Very different from prior recessions when the industry was caught with huge inventories and large production runs.

By Wolf Richter for WOLF STREET.

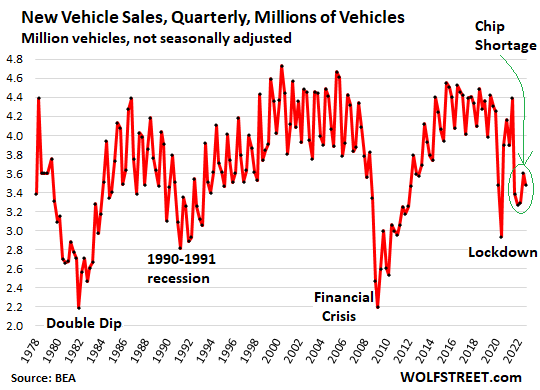

Sales of new cars and trucks in the third quarter, at 3.48 million new vehicles, was up about 2.8% from Q3 last year, according to data from the Bureau of Economic Analysis. But last year’s Q3 had been terrible: It was the quarter when dealers had run out of inventory because automakers had been cutting production for months because they couldn’t get the components needed to assemble their vehicles, because component makers had gotten hit by the chip shortages starting in late 2020 and early 2021. The chip shortages, though improving, continue to dog the industry.

But now there’s this additional wrinkle, triggered by the spike fuel prices: A shift from full-sized trucks and SUVs to vehicles with better fuel economy and to EVs. And supply chains, which are long and complex and go all over the globe, cannot react fast enough for sudden shifts in buying patterns.

So, compared to Q3 2019, new vehicle sales plunged by 19%. Compared to three years ago, quarterly declines have been in the 17% to 25% range for the past five quarters in a row. But sales had also been declining in the years before the pandemic. Compared to Q3 2016, sales were down by 22%. And at 3.48 million vehicles, sales were right back where they’d been in the 1970s.

Over the past four decades, the industry has been stuck essentially in stagnation interrupted by huge declines and recoveries. The troughs before 2021 were related to plunges in demand: the Double Dip Recession in the early 1980s; the 1990-1991 recession; and the Financial Crisis when GM, Chrysler, and a big part of the component makers filed for bankruptcy.

But in 2021 and forward, the trough was caused by supply shortages – not a drop in demand.

Estimating the piggybank of unmet demand.

There hasn’t been enough supply to meet demand since spring 2021. There are long waiting lists for various models that people have ordered because there were none in stock. And demand has shifted some toward fuel efficient vehicles. And there are long waiting lists now for those. There are now reports of 2023 model-year production runs having already been sold out, such as for the Ford Maverik hybrid pickup.

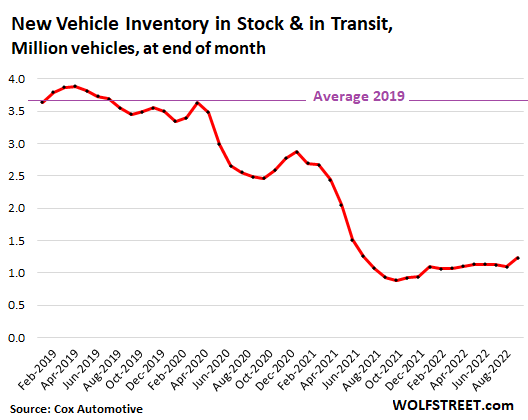

New vehicle inventories remain near record lows. At the end of August, inventories of new vehicles on dealer lots and in transit, at 1.23 million vehicles, were still down by 65% from August 2019 – though there are vast differences between brands: Kia, Toyota, and Honda dealers are essentially out, but Ram, Dodge, Jeep, Buick, and Chrysler dealers have plenty or more than plenty:

Most people can continue to drive what they already have for a year or two or longer. And so most people can wait for supply to arrive. But eventually, they will need to and want to buy a vehicle.

The catastrophic flooding from a hurricane, such as Ian, can remove a few hundred thousand vehicles from the national fleet that need to be replaced quickly. (Watch out when buying a used vehicle with a clear title that had been flooded, which can cause mega-problems, and they will be showing up soon in distant states to be sold to unsuspecting folks).

So now there is this mass of potential buyers out there that haven’t bought a vehicle because they couldn’t get one. And this group of potential buyers grows with each quarter that production cannot meet demand.

