It was half the maximum pace. But rising home sales and, lo-and-behold, rising mortgage refis are about to change that.

By Wolf Richter for WOLF STREET.

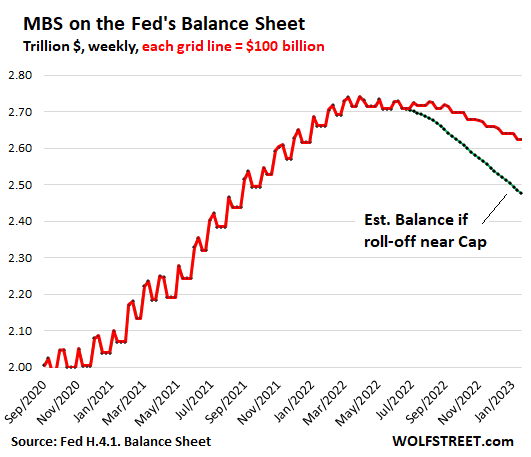

In its Quantitative Tightening plan laid out last spring, the Fed fixed caps that limit how much of its Treasury securities and mortgage-backed securities (MBS) are allowed to roll off the balance sheet every month: $60 billion a month for Treasury securities and $35 billion a month for MBS. As of the latest weekly balance sheet, total assets have dropped by $532 billion from the peak. The Treasury roll-off has been near the cap, but the MBS roll-off has been far lower.

The Fed phased out purchases of MBS in mid-September. From that point on through the end of November, the four-week average roll-offs of MBS was around $20 billion. In December and January, the four-week average dropped to $17 billion, running at around half the maximum pace.

Since the beginning of QT in June, the roll-off of MBS amounts to just $103 billion. But if the roll-off had occurred near the cap, the roll-off of MBS should amount to about $260 billion by now. This chart shows the actual balance of MBS (red) and my estimate of the balance if the roll-off had proceeded near the cap, including the phase-in over the summer with a nod to the lags with which MBS showed up on the balance sheet.

Why the MBS roll-off will speed up.

There are now some dynamics in the mortgage market that will speed up the MBS roll-off in the spring and summer. It might not be enough to get the roll-off to the cap – we’ll have to see – but it’s going to get it a lot closer.

MBS come off the balance sheet primarily via pass-through principal payments that all MBS holders receive when regular mortgage payments are made and when the underlying mortgages are paid off, such as when the home is sold or when the mortgage is refinanced with a new mortgage.

People are still making their regular mortgage payments just fine. But mortgage payoffs have collapsed as the volume of refis has collapsed by around 80% from a year ago, and as home sales have plunged by around 34% from a year ago. And the torrent of pass-through principal payments that the Fed received a year ago and that far exceeded $35 billion a month has turned into a trickle.

Mortgage payoffs from home sales.

The worst period was over the winter. Now the spring selling season starts, when sales volume picks up every year from the winter doldrums and the holiday slowdown of the housing market. Even during Housing Bust 1, sales volume picked up in the spring. The point when a mortgage gets paid off occurs at closing, so it aligns roughly with reported closed sales.

The low point in closed sales is in January or February, based on deals made weeks earlier, so mostly in December and early January, during the dead-point. In March, closed sales pick up and rise through the spring selling season and peak in the summer.

Last year, between the January/February low and the August peak, monthly sales volume of existing homes (not seasonally adjusted, reported by the National Association of Realtors) rose by 34%.

Each time a mortgaged home is sold, the mortgage is paid off. If the mortgage was securitized, the principal portion is eventually passed through to the MBS holders. This stream of pass-through principal payments to the Fed will pick up substantially through the summer, compared to where it was over the last few months, simply by that fact that home sales volume will increase seasonally.

Mortgage payoffs from refis.

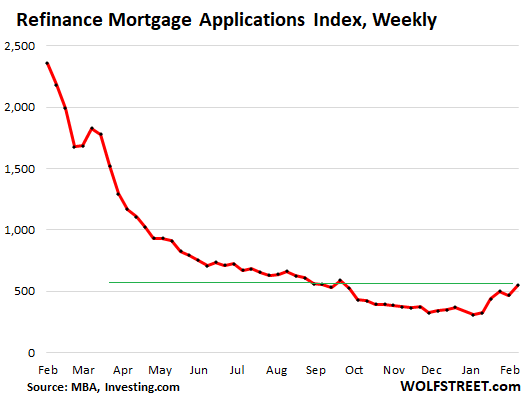

This is hard to believe, but Americans are at it again: Refis have started to tick up this year from the collapsed levels last year, mostly cash-out refis. People are actually refinancing a lower-rate mortgage with a higher-rate mortgage in order to cash out some of their home equity. Maybe they expect mortgage rates to go back to 3% by August, and then they could refinance again or whatever.

At any rate, the refi volume started rising at the beginning of January. From the collapsed levels at the end of December, the weekly Refinance Index, released today by the Mortgage Bankers Association, has now jumped by 77% to the highest level since September.

Pass-through principal payments take their time as they wind their way through the system, from when the mortgage payoff occurs to when the Fed books them on its balance sheet by reducing the balance of its MBS. So we should start seeing that acceleration going forward.

Refi volume is still down 74% from a year ago. But it was down 86% at the end of December. And a year ago, that’s when there was a torrent of pass-through principal payments that far exceeded $35 billion a month. So that’s not the comparison. No one is expecting that torrent of pass-through principal payments.

The comparison is to December and January, and then to the fall last year, to estimate how this increase in pass-through principal payments will speed up the roll-off of MBS, from the current pace of about $17 billion a month.

The Fed just goes ahead and destroys that money = QT.

Every company has a “cash” account, where it accounts for the money it has in the bank or in other near-cash instruments. The Fed doesn’t have a cash account. When it needs money to buy assets, it creates that money; and when it gets paid for assets, it destroys the money.

So what does the Fed do with these pass-through principal payments from the MBS?

The pass-through principal payments reduce the balance of MBS (reducing that asset account on the balance sheet). But instead of simultaneously increasing a cash account by the amount of the pass-through principal payments, as a company would do, the Fed just goes ahead and destroys the money, and total assets on its balance sheet decline by that amount (but a company’s total assets would be unchanged because it’s just replacing MBS with cash, and both are assets).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It was criminal for the Fed to buy MBS in the first place.

It became a political institution as blatantly took side with debtors and asset holders preventing the markets to clear , preventing prudent savers, renters and workers from access to affordable housing.

There won’t be housing crisis but for the Fed but no one seems to point out the real culprit.

If you print and hand out pizza tickets to the proletariat, the price of pizzas will go up, but after a momentary bump, they won’t be any better off. Nobody is making more pizza, just more tickets. (Or as yogi Berra had it, cutting the same pizza into more slices.) And nobody is making more real estate. I’m just happy I bought in before an era of craziness.

“People are actually refinancing a lower-rate mortgage with a higher-rate mortgage in order to cash out some of their home equity”.

Phleep, you can also do this for following reasons:

1. Transfer this debt (the bag of crap) to taxpayers!

2. House prices are going down, so doing this now gives more cash than later.

3. House is no assest, all or does it sit, gather mold and require maintenance. If an idiot is ready to give you more money for equity, while allowing youbto live there, why not take it?

