The good folks in Congress are surely too worried about their own wealth, and sheer greed will keep them from pushing the US into default. But…

By Wolf Richter for WOLF STREET.

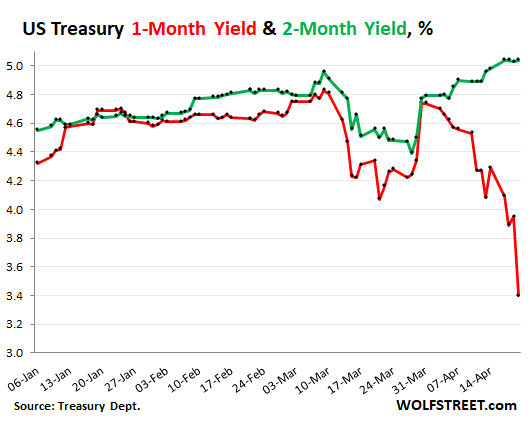

Today was another weird mess – and by far the biggest weird mess – in a series of daily weird messes in the very short end of the Treasury market, with Treasury securities that have remaining maturities of around one month. The one-month yield plunged 55 basis points today to 3.40% at the close – meaning prices of these securities jumped amid huge demand. Intraday was down as much as 75 basis points. Panic-buying frenzy! Since March 31, the one-month yield has plunged 134 basis points (red line below).

But, but, but… the two-month yield – so tracking Treasuries maturing in about two months – was very well behaved, smiled all day long, ticked up 1 basis point to 5.04%, and was up 25 basis points since March 31 (green line).

There is now an unspeakably crazy spread of 164 basis points between the one-month yield and the two-month yield – a sign that some people are panicking and piling into whatever they will be out of at face value in about one month.

The rest of the Treasury market was reasonably well behaved. The two-month to six-month yields all ended above 5%, with the four-month at 5.17%. The two-month yield rose. All other yields fell. For example the two-year yield fell by 10 basis points to 4.14%, after having hit yesterday the highest yield since March 13. The 10-year yield fell 6 basis points. And the 30-year yield fell 4 basis points. It was just the very short end that went nuts.

The cost of insuring US government debt against default has been rising for weeks. Today, the spread on 5-year US credit default swaps jumped further, to a decade high, nearly doubling from the beginning of the year, according to S&P Global Market Intelligence.

There is now a lot of speculation why some people are panickily piling into something that they will get paid back in about one month, and why they’re so eager to pile into it that they’re paying extra to do so, while the rest of the bond market is just sort of fine, within the massive inversion of the yield curve. The stock market doesn’t really care about anything anyway. So for most people, today was a non-event.

But some people are getting antsy about a US default.

The debt-ceiling farce being performed currently in Congress could turn from a mildly entertaining political show that has been played 79 times since 1960, and whose ending everyone knows, into a truly hilarious financial show with a new ending where the debt ceiling isn’t lifted, and where the US will then default on some of its obligations, and where everyone in Congress – these folks are rich – will lose 60% or whatever of the value of their financial assets in no time.

I’m curious to see how they would spin that one. Surely, everyone would blame everyone else. I’m also curious if anyone in Congress is actually hedging their financial assets against that kind of event.

Today’s problem was that tax receipts from Tax Day were somewhat lackluster, which might move the out-of-money-date, the X-date, a little closer than previously anticipated.

The X-date is when the Treasury Department will run out of “extraordinary measures” (I explained those here) and will run out of cash in its checking account, the Treasury General Account at the New York Fed.

The Treasury Department might then begin to prioritize what it will pay and what it will not pay, for example it would stop paying for salaries, travel reimbursements, and toilet paper for everyone in Congress. At least, that’s where I would start.

If the debt ceiling doesn’t get raised quickly after the initial failure to raise it, eventually, the US government might not have enough cash on hand to be able to redeem a bond issue when it matures, and holders of these securities who thought they would get paid face value at the end of June might not get paid anything at the end of June, which would represent a maturity default, which would be very messy. Globally.

Obviously, this isn’t going to happen, knock on wood. The good folks in Congress are surely too worried about their financial wealth, and surely, sheer greed will force them to agree on a deal. But the bet today was that maybe, just maybe, this calculus could be wrong. And it infused a little bit of suspense – as they usually try to do – into the farce so that not everyone will fall asleep, and so that they’ll get a little more political traction with it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

ok, but why the spread between the 1 and 2 month? Is it a bet that the panic will only last a month, and then status quo? Is it a volatility bet? I read the article twice, and I admit, perhaps I’m a bit dense…but what does the spread represent?

Is it that everyone wants to be secured for 1 month, then purely “cash” (not even Treasurys) after that?

Thanks, as always for your great articles.

don’t forget: the “spot” rate (overnight Fed Funds) is near 5%. so it goes 5%—3.5%–5%. V shaped. one for the record books of absurdities and quantitative economic rocket sciences.

some retail-institutional access/flow disparity?

Don’t forget the increased use of the FHLB, and usually points as a timing signal for something just around the corner.

This money has to be coming from somewhere. My bet is that it’s cash from (mostly small and regional) banks that has been seeing <2% returns, piling into money markets that are returning closer to 5%.

This is a big problem for banks who have been carrying long-dated Treasuries/MBS at par, but who have to liquidate at market to fund withdrawals.

Definitely agree that watching that expensive Fed credit line is key here, DEL

Drg1234, that’s what I’ve done. My bank decided to charge me a nuisance fee for my safe deposit box. It was free with a larger account balance. Since they renegged on that I transferred out enough money to pay that fee 100x over. It’s in 3/6 month bonds at treasury direct now.

Stupid banks slitting their own throats.

Does this imply that the scramble for collateral is fueled by institutions that don’t have access to depositing money into the Fed? Can insurance companies and other non-bank institutions access the Fed’s 5% rates? Is there a collateral crisis outside of the banks?

I wish people would stop calling T-bills “collateral”. It is not “collateral”. It is a a debt obligation, a short term bond.

I’d be happy to be proven wrong, but to me this whole “collateral” thing seems to be just nonsense.

If you are buying a bond for the yield, it ain’t to use it as “collateral”. Mixing up these two concepts is just plain wrong.

