The Fed gets more rate-hike material. Only retail trade is back to normal.

By Wolf Richter for WOLF STREET.

These are data points about the labor market that Fed Chair Powell cites every time during the post-rate-hike press conferences in support of the rate hikes. The data points are based on what 21,000 businesses said about their hiring plans, actual hires, actual layoffs, voluntary quits, etc., as the labor market spiraled into contortions, starting in early 2021. There was suddenly an explosion of job openings, record low layoffs, and a huge number of people who quit jobs to get better jobs, while companies hired aggressively to poach workers from other companies, leading to massive churn and job hopping, and the largest wage increases in decades, which are now supplying additional fuel for the already raging inflation – hence Powell’s focus on these data points.

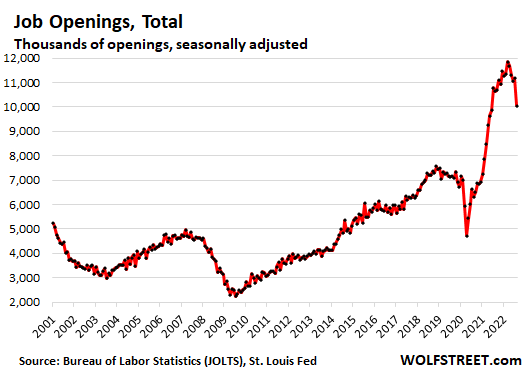

Job openings fell, but remained in the astronomical range.

Job openings fell by 1.1 million in August to 10.0 million, seasonally adjusted (and to 10.2 million not seasonally adjusted), the biggest decline since the lockdowns. But the level of 10 million job openings is still way up there in the astronomical zone, up by 41% from August 2019, according to the data released today as part of the Job Openings and Labor Turnover Survey (JOLTS) by the Bureau of Labor Statistics, based on surveys of 21,000 businesses.

So a slight softening in the labor market that still remains contorted, with labor shortages still hampering some sectors. Job openings didn’t fall equally across the board – they fell hard in some sectors, but rose in others, including construction. The only large sector where job openings are back to normal is “retail trade.” In all other categories, job openings were still way above their normal range. We’ll get to those in a moment.

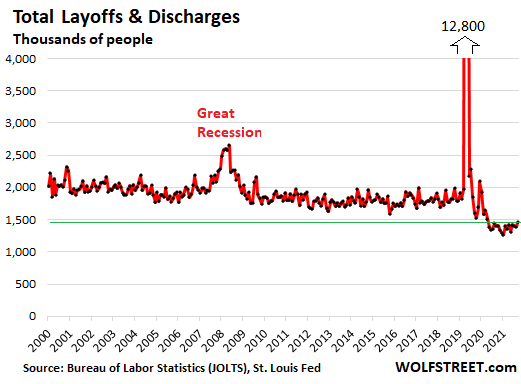

Layoffs & discharges ticked up, but remained near record lows.

The number of layoffs and discharges ticked up a tad after two months of declines and remained in the record-low range in the data going back to the year 2000. The 1.46 million layoffs and discharges in August were down by 20% from the already very low level in August 2019:

And most people that are getting laid off are finding new jobs quickly, with many of them already having a new job lined up before they walk out of their old job.

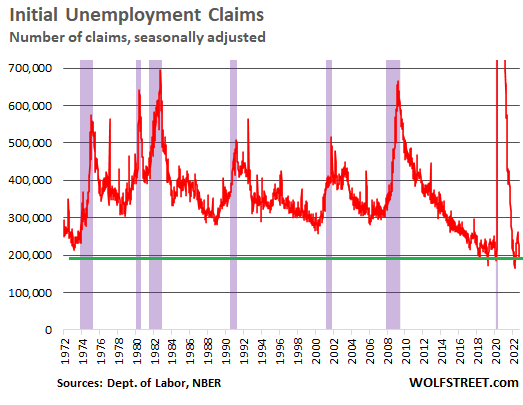

This is confirmed by a different data set, based on people filing for unemployment insurance with their state unemployment offices, and reported weekly by the US Department of Labor. Last Thursday, it reported that the initial claims for unemployment insurance fell by 16,000 from the prior week to 193,000 – near historic lows, further documenting that most of the people who were laid off either already had a new job lined up or quickly found a new job, before even filing for unemployment insurance: another sign from a different point of view of how tight the labor market still is:

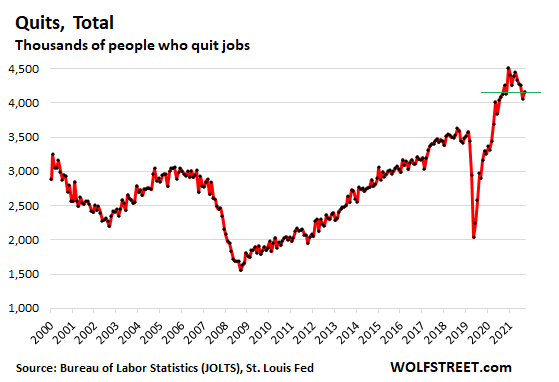

“Quits” rise again: still massive churn and job hopping.

The number of workers who voluntarily quit jobs rose to 4.16 million, after four months of small declines, and was up by 16% from the then record levels in July and August 2019.

“Quits” – combined with a large number of hires – are a sign of churn and job-hopping, a sign that workers either already have a better job waiting for them, or that they’re confident that they can get a better job quickly. These workers thereby effectively arbitrage the tight labor market to get a job that pays more, provides better benefits, better hours, is closer to home, etc. And it remains far above the Good Times before the pandemic:

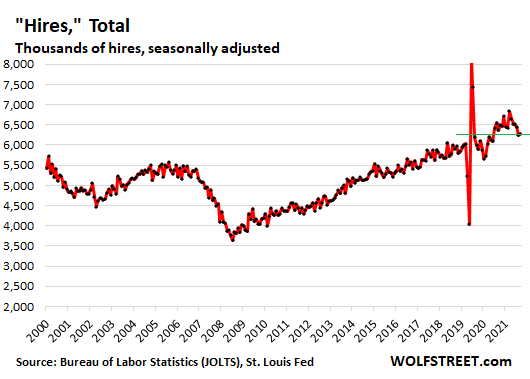

Hiring ticked up a tad.

Employers hired 6.28 million workers in August, seasonally adjusted, up a tad from July, and up by 6.3% from August 2019. Hiring is a function of job openings and being able to fill them, constrained by the tight labor market, with most of the hires being workers who already had jobs and were hired away from other companies.

This shows that most of the 4.16 million people who voluntarily “quit” jobs and most of the 1.46 million people who were laid off became part of the 6.28 million people who were hired by other employers.

Job openings in major industry categories.

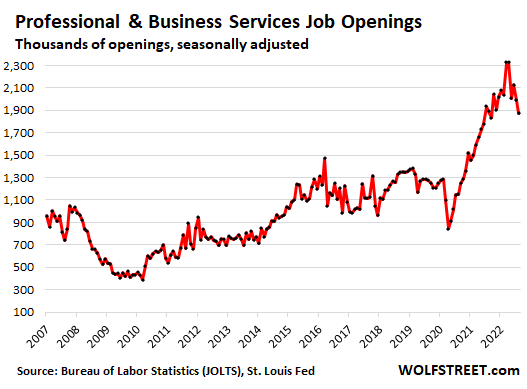

Professional and business services: This large industry category (22.4 million employees) also has the most job openings. The category includes the subcategories of Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

The number of job openings fell by 119,000 in August, to 1.87 million, the second month in a row of declines, but were still up by 47% from August 2019, and remain in the astronomical zone, with labor shortages abating slightly:

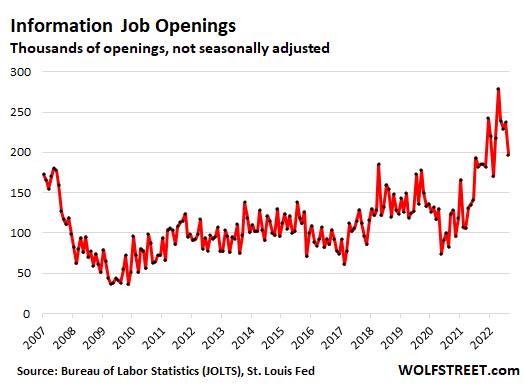

Information: This is a tiny category with only about 3 million employees, and it doesn’t really fit into the list of major categories and doesn’t impact the overall numbers much. But some of the small-scale layoffs that have percolated through the news media are in this category: Web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

Job openings – they’re always small and volatile – dropped by 40,000, or by 17%, in August from July, to 197,000 (not seasonally adjusted), but remain above all pre-pandemic records:

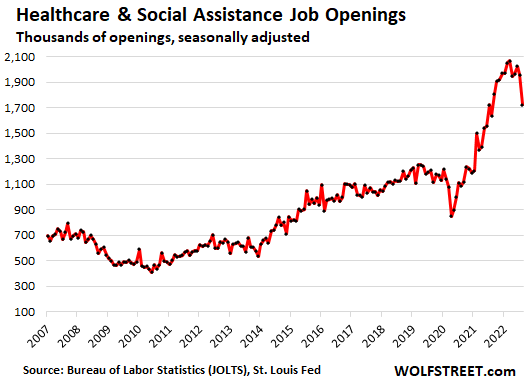

Healthcare and social assistance: Job openings fell by 236,000, the largest drop on record. But at 1.72 million, they remain in the astronomical zone, and were up by 43% from August 2019, as reports of staffing shortages in the healthcare system persist.

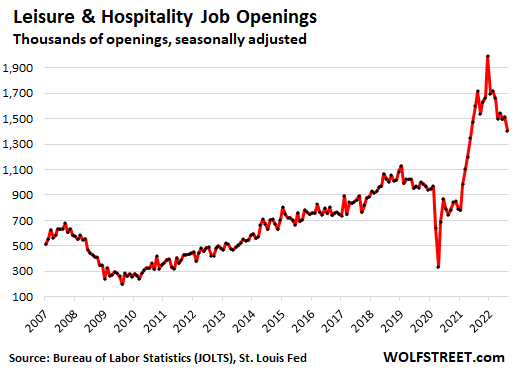

Leisure and hospitality: Job openings fell by 111,000, continuing a trend, to 1.40 million, but still up by 25% from August 2019, indicating that restaurants and hotels continue to make progress in staffing up, but still have ways to go.

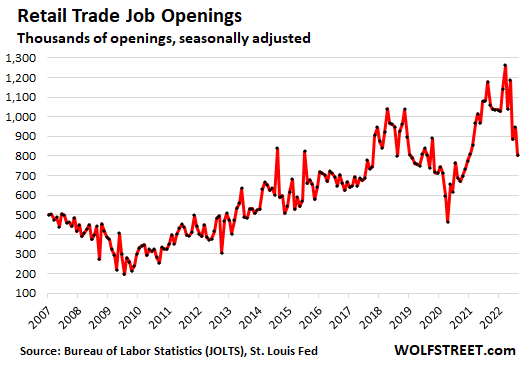

Retail trade: Job openings were already back in the normal-ish range in July. In August, they fell by 143,000 to 803,000 openings, roughly the same as in August 2019, as retailers got their staffing largely back where they need it, after the huge spike last year when whole categories of brick-and-mortar retailers re-opened:

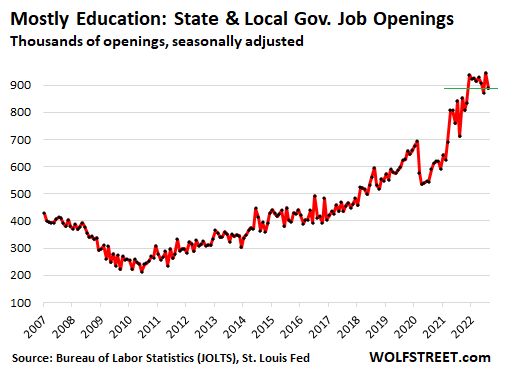

Education – as depicted by state & local government job openings, which are mostly in education: Job openings fell by 58,000 from the all-time record in the prior month, to 888,000. This was up by 42% from August 2019, amid continued reports of teacher shortages.