4. Finally, the Fed will ensure that 99% will go under by transferring their wealth to rich. So expect forbearance and bailouts again.

5. If they can cancel student loans why not housing loans.

6. If they can bailout the superrich shareholders and executives of corporations, why not bailout home owners in future.

7. What will government do with all these empty houses if we lose equity? Erase them?

Also, for many people who thrive on food air water, inflation is higher than what BLS claims and higher than refinanced mortgage rates. So taking cash out and spending it may still make financial sense!

Cash out ReFis make sense if you are paying 28% interest on credit card debt and only 6% on mortgage debt.

Owning a home and the extra square footage has been good so far, but the future doesn’t look as bright. When they figure out wealth taxes are too complicated, they’ll be looking at increasing taxes on RE. The extra square footage and land value is going to attract tax. You’ll be wishing you had a 300 sq. ft. efficiency apartment, with a monthly bus pass.

I think someone living frugally or someone making minimum wage will already think this.

Someone who is WFH and/or with a large family will disagree.

Covid was a huge disruption. I had multiple Zoom calls with attendees working from kitchen tables (with dirty breakfast dishes) while the little kids literally climbed the walls behind the employee.

I think people, with a little help from management and spouses decided a bigger house was needed. RE prices then went up.

Will that change now that WFH is declining? I think it will take time.

I think it is true that Fed monetary policy works to a large extent through housing. A look at the median home price charts Wolf puts up monthly shows how experimental Fed policy has played with life’s basic need of shelter.

Policy this cycle looks worse as the Fed was caught offside, suppressing mortgage rates into the biggest housing bubble ever and most likely will be tightening right into the housing bust.

It almost fits too neatly into the prediction of the hard money thinkers that once you go down the road of fiat money the debt cycles must get bigger and bigger til you have the grand finale.

there does not yet exist a form of government that does not eventually become the enemy of the people. private enterprises that do not create value will go out of business, but government agencies that create negative value can go on forever.

Fed is the reverse Robinhood of US.

I wonder if the Fed started to buy MBS securities because their purchases of Tresuries was starting to cause a shortage.

The market for reverse repos didn’t really exist before QE.

Of course QE is a massive distortion of a free market in money anyway.

I think they wanted to limit Treasury ownership to a certain percentage. They moved over to the mortgage market that is large and is adjacent to treasuries as still government guaranteed, but combining the two gave them more stuff they could buy without being a majority owner.

@Eastern Bunny MBS purchases supported the creditors, no?

No, creditors, other than the Fed, want higher interest rates. Now if you’re talking about transactional activity of mortgage brokers and lenders who originate, package, and sell the loans as MBS, they definitely benefited from the artificial stimulation of mortgage loan demand caused by the Fed’s purchase of MBS.

You are 100% right. Thank you for pointing out who the real culprit is.

The flawed premise for the financial instrument called an MBS is that a mortgage, as a debt instrument, is a “secure” asset (At the right price it is, but not when hundreds of thousands of homeowners are losing their homes because they cannot make their mortgage payments, never mind the MBS tranch multiplication piggybacking money for nothing SCAMS Wall Street was, and probably still is, running with them).

What the Fed appears to have decided to do way back around 2008 when they claimed, with a straight face, that there was “no housing crisis”, is a sort of backdoor “securing” of mortgage “values” via massive MBS purchases. The question many refuse to ask, and you correctly alluded to, is, “Why does anybody think prudent savers, renters and workers who lost access to affordable housing weren’t deliberately targeted to that end by the Fed?”.

This is not a “conspiracy theory”, this is cause and effect! MBS financial instruments had next to zero demand when the Fed began buying them like there was no tomorrow. It doesn’t take a rocket scientist to figure out that this act prevented reality based MBS price discovery.

The price of homes should have dropped drastically starting around March of 2007, but the Fed’s “Wealth Effect” favoring actions prevented reality based price discovery. The Fed kept home “values” from completely tanking due to lack demand.

SOURCE: Median Sales Price for New Houses Sold in the United States

https://fred.stlouisfed.org/series/MSPNHSUS

March 2007 $262,600

April 2009 $205,100

The Median Sales Price for New Houses Sold in the United States went consistently UP after March of 2009. The “value” of homes “recovered” to the 2007 level by 2012, and just kept going up after that.

August 2012 $253,200

Thus the markets failed to clear. Thus the “value” of a home was artificially, not only supported, but inflated (pun intended).

As Wolf said, the Fed can destroy the money they created, but the fact is, as you pointed out, that by creating that money in the first place for the benefit of people who had no business “benefiting” from making overly risky (i.e. BAD) investment decisions, the Fed hurt a lot of prudent savers, renters and workers.

Looking at the Fed chart today, I noticed the steepest drop in Median Sales Price for New Houses Sold in the United States in the entire chart from 1965 to the present!

October 2022 $491,300

December 2022 $442,100

Some will say this correlation is “not Fed MBS dumping causation”.

Well, it sure looks that way to me. Dropping a median of $49,200 in ACTUAL sales prices in two months is jaw dropping when you start to consider what “median” actually means (i.e. HALF dropped MORE!).

That is how Reality Based Priced Discovery works.

Let us hope it continues to prevail, not just in house prices, but in the stock market, which thanks to buybacks being “legal”, has not been reality based for about 23 years.

So…this is good for BBBY? 😀

“This is hard to believe, but Americans are at it again: Refis have started to tick up this year from the collapsed levels last year, mostly cash-out refis.”

Only reason I can see trading a low interest loan for a higher one is because you are trying to buy time to make ends meet instead of biding time because you’re doing OK. If it is to finance other activities en masse, what the f are people doing then, the Joneses to keep up with were taken out back and shot execution style awhile ago.

Is this a return to the mean because conditions were below it, or a sign that economic conditions are worsening? Probably both.

As someone in the business, the people who are refinancing are not doing so to finance luxuries or to keep up with neighbors. We’re seeing people refinance for repairs, renovations, or cashing out to pay off debts. Fair number of divorces as well (refinancing to buy out the ex).

Thank you for the insight, I have a difficult time finding the pulse.

Divorces dropped around 2008, didn’t they? Couldn’t be financed. Bliss!

Don’t disagree F&L, but suggest consideration that in some/many scenarios, renovations, paying debts, and divorces ARE in fact luxuries.

Cynical, realistic?

Agreed, refi’ing into a higher rate is a sign of desperation not strength.

One reason to pull out equity from a home is if you think the home price will tank in the future and it will be underwater. You can potentially walk away with the money you pulled out, or at least you paid alot of bills in the meantime.

This is a sign of future distress in the housing market

BINGO!!!!!

gametv, that is exactly how I’m reading it.

I know quite a few people who bought new homes (fresh building) over the last 2 yrs. Then housing prices escalated when the dust settled on what used to be cornfield, they couldn’t afford their Real Estate taxes (reassessed at the new value). I’m in IL. In the city of Chicago there is a neighborhood that may have a 45% increase in their Real Estate taxes this spring.

“Fasten your seatbelts. It’s going to be a bumpy night.” Well more than a night…..

Could it be used as a hedge against a falling market? Is there any state where you can get a 97% LTV nonrecourse refi and walk away without liability?

