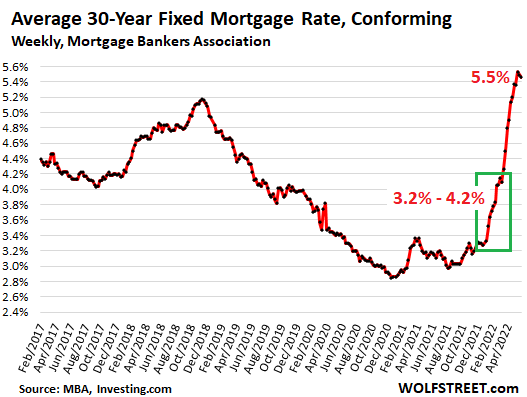

Purchased in a panic when mortgage rates averaged 3.2% to 4.2%, just before the majestic spike.

By Wolf Richter for WOLF STREET.

The home price data released today by the S&P CoreLogic Home Price Index represents the three-month average of closed home sales that were entered into public records in January, February, and March, reflecting deals that were agreed to a few weeks earlier, roughly in December, January, and February, funded with mortgages that were pre-approved before then, and had rate locks from when they were pre-approved.

These rate locks were based on interest rates in effect roughly from November into February, when the average 30-year fixed rate ranged from 3.2% to 4.2%, with the majority of the time being below 3.8% (green box in the chart). These are the rates that funded home purchases reflected in today’s home price index.

There have already been numerous indicators that the markets for existing home sales and new home sales have run into difficulties at the current holy-moly mortgage rates of over 5%, including sharply lower sales volume and rising inventories in existing homes and falling sales and record spiking inventories in new houses.

But the data by the S&P CoreLogic Case-Shiller Index released today and shown in the hair-raising charts below predate those changes in the market by several months and instead reflect the period when a mad scramble was going on to lock in a mortgage rate before it would spike further, and to buy a home, any home, at any price, before the rate lock from prior months would expire.

The mad scramble back then.

The overall National Case-Shiller Home Price Index for “March” released today (average of closed deals entered into public records in January, February, and March) spiked by 2.6% from the prior month and by a record 20.6% year-over-year.

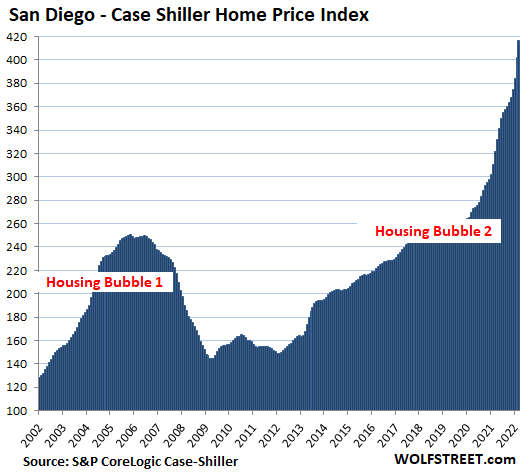

San Diego metro: Prices of single-family houses spiked by 3.7% in “March” (average of January, February, March) from the prior month, and 29.6% year-over-year. The index value of 417 means that home prices exploded by 317% since January 2000, when the index was set at 100.

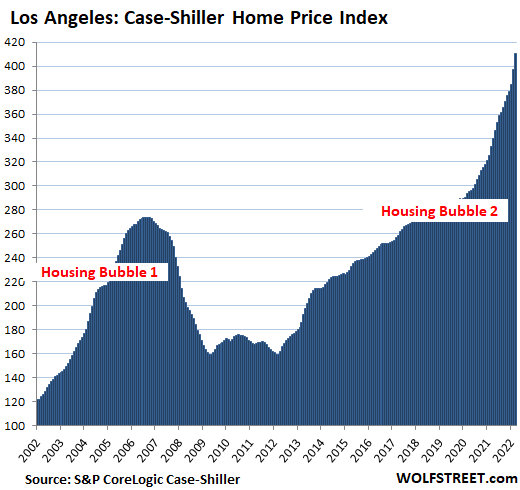

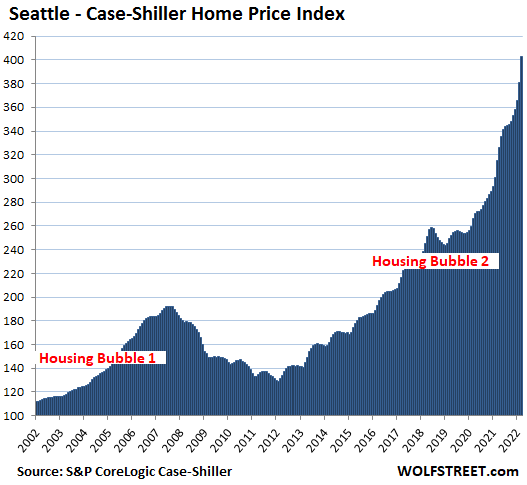

This price growth amounts to 4.5 times the rate of CPI inflation (+70.3%) since 2000. This majestic spike since January 2000, despite the plunge in between, anoints San Diego the Number 1 most splendid housing bubble on this list, followed closely by Los Angeles (+310%) and the incredibly spiking mania in Seattle (+301%):

All charts here are on the same index scale as San Diego.

Los Angeles metro: The Case-Shiller index spiked by 3.3% in March from February and by 23.2% year-over-year. With an index value of 410, house prices exploded by 310% since January 2000, despite the plunge in the middle, crowning the Los Angeles metro the Number 2 most splendid housing bubble on this list:

Seattle metro: House prices spiked by a holy-moly 5.6% for the month, bringing the two-month spike to a good-lordy 10.2%. Year-over-year, the index spiked by 27.7%. Since January 2000, house prices spiked by 302%, 4.3 times the rate of CPI inflation:

It’s house price inflation.

The Case-Shiller Index is based on the “sales pairs” method, comparing the price of a house when it sells in the current period to the price when it sold previously. It tracks how many dollars it took to buy the same house over time (methodology). The index incorporates adjustments for home improvements. By measuring the purchasing power of the dollar to buy the same house, the index is a measure of house price inflation.

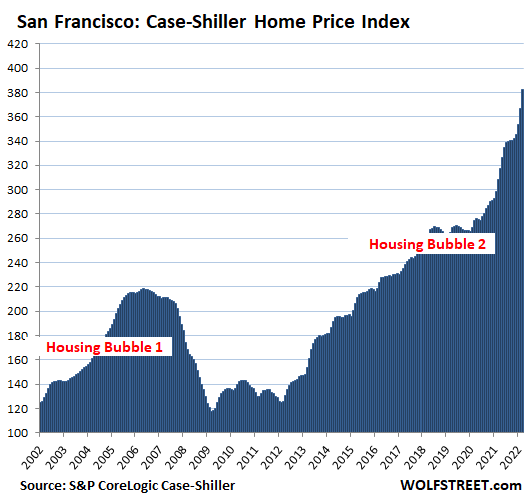

San Francisco Bay Area (five-counties including San Francisco, part of Silicon Valley, part of the East Bay, and part of the North Bay): House prices spiked 4.3% for the month, and by 24.1% year-over-year:

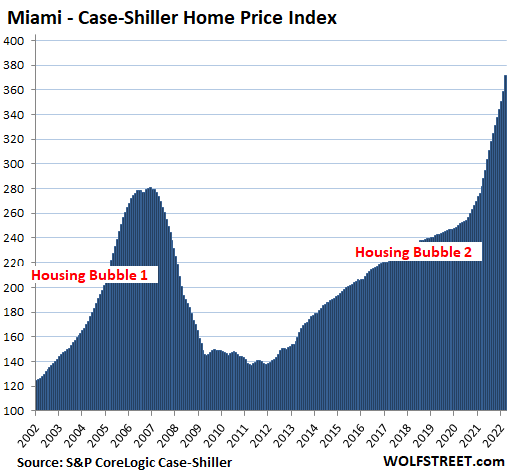

Miami metro: The index spiked 3.6% for the month, and 32.0% year-over-year, the fastest since November 2005, near the apex of the Housing Bubble 1, before the epic Housing Bust:

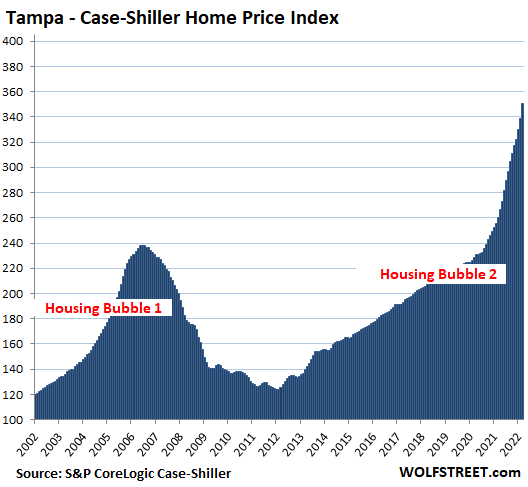

Tampa metro: House prices spiked by 3.7% for the month, and by 34.8% year-over-year, a record spike in the Tampa metro, out-spiking with ease the crazy spikes just before the Tampa’s epic housing bust:

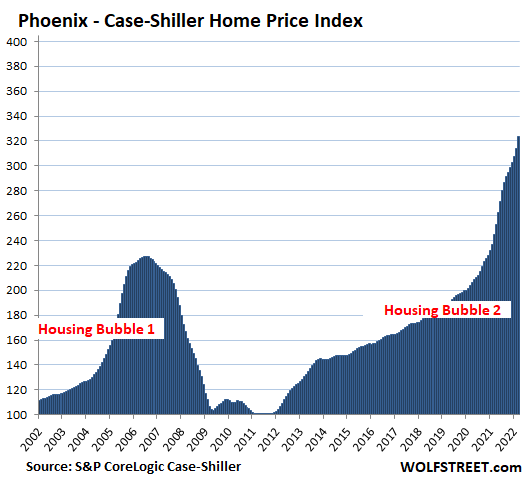

Phoenix metro: House prices spiked 3.0% for the month, and by 32.4% year-over-year, just a tad below the record year-over-year spike in the prior month, and the ninth month in a row of over-30% year-over-year spikes:

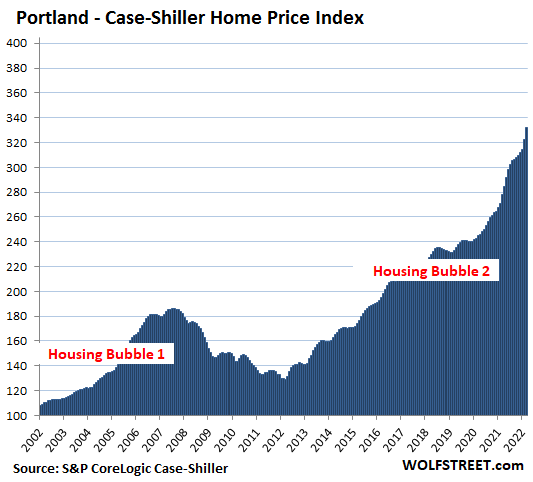

Portland metro: +2.9% for the month, and +19.3% year-over-year:

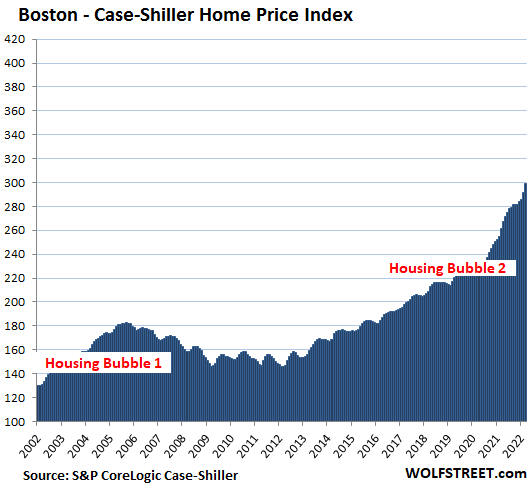

Boston metro: +2.6% for the month, and +14.5% year-over-year:

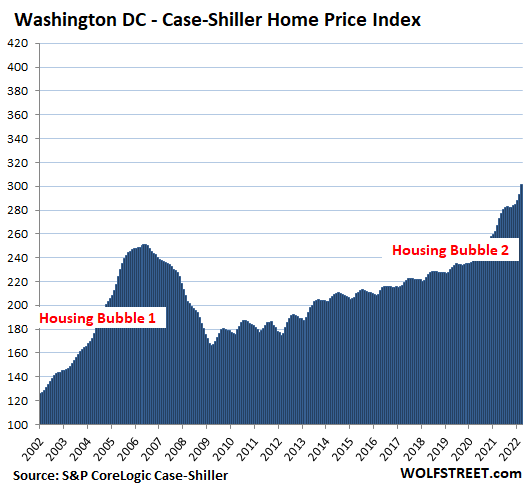

Washington D.C. metro: +2.9% for the month, and +12.9% year-over-year:

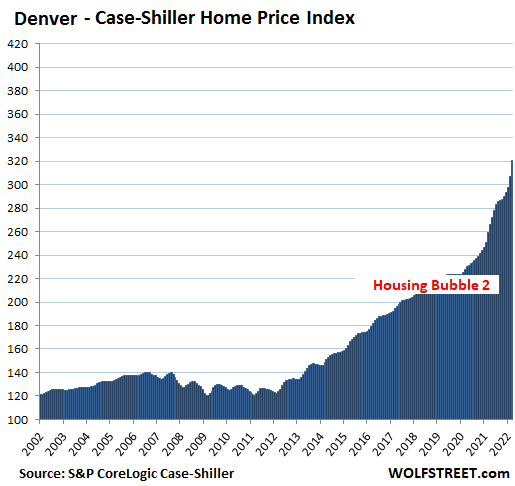

Denver metro: +4.5% for the month, and +23.7% year-over-year:

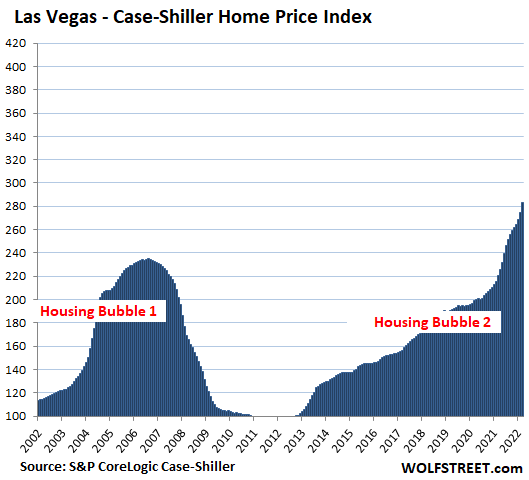

Las Vegas metro: +3.1% for the month, and +28.5% year-over-year:

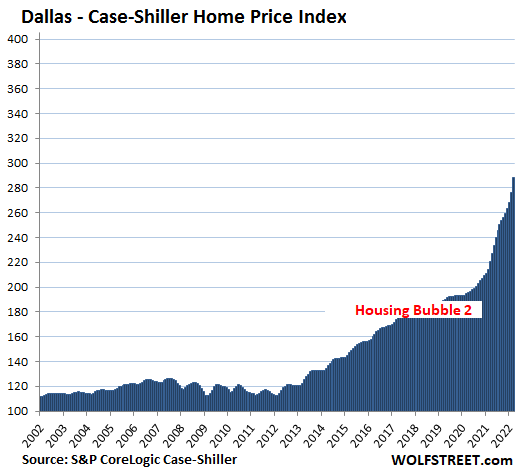

Dallas metro: +4.3% for the month, and a record +30.7% year-over-year:

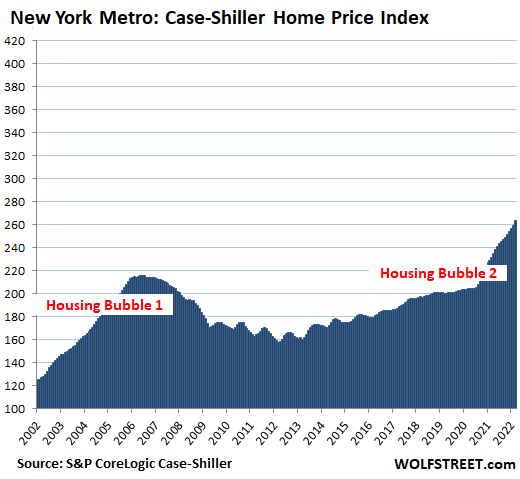

New York metro (a vast market within commuting distance to New York City that Case-Shiller calls “New York Commuter”): +1.6% for the month, and +13.7% year-over-year. At an index value of 263, the metro has experienced 163% house price inflation since January 2000, 2.3 times the rate of CPI inflation.

The remaining metros in the 20-metro Case-Shiller Index – Atlanta, Charlotte, Chicago, Cleveland, Detroit, and Minneapolis – all have experienced substantial house price inflation since 2000, but it doesn’t quite measure up to these most splendid housing bubbles here, and so they didn’t qualify for this illustrious list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just last week, the wife and I finally bailed on our house we were building. We got in in 3.5% so we felt quite lucky.

Our builder informed us that due to supply chain problems, both gas meters and electrical meters were on back order. So while the house is complete other than those two items, they are rather *important* items!

Now our rate lock is expiring and they still don’t have a projected closing date. So we bailed. Hate to lose the $5k earnest, but we were at the line with the house as it was. At that higher rate it would have been impossible.

Sorry for your problems.

Sorry to here that. Hope it works out somehow.

It may be the best thing that ever happened to you.

Very sorry to hear about that. If its any comfort… I have lost more than $5K in my company’s stock in the last year. Some of my co-workers have lost several times more than $5K.

excellent news

want to hear more

sorry you lost earnest money – but $5k is nothing in bigger scheme

maybe by next summer there will be some inventory to pick from

I hope interest rates keep rising

cause we pay cash

Quoted from a previous article:

“Sales of new houses are registered when contracts are signed, not when deals close, and can serve as an early indicator of the overall housing market.”

https://wolfstreet.com/2022/05/24/housing-bubble-getting-ready-to-pop-unsold-inventory-of-new-houses-spikes-by-most-ever-to-highest-since-2008-sales-collapse-below-400k/

According to the Commerce Department, the signed contract counted as a sale. Now, that same house will show up again as a sale at some future date.

That sucks.

You’ll be able to get another in a number of months for much less.

Based on the last crash,,, and others since 1956 to my certain personal knowledge/experience you are correct dj…

Unless, it really and truly IS: ”Different this time.”

FAR shore, different this time IS a, repeat A Possibility…

Wanna bet???

I have been involved with several real estate bubbles and never lost money because of leverage. I provide the liquidity with someone with excellent credit in a down market I fill it up with roommates to cover all costs and sit and wait for the market to turn. I have also done halfway houses in multiple States as an ongoing profit with other groups and hedge fund investors. You must be creative and have solid contracts not too many attorneys know about these little loopholes but it protects all parties concerned.

Seems like you performed assuming you were able to close. I dont see how you eat anything in that scenario?

Sorry. Why couldn’t you just have done the closing and made the builder agree in a post-closing covenant to install those two meters?

I have friends who believe these price levels are sustainable

It certainly is not sustainable. Builders either need to build smaller / affordable houses or not build so many $700k McMansions.

There is still affordable housing in my area in the $175k to $250k range. These are older smaller houses that are in older lower class neighborhoods where schools are ranked 1 star, 2 star, or 3 stars out of 10.

The neighborhoods where the schools rank above 7 stars are start at $400k and inventory is still very low. New subdivision have new schools built in the center of the subdivision and these are in the $700k range. I still see corporations buying some of these houses for now to rent out.

So what I have noticed is that a lot of “Luxury Apartments” are being built right on the edge of these nice subdivisions / school districts. The home owners always protest with the NIMBY but the city likes the tax revenue and lets the apartments buildings be constructed.

What is happing is these luxury apartments are being rented out quickly so parents, who cannot afford the cost of a new house, can their kids into the good school district

It is all messed up.

“Affordable” can mean a lot of things to different people and changes under different market conditions.

To most, “affordable” means the monthly mortgage payment of housing expenses which in the biggest US housing bubble ever, means a substantial proportion of the population have either opted or been placed into debt slavery or debt serfdom.

$175K to $250K is affordable today due to low credit standards and artificially cheap financing but doesn’t buy much of anything in much of the country.

As one example, the starter home I bought with my mother (since sold) for her to live in was estimated at $175K sometime last year. It’s in the Atlanta exurbs near enough retail and regional express bus service but nothing else. A corporate buyer bought it from her. It’s listed now for rent at $1950/month.

Since rents have exploded too, this is supposedly “affordable” but it’s the type of house a “working class” family will choose to rent and it’s not actually affordable to them. The median household income in ATL is not much higher than the national median.

This is the exact same situation where I live including the luxury apartments. The other issue is that as home prices have sharply increased so have the property taxes. Not only is one in for 500k for a less than stellar home but the property tax is the final nail in the coffin. I have no idea how this gets sorted out but if I never own a home again then so be it. I refuse to spend the rest of my life geographically tied to one spot struggling to make a bunch of payments on a house that is certain to lose value. I know people bought more than they could afford during the crazed FOMO home extravaganza of the last 2 years. That bill is fast coming due and I fear the cash slotted for those fat house payments in now being spent on $5/gallon gas and electric bills. Good luck everyone. Duck and cover is the theme for 2022.

Check out the sky high property taxes in the state of Taxes. It used to be a low cost state called Texas but now the taxes on a $500K house are $12,000 a year or more. It’s ridiculous. People can’t afford the taxes on the house they are living in.

Texas is still a low cost state. For the wealthy that is. That is why Elon moved there.

The poors? Well you pay outrageous property taxes and your kids dodge bullets at school.

Apple, as a former TX resident, I’ll tell you they make a lot of money from fees, especially court related stuff. The whole traffic school thing is a ridiculous sham.

“ I refuse to spend the rest of my life geographically tied to one spot struggling to make a bunch of payments on a house that is certain to lose value.”

If everyone thought like that, we’d be in a better place. Kudos.

“Builders either need to build smaller /”

Oh they are my fine friend.

693 square feet 2 bedroom with no place to hang your hat.

Clown World took over most of the building industries many many years ago

Yard space is a thing of the past. You can spend a huge amount on a nicely pointed new home, but with only a narrow perimeter around the house. It’s like buying apple pie but without the pastry. Once again, corporates are telling us we should to live. Yes, land becomes scarcer as populations expand, but it’s hard to justify the price you pay for the sacrifice you are expected to make.

You put your finger on it when you said that builders need to focus on the $200k starter and not the $600k McMansion – but they have resolutely refused to do so for the last 20 years – darkly empowered by the diseased hand of ZIRP.

There will be shrieks of “impossible!!” but there are a *ton* of design choices that can go a *long* way to reducing prices (like 1500 SF houses instead of 3000 SF compounds for 2 adults with zero to 1 kids – all that square footage exponentially hikes surface area that costs money to finish. Ditto convoluted rooflines dreamt up in an insane asylum for millionaires. And on and on. And don’t get me started on cabinets).

Our neighbors renovated top to bottom 5 years back. But they moved and sold to new people who over borrowed to renovate to their tastes. There was nothing wrong with the 5 year old version. But the new folks were mesmerized by the TV shows and the belief that they need to keep up. Granite tops are much better than Corian – so silly. So we all get what we deserve for marching to the marketing beat. Decorators would have nothing to do without new products to pitch. I would have taken those Corian tops but the contractor took them – probably to resell. When I was younger I had more money than brains. Now I have more brains than money. Our kitchen is very functional but not cool without granite. Our Prius is a hero on gas, but we don’t look cool driving it – as if anyone on the freeway cares. They don’t. We are the problem. Corporations just take advantage. Cheers

I think I’d like to hear that story on cabinets. 😉

Interesting that you mention the rooflines.

I look at aerial imagery of some US housing areas and am amazed how complex they are.

Interesting but yeah, not something I’d want to pay for new, or have the liability on maintenance buying used.

I’m amazed the build prices are so high that house prices are then really high, to justify the recent rises.

Hopefully the commodities crash and tech crash and associated fallouts will drop material prices and wages and see build costs crash too.

In the UK I’d love to build my own house but finding plots at sensible prices with planning is pretty much impossible.

$200k starter home? Is that a doublewide mfg home on a 5000 sq ft lot?

Builders have to compete with other builders to buy lots/land.

If a builder who wants to build a 1500 Sq ft starter home rambler [profit $25,000] has to bid against a high end builder who plans on a 4000 sq ft “mansion” [profit $100,000] who do you think is going to end up with the lot? The high end builder could pay $25,000 more, erasing the low end builders profit and still make $75,000.

You can’t build cheap housing unless you can get cheap land.

But then if you have three or four buyers bidding up the price of that “cheap” house it isn’t going to be affordable housing.

It is just a supply and demand problem.

Enlightened,

You made a well thought out point…but you also pointed out how ZIRP ignited and sustained multiple, doomed, leverage based bubbles.

Without the toxic ZIRP rocket fuel, nobody would be building $600k homes (regardless of theoretical profit or lot buying power) because almost nobody could afford them/qualify for the mortgage (incomes have barely grown while new home prices have doubled or tripled).

But ZIRP gives the illusion of affordability (at the cost of expropriating savers’ earning power) thus igniting the mandatory “idiots auction” you describe.

Your points are well taken though and I’m going to spend some time thinking through their implications.

A starter house in Massachusetts is 450k.

Things are so out of range in Canada we just sold our 1977 house in a pulp mill town for $780k. Things are so far out of touch with wages here. Gas is $2.15 /l here. Something has to give.

cas127

Oh, absolutely. The Fed was throwing napalm on the fire back in 2017. It was nuts.

$700k doesn’t buy a one bedroom in Orange County CA let alone a mansion. The Asian community are purchasing cash and locking everyone out of OC. First time buyers don’t stand a chance.

Click, click, click…

Apparently your friends have never been on a big roller coaster. Yes, the view gets better and better as the coaster goes up the big hill.

Click, click, click…

Hey, I can see my car. We are going into the clouds!

Ahhhhhhhh!

They are sustainable, you will just have different buyers and buyers will buy for them less expensive houses.

So everyone just goes down a little but with mortgage rates still way below inflation, it is still very beneficial to buy. May be with some more cash that cannot find a good home on the stock market that is no longer going up and up and up.

You will also have institutional buyers that buy whole neighborhoods to rent out and give the steady income stream like an utility.

mortgage rates need to get near or above inflation . We are anything but there yet

Your comment, “mortgage rates still way below inflation, it is still very beneficial to buy” is one I see surfacing with some regularity. It is true, but only given certain circumstances.

In the last bout of high inflation (roughly 1976 to about 1984), buying a house with a fixed mortgage was an awesome inflation hedge – but only because wages increased along with the inflation rate (not necessarily at the same rate, but at a meaningful proportion of the inflation rate). But a lower than inflation mortgage rate isn’t any advantage if your income doesn’t increase.

Also, as mortgage rates increase (as they are already), monthly payments go up so house prices generally will be steady or decline. So the realizable value of the property may not be what you paid with the low interest rate.

There are a lot of reasons to own a home to live in – in most instances for most people it’s the single best financial move (assuming it’s not a financial stretch or speculative purchase). But simply buying because interest rates are lower than inflation rates is not a good reason to buy (in my opinion).

No Canada housing bubble this month. Wolfstreet must be going through a cost cutting cycle due to investment money drying up.

Gooberville Smack,

No cost-cutting here :-]

I almost didn’t do this one. The reason being that both lag so much that I have to jump through hoops explaining the lag. The Canada housing market has turned big time, and there is now a lot of fretting about it, but the Teranet National Bank House Price Index is still a couple of month away from showing the first signs of that turn. So with that one, which is a little quicker to react than the Case-Shiller, I’m just going to wait a couple of months till the turn shows in the index.

As this progresses, I shall keep the popcorn ready.

In terms of quick turnaround housing metrics, you may want to Google “First Tuesday California Home Sales YTD” – they generate month to month sales prices and *volumes* for CA – which is sure to be the exploding canary in the microwave (greener than a coal mine, for CA).

I dream of California busting. My home of Bend, OR is full of equity refugees. Once the California bubble pops, we will hopefully see less influx of these yuppies.

Wolf, I live in WC/Laf border in development of 160+ of large town homes in hills with breathtaking views. These are homes, but with low pricing due to restrictive CC&R’s. Am trying to convince HOA to loosen restrictions and change things that HOA is responsible for to reduce reserve requirements in inflationary environment. I have one chart of yours comparing home prices to condo prices. do you have anything else that would help with this? Thanks for all the data.

The only thing I have in terms of charts is the 5-county Bay Area Case Shiller data for houses and condos. I have the current one if you want it.

The California Association of Realtors (CAR) has median-price data by county, houses and condos separate. So that might be more helpful. I cannot get the time series for condos. But you can check the data for April here; this is an Excel spreadsheet that opens in your browser. There are different tabs for houses (SFH) and condos.

https://car.sharefile.com/share/view/s14d6028fcc046b1b

July, August and September should be the worst months of the year especially September. The absolute dumbest of the dumb money is still trying to hold the lowest end of the housing market up. The lowest end should in time take the biggest hit of any price range.

Toronto’s still relatively stable, normal (so far) seasonally falling, but look at the legendary Vancouver:

https://www.zolo.ca/vancouver-real-estate/trends

Why have mortgage rates fallen from 5.5% last week to 5.25% this week, in the face of the Fed about to run off its MBS holdings while simultaneously hiking interest rates? It makes no logical sense to me.

Look at the chart. Rates always fluctuate. That’s what markets do, they fluctuate, including the stock market market. Up and down. But don’t lose sight of the overall trend or else you’ll get run over by it.

That spike in mortgage rates over the past few months was historic. And it occurred without QT and with just two rate hikes. The magnitude and suddenness of that spike surprised most people, including me, though I figured that there would be a sharp increase, but not like this. So it was time for a little pullback.

The bull market in bonds lasted greater than 30 years. The bear market we’ve entered in bonds will also likely be a multi-decade process. So there will be a stair-step decline over a long time. That being said, that also means there could potentially be bear-market counter rallies during this process. Even bond rallies that last a year or more! Remember, this process will be long.

Wolf, how much of this is simply because a mortgage bond yielding less than 7-8% is basically losing money with inflation where it’s at right now? Are buyers simply pricing in the inflation risk premium, which is, needless to say, high right now.

If that’s the case then mortgage rates go up another a point or three?

Everything is losing money right now with this inflation — unless you take huge risks with a junk bond that has a significant risk of defaulting and wiping out your investment.

Because they are keyed off the yield on 10-year US Treasuries and those yield have fallen from over 3.00% to now around 2.80%.

“Everthing is losing”

But today I learned a new word on this excellent website which my middle school daughter is fascinated with! Whoa! From fashion to finance. Maybe I can retire early?

The word is ‘CANTILLON’. What it means is that while everthing is losing, the elite are winning big time because money, like lighter than air gas, flows up.

Complementary word: Sinecure.

patience will be needed here for the unwind. an interested trend that may push prices lower is also the seller “taking the early offer” worried about future loss in appreciation but the charts as Wolf presents don’t show that YET. suspect it is coming though as on the ground in the mid-atlantic we are seeing it though with a few recent sales of SFH unit’s at 94-95% of asking NOT above. ah finally sanity hopefully coming. Of course just got my Zillow email about 23% appreciation in the sarasota, FL area from last 30 days. haha. Wolf your thoughts on the “unwind” timeframe, 18-24 months to get back to 2019 pricing? or will we go further to 2017 pricing? realize the fed if looking for a “slow unwind” and the speed of the 2008-09 GFC was quick but due to less stringent loan standards.

From the Federal Reserve Economic Data (FRED) April data reported May 18, 2022:

New Privately-Owned Housing Units Under Construction: Total Units = 1,641,000 units.

This is the highest number of homes under construction on record. The records go back about 50 years. 1973 saw a similar U.S. housing construction boom.

How many of them are excessively large $600-700k+ mini mansions? That’s all they build here, peppering in a few ‘affordable housing’ developments that the middle class can’t get into either.

I live in a $715k (zestimate) dump. 1700sq ft. Bend, OR.

I live in a 4600 sq ft lake front house on an acre that I bought in 2016 for 575k. My 30yr fixed is at 2.125%…

I’ll never sell.

Yeah $700k gets you a pretty average house around here.

I looked up my old place in San Diego that I sold at the peak of the last bubble for 600k. 35 year old rancher that wasn’t worth 400k to me so I took the money and moved to a much much better state. And no, it wasn’t Oregon but I do like that state a lot.

Zillow says my old house is worth 1.7m now. Still ain’t worth 400k to me!

In my market $700k *might* get you a tiny cape so I tend to assume $700k is a starter castle most anywhere else, but as my knowlege of the hybrid car market proved, I’m living under a rock while I wait out the storm.

Still, the ostensibly underwhelming NYC market graph cracks me up. RE will be stagnant here in suburbia and beyond until NYC solves its crime rampage and the novice ‘passive income’ landlords realize what a nightmare landlording truly is.

Lamentably, Batman, Spiderman, John McClane, the Teenage Mutant Ninja Turtles and C.H.U.D. are all ficticious else it’d wrapped up months ago, possibly in a jazzy montage.

How many of these are SFH just like the poster above said he walked away from because it was still under construction due to missing items that are on back order?

OMG that San Diego spike looks scary, but then it can spike higher for all I know, things still very hot in SoCal.

Given the amount of money printed, I think prices will find a new equilibrum at this higher level while the inflation rate will come down and stagnate / go sideways for years.

I dont expect a crash in RE, the loss of confidence in fiat is too obvious for people to get out of RE.

methinks those who have not purchased may have FOBI (fear of buying in) to a peak market as interest rates and especially payments increase.

According to the NAR, numbers of listings are increasing and downward price adjustments are increasing as well. The new construction pipeline is beginning to unlock as supply and labor constraints allow, and these homes WILL be sold, builders do not hold onto inventory. Prices should revert to the long term trend over the next 24-36 months, maybe sooner IF the Fed sticks to it’s word. A big if.

100%

What ‘printed’ money are you talking about? Moreover, the Federal Reserve starts QT (Quantatative Tightening) tomorrow and will be shrinking its balance sheet back down to around $6 trillion.

Down to $6 T? You don’t actually believe that, do you? The Fed isn’t going to get anywhere near that number. They’ll probably be done with the interest rate increases and QT before the election…

At roughly 0.1 trillion runoff per month, after a 3 month phase in, I’ll take the over on getting down to $6 trillion. If they get that far the stock market will just be a pile of burning embers. I’ll bring the marshmallows.

There will be involuntary selling, a lot of it in the upcoming major bear market. This applies to all asset classes, big and small.

I read your sentiments often on any number of subjects. it’s as if the majority of the population will be in any position to choose.

That’s not going to happen.

Wait until utility bills come in at double where they are now, about 3-6 months . Most people will get squeezed , food rent utilities, double END of GAME. For people that speculated

We will need more stimulus. :)

Sadly, the prevailing wisdom to cure inflation is to hand out more money (England most recently). Hurry, we need more gasoline to spray on this forest fire! Idiocracy 2 writes itself.

Peopel in Southern California think we are special and housing can never go down 🙂

Housing can go down???

:-)

After living there for several years after honorable discharge from USN,,,, I AGREE!!!

WE, in this case WE the PEONs of SoCal ARE absolutely ”special.”

Unfortunately for most of WE PEONs in SoCal,,,

WE are NOT different the way WE ”think” WE are, with very very few exceptions…

But WE certainly know how to have fun,,, eh?

Just heard from a relative in socal that an RE agent who sells new homes in Ventura, business is down 80%. Is that a lot? And what few buyers are left barely have enough to put 3% down. RE is toastM

One could rephrase “given the amount of money printed” as “given the amount of asset-based paper wealth that is now rapidly disappearing” and then invert the rest of the logic: Asset Prices will find a new equilibrium at a lower level.

Also, one way to restore “confidence in fiat” is to drain it out of the system and make it scarce again. Does the Fed have the political cover to do that? It appears Biden just gave them a green light in his Op-Ed in the WSJ yesterday.

Sure, Biden will fight inflation by forgiving student loans. Something doesn’t compute. I think the show was to dump the blame on the Fed. So much BS in politics these days. Nobody is serious.

The student loan thing is a nifty wedge issue, but I’m genuinely curious how it will play out when he doesn’t cancel them (and he won’t, shy a few more micro-forgivenesses that mean nothing to the larger higher ed problem).

Lots of people who already over extended themselves on housing and expensive toys pre-inflation/gas prices are gonna be shy a paddle in time for the holiday season.

What makes a person spend $800,000 in National City?

It’s hard not to expect a crash when one sees this.

Wolf, a question here I wanted to ask long ago.

In theory, if FED decides to actively sell off the MBS, it will have to realize capital losses because of the increased rates.

Say FED injected 2 trln dollars in MBS, and then sells them at 1.8 trln. How will pay for that capital losses? Will the $200 bln be just the excess of money that will remain in the system?

The Federal Reserve does not intend to sell MBS instruments prior to their maturities, but simply will no buy new MBS instruments.

SoCalBeachDude,

Per the Fed’s last meeting minutes, and per many comments from Fed governors before then, the Fed is planning to sell MBS outright after the initial phases of QT, and it said it will announce the beginning of the sales of MBS well ahead of time.

That is highly unlikely and would be imprudent and stupid.

SoCalBeachDude,

It’s very likely, should have been done a long time ago, and is the smart thing to do.

The actual smart thing to do would have been for the Fed to never ever buy them in the first place.

The Federal Reserve – obviously – has no reason to sell MBS Instruments for liquidity reasons, and will simply not purchase new MBS instruments when those it owns reach maturity as they are in no rush to get out of these securities and will not sustain any losses at all when they simply allow them to mature. As to whether the Federal Reserve should have ever purchased any MBS instruments, the simply fact of the matter is they should not have but they did and they will be getting out of those entirely and simply leaving the housing mortgage matters up to totally insolvent Fannie Mae and Freddie Mac.

The amount of people that tell us the Fed is lying and won’t do what they say continue to be proved wrong while constantly moving the goal posts of what the Fed won’t do.

If you believe that, I have some beach front property to sell you in Arizona. The Fed will cave, just like they did last time. You can bet on it.

Hahahaha, funny that people still drag this out… like they never read anything about the economy. Last time, inflation was BELOW the Fed’s target. Now it’s 3x the Fed’s target and has become a screaming political bitch, and there is pressure from the White House on the Fed to crack down on inflation. This White House, unlike the previous one, has not taken ownership of the Dow. The number one priority is now inflation, and the Dow isn’t even on the priority list, not even at the bottom of the list.

I heard a podcaster remark that every $500B of QT equates to a 1% rate hike, so 2% per $1T. I wonder if you have seen any other estimates?

The Fed (Powell) has said something similar, I don’t remember the exact figures. And I agree. And I have said this many times. With enough QT, the Fed doesn’t have to raise its short-term rates as much as it used to. I think Bullard is about right with a target of 3.5% for policy rates, plus QT, and then see where this is going, in terms of slowdown and inflation. This combo might produce 7% mortgage rates, and the effect will be substantial. Lots of junk-rated companies will be filing for bankruptcy. And it might bring inflation down.

What are the colors of your Fed cheerleader outfit?

Bull&Bear,

Most of the MBS will come off the balance sheet via the pass-through principal payments when mortgages are paid off (house gets sold or refi) and get paid down with the principal portion of regular mortgage payments (the interest portion of mortgage payments is income to the Fed). There are no losses involved for the Fed.

In addition, after some years, MBS often get “called” when pass-through principal payments have reduced the balance of the MBS so much that the issuer (such as Fannie Mae) improves the efficiency of the system by calling those MBS and repackaging their remaining mortgages into new MBS. When MBS are called, there is no loss for the Fed.

When interest rates are falling, these pass-through principal payments are a torrent; they reached $120 billion a month in 2020. During rising mortgage rates, the pass-through principal payments slow down because refis slow down. To keep shedding MBS at the rate of $35 billion a month, the Fed might get $30 billion a month in pass-through principal payments and sell $5 billion of MBS to make up the rest.

In other words, the Fed will only have to sell a small amount of its MBS. And given its huge interest income from its securities, it really doesn’t matter. The Fed doesn’t need to maximize profits and doesn’t have earnings per share.

So the net effect is just a little less money transferred to Treasury at the end of the fiscal year. Thanks.

Why are we fretting about this.

Inflation 8 %

Mortgage 5.5 %

Who is the winner. Loser?

Yes. Before QE, the Fed remitted much smaller amounts of money to the Treasury Dept. The big remittances started with its huge balance sheet during QE. The old normal is for the Fed to have much smaller streams of interest income, and much less net income, and much less to remit. People forget.

So here to jog our memory, the years 2007 and 2008 predate QE (QE started in late 2008, and those bonds didn’t generate interest payments for the Fed until 2009). Note the much smaller remittances in 2007 and 2008. Going forward, the may be years with even smaller remittances because yields on those bonds that the Fed holds are much lower than bond yields in 2007 and before.

drg –

“ the net effect is just a little less money transferred to Treasury”

Doesn’t this neglects one other major effect:

The Fed’s removing itself as am MBS buyer has already led to a 2+% increase in mortgage rates.

This should lead to further mortgage rate increases, so long as the run-off is not reversed.

I think you have earned the title, Professor, you are one hell of an educator. Well done sir.

totally AGREE EG:

Seriously for any on ”Wolf’s Wonder”

In or near our ” WONDER FULL” GUV MINT,,, please consider our Wolf to be made KING:

Certainly and certifiably KING of economy and finance would be a good start…

Thanks again for all on here with the comments that actually follow the articles,,,

(and to be sure, I am as guilty as can be of commenting somewhat ”sideways” as are others, and just hope my sideways comments allowed by Wolf at least help some young folks understand…

” Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.”

from Fed Reserve site.

Slow play, IMO. The Fed is quick to save markets, slow to save the citizens from crippling inflation. IMO

The caps were $50 billion a month last time (late 2017-mid-2019), and markets sold off and yields jumped.

Now the caps are set at $95 billion a month, after the 3-month phase-in period you cite. It doesn’t take a genius to figure out what that will do to markets.

If Treasury securities mature below the cap of $60 in some months, the Fed will make up for it by allowing Treasury bills to roll off to make sure that the $60 is met each time. That’s a new feature that wasn’t part of the deal last time, and it will make sure that the cap is actually a set rate.

I thought $35B/mo was more of a cap than a target?

Three words.

Blow off top.

Shiver me timbers!

Look out below!

What pops this SOB? Does it have to be a Lehman Bros type situation?

Yee now walks deh rate-hike plank, Matey. Meet Davey Jones’ locker. ..’Pladunk’..

You actually don’t want it to “pop”, that creates panic, chaos and the dreaded freezing of financial conditions – which then jolts Jerome with 10,000 volts into another QE delirium. Instead, root for just a long, continual slow burn, evaporating froth, like watching window cleaner dry on glass. Do NOT make eye contact. Hand out more edibles to the masses and just keep walking, head down.

I fear there are enough financially illiterate kids out there that see no problem paying 100% of their income towards a mortgage each month.

And I fear there are too many financial companies welcoming them with open arms.

My son in Denver has taken a break from looking for a house until later this year.

Too many houses that came on the market in Feb/March/April that listed for the mid-500K’s but due to multiple bidders, ended up selling for high 600K’s.

Crazy.

There are more houses on the market now including a couple below 500K (No idea on the condition). I’ll have to watch to see how long they are on the market and the track the selling prices.

500K is his target to at least get a mortgage payment that is comparable to his just-renewed lease. He has a good job, cash savings for a year, sold all of his bitcoin for the down payment, and intends to stay for at least 10 years.

Your son’s doing the right thing. There is pretty much no inventory around $500k and what there is is super questionable either in structure or neighborhood.

I’m in Denver and I’ve been watching local sales. One up the street from me took a long time to close (I believe their sales ad said the first buyer backed out), ended up selling around $800k which is pretty mid-tier here. My old block had a place sell for just a hair under $1.2 million. My old neighbor just listed and he’s pretty nervous, I’m guessing he’s going to have to drop the price at this point. Ran into another old neighbor at the store and he’s joking “I always dreamed of living in a million dollar home, I just thought it’d be nicer than this one”.

I believe that “later this year” might need to be about a year and a half or more. People really hate to take even a paper loss and I think sales prices will take a while to come down as people capitulate. In 2010 another neighbor took a transfer to a new city and ended up taking about a 15% haircut, I’m told his new employer finally said they’d make him whole, just sell the damn thing. Wrecked the comps for a couple years, funny thinking back on it now.

It’s interesting to read about house price appreciation vs. CPI in this article. Those are some pretty big disparities. Time to pull out the ol’ BLS CPI calculator and FRED tool to make some fun comparisons!

2022 Q1 Median House Price: $428,700

2022 Median Household Income: Let’s guess around $70,000

In 2022 a median house is roughly 6 times median household income.

2007 Q1 Bubble Peak Median House Price: $257,400

2007 Median Household Income: $50,233

At the peak of the last housing bubble, a median house was 5.12 times median income.

2000 Q1 Median House Price: $165,300

2000 Median House Hold Income: $41,990

At the turn of the millennium, a median house was 3.93 times median income.

House affordability for an average family is, as far as I can tell, the worst on record right now. If house prices simply followed CPI, a median house bought in 2000 would only fetch a paltry $283,114 in today’s money. Even a median house bought at the peak of the last bubble would “only” be worth $367,642 in today’s money! It’s unreal how aggressively house price growth has outrun CPI.

Seems like CPI is a joke and does not reflect the reality of inflation. Our government is reporting inflation by absurdly understating the price of housing, the greatest cost incurred by the average American. Yeah, that makes sense!

Housing is a combination of a consumption item (with a long shelf life) and a supposed “investment”.

From about 1982 until 2020, most credit inflation went into asset prices including housing, not CPI components.

This is easy enough to see by looking at the ratio of financial assets to GDP which has exploded over time. This is the source of most “wealth”.

These exploding asset prices were mostly caused by “printing” and the loosest credit standards in human history. It’s manic psychology which convinces creditors to lend as much as they do on such lax terms to so many marginal and dubious borrowers.

That’s how we ended up with the lowest interest rates in history with the lowest credit standards and weakest borrowers in history, all at the same time.

As exhibit A, look at US government creditworthiness. It’s easily the worst since at least WWII and possibly the Civil War. Yes, I know the USG can “print” to service its debts. Everyone knows that and did. It was equally true in the past as it is now.

I think the comparison should be mortgage payment to income.

That’s certainly the way many people look at it, but operating in terms of how many various monthly payments you can fit into your paychecks… Wow, that’s a financially ruinous way of thinking if you ever want to actually own things and accumulate wealth.

I mean, I guess I can “afford” a new Ferrari as long as somebody is willing to give me a 20 year loan at low interest, right? Is that really a good idea though?

ABSOLUTELY correct NS:

Fortunate and very blessed to ”hook up” with a spouse who was very very clear about this kinda ”stuff”….

And after just a few decades, WE, in this case the family WE, have NO debt at all except for my usual monthly CC purchases paid off ASAP.

Mr. Genius in the Idiocracy,

According to your figures Texas is now a high tax state, where the typical household now pays 15% of their income in combined property and income taxes.

Whereas in Taxachusetts, they’d pay just 11% and in Colorado a mere 8%.

Why did everyone move to “low tax Texas” during the pandemic?

Texas is the 5th highest property tax state

I believe there were considerations other than taxes…..during the pandemic.

Q. Why did everyone move to “low tax Texas” during the pandemic?

A. Florida was full.

ROFLMAO AA:

but, all seriousness aside,,, I do not understand why ANY USA State, especially those that continue to at least pretend to be family friendly, etc., still does NOT have something similar to the constitutional limits for property taxes…

That the clearly most ”liberal” and ”progressive” state in USA,,, CA,

+=+ AND one of the very very mixed states,

+FL, have these constitutional protections for long time owners of, especially SFR (Single Family Residential )

is very suggestive, eh???

Maybe FL was to far to drive from CA?

Because Texas doesn’t have a state income tax. And until recently houses were cheap. And comparatively, they still are to a ton of areas.

500k house in Austin will run about 9k in taxes. A single person making 150k in San Diego would be paying 10500 on state income tax alone.

I wouldn’t pick Texas but if I had California money and an overpriced house I’d sell, move to a poor people state, trash the locals and use them for cheap labor and service and just work from home and retire early. Much like a mountain of yuppy Californians have done in the past couple years.

Exactly correct. One has to take into account ALL taxes. With no state income tax and low housing prices (relative), TX is still a deal to us Californians. And the BBQ is certainly better. :)

“500k house in Austin will run about 9k in taxes”

Maybe in West Lake Hills.

In Austin proper it would be 11K.

In Pflugerville it would be 13K.

Texas is still cheap on a comparative basis. We live in pathetic New York state where you not only have ridiculous income taxes, excise taxes, school and property tax. School and property tax is especially difficult here because the combined rate for the two is approximately $42 per thousand assessed value of the home. So let’s just make it $40 per thousand assessed value for easy math. A $200,000 home will cost you 8000 in school and property taxes a $400,000 home is 16,000 a $500,000 is 20 and so on .

“500k house in Austin will run about 9k in taxes. A single person making 150k in San Diego would be paying 10500 on state income tax alone.”

You are missing the point.

According to “Not Sure”, house prices are 6x incomes.

So 150K income household is living in 900K house NOT a 500K house.

In San Diego that’s 9K property tax + 10.5K income tax = 19.5K total tax.

In Austin that’s 20K property tax + 0K income tax = 20 K total tax.

So Texas is even higher tax than California in this case though YMMV.

The point is that when house prices are very high multiples of incomes, property tax rates become much more important than income tax rates.

Alan wrote:

“Texas is still cheap on a comparative basis. We live in pathetic New York state where you not only have ridiculous income taxes, excise taxes, school and property tax”

Yes – Texas taxes are still lower than states like NY, NJ and IL that have BOTH high property tax rates and onerous income taxes.

But with house prices this high compared to incomes, Texas has shot up the tax burden table and is now well ahead of many states with moderate property taxes and income taxes e.g. MA and CO.

It can be cheaper in CA for taxes for long term residents due to Prop 13.

If you look up the CA State tax calculator, tax for $100K income in CA for a married couple is $3K. There is a steep cliff at about 100K in CA for state income taxes.

I know people who are paying about $3K in Prop 13 property taxes on their $1M house due to the cap on property taxes.

Texas does not have this cap and unlike CA, the tax rate can be as high as 4% of the house value.

Joined the Army from CA in 1990. Met my TX Army veteran wife overseas, she dragged me here kicking and screaming with our infant son in 1993. We both earned college degrees here by 1997 and found great career positions here in Houston. Bought second and current 3600 sq ft new construction home for $330k in 2010. Put in a pool for this house in 2013. Raised two sons, both are college grads (classes of 15’ 20’), no loans, both have zero debt, both are making six figures (one son moved to NC). Spouse and I fortunately made $475k last year. We have discussed moving back to CA through the years, even NY, but we have saved a fortune in state income tax here. We have a combined $3M in two 401k’s, $1M in stocks and cash, and only $80k left on our mortgage. We paid $12,840 for property tax and insurance last year for our home that appraised at $400k. Home was just appraised this year for $435k. Utilities average $250 monthly. If we lived in CA, we would have had to pay $43,241 in state income tax (smart asset CA income tax calculator). In CA I’m pretty sure we’d have a much higher house note for a house half the size, though I would prefer a beach over a pool, but I wouldn’t even think of retiring at age 59 / her age 57 in a few years as we will do in TX. We always had the choice to buy a bigger home here (we have four toilets and are empty nesters now, so we’re good) but chose not to and saved a bunch on property taxes. I have learned to find many positives in Texas, without trashing the locals and instead becoming part of a great community with wonderful friends. Yes, TX bbq is awesome. Some services can be very expensive here, you should have $5-6k on hand in case you need a new ac unit installed in the middle of summer for instance. Though I miss CA weather, produce and seafood, it is just not rational to move back. We’ll likely retire to NC which has an acceptable state income tax rate, affordable housing, better weather than TX, mountains as well as beaches, with great proximity to Caribbean and Europe for travel.

Where are those numbers from? Do they include sales and property and income taxes? As a Colorado resident, numbers for CO look a little low and TX a little high.

Texas 0% income tax, 2.5% property tax

Massachusetts 5% income tax, 1% property tax

Colorado 5% income tax, 0.5% property tax

Assuming house price = 6x household income as per Mr “Not Sure” from the Idiocracy.

Of course YMMV depending on income level, deductions etc.

Don’t forget insurance, you will need it when those hurricanes roll thru town.

Wolf, how about adding “Is Texas expensive?” to an FAQ? The answer is simple math and common sense.

My house in Texas doubled in value during the last 15 years and so have my property taxes. Yet, my suburban home is still not above $300K. An equivalent home in Tax Hell State would cost several times more, so the property tax would be comparable.

0% income tax and much lower housing costs are where the advantage is. Seriously, who wouldn’t want to pocket $400K and stop paying state income tax? All of a sudden you’re feeling pretty affluent. But don’t let that turn you into a fool.

If you sell your house in Tax Hell State for a small fortune and your income cannot support the property taxes on a $1,000,000 house in Austin, that’s your mistake. You should’ve bought something in my neighborhood… 5 minutes to the lake, 12 minutes to Whole Foods, 18 minutes to downtown. Walk to all schools. Very safe.

Appendix:

– Boomers in Texas don’t even have to pay taxes until they’re dead

– I haven’t seen my utilities double. What’s this?

– Living in Texas saves me *thousands* monthly vs Tax Hell State

Turtle,

People who want to live in Texas should live there, whatever the ultimate dollars involved. You can never come up with a theoretical answer that fits everyone. And tax rates and costs alone are not the only reason to live somewhere.

If you’re retired and you don’t have to earn an income, taxes and costs are one thing (but California has Prop 13).

If you’re young and you can make $250k in the Bay Area or $100k in Dallas, taxes and costs are another thing.

It just depends. People can do their own math. Maybe you can get a remote job in the Bay Area and make $250k and live in Dallas…

Our insurance premium dropped in half when we moved from Texas to California in 2006 (same high-deductible plan with Blue Cross of Texas and Blue Cross of California). We changed years ago to Kaiser, which provided even more savings. Our healthcare costs have been small (we’re healthy, knock on wood). That has saved us many thousands of dollar EACH YEAR.

Since we’re an hour’s drive from the Central Valley, the superb produce we get year-round from there is a good deal. If you buy the same produce in China Town just down the street and around the corner and up a little, it’s outright cheap. Lots of savings there.

We have no A/C costs, I mean zero. We don’t have an A/C because we don’t need one. Our electricity costs like $40 a month, mostly because my media mogul empire’s computer network runs 24/7 and because I run a HEPA filter.

There are lots of other savings that are hard to quantify “theoretically,” and people will realize what actual savings they gained and what actual savings they lost and how their incomes changed after the move to Texas. It’s a mixed bag.

People can do their own math and rank their own priorities. Everyone is different, and that’s a good thing, or else we’d all try to pack into the same place :-]

Turtle. Welcome back!

– Living in Texas saves me *thousands* monthly vs Tax Hell State

This is because you make too much money. High income tax states affect people making high income. :-)

For retirees who own homes in CA and can limit their yearly income, can benefit greatly from CA’s Prop 13 and low taxes for those who make less than 100K/year.

The taxes then in CA are far lower than Texas property taxes which are unbounded and are up to 4X higher than CA.

Unbounded is the key. Texas needs a Prop 13. I am surprised that a conservative state does not have this. Property taxes are wealth taxes and that is the last thing you want when you retire. Though, you pointed out that in Texas, the Property Wealth tax can be converted to a Death Tax which robs your children.

Utilities are lower in CA since AC and heating are rarely used

CA retirees can also live longer since the weather allows them to exercise daily outside at a perfect 70F (instead of 90+F in Texas).

If I was a retiree who owns a home in CA and can live on $100K/year, I don’t think it would make sense to cash out and move to Texas.

If I was younger, making more than 100K/year, renting out my CA house for a supplemental, then moving to Texas might make sense due to the zero income tax. I’d then move back to my CA house when I retired with a huge savings in taxes.

I don’t know if moving so much for tax purposes makes sense.

There is an assault on Prop 13, so times change. There is also an assault on CA income tax rates. It is hard to predict the future.

Yes, everyone’s situation is different, and in certain circumstances CA is not a tax hell state. My retired father moved from SoCal to South Dakota about ten years ago because that is where he grew up and has many friends and relatives in the area. Because California doesn’t tax social security and he had a favorable prop 13 tax basis, his combined property and income taxes on a modest pension were quite low. The home he purchased in South Dakota cost less than half the home he sold in CA and his property taxes exceeded, slightly, his combined income and property taxes in CA. That’s before considering the winter heating bill. However, the move still made sense for him for personal reasons.

I’m still in CA and have structured our savings to maximize the tax advantages CA does provide by not taxing social security and being able to time withdrawals from retirement accounts. Though, if I had a sizable pension, I’d probably leave CA. Everyone does need to look at their personal circumstances.

Forget Prop 13. In TX, seniors can defer property tax payments until they are dead! Yes, that’s 0% income tax and practically 0% property tax.

Indeed, there is more to consider than money.

Dazed,

I wasn’t looking at taxes, but yes… Higher housing cost relative to income is going to make taxation more painful in states that lean harder on property taxes. In the case of Texas, this is largely offset by the lack of an income tax and property values that are still lower than they are in places like CA. Of the people I know who have moved to TX and AZ from here in ultra-blue CA, political leanings where a probably the largest component of their decision followed by to sell for more here and buy for less there. At the end of the day, people have to look at their own circumstances, weigh the trade-offs, and make a decision to move based on numerous criteria of which taxes are only one of many.

My quick calcs were simply meant to paint a rough picture showing just how badly house price inflation has decoupled from CPI inflation and how profoundly that weighs on the ability of the middle class in younger generations to actually own property (not just maintain monthly payments).

Home prices are high due to laws and regulations that distort the market:

(1) GSAs and FHFA conforming loan limits

(2) MBS, the inventor of which has come out publicly that he wished he never created the product.

(3) Investor giveaways, including depreciation, capital gains exclusion, mortgage interest deduction, home office deductions, etc. You may claim these are not investor deductions, but I guarantee if you took the myriad tax benefits away, the price of homes would drop substantially.

In summary, the big guns have been brought out to goose home values to extremes, turning places to live into primary investment vehicles. Big government is the source of inflation, not the solution.

See continuation of this list, accidentaaly posted as separate comment below.

Tax benefits for owner occupied homes aren’t that significant. The biggest one is the $250K/$500K exclusion but that’s when sold.

The high and rising prices occurring now are primarily from a combination of still very loose lending standards and manic psychology.

Loose lending standards make the funds available to borrowers. Manic psychology convinces lenders to make loans to so many actually dubious and marginal borrowers while equally convincing buyers to pay inflated prices.

Tax benefit(s) for owner occupied and ”homesteaded” homes are significant in the flower state AF, surely one reason folks are willing to put up with the six months of extreme heat and humidity, not to mention the six months of hurricane threat.

As mentioned elsewhere, I do not understand why every state considering itself at all conservative of taxpayer money does not have legislation capping property tax increases as do FL and CA…

Very mysterious for sure.

I’ve been looking at home prices in the small towns in the mountains of North Carolina. Many of the ones on the market have doubled or nearly doubled in the last 3 -4 years. It certainly looks like speculation. That area has a history of boom and bust.

For those of you looking to relocate or a place to retire don’t overlook water quality and abundance. Some of the towns I looked at are going for premium prices even though the water has serious pollution problems. Also consider how the local or regional economy will fare in a downturn.

Looking at home prices in Las Vegas you would think that Lake Meade was at capacity.

I so agree

Pollution? Thats freedom water™.

“™”, lol!

No worries. Vegas will become the mirage it once was. Think of the lovely ruins to be..

Well I did read about all those hidden treasure you find courtesy of the Vegas mobster at Lake Mead. Thanks to climate change, the Easter egg hunt there just got easier.

Would be curious to see Boise’s chart. Probably outpaces even San Diego.

Boise is not part of the C-S list of twenty, but The US Federal Housing Finance Agency tracks many metros that C-S does not, updated quarterly. You can find the chart for Boise here:

fred.stlouisfed.org/series/ATNHPIUS14260Q

Make sure you read the methodology. This index is entirely based on mortgages, including refis.

If a home is purchased without a mortgage, it doesn’t show up in the index. This elimination of all cash deals can skew the figures.

But if someone refinances a mortgage — no sale! — the estimated value of the home shows up in the index. This also can skew the figures.

For example, it shows that home prices in the San Francisco metro declined from late 2018 through Q1 2020, which has not been confirmed by other data. I think the higher end tends to have more cash deals, and they’re not showing up here. There may be other issues with this mortgage-based approach.

So be careful when using this index.

Wolf, Are you sure these aren’t crypto charts from 2017 to 2021 (not 2022)?

Definitely looks like a speculative blow off top.

I’ve been saying, buying a home now is like buying BTC at $68k.

How China house prices are higher than ones here?

Comparevely speaking if a 2000sf house in Shanghai sells for 2 million us dollars, how would a san fran 2000sf home sell for 1.5 million dollars? Makes no sense. More room to go up here and it should.

San Francisco’s population dropped by 6.2% in 2021 from 2020. Labor force still way down from before Feb 2020. Population also dropped in 2020, from 2019. House prices are pure speculation in San Francisco. Huge supply of rental apartments on the market right now. House and condo supply growing. Pending sales -22% yoy. This is going to be interesting.

San Francisco is a microcosm. U.S. rental vacancies peaked in 2009 at 11.1%. They hit bottom in 2021 at 5.6%, then got an uptick in 2022 at 5.8%.

LOL. They will not stay higher for long; mark my words. Every morning, I watch news about China from unofficial sources, since Chinese, CCP propaganda stations are as accurate as old fairy tales. I see how the CCP is dealing with the Chinese people, their Covid lockdowns, and faltering economy, and the news reports bring a smile to my face that stays there the whole day. Keep it up, CCP; keep it up.

China’s housing bubble is worse than the US, maybe second biggest ever after Japan in 1989.

House spikes still seem WFH exodus to wherever one could both enjoy a home with mortgage payments close to one’s former rent and still have a Chipotle down the street. Only question I have is why tech moved into rainy Seattle rather than perfect weather San Diego.

Boeing

Bill Gates didn’t want his programmers distracted by good weather.

State income tax. End of story.

Nerds and geeks never go outside so don’t care about the weather.

But they can do math – and know that 0% income tax is less than 10% income tax.

I’d argue that good weather includes rain, water being essential for life and all. Seattle ain’t going up in flames with all that moisture in the air!

Unless Ranier decides to pull a Mt. St. Helens……

Dallas was up a total of 20% from 2000-2013 and 30% in the last year.

WTF?!

Is that all? I saw 39% YOY for DFW metro as a whole. Take that, Boise!

Anyway, it must be the Californians puffing up our ‘burbs. The builders seem to be aware that they’ll pay stupid high prices no matter how close the homes are to each other.

Dallas and Denver are the two outliers here. It was assumed property tax in Dallas was the reason the last bubble washed over it without a murmur. There may have been a lot of inward investment and relocation because of that perceived value, which has pushed up prices. It just goes to show you money follows money even (nearly always) when it doesn’t make sense. Property taxes will no doubt be a sticker shock to many lured in my no income tax. Swings and roundabouts and robbing Peter to pay Paul.

Flea comment on utility costs rising is spot on. Texas electric rates are up 100 percent from 1 year ago and we are just entering the AC season.

Happened because NG skyrocketed as pointed out by wolf.

Higher transport (oil and gas)

Higher loan ( mtg rates)

Higher utility (all generation capacity types up especially the NG electricity!

Not as much money in budget for homes

Ben, I live in The Woodlands, Texas and my electric rates have not changed in the last year? Actually, they haven’t changed any noticeable amount in the last 5 years.

My daughter lives in Houston and her rates have been constant too.

Many Texans are on fixed rate contracts typically for 12-36 months.

The rate you fixed a year or two ago when you last chose a plan may be much less than current prevailing market rates so you won’t notice the massive hike in rates until your contract expires and you renew.

Having said that, it’s more likely to be 50% increase, not 100%.

My daughter’s Reliant Energy plan renewed last month at the same rate. My daughter’s plan rate is $0.17/kw and that’s all in with fuel charge up pricing.

My plan is with Entergy Texas and it’s one of the only ones in Texas that is still regulated as we get our power from Entergy Louisiana. My cost is just a shade over $0.12/w.

I’ve been in Texas 30 years and have not heard any rumblings of rate changes that are out of line.

Not seeing it but if our rates double (sounds sensational to me), they’ll still be lower than Taxifornia. Everything is cheaper but grapes!

I have to wonder if California is running a covert smear campaign to stop their bleeding of businesses and residents to Texas.

Turtle,

Read my comment about some of the things where you’ll pay a lot more when you move from coastal California to Texas.

And then there are the other things: Do you want to drive 3 hours to go skiing in the winter or 20 hours? Do you want to go running in the summer at 5 am when it’s 85 degrees and 100% humidity, or do you want to go running in the summer at noon when it’s 60 degrees and 20% humidity? Do you want to live an hour’s drive from some of the best produce in the world (Central Valley)? Do you want to live on the Gulf of Mexico or on the Pacific? Do you want hurricanes or firestorms? Do you want long droughts or do you want longer droughts? You see, there are lot of personal decisions to be made. Thank God everyone likes something different, or we’d all try to pack into the same place. I’m glad you enjoy Texas. I hope word gets around, it’s still way too crowded here.

I wished we could just do the right and proper thing and get revenge for 1812 and just take over Canada. And I could also hit the lottery.

I’d move up around Banff and live in the frozen wasteland. Love the cold and snow. Like the isolation even more. I’ve been to Texas and California, the only place I could imagine being worse in the US is Orlando or Jacksonville FLA. Or probably Houston and all of Louisiana.

An igloo to rest this heart of ice is all I need.

Live in the Austin area. My 3-year energy contract just expired in early May. Rate went from 10.2 cents to 14.9 cents, so about a 50% increase.

In terms of property taxes, mine were up 72% y/y. Thank god for the Homestead exemption capping it at 10%! Paying a tax rate of $460K on a house worth over $800K. I’m sure it will catch up in 3-5 years.

That said, my wife & I make 300-350k/year. Texas by far and away makes the most sense for us, outside of maybe Tennessee

It’s been mentioned several times about the quality of the borrowers versus the GFC. I’m not doubting the stats but how does this square with the decades old, “50% of Americans don’t have $600 emergency savings and couldn’t afford an emergency repair…”?

I think we have all heard that a bazillion times, right? So, if that is true, then where the heck are these awesome qualified buyers coming from? 50% is a lot of people.

I’m in Florida and this state has been overrun by everyone else since the 1920’s. Okay, fine lots of people with more money buy it up, always have… yet I refuse to believe this isn’t some kind of fake wealth / giant ponzi of some epic proportions.

I make okay money, have savings and am priced out of anything decent. All of my relatives and friends are the same and all of us were / are looking to buy (all in mid 40’s age now). All of make at or over 100k / year. We’re all a bunch of renters now.

I know there is no way that both ‘the quality of the borrower’ and the ‘$600’ thing are true at the same time. They are diametrically opposed. So, I guess I am gonna call BS on the quality borrower card after all. Cause my eyeballs tell me differently when I go places.

Making $100k or more and can’t afford to buy anything? Sounds like buying a property is not a priority for you. Don’t know where in FL you are but even in Miami which is the most expensive in the state you could buy at least a condo with that kind of income.

mind you, the keyword was “decent”

“Decent” can mean a lot of things. “Decent” doesn’t have to mean granite countertops, Viking appliances, and an ocean view. Expectations that people have aren’t always grounded in reality.

But then we’re constantly bombarded with ads that say “get the luxury you DESERVE”…..

Can’t afford a house on $100k? Sounds, to me, like an outgo problem…. not an in come problem.

No. Your eyeballs are not playing tricks and it has to do with current lending standards. A lot of single family home mortgages were only allowed in multi-family homes before the GFC. Many millennials invested right out of the gate and used some pension as 20% down. Others have several generations in one home. It is a very different time in lending standards. I foresee a lot of baby boomers moving in with children and grandchildren in the near future. This may have a lot to do with inventory rising. Baby boomers, like my parents, are okay. However, many of their friends are not. They are actually selling their homes after building new homes with their children/grandchildren. This is why bigger houses with two primary suites are the rage.

There was/is a trend in Southern California to build homes that are “multi-generational” friendly. Separate living quarters (bedroom/kitchenette/lounge area) for the oldsters, the parents have a “normal house” with bedrooms for their kids. Many were being built in the Irvine area.

The neighborhood that we lived in in SoCal was very popular with cultures that had no problem with 3 or even 4 generations living in the same home. The key was all had first floor bedroom suites and 3 to 4 bathrooms.

Not all big bomber homes are excessive.

Presumably a combination of rental properties, second homes, and foreign buyers reduces it somewhat.

It’s also possible for someone to simultaneously own a home (the title) and still be broke living paycheck-to-paycheck.

These people are also known as debt slaves, a

lot of future foreclosures waiting to happen absent government bailouts.

Whether 5%+ is high depends on your perspective. My three mortgages were at 12.5%, 10.5% and 9.875%. I suppose after a decade of rate suppression 5% might seem high.

We’ve just concluded a forty year secular bull market in bonds … that’s four decades of falling rates. We’re now in a secular bear market and rates will be zig-zagging their way higher for a long time.

What was your purchase price to income ratio at those rates?

We’re at roughly 6x median price to median income right now, which is a historic high. That math doesn’t work out; it’s not a matter of perspective.

George:

We had a similar experience to Finster…. purchase money at 14.75%.

The listing price of the home was 4x’s income. We negotiated it down to our target of 3x’s as the market had died at those rates and the house was corporate owned. That, and our definition of “decent” was also adjusted for market conditions. I think she cried on the entry steps in that one. House before that, she cried on the driveway. Both ended up being her “favorite house” once it was upgraded (not gutted…. updated in what we now term as a “respectful renovation).

I have always subscribed to the theory that you can always change the house…. but you can’t move it. So buy the neighborhood and location therein and don’t fret about how fancy the box is. That can be changed over time.

Why is this clown Bostic at the Atlanta Fed already talking about a rate hike “pause” in September? This is why nobody believes the FED will follow through – two puny rate hikes and they’re already starting to talk about a pause even though inflation is roaring. These creeps are unbelievable.

Nothing the Fed does can be a slam-dunk or else the markets would adjust all at once in one day, which would lock everything up. So it’s step by step, and they’ll throw in plenty of uncertainties to stretch out the adjustment process.

A one day adjustment would be the best thing that could happen. The sooner everything melts down, the sooner we can build something more sustainable. The FED just drags out the pain and misery for years.

Scratching each others backs doesn’t stop on the way down.

The law of unintended consequences makes it undesirable.

I’m a bit of an anarchist and I’d be up for a bit of building it all back from the ground up.

But to expect that from the existing embedded bureaucracy and wealth is pure fantasy.

All we need to accept is that whatever the prevailing economic style, the bureaucracy and wealthy do ok, and the plebs feed the system with their labour, to as far as breaking point as they’ll allow themselves to be pushed.

The more they act in this way the more transparent their obfuscated language appears to be.

Combined with quality analysis of the raw data by Wolf, it actually all starts to feel sensible.

It’s just a long game and you need to be patient.

By the way, QE sure seems to be a “slam dunk.” And, they hammered rates to zero in a day. I smell a rat, Wolf.

I smell much higher interest rates and lower asset prices. I no longer care about all that BS that the tightening deniers have been regurgitating since October last year. Every step along they way, it has turned out to be reeking garbage.

Interest rates are going MUCH HIGHER and the only one to watch of any real important is the yield (interest rate) on 10 year US Treasuries, especially as the Federal Reserve stops buying them and the US government continues to need to borrow much more as well as paying off around $15 trillion a year in maturing ones and having to issue that much and trillions more in new ones.

The people’s are worried 😟 for nothing. I saw that picture of JoeB, Powell and Yellen meeting yesterday. All is well. Don’t worry. 🤪🤪🤭🤭

If I understand you, Depth Charge, you are saying it’s funny how rates can go from 2% to 0-0.25% in weeks, and yet for some (fake) reason, rates can’t be moved from 0% to 2% over same time frame. I agree with you that it is definitely crooked to be so asymmetrical, given the gargantuan one way funneled wealth tranfers to the 1% during those legs down in rates.

If the bond cycle turned in 2020, it doesn’t matter what the FRB does or doesn’t do.

Interest rates are destined to blow out past the 1981 peak eventually or else the USD will crash. They have about 30 points on the DXY to “print”.

Either way, the majority of the American population is going to become poorer or a lot poorer.

They can’t preserve American living standards even if they wanted to, so trashing USD reserve currency status to maintain fake paper “wealth” is idiotic.

The public, economy, and financial markets will be thrown under the bus to maintain the Empire and the “hard power” from USD reserve status necessary to preserve it.

Not sure if it’s true that WE the PEONs are going to be poorer AF:

Seems to me that if WE have NO debt, low ”cap” on property tax Increases, steady GUV MINT income, WE will be able to get a ton more income from savings IF and WHEN the FFR goes up than now.

SO let ‘er rip,,,

And then, with the higher interest rates in the past, ”prices” have generally gone down, eh? Thus making what money we do have capable of buying MORE, eh?

And that’s really what’s important, eh?

HOW MUCH can we buy, or how much MORE???

“I no longer care about all that BS that the tightening deniers have been regurgitating since October last year. Every step along they way, it has turned out to be reeking garbage”

It’s called dissent, Wolf. Harry Houndstooth says (repeatedly) that you tolerate it. BS applies to misstated facts, but future events aren’t knowable or factual so all we have are opinions.

Well, heard ARM mortgage is the new hotness in the land of rising interest rate..I mean wtf can go wrong right?

Seriously Murica is the bedrock of doing the same thing and expecting different results..

Ya, we are not hearing to much about ARMS lately, like back in 2009.

Just had a mortgage broker trying to get me to refinance for some extras cash to a 7y yr arm at 2.99.

His big selling point was that you can refinance again to a lower rate when the rates come back down again.

“If its and buts were candy and nuts, every day would be Christmas ” (no idea who said it)

So the whole economy doesn’t get flushed down the toilet

I’ve listened to his interviews and speeches. He’s concerned about both inflation and unemployment for specific population segments, if you know what I mean.

No, there is no way to accomplish what he prefers.

It’s time for “blowback”:

I see a new trend developing here in the Swamp’s suburbs. The small houses are getting snapped up quickly, while the Mc Mansions are sitting. No one wants these monstrosities anymore.

People are starting to fix up their homes instead of having builders tear them down.

Treasury market faces liquidity risks as Fed pares balance sheet – Reuters