But in Q4, inflation will shoot to 11%, the BOE said. Media reported it as a “dovish” monster rate hike. Whatever.

By Wolf Richter for WOLF STREET.

The Bank of England’s Monetary Policy Committee voted today by 7-2 to raise its Bank Rate by 75 basis points to 3.0%, the largest rate hike since 1989, bringing the interest rate to the highest level since 2008. One member voted for a 50-basis-point hike, and another voted for a 25-basis-point hike.

This maintains the BOE’s spot between the ECB and the Fed: The ECB last week raised its deposit rate by 75 basis points to 1.5%; and the Fed yesterday raised its federal funds rate by 75 basis points to 4.0% at the upper end of the target range.

The BOE has a page for regular people that is not covered with central-bank mumbo-jumbo. And this is what it said to explain its big rate hike to the people of the UK:

Inflation is too high. It is well above our 2% target. High energy, food and other bills are hitting people hard. If high inflation continues, it will hurt everybody. Low and stable inflation helps people plan for the future.

Raising interest rates is the best way we have to bring inflation down. We know that many people are facing higher borrowing costs. In particular, many households face higher mortgage rates. And some businesses face higher loan rates.

It’s our job to make sure that inflation returns to our 2% target. This month we have raised our interest rate to 3%. In total, since December 2021, we have increased our interest rate from 0.1% to 3%.

What will happen to interest rates will depend on what happens in the economy. At the moment, we expect inflation to fall sharply from the middle of next year.

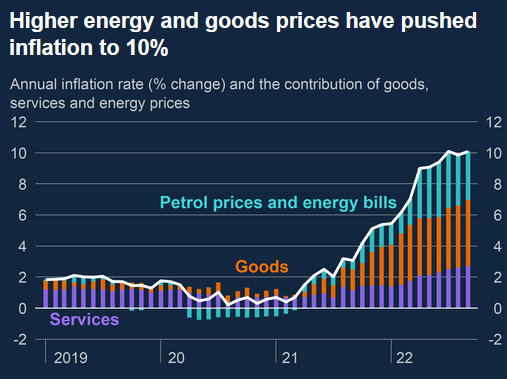

And it provided this inflation chart:

More rate hikes to come, but not as aggressive as markets priced in. “Further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets,” the BOE said in the statement.

The BOE’s own projections that it had made in August figured that its Bank Rate would peak at 4.5% in May 2023. Money markets priced in a peak as high as 5.25% for mid-2023, though this market pricing has now come down some, the BOE said in the statement. Today, money markets priced in a peak of 4.75%, roughly in line with the BOE’s projections last August of 4.5%.

But every time the BOE made rate-hike projections in this cycle, they were far steeper than the prior projection. For example, the August projections of a peak rate of 4.5% was up from the prior projection in May of a peak of 3.5%. The BOE’s projections got more hawkish every time they were made, similar to the Fed. And money markets have been pricing in these future upward revisions of projections.

This statement that markets are pricing in a higher peak than the BOE had projected in August was why analysts claimed that the BOE’s monster hike of 75 basis points today – the biggest rate hike in 33 years – was a “dovish hike.” Whatever.

“There are, however, considerable uncertainties around the outlook,” the BEO cautioned those folks.

“The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary,” it said.

Expects still more inflation despite declining GDP and fuel price subsidies. “There is judged to be a significant margin of excess demand currently,” the BOE said in the statement, and it projected that CPI inflation, which already raged at 10.1% in September – the highest in 40 years – would “pick up to around 11%” in Q4.

But this CPI inflation is being held down by the energy subsidies from the government’s Energy Price Guarantee (EPG) program. Without those subsidies that effectively reduce retail energy prices, CPI inflation would be even higher than 11%, the BOE said.

This raging inflation is occurring even as the BOE expects that GDP will decline by about 0.75% in the second half of 2022, “in part reflecting the squeeze on real incomes from higher global energy and tradable goods prices.” But it added that due to the stimulus effect from the fuel price subsidies, “the fall in activity around the end of this year is expected to be less marked than in August.”

While the subsidies cap the energy components of CPI, the BOE said that they could shift more consumption to other areas and fuel more inflation in “non-energy goods and services.”