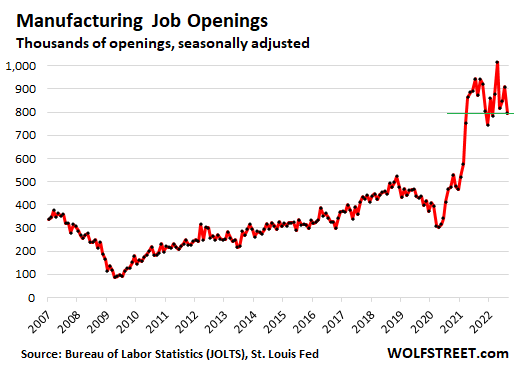

Manufacturing: Job openings fell by 115,000 to 795,000, but remain in the astronomical range, up by 85% from August 2019:

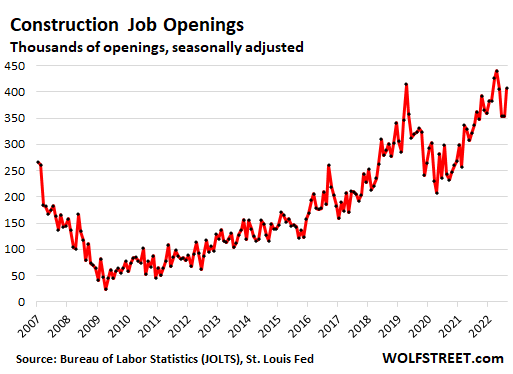

Construction: Job openings jumped by 54,000 to 407,000, up 26% from August 2019. We saw yesterday that construction of single-family houses is backing off a little, but multifamily and non-residential construction continues to grow:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But the pivot they say on CNBC. Inflation defeated they say?

“Inflation defeated” is the biggest BS out there. Even the Fed says it’s far from it. Believe the “inflation defeated” BS at your own risk.

Fed / administration must come out swinging against Pivot crap. Else, with another fake rally and low treasury yields, we risk running an even higher inflation number just before midterm elections.

High gasoline prices almost guarantee a bad inflation report before the midterms.

what I see out there is LOTS OF JOB OPENINGS

for HIGHLY SKILLED WORKERS – which CANNOT BE FILLED by unskilled availables

rest not so much – hospitality, small business, retail(though retirees are getting into gig now)

small business doesn’t pay more than $15 an hour

and everyone thinks they should be making $30 an hour

reality will soon set in

Not much of a pivot at the BOE – hot off the press:

https://wolfstreet.com/2022/10/04/bank-of-england-bought-no-bonds-today-after-buying-only-22-million-on-monday-instead-of-5-billion-per-day/

Is it possible that the CPI readings for Nov-Dec. 2022 will be lower since CPI was “highish” at this time last year?

Does that bring about a flaw in CPI as a measurement of inflation? Prices stay high but CPI goes down since it’s a yearly change measurement.

Thanks

Yes, what you’re alluding to is the “base effect.” That’s why the Fed said it will be looking at the month-to-month figures, which eliminate the year-over-year base effect, though they can be very volatile, and it takes several months to make a trend. So for example, you can take three month-to-month figures and annualize them. That works pretty well, and I have done it here when the base effect gets in the way.

Looks like oil investors are beginning to front-run the Biden administration’s plan (at least as currently scheduled) to stop draining the nation’s strategic oil reserve by end of October, just before the midterms.

It took two months of 15% WTI price declines (each) to essentially zero out headline CPI for July and August. That pace of declines cannot continue indefinitely. So it’s far too early to call inflation defeated.

Stagflation is a given. I don’t think about whether the economy is weak or strong. A projection is based on money flows. Short-term are barely up. But long-term are about to decelerate between Oct. and Dec.

