But even these highest-since-2007 mortgage rates are still far below the highest-since-1981 inflation.

By Wolf Richter for WOLF STREET.

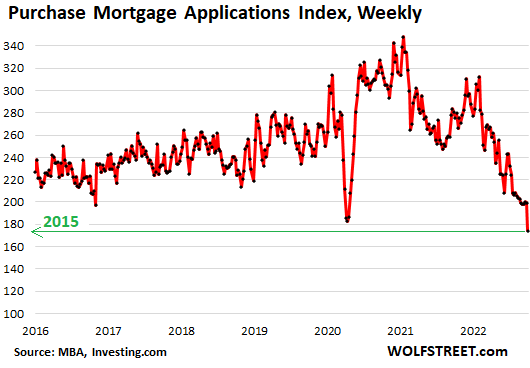

In the week ended September 30, demand for mortgages to purchase a home plunged by 13%, seasonally adjusted, from the already beaten-down levels in the prior week, according to the Mortgage Bankers Association today. Compared to the same week last year, purchase mortgage applications dropped by 37%. They fell through the lows during the lockdowns and hit the lowest level since October 2015! Purchase mortgage applications are an indication of housing demand over the next few weeks.

The weekly drop was in part caused by Hurricane Ian, and in part by the spike in mortgage rates into the 7% range:

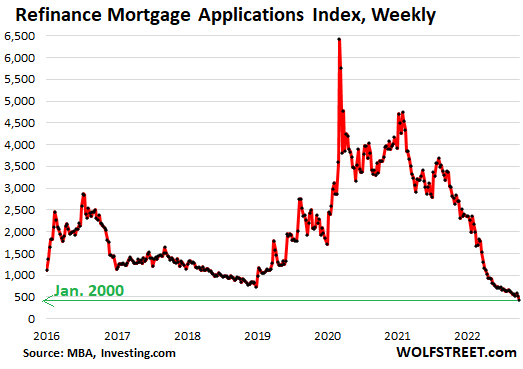

Applications for mortgages to refinance an existing mortgage plunged by 18% compared to the prior week, seasonally adjusted, and by 86% from a year ago, to the lowest level since January 2000. No homeowners in their right minds are going to refinance an old 3% or 4% mortgage with a new 7% mortgage, except to extract emergency cash, which will cost them dearly, and they might be able to accomplish the same for a lot less with a HELOC. So the HELOC business, which has totally died down since the Financial Crisis, should perk up again.

The mortgage refi business is crucial for the mortgage lenders. The largest mortgage lenders in the US – Rocket Companies, which owns Quicken Loans, United Wholesale Mortgage, which owns United Shore Financial, and LoanDepot, all have cut staff by thousands of people each, and their stocks have crashed. The entire industry is trimming back to survive. Some mortgage lenders already filed for bankruptcy. Others have shut down (read: Mortgage Lender Woes)

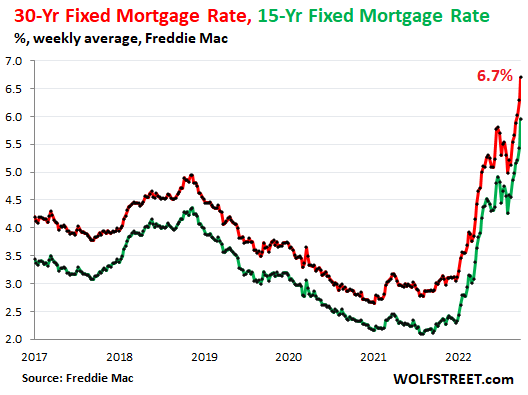

The daily measure of the average 30-year-fixed mortgage rate by Mortgage News Daily hit 7.08% on Tuesday last week. It then dropped back, and today jumped again, hitting 6.95%.

Freddie Mac’s weekly measure, released today, based on mortgage rates early this week, jumped by 41 basis points from the prior week, to 6.7%, the highest since 2007 (red line in the chart below). A year ago, it was 3.0%.

Since mid-August, when the summer bear-market rally ended, the average 30-year fixed mortgage rate spiked by 171 basis points.

The average 15-year mortgage – if you can handle the payment at the current prices – spiked by 52 basis points from the prior week to 5.96% (green line), the highest since October 2008, according to Freddie Mac data.

But wait: even these much higher-than-last-year mortgage rates are still far below the rate of inflation, with CPI inflation over 8%. But mortgage rates are catching up.

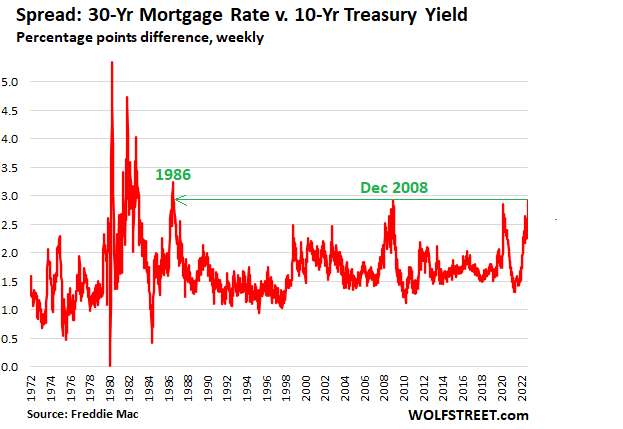

The spread blows out.

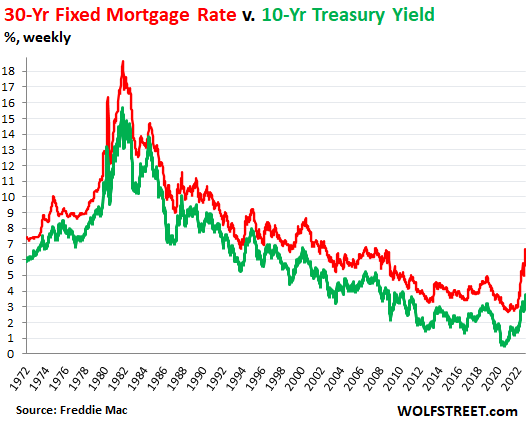

The 30-year fixed mortgage rate runs roughly in parallel with the 10-year Treasury yield, but higher. This makes sense because most mortgages get paid off much sooner than in 30- years, as people refinance the mortgage or sell the home. The average lifespan of a 30-year mortgage is less than 10 years, according to Rocket Mortgage.

The difference between the 30-year fixed mortgage rate and the 10-year Treasury – the “spread” – at today’s mortgage rate per Freddie Mac, has widened to 2.92 percentage points, matching the multi-year high on December 31, 2008, during the Financial Crisis, just one week. To get to a wider spread, we have to go back to 1986.

This chart shows the weekly 10-year Treasury yield (green) and the weekly 30-year fixed mortgage rate (red). Note how to what extent the mortgage rates have out-spiked the somewhat lethargic 10-year Treasury yield:

The chart below shows the spread (the difference) between the 10-year Treasury yield and the 30-year fixed mortgage rate. The spread tends to widen or narrow drastically when yields are in upheaval, when one rate moves a lot faster than the other – with some interesting implications:

The spread will normalize as the 10-year yield catches up.

