Carefully communicating this isn’t a Pivot to QE but a temporary “backstop” to calm a panic. And it calmed the panic with minimal purchases.

By Wolf Richter for WOLF STREET.

This was the infamous Pivot back to QE: The Bank of England announced on September 28 that it would buy up to £5 billion per day in long-dated UK government bonds (gilts) “in a temporary and targeted way.” It said specifically, “The purpose of these purchases is to restore orderly market conditions.” It said the program would expire on October 14.

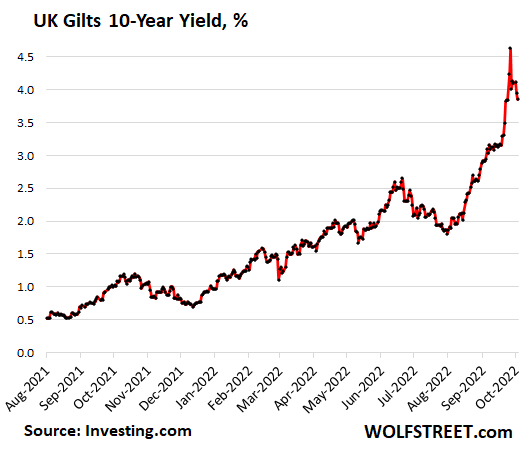

This came after long-dated gilt yields blew out last week, with the 10-year yield on September 28 getting close to 5%. Panic had broken out after highly leveraged UK pension funds with £1.5 trillion in assets had received margin calls on their gilt-based derivatives linked to their liability-driven investment (LDI) strategy (explained here). The pension funds had started to dump gilts along with other assets to meet those margin calls, thereby creating a death spiral for gilts.

On September 28, the BOE stepped in and said it would buy up to £5 billion per day in the secondary market via auctions through October 14. It spelled out that this wasn’t a new round of QE, but a backstop for the gilt market that had become dysfunctional. It would also give pension funds time to sort out their issues.

The announcement settled down the markets, and 10-year gilt yields plunged back below 4%, and yields plunged around the world as everyone breathed a sigh of relieve that the panic wasn’t spreading. And the meme was born that the BOE was the first central bank to “pivot” back to QE.

But the BOE bought no bonds today, almost no bonds yesterday, and very little last week.

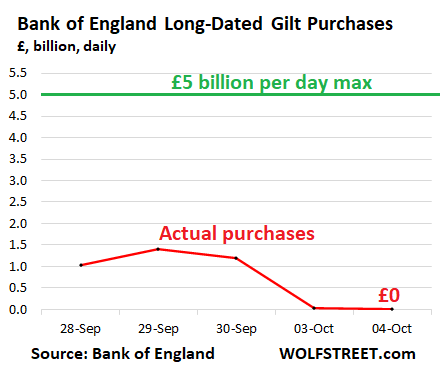

The BOE bought very little over the first three days of the program (Sep 28, 29, and 30), averaging only £1.21 billion per day, instead of £5 billion per day, according the BOE’s daily disclosures of gilt purchases under this program. It bought almost nothing on Monday (Oct 3), just £22 million with an M; and it bought £0 – meaning exactly “zero” – today (Oct 4):

Turns out, the program was highly effective in calming markets, settling down the panic, and unwinding the spike in long-term yields, without big purchases.

The BOE is using reserve pricing at the auctions. On Monday, it had received £1.91 billion in offers to sell gilts, and rejected all but £22 million of them.

Today it had received £2.23 billion in offers, and rejected all of them, with its reserve pricing.

With these pricing limits, the BOE is further communicating that this is a temporary “backstop,” as it calls it, to calm the gilt market, and not the beginning of a new round of QE; and that it is serious about ending the program, as announced, on October 14.

On October 3, the BOE reiterated that “the purpose of these operations is to act as a backstop to restore orderly market conditions and reduce any risks from contagion to credit conditions for UK households and businesses.”

It said that it is “studying patterns of demand and will continue to use reserve pricing in order to ensure the backstop objective of the tool is delivered.”