“Inflation should slow down to about 3% next year, New York Fed President John Williams said Monday”. That belief may be interrupted by OPEC cutting oil production.

As always great data and really contradicts all the “news” stories about how the Fed is going to pivot. I guess even the UN is telling Fed they need to pivot.

I am going to guess that retail returning to “normal” probably reflects more on the state of retail industry then the job market itself.

Yes, Wallstreet is spinning up another Pivot rally in October. Here are the effects of it:

1. Higher inflation based on fake wealth effect and inflationary mindset.

2. Naive investors will get sucked in another pump and dump scheme.

This is very close to elections and the Administration and Fed needs to squash this rally soon, if they dont want to see voters punish them for higher inflation numbers and money lost to speculation.

WA

‘money lost to speculation’

Speculators are expected to lose when they bet on wrong side.

Credit mkt is the foundation upon which equity mkt is built. If cracks start appearing in the foundation, what’s the stability building above?

Reminds me of quote by well known wise ass James Carville. From memory, but it was something like;

“When I am reincarnated, I don’t want to come back as Jesus, or Mohammed, or Buddha, etc. I want to come back as the BOND MARKET, and then I can scare the hell out of EVERBODY”.

He should have said entire who owes who what and how “market”. Those financial “instruments” will just keep coming. Soros said as much at his dog and pony “did you help crash everything during the GFC” hearing?

So: Openings are normalizing for some sectors, but many are still near record highs. And Layoffs, Quits and Hires are all still showing a frenzied labor market, with maybe just a hint of softening. No evidence of rising unemployment yet either.

All of the metrics have a ways to go before one gets to the types of changes that led to a Fed Pivot in 2008.

Nothing in here says wage inflation will be crawling back under 2%. On the contrary, workers all over the nation are looking at large raises and retention bonuses, and retirees are about to get huge belated COLAs from Social Security. Those will tend to sustain CPI inflation.

Nevertheless, market propagandists are touting that now, finally, the Pivot Is In Sight, so the markets have gone insane again… But IMO there are too many people rushing to buy the dip here. This isn’t the market-mood where durable bear-market bottoms are made. If Powell wants to really squelch inflation, he has to humble some more people first.

Was surprised to see a significant drop in 10 year yield. So am really interested in Fed QT update from Wolf. Did the rate of QT actually doubled in September as it was supposed to?

Buying 10 year at 4% might have been a good play, but I didn’t do it. If next phase is yield curve control, then getting 4% might be pretty good.

Also 2 year Treasury paying more than our regulated stock dividend. Why bother with the stock risk?

As I have been saying for quite a while, in case nobody has noticed, the number of public stocks has been shrinking due to M&A and especially being taken private. If you invest in PE corps, THEY dictate the terms, i.e., 1/2 M+ minimum buy in and your money is liquid when they say it is. Few can play there.

So, you get all the zombie companies, SPACS, cryptos, focused ETFs, derivatives, and anything else they can come up with as your only choice, now that pensions are largely replaced by 401Ks, even in much of gov’t.

When I was a kid I never heard from our middle class parents about the “stock market” other than it was just something rich people did.

Rare stuff is worth more, isn’t that “bonehead Econ 101″……(or Econ 1A-B, prerequisite; Calculus completed or in progress.)

The inflation is well in place. Remember, the definition of inflation used to be expansion of the amount of money. That money “printing”, that is inflation have already happened.

What we now see is the inflation working its way from asset price rise to consumer prise rise and wage rise.

To get the price hikes down, deflation is needed. That is reduction in the amount of money. The trouble is, no central bank realy have the means to do so.

They have the means, it’s QT and for the Fed it’s as easy as selling bonds in the world’s deepest and most liquid market. Which of course is front-running their sales by cutting prices (raising yields), so they will sell low after buying high.

What the Fed has not had since about 1980 is the will (or political cover) to push the QT past the point where some idiot overleveraged bankers discover black swans on their balance sheet, like they did in England, and cry out in distress. Too easy to paper over distress rather than root out the problems.

