More people having second thoughts before quitting?

By Wolf Richter for WOLF STREET.

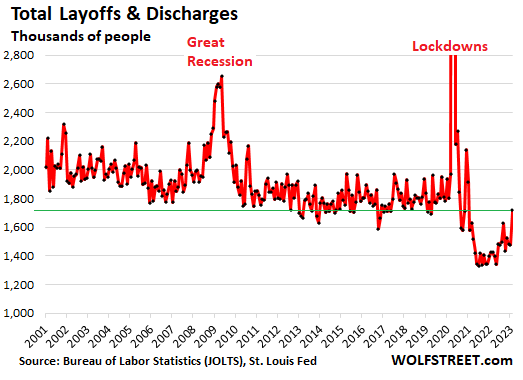

Actual layoffs and discharges in the US – not mere announcements of layoffs by global companies that may not even take place in the US – is one of the major points that stood out in today’s Job Openings and Labor Turnover Survey (JOLTS) by the Bureau of Labor Statistics: After slowly zig-zagging higher for months from the tightest-labor-market lows, they jumped in January.

Every day even during the best of times, companies lay off or fire people, which is part of the normal churn in the vast US labor market. Between 2011 and 2019, layoffs and discharges averaged 1.8 million per month. During good times, most of these workers find new jobs quickly. But during bad times, the flow of newly unemployed workers increases, while companies cut back on their hiring, and unemployment rises. This isn’t happening yet.

What happened in January was that layoffs and discharges jumped to 1.72 million, the highest since December 2020, after having edged higher for months from the historic lows of around 1.4 million in 2021 and 2022. Layoffs and discharges have now reached the low end of the pre-pandemic range. There is a clear pattern of returning to the normal range – a sign the labor market is getting a little less tight:

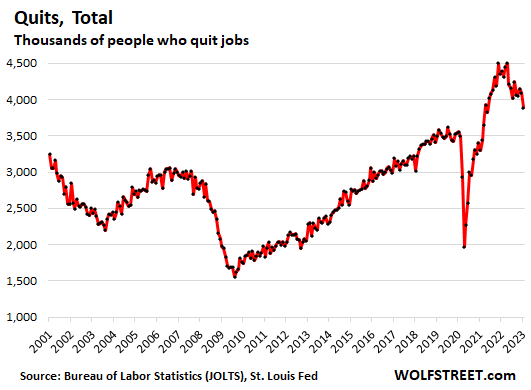

People having second thoughts before quitting? In the tight labor market over the past two years, one of the phenomena was that workers figured out that there were better jobs out there, that paid more or had better working conditions, or less of a commute, and they massively quit their current job to take on a better job, which created a huge amount of churn in the labor force. This arbitrage by the newly empowered workers spread wage increases across the economy as employers had to up the ante to hire and retain staff.

The number of workers who quit their jobs, after having gently zig-zagged down for months, dropped more sharply in January, to the lowest since May 2021, to 3.88 million, down from around 4.5 million in late 2021 and early 2022.

The pre-pandemic record was 3.55 million in January 2020, already indicating a lot of churn in a tight labor market. So this is still a historically large number of quits, in what is still a tight labor market, but it shows that some of the frenzy is leaching out:

The decline in quits from the super-high levels a year ago, to still historically high levels, could be a sign of changes in the labor market, including:

- Employers no longer upping the ante to the extent they used to, providing less incentives for workers elsewhere to quit their current jobs to jump ship.

- Fewer alluring job openings out there in tech and social media, as we’ll see in a moment.

- Less confidence among workers that they will find a better job.

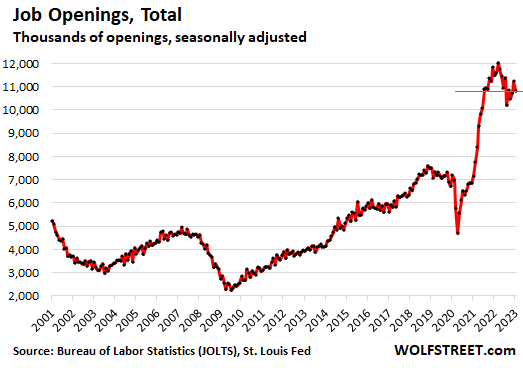

Job openings remained in the same high range in January that they’ve been in over the past two years: 10.82 million seasonally adjusted, and 10.77 million not seasonally adjusted – up from the 7,200 range before the pandemic. This metric does not show any indications that the labor market is getting less tight.

This data is not based on online job postings, but on surveys sent to 21,000 businesses, asking them how many job openings they actually have, the number of people they actually hired, the number of people they laid off or discharged, the number of people who quit, etc.

What is happening is that in some industries, particularly “information,” where some of the social media and tech companies are classified, job openings vanished, while in other industries, such as the vast sector of “Professional & Business Services,” job openings rose.

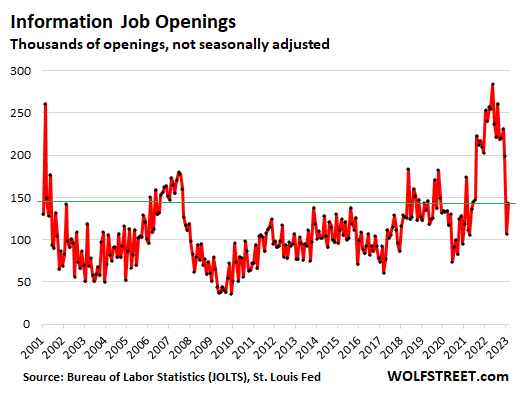

The sector with serious damage to job openings is “Information.” The small sector with only 3 million employees includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. Many tech and social media companies are categorized in it (others are part of the vast and very broad “Professional and Business Services” sector). “Information” is where many of the layoff announcements have occurred.