Despite the decline in GDP, the labor market “remains tight, and there have been continuing signs of firmer inflation in domestic prices and wages that could indicate greater persistence” of inflation, it said. Private sector pay has increased by 6.2%, higher than the BOE had projected in its August report, but far below CPI inflation – hence the sharp decline in real wages.

Hopes inflation will “fall sharply,” starting in mid-2023. Given the various shocks and drags on the UK economy, including high energy prices and the plunge in real wages, and given the higher interest rates and tightening financial conditions, the BOE expects that GDP will decline in 2023, that unemployment – now still very low – will rise, and that inflation will begin to “fall sharply,” starting in mid-2023, “to some way below the 2% target in two years’ time, and further below the target in three years’ time,” it said.

This assumption – or hope – that inflation will “fall sharply” in mid-2023 underlies its projected rate-hike path that would peak in mid-2023 at 4.5%.

If not… “There are, however, considerable uncertainties around the outlook,” the BOE said. “The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary,” it said. Ok then.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s a prelude to a pivot, it’s the end of the beginning, please please Yolo, fomo, btfd bitchezz!!

Will they be ready for ‘hyper inflation’ and then deflation!?

…Or maybe hyperdeflation?

Or a shrinksession. Stable or falling prices combined with outages and less availability of goods and services. No higher prices but empty shelfs in the shops.

Sams, a shrinksession would only indicate the economy needs to see a psychiatrist, which it does.

I agree that the wildcard might be NO availability at any price. Empty shelves will upset folks with money.

I guess they’re saying high inflation is transitory lol … But… what I’d like to know is… Who the hell of the 9 members voted for a 25 basis points hike in the midst of what’s going on there?

Socialists and communists cause that is what happens next if they give in and start printing.

The media is the message and the dems and repubs both love war and free money, 2 humongous debt producers.

Let’s see if the media message to stop QT becomes a mass brainwashing constant, or has the wisdom of decisions made by the elite (those who own the media) during the pandamonium become more questioned by the masses.

It is unlikely that they will be able to raise rates to the inflation rate for a long time.

Hope for the best and plan for the worst!

This war is over neon ,,Ukraine controls 50% . Cany build semiconductors without it ,quit believing propaganda ,globally planned by g-7 ,g20 ?

The best way to cure inflation is with even more government spending…

“But this CPI inflation is being held down by the energy subsidies from the government’s Energy Price Guarantee (EPG) program. Without those subsidies that effectively reduce retail energy prices, CPI inflation would be even higher than 11%, the BOE said.”

Hahaha, yes that’s what I’m thinking too every time I read about a government program that subsidizes consumers for inflation. In California, we have “inflation checks” that are supposed to be sent out now (where is mine, hey?).

If you want to know my own fuel “subsidy” for 2022 is £1050 or roughly $1080….not quite up to USA standards but not bad……

Quite Bonkers….I’m spending my Govt money with more trips to my chiropracter for my dodgy back.(it works by the way)

And I suppose they deny that these checks will add to inflation right?

I think there was some discussion about that but it got squashed quickly. Everyone loves free money, and to heck with inflation.

California’s gov is swimming in cash right now, and they’re handing it left and right.

Other states are in a similar position, and they have similar inflation check programs and other stuff. That’s one of the reasons inflation won’t calm down anytime soon. There is way too much of this pandemic stimulus still circulating around out there, and it will take years to burn it off.

Guess you make too much. I got my $350 Oct 20.

What else are they going to do?

People must be able to drive or the UK economy collapses, right now, today.

The infrastructure is lagging demand for personal transportation by about 50 years or so and they cannot solve that problem unless they also splurge money on that.

They are doing the only thing they realistically can do: Buying time (for a final bout of looting before they can dump the whole mess on Labour)

“Raising interest rates is the best way we have to bring inflation down.”