Another plausible Yogi Berra quote: When you got nothing, they can’t take it from you.

Plus the refi people are assuming home prices will keep going down, so best to lever up now and get the most money possible. Not very prudent but there are all kinds of people. Some think they are missing an opportunity if they don’t keep refinancing.

Could be debt consolidation to lower payments and possibly free up credit card capacity.

Cool. But this is all dependent on Refis and home sales staying brisk, right? And wouldn’t that require long-term treasury yields to stay somewhat lower than they were through the 2nd half of 2022?

Makes me wonder if we are we heading for some truly bizarro scenario where the Fed decides to buy long-term treasuries or at least (to goose home sales and ReFis) so as to enable them to reduce MBS on their balance sheet?

Also makes me wonder if some recent home buyers are (like the equity markets) betting on a Fed pivot to enable them to ReFi at a lower rate shortly.

Funny thought popped into my head…maybe Pow Pow is the smartest guy in the room since we are in such bizarro time that his incompetence combine with market’s never ending optimisim, he action might just end up Homer Simpson the economy into a soft landing…

I mean it sucks for the little guys or people that sat out during the another housing bubble if that’s the case but I guess you need enough Frank Grimes to keep the game going…

Home sales will increase from the January/February low for seasonal reasons. They always do. You can count on that.

The refi story surprised me. But it is what it is. Like used-vehicle prices suddenly ratcheting up again, amid strong demand and dropping supply. It seems people are trying to go on with life despite higher rates.

I understand that there are life events that can force this kind of thing, but wonder how much of this refinancing is by investors who leveraged properties to buy more properties and are trying to mitigate the downturn?

You know, the scheme where as long as everything you buy appreciates, you are fine, so you keep borrowing against that thing you bought, to buy more of that think you bought, so you can borrow against that thing you just bought, so you can buy more of that thing and so forth… the last ten years or so have made that profitable. (Bubble behavior in its purest form)

Really I don’t know how common it is but with “meme” stocks assume there more than a few not too savvy people who’ve made a lot of money that way, and if all your business plan has ever been is cash out refi, why not just continue that, thinking they are going to lose the house anyway, so just take the money and run, or perhaps fool themselves into thinking they can actually continue the same plan and beat the market.

Anyhow, I’m thinking those investors are at the crux of the next collapse the same way flippers were during the last collapse, and their demise is probably precipitated by the collapse of new construction… BOOM!!!!

short term rental property empires don’t need to pencil out as long as everything keeps going up. let’s see if a huff and puff will blow them all down.

still way too much liquidity … but eventually it’s going to fall over. wolves have to be patient.

The blackrocks of the world do the same thing, but with companies. They borrow to buy a company with positive cash flow and some savings, then they borrow again to buy another company, financing the purchase with the first company’s increasing debt. This can go on for a while, but eventually the first company–the ‘cow’–ends up borrowing money to pay it’s own burgeoning debt. Then the equity firm looks around for someone else to fob off the debt by selling it. This is not an investment in productivity.

Yep. They have to go on. Current rates seem to be closer to the historical mean.

6 to 7% mortgage rates seem to be good rates for 50 years ranging 1960s to 2010.

I need a new car. Finally ordered a hybrid. I will be paying 4.9% for 5 years on the loan. In my opinion, that is pretty good. I remember my 1st car I ever bought had an interest rate of 8.5%. Rates could be higher. I am thinking I am lucky to lock in at a low 4.9% rate as auto loan rates will be moving higher in the next few months.

That 20s Show.

Speed up. Sure, but to what extent? That’s like guessing how much further inflation is going to fall before it starts to form a trough.

I think anyone can readily say homes sales will speed up as they “naturally” do in the spring. But, can we really say the same thing about refi’s?

And what happens if inflation ticks up in the coming months like many expect it to do? There’s a very real possibility inflation will rebound this year like it did in 1976.

Yes, to your last paragraph. I can see that scenario.

Burn, baby, burn!!!

Funny how FED was so gung-ho and fast on buying MBS, unwinding it? Let’s do it at leisurely pace cause going at half the pace the last couple of months and even with the pick up coming soon, still way behind the curve IMHO. How about start selling some at the same time?

On a different note, can’t wait to see how Redfin CEO and MSM spin this one in spring, just like now I am sure they will declare the worst is behind us now…market back to the moon again”

“Even during Housing Bust 1, sales volume picked up in the spring

“Like watching paint dry.”

-Janet Yellen

As to “selling some,” Powell once again shot down the idea on Tuesday. Not going to happen any time soon.

“we have said that we would consider sales of Mortgage Backed Securities. But I will tell you that is not something on the list of active things, things actively being considered”

~Jerome Powell, 2/7/23

Yes – quite a change from last Spring (when the CPI number was really taking off) when even the hyper-dovish Brainard was proposing that action.

And some people actually fell for it.

Exactly, I’ve read other statements Fed won’t be selling MBS. I wish I was as confident that the refi’s will be sustained at a higher rate.

Depth Charge – You caught my attention with that quote, nice dig, not an easy find.

If Powell holds to his word, per the Economic Club of Washington D.C. speech today, of only selling maturing MBS, that should help cap mortgage rates. Plus the gap between treasury rates and mortgage rates is narrowing, and part of the reason we seen it hit high fives temporarily. Banks don’t have as much fear now as the rate of change has slowed and thus they have lowered their premiums a little bit.

Since the majority have housing as their only real “wealth effect” asset, the Fed has to be careful with mortgage rates. I read today that in 1980, a week’s wages at the then-minimum of $3.10 an hour bought shares of the S&P 500 that it would take 3 1/2 months to pay for now. Stonks are simply out of reach for a larger percentage. So many get confused why the Fed continued to buy MBS up until the end of 2021, yet the correlation between MBS purchases and SP500/Case Shiller is high (plot them together at FRED), thus the only quick way to create the “Wealth Effect” is to blow a bubble in both stocks AND housing at the same time. Thus an equal opportunity lifestyle enhancing debt mechanism, which was brilliant until inflation returned with a vengeance after a 40 year slumber.

I’d suspect rates bounce between 5-7% this year, and maybe hit 4-5% by late 2024 to early 2025 if the FFR comes down 2% and settles around 3.5% by then. Getting back to 2-3% mortgage rates seems unreasonable, yet a new President and new Fed head could change all of that after 2024 as some previous President promoted negative rates are best. Or crazier yet, inflationary hell breaks loose and we hit 10-12% mortgage rates, and all those refinances at 6.25% rate will seem like geniuses.

Personally, I’m in the transitory disinflation/inflation/deflation/inflation repeat camp and think we are going to have 5-15 years of inflation volatility across the entire world due to numerous reasons over the next 10-20 years. It will get really confusing to society as we can have both disinflation and inflation at the same exact time, depending on the method and duration averaging used. The Bipolar markets will ensure maximum pain on maximum possible of unsuspecting participants, thus could be a real head scratcher for many years.

I’m holding my nose and buy what I need, when I need it, as I don’t know how high inflation is going to average in the future. Yet I’m pretty certain that we won’t be seeing actual “DEFLATION”, as in negative inflation rates, for more than a few months over the next 10 years due to the structural mega changes globally. We currently reside in a grossly overleveraged debt construct fantasy era that is anchored by “faith in fiat” (and binary 0/1 cryptos), and not hard currencies that are related to time or labor. Time will matter soon enough, as it always has in the past.