This includes fleets, such as rental fleets, but also commercial and government fleets, that have had trouble getting their orders filled since spring 2021, and that are keeping vehicles in service long than they would have otherwise.

Higher interest rates will sideline some of the retail buyers, and they may switch to used vehicles.

We can estimate how much unmet demand has been building up. If actual demand would be on average in the 4.2-million-vehicle range per quarter, while supply has been in the 3.4-million range over the past five quarters, then each quarter, 800,000 vehicles get added to the unmet demand pile, which by now is around 4 million vehicles in total.

So even in a recession, this unmet demand for vehicles would be hanging over the market, and would turn into sales as vehicles arrive. As supply increases in a recession, sales might actually rise from today’s desperately low levels.

This is very different from prior recessions, where the industry was caught overstocked with huge amounts of inventory and large production runs to supply more inventory, just when demand suddenly sagged.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Most people can continue to drive what they already have for a year or two or longer.”

Another year or two? What an epic fail of a production model. You could almost start a new car company and produce vehicles in that time fram. What’s really going on with these crooks?

Not in Florida.

No one is interested in measuring units any more. In dollar terms sales may have risen 8% thanks to inflation, price hikes, shortages etc. That’s enough for Wallstreet analysts to predict 50% rally on auto stocks and another 200% rally for Tesla and Rivian.

No one is correcting sales revenues even for inflation. Counting units will expose the real recession: Society gets poorer, drives older cars, car ownership reduces etc.

“That’s enough for Wallstreet analysts to predict 50% rally on auto stocks and another 200% rally for Tesla and Rivian.”

Why not 1,000%? 10,000%? It’s all fake. All of it.

The only competitor to Rivian, I think, is the Ford Lightening F-150.

It was first billed as base model under $40K, but I saw today it is almost $50K. All other models are up similarly.

If you ordered one, but didn’t get a delivery date, you pay the new price. (Per article, today, Yahoo)

Seems like a very useful truck, good range, and can run job site tools and even home for 3-10 days till power comes back, but is there more crap going on here than just a “chip shortage”….or is the “shortage” being milked somehow, like not trying to get said chips very hard?

And on that water damage…..cars today have cheap connectors and other places that when soaked in water can produce many intermittent shorts/opens, some even inside body, pillars, etc, a couple YEARS later…..easily. Most impossibly expensive to fix.

I hope the insurance tracing is good…..but….if there is a buck to be made somewhere….well….rules get “bent”. Send them to Mexico to get “detailed” and hide water traces? Cheap labor.

VERY SCARY for all used car buyers, even with low mi and 3 year warranty. Good for a retired guy’s hobby with a good shop, maybe, similar to restoration.

The parts shortages are real. Read the warnings put out by F. They have no reason to purposely restrict output. Idling factories and stacking up units is very inefficient.

A pleasant “old article” commenter surprise!…..I asked a question, you gave an answer….read Ford’s PR folk’s take on it.

I won’t, but still nice to see a “comments developer”, as it were. Thanks

Did you miss that fun tidbit from August?

Joe announced $7k subsidy for EVs in the Inflammation Reduction Act.

Ford announced a $7.5k hike in F150 Lightning’s price.

Of course, entirely coincidental.

Can’t drive newer cars “forever”. One intermittent short/open on some device on CAN bus…..and…….it’s over unless a GOOD tech gets lucky….not many auto guys know electronics and computers and chemistry and physics…..ALL are sometimes required.

I have CA BAR Smog L1, and L2 licenses…2013….Needed to run real BAR smog machines for diagnostics only, can’t certify pass. Anyway, I know all above stuff and it still wasn’t an easy course, and certainly not nearly comprehensive enough to fix the real difficult stuff.

At some point I know they just total them, I bet lots of them.

Also a plus for EVs. Really are much simpler to work on. With ICE you have to firmly grasp that it is a big vacuum pump, and then work upwards through a LOT of complications.

Yeah, I took the EV/hybrid class, too, so

CAN bus troubles are still there, depending on how many “features” you get.

But car will still likely run without as much damage, and cheaper fix.

BTW, with ICE, a BLINKING check engine lite means pull over and stop NOW. Your very expensive catalytic converter is about to be killed FAST…..not a cheap repair.

