Ugliest-ever trade deficit. But US exports grew to $2 trillion, 10% was crude oil & petroleum products. Pharma & industrial machinery exports were #3 and #4.

By Wolf Richter for WOLF STREET.

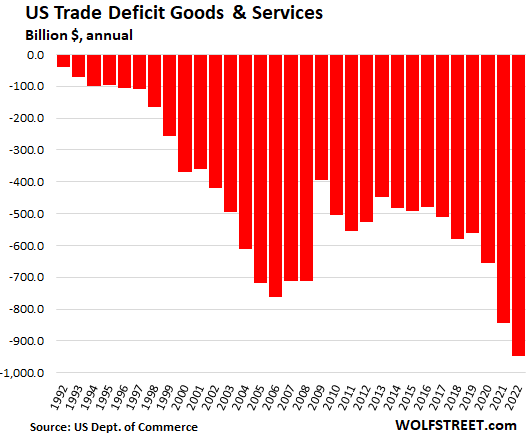

The US trade deficit in goods and services in 2022 ballooned by 12% to an all-time magnificent breath-taking record of $948 billion, according to data by the Commerce Department.

A trade deficit is not a sign of a vibrant economy. Instead, it’s a negative for GDP, a negative for US jobs, and a negative for the overall economy. It exists because Corporate America went in search of cheap labor and products to fatten up its profit margins.

Services trade surplus declines fourth year in a row.

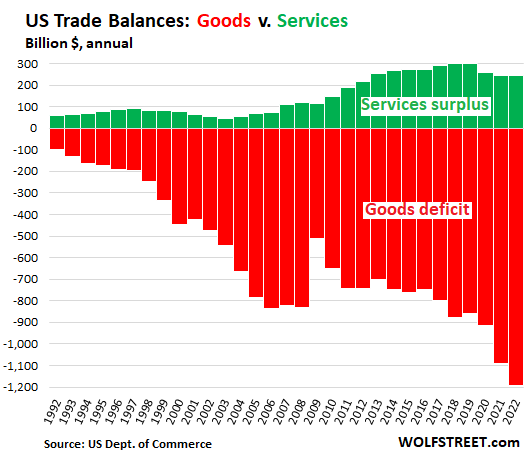

The US trade surplus in services dipped further in 2022, from the already beaten down levels of 2021, to $244 billion, the lowest since 2012, and the fourth year in a row of declines.

Imports of services jumped by 24% to a record $680 billion. Exports of services jumped by 16% to $924 billion.

Spending for international travel is part of the trade in services. When Americans travel overseas and spend their money overseas, it counts as imports of services. Conversely, it counts as exports of services when foreign tourists, foreign students, etc. spend money in the US. Think of it in terms of money-flows: when tourist spend their money in the US, money flows from overseas to the US, as it does with other exports.

International travel has been thrown out of whack during the pandemic. By 2022, most of the travel restrictions were lifted or at least loosened, and travel in both directions has rebounded. We’ll get to the details in a moment.

The services surplus of $244 billion (green) was dwarfed by the trade deficit in goods, which worsened by 12%, to $1.19 trillion, by far the worst ever (red). We’ll get to the ugly details of goods in a moment.

Services exports by major category:

The top four categories account for 73% of services exports. Travel (#3) jumped by 91% year-over-year, as travel restrictions were lifted. This is spending by foreign travelers in the US, and includes travel for personal, health-related, and educational purposes; business travel; and for seasonal/short-term work.

The #4 category, Charges for the Use of Intellectual Property, accounts for software, movies, music, licensing agreements, etc.

| In billion $ | 2020 | 2021 | 2022 | YoY % |

| Total Services, exports | 726 | 795 | 924 | 16% |

| Other Business Services | 195 | 217 | 244 | 12% |

| Financial Services | 151 | 172 | 166 | -3% |

| Travel, foreign travelers in the US | 72 | 70 | 134 | 91% |

| Charges for the Use of Intellectual Property | 116 | 125 | 127 | 2% |

| Transport | 57 | 66 | 90 | 37% |

| Telecommunications, Computer, and Information Services | 56 | 60 | 69 | 16% |

| Government Goods and Services | 22 | 23 | 30 | 28% |

| Personal, Cultural, and Recreational Services | 21 | 24 | 26 | 11% |

| Insurance Services | 20 | 23 | 21 | -6% |

| Maintenance and Repair Services | 13 | 13 | 14 | 14% |

Services imports by major category:

Travel as imports of services – Americans spending money overseas – doubled year-over-year and tripled from 2020 as travel restrictions were lifted and “revenge travel” set in.

| In billion $ | 2020 | 2021 | 2022 | YoY % |

| Total Services, imports | 467 | 550 | 680 | 24% |

| Transport | 73 | 105 | 154 | 47% |

| Other Business Services | 113 | 130 | 138 | 7% |

| Travel (Americans overseas) | 34 | 57 | 113 | 99% |

| Insurance Services | 58 | 59 | 57 | -4% |

| Financial Services | 45 | 50 | 54 | 8% |

| Charges for the Use of Intellectual Property | 48 | 43 | 52 | 20% |

| Telecommunications, Computer, and Information Services | 40 | 43 | 47 | 10% |

| Personal, Cultural, and Recreational Services | 24 | 28 | 29 | 3% |

| Government Goods and Services | 25 | 25 | 25 | 1% |

| Maintenance and Repair Services | 6 | 8 | 8 | 6% |

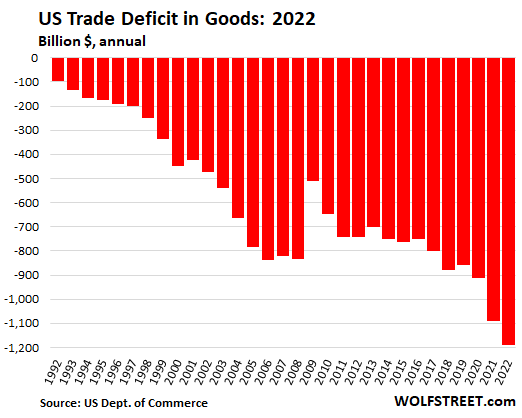

Trade deficit in goods blows out.

The trade deficit in goods worsened by 9% to a mind-bending record of $1.19 trillion.

Exports of goods jumped by $324 billion, or by 18%, to $2.09 trillion

Crude oil and petroleum products reign. Of the total exports of goods, $208 billion, or 10%, were crude oil (up 69% from a year ago) and petroleum products, such as gasoline (up 42%). Price increases were in part responsible for this huge surge.

Pharma products were #3, at $90 billion.

The largest agricultural category by value is soybeans (up 25% year-over-year), at $36 billion, in 18th place, accounting for 1.7% by value of US exports.

Here are the 54 largest categories with an export value of at least $10 billion. Have a good look. There’s some fascinating stuff in it:

| Exports by category, in billion $ | 2021 | 2022 | % YoY | |

| 1 | Crude oil | 69 | 117 | 69% |

| 2 | Other petroleum products | 64 | 91 | 42% |

| 3 | Pharmaceutical preparations | 83 | 90 | 8% |

| 4 | Other industrial machinery | 68 | 74 | 8% |

| 5 | Semiconductors | 66 | 66 | 0% |

| 6 | Natural gas | 40 | 63 | 57% |

| 7 | Fuel oil | 32 | 60 | 88% |

| 8 | Passenger cars, new and used | 54 | 57 | 5% |

| 9 | Other automotive parts and accessories | 47 | 54 | 15% |

| 10 | Plastic materials | 44 | 50 | 14% |

| 11 | Electric apparatus | 43 | 49 | 14% |

| 12 | Civilian aircraft engines | 38 | 45 | 19% |

| 13 | Medical equipment | 40 | 43 | 8% |

| 14 | Other chemicals | 39 | 42 | 7% |

| 15 | Nonmonetary gold | 31 | 40 | 30% |

| 16 | Organic chemicals | 34 | 40 | 17% |

| 17 | Natural gas liquids | 31 | 38 | 22% |

| 18 | Soybeans | 29 | 36 | 25% |

| 19 | Telecommunications equipment | 33 | 35 | 6% |

| 20 | Other industrial supplies | 30 | 32 | 9% |

| 21 | Cell phones and other household goods | 30 | 32 | 5% |

| 22 | Computer accessories | 29 | 32 | 8% |

| 23 | Civilian aircraft | 24 | 29 | 20% |

| 24 | Measuring, testing, control instruments | 24 | 28 | 15% |

| 25 | Industrial engines | 23 | 27 | 15% |

| 26 | Meat, poultry, etc. | 25 | 27 | 6% |

| 27 | Finished metal shapes | 22 | 25 | 14% |

| 28 | Trucks, buses, and special purpose vehicles | 21 | 24 | 14% |

| 29 | Gem diamonds | 17 | 21 | 24% |

| 30 | Civilian aircraft parts | 18 | 20 | 12% |

| 31 | Engines and engine parts | 19 | 20 | 8% |

| 32 | Corn | 20 | 20 | 0% |

| 33 | Precious metals, other | 25 | 19 | -25% |

| 34 | Computers | 18 | 18 | 4% |

| 35 | Other foods | 18 | 18 | 1% |

| 36 | Fertilizers, pesticides, and insecticides | 10 | 15 | 55% |

| 37 | Newsprint | 13 | 15 | 10% |

| 38 | Toiletries and cosmetics | 13 | 14 | 8% |

| 39 | Laboratory testing instruments | 13 | 14 | 3% |

| 40 | Generators, accessories | 12 | 14 | 10% |

| 41 | Metallurgical grade coal | 7 | 13 | 80% |

| 42 | Inorganic chemicals | 11 | 13 | 22% |

| 43 | Materials handling equipment | 12 | 13 | 9% |

| 44 | Animal feeds | 11 | 12 | 14% |

| 45 | Toys, games, and sporting goods | 11 | 12 | 13% |

| 46 | Excavating machinery | 11 | 12 | 14% |

| 47 | Iron and steel mill products | 10 | 12 | 21% |

| 48 | Jewelry | 9 | 12 | 28% |

| 49 | Coal and fuels, other | 7 | 12 | 59% |

| 50 | Artwork and other collectibles | 9 | 11 | 27% |

| 51 | Pulpwood and woodpulp | 10 | 11 | 13% |

| 52 | Photo, service industry machinery | 9 | 10 | 14% |

| 53 | Steelmaking materials | 10 | 10 | -1% |

| 54 | Aluminum and alumina | 8 | 10 | 22% |

Imports of goods spiked by $425 billion, or by 15%, to $3.28 trillion. This caused some heartache when those global supply chains got tangled up, triggering all kinds of shortages, but the search of cheap labor and products rules the day.

Of the total imports of goods, crude oil was #1 by value at $198 billion, up 49% year-over-year thanks to the price increases. Pharma products were #2, at $190 billion. Passenger cars were #3.

Note the imports of tech equipment, categories #5 through #10.

| Imports by Category, in billion $ | 2021 | 2022 | YoY | |

| 1 | Crude oil | 133 | 198 | 49% |

| 2 | Pharmaceutical preparations | 171 | 190 | 11% |

| 3 | Passenger cars | 143 | 162 | 13% |

| 4 | Other automotive parts and accessories | 116 | 135 | 16% |

| 5 | Cell phones and other household goods | 121 | 132 | 9% |

| 6 | Computers | 100 | 103 | 3% |

| 7 | Electric apparatus | 69 | 89 | 29% |

| 8 | Telecommunications equipment | 66 | 79 | 19% |

| 9 | Semiconductors | 70 | 78 | 12% |

| 10 | Computer accessories | 70 | 78 | 12% |

| 11 | Other industrial machinery | 66 | 76 | 16% |

| 12 | Other textile apparel and household goods | 55 | 64 | 15% |

| 13 | Toys, games, and sporting goods | 57 | 60 | 5% |

| 14 | Medical equipment | 59 | 57 | -4% |

| 15 | Cotton apparel and household goods | 46 | 54 | 16% |

| 16 | Other petroleum products | 40 | 53 | 31% |

| 17 | Trucks, buses, and special purpose vehicles | 43 | 52 | 21% |

| 18 | Furniture, household goods, etc. | 48 | 51 | 6% |

| 19 | Industrial supplies, other | 43 | 49 | 14% |

| 20 | Finished metal shapes | 35 | 48 | 38% |

| 21 | Household appliances | 41 | 42 | 2% |

| 22 | Organic chemicals | 34 | 39 | 14% |

| 23 | Generators, accessories | 30 | 37 | 22% |

| 24 | Fuel oil | 28 | 36 | 30% |

| 25 | Engines and engine parts | 30 | 32 | 8% |

| 26 | Industrial engines | 28 | 31 | 11% |

| 27 | Iron and steel mill products | 26 | 30 | 14% |

| 28 | Fish and shellfish | 28 | 30 | 6% |

| 29 | Photo, service industry machinery | 27 | 30 | 8% |

| 30 | Other foods | 23 | 27 | 17% |

| 31 | Fruits, frozen juices | 24 | 27 | 15% |

| 32 | Materials handling equipment | 22 | 27 | 21% |

| 33 | Plastic materials | 24 | 27 | 10% |

| 34 | Measuring, testing, control instruments | 23 | 25 | 11% |

| 35 | Footwear | 20 | 25 | 28% |

| 36 | Bauxite and aluminum | 18 | 24 | 35% |

| 37 | Other chemicals | 19 | 24 | 24% |

| 38 | Gem diamonds | 20 | 23 | 17% |

| 39 | Fertilizers, pesticides, and insecticides | 16 | 22 | 38% |

| 40 | Other precious metals | 29 | 22 | -24% |

| 41 | Televisions and video equipment | 25 | 21 | -13% |

| 42 | Other consumer nondurables | 19 | 21 | 16% |

| 43 | Civilian aircraft engines | 17 | 21 | 25% |

| 44 | Excavating machinery | 15 | 21 | 37% |

| 45 | Jewelry | 21 | 20 | -1% |

| 46 | Shingles, wallboard | 17 | 19 | 11% |

| 47 | Vegetables | 17 | 19 | 11% |

| 48 | Agricultural machinery, equipment | 15 | 19 | 25% |

| 49 | Camping apparel and gear | 14 | 19 | 37% |

| 50 | Bakery products | 15 | 18 | 21% |

| 51 | Natural gas | 10 | 18 | 71% |

| 52 | Automotive tires and tubes | 14 | 17 | 21% |

| 53 | Toiletries and cosmetics | 15 | 17 | 14% |

| 54 | Meat products | 15 | 17 | 8% |

| 55 | Iron and steel, advanced | 13 | 16 | 25% |

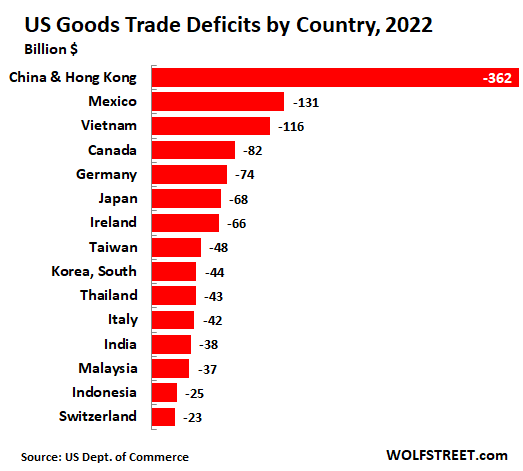

The Goods Trade Deficit, by Country.

Below are the 15 countries with which the US has the largest goods trade deficits. The opaque nature of international trade, such as trans-shipments through third countries, trade invoicing via third countries, etc., produces special effects, such as Ireland, which actually doesn’t export much to the US, but in which many huge US companies have entities – often just mailbox entities – through which winds the paper trail of their imports for all kinds of reasons. Vietnam has become a major transshipment center for China’s exports to the US to dodge US tariffs.

Driver behind gigantic imports of goods: Corporate America.

We cannot blame those countries. The driver of those imports and the gigantic trade deficit is the search of cheap labor and cheap products by Corporate America. The motivation: boosting profit margins. And under the doctrine of globalization, US policies have encouraged rather than discouraged Corporate America to globalize production for over 30 years. So here we are.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am a small manufacturer. I would love to produce my products here. The challenge is all my competitors are buying oversees so I need to be able to compete with there prices. Plus to make it here with similar cost would mean coming up with a lot of financing to make the process highly automated which is both risky and costly.

