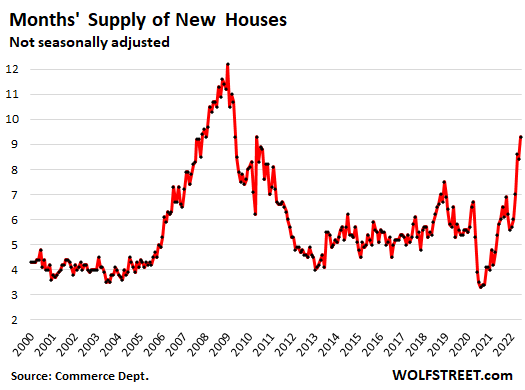

No folks, there is no “housing shortage.” There’s over 9 months’ supply, highest since the Housing Bust. But prices are still way too high.

By Wolf Richter for WOLF STREET.

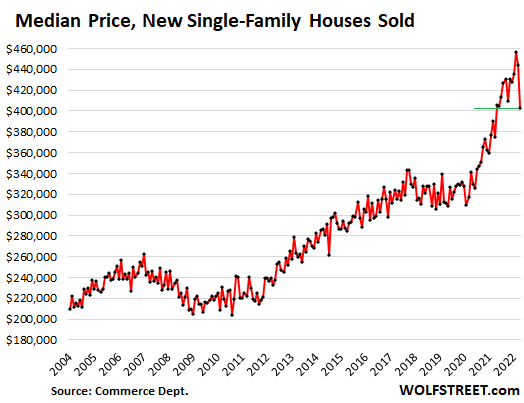

The median price of new single-family houses that were sold in June plunged by 9.5% from May, to $402,400, the lowest since June last year, according to the Census Bureau today. The plunge in June after the drop in May reduced the year-over-year gain to 7.4%, from the 20%+ in the spring.

Median prices are noisy with month-to-month moves, and some caution needs to be used here. But this was nevertheless an extraordinary plunge of a magnitude that occurred only three times before in the data going back to 1965: During the second dip of the Double-Dip Recession (Sep 1981), during the Housing Bust (Oct 2010), and in Sep 2014.

Clearly, potential buyers are now having second thoughts, given the spike in mortgage rates, and homebuilders are responding to this decline in demand and the surge in cancellations by piling on incentives and cutting prices:

The largest homebuilder, D.R. Horton, said in its earnings report last week: “The increase in our cancellation rate in the current quarter primarily reflects the moderation in demand we experienced in June 2022 as mortgage interest rates increased substantially and inflationary pressures remained elevated.

Sales drop to level of lockdown April 2020.

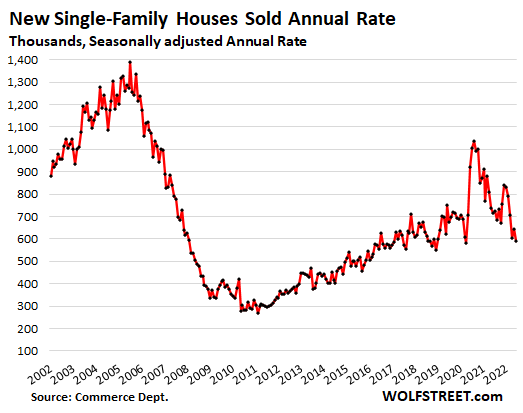

Sales of new single-family houses dropped by 8.1% from May, to as seasonally adjusted annual rate of 590,000 houses, down by 17.4% from a year ago, and just barely above lockdown April 2020, and beyond that the lowest since late 2018, when mortgage rates had hit the magic number of 5%:

Similar drops in sales occurred with existing homes where sales plunged 14% in June from a year ago. So that’s previously owned houses, condos, and townhouses. Particularly noteworthy with existing sales was California’s 21% plunge in closed sales and the 40% collapse in pending sales.

New house sales plunged in every region compared to June last year, but plunged the most in the Northeast:

- Northeast: -37.9%

- West: -32.9%

- Midwest: -22.1%

- South: -8.7%.

No folks, there is no “housing shortage,” but prices are still way too high.

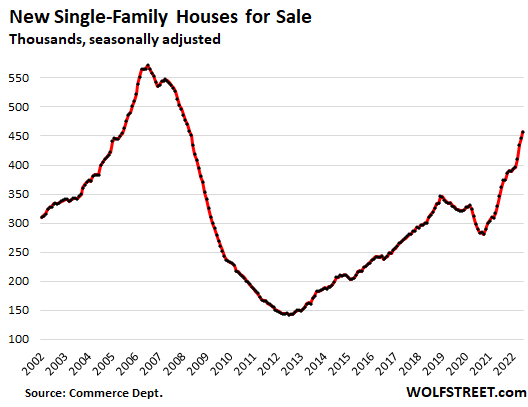

Houses for sale in all stages of construction continued to pile up in an amazing series that began in August 2020 and in June reached 457,000 houses, seasonally adjusted (and 463,000 houses not seasonally adjusted), the highest since May 2008, and up by 113,000 houses, or by 32%, from June last year:

By region, unsold inventory rose in all regions but spiked the most in the Midwest and the South, in terms of the percent increase year-over-year:

- Midwest: +62%

- South: +33%

- West: +28%

- Northeast: +4%.

Supply of unsold new houses spiked to 9.3 months of sales, same as in May 2010, and both had been the highest since April 2009, during the depth of the housing bust. This is a huge amount of supply:

Potential homebuyers gaze at holy-moly mortgage rates.

They’re called “holy-moly” because that’s invariably the sound potential homebuyers make when they see the payment for the house they wish to buy at current mortgage rates and still sky-high prices.

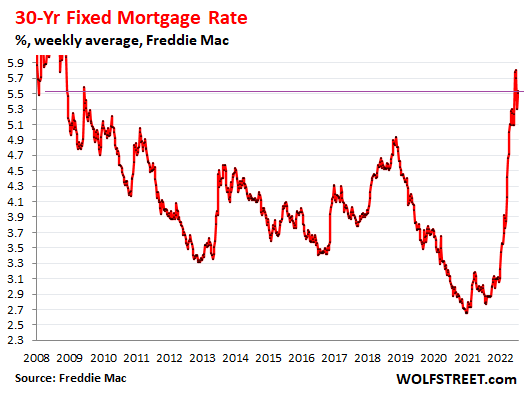

The average 30-year fixed mortgage rate, according to Freddie Mac’s measure, was 5.54% in the last reporting week and has been above 5% since mid-April. With each increase in mortgage rates, entire layers of potential buyers abandon the market as long as prices remain too high:

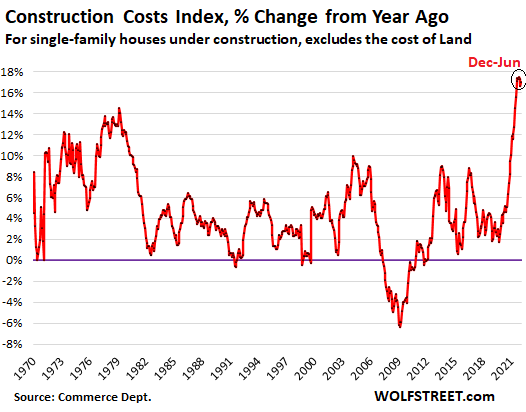

Homebuilders struggle with the worst construction-cost inflation ever.

Homebuilders have been facing shortages of materials, supplies, and labor that delayed projects, and price spikes that triggered astounding cost-overruns, and deliveries of completed houses got tangled up.

Construction costs of single-family houses – excluding the cost of land and other non-construction costs – spiked by 17% year-over-year, and has been in that range since December last year, the worst spike in construction costs ever in the data going back to 1964, according to separate data from the Census Bureau today. June was the 14th month in a row of double-digit spikes in construction costs:

Homebuilder stocks…

Despite a powerful summer rally that now seems to have run into trouble, the stocks of homebuilders are down between 24% and 36% year-to-date and have easily out-dropped the S&P 500 Index (-18% year-to-date):

- Horton: -31%

- Lennar: -31%

- PulteGroup: -24%

- NVR: -26%

- Taylor Morrison: -23%

- Meritage: -30%

- KB Home: -30%

- Century: -36%

- LGI Homes: -33%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is good news for those who have waiting for lower new single family home prices. Double digit price markdowns over the past two months.

