Forbearance and pandemic cash run out. But a lot of fun was had by all.

By Wolf Richter for WOLF STREET.

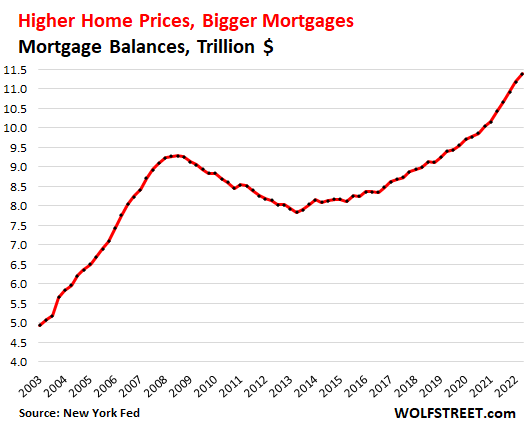

Mortgage balances in Q2 jumped by $210 billion from Q1, and by $945 billion, or by 9%, from a year ago, as prices spiked year-over-year, while people bought far fewer homes – sales of existing homes dropped by 10% from Q2 last year, and sales of new single-family houses plunged by 19% over the same period.

Mortgage balances have surged relentlessly since the end of the Housing Bust in 2012. Over those 10 years, mortgage balances surged by $4.6 trillion, and over the past three years, mortgage balances surged by $2.0 trillion, or by 21%, to $11.4 trillion, according to data from the New York Fed’s Household Debt and Credit Report.

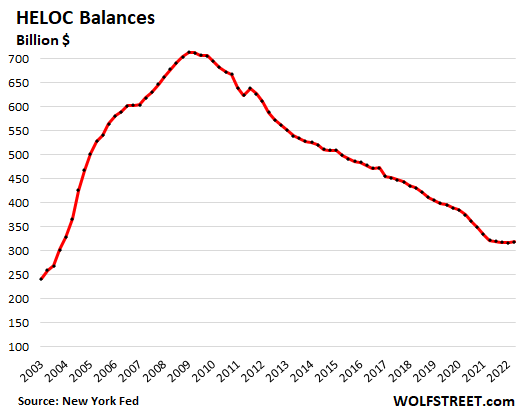

HELOCs end long decline.

Home Equity Lines of Credit fell out of favor after 2009 and balances declined steadily, unwinding the massive surge of the years before the Financial Crisis. As the Fed’s interest-rate repression and QE pushed down mortgage rates, and as home prices rose, folks began to cash-out-refinance their mortgages to generate cash, rather than drawing on HELOCs.

But now the decline has ended. HELOC balances ticked up in Q2 to $319 billion, from the low in the prior quarter. This has occurred as mortgage rates have spiked, and as cash-out refis have plunged.

There is now a new dynamic in place: Much higher mortgage rates: It would be stupid to refinance a 3% mortgage with a 5% mortgage in order to draw $100,000 in cash out of the home. It’s better to leave the 3% mortgage alone, and get a $100,000 HELOC that charges 5% on the outstanding balance, if any. So I expect HELOC balances to rise further going forward because the cash-out refi game has changed.

Mortgages are by far the biggest part of consumer debt, bigger than ever.

Nothing comes even close. Consumer debt balances in Q2:

- Mortgages: $11.4 trillion

- Student loans: $1.6 trillion

- Auto loans: $1.5 trillion

- Credit cards: $890 billion

- “Other” (personal loans, etc.): $470 billion

- HELOCs: $320 billion.

Mortgages is where the big systemic risks used to be due to the sheer size of the market and the high leverage.

But now, commercial Banks in the US only hold about $2.4 trillion of residential mortgages, including HELOCs, on their balance sheets, and those are spread among 4,300 commercial banks. Thousands of Credit Unions and other lenders also hold some mortgages on their balance sheets.

But most mortgages are now securitized into mortgage-backed securities. MBS fall into two categories:

- Most are government-backed MBS. Here the taxpayer is on the hook, not investors and lenders.

- A smaller portion of MBS are “private label” – not backed by government entities. They’re held by global bond funds, pension funds, insurance companies, etc.