A guy in china can buy a 20k machine get a few worker and start to produce. plus he has a supply chain of replacement parts and technicians to service the machine and on top of that they get tons of free money, I think it 80-250k loan per company you export to or something like that.

Yeah but consider…

A couple years ago I spent (no exaggeration) 10-man hours searching for a new coffee maker. I had two requirements: A) it didn’t suck, and B) hopefully made in USA due to ‘A’… which is why it took a literal 10 hours of research to find.

Best I could do was find a BUNN at least mostly assembled in USA and after 2.5 years, it still works like it should and makes good coffee. I paid a nice penny for it, too. As reference, my previous two Chinese made trash makers only lasted about a year and half each.

Point is- I’m not alone. People are tired of buying cheap, worthless crap and are willing to pay more if it doesn’t suck… whatever it is your making. But that’s the key- don’t suck. Cause no one is lining up to go buy a Chevy Malibu or Ford Escape.

I just did the same search to replace my aging Keurig machine. I was looking for a percolator type and couldn’t find one made in the USA. So I lowered my standards and went to Walmart and found an “open box” programmable Mr. Coffee drip machine marked down to $13.47 from $39.99!

And it works too! If it only lasts two years, that would be great as I may not last that long at my old age! If it quits, I could always go back to pods @ roughly $0.50 each (San Francisco Bay brand).

Hopefully you’ll have to buy several more of them. I always enjoy your commentary.

+1 to what Bobber said.

I’m still using my parent’s 1950s Kenmore percolator. Works like new even now and is very retro-cool to boot. You can find them on certain auction sites for cheap every day. No plastic except the phenolic handle on the outside. And no filters needed.

Way back in the 1970’s I purchased a very simple Mr. Coffee 4- cup drip machine (and it still works). Back then, no one make a “programmable” coffee maker. Simple is usually best

With you, agree, we search for non-Chinese, etc. items, Joe above does not understand & expect will not change…

I too needed a drip machine during the worst of the pandemic after several failed $100 Cuisinarts. As a result of the EU-Canadian trade agreement signed several years ago, we are seeing more imports of quality European appliances. I bought a Technivorm, made in the Netherlands at three times the price of a Cuisinart, but destined to last ten times longer as a result of repairability and available parts. Less Chinese originated landfill as well.

Bob—

Yep, I love my Dutch-made Mochamaster Technivorm coffeemaker. It’s lasted 4 + years already and going strong. I feel like I’m back in a high school chemistry lab when I watch the coffee brewing.

Maybe we should go back to products ,Without semiconductors. Appliances couldn’t be programmed to break down as soon as warranty is expired. Happened to me SAMSUCKS then spent 500$ still doesn’t work right don’t buy that JUNK .Although there tv s seem to work well gotta be fair

Um, pour-over?

Or a press? I’ve had to replace our press twice in 15 years because I have 5 thumbs on both hands before I get my first cup down.

Now I have to wring my 5 thumbed hands over our gas stove.

“Point is- I’m not alone. People are tired of buying cheap, worthless crap and are willing to pay more if it doesn’t suck…”

You’re not alone. I’m in that camp. I do a ton of due diligence when buying stuff, doing my best to avoid China. Amazon should have to list where stuff is made, because it can be tricky figuring it out (although many listings are so obviously Chinese…).

Problem, though, is when it really comes down to paying $40 vs $60 for something, MOST people go with the savings.

Recently I was tired of looking for cheap socks that I could stand to wear, and ponied up for some made in the USA socks. I don’t know if they were worth the money, and I wasn’t really in a good position to spend that much on socks. But yes the sentiment is out there, it’s just not always followed through on or available. (For the record, the sock company is ZKANO and based in Alabama with US grown cotton.)

Joe I want to thank you for your efforts to continue to manufacture or assemble in the USA . Your efforts are appreciated especially by your community. Hard to unwind 3 decades of investment overseas. Similar to rebuilding USA generating capacity with renewable energy when the existing one already more efficient. I’m sure that investment is happening overseas as well (haha). You said exactly what the issue is with corporate operations moving overseas for cheaper labor and financing while wallstreet and private equity has enjoyed the unlimited tap of cheaper money to buy back shares vs reinvest locally . You present the complicated picture and you would be out of business if you don’t import goods . Thanks again

Joe,

Your posting reflects the challenges that I’ve heard from many small manufacturers. Automation requires lots of up-front investment – and some of the cost advantages gained there are increasingly-eaten up by increased energy costs (robots do not run on coffee & ham sandwiches).

Plus – there are practical limits to reshoring in the absence of reliable domestic suppliers. Here is a nice article to illustrate the challenges: https://www.bicycleretailer.com/industry-news/2022/12/07/townley-brutal-truth-about-reshoring#.Y-O5La3MK38

A very useful comment. The info on subsidies in particular. People don’t appreciate how much that tilts the playing field.

Thank you for the battlefield level view. Your experience and viewpoint is particularly important for tens of millions of Americans to understand and act upon (economically and politically).

(Do you know of any good, 101-level websites discussing basic manufacturing processes and their distortions over the last 20 yrs? It is the mix of process knowledge and intl economic forces that are key).

The absence of a US supply chain for component parts is particularly scary. Integration/assembly knowledge might be lost…but it can be relearned. But if the *component parts* become unavailable (say because China stops taking our instantly dilutable IOUs to “pay” for real goods they send)…that is a nightmare of Covid-surgical-mask scale. Hopefully other intl component suppliers are avl.

I will be mulling over everything you said.

One massive factor, far too rarely addressed – how the ZIRP inflated cost of housing places a very real, very dangerous floor under what people can possibly work for domestically…almost essentially ruling out *crucial* industries being US based…anywhere in the US.

The more ground level knowledge you can share, the better off we will all be.

(For instance, if you had to restart your business from nothing…what manufacturing info sources would you look to first? Vast swathes of America may someday have to restart from zero.)

I’m thinking of something like a ranked order list of manufacturing skills/knowledge (CNC programming, supplier databases, hierarchies of production process trade offs – ie, stamping is fast but less precise, etc) that could be a blueprint in a ntl emergency.

(You would think the US gvt or military would have Offices dedicated to this, but the entire experience of my adult life is that most US institutions are vastly over-rated shells of near nothingness)

America somehow stood up massive industrialization in WW2…so *theoretically* it is possible…but this is a much degraded country…without adult leadership from *any* source you get inevitable drift and ultimate disaster.

(I reflect upon the development of the “Grease Gun” in WW 2 – large numbers were needed in a hurry, with limited resources…the result wasn’t pretty or perfect…but it got the job done in a time of crisis. The Liberty Ships might be a moderately more attractive model).

The fundamental issue is how to generalize re-industrialization skills to many industries, at relatively low costs, and to do it in advance.

Since so much of this would be *info based* it should at least be theoretically possible…if *anybody* in a position of authority/resources bothered.

If you watch Shark Tank which I don’t anymore, the number one question is “do you have a Chinese supplier” Yes your’re in, No you’re out. I buy US whenever I can but it’s tough to find and I keep looking.

“The challenge is all my competitors are buying oversees so I need to be able to compete with there prices.”

Correct, buyers does not care where product is produced.

Reminds me of a time, several years ago, a major retailer (think largest in America) told us they wanted American product sourced through domestic suppliers (two levels deep). We were more than happy to oblige but made clear several times that their would be an associated premium. We make it happen, win a ton of new business, they’re very happy, launch a PR campaign touting the initiative…

Fast forward 18 months and we’re losing bids on products we ship to them at a loss (they drive volume, gives us clout with our suppliers, drives down our overall cost, we make the loss back elsewhere). We KNOW every source of raw material, we KNOW we pull enough volume from sources to dictate price, we KNOW we’re losing money on every box that goes out the door to them, so point blank we ask… What gives??? They come back and tell us the other guy came in a nickel lower, to which we respond, the other guy is not only sourcing material overseas, their factories, headquarters, and everything else about them is overseas as well… They shrug and tell us, yea but we saved a nickel. LOLOLOL.

I don’t know what business you’re in, I’m sure you know it better than I… but it feels to me like the wind is starting to change directions again. In my humble opinion, think about slowly starting to bring back whatever you can economically where labor inputs are LOW, for everything else think about dual sourcing even if it cuts into margins, and finally keep in mind that whatever you are paying today, the actual labor component is about a third cheaper in Mexico after backing out the national subsidies you refer to. That’s likely to be a trend that continues well into the next decade.