No, taking money back out of the economy is the best way to bring inflation down. We have inflation because we all printed too much. Many countries tried to print or QE their way out of a pandemic and it blew up in everybody’s faces. Interest rates are only part of the problem, and at the end of the day, the elephant in the room is that there is just too much money sloshing around. Normalizing interest rates closer to the historical averages would be fine and dandy because borrowing should cost something. But higher rates aren’t going to stop people and businesses from exchanging their abundant cash. What raising interest rates too high and too fast might do is blow up credit markets before participants have a chance to adjust to a brave new (old) world of not-free debt. A credit crunch of GFC (or bigger) proportions will simply force central banks to pivot hard against what they’re preaching. Rates need to be the smaller part of the equation, while removing mountains of cash via faster QT should be the focus. But we can count on the CBs to eff this up as they always do. They will fight lagging indicators with the wrong tools, something will blow up, and they’ll be right back into loose policy as soon as we the peasants have been crushed only for the big boys to come in and scoop up our little crumbs of wealth for pennies on the dollar.

You nailed it.

Historically “raising interest rates” and “reducing the monetary base” were coupled policy choices. The Fed couldn’t do one without the other. Make a historical graph back to the 1950s (or before) of interest rates vs. the money-supply-to-GDP-ratio, and it’s a beautiful simple curve.

But, the economists spoke about rates as the tool, and now everyone believes it’s the rates that matter… but the Fed also changed the toolbox and separated the rates from the monetary base a few years ago. A bit like taking the transmission out of the engine, and yet they don’t seem to be giving much consideration to the side effects of that little change…

So no, they’re not doing “what Volcker did”. The current QT is slow and will take a few years to rein in the inflation.

That no one gets this would be comical if it weren’t so tragic.

Hopefully Hussman puts up a graph to illustrate how deep into uncharted waters the Fed has gone…

> “they’ll be right back into loose policy as soon as we the peasants have been crushed only for the big boys to come in and scoop up our little crumbs of wealth for pennies on the dollar. …”

Well said. We aren’t in YOLO-land anymore, but maybe the big boys will stage some kind of bear rally, to squeeze the last pennies out. The masses still seem to love to feel giddy and fake-rich.

But for anyone with eyes and mind unfooled, out in the streets, poor choices are showing stark consequences, and we haven’t faintly seen the end of that. I’m not hearing of any government policies that can turn a light switch on that in any short time frame. We can’t do free money handouts anymore, we overplayed that. The era of real, not print-and-extend-and-pretend, costs is here. The alternative to print and inflate, is market discipline, which bodes to be harsh. Clearing the markets can be existential.

I’m basing a lot still around having plenty of liquidity, and low debt. That will prevent bottoming out, if it gets real rocky in any direction.

“Section 2A. Monetary policy objectives

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

It says “aggregateS” … Money AND credit … And it sets a measure for the total of the two … Hussman finally gets that and he’s preaching it … But few others. Forget employment, prices and rates … The law says keep the aggregateS in balance with the REAL economy and the other metrics will balance themselves. So simple… But not for those who want CONTROL.

It’s a race for the Boe to manage to get a correct inflation prediction before UK society collapses.

Apparently the cost of living crisis ( we don’t use the word inflation) is due to the war in Ukraine and Putin’s price hike and there was me thinking it was due to paying the population £25000 a year to sit in the garden and giving fraudsters millions.

A simple perusal of the welfare system costs would show this to be rather untrue.

The impacts of brexit coupled with the shortages caused by the war on the other hand, are making a real dent.

“The BOE has a page for regular people that is not covered with central-bank mumbo-jumbo. And this is what it said to explain its big rate hike to the people of the UK:”

Too bad that page didn’t include an explanation as to who and what got them into this bad situation in the first place.

The BOC did a 50 basis point hike to protect the housing bubble while food costs continue to rise globally.

Wait until you are done bringing close to 1M people into the country. The funny thing is most of the 1M will required govmint subsidies for a looooong time..

It’s almost C$2000 to rent a one bedroom in Ontario. I wonder where are the jobs to pay for that. Canada sounds like a Ponzi scheme scam right now.