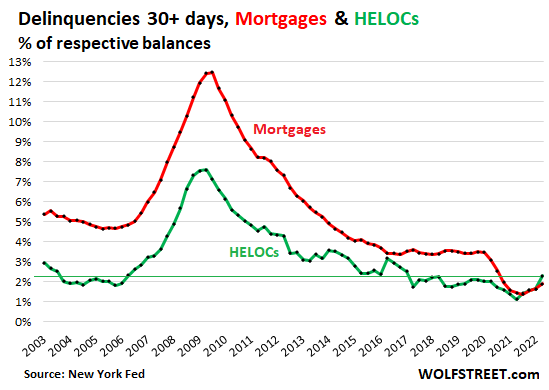

Delinquencies start trip back to reality. A lot of fun was had by all.

Under the pandemic-era forbearance programs, homeowners that fell behind on their mortgage payments, or stopped making mortgage payments altogether, and then entered into a forbearance program, were reclassified to “current” instead of delinquent. They didn’t have to make mortgage payments, and could use the cash saved from those not-made mortgage payments for other stuff. Eventually, they would have to work out a deal with the lender to exit the forbearance program.

The spike in home prices since spring 2020 allowed homeowners, when it came time to exit the forbearance program, to either sell the home and pay off the mortgage and walk away with extra cash; or work out a deal with the lender, such as a modified mortgage with a longer term, a lower rate, and lower payments. And a lot of fun was had by all.

But with forbearance programs over, mortgage delinquencies started to rise this year from the record lows last year.

Mortgage balances that were 30 days or more delinquent rose to 1.9% of total mortgage balances in Q2, up from 1.7% in Q1. It was the third quarter-to-quarter increase in a row, from the record low in Q2 2021. But it remains below all pre-pandemic low points (red line).

HELOC balances that were 30 days or more delinquent rose to 2.3% of total HELOC balances, the fourth quarter-to-quarter increase in a row, from the record low in Q2 2021. They’re now higher than they were before the Housing Bust (green line).

The HELOC delinquency rate in Q2 was higher than the mortgage delinquency rate for the first time ever, which makes you go hmmm.

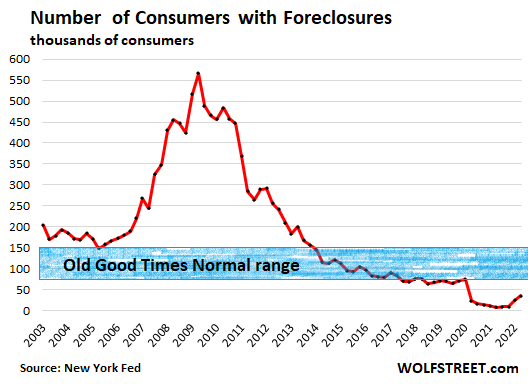

Foreclosures rose, but are still near record lows.

The number of consumers with foreclosures rose to 35,120 borrowers, up from 24,240 in Q1 and up from the record low range of 8,100 to 9,600 last year.

Foreclosures are still far below any of the prior lows before the pandemic. At the low point in Q2 2005, during the Best of Times just before the Housing Bust took off, there were 148,780 foreclosures, over four times as many as now.

By comparison, during the three-year time span from 2008 through 2011, the peak of the mortgage crisis, over 400,000 consumers per quarter had foreclosures, including 566,180 at the peak in Q2 2009.

During the Best of Times before the Housing Bust, around 150,000 consumers had foreclosures; and during the Good Times before the pandemic, about 75,000 consumers had foreclosures per quarter. This range from 75,000 to 150,000 foreclosures might represent something like the old Good Times Normal (blue box), and we’re still not there yet:

Home prices and foreclosures.

A surge in foreclosures cannot happen unless there is a plunge in home prices. When a homeowner who’d bought the home two years ago for $400,000 gets in trouble now, when the home price has jumped by 25% to $500,000, they can just sell the home, pay off the mortgage, pay the fees, and walk away with left-over cash. And there won’t be a foreclosure.

If the price of that house drops 25% eventually to $375,000, and the borrower owes $390,000 on the mortgage, that exit is getting tougher.

If the price plunges by 40% to $300,000, the easy exit is closed. That’s when foreclosures are starting to happen in large numbers, especially if they’re accompanied by a large-scale surge in unemployment, and that’s what happened during the Mortgage Crisis. But that’s not on the table just yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A House Is Not A Home

The hangover is going to be a doozy.

you mean the ILLEGITIMATE GOVT DEBT CONgress spreads around like cow dung

What is so difficult about people in the US learning to LIVE WITHIN THEIR MEANS and then actually doing so?

