Used vehicle prices continue to back off from ridiculous spike. But drop in gasoline prices was “transitory,” as we’re now learning at the pump.

By Wolf Richter for WOLF STREET.

The headline measure of the drop in purchasing power of the dollar, the Consumer Price Index (CPI), released today, confirmed that inflation is spreading deeper into the economy and is tearing into services.

As some product categories lost some of the inflation oomph, such as used vehicles and gasoline, others picked up oomph, such as housing, food, new vehicles, and air fares. It’s the arcade game of Inflation Whac-A-Mole in full swing, ridiculing the Fed’s assertion last year that it was temporary or transitory, when this horror show is now fully embedded in the US economy.

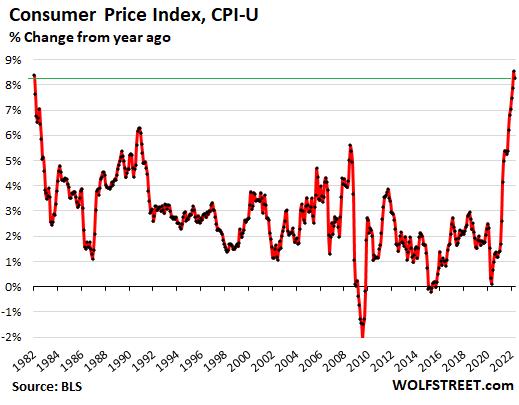

The overall Consumer Price Index (CPI-U) spiked by 8.3% in April compared to a year ago, the second worst since 1981, slightly less red-hot then the 8.5% spike in March, according to data released by the Bureau of Labor Statistics today. On a month-to-month basis, CPI jumped by 0.3%.

The year-over-year reading of CPI is never a smooth line, but zigzags up and down, as you can see in the chart above, because the year-over-year reading depends on two factors: The base figure last year, which creates the “base effect,” and the current figure.

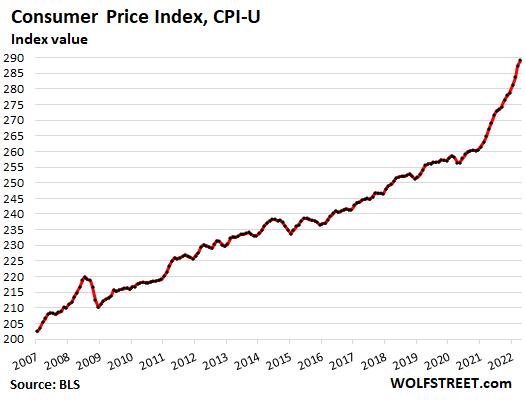

The index itself, not the year-over-year change in the index, is not subject the base effect, and is shows where this horror show is going and its cumulative effects:

For most people, actual inflation is a lot worse because CPI lags in picking up housing inflation, as we’ll see in a moment, and because CPI is skewed to the big spenders, meaning higher-income households. As Fed Vice Chair Lael Brainard pointed out earlier this year, lower income households face inflation that is much higher than CPI, and they feel it much more because they spend most of their income on necessities, where price increases have been particularly harsh.

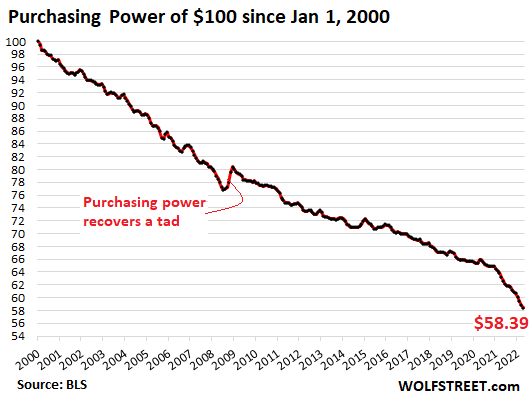

WHOOSH goes the Dollar’s Purchasing Power.

CPI inflation tracks the loss of the purchasing power of the consumer’s dollar, including the purchasing power of labor. It’s not a sign of growth or wealth or anything. In April, the purchasing power of $100 in January 2000 dropped to $58.39, and this is why these kinds of price increases ruin the mood of American consumers:

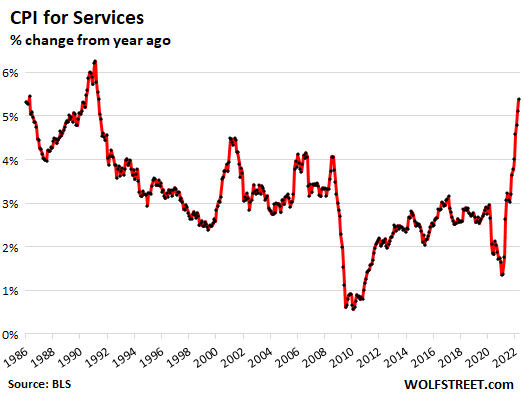

CPI inflation in services spikes.

