Pent-up supply suddenly shows up – those vacant homes that no one was counting as vacant.

By Wolf Richter for WOLF STREET.

For the last two years, the story was that there’s no inventory for sale, that there was a housing shortage, and that’s why prices were skyrocketing. Then there were other folks like me that pointed out over and over again that people weren’t putting their old homes on the market after they’d bought a new home, and that these people now owned two or three homes and that they were going to ride up the hottest real estate market ever where prices soared 20% or 30% or more per year, and then they’d sell those vacant homes which no one had ever counted as vacant.

And because they already lived in a home, they could sell their vacant homes without having to buy another home. This is the “shadow inventory” that is now coming on the market, just when mortgage rates have spiked, and sales are plunging. And to get things moving, price reductions are spiking.

Pent-up supply, plunging sales: it’s just the beginning, but it is happening.

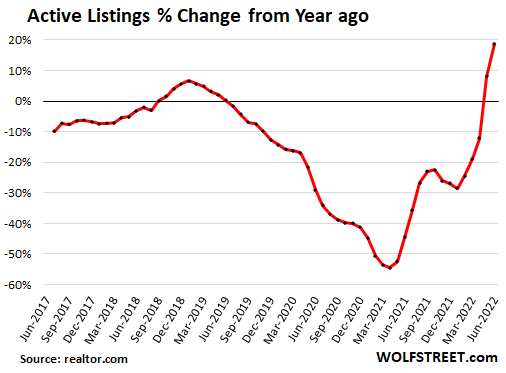

Active listings jumped in June by 20% from May, and by 19% from a year ago, the second year-over-year increase in a row, after an 8% jump in May, and both were the first year-over-year increases since June 2019. There were about 98,000 more homes listed for sale in June than a year ago, according to data from the National Association of Realtors today (data at realtor.com):

Active listings jumped for two reasons:

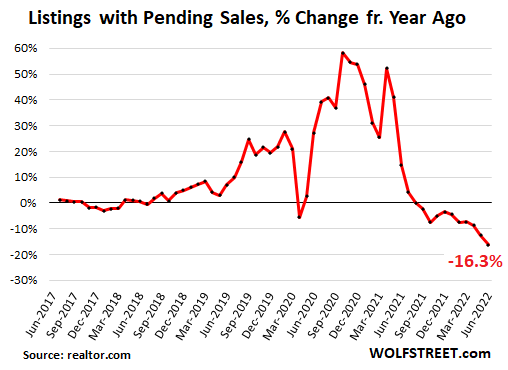

ONE, pending sales in June plunged by 16% year-over-year, after the 12% drop in May, and the 9% drop in April, as potential buyers lost interest in sky-high home prices and holy-moly mortgage rates. These are listings in various stages of the sales process, but before the deal closes. June was the 10th month in a row of year-over-year declines. Back in June, the NAR had reported that “closed” sales in May also dropped for the 10th month in a row. And this doesn’t bode well for closed sales in June:

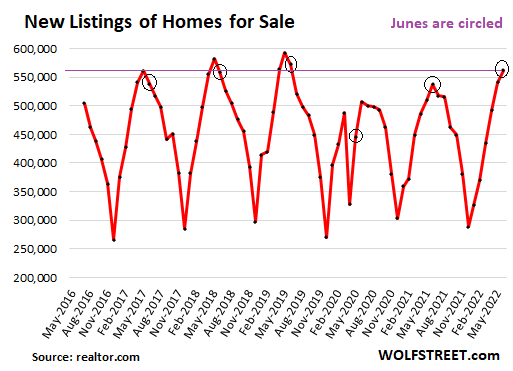

TWO, new listings rose in June to 562,000 homes, the second highest June in recent years, behind only June 2019. And interestingly, new listings rose in June, when in normal years they peaked in May and dropped in June. I circled the prior Junes (data via realtor.com).

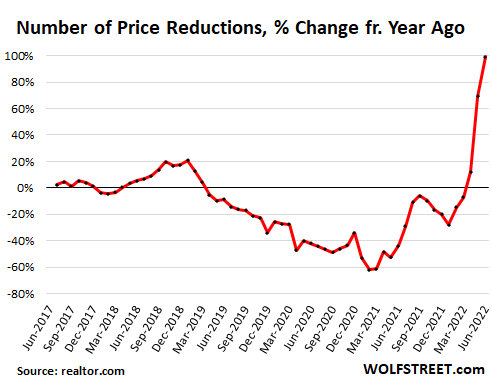

Price reductions spiked by 50% in June from May and about doubled year-over-year, as sellers are trying to get buyers to show up and take a look as foot traffic has dropped and bidding wars have receded into fond memories. This is a sudden reset. But more sellers are coming to grips with a new reality: Prices have to go where the buyers are, and buyers are around somewhere, but they’re a lot lower (data via realtor.com):

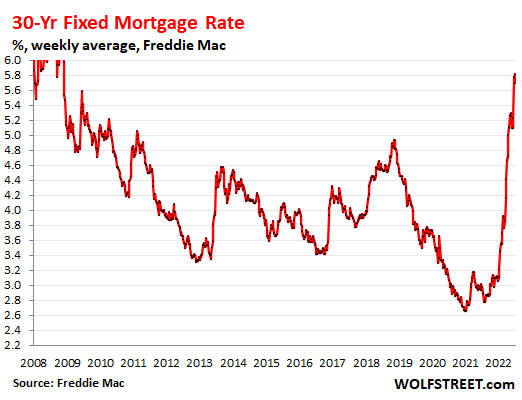

Holy-moly mortgage rates – so called because that’s what people utter between their teeth when they first see the mortgage payment for a home they want to buy – are hovering around 6% for a 30-year fixed rate mortgage, roughly double of where they’d been in 2020 (data via realtor.com).

This type of mortgage rate, having doubled from not too long ago, and home prices that have spiked by 40% or more over the same two-year period make for a toxic mix. Something has to give, and it’s not going to be the buyers – because they can’t, they’re boxed in – but the sellers. Or there is no deal.

And buyers who could buy, the infamous cash buyers, they don’t want to buy at those prices either, now that the craziness is hissing out of the market. No one wants to overpay at the insane peak of what was a totally crazy market.

Huge difference in listings among the 50 largest metros.

Among the largest 50 metros, the number of active listings in June spiked the most in Austin (+144% year-over-year), Phoenix (+113%), and Raleigh (112%). In 31 other metros, active listings surged by the double-digits. And active listings fell in only a handful of metros, led by Chicago (-13%), Virginia Beach (-14%), and Miami (-16%).

The table is sorted by the year-over-year percent change of active listings (data via realtor.com):

| Largest Metros, Active Listings, June 2022 | % Change YoY |

| Austin-Round Rock, TX | 144% |

| Phoenix-Mesa-Scottsdale, AZ | 113% |

| Raleigh, NC | 112% |

| Salt Lake City, UT | 98% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 86% |

| Riverside-San Bernardino-Ontario, CA | 72% |

| Seattle-Tacoma-Bellevue, WA | 66% |

| Sacramento–Roseville–Arden-Arcade, CA | 65% |

| Dallas-Fort Worth-Arlington, TX | 62% |

| Denver-Aurora-Lakewood, CO | 58% |

| Tampa-St. Petersburg-Clearwater, FL | 56% |

| Tucson, AZ | 55% |

| San Antonio-New Braunfels, TX | 54% |

| San Francisco-Oakland-Hayward, CA | 46% |

| Las Vegas-Henderson-Paradise, NV | 45% |

| Jacksonville, FL | 38% |

| Oklahoma City, OK | 37% |

| Charlotte-Concord-Gastonia, NC-SC | 37% |

| San Jose-Sunnyvale-Santa Clara, CA | 34% |

| Memphis, Tenn.-MS-AR | 33% |

| Orlando-Kissimmee-Sanford, FL | 31% |

| Portland-Vancouver-Hillsboro, OR-WA | 31% |

| Kansas City, MO | 28% |

| Birmingham-Hoover, AL | 26% |

| San Diego-Carlsbad, CA | 25% |

| Atlanta-Sandy Springs-Roswell, GA | 23% |

| Indianapolis-Carmel-Anderson, IN | 22% |

| Louisville/Jefferson County, KY-IN | 22% |

| Los Angeles-Long Beach-Anaheim, CA | 20% |

| Detroit-Warren-Dearborn, MI | 18% |

| New Orleans-Metairie, LA | 16% |

| Buffalo-Cheektowaga-Niagara Falls, NY | 13% |

| Columbus, OH | 12% |

| Houston-The Woodlands-Sugar Land, TX | 10% |

| Providence-Warwick, RI-MA | 6% |

| St. Louis, MO-IL | 5% |

| Cincinnati, OH-KY-IN | 5% |

| Pittsburgh, PA | 4% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 2% |

| Baltimore-Columbia-Towson, MD | 1% |

| Boston-Cambridge-Newton, MA-NH | 0% |

| New York-Newark-Jersey City, NY-NJ-PA | 0% |

| Minneapolis-St. Paul-Bloomington, MN-WI | 0% |

| Cleveland-Elyria, OH | -2% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | -2% |

| Rochester, NY | -4% |

| Milwaukee-Waukesha-West Allis, WI | -4% |

| Richmond, VA | -6% |

| Chicago-Naperville-Elgin, IL-IN-WI | -13% |

| Virginia Beach-Norfolk-Newport News, VA-NC | -14% |

| Miami-Fort Lauderdale-West Palm Beach, FL | -16% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It sure is beautiful to see active listing and price reduction spiking up this fast, maybe this crash will experience peak to trough faster than last time from 08-12. For now though, the median and asking price is still stubbornly high for most of SoCal, although that usually is the last to go.

The huge amount of cognitive dissonance and the whole house price will only stay flat worse case scenario gospel will take time to roll over while RE agents still busy telling everyone it’s a great time to buy still, mortgage rate came down just slight this week, so better get in now..

They say housing prices will not drop all that much, maybe 15%. Before 2008 they’d say “housing prices never go down”.

We had a Realtor pull up a diagonal line chart dating back from 2000 that showed the market was actually ‘fair’ valued.

I laughed.

most excellent

maybe now we’ll get some flippers going under cause they borrowed big

have cash will wait

The only people who ever say those things are RE sales people, and people who are too young to understand the business cycle.

This bubble is bursting far faster than the last one. I was in San Diego which topped in some areas late 2003-early 2004! There was little social media being used at the time, just massive advertising from real estate agencies in the various media. Telling people you thought it was a bubble would have people think you’re crazy and a fool. Only years later after the entire economy blew up did people acknowledge that I and a few others were correct. Now there’s blogs like this and people on YouTube, Twitter and Reddit documenting every little crack in the facade as things start to fall apart. It’s pretty interesting from a psychological viewpoint.

The good old days of being called a ‘doomer’ on the Zillow forums.

You can walk away from a mortgage in California. All you ever risk is the down payment. In Illinois and some other states, you are liable. So prices don’t go up wildly.

This discourages speculation in real estate. If you have limited down-side risk why not buy into rapidly rising prices? You might get lucky.

efertik,

Yes, there are 12 states that are “non-recourse” states, such as California. The rest of “recourse” states.

But even in California, it only covers purchase mortgages. If you refi, which a lot of people did, you no longer have a purchase mortgage; now you have a refi mortgage, and it may be full recourse. So people should read the mortgage document VERY carefully before walking away.

here is more on this, including the lest of states:

https://wolfstreet.com/2018/06/20/us-style-housing-bust-mortgage-crisis-in-canada-australia-recourse-non-recourse/

This is a great point seeing as I would estimate the majority of mortgages are now refi’s as people took advantage of falling rates over the past decade.

That means for a lot of people who are in real trouble, the option to walk away is replaced with the reality of bankruptcy.

I think there’s still a tax liability on the portion of the loan written down as well

Will government forgive those refis like student debt? /s

The last thing this country needs is more moral hazard. Rewarding people for doing the wrong thing is a policy that can only create ever growing problems. In addition, it is creates animosity among different demographics.

“But even in California, it only covers purchase mortgages. If you refi, which a lot of people did, you no longer have a purchase mortgage; now you have a refi mortgage, and it may be full recourse”

This explains why our credit union offered us a no fee refi 6 months after our purchase mortgage back in 2011. They wanted to instantly convert us to full recourse.

They also get paid a fee for each mortgage they write and sell to Fannie Mae.

In the UK a mortgagee is totally liable but that doesn’t stop people borrowing as much as they possibly can as apparently ” you can’t lose on bricks and mortar”

Mortgagee is the lendor and mortgagor is the borrower.

Investor money needs to be removed from all residential resale real estate of 4 units or less so that families and individuals can have an opportunity to buy a house as the prices start to fall.

100%

Don’t worry, it may be a while, but institutional demand will decline or disappear entirely once prices stagnate or decline persistently and when renters can’t pay current ridiculous rents.

To the institutional buyer, it’s all about ROI.

Unlike homeowners (many actually debt slaves), institutional buyers have no attachment to their properties and will not hesitate to dump it.

What is the whole of the situation that will roll back rents?

Well, this headline on the surface counters some of the fear mongering that institutional buyers will own it all. Maybe there’s more context to it but when they do dump, they dump fast.

Mom and Pop investors probably didn’t get the memo yet or still have some emotional attachment mix with cognitive dissonance to HODL until they can’t anymore.

“Sternlicht’s Starwood Capital explores sale of 3,000 homes for $1B”

It may not even take that long. If institutions can make more money from Treasuries than housing there is no way they will stay in housing.

Good points but I am not sure all institutional investors will dump. I thought the same thing as you.

But some of these big investors like Blackrock have bundled the mortgages of the properties they bought into MBS and sold to investors. So how can Blackstone sell if they do not own the mortgage? They only service the loans and the property.

Are you suggesting that the government force investors out of 4 unit or less space or are you saying that once all the investor money is out of the 4 unit or less space then the prices will fall?

My suggestion is that they take away laws that make single family homes attractive to in vestors such as capital gains exclusions, mortgage interest deductions, depreciation, support for GSEs such as Fannie Mae, etc. That would be deregulation, not regulation, so all the free market people can be either happy or hypocrites.

You do realize this would devastate the rental market… right?

Regulating free markets is always the road to disaster.

You mean like SEC regulation on investment vehicles which can swindle regular folks out of their money? I think that some regulation is very good for the public interest. I am not one to think that everything governmental is bad and wasteful.

You know some regulation is a good thing in RE, right? Slum lord laws, fire codes and extortion laws exist for a reason. There are wealthy – bad people looking always to make a quick dollar at the expense of a fool. It is why back in the late 1930’s laws created better living environments. We use to publicly train students in primary school about the rights. Standardized testing did away from important education like rights and financial freedom. There is an old law on the books back from 1939 that forbade large organizations, like the ones technocrats exploit, in which they could not buy land or houses to sublease back to people. It had made purchasing and owning home with self-sufficient land possible. I grew up in a coal mining family that taught for generations fair pay and the right to purchase your own home. Otherwise you lived in company housing and if you got sick, lost your job, your family lost their home. So, yes, we absolutely need fair and balanced regulation to protect The People from rich predators! I digress….

SEC regulations would not be necessary if government did not create corporations to begin with and give them special advantage over real citizens. To say we need regulations to govern what government created in the first place is oxymoronic.

Jdog, without government, do you think corporations would cease to exist?

Historically, I am not sure if not corporations actually predate the rule of law. Not legaly corporations as there was no nation state law regulating them, but still self serving and governing organisations.

“Regulating free markets is always the road to disaster.”

Keeping rates at zero for a decade is “regulating” markets.

Pumping up markets and lowering rates with QE is “regulating” markets. Bailing out banks with taxpayer money is “regulating” markets.

What should have happened in 2008 and what a “free” market would have done, is jack up interest rates and flush out all the bad debt. Instead we got the exact opposite. Think about it, if money is scare (bank failures, markets crashing, property values dropping) then people are going to be more guarded with the money they still have, hence rates should go up. charging a premium for the use of money, instead we get the opposite. At least they don’t blast on the media anymore about free markets and so forth, they aren’t that hypocritical.

Sams

Corporations by definition are entities created by government charters. Their primary purpose is to escape criminal legal prosecution for crimes committed by the corporation. At the beginnings of this country, they were not legal except in the cases where they were needed to build infrastructure and then were dissolved. I believe most States had a 5 year limit on their opperations. As time went on, businessmen bribed public officials to allow them.

Our forefathers wrote about the dangers of corporations having seen how they created economic inequality and indentured servitude in Europe.

Today they own our country and our government.

“I hope that we shall crush in its birth the aristocracy of our monied corporations which dare already to challenge our government to a trial of strength, and bid defiance to the laws of our country.”

― Thomas Jefferson,.

Jdog, I will be DAMNED if I can figure out just what in the hell you would like to SEE happen regarding either corporations or government. It’s like some kind of weird “what came first the chicken or the egg” puzzle.

But I do have a hunch……and it doesn’t bode well for this democracy experiment.

Other than that, a good article and I really hope this is the top of the current housing bubble, at least.

Nbay

Free markets are self regulating. There is no need for governments to interfere, and it is in every case, detrimental. At least to the general public.

When human beings try to control things they do not fully understand or is beyond their control they unleash the law of unintended circumstance which is usually a bad thing.

So far as corporations, they are a tool to dominate and control business using government bribery to change the fiduciary responsibilities of government to represent the interests of the wealthy corporations over the Citizens. How is that in any way beneficial to the average person?

It is not possible to serve 2 masters, and our government has chosen to abandon the welfare of the Citizens in order to give special privilege and advantage to the wealthy as the disparity in wealth clearly shows. The tool they use to redistribute that wealth is the corporate charter.

The phrase “That government is best which governs least.” is as true today as when it was spoken 220 yrs. ago.

Kinda what I expected…..I’ll be the dyslexic one here, ok?

Amazing how Faux News and the GQP have convinced people that unregulated private companies and investors will somehow be better for their interests than common sense regulation.

No… what is amazing is that people believe socialism will ever work when it has been proven not to in every circumstance. Of course it actually does work for the people who control it, and I suppose that is the whole point.

@jdog

Ah, so you don’t really know the difference between socialism and regulated capitalism. Got it.

Because there is no difference. Socialists favorite deception is the renaming of things in a attempt to redefine them. A trap for fools.

I liked what Trevor Noah (or his writers said);

“On jan 6 the people attacked the Democracy Store and demanded to speak to the manager.”

The rental market is already devastating. Bring it.

Your right, this leaves the rest of use with nothing. I’m not going into a bidding war, I don’t have the money. The banks has paid billions to their shareholders leaving the small people with a high interest rate,now we can’t afford the increase. Who’s going to help us get the home that was promised to us if we save for it.

Great idea. Good luck getting that to pass. Implementing it is unlikely, to say the least.

Via “contributions,” legal and illegal, the banksters and financiers now control enough of both parties in our government as Simon Johnson in “The Quiet Coup” basically said and other commentators also have explained. Even forcing the ultrarich to pay the same percentage of their ginormous incomes in taxes as ordinary Americans is now off the table.

Nevertheless, the banksters-financiers might have to liquidate some of their massive real estate holdings if their stock “investments” in mainland China (purchased to re-sell to the stupid) are not purchased by enough gullible, American investors

Just a reminder that in the US, housing units per capita are at all time highs.

There has *never* been more housing. Obviously much has been secreted away, only to show up when prices are decreasing.

I’d like to see the per capita stats over time, honestly. Might be possible, there are a lot of vacant properties…apparently…despite high carrying costs.

Since everything comes down to supply and demand, those per capita figures over time would be very telling. Population growth has slowed markedly, but IDK if also slow new homes additions have paralleled it exactly.

Econimica blogspot has the per capita housing charts over time.

Dale – please provide data reference; my data has shown otherwise.

Census.gov – for July 2021: 142M housing units, 332M population.

So, 43 housing units per 100 population.

And for April 2010: 132M housing units, 309M population, so… 43 housing units per 100 population.

No change in housing/population ratio over 11 years.

Looks like one would have to look elsewhere to explain all the increasing homelessness, living with parents or several roommates, or multigenerational households, then….eh?

NBay,

If you’re saying we should build more housing, you’re correct. But the issues you’re talking about are more complex than just housing alone.

Homelessness also has a lot to do with the rise of narcotics like Fentanyl, decriminalization of drug use, shuttering of mental hospitals, increased limitations on policing, perverse welfare incentives, fatherless homes, the list goes on. People vote for what feels good, rather than what is good.

Roommates and multigenerational households are definitely interesting though, and probably more closely relate to housing supply and cost of living. One observation is that young people seem to be more materialistic and focused on instant gratification, choosing to prioritize luxury goods and cars today over housing and independence tomorrow. They blow their cash Balenciaga and Off White. The question is, which came first? Is this a result of high housing costs? A generation demoralized by a feeling that they can’t get ahead, so they focus on the now? Or is it a cultural shift, a result of impatience and a shortened attention span in the digital age? Maybe it’s both.

@ George –

It is a result of high housing costs.

Now you get to explain why housing costs are high.

I do agree with Dale’s other comment – When there’s a bubble in prices and extreme wealth inequality, you get hoarding, supply that has been “secreted away”, only to show up when the bubble pops.

That’s how “All time high housing per capita” CAN be consistent with both “extremely high prices” AND “increasing homelessness, living with parents, roommates & multi-gen households”.

The idea that markets are “efficient” and generally in “equilibrium” seems very suspect…

Then how about TOTALLY INSANE wealth distribution due to years of extremely effective unilateral class warfare since the oligarchs decided to install the Reagan puppet as a more general cause of all of the above? Just throw in the cost of the Vietnam war and here we are, picking through the rubble for partial answers.

According to Lendingtree, we currently have 16 million empty houses in the US… That is about a 15 yr supply at an average 10yr build rate of a little over a million units per yr. It appears the housing “shortage” is being somewhat misrepresented….

My offer still stands. First to pay my Zestimate wins!

I’ll pay your zestimate…. from 2013…

Pick any month, I don’t care…

Did I win? … :)

If that offer still stands in 2024/2025 he might take it lol.

It is such a slow train wreck to watch. The housing-driven stocks have largely figured it out but it will take the buyers a bit longer it seems.

It is generally about 4 years from the time prices begin to drop to when they reach their low point. The reason for this is that many of the first properties to hit the market are the ones most leveraged. People operating from a weak financial position will put off a loss as long as possible especially if that loss will trigger a bankruptcy.

Lenders are equally hesitant to begin foreclosures because in a falling market it is always a losing proposition for the lender to foreclose.

Bank executives are concerned with the reports and statistics that reflect their own performance and will do whatever they can to make things look as good as possible for as long as possible.

With foreclosures, I also suspect that politics is a factor with unnamed demographic groups but not going to be more specific than that.

I have one friend who told me she is headed into foreclosure; I think next Friday. To my knowledge, she hasn’t paid her mortgage in over a year.

It could also be what you state, the property is “underwater” but not sure about that.

Jdog and AF together have more than enlightened me a bit.

AF

I agree with you. Our elected fleecers have set precedent that whether you are a SFH owner or SFH investor with a loan of any kind, the terms of said loan contract can be modified by emergency legislation.

Check a box on a form and paying your mortgage becomes optional. Foreclosure might be one of those words that gets removed from Webster’s within the next few years.

Home construction stocks like DR Horton have been rising in value recently.

I was expecting a 10-20% rent increase but was hit with a 33% one today. It was either sign or hit the road.

It is a deteriorating wooden apartment building, complete with dry rot, sagging floors, no thermostats in the individual apartments, etc, etc. My apartment was rough when I moved in, and hasn’t improved any.

My neighbor got hit with a $525 increase, 68%, because their rent hadn’t been increased for several years. New owner wants every penny while spending as little as possible.

A month or so ago I was talking with an older gentleman who had built his home years ago. He said he listed it the very week mortgage rates spiked, for $6000,000, as that HAD been the going rate the week before. Now it was just sitting there.

He had already moved out, downsizing, and doesn’t need the money, and doesn’t want to leave it to the kids.

In San Fransisco I’m seeing asking rents are lower than when the pandemic just started. And brck then rents tanked by 1K/month. Now it’s about $1200 down (from the top).

What’s it cost to live in that leaning tower?

Pricey, but the incline helps with my snoring.

I’m inclined to think it’s a good deal.

Now that’s a good example of the type greedy landlord I absolutely loathe. It’s one thing to make a little money from your tenant, it’s another to see them as suckers and ring every dollar out of them. These types of landlords are just asking for tenants that will eventually burn them.

When rent finally crash and these type take it in the chin, I got plenty of schadenfreude reserved just for them

As the major bear market (which I assume has started) progresses, I expect rental vacancies to soar.

It’s contingent upon the labor market and the economy, but once both weaken noticeably, large numbers of renters will be “doubling up” or moving back into their parent’s basement.

There is a lot more potential housing supply than the optimists believe. It’s been there all along.

AF,

You have had strong insights of late…but how to reconcile 20%-25% yoy rent hikes in most metros around the country with the “hidden supply” you suggest exists…why hasn’t that supply moved to market, taking advantage of historically high rental inflation?

Even if you just mean doubling up…why hasn’t enough occurred since early 2021 to put a leash on these very, very high rent increases?

You might be right (I hope you are) but rents have been soaring already for 12 to 18 months (following a million death pandemic, amazingly).

Unbalanced markets are not caused by landlords, not even greedy ones. Unbalanced markets are the result of corporate and governmental manipulation of free markets. The unfairness of economic disparity is caused primarily by government and governmental policy. The elected government officials work for who pays them. It is a corrupt system and you vote to maintain it.

@ Jdog-

and the alternative vote is?

I don’t believe I saw that option on the ballot ………..

What city is this?

Wolf,

It is a small resort town that has had it’s own housing bubble for decades. Think Vail light; no movie stars. Add Housing Bubble 2.0 on top of a resort town’s normal bubble.

If memory serves me correctly, over a year ago a realtor was saying there was no homes for sale for under $400,000. Even they were commenting on how insane it is.

Tons of homes being built, but not visible, as they are hidden away in gated communities or forested areas. I don’t know if they will have buyers for them all.

It is a slice of California outside California. Voters routinely vote to increase the cost of living, trying to address the high cost of living. A sit down breakfast is $15-20 per person before tip. That may be cheap for people living in CA. I hear people questioning their bill at the register. When I hear the bill for a family of four I cringe.

Local paper applied a “temporary” gas surcharge to all subscriptions, to compensate delivery drivers and offset their own increasing costs.

Notices and articles in the paper mention numerous proposed or pending tax increases. Increased property taxes on top of inflated home prices.

On a side note, the nearby used car dealer has lots of empty space on their lot. They seem to move a lot of inventory, retail or wholesale I don’t know. They are parking cars sideways to fill the voids.

My option in regard to rent is pay or move to the street. A tenant moved out of the apartment building next door in the middle of the night a couple months back. There is a rent sign up, which is unusual. They have built hundreds of apartments the past couple of years.

Rodger Dodger—

Sounds like Couer D’Alene, Idaho or maybe one of the resort towns in Northern Michigan to me!

“It is a slice of California outside California. Voters routinely vote to increase the cost of living, trying to address the high cost of living.”

“Local paper applied a “temporary” gas surcharge to all subscriptions, to compensate delivery drivers and offset their own increasing costs.”

Yes, your speaking our language. This is happening down in Texas now too (an esp bitter irony since a lot of Californians left California in big part to escape these prices spirals). It’s another reason why the Fed has to be even more aggressive with interest rate hikes and QT now to fight this inflation, it feeds on itself for exactly this reason. The buying power and value of the US dollar keeps plunging, forcing up costs and then all stake-holders just push up prices more because everyone’s costs are going up. Nasty vicious cycle. Has to be full Paul Volcker for the Federal Reserve, it’s only way to break inflation like this.

…the costs of herding an increasing number of two-legged cats is not inconsiderable, as y’all have noted…

may we all find a better day.

Time to go live somewhere else.

Channeling Yogi…in all of the nice places “It’s too crowded, nobody wants to live there any more.”

That’s messed up. Sounds like half a dozen other boomers I’ve conversed with about their homes. “I’m not leaving my home to my kids or grandkids, why would I? I did it on my own, they can too.”

Having the system for your entire life in favor of you (pensions, social security, your portfolio, RE) and then taking it all with you into the grave is selfish in my eyes. When it’s my time, I’m leaving everything I have left to my kids so they can have a leg up on their life than I did.

Itsbrokeagain,

I have news for you: Not even the hated and maligned boomers can take their wealth (if any) with them. They too have to leave everything behind. That’s the deal down here.

I expect a lot of boomers will take out reverse mortgages to fund their lifestyles and then the banks get their house upon their death. The pretty much cuts off their heirs.

Read a book back in my youth about the difference in physiology between between uber wealthy dynasties and regular people. Dynasties tend to teach their children from an early age that the money they will inherit is the “families money” and not theirs personally. Their duty is to grow it and pass it on to their heirs.

Kind of seems like financial common sense for any family.

Re Tony, the idea to be well underwater ecomical when going in the grave is a rational thing to do in a debt based society. No one taket anything with them, nor are charged afterwards.

With some planing it is even possible to transfer wealth to children and granchildren and leave the debt to the bank.

With a declining population the bank might then be in a bad position.

wow. that’s a lot of hate for me and my gen, and you don’t even know me. I’m not rich and have my millennial kids either living with me or I’m sending money. I would tell you to stop your fixation on hate and create some positivity…or you will pass your hate down to your kids.

Collectively, the Boomers made it easy for their kids to hate them – those they didn’t abort…they indentured.

And, more than a little, abandoned (huge increase in divorce and unpaid child support).

The Boomers inherited the richest country on the planet…and are leaving a steaming pile of debt.

New owner, eh?

“He had already moved out, downsizing, and doesn’t need the money, and doesn’t want to leave it to the kids.”

Then sell it for lower if you don’t need the money. Or he can’t because of the “principle”?

Don’t know all the details. I believe it is paid for, as he built it himself, and home values ballooned later.

I believe he is likely emotionally attached to it, but also doesn’t like to visit it, perhaps because of the emotional aspect. I believe he lived in it with two wives who both passed away, and then likely also the kids.

You are exactly correct IMHO Kmf:

Told the wonder woman in my life to ”instruct” in her will for our little cottage to be offered to the fire department for practice.

Then, let the children sort it out to either build new, or just sell into the ”dirt” market so someone else can build new.

This house, built 1950, truly a ”tearer downer” I used to HOPE,,, might end up being just a ”fixer upper” the way it’s going these days.

I am rehabbing a 3bd rental. I will raise the rent 35% from $650 (prior to rehab) to $1000 when I finish the rehab (renter destroyed the place. $25k to rehab it) . Wiped out 4 years of profit. But I could charge 1100 to 1200.

I also have a 4 bedroom rental I am going to raise rent about 20% from 1600 to 2000. I could easily charge 2200.

Now before any hate comments. I typically charge 20% under market value to long term….good renters and if they are willing to do some of the handyman fixes.

But the rise in property tax, insurance, maintenance supplies, and handyman wages leave me no choice.

You’re raising the rent closer to 54% on the 3bd. You’re raising the rent 25% on the 4 bedroom. You shouldn’t have any qualms about charging the market rate, but it does illustrate inflation in housing costs.

What are are you in?

Just sorry to hear you and your neighbor having to deal with this, may not be much comfort but it’s cases like yours that make a lot of us very, very mad, and it shows the real cost of the USA’s insane Everything Bubble and why it’s so damaging–it’s not just a bubble in dumb frivolous things or vaporware like crypto or tulips. Our institutions stupidly allowed the bubble to extend to absolute survival necessities like shelter, healthcare and education needed to get employed, This is a reason why extreme ZIRP and QE can be argued to be not just damaging to a country, but a kind of criminal level negligence. We can roll our eyes when asset bubbles hit things like crypto or NFT’s, but housing is something everybody needs and so a housing bubble is grossly damaging and painful to Americans already struggling to stretch their incomes for basics–on top of the general inflation. One of co-workers has even gone so far to argue that landlords who do such awful profiteering should be prosecuted, she’s a landlord herself but sympathetic to how the renters in her overheated market are suffering.

Just here to remind everyone that QE and ZIRP are just response of the elites to maintain the status quo while consumption capitalism is collapsing. Good riddance, it was never that great to begin with, it almost destroyed the planet. Time to focus our energies on what comes next, a more peaceful way of coexistence with nature.

We all just need that magical candle to make it happen!

Roger, sometimes landlords jack up the rents to intentionally get people to move out so they can renovate and demand higher rents going forward.

All those I asked about mortgage rate who bought recently got adjustable rate morgage at 4.5-4.75% range. Many plan to refinance later.

They won’t be able to refinance if they go underwater.

They must all be true believers that FED will pivot and eventually start buying MBS again if they believe rate will adjust lower and they won’t be upside down by then..hopium do go a long way

Oh, so that’s how they’re fleecing the suckers now. I’m sure they’re running “teaser rates,” too, right? Banker scvm have a trick for every market to try to prop up prices.

Yeah it’s just sickening to hear this. There’s so much confusing information out there that even highly educated professionals get confused by all these financial instruments, or how dangerous these ARM’s are now. This sort of fleecing of vulnerable Americans should be criminal imho.

Our banker told me we would be fools to go with anything but a 7/1 arm.

Only “suckers” are getting 30 years these days.

Mind blowing.

why no recession in 7y or Fed won’t lower rate in recession to refi? Doing ARM in low rate period is risky.

Man, that’s dangerous.

Almost everyone I know that purchased a home in California since 2005 used a ARM. Everyone I know in Texas go a 30 year fixed.

I fell for that trick in 2006. Never again!

Same in 2005. We bought as much house as we could afford, stretched all the way out. It worked out OK (mostly for my ex who kept the house in the divorce) but now I see what a crazy risk I took. 30 yr @ 3% now, I may not ever sell this place.

What you’re calling “holy moly” is just a blip in the long term chart of mortgage rates. Before 2000, 10% or higher was common. This could just be the start.

The one thing you’re ignoring is the price. Interest rate repression has inflated home prices. So that $200k shack in 2000 is now the $800k shack. And that’s not the same thing anymore, in terms of mortgage payments. The impact of 6% mortgage rates today is huge. My first mortgage was 8%, but I didn’t buy a $800k shack with it.

Absolutly true. However, on the lower end where I exist the price of a house as in monthly total cost to own correlates very close to the rental prices. The fact that large companies are in the market controlling close to 30% of rentals does determine the housing prices when the number of houses I’d less then the number of buyers. I have sold most of my rentals and have evaluated the price reductions on the rest already. At a 20-25% reduction in value and increasing rents I still win if I collect income for another 5 years and that is the worst senerio. Also when prices go down 25% I may start buying again as I have cash from the last run up. It’s like planting and harvesting to long term investors, we simply don’t care what happens.

I would guess that the Feds might let housing prices drop until all the owner’s equity is gone and the lenders start taking hits. Then they step in to “stabilize” the market before they have to bailout the banks again.

Most of the mbs is held by government.

This time I don’t see any threat to banks unlike 2008.

The Fed is owned by the banks.

Most mortgages now are created by non-banks, competitors to the banks.

All securitize the loans and sell them off ASAP to bag holders.

The Fed will feel little need to buy up MBS to bail out the banks this time around. It would do it only to stimulate the economy in general, which would directly conflict with its goal of quashing inflation.

Fed owns about 25% while pension funds own about 11%.

Fed owns around 2.7 trillion of MBSs…

in 2006 they owned none

Will the Feds have to bailout Fannie and Freddie again? I guess I meant to lump them in with “banks”.

Wolf I appreciate your restraint in not blasting Harrold with both barrels. Your must have been sleepy. How he made that comment without factoring in the new holy-moly house prices is beyond me.

As always thank you for this site.

Mark,

I keep my trusty old side-by-side 10-gauge goose gun right next to my desk, just in case. But Harold didn’t say anything that required that kind of racket. He just looked at one component of a two-component issue.

What Harrold said was correct. Interest rates will be raised to whatever level is necessary to get inflation under control, and if that devastates the housing markets, and the people who over paid for homes, then so be it.

The Fed cares a lot more about correcting inflation, than it does you losing money on your RE or stock investments.

this for Wolf:

”Goose Gun” is always long barreled, at least 30 inches and preferably 36”… 8, 10, or 12 gauge makes no matter if aim is good…

IOWs, not double barreled, as would be way too heavy…

What you mean is your ”Mossburg 500” or equal, designed and made to lie quietly next to the bed without one in the chamber,,,,

According to many reports, the only thing needed these days is the noise of ”chambering a load” to deter many bad folks who apparently are well acquainted with that sound.

Similar to the old model 1911 .45 whose ”snick snick” was very well known ”back in the day.”

Nah. Nothing better than a 36′ 10 gauge side-by-side to shoot down high-flying comments with. That’s the only thing I use it for.

“Mortgage rates are still low by historical standards” is one of the cutest cope statements ever, uttered by people who do not understand the very basics of economics.

It’s an incomplete statement. It should be followed up by “Home prices are STILL high by historical standards.”

Except for the rich/wealthy, monthly payments matter to people. Rates go up, prices must come down to match. Demand and supply, very basic.

Vehicles should get there soon. I’ve never seen so many used cars with temp dealer tags in my life.

That’s what I was thinking, too. On one hand yeah, home prices are ridiculously high and that’s the bottom line here. Sure, one way to look at it is that higher rates would make those high prices even more unsustainable. But it doesn’t follow then, that “this limits interest rates from going as high as before”–that just means that housing prices have gotten even stupidly higher than we thought, and this real estate bubble is even more beyond anything that should have been allowed to happen. The ultimate determiner of what housing prices should be, like with other assets, is US incomes. And American incomes haven’t kept up anywhere near enough to tolerate real estate prices and general costs of other basics. So if home prices have to fall even farther as yields go up even more, so be it. Like i said there are a lot of US markets where home prices and rents would have to fall something like 60 to 80 percent to get closer to actually salaries and earnings for the people there.

“Mortgage rates are still low by historical standards” is one of the cutest cope statements ever, uttered by people who do not understand the very basics of economics.

Mortgage rates are low, but mortgage payments are high!

Mortgage rates are low by historical standards

People who lived thru sharply higher rates know this

People with charts know this

People who measure 30yr rates vs inflation know this

Reality will intervene into the Fed circus which has been going on for the past 16 + years. Suppression of the interest rate function has been the fools economics, writ large. That is what we have, QE.

Prices are too high for the median citizen too afford so they will decline gradually or violently. We will see.

“Prices are too high for the median citizen too afford so they will decline gradually or violently. We will see.”

Yep, this is what matters. This is the pain that QE caused. It was fine maybe as a very short term intervention when COVID19 was causing its most damage, but it’s one of those things that has to be withdrawn aggressively as soon as even a hint of inflation starts showing up (including asset inflation in homes). Continuing QE for years even after the housing bubble was showing up was totally irresponsible. A bubble is simply when prices go beyond what incomes can afford, simple as that. It should have been a red-flag when asset prices kept soaring beyond incomes, that’s always going to lead to inflation in general goods and services.

Notice the Fed does not speak of price rollbacks but only slower rates increases on top of the recent price hikes

THUS 12 months from now, theses current prices plus X% is a Fed victory

People cant handle that

Remarkable the Fed does not press for zero inflation

City of San Diego politics has driven a speculator frenzy of buying. Things have cooled here but the developers are swooping in with suit cases full of cash in areas they see as the best for multiple units. I’m curious what that chart looks like for the city of SD only. Some stuff is sitting longer, some pulled and put back on, but some stuff is still selling for ridiculous amounts, again, if the multi units numbers pencil out. The entire city is zoned for multifamily now with San Diego’s generous ADU program, especially anywhere within the TPA (transit priority area).

Don’t worry.

San diego prices would also come down to ground to sane levels.

I am seeing multiple proce reductions.

Although my friends think San Diego is special and this time is different so come what may home prices in San Diego would never go down ,

> come what may home prices in San Diego would never go down

In ’08 my place fell to half its price. The nearby multi-unit project was delayed about 8 years. So these “friends” are blowing smoke. If they are staking their money on it, it is their problem. Beware these “friends” may be hitting you up soon for cash.

Has a one GREAT zoo if you don’t mind a lot of up and downhill walking. Really wanted to see the Tasmanian Devil (was inspired by the cartoons) but it was all dark in there and it just was sleeping in a cuddly little ball…could have been a rock I saw, too…..was ONLY letdown, though.

My wife and I took a Baltic cruise out of Copenhagen at the end of May. We had a day in Copenhagen after the cruise before we flew out — and fortunately had great weather that day. We went to the zoo. One of the exhibits that really stuck in my mind was the Tasmanian devils. They were outside only about 8 feet from the railing feasting on a carcass. I’m guessing some kind of antelope judging from the legs and hooves. We commented that you’d not likely see something like that in an American zoo! Even if they were being fed I don’t think it would be on something so recognizable as a part of an animal.

We had zero fun last time we visited the SD zoo because it was so very crowded and that was on a weekday. Now the Safari Park is another story. It’s hard to find a parking spot but the park itself is so spread out that it’s easy to see the dang animals.

I think the entire state of CA is now zoned for 2 units after SB9 was enacted in 2021.

The entire state is zoned for two from the state adu law, three is you toss in a JADU. Sb9 takes it to a minimum of 4 (lot split with a Dulles on each lot) . San Diego is unlimited within the TPA. This isn’t anecdotal, the term unlimited is actually spelled out in the city code. Outside the TPA we’ve calculated that 5 units is the limit. Both these caps are by using the “bonus” units which are allowed by creating “adfordable” units. Ironically, affordable units, per the code, are anything up to 110% AMI. It’s a density ploy, nothing to do with affordability.

That’s insane. What’s wrong with high rise condo complexes? I’d rather cars be parked underground in a garage than lining the streets of every suburban neighborhood.

Masochists.

SD is the last delivery location for imported water from the Colorado River which isn’t doing all that well, and there isn’t really any well water possibilities in SD either.

Yet still the fools are building big residential blocks like there is no tomorrow. They have the aesthetics of Stalinist architecture. At least they lack lawns.

So bye bye golf courses and swimming pools (there is an ocean, ya know?) and all AZ type landscaping?….ahh, the sheer agony of it all, but then it really IS all a desert down there. We gotta get them to pass a law on what North CA water can be used for down there…..maybe that “density ploy” will help.

But the ocean has pee and poo in it right now, for a good portion of the county. Plus where the heck are people going to park? It’s truly amazing prices are so high in SD.

Desalt plants in the future? What other options are there.

That is the only option for the future. Add it to all the other costs and watch quality of life decrease even more.

But if you listen to the leaders in SD today, they sound absolutely confident that their water supply is secured for decades because of some deal with Imperial. They made a deal with the desert… for water, from the Colorado. Okay, good luck; still last in line for a water source that’s diminishing.

The inhabitants of San Diego are suffering from mass psychosis. They still believe that it is a wonderful place to live despite being hit in the face every day with the reality that it is not. Overcrowding killed SD living standard a long time ago, and it is only the illusion that keeps it going.

My life here in SD is incredible. And affordable. Go look for a straw man somewhere else.

Lived in SD for 37 years. Used to be wonderful. Hate it now. I can afford it, but it’s way too crowded, too many homeless, too much traffic, too much tension in the air, probably from all the people who can’t afford it. Have great job, but not great enough to keep me here much longer.

Lived in SD from 1960 to 2018, it used to be nice, but now it is neither affordable or does it have a decent standard of living. That is unless you enjoy putting up with all the problems overpopulation creates, and spending a large portion of your life stuck on a slow moving freeway with people who will risk your life to get one car space ahead. The desperation that comes with overpopulation makes people act uncivilized and depresses the hell out of me.

Had a beautiful estate 1.5 ac. in a great area, and still could not wait to leave. Best decision I have made in a long time. Only problem now is too many idiots from CA are moving here with their poor manners and self centered attitudes. They are still a small minority though, and will not be able to totally screw this area up until after I am gone.

You must not live south of the harbor, where the pollution has closed the beaches all the way to the border. This includes the very tony Coronado. And as others have noted, the rest of the county is really crowded with tons of building and traffic from the north every weekend. Left 15 years ago and so happy I did!

I think he meant “mass physiology”. See comment above concerning his reading background.

Are you being facetious?

I left 15 years ago after living in SD for 20+ years. Funny things is now I can afford to live there (right, in a $1,000,000 box of mediocrity) but have no desire to. The traffic alone is enough to make it not worthwhile.

@Iona Thanks for mentioning that! Was nearly about to book that fancy pants hotel on the shore of Imperial Beach. Nearly $600/night for freaking sewage? What a joke. And the only reason for IB was to not spend half my vacation stuck in traffic. Good grief, can’t wait till my fam builds a hotel or two in their backyard.

“Overcrowding killed SD living standard a long time ago, and it is only the illusion that keeps it going.”

This sounds like Phoenix too, and more and more cities throughout Texas and esp Florida. Arizona and Texas esp are running out of water in many places and Florida has its own infrastructure and sustainability issues. Absolute insanity for prices to have gone up that high there. At the very least there are cheaper options in much of FL, AZ and Texas for now (which is why so many Californians are moving there), just so long as they can keep the plague of speculators and institutional buyers away. They were the ones behind a lot of those outrageous rent hikes in ex. Tampa a few months ago. Really need to be limits on that sort of thing.

FL is literally owned by the developers/speculators, and has been for decades Miller.

There used to be a ”square” of doubled double wide trailers set up in Tally, every minute the legislature was in action, in which any of our elected representatives could get anything they wanted to eat or drink or otherwise…

That was in the sixties to my certain knowledge.

I suppose they use more sophisticated methods of blackmailing the legislators these days, eh???

The clear results of Hurricane Andrew and subsequent storms may have put a hitch in that giddy up???

When I was a kid, San Diegans prided themselves on not being LA, and then they turned into it.

XC-true dat…(all the way back to ’77 when i departed…).

may we all find a beter day

California pols want this for the entire state. There’s not enough water, but they demand towns create more housing even if it means destroying the character that drew people there to begin with. Not to mention the sanctuary state b.s. Density will ruin quality of life up and down the coast as amenities, services and infrastructure don’t increase with the population. I foresee more homeless, crime, trash along freeway, requests to cut back water use, while politicians here increase the racial division with their identity politics and calls for equity which are veiled wealth redistribution schemes. Happy 4th!

If a buyer can barely afford a $500,000 house with a 3% rate 30 year mortgage (i.e., housing cost of mortgage/tax/insurance/hoa fee is 38% of monthly income), then they can’t afford the same house at a 6% rate.

The price would have to decrease from $500,000 about 10% for every 1% increase in the mortgage rate.

That means the house price would have to drop to $350,000.

Imagine how fun this will be when 30 year rates go up to 9% or so!

No worries. You just buy with a zero down super teaser 2% ARM sheeple special, with a side of super PMI. Buy now and get priced in forever.

If the progression of auto loans are an example, won’t we see 50 year mortgages soon?

Why has the 10-yr yield fallen by an entire 50 basis points since the June Fed meeting (from 3.3% to 2.8%)? If the Fed plans to continue hiking later this month, even if it’s a ‘light’ 50 bp hike, the 10-yr yield free-fall seems to defy reality.

Not sure if this aberration provides a temporary reprieve from ‘holy moly’ mortgage rates enough to bring in a final decent gaggle of buyers or not.

Why has the 10-year yield doubled to over 3% when the Fed just start started hiking rates?

There is a lot of demand for Treasury securities — which keeps the yield down — because at least you get your money back if you buy at auction and hold to maturity. People rather make 3% when inflation is 8% than lose 50% when inflation is 8%.

There is no signal from the bond market on a day to day basis. Look at the long term chart, and you’ll maybe see a signal.

Wolf, thanks for your reply and, yes I acutely understood the overall parabolic leap from the 2020/2021 yields. I was more interested in the driving force behind the 50 bp drop over the past few weeks only. Seemed overbought to me given the likely circumstances ahead.

CNBC explains it as recession fear driving safe haven investing.

High demand for the bonds is driving the price up and the yield down.

Yea. I saw a couple of charts on odds of recession and both charts are spiking up to where that is becoming most likely outcome. Long dated treasuries is normally the go to for recessions.

I picked up one of my favorite dividend payers yesterday with a 3.2% spread over 10 year Treasuries. Doesn’t happen very often.

@ Old School who said: “I picked up one of my favorite dividend payers yesterday with a 3.2% spread over 10 year Treasuries. Doesn’t happen very often.”

———————————————–

Name and ticker?

How confident are you of the continued dividend?

Wolf doesn’t like stock pumping, but if you want to figure it out it’s the biggest pet pharmacy. No debt, dividend $1.20. $5.00 plus cash on the books so that is 4 years of dividends. Stock price has a $19 handle. Company is not growing and has completion so it’s not a slam dunk. I have bought and sold it for about 14 years depending on price.

If someone asks, feel free to tell.

….oops. has competition.

Acute tap dancing is kinda like “fast comeback” in HS which I never bothered to learn…..really stupid game. I just said FU and took the loss, and if the victory was pushed I said it again but in the fighting words way. So they all left me alone.

CB

Ticker symbol is PETS. World’s best balance sheet for a small public company, but the business is competitive. Might be more down side, but buying with dividend 3% higher than Treasury seems acceptable, but you can hold out for lower price higher dividend if you want to have more safety. Good luck.

“There is a lot of demand for Treasury securities — which keeps the yield down — because at least you get your money back if you buy at auction and hold to maturity. People rather make 3% when inflation is 8% than lose 50% when inflation is 8%.”

Clear as a bell. That’s why I like this site. I might have to crack open my wallet and send in a donation.

Hey Wolf, what do you make of the massive volume yesterday in the 10 year etf, ief? Looks like 2 whales made moves but I can’t help but think it was selling into strength. Based on your view of bond funds, for them to be buys would mean serious idiocy.

Easy.

Two and five year yields are above 3% (which also means the Fed has lost control over the short end of the curve which is the only thing they could still pretend to control). Even 7 years are at 3%.

That means an inversion of the yield curve.

It is called “pricing in a recession”.

Cannot really understand having much interest in the 10-30 yr. when the short terms are paying more, and make access to cash less risky. You can always sell long term, but if rates go up you will lose. Can’t complain though, it plays to my personal advantage.

Yeah, 26 week T-Bill is around 2.5%

Not bad!

I don’t play beyond 5 year bonds, but there is a reason to own long dated securities if history is a guide when you get to a certain point in cycle near recession. It’s similar to shorting stock market.

They are bought to ride out the Fed cutting cycle and you can make a big capital gain if you buy and sell right. Not for me though, because you can be screwed if you get the timing wrong. I don’t like investments where you have to be right on timing.

With CPI at near 10%, and likely to stay at nosebleed rates for at least a year, possibly two, I don’t get it either.

My impression is that the fed can do whatever they want to the yield curve because of the content of there balance sheet. But instead they choose to do what they do for reasons I do not understand. They could sell longer term debt to to push up those yields if they wanted. I think they don’t do that in a reactionary manner because they prefer to sell according to a well telegraphed plan. That is my understanding of QT as it currently exists. Maybe someone can provide more insight. So, bond market trading still affects yields like the good old days, but there is an enormous bias courtesy of the Fed, and that bias exists far beyond the low end.

Not really, you must understand that the Feds primary concern are its member banks, and their profits, they are the Feds shareholders. That is why it is so concerned with keeping low stable interest rates.

Run away inflation is the worst case scenario for banks because it dictates that the money they loaned out already is paid back in substantially depreciated dollars, which they did not factor when they originally made the loans. This can create huge losses over a relatively short time.

When it comes down to choosing between the economy, and the health of their member banks, the Fed is always going to do what is in their shareholders interests.

The Fed controls the entire yield curve.

They didnt when the balance sheet was $800 billion…now over 9 trillion they have plenty of ammo.

Thus to look at inversions and then make a prediction is faulty IMO

The yield curve is just what the Fed wants it to be.

I saw an article on a MSM today talking to a 80 year old from north of Seattle complaining that two months a go zillmate had her house at 1.1M but right now she and husband can’t even sell it for 900K. She (and many other hone owners ) truly believe their house worth over a million just because zillmate said so and feels she is been screwed selling it for less!

Meanwhile in Boston (and DC) new inventory still being priced even higher than couple of months ago, it’s like no one has gotten the memo yet.

Did anybody ask that old skinbag if she could afford to buy her house at today’s prices without having the money from the current house? In other words, STFU, greedheadgranny.

I like Charlie Munger’s saying when you see financial problems which is basically invert the situation and try to come up with a solution. The world’s biggest asset bubble is probably one of the biggest opportunities if we can think of the correct financial decisions to make.

Does your response have to be filled w sexist, ageist digs? Lots of younger people who are male are thinking the same way she is. Nasty isn’t necessary.

Hate-speech is very fashionable these days. The most unfortunate part is that those who have an abundance of it want to spread it around.

People that still list higher than market price now and refuse to reduce price it’s so oblivious or stubborn, kind of reminds me that one guy in school that thinks he has the hottest girlfriend meanwhile everyone around knows she is about as ugly as sin.

I also hear stories of people arguing and offended at their RE agent why aren’t they listing well above market asking or getting offer at slightly or at asking. Some comedy gold right there..

Correct. I just dealt with that last year. Offered on a house in the Minneapolis / St. Paul Metro (Edina) on a fixer upper. House had good bones, owner demanded listing it at 575 (way over comps). 3 price reductions later, I offered 450, countered at 465 and the owner wouldn’t budge said his realtor. He fired his realtor and relisted in the winter with a newly staged house and much better photos (polishing the turd mind you). However… 1 key difference on one of these photos – Snow now on the exterior and roof. Why is this important? Whoever the owner was, put a brand new roof on 1 year prior and chose the hideous green contrasting with the home exterior. So you can only guess how the rest of the house looked… yes, Christmas lights in the basement bathroom – Horrid. House sold for 525 Feb 2022. Can’t wait till the new owner finds out they have a sweet new green roof. Ha ha. Only one choice now… paint the house white.

not ANY kind of good analogy pi…

if any other venue, i would tell you to ”get a life”

and stop picking on girls from your apparently unhappy childhood

in reality, there are NO ”ugly” people except when any people make themselves ugly by choice

Behavioral finance, a really simple name, endowment effect. People value what they have, highly. People are averse to risks of locking in losses, perceived ones along with actual. This is as natural to a dog as a human. They will lag at lowering prices. Most folks do it to some extent. But it is also natural for people to try to be insulting and snarky about absolutely anything, trying to sound “smart.”

If a guy values his girlfriend, that is his business and his freedom and meaning. Only if he is trying to pimp her out, does the analogy hold up, and only for idiots who rate women like cars. And that’s not a world I traffic in.

This is right. Is the guy happy? Nothing else matters.

“…danger, Will Robinson! i’m detecting an outbreak of basic decency!!!”.

may we all find a better day.

He’s trying to make a point, probably with a made up analogy, not something you are supposed to take seriously, any more than the Geico gecko. People have forgotten how conversation works. Waiting for people to over react and cancel me now…

In fairness the Zestimates are presumably based on comps so houses around her were probably selling at those inflated prices. I’ve created basic spreadsheets to model house prices based on square footage, number of bedrooms, bathrooms etc. and they worked fairly well. You can do even more advanced stuff with Machine Learning. I’m sure the models Zillow created did a fairly good job with modeling current trends. We’re I think they fell apart was not factoring macro economic conditions like interest rates, stock market, etc.

How does zillow factor in a green roof, mold, bad landscaping, a shot water heater?

They don’t. You have to factor in those details yourself. I find Zillow, or similar pricing sources, very useful.Be it cars, RVs or houses, intelligent end user input is critical to arriving at a realistic number.

That’s where zillow took some big losses, making offers on houses based on their algorithms, not the actual details. In the last “tech boom,” there was a big hype and then breakdown of many algo models in many areas, including insurance, etc. There is a lot of data lost by making gross assumptions about something being traded, that is not truly fungible (like grades of wheat).

This sort of thing happens in waves by region.

Boston’s inventory is so restricted that prices may never go down. The local governments restrict new builds so well that there will never be a large increase in inventory.

I have noticed that many people get REALLY emotionally attached to the perceived value of their home.

While there are rational folks that understand that the value of a home is what a buyer will pay for it, there are many who will stubbornly insist on their price.

I you have a property on the market for 6 months (really 90 days would be better) and have no buyer, your asking price is too high.

Pure schadenfreude :D

I counted up the homes for sale with price reductions just now in and around 20+ miles of one town in rural far northern Ca. 50% of the homes had price reductions. Also about half of the newest homes for sale had lower relative prices. The other half are seriously overpriced and in denial about their lack of maintenance- even on the higher priced homes.. I see homes with ruined flooring, questionable septic and peeling decks at the same relative price as very good quality homes with pools and very well maintained structures and landscaping.

Also saw more homes go pending this month then back on the market without closing.

I think, in my greater area at least, prices will be coming down much faster than in 2008.

I love the smell of barbecued speculators.

Yeah, and put a LOT of salt on those fresh wounds baby!

I think also the Chinese are pulling out of the US a bit. Seattle, LA, I think Portland have been propped up by them as well as some towns in between. And of course the Russians are spending less here. I read one small report that they are digging into all RE owned by them, not just the mansions, and freezing all sanctioned ones they can find. Good. About time. I’d like to see the mansions in particular turned into low income and below market rate workers’ housing.

Love me some kung pow speculators…Those Chinese “investors” I hope they take their money out now whatever they can get and go ruin some other countries or take it back home to cover whatever debt and RE bubble blowing up over there. Before 2020, couple of years back, all I hear in SoCal is how these Chinese investors are buying areas like Arcadia cash, the tend to gravitate towards SGV.

Don’t know how many have to pull out now because of all the turmoil from Evergrande..etc but if they do…good riddance.

” I read one small report that they are digging into all RE owned by them, not just the mansions, and freezing all sanctioned ones they can find. Good. About time.”

Private citizens loosing assets due to something their country did is NOT a good thing. Also illegal and unprecedented.

Personally, I hope they sell every last piece of their property and put the money into Ukraine’s war account for long range missiles.

At some point it should be illegal for foreign investors to own any residential property in the US unless they live in it full time. In peacetime as well as war. Both China and I’m pretty sure Russia have extreme limits on foreigners owning land in their countries.

Yep been hearing the Chinese have been pulling out of West Coast real estate A LOT, esp out of Seattle, LA, SGV, Bay Area and of course Vancouver. That may be doing more than anything else to moderate home prices there a bit. The Chinese will be leaving with good profits but so be it, whatever gets them to stop this speculative frenzy will help make prices more reasonable. The odd thing is the dumb bagholders buying up the homes from them more and more seem to be institutional investors from what I was seeing as of late last year (and plenty of FOMO first time buyers), but whatever it takes. As for the Russian oligarch real estate investors, if they had anything to do with starting or profiting from the Ukraine War, I say seize away, that’s the price you pay for starting a war of invasion. (And in case it comes up, I didn’t like it when the US did the invasion of Iraq on false pretences either so wouldn’t mind if our own American oligarchs get some assets seized for that too.)

I read an article a while ago that stated that in general Chinese investors were more highly leveraged than American investors. I suspect a lot of them will be taken to the cleaners so to speak.

I suspect a lot of bulk RE buyers are also funded by Chinese money.

Yeah it smells like sweet and sour, depending on which side you’re on.

I wonder how much of the declines of new sales are due to the higher interest rates, lower stock market portfolios and ridiculously higher prices vs. some of the more psychological factors such as a concern that everyone is suddenly talking about a recession (e.g

Mark Zuckerberg “worst downturns that we’ve seen in recent history”) and layoffs (while there have been some high profile layoffs the numbers are still small), concern over the drought in the West (Lake Mead and Lake Powell have declined to their lowest levels since they were filled and everyone remembers the day the sky was orange due to the wildfires). If the market is currently only starting to price in the first 3 factors and not the others ones we have an even larger drop ahead of us.

I’m friends with several realtors and the sales pipelines has really slowed. Yeah, they still have good sales action but not like when rates were low. Rates are a huge thing for buyers. Huge. Throw in war, gas prices, groceries, rising taxes, political instability, monkey pox, drought, stock market (big one), etc… yeah, I’m curious myself about the psychological effects as well. Stock market seems to be a big one for a lot of people. I know my dad always seems to use it as a barometer that the country is doing well. His logic is flawed though, as he still doesn’t seem to grasp the logic behind a currency printed on nothing and backed by nothing. Will be interesting to see how the US Dollar ends. If I’m not mistaken, every single fiat currency has failed with the average fiat currency lasting 27 years. Grab the popcorn, a beer (poured in a Wolf Street mug) and your 3D glasses for this ride.

The stock market is often wrong as an indicator. And pumped up asset prices reduce liquidity in the productive sectors. The money literally gets ‘trapped’ in these assets, never getting back into the economy as productive assets.

money never gets trapped in assets. money is exchanged for an asset, so both the asset and the money have a new owner. the money stays in the system.

That average 27 year lifespan should alarm people. Our current FIAT system is then overdue to fail.

Averages are meaningless.

Well, I do not know of a FIAT monetary system that have lasted longer than today system either;)

The whole USA wealth phenomenon has lasted a lot longer than many folks expected. I thought it would go under in 1979. Each situation is different.

England’s gold-based pound sterling didn’t last very long, at a stretch. England and France and everybody suspended convertibility to gold several times in several hundred years meaning they went in and out of fiat. Then they went broke over a very long period, the Romans even longer as they diluted their currency. It is ridiculous to generalize with something like this 27 year alleged “average.”

A river on average 3 feet deep might in one place be 1000 feet deep. So what?

British pound sterling has been around since 1694.

Even the various “gold standards” (and yes, they were plural) were fiat insofar as the sovereign set the convertibility.

And convertibility, as other posters note, goes “on holiday” at the whim of the sovereign.

So — it’s fiats all the way down …

Monkey pox will burn out. You need to worry about the Sloth Pox. It’s a slow but certain killer. Lies dormant for ten years then you need to spend your last dime on chemo.

I was looking for a home in the Chattanooga area five years ago, and got a cold call from a realtor there last week asking if I was still interested in buying. If that was not an abberation but rather an indication, then heaven help us.

“ wonder how much of the declines of new sales are due to the higher interest rates, lower stock market portfolios and ridiculously higher prices vs. some of the more psychological factors such as a concern that everyone is suddenly talking about a recession “

Josh,

Not discounting what you’re saying but it could also be as simple as a shortage of greater fools…

Remember as short ago as 2019, housing was pretty darn affordable until the Great Panic of 2020…

Manias, by definition, don’t need to be defined or overthought because typically they are a psychological vs a rational event…

Best to avoid them, as many, many people will soon find out…

i’m sure you meant to say, ”irrational” as opposed to rational cowg!

Nothing goes to heck in a straight line is one of the few,,, very few IMHO ”adages” upon which WE, in this case the very cautious WE, can rely.

Most of the rest of the news might be best considered as advertising AKA propaganda.

Wolf does a really great job of making clear what WE, in this case WE the PEONs, need to know to be able to actually ”invest”…

As opposed to ”gamble” of course…

I did, Vet…

Thanks…

Housing was only affordable because of artificially low rates and fake “growth”, even in 2019. By affordable, I’m referring to the monthly carrying cost, not the price. Prices in many markets were already absurd.

If the bond bull market really ended in 2020 which I think it did, rates are ultimately destined to “blow out”, past the 1981 high. It won’t happen immediately but will be a headwind for real estate for a long time.

Housing got affordable for the masses in what, the New Deal? The government’s finger pressing on the scales has been propping up the middle class housing market and manipulating the prices, ever since. Take that away, and you get real price discovery, something I’m sure almost no one is psychologically ready for.

But now, are we reaching an end game on all that? Is Japan? Might it finally actually be different this time? I suspect some other ‘facilities” will be dreamed up and implemented, and the typical person like you or me here, will be grousing about it.

The financialization of everything due to interest rate repression led to people buying a payment, not a price, with reliance on the greater fool theory, which I’d argue is the most accurate economic theory.

So, let’s say you pulled money out of the stock market before it tanked, where do you put it? Bonds for short term, real estate for long term. Here in the Seattle area we have tech employment supporting re prices with continuing price growth. Some additional supply from perception of a price peak, but still general price growth. Do not delude yourself I to thinking it is safe to rent lifelong, retire.ent will be way more e pensive then..

I will take the counter to that.

There is an opportunity cost to buying a home. It’s true for the very long term that the SP500 has out performed residential real estate. If you choose to lever up your residence 4:1 or 10:1 sure residential real estate can outperform stocks, but you are taking a risk on a non liquid asset. So to be fair you have to try to compare apples and oranges or in this case a non liquid, leveraged asset to a liquid, non leveraged asset.

I always say if you know real estate you can make money in real estate and if you know business and stocks you can make money in stocks.