Lizard brains meeting consumer marketing in a bid to elevate or maintain their status relative to their peer groups.

How else can you explain Tesla?

Buying a Tesla Model 3 has actually been a really good financial decision. Save a hundred dollars or more on gas per month. Save hundreds or more on maintenance and repairs. Higher residual value.

But that batter replacement…

Higher residual value only matters in a lease. The residual insulates the lessee from a disastrous drop in resale value and provides opportunity in a blowout increase in resale value.

gametv,

How much has your electric bill risen from charging the Tesla every night?

Hope batteries don’t go bad ,way more money than maintenance on a ICE car.people need to consider every consequence of ownership

I love the line “save on repairs”. Wait until it breaks and there are no spare parts available. And don’t think it’s a sour grapes statement. Just takes a little tap or hitting a pothole and bending a control arm. One guy hit some debris in the road and it broke the cooling pipe to the battery. Tesla quoted like $20K+ for the part. Electrified Garage fixed it with some Home Depot bits.

Or look up Rich Rebuilds and the nonsense he went through trying to repair a salvage Tesla. In one of them he stuck a GM V8 in just for fun. Calls it “Ice-T”. He’s stuffing a Cummins Diesel in another.

It is “the pride of ownership”. Like Senator Stabenow stated, “I just have to say just on the issue of that at gas prices; after waiting for a long time to have enough chips in this country to finally get my electric vehicle, I got it and drove it from Michigan to here this last weekend and went by every single gas station. It didn’t matter how high it was.”

Pray that car doesn’t ignite while you are still in it.

Not everyone is going to have a bad Tesla experience, but an anecdote does not an aggregate make.

My car (a standard hatchback- uk parlance for a compact) cost a fraction of the price compared against a Tesla and still gets me and four other people from A-B, so how can a Tesla be cheaper? If you consider yearly mileage of 10000-15000 miles I still win hands down.

Have you heard of advertising industry, FOMOs, millennials and the wealthy flaunting their lifestyle all within the US?

Good time to buy!

So this unwinding of home price can take 3years or longer before we might see a repeat of 2005-2009.

We’ll keep our eyes on it on a quarterly basis :-]

It also depends on the job market.

If you lose your job and become a distressed homeowner who HAS to sell then you will need to drop your price to find the current market.

When houses were selling quickly this was not a problem. But now, with so many more houses on the market competing with each other someone’s prospects for a quick sale are less assured.

Don’t forget, those in the housing industry themselves – like RE agents – are generally self-employed. They don’t get laid off, they just have their income cut drastically. And during the pandemic, they were able to collect unemployment (PUA) to help. Now, there is no PUA and those self-employed won’t show up as collecting unemployment.

For every home sale transaction that doesn’t happen there are people who don’t get paid but aren’t laid off either. Pretty soon, it will be the RE agents having to convince the seller to lower their price just to find a transaction price so they can get paid. Seems the salad days are over for now.

One concern is the large amount of mortgage financing now provided by non-bank lenders compared to traditional commercial banks. Personally, I don’t find the attitude of “Oh, don’t worry, Uncle Sam will protect us” to be very compelling. This could get ugly…

Well, Uncle Sam isn’t going to protect you, they/them is going to protect the most irresponsible.

They’re not going to ‘protect’ anyone.

If by “most irresponsible” you mean the most irresponsible banks or quasi-banks, then yes.

I recall clearly that in the great housing crash in 2008-9, the banks and some major corporations got bailed out but individual consumers and homeowners did not. I agreed with the decision to not bail out individual homeowners, but it still stank. It crystalized a feeling that the well-to-do were routinely treated better by gov’t than the Average Joe.

Moral hazard for thee, but not for me, sayeth the bankers.

~Zero foreclosures for two years.

Yeah, this is just getting started now that the forbearance programs are over. Takes a while to get foreclosure going!

Look out for the next forbearance program, with some stupid name like “Saving American Homeowners Act”….