The CPI for services spiked by 0.8% in April from March, sharply accelerating in recent months. This pushed the year-over-year increase to 5.4%, the worst since 1991. This includes housing costs, which we’ll get there in a moment, plus other items, such as:

- Health insurance: +10.4%

- Airline fares: +33%

- Lodging in hotels, motels: +22.6%

- Car and truck rental: +10.4%

- Delivery services: +13.9%

- Laundry and dry-cleaning services: +10.3%

CPIs for housing costs jump, trying to catch up.

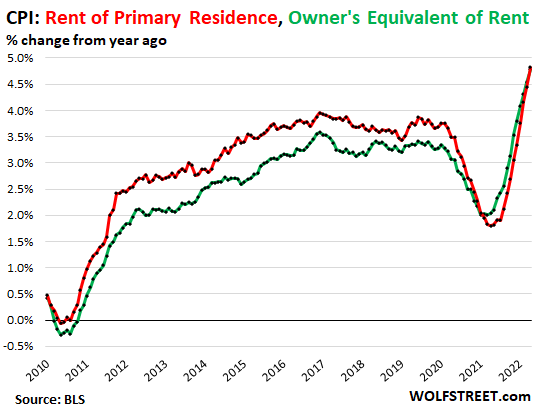

The CPI for “shelter” is the largest component in the overall CPI, representing a basket of services that is designed to reflect housing costs as a service. It accounts for 32.5% of total CPI. The largest components in this basket are “Rent of primary residence,” accounting for 7.3% of total CPI, and “Owner’s equivalent rent of residence,” accounting for 23.8% of total CPI.

“Rent of primary residence” jumped by 0.6% for the month and by 4.8% year-over-year (red in the chart below). This tracks what tenants reported as the change in their actual rent payments, including in rent-controlled apartments.

“Owner’s equivalent rent of residences” jumped by 0.5% for the month and by 4.8% year-over-year (green line). This tracks the costs of homeownership as a service, based on what homeowners report that their home would rent for.

Both measures are still below the overall CPI and therefor are still holding down CPI, just less than before.

These two rent measures are lagging, and they will continue to rise as they catch up, even if housing inflation were to cool down a little over the next 12 months. So these housing components that account for nearly one-third of CPI will fuel CPI inflation well into 2023 (my discussion of this phenomenon).

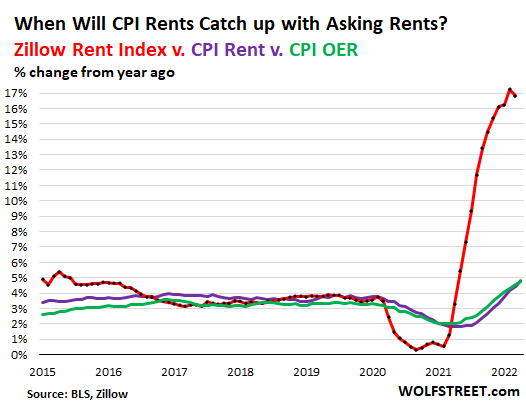

“Asking rents,” on the other hand, track advertised rents and are a measure of what landlords are asking for their apartments and houses that they have listed for rent. They do not reflect actual rents paid by tenants. But they show where the market is “today,” and these asking rents are red hot. The Zillow Rent Index has shot up 16.8% year-over-year, despite the slight dip in March (latest data available). Even though “rent of primary residence” (purple) and the “owner’s equivalent rent” (green) are now trying to catch up, they have a lot of catching up to do, and they’ll catch up some more, but with a lag:

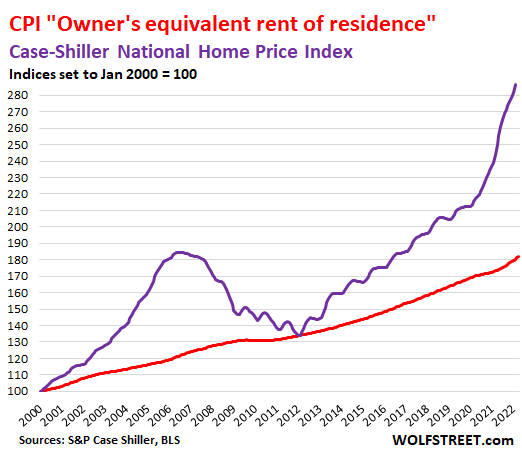

The cost of buying a house spiked by 19.8% year-over-year, according to the Case-Shiller Home Price Index (purple line below), reflecting the raging mania in The Most Splendid Housing Bubbles in America.