Thank you for these thoughtful blogs. It would have taken me months to find this data which you so eloquently presented.

I also like your interesting interpretation of the data.

best wishes

The crude oil improvement in exports is probably the result of the “new” oil field discovery called the Strategic Petroleum Reserve.

It’s not material. I’m against using the SPR for political purposes but that doesn’t make it material.

I’ll just repeat my comment here:

1. It’s relatively small, given the overall volume of US oil production.

2. You have to look at the other side of the equation. That selling from the SPR — amplified by concerted selling by several countries at the same time — we’re talking about market psychology here — brought oil prices down, and lower oil prices mean lower export dollars, which is what we count here. The price of oil plunged about 40% from the high early 2022!

A breakdown of the trade deficit by *product/industry* is enlightening (it can be done by netting imports against exports individually).

I’ve looked into it before…the takeaway is that the trade deficit nightmare is concentrated in a smallish number industries (either because of those industries sheer size or particularized American incompetence).

1) Oil – Deficits here get huge but are volatile. Fracking *had* helped in a major way.

2) Autos/auto parts – 40 to 50 years of continuing US failure in one of the key manufacturing processes on Earth.

3) Computers/smart phones – An auto-industry level disaster for last 20 to 30 years. Left unaddressed, this will end America as we know it. And yet, Fed programs like chip reshoring often become sewers of noncompetitive corruption.

4) Electronic components – See #3.

Those 4 industries (out of many hundreds) may account for 50%+ of the trade deficit. But they are huge and crucial.

Amen bruddah. The aircraft industry will disappear soon too. Max ten years if not sooner.

Moi,

The thing is, if we could just turn a corner on these 4/5 industries, the nightmare would at least stop growing.

The problem is how to manage an achievable (no political consensus rqd – DC rather suicide than think, no corp money willingly avl – corp leaders profit from existing debacle for US) changes in a relatively short time.

Diversifying import sources (if possible) could theoretically be done fairly fast (help save this old fool nation, India/Mex…) and in theory the internet *could* teach re-industrialization basics very quickly (but where are the American-made Covid respirators and masks that were bandied about by industrial blowhards three yrs ago…).

The perpetual failure of US institutions for 20+ yrs now has me very frightened.

Hi Wolf …

THANK YOU for spending TIME

keeping me updated on the USA Economy

Why is everything measured in dollars here? Wouldn’t it be more appropriate to measure deficits against a basket of currencies that have been weighted out? Plus it’s normal absolutely normal for a rich country to have a deficit with poor country it’s normal nothing that unusual about that it’s happened for centuries that way. So what’s wrong with that? It’s like saying that a deficit between North Carolina and South Carolina could be some sort of issue when it’s a nothing Burger

Why would it matter what money it’s tracked in if the converted final number is what wolf has stated?

How can you look at 1,000,000,000,000 dollar figure deficit and think “well we’re losing the money to poor countries”

“Why is everything measured in dollars here?”

You’re funny. You apparently haven’t figured this out, so I’ll help you: we’re in the US, this is the US trade data, and the currency in the US is still the US dollar, as much as some people hate that, and it’s this hated US dollar with which ultimately all imports are paid for, and most exports are paid for.

“it’s normal absolutely normal for a rich country to have a deficit with poor country…”

No, that’s not normal at all. Most of the rich countries have long-term trade surpluses, or have a balanced trade, such as the countries in the Eurozone, including Germany, which has a huge trade surplus, and it includes surpluses with poorer countries. Japan has a history of trade surpluses, which turn into deficits only when it has major issues with energy, such as the Fukushima disaster, after which it shut down its nuclear power generation across the country and had to import vast amounts LNG to replace nuclear energy; and in 2021/2022 when the surge in energy and commodities prices caused the cost of those imports to spike. That is now unwinding, and the trade balance will return to surplus over the next few months.

“like saying that a deficit between North Carolina and South Carolina”

That is the silliest comparison I have read all day, LOL.

Brian is just myopically regurgitating the clearly failed pieties of certain wholly-detached-from-empirical-reality schools of economic thought.

Simply repeating things endlessly in Econ 102 circa 1987, doesn’t make them *true* in reality…they are theories (predicated upon *assumptions* that the myopic ignore).

Don’t be lulled to death…re-examine *what has actually happened* over 35-50 years.

I love it!

I’m glad you responded to my comments because that was an exercise to see if you’re actually listening. I totally knew that these questions were stupid and I’m glad you explained everything to everyone because well other people have the same thoughts and I’m that guy in class who’s typically as smart as the professor and ask the questions for the professor to answer so people understand what’s going on. I’ll do that with you occasionally and I hope that’s okay because some of these issues are hard to understand I’m not sure you explained anything but you try and give it some effort and I guess that’s enough for now until I get bored with all these dumb comments and essentially responses that well put people down so that’s internet these days pretty vicious pretty useless and the ultimate end of humanity. I’ll see you in heaven!

No, it’s not at necessarily normal for a rich country to have a deficit with a poor country. It means that the poor country is getting nothing in return from the rich country except that country’s currency. Unless it’s using that currency to buy usefully stuff from other countries, balancing trade overall, it’s losing in real terms. If those countries, too, are running trade surpluses with that rich country, the rich country (overall) is consuming at everyone else’s expense.

And eventually the exporting countries get sick of being paid in immediately diluted USD…and will shift exports elsewhere or turn production inward.

DC policy has been playing economic Russian roulette for decades.

My random observations are:

Ironic to see growth in all US exports of services except financial services and insurance.

Since jewelry has its own category within goods imports, is non-monetary gold (#15 no less) some kind of dental cartel?

Finally, you can lecture all you want about Ireland’s distorted trade deficit being the result of postal shenanigans, but I’ll vouch that a couple of hundred bucks of the $66 billion deficit in goods is real. Nothing like a Guinness!

Otherwise – wow! I understand reserve currency and stuff, but this can’t go on forever, can it?

Can you venture an expiration date to all this if nothing changes?

Above all, thanks for the article. Who else reports on it but you?

The problem is not how to feed the poor, but how to feed the rich.

The export side of the equation looks better than it would’ve been by circa 10 billion $ due to Biden’s selling of mericka’s strategic oil reserves!

Well, no.

1. It’s relatively small, given the overall volume of US oil production.

2. You have to look at the other side of the equation. That selling from the SPR — amplified by concerted selling by several countries at the same time — we’re talking about market psychology here — brought oil prices down, and lower oil prices mean lower export dollars, which is what we count here. The price of oil plunged about 40% from the high early 2022!

Well, no, Wolf. Why hasn’t oil rebounded back to over100$ if it dropped due to SPR sales? Don’t say OPEC as they have kept output relatively stable for the past several years.

And it didn’t plunge. It worked its way lower over many months as the war premium eroded, as did many other commodities.

What’s the saying?

Death and taxes….and a yearly trade deficit.

Glad we have king dollar to export some of the inflation

In the last 6 months DXY is down from 115 to 100.

Our service to the world : we rule the waves from South China sea to the

Gulf of Oman. We control every choke point in the world, on the waves, in the sands, the air and space. Without our service bad things can happen.

Boeing never recovered. Our export to Ukraine is hidden somewhere.

My friends in Vietnam and Middle East mention the export of military frequently thanks for raising that great point .

Lately it has jumped back up to slightly over 103 but it looks like that rally has run out of gas for now.

7 comments so far and none of them have anything to do with the main point you made: Corporate America has abandoned American workers for cheaper labor and greater profits. There are now oligopolies in almost every industry.

And to “All Good Here Mate”‘s point about products that “suck”, American producers are TOTALLY capable of producing the best products in the world. It’s just a matter of paying for that quality in the production of those goods.

Yes and no.

Corporate America seeked for higher profits and larger bonuses for their execs. This is the way of capitalism. Unless it pays to play “nationalism”, why should they pay Americans 5x times that of other workers. If Americans don’t have jobs and can’t pay… but that doesn’t seem like the case here.

The USA does not have “industrial capitalism” is has a sort of “financial capitalism” where it is possible (in the short-term) to generate huge gains by “reaping without sowing” if you will.

And Americans “can’t pay” based on their credit card balances – which forever requires “debt deflation” to keep the scheme going..