And it said that “the Bank stands ready to adjust any of the other parameters of the auction in order to secure that objective.”

In the same announcement, in a further sign that this is not a new round of QE, it said that it asked gilt dealers “to identify” whether offers are made on behalf of themselves or on behalf of their clients, starting on October 4.

The BOE is caught between the unruly gilt market and 10% inflation that is wreaking havoc on the economy.

The 10-year gilt yield has dropped about 100 basis point from the peak of the panic to 3.87% now, about where it had been on September 23:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So…this is just a fake bear market rally based on central bank jabber that is gonna end soon?

Good to see that there was no significant Pivot. Why mainstream media doesn’t show this data instead of speculating on pivots to spin up fake rallies.

I would also like to see BoE hols the pension fund managers accountable. Why did the pension fund broke first and not some private fund. What prevents financial sector from dumping the bag to passive pension funds when risks materialize. After all the same companies own all these funds.

Correction : Same companies “manage” all these funds

Truss, the not elected PM by voters, also, reversed her billions in tax cuts–basically for the rich–which signaled the gvt would be adding to their already mountain of debt! This took away a lot of intere4st rate pressure, too!

Good

GringoGreg – no UK Prime Minister is elected into place by UK voters; they are voted head of their political party, and the head of the party with a majority in parliament becomes PM.

This can come into play when voting for your local MP, which in effect is a vote for their party, and thus who becomes PM, but there’s no voting for them as an individual, unless you’re a voting member of that party when it comes time to choose a new leader.

Pension funds are a likely place for the system to crack. In a former world the survival rate for pensions would be 100% as there would have been matching of liabilities with bond interest payments.

Now with over promised and underfunded pensions many pensions are solvent if there is only fair weather ahead.

It is worse then what you suggest.

You need to take into account long term investments that take time to unwind (real estate for example) and market volatility (since part of the money is invested in stocks and those need to be bought & sold as well).

In short a pension fund that has less then 105% to 110% of liabilities in investments to cover those liabilities should be considered insolvent. To be comfortable it should be 120%+ so that in the event of a recession the drop in value of the investments will not result in a drop below 100%.

If you open up a long term chart and see the carnage of just how savage that gilt move is, I think you’ll agree the relative correction has been well, tiny. Jawboning might have delayed the inevitable by some days however you’d imagine the market will soon enough be pushing back.

Anyone buying a government bond should be prepared to hold it to maturity no matter if the market price collapses. Just shows how leveraged some institutions are that they can not do this.

But will the BoE really start selling gilts by October 31st?

Haha….Powell boy is pretty influential after all…he got BoE to rip a page of out the jawboning playbook and it worked…well until the market wakes up again and spike the yield higher again..

Central bank whack-a-mole getting started!

Whacking these moles is a bitch. Bastards are fast.

Damn right. No matter what the event some angle will be found that supposedly points to an upcoming “pivot.” And that is pounced on in record time. Amazing the speed and creativity in which that narrative can be spun.

This particular dead cat must have taken a shot of helium prior to the agonal gasp. Surprisingly high bounce the past two days.

Speaking of moles (and gophers) a good hungry cat is mandatory if any of you have or are planning to retreat to more rural areas to survive….ah….whatever is coming.

Off grid all weekends, vacations 1990-2000, then full time till 2006, I know. Lost prized Apricot tree to rotten little rodents. Had couple fake realistic owl statues I moved around, too. Didn’t reduce bird damage, they crapped on their heads….rodents, really don’t know.

Yet there appears to be little concern about the pension funds’ role in the crisis. Should they be playing with risky derivatives in the first place?

1) I don’t think they’re supposed to be risky, because…..

2) central banks aren’t supposed to be f*cking around with rate suppression that forces pensions into using them.

Which has gotta make you wonder how many other layers of moral hazard are buried under this mess waiting to surface. So much for the 2010s theory that there’s no such thing as rates that are too low.