Everything is hard to predict- too many variables. It is like blaming global warning solely on human consumption. The universe is interconnected. Our solar system is affected by other solar systems, and all that goes on in each.

Quantum theory has proven this interconnection with Einstein’s relativbity theory and gravity. The life period of our sun is always at a different stage of atomic exposions that create solar flares.

The life stage of our solar system and our sun probably have more impact on our weather system s than anything else. We have had at least 12 ice age periods that they are able to measure by looking at cores from glaciers.

The point being that it is hard to know when any variable related to the economy will reach an inflection point, and be a dominant variable that was not expected like the colloiding of 2 white dwarfs 30 llight years away, or the feds policy not able to work longer than a several years without a major inflection point being reached. Change is the only constant.

“Our solar system is affected by other solar systems, and all that goes on in each.”

Um, no on the climate change front.

Milankovitch cycles, yes, but that takes tens of thousands of years.

disinflation is inflation so yeah you can have them at the same time

Maybe it is part of the plan to accelerate the MBS roll-offs.

During the entire time I’ve had a mortgage, if the rates drop 1%, or more, I would refi. Mortgage rates did drop 1% during January. Anyone with a 7.25% mortgage could refi to to 6.1% rate. I don’t know how many MBS’s the Fed owns have rates over 7% but the mortgage rolled off if it was refi’d.

Also, the January rate drop opened a window for people to get a higher asking price for their house if they needed to sell. The seller mortgages will also roll off.

The Fed isn’t buying any more MBS’s so if they goose the mortgage rates a percent or 2 lower, this will accelerate the roll-offs.

As Wolf said, I hope people aren’t refi’ing their 3% mortgages to 6.1% just to get more cash out. We are in trouble if this is the majority. Though the thought process may be “6.1% is better than a credit card 28% interest”. This is true but we are still in trouble.

I was thinking the same thing.

Many of these refis are by people who just bought a house recently at higher rates.

Some of them either never plan or expect to pay off the house completely (past their life expectancy), so who cares if they just roll the cost into their mortgage balance repeatedly as long as their monthly payment goes down.

I highly doubt many refis are the 7% mortgages, because the Fed holds so few of those. The easy majority of their MBS purchases were when rates were a lot lower.

To the poster (Gametv?), who thinks those refinancing may be trying to suck out equity before a crash… yeah, maybe, but I doubt that, too. People are lazy as hell, and usually let even routinely predictable trouble ahead steamroll them. ESPECIALLY when it comes at the cost of a doubled mortgage payment! That’s one hella expensive insurance contract, and crooks who’d pull that stunt seem the least likely to pay it.

I wouldn’t refi a 3% mortgage to 6.1% but there may be a couple of cases where this may happen.

1) High credit card debt. Refi or HELOC to drop the rate from 28% credit card interest to 6.1% mortgage. It is a debt consolidation strategy for the short term. For the long term, if the stock market or housing doesn’t start rising, it is a disaster.

2) If you are playing the game like some have been doing, refi as much as you possibly can to leverage into other properties (or crypto) and if the market drops just plead with the lender for a short sale or just foreclose and wait for the market to start rising again and do it all again. This is happening but I don’t know to what extent.

“The Fed isn’t buying any more MBS’s so if they goose the mortgage rates a percent or 2 lower, this will accelerate the roll-offs.” … Can you explain how they can goose the rates lower if they aren’t buying MBS? I thought buying was the mechanism that drove rates lower.

Good point.

Maybe the 1% mortgage drop in January is a natural drop from the MBS roll-offs?

Or the 30 year is leaking into the 10 year.

Your point that the Fed isn’t targeting a drop in the 10 year is correct. If the Fed actively sold MBS’s, the mortgage rate would rise instead of fall.

Why did the 10 year drop causing mortgage rates to drop?

Is the market searching for equilibrium after an natural overshoot or is their something else happening?

It would think it would be better to do a HELOC than to refinance to a higher rate?

Where do HELOC loans go? Do they pay off prior HELOCs that are part of MBS’s? How many HELOC’s can one have on a property?

HELOCs have dropped off the cliff the past 10 years because refinancing was the way to go.

Now to keep their low mortgage rate, people will start taking out HELOCs to buy a car, do repairs, take a trip. That is the phase we are in. Now if they cannot pay back the HELOC, they will have to refinance at a higher rate and take out cash to pay the HELOC.

But we are not in that phase yet. This is what happened in HB1 when the FED started raising rates. People started doing HELOCs to tap into their housing bubble equity.

FYI….there is 25 trillion in home equity that can be tapped. In 2008 there was only $11 trillion.

Will people tap into their equity. If they are short on cash they will. But nobody is short on cash right now. Fidelity said workers have been increasing their 401k contributions all through 2022.

1st you see credit card debt go up.

2nd you see 401k contributions stop.

3rd you see people tap home equity

4th they sell top 401ks or take loans

5th they default on credit cards or home loans.

We are only seeing stage 1 right now.

Time will tell? The economy is still strong.

I guess my question is: Can you have multiple HELOCs on a property?

If not, does the balance of the old HELOC, get rolled into a higher interest rate new HELOC? Or are they handled as separate loans? Who holds these HELOC loans?

What happened to the old HELOC that is now gone? Was it part of an MBS? If so, the Fed has more roll-offs.

I’ve never taken out a HELOC so I really don’t know.

Bob – A HELOC is a line of credit but your house is the collateral. You probably should google it.

A 2nd mortgage is usually a loan taken out that has a fixed rate and fixed payment. Lets say you take out a 3 year loan of $10k loan to build a deck your house. You have to pay it back over 3 years. The loan can be from anybody. But if you do not pay it back, they will try to force you to sell your house so they can get paid back. When it is paid back. The loan is closed.

A HELOC is a line of credit against your equity. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loansFootnote1 such as credit cards. A HELOC often has a lower interest rate than some other common types of loans, and the interest may be tax deductible.

How a HELOC works

With a HELOC, you’re borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if you need to, and you can borrow as little or as much as you need throughout your draw period (typically 10 years) up to the credit limit you establish at closing. At the end of the draw period, the repayment period (typically 20 years) begins

I’d say yes, especially in the case of someone only needing maybe $20,000-$30,000.

The Keynesian State (dominant in the West for about 75 years) views private savings as an “impediment” to State “optimization” of output/employment (basically seeing “excess” private savings – whatever that means in practice – as the cause/symptom of “idled” resources…which it can/will “fix” (and good).

That is how you get 20 years of DC’s deathly silence on ZIRP (which taxed/expropriated every dollar holder on Earth…without a single vote…ever).

As between the State’s power and everyone’s savings, the State will never *not* choose its power. The fact that this is a fundamental betrayal of Constitutional principles hasn’t mattered for 70 yrs.

Let’s just change the national anthem to Three Dog Night’s “The Show Must Go On”. The high wire can stand in for a street car line when all the monkeys get choked and the rest of us go to heaven or hell in the little row boats.

