a financial system with nothing but hot air behind it! Well, their “slice” of the moose turd pie they made is going to taste just as bad as what is served to everyone else!!