Fits with Tesla’s big price cuts, aimed at internal-combustion-engine vehicles.

By Wolf Richter for WOLF STREET.

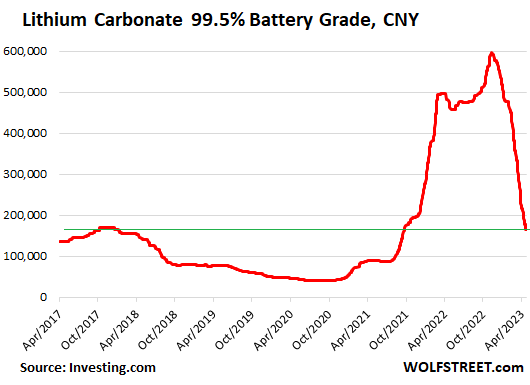

Lithium is no exception. The spot price of lithium carbonate 99.5% battery grade, trading in Shanghai and serving as a key benchmark, spiked by 590% in 16 months, and then collapsed spectacularly in four months. Over the last couple of days, it seems to have found a bottom. Like so many commodities, it didn’t collapse all the way back to the starting point of the price spike – at least not yet.

The price spike started in July 2021. At the time, it had been trading at 87,000 CNY per tonne. On November 11, 2022, it hit 600,000 CNY, a ridiculous gain of 590%. Then it lost its grip, speculation blew up, and the price plunged 72% in nearly a straight line, before ticking up for the first time.

A couple of days ago, the plunge stopped to take a breath at 165,000 CNY. And it ticked up from there. On Friday it closed at 177,500 CNY. While this is down 70% from the peak, it is still double the price of July 2021 (87,000 CNY).

For your amusement: The prior lithium bubble in 2017, when the price hit 175,000 CNY, also imploded spectacularly – but more slowly. Over the next three years, the price dropped 77% to 39,800 CNY by August 2020.

Commodities prices are not driven day-to-day by underlying long-term fundamentals but by huge speculation that can lead to absurd results, such as futures contracts for crude oil WTI plunging to minus $37.63 a barrel on April 20, 2020 before spiking back up, or lumber futures that spiked to ridiculous highs and then collapsed, or natural gas futures that spiked to ridiculous highs and then collapsed. Same with lithium.

But fundamentals are constantly cited to support, promote, and prolong a price spike like this. This was played out with immense hoopla in the media. There was going to be a global lithium shortage for years to come because EV production and sales were skyrocketing, and battery cell makers would run out of lithium and wouldn’t be able to supply battery cells to the EV makers.

And true, EV production and sales have skyrocketed, and continue to, creating rapidly growing demand for lithium, as Tesla’s big price cuts are aimed at grabbing market share from vehicles with internal-combustion engines. But what hasn’t happened is that the world ran out of lithium.

Commodities are in a dynamic world, full of actions and reactions, where high prices beget investment in production, which begets increased supply, which cures high prices.

All kinds of new lithium mines are being planned and are coming on line, and a lot of it has been in the works for a long time. And suddenly there’s talk of how a global lithium shortage turned into a global lithium glut over the course of four miraculous months.

But it also shows that price cuts by EV makers – driven relentlessly by Tesla which has the fattest profit margins of any major automaker and can afford to cut prices – are getting less onerous for them as the lower lithium prices filter into lower costs of battery cells.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In Oct 2008, after congress approved president Bush request, gold popped up from $681 to $1920, before its plunge.

I feel this is what will happen with real estate late summer when the truth about supply shortages of houses will come out.

Thanks to all the FOMO buying during Pandemic, and the pending hyper-bubble popping, there is going to be a big shortage of buyers as supply jumps.

Every single market is driven more or less by speculation and FOMO.

And for the real estate market, the biggest speculators are the central banks

Not as much lithium will come on the market as anticipated. It takes forever to get a mine started in the EU or US and South American countries plus Mexico are nationalising the Li industry which will reduce investment and production

a sign of “too much money”. This is why i totally have my doubts about this “banking mini crisis” we have! Depositor funds are only on “itchy withdrawal trigger finger” mode ONLY for SVB, Signature, and FRC? All the other banks, no depositor problems, no deposit-flight-capital-loss doom spiral? Hmmmm……….this is the narrative being “sold” at the moment. ANd, the narrative also implies the small banks have ZERO brand value…nobody “really” wants to acquire them, unless FDIC adds “gravy, by the tonne” on top.

“I feel this is what will happen with real estate late summer when the truth about supply shortages of houses will come out.”

I disagree. The speculative forces are much lower for housing, and there is a huge organic need for housing. The speculation in housing is a small fraction of total sales. Commodities OTOH, trade in enormous volumes relative to the underlying demand, and so the whipsaw in prices can be crazy. Most commodities contracts don’t even result in actual physical delivery, while housing always results in physical, so it’s constrained in volume.

Just to be clear, I’m bearish on housing. Just explaining that it’s nothing like commodities.

People moved from huge cities to podunk ,now podunk isn’t very appealing,always reverts to the mean

Wolf, a question regarding Housing mortgages:

In Seattle and San-Francisco, both of which are in non-recourse states, many loans are Jumbo loans with 10% or lesser down payments.

Many houses bought from these loans during Pandemic are underwater today (more than 10% year on year with case shiller 3 month lag).

So if we do math for buyer: 3% closing cost + 10% down payment + 3% emi for 1 year, the buyer spending is only 16% on the cost of house. Given that it costs ~7% to sell a house in these cities, and the house is already down by 10%, the buyer loses 17% in sale today and this amount keeps increasing, so these buyers are better off handing over keys to the bank than selling the house.

Which entities bought these Jumbo loans from banks? These entities are going to be in trouble. If the bank didn’t manage to sell it, banks will be in trouble. Asking this question because I still see a lot of reckless Jumbo loans being made by banks at crazy 2022 house price appraisals! This liquidity is what is preventing housing markets from correction.

I think Jumbo loans are not secured by taxpayers backed Fannie and Freddie, so there may be another idiot in this game that’s going to blow up!

May be consider quiting an article on Jumbo loans.

To give you a feel…

The portion of non-government-backed residential MBS is small: $840 billion compared to $10.7 trillion government-backed MBS.

There are $1.5 trillion in total non-Agency MBS outstanding, including CMBS — meaning mortgage pools composed of mortgages that are not government-backed. These MBS are traded and bought by investors.

They fall into two categories:

– Commercial mortgage backed securities (CMBS) = $673 billion

– Residential mortgage backed securities (RMBS) = $840 billion

We discussed the CMBS here a lot recently with regards of CRE defaults.

By contrast, the total government-backed “Agency MBS” = $10.7 trillion.

Banks – including famously First Republic – also hold some jumbo loans on their balance sheets that have not been securitized.

It wont come down. Dollar has nothing to do with gold. Dollar is what you are talking about and dollar is toilet paper.

“and dollar is toilet paper.”

Rather than wasting valuable water flushing dollars down the toilet, send them to me. You can send them electronically, not much waste, very clean disposal.

hahahah

I also won’t refuse if you send me dollars, but I would accept other currencies as a gift

So what drove the lithium price drop?

Coming into 2023 lithium was selling at peak prices.

China ended domestic subsidies for EVs in 2023. Demand dropped (i.e., rate of growth of EV purchases slowed), lithium inventories increased. Lithium prices dropped (i.e., over-supply).

The discussion also needs to account for the grade of lithium under consideration. In the event, lithium carbonate prices have recently started to climb. According to commodity analysts, lithium carbonate prices are expected to be volatile over the next several years and then begin a longer-term climb.

One data source is https://tradingeconomics.com/commodity/lithium. There are others.

phillip jeffreys,

This — “Demand dropped” — is a bullshit statement.

And your own quote then corrected the bullshit statement: “(i.e., rate of growth of EV purchases slowed),”

Demand did NOT “drop.” The exponential GROWTH RATE is still huge but no more exponential. A growth rate that slows from huge to less huge growth rate is still growth and NOT a “drop in demand.”

I get so tired of this braindead BS getting regurgitated here.

Tesla is no longer the world’s leading EV producer – by a substantial amount. It may not change your lithium narrative, but Chinese manufacturers can’t be ignored on the global stage. In fact, could that be part of the reason for their price cuts?

The reason for the price cuts is to sell more. Price cuts in China don’t sell more vehicles in the US. US price cuts sell more vehicles in the US. In the US, Tesla cut its prices serially and is eating everyone’s lunch. Model Y and Model 3 are now #1 and # 2 bestsellers in California, ahead of Camry, RAV4, F150, et al. Tesla also cut its prices in Europe.

But yes, the Chinese market leads the US market in EV sales and in EV market share by a big margin, and there are hundreds of EV makers in China.

In China, Tesla is upmarket from the mass-market vehicles of BYD, for example, but the price cuts put Tesla smack-dab into BYD’s territory. Think about that!

I read in the WSJ that the model 3 sells for about $6,000. less in China than it does in the USA.

Everything sells for a lot less in China than in the US. People make a lot less money too.

But Californians are, for the most part, psychotic. I live in California, so do you. You should know. California is a huge market and will carry Tesla for a while. However, I would not extrapolate Tesla’s sales experience in California to the rest of the country.

I imagine lithium prices are also down because people are waking up to the disadvantages of EVs and are not buying them like they are expected to (except of course in nutty California). Increased supply along with decreased demand leads to lower prices.

Well, lithium is used to treat psychiatric disorders, right? Maybe that’s why EVs are so popular here.

William Leake,

Tesla sales are booming ACROSS THE US, IN CHINA, AND IN EUROPE. What’s your problem? California EV market share is behind China. In China, EV market share is 22% now. In California, it was 17% in 2022 and is going to be higher this year, but so will be China’s. These are moving targets.

Tesla GLOBAL deliveries in Q1 jumped 36% year over year, and 4.3% from Q4. Both were record quarters. The other major automakers haven’t had a record year in terms of deliveries in many years. READ THIS:

https://wolfstreet.com/2023/01/08/wild-ride-of-us-auto-sales-in-2022-below-1977-charts-for-gm-toyota-ford-stellantis-hyundai-kia-honda-and-nissan-oh-dear/

Your second paragraph is uninformed BS. People are waking up to EVs being less costly than equivalent ICE vehicles. EV sales are booming, it’s the only segment in the auto industry with substantial growth. ICE sales have plunged. Don’t you ever read any of my auto industry articles and look at the charts?

William,

I am in NC. Since early this year, Teslas have been growing rapidly in number. I didn’t even know about the price drops until I started researching why I would be seeing so many new ones on the road. It is definitely not a CA thing anymore. As for psychotics, we have our share but not enough to explain the Tesla surge.

Listen to Wolf, he’s a car-guy!

“And finally, what happens in 8-10 years when these cars need a battery replacement? Do we just throw them in the scrap heap and let Elon sell us another? Because they will need a new battery.”

I dunno … maybe just …. replace the battery?

Replace the battery pack (not battery) at what cost? Right now that little expense ranges anywhere from $5k to $22k.

Go look at who really benefits from the SVB bailout. VCs, 1500+ climate change start-ups, Dem mega-donors. Tie-in over $300 billion in climate change tax credits and subsidies in the so-called Inflation Reduction Act and the money trail lights up like a beacon.

We (the taxpayer) are so screwed it’s not even amusing any longer.

I live in CT, wealthy state in New England, and they are definitely not common here. I might see a couple a day if I use the highway. Locally I rarely see them, and don’t know of anyone who owns one.

Looking at state data though, although the EV fleet remains miniscule in CT compared to ICE, Tesla indeed dominates sales (of the admittedly tiny market.)

No more fat margins in q1 even though only the rolling discounts didn’t have full impact. They also booked IRA credits as automotive revenue further inflating their margins. It doesn’t necessarily scale with each car because they sell globally.

I’ve never seen a bigger man crush than Wolf has on Elon. Pretty sad honestly.

I have a crush on price cuts and what they’re doing to the legacy auto industry, in which I worked for a long time, and which I came to despise for its oligopolistic behavior that has produced vehicles that the average American can no longer afford — average transaction price is now $47k, which is nuts.

These price cuts are a huge thing. They’re shaking up the entire industry. They wouldn’t matter if Tesla had just one plant and couldn’t produce more. But Tesla has ramped up its production capacity, and it continues to build new plants, and it is expanding production at its existing plants, and it’s cleaning everyone’s clock.

I have for years given Musk credit for shaking up the legacy auto industry. This is something I’d wanted to see decades ago, and I thought the bankruptcies during the financial crisis would provide a new start, but what came out of it was just the same-old same-old legacy auto industry, but even more concentrated with even more oligopolistic behavior, and even more expensive vehicles, topped off by a big pivot by US automakers to China for the design work and their components.

I’ve also said that Tesla’s stockholders hate this policy of price cuts and have come to rue the day, and I said that the shares are still ridiculously overvalued, though they have come down a lot.

Wolf is correct: Tesla’s move is to position their EVs as *significantly* more affordable than vehicles built by the legacy automakers’ internal combustion alternatives.

As a self-professed car guy, I’m not ready to make the EV move just yet, but Tesla’s (still profitable) moves are going to yank the rug out from under the legacy automakers as mass-market consumers find their products increasingly unaffordable.

oligopolistic behavior in legacy auto industry …

You got that right! But it’s nothing new. Henry Ford started in early 1900s with model T. The first year had five color choices two of which were grey and black. Within 5 years it was down to just black. Which led to his famous dictum:

“Any customer can have a car painted any color that he wants, so long as it is black.”

I have several problems with Tesla/Musk:

I’ve heard Tesla repairs are bonkers.

Musk compensation amount was just stupid

Debt is off the charts

Worker treatment is (allegedly) very bad

Loading “Autopilot” and games that kill other drivers (statistically it may be safer? idk about that) I prefer Waymo or slower rollouts

Finally, I really hate all the BS that Musk spouts. It boggles the mind that people believe it.

He’s actually been sued and called the self driving an “aspirational goal.”

He’s promised self driving “next year” since 2014.

Remember the Hyperloop or all the tunnels?

BS hype man floating on debt.

My brother & his wife love their 2 Teslas tho ;P It was a very smooth ride I admit.

Musk is awful at making predictions, analyzing data and understanding complex implications. He is a great marketer, however, and has gone very far on that strength.

His price cut strategy is simply a move out of desperation to meet the primary criteria above all – meeting volume objectives. Without volume his capacity buildup will hit margins even worse as he will be forced to amortize / burden unit costs at less preferential rates and his capital costs will skyrocket – at the same time.

So he’d had a market collapse and profitability collapse. He also isn’t blind to the macro outlook and demand slowdown that will hit 2H this year.

In Q1, Tesla’s sales volume was up 36% from a year ago, so that’s not a “market collapse,” and its net income, despite price cuts, was higher than GM’s income, and that’s not a ” profitability collapse.”

I’m like so done with this nonsense.

I dont understand where all the Musk hatred comes from ? Musk has an engineering background. He’s a product guy. He saw an opportunity in cars and in space launch that were solvable with new products based on new engineering. The last thing legacy American corporations think about is engineering that is why they are helpless confronting Tesla and SpaceX.

Electric cars are a great idea. Battery tech is what holds the idea back. That will be solved incrementally with careful engineering which is the reason GM and Ford and the rest are doomed. Their accountants and MBA’s say, “lets let the Koreans and Japanese figure out the hard part and we will all just buy our batteries from them”.

All that said, I see no reason to subsidize EV’s or to mandate them. In the end that will hurt EV adoption because there will be no reason to continue pushing the engineering that is required to move EV’s from urban commute cars to general purpose transportation.

Wolf lets the facts do the talking; you let your prejudice speak. There’s none so blind as he who will not see. Pretty sad really.

“I dont understand where all the Musk hatred comes from ?”

You’re not being honest. The guy is easily, patently untakeable. Just short of odious.

You do realize it is simultaneously possible to hold high disregard for Elon Musk and his nutso behavior together with an admiration and respect for what Tesla the company has accomplished and is doing, in the same brain, right? I despise the *man* but still understand the impact and influence of the company and its EVs. Would an infrastructure bill – a true one, not pork-barreled nonsense – signed off by Trump be less significant in my mind just because of the signature? What if by Biden? Is it possible to support ideas, policies and concepts even if you don’t like or support those generating them?

This cult-of-personality – both positive and negative – combined with a blind “red-team/blue-team” mentality is all that’s wrong with us these days.

Been following Wolf for over a decade, and I don’t recall him ever fawning over “Musk the Man.” Musk’s business decisions? Maybe, but I recall him calling out a few others. Tesla, the same. The only crush I can identify Wolf as having is, maybe, beer, though I’m not certain what his favorite type is.

Back off and breathe, bruh.

I don’t know about world Lithium availability, but I know it’s a nasty business like rare earths. Power tools with li-on batteries are awesome.

I think silver, because of somewhat small supply, will be in the limelight soon enough. Some billionaires with more resources than the Hunt bros will buy heavy and drive the price to the moon, then it will plunge back to reality.

You do know what happened to the Hunt Brothers???

There’s a lot of billionaires worldwide,remember what happened in nickel trade. Totally manipulated to save a Chinese billionaire.

Please expand, I remember the Hunt bros, but didn’t follow after the silver crash in the 80s.

Hunt bros tried to ”corner the market in silver in early ’80s, apparently not realizing RU was sitting on gazillions of oz at that time…

Was in London at the time, managed to buy a bunch and sell in time…

IIRC, AG went from single digits to $50 or so, then plunged back down again fairly quickly when their lack of information became clear.

Bought in again at $3 or so, thinking it was the bottom, which it was… did well that time also.

Beginner’s Luck!

Wolf obviously hasn’t seen a cobalt mine with the little kids swarming in an open pit with kitchen utensils for tools. Maybe cognitive dissonance is a green virus let loose on the pagan worshipers.

Those open pit mines for this poison are real beauties. Slave like labor everywhere I look to make this stuff .

Therefore, to quote Wolf.

I’m done with all this green nonsense.

OK, for ICE vehicles, add the environmental damage of fracking and refining and transporting crude oil and petroleum products, and the environmental costs of mining the metals and minerals that the ICE powertrain is made of, such as bauxite strip-mining so you can have an aluminum engine block, transmission case, radiator, and other components, the environmental damage from steel production, iron production, aluminum smelting, etc. needed for the ice power train.

We’re just used to all that. That damage and ravage is now part of the landscape. And we accept it more or less.

Every EV that is built replaces an ICE vehicle, so cobalt and lithium mining replace the mining necessary for the metals in the big, heavy, complex ICE power train and components, the fracking and refining necessary for fuel for the life of the vehicles, etc. etc., to the great fear of the oil companies and all the others that form the backbone for the ICE world. Hence their swarms of trolls attacking EVs with BS.

There are no free lunches when it comes humans wanting transportation. Everything is a problem and a tradeoff. The best thing for the environment that people could do is not buy a vehicle at all, and walk or ride a bike (not ebike). But that’s not going to happen. We like our 6,000 pound 4×4 Crew Cabs.

I not only love my Ford F250 super duty for doing actual work instead of talking ( ever pull a lowboy with an excavator up a gravel mountain road in 4wd Wolf?).

But you and your types will continue to punish me for it.

While I agree that everything is a trade off, your insane quip about everyone on bikes is bizarre. That impulse is what scares me. You do not belong anywhere near making decisions about my freedoms yet here your type go.

I’ll take a little oil well over an open pit cobalt mine, lithium holding ponds and stupid bird choppers any day.

KMOUT – There are clearly needs for legacy vehicles in the field still but that doesn’t mean there isn’t room for EV in other applications.

The battery tech is also moving beyond cobalt (see Just Have a Think on youtube if you can stand it) and will come along in due time.

The only constant is change but many have problems adjusting. Hope you can see there is room on the road for all.

“But you and your types will continue to punish me for it.”

The paradox of you attacking Wolf for supporting EVs and then, minutes later, claiming to be a victim of judgment and persecution is not lost on me.

Hilarious.

KMOUT — the outrage in your post comes off a little babyish & flimsy. The size queens with their crew cabs and dualies and a hitch for towing a small service station behind them are nothing more than walking targets for very effective marketing campaigns designed to tickle your TUFF GUY gland. You’ve been had, man. This bigness obsession that you call “liberty” has trashed our once magnificent western landscape — including inner cities that were designed around ICE vehicles as the primary means of conveyance. I guess you were one of the few who didn’t see the lull in traffic jams, the return of sweet water and birdsong during the beginning of lockdowns 2020 as a very bright silver lining. Whether it’s by way of Lithium mines or oil fields — Enjoy your blight.

I’d be ever so curious to know if you’ve ever bought tennis shoes made in Malaysia, diamonds for your fiancé from overseas, or powered your house on electricity generated by coal…you know, since you’re moralizing.

The basic truth is almost *everything* we do or purchase in the modern west carries both an environmental and human cost that is intentionally hidden from our eyes. If we really want to “save” the environment or eliminate slave-like work conditions, we need to be prepared to give up a lot more than automobiles.

But you go on with your preacher-self and toss those stones at them glass houses, bruh.

Nothing goes to heck in a straight line…

Ummmmmm….

Lithium crashing is really depressing news, but there’s a cure for that.

Ha! I hot it!

‘got’

Fine, here’s your +1

Musk can pivot on a dime, unlike other corporates. He doesn’t have to hold the usual huge endless dreary bureaucratic confabs (as even his Tesla board is said to be very cosy and compliant). Sometimes this nimbleness (or whimsy) is for better, sometimes for worse.

Tesla actually has a significantly longer time to market for new models than other brands. The industry average is 4 years, and for Tesla its 7. F1 Lightning was announced after the Cyber Truck. Only one of those two can you drive today.

No one has yet been able to succeed with a stainless steel body. DeLorean tried and went bankrupt trying. So the challenges for the Cybertruck are huge. I think that’s what’s holding it up. Will be interesting to see how it will work out. Stainless steel is a nasty material to work with for car bodies.

To me, the introduction of the Cyber Truck is going to be very interesting to observe. At the time it will go on sale there will be 3 compelling competing products on the market (Rivian, F-150 Lightning, Silverado EV) with another waiting in the wings (Ram EV). This will be the first time a new Tesla product will face significant competition at the time of its introduction. Should be fascinating to watch!

I’ve used stainless steel plate and 1″ square stock for building a machine tool. It takes more force to drill through than carbon steel or steel alloy. And it also takes a steady cut-rate. If one doesn’t keep the bit working through the stainless carefully, all of a sudden the bit will catch and break.

But when drilled and tapped properly, stainless is fantastic for many applications.

Hell, there’s plenty of stainless steel in my body from being rebuilt via orthopedic surgeries, and some titanium inside too! Gotta keep the old machines running, you know.

Prairie Terminator

Wolf, Forget the stainless steel matter; no matter how hard you try, you can’t fix ugly – and the Tesla truck is very ugly. Not only is it ugly, but it looks like it escaped from the back lot of Judge Dredd. It’s hard to believe that the Tesla pickup will win the hearts and souls of American pickup truck owners who drive Ford F 150s, Chevy Silverados, and Dodge Rams.

I’m not a fan of it either, the way it looks, but there are lots of people on the waiting list who love it. So who am I to judge what looks good? Everyone has their own preferences. I have to say, it IS DIFFERENT. The Rivian, of which I’m now seeing quite a few here, looks similar to the other big pickups. It could be a reskinned F-250 Crew Cab.

electrek dot co, a well-regarded EV news site recently did a reader survey regarding the design of the Cybertruck. More than two thirds did not like it. I think given that most of the readers of electrek are devoted Tesla fanbois, the fact that two thirds of them dislike the design does not bode well for its acceptance among the general public.

…ah, ‘stainless’. The power of a term when read by those who never spent a year on the factory floor…

may we all find a better day.

“Invented in the MIT lab of Dr. Yet-Ming Chiang, Semi-Solid electrodes use no binder, mixing electrolyte with active materials to form a clay-like slurry. The unique slurry allow us to create thick electrodes with less volume, mass and cost while enabling a simpler manufacturing process. It’s simpler and safer with more reliable performance.”

Two weeks ago, 24M Technologies, the company with this technology that’s been developed in the last two years, signed a deal with the United States Advanced Battery Consortium LLC for $3.8 million. They will have a 50 percent cost share on developing better EV battery technology with this contract.

What this is based on is replacing the liquid electrolyte that sits between the positive and negative electrodes with a thinner and lighter layer of solid ceramic material, and replacing one of the electrodes with solid lithium metal. This will make batteries smaller, lighter and less prone to burning up.

With liquid electrolyte, metal dendrites (branches) can project between electrodes and short out the battery. The new batteries will be “squeezed” to help prevent dendrite formation.

Brown University and MIT have been working on this in collaboration and with support from U.S. National Science Foundation, the US DOD and the U.S. Department of Energy.

Add in this piece too: Nickel-iron magnet technology is being advanced and is in production in northeast Minneapolis now as well. Niron Magnetics has a process developed at the University of Minnesota by Professor Jian Ping-Wang and a 22,000 square-foot manufacturing plant to build magnets from non rare-earth materials.

Things are happening out there, eh?

Polaris is about to ship out of their Alabama manufacturing plant the new Ranger XP Kinetic electric ATV. A bit spendy to start with at $25k to $30k, but it’s on the way.

Are all these professors,Chinese American educated.Where are the anglos ?

Flea,

The 24M ‘Leadership Team’ has eleven men profiled on their website’s ‘about-us’ page. I’ll leave it to you to look over these profiles.

24M’s Commercial Partners are Kyocera Group, GPSC, Itochu Corp., FREYR Clean Battery Solutions, Lucas TVS, VW, AXXIVA & FujiFilm.

Again, the scientists behind 24M are from MIT and Brown. Funding came in no small part from the Pentagon.

Minnesota has nickel, copper, and yeah, we still have iron that can be mined in the Iron Range of northeast Minnesota. Politics and legislative hurdles are in place to hold back mining for nickel and copper at this time. We have “The Boundary Waters” next to these mineral deposits; so, it is a delicate issue. The U of Minnesota has Material Sciences research as part of its core.

In December 2022, Niron was awarded $17.5 million from the U.S. Energy Department’s Advanced Research Projects Agency, and has also raised $60 million — $45 million in private equity. Niron was founded in 2012. Prof. Jian Ping-wang was a founder and is an advisor.

“There was lots of scientific and engineering work over the last decade,” said CEO Andy Blackburn. “We are a 10-year ‘overnight success.'”

“Their magnets will be used in wind turbines, EVs and electric motor-powered equipment that today are largely reliant on increasingly expensive magnets made from rare-earth materials mined in China.”

The lack of Americans in tech has more to do with our way of paying for University. I knew many a US scientist who decided against it based upon the financials, and got their masters instead of a PhD.

Hi Wolf,

I just wanted to ask about where there’s more information about EVs being simpler cars than ICE cars (from a build and parts standpoint). I know you’ve mentioned it a bunch of times; would you mind sharing with me where you found out this information.

Thanks!

Just open the hood of your ICE vehicle and look at the engine, the components, the cooling system, the exhaust system, the 10-speed or 8-speed transmission, the high-pressure fuel system, the engine control system, the emissions control system…. All this is difficult and costly to manufacture. Then look under the hood of a Tesla (it’s a luggage compartment).

In terms of numbers, look at the gross profit margins of Tesla, which are the highest of any auto maker.

In Q1, despite all the price cuts, Tesla had a larger net profit ($2.51 billion) than GM ($2.35 billion).

Bingo, Wolf. EVs are 1,000 fold less complex than traditional ICE vehicles.

In fact, if you think about it, it’s a miracle that a new BMW M340i can reliably and safely pump out 375hp and 30mpg. The engineer in me marvels that it all works as well as it does. I also appreciate the fact that the EV’s simplicity is beautiful to behold.

Since they are so simple in technics and production they should be much much cheaper than gasoline cars but they were not in the last couple of years. Why I should sponsor the huge profits of that EV car makers and buying the big disadvantages those cars have that is range at higher speed and time to refill them. So you loose mobility and not gain mobility. And this is not BS my dear EV lover that is the truth. And pls do not always delete the reply button just because you cannot accept critical replies.

Harry Haller,

“And pls do not always delete the reply button just because you cannot accept critical replies.”

LOL. about your whole comment. But I’ll just address the last line — such ridiculous BS. Comments go four levels deep (nesting). So: original comment (level 1), reply to original comment (level 2), reply to first reply (level 3), reply to second reply (level 4). And that is it — for any and all comments. There are no more replies possible because on mobile devices the columns get too narrow to read once you get to the fifth level.

Wow Harry you sound… special.

There was an article in Car and Driver many years ago in the 2000s, about how in the 80s, the 4 barrel carburetor reached a level of complexity that automakers found difficult to maintain, and before you know it, they’d switched to throttle bodies and fuel injection.

With Tesla, the two main things they seem to have ditched are the engine and the dealership.

EV owner here (Chevy Bolt), and I can attest to the “open the hood” remark. I don’t need to add oil, replace a filter, worry about pistons breaking through the chassis, get emissions testing, concern myself over a muffler falling off, and never get complaints about the noise of my car driving through a neighborhood.

All joking aside, I’ve only put in the cost of rotating the tires as “maintenance” on my now-4-year-old EV. Combine that with paying far less in mileage for the electricity than I would have been for the gasoline, and the reduced costs are a game-changer. This being said, EVs have considerations that must be made before purchase. Mine is a commuter car, and if I travel long distances (beyond 300 miles) I need to plan ahead to allow for charging at any of the many places along the route. If you live in the countryside where chargers are rare, or plan on traveling extensively there, it’s not time for an EV yet.

Tesla has its own network of Superchargers. They’re all over the place. Other EV brands, such as GM, haven’t built their own networks, so it’s a little more complicated for them.

All vehicles are machines, but we don’t think of cars as machines. We think of them as “cars.” Think of EVs as battery powered machines. The car itself is a DC powered machine. The BATTERY (DC) powers electric motors. No conversion required, just voltage regulators.

ICE vehicles are powered by the fuel burning engine. Mechanical energy from the turning of the engine must be converted for EVERYTHING. Although today’s engines are far more efficient and superior to the engines of the past, energy loss is much larger with ICE vehicles than EVs. The engine energy (combustion) must be converted to power the wheels via gears/shafts/transfer cases. The heat generated by the engine is then converted to heat for the climate control via a passive radiator system. An alternator is used to power the electrical system and charge the battery. So not only do ICE vehicles have a complex electrical system, they then add a complex mechanical system and then a plumbing system (HVAC). These three systems require multiple bases of knowledge which is why we have mechanics who specialize in certain things. Ask any mechanic to show you their ASE certifications.

In my opinion, EVs will eventually become plug and play toys to modify as we see fit. The plug and play capabilities are insane.

Nunya – the longterm (and we’ve been living in the transition for a decade, now) issue still seems to be energy density, portability, affordability and availability of fuel for either type of machine at the individual level – similar in many ways to the historic shift from horse-drawn individual transport to motorized (…throw in organic vs. industrial operational pollution, transitional highway construction/maintenance funding, and embedded carbon from vehicle manufacture for additional dressing on this salad…). Going forward, ultimately the pocketbook wills out, reasonable arguments to the contrary from either proponent notwithstanding…

may we all find a better day.

Agreed that the pocketbook will govern. Every time we decide to buy a car for whatever reason (baby on the way, 16 year old driver, downsize, better fuel economy for longer commute, etc.) I do the math on gas/diesel/hybrid/electric. Last time I did the math was 2018 and hybrid won out in the class of car we were buying. It’s not a clear cut answer of “electric ALWAYS wins”. At least not yet.

I’m crossing my fingers that the next time I go car shopping, electric wins. We shall see.

BMW is and has always been ‘the ultimate driving machine.’

Go ahead, parrot what they tell. It only delays your eventual realization of Audi’s greatness.

…’self-driving’ is steadily appearing to be considered the ‘ultimate driving machine’ among many of the coming generations (…you’re both still driving stick, periodically- tuning the carbs and manually-adjusting your ignition advance and engine lubrication feed, nay? :) I loved my long-gone E30, but that ’66 Giulia Super, much longer ago, will always have my heart (after motos, natch). A horse for a vanishing course, though…).

may we all find a better day.

for 91B20:

Giulia Sprint Coupe lent for the day with instructions to tour all of Oahu in fall of ’67!!!