The Federal Reserve cannot sell off the MBS if they bought mortgages at top dollar and a low interest rate as they would have to discount and show a loss. At this point inflation is in the Federal Reserve benefit to preserve their balance sheet and good for any Regime to lower the value of government debt; for proof look at that negative account at the Treasury where the supposed “profits” from the Federal Reserve are “returned to the taxpayer.” Some historians say the US is like Rome of 250AD, the Edict on Maximum Prices was issued in 301 AD by Diocletian for the debased coinage under pain of death. Right now Powell is heading (chief PR spokesman) 1970s stagflation only this time the debasing of currency has military competition and new economic alliances, explaining the Western initial and current responses in Ukraine, that probably should be renamed “Powell’s War” to “honor” the importance of the Federal Reserve.

How would losses due to MBS selling affect the Fed? I have been under the impression that this wouldn’t matter, which has led me to wonder if they have chosen to not sell MBS because they don’t want to accelerate the housing correction anymore than they already have. The Canadian CB is now altering their policy due to similar concerns.

If the value of an underlying asset decreases or the interest rate increases, the note (MBS) is no longer worth it’s face value; hence the note would need to be discounted to sell and a loss booked. Currently, the Federal Reserve is putting their losses in an account of what profits are paid to the Treasury, always peanuts, and the current losses are about 30 billion dollars, rather small. The Federal Reserve is now by definition an insider trader and worse they make the rules for the biggest scheme in history. However, the world as an external force uses the dollar, when they stop Powell will have no more buyers other than Americans who are forced to. Perhaps gold will have to be made illegal again as an economic crime.

I think the Fed is not selling MBS because it doesn’t want to be BLAMED for a fall in housing prices. Letting MBS run off doesn’t look as culpable as actually selling MBS…

There’s a lot to that, I think. The housing market is already tanking hard.

Jim “housing to tank hard” Taylor. If you know who that is, you’re special. Hopefully he’ll finally be right, half a decade after going silent.

SnotFroth,

Ha! Memories!

Jim “Housing will Tank Hard Soon” Taylor posted from about 2010 to 2014 was half right.

According to an updated post, he purchased a home in the 2018 timeframe and was doing well.

He failed at timing the market. I did also.

To let everyone in on the joke, for years from 2010-2014 Jim Taylor would post just:

“Housing will tank hard soon”

On every blog post. Just this one line.

Then he disappeared after a couple of years of rising prices.

Blog commenters are so much fun. When they are proven wrong they just disappear. SoCalJim where are you?

Housing to have tanked hard in 2025!

Gary Fredrickson,

The Fed has zero problems selling securities at a loss. It creates its own money, and losses don’t matter. It will just add the losses to its account called “Earnings Remittances due the US Treasury” where it now already sticks its ballooning operating losses, and forget about them. Its capital won’t be touched at all.

I explained this in the article linked below in detail with a chart. Scroll down to the section, “The Fed’s cumulative losses.” The Fed discloses all this on the balance sheet.

https://wolfstreet.com/2023/02/02/feds-balance-sheet-drops-by-532-billion-from-peak-cumulative-loss-reaches-27-billion-february-update-on-qt/

I read that the CBO listed the decrease in Fed remittances to Treasury as one of the reasons for the higher than expected government deficit reported today, which pulls forward the date on which Treasury can no longer juggle the debt limit away. So the Fed may not be affected, but this does matter to other agencies. (And yes, just increase the limit and take the fight to the next budget.)

Yes, the Fed pays an effective tax rate of 100% and it used to make a big profit. So now it pays zero, given that is loses money.

The remittances, when the Fed was still making money, ran around $100 billion a year. That has now dried up.

Had a casual conversation with a couple of loan officers at Wells Fargo in Laguna. Some anecdotal evicence if you will.

The WF loan guys said WF was not doing ANY equity cash out loans – period. Not for customers, not for correspondents, not for affiliates – NADA. They stated managment did not trust the current equity valuations and decided to avoid the risk.

Again, this is anecdotal, so take it as you wish…

Same thing I have heard recently from Chase loan officer. Something is up.

“Something is up”. Yup, or better yet, something is down. As in prices. The bankers know where the market is headed.

Wells Fargo also stopped doing HELOCs a couple of years ago. And they pulled out of other mortgage segments. Why? Their assets are capped by the Fed (bank regulator) for bad behavior, and so they have to choose what business they want to keep and grow because their asset cap is about maxed out. That’s what you get for being a bad boy.

They should have been taken out back and executed, with their assets rewarded to smaller institutions.

Exactly right. Why do people do business with these criminal banks? I stick to my credit union and the rest of them can all go bankrupt. The American people are their own worst enemy.

During the 1980s, it was the savings & loans that went bankrupt, causing the huge “savings & loans crisis” that ultimately got resolved with a government bailout, and a bunch of people went to jail.

“…and a bunch of people went to jail.”

The good old days. When laws actually applied to bankers.

Long before Tim “now is not the time for blame” Geithner.

My local Credit Union is pushing HELOCs big time

Is it 1980 all over again?

Credit Unions are similar to the S&L’s of the 1980’s. Mostly local.

At the current rate of $900bn per year it will take thirty years to get rid of all the MBS’ The Fed is a joke

Nah, it won’t take 30 years. There is a very good chance these things are gone in 6-7 years. Here’s why:

1. Your math is wrong. The current max rate = $420 billion a year in MBS runoff (not $900 billion). At this $420 billion rate, it would take only 6.3 years (not 30 years) to get rid of all MBS.

2. MBS have maturity dates, usually either 15 years or 30 years from the issue date. Lots of those MBS have been on the balance sheet for years. So all them will mature before 30 years from now.

3. When an MBS shrinks so much due to years of pass-through principal payments, the GSEs that created the MBS will “call” it, meaning they will pay the remaining face value to the Fed, and then they will repackage the remaining mortgages into new MBS and sell to someone else. This takes the entire MBS off the balance sheet.

4. Home sales volume will eventually normalize, maybe at much lower prices, and these increased sales will trigger a surge in pass-through principal payments.

5. If and when mortgage rates drop, it will also trigger a torrent of pass-through principal payments that will clean out those MBS in a hurry.

“Nah, it won’t take 30 years. There is a very good chance these things are gone in 6-7 years.”

One giant caveat there….this is assuming there’s no major financial event, black swan, severe recession…etc to cause the FED to bring out the bazooka again. Best case scenario pause QT, worse case QE and MBS purchase again. To carry on current course for 6-7 yrs, I give that probability roughly the same as me winning the next Mega jackpot.

If QE starts again — big if because everyone is now facing the issues it caused — it will likely be just Treasuries.

My gut feeling is that at the next crisis, the Fed will handle it as it handled crises before QE: with repos. Repos unwind quickly and don’t linger on the balance sheet once the crisis is over. That’s why the Fed reactivated its standing repo facility in 2021. It had been shut down since 2008.

3. When an MBS shrinks so much due to years of pass-through principal payments, the GSEs that created the MBS will “call” it, meaning they will pay the remaining face value to the Fed, and then they will repackage the remaining mortgages into new MBS and sell to someone else. This takes the entire MBS off the balance sheet.