The CPI doesn’t track the cost of purchasing a house (an asset); but attempts to track the cost of the service that a home provides, namely “shelter,” which it does with its “owner’s equivalent or rent” (red). Both indices are set to 100 for January 2000:

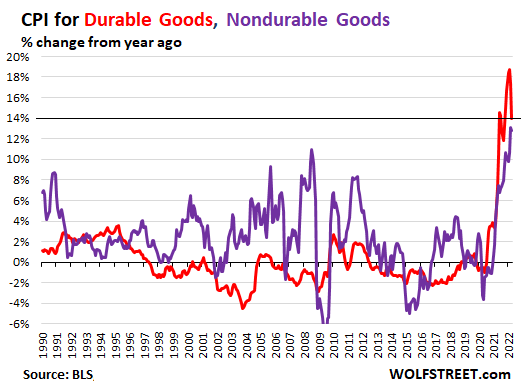

Inflation in durable goods v. nondurable goods.

The CPI for durable goods – new vehicles, used vehicles, consumer electronics, furniture, appliances, etc. – was roughly flat in April from March. Year-over-year, it was up a stunning 14.0% (red line). The last five months had been the worst year-over-year spikes in the history of the monthly data going back to the 1950s amid ridiculous price spikes in used and new vehicles.

The CPI for nondurable goods – dominated by food, energy, and household supplies – declined by 2.5% for the month, whittling down the year-over-year spike to 12.8%, the second worst since 1980 (purple line):

“Food at home” CPI inflation spiked by 1.0% for the month and by 10.8% year-over-year. Major categories, and their year-over-year spikes in CPI inflation rates:

- Cereals and cereal products: 11.9%

- Beef and veal: 14.3%

- Pork: 13.7%

- Poultry: 15.3%

- Fish and seafood: 11.9%

- Eggs: 22.6%

- Fresh fruits: 8.3%

- Fresh vegetables: 6.2%

- Dairy and related products: 9.1%

- Coffee: 13.5%

- Fats and oils: 15.3%

- Baby food: 13.0%

“Food away from home” CPI jumped by 0.6% for the month and by 7.2% year-over-year, the most since 1981. This includes any food eaten outside the home, from snacks in vending machines via cafeteria food to high-end restaurants.

The Energy CPI fell in April from March, on a sharp pull-back in gasoline, now already obviated by a new reality as gasoline and diesel prices on Monday spiked to a new record high, rendering the drop in April “transitory,” to use Powell’s term. Compared to year ago, energy CPI spiked by 30.3%. This Energy CPI weights 8.3% of overall CPI. Some standouts:

- Gasoline: -6.1% for the month, but +43.6% year-over-year.

- Utility natural gas to the home: +3.1% for the month and +22.7% year-over-year.

- Electricity service: +0.7% for the month, +11.0% year-over-year.

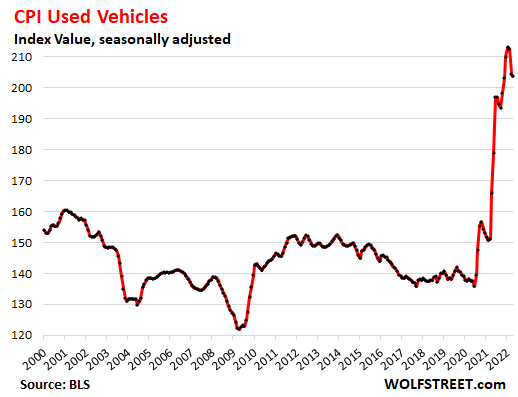

The used vehicle CPI declined for the third month in a row from the prior month, but this time just 0.4%, after the 3.8% drop in March, unwinding a small portion of the ridiculous price spike last year. Year-over-year, it was still up 22.7%. This chart shows the index value (not the year-over-year % change of the index value):