Job openings in the “Information” sector, after a near-50% plunge in December – the biggest plunge since the Dotcom Bust – bounced a little, in line with the noise throughout the data series, and remained far below the frenzied levels during the past two years. The 143,000 job openings in January were down 38% from a year ago:

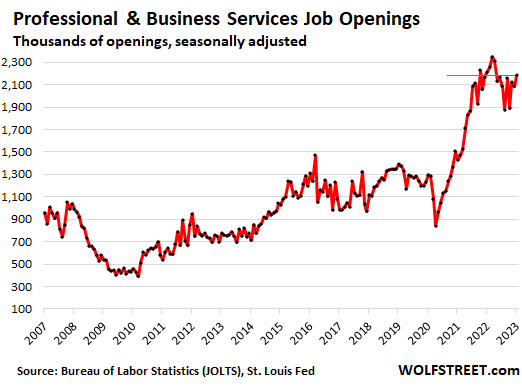

By contrast, job openings in “Professional & Business Services” rose and remained in the astronomical zone. This is a vast category, including some tech companies, with 22.4 million employees in these subsectors: Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

Job openings rose to 2.18 million, very much in the astronomical zone, and barely down from the peak in March 2022:

After over-hiring in tech and social media…. What CEOs of tech and social media companies are now admitting in their mea culpa blogposts is that they over-hired during the pandemic, to expand for a future that did not come, and that they’re now trimming a portion of the expanded workforce to get their costs back in line.

What is also happening is that the startup bubble has imploded, and that these outfits that are burning cash like there’s no tomorrow aren’t getting more VC funding, and that those that made it out the IPO or SPAC window got crushed in the public markets and cannot raise more funds from the public. And they have to cut their staff in order to slow the cash-burn to push out the day of reckoning – the out of money day – a little further.

But what this data also shows, along with the rest of the pile of labor market data, is that most of the rest of the labor market is still largely on cloud 9.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I don’t have a great data point here, only an anecdote that might be telling. I work in a rather wealthy school district in a very prosperous part of Texas. And we are being quietly told that next fiscal year (Aug 23 – Jul 24) will be quite ugly. I’ve personally been told to make non-essential purchases now because budgets will shrink next year, and there will be something like a hiring freeze. No new positions created.

Ominous signs for a district with an excellent financial rating from the state auditors.

Is this related to a lot of government pandemic assistance programs expiring about now? Read an article about a federal program that funded school lunches without means testing. Congress allowed the program to expire, so now some districts are back to taking on debt to provide lunches to children who don’t meet the means test.

It probably doesn’t have anything to do with pandemic programs running out. Texas has a $33 Billion budget surplus to spend, so the state is not hurting for money. In fact, they are considering spending $15 Billion to lower property taxes over the next two years. Since property taxes in Texas are used to fund schools, some of this $15B would be directed at funding school systems, which would allow counties to lower property tax rates (while maintaining existing funding levels for schools).

Without more details, this is nothing more than an anecdote.

We’ll see if that legislation goes anywhere or works the way it’s being portrayed in the news. The thing about Texas is that for all the crowing about “big government bad”, the legislature in Austin almost always goes against the will of the people when it comes to land development, taxes, oil/gas, and local ordinances that go against special interests.

Anyway, back to the subject: Lots of districts in my area have seen 10 years of ludicrous population growth, but costs are increasing and property tax income is not. So that’s probably what is happening here. I suspect the next 3 – 5 years will not be an improvement either.

In Austin the prepandemic trend was that AISD was shrinking by about 2% enrollment a year (going to home school, charter school, etc). Since the pandemic it is in the 5-7%, 5his is severely effecting AISD’s budget. On the other side maybe they will start prioritizing the correct things instead of wasting money left and right. If I remember correctly, something about bond funding changed for the upcoming fiscal year, Austin pushed through some large bond approvals last election to front run the changes and to guarantee capital upgrades.

I am so happy to no longer be a taxpayer in Austin…

Venkarel – Funding is set by tax base. They should have more money per child if fewer decide to attend. That’s why so many are screaming about school choice. They feel like they should be exempt from school taxes if they don’t attend. Property tax has been going up with home valuations. Even if the rates don’t increase, home prices have gone up dramatically, hence the surplus.

Texas is a Robinhood state, wealthier districts support poorer ones. From what I understand, funding is not set from the tax base but from school population and attendence, this is why people leaving the district is such a big deal. Travis county transfers the most money to other counties out of all of them in Texas. This is not an endorsement of AISD or Travis county spending.

“Texas is a Robin Hood state”

Damn, that explains all the folks running around with guns!

One big Sherwood Forest kinda deal?

Expect another uptick on layoffs in April, specifically in info sector. Reason: meeting quaterly financial targets.

Some people are getting fired in some areas of the USA while others get 15-25% raises in other locations. Labor force inflation/deflation volatility is area and job specific. Shortages of workers is still ongoing in many areas, especially the areas where people are fleeing to in large numbers and increasing the local economy growth rates.

For example, Texas House Bill 1548 which would give teachers a $15,000 pay increase as well as a 25% raise for other school employees…TBD, not sure likely it will pass.

One Texas police department handed out 25% pay raise recently to the entire county, according to another Texas article.