The housing bubble is imploding already…

https://wolfstreet.com/2022/10/21/the-most-splendid-housing-bubbles-in-canada-october-update-prices-plunge-at-fastest-pace-on-record/

… and 50 basis points is a big hike. The BOC is now at 3.75%, which was higher than the Fed, and as of yesterday is at the lower end of the Fed’s new target range.

https://wolfstreet.com/2022/10/26/no-easy-outs-to-restoring-price-stability-bank-of-canada-hikes-by-50-bpts-to-3-75-more-hikes-to-come-qt-to-continue-as-unsustainable-home-prices-plunge-fastest/

It needs to go higher because rents are not falling in Ontario.

It’s almost C$2000 plus electricity a month for a one bedroom in Toronto and the suburbs.

Is it any cold comfort to point out C$2000 is only $1,460 USD right now?

We don’t earn US dollars in Canada. Our salaries are lower too.

Elliott Management issued warning of coming hyperinflation and economic collapse.

It is time the Federal Reserve and Federal government take real action. The Federal Reserve should begin to dump Treasuries and MBS at 500 billion per month. The MBS should be lquidated first to allow the market to set the correct rates.

I think that the Fed did not want to go into full shock and awe ahead of the elections, so it didnt actually go full out. But after elections, the Fed will go 100% at the next meeting.

After the Republicans destroy the Democrats in this next election, the Federal government spending needs to be reined in.

The stock markets tepid reaction to the financial crisis is merely due to some investors thinking there will be a santa claus – election cycle rally. After the elections that hope will fall apart and then the real downside starts. It looks to me that the Fed knows the financial markets will need to get creamed BEFORE the real economy finally slows down and inflation gets destroyed.

If you think the Repubs (if they win), will ACTUALLY CUT spending… you are deluded my friend… the old concept of the Republican as fiscal conservatives is LONG gone… at this point, they are 2 sides of the same coin (though the DEMS are much more transparent about their goal). Each side is part of the problem, though these days I’d agree that the DEMS never saw a problem they think money won’t fix, while the Repubs are just more subtle and choosy about their spending habits….

Hmmm. Could be, although two different trillion dollar wars in the 2000’s to find WMDs that didn’t exist and new oil fields for their cronies suggests that Republicans really aren’t subtle or choosey about their spending. Just as long as it’s red meat for the base.

And to think I was just getting used to my standard of living…

Yea, I’m receiving a “1 time ENHANCED GST/HST” check tomorrow for $471 here in Canada.

Just another gift from the bozo in charge and his first mate Chrisy.

That should make a dent in our inflation and keep the masses at bay for another week.

Good Lord.

The UK is world of hurt, or will be, from the Guardian, their analysis says this is it for interest rate increases outside of maybe 25 points here or there. This was followed by editorial calling for increased spending to beat the coming recession. Talk about being stuck between a rock and hard place. I wonder if things will get bad enough there will be another large scale exodus of the UK to former colonies?

I thought I saw somewhere (BBC or Guardian) that the UK is heading for its longest recession ever.

That’s the prediction. Growth hadn’t returned to the UK post covid whereas it has for other g7 countries.

Not that that is a good indicator of the younger generations, anyone below 45 in the UK, are being priced out of living and that growth isn’t enriching them (obviously simplistic readding but atm, fiends in their 20s have no hope of buying a house ever whereas in the 90s, that was a norm).

It is a rock and a hard place.

But the moment they pivot, boom, inflation runs up over 10% again.

Gov borrow money to subsidise people’s costs, £ dives again.

The only viable solution is to crash the economy.

I’m not sure why that’s such a big issue.

High inflation or high interest rates, they both lead to a big recession.

Personally I’d prefer to bring it on sooner and more stably, than let a recession invoke itself organically with myriad unforeseen consequences.

Sledgehammer to crack a nut. The big issue in UK is i reckon not the rise in interest rates but of energy costs. Next to nothing interest rates couldn’t last and it has only been a question of time for rates to return to a more sustainable level. But the cost if living is soaring by reason of the price of electricity and to a lesser extent gas.

A rise in interest rates is welcomed by savers whom for too long have had to accommodate derisory return on their bank deposits and such like. Having to dip into savings to pay your way when the banks are lending your money at hefty rates is inequitable.

Those of us old enough to remember what it was like during the early 1970s during the oil crisis or later when base rate was 10% or so managed.