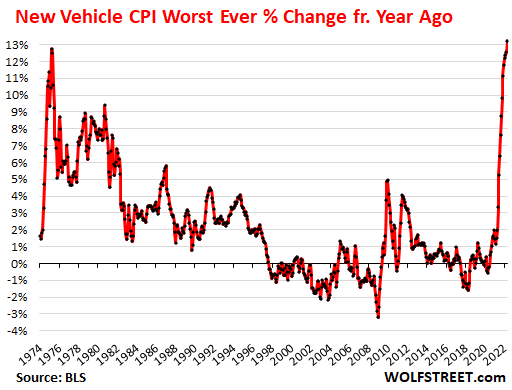

The new vehicle CPI spiked 1.1% for the month and by 13.2% year-over-year, the worst spike ever in the monthly data going back to the 1950s, amid widespread “above-sticker” prices and nearly empty dealer lots:

“Core” CPI.

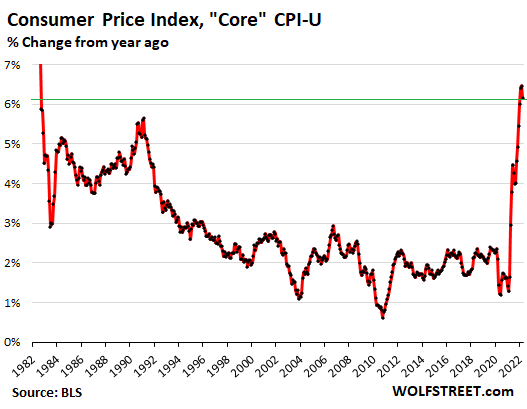

The “core” CPI, which excludes the volatile commodities-dependent food and energy components, attempts to measure inflation in the broader economy. It jumped by 0.6% for the month, accelerating from the prior two months (0.3% and 0.5%), and by 6.2% year-over-year, down a tad from March, and the second worst since 1982:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

CRAPTOS CURRENTLY CATASTROPHICALLY CRASHING!!!

BIT IN CRISIS…

COINBASE warns bankruptcy could wipe out user funds…

Loses half its value in week…

Billionaires’ Vast Wealth Destroyed…

Crypto market awaits rescue…

FAST FOOD LABOR SHORTAGE SOLVED !!!

The worst is the collapse of UST, that supposed “stablecoin”.

Not surprising since crypto is actually nothing valued at something.

Best joke from the last decade: Crypto is a good hedge against inflation.

ROFL Coin launching tomorrow!!!

Yes, what a hedge!! They were all chanting it..Got to watch yourself out there…

LOL, as if the crypto-tulips ever had value.

What we are seeing is Thomas Jefferson’s prediction about the theft of all Americans’ wealth by banks through inflation if they were given the power to create money, as they were given that power by their Federal” Reserve getting that power, slowly coming true. Commenter John Apostolatos wisely reminded us of it.

President Jefferson was a genius!

remember INFLATION is govt made up word

it is REALLY the DEVALUATION of the fiat $dollar

because we no longer have gold standard(though FRIENDLY NATIONS like RUSSIA do)

WE THE PEOPLE GET TO PAY FOR ARROGANT people doing the WRONG THING OVER AND OVER AGAIN

Inflation used to be defined as growth in the amount of money. With hard money, gold, it was also pretty easy to track the amount of money. With fiat money, keeping track of the amount of money and amount circulating it become more and more difficult. Along came price indexes as a measurement of inflation.

What was left out, maybe of convenience, was that stock market indexes and real estate value indexes are as good indexes to measure inflation on as the CPI. Measuring on different items those indexes only measure part of the effect inflation have. They do not measure the amount of money in circulation. Now, more money in circulation do not raise prices if the amount of goods to be bought also increase. Measuring the amount of goods is not that easy either, but the amount of real estate is somewhat easier to measure. And no, it did not increase with the speed the money did.

Then todays CPI inflation should not come as a surprise. Stock market indexes did race upwards, real estate indexes followed and estimate of money in circulation did go up. To expect that the growing amount of money would never also be used to buy consumables I find strange. That the amount of consumables to buy should increase as rapid as the amount of money another strange thought.

In hindsight, the CPI do now just show what was to be expected looking at other price indexes and estimates of money in circulation.

Most supposed “money” isn’t money at all, it’s someone else’s debt.

Most supposed “money” in the “money supply” is subject to direct default. This includes bank “deposits” which are actually loans to a bank.

That’s why the financial system remains at risk of a deflationary credit and asset price crash.

As icing on the cake, a lot of the debt is backed by real estate value. If the valuation of real estate goes down, the backing loses value. That is the flip side of mortgage-backed securities.