I know there is pent up demand, but I dont think it is as great as Wolf thinks. For one thing, COVID caused people to stop using public transportation and as it continues to normalize, people will go back to pubic transport.

But I think in these inflationary times, there are many people who can simply hang onto cars longer. So the flow of older cars down the chain of owners is longer.

Sure there will be some pent-up demand for hot cars, but in aggregate, I just think there will be alot of lost sales and older cars on the road.

Interesting perspective on public transportation.

I think the significant shift to work-from-home for many will continue, which will result in less mileage and wear and tear on erstwhile commuter buggies. The lower cost of ownership will be further encouragement for some to hang onto existing cars versus buying something new(er).

“Higher interest rates will sideline some of the retail buyers, and they may switch to used vehicles.”

Interest rates are even higher on used cars than new.

But instead of financing $50K, you’re financing $25k.

Exactly Wolf.. just got offered 3.5% on a used car for 24k, or 2.9 for a new one at 38k. I took the cheaper.

I bought a new RAV4 with no bells or whistles in 2017 for $24K. Those were the days. Unless I wreck it, this will likely be my last vehicle, at least for the next 10 years.

Oh, and I paid cash for that RAV4.

We have 3 cars in our family and might have sold the old one (my 2022 Mercedes C240) and bought our daughter a new car, but with prices and shortages, decided to hang onto the old Merc for her.

Why not? We hardly even drive any of the cars, except the Tesla. Heck I can drive the Merc once in a while. Kind of nostalgic for me.

I know there is pent up demand, but I just think that the cascade of ownership for cars just gets extended out to fill the void.

2022? How many miles can you have on that car?

2022 Mercedes is Old? My father bought a 220S and a 220SE in 1962 and kept them for nearly 20 years. Had over 200K and 300K miles on them.

I’m guessing gametv means ‘2002’

Fear not! Once the social value scores have been assigned, the government will simply sieze your vehicle and assign it to one of more “worthy” status. In exchange, you will recieve central air tokens good at all machines dispensing Brawndo. It’s a brave new future, all brought to you with no additional work needed on your part. Don’t forget to have your tatoo bar code scanned on the way out where you will recieve a three day bus pass complements of the management. Prez Camacho thanks you.

QE gives money to 1% and Inflation sucks money from 99% in this zero sum game. No need for government to steal or confiscated, they have already figured the legal process to hollow the 99%.

That makes sense… used cars carry more risk of complete repayment than new. It’s not a conspiracy.

New car dealers couldn’t get inventory, so they bought lots full of now overpriced used cars, what could go wrong?

There are tons of dealers who have 3+ month old used car inventory on their lots, because “not gonna give it away.” They don’t want to accept that they overpaid and take their losses.

Seeing that also. Went looking for a RAV4 for wife and they had 24 used priced at ridiculous high prices but only one new one. Six months ago you were lucky to find one used RAV4.

I was at a Toyota dealership looking for a Highlander hybrid. They had one with 5,000 miles that they were selling above new MSRP on the grounds that it was not registered (was used by the dealership) and thus was “new.”

They meant, “knew”, not “new”.

Gasoline and diesel prices are starting to spike up again now that OPEC+ has announced 2 million BBL/day cuts in production over the next few months. I suspect that gas hogs (big trucks, SUVs) will be in less demand going forward and that’s what the big auto firms like to build and sell.

Ford Maverick orders are closed for 2023 and Ford has not opened 2024 ordering yet.

…and so will dealerships. Car manufacturers are using this as a test run for a Carvana type future where you order your vehicle online and they deliver it to your driveway. No middle man necessary.

But for automobile franchise state laws…… ain’t legal in most states.

Tesla got away with it in most states because no one ever expected it to amount to a hill of beans. I think there’s still 8 states where they cannot sell direct to consumer.

NADA, AIADA, NAMAD, and the congresscritters won’t be going down that easy.

If the online sale happens in a state that allow direct sales, are not the seller allowed to contract someone to ship it to the buyer?

Next, what do stop the manufacturers to establish their own “franchise” dealer network that they have full control with? Set up with offshore ownership in a country with suitable laws and legally to the letter of the law.

Laws can change.

Or the way dealerships are set up could change. A few “salespeople” to do any needed in person handholding after the sale is made online.

