But the 26% plunge in gasoline prices hit gas stations. The pandemic home-remodeling & furnishing boom is over. Ecommerce is still killing department stores.

By Wolf Richter for WOLF STREET.

Retailers have a problem: Prices are no longer easy to jack up. Inflation shifted to services last year where it still rages. But inflation in goods has cooled, and goods is what retailers sell. Gasoline prices have plunged from the peak a year ago; food prices on a month-to-month basis have leveled off this year and even dipped a little; and durable goods prices are up less than 1% from a year ago, with some categories showing declines (detailed discussion on the Fed’s favored inflation measure). Prices are reflected in revenues, and when prices don’t rise, or when they fall, revenues get hit.

And yet, despite these pricing dynamics, retailers reported that the drunken sailors still haven’t sobered up.

Retail sales rose 0.2% in June from May, after the upwardly revised 0.5% jump in May from April, and 1.5% from a year ago, seasonally adjusted. Not seasonally adjusted, sales rose by 1.7% from a year ago to $705 billion. And this despite the large-scale shift of spending from goods to services over the past year or so.

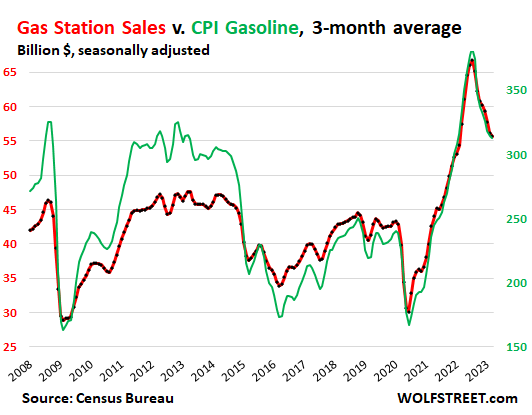

Sales growth continues to be driven by large gains in ecommerce, despite all predictions that people would return to brick and mortar stores. Sales at auto dealers jumped over the past three months, and we knew that from the jump in new-vehicle unit sales. But at gas stations, sales plunged 19% year-over-year due to the 26% price-plunge in gasoline from the peak last year (you’ll see in the chart further down that overlays sales at gas stations and the CPI for gasoline).

Retail sales are not a measure of consumer spending. We track consumer spending separately, which includes not only goods, but also services where consumers spend nearly two-thirds of their money, and it’s adjusted for inflation.

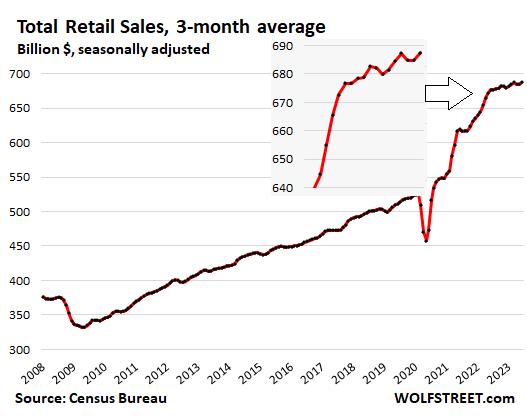

The charts below show the three-month moving average to tamp down on the drama of the monthly ups and downs that obscure the trends.

Retail sales, in terms of the three-month moving average, rose 0.4% from the prior month and was up 1.6% year-over-year. This is a weird looking chart for the history books on how to overstimulate an economy with government handouts:

Retail sales by category, 3-month moving average, seasonally adjusted.

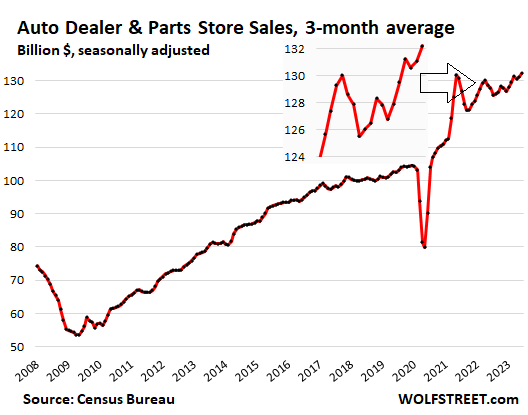

New and Used Vehicle and Parts Dealers (22% of retail sales):

- Sales: $132 billion

- From prior month: +0.9%

- Year-over-year: +3.4%

- CPI used vehicles: -0.5% for the month, -5.2% year-over-year

- CPI new vehicles: 0% for the month, +4.1% year-over-year.

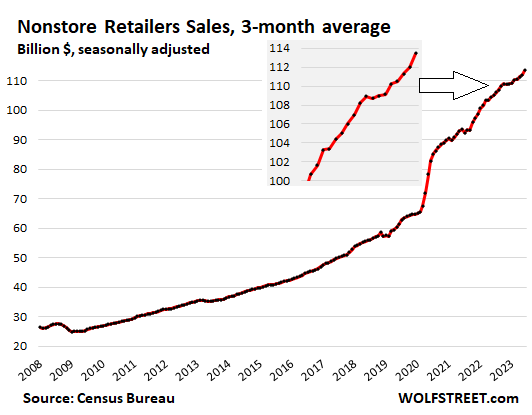

Ecommerce and other “nonstore retailers” (19% of retail sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $113 billion

- From prior month: +1.3%

- Year-over-year: +8.0%

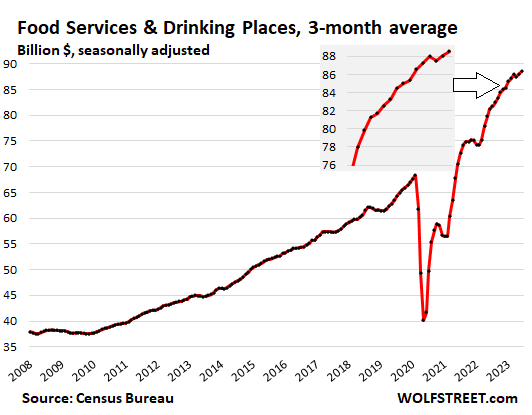

Food services and drinking places (15% of retail), includes restaurants, cafeterias, bars, etc. Note that Americans now spend quite a bit more at restaurants and watering holes ($89 billion in June) than at grocery stores ($82 billion, next chart down):

- Sales: $89 billion

- From prior month: +0.6%

- Year-over-year: +9.0%

- CPI for “food away from home”: +0.4% for the month, +7.7% year over year:

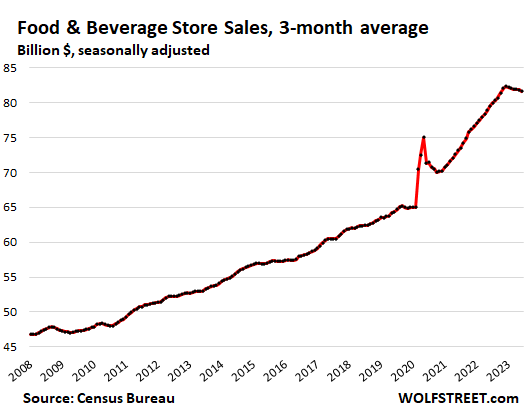

Food and Beverage Stores (14% of retail). You can see the leveling off and slight dipping of grocery prices in recent months:

- Sales: $82 billion

- From prior month: -0.3%

- Year-over-year: +2.6%

- CPI for “food at home”: 0% month-to-month, +4.7% year over year:

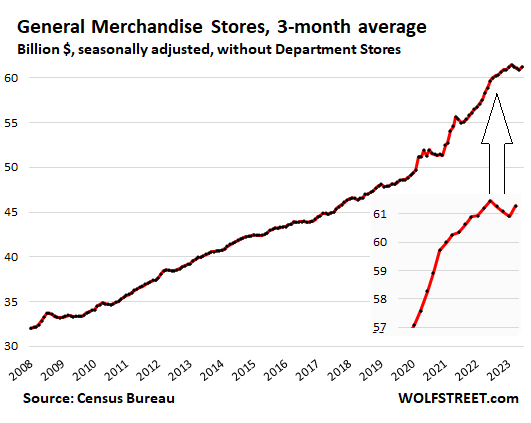

General merchandise stores, without department stores (10% of retail):

- Sales: $61 billion

- From prior month: +0.6%

- Year-over-year: +2.6%

Gas stations (9% of retail):

- Sales: $53 billion

- From prior month: -1.5%

- Year-over-year: -19.2%

- CPI for gasoline: +1.0% for the month, -26.5% year over year:

This chart shows the CPI for gasoline (green, right axis) and sales in billions of dollars at gas stations, including other merchandise gas stations sell (red, left axis). It shows that the sales declines are driven by price declines, not because consumers are driving less:

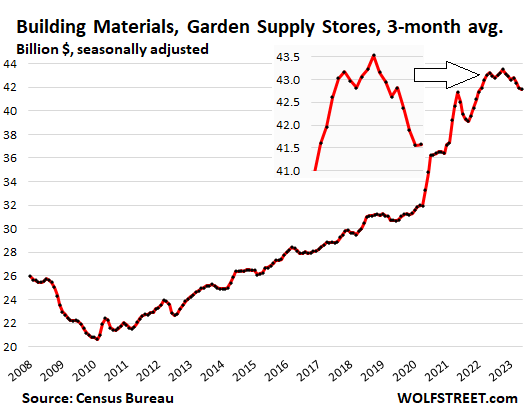

Building materials, garden supply and equipment stores (7% of retail). Home remodeling boom is over, back to normal:

- Sales: $42 billion

- From prior month: 0%

- Year-over-year: -3.3%

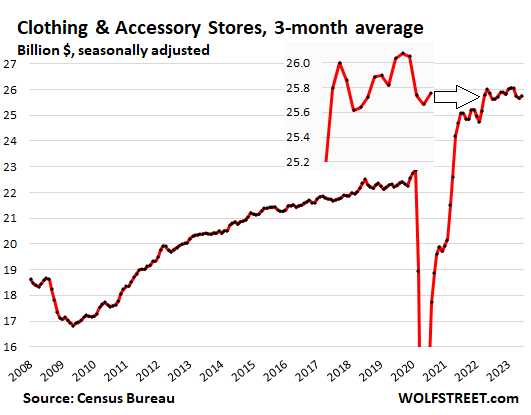

Clothing and accessory stores (4% of retail):

- Sales: $26 billion

- From prior month: +0.3%

- Year-over-year: -0.4%

- CPI apparel: +0.3% for the month, +3.6% year-over-year.

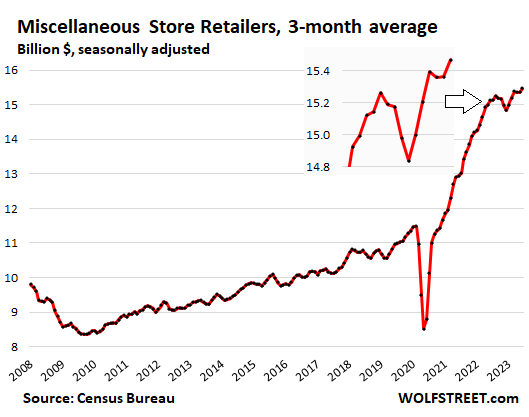

Miscellaneous store retailers, includes cannabis stores (2.6% of retail): Specialty stores, from art-supply stores to wine-making supply stores. Cannabis stores are the growth driver.

- Sales: $15.5 billion

- Month over month: +0.7%.

- Year-over-year: +2.3%

The Cannabis Benchmarks U.S. Spot Index reported that the average price in the US dipped in June from May and was down 5.1% year-over-year. The chart reflects in part the drop in price of cannabis products, with the sharpest price drops having occurred starting in early 2022 through March 2023:

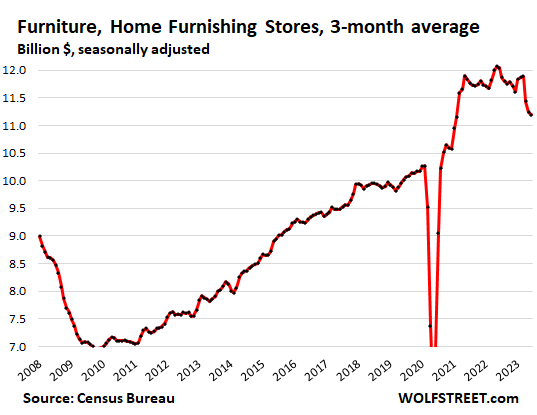

Furniture and home furnishing stores (1.9% of retail). Clearly, the pandemic boom of sprucing up the house is over, and the entire pandemic-bubble has been unwound. Now it’s back to trend:

- Sales: $11.2 billion

- From prior month: -0.4%

- Year-over-year: -7.0%

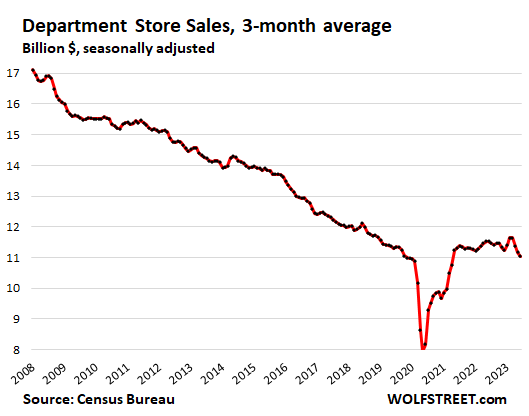

Department stores are on their way out, now down to 1.8% of retail sales, from around 10% in the 1990s. Most of them have vanished. Just a few chains are still open, and they’ve been closing stores for years. Consumers are buying the exact same stuff online, including at the ecommerce sites of the few surviving department store chains. Online sales by department stores are included in the ecommerce retail sales chart above.

- Sales: $11.0 billion

- From prior month: -1.2%

- Year-over-year: -4.2%

- From peak in 2001: -40% despite 21 years of inflation.

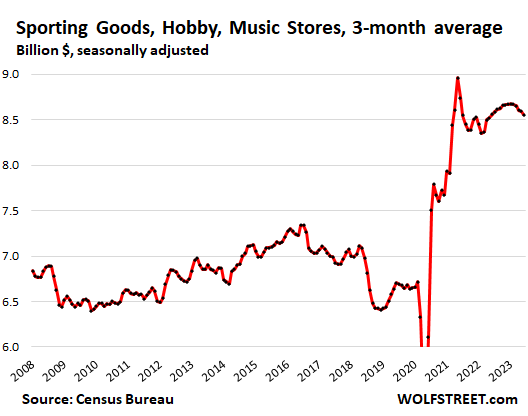

Sporting goods, hobby, book and music stores (1.4% of retail); another bizarre pandemic-boom-is-unwinding chart:

- Sales: $8.6 billion

- Month over month: -0.5%

- Year-over-year: -0.1%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Without high unemployment the inflation and customer spending will not come down. Neither will asset prices come down.