“especially if they’re accompanied by a large-scale surge in unemployment”

Not just especially… The job market is the key this time. I keep hearing that the quality of mortgage debt is so much better than prior to the GFC. If that’s true and loan originators have been doing their due diligence, then mortgage holders are going to keep on paying their mortgages as long as they have jobs.

In my opinion, loans originated by banks are probably reasonably good, but there may be all kinds of skeletons in the closets of the non-bank lenders (Rocket Mortgage and the like), and we’ll see how that plays out. The craziness of the last couple of years is clearly cooling, but if employment doesn’t cool down significantly, don’t expect any huge collapse in housing.

Does Rocket Mortgage hold the note or do they strictly originate? Many real estate agents have said they are as easy touch.

They only originate. They hold the note for as little as possible before they sell it to Fannie, Freddie, et al.

Seems crazy that politicians have back stopped the mortgage loans and student loans with taxpayer money.

I am seeing if our county will permit in a $20,000 tiny home on a residential lot while the home I live in is being completely remodeled. It’s a good time to try out alternate lifestyle and leave traditional housing market behind.

No real impact on home prices in San Diego.

A realtor messaged me saying that although rates have gone up but home prices in San Diego has increased 1% so far in 2022.

People who have been cautious and wise with their money have been proven fool.

“A realtor messaged me saying”

Ha ha Realtor

Sorry, I meant 16%.

I don’t have much respect for realtors for obvious reasons but the fact is, home prices have indeed increased 16% or so in san diego.

The fact that price increases have effectively stopped is a very real impact, particularly since inflation far exceeds 1% so far in 2022. After all, prices need to stop going up before they can fall. It sounds like the SD market is at a tipping point. I’m curious to see how San Diego fares in Wolf’s future reports on the glorious housing bubble.

Well that makes a difference.

Property taxes in Chicago, Crook County and the metro ‘collar counties’ won’t fall because the public pensions need the money.

There is still a lot of “easy money” still slushing around in the economy, but the faucets have been turned off. I think 2023 will be a rough year for the economy unless O’Biden dumps more money on it.

So, if I’m understanding this article correctly, if unemployment goes up and home prices fall, there will be another housing crisis?

No, it will be a return to normalcy instead of the everyone’s happy Unicorn real estate market we’ve all been enjoying the last couple of years.

…which will feel like a housing crisis.

It may feel like a housing crisis if you can’t get 50-100% over list price on your house like it has been the last 2 years.

It is not a crisis if you pay 90% of list.

It is not a crisis if the appraisal is short.

It is not a crisis to ask for a price reduction or cash back based on a home inspection or appraisal.

This has been the normal housing market for decades. We are finally getting back to normal.

Unemployment is at 3.6%. Normal is 5%. 2012 during the housing crisis was at about 10%. We are a long way from a crisis in unemployment.

House prices crashed 30-50% from 2008-2012 back to 2001 levels. A lost decade from 2001-2011. During 2021-2022, house prices increased about 30%. Even if prices fall 30%, they will be back to 2020 levels. It will not affect most homeowners (except on paper).

In my opinion, the Fed is raising rates to stop inflation. They will lower rates if:

1) Unemployment reaches 6%.

Or

2) If housing prices drop 30% back to 2020 levels.

So far, we are not even close to this.

We dont need a recession for home prices to plunge. It is about growing supply and falling demand and the new economics of monthly payments.

More than 33% of all Americans own their houses free and clear of any mortgages, and nearly everyone in my neighborhood simply pays cash when they buy a house here so ‘monthly payments’ are entirely irrelevant and have always been.

Paying cash for a house when interest rates were 3% is pretty stupid. Not many people did that, especially not wealthy people who know something about finance. On the other hand, money launderers do it because their primary purpose is to launder money.

Also jobs drying up immigrant might go back home

One day…student loans will be out of deferment.

…and then this economy falls of a cliff.

I’m guessing that day will ultimately be Nov 30. Not sure which year.

But if you borrowed at interest rates well below inflation….that’s a good move.

Are those with 2.9% 30 yr mortgages in a good spot or a bad spot?

They’re in good spot until they have to sell house because they want to move. Then they have to sell the house to someone who gets a 6% mortgage rate.

If this is their forever house, that’s great, enjoy. No worries about the price dropping 40% or whatever because it doesn’t matter to them.