Grandpa’s ”friend” was fine folks, far damn shore, but THAT car was and still is my all time fave, beyond any of Dr. Porsche’s finer machines, not to mention the Arnoldt Bristol raced in SCCA in the early sixties…

VVNV – ah, can only imagine what it was like to be an Alfisti driving Hawaii in that sweet handling and (IMHO) most-beautiful of Bertone’s production coachwork! (…’n yer sooo right about Porsches, only those of certain years will recall the epic SCCA and original TransAm Alfa-Porsche-Datsun ‘B Sedan’/2 liter class wars…). All best!

may we all find a better day.

You might also read up on the Tesla semi trucks where the three motors to power them are each about the size of a breadbox. Unless climbing or when needing maximum power, only one is used. The reduction in complexity is amazing.

Oil prices should be collapsing right now but those rogue states are deliberately cutting oil exports to enrich Poutine.

If I ever fall off a building you know it was related to my comment about these rogue states.

This reminds me of the “Peak Oil” days prior to the Great Recession/Housing Bust 1.

So many fun times from that negative oil barrel price. One of the only times I truly regretted not having a ton of capital available on a sure win.

I’m switching over to lithium one battery at a time. Looking forward the day when the price of a lithium car battery or boat (house) battery comes down…

Speculation is bad for the economy and bad for society. The FED is a disgusting, fraudulent cabal of thieves who have hijacked the US economic system and turned it into a casino where they and their wealthy buddies run up the prices of life’s essentials for a buck while the people who actually work for a living suffer mightily.

The mainstream media is a bought and paid for propaganda arm for these thieves, and runs cover 24/7 with wedge issues and BS conjured up by the political toadies to get people riled up and at each others’ throats while the grifters make off with every last penny. The sheeple latch onto one political party like it’s a sports team to root for, and get nasty with the fans of the other party. Meanwhile, the Uniparty is busy scalping them to the bone.

Anybody hear the one about Boris Johnson’s banker being “appointed” to the BBC as chair? Then resigning due to having given old BJ a loan for 800,000 pounds before the appointment/nudge nudge.

What a classic

Every Time ! plus 1,000 % to Depth Charge

It’s really simple, when you think about it …..

DC

It’s called “Managing by Conflict”. When you have no ideas, are incompetent, and evil one way to retain power is to divide the opposition. It works. The only problem is while you may retain power the whole castle collapses right on top of you eventually.

SC – when greatly aided by lack of a reasonably-united citizenry’s observation and engagement, so rolls history’s wheel…

may we all find a better day.

“You can observe a lot by watching.” -Mr Yogi Berra

“The price good men pay for indifference to public affairs is to be ruled by evil men.” -Plato

Lithium-ion batteries do amazing things. EVs are a great option, and addition to ICE vehicles.

But the “carbon-free” and “climate-change” mantras needs to be looked at in an objective way. Dr Judith Curry is a wise person who does so. Her work is worth a read IMO. However, she doesn’t espouse the current popular narrative as it is preached by mainstream media and politicians, and as a result has been cancelled to a degree. That is a shame.

Minnesota has just passed legislation mandating that electricity production for both residential and business customers must be carbon-free by 2040. Xcel Energy was planning to try to get there by 2050. But this will not be easy, affordable or probable to achieve. The DFL-Governor, DFL-majority House and DFL-majority Senate members who passed this are all running virtue-signaling victory laps. I wonder, how will history record this moment???

Per Plato, I can cast my vote, and I certainly watch and observe.

But, as always, with time moving along:

“So rolls history’s wheel.” -91B20 1stCav (AUS)

DanRo – have a sense that our current fashion of believing genuine technological advances can simply be dictated will ultimately find a place beside the ancient anecdote of Canute being submerged by the tide he commanded to recede…

may we all find a better day.

Interesting side-bar!

What I found far-fetched a year ago I am no longer certain about – I do believe the chance for several states seceding has become statistically significant. Domestic polarization has passed the point of no return IMO.

But I digress.

One of best comments ,in a long time .DC never give in your fan Flea

Design stage of lithium battery doesnt appear to include whole of life cost, ease, efficiency, footprint of lithium-ion battery recycling process.

Solar wall batteries took off in Oz – uses similar tech to car – before Tesla. Now Oz is discussing lack of planning given to recycling batteries with lithium.

Your graph may show lithium Biden review result in May 2021 inferring market spike might have been USA policy centric trend.

Gen Z – users and sponsors of future elec cars – require environmental impacts of recycling to be attractive. Can AI be programmed to build recycling in to aĺl new technology designs with the purpose to maintain soil nutrient fertility to support continued species diversity?

Recycling debate will force environmentally friendly tech out of the patent suppressed closet eventually.

You mean that Capitalism works… even in the Lithium markets? Who would have thunk it?

In Mar 2020, during the crisis, after the Fed raided “other” people money, gold popped up from $1,450 to $2,089 in Aug 2020. Gold is trying to breakout after SVB, CS and FRC banks “events”. Banks assets rose from $15T to $18T, with a dent below peak. Lithium plunged.

The Fed overextended the Pareto top by using “other” people money, by distributing your money to shingle mums, restaurants and China, No printing. No QE.

==> deflating your money without your knowledge or permission.

Gold? LOL no.

I think he was being sarcastic about gold. No one takes gold seriously.

From his own perspective and as an investor who has been dealing with lithium for many years, this article has been completely undifferentiated. The reason why the lithic prices collapsed have strategic causes. Above all, the Chinese were high and so they decided to do something. Subsidy deletions on electric cars and subsidies on combustion engines were the first measure. Then Catl negotiated the prices on this basis, Tesla lowered the prices to compensate for the subsidies. The empty sellers also had their long-awaited narrative of the collapsing e-car market. It is true that there is enough lithium, it is wrong that it comes quickly online. It takes about 7 years, from the first groundbreaking to production, then the purity and quality also counts, which is only a little. With their lower quality and the insolved price crash, the chins were shot themselves into their knees because many cheap junior producers can no longer get online, due to the price .. And that is a parr. So you cannot agree with your article in any way

Read paragraphs #5 and #6 in the article. Here they are, just for you:

Commodities prices are not driven day-to-day by underlying long-term fundamentals but by huge speculation that can lead to absurd results, such as futures contracts for crude oil WTI plunging to minus $37.63 a barrel on April 20, 2020 before spiking back up, or lumber futures that spiked to ridiculous highs and then collapsed, or natural gas futures that spiked to ridiculous highs and then collapsed. Same with lithium.