I don’t think the fed policy is having much effect on unemployment/customer spending/asset prices, etc.

The Fed has failed to cause as recession like many on this blog have anticipated.

I don’t understand why so many people want a recession. A recession means more QE, artificially low interest rates, and Section 13 programs. A soft landing means rates can at least stay somewhat high. Do we really want to go back to the ZIRP/NIRP world of the previous decade?

While it would be nice to see a proper recession that flushes out excesses and is NOT followed by trillion-dollar stimulus, unfortunately the current political environment favors extraordinary govt & CB intervention to prop up economies & markets, and voters have come to depend on it & expect it from their elected officials.

We want a recession to clean out the excesses. If our idiots in charge wanted to do more QE and ZIRP, that’s on them.

I’m not going to pick the lesser of two evils. That just means I get evil.

Why do we come to this blog looking for a landing? Because, we were grossly screwed, and we know that this shit is not sustainable. So we hope that this obscene casino party will end and we will return to normalcy.

Guess what, there cannot be a “soft landing” anymore, too much bad Karma has sealed the future of masses.

There will just be more fudging of numbers till they become completely absurd, as majority gets poorer.

My predictions of the past are better than my predictions of the future, but I think the Fed has learned its lesson regarding QE. In the event of a hard landing, the Fed will likely slash the federal funds rate to zero and create some special lending facilities, but probably will suggest that Congress try using fiscal policy instead of relying solely on monetary policy. I think the Republicans will insist on more tax cuts for corporations and billionaires, and the Democrats will insist on sending stimulus checks to everyone on the planet.

Because they think / hope that a recession will cause millions of unemployed Americans which should lead to lower housing prices. According to their theory…..

Reality is of course that with historic low inventory the prices will remain stable or go up during recessionary times: the ten year treasury yield will go down which pushes mortgages rates down…..we all know (should know) what happens with lower mortgage rates…..

@LIFO Doesn’t even need a recession for that. The Tax Cuts & Jobs Act of 2017 (aka the Trump Tax Cuts) expires in 2025. If one party captures the trifecta next November, it will get to unilaterally decide the fate of that legislation. But given the Democrats’ starting negotiating position is to sunset the cuts for the highest tax bracket while leaving the remainder intact (i.e. where the bulk of the cost comes from, because the middle class far outnumbers the rich), we’re looking at more trillion-dollar deficits no matter what. And if it’s divided government, analysts are predicting the most likely compromise is trading something expensive for something expensive (e.g. immediate R&D expensing for expanded child tax credit) — deficits explode, but both parties get what they want.

You clearly own a house.

And a car, already.

The 65% of the households that own a home probably would not want to see home prices decrease. Nor would they want a recession that could cause them to lose a job.

That being said, Goldman Sachs does predict home prices will grow slower than the rate of inflation during the next few years.

Thus it will be better to rent the next few years and put your money in to Treasuries or bonds earning 5%.

———–

Goldman Sachs’ forecast model predicts a very faint increase in U.S. home prices as measured by Case-Shiller:

Their model expects U.S. home prices, as measured by Case-Shiller, to rise…

+1.3% in 2023

+1.7% in 2024

+2.4% in 2025

+3.8% in 2026

To put this into perspective, the average annual growth rate of U.S. home prices since 1976 has been 5.5%, including an unprecedented surge of 19% in 2021.

Furthermore, the forecast anticipates minimal relief for mortgage rates, projecting that the 10-year Treasury yield will average 3.75% between 2024 and 2026. If this scenario unfolds, mortgage rates are likely to remain around 6%.

It is important to note that U.S. home prices have already increased by 2.3% this year as of April. Therefore, for Goldman Sachs’ prediction of a 1.3% national house price gain in 2023 to come to fruition, prices would need to experience a slight decline between now and the end of the year.

It sounds like Goldman Sachs does indeed expect some softening this fall.

RU82 — I think GS is just wrong, here. It supposes that housing was underpriced before the pandemic run-up, which it was not.

I think a large part of what you’re seeing move the market are people who sold their homes and made a bundle sometime during the last 4 years finally capitulating in their staring contest with stubborn sellers. That, and Only Fans winners. I think a long slow decline. No upward trend for years, despite some phantom zags

As Wolff said, unless there is some major crash in the economy, even though this inflation is such a crash, the FED will only play with interest rates, no QE. By the time he lowers the rates by 1-2 points, inflation will rise again and the recession will subside.

We won’t see QE anytime soon

How are they not coming down?!

Decades of money printing -no rates are up!

But markets keep going up!

What is going on?! Is this a joke?!

The consumer will start eating their seed corn. The desire (or need) to spend has more utility than the desire to invest (or save). Stock dividends are way behind the curve in terms of income generating investments. The same thing happens in closed end bond funds when they sell their holdings in order to pay their dividend. Your dividend is paid out of your principle.

I think the typical American buys stocks, houses and cars right up until the clock strikes midnight and then stops spending cold turkey when he realizes he made a mistake. YOLO.

For anyone getting close to having to take RMDs or maybe early in the process, I spent a couple of days boning up on it. Most likely three more years of low income tax rates before they return to previous rates.

There is a free program on line that allows you to load your information and it will optimize the best Roth conversion amounts. It has the current and new tax rates plus the three or four other taxes that kick in at different income levels. Beautiful output visuals so you can see all future income and taxes based on current tax law. Its called ORP (Optimum Retirement Planner).

My friend got caught in what they call the widow trap which means your husband dies and you end up with so much money in deferred accounts that you are paying very high taxes and so will your kids most likely. If you wait too late, you have very few options for tax minimization

My understanding is the guy that wrote it is a computer programmer, not a finance major.

well it’d be nice to have some retirement funds to convert

I converted my stuff 20 years ago

now I have rental property and notes(on RE) in my ROTH

making my 15% ole fashion way – cash flow monthly

have only contributed once to retirement in past 15 years(2 years ago)

that’s sitting in bank in cash waiting for lower income year to convert

no pension, just investments I’ve grown in past 25 years

my wife’s pension from local school district ought to be enough to pay for her medicare supplement and that’s about it

SSI under $1k

mine – well put it this way – I didn’t invest for SSI return

Ambrose – The consumer will start eating their seed corn.

well I don’t doubt that – problem is govt keeps printing more seed corn to eat

I don’t own any stocks, bonds, wally street, insurance(well other than policies I pay for)

I like assets I can kick – problem is REAL INFLATION is 30% and kicking ROI down from 25% to 10% for now

Auto repairs vs buying new: Net national product.

People have been driving older and older cars and trucks for years now. But the average mileage is now so high that very expensive rebuilding and major repairs are needed. The cost of parts and labor is astronomical and try to find a competent mechanic! Not even the dealerships have the skilled mechanics to totally rebuild these things anymore!