The spread has widened this year because the 10-year Treasury yield has been slow in moving higher. It always reacts much more slowly to changes in monetary policies than short-term yields. The one-year yield has spiked by nearly 400 basis points since late last year, as the Fed embarked on its rate-hike cycle. But the 10-year yield has come up only about 200 basis points over the same period. And the yield curve inverted over the same period, with short-term yields higher than long-term yields.

So the mortgage market has taken its cues of where rates are going from short-term yields, while the 10-year yield was dilly-dallying around.

But the Fed’s QT has now kicked in at full pace, and this will allow the 10-year yield to drift higher. As the 10-year yield comes up faster than mortgage rates, and makes up lost ground, as QT continues, and as the Fed pauses its rate hikes next year in the 4% to 5% range to watch what happens with inflation, the spread will narrow back into the normal-ish range of about 1.5 to 2 percentage points to – just a guess – a 7.5% mortgage rate and a 5.8% 10-year yield?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“But wait: even these much higher-than-last-year mortgage rates are still far below the rate of inflation, with CPI inflation over 8%.”

Just to pick nits, mortgage rates are still far below *trailing one year* inflation, not necessarily the current rate of inflation. We know the challenges (and potential inaccuracies) of measuring current inflation via 1, 2, 3, months, etc.

And no, I am not a denier of any sorts, nor do I think the Fed should pivot!

Don’t you watch CNBC. All inflation is because of Ukraine-Russia war and OPEC production cuts and nothing else matters (Sarcasm!). So Fed should Pivot to protect financial markets and even developing nations (UN is finally pretending to work).

Think about the poor buyers that are drawing a 7% to buy their American dream at absolute peak. How sad they will be after 1 year when their houses will be down by 30% to 50%.

The words of their real estate agents “Buy it for living in for long term and not as investment ” will suddenly sound phoney. They would have saved 3 years of their in hand income by waiting just 1 year to buy a house!

Sellers are fighting it kicking and screaming on the East side. Angry sellers are on social media mocking sidelined buyers for ‘renting instead of owning’ and ‘being scared of an only 4% rate increase’.

Two owners down the road still can’t unload their ridiculously overpriced houses after 4+ months on the market. One dropped the price of his 3BR $600k bloat house a whopping $5, just to get the ‘recently reduced’ MLS attention I suppose. Five whole dollars.

Further down the road, a tiny 1BR/1Bath shack awkwardly sitting on the corner of a busy main intersection, still can’t figure out to drop from $260k last I checked. A box truck taking too wide a corner will surely take it out before it sells at that price.

Lili, I hope you aren’t contemplating buying the shack at the busy intersection. Realtors are the only ones who benefit from those as the turnover rate of noisy properties on busy streets is very high – back on the market muy pronto. Rental turnover is even worse.

What would we do without social media! Imagine the conversations on NextDoor.

Here, they raise the price $5 to move up in the MLS listings.

My (actual) friends who are RE agents are still saying don’t buy now. I’m seeing a few in my price range, sort of, but the repairs they need put well them out of range.

Be careful- try to get a contractor or even an experienced all around carpenter to do an inspection if you don’t know anything about roof, foundation or structural damage. If it has a septic or well make contingencies on it being fine & have it inspected by a septic or well installer. Most house inspectors (at least in my area) don’t have experience or a lot of knowledge in major problems.

When is gov’t going to crack down on people who play this AirBNB crap? It’s completely out of hand….but lucrative as hell for the players, and I guess AirBNB, too.

Such things happen in my town with crashes (auto not housing)!

Are these market dynamics feeding into service inflation via higher rents and when will this stop? In my little corner of the midwest I recently rented a three bedroom single family at a 25% rate increase after the previous tenant left and I could have gotten more. I was afraid the increase was too strong but there were people beating down the door. Over 24 inquiries in 4 hours and it Rented in two days. The story I kept hearing was ” I can’t find a reasonably priced house to buy and there is nothing for rent.” And there were at least 3 applications that I would have loved to have seen three years ago.

“Buy it for living in for long term and not as investment ”

I agree that it is not the best time now to buy.

However, the phoneys said the same thing to buyers in 2006-2007 at the peak of the last bubble.

These buyers are now up 50-100% and if they had a 15 year mortgage, their house is paid off. They will never pay rent again.

That was a great long term investment.

So I agree with “Buy it for living in for long term and not as investment ”. Long term is 10-15 years.

Americans move a lot. They move to make job and career advances. They move because their life stage has changed. Example: A couple in a large house with high taxes and excellent schools become empty nesters. They downsize to a smaller place, often a condo, to give themselves more personal time and discretionary income. 60% of marriages end in divorce, and one person, maybe both, have to move. If you have psychic powers and can accurately know all this in advance, then waiting 10-15 years for the market to revert to the mean is a good approach.

Markets don’t always repeat. And the fact still is that, if someone had waited until 2010 to buy, they would have saved a cubic butt-ton of money.

What happens if we’re truly at the end of declining interest rate period? Then someone buying now might have to wait a whole lot longer (or forever) to break even, just like if you bought Cisco at its peak during the dot-bomb bubble.

@Roddy,

If you have psychic powers, you would have an amazing life, timing your stock buying and selling even better than Satya Nadella :)

I agree that it is still a gamble but it is a safe gamble. There are great times to buy and good times to buy over the long term. (I am not a RE agent).

The odds have never failed if you buy and hold for 10-15 years.

You have historically always made money on a house and grown financial security. Look at Wolf’s charts.

So, it is a 10-15 year long term investment.

It should be primarily a place to live. Once the 15 or 30 year loan is paid off, you are financially secure against rent increases similar to what has happened during the last 2 years.

Anyone who purchased at the peak of HB1 16 years ago and held onto their house is doing very well financially. Where will you be in 10-15 years? If you buy now and hold on, historically, you will also also be doing very well at that time. It has never failed.

The trick is holding on through job losses, divorces, deaths, downsizing, disasters, etc….. Sh*t happens that is hard to plan for but I wouldn’t bet on it.

I had to add one more comment.

The move for a better job/promotion is a tough decision but it is a financial decision.

If you think you might be offered a job for a higher salary that involves moving within the next few years, I wouldn’t buy now at a likely peak. Only buy if you think you can hold on to the house for 10-15 years.

I had that situation 10 years ago. I was offered a nice promotion with a 20% raise to move to an area that had 20% higher housing costs. I turned it down for 3 reasons:

1) I’d have to also sell my house at a loss in 2012.

2) It didn’t want to move where the offer was. Especially with 20% higher housing costs.

3) If the raise was 100%, it would have been a tougher decision.

Turning it down affected my current raises so I looked around locally and received a 10% raise locally without having to sell the house.

Make sure you like the area where you buy and there are alternative jobs that will allow you to stay. Higher pay elsewhere with higher living expenses is not always a good decision.

Work to live and don’t live to work.

Bob,

It’s not necessarily true that holding 10-15 years will always work. Currently, it took a second enormous bubble for people who paid peak prices in 2006 to come out ahead today. What if the Fed didn’t inflate another bubble?