Finster

The first sentence, of your 10.11pm post, perfectly identifies the greatest challenge central banks are set to confront as a natural and inescapable consequence of their historic recklessness and current tightening actions in the face of inflation.

The amassed forces of moral hazard are immense and deflationary, also present whac-a-mole characteristics and will be unable to be ignored. This is the denial stage.

One just needs to sequence events, rather than take a side and disparage the other.

Yeah, open mouth operations, yet while a bunch of more funds UK have gated their withdrawals or shifted their redemptions from daily to monthly… will do wonders for liquidity… lol

Nothing has been solved, just another can kicked…

Those funds should NOT exist in the first place. There should be no open-end mutual funds that allow their holders daily liquidity. Many of those funds are in totally illiquid assets, such as real estate, and they allow their holders to draw out money on a daily basis. This “liquidity mismatch,” as this is called, is totally nuts: it’s a huge systemic risk. They’re going to get a run on the fund, and then they’re toast. The fund can lose 80% of its value even if its underlying assets are good. It’s the most predictable thing in the world.

I have covered this for years here — these open-end mutual funds holding illiquid assets are death traps. No one should ever invest in them.

People who buy open-end mutual funds that hold corporate bonds, loans, or real estate have no idea that they’re holding a hand-grenade.

People who start these funds need to go to jail.

To be consistent , you must include the universe of ETFs in your criticism .ETFs allow their owners to liquidate their holdings on a second by second basis . The buyers are “ authorized participants “ who then sell short the underlying securities who make an arbitrage profit in a process called redemption . In essence it is another form of negative gamma in that the process of redemption will result in selling the underlying securities on declines . During fast markets the bids on ETF will melt as buyers for the underlying securities disappear and the process will feed upon itself .

Yes, agreed, there is that risk.

So a reit etf that you can trade in real time would be even more dangerous, no? They must have some cash reserves in order to meet redemptions up to a point, but probably assume redemptions will not have a 6 sigma event.

Iona,

No, not at all. Because you’re not pulling your money out of the REIT itself when you sell, you’re pulling your money out of the buyer that buys your shares — liquidity is provided by the buyer, not by the REIT. Same as with any stock that you buy or sell.

When you sell a mutual fund, you sell the shares back to the mutual fund itself, and the mutual fund has to come up with the cash to pay you.

When you sell the shares of a REIT, the buyer – someone in the market – has to come up with the cash.

REITs are not mutual funds at all. They’re not ETFs either. They’re companies that own property, and they issued shares to the public via an IPO, and under a special tax rule, they pass most of their income on to their stockholders via dividends. There is no “liquidity mismatch” risk with a REIT. I have owned and would not hesitate owning REITs if their business is sound.

> People who start these funds need to go to jail.

we both know thats not gonna happen lol

More likely, ppl running them will end up either serving their country as a “regulator” :P

or a legislator.

Wolf….

were these funds involved in the Repo blow up not long ago?

and if so, is not the Fed placating the existence of these funds?

Mortgage REITs were involved. But it’s not the “run on the fund” that hit them, which is what topples mutual funds. It’s that the repo market got nervous about them, and they could no longer borrow at low rates in the repo market short term to fund their long-term MBS holdings. That’s a very different issue. It’s always risky to borrow short-term to lend long-term, and that’s all mortgage REITs do, and they’re leveraged.

“This “liquidity mismatch,” as this is called, is totally nuts: it’s a huge systemic risk. They’re going to get a run on the fund, and then they’re toast. The fund can lose 80% of its value even if its underlying assets are good. It’s the most predictable thing in the world.”

Q: Is the standing Repo Facility then a safeguard against this “systemic risk”, but at the same time allowing this situation to exist which you predict must end poorly?

IMHO, the mortgage REITS should have been allowed to implode in late 2019. It’s a risky bad business model. They weren’t that huge and contagion could have been managed, and it would have taught some lessons.