I also have friends who have got 15% raises in healthcare in Texas, and many are getting 10-20k starting bonuses. Probably area specific, but in the hot areas of the USA, labor has all the power right now. In other areas, tens of thousands are getting fired.

My concern is that due to 7% mortgages, worker mobility has most likely decreased and the labor force won’t be able to move where needed, and this could extend the labor shortages in some areas and increase unemployment in other areas.

The Fed should have never gotten involved with purchasing trillions in MBS, as the consequences are more complicated as compared to just simply monkeying with the FFR or just straight up QE. But hey, at least Jay is going to visit that homeless camp in CA someday, right??? (sarcasm)

“My concern is that due to 7% mortgages, worker mobility has most likely decreased”

Good point. I was wondering how that will effect job mobility too. The people with the raises can afford to move, they just don’t want to downsize while paying the same monthly payment or having a much larger payment for the same size house.

On the other hand. Maybe it is a good time to move and profit the equity gains, rent, and buy when housing conditions are better. I do know a couple of people who just kept their old house and low mortgage and rent the house out.

It’s Texas — they’ll sop most of that gravy back up on the other side with taxes.

Still no state income tax in Texas. Or city income taxes like in some big cities…..plate sticker for your new Mercedes…? $75.00

To compare taxes between states, one must do a detailed, and exhaustive comparison of all taxes imposed on the affected populous.

The overall tax burden in TX — from property to sales tax, to fees & other hidden dings — in particular, central TX, is always grossly understated by the “Texas Miracle” pumpers. Just because no-ones reaching up your backside and pulling out vital organs like in CA, does not mean it’s a low-tax burden state.

I’m not a TX resident, but my understanding is that the only real outlier in TX tax situation is property tax, which is very high, like top 5 in the country. For upper income working people, no income tax is well worth higher property taxes. And you do have some control over property tax, just buy a smaller place. But if you are retired or middle income, high property taxes is probably not a good thing. That’s why I am always surprised when I hear someone is retiring and moving to TX.

But let’s be real. Places like NY and NJ and even IL are so much worse for taxes it’s astonishing that anyone lives there still. And while CA has low property tax rates, and long time homeowners are protected by prop 13, for anyone moving there. The cost of real estate is so high that the combined income and property tax burden is similar to the high tax Northeast states.

8.25% sales tax in Austin. Adds up quick. The annual property taxes on my last home were 16K a year and that’s after successfully challenging my assessment.

If you’re trying to dodge taxes, move to Florida — hell, even anywhere in Washington state besides Seattle. Then there’s Tennessee. Any of those places will treat you better. Less barely closeted waffentwerps running around in the case of the latter two, too.

“Plate sticker for your new Mercedes is $75”

Is that something to be proud of?

(May have been a complaint)

Had a buddy who upon seeing very expensive basic transport calmly said, “There’s a nice display of excess”.

Always made me think of a peacock.

Forgot the Biology term for it, but same principle.

I think the cultural term for it is “lifestyle”.

If Texas is like Florida.. also a zero income tax state! An awful lot of state tax revenue comes from Doc Stamps on the transfer of real estate. Including refinancing. After some great covid years real estate transactions in Florida are drying up fast!

Texas has no property transfer tax. You only pay the fees for recording of the deed and/or mortgage.

I wouldn’t touch a FL condo with a ten foot pole. The assessments are out of control, the insurance is out of control, and developers are targeting buildings to reverse condo ownership.

And many of the buildings will be literally underwater before too long.

MArMar’s point is interesting. Most buyers think they will own their home for fifteen years. The median is 13 years (big jump over past decade). 13 years is 2036. A buyer in 2036 will be looking at selling in 2049, by which point the house will be flooded or doomed to be flooded within a short period of time.

So much for real estate being an asset. I don’t believe in gold but at least it keeps its value six feet under water.

Texas receives 6.5% from each automobile sale, so the increase in prices, the state coffers in Austin must be overflowing.

Yes, that’s “sales tax” just like on everything (well, mostly) one buys.

Non essential purchases should outlawed in any government entity.

YEAH!

Serve 5hr Energy and water ONLY at ALL government functions, and get “something done”. Unless they have a note from their cardiologist or urologist.

Maybe people know something. Is your Texas governor looking to pull a DeSantis on schools? 40% of math textbooks banned? Trashing AP courses? Dismantling tenure and destroying hiring?

Can’t do that to educated and sophisticated populations without facing dire consequences.

FL has terrible public schools with overpaid teachers. But they have a great home schooling system called the Florida Virtual School. I used it to home school my son through high school.

Overpaid teachers? FL one of the worst for paying teachers a fair salary. Teachers are so underpaid they can barely afford to live where they work

Americans are ignorant and un-educated by developed nation standards. Education and teaching are undervalued and it shows. Perhaps many of America’s faults could be cured by supporting education?

As for home learning, this means you need smart parents in the first place, which, as I pointed out, is not the case in America. Second, you need a full-time parent who could otherwise be earning a six figure salary. Seems to me that teachers should be paid six figures, then.

@Lisa: In most instances teachers are not underpaid. The teacher unions like to present full-year salaries as “proof” they are being underpaid but they neglect to mention that nearly all teachers in the US only annually work a total of nine months out of twelve. On an hourly basis most teachers are well-compensated.

Nope — Lisa’s correct. For starters, no-one should have to work more than 9 mos a year. Let go of your labor fetish. It’s ok…nobody (short of maybe artists) ever get to the end of their mortal coil and find themselves wishing they had just one more day left to generate some taxable income.

But also, and more importantly — have you ever taught public school? Ok — have you ever attended it?? In the 21st century? It’s glorified community service, at best. Those 3 months off (which aren’t totally free-n-clear, besides) are insurance against inevitable burn-out. Kids suck.

Next you’re gonna tell me firefighters get paid to lay around or workout, since much of their paid time is spent at the station in hot standby.

(No…)

Anyone who insists that public school teachers are overpaid has spent literally zero time in a modern classroom. Zero.

Texas is trying to ban the fraction 3/5ths from all math classes.

That’d be right: Texas left with “two fifths of f*ck all”.

Auld – That’s y’all!

Simply Dynasty Building. The more ignorant the populace the more likely they will support a “DeSantis”

No one is trashing AP courses or banning books in Texas, with the exception of books like “Gender Queer”. It magically appeared in my Austin suburb’s middle school library, and in many other Texas elementary and middles school libraries. The book graphically depicts a 10 year old orally servicing his 40 year old neighbor. There were a few others. One was a graphic novel style, with sketches of what appeared to be 5-10 year olds engaged in various sex acts. If you want your child to read that, by all means, hand it to him/her in the privacy of your own home. It has no place in a school library.

Authors and Publishers please, since you ACTUALLY read them.

Or is that the end of your (or Tucker/Laura et al’s) story?

A guess…was there a large surge of Fed pandemic era funding that will be going away? A lot of pandemic programs had marginal relationships to the actual pandemic (school district funding? How flexible the definitions? How fungible the funding?)

A case can be made that DC was trying (again) to reboot a crawling/collapsing macroeconomy…this time under the aegis of “pandemic fixes”

It would be easier to sympathize with DC’s goals if they were more open with all facts and less prone to use pretexts to preserve “public confidence”.

You are in the Austin area, as I am, and the reason things are going to get ugly is that public schools are seeing a decline in enrollment. Parents are moving their kids to charter schools. Round Rock ISD, which I’m sure you are familiar with, is at approximately a 5 year low. Folks are fleeing poorly run districts. As home prices settle and school revenues decline, coupled with districts exceeding spending caps, more $ will be shuttled to other districts (the “Robin Hood” law).

Settle…you mean fall.

(And Round Rock isn’t Austin — not really. I’d never live there.)

“Wealthy” now and in the past, but in case you haven’t noticed,

POVERTY TRICKLES UP….like I’ve been saying for years, you aren’t along for the ride with those much closer to the top, wealth and power wise (not sure if there is always an obvious difference).

Income, even low live make money with money, doesn’t mean as much as in used to…..post FDR.

“They” have been working hard at making it so for decades.

The George Carlin “They”, more or less.

Damn, that was for the guy in the “wealthy school district”.

So I had to go back and read everything in between and was compelled to put in my usual 2 cents.

“Even low LEVEL make money with money”…..spell check got me.

It looks like March is not turning out to be a good month so far for all the buy-the-dip fantasy bull buyers, first Pow Pow had to throw some cold water to their party with his little talk with Congress, and now these numbers give him more ammo to keep on hiking without any excuse.

Wonder what kind of fantasy WS and MSM will try to sell to people about the next bull market right around the corner. Please be creative this time and stop using the same lame FED will pivot or we will have no landing narrative..

For all of his bold talk, Peashooter Powell said today that no decision has been made on the size of the rate hike later this month. Pencil in another 25 basis points, because this fraudster is trying to talk tough and jawbone markets while doing the bare minimum.

For those ready to pounce with “but he raised the fastest in history!” – step off. He DID NOTHING for over a year straight when he should have been raising the entire time. He allowed inflation to become entrenched, calling it “transitory,” then came in over a year late with all sorts of false bravado and bluster.

After the most deranged, maniacal money-printing extravaganza in the history of the world, such rapid rate hikes would have been required out of the gate. Waiting more than a year to start raising, while simultaneously fire hosing QE money like explosive diarrhea, has done irreversible damage.

We continue to have an overheated economy, evidenced by the jobs market. Lose a job, immediately find 10 more. Everybody is hiring. Fog a mirror, start today.

One thing that J Powell is seriously concerned about is the number of homeless encampments that he has to see on the way to his office on Constitution Ave. They are expanding at an alarming rate, under freeways and public spaces. They are now everywhere in the high rent areas of downtown DC. I have to look at them myself and they are very unnerving to say the least. This is suppose to be the Nation’s Capitol, not some third world hellhole.

Perhaps we should strive for a more just society where everyone has a place to sleep that’s not outdoors on the street or in a tent? When there are huge winners and an enormous disparity between the haves and have nots, these homeless encampments that you have such a problem with are a natural consequence of such a society.

Whaddya got some kinda vision-thing there, Sam?

Is it a crime that I just don’t care to be unnerved by the sight of all the human jetsam strewn about our otherwise first-world dreamscape?

Sure, the pharaonic scale of wealth disparity underpinning the rot in our casino society is out-bloody-rageous, but c’mon…these downtrodden and dispossessed takers don’t really need to pitch their shabby little tents *right there* where I have to look at it on my to taking the missus out to the PF Changs, or when I’m headed across town to play 18 holes. It’s alarming, to say the least. Can’t they just go opiate the horrors of their lives shredding apart somewhere off-camera? Maybe up in a tree somewhere on the outskirts of town — just not the tony, high-rent areas, please.

…well, there’s always the option of the post-WWI ‘Bonus Army’s treatment as carried out by (and probably for the same aesthetic reasons, Bul) a young Doug MacArthur…

may all find a better day.

Well, you see there is still a difference between the US and Colombia. In Colombia a nice apartment costs about 5x median income. Here it’s more like 15x. So the difference is in the third world countries the homeless aren’t working. Here most of them are.

Sam,

I agree that things are bad and likely to get worse…but it is also possible that more or less *everybody* in the US macroeconomy has been doing worse for a lot longer than publicly acknowledged.

(I’m not arguing that a billionaire losing 25% is hurting…merely that American decline – determinedly unadmitted/unaddressed by DC – may have been impacting more or less everybody for over 20 yrs…creating an even-more-than-normal resistance to redistribution.).

At some point things are likely to get bad enough, for enough of the public that redistributional taxation will have to be imposed (the money printer solution having likely undone itself after 20 yrs of DC ass covering).

91B20 1stCav (AUS) and Sam — I hope my tongue in my cheek didn’t look too much like a chip on my shoulder. I am a bleeding heart.

bulfinch, I’m not one of the above posters but it was clear to me and I appreciated your comment.

bul – i always appreciate your comments, my tongue was pushed firmly sideways in concert while recalling another bit of our constantly, and consensually-forgotten, not THAT long-ago, history. Best to you…

may we all find a better day.

He should be seriously concerned. In so, so many ways. Not only is it a disgrace and embarrassment for a civilized nation to have such a wealth gap, it is also a growing safety concern especially for the likes of Powell.

And, this is what he and other bankers have DONE. This is the ultimate product of their policies. The absolute depravity of policies that has caused this festering powderkeg to grow and grow for over 20 years.

VERY NICE string of comments you brought on Swamp.

So, yes, it WAS GOOD you “have to look at them”.

91B20- I read that, maybe even Patton in on it? Anyway, DM, et al, made sure it looked like someone else gave the orders….and of course the accountability trail disappears, like in any good large organization, Corp, Military, Gov’t, etc, etc.

Still pretty close to full blown Gilded Age organizational mode then, too, our destination if the wrong people have their way.

No Roosevelts on the horizon.

Cas attempt to insert his less informed 2 cents in THAT particular string was just mumbling. Yeah, yeah…”government bad”, Cas.

Where my brother works ,they hire people,but most are on there phones going to bathroom or hiding .Want a paycheck to show up late,most refuse overtime get madat boss don’t show up for work. This country is screwed when the inmates are running the asylum

Agree Flea. Lots of bad bosses out there are really trashing things.

“Powell said today that no decision has been made on the size of the rate hike later this month”

LOL, yes, that’s how it is done every time. At the FOMC meeting, they vote on the rate hike, and that’s the decision. There is no decision before the vote. What did you expect?

I didn’t expect him to announce it, Wolf – he was asked – but my point is that all this hubbub about 50 basis points this next meeting is a joke, that it is probably not even going to materialize. Powell loves jawboning. You know that. That’s his favorite trick. I call it by its real name – LYING.

“What did you expect?”

A Fed Funds rate that isn’t 8% below the rate of inflation ?

Fed Funds rate in 1982 was 16%. That’s how you fight inflation.

I had funds in a Merrill Lynch CMA at 21% in 1982.

Transitory Powell is a joke.

LOL…talk us really how you feel about Pow Pow…

I get it though…the supposed firefighter unfortunately was also the biggest arsonist in history just 2 years ago

And will never be held accountable for it.

Simple mental model is the economy is experiencing Fed policy from one year ago which was still loose. Next year at this time we will feel the affects of 5% funds rate and it will not be pretty unless Congress does another money drop.

Adjective man!

The only thing I really have against Powell is I hear he is worth $30M….that’s a total asshole in my book, end of personal critique.

Just following the action and hoping it works, now that that’s out of the way.

Nothing personal. Like Wolf said, you are an institution here.

ADP reported 242,000 new payrolls were added in February. This added job growth is much stronger than what was reported for January.

David Hall

After that employment report, and the upward revisions of JAN/FED CPI we need the Fed to shock the markets with a 1 point rate hike.

The scary thing is that the Fed has manipulated so long that the whole system may be poisoned.

For instance, historical housing price spikes require new supply to be undone…but soaring interest rates work against that in the long run.

The Fed has pumped so much distortion into the system for 20 years, that normal price/interest rate relationships have become badly, badly unhinged.

Oh, they might, Swamper…. Just with the decimal scootched over a spot in the wrong direction.

“What CEOs of tech & social media companies are now admitting in their mea culpa blogposts is that they over-hired during the pandemic, to expand for a future that did not come, & that they’re now trimming a portion of the expanded workforce to get their costs back in line.”

Sounds a lot like the Freight Brokers who over-hired when they needed bodies to find trucks when capacity was tight. Now with the market for trucks loosing up they have announced layoffs starting in November last year with CHR.

CHRobinson 650

Uber Freight 150

Coyote 200

Convoy “undisclosed”

Freight business is shrinking – as shipping demand for trucks shrinks. Just another sign that a recession is coming.

I wonder what lumber prices are looking like…

Falling like a rock – I bought 12′ deck boards yesterday for $9/each. I really wanted to use 8 footers but the 12′ standard boards were cheaper than the 8′ prime and looked the same.

It’s a buy.

So many people. Making s-tons of cash. Doing very little in terms of contribution and actual work. That’s been the frustrating realization over these last 10 years or so working in the corporate world of downtown SF.

I’m talking about people (not only tech) pulling down $250k-$1m who seemed to do very little and more importantly knew very little outside of maybe a very narrow band of expertise.

I’m talking about guiding very highly compensated individuals through seemingly basic and foundational issues they often times they could not grasp.