I’m sure it’ll still be some time before they approach a reasonable level, and nothing goes to heck in straight line. But yes, there is some hope that younger folks whose lunch hasn’t been eaten by inflation will get a crack at home-ownership.

Get off the sauce, you are delusional. Prices still way way too high.

Compared to what, my friend…

What YOU think or what the buyers think who actually purchased a house…

Apparently, over the last two years, the buyers have spoken…

Going forward, who knows…

Yeah, right. You do know that interest rate have skyrocket now? The average mortgage rate is now over 5%

It all depends on how far down prices fall, and how high interest rates rise.

Still historical cheap,7-10% is about right of course houses have to drop dramatically

Depends upon what is meant by “historical”.

Rates are low for post-1971 (an arbitrary cut-off I am using due to the closure of the “gold window”) but that’s when financial conditions started down the path of not being normal.

Current rates aren’t low compared to the period prior to that (post 1930’s when the 30YR FR mortgage was first introduced), to my recollection.

Current rates may be low historically but current prices have also skyrocketed historically in comparison with wages.

So, it may take small uptick in mortgage rates for the buyers to back off because of un affordability.

And that’s still a great bargain. If the Fed gets serious about dealing with inflation, look for double digit mtg rates.

6% money buys how much house as 3% did in 01/22? bad at math…but did $240k 30 years at 6.505% is $1518/mo. At 3.505, its $1078. Like squeezing a tube of toothpaste, prices come down interest up still no “bargains…”

The sellers are chasing a limited supply of financially naiver buyers. There is no reason to buy a home right now, when they will be priced much lower in another 2 years. Only the financially naive would purchase at this juncture.

I seem to be able to get 4.5% with 20% down and 2 pts, with the points off first year

Those aren’t markdowns, those are double digit decreases in the number of sales. I don’t see the 9 months of housing. Where are you getting that data Wolf? My markets show 2-4 months max and I’m a local appraiser.

Dano,

New house sales and inventory and price data, plus details, from the Census Bureau’s “New Home Sales” data dump today. You can get all the data here:

https://www.census.gov/econ/currentdata/dbsearch?program=RESSALES&startYear=1963&endYear=2022&categories=ASOLD&dataType=TOTAL&geoLevel=US&adjusted=1¬Adjusted=0&errorData=0

The press release is here:

https://www.census.gov/construction/nrs/pdf/newressales.pdf

I agree with Dano…I’m a Broker in a southern Maine and absorption rates are about 2-4 months here. Sales are down due to lack of inventory. Got into a multi offer scenario just last weekend with 17 other offers. Real estate is local folks…

“Got into a multi offer scenario just last weekend with 17 other offers. Real estate is local folks…”

17 offers. Uh-huh………Liar.

I went to an open house in prime Los Angeles last weekend of a penthouse condo priced very competitively. At this price they would have got 10 offers in one day 6 months ago. The agent told me that a total of 2 potential buyers showed up the entire day and zero offers.

Rich people bought tulips too.

Just because the buyers this round were better heeled and better qualified borrowers doesn’t mean they were immune to bubble dynamics. Greed and foolishness are vices of the rich and the poor alike.

+1

Spot on.

But are the buyers actually “better heeled and better qualified”?

I venture that the goal posts were moved. ie, the rating agencies increased people’s scores due to federal regulation changes, but the credit of those people is the same as it was before the financial crisis.

https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

Kunal,

Tesla is down like $70 from Friday’s top. That’s almost 10%. What happened?

A reprieve for more dry powder building…remember don’t bet against a porky pale narcissistic genius like Musk. The 10% down is just a gift from the dip god for retail investors to load up.

Not to mention these people likely still believe in the FED pivot and QE is right around the corner, don’t miss out on this buying opportunity now when that does happen..to the moon!

Musk. A rich guy who needs to tweet and cuckold his friends because money and success are not enough to fill his ego. Why folks choose him as their tribal leader is a mystery.

Well, that’s a definite maybe. You can’t believe everything you read.

Not to mention he’s a narcissistic pervert who justifies his numerous affairs on the grounds that he is solving the world’s underpopulation of geniuses by breeding. There’s something very wrong with him.

Musk is a visionary, but then, so are adherents to the peyote culture.

He’s sweet on “longtermism,” a vision of deep-future human happiness that’s even crazier than you think.

All macro economic factors, slowing economy, bad earnings from other big companies announced this week, the fed is about to raise interest rate tomorrow, etc.

LOL

Money in my pocket so far. Keep it coming TSLA.

Nice.

It wants to go to $900, and may still if market holds. But vix is not very high here, and not so many ‘ridiculous’ stocks left. Most already dropped 70-90%. With longer term otm puts this could be 10-bagger. With otm need to leave enough time for self and the next guy. Good luck.

As always, California is extremely late to the party when it comes to price. Maybe it’s that California NIMBYISM pride that translate into different in my area and this time is different mentality. Price even with little drip feed of reduction is still ridongculous. So Sick of seeing $1M here and there popping up on my Redfin feed for houses in Placentia or Chino Hills.

Let this trend continue and worsen, only way to force sellers into being less stubborn about wishing for prices from a year or 6 months ago.

On a side note, wonder how many comments we will get for repeating the housing shortage narrative. Wolf should get this megaphone ready for some serious screaming :)

“repeating the housing shortage narrative”

But but Dave Ramsey told me prices can’t go down – he said there’s no inventory …..

hahahahhah

To see the younger entitled generation post expecting they should get a Crack at home ownership, good luck. You little kids have been living in a fairytale world of low interest rates and free money. Growing up, most my age didn’t think about owning houses until mid to late 30s. 12% home rates, 12 to 18% vehicle loans were the normal. Americans are soft and entitled now. Free money. Artificially low interest rates, socialism is the political preference of everyone under 40. Maybe millennisls and zoomers can share their houses with iillegal aliens. Yhat socialism. Share it all.

There’s so many things wrong with your posts I don’t even know where to begin..best to not open that pandora box

All I can picture when I read your post is that picture of Grandpa Simpson captured as Old man yelling at clouds in the local news paper

Possibly the most out-of-touch (dare I say, boomer) comment I’ve seen on this site and that’s saying something.

It’s not difficult to compare median income and median home prices in 1975 vs. those measures today.

1981 median home price = 68k

1981 median household income = 22k

68/22 = 3.1 home-price-to-income ratio

2022 median home price = 430k

2022 median household income = 68k

430/68 = 6.3 home-price-to-income ratio

Yes rates were sky high in 1975 but that also presented opportunities to partially offset mortgage interest expense by investing in high-yielding CDs and money market accounts.

Anyone who bought and maintained a house in a growing area in 1975 is enjoying returns far in excess of whatever rate they paid on their mortgage.

I’m not worried about it myself (27, single, ~160k income once I finish my MBA, very manageable school debt) but it’s hopelessly naïve to not comprehend a lot of millennials are not in the same place as

Cheers to a housing crash for all of us 20s somethings.

*are not in the same place as 1980s buyers.

But almost no one in the USA cares about home prices, they care about payment amount. A 68k house at 12% is about $700 payment. A 430k house at 2.5% is $1500.

If your income went up from 22k to 66k you are in a similar boat, right?

Nope.

Assume a mere 2% inflation rate over the 40 years. The equivalent today of $22k would be $49k. The equivalent today of $700 would be $1545. So far so good.

But the equivalent of a $68k home would be $150k. At $430k it’s 180% greater. Now maybe that $430k home is 180% more than the $150k home and maybe it isn’t.

Let’s not even get into the disparity in rates.

P.S.

I suspect that bump from 150k to 430k would have to do with inflation in which case the inflation rate is more like 5% than 2%.

Far right

You’re funny. So glad to see you’re so confident in your future at such a young age. As a good friend of mine once said to me as my children were growing up. “They have all the answers, they just don’t know any of the questions “.

Jeeeez, Galan. Did you walk 10 miles to school in the snow, before your after-school job in a factory full of whizzing belts and whirling gears?

Get a grip, dude. Most youngsters are victims of an out-of-control system designed to enrich the oligarchs, same as you and me. You sound naive and out of touch, to say the least.

Smith

Have you taken the time to pull that Participation Award off the shelf and polish it lately? You know, the one everyone received just for showing up.

Hey Space,

I’m in my mid-60s. Nice try. Please play again soon.

Sounds like the 1970s, when 11% on a mortgage was pretty good. Then there was the 1999-2000 market, which had pretty high rates, too, although they dropped early in the new century.