Keep the finance and add-on department on the lot, but this work is done online too. And the mechanics as that area makes the dealership a ton of money.

All sales move to preorders for the next year. No push to move out this year’s/last year’s models. Huge reduction in RE lot space, just a fancy showroom with a few units indoors.

Break off the used sales to completely separate places.

Back in the dark ages, manufacturers did sell direct to consumer. It didn’t work out like many people think it would. Ford tried it again with their “Auto Collection” back in the late 90’s or early 2000’s. They lost their tuchus and sold them out after a 3-year experiment. I think they sold them back to the original dealership owners at a steep discount. The postmortem was basically – manufacturers make lousy dealers as they aren’t playing with their own money so they bleed red. I guess Farley is a slow learner.

Just because you order it “on line” doesn’t eliminate the horse trading as a used car cannot be appraised over the phone. Just like right now: I wouldn’t buy a used car online after the most recent hurricane. Plenty of “late model” used cars with clean titles that were flooded will appear on the market. They’ll cobble them together so they run, take them to the auction, some other fool buys them, sells it to you, and once you take possession, rotsaruck. Once the contacts in the electronics and wiring harness connectors corrode from salt water (even spray – a car doesn’t have to be submerged) it’s a nightmare to make reliable again.

When manufacturers sold DTC, there was no competition. That’s what the dealers brought to the market. One independent dealership would undercut the other on price and eliminated price fixing by the manufacturers (anti-trust behavior). When we had meetings with multiple dealers, if the topic of price came up – we factory folks would walk out en mass because of anti-trust concerns and the risk of the perception that we were participating in /entertaining any pricing conversations. That’s why the Monroney label says “Manufacturer’s SUGGESTED Retail Price”. The mouseprint says “dealers are free to sell at whatever price they deem appropriate”. The ads on leases have disclaimers as well (dealer participation required) and term disclosures as well.

I’m not defending dealerships…. it’s just that the DTC model is another “what’s old is new again” concept and has more pitfalls than one can imagine.

Here’s something to consider: If you lost your car in a hurricane, could you wait a year to have it replaced on a “build to order” basis? Probably not. Our production plans were 90 days out from the date of order, even for units for dealer stock. We also built what we wanted (for the most part). The cars were allocated to the dealer, not free order for plant efficiency. All components were not always available and production plans got revised on the fly monthly.

And laws can change? The auto dealers are a powerful lobby. They are wealthy and many of them are owned by public companies (Lithia, AutoNation, etc.,) and they carry a big stick. Auto dealerships are also large sales tax generators and the states and municipalities love them for that reason. Dealer laws, if amended, usually make it harder for a manufacturer to do business, not easier.

Yes, the workaround to get a Tesla in TX is buy it out of state and go get it or have it shipped. Shipping is an extra expense on you – Tesla doesn’t pay. Plus, if the vehicle gets damaged, it’s your problem. Having spent time in distribution, the carrier damage is a lot more prevalent than one might think. Dropped chains, rocks sucked up under the trailers, tie down damage….. it’s real. And the states could close that loophole by allowing the sale, but not letting you register it. There also can be sales tax issues which require jumping through a lot of burning hoops. States with inspection laws would require the vehicle be inspected before you could drive it on the street – which also may require you to tow it to the inspection station (as German TUF laws require). Try bringing a non-compliant car into CA.

El Katz, my impression is that built to order work in Germany and other European countries. The story about the couple going to the Mercedes factory to pick up the new car and the man forget his wife when leaving may not be true but is entertaining.

If the car manufacturers do not own the dealership where I live, they have them on a short leash. It differ a little between the car makers, but some are close to being subsidiaries of the car manufacturer.

As for the used car part, I do think that around here Polestar sell new cars online or from their showrooms, period stop. No trade in, end of story. There is some work to sell your old car then, but on the other side a private sale gives a better price than trade in.

Auto was rescued to support that downstream affect on labor, I doubt you see factory to consumer soon as you state. Dealerships are good little business centers for cities, give back and nice tax revenue. 80 jobs per rooftop on avg.

Then swim down to the suppliers and vendors of. Its a network, break it and there will be some issues in bandwidth of America

GM used to allow you to order a Saturn and pick it up at the factory.

Of course, you still had to pay the dealership transportation and prep fee.