However, persistent inflation has a way of transplanting spinal columns into central bankers. We’ll see…

“Job openings fell by 1.1 million in August to 10.0 million, seasonally adjusted (and to 10.2 million not seasonally adjusted), the biggest decline since the lockdowns.”

Looks like that’s all the ammo the WS pivot peeps need to start planning for the moon again based on today’s rally.

They read this as labor market will now motivate Powell to pivot, these people are freaking insane but by all means, rally this market up and it’s quite interesting to see them get slap down over and over again…I guess the pivot peeps are sucker for punishment. a temper tantrum proned dumb child that just never learn…and then you have the buy the dip zombies…

Fed encourages this behavior by doing too little, too late.

When real interest rates are still an absurd -5%, why not let it go to -10%. Finally both policies reward borrowers with no productive use for this money.

Yeah this and also to think of it in a different context..Powell’s credibility is so far down the toilet, even after Jackson Hole and rapid rate increase, the market still see him as this ultimate wimp that will likely back off like a biatch so current action and words rung completely hollow to a crowd that are high on hopium is no surprise there.

Jerome boy has his work cut out for him, credibility is just like trust, take years to build up and all it takes is one moment to shatter it to pieces and many more years to ebuild if you’re lucky. Combine this with a market full of crybabies and people that never sobered up from easy liquidity,maybe to sober up this market to tame inflation might require more than just cold water to the face, might need some scolding hot liquid to do the trick..

Its all wall street and the degenerate gamblers have – the casino hasnt been much fun this year for the buy the dip crowd but they have to trot out the pivot nonsense like weekend at bernies and prop it up, pretending theres life there.

Look at shopify, up 13+% today! This market is a short sellers/traders dream if you can see through the fud.

Data point from NYPost:

Several employees told the news site Insider that as much as 15% of the company’s workforce could be slashed within the next few weeks.

Eliminating 15% of Facebook’s workforce means that some 12,000 employees could be out of a job.

I encourage retail investors to buy, buy, buy! To the moon, Alice! Keep that balance sheet on edge! Keep that consumer spending red hot! Then, when stuff crumbles, be sure to righteously blame whoever one doesn’t like politically. I.e., jump from one melting iceberg of hope, hero worship and confirmation bias, to another. Thence, to righteously demand a bailout, under whatever name. I pray that one of these days, financial anti-gravity wizardry and chicanery will be exposed. It’s too much to hope, I know.

Meanwhile, I am long my boring steady job, and volatility bets.

Not trying to play devil’s advocate here, but what if the Federal Reserve really *is* tightening too fast?

A 1 million+ M/M decline in job openings is not insignificant, which was why stocks rallied hard today, once again on speculation of earlier FOMC pivoting. It’s now clear that belt-tightening is underway across the most highly rate-sensitive industries, including real estate, tech, finance, etc.

As a saver who wants higher rates, of course the most ideal scenario is the economy easily absorbs the rapid tightening. But if this is not the case, I’m hoping for a softish landing that ensures interest rates can stay high, instead of a hard landing that takes us right back to ZIRP & QE as soon as next year. Wall Street clearly prefers the latter, which is why stocks rally hard on any sign of economic deterioration.

He got so far behind the curve he has got to try to get the job done fast. Yellen didn’t finance US government with cheap long rates wen she could. It would be disaster to have bond rates at 4% plus for a few years as it would result in $1 trillion plus interest payments.

The bond market is (currently) suggesting US interest rates will peak around Apr-May 2023. Assuming Wall Street (typically) looks 6 months ahead, the S&P500 today may not be too far from the bottom.

“29 companies had a MKT CAP >10B with EBITDA of <-100M … ALL this silliness must go" I believe Burry on this one. All silliness must go before we reach a bottom, we're not close.

LOL markets have been “predicting” a rates “peak” in “6 months” for like the last 6 months.

The market has been forced several times to “adjust” those “predictions” after getting gobsmacked by reality and/or by Powell.