If only there was an alternative economic theory.

I prefer corporate feudalism with .gov as the largest corporation.

Something no one here mentions, nor seems to care about:

American workers have the most expensive overhead in the world, which they pay (after taxes) out of their wages.

1. They pay the medical cartel for the most expensive health care in the world.

2. They pay for their own education (training). Another field that is seemingly dominated by for-profit private schools.

3. Should I mention housing here too ?

All valid points illustrating the baseline uncompetitiveness of America…and its sources.

When they print Monopoly money,everyone has money because it’s worthless. Wonder what rich can buy with worthless dollars.DONT THEY REALIZE ,THERE NUTS WILL BE CUT OFF TOO ,GOD BLESS THIS MESS

Yes..corporate sought more profit, AND consumers sought cheap. I ask my customers how much more are they willing to pay for employees to have that “fair wage”, plus FPML, plus benefits, etc.?we all should be willing to pay for excellence and pay for employees to prosper. They are our families, friends, community. Cheap is not on either side of the equation.

If their wages had kept up with inflation, they would be able to pay. Please stop blaming the workers for their losses in real wages over the past 40+ years.

Not blaming the workers, but assigning value to their work, which we as consumers should be willing to pay to insure employees get a fair wage. If companies refuse, employees do have options, unionize, or shift jobs, just as we have experienced in the last year. Also, yes, companies need to be less greedy, which is the other half of the equation.

“Please stop blaming the workers for their losses in real wages over the past 40+ years.”

Why?

They as a voters vote for socialist nonsence, which directly or indirectly cause inflation.

Who is this ‘we’ kemosabe? There is no we. Your wages and expenses are your issue, not mine -typed from my mostly foreign-made computer.

I’m willing go America,being destroyed by greedy corporations. Bet you 2$ none of Bidens tax increases pass . Rich politicians don’t raise there own taxes .Corporations RUN this country,you want cheaper prescriptions eliminate tax write offs for food ,my daughter works in a doctors office,prescription representatives feed whole office 3 times a week . We pay its BULLSHIT. America can be fixed in a week ,But corporations and the rich have to PAY TA XES

“Corporate America has abandoned American workers for cheaper labor and greater profits.”

Maybe American workers where too greedy comparing to hungry 3th world workers.

Corporate America employs more Americans than ever before. America already produces more than it ever has, it’s just in highly value-added stuff not TVs (which are indeed better than ever, as well as computers).

damn, i thought the oil & gas prices would lower the trade deficit for the US in 2022.

I just looked, I thought that at least the trade deficit between Germany and the US would have shrunken in 2022, but nope, it increased by 5.4%.

There’s been a lot of panic-buying of German-made stuff since Q2, 2002 based on fears that those goods may soon not be available.

Oops…meant Q2, *2022*!

When you go through de-industrialization, knowledge is lost and therefore a point of no return is made. It will only get worse.

Correct. See my postings below.

Chinese/Asian advantages are far more than cost-related now and their cost advantages are far deeper than mere labor costs.

It’s not about the higher profits. Its about the distribution of those profits. Why should CEO’s make 400x their employee’s wages now!!!! In 1985 that number was 50. Wonder here the middle class went. The upper class ate them.

On top of that, companies whi abandoned their US workers were allowed to repatriate offshore profits tax free. They promised to invest it back into capital and labor. Most of it went to stock buybacks at the top of the market that benefitted those same 400x CEO’s and top shareholders.

The inflated multiples for C-Suite compensation are substantially the result of financialization from equity compensation. No asset mania, much lower compensation.

It’s awful corporate governance, but concurrently, there is no “right” multiple in the sense you imply.

Its not really American companies dumping US workers, they don’t care as long as it sells.

Its that US workers prefer to buy cheaper foreign goods. It wouldn’t matter even if those overseas dollars came back with balanced trade, but trade isn’t balanced because you have the curse of a reserve currency.

Notably, the Japanese who do tend to buy made in Japan whenever possible, will have a hell of a time finally unwinding their decade long trade surplus because the reverse is to flood their own market with goods manufactured overseas,and one of these overseas markets is going to be a producing US. Same for China. Mercantilism can’t work forever.

However, my point is Corporate America certainlyl didn’t abandon the US workers, they abandoned themselves. Nothing has ever stopped US workers buying Made In the US. I remember watching some program asking low-income Americans why they thought Nikes were so cool when the company wouldn’t even consider creating any jobs in the US (that was a while back).

Its another snag in the fiat system. Under gold the outflows would inevitable stop as the US ran out of gold. If Nixon hadn’t issued more dollars than redeemable gold the US wouldn’t have had to abandon the gold standard, which itself traces back to the need to fund the Vietnam war. Its amazing really how the consequences of all these events stick with us negatively decades forward like glue, forced into fiat, the distortion of post-war baby boomers, Greenspan put etc

I invested in a U.S. company that owns 25% of a foreign company. Somehow them exporting to the U.S. may help me.

I was told some time ago ” You can buy a finished product from China for the same price as the raw materials alone cost from an American manufacturer. That is just mind blowing.

Yes. China’s cost advantages (and they have more advantages than mere cost advantages, btw) – go well beyond the hourly wages paid to workers.

But why would China’s input costs (natural resources are globally priced, component exporters will sell to all comers) be intrinsically lower than US’ costs?

You weren’t addressing me, but the answer is massive government subsidies for their companies has been going on for a while, a “growth at any cost” mindset, where they paid for ghost towns to be built, subsidized entire industries so they could take over those industries from other nations that didn’t subsidize them, and basically zero health and safety or environmental regulations (and a big toll on the health of their land and population because of that). Any country can have super low costs if they have zero regulations and don’t care if the industry makes a profit.

That is almost exactly correct.

I got a contract from Honeywell to do a made in America version of a product they buy from China as a finished, boxed item. My costs were the same as their price.

I can offer up some “good news/bad news” observations concerning the 2022 trade picture. Unfortunately, it’s mostly the latter…

The only Good News was that we saw exaggerated imports of Consumer Goods for most of 2022 based on several factors including: too-optimistic expectations of consumer demand, shipping congestion, and China’s Zero-Covid lockdowns. As these began to play out – retailers found themselves with too much inventory and those imports began to normalize in the last 1/3rd of 2022.

Now for the Bad News…

Wolf’s treatment of the problem – i.e. the ever-present striving of corporate America for higher margins arising from cheaper labor – is a bit too simplistic now. And that’s the bad news.

Until about 15 years ago – I’d say that lower labor costs were basically the sole driver of offshoring. It’s still a key piece – but there are now several components here and they add up to a much more secular/intractable problem.

China has a colossal advantage in manufacturing expertise (including workforce skills), supplier ecosystems, infrastructure, cheap energy, and a much more straightforward regulatory and taxing scheme. It would be extremely difficult/expensive to replicate that elsewhere – particularly the West.

Right now – for a product of any real sophistication barring a few sectors – you are building it in China or you are not building it.

It gets worse. Given that China has become a sort of gateway to the rest of the growing Asia markets – it doesn’t make a whole of economic sense to replicate this on a wide scale. By that I mean – as the USA becomes a smaller slice of the demand pie – it simply makes more sense to build it in China or other ASEAN countries and export it to N. America because the size of the market in N. America simply doesn’t warrant the investment to produce there.

There’s nothing on the horizon that makes me think this is going to change.

There’s really not much broad-based workforce development in the congressional bills that have passed in the Biden Administration (the original “Endless Frontier Act” – DID). There are no great industrial infrastructure gains in the IRA or the Bi-Partisan infrastructure bill, either.

Here’s a graph that would tend to dash the hopes the hopes that there’s some broad-based re-industrialization going on in the USA. It concerns the import of capital goods – which is “the stuff required to make stuff”. If a major re-industrialization effort were underway (like the Chinese performed in the 80s and 90s) – you’d expect a big surge here.

https://tradingeconomics.com/united-states/imports-of-capital-goods

There’s an uptick here, yes, but it’s by no means a “surge” and it seems already to have plateaued (the latest data is for November, 2022). If I were “uncharitable” I could actually explain away the entire increase without concluding there’s any sort of increase in industrial capacity expansion going on in the USA. But I’ll give it the benefit of the doubt and say that while there probably was an increase in industrial-related activities in the USA – it’s very marginal. And I very much doubt it’s going to continue in any broad-based fashion given the increasingly-ugly PMI data of the past half-year or so.