The maverick order banks were open for 6 days on the hybrids and 7 days for the ecoboost 4 cyl. Production is slated to begin mid November for the 2023 model and my dealer told me to expect to wait 9 months from then for the hybrid I ordered. There seems to be no end in sight. You have to be almost a year ahead on some vehicles apparently…. just hoping my 200,000 mile vehicle makes it. Another interesting observation is that if you even can find inventory of some of these vehicles, it is always the very top platinum level trims that you find. I ran into this in 2022 and again when looking for another vehicle this year, hence my decision to order. That alone is certainly driving up the cost of new vehicles.

When I was younger I used to marvel at these old timers who drove old cars and happily let everyone know that their payment was zero. I’m one of those old timers now.

We live very near good public transportation and can walk to most of what we need/want. This lets us have one car, which is old and paid for.

Being old timers is just fine for us.

I’m in the club too. One car now (wife can’t drive anymore), paid off, just turned 19 K, and it should last us another 10 years at 12 K miles per year.

Been in that club for many years. Peace of mind.

“This is very different from prior recessions, where the industry was caught overstocked with huge amounts of inventory and large production runs to supply more inventory, just when demand suddenly sagged.“

This dovetails right into your QT and rate hikes for longer theory going well into next year.

Nothing has been solved yet. And as we have seen, there is a wall of money waiting to BTFD in stocks and everything else. People have vastly underestimated how much money is currently sloshing around, and the damage it’s doing to price stability.

There is no “cash on the sidelines” if that’s what you mean. There isn’t now and never been in the past.

This “cash on the sidelines” only changes hands which can be at both higher or lower prices. It doesn’t increase or decrease as a result anyone buying or selling stocks.

Plenty of “cash on the sidelines” in Japan which hasn’t driven stock prices higher since 1989.

You post a lot of intelligent things, but this is not one of them. I said “wall of money waiting to BTFD,” and I meant it. You don’t seem to understand the effects of fiscal and monetary policies on asset prices and market swings.

Mr. Frost, I have to side with Mr. Charge on this one… There’s definitely still an unimaginable pool of money out there. The poor are getting crushed by this inflating economy, but the lower-rich class, upper middle class, and even middle class homeowners are often swimming in cash and they’re not happy about sitting on it while inflation eats it up. Not to mention public spending is still off the hook… Cities, counties, and states are drowning in surplus cash.

Housing may have slowed down, but houses around my neighborhood in SoCal are still often moving in a couple weeks compared to a couple minutes, and they’re still going for $600k, $800k, $1m. Somehow, somebody is still buying this stuff. Maybe not at the fevered pace of a year ago, but turnkey houses are still moving just fine despite prices that are nuts. People are paying whatever the sticker says on cars, maybe not as quickly as they were, but they’re still buying. Fast food for 2 people can easily reach $30-40 now, and they’re still packing into restaurants. They’re still using door dash and other expensive services.

Indeed, a lot has been spent, and perhaps the hottest spending is behind us… I sure hope so. But I’m not holding my breath waiting for deflation that will never come. If cash doesn’t go back into stocks, it’ll continue to go somewhere, and it ain’t conventional savings accounts. It’s just hard for human beings to even begin to be able to have any concept of how much money $1 trillion dollars is, much less $5 trillion.

And those folks will BTD all the way down. They always do.

this is true but what I am hearing from small to medium business is credit risk management or lack of is now coming back to bite in the booty or slow things. It seems a lot of small business started inhouse loans to sell more into all that sloshing money but now defaults are picking up, payments slowing down. So they are looking at credit data, KIQ and fraud tools to look at risk. For 14 years risk has been mispriced, should be interesting moving forward.

Soon you (the 99%) will own nothing and be happy(a slave)

Most of the people are still flushed with lot of money. Hence people are willing to pay thousands over msrp at least for new cars.

I don’t see demand coming down yet.

That won’t end until the $5 trillion that was printed in response to a health issue is removed from circulation.

Einhal,

I think the $5 trillion was printed in response, to among other things, the repo crisis, but Wolf and John Titus are better informed than I on that subject and defer to their judgement.

Ian destroyed ten of thousands houses and cars. People will sleep in

the back seats of their cars. Demand will be high. OPEC cut production, but WTI didn’t care, because Put dump oil at a discount.