That is one of the why the financial system remains at risk of a deflationary credit and asset price crash. Only that the amount of money (debt), do not deflate unless there are defaults.

Price indexes may head down in an asset price crash, only defaults bring about monetary deflation of some scale.

The “Purchasing Power of $100 since Jan 1, 2000” graph always gets my attention.

If the inflation isn’t stopped fast, the dollar will soon have lost half its purchasing power since the turn of the century. Other currencies even worse.

If it wasn’t for the occasional small wiggle, the dollar would be going to heck in a straight line!

Currently both gold and crude oil have outperformed the stock and bond markets since 2000. Who would have guessed?

The future looks like stagflation too, thanks to the popping of the Everything Bubble.

Another 1-2% rise in interest rates and bond market index investors will have lost to inflation since the turn of the century.

We’ve heard of “lost decades” but this could be a “lost century” if things don’t change!

Plenty more can go wrong… Eventually something will go right but it looks like that might take a while.

Inflation *was* low for 20 out of the 21 years.

I’d argue that it wasn’t, but they told us it was and we believed them.

New Wolfstreet Dictum: Nothing Goes to Heck in a straight line, EXCEPT the value of US DOLLAR

“Straightish” line, according to Powell.

There was an old economic term once in very common use called;

Marginal Propensity to Consume

I submit it is no longer in use because wealth and income inequality are so severe that the concept no longer can be applied nationwide.

Having TWO of these terms would be admission of the situation.

TAX THE CLASS WAR MONGERS! NOW!

And pay for some intelligent capitalism, like the COMPREHENSIVE GREEN NEW INDUSTRY PROGRAM! It won’t require the dreaded communism, just more Roosevelt 1 and 2 types in government and industry, and increased taxes. The Chicago School did what it was designed to do, bring back the Gilded Age…..which sucks.

If it was low for the last 20 of 21 years, why was the MSRP on my 2001 F250 $39,000 and it is $95,000 on my 2022 I have on order?

Such a tragic story. I weep for you.

Inflation was misreported for most of those years, because the measure of inflation, the CPI, was modified and modified to hide the true inflation. Why? Inflation is and was always in the banksters’ best interests:: e.g., if the true inflation rate for those years as about 4% per year and the banksters were paying US depositors about 2% per year or less, as they were in round numbers, then the banksters were effectively stealing about 2% of depositors’ funds per year.

The sums that the banksters were paying back to depositors were thereby effectively less than what depositors had given them, even though those foolish depositors had not realized that the “Federal” Reserve’s creation of inflation was robbing them of their money.

> The “Purchasing Power of $100 since Jan 1, 2000” graph always gets my attention.

You really need to stop buying all that AdVocAdo tOaSt!

This is what needs to take place, before it can go right.

Inflate until people are broke. They stop spending, and then deflation.

I’m surprised that the volatility of volatility has been relatively mild compared to 2009. I guess that It is waiting for the real crash to begin. It takes a lot of chaos to get back to normal!

Good thing those series 1934 federal reserve notes I have are inflation-protected.

Yes. My “one dollar” “silver certificate” promises to pay me one dollar in silver . . . But what does that mean?

But . . .but . . . Surely the Federal Reserve wouldn’t try to scam me

You know you are in BIG bear when Apple leads…..down over 5% today.

Most of the workforce now believes that they can sit at home and become millionaires on rising home prices, without having to do any work.

Free Money -> Big Speculation -> No Work -> No Products & Services -> High demand -> More money chasing fewer Goods and Services -> High Inflation.

Inflation will only get in control after house prices start crashing like the stocks.

I have lot of friends who are holding multiple properties.

They are in the camp that so what the stock market is crashing.. it won’t impact home prices in any way.

Lets see. Only time would tell.

Jon,

Two of my three brothers have sold their homes in the past six months – one of them makes settlement tomorrow. I believe he caught the top of the market perfectly. My third brother will decide whether or not to sell by the end of this month. Two of the three are/will rent.

About to RTGDFA but first just based on your headline here and want the kids have done in the markets so far today at 1:45 PST: Whooshapalooza!

Bullard…….stated today that inflation is broader and more persistent than they thought…….LOL……

Gee……it sure is nice having these highly educated, connected, experienced fed heads telling the rest of us…….what the rest of us figured out a year ago…….and they get paid for this crap.

Difference between a rich man and a rich fed head………one of them worked, sweated, risked, invested and did some deep thinking. The other inherited……and always ends up in a great no show job after government service.