Some more possibilities:

1. May be both super rich parties are desperately pretending to be working class friendly and lower class friendly by showing that they are not fanning the inflation inferno.

2. May be both parties want to scare the 99% again with layoffs and other bad things to come, so that they can then again use the crisis to give cents to 99% and dollars to 1%!

3. May be its not about debt ceiling and some insiders know about something else that can blow (cmbs? Banks?)

Just wait until enough of those avaricious CONGREA$ED critters pass the RESTRICT Act… then Wolf and other fine purveyors of non-usless legacy info will ..!presto-change-o!.. will become ‘blogonae nongrata’, thus relieving said pols from changing ANYTHING that stops the $pice flow to continue their way, even if the country has to completely collapse in the process.

Because the bottom from COVID only took one month prior to the massive rescue. They want their money back for the theoretical bottom of such a crisis.

The “I want my money handy/liquid in a month” outlook does seem to be the driver here…but the question is what do these surge buyers expect to happen sometime shortly after mid May? It might simply be anticipation of spiking rates in longer term Treasuries as a result of default Kabuki.

I can only speak for myself. I have been concentrating on the shortest term of 4 week T-bills because I don’t want to miss the opportunity of a market crash.

The 3.5% to 5% helps somewhat against inflation while I stay positioned for the huge correction.

Granted, it may not come anytime soon but history tends to repeat itself.

If this isn’t the fall of Rome, then I don’t know what is!

It’s because of debt ceiling limit

Perhaps what we’re seeing here is a whole lot of money pouring into money markets.

I agree, and why I’d do the opposite.

Shoe shine boy and all that.

Makruger,

Agreed. Money markets and ultrashort bond funds like VUSB.

Why get .45% when you can get 4.27-5%?

I like Schwab, but the CEO said they’re not raising Checking/Savings rates “…because it doesn’t affect consumer behavior.”

I pulled $5k from Savings and put it in a money market same day. Vote with your $$$

This is just the beginning.

Amen. There are many articles about how interest rate increases like the ones we have seen recently will so increase total federal interest payments on its regularly, rolled over treasuries that the federal budget cannot meet its defense, interest, and entitlements obligations without interest rate charges. We are there now or rabidly approaching that moment.

Unless the government taxes the vast wealth hidden by the ethnically diverse US billionaires (underestimated at just $30 TRILLION by Reuters, part of our billionaire owned news media) that has avoided US taxation by running quasi-slave factories in China (whose foreign profits, even if owned by a US person, were not even subject to US taxation until 2017, the government will have to create so many US dollars that hyperinflation is inevitable. See Tax foundation on “How are multinational corporations’ profits treated around the world” which discusses also how subsidiaries’ income was not subject to taxation until remitted to the US, parent corporations.

Of course, those multi billionaires who wisely put their funds in foreign trusts (which can be created even if they are beneficiaries to those trusts and one of the trustees!!!) never had to and still do not have to pay US income taxes: except for fees they get for being trustees, their foreign trusts’ distribution are still NOT subject to income taxes. The “reforms” conveniently ignored that loophole—despite whatever misrepresentations desperate “trust fund babies” (as we called them) may claim.

clear signal: 150bps yield curve inversion just 4 weeks into Treasury curve! The crash is NOW.

This is what happens you leave it to the PhDs in e-CON at the Fed. The “inflation” was NEVER real. just a covid cash dump. what colossal idiots. the clown music is beginning. At least yellen got her $millions in speaking fees from citadel. what of the rest of us?

I kept saying they’re idiots. In moderation pit now.

I get put in moderation mode guide often

Flea,

You’re not on any kind of list I have. But my site also uses a cloud-based spam and firewall system that I don’t control that flags suspicious comments, which sends them into moderation. This could be related to the server that your comments are routed through when you send them; this server might be known to spread spam or malicious content. There are a few other commenters here that are in the same boat. Sometimes the problem disappears, sometimes it goes on forever.

Funny because this Fed is currently very loaded with folks with either a) no econ PhD or b) a less reputable PhD. The non-PhD credentials are also generally lackluster.

Powell is not an economist by background and his incompetence reflects this. In fact several highly-educated, reputable economists (with stronger forecasting track records) have been highly critical of Fed policy. Mostly that the Fed raised far too late and then (now) raised too much.

The lack of better educational pedigree is telling. Also, the range of intellectual quality in even the best (most competitive) programs is wide. But in lesser programs, it is embarrassing.

Truth

“The Federal Reserve Board employs just over 400 Ph.D. economists”

https://www.federalreserve.gov/econres/theeconomists.htm

IMO we would be better off now if Fed Funds had stayed at 2%, 30yr mortgages had stayed at 5.5%, and the Fed did not do any QE (pump the money supply)

In other words, END THE FED (at least how they operate)

Cryptos and such would be off the charts, a Big Mac would hit $50, and the poor would be throwing cinderblocks down on freeways.

Phleep you misspelled gold

Ph.D. stands for “Piled high and deep”

John Maynard Keynes failed to recognize the long-term drug addict problem from the result of hooking the patient on that first dose of Government juice (heroin).

We don’t have a real economy, just a Fiscal/Monetary gong show.

Truth,

The Fed should have raised in April 2020, after markets settled down. It should have never ever done QE. Not in 2008, not ever. It could have resolved the issues in the Treasury market in March 2020 with repos, as it had done in the decades before 2008. By Dec 2020, it should have pushed rates above the rate of inflation.

The Fed should not have loosened bank regulations on midsize banks.

The Fed, the FDIC, and the Treasury should not have bailed out the uninsured depositors of the failed banks.

The Fed should be fired as bank regulator, and should be replaced by the FDIC, because the Fed is too conflicted to regulate banks:

https://wolfstreet.com/2023/03/24/powell-discussion-of-silicon-valley-bank-regulatory-failure-shows-why-the-fed-should-be-fired-as-bank-regulator/

There is only about ONE thing the Fed, BELATEDLY, has done right: Rate hikes and QT.

So, Powell is bad, but he isn’t all bad. And he isn’t nearly as bad as Bernanke, who was the worst, most reckless chair in the history of the Fed. The long-term damage his QE and interest-rate repression policies did to the US economy is huge. And he’s an economist.