“It concerns the import of capital goods – which is “the stuff required to make stuff”. If a major re-industrialization effort were underway (like the Chinese performed in the 80s and 90s) – you’d expect a big surge here.”

Here is the long-term chart of the link you provided, of capital goods imports. Year-over-year: +13% per Census data and up substantially from prior years:

Wolf,

You are definitely right to point this out, but…

A 13% gain is not a HUGE upsurge and whatever component of that gain reflects “net reshoring” is eroded by several factors including:

a) The expected bounce accompanying the CapEx plunge associated with the pandemic

b) Inflationary factors (though the USD was strong for much of the year)

c) Demand Pull for capital goods from certain markets due to availability concerns

It will be interesting to see what Capital Goods imports do in the next several months.

In any case – I am rooting very hard for domestic manufacturing to recover and thrive. But it would take a HUGE shift in how our political economy operates and I don’t think either party is proposing anything like the changes required due to a combination of vested interests and a general ignorance about the nature of the actual problem.

From a purely “information-based” perspective (steps requiring no immediate political changes/adulthood or sizeable upfront financial investment) can you think of three steps/information sources that could help aid American re-industrialization (to any decent degree).

I am getting more concerned (frightened) than I have ever been about America’s (near term) future.

For 20 years and three busts, I have seen nothing (*nothing*) but counter-productive “solutions” come out of DC/corp HQs.

The word is reckoning…and absolutely no one in a position of power has done anything about it for decades.

All I’ve seen is institutional failure after failure.

To rail against corporations as the “cause” of these massive trade deficits is baloney. The root cause is much deeper and nuanced.

Large corporations are simply following the money, just like legislators. You can’t blame them, but we certainly should be scale back their size and influence.

How many times did Trump and Biden meet with large corporations and trade organizations? Compare that to the number of times they met with labor organizations.

There’s your problem. There’s a misguided notion that corporations represent their employees, so if you coddle corporations, you help the employees as well. The employees may be served to some extent, but corporations don’t care where the employees are located.

TRUMP passed a tax cut for himself = business and we wonder why this country is going to shit .My son owns 4 companies never hab so much money ,always traveling hardly working. Great life ,first 10 years were really tough .

Here’s one little datapoint. I’m a product manager for a multinational that makes medical devices – our exports are down this year, particularly to the UK, thanks to Brexit. The Tories have so completely f’d over healthcare, decimated demand, and caused a mountain of new bureaucracy (never mind managing to create the worst performing economy of its kind in the Eurozone) that we are now stopping any effort to ‘push’ product to the UK and redirecting resources elsewhere.

We now look at that region like we look at Argentina. A 3rd tier market. Word to Red States. That’s what asinine culture wars get you.

Evan,

IMO, the UK is at serious risk of experiencing what played out in Lebanon a couple years ago. It would require amounts of FDI to restore to any sort of economic health and it’s not a good destination for it.

You were good until you injected RedStates. That diminished your assessment.

I think he was just reporting his experience. I’ve seen a lot of people in blue states making a lot of money. They just don’t understand that the things they are doing don’t justify that pay, and that sooner or later, reality will assert itself. I’ve seen that happen, too, and it is always a hard adjustment, being unemployed, then taking a job with much lower pay and prestige.

Good point. I’ll actually go a bit farther…

Blue States – States that benefited from the USA’s substitute of Finance Capitalism for Industrial Capitalism

Red States – The states that did not benefit.

You were good until you injected RedStates. That diminished your assessment.

Maybe that’s how he sees it? Just because someone sees the Red States as crime ridden, poorly educated, low income places doesn’t mean that it’s not true.

This wasn’t helpful. I live in a blue city in a blue state and the crime is very high, the education is one of the worst in the country and there are many here who don’t have the income to afford rent, because of bad policies by the city and the state.

True. The Red/Blue comment diminishes the argument.

(I myself am kind of in no man’s land. I like the lower taxes and government of the red states, but I prefer friendships with and to socialize primarily with blue-state type liberals.)

Hilarious, he said that clearly to start some culture war skirmish while bemoaning culture wars. Remoaners aren’t the brightest.

LOL Britain’s inflation is lower than much of Europe’s. Just wait until Italy blows up. It’s been nothing but vindication for Brexit and sour grapes from Remoaners so far, and it’s just getting started.

My mom at 90+ still does amazing things on a Singer sewing machine, every year since bought in 1952. But how could we support the current global “lifestyle” economy on that?

Teaching college, I am having an upswing of foreign students. very welcome as I am also exporting the best of USA’s principles, as ‘business law.” Some cynicism has to be disseminated in that package too.

Is she selling clothes?

phleep,

My mom grew up during the depression and learned to sew as a youngster. When she was an executive editor at West Publishing in the 1970s & 80s, she took pride in her ability to sew perfectly tailored, and beautiful suits and skirts. Formal dress attire was the norm for men and women at West back then.

My sister and her oldest daughter have some of mom’s skill with a Singer sewing machine too, but they don’t take it quite as far.

Thanks for the comment that made me think fondly of my mom.

“Planned obsolescence” was conceived of and defended by minds like Edward Bernays in order to “preserve” the manufacturing jobs in the US that developed during the war-time boom by creating a stable and endless demand for what we used to deservedly call “durable goods.” Durable goods were “clarified in the 90s to mean “something that lasts for several years.” Hmm. I wouldn’t consider a refrigerator that breaks after 3 years durable.

As it turns out, these measures didn’t save manufacturing jobs and now we have cheap crap from around the world that somehow breaks faster than the stuff we used to crank out that was designed to break after a fixed period.

There is an economic argument about it, though. If you make a rain coat that lasts forever and is highly resistant to rips and tears, your realistic upper limit in how many you can sell in the US is around a hundred or so million (about 1 in 4 residents), and that’s with minimal competition. That’s why advertising (I need the best), brand loyalty (I’m a Nike guy), and novelty (I need the newer version) have been the dominant aspects in American markets. It’s a lot easier to get people to buy cheap crap that lasts half as long (or less) as the same goods made 3/4 of a century ago with some cheap bells and whistles (look, we stuck an iPad on your refrigerator!) when you convince them it was their idea and it’s what they actually want.

I have a couple of old singer machines with motors that can perform leather stitching for wallets belts etc.. Great machines, simple and strong, In general anything bought after the 1950’s was not made to last, once plastic was introduced to sewing machines.

Now that I’m semi-retired I don’t use them as much. One of the machines was built before 1920 and I use it for my own clothes repairs. The other has a long arm arbor, and the needle can rotate 360 degrees. For instance, It is good for sewing the mouth of a shoe where a flat stitcher couldn’t.

There are still a lot of good old steel sewing machines around that were used during the depression, and they still run great, like a broken in baseball glove.

People might need skills and machines like that again in the future. You don’t have to use the electric motors with either of them, as you can just turn the drive shaft wheel. I have replaced the round leather drive shaft belts a few times, and oil them occasionally.

Magnificent article, Wolf!

“In a note released Monday titled “Transitory Disinflation?,” JPMorgan strategists Marko Kolanovic, Thomas Salopek and others indicated that companies face the difficult choice of either laying people off or seeing their margins worsen, and right now “we continue to be on a path toward worsening margins, which will eventually produce layoffs.”

Dollar a wee-bit weaker and trade balances probably stay ugly as far as the crow can see. Globally, everyone is in the same boat, going nowhere. Beware of giant squid!

I don’t think people realize how deflationary those Chinese lockdowns were for the USA.

Lockdowns disrupted production *schedules* but overall production were not negatively-affected. Delivery simply ebbed and flowed.

Effects of the China lockdowns included:

a) Dropped the Yuan considerably against the dollar (deflationary)

b) Suppressed consumer demand in China (which led to things like export tariffs being removed – again, deflationary)

c) Reduced demand for commodities, particularly energy (again, deflationary)

With China re-opening – that all goes away. And if consumer demand recovers in a meaningful way – economies of other Asian countries that trade heavily w/ China will also speed up and that’s going to increase commodity demand and prices.

The FOMC talks about Russia/Ukraine and is only just ceasing to talk about the Pandemic – but they have a real blind spot for what is happening with China which could be highly-inflationary.