But fundamentals are constantly cited to support, promote, and prolong a price spike like this. This was played out with immense hoopla in the media. There was going to be a global lithium shortage for years to come because…

Hey Sandro – I’m thinking the 7 year time line you’ve attached to mining start ups is more applicable to developed countries with strong environmental and labor standards. African (Chinese owned) lithium mining operations wouldn’t require so much time. I’m Canadian and my country’s prime minister (I’m not a supporter) has recently come out and try to shame China on such mining operations utilizing forced child labor – my guess is he’s trying to decrease China’s production cost advantage on the basis of civil and labor rights – good luck with that. Whoever the PM is trying to “friend shore” will not want to pay a high premium on Canadian lithium – more industry subsidization???

I think you need to look at the contact prices the companies are negotiating . I believe you can derive it from from some of the major producers earnings. SQM is a good one to look at to get an idea of what they are paying.

Time to convert the US military to EV type platforms.

It is in our national security interest another way to justify spending $3 Trillion dollars on US military transport and armored vehicles programs.

We cannot afford the dire consequences of allowing some other country to out EV us.

We need immediately the e-variant vehicles … eHMMWV, eBradley, eM1A3.

This is an “existential weapons” program for the US military.

What is at stake? – Our freedom, our economy, our total way of life, our low interest rates, our high homeownership rate, our low unemployment numbers, our flag, our apple pie recipes, our ability to project military power into more underdoped parts of the world in a greener, more sustainable manner and become a more lethal democracy building police force for the world.

EV military vehicles would also mean fewer fuel dumps for enemies to target. OK for light vehicles at present – but it creates a problem for large vehicles due to the increased weight from enough batteries to haul around both the vehicles and enough batteries to give them sufficient range.

I expect hydrogen-fueled large vehicles for such roles – especially if portable water-to-hydrogen and the needed power supplies to run them become available. The US Navy will likely take the lead on that, as ship-based power plants would be able to power the equipment needed to power electrolytic splitting out hydrogen from sea water.

Lithium batteries aren’t just in EVs, they’re everywhere – laptop computers, power tools, lawn equipment, scooters, electric bicycles, you name it.

I don’t know what the percentage breakdown is, but I’d put my money on the non-EV market right now.

I even looked into a battery-powered lawn tractor. They’re starting to come on the market, but their smaller cousins, battery powered mowers, are readily available.

Every lithium battery I’ve ever had – every battery I’ve ever had – becomes a problem in less than 5 years. They get one full charge, then every subsequent charge is just a little less until they perform so poorly it’s time for a new one. I have A LOT of battery powered tools as well as 12 volt batteries in equipment. Maintaining all of them is very time consuming.

And costly. I should have mentioned costly.

My gas operated machines require money and time to maintain too. Weed wacker’s are good to throw away after 4 years, and I am old school, hands on. For the amount of time they are used, electric vs gas are becoming equal if not favorable to battery. The electric supply co-operative’s in the Midwest are hampered by legislation and corporate oligarchs for supply. There are hundreds of solar and wind generator’s on private land, just goes to show the coming alliance of people power.

I have a battery powered push mower & hedge trimmer. These are perfect candidates for electric motors, since they sit idle more than half the year.

Lots of small engines are more practical as electrics imo… just not portable generators.

Wolf,

What model of Tesla do you own? Can you drive to Mendocino from SF on a full charge? Where in Mendocino do you re-charge the battery, and how long does it take?

Thanks

1. Ford Fusion hybrid, LOL. Nice car. Which Ford killed, these morons. Talking about idiotic legacy automakers! Gonna hafta buy an EV next time.

2. yes, easily, with the base battery. Out-and-back on the same charge, if you have a Model S with the high-end battery. I just looked this stuff up.

3. There are Tesla Superchargers all along 101, which is how we go. If you want to go the slow but scenic route on Hwy 1 along the coast, there are Superchargers along Hwy 1, looks like about 10 miles apart — more than there are gas stations, it seems.

4. In Mendocino, there are 3 Supercharger stations. In addition, there are four Superchargers a mile south of Mendocino in the Little River area — a beautiful estuary with a resort, campground, etc. I just looked this stuff up. The Internet is a great invention. Only takes a few seconds.

5. How long does it take? About 25 minutes to get enough to go back to SF. Mendocino is worth a lot more than 25 minutes. You should spend at least two nights there.

From commenter Duke who actually bought a Tesla:

https://wolfstreet.com/2023/04/22/i-love-how-tesla-wreaks-havoc-among-automakers-with-massive-price-cuts-huge-sales-growth-even-huger-production-growth-and-overcapacity/#comment-513710

I bought a model Y with 279mi battery in Sunnyvale March 31st. Made in Texas! (I love the irony of buying an EV made in Texas truck country). You typically only charge to 80 or 90% of battery capacity. So that gives me a real range of low 200s. I drove at the next day 450 mi home to Southern California in the middle of nowhere. I had no range anxiety as there were 364 Tesla supercharger plugs along my route. Using a supercharger for the first time is a joy. You back up to the supercharger and plug it in. That is it! all payments happen behind the scenes through the phone app. Everything was set up for charging payments when I put a $250 deposit to buy the car on a credit card. Average time to charge on the road to gain 150 to 200 mi range was about 25 minutes. Food, bathroom, checking messages on phone meant that I never felt I was waiting around doing nothing.

Wolf has a new toy! :)

Congrats wolf!

Remember that Lithium does not like being supercharged. But anywho hope it lasts you a long time. If not Clark Howard said he owned one for a year and then sold it for a large profit to Carvana.

Give Tesla hell at the dealership, tell them about “the good old days” while they give you the lost stare. Haha

sufferinsucatash,

Not new. Had it for years. Runs fine. 2018 model.

Mendocino to SF is 150 miles. Easily done in any modern Tesla. So many Tesla destination chargers in Mendocino.

Remember Canada forcing China to sell off Canadian lithium mines at the bubble top? China wins again LOL.

BTW the real reason lithium is collapsing is because China is mass producing Sodium battery this year.

” mass producing Sodium battery this year.”

Sodium batteries are being dabbled with. And that’s it. They still have a much lower energy density than lithium batteries and would have to be even bigger than lithium batteries. So maybe in the future they’re ready for EV prime time. So by the end of 2023, a Chinese company is going to come out with the first EV with a sodium battery, to experiment and test. Automakers are dabbling with them because they’re interested in the tech and want to test it, but this tech isn’t ready for mass-market EVs. It may be years before it is.

Researchers at Vienna University of Technology have developed an oxygen-ion battery based on ceramic materials that has a longer lifespan than lithium-ion batteries. The new battery can be regenerated and does not require rare elements, making it an ideal solution for large energy storage systems.

Lithium, Sodium …. nah

I’m waiting for solar power direct from the sun microwaved to my car via orbiting satellite!

😉

Aluminum graphene batteries have more energy density and charge faster than Lithium. Also don’t have runaway reactions.

1) EV sales are rising globally, yet Lithium prices plunged.