The market’s “predictions” have less credibility than the Fed at this point.

Other than Wolf and a small handful of others, there aren’t enough people with loud voices who have a clue what happened in the 1970s.

The market is flying blind based on miscalibrated instruments that don’t know what an inflationary hurricane can do.

“The bond market is (currently) suggesting US interest rates will peak around Apr-May 2023”

And what was the bond market suggesting 3 months ago? They don’t have a clue.

A pivot is possible, not because inflation isn’t entrenched on its current path, but rather because an economic emergency, triggered by QT and hikes, dramatically reverses monetary priorities. This is what I anticipate. The tightening-denier labelling can be quite challenging to navigate.

Events in the UK should not be overlooked. It has approx 10% inflation and switched from fiscal and monetary restraint to fiscal and monetary easing in a matter of days.

It’s becoming clearer that the value of bond collateral within the global debt Ponzi scheme can’t dwindle much more without an explosion of new consequences.

The past decade has incontrovertibly shown that money printing (aka deflation fighting) has been more entrenched than any other metric in Economics.

Per my understanding, events in UK was over blown.

It was not really a QE by any measure, a very temporary measure but it soothed the market.

Let’s see.

The market rally is givng more ammo to FED to not stop QT.

Hot off the press –not much of a pivot to QE:

https://wolfstreet.com/2022/10/04/bank-of-england-bought-no-bonds-today-after-buying-only-22-million-on-monday-instead-of-5-billion-per-day/

We don’t? Why not?

And what of all the hand-wringing around the strength of the dollar raising inflation overseas (Britain come to mind) forcing the Fed’s hand to slow down interest rate hikes and weaken the dollar?

Just thinking what might come next.

This is the reason the fed won’t slow down more than they’ve said they would. The US is effectively exporting inflation to the rest of the world right now bc their central banks have even less credibility with few exceptions.

So their people ditch the pound/euro/yen/whatever for USD and slow US inflation while accelerating their native currency’s inflation.

I think if the federal reserve wants to reign in speculation, they should massively adjust margin requirements. Leverage is where the problems get magnified and become “too big to fail “. This would target markets more than Main Street.

I declare “pivot” the word of 2022. I rarely heard it before this year. Now I see it all day everyday.

Stop hiking rates and put price controls on everything is the U N’s way to control inflation. Didn’t Nixon try that in the 70’s? Let’s whip inflation now!

1) The front end of the boomers have reached 77. Every ex-date is

gov dividends.

2) In 2020 a million boomers expired within two weeks instead of 20 years.

They left behind apt/ houses and other assets for the gov to collect taxes.

3) Between 2020 and 2022 the stock markets went up. Investors cashed

in paying real gains taxes.

4) Every day the boomers are retiring, expiring in big numbers. Real wages might be rising, but disposable wages are falling, because the gov collect more benefits.

5) The boomers trend is up. There are not enough people to fill the gap. The cartel, paying high dividends, is filling the gaps..

I fear the CPI print will be “surprisingly good”, and Powell may increase only 50 basis points and give dovish guidance. We are very close to a national election of enormous importance, government “data” tends to get warped when elections cause gravity fields in truth-telling. Powell is under enormous pressure behind the scenes to slow down the rate increases, and a juiced CPI report is all the excuse he needs.

Gubment going strong in the land of the free.

Everything else: Not really.

People stop pretending to work so employers have to stop pretending to pay them. What’s the point anyway.

As that famous economist said:

“I’m back in the USSR”

Did the J. Powell really make a mistake? The result of the mistake is the world’s biggest debtor gets to finance it’s drunken spending at negative 5% real rates for a couple of years saving Uncle Sam about 3 trillion in real interest payments.

Retail jobs & shipping taking a dive going into the holiday season.

Energy & food going the opposite direction. Not hard to see how this is

going to end.

I know multiple people work remote jobs who are working simultaneously at both jobs (medical research / consulting/ IT). Do you think this is rare or statistically significant enough to affect stats? This could explain how people are able to find jobs right away.