The GSE’s Fannie and Freddie, could start bailing out the Fed with calling larger mortgages? What is considered a small mortgage with all of the servicer fees? I think my loan holder is likely losing money now since the interest is so low and inflation must be driving up servicing fees. What does my $200 in interest that I send in every month cover? I have noticed that it covers less service with Loan Depot.

Do you know the call level now?

Here is the expensive path of my last refi.

1) I approached multiple “Loan Originators” a few years ago and asked for quotes for a refi. I picked Loan Depot as a loan originator because they had the best rates for the lowest points/fees. Loan Depot made money from fees and points paid by me when I refi’d the loan. It was a huge boom for loan originators with likely billions in fees being collected as many homeowners refi’d to the lower mortgage rates being driven by the Fed. This is no longer the case, so most “Loan Originators” are downsizing.

2) Loan Depot became my “Loan Holder” and “Loan Servicer” for about a year. I used their deluxe Web Site to pay my mortgage and used their tools to calculate what would happen if I could refi at a lower rate or pay down the mortgage.

3) About a year ago, I checked and my loan had been sold to Freddie which is a government GSE. I’m sure Loan Depot made money from fees when selling the loan to Freddie. Freddie became my “Loan Holder” and Loan Depot continued to be my “Loan Servicer”

5) Freddie likely bundled my loan into an MBS for another fee and sold it to someone. Maybe the Fed? This is not public information.

4) A few months later, I received a letter saying that my loan was being transferred to another division of Loan Depot with a new address and web page. The new web page was very low budget with a more difficult way to pay my monthly payment.

My monthly payment remains the same since it is defined in the mortgage contract. It is just more of a hassle to pay it now.

3 years into my loan, my monthly interest payments are now only in the $200’s and dropping every month. How does the MBS holder, loan holder, and loan servicer make labor, processing, legal costs and any ROI on such a low interest payment? I would expect the legal costs to be high since kicking someone out of a house is likely not cheap in a foreclosure.

If my loan is part of an MBS, it is likely that it will be called by Freddie. My loan servicer is likely seeing higher labor costs and legal costs. They are being paid by Freddie to collect my money or foreclose on me if I don’t.

I have read that “Loan Originators” were not making loans for under 100K when refi’s were booming. The cost to service these loans were too high at the time for the interest income received to generate any profit or ROI. Loan Originators, Loan Holders (GSEs), MBS holders, and Loan Servicers are all skimming their fees and profit along the way.

Freddie is betting that loans will be rolled over and a bigger mortgage will be taken out before the loan amount an interest received drops below the servicer/legal costs. It may be a safe bet since most people didn’t hold their mortgage longer than 7 years. However, they may hold them longer now because it doesn’t make sense to refi or buy a new house at a higher rate.

There’s always, death, divorce, and disaster driving people to sell their houses and buy a new house.

Re:. People are actually refinancing a lower-rate mortgage with a higher-rate mortgage in order to cash out some of their home equity.

Last night I was pondering the concept that instead of a banking crisis similar to the GFCI, we end up with some mutated offspring related to mortgage mismanagement.

I was looking last night at a concept that was intriguing at calculatedrisk blog during GFCI, which was MEW.

Mortgage Equity withdrawal

Granted, the pandemic caused a lot of nonlinear weirdness, along with wrecking most every economic model, if one steps back and accepts that housing has been in an epically monstrous bubble, a bubble where homes are like casino chips, then there’s a huge likelihood that there’s going to be something happening with financial leverage.

As with every single bubble, leverage is the giant pinta at the party. Maybe this time, instead of a centralized epicenter of traditional banks being crooks, we have some type of decentralized stress fractures that build into a destabilizing force (that’s unexpected).

My latest vision, is rising mortgage rates that (eventually) collide with an unexpected tsunami of housing inventory.

As visions go, what happens if through most of 2023, we see a sellers strike, where there’s stubborn solidarity by home sellers, to hold out for higher prices. A market dynamic of excess greed. As this buyer strike moves glacially, month after month, mortgage rates head towards 8 percent, because of several Fed rate hikes, weird MBS plumbing and a 10 year rate far higher.

If that’s the backdrop, then we add-in the variable of a tsunami of dumb homeowners leveraging bets, that end up in a long chain of dominos that explode into a black swan?

In the simplest terms, I think there’s a huge amount of hidden leverage in the housing pinta. We all know the income per Capita versus home valuation doesn’t make sense and this party is in no way sustainable.

Black Swan. The leverage will find the weakest link to equalize. Imho, the world enters numerous hot wars this year which drives everyone to panic and standstill. Result.. depression. Leverage gone with most everything else.

…without a functioning Ground Fault Circuit Interrupter…

may we all ind a better day

“All is well in the garden”. Chauncey Gardner

If you watch CNBC, the narrative is that now is a great window to buy real estate, because sellers are nervous and dropping prices, and you can pick up a bargain. Within the year, real estate prices will be rising in again, and you’ll be chasing. Also, you’ll be able to refinance in a year or two at lower interest rates.

Today, earlier this very afternoon actually, I finally banned CNBC from my news feed. “This 27-year old only works 14 hours a week from home and makes 175k selling Optivia”….

It’s been so long since they had a real, actual, halfway factual article…Just can’t do it any longer.

Utterly stupid commentary from CNBC if they said that.

I suppose the truth is that their supporters (advertisers) would benefit from this.

So what Wolf never really states is that the Fed is boxed in a corner on all these assets if inflation ticks back up because the assets are inflationary, driving the value of a dollar down, yet if they try to liquidate them at a pace faster than roll-off, they incur very large losses. Sure, they can put them on the balance sheet as deferred assets, but that is just corrupt accounting.

If inflation remains high, then interest rates cant drop again soon, and that means the Fed can only roll off the junk as fast as it rolls off.

Of course, this only becomes a big problem if we have stagflation, an economy that sucks, but inflation that remains high.

Is anyone else seeing the massive bubble burst that I see coming?

I see stagflation now and expect it to become extreme from deglobalization and debt collapse.

Lots of debt is backed with equity valuations that are inflated. So the federal reserve is holding these to maintain those valuations to prevent the whole thing from coming down in a mass deflationary scenario.

The other alternative is inflating away until the inflation catches up with the equity valuation number.

Which means either we see 2008 bust and stock crash or bad inflation for a long time. I’m guessing #2 will happen because Fed is so far gone that they have no authority left. This economy is fake and goosed. We all know it. There’s no reason for the stock market to keep climbing.

Banks are returning 0.0% basically for savings accounts (unless you’re an online high yield savings account) and rebuilding their incomes off of inflation to pay for the house equity valuations. You want this to stop, tell people to put their money into high yield savings accounts offering up to 5%, reduce their savings accounts in traditional brick and mortar, and starve these banks until they start liquidating the homes to try to survive. That’s when you’ll see deflation. Right now they have too much of everyone else’s cash making whatever percent parked in the reserve and treasuries and making money and interest off of everyone.

If you starve them though, they will probable strong arm the government into a too big to fail bailout. Cancer is eating too much. Inflation will get worse whatever Powell says. Plan accordingly.

“People are actually refinancing a lower-rate mortgage with a higher-rate mortgage in order to cash out some of their home equity.”

Do we have more data on what is getting refinanced there? Refinancing a 3% with a 6% would be utterly stupid, although it’s possible people are so deep in their 20% rate credit card debt that it makes some nonsensical sense.