Meanwhile, us on the frontlines just couldn’t fathom how upper management was keeping these folks on the payroll. Finally last year many of these got the axe. But what a waste!

Fortunately I got the axe as well. So glad to be out that world.

Many of these well to dos brought houses and second houses predicated on the basis of a continuing stream of good fortune (that of course they earned and deserved}

These bloated salaries blossom from the same free and easy money mindset. I think it’s over.

It (psychopaths failing upwards) is definitely not, (over).

Interesting science article came up today.. about the higher rate of Toxoplasma gondii infection in business students than in the general student population. Business students were 200% more likely to be infected. General rate of infection was 20% in the general population. “What makes us bold”. It may make mice and men bolder but does not make for better judgement.

Leads to thoughts like a good or bad sci fi novel..

oops, 22%.

In rodents, T. gondii has been shown to alter behavior in ways that increase the rodents’ chances of being preyed upon by felids.[7][8][9] Support for this “manipulation hypothesis” stems from studies showing that T. gondii-infected rats have a decreased aversion to cat urine while infection in mice lowers general anxiety, increases explorative behaviors and increases a loss of aversion to predators in general.[7][10] Because cats are the only hosts within which T. gondii can sexually reproduce, such behavioral manipulations are thought to be evolutionary adaptations that increase the parasite’s reproductive success since rodents that do not avoid cat habitations will more likely become cat prey.[7] The primary mechanisms of T. gondii–induced behavioral changes in rodents occur through epigenetic remodeling in neurons that govern the relevant behaviors (e.g. hypomethylation of arginine vasopressin-related genes in the medial amygdala, which greatly decrease predator aversion).[11][12]

Long way from rodents to business students, many questionable variables, but yeah, I DO get the Sci-Fi implications.

“Attack of The Cat Lovers”?

But SF isn’t the world/US…just the most distorted end of it.

(Like the $500k Facebook employee recently complaining that his $1 million salary goal is now only 50/50 likely to happen…)

The vast majority of the country has never seen ever a sliver of the SF/SJ crazy boom…and yet it is being sucked toward the abyss too.

You left out the LA and Hollywood Cartel. They use a LOT more Adrenochrome than we do…honest!

Just follow the well dressed rabbit with the watch and you’ll see!

this is bat country

It sure is (and very literally in the North Bay).

And we also work with the Chinese Lab in Wuhan..

..pangolins my ass!

I also wonder how deep the salary inflation has been during these QE times and if people can adapt to lower in the high cost areas.

Wolf,

Your level of research and knowledge are impressive and highly appreciated.

I know you have explained this in other articles, but my comprehension is not what it should be.

For dumb dumbs like me, we hear things like “once the federal funds rate gets to ‘X%,’ 100% of US Gov’t tax revenue will simply go to paying the interest on our debt.”

This sounds like a reason why FFR can’t go too much higher.

But then I read your comments where you said something like “the US can just print more money to pay our debt service.”

Maybe I am just too financially illiterate to see that these things aren’t even related.

But the way I’m understanding your comments are “The federal funds rate can go as high as it wants, and the US never has to worry about paying its debt, because it can print infinite money with minimal consequences.”

I know this can’t be correct but this is how I’m interpreting the comments. If you wouldn’t mind explaining it to a smooth-brained paint chip eater I would appreciate it.

Thank you.

There is a huge pile of silly stuff floating around out there about this.

Inflation is boosting tax receipts, and other factors boosted tax receipts, and tax receipts spiked (details are here):

Tax receipts are going to pay for interest expense just fine. Here is interest expense as percent of tax receipts, which shows that so far the burden of interest expense is historically low, though it will rise. It would be nice to have a Congress that’s a little more responsible. But that’s not what we ever had. If interest expense hits the levels of the 1980s, maybe they will get a little more disciplined:

So why can’t we balance out budget?!?…

Like I said in my comment: “It would be nice to have a Congress that’s a little more responsible. But that’s not what we ever had. If interest expense hits the levels of the 1980s, maybe they will get a little more disciplined.”

The answer is very clear. Government revenue is way way up, but spending is way way way way way up. We have a spending problem. Both parties are at fault.

To Clarify: I was misunderstood in my previous post. I believe Congress bears the most blame for the current inflation, even more than the Fed. The massive deficits are destroying the currency of the USA as we speak. The Fed is in a box. If they didn’t print the money to monetize much of the deficit like they did over the last 14 years following the GFC and the pandemic, we would have had an economic collapse like the 1930s. But maintaining interest rates at near zero for 14 years is inexcusable. Massive malinvestment has occurred over this period and it has to be unwound and it will only be done with a HARD LANDING.

NO wonder the tax receipts are going up. They took away nearly all your deductions and put everyone on standard deduction. Now they are letting inflation increase your taxable income and there you go. Sounds like Jimmy Carter 2.0. Next year they are discontinuing the write-off for capital equipment to 80% then 60% the next year. I just finished doing my 2022 Fed taxes. I’m paying nearly the same amount of taxes percentage as I did before the T tax cuts.

“…as I did before the T tax cuts”

I think you misunderstood. Those tax cuts were not for the people. They were for the rich.

The 2017 tax law has complicated implications for people in different ways.

It’s great for high W2 income working people, who got the majority of the break.

For Billionaires, there are some business and real estate related breaks, and corporate rates were cut, which benefits both corporate employees and stock owners, but the main capital gains rate didn’t change. So some benefits but not as much as for W2 high income people.