But those mortgage REITS are languishing. The biggest one, which I used as an example in my podcast back then because I know the guy who started it, now trades in the $8.30 to $8.50 range. All-time lows. Their total assets have plunged by half since 2019. They just keep shriveling. I think they’re going away on their own gradually, or are getting small enough to where they don’t matter, and will be allowed to implode or whatever.

Apart from your last sentence, well said!

I think going to jail should be reserved fro people who break the law rather than people who just earn the scorn of the citizenry.

What else is there to invest in for the pension fund?

I believed that these pension funds operate on a management fee of 1% of the capital and 20% of the capital growth of the fund on an annual basis.

With zero or even negative interest rates and nearly zero interest paying bonds and then deduction of the management fees, these pension funds are going to be worth less than what is paid into them.

I had been telling my clients to cash them in for the last three years and not even to put the money into annuity because how long can those stay solvent?

Our leaders just don’t get it if they think this will work long term. But then again, most of our people don’t either. From an article on CNN about retiring during the pandemic:

“I was really grateful for the stimulus checks that the government distributed earlier in the pandemic – it would be nice if we could get one more to get us through until inflation cools. Temporarily reducing our taxes would also offer some much-needed relief. And raising the federal minimum wage would certainly help those who are lower-income and would put more money back into the economy.”

Sigh.

“Our leaders just don’t get it if they think this will work long term.”

Please avoid the terms “leaders” and “elites.” They deserve neither. And what else are they or, rather, the central planners called central banks going to do? Allow a return to actual markets with the associated destruction of vast amounts of phony wealth? I think we’ve FINALLY approached the point when their hands are tied and a “soft landing” allowing the continuation of this garbage is impossible.

Winston

Totally agree. Those two words do not describe these elected officials and/or their appointees.

No need to glorify a public servant or corporate fiction.

Cnn? Really?

Yes, really. CNN is a mainstream media source, even if I and many others don’t like it.

That aside, I’m referencing this as it provides a window into the mind of how many of our fellow citizens “reason.” She was “grateful” for the stimulus checks, and even wants another one to help us get through inflation! But she never connects the dots, and realizes the stimulus checks in part CREATED this inflation.

Enihal

The Krugman people. They are a smallish minority of Americans now, but there are still millions of them. He’s like their holy man..the one they have to follow and believe in, and believe that the politicians must pay attention to his advice, if America is going to be saved. It’s as bad as any other political/economic cult around.

HA-HA-HA!

Slowly materializing out of a fog while flashing both shadowy profiles, and then saying, “Only I can do this”, is really over the top and gone….especially when the “this” is never clearly defined. Jim Jones never even did that. And Krugman is just another talking head among hundreds or thousands.

I may have missed this in the original post from a few days ago but what is magical about Oct 14? Will the pension funds be able to unwind their leveraged bets by then or is this just kicking the can down the road?

Nothing magical. Just mid-month. And it was about halfway between Sept 28 and the BOE’s next policy meeting. They want to get this over with before their next policy meeting.

It was leaked days ago that the BoE’s outlay was minimal. The extent of the pivot is hardly the point. Downplaying what occurred in the UK surprises me.

In those brief flashes of lightning, the vulnerability of the entire financial system was laid bare.

If you read my article on Sept 28 about what the BOE did, you would have known that this had nothing to do with QE. It was a panic, and the BOE calmed down the panic.

Trumping up what the BOE did as a “pivot to QE” surprised me. That was completely nuts. Just BS.

There are underlying problems, such as the leverage at pension funds, and 10% inflation, but no one can solve underlying problems during a panic. First you gotta calm down the panic. And then you can deal with the underlying problems.

Why are we having “panics?”

There always were and there always will be financial panics – some small and specific such as this one, others huge and wide – as well as other panics. That’s why we have a word for it. Why? Good question. Human nature?

I had many “financial panics” for several years during the 80’s recession.

First time I ever drank alone, Popov vodka. Medicinal.

I was VERY lucky to finally get out, many millions never did.

I was applying the BoE’s definition of QE available on its website.