Ilan is the largest share holder of TSLA. If TSLA pay dividends TSLA

will attract dividend investors and be able to pay for Twitter within few

years.

WTI didn’t care? Zoom out a bit. WTI has been pricing in this OPEC cut for over a week now. The only surprise was the move to 2m barrels, and even that was leaked yesterday.

Considering OPEC+ is pumping below quota, this cut is about 500k-700k barrels of actual cut, so if anything WTI is finally getting the message we really aren’t in a normal recession and this winter will bring natgas to oil conversions.

With recent laws mandating EVs in NY and CA by 2035, the automakers have incentives to fix EV supply chain issues and improve range. That’s only 13 years away (The average life of my gas cars).

Will I be able to find a gas station by 2040 in CA or NY without driving 100 miles?

My gas cars still have 5-10 years of life so my next car will likely be an EV.

If I was planning on buying a car this year, an EV would be a better choice for the environment, but even if I purchased a gas/hybrid car today, it will not be until the late 2030’s when I would likely start feeling personal pain trying to find gas. What are the owners of the 100,000 cars flooded by Hurricane Ian going to purchase? Prices will go up for both in the near future.

However, government edicts that far in the future have a high likelihood of slipping.

Are any of these hurricane damaged cars covered by insurance?

Comprehensive coverage pays that

Bank gets paid first.

Just because some government passes an arbitrary law doesn’t change reality and make it feasible in the real world.

Passing laws doesn’t magically create some “deus ex machina” to make it come true.

It’s also about to become plainly evident in the future economic depression when many more people and governments are obviously broke.

Passing laws don’t prove success. However, they provide motivation and direction for business to achieve the goal if possible.

Ie.

“I believe that this Nation should commit itself to achieving the goal, before this decade is out, of landing a man on the Moon and returning him safely to Earth.” – JFK 1961

Djreef

I concur. Auto sales are a huge component of retail sales in the USA. With limited inventory, inflation will stay for awhile longer, so Fed rates should continue their upward march.

I don’t understand title washing. Doesn’t the previous flood salvage still show on the Carfax or other similar VIN report?

Not if there is no insurance claim

Certainly ”seems” to be the case apple:

Had a RV drive me into the median bumpers a few years back in spite of my horn, flashing lights, etc…

Driver was another VN vet (Army) with full,

repeat full insurance coverage and very good guy to the point of acknowledge of his responsibility.

Maybe because he instructed his insurance CO,,,

My vehicle was totally repaired, with NO report.

His insurance co folks were SO polite and thorough and easy to deal with, I almost went over to that company…

I’ll be happy if we just get back to the point where used cars depreciate before they hit 100K miles. I try to purchase used vehicles that still have several good years left, but lately those have been priced so close to new that it’s just not worth it. Fortunately I can wait a few more years. Patience is my friend.

In the last three months WTI is down from 124 in June

to 76 in Sept. We live in a different world : US economy have entered Ft Necessity.

Someplace (don’t remember where) I read that M2 money velocity had increased second quarter. That would imply in my opinion we have continued higher inflation just hard to predict where the numbers will pop up. And with the need for more car sales that should also create a secondary market for money circulation no large decrease in inflation yet

I bought a Camry this summer, to replace the 13 year old Altima with no AC and $3,000 repairs needed. I had to pay a deposit, just to get in line to buy a car that might be coming in. I’m in Texas, so you can burn to death in your car in the summer. I settled for one that does not have smart key, or push button doors, because several sales people told me they were not making them any more. The sales guy said that used cars were selling at new prices, and I could probably trade in the car for one with smart key for very little money.

Three weeks later he tells me he has one coming in, and he wants to pay me $3,000 less than what I paid for my car. He kept trying to convince me that I was saving money on taxes, due to the trade in. That is 3 weeks of driving a car, for a $3,000 loss. I passed on his generous offer. I could sell my car myself and buy a new one with a smaller loss.

Used cars do cost as much as new ones now. The finance guy told me that people were buying several new cars at once, and re-selling them for more money, or driving them for 2 months, and selling them to someone as used, at a profit.