I just got the bid from the dealership to do a drop in engine replacement on my Duramax diesel truck: $38,500. A new drop in reman engine is $17,000, but the truck is $80,000+- new. *And* it was the dealership that blew it up in the first place while it as on the their own test stand for something else! Oh, and they no longer have a diesel mechanic who can fix it and arent sure it will run after that! Damn rights I am fuming! Its just out of warranty!

This economy has been coasting on fumes for decades thanks to MBA profit squandering, purposeful neglect and not quite in time everything and now its going to hurt. You need to start looking at NNP which shows a more accurate picture.

High inflation has only a low correlation with low unemployment. It is quite easy for inflation to rage with double digit percentage unemployment. Just as it is possible to have unemployment just slightly about the total employment line (that is somewhere between the 4.5% & 6%) and deflation. Below that total employment line you do get a small but sustained upward inflationary pressure until employers decide that labor gets to expensive and you get above that line.

Seeing that the US is currently in a total employment situation there is that small but sustained inflation going on. Thing is not to the point as the amount of inflation in services. What you are seeing there is mainly the result of excess money in the system. That is also the reason that what the fed is doing doesn’t look like it is working. It works since the fed is (finally) draining that excess money from the system. It is just that it takes time (and seeing the excess, as documented on Wolfstreet, it won’t be over soon), while the fed is only daring to take small steps since to the fed the system as it is now is fragile and they don’t want to get a depression/recession/stagflation going by accidentally putting too much pressure on it. And while the higher inflation is unhealthy for the system (there is a reason that inflation is supposed to be between 0% & 2%) it can handle a decade or so of higher then wanted inflation while the fed slowly tamps it back down to that 2% line.

My personal goal is to reduce my expenses by $6000/year without in anyway reducing my quality of life. I’m 2/3’s of the way to my goal and have identified the last $2000 of expense reduction which I will implement in September. Are there others out there like me ? It’s not because I need to, it’s because I want to withdraw my support as much as possible from this culture and economy. I am starting with what causes me the least personal inconvenience and trying to prepare mentally for the hard stuff that comes later.

Certainly, not my wife.

I was thinking “…he must not have a spouse or children…”

Ditto.

I applaud your abstemiousness — sort of like playing the home econ version of the sober copy editor, hacking away at the tautological fluff & fodder with your red nib’d machete. How full can one cram one’s closets anyway? YouTube George Carlin’s bit on Stuff, sometime.

From where I stand, so much of what provides the engine for consumer spending is quiet but certain misery — misery effectuated in large part by the very drudgery that everybody’s apparently getting these big fat juicy raises for showing up for. And before you chime in with how much you love your gig — yeah, ok; I like what I do, too — but I’d be pretty ok with collecting an attaché case full of cash every month from the Money Courier before waddling back up the driveway to my hammock, chips ‘n’ dips and robot masseuse.

How long before the average US consumer realizes they can’t fill that hole with the latest/greatest? That the latest jeans aren’t going to win her back? That a razzle-dazzle model X automobile is THE most visible and risible sign of insecurity there is? Is the backlash against consumerism not in the mail?

I love how posters judge others using their own standards.

I/ we are doing the exact same thing. Repairing any house issues, auto issues, health issues, financial issues as we move forward into next year. We have pared down everything the past 2 years while still living comfortably and traveling regularly. Our total living expenses including taxes, insurance, food etcetcetc now total $3500/month. Previously almost $6000/month.

We HAVE the money, which is not the issue. Just believe we can live better for less.

I did it after my divorce. Got rid of everything, quit work and lived 5 years on a total of $75,000.

Right now I am helping my elderly parents so I have no housing cost. Probably spending less than $500 per month. I just bank my income for the future when they are gone.

I have learned a lot since I retired. Pretty easy to make it on a $1000 per month, but you aren’t living the middle class life.

I have always spent money upfront if it meant less per month afterwards. Lowering my monthly costs has been my goal for decades. It is not a once in your life event.

I genuinely mean this non-judgmentally. I really do. I am happy for you. No insult meant.

That said, by saying “Right now I am helping my elderly parents so I have no housing cost. Probably spending less than $500 per month.”, you provide the best fluffed up description of saying “I live with my parents”.

Good for you. Genuinely. Just made me laugh.

If you hate this culture and economy, why do you live here?

I’m confused. We live in the richest time in human history (from a technology, human rights, etc. perspective)….in one of the richest countries in the world. Yet….all this whining.

Sure things could always be better, but I’m 54 and I remember times when things were worse in many ways. Perhaps you’ve read of some times when things were FAR worse?

So Dan’s gonna cut $16/day off his spending. I could do that to. It would be smart. But not to “withdraw support from the culture and economy”. Who would I be kidding…..will Dan and I’s $32/day protest upend the world order? I don’t think so….

I’m here for the same reasons everybody else. Trying to figure out what’s going to happen and why. Instead of whining about the Fed and hoping for an economic collapse, maybe go for a bike ride or something.

I’m with both of you on this. I started cutting my living expenses a decade ago. Paid off the mortgage and other debt. Learned to enjoy cooking at home. Make my own repairs, etc… I live off of roughly $55k/year which includes multiple vacations.

That having been said, I didn’t do it to hurt the economy. I did it to have less reliance on an employer. I work part-time now because I want to. I could fully retire and live just fine.

And you are right. This is a wonderful time to live (at least for me). Everyone in my family who wants to be employed is employed. Nobody is worried about being hungry. The grandchildren have amazing lives. Lots of friends, great educations, lots of gadgets to play with.

I’m 61 and this, right now, is the best time I ever recall the economy being. People complain about inflation. Stop complaining and stop buying overpriced crap. Nobody said you had to buy the F150 Raptor. In real life, it’s a meaningless waste. And for God’s sake, why do people want a recession? Recessions mean good people lose their jobs, their houses, their cars. That could be you, your family, your kids, your friends. It’s almost psychopathic how little people care for others.

Because recessions mean companies that turn $1.00 into $.90 cents go bankrupt and that frees up resources for companies that turn $1.00 into $1.10. At least that is the theory.

“I’m 61 and this, right now, is the best time I ever recall the economy being.”

House prices are more than 10x median incomes, but it’s “the best time you ever recall the economy being.”

Can you tell us how you sell your message to the people who cannot afford to buy a house at even 50% of their current values, or even rent for that matter?

Let me guess, your housing costs are fixed, so you just casually gloss over that…

Who knows if anyone is reading this thread any longer.

I live in America because I was born here. I’m too old now to move.

In a single life time, our culture and economy seems to have changed from something generally positive to something other that positive. Or it could well be that it is I who have changed.

Looking back it’s obvious that even when I was young, the seeds of rot were in place but like many, the nation was my idol and I worshipped it by accepting it’s narratives even as the underlying realities drifted further and further from the meaning of the words used to frame the narrative. For me the first hint of real trouble was when I noticed the casual way in which my “leaders” were happy to begin redefining the words they were using.

Today, if I were a young man. I’d learn to speak Russian. I’d gain a skill. I would go visit Russia and spend 6 months there living out in the country side and see what it’s really like and consider living there. Such a vast land with so much of it’s life concentrated in a few dense urban areas. Russia will be a land of great opportunity in the next 50 years. This next 100 years might even be the golden age of Russia…or not. Russia today is what America was 100 years ago – with a Russian flavor and autocratic tradition of course. Thats the unknown part.

But, too late for that now. I’m old and will be dead soon enough and in the meantime, I’m happy to be an observer

At first I was just going to dismiss your post as one of an old fogie dismissing younger culture (rock and roll is destroying kids minds….). Thrn you went off on this strange Russia digression and you completely lost me.

Russia sucks unless you are one of the elite. I know some of the propagandists take advantage of the ignorant in this country by playing up the Gini divide in the U.S. (and it is a problem, don’t get me wrong), but inequality on the U.S. is no where near the same as Russia.

A person who lives at the 25% mark of the U.S. economy has far more opportunities than someone living at the 60% mark in Russia.

I agree with you in wanting to “withdraw support as much as possible from this culture and economy”. When T was charged I moved our voluntary Pension pre-tax to nosebleed levels to deny taxes to the Fed. Then I realized that would stop me paying off my credit card thus paying continued interest to the temple money changers, so we dropped from max 403b back to 5%. All to try and starve the deep state of taxes and reduce temple money changer interest. Next step, moving from MD to TN for better demographics re: MS13, money changers and ghetto thugs.

I’m sure you won’t encounter any “thugs” in Tennessee. You’re also going from a “good” healthcare state, to one of the worst ones

One of the biggest images I had growing up was of my uncle. He was sort of a successful businessman. The tax cost at the time was ridiculous (more ridiculous than it is now). Anyway, he hated paying taxes. He would spend $20,000 investing in silly oil well schemes in order to avoid paying $15,000 in taxes.

He would rather pay nuts and accountants extra than pay the federal government.

Crazy.

Just a note on the “Drunken Sailor” meme.

Sailors were paid in cash. Then went on shore leave after a few months at sea. Spent all their money on good drink, good food and good company because in a day or two they were out at sea for a few more months.

They went back to the ship with a headache, full stomach and with new friends. And broke. But they didn’t really care as three Navy hots and a cot were waiting for them.

AND zero debt.

Actually, sailors get paid in cash from what is left after sending most of their pay home in the form of an allotment check to the wife. In my family of sailors, most of the men sent half of their pay home to the wife. My mother got it in the form of a check from the steamship company once or twice a month. The rest of the money can get withdrawn from a purser on the ship as needed. Most experienced sailors take the bulk of it out at the end of the trip.

The drunken sailor image is true of the younger unmarried guys who do blow all their money in the first few years. But even they learn to stop eventually.

2banana

” good company” ??

More like “The women of the night”

“Ladies of the evening “??

Our drunken sailors just got the biggest pay raise of their lives after years of measly pay raises. Like almost all of us they know exactly how much they make but not so much what they spend. They don’t care how much things cost because all they can think about is that huge raise and the next one that will be even bigger.

They sober up when they run out of money or that next pay raise is not so great.

That’s why years of QE didn’t cause inflation in Japan to the same degree as here. Japanese don’t see every cash infusion as an opportunity to blow the whole wad. Americans do. We don’t have a price point at which we will resist. If we have the money, we’ll spend every penny of it.

Not all of us act like that.

But most do.

You’ve obviously never bid against Japanese buyers at auction. Money is no object/no expense spared are the twin sine qua nons of the Japanese I’ve known over the years.

You are referring to the wealthy, the types of Japanese you’ll find in Vegas gambling at the high roller tables. I can assure you after having lived in Japan for a while that the average middle class Japanese doesn’t spend every dollar he makes on crap and go into debt.

Japanese culture is frequently attacked, worldwide, by economists because the Japanese are prudent savers, i.e they have a propensity to not blow their money consuming crap.

I didn’t say anything about crap. The Japanese know how to spend and are more willing to invest in quality goods/services than any other developed nation I know. And they go large where collectibles are concerned. In 30 years, I’ve never outbid a Japanese buyer at auction.

Again, the people against whom you are bidding are not representative of the Japanese people as a whole.

No — just like you, I’m speaking empirically; living and doing business there off & on for seven years shaped & colored my impression.

My wife.

I too take great exceptions to the mischaracterization of my fellow drunken sailors, even though I retired from the Army. It is my experience that even drunken sailors are smart enough to know that when they’re out of money, they’re heading back to the ship. Marines on the other hand…. (Just kidding about Marines)

I felt bad for the marines on the aircraft carrier. They were basically the ‘police’ on the ship and as a result not too popular with the rest of the crew.

Wolf,

There appears to be something

wrong with the little inset graph for

“General Merchandise Stores”. The

numerical scale is off, at the very

least.

J

Thanks!

Wolf,

No, thank you for having a site

that is worth more than the

time spent reading it.

J.

Lots of liquidity still out there. The o/n RRP that had well over $2.2T consistently in it has been consistently coming down the last 2 months and now $1.7T. Lot of money keeps coming out of that and going into somewhere else…stocks, bonds, RE, consumer spending presumably, etc…

Short term bonds currently being issued by the Treasury.

Is that basically whats left of the COVID money before it gets spent? or maybe just someone elses profit saved? might never know

Wolf,

Do you have any thoughts about what is going on in the UK with inflation/consumer spending/wages and the increasingly serious labor strikes?

I don’t know if my perspective is biased because I am from the UK, but I feel like a major second wave of inflation/strikes, etc. 70s style is coming here.

My feeling is that the UK experience is maybe 1 year ahead of us (meaning in a year we will be dealing with a lot of the same issues), but I don’t know if my life experience is coloring my perceptions.

How are you thinking about what is going on in the UK and Europe and whether we are headed that direction?

UK does not have the cheap energy production like USA we have a real advantage here in USA with shale oil and gas

The UK has the North Sea.

?? The North Sea is almost done. Like seriously?

The UK and US situations are not comparable at all.

The UK is still suffering from the consequences of Brexit. That suddenly resulted in a massive labor shortage (most of those icky Continental people stealing British jobs suddenly had to go back to the continent), a logistics nightmare not just at the borders but also it turns out that a lot of internal transport was being done by those dastardly non British people. They still can’t guarantee that fresh produce from the continent arrives at stores while it is still considered fresh (it is getting better). Add to that prices increases due to leaving the EU and the EFTA. Cost of living have soared without the concomitant increase in wages which a lot of companies cannot handle or barely handle in addition to all the other cost increases so wage increases have been the proverbial can kicked down the road.

Then to that add the clusterfuck that is going cold turkey on Russian energy in Europe (Politically a logical idea but economically speaking a disaster), while the UK is a net exporter of energy and thus should have enough for internal use reality was/is a bit different seeing that (mainly) Germany was willing to pay multiples of the normal market prices for energy resulting in production going there unless UK consumers were willing to match those prices.

Add in that Europe (including the UK) has a more robust labor movement then the US.

The result being that the UK workers that are being turned into working poor trying to prevent that.

As for Europe itself. Another though winter since there still hasn’t been an adequate replacement for Russian energy though not as bad as the 2022-2023 winter even if the 2023-2024 winter is a normal winter. Second half of 2024 should be the seeing the first linkages of North-African energy to North-Europe. From 2025 on the energy situation should stabilize.

Monetarily speaking things will be interesting since one of the major reasons for negative interest rates (and other suppression strategies) was to provide cheap money for government deficits of the more profligate spenders in the Eurozone. France, Portugal, Spain, Italy, and Greece might run into a recession if not depression since the ECB can only buy so many government bonds to depress rates while it has to raise their primary rate to fight inflation.

Ugh don’t know why I wrote EFTA when I meant EEA.

Who Cares,

Excellent job on the write up.

What would you be looking at for confirmation/disconfirmation that the labor unrest we see in UK/EU is heading to USA?

Thinking that the Hollywood strike might hold some clues.

If labor unions are able to get concessions, then labor inflation will be much harder to contain.

The writer strike does not compare to what is going on in the UK.

In the UK people are on strike to get higher wages or else they can’t live.

The writers are striking for three reasons (in addition to prolonging the old agreement).

Standardization of residuals from streaming.

Replacement fear, they do not want to be replaced by ChatGPT or similar tools.

Job security in the form of mandatory minimums of writers each with a guaranteed minimum number of hours/week.

The first is reasonable, the movie/television/series producers have a documented habit of screwing over anyone in an attempt to squeeze blood out of a stone.

The second one, not yet relevant but reeks of buggy whip manufacturers demanding that cars must be provided with a mandatory minimum supply of whips.

The third is just unreasonable and sounds more like a pie in the sky demand that they can drop when negotiations finally start.

And if labor unions don’t get these concessions the economy will collapse due to the goose with the golden eggs being killed. The problem with the current inflation is more that there is an excess amount of cash in the system, the increase in labor costs is merely an attempt to keep the amount of money owned by the workers at the same percentage.

Some folk talk of the UK’s cost of living crisis as.. a ‘Cost of Lockdown’ crisis.

UK is the world’s fastest-growing G7 economy for 2 of the past 3 years, since Brexit officially began in 2020. The UK outgrew the US in 2021 and 2022. UK has been outgrowing Germany, France and Italy for most of the past decade. UK unemployment today is near a record low. Everyone who wants one has a job. UK exports, as a % of GDP, are at their highest level for about half a century. London recently got voted the tech, finance and tourism capital of the entire world. London also got voted (again) the best city on the whole planet.

UK is actually doing pretty good. Better than many realize :-)

The UK is an insolvent disaster and can’t even pay their National Health workers at this time and the EU won’t be giving them any bailout as the whole little island collapses into the ocean.

Nice parody of the exiters.

👍

Of course its going to recover sharper if the recession was deeper. How about looking at 2019 Data?

2020 is not pre Brexit.

Nor is today fully post Brexit with the Uk still not implementing many boarder checks.

GDP per capita 2019 – 2023

UK 47,568 – 46,066 = -3.16%

France 47,766 – 47,988 = +0.46%

Italy 42,893 – 44,226 = +3.11%

Germany 54,181 – 53,947 = -0,43%

After Brexit, France with an higher GDP per capita.

Everyone who wants a job…. has a job in Europe or the US, too. China not so much.

Dude, there are puplications which vote more or less any city on this planet best … in their respective countries.

You need to realize that the phenomen of the “cost of living crisis” is a UK problem. It is virtually absent in the media here on the continent. While inflation is an issue, the UK and especially its incompetent goverment has problems on a nother level.

Inflation is coming down. Fed did a good job?

Our salaries went up and as long as there is no job loss recession we should come out of this one in pretty good shape?

Lower prices are great for all of us…..what about the housing market though? Prices seem sticky.

Americans love shopping and that continue to be the most desirable thing for nearly all Americans to do with their time. Obviously.

Where is this recession everybody was talking about? Markets up energy down!!

Low rates, decades of printing. Rates now up, but markets still going up and people have money like it’s no tomorrow?

What the hell is going on and why am I broke?

U spend to much,stop keeping up with the jones

The markets are inflating with everything else, the extra $7TT is still sloshing around out there + the $2TT yearly deficit. If interest rates blow out then they start QE again – win/win

Volker was told to bring it Down and he did.

The current Chaiman ( who isn’t even an Economist )

has been told to bring it Down and he will

Chinese automobile manufacturer “NIO” is putting new “solid state” lithium batteries in their electric vehicles (EV) available now. The batteries are made by the Chinese firm WeLion; and have an energy density 44% higher than currently used lithium batteries, with much more range. Solid state are supposed to be safer with no flammable electrolyte, but that claim is not in the news soundbites.

Toyota in Japan has reportedly over 1,000 patents in solid state batteries. Unlikely that our quarterly driven US economic model (corporate), 6 weeks for the Federal Reserve, has positioned themselves for economic success, although some key patents may be potentially held in US firms.

The conclusions and effectivity of the IRA in an environment of patents held by competing firms (a patents purpose) may change the automotive sector and spending graphs, perhaps in the near future.

Additionally, an avenue to present Chinese automobile dealers or product lines (including gasoline powered) in existing dealerships may have an effect similar to the Japanese cars of the 1980s that was dramatic in that day.

Sorry to go off topic Wolf, but rents are going down: https://open.substack.com/pub/calculatedrisk/p/nmhc-apartment-market-continues-to-ba5?utm_campaign=post&utm_medium=email

Your comment is stupid BS. The article you linked has zero to do with rents. It’s about SELLING APARTMENT BUILDINGS, debt-financing apartment buildings, equity-financing apartment buildings, etc.

…man, not mine. ~20% increase in central Austin.

With gas, I notice that the Strategic Petroleum Reserves continue to drop, nearing 40 year lows. That said, as EVs slowly increase, that should reduce demand for gasoline. And oil has inelastic demand, so if the world starts using say, 10% less fuel, the price could go down further than 10%.

I’m not counting on oil rebounding in price.

Most projections show global demand for crude oil to increase for decades.

On a very long trend (past 2050), yes demand is expected to fall back, but not to zero rather levels seen at the turn of the century. Demand for petrochemicals is huge and continues to grow.

Tech changes though and perhaps bio-chemicals will become more prevalent.

Wait and see what happens to retail sales when gasoline prices start going up again – they’re the one component down dramatically (+/- 20%) It won’t help inflation numbers either.

Drilling rig counts are down for 10 of the last 11 months. Lower oil & gas production equals higher prices, unless demand suddenly drops for some reason – maybe the no-show recession eventually shows, but not any time soon.

The Dow is breaking out. Next stop : 1929 to 2000 highs.

I think I saw that in the tech boom we had the blow off top “after” the Fed held rates flat at just over 5%. Maybe its a repeat this time. If I was young and a gambler I might play a blow off top, but all I need from this point on is to keep up with inflation so I won’t play.

Tech bubble peaked in March 2000 (NASDAQ over 5k). Fed Funds Rate was about 5.5% through Sept 1998 and dipped down to 4.6% in Jan 1999. It then went on up to 6.5% over 18 months through June 2000 where it held steady until Dec 2000 when it started its downtrend. So the blow off top occurred while the Fed Funds Rate continued to go up (5.85% FFR was when the peak in March 2000 happened and then down after that).

I gave up on e-commerce. I can’t stand dealing with the packing and cardboard boxes. Now I only buy things at the Hardware Store down the street ( big deluxe version with crusty old guys to help you.) It’s so much nicer to pull a broom or bucket off the shelf and have no packages to deal with. I told my wife, if they don’t have it at the hardware store I don’t need it.

I agree that I am shifting purchases back to local stores where possible, but there is so much stuff only available online. The long tail is the ultimate reason ecommerce wins.

I always try to buy locally first. Buying online is a last resort.

True Value great. Lows & Home Cheap-o — not so much

I envision a day where a brick-n-mortar concern emerges which specializes in all tools, hardware and other type supplies being locally sourced, union-made, or otherwise the best import versions of the above.

Tradespeople trade at brick and mortar. supply houses that are oriented towards the individual construction trades with specialty materials and professional tool lines. They offered credit accounts and volume discount before the big boxes existed. And you can’t do industrial construction out of a big box. But lowes and home depot are cheaper on commodity items like residential light fixtures and Chinese plumbing blisterpacks, and they give a retired and active military discount, so my retired friends buy much unnecessary stuff saving money. Love old-time hardware stores, hope they survive corporatism.

For some things it’s definately still easier to do it with physical stores, for me especially since I travel for work and deliveries keep coming late so I may have a package sitting there for 2 weeks because I left the day before. Quality can also be spotty with online, I’ve ordered tons of junk before that looked great in pics and sounded awesome on fake reviews, or the fit was wrong, then I had to deal with return shipping which is annoying.

Having said that online offers a massive selection, can’t avoid all online shopping forever. At least I can’t.

Nice soft landing. More inflation in the future as supply becomes more of a problem as we drill deeper, mine deeper, and deal with more weather.

India now has more people than China and will be using more and more, energy, metal, and food. After China and India there is the rest of the 2nd world and then Africa and everybody will want to have everything of course, just like you and I. COMMODITIES COMMODITIES COMMODITIES

China is having problems with a lack of foreign investment and will have more and more problems with it’s export driven economy. The rules of the game changed. New factories are being built at home or regionally in friendly places. First 4 months of this year Mexico was U.S.’s biggest trading partner. I expect that to only grow.

I own companies that harvest the Earth and have safe dividends.

With numbers like this, Pow Pow needs to stop looking so serious and down and sing that line from 80s supergroup with Nugent…no more soft or no landing talk…it should be “Can you take me higher?” – High enough by Damn Yankees

Good time to be a FED chairman. 10% inflation (CPI) to soft landing. That has never happened before.

Before the pandemic we had one of the longest bull markets in history.

The dismal science is not quite so dismal anymore.

The FED may take a bow!

You don’t really think we’ve had a soft landing, do you?

Goods inflation has been reduced to almost nothing, almost all inflation is in services (which is mostly related to labor input).

How is that not a soft landing? Inflation killed except for labor, very definition of a soft landing.

Now the FED just needs to tighten a little bit more to curb labor inflation

Take a bow after igniting a massive inflation firestorm and destroying the financial lives of the working class and poor, driving shelter prices out of reach? Get a friggin’ clue.

The celebration (and bows) should wait for core PCE to reach 2%, until then the Fed continues to be a failure at its most important function: price stability.

The smart money was made last November.

How is that related to the Fed taking a bow while inflation is still over double its target?

It’s going to be a hawkish hike next week. Market will shrug it off as usual, though.

Howdy Folks, good deal, people are supposed to keep on living their lives. Higher for longer is fine for the economy. 4 to 6 % interest rates were never a problem before.

A sober sailor that will keep spending because I can and want too……

Rates by themselves mean nothing. Rates relative to markets mean everything.

Thetenyear was at 4 – 6 % in 1999/2000. We know how that turned out. Markets did not turn around until rates fell below 4%.

They hit 4 – 5% in 2007/08. Thetenyear crashed well below 3% before markets recovered.

In the lead up to 2020 the market was once again overvalued relative to Thetenyear. Didn’t get much above 3% and that was too much for the markets to handle. Again, markets did not turn around until rates crashed.

Now markets are at all time highs relative to rates. This did not end well in 2000/2008/2020. I don’t know why this time will be different.

Howdy tenyear, some folks dont play the stock market or care if things are long or short. Earning a little interest on savings encourages folks to save some of their hard earned money. Old school way of doing things……..

On price to sales I think we are back at 2000 tech boom/bust levels.

You could make a case that SP500 will not outperform t-bills or 10 year treasury the next 10 years. Smart money will probably take money from us peons again.

When housing is unaffordable, the money spends on something else.

The only other thing going up in price a third of a percent every day is the stock market.

4700 by Labor Day.

I at least understood why people were doing that when it was TINA. But to me, buying stocks (for every seller, there’s a buyer) at these valuations when you can get 5% in risk-free bonds is just the height of lunacy.

10 year S&P risk premium is negative. Everyone betting on QE or getting out first. Music is playing, retail investors are back in. Legit FOMO for the losers at the housing lottery. Can’t blame them. Capitalism is rotting.

I just love the “drunken sailor” analogy. Really hilarious and truly sad and reckless behavior by so many folks out there at the same time. I think “drunken sailors on leave in a house of ill repute” starting to seem more appropriate. Gotta have that “sizzle” I guess. I am so content with my “less is more approach”…my wife is even more careful and that’s saying something. I am truly a lucky man!!! So many will be hit upside the head by the proverbial 2 by 4…make that a 4 by 8 with what’s coming down the pike. Not negative, just realistic and brutally honest. Problem, is so many out there think that honesty is indeed brutal these days.

It’s the free money recipients who are spending like “drunken sailors.” When you’re handed a financial windfall, you just spend it with no care in the world.

When there’s no correlation between the labor required to acquire money and the amount spent, money has no meaning. Even managing your existing funds is *work*….

It’s kind of crazy that people are still spending like no tomorrow especially when it comes to service like dining out. Just came back from AYCE sushi in SoCal, $45 freaking dollar per person for nothing fancy. I think it used to be $30 just a year or two, so a 50% increase. Guess everyone got a 50% wage increase the last 2 years.

Yet just like the graph here, people are putting up with it and restaurants still packed even for a Tuesday night. You gotta give it up to Americans, their propensity to spend like nobody’s business is not rival by probably by any other countries on this planet.

For some reason the US gets the largest asset bubbles, except for maybe Japan but that was back in the day. The inflation in the U.S. is very top down, the bottom 1/3 make less than $25k a year so it’s not like they can cause any sort of inflation………….welfare check inflation????

Wolf you should do an article on how much the banks make each year from the fed balance sheet. Most of that money is being reinvested and someone is collecting fees, it’s not like they’re non profit institutions

They’d make even more if they bought Treasury bills with it instead.

Well, I have to agree about department stores dying. I was looking forward to the Nordstrom Anniversary Sale and it is a huge bust for me for the second year in a row. The deals aren’t there, the merchandise is too expensive. I guess I will be using my extra money at the big box discount stores, which have better deals, but are also getting more expensive.

There’s always Nordstrom Rack….

I WAS a “shop local” guy… even though I could find better deals on the net. But things changed when I went to the local dollar store for some household items and found they were giving no bags for my items (a new law in New Jersey). So I stuffed some of the items in my coat pockets and carried out the rest…. But the next time I needed household items, I went online. I had better choices, better pricing and free shipping (sometimes “Same Day” shipping. AND, the items arrived in boxes and bags… (I guess the “no bag law” was lobbied in by Online Venders). And the best part… I no longer waste my gasoline driving around, looking for the items I need. So I am saving time and money. But one of my favorite former local venders is going out of business and the longtime clerks will be out of work… That is the downside for them… and for me.