Forever home of the American lasts about the amount of time it takes to get 125k of vehicles a boat and eating out 3 days a week and several “well deserved” exotic vacations. A 4 wheeler which is actually a small truck and a place at the lake appear toward the end of “forever”. If a couple of horses appear with stabling and a training ring with trainer a divorce is usual going to be included in “forever”.

¡¡ Brilliant !!

Question: when a home with a government-backed/secured mortgage is foreclosed on, does the government become the property owner?

Yes, and they sell the homes.

Back in the day in Tulsa, following the oil bust there, my neighbor bought his place from the FDIC. The FDIC had ended up with it because it had taken over the bank that had ended up with it when the developer defaulted.

Had a mortgage on small apt bldg in late 80s. Nothing to do with me, but the lender Great American Federal Savings of Oak Park, IL went under via RTC. I paid on the note to a non-descript servicer who took it over. No drama. Those were the days.

1. Hi Yall…

2. I donot trade stocks for living and have no intentions of being a stock trader

3. When do you call the stocks reached a bottom? Dow jones or S&P? I dont know really…

4. Ok. If you have 100K just dry powder right now (savings or retirement) what you would do?

5. Let’s say, markets reached a bottom. What stocks would you be investing in.

6. Just for educational purposes only.

4. move to South America/SE Asia while you still can

phoenix,

I second your motion and have already done so

3. When the same persons who now say the FED will never start QT, stop QE or rise rates enough will be writing comments here about how this time is different and that stocks have reached a permanently low plateau – then you will know it’s time to buy :)

3A. For forecasting purpose only

Fed balance sheet dropped by $16 billion in last week. Not nearly enough, but a start. These guys need to speed this up, pronto, or inflation will never subside.

I’ll note that this is the speed at which they said they’d go, around $40 billion a month between treasuries and MBS. But they really need to let more run off, or even sell. The fact remains that there is too much liquidity in the system. Interest rates are not enough. They have to drain this excess liquidity.

“5. Let’s say, markets reached a bottom. What stocks would you be investing in.”

Answer – Only the ones you think will go up. (Just for educational purposes only.)

Nobody knows when the bottom is in. If you have 10 years before you need the money then put it in s&p index fund it will probably be worth more than $100K in 10 years. If you had put it in at the start of the pandemic you would now have doubled it ( when everyone was scared to death). Watch the news carefully and when everyone else is advising you to buy stocks SELL them, and when they are down and everyone is advising you to wait for them to go down more then you BUY them. But since our instincts probably won’t allow us to act against the common majority beliefs and all the experts ,then it is probably best to just buy a little every month and over time it should keep up with inflation, or buy a REIT Index fund or a hi yield diversified stock index fund and spend the dividends and take some money out whenover we need a little extra cash.

The people that are trying to call a bottom right now just come off so desperate and confused. We had over a decade of QE, and just a couple months into QT, people are panicking.

We’re just getting started. We’re nowhere near the bottom.

If a couple months of QT makes you squirm, you were never secure in the first place. You were just propped up by fake money printing. You got 10 years on the house, and the bill has finally come due.

A house is not an ATM machine!

I agree with many of the Commentariat as to how this will unwind…..slowly. There are not gonna be great deals like when there were 500K foreclosed homes 10-12 years ago. Wolf’s charts are showing this. 40%-50% drop on a home that has gone up 40% in the past 3 years is a nothing burger – still overpriced and / or unaffordable !!

See the HELOC chart. That one is interesting to me. It peaked at 700 billion. At that time there was 11 trillion in home equity capacity. Of course, as home prices dipped, so did the amount of home equity. Maybe it dropped to 8 million.

Now we are at $325 billion in HELOC with a total of $27 trillion in Home Equity capacity. Will people tap into HELOCs this time? Most who owned homes during HB1 will most likely not as they know the pitfalls but will the young home owners tap into HELOC?

8 trillion drop in Home Equity….not million

If someone(s) goes into foreclosure in the neighborhood and property(ies) sell cheap then some HELOC lenders may reduce or kill the unused portion of the line for everyone else in the vicinity. Saw it around 2010. Surprised Citi was that much on the ball.

I also remember around that time Mish was talking about people maxing out their HELOC to either invest, put it under the mattress or head for the hills.