Just wait they said a lot of the same stuff in 2000

Why not just remove all non-essential chips with a redesign of “accessories”. Go back to manual door locks and windows if that’s what it take. My guess is the reason manufacturers don’t do this is because all the profit comes from accessories and fixing broken accessories. I don’t want to pay $10,000 to replace a bumper with electronics in it if I can pay around $2000 to replace a bumper without.

Nobody would buy them.

They would sell a lot of cars like this. Everyone I know complains about the computer “junk” which you are forced to buy with every car. They all want normal metal keys instead of remote controls that just get in the way. As you said, this is just about jacking up the price.

JeffD and Harrold,

Maybe for basic “get from point A to point B” vehicles, the need for computer “junk” is not there.

My 2006 Chevy Silverado 1500 is as basic as it gets; roll-up windows & no electronic door locks. It does have cruise control, ABS and an FM stereo radio though. Perfect for a utilitarian work truck.

But my SUV, my car, my motorbike and my bike all have high tech that makes the machines superior to those without it. I am into performance — as are a lot of people — and performance from computer aids is fantastic.

For example: my car has a “smart” rear differential. Merge onto the highway from a clover leaf & step on the gas; the differential puts every bit of power and torque into each rear wheel — precisely at the point of maximum traction. A good driver and a posi-grip rear diff can do a close match to this, and a driver can wiggle the back end loose a bit to find the limit (which is fun sometimes), but my car always does it for me — without the wiggle. I like the way it feels and the way it works.

And having a motorbike with traction control, ABS and wheelie control is not only a blast to use, but also, it’s a safer machine to ride. Computers and the six-axis IMU (Inertia Measurement Unit) make it possible.

The technology in my vehicles improves my quality of life. It make the machines faster and safer.

The premium per gallon per grade of gasoline had gone to I think $0.40, maybe more.

This week it is $0.15 from 87 to 89 octane, then $0.05 from 89 to 93 at Sheetz in Ohio.

What is going on there?

It differs by state. Where I live in Virginia, there’s a dollar difference between regular and premium – $3.79 vs. $4.79 at my local station. Glad my car takes regular.

Hmmm… the comment from DEL that I am responding to disappeared after I posted the above remark.

Cannot blame everything on that tired beaten up supply chain.

Few other contributory factors which further explain reduced purchasing volumes:

1. Cost of new vehicles substantially outpaced inflation and income. Average new vehicle price is approx $45,700. According to CNC poll, approx. 82% of the new vehicle buyers are paying above MSRP prices.

2.New car dealers are adding “market adjustment premiums” to the selling prices of new vehicles. The premiums are added to the MSRP and range from $2,000 to $4,000 on common cars, up to $50,000 or even $100,000 for “specialty” cars.

It is not surprising that sales are suffering when one considers that monthly payments (principal and interest) of $700 – 800 are very common for average, ordinary cars.

The predatory “market adjustment” premiums will ensure that many buyers will have negative equity in their vehicles during the entire time of ownership and likely to discourage future sales because owners will be less able to afford the future cars with predictably increased sale prices.

So select the most enjoyable car/truck because the buyer of today’s new vehicle will be driving it for at least 7 years, unless willing to refinance the negative equity present in the loan to car value.

negative equity is refinanced in new loan for what seems like forever but I’m old, nothing like today but its been happening for quite a while…

thanks for explaining so clearly that we could have a recession with sales of goods still going up and the demand for the raw materials for those goods remaining strong and that demand leading to commodity inflation and causing recession plus inflation with rates still negative and stocks hitting the shitter. thanks wolf

Time to binge watch old Mad Max movies.

Just let me know when the Van Life fad is over so used vehicles for the trades can be found again.

Car sales are booming here in Port Jervis, NY. Not used cars, but spanking new cars of all brands–iincludimg Ford. This is weird, because Port Jervis i one of the poorest, perhaps , in NY State. At first I thought that people from Pennylsvania or New Jersey , both of which are very near PJ, were coming over the bridge to shop at our two car dealers. But I noticed that

these spanking new cars wer parked in large numbers her in PJ J. But no one shops here from outside this nearly abandoned semi-ghost town of a city. Just the reverse–everyone here shops in Pennsyvania, just across the river. Most of the cars werte very upscale. I even saw a Jaguar parked on our main shopping street. Whats going on here? Is this a widespread reality across the nation? A penny for Wolf’s, and everyone else who comments , about this atrange situation.