NJ sucks. Move out.

I like to buy local… but there’s usually limited to no inventory and “ship to store” isn’t that attractive as I have to wait and then make an additional trip. If I’m going to wait, I’ll buy it online and have it come to me.

IMHO, the online shopping will accelerate as a percentage of transactions as we geezers meet their maker.

I go to Aldi really not hard to bring your own t reusable bags ,plus less oil ,better for environment

Good day Wolf.

I find your posts extremely useful, as you dive into the detail, tell a story about it, and provide some conclusions – that isn’t available many places these days.

I really find these ‘Venn diagram’ type run downs even more useful.

as a small aside, on the percentages of each category, I did the math (I think it is the correct way, tho I might be wrong) – Department Stores percent of total retail – you listed 11b as 1.3%. then I saw Sporting Goods of 8.6b as 1.4%. So am I correct that these %’s are just a bit off? I factored it as 1.6% and 1.2%, respectively, on $705b.

Thanks again – your insights are pretty valuable. Stay Calm, Stay Well, and Carry On!

Department stores = 1.8%, typo.

The percentage is of retail sales excluding “food services” sales (restaurants, bars) because food services are actually services, not goods, but are included in the retail sales data. I switched to retail without food services for logical reasons (sticking with goods).

Thank you sir.

You really do have to wonder if/when these sales categories come back down to the pre-pandemic trendline or if this is a permanent shift towards greater sales growth. The much-anticipated and now nearly cancelled recession would likely be that forcing mechanism to get the train back on the rails. Interesting case study on black swan events driving fundamental changes in consumer spending patterns.

Jamie Dimon says that consumers still have more than a trillion dollar surplus remaining in their checking accounts due to Covid stimulus and that they will spend most of it by the end of 2023. That might explain all of the drunken sailors’ current behavior. It also is an indication of when higher interest rates might, at last, start to slow down the Main Street economy. The monetary excesses of the Covid interlude were of a magnitude never seen before and are the main reason why there has been no landing, soft or otherwise, so far. The distortions they created will still be affecting the economy five years from now.

Americans haven’t received stimulus money in over a year (actually longer) It is crazy to still think it is affecting the economy in any meaningful way.

People talking about stimulus money are just taking advantage of younand your predilection for victimhood.

During the past 5 months, I have never seen so many temp tags on cars that were just purchased.

That being said. I bought 2 new cars myself. The average age of my old cars were 16 years so it was time to sell the used cars at premiums. LOL

I’m getting $40,000 more a year in interest compared to last year. Very stimulative. Thanks, Fed. I don’t spend like a drunken sailor, but I don’t hold back either.

Wolf,

My brother had a Japanese girlfriend like you, but it was 40 years ago.

He had served in the US military during the last stages of the Vietnam war, he got a chance to audition for a Japanese made movie, the audition was prove how far you can wheelie a Honda 750 4 cylinder motorcycle across the parking lot, he beat everyone. It was a motorcycle saga, traveling across Asia and the middle East with 2 other actors and the film crew.

The film absolutely bombed at the Japanese cinema.

Oh well, my long haired brother met his Japanese girlfriend – tall one. Within about a year he left her and Japan, never again to contact her – – until just before he died, he wrote her a sorry letter. He died of brain cancer.

Such a sad story.

I have always thought that “Furniture and home furnishing stores” would be a leading indicator of a downturn/recession. You can always put off buying a new mattress or sofa… unlike most other retail goods. That is a really steep drop in Wolf’s chart…

These are brick and mortar stores. And they’re dying, like department stores. This stuff is now being sold online. We’ve bought ALL our furniture over the past 10 years online (including entire living room and a huge armoire for the bedroom), and ecommerce is BOOMING.

I don’t know how anyone could buy seating without trying it first. Case goods and accent pieces…. sure. Seating? Not so much. Maybe because the bride unit is the incarnation of “Goldilocks” and everything has to be juuuuuust right. I think we tried 300 chairs before she finally settled on one.

It worked great. In terms of ordering, it’s actually better than if you go into a furniture store. They don’t have anything you like, and they have nothing in stock, other than the showroom models, and you have to order anyway. And you cannot find what you want in one store. In our experiences, this involved many many hours, spread over multiple Saturdays, going from store to store. Then finally, you find something that halfway works in their catalogue, and you buy it and wait two months for delivery. I hated it.

Now we spend two hours online, glance at 1,000 models, give 10 of them a closer look, whittle those down to two, and then pick one and order, and three weeks later we have them (“minor assembly required,” make sure you have a power screwdriver). Easiest thing in the world. Two hours shopping online plus an hour or so unpacking and putting it together. We’re super happy with the stuff we bought.

One time, we got a cabinet (nice piece) with a damaged corner of the base. We called to get a replacement base. And they said, no problem, and what they sent us was the whole cabinet, and we could keep the one we’d bought. So now we have two for the price of one. I fixed the damaged corner, and you can’t even see it.

I HATE shopping. Such a waste of time. There are so many better things to do in life. I used to buy as much as I could via catalogue, including clothes and shoes and some stuff for the home. And when ecommerce came along, I was in hog-heaven.

I am with you on this one. Retail stores are the “showrooms” and they deliver the stuff to you from some regional warehouse. Fine.

And maybe you can get by with buying wooden furniture from the internet.

But buying anything with a cushion based on some pictures on the internet??? Nope… not going to do it.

I get a dozen or so mail order catalogs. I’ve been ordering off of these for a decade or so using snail mail. This works great because you don’t have to stare at a computer screen all day. I prefer this to on-line shopping. Haven’t been to a mall in a decade.

I was wondering why Target and Walmart are not classified as department stores, so I looked up the official definition:

https://www.census.gov/naics/?input=44&chart=2017&details=452210

And in part: “Department stores may sell perishable groceries, such as fresh fruits, vegetables, and dairy products, but such sales are insignificant.” Bingo: Walmart, Target, Costco, Sams Club, etc are not “department stores” because they sell food. Why do they sell food? Well, consumers are still loathe to buy food online. You want to be able to pick out your steaks and peaches in person. So in the era of online sales, how do you get people to come to your brick-and-mortar location? Sell food. Therefore, the decline of “department stores” is really the decline of a certain set of general merchandise retailers that chose not to sell food, making them much more vulnerable to online sales erosion.

Wolf, I know your point was brick and morter stores are dying (they are, to some degree), however what insee from this article is that inflation for goods has been tamed but anything with a large labor component (like services) is still running wild.

Both may be true, but it can be surprising the differences of conclusion that can be drawn from the same data.

No, yours is not a different conclusion. It matches what I’ve been saying. But services inflation started heating up in 2021. Brick-and-mortar has been spiraling down for a decade, and I started writing about the “brick-and-mortar meltdown” in 2017. These are separate movements. Brick and mortar is getting killed by ecommerce, unrelated to inflation.

The hair salon business is the next one to go under. You’ll see empty salons in every mall. Sunday, Mrs Swamp is going to get her hair done at a WFH hair stylist about 10 miles from us. She has no overhead, doesn’t have to pay some crooked Hair salon owner, and gets paid in cash. She can charge much less for the same or better service than a hair salon. This will become the new norm.