“Quantitative easing is when we buy bonds to lower the interest rates on savings and loans.“

Whether it’s the prepared £65 billion or less, it’s QE.

Trumping up might apply to those seeking new definitions and nomenclature when existing definitions and nomenclature suffice.

Reread your own quote of the definition of QE, and you will see that the current action by the BOE wasn’t QE. The BOE told you exactly what it was for — “The purpose of these purchases is to restore orderly market conditions”– and this has absolutely ZERO to do with “to lower the interest rates on savings and loans.”

When markets are based solely on central banker jawboning and speculator emotion, they are useless. Fundamentals don’t matter anymore, apparently. What a f**kin’ joke everything has become. The slightest little thing spooks a bunch of speculators and the worlds’ economies melt down. That’s a broken model.

It’s time to neuter the worlds’ central banks. They are abject failures, and serve hardly any good purpose with the exception of financially raping the middle class and the poor, and handing it to the already wealthy. They have spent the entire past 50 years hollowing out the US in lockstep with their corrupt political buddies and globalist crony capitalists.

The whole system is so marbled through with all these instruments and schemes tiered upon the central back suppression regime, the unwind could be scarcely imagined. So many houses of so many cards would fall.

A system-wide meltdown (without a pivot) would clear a lot of it. Then we can talk about massive social disorder and dislocation. The tent cities now would be nothing, next to it. I am trying to think what “Plan B” could even exist. I don’t see the central bank disappearing, because they are here to re-paper the whole thing, when the existing paper (social contracts, promises piled deep) crashes. They may have mismanaged the “forestry,” but they are also the after-the-fact insurance entity, the fire department.

There is no “Plan B”.

I constantly see posts here thinking that there is some mostly painless way out of this mess. There isn’t.

The majority of Americans are destined to become poorer or a lot poorer over the indefinite future and there is absolutely nothing any central planning committee (government or central bank policy) can do to prevent it.

A century ago Argentina was on of the richest countries in the world. A popular expression was “rich as an Argentine” and not sarcastically. Now it’s an economic basket case destroyed by years of rule by political cult leaders. Now the US is embarking on its own journey to the bottom with a huge segment of the population idolizing their own Juan Peron.

Escierto, correct. Around the turn of the 19th to 20th century, Argentina was the 7th richest country in the world. Many Italian emigrants went there instead of America, and it wasn’t an obvious choice as to which you would pick. That’s why Argentina has more people of Italian descent than Spanish descent.

What got Argentina into its current mess is promises that couldn’t be paid for and corruption. Fortunately, it’s corruption hasn’t led to the level of violence you’ve seen in Mexico, Colombia, and other places in Latin America, so it’s still relatively safe.

IMHO there can’t be plan B for the entire country, this country is ungovernable. However if country splits into the independent states, then some of these states may be able to drag themselves out of this mess individually.

Exactly

These are the kinds of morbidities you should expect when legislators abandon their responsibilities to exercise appropriate fiscal policy with the politically convenient fiction that central bank technocrats can carry the load all by themselves.

Good one eg, and I could not agree more with you!!!

Crazy crazy times far damn shore,,,

And, ”What to do” with re ”investing” should be first and foremost,,,

Unfortunately, and in spite of Wolf’s GREAT ”teachings,” WE the PEONs will once again take the burden.

As Kay says in the original Men in Black movie…”A person is smart. People are dumb, panicky, dangerous animals and you know it”.

Can the pension funds sort themselves out? Isn’t the problem that they have effectively bought cover against falling interest rates using gilts as collateral, and now face rising interest rates. In other words its all gone against them.

This printed money is not an insignificant amount for the UK at 2000 GBP per worker and perhaps more problematically as far as BoE forward guidance is concerned its very revealing that for -any- market trauma price caps will be established through printing money despite an extremely high background rate of inflation.

I remember in 2006 anticipating a mass housing collapse in the UK which did not happen because nobody anticipated money printing, at that point only associated with Weimar Republic and Zimbabwe.

If the BoE cannot stop printing money now then when.

How exactly do the pension funds extricate themselves without the BoE maintaining a cap on gilt yields? Genuine question. How can they avoid losses?

The BoE, and Japan, are effectively killing the first move speculators and thats the threat. Its a guy with a gun against a 1000. People should also be aware that pension funds in the UK are supposed to be the -safest- of investors, and are also regulated. So the fact they’ve blown up so quickly doesn’t bode very well.

I have said it before, but David Stockman had the big picture correct in 2010 when he said cheap money is going to cause speculation and gambling. Twelve years of crack they have to ring out of the market.

The more important point is that the BOE cannot save British living standards, whether they bail pensions out or not. Same for the British government.

It’s a question of who is going to be a winner and who is going to be a loser. I think we already know the answer to that question.

Under a “democracy”, it’s always going to be the highest bidder which isn’t the public and never will be.

No reason to expect any other outcome either.

Thanks Wolf!

It’s strange how Powells every attempt to bring down a market crash is propelling it higher. I think k he may need to hike by 400 basis point next time atleast to start getting his plans working.

Powell is engineering in a sense a slow-motion market decline, a deceleration hopped not to be a crash. Hiking 400 would pop us into a recession that day. Layoffs would be massive, and nobody would be sure who is solvent, so a run on the whole system, by everyone, would follow. Not just the financial system, but main street. Any pretense at musical chairs would end, and there would be a lot more players than chairs.

That’s why cars have anti-locking foot brakes and not merely a handbrake.

Whatever one thinks about the Fed’s recent doing, we are here, and must try to pilot the craft without inducing crashes.

I’m all for it! However, there may be too many retail investors that would catch a windfall of option premiums from such a move. Definitely can’t have that.

One of the reasons why that type of increase worked in the 70’s is partially because there wasn’t a quadrillion dollar derivative market that would start blowing up as rapidly as an old brick of Black Cat firecrackers.

(On a side note: while thinking about derivatives, did you see the spike in CDS prices for Credit Suisse?! It looked like they were tied to its 2024 bonds. Bonkers. BIS to the rescue??)

It would be a helluva show: watching the Limit Down hit across the equities spectrum – trading floors in pandemonium – maybe get a re-do of the dude calling the future market flash crash – and so on.

125bps, just to shut these TV people the F up while serving a shot to the chin of the “pivot people”, doesn’t seem too treacherous. However I have no idea what kind of interest rate swaps are out there so…

,,, because there wasn’t a quadrillion dollar derivative market

Neither were there 401k, 403b and IRA.

Everyone at the Fed, and especially Powell, breathed a huge sigh of relief when markets shot higher on Monday and Tuesday. It allows them to do their rate-hike business without having to deal with a crash. These bear-market rallies are an essential part by the market in digesting the higher rates. Works pretty well too.

A big crash — say, -10% a couple of days in a row — could cause a Fed pivot, and that would be bad in terms of taming inflation.

Someone in the UK is pushing MMT as the solution. QE in all but name? Ironic that it can also mean ‘magic money tree’.

I have come to view the stock market as completely corrupt and increasingly irrelevant – a rich person’s gambling hall where they trade fictitious companies at fictitious prices.

… when markets shot higher on Monday and Tuesday

Do you think this was due to US markets being the beneficiary of Brit and/or European funds flowing to the US for safety because of the BOE thing?

Just general excitement and the effect of a brutal sell-off always leading to a bounce, just a question of when.

Markets don’t make logical decisions like this (whether you consider that logic or not). The stock market is the most immediate expression of sentiment and applying any kind of fundamental “reason” why the market makes a move is a losing game.

This is why good earnings can cause a stock to drop or visa versa. It’s why the Fed can say one thing that “makes” the market move in one direction, then their notes come out repeating the same thing and it “makes” the market move in the other direction.

The true answer is that the market is ready to move in one direction or another. Sometimes it waits for a catalyst (like a Fed meeting), and other times it just does stuff without anything happening.