Your math sucks. Say a median priced house of 300k went up 40%. That not puts the price at 420k. If that house price falls 40 percent from 420 you now have 252k.

300K to 252K still not a “drop key” situation for most people. Banks will likely agree to a short sale vs foreclosure.

Wolf

I’d love to see % of homes and apartments that are being used as Airbnb investment properties. I’m seeing a lot of apartments especially high end ones that are being rented as Airbnb’s by tenants. I have never seen any numbers. Multi economist Jay Parsons says that the number is minuscule but if you go on Airbnb there are large numbers of them. Obviously this could produce an air pocket for prices and rents.

When entities can find yield in much simpler investments with real interest rates, they will all exit the housing market. Maintainece, taxes, little control over local zoning and laws. There was a reason it was never like this.

Good scenario’s in the last 2 paragraphs.

Here are is another possible scenario.

If we hit -40%, we will probably be in a nasty recession. Will the Gov and the FED panic? When jingle mail starts, it is contagious which the government learned in HB1. So what did they do during COVID…. forbearance. I could see that again.

Any dip down to 40% will be brief IMHO. Maybe a year at most because the helicopter money will be dropped. If the owner has a loan at 3%, it would be best to move out into a cheap affordable apartment and rent out the McMansion? But then again he would need to find a renter in a recession.

Here is how I see it unwinding in a Denver suburb. I’m running a fixed query at one of the RE sites. Three months ago the result listed 19 homes. Today it is up to 35. Here is the price history of the house at the top of the list (low to high). Interesting to see how it almost looks like a computer bot is lowering the price each week now. Notice how it was flipped -attempted- with a 200K markup.

Date Price Event Source

08/02/2022 $500,000 PriceChange Real Estate Colorado #1584664

07/30/2022 $510,000 PriceChange Real Estate Colorado #1584664

07/17/2022 $515,000 PriceChange Real Estate Colorado #1584664

07/02/2022 $530,000 PriceChange Real Estate Colorado #1584664

06/16/2022 $542,000 PriceChange Real Estate Colorado #1584664

06/10/2022 $550,000 PriceChange Real Estate Colorado #1584664

04/14/2022 $565,800 Listed For Sale Real Estate Colorado #1584664

02/20/2020 $371,000 Sold

Public Records

01/26/2020 $365,900 Pending Agent Provided

01/24/2020 $365,900 PriceChange Agent Provided

01/16/2020 $369,000 PendingToActive Agent Provided

01/09/2020 $367,900 Pending Agent Provided

01/07/2020 $367,900 PriceChange Agent Provided

01/03/2020 $370,900 PendingToActive Agent Provided

12/18/2019 $370,900 Pending Agent Provided

12/18/2019 $370,900 PendingToActive Agent Provided

12/11/2019 $370,900 Pending Agent Provided

12/06/2019 $370,900 PriceChange Agent Provided

11/21/2019 $369,900 PriceChange Agent Provided

11/15/2019 $377,000 PriceChange Agent Provided

11/04/2019 $379,900 Listed For Sale Agent Provided

10/02/2019 $265,000 Sold

Public Records

This is what I call chasing down the market.

I had a friend in 2009. Listed his home for sale at 820K in San Diego, someone offered him 760K he declined, then he came down to 780K, someone offered him 730K, he declined. Finally the home was sold for 480K after 2 years. Real estate moves very slow usually but may be this time is different and it may move faster because of SMs aka social media proliferation.

If the house sells for 500K, it is still up 35% in 2 years.

That is a crazy ROI for a house over 2 years.

There are flippers who bought one month ago and relocating for 200k more.

I meant reselling

“The boat is still floating…” -Titanic passenger, 15 mins after a loud thump at the bow

Of course that’s still a crazy ROI. That’s not the point. The point is we’re trending downward. The point is the boat is sinking – not that it’s sunk.

A few months ago, the narrative was “the housing market will just keep going up”. Then “the rate of appreciation may slow, but it will keep appreciating”. Then “ok so it may flatten, but it won’t go down”. Then “yeah so it went down, but only by a little, it’s still up 35% and that’s a crazy ROI”.

That’s where we are now. Your comment.

Which precedes, “alright so it’s down 20% but this is definitely the bottom and most people have positive equity still, and this looks nothing like 2008”. Which of course precedes utter silence.