But is it possible that these are mostly ARMs? It would make a lot more sense if people who were betting on perpetually low rates are starting to panic now and want to lock in. Does the FED actually hold ARMs on its balance sheet or is it exclusively 30y fixed?

Again, from ancedotal evidence, I would venture the ARMS are the source of refi’s. My friend has an ARM, which he did not refi when rates were low, because the ARM was 2+%…. then it went to 4%+, now it resets this spring at nearly 7%….

He is looking to refi…. it’s tough – he may have to eat the higher rate…. He admits its his mistake …. greed blinded him.

Again, anecdotal evidence, take it as you wish…

That’s why I tell people never to get an ARM unless it has a 5-10 year fixed component, and even then, only if they’re prepared to pay it off when the rate resets.

That’s an excellent point!

How many people are stuck with a rising ARM loan? I hope it is small.

The Fed is not selling MBS because it doesn’t want to be blamed for the coming housing crisis (and selling MBS would look like a smoking gun).

Rather than sell MBS to get to the $35 billion target, the Fed would do well to remove the $60 billion cap on Treasury runoff and just let Treasury runoff fill the gap between actual MBS runoff and the $95 billion total runoff target…

If the Fed sold MBS at a loss, wouldn’t that be a form of QE? If they sold $2T of MBS for $1T, the $1T would disappear when the Fed destroyed the dollars. But the mortgage pass through payment which would have gone to the Fed and been destroyed would now be back in the economy. In the end, there would be $1T more in the economy than if the Fed had not sold them at a loss.

Am I thinking about this wrong?

1. They’re not going to lose 50% on those MBS. Right now, they might lose 5% to 20%.

2. If they sell MBS (of whatever face value) and get $1 trillion for them that’s $1 trillion of QT right there on the spot, market collapses, end of everything, LOL

3. What happens later in the private sector with interest payments and the pass-through principal payments is just normal private sector stuff. No impact on QE or QT.

4. So it seems to me – late at night – that when the Fed bought $1.1 trillion in MBS two years ago, that was $1.1 trillion in QE. If it sells them for $1 trillion, it does $1 trillion in QT. That remaining $100 billion left over is a loss to the Fed, and it represents the portion of QE that never got unwound. It’s not again QE a second time, but it just didn’t get reversed. It just disappears, rather than turning into QT. That’s how I would say it.

To build on your thought, interest paid to the Fed on its bond holdings, whether Treasuries or MBS, usually is remitted to the Treasury, and thus the interest received would in normal circumstances not be destroyed.

However, in the case of the $100 billion loss in item number 4 above, that amount would be offset by future interest payments not remitted to the Fed, and thus that $100 billion would eventually be destroyed. Over time, the total QT would be the full $1.1 trillion.

as QT moves forward would we expect real interest rates to increase? I.E. less money supply means higher cost to borrow?

QT should push up long-term yields/interest rates, not short-term rates.

Not doing a great job though, at the moment.

The Fed sells the MBS to someone that must sell other assets to buy the MBS, so that reduces the bubble in some asset.

The Fed buying 8 trillion in bonds has effectively pushed investors into other assets, thereby pumping up their prices. A pure speculative bubble.

My thought is the Fed knows exactly what it is doing, creating bubbles for the rich, while it suppresses inflation by raising interest rates that impact the real economy.

The Fed is FINE and DANDY with trashing the real economy, as long as asset prices remain high because the Fed cares alot more about bankers and rich people than about your average joe who loses his job.

If we had a responsible Fed, they would have tightened conditions by selling a ton of their balance sheet. And it would have not only tightened financial conditions and stopped inflation, but it would also have deflated the bubbles that are everywhere. Of course, those bubbles should have never been allowed to grow in the first place.

The Fed is just a bubble machine.

I think your understanding is mistaken.

FED is indeed responsible, not to general public but to their masters and Elite.

Only naive think FED is working for the public.

Now that the FED no longer buys MBS’s. Who is taking up the new ones? And are they willing to take that all on? What if they are not willing or able?

I tried to think of what impact that would have. Would interest rates be set by the ‘regular’ market? And in what way? Would rates go up, because the market has to take the risk now, instead of the FED for which it actually was no risk at all?

They’re guaranteed by the government, similar credit profile as Treasury securities. Lots of demand by institutional investors. If the yield is high enough, there will always be demand for them.

That’s the whole idea of QT… the Fed removes its own demand from the market, which in theory should push up yields because other buyers will have to be pulled into the market by those higher yields.

There will always be demand if the yield is high enough. But a higher yield means higher mortgage rates. Which is also part of the Fed’s goal.

Based on results from Disney and Pepsi, my position is that we have had NO landing at all. Companies continue to raise prices, and consumers continue to spend. The trillions that were printed or working their way through every facet of the economy.

Need an edit button. I’m convinced that when all is said and done, we’ll have shaved 40% off the value of the dollar.

Fannie Mae stock is worth a whole 47 cents a share, it seems the market has spoken as it’s down about 99% off it’s highs from the 2008 housing bubble numero uno crash.

Nah, you’re missing the entire story here. The stock price is meaningless and says nothing about anything except that hedge funds lost their appeal to the US Supreme Court after more than a decade of litigation, and it’s over.

During the financial crisis, Fannie Mae and Freddie Mac were entered into “Conservatorship,” where the government has taken over and runs the show, makes all decisions, and takes nearly all profits, leaving those companies with just a modicum of capital. They’re called Government Sponsored Enterprises (GSEs) for a reason.

There were a bunch of hedge funds that bought the shares during the financial crisis for 20 cents or whatever and then sued the government to have that reversed, and during that litigation, the shares rose to over $4 on hopes that the hedge funds might win. And after years of litigation, they lost their appeal to the US Supreme Court, and it’s over, which is reflected in the stock price, which should be zero.

I considered a refi just before the Fed Increases with the General Contractor remodeling his own ranch with a labor/profit minimum of $100K on $100K borrowed. In the best case scenario it would be possible to make $200K on my property due to the 24 new homes ranging from 1to 1.5 million one block away.

Instead, I found the construction estimates way out of line with the minimum goal of $100K possible and due to unforeseen contingences previous actual profit experience might 75K due to multiple price increases from conception to completion. Instead, I decided not to move yet.

Now, the high prices are still holding but I am starting to see the beginnings of a recession but in the 50 years I been building I have never seen labor/business do as it is in this “recession.”

Since the Fed is theoretically the arbitrator of the wage/interest rate seesaw the concept of recession is not showing itself as most here have seen in there lifetime.

I still cannot see how this picture interrelates as a big picture and what the big drivers are….

Is it because government/business/capital all are forcing upon us change that cannot be done via government as people would reject most of these changes if the scrutiny government allows does not exist in an “understanding” between the entities?

Just as the Russians said they did not plan to invade and the obvious untruth it seems the same idea is happening in terms of government directing business/capital to heed ESG in spite of the likely rejection of ESG if most understood the realities associated with the ESG for the group of investors here who make decisions on past assumptions no longer valid or still valid but rapidly losing an relation to past assumptions.