There are excellent methods to predict and profit from these moves, but you have to “unlearn what you have learned” when it comes to logic and any kind of fundamentals.

Here it comes – “Markets don’t make logical decisions like this (whether you consider that logic or not). The stock market is the most immediate expression of sentiment and applying any kind of fundamental “reason” why the market makes a move is a losing game.”

an insider comment – if they only knew how it really works . . .

He needed to be raising a point/meeting since March (really, since last Fall, but that water is even further past the bridge). This is why the market doubts rates ever get past about 4%- Powell’s actions aren’t convincing enough.

“My word is my bond”

Words always come out somewhat misfit with reality. Always did. That’s why contracts are modifiable. That’s why partnerships, marriages, etc., are a series of adjustments and renegotiations.

That’s why “smart contracts” are so often such rigid, imploding jokes: because their word absolutely, irreversibly, is their bond.

Teaching law is like teaching “fast comeback” in HS. At least in grammar school we just had memorized lines.

Law has BOTH. Have fun turning out new and better useless Sophists.

By the way, the ambulance chaser ads are really flowing hot and heavy on TV. Have a connected relative that says most all are just milking callers with promises of money…for as much “retainer” as they can get. There are at least mutterings of a crackdown on this stuff in her gov’t agency….a well known one.

Too bad you are one of the commenters who only likes being in the “chat room” up front. Short attention span? Need or prefer immediate talk and feedback? Maybe a classroom thing.

Oh well, to each his own.

How long until the markets become immune to this trick?

Next time they’ll have to buy longer.

Then longer.

Or maybe there is a whole new form of economics out there.

> maybe there is a whole new form of economics out there.

No, just the same old process of making adjustments as reality comes out misfit with expectations and best-laid plans. And meanwhile, the fleet of foot and mind will cash in on the discrepancies, and dodge the costs. And government will be left to pick up pieces, and be scorned, like some burned-out parent picking up broken toys.

If someone wanted to unload 2 bilion of Gilts on the BoE i guess they have a reason for it.

That gets out. And now everyone knows who’s been swimming naked.

If the BoE turns that down, they make matters even worse. Much worse. This is stupidity that only a central banker can provide.

Give time for the pension funds to sort out their issues. Except they won’t. No pension fund would touch derivatives if they knew they were on their own when the bet blows up. They know they will be bailed, so why should they stop?

In these times of easy money, sentiment speaks louder than actions?

BoE printing bailed out the banks, it printed to provide (pandemic) furlough, it was ready to print £65bn to bail out the pensions industry. The British public are quickly beginning to understand the BoE will print every time, no need to worry??

If governments are going to step in every time a pension fund has a hiccup then why not get the blood-sucking middleman out of the equation and nationalize?

Because in the UK the spivs who run the private pensions are the Tory donor class (along with homeowners whose short-sightedness convinces them that rising house prices are the sole objective of policy making). So you get ideology and “jobs for the boys” implicitly backed by the state in the place of sensible and solvent public pensions. That this ends up looking more like a casino ought to surprise no one who understands the underlying motivations.

Fees and commissions

So it turns out the whole pivot thing was “financial misinformation.”

Too bad our helpful tech overlords didn’t put little stickers on the tweets (“see the actual policy statement at the BOE”), along with taking down youtube videos, because – “violations of terms of service.”

Maybe that’s coming next. A Trusted News Initiative for financial information. Wouldn’t that be just awesome?

Seriously though, great information in your post. Explains nicely what prices are doing this morning.

The move past $1.11 (GBP/USD) last week put us in the most bearish scenario. Unless we break over $1.17, I see the bottom coming in around $0.95 some time in the next year or two. In normal conditions it would be a year or two for this to happen, but the moves over the last few weeks have occurred in such an accelerated fashion it could be just a few months from now.

That said, after it finally bottoms it should head on a decade long tear back to the $2.00 range (this is in part because of a weaker dollar).