Many economists are just promoting an agenda, such as those who’d promoted the whole insanity of QE and negative policy rates (the latter is something the Fed never did, to its credit, though there was pressure on it do so). The fewer economists sit on the FOMC, the better.

Without QE most 401Ks wouldn’t be close to where they are at current levels.

Not just QE …

but the Federal govt with their massive spending in the name of COVID relief……which still is not entirely spent! One would think returning the money to the Treasury might be suggested.

And many states used that “relief” money to balance budgets (temporarily) and fund pensions (temporarily).

And an estimated $80 billion in PPP fraud!

Let no crisis go to waste….someone once said…..to justify the govt spilling money.

I recall Ben saying “there needs to be some fiscal responsibilty here” back in ’08. Not a complete fool but went along for the paycheck. Then moved on to Brookings for the paycheck. He had to finance his son’s $400k mortgage. Not sure the Phd’s are morons but they are up against congress and need the money. Janet is a whole different story.

Couldn’t agree more. Very well said Wolf, as usual.

My 401k would be higher since I have been focused on income and “safer bonds “ the melt up of stocks due to suppressed interest rates have done much more damage as noted by Wolf. The stock market values and asset values are all a result of NPV calcs

Technocrats who were onetime monetary conservatives change instantly when they perceive themselves to be staring into the abyss. Somehow the idea of contagion freezes their brains. The finger goes to the “print” button, hard and repeatedly. Then, they don’t seem to change back. The ones who were never conservative just stay the way they were.

“The Fed should have raised in April 2020, after markets settled down. It should have never ever done QE. Not in 2008, not ever. It could have resolved the issues in the Treasury market in March 2020 with repos, as it had done in the decades before 2008. By Dec 2020, it should have pushed rates above the rate of inflation.

The Fed should not have loosened bank regulations on midsize banks.

The Fed, the FDIC, and the Treasury should not have bailed out the uninsured depositors of the failed banks.”

Wolf, why do you hate economic growth?

;-)

“And he isn’t nearly as bad as Bernanke, who was the worst, most reckless chair in the history of the Fed. The long-term damage his QE and interest-rate repression policies did to the US economy is huge. And he’s an economist.”

You are talking about a Nobel Laureate, who saved this world with these policies.

rich or poor the safe keeping of a bank deposit should not be questioned

In the setup we have, all deposits are unsecured loans to the bank. So we have government deposit insurance, and it has limits that are well-knowns. That’s the setup we have, and it should be allowed to work.

totally agree with everything. add Yellin after Bernanke for crossing the Rubicon. I nominate Wolf as new Fed chair.

Why should Fed seek qualified individuals? Merit is not required for anything else that they have a say about these days.

Ya know it’s wierd that first thing they do is close Federal Public Parks. Where no Public Employees actually work, they are privately run. Just a pressure tactictic to make people think they are being cheated..

“Ya know it’s wierd that first thing they do is close Federal Public Parks.”

They close National Parks.

“Where no Public Employees actually work, they are privately run.”

Have you ever actually been to a National Park? National Parks are full of Federal employees, including, chiefly, the Park Rangers who maintain trails and, in some cases, enforce the law inside the parks. During the last few shutdowns, mouthbreathers in 4x4s ran amok in some of the NPs here in Southern California, camping wherever they wanted, leaving behind litter and cutting down protected trees for firewood.

If your only experiences with Martial Parks are hanging out in the lodges and gift shops, I could see how you might think they’re “privately run.” Those places, along with some of the developed campgrounds, are run and/or cleaned by concessionaires.

“Martial Parks”

Err, National Parks. Gesture typo.

I nominate Depth Charge as the new Fed Chair

But Im not convinced that an economics degree makes you competent since there are many economists who have absurd views of how the world works yet they still have PhDs.

Powell is not just bad because hes not an economist but because hes not clear and decisive in his communication.

Sorry dude but the private park people bailed out of CA because the gov was so viscious they could not make a living. And I have camped in ever one of them from coast to coast. Check out what the Forest Service has done.

Moi:

You don’t have the faintest idea what you’re talking about, and it shows. The best thing to do in that situation (not that I have much faith you’ll take my sincere advice) is stop talking and start researching. Start with researching the difference between the Federal Government and the government of the State of California. Then look up which of those two governments runs and sets policy for National Parks in California.

His lack of clarity is intentional. Parsing Greenspan’s text was an art in itself.

He (Powell) is incompetent. He raised rates too late (though never should have raised in April 2020) and has now raise them too far. The FOMC as an org is under qualified but I get it – they aren’t going to land the best and brightest.

Ok fine I apologize But really there is no worse way to die but choking to death and being burnt up in a fire. I care about people and wildlife. And the CA gov just doesn’t seem to. So the greens and the PS can do what they want.

kiers

Agreed.

The Fed has broken the real estate market which has become even more illiquid …

and now the debt market is becoming erratic and illiquid.

Traders in stocks feeling the same ….

Subjective decision making, Fed speak, the realization that the massive money dump with the COVID excuse is irretrievable all lay at the feet of the Fed “geniuses”.

The Fed’s willy nilly policies must be halted….and a formula driven monetary policy, one which people can rely on, must be implemented.

Short rates pegged to an inflation index, and the Fed OUT of the long end, for starters.

As for Yellen, she has at least THREE govt pensions…..U of CA, Fed, Treasury…not to mention speaking fees, speaking to seat fillers forced to listen to her

All formulas, all vows, all range-bound policies are off when “contagion” is perceived. Nobody will ever agree to an absolute hard limit, and if they do, they will find loopholes when they need to.

The US receives more than enough in taxes to pay the interest on national debt. We will not default. Debt ceiling fight is all theater and a way to get more debt money for political purposes (e.g., student loan forgiveness).

Social security recipients may lose their benefits or SNAP recipients may starve death, but we will not default to save the financial markets where the Pelosis have all their wealth.

Why no mention of where the GOP leadership has their wealth. I suppose they are all just honest hard working public servants?

Absolutely right. Federal debt is protected by the constitution. A default just turns over decisions about cuts to the President. I would NOT want to live in a red state should that happen under this president.