Lastly, type in “proptech” and you will see multiple real estate tech platforms for all manner of investment options such that everybody and their mother is a real estate investor. Or like me, I have neighbors that fly their drones around and examine your house so they can make you an unsolicited offer on your house.

As I am waiting for contractors to get desperate (which I think will happen at some point) to maximize property sale price the timing is everything but again, things are not happening as in the past….

So…….???????????????????????????????????????? What does it all mean? How does it all interplay?

Things would happen but housing takes time generally. One needs patience.

This would play out for few years I guess.

Housing is still and always a large part of the economy. It is literally the cycle of life. Those areas of the country that have a healthy and growing young population with job creation will have a healthy housing market. My daughters Denver market neighborhood has been turning over quickly for the last 4 years. Mid 60’s homes. The old are down sizing and the young are wanting to create families. Million dollar home listed on Friday, under contract Monday night. Healthy housing markets are still where the jobs are.

“healthy and growing young population with job creation ” unless the job pays them enough to buy these bubblicious priced homes.

The prices are too high, either the rates need to come down hard or prices need to come down hard or people are being paid more for high home prices.

The wage increase I see normally is for lower spectrum jobs. e.g. Mcdonalds used to pay $12/hr , now pays $18/hour. People working in these jobs can’t still afford $400K homes.

Jon, I used to think the same way. As in since the ’90s.

The buyer of a median home is NOT a median earner.

I agree but we already have declining home prices in play and the issue for this is just un-affordability.

Also where I live, people with high wages are feeling the lay off threats but not people at the lower end of the spectrum.

It means that people who can afford homes won’t buy keeping in mind the macro economy and people who can’t afford, don’t need to even think about it.

I am in southern CAlif and medium home prices are 1 million usd.

People who can afford not wanting to take the plunge for obvious reason.

Same story where I’m at. I just got a raise in January; approximately 5%. Company has been crumbling under employee turnover. Company did an additional regional raise (~100 persons) of 12% for March. Still slightly lower than comparable positions in this area.

Still doesn’t mean anything. It’s a nice thing to get extra money but starter homes here are still 500k dollars in crappy 1/4 acre subdivisions. Trailers out in the woods rotting away with mold and abandoned cars as yard deco are still 300k. 1990s pickup trucks with 200k miles are still over 10k dollars. God forbid it has the luxury marque of Toyota on the title.

I’m very glad I found a very nice and cheap living accommodation. Otherwise I’d be spending 1000+ bucks a month on a studio apartment and unable to sleep since I work nights.

It is quite interesting how people are still spending like a drunken sailor. I’ve cut back on nearly everything. If I’m not at work I stay inside and sleep or surf the web. Unnecessary expenditures have all gotten the axe. Meanwhile people at work are buying more and more new toys and vehicles. One was saying this new raise means he can work less hours than he already does which is less than 30/Wk now.

Still praying for the housing crash. I’ve prayed for a lot of things and praying has never worked before. Maybe I should build a shrine… Of Jerome Powell?

Are HELOCs considered a refinance?

No. They’re additional to the existing mortgage which remains intact and doesn’t get refinanced.

Are reverse mortgages considered refi’s?

Maybe more seniors are using reverse mortgages to subsidize their income with inflation eating into their social security.

My social security is up $300 (net) which doesn’t come close to covering my inflated grocery and gas prices each month.

“counted” as refi’s

First off, related to Fed MBS selling, that’s not gonna happen in any serious material way, because the Fed isn’t going to be in the business of selling anything at a loss. They will never see a precedent that they will burn money. The MBS will move glacially in the shadows and eventually roll off.

Second, I find the following quote, indicative of the naivety, arrogance and stupidity of mega cap managerial thinking, in terms of future market growth dynamics. It screams of a demographic, generational ignorance that’s at the core of post pandemic speculation fantasies versus realistic core thinking related to investment.

Perhaps crypto laundry tokens will play a small role in future speculative fun money games, but to suggest sluggish crypto gambling is impactful to earnings is plain stupid. But, to add onto to that laser focused thinking, we also need to get home prices back above unsustainable values, in order to help accelerate cloud growth … I will never waste money shorting stocks, but if ever there was a case to be made, by a moron, this is a sure bet…. Amazon is excessively overvalued and run by idiots!

“Amazon Chief Financial Officer Brian Olsavsky said on a Feb. 2 earnings call that mortgage lending and crypto trading were two examples of the many slowing industries dragging cloud growth.’”

Here is an idea I have that people should consider.

The debt ceiling fight that is coming forces the federal government to stop issuing new debt that exceeds that limit. So the bond markets are being starved of new issuance to fund the government. That is impacting the supply-demand curve for Treasuries, probably long term Treasuries even more than short term.

So once that debt ceiling battle is cleared, expect there to be an excess of supply related to demand and interest rates will take their next leg up. So keep an eye out for a good time to sell off bond exposure and look for the bonds to sell off sometime after or maybe as soon as their seems to be a debt ceiling agreement.

Of course, there will be other factors impacting yields, but this lack of bond issuance is definitely changing the supply-demand relationship.

if you look back to the last debt ceiling fight, this same thing happened. interest rates rose only after the debt ceiling was cleared and the Treasury could issue more debt, although i think that it took a couple months after the debt fight for the cumulative supply-demand curve to move up higher (maybe a lag effect)

I get it but to make things clear, you are talking about long duration bonds right ? say 10 year or so.

MW: Deeply inverted Treasury curve heads for 41-year milestone

I find it hilarious that loan officers are getting folks refinanced at higher rates. What’s the play here? “Get the cash out of equity while you still can because values are going down”? or “Pay off that 20% APR credit card at 6% 30 yr loan, even if it does go up from 4%, plus those (pesky) closing costs”?

I wonder how many of those LO “brainiacs” were pushing people into ARMs in anticipation that Fed will pivot this or next year?

I guarantee you that every single Thought Leader at mortgage lending companies is pushing the Fed Pivot narrative. I’ll bet my Super Bowl edition Oreo cookie on this.

Hilton Hotels said business is better than pre-pandemic and future bookings are not slowing down and look great.

Nothing to look at….move along.

More reasons for FED to keep hiking and that too more aggressively!

People have too much money.

Most people have 2 weeks of paid vacation per year. You bet they will continue to travel at least once per year. And obviously hotels are cheaper than Air Bnb, so I am not surprised. Now add in business related travel etc.

Any chance that MBS roll off actually exceeds the cap of 35b in one of the next few months?

If that happens will the Fed actually buy MBS again or is it a cumulative cap?

I don’t think that’s going to happen over the “next few months.”

Wolf, great site. I learn a lot from the articles. And value what you post greatly.

I’ve had posts deleted due to a misunderstanding around the Fed Balance sheet. It’s your site; you can delete whatever you want. No argument from me.

Your estimate of the Fed balance sheet if MBS rolloffs had been near the cap highlights what I was trying to say in my previous posts, and failed to get across. I want the balance to go down faster. It wasn’t going down faster. Due to your articles I now know why it wasn’t. Thank you!

Basically, we were told it would go down by X, and it didn’t. Your estimate is not what we got and that was what I complained about. I wasn’t arguing for a pivot. That would be madness. I wanted the balance sheet do down faster. In part to get that huge weight off the long end of the interest rates.

Thank you for the great content!! We are all better for it!