That would be quite a trip back up to $2. Why do you think the USD will fall that much looking ahead? I agree that it’s overbought but I don’t see it falling as you predict. Curious why you think so?

It’s just the analysis methods we use. They don’t tell us much about the timing of “when” it’ll reach a target, but they’re strikingly accurate with price.

Long term charts, this is where GBP/USD looks to be heading. DXY has likely topped for now (possible there’s one move higher), but it will be dropping quite a bit over the next year or two.

King Dollar is here, the cleanest dirty shirt. Now, everyone else is going to have real austerity while we adjust interest rates back to reality.

Leverage kills, once again. And owing dollars while your home currency drops 30 percent is incredibly difficult.

So, they bluffed. What happens when they are raised again by the market? Will they bluff again, or will they be forced to follow through?

This incident should make it evident that both the actions by market participants and the BOE were psychological. It was negative psychology that triggered the potential panic selling and the BOE used the response as mechanism to counteract it.

So, to answer your question, the next time it happens (which it will at some point), it won’t matter what the BOE (or any other central bank) does or doesn’t do.

Under adverse circumstances where market sentiment moves against them, whatever they do will be viewed as a failure.

They can choose to attempt to rescue the bond market but then the currency will crash. They can’t save both and maybe neither because “printing” isn’t actual wealth which is what market participants currently assign to this fake “wealth”.

Too bad they can’t print up gasoline. Gas price in the UK now over U$D7/gallon. In this state price went up 50 cents in the last week to $5/gallon off-brand, $5.50 name brand (both come out of same local refinery). Nothing like a weekly $100 fill-up to remind the masses who is getting bent over…. with a precious exercise in democracy just a month away.

Truss, but verify.

+1 for the play on President Reagan’s words.

+2 because him and Thatcher were of the same ilk. Good international pun.

There are never “temporary govt programs.” They will go on on. Will some remid the BOE if it is sill doing it for next six months or symply say we knew they were lying?

We will see on the 14th if they will sell the bonds!

Citizens United doesn’t appear to be temporary either. But seats in Congress aren’t outright auctioned off to highest bidder (like in the ruling body of the City of London)….so there is some hope for democracy…..some.

>>But the BOE bought no bonds today, almost no bonds yesterday, and very little last week.

IMO: printing over £1B per day for several days does not qualify as “very little”. Sure, it was only ~20% of the declared daily limit, but setting the limit very high was part of the messaging game, I think.

Hi,

There is another theory out there, and that is that the Fed opened a swap line with the Bank of England. According to this theory, the Fed has essentially backstoped Gilt purchases. It would not be the first time the Fed had run swap lines with the Bank of England. It did so in 2008 and the Bank of England only came clean about it on its own website two years later in a press release. I would be interested to hear if anyone has tested (or can test) this theory with their trained ‘published Fed data’ eyes.

RW,

BS “theory.” Why don’t you just look it up instead of making it up? The Fed has had a swap line with the BoE forever. The New York Fed publishes the swaps with all central banks on its website daily:

https://www.newyorkfed.org/markets/desk-operations/central-bank-liquidity-swap-operations

Outstanding swaps with:

ECB: $274.8 million

SNB: $20 million

BoE: $5 million

$5 million with an “M” — this is just petty cash for a central bank.

Wolf – I caught a typo; “The 10-year guilt yield” – it’s a pretty nice one actually

Thanks. Autocorrect humor.

Thanks for the link.

Using the entirely of 2007 and 2008 and selecting the BoE gives you zero results for USD and non-USD swaps. Yet the BoE clearly admits swap transactions occurred during this period…

“Using the entirely of 2007 and 2008 and selecting the BoE gives you zero results for USD and non-USD swaps.”

Because the detailed data that the New York Fed makes available today about which central bank did what volume of swaps goes back only to 2013. Before then, only the total was posted. Look it up before concocting BS.

The large volume of swaps started in December 2007, disclosed by the New York Fed and on the Fed’s balance sheet. The detailed info as to which central bank did what starts in 2013.