BigAl, China is forefront on many minds and mouths. I keep hearing about it all over the place. So I doubt there’s any blind spot. If anything, the “re-opening” is overdone/overthought.

Look at their GDP. Barely dinged. China has largely been open, regardless of what we think.

What is the story with petroleum? Why is it both such a large import and export? Is this all unrefined oil ?

The link below is something from 2019 that explains the dynamics of US crude oil and petroleum products imports and exports. The numbers are outdated, but the dynamics are still valid. I may have posted more recent articles on this, but this is what found quickly.

You will see in it for example, that California imports a lot of crude oil, refines it, and exports gasoline, diesel, jet fuel, etc. mostly to Latin America. This is a huge profitable trade. The Gulf Coast is also full of these types of operations, but they mostly use US-produced crude oil.

The trade in oil and petroleum trade is huge and complex, and it includes the US petrochemical industry, the largest in the world.

This article is in terms of barrels, not dollars, so you see the actual volumes

https://wolfstreet.com/2019/11/29/us-becomes-net-exporter-of-crude-oil-petroleum-products-for-first-time-but-energy-independence-is-complicated/

Here are the import-export numbers for 2021 in terms of barrels. We’ll get the 2022 data in about a month, and I will report on it:

I purchased a new 5 axis machining center for my business this last year. The one I got is assembled in Indiana, from machined Taiwanese castings, using an American engineered and built control driving Japanese motors, and motor controllers. There are no longer any fully US built machine tools, but this is not just a matter of money. They have thriving machine tool business’s in Switzerland, Italy and France in addition to Germany and Japan. It is just an industry we abandoned as a country like industrial robots and machine controllers. I got all my tool holders and work holding from Switzerland also, I am able to get almost 100% of my carbide tooling from the USA ( and I do) I can even get the bulk of my carbide tools from a local small business , courtesy of their 5 state of the art tool grinding machines from Switzerland.

Yes, the USA certainly depends on imports for Capital Goods – like the Machine Tools you mentioned.

Getting that sort of stuff back to the USA would take decades and nobody in Washington D.C. is really offering a useful roadmap for doing that. “Free College”, or tax giveaways that reward passive income (I’m looking at you, TCJA) – ain’t gonna cut it.

Similar experience with less sophisticated but still specialized tools we work with. The frustrating part is some of them are made in the same factories under different brand names for the European market and sold there at a substantial discount, exact same tool with same specs, not available for us in North America.

1) US trade deficit : possibly an inverse H&S. In the next recession we might get a RS to complete an inverse H&S.

2) Crumb people will produce real stuff with AI and robots. There will be a shift from high tech Ripper to tomorrow, more productive high tech.

3) China & HK @ (-)$362B is an aberration. It’s about the size of Mexico, Canada, Vietnam and Germany combine.

4) We will prick that balloon.

4) “We will prick that balloon”…with a $380,000 sidewinder missile traveling 1,900 mph, launched from a $200 million Raptor jet. The CA balloon-chair-guy could have done it for slightly less using a sharped stick?

5) Tom Cruise, The Last Samurai, could have pricked that balloon with a ninja blade and grabbed the thousand pound plus payload with his bare hands, with Eyes Wide Shut.

6) Trade deficits won’t matter in the end, if we continue to use fiat currency-n-bonds at financial weapons. Zero sum game, reset possible and/or inevitable?

Lets Build Back Better!!!

Refill the Strategic Petroleum Reserve.

Made in the USA 🇺🇸

Is all the fentanyl coming across our borders included in the pharmaceutical imports? Just joking. Thank you for the meticulous accounting of the US Trade Deficit.

While I appreciate the personal data points listed by various commentators about why they can’t manufacture in American any longer, the truth is that, for most high tech goods, labor is a very small component of cost. Unless your business is running a sweatshop making nike sneakers, or using illegal immigrants to pick strawberries, labor costs are likely a small component of your costs.

For example, it’s estimated that less than 5% of an iPhone’s cost is labor. Moving production to the US would raise the price of a thousand dollar iphone by about $10-20.

IOW, it’s not “lazy, overpaid” American workers that are “forcing” companies to move work overseas. It’s other stuff, usually things like lax environmental regulations, and tax advantages. If we change those things, we would see a lot more manufacturing in America without having to race to the bottom of wages.

Also, a word on Ireland. Wolf glossed over it, but I think it’s the most appalling part of the whole graph. Ireland is a tax haven. So major global corporations (and others like Bono’s U2) domicile their intellectual property there. Here’s how it works: you develop your intellectual property (IP) in Silicon Valley. Then, the American corp “sells” that IP to its Irish subsidiary for $1. So America gets 30cents in tax on that sale. Then, every iPhone you sell, you charge a license fee of $300 for all the IP that goes into that iPhone. But since it’s the Irish company that “owns” that IP, they’re the ones that get that revenue. And since IP has basically no cost once it’s produced, that’s $300 of pure profit that gets taxed under Irish law (i.e. no tax). When the iPhone is sold in America, the “profit” attributed to the American corporation for selling it ends up being close to zero: Foxconn in China gets its revenue for producing the actual phone, Apple-Ireland gets its money for licensing the IP, and so Apple-America gets maybe $5 in profit from selling the phone. And that $5 goes to pay Apple-America’s engineering costs (the people that produce the IP), so that Apple-America can show a net loss every year, and not only not pay tax, but claim tax rebates because of their losses (note Apple itself doesn’t get tax rebates but other companies do, all while reporting record profits to Wall St).

Lune,

The cost penalty you cite – of $10-20 – to move iPhone production to the USA is immensely mis-leading.

That $10-20 figure only covers assembly costs of the product from its intermediate components. If you were to move the entire supplier chain to the USA – the cost penalty would be several hundred dollars and – at the present time – it’s not even clear that that is even possible.

Sure, and the iphone is probably an extreme example of how little labor costs go into production.

This is a complex subject. Take the assembly part you mention. On the one hand you could argue if moving that would only raise prices by 10-20, why not do that? Leave the rest of the component manufacturing where it is? Something is better than nothing. OTOH one could argue that’s not really high skill or high value add manufacturing so is it really worth bringing it over?

My own position is something is better than nothing, and once you have assembly here, you’ll gradually start rebuilding the rest of the supply chain here until the capacity for hi tech component manufacturing is rebuilt too. This is how every other country did it. China started with cheap assembly services, which gradually attracted more parts of the supply chain to be built there. They didn’t start with hitech semiconductor fabs and then build assembly sweatshops.

The US still excels at high end, high skill manufacturing, like semiconductor design, machine tools, hi precision parts, etc. And that’s great. But this isn’t a zero sum game. There’s no reason why we can’t keep all of that and add more.

Also, forgot to mention, sure the 10-20 is only for assembly. But it’s precisely low-tech assembly where the share of labor cost is highest. Building the hitech parts like the microchips, screen, etc, has an even lower proportion of labor costs. At the extreme, a modern semiconductor fab costs $10bil but usually employs only a few thousand people. Just the cost of capital and depreciation of the equipment will dwarf the labor costs in a factory like that.

The entire cost of building an iphone is about $500 (hence why Apple has such high profit margins). There’s no way several hundred dollars of that is labor costs.

One thing I like about Warren Buffett is that he has built his empire by investing 90% of his funds in the US and generally in useful things. Food, energy, transportation, insurance, housing. Not any sizeable investments in explicitly harmful products like tobacco.

He learned his lesson early in textile industry that you can’t save a declining industry from going overseas for cheap labor no matter how much capital you throw at it.

Old school,

I think you are referring to “Dexter Shoes” – which closed in 2001 and resulted in the loss of 800 jobs in Dexter, Maine.

Actually, some of those ex-Dexter employees opened a small shoe factory in Dexter, Maine in 2017. It’s known as “MaineSole”. It’s a tiny operation and their shoes are not inexpensive…but they are doing OK and are even managing to grow…albeit slowly.

Old school,

Buffet no longer invests 90% of his funds in the USA. He has, for example, a very large stake in a very large Chinese electric vehicle maker – BYD.

Any comments out there on dynamics related to SPR? Seems like it’s another political football that has weird economic linkages. Obviously, gop won’t support any plan, but as we see with trade balances, dollars and deficit stuff, energy plays a huge role in everything, including keeping inflation higher for longer. Pretty wild times and headed into chaos…

The DOE solicited offers in December to begin refilling the reserve after the drawdown of more than 200 million barrels of reserve oil in 2022, but it has yet to find suppliers interested in selling at the department’s desired price of between $67 and $72 per barrel.