Well, one could always move to, say ..the Grand Douchy of Portlandia, or Principality of PhillaHELLthia.. to be protected from such politically charged ‘decisions’, no?

its always same smoke and mirrors show when it comes to debt ceiling. There should be no debt ceiling. Its nothing, but a waste of time. Both sides will raise it over and over again.

The Pelosis? How about the McCarthys and the Chip Roys?

Chip Roy has over 100 million dollars from inside trading? Wow.

“more than enough in taxes to pay the interest on national debt.”

Yes. Of course. Just tell all the other Government Promise Holders they will get paid just a soon as Bond Holders, including the Fed, get their vig.

It will be interesting to see the results of this past tax season. Prior to Covid, less than 50% of tax filers paid no federal tax. In 2021 and 2022 it went over 50% but were skewed by Covid programs still.

Once you have over 50% not paying Federal taxes, it will be hard to ever raise taxes. Everyone who is not paying taxes will vote not vote for a person who wants to raise taxes. Now the people do pay taxes will vote for taxes to be expanded to those who do not. But we probably passed the Rubicon and there is not turning back.

Printing as the path of least resistance has a long pedigree, by now. Heck, this country was founded by a bunch who didn’t want to pay taxes, even if it was to pay for the French & Indian War that protected them. The first currency of the fledgling revolutionary regime, the Continental, was built to depreciate.

Interest charges was “without tax increases on the secret billionaires to pay increased interest rate charges.” Amazon tablet does not like that phrase? LOL

Harry,

I reached my debt ceiling on SQQQ calls.

Just kidding. In it to win it.

Thanks for bringing this to attention of your readers. I follow the treasury market fairly closely but I have to admit I don’t pay much attention to 1-month t-bills and this totally got past my radar until seeing your article.

This is totally bonkers, irrational trading. Even the debt ceiling doesn’t explain it. If investors are trying to avoid default, I can’t imagine 1-month t-bills having anything at all to do with it because there is no scenario in which default is going to #1) Happen in the next 30 days and if it DID #2) Be totally resolved within 60 days (such that a normal 2-month yield suggests).

Something else is going on here. To me, this reeks of computer algorithmic trading gone haywire, maybe because of other derivative instruments that are being used to bet on the default going sharply up in value. Maybe that triggered the algorithms (i.e., spooked the computers).

Fat finger? 4-20? Fat doobie? Nope, Wolf’s graph suggests it is not a one-day screw-up. It is close to trend since the end of March.

Wolf’s graph shows an increasing divergence between the one-month and two-month, as if some sort of structural change starting around the end of March. Note there was also a relatively minor but noticeable divergence around March 10, when SVB collapsed. This was followed by convergence for a while until the end of March, and then the really big divergence. I don’t know how this would relate to bank problems, but if it does, it suggests the bank crisis may not be over.

I am curious about all the dots in Wolf’s graph. It was my understanding that 4 week Treasury bills were auctioned weekly. Are there some sort of inter-weekly auctions?

Every one-month “constant maturity” Treasury yield index is a construct based on market yields of Treasury securities of various types that mature in about one month. It’s not an index of 1-month bills. And it’s not based on auction yields.

Remember, in theory a 10-year Treasury that matures in one month trades like a 1-month bill that was just issued or a two month bill that was issued one month ago (there are some differences though in reality).

Here is a somewhat readable explanation of how a constant maturity Treasury index is constructed:

https://www.investopedia.com/terms/c/constantmaturity.asp

Thanks.

Thanks for the info/link.

The one month treasury auction that took place on the 18th had 186,203,247,400 tendered and only 61,390,672,400 accepted. So 3 times oversubscribed and the rate for that date was 4.01% i believe.

Sine99, I think Wolf’s explanation could be much or most of what is happening, but I admit that my view is biased by my own actions. I have been rotating into increasingly short durations with the eventual goal of being completely out of treasuries (temporarily) during the silly days. I think a default is unlikely, but I have no confidence in congress. None. I imagine many others share that opinion, and that could be the basis of the current rate behavior. The other way to play this would be a rotation into longer duration, I think, but I haven’t considered that idea carefully enough to say any more about it. Finally, I’ve seen recent chatter from GS and elsewhere that the X date might be sooner than has been widely estimated, with reason being reduced tax revenue, and the reasons for that being things like lower capital gains, etc. Who knows? Crazy world.

As someone who recently bought 6 month tbills, can you clarify what would happen to tbills if the default did happen? Would people simply not get their money back when it matures until after the debt ceiling would be resolved? Or is there a scenario where I would have to take a haircut? The government is more out of control than at any time in the last 100 years so I see at least a 10% chance of default.

So if there is a default, and the Dow plunges 10,000 points in one hour, and everything goes haywire, Congress will likely figure out how to raise the debt ceiling. So if there is a default, it will be short-lived. And maybe nothing at all happens, other than a huge crash, and big downgrade of the US debt by the credit rating agencies, and higher yields forever.

If there is repayment default, then holders of that particular bond issue will not get paid at maturity. But they will get paid when the debt ceiling is lifted and the government can issue more bonds. I would assume they would also get interest for the period, and in the end, they may not have a loss of any kind.

You can tell, I’m not particularly worried about this stuff. And I have Treasuries.

>> “…a default, and the Dow plunges 10,000 points in one hour, and everything goes haywire.” <<

I guess that means the politicians really _must_ be allowed to continue trading and owning stocks. Selfishly having skin in the game will keep them from destroying their biggest source of wealth??? What a fine system we have.

Circuit breakers:

“U.S. regulations have three levels of a circuit breaker, which are set to halt trading when the S&P 500 Index drops 7%, 13%, and 20%.” – Investopedia.

Place your limit/buy orders in at -19.5%, eh? What about day 2??

Also, there will be massive buying opportunities in equities because the 10,000 point drop will be mostly unwound once the ceiling is lifted and treasury holders are made whole.

I heard that McCarthy doesn’t have the votes in Congress to block the increase in the debt ceiling. So, we have another case of a lot of talk but no action on cutting spending. Get ready for another round of inflation and recession. STAGFLATION on steroids. Enjoy.

The time to worry is when nobody is worried. The debt ceiling has always been a clown show and I agree with your comment but at the same time, something seems a bit odd with the thinking of people in power these days. It’s as if they are all hearing voices you and I don’t hear.

Alternate interpretation: those in power know this is the utterly familiar dog and pony show.

Sounds to me like an excellent buying opportunity at greatly adjusted prices.

Greatly adjusted prices.

Well said.

Wolf, I read that the current temporary QE to support the new banking crisis hit $440 billion of new securities at the US Fed. Is that a valid number and how quickly does that new support expire?

Seems like a topic worthy of an article.

1. You’re a month behind.

2. I write about it regularly, but you don’t read my articles about it, so I just waste my time answering your questions here because you don’t read my articles? RTGDFAs

3. It wasn’t QE but a temporary liquidity support for the banks. If you ever read any of my articles about it, you’d know this.

4. The spike top was on March 22, at which points total assets had spiked by $390 billion. If you ever read any of my articles about it, you’d know this.

5. In the four weeks since then, total assets have PLUNGED by $141 billion, and will continue to PLUNGE as the liquidity support is unwinding and as QT continues.

This is from two weeks ago. READ IT:

https://wolfstreet.com/2023/04/06/feds-balance-sheet-plunges-by-101-billion-in-two-weeks-as-qt-continues-and-bank-liquidity-support-begins-to-unwind/

This is why I religiously read Wolfstreet. I exist on the short end of the Treasuries, and this spread has me wide eyed. So, I’m wondering… some speculate it’s some rush to safety. “Getting out of what they were in”, and into the short end guaranteed. It’s too big. It’s too much money pouring in to depress the yield like that. Could this be a result of banks, exposed to the long end of the curve, eating the losses, and trying to catch up on the short end?

I agree that the treasury market is big and these kinds of moves are indeed interesting from that perspective. It’s certainly not retail money making the treasury market move like this. I wonder a bit if there is some kind of supply shock, meaning the Treasury is starting to not issue new debt on the very short-end because of the debt ceiling and the supply shock is driving the move? Pure conjecture on my part. Should be easy enough to look into. The Treasury probably publishes new issuance numbers.

OK, I agree it’s hard to believe that retail investors could do this. Unless maybe the nonretail aspect is very stable, and only the retail portion is changing? I don’t know.

The Debt Limit/Ceiling will be raised, it always has.

Yes a few days/weeks of fighting between Liberals and Conservatives, but make no mistake, Congress will make sure, they are fully funded.

A market crash, default on US Debt ?

Not with the World’s Reserve Currency.

A market crash will come, Bull Cycles and Bear Cycles are normal.

Everyone believes one more QUARTER POINT……..Then the Fed will rely on data to hold Short Term Rates near 5%.

Subprime is not a problem. Not yet.

Office real-estate is a problem, but small in comparison to the total debt.

Where or When the next real market crash comes from, I do not know.

Some are scared, buying huge amounts of short term treasuries.

Some are scared, buying gold at near all time highs $2000/oz.

Steve Hanke’s “Gold Sentiment Index” shows gold at an extreme level of bullishness, so he suggests that it will revert.

What’s a good way to play a relatively short-term reversal of gold, say within 3 months or less?

(I have never “invested” in precious metals b.s.)

I believe you can short a gold ETF. You probably could also buy puts on it.

Big gold miners move about 3:1 vs gold. You can short them, but shorting is risky.

It’s interesting hearing Buffet discuss humans having the desire to gamble which leads to a lot of poor decisions when it comes to investing. Restraining the desire to bet on price movements and focusing on buying future earnings at an acceptable price is the way he did it. Its boring but its probably the best risk adjusted way to make money.

“Restraining the desire to bet on price movements and focusing on buying future earnings at an acceptable price is the way he did it. Its boring but its probably the best risk adjusted way to make money.” Worth repeating!

OS, I agree with your points, completely. I hope that other, younger readers take the wisdom on investing that you’re offering.

The miners USED to move in the ratio that you mentioned but this has not been the case for a while. Gold miners are suffering from high costs so their margins have been bad. There is no pot of gold investing in the miners.

If gold is at an extreme level of bullishness how come the price does not reflect this? It’s actually in the toilet compared to other investments. You would think that gold is at $3000, a price I am sure it will NEVER reach. You are better off with other safe harbor assets.

Gold is a very small market, compared to equities and bonds. The gold price is easily manipulated by big players. Central banks do not particularly like gold as it can be seen, in some ways, as an alternative to their currencies as a “store of value”. Central banks are not much concerned about gold being a “means of exchange” because most people would probably have difficulty purchasing their groceries with gold. In short, central banks can easily hammer down gold prices any time they want.

Gold Fear & Greed Index is moderate at the moment. Not sure how the index you refer to is calculated.

Depending upon your own psychology and trading ability, Gold should be used in two ways: 1. If you have superior knowledge or ability at trading, it can be used as a trading vehicle because it generally has a wide annual trading range that can be effectively used by some or; 2. Lacking the skills or knowledge of (1.) it can be used as wealth insurance in case of a breakout of Argentinism wherein the value of the currency depreciates rapidly as is currently occurring in Lebanon, Sri Lanka, Venezuela and Argentina where the current annual inflation rate is over 100% and increasing every month. In all these countries, currency is being added to the system at a much faster rate in comparison to the availably of goods and services, which is what has happened in the US over the past 3 years, just not to the degree that it has in those countries (yet!).

The US is running a projected 2 trillion dollar deficit this FY under a business as usual scenario despite Covid benefits slowly expiring. Inflation is running hot. The majority in Congress wants to continue business as usual anyway and so it is unlikely a small minority of Republicans can stop the gravy train that both parties ride. If the minority actually gathered wider support and forced the issue, we can presume that the Fed will create a SPV or do something else creative to lend money directly to federal agencies to make payroll, pay SS benefits, redeem mortgage bonds, make SNAP payments, etc. As for creditors of the Treasury, they might have to wait a while. This could get interesting, but I doubt it.

I think most representatives in DC plan to keep pushing spending until we have the Minsky moment. Nobody knows exactly where that is, but when it occurs debt will be defaulted on most likely through yield curve control or a new layered on tax like wealth tax or value add tax.

I think 3k on the Dow would make the rump bizRepublicans blink. The fact that Biden said just pass a clean bill, and I will sign it means that the strategy of bluffing with a few votes to spare is doubtful at best, and stupid given how some may not vote for the simple clean bill.

But will we do a default? No, because that would utterly end any R contributions from most of the financial sector. The idiot Speaker knows this, but is still trying to allow the stupid bill with all the cuts up on deck first. After that fails, meh. The shutdown ended up a loser before, and then we can do a default and a shutdown? And then no confidence the Speaker of the House. And depending on Andy Biggs and Paul Gosar the Arizona morons? In short, the Republican Party is going to have figure out a real economic policy or commit voter suicide.

The economic turmoil is also going to be continuous until the next election with our unstable congress. And that more than anything will be a huge problem in containing inflation and returning interest rates to the 5% level consistent with some stability. Lower rates than that are going to be a fond memory for a long time.

In other words, this split congress is going to doom the economic stability necessary for the Fed to increase rates. The recession is going to be a lot deeper and the as Wolf stated the long term costs of higher interest rates are going to retard the economy.

This, combined with the possible trade stability problems with China is going to make a challenging decade.

In some ways US government financing is the third and final stage of a ponzi, borrowing money so you can pay your existing debt payments. You could say $32 Trillion is a good limit for a few years til we work off cost of pandemic, kind of along the thinking of Keynes.

It’s up to Fed to control government spending, by being focused on never letting inflation blow out. If Fed doesn’t do its job they will not get confidence back until dollar has an anchor.

Don’t blame Keynes. He felt that stimulus was needed during serious downturns (start the flywheel), but that very stimulus should be removed when the economy is on better footing. The last part never happens, though.

Sorry, but your analysis of this situation is looking in the rear view mirror. Things have changed mightly. The dollar is at great risk across the world today. A small handfull of newly elected Republican representatives are not going to budge; nor should they. These ongoing huge budget deficits will soon end this country.

Biden will blink. And again, all of Congress needs to blink. We have to seriously get this budget under control. Including defense spending.

It looks like a fat finger or a fed rule tweak (did not find one…).

You would earn more with overnight deposits on this timeframe.

A fat finger that started pressing the key at the end of March and just kept pressing it? No, this is a classic day after day plunge in yield (surge in price). It means that lots of investors have been massively buying these one-month maturities.

The trend since March is a valid point but the one-day move today was eye popping.

Eurodollar market and scramble for collateral. That’s a theory I’ve been hearing about.

You are wrongly assuming that they are competent. They are too many uncompromising ideologues in congress.

This has the potential to blow up like brexit. Did any one here guessed that it would go the way it did? Are you still sure that they will do the logical thing?

And there’s Trump and his legal troubles that could give the slight push to disaster. And the banks, and China…

You also wrongly assuming that an actual default is needed to cause serious problems. You just need to spook the markets enough. Many banks are already sick with low yielding treasuries, that could push them over the edge.

You your self said that you weren’t worried. That’s an aggravating factor. It means there’s higher probability of a default happening because of overconfidence. And when it happens, it will surprise the markets in a panic harder.

You need to see the big picture. All current problems can combine and amplify one another. The system is already cracked, an other hit now might brake it.

Instead of inflating with more and more printed debt, how about considering the stopping of spending more phony money. Or is it such an orgy of the Widening Gyre that it’s really already over?

Just freeze it where we are now and see what happens. It would be fun to watch.

In reality we know there’s now way to pay down 31 trill and blowing upwards but I’ll ride this train with Wolfie and the rest of y’all into the economic hell that awaits.

KMOUT – If they stop the deficit spending that would cause the economy to fall quite a bit. Government spending is a the core of all this inflation/robust economy, along with that massive balance sheet.

A couple days ago I saw the strange drop in the 4-week Treasury note yield, so I switched my on-deck rollover to be 8-week.

Now to decide whether to keep about a third of these cycling tranches in cash for possible buying at the bottom if there really is a longer default triggering stock market cliff dive.

“folks in Congress are surely too worried about their own wealth, and sheer greed will keep them from pushing the US into default”…..

You can bet your swingers and family heirs on that… Circuses of the damned will be Paid and Grifted as it was intended. The Spice must flow !

So now the yield curve looks like a bell curve? Or a blue whale?

So why the rush to get into short govt debt if there is to be a default?

Perhaps this has more to do with Geopolitical forthcoming events?

Stocks don’t seem to worry much….

SPX : the wolves howl in Apr 2023 when they see the stars.

“The good folks in Congress are surely too worried about their own wealth, and sheer greed will keep them from pushing the US into default.”

Fear of the masses if that would happen is what they probably fear most. That’s why the CCP in 2010 during the GFC aftermath spent more money on internal police forces and security systems than on their military.

Timely article. Thanks!

I love the idea that you can insure US government debt by buying insurance of US banks.

Like betting a condemned man he won’t last to the end of the week.

When does he pay up?

In advance of course.

Duh

Bond market would get over the situation quickly if they prioritized interest payments and then forced government to start cutting expenses like a normal enterprise, but we know that is not going to happen because then a true accounting of the Enron/FTX like finances would be exposed.

It’s like fractional reserve banking: don’t look too close. It’s all a confidence trick. Always was.

Doesn’t mean it isn’t useful, or even necessary.

– During the In the last years and decades there have been multiple “debt ceilling emergencies” and the US still “alive and kicking”. So, it all has been “Kabuki theater” and I expect this to be another one.

I think you are a victim of escalating normalcy – a frog in the hot pot. The US is nowhere near “alive and kicking” now as it was years ago.

Well yes, one day it truly will be, “this time is different.” In which case, you will have plenty to worry about, far beyond parsing interest rates or critiquing budgets.

Could the Crypto-bois have anything to do with this? 1-Month Treasuries were recently ‘tokenized’ by PV01.

Add another layer of scam on top of a scam on top of a scam? Lots of smart people are using their braincells precisely to do that.

Just trying to understand what might be going on with the 1-Mon T-Bill, still getting bought up again today.

I expect this phenomenon has more to do with banking unease then the debt ceiling.

I own a business that sometimes has a pretty high checking account balance and when the banking crisis started we decided it would be prudent to lower the balance in our business checking account even though it is operating capital that may be needed on short notice. We buy 30 day T bills no matter what the yield is. Because it’s not about the yield it’s about reducing risk from the banking sector.

This makes a lot of sense. Businesses protecting their cash in bank accounts.

I think this is a good point. If I ran a business that had monthly or quarterly expenses that caused my account to exceed the FDIC limit, then I would also try to diversify where my money is held. I’d do as you suggested and put it into 1 month or 3 month Treasuries to make sure my account does not exceed 250K and pay my bills as these Treasuries mature.

The added bonus is higher interest rates than trying to diversify into different banks. Interest on 250K at 5% is $12,500/year. Interest on 250K at .01% is $25/year.

Since I don’t trust the stock market while rates are being raised, I do the same thing with my personal savings. Not because I have over 250K, but because these rates on these short term bills are very high. I can ladder my cash into 3, 6, 12 month T-Bills to come due when large bills are due (insurance, property taxes, etc). My bank also offers CD’s but these are offered through my bank so they count as part of the 250K FDIC limit.

Once you get past the weird Treasury Direct Website, it is very convenient to set up a ladder of Treasury bills. Money is withdrawn from your checking account to purchase and magically appears (with interest) in the same account when the bills mature.

Treasury Tax and Loan accounts?

What if the “good folks” in Congress leading this budget charade are positioned to profit from a meltdown?

Exactly right. What is to stop a group of Congressmen from blocking an increase in the debt limit and shorting the market? You don’t think a scumbag like Chip Roy (my worthless representative) would not try this strategy? Of course he would!

One thing people need to bear in mind, which was something I made a big point of back in 2011 when the US got its first-ever credit-rating downgrade is that congress does not have to let things default for US credit to be downgraded. I said back then the US would be downgraded for the simple fact that congress was playing chicken. My argument was that, while congress felt comfortable walking the wire and going right up to the deadline because Republicans KNEW at the last minute they would sign what deal they had to to avoid default (so were just holding out for the best deal they could), CREDIT AGENCIES did not know that and there would surely be one that would not wait to the last minute before downgrading US credit.

Could all the turmoil here be from something only a few Big Boys with insider knowledge see coming?

Maybe derivatives? I don’t see where anyone here is even considering what surprizes could be lurking there. How many derivatives are bets on asset prices? Seems like a fertile source of stress at this time.

Assume there is a “default” and the theatrics in Congress prove to be idiocy. Even then under “extraordinary measures ” the treasury could mint an $X Trillion dollar coin 🪙 and bam problem solved and theatrics start over again.

Treasuries benefit from being the lower safer part of the credit pyramid, so as the banks face solvency issues people not unreasonably transfer funds from the banks to the government. Whether that’s a significant inflow I don’t know but as the UK so foolishly demonstrated, you can announce government borrowing a step too far and when you cross the invisible line events move fairly swiftly (this is referring to the short-lived Truss announcement of unfunded tax cuts leading to an immediate sell-off). At what point people decide the US has gone hopelessly too far I don’t know but that point getting closer.

Probably this is why it’s always a big deal because one of these debt ceiling increases is going to be the big one. Fortunately, although with disturbing undertones of the deep state, for the UK the elected prime minister was immediately replaced and spending plans immediately abandoned.

Treasuries are safe in the picking up pennies in front of a steamroller sense imo.

The core problem with the US debt ($32 trillion) and current US deficit of around $2.2 trillion a year is that everyone wants the benefits but nobody wants to pay for those benefits. American greed and stupidity rule. Very little of US government spending is discretionary. Almost 90% of the federal spending is 1) Social Security, 2) Medicare / Medicaid, and 3) Military Industrial Complex spending. About the only thing that can be done to actually curtail the US debt and deficit is to cut federal spending across the board by at least 20% per year and then start eliminating any spending in areas that are totally outside the scope of the federal government and stop any and all increases in spending for the foreseeable future. Nothing else – including raising taxes – is going to even put a dent into this growing debt monster issue.

People been saying that for years. And now they propose illegal immigrants get free Obamacare. When I was stuck on that turkey it cost me $1500/month for nothing because of the deductible.

It isn’t craziness, Wolf. There is a real possibility that there will be a short period of time where you won’t get the principle back immediately. Even a single day of such an event can cause some institutions major problems in this regard.

Now, I think a limit increase is 99% assured to happen before any such default, but that 1% does matter.

Pure power politics.

Under the new rules recently passed by the House , only one vote is required to force Speaker McCarthy to vacate his position . In essence anything passed by the House must be approved by the Freedom Caucus . And controlling the debt is a priority for these Republicans . Given Biden’s complete recalcitrance to discuss the budget , the odds rise each day that there will be a funding crisis at the Treasury .

If the markets were really worry longer term about a default , interest rates on the 10 and 30 year would be much higher.

There will not be any default by the Government. Yes they have 30 trillion in debt but they also have over 220 trillion in assets.

The government could sell a lot of the Alaska land they owned to pay off the 30 trillion tomorrow. LOL

Blackrock would buy and then bundle the loan into a MBS and get it guaranteed by the GSEs.

///

No matter what happens this financial system ,in its current form, has an answer ,ONE ANSWER, to everything…Throw money at it. A perpetual bailout of all things financial. And I am sure they will raise the cap, and badabing-badaboo-pufff…Resolved!

///

Achilles dipped in the river Styx, Achilles the invulnerable.

///

And as long as this approach is viable and effective it will be used. And one day, the USA will default, and the government will say “So what? You all knew this is a scam. You had a nice ride and got some nice money in the meantime. Deal with it.” And they will keep printing and issuing bonds like nothing happened. But the new ones will be special and they will not default for sure (cross my heart, pinky swear, wink-wink)…

///

With the level of morons we are dealing with here, i.e. No negotiations Biden, It will come down to a baroque period farce where telephones don’t work and Ubers are unavailable and health relapses delay attendance for: The Big Vote.

Hell, Biden might be taking a nap and forget to sign it, or having a snit and delay signing in a huff.

I should be selling popcorn to the rest of the world who are watching this Marx Brothers movie.

Someone once said the democrats pull stunts that they know the republicans will not copy because the republicans know that if they both do it, it will be the end of the republic.

Have at it Wolf.

It’s Republicans in Congress who started this, not Biden in the White House. Did yo already forget?

After 42 years of voting one thing I have learned: After all the paint dries there is zero difference between Republicans and Democrats. The wall only looks different while it’s wet.

Yes, many of us feel that way. It’s like back during the Financial Crisis, when the bank bailouts were being discussed, while presidential candidates McCain and Obama were butting heads. They were both asked (can’t remember when, maybe during a debate) about the bank bailouts, and they both said that they would bail out the banks. It took my breath away.

joe2,

There’s a great comments section over at the NY Post where you will fell perfectly at home.

I don’t have any strong feelings about what is causing this but maybe:

1. The switchover from LIBOR to SOFR.

2. Attempt to handle maturity mismatch that did in SVB.

#2 is very weak. Regional and local banks might be switching their long dated treasuries to 1 month treasuries in hopes of avoiding a bank run. But even if SVB had 1 month instead of long dated the bank run would have still happened. The bank run happened in a 24 hour period – even 1 month treasuries are too long dated to do any good.

My theory is pretty simple- everyone wants to have cash available in case there is a scare/actual default and stock prices tank. So some percentage of 8, 13, and 17 week holders replaced their T Bills with 4 weeks rather than re-investing in the same duration that could span potential default. Looking at the charts it’s easy to focus on the 4 week plummet, but the 13 and 17 have crept oddly high due to less demand as many rotate to the short ones that mature before potential default. This could be exacerbated by concerns that matured T Bills 8 week or longer could have payments postponed if there is a default. And if banks etc. are rotating shorter too, that could do it. Like Wolf, I personally haven’t cancelled my T Bill reinvestments which is insane considering my lack of confidence in our government to get anything done right.

What most people are missing is the fact that the congressional members of the Freedom Caucus are far right ideologues and they cannot be relied upon to act rationally or in the best interests of the nation. For more than 40 years, the Freedom Caucus, and its predecessor organizations, have dreamt of crippling the federal government. If you think back to Grover Norquist, the goal is shrink the federal government so that it can be drowned in a bathtub. Additionally, the Freedom Caucus is loyal to Trump over all others. Trump’s narcissism has been widely reported, and several experts have warned that Trump will do anything to seek revenge for losing to Joe Biden. What better revenge than to ruin the economy while Biden is in office! Best guess. Trump will instruct the Freedom Caucus to blow up the debt ceiling for the express purpose of causing a default. Several months ago, MGT was spouting off about not raising the debt ceiling and forcing a default. Although she and the other FC members have been silent on this topic since doesn’t mean that they have changed their minds or intentions. I hope to god to be wrong.

There are two sides to this (at least). I find it essential for my clarity and equilibrium to do my best to see the other’s argument in its best light. I got so fatigued a few decades back hand-wringing about that day’s version of just this. We are still here, and generally intact, and I would have burnt a lot of neuro-gear in my head, without a different result. And Trump was never a budget puritan. He’s quite comfortable letting the presses rip, and throwing around other people’s money.

It’s not just Freedom Caucus but groups/parties from all walk of life can screw USA for their own benefit.

I remember, how democrats were smiling internally when covid was raging in USA as they saw this an opportunity to defeat Trump :-).

Of course, not a fan of Trump.. he can go to any level for his revenge.. but same for other people as well.

The economy is already ruined, thanks to the Fed. Certainly all of Biden’s policies further contribute to economic ruin. People like me are trying to survive among the wreckage. It’s possible but it takes a lot of work.

Would a default on repayment of Treasury bonds really result in a financial melt-down? Wouldnt everyone just assume that it would get worked out, so it would be a temporary hit?

My assumption is that they will go further into default than ever before (whatever that means).

Question: if the Fed does an outsized rate hike at the May 2/3 meeting, would the owners of 1 month treasury bills stand to gain?

No. Holders will get paid face value plus interest when the bill matures. Nothing is going to change that, assuming there’s no default beforehand, knock on wood.

Interesting.

Lots on here have been calling for the Fed to supersize their hikes, and i see the market is pricing in an 87% chance of a .25 increase in May, but something unusual is brewing – the market is more disconnected than normal, to put it mildly. A massive amount of guaranteed income would hedge a long position in equities quite nicely in the event of a plunge. Looks to me like an informed trader making moves.

WSJ 4/22

Article on credit default swaps on Treasuries….

some are paying $9600 to insure $1 million ?

It is remarkable to think the Fed would print (QE) at the pace they did, yet not accommodate debt repayments by the Treasury.

Wolf’s graph and some commenters suggest problems with banks. Nobody knows for sure what is behind the huge divergence.

One way to see which banks are more-or-less desperate for deposits is to look at brokerage CD’s. MORGAN STANLEY PVT B NY figures prominently as offering the highest or nearly the highest rates in 18 month, 2 year, 3 year, and 4 year CDs at Schwab (non-callable). UBS Bank USA UT and DISCOVER Bank are up there. None, as in zero, of the big four banks (Chase, BofA, Citi, Wells) are offering any non-callable brokerage CDs of any duration at Schwab. Note that I only look at non-callable CDs. Nobody in their right mind would buy a callable CD, imho.

My country central bank PAUSED this April meet. (Most Asian Central banks except NZ are pausing ) . Our Central bank + ministry of Finance guarantee per bank per TIN (called PAN over here) is only ₹500,000 ($6250).

big or small all banks under the Cental bank umbrella all FD’s are protected up to ₹500k. For seniors (over 60 years) there is a 0.5% extra in all banks in FD interst. I have made 12/15/18 months at an average 7/7.5/8/8.25 %in the last 6 months in many many banks slowly catching the interest rate hike cycle. Our cental bank CRR is 6.5% with this pause. I dont think it is going higher. with fake inflation statisticss, they will pause another 2 meetings and drop rate possible in early 2024. Living on FDinterest is a challenge .

The new 15% corporate minimum tax went into effect earlier this year.

To me it seems like tax receipts at the treasury dept. should be up not down.

That tax only impacts a few of the biggest corporations. You’d be amazed how little in taxes, if any, these big corporations pay.

Its all a clusterfuck or epic shitshow. We are left holding the bag, and its the size of the sun.