OK boomer

Millennial here, some of us work very hard and do not expect free stuff from the government. Typecasting us all as entitled babes is unappreciated.

Random Youngster.

Thanks. IMHO, all these generalizations about “generations” are idiotic. The cut-offs for each “generation” has been chosen arbitrarily by whoever, and now they’re etched in stone, and if you’re born one year later, you’re not a Gen X but a Millennial, but you’re still the same person, except now, these generation-mongers will heap different kinds of BS upon you. I just hate this stuff. My delete-finger itches every time I see this crap.

Galan’s steaming pile of wisdom;

“socialism is the political preference of everyone under 40”

As tempting as it may be, you are correct not to delete, but rather to call them out. Then, maybe, others who spew the same crap will read it and see how absolutely disgusting their opnions read, if not at least we can see their true colors.

Galan, you should look in a mirror and read your post to yourself.fu

Random

Could not agree more. The same goes for us boomers. Many of us simply kept our heads down and did what we thought was right and put our trust in the system. I’ll admit that was a mistake.

OK BOOMER!

So far your home equity and 401k, have grown very high on the same low interest.

Yours,

Former Little Kid

“… until mid to late 30s.”

I’m 36 and I would like to own a home. I have kids who would also like to have a place to call home. I guess that makes me soft and entitled.

Have some empathy.

I will own a nice home for my family in a decent neighborhood.

Now, write that on a post-it note, stick it on your bathroom mirror and leave it there.

This will reinforce the plan with the only person that can make it happen, and I’m absolutely certain you can do it.

It’s a boomer’s boomer in the wild! To think that some people say this kind of stuff un-ironically.

How old are you?

My parents, now in their mid 70s were an English teacher and a house painter. They built their first house at age 24. A few years later, they moved and built their second house at age 30, in 1978 when interest rates weee crazy high.

No help from mom and dad, no magic money they’d scrimped and saved for years. They simply could afford it because the home prices were so low that a 13% interest rate wasn’t a shocking payment and the down payment was a few grand.

They also had a boat, horses, and newer vehicles.

If you honestly think an English teacher and house painter can even dream of this today then I want some of what you’re smoking.

Teacher 50k, painter 50k, 100k family income. I see no problem owning a house, a boat, new car etc or not owning all the extras and pay the house off in 10 years.

You might as well have just said blah, blah, blah!!!

Spewing rubbish.

Should anyone be entitled to anything? Why not?

only you?

Now, we just need the housing building materials supply side to catch up with the existing home inventory then buying an existing home will be equal with building a new home.

And remember … never count your weasels before they pop!

The “Labor Shortage” is a mystery to me….

Are we talking residential construction only? Is that industry struggling the most?….

Maybe they’ve had such a long run on cheap labor for so long that folks (including immigrants) are finally figuring out that they can’t make their mortgage payments on farm labor rates..

These big generals that control most of the market are finally getting a taste of reality in terms of skilled labor turning their backs on them….

The labor shortage is always “A shortage at pay rates that I want to pay my workers.” There are always workers available at the right price.

Disagree there, part of this in healthcare is the requirement for certification. There is a nationwide shortage of echocardiography technicians / icu nurses, etc and the pay is very good but The volume of people being trained is exceeded by the number who retired. Many factors including demographics ( gen x is small), it’s just not so “simple”. Any hospital system dumping money to get them, is just “taking” them from another health system. Why would anyone go into a skilled field like icu nursing in the last decade when tech jobs paid more with less training, better hours and less stress. Though there is profit in the healthcare system, it’s not free market system either as rates are essentially set by the government via Medicare advisory board. Hate hearing “if they just paid more” BS when talking about labor shortages in more highly skilled fields. It demographics, Covid resignations, requirements for certification and artificial limits due to governmental control as the setter of reimbursement in healthcare. Hard work wasn’t rewarded with loose credit allowing for competition from “bitcoin trading “ and “zombie companies” jobs.

I don’t know if this is just in my local area or if it was a tendency in other areas, but the local colleges here completely cut out the nursing programs for several years because they “didn’t make enough money” for the colleges. Those programs were always full.

They are now back because of popular demand and outrage, including a few small protests.

Just as an aside, most public and state colleges make more money in tuition from foreign students. I think they also make more money from out of state students, but most students I believe choose colleges in their own state. There seems to be an increase in foreign students in the past decades along with a great increase in tuition. I don’t know how many foreign students become nurses, although I think a lot do become doctors. If a family outside the US can afford to send their kid to school here I’d imagine they’d encourage them to take even higher earning jobs.

“Pay is very good”….this is a relative term.

Most of the non-doctor medical jobs require between 2 years and six years of education/training to be qualified.

Let’s use RN for example: Needs a master’s degree which is typically six years of college. That’s six years during which you aren’t making any money. Six years of paying somewhere between $10,000 and $30,000 in tuition/books/fees. Plus all your normal costs of living….call it another $30k/year. Times 6. That’s a $360k investment up front before you see your first paycheck. For that investment you get an $80k/year job which carries a punishing work schedule…rotating shift work with plenty of night/graveyard shifts.

Except it’s worse than that….because not only did you SPEND $360k, but because you weren’t working for those six years, you lost $240k of income you’d have made working at $40k/year. So that nursing degree cost you $600k. And you’re launching into nursing with 0 experience, instead of six years experience at whatever you worked at instead of college.

Or you can spend around six months in a coding boot camp and get an $80k job with a 9-5 schedule.

By the numbers alone, medical is a horrible way to make a living. For some people it’s a passion and worth the sacrifice. There just aren’t enough of those.

What do you get when you throw 10 trillion or so of fake money into an economy? A boom from excess fake jobs, excess people working those jobs, excess over investment leading to greed speculation and malinvestment. Nobody mentions overpopulation until the metrics force you to. We don’t have a shortage of houses. We have too many people, and too many unsustainable jobs. What caused the housing crash of 2008? It was not bad liar Loans. Nobody bought intending to default. It was layoffs when the overstretched had no way left to make their payments. We have a historic shortage of homes in ratio to people, but in the ratio to sustainable jobs we have a historic over building cycle beyond comprehension. When all the unsustainable fake jobs from fake money disappear as the historic debt piled up defaults, now you’ll see the result of unprecedented over building. We have already seen that in commercial real estate as endless commercial industrial buildings sit empty everywhere. A 50% drop in housing would still leave prices overvalued when you factor in all the upcoming layoffs and defaulting debt against it. The Fed cannot prop up these valuations anymore because the inflation genie is out of the bottle. So now here we go back to fundamentals. And the math is simple just look at the medium income in a city and look at the valuations. Then look at the interest rate and payments. Then adjust for massive layoffs contributing to supply and a change in psychology to the negative. You can figure out where this is going. I read the real winners in a bear market are those who lose the least. It will be very interesting just to see who survives this downtrend with all the debt and leverage at risk. Bitcoin windfalls…gone. Ponzi windfalls…reversing. It all depends on the access of liquidity but if I was a lender… I’m just glad I’m not one. Good debt is good, until it is bad. Then it was just a bad investment. Who knew? It can take 10-20 years to recover from being totally washed, if you learn. I know firsthand(2000).

“What caused the housing crash of 2008? It was not bad liar Loans. Nobody bought intending to default. It was layoffs when the overstretched had no way left to make their payments.”

Bingo, this is the point that most MSM either missed or intentionally mislead to drive their narratives. Much easier to create a one time boogie man to blame certain group than to look at the real root cause or do some self reflection. One of the MIT professor did quite a study on the root cause of 08 and there’s another one from below as well. You rarely hear this anywhere being mentioned in MSM though.

“A working paper from the National Bureau of Economic Research says that rather than the poorest American homebuyers taking out mortgages that they could not afford during the 2001-2006 credit peak, the crash resulted from middle-class and wealthy borrowers.”

A client came into my office in 2101 and said she found about $100k in cash in her husband’s closet. I was tempted to ask her if she took half did he notice. Turns out he bought 5 homes never intending to pay anything and rented them in cash until the mortgages foreclosed. In FL it took an average of 800 days. $7500/month times 30 months is $225,000, tax free not a bad grubstake…

2010…

4c of lending:

Capital, collateral, credit and…capacity.

Banks’ own fault. It was a sad day when they were bailed out.

The investor clients I had at the time were the first to stop paying the mortgage. The investors did not tell me or the tenants they had stopped paying. No one knew until the notice of foreclosure was taped to the door.

The people with the money had no intention of giving up one thin dime. Not illegal, but underhanded and caused many families much pain and panic.

Yep, I bet lots of airbnb gurus will convert their places to long term rentals, stop paying the note but continue to collect rent as long as they can. Its up to renters to do their research and if they have a deadbeat landlord, they should also stop paying rent. In fact, if I was in the market as a renter I would look for a specuvestor in the hopes that I could pull such a move off!

My ex did that for a year before he lost his house in foreclosure….he moved out, rented it and pocketed the payments….business wasn’t so great at the time and it was a way to survive. Many people lived in their homes for several years without paying the mortgage….it was a great way to save!

Heron, how on earth would someone research that?

Yeah they had some shady homeowners trying to pull off such scammy rentals in Texas too, caused a huge mess for everyone–buying up groups of homes as rentals but with no intention to pay the mortgages, just cut and run. It’s the real estate equivalent of pump and dump, with similar corruption in privatizing the ill-gotten gains and socializing the losses. These scam landlords (as one of the local newspapers called them) ripped off the banks, tenants and the local municipalities that had to bear the costs of their cutting and running, and forced those costs on the community. It’s another reason I’m a bit skeptical of some of the pretty-looking homeowner statistics the media loves to trot out, about how upward of 60 percent of Americans (or at least American families and households) own their own homes. Among other things, “owning” a home in this case does not actually mean paying off the home free and clear, or even holding significant equity. It just means someone living in the home has a mortgage on it, and then the occupants become “homeowners”. They might have paid off as little as 5 to 10 percent of it, or might even be one of the shady homeowners described here with no intention of paying the mortgage at all. But they’re labeled as homeowners even if they truly can’t pay the mortgage (or in this case, won’t pay it) and wind up in foreclosure.

Liar loans certainly didn’t help. Many borrowers had no chance to pay the mortgage, even if they weren’t laid off, once the interest only period ended. The intent wasn’t to default, but sell for a profit since house prices only go up. Many loans were designed to blow up if prices stopped rising. Of course there were other factors like financial derivatives and yield chasing speculation. However, liar loans, as the name implies, were part of the problem.

I put the blame on loan officers. Just make a quick dollar and have a good time.

At the time, in Az, there were no real requirements to be a loan officer, a Broker had to have a license. But there were hundreds of people hired to make cold calls, sell the loans in any way possible. And as long as most people were uneducated, the lenders sellers made a lot of money.

The loans were through companies that sprang up over night, they sold the loans to bundlers, who off loaded them to pension funds and cities around the country.

Lots of money for nothing made by selling houses/loans to people who were simply told they could have a home of their own. The American Dream.

“I put the blame on loan officers. Just make a quick dollar and have a good time.”

I first put the blame on the FED who lowered rates to at the time a historical low of 1%. I next put the blame on the banks who knew better then to loan to people who couldn’t afford it but just couldnt get over their fear of missing out. The people who took the loans i don’t blame at all. Not their job to separate the wheat from the chaff. 2010 thru today is the same thing only worse, and the outcome is going to be magnitudes worse then 2008. Heck you can already see it bubbling up in society and we’re still on a printed money high.

The people running our society are the steward of Gondor from the lord of the rings, how did that end for him?

This also lays waste to the argument that there will not be any increase in inventory because those who locked in 3% rates will hold them for the next 30 years.

That, of course, assumes that life doesn’t get in the way, that the borrowers aren’t laid off, that they don’t get divorced, have another child, have to move for family reasons, or whatever.

If you live paycheck to paycheck and lose your job, it doesn’t matter whether your interest rate is 3% or 6%. You’re going to default.

Phoenix_Ikki,

Re-writing history???

You/they got the timing all wrong. Did people already forget? Is memory this bad? At least look it up.

Housing bust happened first, triggered the financial crisis and recession which came two years later.

Timing:

2005-2006: Housing bust starts. Economy doing OK, employment grows.

Early 2007: housing bust gets bad, smaller mortgage lenders begin to collapse. MBS begin to collapse. House prices are plunging; people, including many investors are defaulting on their mortgages, making the MBS mess worse. But employment is still growing.

Mid to late 2007: MBS blow up, move to the forefront, Financial Crisis starts to crack the surface, everyone is getting nervous. Shit is blowing up. But employment is still growing.

Dec 2007: Home prices plunge, people/investors are walking away. MBS dish out huge losses. Employment peaks. Official recession begins.

Jan 2008: Employment starts dropping .

Early 2008: Bear Stearns, which had been teetering, begins to implode for all to see. Now companies are getting worried. Financial Crisis is happening. MBS blow up front and center.

Sep 2008 – three years into housing bust and mortgage defaults: Lehman and AIG implode, all heck breaks loose. Everyone gets spooked, consumers & companies stop buying stuff, big layoffs, etc. Fed goes bailout crazy.

JPM is my favorite short going forward.

No, not trying to rewrite history but thanks for the timeline. The question would be then what’s the main underlying cause of the housing bust back then? From what I have read subprime wasn’t the main primary driver and prime credit played a big part, if not a much bigger part that conventional mainstream narrative. Is that not the right assessment since that’s the point I was trying to make.

Not if you’re telling me subprime and only subprime is the primary driver then I would be incline to educate myself more on this matter.

Wolf,

I immigrated to land of opportunity in Sep 2008 with high hopes!

Well, I hit a closed invisible glass door there. No one was going to give an engineering job to a fresh graduate emigrant with poor English, when hundreds of thousand of professionals are getting laid off !

Great recap. Anyone who didn’t live through it only knows sept of 2008. I remember peak sales in 2005 peak price in 2006. My landscape buddies started talking about how their work dropped off a cliff in 2008 into 2009. Loan mods all the rage in 2010. Those were tough times but I think this time will be worse for folks, despite the fact that I think there will be areas of the country that don’t get hit nearly like other areas, San Diego being one of them. That being said, landscape supply houses here are telling me that their sales have plummeted in the last few months.

Its interesting to note that housing didn’t bottom until around 2012. From 06 – 12, 6 years to reach the bottom.

I think we have a long way to go from here…

Didn’t Goldman loaning money to AIG and then called the loan early and refused refinancing which forced AIG into default? I remember reading something about that.

Went and looked it up and so far pretty fascinating. I was completely incorrect though the (maybe) shenanigan’s came with the government take over of AIG. Paulson then installed a former Goldman partner as basically a single person conservatorship, who then used government money to make sure the squid got paid.

Petunia,

I get what you are saying about JPM but…there is an informed school of thought that JPM is viewed by DC as the ultimate too big/important/key to fail bank.

Essentially DC’s failsafe bank for the Apocalypse…when zombies are eating the brains of 300 million Americans…DC’s highest priority will be propping up JPM for after the zombies starve to death.

DC will be drafting people for zombie chow before anything too bad is allowed to happen to JPM.

The Bob who cried Wolf

Most SoCal now have watering restrictions. My town is down to one day a week. Ventura County. So that will lead to and has led to a lot of brown yards that no longer need lawn service FWIW

This was a really helpful recap. It looks more and more like we are reliving 2006. I didn’t realise that employment was so good through most of the years the economy was sinking. – I remember people walking away from their homes and landlords not paying mortgages but still charging rent. I didn’t realise the unemployment came at the end of the drama – not in the middle of it.

I live in affluent Orange County, and that is not the timeline I remember in my area. So though Wolf is always right having reliable verifiable statistics. I’m going to disagree on at least some terminology definitions. Late small investors were still buying into the housing boom all the way into 2007. There were not much price drops and news articles about any turning point. Though the investors had thinned out, it was still game on for enough in denial still going for it. Hords of investors had 3-10 houses each and we’re all renting them out. Within one month, the whole psychology of the market flipped in reverse. Things started going the other way and everyone knew it. Those hordes of small investors started putting homes for sale. When they did not sell, all the for rent signs came out They needed to pay their mortgages on all their houses. This was in 2007. Into 2008 they could still not find renters. People had lost jobs and there were no renters for all their houses. This investment class paid their own mortgages with their own cash as long as they could until their money ran out. Now they were getting deeply underwater and just threw in the towel and let the banks have them. There was nothing more they could do. This is when I say the housing bust began. When they couldn’t pay and defaulted. But the psychological one month turning point in 2007 was when the market flipped and turned imho. That could have been a bust starting point too. Prior to that, I saw no housing downturn, though some slowing may have filtered into the metrics. So from my vantage point of what I saw, a slowdown may have occured prior to 2007, but a bust happened when the small investor class ran out of money and couldn’t find renters in 2007-2008. Which is imho exactly the same scenario we will see again this time around. A bust will not happen until renters get laid off and the investors, of all sizes, can not find renters and run out of money and throw in the towel as they see themselves getting hopelessly underwater with prices crashing. We are not their yet, but most certainly will because it the only thing that can end this grand housing mania and…every mania ends in bust. Every one in history.

Yup. It was investors defaulting on the loans. A homeowner has a lot more incentive to make the payments come hell or high water.

There are only 2 choices for the ‘excess people’: bullshit jobs or guaranteed income. Otherwise there’s no social stability. Folks are tired of the BS jobs. What’s next?

Debtors prisons like the good old days.

“There are only 2 choices for the ‘excess people’: bullshit jobs or guaranteed income. Otherwise there’s no social stability. Folks are tired of the BS jobs. What’s next?”

As Augustus Frost frequently mentions…

A lower standard of living…

Nobody guarantees anybody anything…

Rule one in poor people land…the guy that gives you the sob story today, will be the one stealing your stuff tomorrow…

If you let it happen, that’s on you….

Is this perhaps called social darwinism? Nice.

And where does that guaranteed income come from? Taxing those that do work? And how long do you think those workers will support that? And then the guaranteed income goes away. Socialism has never worked and there are many examples.

A healthy mix of socialism and capitalism have worked in Europe and Australia for a long time while predatory capitalism has been a slow death for most Americans. I’ve lived in all three places and in my opinion, people are happier in Europe and Australia and it is clear that the working and middle classes have fared better.

A guaranteed income simply means that what people earn – a full time Walmart employee for example – is subsidised up to reaching a liveable income so the worker has a living wage. Not all poor or on-the-margin people are lazy. Some work very hard. Don’t those people deserve to live a decent life? Not everyone is the child of a surgeon who could afford to put him/her through a private university to get a degree that opened doors for him/her. That was me and I can tell you that it set me up for life. I have friends who weren’t so lucky.

LOL….crony capitalism is working great!

Only two choices, eh? You sound like somebody who prefers the “guaranteed income” that comes from those who work for a living.

There was no ‘fake money’ of any sort whatsoever. Get real.

Printing is fraud against people by inflation. Real money is earned. Fake money is printed not earned. But if you like, fake real money. It doesn’t matter. It’s the understanding of repercussions that’s worth discussing.

Steve said: “What do you get when you throw 10 trillion or so of fake money into an economy?”

——————————-

I get your point Steve, but unfortunately it is not fake money. It is newly created money that stays in the system and that makes your saved money worth-less. It has been ongoing for years.

The fact that the new money is not fake does not mean that its introduction and dispersion is not fraud ………….

So goes housing so goes economy something I heard a couple of decades ago.

The new home inventory plus the shadow vacant homes coming on the market as holding costs begin to work into the system.

Inflation on a month to month basis still high.

This is still true.

Housing is still where most Americans have their money.

It used to be even more true before pensions were changed to 401k’s to shift the risk. Now the equity markets move the real economy more than they used to because of the attention the middle and upper middle class pay.

So many people watching every little squiggle on a chart, its mind numbing. I watch some of the technical analysis video commentaries from time to time and they never talk about the fundamentals of an investment, just RSI and MACD and OBV and a score of other ways to discern what the squiggles of a stocks’ chart might mean. Very strange.

The correct version should be –

so goes money creation so goes housing

Sellers don’t seem to be getting the message in my neck of the woods (Hudson Valley). Had seen some price drops around town on the MLS for a bit and was hopeful, but stagnating in the past month or two. A lot of For Sale signs cropping up (heavy second home market here due to the lakes and hiking) but nothing seems to be selling, or at least not getting scapped up within hours sight-unseen anymore.

As long as they still want $350k for a 1,000 sq ft townhome that was $90k not 2 1/2 years ago, they can KMA. I’ve tapped out and so have many friends and collegues. Waiting at least another 6 months to see where things are, then re-evaluating knowing full well the hubris is engrained into NYC-area culture. It will never be reasonable here for the working class. Didn’t get hit too hard in the GFC either.

LVS,

As an aside, I saved up for the Nordstrom Anniversary Sale on this month and I have yet to score any good deals. They have everything I want but nothing is really on sale. This is the first year I didn’t score a great find.

Watch the numbers on this sale, Nordstrom is the cornerstone of the middle class shopper.

I’m solidly middle class by all conventional standards and gotta shop the local thrift shop for clothing, really high falutin’. Plus side of thrifting in a wealthy area are all the clothes wealthier people donate still with tags on. Certainly Nordstrom is nice if you can swing it, but don’t know too many lower-middle and solidly-middle class folks around here who can without living on their credit cards.

Can’t justify paying $150 for a basic cotton t shirt, couldn’t imagine a sale there being enough to get me in the door but maybe I’m missing out in ignorance. At least they’ll validate the parking!

It was always a demand spike, not a shortage. If supply was impacted, then it was mostly because the foreclosure and eviction bans seized up some real property making it to market, which was temporary.

The past claims of historical under building seem undercooked and questionable. Easy to say, makes intuitive sense to a degree, but can’t explain the spike. Houses should not behave like oil prices. While both are for most consumptive purchases, people can and commonly do delay buying. Substituting home purchase with rental is a lot easier than substituting gas for more efficient transportation or public transportation, if available.

Still an open question whether this means nominal declines, since they are historically rare, or inflation will mask the declines. Really depends on what happens with layoffs, probably, which is tied into inflation. In my uneducated opinion, we kind of need high enough inflation to improve fundamentals without a panic but not so high fed is forced to push the economy into a real recession. Tricky and dangerous spot to be in.

No escaping lower living standards, noticeably lower living standards for the majority of the population.

Like the rest of the asset mania, housing bubble wealth is fake wealth. Flat prices with inflation will appear less messy. It doesn’t change the outcome.

The problem is too much debt which is also someone else’s “wealth”. Devaluing this fake wealth will hammer the (mostly older) middle class who will experience a double hit from declining wealth and higher living costs.

It would be interesting to see how much of the ‘fake wealth’ was bought/suckered in by the older generation verses the younger generations. If wisdom is gained by age, then poor choices should decrease with age.

The “mostly older middle class” probably have most of their assets fully paid for. Or at least almost paid for.

Some of these oldsters could easily retire and live well on savings, SS and any pensions/retirement funds.

People living in their toe tag home don’t care what the value is.

Can someone do a new home price vs existing home price graph? That might be very revealing as a leading indicator. Beause the general public is not as well informed as NAHB.

I can do that. I’ll check it out when I have some time.

I don’t have a graph, but I can tell you that in Central Ohio suburbs, the price of a new home averages around $160 per square foot. Existing home is going around $140 a square foot. The homes prices below $350K are on the market for a week and get up to $50K over asking price. Houses priced beyond $500K take about two weeks to sell and at asking price. Many flippers are still in the game.

We are already in recession. How long until Powell starts easing again, convinced that inflation is over? Then stagflation. Maybe hyperinflation. Definitely the Fed doesn’t want to be seen as the cause of a deflationary depression. It’s all about optics and narrative these days.

Jerome Powell 6/15/22: “We need to get back to a place where supply and demand are back together. And where inflation is down low again and mortgage rates are low again.”

Focus on that last sentence. The Fed is not staffed with a bunch of dummies. They know that low mortgage rates drive house prices up. The Fed wants to get back into a low interest rate environment as soon as possible. They can’t do that at the moment since their hands are politically tied by inflation, but the real economy hasn’t been strong for years, and that weakness is becoming visible really quickly now that the QE/Stimulus adrenalin shots are wearing off. It only took a little jawboning, a handful of anemic rate hikes, and most importantly withdrawal of their QE drug to meaningfully destroy demand within months of starting. If the job market starts showing some signs of weakness next, it will be accompanied by the disinflation that the Fed needs to get back to low interest rates and reigning in QT, maybe before it ever really gets cooking. Growth of our money supply never slows for long, and house prices follow over the long term. The Fed will never allow themselves to be caught starting a deflationary spiral, even if they have to turn us into Japan to avoid it.

Really gotta wonder, with two thirds of a million people wandering around homeless in this country, and millions of people living in camping vehicles, is there really “no housing shortage.”

Somehow, i don’t imagine if Powell induces a lil mini recession, that’s going to make these houses any more affordable to the people looking to move into them, especially when it’s so far been the white collar workers getting laid off, and the month-to-month blue collar workers are the only ones with any position to negotiate their salary.

And god knows, we’re not going to see prices droop low enough they can afford them, prolly just low enough PE firms can step in, and turn them into rentals.

And the price that triggers the interest of a PE firm like Invitation housing sure isn’t that low, when you’re looking at the P-to-E capabilities of a blue collar class that’s negotiating 1$/hr raises.

Stop me if you’ve heard this story before.

Guys living in tents and rvs, in general, are not unable to qualify for a big enough mortgage. They are unable to qualify for a lease at the low end or even a credit card to stay at an extended stay hotel.

You can only gather so much data from different, albeit related markets. Is there some shifts? Sure. But the cause of spikes in SFR home prices and a lack of low end rentals are different. The former was driven by a temporary demand spike and historically low rates, a classic RE bubble cocktail. The latter is more due to local zoning, nimby activism, and behavior shifts back towards the core than the exurbs as cost and time of commutes went up. Walk around almost any other major city in the rest of the world, wealthy or poor, and you see a lot more density.

Tijuana is an excellent example!

[Really gotta wonder, with two thirds of a million people wandering around homeless in this country, and millions of people living in camping vehicles, is there really “no housing shortage.”]

I would say there is a housing shortage for people with mental illness. Be thankful if you have all your marbles.

And there is a housing shortage for developmentally delayed adults, Veterans who were messed up in foreign wars, and the elderly.

The escellating cost of housing has left many behind…many of those affordable housing units have been gentrified away in most cities leaving those folks with few if any options.

There’s also a housing shortage for those in poor health and also for those who make low wages.

Whole communities have lost their workers because housing is too high. The working people have moved away. Some became homeless. Once people become homeless even those who don’t have mental health issues have a harder time getting hired because of hygiene and stress related issues. Some of them start to steal.

This all means the owners of gas stations in those areas have to work longer hours, owners and managers of hotels and motels have to do their own cleaning, hospitals are short of workers, stores are short, and people can not find people to hire to fix their toilets or roofs, to do handy jobs, landscaping or house cleaning. Etc etc. In some communities the ones left are panicking.

I use the following absurd example to counter the ridiculous claim that most of our inflation is due to “supply chains” rather than excess demand.

Let’s say at any given time, there are 200,000 bicycles in various stores around America. Then let’s say, Congress suddenly bans cars. Full stop, no more private cars allowed. Suddenly, many people who previously drove everywhere will have to find alternatives, including riding bikes.

Those people would rush to the store to buy bikes, and they would quickly sell out. Prices would skyrocket.

That’s basically what happened with cars, cars, RVs, houses, and everything else in the past year and a half.

There was never a problem with supply. The problem was with excess demand. No supply chain will ever be able to keep up with a massive amount of excess and artificial demand, all thrown at markets at the same time.

Take that demand away, and the “shortage” disappears.

Regarding layoffs at the top end and popping the asset bubbles not affecting lower income people, I disagree, for one reason.

Ultimately, supply chains are fungible. A cargo ship moving luxury cars around the ocean or a truck transporting fancy exercise bikes across the United States is displaced from transporting other things. So excess demand in those areas causes prices to increase in others.

Pop the crypto, stock, and housing bubbles and a lot of the people who were “spending their gains” on toys over the past two years will suddenly learn to rein it in.

That frees up supply chains and manufacturers to use their capacity on non-luxury goods. That’ll decrease prices for the middle class.

There are slight variations, but you get my general drift.

Food inflation arrived as almost 20% of the world’s grain exports were blocked by the Russian navy since the Russian invasion began. Food inflation may also be linked to a reduced supply of natural gas in Europe. Natural gas is used to make nitrogen fertilizer. Raising interest rates is not the same as a successful corn harvest. Complaining about the price of a house being high is not the same as producing vinyl double hung windows. I used to keep cash in the bank in case of emergencies. Recently I found a way to buy treasury inflation protected bonds. They are better than cash, except in times of deflation. The stock market is an interesting study too.

There is a HUGE affordability problem. Home prices and rents are WAY too high. That’s the #1 issue. After all these years of money printing and interest rate repression, all asset prices — including housing — have been inflated to ridiculous levels. They (including rents) need to come down by a lot.

But a lot of homelessness is caused by issues other than housing. A big part is caused by addiction and mental health issues, and those need to be addressed differently, and we as a society have failed to address those issues. I certainly don’t have any solutions for that either.

You can also go with LA city draconian approach, throw them in jail..I am sure that will fix the problem alright. In the eyes of the elites, out of mind out of sight, problem fixed.

Or the new British Columbia way.

“In the eyes of the elites, out of mind out of sight, problem fixed.”

You have a back yard, right? Could fit a lot of tents there ….

Three decades ago, there was no “homeless crisis.”

That’s because the mentally ill were sent off to state run sanitariums. Of course, the bleeding hearts told us that it was much more humane to get rid of those sanitariums and allow the mentally ill to live free among the general public. How did that work out, America?

Now we have two crises: 1) a homeless crisis, and 2) a multi-billion-dollar government bureaucracy (the Homeless Industrial Complex) that only serves itself.

Wolf, I have to think addictions to opioids and methamphetamine to escape the soul-crushing pain of an increasingly stressful economic system overall ties into homelessness as well. It’s very expensive servicing an addiction without even considering the housing factor.

How many end up with mental health issues or some type of drug (can’t handle the reality of) dependance is caused by homelessness?

How much is caused by hopelessness?

How much is caused by having your kids taken away because you were evicted?

There is some well-documented data on this. Go google it.

Wolf said: ” I certainly don’t have any solutions for that either.”

——————————–

Here is some help,,,,,,,,, though I am sure you know this.

put the criminals in jail.

put the drug addicts in re-hab.

put the mentally ill in mental hospitals.

put the disabled on disability.

put the non-lazy indigent on welfare.

put those too lazy to work in tent work-camps near Barstow with rations.

Michael Shellenberger has some good ideas.

This. Apocalypse Never is a very informative read. I’m in Georgia but was rooting for him for CA governor

Larry Summers says we need a good 2 years of 7.5% unemployment followed or 5 years of 6% unemployment to stop inflation

I don’t care for Larry Summers. But the guy has a habit of being right.

Larry is always looking out for Wall Street LOL.

Unemployment rate is 3.6%.

Larry is very bright and correct and that would help substantially.

At what cost to society would Larry’s solution be?

How many more homeless?

How many hungry kids?

How many over stressed families breaking apart?

That’s a read herring. But billionaires would become quarter-billionaires, and they’d still have enough to last a lifetime.

Josap, I think right now the first to lose their jobs would be those in higher paying positions like tech and finance and investors. Not the people working at Burger King or plumbers for instance. Many blue collar workers are used to work being in cycles and scheduled smaller jobs as the economy contracts.

As it is right now I know people who are working full time and living in their cars, staying with parents or camping out in bushes. Every time housing prices go up the homeless population increases. In my very small extremely rural town I know of 9 homeless encampments. And I’m not in the loop- there are probably others I don’t know of.

Either way it goes is rough. Increasing housing costs are as bad I think, and worse for those on the bottom earning percentages.

That might be true from a finance point of view where only numbers on a spreadsheet matter. However, an economy and society are far more nuanced and include (and make visible) all those unemployed people who for whatever reasons – probably, not because they haven’t done their jobs well – lose their employment and can’t find meaningful work for years. Those people matter too or at least they should in a society.

@ Wolf – Here’s another red herring ……….

Billionaires, or quarter billionaires, would pick up more assets at depressed prices. perhaps with inside financing …..

(Larry Summers talks his book and that of his Masters)

The “blackstone put” is a myth, the idea that PE will just catch the falling knife in its entirety is right up there with “bitcoin can’t mathematically fall below 30k” and “they can’t raise rates because of the national debt”. Both of these happened, and fast.

Yet DR Horton (DHI) is still trading at $75 and change, 25% higher than any time ever Pre-Pandemic reaction….

Can someone explain this to me?

share buybacks. 40% of stock gains since this blatant bit of self-dealing was made legal in the 50’s can be ascribed to stock buybacks

80’s during Reagan years.

Down 31% year-to-date. That’s pretty good for a start. And that’s what we’re looking at here, the beginning, and not the end. So be patient. It’s not going to happen all in one day [I hope].

And Horton (which is one of the 2 biggies in homebuilding, which is heavily fragmented) is one of the very few players who retained some capacity for low end homebuilding.

Their median pricing is inflated too…but nowhere near as insanely as most big homebuilders (who have lost the capacity to build entry level housing).

Makes sense to my simple mind.

Hot sales means increasing prices.

Then, rates and inflation kill the lookers who also can’t find a buyer.

Takes a little while for sellers to realize no one buying and to lower prices. In that period, inventory has to build.

Other stuff:

Can’t sell existing house to move.

New house savings suddenly claimed by inflated living costs.

Sort of like a rocket running out of fuel, now arching a bit downward from apogee.

I got a neighborhood newspaper yesterday that said 28% of the home sales in my zip code were made to investors in the past year, Houston suburb. Pricing people out of their homes one house at a time.

If housing purchases were limited to organic demand (i.e. full-time live-in purchasers) and to LLs who were obligated to rent to full occupancy at reasonable multiples of prevailing local median wages, housing in this country would be become very affordable very quickly.

But this would be very unfair to the overclasses that depend on lower-class suffering to underwrite high asset inflation.

You are describing rent control, which historically has been a great way to reduce investment in new housing and motivate landlords to cut maintenance expenses eventually leading to slum quality housing.

It’s a relatively recent development, but mass scale corporate buying is only possible because of prolonged artificially cheap money.

If housing prices fall far enough and enough tenants lose their jobs where the rent can’t be paid, corporate landlords will be forced to reduce rents and many will sell.

Augustus, I’ve read many of your comments and usually take something good out of each one.

I value your insights enough to ask:

Do you think the Fed will chicken out with a dovish pivot if the pressure from a deteriorating economy becomes too great? How steadfast will JPow really be in his new role as Paul Volcker Jr.?

High house prices are used to force people to work.

In North Korea you get a gun in the face and you are told to work.

Here it’s roundabout but it amounts to the same thing.

Unquestionably it’s used for coercion.

As evidenced by the large homeless populations in American cities, many have opted out and chosen tents instead of rents.

“ Pricing people out of their homes one house at a time.”

So be the leader of the new movement and put your money where your mouth is…

Sell your house, if you have one, at 50% valuation and help keep the investors at bay…

I don’t know about everybody else, but I’ll clap and pat you on the back…

Or did you really mean it…

That there is funny!

You believe the media? How gullible, they’re trying to create demand playing on the greedy. The simple fact is prices will collapse & it makes zero difference who’s the fool buying, people or investors are one of the same thing, they buy they’ll get buried.

Investors are trying to offload so paid a journalist to write a piece, happens all the time.

Property taxes in Harris County where Houston is located are what price people out of their homes and are among the highest in the country at around 2.5% of property value which annually gets reassessed higher. I had a friend who inherited his grandmother’s house in River Oaks (the Beverly Hills of Houston) on River Oaks Boulevard 6 houses down from the entrance to the RO County Club and property taxes hit $160,000 a year in 2011 and he sold the house as that was just too expensive.

Ain’t nobody feeling sorry for the guy “forced” to sell a $6.4 million house in River Oaks that he inherited (in 2011).

It is enough to make me side with Unamused…and do you know how blind a comment has to be for *that* to happen?

This a country where both parents work to earn about $60k (median) so they can afford to raise .6 kids.

The problems of River Oaks multi millionaires are just, just, just…really, nobody gives a sh*t.

Property taxes are actually closer to 3 – 3.25% depending on what school district you live in. Also, the various taxing jurisdictions, flood control, county taxes, city taxes, etc.

school taxes being the major portion.

With no income tax in TX (thank god and past voters) the funding has to come from somewhere and, sadly, 6.25% state sales tax apparently isn’t enough.

I’m late to comment on this, but I am continually surprised about people thinking that property tax is better than income tax.

Here you are, living in a state (I lived in TX once, too), where freedom is paramount everything, and yet here you are, paying rent to the government on a piece of property dependent on a ascertained non-realized value, and regardless of your income or ability to pay. That sounds pretty unjust. And scary for anyone on a fixed income.

At least with income tax, it’s taken out of an amount that you’ve proven that you can earn. If you don’t earn any money because of disability etc, you don’t pay any tax. Additionally the government is incentivized to improve employment and wages because it increases their tax base. With property tax the government is arguably rewarded for NOT allowing more housing to be built, increasing paper values. Property tax is further disconnected from the local economy because of the slowness at which the property market works versus the labor market.

Is there any information as to how much house prices will drop in San Francisco in this downturn?

Nobody knows for sure. A lot would be the best bet.

A collapse of 60-75% from peak is coming.

Based on exactly what? Kentucky windage?

I predict a 100% collapse for that leaning condo building.

20% at most and the fed is done until November after tomorrow’s hike

Inflation is backing off and more so next month

BTW, accepted full offer over weekend

There are not 1200 banks and Bear Stearns closing along with little surprime with most paper 750 and above over last 5 years

Scared money makes no money

Scared money makes lots of money for those who make timely prudent purchases.

Enough to end Governor Hair Gel’s campaign for President.

Headquartered out of the French Laundry.

It depends on the neighborhood. Most of Northern SF will hold value well.

The Southern half of the City maybe not so much.

No housing shortage? Explain that to those paying rent.

It’s an affordability crisis, not a housing shortage. For example, there are 5,000 apartments for rent now in San Francisco, this is three times as many as before 2019. And yet rents are still sky-high. There is no shortage of apartments in SF. But they’re too expensive.

We need 10% mortgage rates for 5 years to bring asset prices down across the board, and that will bring rents down, and if landlords don’t like it, they can let the property go back to lenders and CMBS investors, and if they don’t like it, they can go take a hike.

It seems to me, residing in Europe, that carrying cost of real estate is very high in the US. These vacant appartments must lose their owners a lot of money no?

@ Wolf –

Well stated ………..

There are plenty of houses for sale. They are just too expensive.

“No folks, there is no “housing shortage.””

The fact that the real estate industry shills and the bought-and-paid-for mainstream media got away with this lie for so long is indicative of the level of corruption and collusion within the system. They lured people in with mass FOMO and blatant obfuscation and lies.

There has never been a shortage of housing going back to the first bubble. You can, at times, have a shortage of houses for sale since they are appreciating so fast nobody wants to give up that $10k per month gain (thanks, Weimar Boy Powell) so they keep them off the market, but the narrative that there were too few houses to shelter people was always a lie.

The US is in moral decay, and it starts at the top. Like they say – “the fish rots from the head.”

The US is Rome at it’s end, ya right in everything ya say, I’ll add this, due to all the lies & delusions prices have to collapse brutally to reverse the brainwashing & the speculative addiction, a perfect symmetry. The bigger the lies, corruption & speculation the bigger the collapse & lesson.

2008 will look tiny compared & with 9.1% inflation & really it’s 18% they’re totally ******.

Agree. But nobody is even pricing in catastrophic global potential geopolitical black swans or even devastating climate change. The level of risk is past the moon, but the greedy won’t listen.

Best way to stop fish rotting is to ”gut it” and cut off the head and throw both to the pelicans and sea gulls…

May bee time to do just that once again,,, and especially get rid of ALL the old and older and obviously senile ”heads.”

Age has very little if anything to do with it.

I know post war generation folks to gen z’ers who know most our “leaders” are fools.

There may be something to Depth Charge’s contention that FOMO is a big factor in hot real estate sales.

The operative word in FOMO is FEAR.

Fear is the the biggest driver among human emotions. 20th and 21st century politicians and elites have seized on this in so many ways to whipsaw the public into obedience to even the most absurd demands simply out of fear of the hyped event that never occurs, but “might” or that “their science” says will occur. Climate change, viruses, BTFD, pet rocks, Monkey Pox, beanie babies, Cabbage Patch dolls, all a form of FOMO or on the political side, FOB (Fear Of the Boogeyman).

It is truly amusing to watch unfold daily, except that is actually so very sad.

The CDC is saying you can’t catch monkeypox if you have a mortgage…

Watch realtors who promote on TikTok & IG Reels.