2) In 2021 China was fully committed to Lithium, buying piling inventory,

cornering the futures market for deliveries.

3) All of the sudden demand stopped and prices plunged. Lithium miners

were in troubles.

4) China deflated the largest producers in order to buy them at 25 cents/dollar and dominate the Lithium market.

5) Albemarle and SQM were nationalized, saved from the grip of China.

So then contrary to popular belief, the interest rate hikes are having their intended effects and the recessionary timeline is progressing exactly like it always has as they begin to hit and take effect with a lag.

LOL, inflation has shifted to SERVICES a year ago, and is raging in services now. Energy prices have plunged, food inflation has come down, and some goods prices have dropped, including used vehicle prices which have been dropping for an entire YEAR. Did you sleep through all this?

Wolf…

A question..

Why dont you consider the replacement costs of housing as a factor?

Isnt the labor , contractors, plumbers, electricians, carpenters etc. considered services?

I think those expecting housing to drop significantly dismiss the replacement and construction costs regarding new supply and replacement.

I look at the brick work in my house and wonder what that would cost today.

you can buy a new house. Builders are now cutting prices and buying down mortgage rates to compete with existing homes, they’re the pros, they know how to sell houses in a down market — CUT PRICES — and people who were looking at an existing homes discover that they can buy a new one sometimes for less.

Longstreet,

Look at the profit margins of major builders. They were through the roof in 2021 and 2022. A significant amount of price decline can happen simply through reversion of those profit margins to the mean.

Also, lumber down 70% from highs. Land is the biggest cost, and that can drop like a rock. Was astonished today to a postage stamp lot near Redmond listed for $1.3M. That could drop 40% or more in a bad market.

You know employment will be the last to respond to higher rates and services inflation will follow the rest lower. I want to have a deck built and will wait until the recession is raging and contractors are hungry. The price will be lower on supplies and labor.

Yes, lots of people are waiting for that moment, and given all this pent-up demand waiting to jump in at the slightest squiggle, thereby creating more demand, we might never get that most-hoped-for recession, LOL.

Wolf – I’m imagining a traditional ‘one way’ traffic sign, but double-pointed with the word ‘FOMO’ between the points…

may we all find a better day.

Lithium….they ain’t makin’ any more of it.

…freshwater, fresh air, arable/forested soils, oceanic heat sinks…

may we all find a better day.

But the element factories we call stars are making a bit more of it. There is a theory that red giants make and burn Li during/after He and all stars make some Li.

Venk – think Dis was referring to the supplies on our spacecraft…

may we all find a better day.

Not how much but where. Location, location.

And if if it’s in your backyard, the neighbors won’t let you dig it up. There are higher principles than profit. Until it costs too much. By then it costs more. A greatly inflated amount, the filthy price-gougers.

Remember the CHIP SHORTAGE?

High prices cure high prices.

Wait.. Wolf.

Your reply is uncharacteristically not well thought out.

Are you claiming Tesla doesn’t use aluminum and iron?

Are you claiming they use way less???

I understand weight is MORE important to EVs.

P.S. – I googled it and it looks like EVs use ~25% MORE aluminum.

I’m not bashing you. I actually like EVs. Just surprised as your replies are generally very logical.

Jeeesus. Don’t people know how to read anymore???

1. “ICE POWERTRAIN.” That’s what I said.

An EV doesn’t have an “ICE POWERTRAIN.” It has electric motors. There is a HUGE amount of aluminum in the huge ICE powertrain.

2. Your weight comparison is BS. Compare base version Model 3 to base version BMW 3 series, which is the direct competitor of the Model 3 (near-luxury rear-wheel drive, sports sedans). Compare the Ford 150 Lightning (4×4 Crew Cab with 600hp) to the Ford 4×4 Crew Cabs with equivalent power, and you get two models that qualify: the F-150 Raptor and the F250 diesel 4×4 Crew Cab. The Raptor is a little lighter, and the diesel is heavier. None of them have the power of the Lightning.

3. I’m just so tired of this dumb stuff, after having to read the same copy-and-paste stuff for 10 years. You’re wasting my valuable time with this stuff.

…the temptation to fritter OPT has always been more widely-embraced and abused than even OPM (…I fear I’m doing it now…)…

may we all find a better day.

Hello, you say and I agree: “Commodities prices are not driven day-to-day by underlying long-term fundamentals but by huge speculation that can lead to absurd results”

But if the time scale is enlarged, raw materials increased much, much more than inflation from 2002 onwards.

Regarding the prices of the minerals used to make windmills, solar panels and electric cars, there are serious problems of bottlenecks in the medium and even short term.

Let’s remember that the sale of electric cars is growing but they still do not represent much in the automotive market.

Regarding the disposal of minerals for the transformation of fossil energy into renewable energy, the work being done by the Australian geologist, associate Professor of geometallurgy at the Geological Survey of Finland, Simón Michaux, is very interesting. With data and evolution of the consumption of these minerals

Exactly. If the CO2 is tracked from the exploration of minerals including drilling, camps, helicopters, processing of minerals right to refined product any new vehicle has a high carbon/fossil fuel footprint.

Wheat, corn, canola are sort of the same spike and now it is coming down.

If I recall, people around the world where supposed to starve because of the Ukraine conflict and we would have mass shortages.

Prices went up but no shortages. LOL

Hello

If you analyze the world there are many people starving in various countries of the planet and many people who eat less or eat cheaper but less nutritious food. It’s called malnutrition in obese people, that happens a lot in many places in the US

Maybe I am too old, but I hope Wolf will allow me this rant… I actually knew people who lived in this world BEFORE there were automobiles (and airplanes too). I actually knew people who delivered ice in a horse drawn “ice wagon”… this was how common folk refrigerated their food at one time. People along the northeast coast used to light their homes with whale oil lamps… “And this too shall pass”. I am sure the ice delivery guys were not happy about electric refrigerators taking their jobs and the horse and buggy guys were not very pleased with the rise of the automobile. My point is this: EVs are the next step in human transportation technology. The EVs will displace the “gas guzzlers” like Ford Model T’s displaced horses. Some people will grumble and try to deny this ongoing evolution of technology. Some will desperately quote “facts” which are not really facts at all…. but rather, they are wishes. And we know, “If wishes were horses, then beggars would ride”. Like it or not, there are amazing things coming… and when it comes to transportation technology, that has certainly provided us with MORE freedom, not less.

Yes…Schumpeter was correct.

That does not ipso facto imply all “progress” is “progress” or that all new ideas are investment worthy.

“…wherever you go, there you are…”

(from ‘Buckaroo Banzai’, a gloriously chaotic fire drill of a film…).

may we all find a better day.