I have friends who bought just after the peak in 2007 and thought they were getting a deal paying $655K for a home initially listed for $725K. Eight years later they needed to move out of state and sold it for $562K. After commissions and expenses they were still down well over $100K. At the current peak the home was worth around $800K, so by holding they could have done OK, but is it prudent to count on another bubble? Many people also can’t plan 15 years out. It may be difficult to pull off the trick of staying through job loss, divorce, etc.

I just don’t think it’s ever time to overpay, and with interest rates this high prices need to come down to make any sense. I hope we don’t have a third bubble in the next 15 years, but we’ll see.

Could have invested in the stock market and be in about the same position or better depending on the rent vs total home ownership cost. All depends on how disciplined one is.

@SIAB Bob,

Buying a house is NOT necessarily a safe gamble. Sure, if you have a steady job, steady marriage, no interest in moving, neighborhood isn’t likely to go down hill, etc, over the long term you’ll probably be OK. (Yes, there are no guarantees in this life, and most of us aren’t psychic, so you make the best decision you can based on all the information you have, including what your situation is and what you value).

So, yes, buying can be a reasonable gamble, but in general, to buy a house TODAY is a stupid gamble, since it is extremely likely that house prices will continue to come down substantially. The Fed isn’t going to pivot anytime soon, and home sellers have yet to adjust their prices to meet the reality of current interest rates, let alone what mortgage rates will likely be in six months.

Being locked into a house because you can’t sell is very different from staying in a house because you don’t want to sell.

RojoGrande,

As you pointed out, holding for 10-15 years has always made money. Selling before that is a risky gamble. Your friend found this out selling at 8 years. I hope he had a huge raise to cover his losses. It was a financial decision.

I hope we don’t have another 30% bubble. Ever.

However, with inflation raging at 8-10% per year, as long as wages go up 30% over the next few years, we won’t have a crash or need bubble to save us. House prices will be flat or fall slightly if wages go up 30%.

Inflation has historically been a floor for house prices. The CPI inflation curve intersected with house price curve in 2012 when the last bubble reached a low. Back then, inflation was only at 2%. The house price curve crashed. The inflation curve rose at less than 2%. Wolf has the great chart showing this.

Now the inflation curve is rapidly rising. The house price curve does not have to fall as far to intersect again.

When the 2 curves intersect again, that is the time to buy.

Due to inflation being so high, housing prices will not fall as far as 2012. I estimate 10-20% max.

I believe for a Fed driven soft landing, the CPI inflation curve and the house price curve will intersect again. House prices should then track inflation as they have done during the 20th century. It is only since 2000 that this has not been true. Probably due to speculation at low interest rates and Fed intervention with low savings rate.

With inflation at 10% per year, house prices will not fall as far as 2012. Once we get back to a low inflation and housing is tracking, 2%, then it should take 3-4 years of house appreciation to break even to cover closing costs. Just like it was back in the 1900’s.

Back in the early 1980’s with raging 15% inflation and 18% mortgage rates, house prices were flat or slightly rose. Wages were also rising rapidly which balanced the high mortgage rates.

Uggghhh…compare that to the returns from the S&P. 50-100% ROI nothing to brag about over that time period. Sure, it’s nice to not lose money but over a long time period, like 15 years, it’s really hard to beat equities as far as asset investments go. There are perhaps exceptions, but once you get past 10 years they start fading.

The hardest part is tuning out the noise of greed and panic, as well as hoping you didn’t put your money into a asset bubble Japan at the wrong time.

The logical fallacy in your claim is assuming that things work out on average.

Well, no one’s experience is the average. There are no absolutes but buying in the most overpriced housing market ever in the US is terrible timing.

Pointing to the GFC doesn’t change that. Millions of people had their stock “investments” cut in half, the real estate market crashed, then they lost their job, and then lost their house to foreclosure.

The third phase of the asset mania (the one now) bailed most out but millions (many millions) never recovered, and a subset of this number were permanently financially impaired if not ruined.

The first objective in financial planning should be to void financial failure or ruin. The typical homebuyer is financially marginal, a “weak hand” and a noticeable percentage will be forced to sell in a major bear market which is the prospect facing this country.

This is a great discussion. You all have good points.

I agree with Augustus’ statement: “The first objective in financial planning should be to avoid financial failure or ruin”

Losing your house is financial ruin. Have a cash reserve and don’t overbuy to avoid that. Most should have their house paid for by the time they are 75. All of my elderly relatives have paid-for houses. Their payments were fixed and they knew exactly how long they had to work to have a stable retirement.

It is also financial ruin to be 75 years old trying to rent a small apartment for twice your income while the stock market is in a Bear Market. All of my younger friends who rented all of their lives are being squeezed into financial ruin with rising rent and the start of a Bear stock market. Their rent payments are 3X my house PITI. I hope they don’t lose their jobs and want to live in my safe, secure (Not quite paid for) basement.

Pick your financial ruin. Nothing is completely safe. IMHO, a paid-off house that you live in is the safest. By the time you retire, your main expenses are stable and predictable.

There is a HUGE difference between 2008 and now. In 2008, there was no inflation and had not been any inflation for a very long time. So the Fed thought they could just lower interest rates and that is what has caused the massive price increases. Now that we have seen the inflation monster come out of the cave and tear the village down, they cant do the same thing, even if inflation abates. Sellers will need to lose 3-5% of the value of their home for multiple months before they start to get serious about price reductions. In the meantime, there are still a handful of suckers who will buy into these high prices.

The time to buy real estate is when there is blood in the streets. So once inflation has truly broken down and the economy is in tatters and there have been oodles of distressed homes hitting the market, then you are safe to buy.

Zillow has their zestimate, which is based on comps. I would like to see a zestimate that is based on monthly payments versus incomes. My bet is that homes in California selling for 1 million should be selling for $600K in a normalized market.

Wall Street gambling degenerates have become the laughing stock of most sane population. We now have a reverse Jim Cramer ETF on top of the anti Kathy Wood SARK. Who’s willing to short science & tech, the new religion, and its high priests?

House prices will be down 30-50%, WA? What do you suppose will cause that? I get it… A few extra percentage points on the average mortgage is already causing downward pressure on volume and prices, so it’s definitely reasonable to say that the market has cooled and will continue to cool as the Fed tightens at least until they pause, but you think prices will be cut in half by historically reasonable 6-7% mortgage rates?

What you’re suggesting would require an implosion of mortgage debt with an accompanying credit crunch similar to the GFC, and I just don’t see that happening. I wish it would, but I’ve given up on that hope because the numbers just don’t support it. We had high inflation and very high interest rates in the 70s and 80s. Nonetheless the national median house price nearly tripled in the 70s and then doubled again in the 80s, which thoroughly debunks the claim that a relatively measly 7% interest rate MUST lead to a catastrophic collapse in house prices.

A much more reasonable prediction would be that house price appreciation goes flat like it did in the first half of the 90s while dollar devaluation catches up a bit. It will resume whenever the Fed softens up eventually. The Fed is targeting a slow-down in price appreciation, but don’t forget that deflation is something they will never ever tolerate. They drag their feet, and jawbone, and reluctantly inch their interest rates up little by little in the face of massive inflation, but every time they even sense a tiny suspicion that they could possibly be up against even a little deflation, they drop interest rates and fire up the printers for a financial shock and awe battle within minutes.

Not Sure,

What WA is suggesting that prices go back to where they were a couple of years ago. A two-year rollback is no big deal. Only a relatively small number of people bought over the past two years, and only a portion of those would be under water. This isn’t a biggie.

For example, in Seattle home prices (Case Shiller) spiked by 60% from the beginning of 2020 to early 2022. If home prices plunge by 38% from the peak (they’ve already gotten part of it done), they’d be back at early 2020 levels. That’s your two-year rollback. It’s really no big deal for the economy or finance. Those few people who bought near that top are just going to live in their homes and make mortgage payments for a couple of decades, like they’re supposed to.

Valid points Wolf, but my question to WA was aimed at the potential cause of a big price drop rather than the downstream effects that such a drop would have.

The FRED median price data goes back to 1963. Sure, it encompasses a nationwide low-resolution view of all local markets over the years. But the biggest drop in FRED’s national median price was the GFC, and even that was only $257k peak to $208k trough (19%). In the bubbly markets, the GFC was usually a 30-50% plunge rolling back 2-4 years of gains based on your last splendid bubbles article. But this time, pretty much all local markets went up in unison. Even markets like Denver and Dallas that stayed stable in the last bubble went nuts this time around too. Since practically all local markets went up, all of them would have to fall hard to meet WA’s prediction. The only thing that would cause a 30-50% drop across the board would be a major financial crisis. I could see residential RE dropping 10% in many markets, maybe more in the tech hubs and odd bubbly places like Boise as long as the Fed holds its course. But how would we reach 30-50% without a massive spike in foreclosures and unemployment to drive that drop? All drops & flat spots in the national data are accompanied by recessions, and the only drop anywhere near 20% nationally was the last financial crisis. What would be different this time?

@Not Sure,

It’s not the same as the 70’s or 80’s. For one, people look at where the market (and interest rates) has been recently, NOT 40 years ago! Also, many areas had other factors helping home price increases such as building restrictions, increasing population, and growth in jobs, especially high salary & stock options. And, of course, the last two years of WFH, QE, and such.

Look at it this way: for a given monthly payment, how big a mortgage can you afford at 3%? At 7%? Let’s run some numbers: for a $1,500/month mortgage payment, at 3% you’re looking at ~$356,000, while at 7% it’s ~$225,000, a decrease of ~37%.

For the same loan amount, the monthly payment will increase by ~58%; do you think wages are going to increase by 58% within the next year?

My guess (absent Fed & government fiddling) is that prices will decrease substantially, then level off while wages catch up. But I’ve been a lousy prognosticator.

No mention of the Fed selling MBS which increases the spread between mortgage rates and the 10 year?

They’re not yet selling them, and won’t be selling them for a little while. Right now, MBS are coming off via the pass-through principal payments. But they may start selling them next year.

It seems unlikely that they will sell them. The Fed doesn’t hasn’t demonstrated an appetite to take losses on its long term debt historically, and the MBS they picked from 2010-2021 would all be a loss.

The Fed is already going to be returning a *lot* less to the Treasury this year. Their average duration is close to 10 years which means their $9T debt instruments are stuck yielding 2-3%. Their IoER vehicle is going to start to be very costly as short term rates reach 5% on 3 trillion of excess deposits. The Fed will have little room to take big losses on MBS or any long term debt without it impacting their equity position. $100B in 3.5% yielding MBS is a $25B loss when selling into a 5.5% market.

My guess is the Fed will continue to use alternative mechanisms to mop up excess liquidity before selling material amounts of debt – simply because they can’t afford it (realizing the irony of that statement given that they print money, but you know what I mean), especially if banks continue to park huge excess reserves at the Fed and the Fed wishes to keep using IoER as a very direct way to control the federal funds rate.

John,

Losses don’t matter to an entity that creates its own money. The Fed already acknowledged that it will lose money, and it outlined how it will account for it. It’s a non-issue for the Fed and will not impact its decision making.

Over the past 20 years it remitted $1.27 trillion of its profits back to the US Treasury Dept. As you said, that will fizzle or end this year. And there won’t be any remittances next year. See chart below.

The big losses won’t come from selling MBS. It would not have to sell a lot — the cap for MBS is $35 billion a month. If pass-through principal payments fall to $20 billion, then it would only sell $15 billion a month. And if it loses 10% on those sales, it’s losses for the month on those MBS would be $1.5 billion. And it’s still earning a gazillion in interest from the MBS it is holding.

BTW: “$100B in 3.5% yielding MBS is a $25B loss when selling into a 5.5% market.” That’s categorically wrong. This ignores the remaining maturity of MBS. That’s not how regular bonds are priced. Much less MBS.

The big losses will come from paying interest on reserves and RRPs, combined currently $5.4 trillion, and shrinking due to QT. By next year, it may have to pay 4.5% or 5% interest on $4.5 trillion average … so $200 to $225 billion a year – that’s where the losses are being generated, not MBS sales.

It will generate $100 billion plus in interest income to offset part of the interest expense. So the Fed will likely make a total loss of over $100 billion next year. It will simply create an asset account with the amount of the losses and amortize it against income in future years (corporate accounting has been doing that for decades).

My 3% mortgage refi taken out with Loan Depot that was sold to Freddie and likely bundled into an MBS and sold to the Fed. After all of the skimming by Loan Depot and Freddie, the Fed is likely making 2% profit on my loan.

Meanwhile, 10 year Treasuries are paying almost 4%. I’m not paying off or paying down my loan. I’ll let the Fed deal with this loss for the next 10 years. They created the problem.

If you participate in the scam, you are part of the problem. This is the very definition of moral hazard. People without morals are encouraged and even bribed to participate in the Ponzi, to justify the bailouts later.

I know a few IT professionals at Loan Depot. They stopped all 401K matching immediately. They have a lot of restructuring taking place in management and a lot of employees are fleeing the org in leaps and bounds. My contacts are worried the org is getting ready to close its doors. Why are these organizations always in trouble less then a year after dropping tons of money in branding large initiatives?

Mortgage companies made most of their money on refi’s.

1) They staffed up quickly to handle the huge load

2) They paid for advertising to attract refi customers as rates dropped.

3) They paid put their names on stadiums (Loan Depot Park)

4) Then rates went up and refi’s dried up.

5) They now have to lay-off all of that growth.

It reminds me of the DotCom bubble and sock puppets.

They didn’t diversify their businesses. They may survive as a much smaller version of their former selves without stadiums.

Selling MBS’s into an already fragile mortgage market would likely depress the value of MBS’s even further. This would cause mortgage rates to rise and house prices to fall more than they otherwise would without MBS sales. This would open the Fed to political attack.

A better idea might be for the Fed to decouple MBS runoff from QT, and announce that MBS runoff will continue until all MBS (and CMBS and agency bonds) have run off. When QT ends, the MBS runoff would continue and proceeds would be reinvested in Treasuries…

“decoupling…” Yes, it already did that last time after it ended QT, it allowed MBS to roll off and replaced them with Treasuries … also with repos during that time as it bailed out the repo market while MBS kept rolling off the balance sheet. The MBS rolloff didn’t stop until March 2020.

Wolf, is there an update on MBS runoff coming soon now that we’ve got 2x September under out belt?

In a few hours.

The Fed still….STILL holds 2.7 Trillion of MBS paper off the market. Imagine if that load was out there in the real market ( like pre 2006 when the Fed held NO MBSs ), looking for a bid.

Another fine mess you’ve gotten us into Ollie.

I had the exact same thought this morning.

… like two peas in a pod.

5.8% 10 year? What is this heresy?! I was told there would be a pivot any day now.

Lol, good one.

Imagine what home sales will be like at 7.5% rate mortgages.

Home prices are going to have to crash significantly over the next 6 to 9 months if anyone is planning to sell their home.

Yeah, we had interest rates this high previously, but we didn’t have 20 some odd years of goosing home prices (courtesy Fed QE) into the stratosphere prior to mortgage rates being up over 7%. That is the massive difference this go around.

Wonder if we will ever experience a REAL Great Depression where they actually allow markets to ‘correct’ with out Fed intervention.

If the Fed achieves 2% inflation. Mortgage rates should be above 7% long term anyway. My 1st and 2bd home purchases had loan rates of 9% and 8%. It did not deter me from buying a home either time.

People need housing. They will eventually come to terms with a normal interest rates, they will just will need to buy a smaller housing unit.

Core PCE inflation isn’t dropping back to 2% anytime soon. Eventually, it will get down to 3.5%, and a strong argument can be made for the FFR to always equal to PCE, making sure the bottom 50% of earners don’t fall too far behind on their savings value.

Or, more likely, housing prices will have to come down substantially.

There’s nothing special about prices going up; they can come down just fine, too.

“They will eventually come to terms with a normal interest rates, they will just will need to buy a smaller housing unit.”

No. They will buy a housing unit at a lower PRICE, but that does not necessarily mean smaller. Do not conflate size with price. They are only connected in the short to medium term.

People don’t “need” to buy a smaller house because they can just rent one and wait for prices to come down further to reflect current interest rates. The prime buying generation graduated college into the GFC. They are not looking to catch a falling knife and already have some experience watching housing bubbles crash.

I am fully prepared to pivot as we speak.

I think the 7.5% 30 year next year is a good guess. (If we’re lucky). I’ve been watching the 10 year and the spread between mortgage rates like a hawk the last couple months as I’ve been trying to close out a construction loan. Cringing every time it makes a big jump.

Thanks for the great charts in the article!

Let’s be honest with ourselves here.

Whatever mistake(s) the Fed made, they made it years ago. Painted themselves into a corner.

Who will pay for these mistakes? We will.

How can they make us pay for their mistakes? Printed money. What else?

They painted themselves into a corner….and asked for more paint.

Central bankers seem to believe more in “magic” than reality. For every action, in physics AND economics, there is an equal and opposite reaction.

Powell has neither an economics degree nor a physics degree. But it seems he has had an awakening of sorts. What to do with the extra $4 Trillion still sloshing around out there…

“Who will pay for these mistakes? We will.”

The working class, the poor, retirees and fixed income folks have already been paying an extreme financial price for years. The forests, deserts, parking lots, highways and byways are chalk full of homeless people who can’t afford shelter anymore. But people think Powell is worried about the stock market and will pivot soon? HAH! Inflation has and is continuing to exact a vicious toll on those who can least afford it.

Andy,

Well said

and that in nutshell is the solution –

as i make my own financial navigation decisions right now

I keep reminding myself that this is their goal – regardless of all the other noise

Print Money – to inflate (depreciate the debt) – it’s the only path out

The problem “right now” – is it got away from them – printed too much too fast

And if they turn the boat to fast the other way (Rate Increases) – they’ll need to whip it back around again and print.

Because it’s political suicide to inflict pain on the masses

PS – Wolf – great forum and articles – thank you

An interesting side not to this is that avg points charged on a loan also declined(20+ %-from1.15% to .95%). So not only are the MTG guys starving for business , they are also getting paid less per loan. If you need to do a loan now, there’s an A++ player out there who’s hungry for your business.

Wolf, any guesses where 1-5 year rates might end up by spring?

Perhaps they want the market to crash as well as the Home market that seems to be a possible agenda

if so why ? to start all over again ? what worked before and made insiders a lot of Money is this the repeat trail

when you lose trust well that’s it.

Increased ST rates are working but so what if long term greed is also is all part of a plan the rich get richer and the poor remain

Chart’s tell it all don’t need hand writing on the wall the story is already out

The whole thing is getting thing tiring and out of hand. Recession and major changes are happening to see that all stop looks improbable.

If they really want to make housing affordable they would put limits on investing, especially corporate and foreign investment in our housing.

Other countries disallow or limit outside investment in housing. Foreigners can’t buy up everything in Switzerland, Denmark, Mongolia, China, Kazakhstan, Thailand, Taiwan, Vietnam (& most of Southeast Asia) etc etc.

In the Netherlands municipalities demand that a buyer of a house below € 350,000 also lives in that house. This preserves their working class homes for workers. In Malaysia each region has a minimum property price for foreigners.

Foreigners can purchase property in Mexico’s interior region, but are unable to directly buy inside it’s “restricted zones”. UAE has the opposite- can only buy in tourist areas..

Australia has been trying to limit foreign investment by requiring the person to live on the property (I don’t think they’re very good at enforcing that though).

This direction is what it takes to protect your own economy and ensure your own citizens don’t get priced out of housing cyclically by the globally wealthy. Anything else is just a game.

The politicians in the US just don’t care.

I think Wolf is getting ahead of himself here predicting that the 10 year yield will keep climbing. If BoE is any indication, the first serious stress in the markets and you will see the yield go down.

Actually I think a 4% yield in the 10year is a great investment.

Its possible that the housing market will stagnate here as the yields come down and provide some support but I see pain for the stock market first.

The BOE??? Hahahahaha, its “pivot” is already un-pivoted:

https://wolfstreet.com/2022/10/04/bank-of-england-bought-no-bonds-today-after-buying-only-22-million-on-monday-instead-of-5-billion-per-day/

Wolf, when referring to the actions of a Reserve Bank, you must not use Hahahahaha.

The correct term is Bwahaha.

Wolf knows a lot that much i can tell.

(I’m a economics novice relative to many here in wolfspace).

Still… any mention of yields going down and… he becomes Wolf Reactor.

:)

Home prices need to fall a lot.

It increased more than 40 percent in last 2 years

The stress in the UK was not a stock market or housing market crisis, it was a currency crisis, a one- day 3 % decline in the pound against the US dollar. This is what provoked the panic in gilts, aka UK gov bonds, held by UK pension funds, as well as rising the price of all imports by 3% in one day. This crisis in an SDR reserve currency is a measure of how strong the US dollar is and how far it is from a currency crisis.

Why does it feel like this time the Fed won’t be able to save anyone? Is it too optimistic to think this time around the institutions that need to fail will fall and no one will be there to pick them up?

Because, in the final analysis, markets are bigger than governments. Governments and central banks can’t will wealth or prosperity into existence. All it can do is reallocate wealth, meaning steal from one and give to another. At some point, that fails to work. We’re nearing that point, in my opinion.

It is a spectrum, and both ends are crazy-unworkable. Total reallocation of wealth is communist disaster. Zero reallocation means a few players will own everything in a short time, which is a gangsterism disaster. They both wind up identical: the masses have bupkis, and some tiny sliver of people have the wealth and power.

Our situation is very far from these worst of all worlds. On the other hand, posturing like a noble purist is cheap talk, found everywhere in comments sections. It is worth every penny paid for it.

Maybe because while the fed is fighting inflation, we still have huge government spending, and an energy crisis with no end in sight?

I’ve plunked the max allowed in US Treasury I-savings bond for the last couple of years (currently paying 9.62% interest).

A week or so ago I stuck a toe in the TreasuryDirect treasury bill pool, putting $5,000 in 4-week bill – the auction resulted in 2.7% on October 4. My Citibank “Accelerate Savings” interest rate has also been going up relatively fast this year (2.2% in September).

Although losing significantly when inflation is factored in, it’s good to see savings yielding a bit more. I certainly do not have a green-thumb for investing in stocks, etc., so relatively safe investments are pretty much the only thing I’m doing at the ripe old age of 71.

drifterprof,

great info–thank you. I know these US Treasury I-savings bonds have been brought up in the comments section before and I need to get of my arse und finally do it!

If you are going to buy I-Bonds, do it this month of October, preferably at least a week before month end. The 9.62% rate is captured for 6 months starting the full month of October. In mid-October the Treasury will announce the next 6 months I Bond rate starting on November 1, and this will be your rate starting in Apr 2023.

Some people aren’t worried about this stuff at all. North Oakland home (San Francisco Bay Area) just sold for 2.5 Million, 25% over asking

So I checked the link before I deleted it. Turns out the asking price of $1.995 million was up only 14% from the last sale price 5 years earlier of $1.75 million, when prices have soared during those five years. Which tells you that the asking price was set very low in order to sell and get some excitement going. Oldest trick in town.

The fact that you didn’t mention it, shows what you are: a real estate troll that is spreading manipulative BS. But dude, it’s too late. This market is going down.

Not sure if mutual fund recommendations are appreciated (appropriate) here.

But here are 3 relatively low risk actively managed funds you can check out at Morningstar or elsewhere:

PRWCX, FPACX, LCORX.

All have managers that have been around a long time managing their funds. Well sure about Giroux (PRWCX) and Romick (FPACX).

Less sure about Ramsey (LCORX).

Drifterprof, the news coming out of Thailand is so tragic. You must all be in shock.

Yes. Bad drugs and human weakness = evil

I hadn’t heard about it so had to do a search. It was a guy high on meth. Meth is the worst drug there is. People do absolutely horrific things when under the influence, yet the powers that be turn a blind eye.

The mass murders in Canada were committed by two brothers high on meth. Somebody reported them laughing while they did it. A woman recently murdered and dismembered a man in the upper midwest (Michigan?) in his mom’s basement while she was sleeping upstairs, then was playing with the body parts, high on meth. These stories are a dime a dozen.

that just ruined my day. dang. disgusting. i could puke.

5.8% on 10 year seems unlikely with current market participants. It should already have touched 5% in a healthy economy. But since markets are just trained to expect a fed pivot, that yield is lagging far behind.

Personal opinion – but I think there is a lot of potential for MBS to go to junk bond level. There are many corporations whose existence depends on narrow spreads. As spreads widen these companies risk going out of business which are also a bulk buyer of MBS. A couple of big names going bankrupt and MBS spread will widen fast leading even more of them to go bankrupt. Might very well be a Lehman brother moment in MBS.

Things happen in finance that seem unlikely. If 10 year hits 5.8% and we get a recession we could be looking at 800 on SP500 for fair value.

I agree with you on the 10-year. Very difficult to see it hit 5.8%.

Disagree however on MBSs going to junk bond level. Not only are lending standards more stringent these days but more importantly, practically all MBSs carry a government guarantee nowadays and as such MBSs might go down but to “junk bond level” is highly unlikely. Private-label mortgages are a relic of the pre-great recession era. The banks have learned their lesson on that one.

Yes perhaps not to junk bond level but I keep wondering how and where does MBS find its balance now that anchor buyer like fed is out of the picture. And Powell is now openly talking about a ‘difficult correction in housing’ – his own words. I am sure that is scaring some investors. And this is a smaller size market, more vulnerable to volatility. I suppose we will find out.

“Not only are lending standards more stringent these days”

There’s that lie again. Whenever I see somebody post this, I automatically know they have zero understanding of the mortgage market and are just talking out their ass.

Anecdotally, I’ve seen the opposite if anything. Low to no down payment, loans backed by crypto/stocks, etc. I have a friend who’s offering $530,000 for a house right now and can only come up with $25,000 to put down.

By private-label I assume you mean jumbo mortgages, and, while small, it’s not insignificant. Fannie Mae has a max value of any loan it will buy (used to be a hard limit but now based on a region’s average house costs). Those multi-million houses being sold in big cities are almost all jumbo loans aka not insured by the Fed.

When you see statistics about what percentage of mortgages are backed by the govt make sure they’re counting by value and not just by number of loans: one mortgage for a jumbo $2mil actually affects the market as much as 10x$200k loans owned by Fannie Mae (although for sure far more $200k loans get written than $2mil). Here are stats on the MBS market:

https://www.sifma.org/resources/research/us-mortgage-backed-securities-statistics/

It’s small but not insignificant.

Those private loans haven’t been a big deal because default risk was low: housing is going up so even if a borrower can no longer make payments, he can sell the house, pay back the loan, and pocket some equity.

That’s going to change very fast. As soon as jingle mail becomes a thing again, private label MBS will take down a lot of investors and interest rates (compared to govt-backed so-called conforming loans) will spike.

MBS wont go to junk level.

1 year back, it was impossible to think 10 year yield at ~4% and we are currently at 3.8% plus.

I don’t see the reason why 10 Year Y can be at 5.8% in 1 year or so.

If an event can be be thought in our mind, don’t rule out it wont happen.

Mortgage lending standards remain a complete joke. A conventional 80/20 mortgage in today’s bubble markets is nothing close to prudent or conservative.

The only “natural buyers” for mortgage paper are pensions and insurance companies with long-term matching liabilities.

Without government guarantees, no one else would buy this paper with their own money at their own risk, except to speculate on interest rates.

“But wait: even these much higher-than-last-year mortgage rates are still far below the rate of inflation, with CPI inflation over 8%. But mortgage rates are catching up.”

We need to take care in interpreting such a comparison. The CPI inflation rate is a figure measured over the past year. The mortgage rate is what you will pay over the next thirty years. Any temptation to conclude that the real rate you’re signing up for is negative rests on a foundation of shifting sand!

Yes, but there is reason for alarm. Inflation bites hard, and bites early. At 8% CPI inflation, a 10-year bond investment could lose 20% in less than 3 years, and that cannot be recovered. If inflation subsides a few years later, it won’t matter. The losses have been incurred.

With CPI inflation running at 8%, investing in a 10-year bond is way too speculative in my opinion. Honestly, given the Fed’s track record of printing money, Bitcoin or gold might be a safer bet than the 10-year treasury right now. But, in my opinion, the best bets will be cash (in the short-term) and value stocks in the long term.

Uhm … did we miss something? There was no mention of buying a ten year bond. My point was the time mismatch between the inflation figure and the mortgage rate … that you can’t just subtract one from the other to find a “real” rate. The rates apply to different time frames, one to the past and the other to the future.

For instance subtracting last year’s inflation of 8% from from the next thirty years mortgage rate of 7% and concluding your “real” mortgage rate is -1% would be a logical no no.

Wolf can anyone survive a 5.8 % 10 year rate and corporate bonds at 7-8% and other country bonds at 8-10%, with the leverage in the global economy and the unsustainable interest rates at those levels, surely something will give before that.

third world bonds like the UK

corporate bonds of leveraged corporates

the acceptable PE on stocks

surely something has to collapse before then..

“can anyone survive a 5.8 % 10 year rate and corporate bonds at 7-8%”

Sure. But refinancing debt and new borrowings gets a little more expensive, which would cause corporate America to be a little more prudent in levering up their balance sheets, which would cause for example debt-funded share buybacks and leveraged buyouts (LBOs) M&A to get scarcer, all of which would be a great thing for the economy, but not for investors. Higher rates enforce better decision making, which would be a great thing. Higher rates will tamp down on capital misallocation – a great thing.

Higher rates on new debt also generate higher cashflows to investors, such as yield investors and savers, and they’re going to spend this cash flow, which would be a great thing.

Many overleveraged zombie companies will have to restructure their debts at stockholder expense and also at the expense of some creditors, and these companies can then emerge with new shareholders and less debt, and cleaning that up would be a great thing for the economy.

Low rates have caused huge distortions and have hurt the economy. It’s time to clean this up, and the discipline of higher rates will do this.

Yes, once upon a time, interest rates had a meaning. It reflected the scarcity of capital, the risk of renting it out, and the willingness to delay consumption. If the folks in charge declare (if only by sheer manipulation and oversupply) that money quantity is meaningless, or interest rates are meaningless, then that is what they will become. And that is what they were becoming in recent times: unmoored from reality.

Yet folks are cheering for a pivot, like a dog returning to its vomit.

Local North Bay joke from 70’s ( later part IIRC) about the three biggest lies in LA.

The Mercedes is paid for, I can get all the money I want at 10%, and it’s only a cold sore.

I get those points about fiscal discipline , efficient use of capital etc. My point is when there are so many leveraged entities with so much debt that all go bankrupt at the same time when rates rise, isn’t that a systemic risk?

They don’t all go bankrupt at the same time. This never happens. This gets spread over several years. Each company dances to its own drummer, each company has different resources to deal with. Some go in and out of bankruptcy very quickly, especially if it’s a “prepackaged” bankruptcy filing. Others get tangled up in long and complex bankruptcy proceedings. Others get liquidated in bankruptcy, and their assets and divisions are sold at bankruptcy auctions to other companies, PE firms, etc. If there is any useful division in a company that files for bankruptcy, it will go on and emerge nimbler and stronger.

Bankruptcy filings generally (but not always) mean that owners (shareholders) get wiped out, and that unsecured creditors take a big hit, and that the ownership of the company is transferred from existing shareholders to the creditors. Bankruptcy is really bad if you’re a stockholder or unsecured creditor. It’s not bad for the economy. On the contrary – a debt overhang is bad for the economy.

Sure, if nothing drastically goes wrong where incomes and revenues increase soon enough as the currency is further debased.

The only way it “works” is by increasing the level of perpetual theft, otherwise known as inflation or currency debasement.

That’s how it’s supposed to work and in this fantasy world, debt can supposedly increase and compound toward infinity forever.

In the real world, “accidents” happen and things don’t always go as planned.

Great summary of the spreads for MBS and the 10 year. Also the delinking between demand (lots of demand for MBS at 3%) and supply. Money supply is shrinking for sure. Lots of movement up and down for the 10 year this week. Even one statement by 1 Fed that said maybe he thinks a pause in Dec would be better. The core inflation rate is the indicator to watch for direction of the short term rates. The 10 year lag will follow. Something between 5 and 6 percent might be the norm.

As much as I would love to see it, I have a really hard time seeing the 10-year reach 5.8%, especially given how stagnant the 10-year yield has been lately.

think black flag event

the pound loss of confidence and margin calls probably will take weeks to surfacec

Depends upon your timeframe.

If the interest rate cycle bottomed in March 2020, rates are destined to “blow out” later, no matter what the FRB does or doesn’t do. The “fundamentals” will fall into place later, just as occurred after the last cycle peak when rates topped in 1981.

Back in 1981, no one would have envisioned subsequent debt levels, ZIRP, or NIRP.

Given how awful the long-term fundamentals actually are today, it’s not going to take anywhere near as long for rates to “blow out” either.

The disconnect between “fundamentals” and “value” has never been larger.

Forty nine years ago, on Oct 6 1973, Yom Kippur war started. Mortgage

rate were 9%, before moving higher. The world have change. Gravity with

Germany will limit it’s rise. Mortgage will not rise to 18%. EFFR will not rise to 21%.

OPEC+ and Putin are back with Yom Kippur surprise II. They are helping us not entertain fantasies of an ill-considered pivot. Which means, I guess, housing trends will continue.

A used home in SoCal was worth about $100k in 1981, that same much older home is now ‘worth’ close to a million.

Yep. In another 20 years it will probably be worth 2 million.

The actual utility of the home is probably the same but it may have granite counter tops now. It is just an example of a depreciating currency.

Yes, except that the currency didn’t lose anywhere near 90% of its value.

It’s the asset mania creating this “wealth”.

I have TNX with price target of 60, overshoot possible, but that is weekly chart….

I have read REIT’s – Real Estate Investment Trusts are highly leveraged, seems like this will be the next shoe to drop. Can you do an article on them? In the UK, their pension plans were highly leveraged, look what happened.

Here you go, from two days ago.

https://wolfstreet.com/2022/10/04/office-reits-massacred-as-the-future-that-office-markets-were-built-for-got-cancelled-by-working-from-home/

For folks interested in speculating on the short side of the CRE market, are there good equivalents like there are with SARK and others?

Closings will slow even more in the coming weeks as a good-sized chunk of Florida is off the (closing) table until the insurance companies can write policies again. You can’t close without coverage, and coverage is hard to get right now, according to a realtor friend.

Plus, of course, a lot of inventory is currently uninhabitable. We’re waiting for power and water in the pipes instead of the streets before we return to start cleaning up the downed trees.

Let the real estate bubble go down to the free markets.

I can’t understand why landlords in Toronto want to charge 900 a month for a shared bedroom in a cul de sac of Etobicoke or Scarborough, yet the job market is being phased for temporary contracts and lower wages.

They “want to charge” every last penny they possibly can, but are they getting it? My guess is “no.” I wouldn’t live in a bedroom in an occupied house for free. Pay for it? Hahahahahahaha!!! Hell no.

Foreign students beg to share rooms and they want to become residents. They are sold a lie.

Good article, Wolf. Some good predictions on the 10 Yr Yield. But don’t you think a 5.8% 10 Yr Yield will break parts of the economy? And you don’t believe the Fed will at least try to intervene to introduce some stability into the market? The UK pivot & unpivot happened because the market stabilized just by the announcement, and the GILT went down on the news.

I suppose anything can happen, but let’s connect in 6 months and see where the 10 Yr is. My guess is it hits 4.8% at the highest, and the mortgage rate stays consistent at 6.7%. Thanks for your insight. ;)

I sense a lot of wishful thinking in your post. Are you a used house salesperson? Because mortgage rates are already above 6.7%. How could they peak when the FED isn’t even done raising?

Also, we must consider that government has less ability to bail out weak players because inflation is running wild. Bailing out speculators would simply re-ignite inflation.

We are probably at the point where the government has to let some capital restructurings occur. If that’s the case, the default risk premium implied in all bonds is WAY TOO LOW. People are kidding themselves if they believe speculative junk entities are crucial to market functioning or the economy as a whole.

I wouldn’t be investing in bonds of entities that would be first to fail (i.e., junk bonds). These entities will feel acute pain, like an appendix attack. The Fed will respond with surgery, but the appendix will be taken out and thrown in the garbage.

Much depends on how fast you get there. An economy and markets can adjust to all kinds of things if they have enough time to do so. What happened in the gilt market was wild, it was a huge spike in a matter of days. The same increase over a few months with some ups and downs would have worked fine. So if by the end of the next week, the 10-year Treasury yield is at 5.8%, all kinds of things will break. But if it gets there a year from now, the markets will have had time to adjust. Sure, we’ll have a recession in that scenario, and that might actually start bringing down inflation.

Sellers are still completely delusional in the Central Valley. People who just purchased brand new builds in 2020 are still trying to get a 150k-200k return with zero improvement to the home.

They aren’t making anymore Fresno.

Is that a joke? Sure they are! The entire central valley is just an extension of Fresno, there’s more Fresno literally everywhere in California.

I’ve seen a fixer upper in San Diego being offered for sale at 850k, after being purchased in June 2022 for 650k. Of course, in September 2022 is still a fixer upper. No work have been done

If nominal T yields rise to decrease the spread with mortgage rates and, likely, credit spreads, such does not portend well for equity returns. Real TIPS yields have risen rapidly along with nominal T yield rises. Powell has indicated he want real yields to rise. If inflation breakeven yields (BEY) remain relatively constant, then most of the nominal yield rises for conventional T’s will translate into real yield increases. Inflation BEY’s have been relatively constant, despite elevated CPI and PCE reads.

Do not see US equities going up if TIPS real yields continue to rise and not insubstantially.

If a reasonable case can be made that intermediate and long-term nominal T yields rise from present levels, then I would short T ETF’s.

My hunch is that the Fed will reverse QT quickly if 10-year T yield starts to approach 5% level. While not super high by historical standards, added T issuance combined with possible muted demand could induce a downward price spiral and rising OAS spreads. I would not expect market liquidity to be ample, sans Fed actions.

Current market focus seems to be on when the Fed will begin to reverse itself and stop rate rises. Fed speakers have indicated they will continue their current campaign but markets seem somewhat disbelieving. If Fed really disappoints markets by not pulling back either rate rises or QT, downside price momentum could result.

Despite projected EPS levels (S&P 500) that are elevated over 2019, I would find it difficult to project P/E ratios that would not drop from present levels.

If you are right, then there are trade opps.

Prices are down but still too sticky here. Remarkable as something like 75% of people think there will be a recession. I guess all those with extra properties are the 25% that are left.

Yikes, housing market so screwed up right now. Feel bad for the RE agents and builders that make their money on transactions closing.

Good for the owner occupants mental health, I guess, as they don’t have to do write downs to calc their net worth and can hope prices stop falling for a while longer.

Owner occupants don’t care unless they want to refinance and leverage their home- bad idea in this economy anyway. In fact a lot of them much prefer valuations to go lower so they can re-appraise and pay lower taxes.

It’s all relative. If someone wants to sell their home and buy another, the new home may cost even less by the time the paperwork is done on the first.

Haha. Never a better time to sell. Don’t feel sorry for the RE agents. They should have seen this coming if they weren’t on drugs. Hopefully they also saved some of their PPP money.

IYR has target of 62-5

DRV 125

SRS 34

Let me give you some numbers from South Florida. I rent 2bed 2bath apartment for $2600. Apartment for sale in the building for 600K, same rooms, a little bigger and more polished. HOA $500/month. According to Zillow if I buy it I pay 120K down and more than 4K/month, but I have to loose my mind first.. This is how ridiculous the market is..

If mortgage rates go to 7%, it will require home prices to drop about 35% to make the mortgage payments equal to what they were in 2020.

If there is a correlating drop in the stock market, then you would expect that to impact jobs and unemployment proportionally.

I bought my first house in 1995 at 7% interest. We were excited to get such a low rate! Being inexperienced , we sold that house six years later, For sale by owner, and pocketed $8000. Now the house is worth nearly triple. I wish I would’ve kept it. It’s the only property I’ve ever sold. The rent would’ve made the payment even back in 2000.

In regards to property, I would suggest a buy and hold technique of as many properties as you can get your hands on. When you die they go to your kids federal tax free. The federal tax of selling a rental house ( without a stressful 1031 exchange) will eat you alive and selling makes no sense! Meanwhile it’s been fun watching everything double in price including the rents, Which allowed us to retire at 50 years old.

Don’t be afraid of 7% interest. Just be financially secure enough that you can buy and hold until the rates go back down again and refinance. Meanwhile, when the prices of the house has increased you can take out a second mortgage for a down payment on another property! The secret to wealth my friends is not buying and selling. Buy and hold!

The conversation here is interesting but you all are over analyzing the numbers. Real estate is quite similar to the stock market. Studies have shown that buy and hold will win long term every time.… not to mention the tax advantages of real estate!

“Real estate is quite similar to the stock market. Studies have shown that buy and hold will win long term every time.”

What kind of BS studies are you reading? Here is reality, no studies. Just look up the numbers:

In the stock markets of most developed countries, but also in China, buy and hold has been a disaster if you bought high. Those markets never went back to their highs 14 years ago or 20 years ago or 40 years ago. The only way to win in those markets is to buy during the low points, and then to SELL high. If you bought high, you’re STILL screwed. The US stock market has been one of the few exceptions in developed countries, and that may now change.

There are some RE markets that never went back to their bubble highs. Japan for example. If you bought in 1979, you’re still underwater. They had a huge bubble. Now we had a huge bubble

Well good for you that you’re probably not in that market… just saying . By the way I’m not reading anything, I’m telling you from first-hand experience which is worth it’s weight in gold— take it as you will

“Well good for you that you’re probably not in that market…”

I’m in the market, but on the short side. This is public knowledge around here, and I’ve gotten plentifully pooh-poohed for it here :-]

There is a meaningful percentage of housing that has yet to recover to HB1 levels on a nominal basis. On a discounted basis, they are selling at material losses even in HB2. The whole housing always goes up narrative sounds good, just doesn’t happen to be true.