Came across one last night giving her clients ‘the straight truth’ about the RE market: ‘it is not a bubble, there is no decline, it is simply a ‘plateau’, RE only goes up–of course– but currently the upward trajectory isn’t rising as sharply as it has been. So get in while you can Buyers! And be patient but firm with your prices, Sellers!

People really buy into this tripe.

Feels like sitting at the peak of a roller coaster, waiting out the slow suspenseful pause before the big drop.

Taking financial advice from TikTok or IG reel..that sentence in itself said it all. The people taking these advice seriously deserve the disastrous outcome.

That lady from TikTok, I think I saw her in The Big Short too, it’s just a gully right?

You should see the frantic cheer leading going on on the online investor forums. I think some of them are priming the others for a dump.

If politicians and the media can make you afraid, they can control you. (I did not name a political side or a media station. It is all of them.)

FOMO is just a symptom.

Depth Charge correctly identified the root of the the problem as “Weimer boy Powell.” Powell is just the current front man. The problem, the rotten fishes head, is the FED/Banking/Wall Street money digitizing system. It is a contrived system designed to create debt slaves and transfer wealth and service to the Masters.

And as George Carlin might say …… most of you ain’t the masters.

Second homes.

Vacation homes.

AirBNB homes.

Investor homes waiting for the perfect tenant who can pay higher rents.

Foreign owned homes that sit forever vacant.

Lots of properties unlived in. Lots of people who can’t afford to live in what is available on the market.

You can see the desperation in the market, the sudden attempts to spike prices to attract the already broke retail investors, it’s not working cuz they’re broke, they’re desperate & soon it’ll totally collapse as they all try to escape & turn on each other in panic.

The corruption is so flagrant now 99% of the market is leverage call options, it’s gonna be a blood bath.

NG sector is printing money at 8-11 % for me plus made great change on biotech cheap seats from month ago

Cycles abound, find the ones that make sense and take your cash when cycle tops

The world is not ending it just feels that way with inept admin in white house

The middle class around me is not by any means broke.

Good jobs, nice houses, top of the line pre-schools, newer SUVs and trucks. Sure, they complain about gas prices, but they have little else to complain about.

Saw that too…in 2007. Also in 1999.

I was asking Augustus in the comments above how steadfast JPow will truly be in his new role as Paul Volcker Jr. There was no ‘reply’ button available for him to respond, so I will repeat this question here.

Will Powell and Co. fold and pivot to loosening again at significant signs of economic distress even if inflation stays above 2%? Or will he be Paul Volcker II with all the brass cajones required?

This is probably the single most important question to tackle for any long term investment decisions overall. just my humble opinion.

NO. WHY WOULD THE FOMC DO SUCH AN INANE THING?

If he pivots he’s making it obvious he doesn’t care about society being destroyed by inflation & only cares about protecting the inflated assets of the wealthy. That could easily result in an explosion of anger, riots & total anarchy. I don’t think he can pivot but will pray inflation comes down quick enough, which will happen when stocks, commodities & property collapse hard & fast.

I don’t think people realise the nightmare coming, they really are trapped. That’s what becomes of arrogance & hubris, markets will all collapse so hard & fast it’ll create deflation allowing a reversal to easing. The Fed needs a collapse even if they don’t realise.

That’s the $64 trillion dollar question isn’t it? Everyone has there opinion, assumption, forecast on this matter but only Papa Powell know for sure. If you can read minds and predict with 100% certainty of his action, I would say that’s probably worth more than a Powerball lottery ticket since you can just buy or short and knowing pretty exactly what the market will do. Since we have a joke of a market that pretty entirely depend on the action of the FED, they are the ultimate playmaker, totally not how a stock market should function but here we are…

Phoenix & JackX, thanks for both of your replies.

More specifically towards Phoenix, I certainly wouldn’t realistically expect to predict the Fed’s actions with 100% certainty.

I’m only wondering roughly how strongly Powell will ‘stay the tightening course’ using clues from his words and actions, along with all the indicators on the Fed’s radar screen,etc.

So far it seems the Fed is willing stick to it through thick and thin for a while at least, as JackX said above and through Wolf’s implied beliefs in his earlier postings.

Well nobody can predict the future. What we do know is that the Fed will either stay the course of fighting inflation by rising interest rates and QT, or they will pivot.

So my question is… What would you all do if the Fed does pivot?

Would you buy 30 year treasury bonds in anticipation of interest rates going lower?

Would you buy real estate in anticipation of a turn around in the housing market?

Would you buy stocks in anticipation of another stock bubble?

Would you grow a scruffy beard and move to Alaska?

To the above post, I’d probably sit in cash. I say “probably” because I’ve thought about it and could see NIRP like interest rates, high(er) inflation than now, a sinking DXY, and more maniacally priced asset markets.

If a “pivot” is “successful”, the majority of the US population will be impoverished because there will be no “moderate” inflation and an even bigger asset mania. The psychology for that ship has sailed.

If a “pivot” successfully inflates manic psychology even more, the ultimate market collapse will just be bigger.

As the biggest mania in human history, it’s already destined to be the biggest bust in history, but it will be a process, not an event.

“Would you buy stocks in anticipation of another stock bubble?”

Another one?

Are you kidding?

The current one hasn’t ended. We’re still in it now.

I don’t see an eventual recovery until Powell is replaced. He’s weak and wavering. The market needs a more formidable ringmaster to emerge from whatever it is we’re heading into.

All policy decisions at the Federal Reserve are made by the 12 member FOMC (Federal Open Market Committee) comprised of the 7 member BOG (Board Of Governors) of which Chairman Jerome Powell is just one member plus 5 of the 12 regional Federal Reserve System Presidents.

There is no “brain trust” that change anything for the better. Most people’s idea of better is the continuation of getting something for nothing.

If the credit cycle from 1981 turned in 2020, rates are destined to ultimately “blow out” and living standards are going to decline noticeably for the majority of the US population, no matter what the government and FRB does or doesn’t do.

The Fed has dropped the fed funds rate in every recession since 1954 when the St. Louis Fed’s record begins. That is every recession during peacetime, wartime, high inflation, low inflation, you name it. It’s possible that this time will be different, but improbable. The nature of the beast doesn’t tend to change.

The Fed might wait until they see some actual weakness in employment to drive a narrative of softening inflation, but they will probably chicken out over the course of the next recession one way or another.

It is going to be known as a transitory recession BTW. Very short. Then very long

If your data is correct that does check a box. That would explain why they need to keep pumping rates up so they have a place to drop them to when the White House officially accepts a recession.

It’s not my data, it’s the data published by the Federal Reserve Bank of St. Louis via their FRED research tool. Search google for “FRED federal funds rate” or look up their FEDFUNDS data series. They even highlight each recession on their chart in grey. It’s simple to verify my claim. See for yourself.

To continue rate increases or even hold the current rate through the next recession, Powell would have to turn his back on basically all postwar precedent set by the Fed. He would even have to top St. Volcker himself, who also dropped the fed funds rate in both recessions over which he presided.

Not Sure,

Sorry to throw cold water on your theory.

From what I can see is that the Fed has NEVER CUT the federal funds rate when it was BELOW CPI.

Now the FF rate is way below CPI. Have a look:

Wolf, the FF rate has spent the vast majority of the last 2 decades well under CPI, and the only 2 times it was briefly over CPI in those decades was a short period right before the GFC and an even shorter period before Powell’s more recent U-turn. All kinds of economic measures are different this time, and the Fed’s long held practice of dropping the FF rate in recessions could be cast aside as nothing is 100% certain, but it would be a huge change in behavior. One could imagine CPI will be back on its way down as we get into the next recession, employment cools down, and supply shortages turn to gluts. That would be a sufficient excuse for the Fed, but it’s tough to imagine a proper recession setting in until we see unemployment coming back up.

Besides, I thought you like to praise the virtues of the natural high one can get from a good dip in cold water! Very refreshing!

I just shot down your “always” with my “never.” You take your pick. In reality, the Fed gets to do whatever it wants to do :-]

Replies are smaller and moved to the right to accommodate the connecting lines that indicate what the reply is to. After a few nested replies, the reply button disappears because there’s no longer enough horizontal width to keep shrinking them. The common way around this is to go up a level to reply, but begin with “hey bob—” or whomever to indicate that’s who you are really addressing.

So, we can actually reply to anyone, with or without the button.

JJ,