Question on trade deficit…

If you use Apple and calculate the net trade deficit of Apple to USA, you’ll see that the number is bad for the US. Materials/components export out of the US to make an Iphone, which come back to the US as an iphone with > 50% margin. All that profits go into bonuses for execs and high salary for tech-workers. How is that calculated into this whole trade imbalance?

Nike make all their stuffs in the China/Vietnam which then exported to the US. Does China get the bad rap for this trade imbalance when all the profits go to Nike?

The chips in the iPhone are imported into China from Taiwan, South Korea, etc. But the total cost is counted as import from China. So the huge trade deficit with China doesn’t reflect the flow or the benefit. The net benefit for China is that $10-$20 assembly. This is true for all high-end electronics.

Good stuff. I went into Home Depot just because I am curious. I checked every power tool. Every one, even high quality machines like DeWalt and Bosch, were made in China!!

I have two jigsaws – one cheapy and a very old one my Dad had before me that was made in the U.S. Older one is fine, but does not have the angle gradations for angle cuts. For all other work, it is what I use [it is also smaller than newer tools, thus easier on hands getting older!].

A lot of the tools available in Home Depot are not considered “high quality” in the trades, although most tradesmen will use them. Currently, we consider Hilti top of the line for many things but you can browse the Hilti website to compare the cost difference, it’s not small, but if you want it to last or need accuracy then the cost is worth it.

Bosch is a funny one, they have 2 lines (Blue and Green) though I can’t remember which is which, one is for Home projects and the other for professionals, we very rarely buy Bosch but the last time I did it was a hammer drill assembled in Germany (components from all over the world though). Alongside this hammer drill we purchased similar spec’d Chinese manufactured Bosch, the one from Germany cost about 2x more, but outlasted the Chinese made one by at least 4x. We had it spitting oil from overuse at one point and it just kept going. In Europe professionals who can not afford Hilti swear by Bosch, but here in Canada and USA we avoid it because it’s usually not the same tool even of it looks exactly the same.

Anyway, if one is willing to pay up, Chinese made tools can be avoided, though it isn’t just China a lot is made in Mexico as well. Most choose not to pay up and hence Home Depot carries the cheaper stuff.

I’m assuming Snap-on tools aren’t made in China. Those price tags…wow! Even their cabinets are the price of nice cars.

One thing I didn’t understand is why there is no mention of the strength of the US dollar regarding the trade deficit. Third World currencies have never been lower via a vis the USD – it’s shocking just how much purchasing power they have lost. No one in the world can afford to buy US goods – they are too expensive! Meanwhile everything in the rest of the world is marked down like a fire sale. Currencies like the Colombian and Philippine peso have been chopped in half in their USD value.

It’s not that simple: the Mexican peso has actually strengthened against the US. It’s now 18 to the USD, a year ago it was over 20 to the USD.

Indeed you are absolutely right about the Mexican peso. It cratered in April, 2020 and lost almost 30% of its value but it’s recovered almost completely since then. It’s peso brothers in Asia and Latin America have not fared so well!

Hi Wolf. Shouldn’t the US Capital account show an increase that is the exact opposite of the decrease in the current account? Maybe money is flowing into the US because our central bank is ahead of other large central banks in raising rates.

In reading the comments I have a few notations/questions or stories.

Somewhere above someone mentioned their mother using an old Singer sewing machine. Well I went to 1st grade wearing homemade clothes. For this I was shamed rather badly. My parents grew up during WWI and I still have several quilts made by my mother and grandmother. There is also a homemade cedar chest made by my paternal grandfather.

After returning from service I purchased a Ford Mustang on credit. The highest APY, I’ve ever paid. During this time I found work and it required one week to pay the car note. Another week for rent. The third week went to food, utilities, and savings. The final week was mine to spend. As shown here I always paid myself first and then spent the rest. These weeks were 6 day weeks by the way.

In today’s world I believe this is impossible.

There is also mention about ALL the regulations concerning our manufacturing complexes. This along with OSHA, EPA, and all other agencies we must pay our dear government many dollars, for some kind of service. Then everyone wonders why we no longer produce much of anything used in our country.

To me this is the very beginning and end of our problems.

Wolf,

Thanks for hosting the platform and all the excellent work and comments.

Rider,

1) In Mar 2020 wages popped up, because co had to pay ER nurses, doctor, supermarkets employees, takeout window girls, essential energy workers and mfg employees…to compensate them for the risk and to keep us alive.

2) In Apr 2020 Crude oil futures plunged to (-)$40. In May 2020 inflation

was down, testing 2015 lows. Finally inflation took off in Oct 2020, a half a year after wages took off. The Average Employees wages still cont to rise in a straight line.

3) Inflation was behind the curve. Inflation had to catch up with wages !!

4) Workers benefit from those who sacrificed so much 3y ago. That should change, because co no longer have to pay employees for risk premium.

5) In the flyover areas workers can pay rent, buy food… and still save

tens of thousands dollars, like u when u were younger…

Which flyover area? When I moved to Texas in 1991 it was a wonderful place with a high quality of life. You never saw a homeless person because rents and real estate were so cheap. I bought a house in 1994 for $30k and people in California refused to believe that this was possible.

In the years since then (especially the last five years) rents and real estate prices have skyrocketed along with property taxes and insurance. There are now thousands of homeless people everywhere you look along with violent crime and theft. Wages are very low in Texas so no, it’s no longer possible to save anything here.

A $948BB trade deficit is really not that bad, thats less than 5% of GDP and is completely manageable. I would be more concerned with debt and debt servicing levels.

Problem is not just coporate america – it is also american culture that worships buying crap people can not afford.

Unemployment is already at near record lows … so who would make all the stuff if production was brought back to the US???

The problem is americans spending too much and not saving enough. The trade deficit works out at roughly $3,000 per person/year. Just stop filling up garages and storage lockers with crap people don’t need . Can anyone actually park their car in their garage? Why are storage units one of the fastest growing businesses? Too much stuff (that caused the trade deficit).

Who’s fault is it that American’s buy everything though?

Look at how much money is spent on advertising!

I know it’s crazy but ads actually work on tons of people not to mention our keeping up with the Joneses social mentality or social ladder.. Marriage… Home…2nd home…3rd home…etc

Make no mistake it is all corporations fault

Soooo excited to see this death star blow up. 🤞🤞🤞

I’m personally frugal as F**K mainly because I hate corporations and the best things in life are free or relatively cheap

Apologies Wolf, the huge increase in Services Imports-Travel is my fault. We spent three times the normal amount on travel in 2022. There were three trips to Canada alone. Revenge travel. In 2023 we’ll spend even more. I’m throwing everything into the grand finale fireworks show these next few years. I’m not pissing around anymore assuming my health will last and governments will let me travel.

Just watched a nice sunset in Tahiti tonight. If you want a laugh, search for Air Tahiti Nui’s preflight safety video. It’s so well done, and the oxygen mask demo is hysterical.

Isn’t the trade deficit always equal to the net capital inflow? The only way there can be a trade deficit, is if foreign investors move cash into the US so the US can pay for the trade deficit.

It’s not clear drives the other. If investors wish to move money out of their home nation, for whatever reason, it has to show up in the net capital inflow. Yet who is driving the cart, corporate America looking for cheap suppliers, OR foreign investors looking for a “safe” location to park cash?

There are gobs of investment trouble in the world, and for better or worse the US bond market, US banking system, and US government remain one of the best of the lot. To the point that through most of 2022, the US dollar surged in strength with all of the net capital surpluses that were coming into the US, clearly outrunning the trade deficit.

I don’t know much about what’s going on with the UK, but I used to be able to buy books on ebay for basically the same shipping cost from the USA or the UK. Now the UK cost would be 20 bucks a book or something ridiculous like that. I suppose whatever postal treaty we had with them hasn’t been renegotiated. Meanwhile Chinese firms still ship basically for free and American sellers (on ebay or elsewhere), our prices keep going up. I think if the postal laws with China were changed, we’d see big improvements for American sellers. Shipping from across the globe should not be free/cheap while it costs more every few months to ship to the next state over…