RBC has just announced that Vancouver sales in July 2022 were down 43 % from July 21, and that this is the steepest downturn in the last 5 downturns.

Don’t know if this includes the early 80’s which was brutal. Note: this is volume not prices.

Declining sales volume, increasing inventory are the first few steps in real estate downturn. This is happening with historic low unemployment rate.

Wondering how would this look with increasing rates and increasing un employment rates.

Some of my friends in bay area were impacted by high profile lay offs.

They are now looking to move out.

We’re seeing similar sales collapses in California.

Question:

Is it true that MBS carry an implicit guarantee from the USG?

If so, and it is not an explicit guarantee like treasuries or FDIC, can the US actually choose to not back these loans at some point?

MBS come in two flavors:

MBS issued by government agencies (VA, Freddie Mac, USFD, etc.) and by government sponsored enterprises (Fannie Mae, Freddie Mac, etc.) are guaranteed by the taxpayer.

MBS that are “private label” are not guaranteed by the taxpayers.

The majority of MBS carry a government guarantee.

What is real anymore?

I’ve read online media that something like 40% of this country couldn’t drum up a thousand bucks cash if they tried.

I read all this comments and you all are financially intelligent folks.

All the talking heads I follow appear to be smart and they say the whole bottom is falling out of everything.

Sit quiet and wait….or “move to south America?”

What does one do?

The bottom is falling out of the talking heads.

Except the Talking Heads, that band is still good to get the heart rate up and make one feel good.

What should one do? I sit back, make some popcorn, grab a drink, and watch the show. Very entertaining. I saw this unfold in 2007-2008. I was not in the market to buy a house, but the prices had come down so much that it was hard to ignore. I became a homeowner at 23.

Opportunities don’t care if you’re ready for them. They just appear. I’m waiting for the opportunities to appear in this market. Not just from housing, but stocks as well.

Sit back, relax, grab a snack, and put some cash to work.

Nunya, you have the best seat in the house and the best approach.

I never made a better choice than to pay off all debt by the end of 2019, and never use credit that can’t be paid off before it begins to draw interest.

Pass the popcorn please brother, the show is about to start.

Argentina is a lovely country,I hear but u might starve there

The insanity of government meddling in real estate lending is clear seeing that the (unadjusted!) number of foreclosures has been for many years now below the floor set during the highest speculative bubble pre-GFC. The government has made it impossible to default on RE. All paid with my tax money.

Why is PMI no longer required? You used to have to carry default insurance if you didn’t put 20% in up front. Resuming this requirement would solve all ills; give the purchaser some stake in the game so they just don’t nonchalantly walk away and cover the mortgage if they do so the taxpayer or lender doesn’t get stuck with the loss.

Heloc’s are not a bad thing now that interest rates have gone up on mortgages and will continue to do so in the near future. I understand that the interest is tax deductable if used for home improvements.

Reporting Semantic Gymnastics.

*Forbearance somehow redefined being delinquent as being current. What?

*Has the end of forbearance now re-redefined those formerly delinquent, but called “current”, as delinquent again?

At this point, who knows WHAT is reality?

They exit forbearance either through selling the home and paying off the mortgages, or getting a modified mortgage from the bank.

If, after they exit forbearance, they fall behind on their modified mortgage, they’re “delinquent.” And now there’s no forbearance. And they have to deal with it.

Quick question Wolf. Do forbearance programs add missed payments and interest back into the principal balance on the debt? Or is is just a mish mash of provisions depending upon the lender.

Yes, all missed payments get added either to the principal of a modified mortgage, or get added to the end of the mortgage, which might turn a 30 year mortgage into a 32-year mortgage, or something.

Bubble cancelled. I’ll be a renter forever. Maybe I can find success in another country?

I’m failing to see how a doubling of mortgage debt over 18 years is a concern. This is 3.9% increase a year which seems very reasonable considering how building regulations, NIMBY-ism and the cost of building a home has increased dramatically over the last decade. 3.9% seems low. Especially when you consider HELOC debt increases over that same period were pretty much flat. What am I missing?

It’s not a concern until home price fall enough. It wasn’t a concern last time until home prices fell enough, and then it blew up the financial system. So it’s never a biggie until prices drop enough.

I beg to differ — a lot of fun was NOT had by all: