Margin debt started dropping a month before the Nasdaq went south, and it’s still dropping.

By Wolf Richter for WOLF STREET.

The total amount of leverage in the stock market is unknown and takes many forms. The only form that is tracked and reported on a monthly basis is margin debt. The other forms, such as Securities Based Lending (SBL) and hedge funds leveraged at the institutional level are not tracked. Not even banks and brokers that fund this leverage know how much total leverage their client has from all brokers combined, which became clear when the family office Archegos imploded in March 2021 and wiped out billions of dollars in capital at the prime brokers that had provided the leverage.

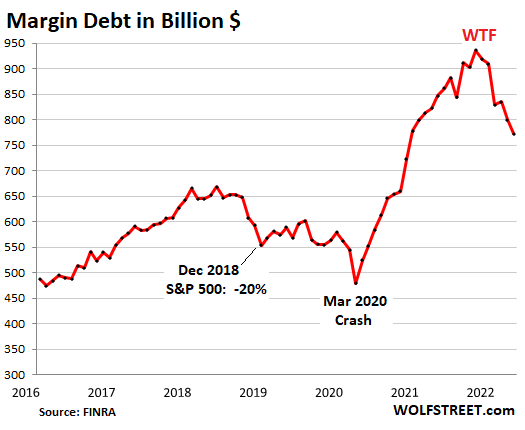

But margin debt – the tip of the iceberg and indicator of the direction of the overall stock market leverage – dropped by $27 billion in April from March, to $773 billion, according to Finra, which gets this data from its member brokers. Margin debt peaked in October last year at $936 billion and started falling in November. Over those six months, it has dropped by $163 billion, or by 17%. But leverage is still massive, and the unwind has a long way to go:

Not included in the margin debt data today is May. So far in May, the S&P 500, despite today’s rally, has dropped 6.2%, and the Nasdaq 8.3%, and many of the imploded stocks have gotten brutally crushed over those two weeks, including Coinbase, whose huge gigantic rally since Thursday morning didn’t amount to flyspeck compared to the devastating plunge in the prior two weeks and since its IPO and is barely visible on the stairway to heck since the IPO.

These kinds of selloffs trigger big bouts of forced selling amid margined stock jockeys that have concentrated on these stocks.

Hundreds of stocks have plunged by very large amounts, by 70%, and 80%, and even over 90% in a replay of the beginnings of the Dotcom Bust, only bigger and broader, and it’s going stock by stock, and it started in February last year, and seriously got going in November, and some of those I’ve captured in my special column Imploded Stocks.

Here is a sampling of well-known names amid the brutal bloodletting. The percentages are from their highs through the close on May 13:

- Carvana: -90%

- Vroom: -98%

- Rivian: -85%

- Snap: -70%

- Pinterest: -76%

- Netflix: -73%

- Wayfair: -84%

- Chewy: -78%

- Shopify: -77%

- Teladoc: -89%

- Lyft: -77%

- Zoom: -79%

- Palantir: -81%

- GameStop: -80%

- AMC: -84%

- Coinbase: -83%

- Zillow: -81%

- Redfin: -88%

- Compass: -75%

- Opendoor: -82%

- MicroStrategy: -85%

- Robinhood: -87%

- Moderna: -72%

- Beyond Meat: -87%

- Peloton: -90%

- DoorDash: -72%

Leveraged investors in those instruments had to reduce their margin as their collateral values vanished into the ether, sometimes overnight, turning these investors into forced sellers to raise the cash needed to pay down their margin debt.

A margined investor that was heavily concentrated in these stocks and didn’t dump them in time could get wiped out and might be thinking about rejoining the labor force to help solve the labor shortages.

Margin debt peaked in October. The Nasdaq was a month behind and peaked in November. Since then, margin debt has dropped by 17%, and the Nasdaq has dropped by 27%. And in terms of stock market leverage, that’s the tip of the iceberg.

When lots of investors take on leverage to buy stocks, and leverage rises, it creates buying pressure with borrowed money, fueling heat in the market.

But when investors come under pressure because of their leverage and vanishing collateral values, they sell stocks, and it creates selling pressure.

This is how stock prices and margin balances are linked. High leverage in the stock market is a precondition for a spike in stock prices and a precondition for a massive sell-off, which then unwinds that leverage. It takes leverage to go to these kinds of extremes.

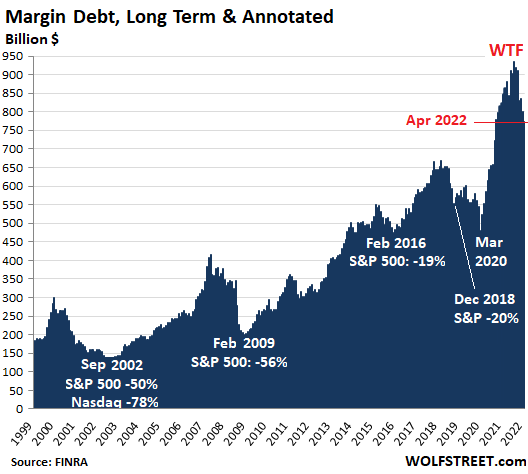

Margin debt and stock market “events.”

The trick is to not get sidetracked by the absolute dollar amounts over the decades. They don’t really matter. What matters are the steep increases in margin debt before the selloffs, and the steep declines during the sell-offs. The chart shows the relationship between margin debt and “events” in the S&P 500 index.

But nothing compares, neither in dollars nor in percentages nor in sheer beauty, to the near-vertical spike in margin debt from March 2020 through October 2021, during the Fed’s $4.7 trillion money-printing binge and interest rate repression mania, and all of it is now unwinding:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Although not formal margin debt I wonder how much of the peaking up to 50B/quarter mortgage equity withdrawal has been placed in the market, as has been irresponsibly advised. Or maybe thats just considering retail investors losses differently.

Can some of that mortgage equity withdrawals be the big players rather than the retail investors?

I don’t see how. Corporate buyers don’t have traditional retail mortgages.

Would be nice if we have data to see how much leverage or margin like instruments are being use to buy properties, especially for the mom and pop investors.

Those percentage drop from all time high for these high flying stock, wish same thing can happen for ultra expensive RE market like SF or SoCal

Especially since you basically take out those loans in cash.

Shouldn’t this graph be corrected for inflation to give a more realistic picture since we’re comparing current dollars to past dollars?

RTGDFA

This is what it says in the article right above the chart:

“The trick is to not get sidetracked by the absolute dollar amounts over the decades. They don’t really matter. What matters are the steep increases in margin debt before the selloffs, and the steep declines during the sell-offs. The chart shows the relationship between margin debt and “events” in the S&P 500 index.”

I always RTGDFA, but don’t you think there is useful information in the absolute dollar amounts or maybe a % of total market value or trade volume or some other metric to have an even better perspective? Your WTF annotations are always fun to look at, but the first thing that we all look at is how high that peak is above all the other peaks. It creates a possible mental bias when evaluating the big picture. I think the best example is how you have repeatedly pointed out that oil/products may look like they are making historical highs, but they are really not when inflation adjusted.

The long-term chart compares margin debt to S&P 500 selloffs. THAT IS ALL IT DOES. The S&P 500 isn’t adjusted for inflation either.

I’ve been telling you for a year that this margin debt is predicting problems in the stock market, and you people keep wanting me to adjust it away in some form (for inflation, via log scale, etc.) so you don’t have to look at the warning because you don’t like what the warning says. The purpose of this chart is to WARN ABOUT STOCK MARKET SELLOFFS. And now the stock selloff that it has been warning about is happening (started in November).

Not a sell off wolf. The market was just at a peak buying opportunity. Lots of folks got a bunch of industry leaders on sale the past week. Everything is back up like almost nearly 5% in just one day. That’s gotta be a record. Cramer says the world isn’t ending. Time to buy.

DJIA up to 40k by Christmas. I’ve personally bought 40k worth of crypto for half off just to match my dow prediction Don’t need a down payment for a house, real estate only goes up, can only buy if I hit the stock lottery. To the moon Wolf! To the moon! To the moon in our shiny new lambos!

The BLS CPI is massaged BS anyway. Due to large changes in their methodology, trying to compare inflation over time is highly misleading. Almost apples and oranges.

Wolfs right, a sidebar to the market, like mortgage or crypto, can bring down an entire market. Was bullish for a long while, and still support the notion of a melt up, but that would be precursor to a (functional) collapse. 2029, the centennial, is not far off.

@Ben – Comparing margin debt as % of market value isn’t informative because both move together. Total market cap is itself inflated by the margin debt and the other speculative behavior that the margin debt is a proxy for. Also by comparing with anything else you’re mixing in other information and potentially garbling the signal provided by the margin debt numbers.

If you want to play with the data it’s readily available, just search for FINRA margin debt. It’s a spreadsheet download.

I’m relatively new to this website but have found it to be really interesting and informative. So, thanks WR!

My comment is general in nature, so not sure if it will be answered but I’m sure it’s on everyone’s mind: What is the prudent thing to do now? Buy, hold, …sell???

At 63-years-old, I’m not sure if I want “ride out the storm” again. Haven’t bought any bitcoin, and don’t intend to!

Prudent: “acting with or showing care and thought for the future”

My amateur opinion: With the leverage looking as though it’s peaked, which historically correlates with ensuing bearish correction events, reduce stock market assets. And with interest rates and high inflation, get out of long term bonds.

If you don’t believe this is the most overvalued US stock market and the biggest global asset mania in the history of human civilization, then buy or hold.

DJIA dividend yield is 1.83% now even after a 15%+ decline. By comparison, it was 2.89% on September 3, 1929, prior to an 89% decline into the July 8, 1932 low..

The bond mania from 1981 appears to have ended in 2020. If it did, UST rates will eventually blow past the 1981 high of 14%+. Rates have barely increased from the low (in absolute terms), yet UST bond prices have been hammered.

It’s just the beginning.

The long-term fundamentals are absolutely awful. It isn’t fully evident yet because the loosest credit standards and fiscal policy in history support an artificial economy with fake “growth” and paper over the in-plain-sight extensive social and economic decay.

If we knew the answer to that question, we would be diving into pools of gold coins like Scrooge McDuck.

There are so many people getting paid for short term performance that for an average person it’s probably best to being a boring asset allocator using low cost index funds.

Buffet has been successful primarily with two assets US equities and cash, so you don’t have to get more complicated than that. If you own SP500 you own it all: REITS, gold miners, technology, home builders, banks, tooth paste makers, etc. Let the gunslingers pay the trading cost of trying to determine relative value.

When markets really croak 50% from time to time, having cash is the only real protection. Having a two asset model makes the math easy. If you can only handle 25% portfolio downside, use 50% cash, 50% stocks.

And of course if you are rebalancing it has buying in market busts and selling in market booms.

Old School’s comments are general and sensible, IMO. I’d add that you might consider using “equal weighted” ETF’s in order to avoid buying into funds that are heavily overweighted in those very stocks that have been LAST YEAR’s best performers, which stocks are subject to huge reversals.

Nothing has been made clearer by Wolfs growing Wall-of-Shame list than the danger of overweighting today’s most popular stocks. Today’s manic buying too often leads to tomorrow’s panic selling.

(For an example, google “RSP + portfolio”; 507 holdings; largest position way under 1% of portfolio)

I can see the sell-off in “crazy stocks”, but will there be a “flight to quality” following the crazy stocks crash [if anyone has any money left]?

You can dump your stock in Vroom, but then what do you do?

Are there any stable stocks, in say, the S&P 500 that will just stay stable or is every listed stock going to crash?

The rising tide lifts all boats, and the same thing happens when the tide goes out (boats sink).

Could be that once the “disruptive stocks” mania is flushed out, value stocks (those that sell real things and make real profits) will be the ones to own.

Or, if you want to play safe, when interest rate peak, load up with quality bonds and clip coupons.

Look at the GFC. How many stocks increased, maintained most of the peak value, or lost a lot less than the averages?

Or look at the “Nifty Fifty” at the peak in 1973 prior to the 45% decline. It included stocks like McDonalds, Coke, and 3M. Companies that are perceived as stable now. Many of the “Nifty Fifty” lost more than the average.

In a major bear market especially one with massive debt and leverage like now, everything or practically everything gets sold and hard. Been covered by prior articles here.

Back in the GFC, gold fell from over $1000 to $680. Silver from $21+ to $8.39. Both are usually viewed as “safe havens”, by some.

UST and other high quality debt about the only thing that did not. Maybe real estate in some markets (some Chinese cities) where the bubble was still expanding.

However, many “safe havens” there are this time, it’s not going to be bonds with the credit mania over which equally means it won’t be much of anything else.

Frost

“Maybe real estate in some markets (some Chinese cities) where the bubble was still expanding.”

Well, real estate in my neck of the woods doubled in three years [so far]. Even if it drops 25% before going back up again I am still way ahead. Plus I had a place to live.

I haven’t seen much of a slow down yet. More inventory on market but still selling.

So a bet on real-estate in 2012 paid off big time.

Will the same thing happen with quality stock? You have to put your money somewhere and inflation is a killer. Commodities?

Lumber and oil? Bonds? [ I know nothing about bonds and too old to learn].

all those stocks Wolf has listed were all way overvalued. the mania was like the dot.com

Zoom is now priced we’re it should be. i tried to tell people on stocktwits that. At its peak, Zoom would have had to capture the entire video conferencing market. Nit now but in 2025. In 2021 it’s valuation justified 150% if the entire teleconferencing market

EL,

Yes, real estate turned out to be a good buy in 2012, but not in 2006 or 2007 at the peak of housing bubble 1 in most markets.

I don’t know where you live but as I presume you know, all real estate is local. Mortage rates are a big factor but only one.

Whenever the peak of this mania arrives, I see long-term stagnation and decline. It won’t happen everywhere and it won’t be a straight line, but a lot of (expensive) real estate is likely to lose value for structural reasons, because the local area’s economy and social fabric are falling apart.

There is going to be a lot (and I mean a lot) of that in the future. I live in ATL now and believe much of the metro (especially the core) will decline noticeably longer term.

The economy is diversified and it’s the economic capital of the south. it’s also congested with an already high proportion of poor people who are destined to become a lot poorer.

Vroom actually didn’t report that bad of numbers given the circumstances. I actually picked up some $1.30.

Carvana: -90%

Vroom: -98%

Rivian: -85%

Snap: -70%

Pinterest: -76%

Netflix: -73%

Wayfair: -84%

Chewy: -78%

Shopify: -77%

Teladoc: -89%

Lyft: -77%

Zoom: -79%

Palantir: -81%

GameStop: -80%

AMC: -84%

Coinbase: -83%

Zillow: -81%

Redfin: -88%

Compass: -75%

Opendoor: -82%

MicroStrategy: -85%

Robinhood: -87%

Moderna: -72%

Beyond Meat: -87%

Peloton: -90%

DoorDash: -72%

Hey, isn’t this approximately the ARKK fund, x-TSLA? :-)

* Full disclosure, I’m short ARKK.

ARKK has Tesla in it plus some others. Tesla is about 10% of the fund. There are some other biggies in it that are not “yet” on this list :-]

She buys everything that most people wouldn’t touch with a bargepole. It worked well in the mania market when nothing made sense.

I noticed the other day after being a TSLA bull forever she sold some TSLA after it dumped 40% to 700 and bought COIN.

Musk’s down 60 Billion on paper in the last few weeks, 100 Billion since last November. Maybe by abandoning the TWTR offer he’ll make it back pronto.

It will be a game of musical chairs when the music stops, who’s on the fallen list that will not have chairs to sit on.

just think if the $1,500 TRILLION of derivatives were to go pfht

it might be wonderland of biggies

Those are the notional amounts, imaginary points of reference against which formulas operate in derivatives. They are not truly sums that could or would evaporate.

Agreed, at their more levered forms they can help lever things in weird directions. They can transmit financial contagion. But they are not as menacing as the attention-grabbing notional amounts seem to suggest.

Nobody ever does.

I find myself plugging figures into the I flatiron calculator often.

So buy when Marvin is increasing and sell when it starts going down

Who’s Marvin? Lol!!!

Ha!

Just noticed.

Severe Marvin call. Marvin, your mother the broker of doom is calling. Back to thy basement!

Threw me for a loop too. Will go down as one of the epic autocomplete efforts at humor.

I need to keep an eye on Marvin for buy and sell signals

Melvin?

Get with it, old farts.

Prophet Marvin is a famous tik tok talking parakeet stock picker that uses a ouija board. Never had a single down year!

It’s disturbing how every single time the Federal Reserve starts normalizing policy (raising federal funds rates to 0.75% is hardly “tightening” yet), the entire financial media starts scaremongering over impending doom. Can’t go a single day without seeing “recession” or “stagflation” in the headlines. The CNBC talking heads are in bed with Wall Street, and all they want are lower rates & more stimulus.

Financial conditions are still historically super easy. Most of those imploded stocks are 3rd & 4th tier companies lacking credible business models (besides selling shares) and arguably should never have been allowed to go public to begin with.

Yes, it’s such a shame the Fed quit printing money to inflate stock prices because those overinflated stocks now cannot stand on their own two feet, and that includes the biggies, from Apple via Tesla to Facebook. Money printing pollutes the mind of investors.

But I agree with you; I don’t see a recession in the near future, and I’m not in the stagflation camp. There will be a recession some day because sooner or later recessions must happen, but I don’t see any data that point at a recession right now. What I see is a huge amount of demand, and some of the demand cannot be met by supply, so there is pent-up demand, and there is a huge amount of money still floating around among consumers, businesses, and states, that will be spent. So I don’t see a recession.

What I see is a stock market sell-off that will drag on for a long time because since 2009, the only thing that inflated stocks to these ridiculous levels was QE and interest rate repression, and they’re now gone. Now we will get interest rates of the kind we haven’t seen since 2006, and we’ll get QT, and that will pull the rug out from under stocks, even as the economy, in terms of GDP and employment, is plodding along reasonably well.

GDP when measured by real inflation (aka Shadow Stats 1980 GDP calculation) shows the economy contracting for 10+ years running but still ‘No Recession Yet’ eh?

Like you, I live in the same Bay Area that’s done an outstanding job of concealing the Depression playing out virtually everywhere else in the US of A. Saying that we ‘might’ go into a recession is the modern equivalent of “Let them eat cake”

Hyperinflation IS the soft landing,

I understand that the US has been in a depression ever since Nixon took it off the gold standard in the 1970s, and that GDP growth is all fake, and that all the numbers are fake, and the employment numbers are fake too, and that no one has a job, and that no one can afford to buy anything, and this started in the 1970s with Nixon taking the US off the gold standard, and that the dollar is all fake, and that everyone is just sitting around at the house with nothing to do, and not spending money, and not working in this fake economy, and that in fact the houses that these people sit around in are also fake, and in fact, everyone is just living out on the street in cardboard boxes looking at these fake houses, and the fake cars driving buy with fake people in them going to fake jobs, earning fake money, and they’re looking at all the fake delivery drivers delivering fake boxes to fake houses, bought with fake fiat. I totally get that. And Shadowstats has been a big and noble contributor to this profound understanding.

LOVE IT Wolf,,, please continue to address those among us,,, almost always amongst us according to many of the best analysers for many years,,,

based on the best book ever of ”statistics” used by a prof on that subject in the Psychology Dept. at CAL in the late 1960s, “Lies, Damn Lies, And Statistics.”

That Prof, and many others at CAL ”at that point in time” were not only really great teachers, but were totally ”aware”…

Ladies and Gentlemen-

This is an excellent example of why you need to tune into Wolfstreet. There is no better place to get financial advice.

Gold has had NO RELEVANCE WHATSOEVER to the US Dollar or US economy since 1933 when the so-called ‘gold standard’ which was nothing other than a failed 60 year experiment from 1873 to 1933 was entirely abolished for a domestic purposes in the US and only a tiny vestige of it was still kept in placed for some international transactions until 1971 when that was entirely abolished.

I sincerely hope you are correct Wolf.

Rate repression and QE have benefitted the wealthy for a couple decades now. That trickle down people imagine is just urine falling on their heads.

Of course Wall St will gnash their collective teeth, issue dire warnings of economic calamity all in an effort to scare citizens and their bought and paid for politicians. While in reality their only concern is to keep the status quo so they can hoard more.

Yes.

Ultimately, the ‘Two Rules of Money’ must be obeyed.

1. Steal all you can…

2. Don’t get caught…

:)

COWG,

Is stealing from government [federal, state, county, city] even a crime anymore? Does anyone prosecute it?

It seems so common and blatant that I thought it had been defacto legalized while I wasn’t looking, kinda like of hard drugs here in Seattle.

[I live in Redmond].

“Yes, it’s such a shame the Fed quit printing money to inflate stock prices because those overinflated stocks now cannot stand on their own two feet, and that includes the biggies, from Apple via Tesla to Facebook. Money printing pollutes the mind of investors.”

LOL, it’s obvious you don’t work for CNBS.

Wolf,

I have to disagree with your analysis.

A massive sell off in the stock market will create the ingredients for a full fledged recession or min-depression. When people lose all this money in the stock market and 401K’s and they see their wealth decrease, it makes them feel poorer if they werent already due to the inflation. That makes them spend less. Add that Europe is in a recession, with horror stories about cutoff in gas supplies, and we have all the same factors that will bring on a fall in demand for durable goods and discretionary items. Of course the Fed action is ill timed and make things worse. Sounds more like a Herbert Hoover economy than anything else. The plunge in Silver may be a signal that the economy is headed into the tank. Commercial Real Estate will be the leading item to break the economy, followed by residential housing. Except for Condos, residential housing in DC is already leveling off and in the beginning stages of a decline similar to 2006/2007 because of the rising interest rates and unaffordability. This latter information is going into our reports, and is based on actual data on the MLS system.

My theory it’s all being done to choke off china

Flea,

I wonder what China invading Taiwan would do to the supply chain? Say we had to do what we are doing with Russia, cutting off all imports and exports. I’ll tell you what. Instant depression. Notice no one is talking about this. We’ll be reduced to a barter system overnight.

A Stock market crash won’t effect the bottom 50 to 60%% percent of the people because they don’t own stocks and if the have a 401k it is very small. A stock market crash will really only effect the top 5% to 10% of the population.

I have several low income relatives and they do not follow or care about the stock market. They care about paying rent, buying food, paying medical bills.

I also think that the pendulum will swing past the decrease in demand to a recession.

IDK Swamp.. is it possible for a recession for only the top income earners (who tend to have stock & assets) and not for the bottom to have one? The spending of the bottom half of the US is already severely curtailed by housing costs. If housing costs go down there would be more money being spent that would support small time businesses etc.

“… and interest rate repression, and they’re now gone.”

Give me a break! Interest rate repression is far from gone. Get back to me when once again the market determines the rate.

History has taught us that bear markets have sharp stunning rallies. That is why we are in cash as new lows are probed, and successful investors short the rallies in a bear market and get back into cash with the subsequent drops.

The market will eventually throw out the baby with the bath water. There will be the opportunity of a lifetime at the bottom. We are not there yet.

That’s because the actual fundamentals (without current monetary and fiscal policy) are awful.

I’ll take the “under” on the economy. Yes, I’ve read about the labor market shortages and demand both here and elsewhere. I just think it will reverse a lot quicker than seems evident now because I expect the bear market to be much bigger than most do.

For starters, zombie companies must collectively employ close to several million. It’s not that far before they are shut out of the capital markets completely or won’t be able to raise enough money. These companies also provide noticeable collective demand for other companies.

An extended bear market also means companies will be scrambling to cut costs to try to keep their stocks from sinking, even before they start missing EPS estimates.

There are also potential financial neutron bombs ready to detonate elsewhere, like China’s real estate market.

Regardless, whether the economy enters a technical recession or not in the near future , above trend inflation and falling markets still means most Americans will become poorer.

Exactly. Somewhere around 20% of companies don’t earn enough profit to cover interest expense (i.e. zombies). 20%! There’s your WTF. What happens to the economy when they fail?

I did my Smurfing again.

Going to my “banks” and drawing out cash, under $3,000 per day and less than $10,000 a month (so that I am not a drug dealing terrorist criminal).

So, I withdrew $2,700 from the teller who knows me and likes me (I know. Hard to believe but there are a few people who like me, or at least can fake it).

6 of the notes were the “new” paper notes. 21 were the old bills.

21 OLD paper notes

Now, I never get the old 5’s, 10’s or 20’s. Never. What happened to them? Or, the better question is, why am I getting old 100’s? Who made the decision to NOT shred them? To warehouse them? Who knew they may be needed?

Where are they going? Where are they?

The fact that I was fortunate to live all over the world, (and not even being born in America), gives me connections. So, I know the answer to my own question. These 100’s are going to Turkey, Lebanon, Venezuela, Brazil…the Dollarization of these Nations.

The people are dealing in Dollars. Even though the dollar is basically (not even basically) worthless, it is less worth less than the other paper.

I have also learned that silver coins from pre-1964 are being used in many of these countries. This may explain why the Premium on Silver “junk” coins is higher than the premium on any other Silver………..

I think it would be interesting if a Gas Station would price their gasoline in Silver Mercury Dimes. Imagine a sign saying ” REGULAR: 29 Cents”. But, then, the owner of the station would be arrested for being a Terrorist, or Privileged, or a Rand supporter.

I get $3000 at a time also Don’t really look at the quality just stick it back I’m shocked at the dollar being so strong I can’t wrap my head around it

Maybe we can’t imagine how bad the dollar’s competitors are.

Like the Rouble you mean, which is the best performing currency this year.

I hope Wolf can do an article on the Ruble.

I remember seeing a statistic claiming that there are more GENUINE US 100 dollar bills in Moscow alone than in all of the United States.

With the amount of counterfeiting ( call it “money printing” if you want) that our unelected bankers have done, it wouldn’t surprise me.

I wonder how much real counterfeiting of the greenback is going on?

With something like $2.5T in circulation, it could be a lot and still not noticeable.

Wells Fargo keeps running out of $50 bills at the ATM machines? Especially on weekends. I wonder if there a run on cash that we don’t know about? We had to cash a bank check the other day. The teller wanted 2 ID’s. We’ve been banking there since 2009 when they bought out the Wychovia customers. Now we are treated like a number not as human beings. Some of the branches are closed except for drive in, where they have a bank teller who looks like he just graduated from Jr high school, and is probably paid minimum wages. I never go in the bank anymore and use the ATM machine almost exclusively.

SC- in 2016 a fifty dollar bill cost 8.2 cents to print, jumped to 19.4 cents in 2017. Same years, a hundred was 13.4 cents and increased to 15.4 cents. Twenties went from 11.8 to 12.2 cents. Tens actually went down, from 13.3 to 10.9 cents. Far fewer tens and fifties are printed yearly than the other denominations . but my coin guy paid me with nine fifties this morning for a coin. And there’s more old hundreds in circulation than I’ve seen in years.

The Mint ran out of silver planchets for Eagles and the commemorative dollar restrikes this spring, but by law they can’t buy on the open market for any price, so it’s not supply, just price/origin. It’s possible that the pandemic affected the Bureau of Engraving and Printing as it did the Mint, hiccuping the specie distribution. For whatever reason there’s a churn of old notes. I hope they keep releasing old money, I need a$5 “Indian chief” note to put next to my $5 woodchopper.

Printing costs courtesy of the Federal Reserve 2018.

Tell them you are going to spend the cash on booze, gambling and prostitutes. What are they going to do about it? Add you to another secret list? Double secret probation? Extra airport fondles?

“Imagine a sign saying ” REGULAR: 29 Cents.”

Being an old-timer I remember reading an ad in the local newspaper circa 1979, that the owner of a gas station was selling gas at 10 cents a gallon, assuming the dime was pre-1965. At the time gas was priced in the mid-forty’s and silver high teens.

I clearly remember a sign at a Pure gas pump at the little general store at 14.9 cents during a “gas war” in the late 50s or so.

my fave is when driving across country, picking up every hitch hiker to ask them for gas money,,,

came over the hill into the city of the angels on I-10 and saw the signs for gas at 10 cents — major gas war going on all over the area,,, big sigh of relief

1970 ish,,, don’t remember exactly, as the story goes, IF you remember the ’70s, you weren’t there.

curious-just curious, what was national average individual annual income/house cost in that period?

may we all find a better day.

Time to pull an India and create a new $100 bill, give everyone 30 days to exchange the old ones for new ones (at a bank only, where you will need to make an account and be tracked) and then stop accepting the old bill. That’ll shake ’em up

Wolf said:

“What matters are the steep increases in margin debt before the selloffs…”

How does the margin loan interest rate (effectively a variable rate, I thin) correlate to the short and long term interest rates set or influenced by the Fed. I would assume the FFR strongly influences the margin rate, and therefore by keeping rates down, Fed is implicated in the steep spikes that lead up to the sell-offs.

Doesn’t sound like a recipe for market stability to me.

The “Fed” interest rates represent the bottom interest rate to which a risk premium would be added, depending on the degree of risk and margin. For example, if the margin was on shares of AMD and represented only 50% of those shares’ value, then you would only need to charge a huge premium if you expected those shares to dip below 50% of their current value at the time that the margin was obtained.

Nonetheless, the avaricious brokers and greedy banksters who provide the margin actually charge large premiums on all debt, not just margin debt, because their business model is to use the “Federal” Reserve’s deception of most Americans to covertly create inflation (while charging ordinary Americans sky-high interest rates), so banks that pay their depositors 2.5% per year of their deposits (for example) profit off of the true rate of inflation which now is truly about 9% or more. Even when inflation ran only at 5% per year, their profits would have been enormous, because the average deposits of Americans were enormous.

Current inflation trends signify their profits will increase and increase until the stock markets crash, at which time they will lend their banksters billions of dollars to purchase our shares (at collapsed, low prices), to the banksters make even more, gigantic profits. Parasitism has been very profitable for the banksters and their cronies.

By inflation and also by later deflation, the banksters are robbing more and more of Americans’ assets and converting those Americans into debt-slaves. Thomas Jefferson wisely foresaw these tactics in the 18th century: “If the American people ever allow private banks to control the issue of their currency first by inflation then by deflation the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered… I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people to whom it properly belongs.”

Like the parasitic CCP, the banksters will continue these schemes until they are stopped. (Incidentally, I congratulate the banksters’ ally, Xi, on his decisions this year, which are exactly the quality of decision-making that I have always expected of him. I look forward to traveling to China and taking a selfie someday while looking directly into his own, doll-like eyes. I challenge him to have the courage to continue with his existing policies, which will result in his getting what he deserves.)

Margin (or “call”) money was a huge issue in the lead-up to the ’29 crash. Some people troubled by this were (1) common folk such as farmers whose money was being channeled to call loans in money center (such as New York City) banks rather than more widely used credit) hence to stock market speculation. Also (2) the cheap credit of the time was being created for various social purposes (Fed chair Benjamin Strong supporting Britain and his pal, Bank of England head Montagu Norman). The spillover, as now, was its exploitation by the elites to gamble in the markets. This drove prices steeply up and steeply back down into an overshoot. Whether we face such an overshoot now is the big question, but my wild guess is, we would need a bigger exogenous shock than what we see now. But these can easily (and unpredictably) happen. The system’s health as a backdrop is important.

RH and Phleep-

Then, the market walks on a razor’s edge. Scylla and Charybdis.

WWJD? (What will Jay do?)

Hint: Vascilate, eventually, as the Fed always has. And with ever-greater consequences to asset prices and wealth distribution.

Is it me, or does that chart look like a swan?

The first one, yes, I can see it, if I try.

A white one.

A gray one, so far: somewhat predictable. It turns black if something really weird happens this summer.

Rorschach test

A guy is in his psychiatrist’s office and the Dr is showing him ink blots..

Dr: what does this one look like?

Patient: It looks like a _________

Dr: What does this one look like to you?

Patient: It looks like a ___________

Dr: You have a dirty mind

Patient: Wait, You’re the one with all the dirty pictures

Stop looking at me Swan!

Maybe margin debt as a percentage of overall market cap makes more sense to track than absolute numbers.

RTGDFA

This is what it says in the article right above the chart:

“The trick is to not get sidetracked by the absolute dollar amounts over the decades. They don’t really matter. What matters are the steep increases in margin debt before the selloffs, and the steep declines during the sell-offs. The chart shows the relationship between margin debt and “events” in the S&P 500 index.”

Wolf, def read the article. Q I have is how to think about the steepness of the increases and decreases to understand the significance of the latest decrease. I think some of these questions are getting at OK what’s the level these need to get back to in order to no longer be distorting to the upside. I know some are refuting that there’s a problem, but I’m interested in the absolute level only as a measuring stick for when it’s no longer excessively stimulative to prices on a historic/relative basis.

Rory,

A dollar comparison in the chart probably wouldn’t help much…

Wolfs chart shows margin debt that is quantifiable…

The actual margin debt is unknown and who knows how much greater it really is than what the chart shows…

I do think the chart gives much evidence to Augustus Frost’s psychology driven market events…

Rory,

Here is what matters, in my comment above:

https://wolfstreet.com/2022/05/13/massive-stock-market-leverage-unwinds-amid-brutal-bloodletting/#comment-433761

“The long-term chart compares margin debt to S&P 500 selloffs. THAT IS ALL IT DOES. The S&P 500 isn’t adjusted for inflation either.

“I’ve been telling you for a year that this margin debt is predicting problems in the stock market, and you people keep wanting me to adjust it away in some form (for inflation, via log scale, etc.) so you don’t have to look at the warning because you don’t like what the warning says. The purpose of this chart is to WARN ABOUT STOCK MARKET SELLOFFS. And now the stock selloff that it has been warning about is happening (started in November).”

…and unknown margin debt continues to: “…tick, tick, tick…”.

may we all find a better day.

For your bleeding unicorn list I nominate Grab holdings. Which by my calc is down 83.5% from its 52 week high – which wasn’t even right after the IPO. As you say there are many stocks that are down that much.

Yet the S&P is just barely touched -20% before bouncing off the number – the big caps are not rotting on the vine like the no-revenue stocks (also just like 2001).

People still have money as Wolf pointed out. Housing will need to turn south by quite a bit before there’s a bigger crash in the stock market.

PPI came in hot again so CPI will be hot next month too. The Pew Research Center recently did a survey on Americans’ biggest concerns and Inflaton came in tops with 70% people saying that it’s a concern. The next one, Affordable Health Care is another inflation related item too. We are probably looking at riots later this summer or by fall.

The S&P 500 lost about 50% in the dot.com bust. Real estate didn’t crash or even decline.

A real estate bust isn’t required.

True, S&P can crash 50% without real estate as in dot.com.

Given this, how far can S&P go in this now real bear market …

Stocks with dot.com valuation

There was no housing bubble or QE then.

Interest rate repression for a decade

The excesses of the last 15 years is mind-boggling. Who knows but for inflation showing up it might have run for another 15 years.

Which bear market are you thinking of?

I ask because the mania we are in now is the same one from the late 90’s and included the dot.com bust.

The bear market I have in mind will last decades with numerous economic recoveries and bull markets, somewhat like 1966-1982 but a lot worse.

The financial excesses now are so large and the social decay so extensive, only a “deus ex machina” (magic) will dig society collectively out of this hole to escape the consequences.

Since I expect a lot of inflation (eventually), the nominal stock market may ultimately increase but measured by what it buys, the decline should be worse than the 1930s because the fundamentals are far worse than 1929 and the government is already so big relative to the economy, it can’t provide the backstop most think.

SJO, who is going to be doing this rioting? The presidential elections are over and the staged riots are finished. Is someone going to fund the riots you say are coming?

> Is someone going to fund the riots you say are coming?

The welfare state staves them off right now. Despite the claims about stronger consumer balance sheets, and a “middle class” employed and holding on, how many tens of millions of people here are total financial basket cases, a few handouts from the edge? And inflation will put pressure on that. Despite all the jobs I’m told are here. This would apply, I would think, especially to older metro areas.

Poor people will do it out of necessity, no staging required. The Srilankans are poor, and yet they had no problem burning down the house of Srilanka’s President just a couple of days ago. Americans also have plenty of guns. Heck most gang members are poor but that hasn’t affected their access to some serious firepower.

One of my former co-workers is now working for Bird Scooters. Stock symbol BRDS. They make electric scooters that you rent in the city. He got a terrific bump in salary when he went there. They are a new company, founded in 2017. So I thought I would look up their stock today, down 82.8% YTD.

Quarterly Financials:

Net income -39.5 million

Net profit margin -73.26%

Not so good?

One of our team members just left my company, global financial, to go work for Zoom. We all wished him the best. Scary times anywhere near these companies that are newish. They made him an offer he could not refuse. I expect Zoom will be bought up by a big player. I remember applying in 2000’s for cars.com and the sticking point was low pay and high stock option. Six months later that interviewer was interviewing with me.

Another set of musical chairs: labor markets.

Anecdotal: I am seeing a drop in quality in my everyday dealings with the lower level (retail, home consumer) functionings of amazon.

It’s another company that should be worth exactly zero or, if it can miraculously turn a consistent profit and pay “respectable” dividends, qualify as a very small cap stock. No reason for it to ever be more than that. It’s a concept stock.

Zoom is another ridiculously inflated stock. Nothing revolutionary about their primary product and no barriers to entry. I can see it being bought out but no logical reason to do it. Wouldn’t surprise me if MSFT buries them now that Teams is integrated into Office.

The other stocks listed in the article, most should be worth zero or a very small fraction of current crash value, Moderna and Netflix excepted.

Even with Netflix though, I see them running the Red Queen’s Race trying to spend enough on new content to even maintain their current subscriber base. They are going to have to change their business model, if they haven’t already. I don’t pay for the service anymore.

Harvey:

Profit Margin -73%, Loss of $39 million.

Only conjured money and negative, inflation adjusted interest rates keep this lead balloon, American economy on life support.

Imagine if the past 20 years was honest interest rates, controlled money/credit creation, and

TOO BIG TO EXIST clean up on aisle 3.

Once upon a time (before the Great Recession), margin interest rates at the major brokerage firms were much closer to the Fed Funds rate than they are these days. I suspect that margin interest is a major source of profits for these firms these days.

I went to see a street fight and an economics debate broke out.

“I went to see a street fight and an economics debate broke out”

Who said that? At the least you inserted it on the perfect site, and if it’s your own line, kudos!

I would have used quotation marks if it weren’t mine. Thanks for the kudos.

Sometimes, when I read the comments, they remind me of the kind of language that takes place at my family’s annual Thanksgiving Dinner event.

A play on an old Rodney Dangerfield line I believe, “I went to see a fight but a hockey game broke out”.

Getting older now, and it always seems to be the same old story. Rates go up, there’s less money to go around (leverage such as margin debt decreases), and it ends up as a game of musical chairs, whoever has the most leverage, the stupidest business plan, the ponziest scheme, etc. is the first to find themselves without a chair.

Admittedly, crypto is a level of brazen stupidity I never expected to see. I remember a year ago, trying to explain to my nephews and nieces (in their early 20’s) that by the time any investment ideas reached them, they were the greatest fool – no idea if they listened or not.

In 2006-2008, the U.S. mortgage market was the biggest butt that couldn’t find a chair, hitting the ground so hard when the music stopped that all the other players almost fell over. Crypto and the tech bubble are obvious suspect this time around, but probably aren’t big enough to slow things down on their own so there will be more players to be eliminated before the music starts playing again.

Some of the over-leveraged housing market countries, sure (Canada, Scandinavia, Australia/New Zealand, China), maybe some riots in the grain importing countries (Sri Lanka is already taking one for the team), but still more eliminations are likely to be required before the cycle can start again. Obviously Russia and Ukraine are cutting back their consumption (of all but weapons and coffins) for our benefit.

I guess we will find out in the next year or two who else is swimming naked.

The U.S. got hit hard enough last time and is a relatively clean dirty shirt (with respect to energy supply in particular) such that it can probably find a chair this time around (aside from the obvious scams like crypto and the worst valuations, as our host has helpfully tracked in SPACs and unicorns and so on) which is a good thing – I don’t think the broken social scene in the U.S. could take another serious downturn at the moment.

very good comment sg,, please continue to contribute to the Wolf’s Wonder…

thanks,

The worst excess is in the debt markets, as that’s the one enabling everything else.

If you’ve read “Extraordinary Popular Delusions and the Madness of Crowds”, nothing in that book comes even close to what everyone has seen for years recently. Crypto and SPACs are the equivalent of the purported “An Undertaking of Great Advantage but No One to Know what it is” which sounds so ridiculous it might not have even happened. But at only 5000 GBP, it’s nothing compared to either of these two.

For those here who haven’t read it, the book covers the British South Sea Bubble, French Mississippi River Scheme, and Dutch Tulipmania.

Yes, the current global mania is way worse than all three – combined – by leaps and bounds.

If there is any honesty left in scholarship, historians will be writing about the excesses, distortions, and fraud in this mania for centuries.

Great book. Still relevant after 180 years.

Augustus, they still think it’s all normal except for few bubble stocks.

I know, but most who are bearish here don’t seem to see the actual awful fundamentals.

It’s like, we’ll have a big (GFC) type event (only somewhat bigger) and then we can “party on” again resuming living beyond our collective means essentially forever.

This is after all America and the country has a birthright to some arbitrary perpetually increasing living standard, no matter how much social and economic decay occurs.

That’s not going to happen.

Augustus Frost

You left out the witch hunts, we’ve got those also currently!

People only think of housing when they think of 2008. They don’t seem to remember that all the insurance companies were going to go bust, the banks were going to go bust, the schools were going to go bust (.gov nationalized the loan industry essentially in 08). Nobody seems to realize that all of those industries are still bust, just papered over. And maybe Wolf is right with regards to the TBTF banks having repaired their balance sheets, but i’ll wait to see what happens when this bubble burst. Oh and Europe went bust in the early 2010’s and that still hasn’t been sorted out. When this sucker goes its going to be one for the history books.

I see the same things as Mr Wolf but the numbers make me scratch my head.(scratch, scratch?) There is still huge amounts of money floating about and people are still buying but USA growth fell by over 1% last quarter…. So if growth drops another 1% this quarter then it’s officially a recesssion but it’s not, because there is still money about and people are still spending….(scratch, scratch?)

Anyway, glad to see that awful product fake meat lost 87%. Never understood why veggies and vegans want to have their food taste of meat if it’s so bad…. (scratch, scratch) They seem to think fake meat made by a chemical company using a chemical process is so much better for you (scratch, scratch?) It really is beyond me…

The problem with Beyond Meat was a bit more subtle. There are two or three existing fake meat companies (Loma Linda, Morningstar) who have been serving the veggy market for many decades. The new product isn’t better than the old, and the veggy audience isn’t very large anyway. The investors who dumped money into Beyond Meat were obviously not veggies, and didn’t understand the specialized market situation.

Agree with you totally re meat taste of veggies A.

As a confirmed carnivore/omnivore currently ”healing” with so called ”vegan diet” while approaching ”Dr Ehret’s Mucousless Diet Healing System” allegedly used to cure some folks of cancer, I LOVE the tastes of the veggies, including the rice and oats soon to go away also, per Ehret…

While there was once, back in the day, (sixties) a couple of restaurants in Berzerkeley that made THE most delicious full taste meals that I and many others had no clue were only veggies, nothing else has ever come close, and they both closed years ago when their owners passed to the great pasture in the sky ( or some such place, eh? )

These modern versions, all made in some super factory apparently, are so, so blah!!!

A lot of people who don’t eat meat do so out of compassion, not because they hate the taste.

Lots of people eat vegetarian not out of compassion with animals but because they hate plants :-)

Monoculture crop fields sprayed with insecticides and all manner of anti-nature practices, leaves you wondering how there is any more compassion in that choice of food.

Unless you believe one cow deserves more compassion than a field full of insects and all the associated food chain dependents.

Wolf, on the margin debt vs Nasdaq (possibly the most effected index at first these days?), any chance of ATH dates for the rotations for the big drops?

Is this a good pre-indicator?

Care to share the raw data for the chart?

Many thanks

Did you know that the DNA of bread is 2% rabbit…lol

and I’m not kidding. Those big machines are faster than bugs bunny……

Anthony,

I am a son of a breeder; wheat that is.

Humans have two copies of 23 chromosomes, for 46. Humans have up to 25,000 genes.

Wheat has six copies of its seven chromosomes, for 42. Wheat has anywhere between 165,000 to 330,000 genes.

DNA marker-assisted selections, and DNA sequencing to locate specific traits in genomes helps breeders to make crosses in order to get the end product that goes onto your bread. Resistance to disease & milling and baking quality & standability of the plant are the three main traits the industry is after.

The “bread” in my portfolio came from Triticum aestivum.

Kenny Logouts,

Far too many farmers spray glyphosate herbicide on non-GMO crops before harvest. This allows them to set the timing to their liking, make it easier to harvest with the combine’s cutter bars, and make the grain drier so that it thrashes easier and with less of a break down of the grain. It also puts bad chemicals into our food supply. Canola is probably the worst of them.

Anthony,

” USA growth fell by over 1% last quarter”

That Q1 GDP was a freak event that will get unwound in Q2: Here are the details and charts:

https://wolfstreet.com/2022/04/28/gdp-sunk-by-trade-deficit-result-of-globalization-drop-in-government-spending-consumers-held-up-despite-raging-inflation/

1. Consumer spending in GDP in Q1 rose by 2.7%, which is fairly strong.

2. But the trade deficit exploded, which pulled down GDP, but this was the freak event. It exploded because companies are trying to restock, and the goods arrived in the US to do so.

3. But the trade deficit will get much small and be a smaller drag on GDP. Consumer spending has been switching to services, and they are cutting back on buying goods, which will reduce imports and the trade deficit, so once those imports catch up to replenish inventories, they will slow down, and the trade deficit will get smaller and much less of a drag on GDP. This is happening now. We’re all seeing US transportation volume slowing down (my article on Thursday about trucking slowing down).

4. Government spending (federal, state, local) on equipment, supplies, fuel, etc. (not salaries and social spending) fell, which also dragged down GDP. I don’t expect that to persist because governments are awash in money and they’re going to buy stuff with it. It just takes a while sometimes.

Yep, the numbers didn’t add up. I wondered how…..

Enough here in this comment for a full article Wolf.

Maybe call it:

Q1 GDP was a freak event that will get unwound in Q2.

AV8R,

Yes, you’re right. Great headline! Why didn’t I think of it”?

I should have done it that way when the data came out. Maybe more people would have read it? GDP articles are not popular :-]

I might still do it, come to think of it. There is a lot of misunderstanding out there about Q1 GDP.

The Fed might say Q1 GDP was only a “Transitory” event too!

Wolf will u do a chart on Schiller comparing America to Europe,emerging markets ,Asia China . I think people would find these results ,like a slap in the face.Thanks excellent work

Wolf,

When you write the post about 2nd quarter GDP there is another factor to consider which I don’t recall you mentioning. And that is the Feds commitment to rising interest rates is causing the dollar to spike, now over 104, an increase of over 10% this year. As the Fed continues to raise rates, and the dollar continues to spike, problems will emerge, including further increases in the trade deficit with expensive US goods and cheap foreign goods [this will counter your supply chain impact]. Back in the inflation of the 70s, the Feds increase in interest rates (and the subsequent increase in the dollar exchange rate) got to a point where international agreements had to be established to ease the situation. See the Plaza Accord of 1985 and the Louvre Accord of 1987. This could be in our future in the current situation.

Aha now I am a bit more worried about my bond buying, may be jumping the trigger a bit. Good points Wolf.

Trade deficits,National debt will never be repaid . probably end in war ,not a ideal situation

“the numbers make me scratch my head.(scratch, scratch?)”

One imagines traders could have fun with Beyond Meat by referring to them as Beyond Me.

THAT is funny !!!

And what makes it funnier is that it is true !!!

It was Alex Vieira initially buying the stock. When he buys stocks make massive swings upwards especially when the market cap of a company is small. Same story with Shopify in Canada.

Fun facts:

1. Crypto market cap is down by 1.7 trillion

2. Subprime mortgages in 2008 were 1.3 trillion.

3. On the height of the “tulip bulb mania” in 1637, the bulb of a tulip, known as “the Viceroy” (viseroij) was offered for sale for between 3,000 and 4,200 guilders (florins) depending on weight (gewooge). A skilled craftsworker at the time earned about 300 guilders a year.

Well, at least those suckers got a tulip which is something tangible.

At $63,000, BTC cost just under the annual US median household income and it’s literally nothing but a string of 1s and 0’s which doesn’t do anything. Now, it’s selling for a 50%+ “discount”. Many NFTs, far worse.

Augustus Frost,

But, BTC DOES do something. It facilitates ransomware crimes, and trade in countless illegal things, and channels. It also provides a kind of flypaper to separate hopeful fools from their (real, actual) money.

I wish it was just ransomware…it’s the trade in the other “illegal” things that irritates me… Things that can’t be mentioned here….I guess nasty crime has always had a “crime bank” to support it….

In trying to figure out how far this will all fall that the last (long run historical) chart shows that the Margin “highs” always get higher… and so do the “lows.”

If so then the Margin debt wind down should end at about $600 billion. Another $173 billion to go.

Yeah was trying a ‘least squares’ line on that curve too. :) As Wolf mentioned a lot of printed money out there still so the bottom might be a bit higher than that tho, especially if the economy muddles along ok. Maybe only a 30% drop total on the SPX for now? 10% to go…

Or it could go the other way. When I swagged the numbers I wondered if the margin bottom might not be more towards the $550 billion level.

My personal guess is that THIS TIME actually is a bit different than all the others. While I think we will see a TECHNICAL recession (two successive quarters of declining GDP) it is more of a sideways movement than an actual decline.

In that case, the time period to use for comparison isn’t the 81-82 period that Volcker was famous for but rather the 77-78 period of “stagflation” where GDP growth was consistent but was beneath the inflation rate. That was also a time when the Fed dithered and delayed in getting the Fed Funds Rate above the inflation rate.

Obviously both the economy and the stock markets were different back then. Dominated by large companies rather than entrepreneurial startups. I am not sure we really have “conglomerates” any more.

Been wondering about the ‘this time Is different” thing too lol. Don’t see the economy dominated by anybody but the oligarchy tho, manipulating to their benefit w all the corporate welfare and etc. I see that bit continuing… Maybe they’ll pull the plug on all the assets so they can buy em up cheap w all that free money they’re sitting on and make sure the drop is more than the inflation rate…

If things manage to normalize at all Mr Frost below suggests a reasonable expectation. I’ve been thinking sideways to down for a while now which should level off at sideways for a good while looking at the demographics and assuming the financialization of everything hasn’t screwed the pooch completely.

There will be big bear market rallies during which leverage will again increase, and the process starts all over again.

During the dotcom bust, in the summer of 2000, the Nasdaq rallied 35% and regained some ground (but never got close to its prior high) before collapsing entirely (-78%). Lots of people were drawn into the market during the summer rally and got wiped out. Then in 2009, the Nasdaq dropped close to its 2002 low… only money printing got the Nasdaq to do what it has done since. But now QE is over and QT starts.

Whenever this stock mania actually ends, the bear market will more closely resemble 1966-1982 than the dot.com bust, but just noticeably deeper and almost certainly longer. Longer because the government and FRB (here in the US) are guaranteed to do more of the same to “kick-the-can” down the road as far as possible.’

There were multiple bear markets and bull markets during this 16-year period, with the worst bear market being the 45% decline into October and December 1974.

Whatever anyone wants to call it, it’s going to be a whopper because the financial excesses are greater than ever and the actual long-term fundamentals (papered over by artificially cheap money, the loosest credit standards in history, and government deficit spending) are absolutely awful.

It also depends upon whether the bear or bull market someone has in mind is from the last five minutes, week, month, year, or longer. There are bull markets within bear markets and vice versa.

I see hyperinflation starting in 2023. Of course the inflation rate will magically fall coming into the midterms only to reaccelerate in 2023 and beyond. All the variables I see point to hyperinflation in America.

I have some friends whose family have been active in the real estate market in central Texas (in and around Austin) over the years. They have 3 single family homes which they rent, in addition to their own home. They’ve been fortunate in that they’ve had these properties pre pandemic (before the fed went on its liquidity binge). The valuations on these homes have increased anywhere from 30% to 60% in the last 2 years. This paper wealth has been burning a hole in their pocket, and the recent spike in inflation has convinced them that they should be taking out as much debt as possible (their logic, not mine). As a result, they’ve decided to make another RE purchase in Austin (it’s a commercial/residential combo property). The purchase price is 1.5million. The property was appraised at 750k in 2020, before the Fed’s QE. In other words, the property has doubled in “value” in 2 years. The current seller purchased it in mid-2021 for roughly between 800k-900k (based on 2021 appraisals), and has held the property for less than a year.

To finance this purchase, they’ve taken out 2nd mortgages on their properties to the tune of 500k (30 years at 5.25%), another 250k from liquid savings and a 50k 401k loan to help with closing costs (the other half of the purchase price is coming from their in-laws, which they are also financing with debt and cash). The resulting LTV ratios on their current properties are between 60-80% (based on May 2022 valuations), but the resulting rental income from all of the properties (including the new property) will slightly less than the total resulting debt service. They expect to make up the difference with rent increases as leases come up for renewal this year and the next.

I’m curious to hear from the Wolf Street community on this “investment” decision. Not just in the context of the general real estate bubble that has been covered thoroughly on this site, but also the tech bubble and Austin’s exposure to the tech bubble. Sorry for the long post.

Austin is a de facto suburb of Silicon Valley now…

Re your friends…

By leveraging into mania valuations, they have essentially wiped themselves out, at this time… any hiccup of a devaluing of their (overvalued) assets will result in “ a bridge too far” moment and could possibly force them into bankruptcy with negative net worth… making the deal on 2019 valuations might have been viable… but if the 3 houses were carrying themselves with a buffer, why screw it up…

In my view, a terrible maneuver because now you have zero equity in anything…not to mention any devaluation puts you deep in the bankruptcy odds… add in the in-laws, and you have the possibllity of a real $hitshow…

If valuations continue to go up, maybe a win… but I don’t think so…

Totally agree.

They forgot the end goal of individuals (as opposed to institutions) shouid be to maintain or improve living standards.

This includes not putting yourself in a position to financially fail, which they have done.

I expect this to happen to a large percentage of the currently affluent.

I live in The Woodlands, Texas which is not in the same area as Austin (1 hour drive away). I have many friends in Austin that work for Dell and other tech companies. I have heard about the crazy, by Texas standards, valuations in the greater Austin area due to the influx of California people moving there.

We are not experiencing those kind of property valuation run ups here in The Woodlands, which, BTW, is a high cost of living area in Texas and was recently named as one of the best places to live in the U.S. Also, I see California plates here on cars so they are moving into this area.

Property values in The Woodlands are currently staying flat and maybe even decreasing. One of my best friends here is a RE agent (years here doing this) and another friend is a mortgage broker. Both have said “it’s getting strangely quiet” in both the sales and financing of RE.

Both are saying it’s getting to be time for the RE agents to go back to the tennis courts (an old California saying when RE gets slow).

Honestly, I hope it works out for your friends, but leveraging up at the top of the RE market in the face of a recession is not a wise decision.

You must drive at Formula 1 speeds to get from The Woodlands to Austin in an hour. Try 3 hours.

COWG/Augustus Frost/Anthony A,

I appreciate the perspectives. I believe the salient point you are making is that, why consciously pursue an investment that unnecessarily creates a risk of bankruptcy where none existed before, especially when you’re already in a very comfortable position financially (and the credit cycle has peaked and is about to reverse)? (rhetorical)

If you presume the froth in the Austin RE market is reflected in the increase in RE values from Q1 2020 to Q2 2022 (the period of QE), and you presume further that this froth will be wiped out by QT and deleveraging, then yes, the resulting valuations on their 3 rental properties and their primary residence would be underwater. Note, Case-Shiller doesn’t publish an Austin home price index, but FRED publishes a quarterly housing index “All-Transactions House Price Index for Austin-Round Rock-Georgetown” (ATNHPIUS12420Q), which indicates that from 1/1/2020 to 10/1/2021 prices have increased approximately 42%. Presumably this has only increased further in the 1st quarter of 2022.

But this would only put them in bankruptcy if they were forced to liquidate at these pre-QE valuations. Provided they can still service the debt via their rental income, they could survive. So they’re essentially at the mercy of the Austin rental market for the foreseeable future?

Reminds me of the old saying :

“When the tide goes out you see who’s been swimming naked.”

“So they’re essentially at the mercy of the Austin rental market for the foreseeable future?”

Yes, it looks that way.

Believe Wolf and the FED when they say that interest rates are headed up and that will freeze the RE market.

J5,

What do YOU think of your friend’s RE play?

COWG,

My instinct is that this is not a good decision, but that instinct is biased by my memory of the GFC. If I came out of that period with only one lesson, it was to never view a house as a commodity/investment. Because of this bias, I am cautious about relying on my instinct in this circumstance. Which is why I’ve tried to focus on the data.

The RE prices in Austin (as well as other major cities) clearly spiked following the Fed’s QE and the resulting drop in mortgage rates. If that is unwinding now, and Wolf has clearly made the case as to why it has to (Re: Inflation), it would seem reasonable to assume that this unrelenting asset price inflation over the last 2 years would also stall or reverse. At the very least, this should significantly hit the demand side of the RE equation via higher mortgage rates. And the early evidence is that it has.

According to Realtor.com RE data, Y/Y Active inventory in the Austin-Round Rock metro area has been positive since February, driven mainly by Y/Y sales declining (not from new listings), implying that buyers are disappearing from the market. But the active inventory still has a long way to go before it returns to pre-pandemic levels (which I presume would be necessary to trigger RE price declines). So the next question is, what causes housing supply to significantly increase to bring the active inventory levels back up?

The number of single-family homes + multi-family homes under construction is at or near a record (I believe it’s the highest level since Feb 1973), which should add significant housing stock to the country. Unfortunately, this data is only available at the national level, so I can’t assess its potential direct impact to the housing inventory in Austin. But the addition to the single-family housing stock should add to the inventory and negatively impact prices. However, if most of the single-family housing stock under construction is already purchased, as has been claimed by Bill McBride over at CR, this won’t directly add to the active inventory when these housing units are completed. That said, these households will have to vacate the housing units they currently occupy. At the very least then, this should put downward pressure on rents (apartments and single-family rentals) as these households move out of their current shelter. Of course, to the extent this housing stock under construction has been purchased by investors to rent, this will add to the single-family housing rental stock and depress the single-family housing rental prices further.

There is also potential housing supply from investor purchases pulling inventory off the market in 2021 (see the Redfin and Corelogic quarterly reports on these investor purchases). This effect partially explains the collapse in active inventory during 2021 in Austin and other metro areas. This shadow inventory seems to be real and material, although it’s difficult to measure in Texas (The Redfin quarterly report on investor purchases does not publish data on metro areas in Texas for some reason). This inventory has to eventually return to the market, ether as active inventory for sale or single-family rentals.

There are a lot more “ifs” around the supply side of the RE equation. It seems more likely that single-family housing rents would drop before or instead of RE prices. However, to the extent that leveraged landlords can’t support their debt service with rental income, this could trigger the forced sales that cause RE price decreases to materialize. That said, I don’t know how this plays out any more than the next person. But the momentum doesn’t seem to favor purchasing RE at this time (either as a long-term investment or to rent out).

Usually, an expensive real estate market has not just high priced homes and good jobs, but also great amenities. Austin is a real bedroom community in the sense there is not much in the services, entertainment, and dining scene. The social scene is not sophisticated enough to hold anybody who dresses for dinner, likes art or theater, and something other than country and western music. So why pay all that money for a house there?

” Austin is a real bedroom community in the sense there is not much in the services, entertainment, and dining scene.”

What planet is your Austin on?

I’m more than willing to be guided. Tell me why I shouldn’t go to Miami instead.

I’ve been to Austin twice though it was last slightly over five years ago. I thought it was overrated. Stayed in the downtown Omni hotel where I was told it was near the center of cultural scene too.

Petunia: Austin has “grown up” and has all those things you said it does not have.

Miami and Austin now have something the Twin Cities does not, and most likely never will: Formula 1 racing.

The Twin Cities does have a lot of Fortune 500 companies though. And a pretty good orchestra.

We definitely have four seasons, and on a glorious weekend like this one, people are outside enjoying the start of summer.

They are gambling as hard as they can.

The Gambler’s Fallacy is as old as gambling, and still as popular as ever, as are a number of other fallacies.

Even though people have won the Nobel Prize for showing that investing markets are not rational, knowing that hasn’t changed anything at all.

una, while,

” Even though people have won the Nobel Prize for showing that investing markets are not rational, knowing that hasn’t changed anything at all.”

may, in fact bee true in YOUR world/community/family,,, it is absolutely NOT true in my such:

Almost exactly opposite to sunny guy, WE have been out of the SM since mid ’80s

based on exactly such rational exposition,,, and will continue out of SMs until equally rational explanations convince us otherwise, especially based on the very rational and reasonable charts and narratives here in.

Thanks for your many comments on Wolf’s Wonder, and hope you will be able to obtain and focus on more of the clearly always available ”HOPIUM” in spite of all of our challenges as a species, etc., etc.

Austin is ready for a good bust. Rents have gone up 10-fold in 20 years. Not sustainable.

WEEK OF THE CRYPTO LOSERS…

Perfect Storm of Fear and Panic…

COINBASE Customers Sue… Luna $0…

Will Bit Billionaire End up at MCDONALD’S?

Stocks suffers longest losing streak since 2001…

Great piece as always Wolf. You might want to add UPST to your stock “List of Shame.” They’re definitely a contender.

✔

https://wolfstreet.com/2022/05/09/the-massacre-doesnt-let-up-another-ipo-stock-upstart-plunges-43-percent-afterhours-90-percent-from-high/

Archegos. I never heard of Archegos until it collapsed in 2021.

How many hedgefunds (I never heard of) are going to collapse in 2022/2023? How many entities in the (ahem) … “Shadow Banking sector” are on the verge of collapsing?????

We won’t know until we read it in the morning papers.

Jim Rickards said it best, “Stock Market crashes are like an earthquake and liquidity crises are like termites eating at your foundation … they eat and eat until one day your house caves-in.”

We are going to see both, IMO.

One of the biggest problems with our stock markets is that hedge funds like to swoop in and buy up the companies with the most potential. So retail investors are really left with just a choice between the “Best of the Middling” and the Dow 30 that are too big to be bought out.

Banks definitely knew of things like Archegos, but each one did not know the whole picture of its finances, and had a piece of its business. This is like Long Term Capital Management in the 1990s. The banks started to reverse engineer what was going on, so when Archegos started to blow up, as happened with LTCM, a couple banks were big bagholders (Credit Suisse this time), and the weakened ones tried to work a “collective” solution. But instead, the better positioned banks ate their lunch, trading against the bagholders. CS took, I think, a $5B loss or something. Now this very activist SEC is implementing some surveillance, saying it affects the wider public markets, which is their job. The latter seems widely, basically reasonable on their part.

About time ,except some vert rich people lost tons of money. Now it’s jail time,why isn’t Cathie in same boat. Oh screwing little investors is OK .Fraud

Cathie’s loophole might be something like this: “opinion or puffing” talk, glowingly about hypothetical future values, is generally not a representation of “fact,” as is required legally for “fraud.” Fact is something that can be proven true (or false) now, and the future is not such a thing.

If I say, buy this house from me, take out a big loan, house prices will only go up, I am expressing an opinion about future events. I am not, by that alone, promising or guaranteeing the counter-party that prices will rise. “Sophisticated” people know this. (I teach it in Business law in college, to everyone I can.) That’s why such folks tend to be winners in trades, walking away with the spoils.

That’s how credit rating bureaus walked away from their awful bond ratings in the past: a credit rating is an “opinion” about future returns.