There was a small cut for the middle class, per the tax foundation, about 1%, but the details are complex. For retired people or people with large families in lower cost areas, the increase in child tax credit and the 25K standard deduction are major cuts. For middle income people without children in high cost high tax states with large mortgage bills, they got a tax increase. But most middle income people got a small break.

And for high income in high tax states, particularly the very wealthy living on capital gains, the SALT limitation offset the other minor breaks for this category, and they are paying more taxes. That’s why so many of them are moving to Florida.

Also, remember that if you are proposing to cut to access, the top 10% pay, almost 90% of federal income tax. You can’t cut taxes in a meaningful way without cutting them for higher income people.

Anyway, it isn’t oversimplification to suggest that all of the benefit from the 2017 tax law is for the “rich”. It’s more for high income W2 working people, many of whom aren’t “rich”, which is probably best defined as someone living off investment income. Remember when politicians talk about taxing billionaires, they are mostly talking about raising rates on high income employees, who are paying the highest income tax rate. That’s doctors, lawyers, software engineers, consultants, etc, but not Warren Buffett or Elon.

Lots of typos in that previous post, sorry…

The T Tax cuts & jobs act was suppose to make it easier to do your taxes. According to Paul Ryan it was suppose to allow you to file it on a 3 x 5 index card. My latest taxes for 2022, with just one Schedule C took over a dozen pages, and that’s not counting all the supporting documentation. It is more complicated now than before the passage of the Tax Act. You can’t deduct any medical deductions unless you get run over by a truck and survive. Enjoy.

Thank you for the response, Wolf!

One thing that jumped out at me is seeing ~50% of our tax receipts going toward national debt after the last rate hike cycle (early 1980s).

Given the remaining (soaring) expenses (entitlements which no politician has the desire to tackle, military spending, foreign policy expenditures, etc) how are we realistically able to make room for higher debt service payments this time around?

RIP Silvergate.

Aren’t these tech workers losing 6 figs plus stock bonus’s and free lunches? They have to take salaries that are much less and they can’t refinance their million dollar mortgage because the rates are too high.

Seems losing a bunch of those jobs will have a bigger impact on the economy then 600 Walmart jobs.

Not sure how accurate the following is:

The Fed started raising rates in May 2004 and finished in July 2006 – over two years later.

Unemployment hit its trough in May 2007, 10 months after rates hikes stopped, 36 months after rates started increasing

The stock market peaked in October 2007 – 15 months after rates stopped rising, 41 months after they started increasing.

Recession started (officially) in December 2007, 43 months after the Fed interest rate increase cycle started.

Seems it will be awhile before we will know what the future holds.

Yes, the infamous “long and variable lags” between changes in monetary policy and the reactions in the economy. To let these “long and variable lags” play out is why the Fed slowed the rate hikes, and why it will eventually pause (now seen between 5.5% and 6%). It makes sense to me. No one knows today how those rates and QT will play out a year or two from now.

The lags are made longer by the $5 T that the Fed is still liquifying their pet project, the rich.

Both agree that reduction of asset values is certainly not a candidate for policy goals. A complete reversal of the path of the asset price expansion is incomprehensible.

“the Fed is still liquifying their pet project, the rich.”

Well put…

Looking back I think Powell rolled things out slow to make sure viable corporations had ample opportunity to lock in low interest rates. At least some locked in roughly 3% money for five years. That should ensure they weather the tightening cycle pretty well if they can grow revenue nominally over the next few years.

Yes, and they did.

I also think that the Fed was slow in part to give other countries with fragile currencies and whose governments and companies borrow in dollars time to front-run the Fed to protect their currencies. And some countries did, including Mexico and Brazil. They jacked up rates early and by a lot, starting in 2021, and their currencies held up well and even rose against the dollars when the Fed started hiking rates. That prevented a lot of financial upheaval in those countries. Other countries (a whole slew of them) ended up defaulting on their foreign currency debts and are now cut off from funding and are waiting for IMF loans.

For an economist to even talk about monetary policy’s effects – which are elongated – without talking about congruent fiscal policy effects is, well, professionally amateurish, is it not?

An economist talking about congruent fiscal policy would be celebrated as remarkable.

Policy’s effects always seem to take longer, the further away from the source one is.

I certainly have learned a lot about Economics from this blog mostly in words I can understand but not all :

I quit my Employed Job in 1966 Lol best thing I ever did as I gained some wealth and lots of freedom as an added Benefit > They made it hard to walk away with $200 Cash extra + Full pay and benefits each Month and in 66 $200 was a lot of money but just a good tip these days

Working for others unless they are perhaps relatives that you want to help out is certainly not a good way to get ahead at all

Learning from you Job has benefits for some no doubt as to how to get ahead perhaps that’s what members of the Fed and Congress have done leaving behind just the commoners .

Why more people are don’t go on their own bewilders me completely and how they can afford to not go on their own as well .

Guts and Glory ? that can’t play a big part or does it

Only thing I think of just now is how boring and time wasting it is trying to get ahead by getting your employer ahead in other words making them wealthy . Perhaps a Lay off may be a good thing spurring you on to riding your own horse ? perhaps if you have Guts you may gain Glory but just the Freedom and newly gained wealth is enough. Now if one can do all that with no employees at all a viable rarity also but driving slaves

as they are sometimes called is as old as the hills

Lol not everyone is a plumber or roofer. Highly specialized jobs require a complex ecosystem that can only replicated at great corporate scale expense. These days even corporations cannot afford to replicate, they just buy indiscriminately.

Mendo, that is a lawn of drivel which, if I’m attuned to the environment correctly, then maybe it all makes perfect sense.