I remember gas lines. Get a hot tip and get in line at 4am and hope they didn’t run out before you got there. Had an even/odd license plate number going scheme, too. Not sure if it was enforced, probably not. This was when having friends working at gas stations paid off. Even took mom’s car and got gas for her. People GOT to get to work and bus system was not good then.

Was a story on the news where a lady in SF on Lombard (in a new Cadillac) cut in front and wouldn’t leave until she got gas. Attendant threw her gas cap keys down the storm drain. And yeah, siphoning was rampant so locking caps really sold.

When I was taking Auto Shop (10-13) knew guys that did oil changes (some did much more major repairs) out of their garages. Waste oil no problem, went to people who’s cars rear mains leaked badly.

I wouldn’t be so quick to say savers are being rewarded. My HSBC on call savings account is paying 1% interest. You can get an online savings account that pays 3%, but it’s limited to £10k of savings. Meanwhile, inflation is at 10%, so my savings are devaluing at the rate of 7%.

Personally, I’d rather have the days when I got 0.1% on my savings, but inflation was only 2%.

Believing that savers are going to get some kind of ‘justice’ out of this whole exercise is pretty optimistic in my humble opinion. Personally, I’m busy converting my savings into stuff I might need over the next 5 years, because the only thing I’m absolutely sure off is that my savings will never buy more than they can today.

Goldman Sachs said a couple months back they expect inflation to hit 22.4% next year in the UK (very specific number) if energy prices continue to go up. I will agree with that. UK is done imo. Their rates are still way too low and whoever voted for 25 basis points needs to be kicked out.

See how CNN reported Powell’s press conference:

Fed’s Powell: ‘Time for easing rate increases is coming’

I heard gas is $10/gallon in London. If that happened in the USA, there would be riots. Americans are addicted to their automobiles.

California already had closed to $8/gallon gas. Nothing of this sort happened.

Common people has no ideas whats really happening and what can they do.

They are busy with their digital screens and looking at things to buy.

Seems like even in 60’s they paid more. Also had tax based on engine displacement.

A VERY good idea here, along with bringing back 55 or even 50 limit.

Saves gas, saves lives….was proven beyond a shadow of a doubt.

22.5%??? Yikes! So I should invest in wheelbarrows.

As a UK citizen i can tell you that in my situation the level of UK inflation in food, energy and petrol from one year ago stands at 38%. The majority of the increase has occurred in the last 6 months. Only yesterday i had an item in my weekly shop increase in price by 20% from last week!!

Sorry to hear that. I was planning on going to Wimbledon next July, but I’m reconsidering now. If things continue the way they are for you and others in the UK, I’d imagine a lot of workers will go on strike. I can’t risk getting stuck over there with my current line of work here in the US (healthcare) if airline/travel and transport services stop temporarily.

Don’t miss Wimbledon! I’m local and go most years.

The BoE couldn’t predict last weeks lottery numbers. It’s true prices are increasing from one shop to the next. Fortunately I can absorb it despite my salary increasing by 3% this year. I suspect many can’t.

Another UKer here.

I use a credit card and clear the balance monthly for day-to-day out-of-pocket spending. It makes things easy to track.

My lifestyle hasn’t changed; my personal inflation rate is 27% per annum.

The BOE “Will Respond Forcefully”!

Such nonsense…

The Federal Reserve sets the rates and everyone will follow. That is how it works, no exceptions.

The idea that these small central banks can work outside of the sphere of the US central bank, to me seems ludicrous….

“The Federal Reserve sets the rates and everyone will follow. That is how it works, no exceptions.”

Japan called. They left a message. It says, “俺のビールを持ってくれ.” Translation? “Hold my beer.”

LOL

“Jay Powell and the Federal Reserve Fail Again,” he tweeted. “No ‘guts,’ no sense, no vision!”

Trump wants the Fed to push interest rates down to zero or even into negative territory. Trump argues that the current rates put ….”

Remember that?

Yep.

His REAL FOLLOWERS (those who went to his very upscale expensive businesses) liked a hot stock market.

Fooled the rest with total meaningless BS.

The Dems simply don’t want to be voted out, as it’s now “all their fault”).