My son-in-law watched his mother own her business all of his growing up years. He learned he had rather get an education and get a steady paycheck than take over the business.

After studying the past 20+ years of layoff announcements and BLS stats, an important finding is that there is a 4-5 months lag. Next month’s figures will start coming much uglier

Vadim – 4 or 5 months lag from what (or to what)?

Perhaps expand the thought a little. Curious.

DJ J — Announcements lead BLS figures by 4-5 months with an 82% R-squared.

Meaning it’s fairly close to a linear deterministic relation.

Good article. My take away is the good news that jobs are plentiful and the salaries are rising. To me, that is exactly what I would like to happen.

Without the imposition of inflationary price increases by the producers, who seem to be holding the whip hand at the current time.

Americans seem to be standing pat on the competition between bid and ask. The ask is hesitant to meet the current bid because it is so far below the ask that, at first, it feels like an insult.

A year from now a bid like that would be appreciated.

The most visible and obvious asset price bubble is the stock market. Still priced like a Fed put at 2X it’s value in the future which, by necessity, is returning to the Keynesian economic motivation.

In the sense that Keynes envisioned the solution to the malaise of the Great Depression and prescribed government spending as the only fix. Which has been proven in the economic quagmire of make believe, that his epistle was grudgingly, essentially correct, even if has those odd proclivities.

Keynes’ solution for inflation was to reduce the money supply, increase interest rates because inflation is an insidious economic poison that impoverishes the fixed wage and income recipients.

The Fed is so far behind the curve that it has become, as predicted by a number of jhonny come lately Ivy economists who are now castigating the foolishness of monetary policy. Fifteen years late but, hey, making amends is always recognized as a noble effort.

As we all recall, the demise of 40 years of Keynesian policy failed in the one area.

There was no plan for stagflation following the cessation of the monetary stimulus injected through the military during the Vietnam conflict.

Remember, stagflation is the sum of two components, an incipient recession at the same time as inflation has become an automatic consideration.

I get tired of folks characterizing rampant spending as Keynesianism.

No, it isn’t.

Keynes advocated spending to get out of a depression/recession, not spending 24/7. The spending we have now was never advocated by Keynes.

That is a fair distinction. A shot of adrenaline — not a years-long addiction to it.

…’course, it seems the classic ‘Murican approach is: ‘…if a little is good, then a whole lot more is better…’ (nuance not really an appreciated component of our national thought/discourse/action…).

may we all find a better day.

I remember the tech bubble where some tech company was giving employees a new car to keep workers. It can change pretty quick. Workers in the US can’t get too uppity as there are plenty of people in India, Brazil and the Philippines that have the ability to work for less.

There are two sources of quite illogical errors in Wolf’s general approach to Crypto and the Fed: 1. Too much faith in Powell and his group of politicians masquerading as Central Bankers; 2. Massive underestimation of just how much inflation is a fundamental part of the system and how statistics from the BLS are distorted. These combine to people like Wolf still missing the key aspect: financial conditions are actually incredibly still easing despite QT, despite rate increases, despite Powell talk, and this is reflected in crazy behavior like used car prices jumping upwards, risk assets doubling in a few weeks (NVDA, TSLA, META doubling from lows on pure speculation), Blackstone charging students $3-$4k per month in rent and planning to raise rents by 20% while the University of California bails BREIT out with $5B, the list goes on and on. If 2 years ago inflation was near 2% and I could borrow at 0%, financial conditions were easy to a rate of +200 basis points in my favor. If today inflation is closer to 8% and I can borrow at 5% then conditions are even easier, to the tune of 300 basis points! No wonder February was a record for corporate borrowings. The sign is on the wall: massive inflation ahead. If so, a fixed quantity coin like Bitcoin is likely to go up in price as even more regular people abandon the system.

Nah. Crypto is way down in the toilet where it belongs. In the beginning, it reeked of some wannabe Yoyodyne counter currency created by/for geeks who saw paying for a copy of the Anarchists Cookbook with a bitcoin as some oblique form of disruption or sedition. Then it became the speculators darling. Everyone’s uncle was bleating about it. Bleagh.

Besides, chicks never dug it.

Yesterday, there was an article in the WSJ about the tech employees who still have jobs losing their pet insurance, laundry service, and after-work dinners. It was a real tear-jerker.

Love the site, Wolf. I’ve been reading it for awhile. I’m sending you a donation via snail mail.

The sector with serious damage to job openings is “Information.” The small sector… broadcasting including over the Internet, and telecommunications.”

Don’t forget the disinformation business.

Lots of liars going to lose their jobs at Fox News. ROFLMAO

I’ve been telling folks for a couple years now that the shift to remote work is a double-edged sword. If you work from home and move to Montana for a lower cost of living, you’re now competing with the rest of the planet for that same job, and people will absolutely undercut you. Why pay bay area wages when you can find someone who will do the same work, remotely, for far less in another state? You’ve already decoupled the job from the cost of living where the company is at. My suspicion was that WFH workers with inflated wages would be the first to see their jobs cut in a downturn.

Additionally, while jumping ship during the churn was tempting, I also had a feeling that a downturn after the pandemic meant that people with shorter seniority and higher wages would be on the chopping block. I wouldn’t be surprised if a lot of the people who jump ship are, again, the first to get churned over.

We finally got our answer. Amazon will “pause” building its H2 in Virginia. It is French for “we ain’t going to build it anymore.” Will Amazon give back the bribe errr…incentives it got for not creating the 25,000 that it promised? This is example # 454555 showing that tax abatements never work.