I used to believe that they have some sort of plan, or a reason to do what they’re doing. I genuinely believe that it is complete incompetence at this stage.

They control the math.

To understand the strategy is to understand the players.

These fools FED ,better be careful,the world has changed ,and not in a good way

FF-

“It is now widely accepted that monetary policy cannot directly deliver permanently higher levels of employment and output.”

– Lee Hoskins, former Cleveland Fed president, June 1989, Rethinking the Framework for Monetary Policy

He got it. The current crop are much less humble.

=CPI is never a smooth line, but zigzags up and down=

Since Alan Greenspan wrote “The Age of Turbulence” smooth lines can only be found in my old Paul Samuelson’s “Economics” textbook (1974 edition with yellow-brownish charts and diagrams).

Laminar Flows are thing of the past, Turbulence appears to be the general order of the day ( cue: Reynolds #).

Brigade of FED’s PhD’s is well equipped to handle EVERY chart coming their way. Non-smooth Functions can be dealt with by methods of Theory of Distributions (aka Generalized Functions).

Even weirdest of the weird functions like Dirichlet function (which has values of ZERO at irrational points and values of ONE at rational points) is Lebesgue-integrable (but not Riemann-integrable).

Bottom line:

Uncle Jerome & Auntie Janet know what they are doing.And Math will conquer the World !!!

Afternoon Brent,

I used the same exact text book. Back then, some things seemed to make sense.

😀

Remember one example from this edition where Mr Samuelson mulls the fact of truck driver making $20K per year (late 60’s – early 70’s) ?

I guess Mr Samuelson’s prayers were answered.

As to truckers-

They thought that regulation (Motor Carrier Act of 1935) was bad…

And they also thought that deregulation (Motor Carrier Act of 1980) will be good 😀😀😀

How is it that Jerome Powell can fail so massively at his job yet be reappointed, and by a new administration no less? He has been intentionally ignoring the mandate of the FED and, in turn, has created the most massive SUPEREVERYTHINGBUBBLE in the history of the world. What was this guy doing, and how come he is not held to account?

Now there is chatter that the FED needs to hike 75 basis points next meeting. But Weimar Boy Powell assured us that was not even in the conversation last time. Just more and more failure by this guy every day, with zero consequences. All of this was avoidable. All of it.

If the Fed hikes 50 basis points at every meeting for the rest of this year (6 more meetings), the top end of the target range will be 4.0%. I think that’s a good start, along with lots of QT. The markets are already doing a lot of the heavy lifting.

I trust what you say. Evidently leverage works both ways.

“The markets are already doing a lot of the heavy lifting.”

This is just letting some air out of the balloon. Except NASDAQ others are just threatening to scratch the surface of a bear market.

If they do a lot of QT, the mortgage rates will rise eventually leading to drop in home prices and economic activity due to its multiplier. One cannot be sure of the domino effect.

It cannot be without consequences (may be not a Lehman moment). You do not need a big guy to fail to set off a domino in a financial chain (LTCM) as interconnected as today. Thus you could have a credit event.

In short, there are real chances that something can break.

At that point the Fed will have to come out with a bigger printing press. Would it have any other option?

Re “Except NASDAQ others are just threatening to scratch the surface of a bear market.”

I’d argue that the modern “20% down = bear market” technobabble quant definition is nonsense.

The real definition of a bear market is psychological, not numerical. In a bull market everyone wants to own, and they’re either holding or waiting to buy a dip. But in a bear market people get progressively more distressed about holding on, most get killed every time they buy a dip, and the pain piles up. Thus at the end of the bear market most people would rather do just about anything than buy the asset. Only then does the speculative mindset get crushed, and the final bottom arrive.

The 2020 crash was more than a 20% plunge, but it wasn’t a bear market, it was a deep correction in a speculative bull market. People were itching to buy the dip, knowing the Fed was going to act.

Currently people are still itching to buy the dip. This isn’t a bear market yet.

So long as people believe in a “Fed Put” protecting them from losses, this will remain a speculative bull market.

Only when people realize the Fed is no longer backing their shenanigans, that the Fed CANNOT print to infinity, that everything people own has to deliver a return on its own… only then will the speculative fever fade into a painful realization of the consequences of a decade of poor decisions.

And it’s just this sort of inflation that forces the Fed to stop backing the market…

WS-

Insightful post.

Add to your thoughts: the perception of a safer alternative.

During turbulent markets, if the investor perceives a half-way reasonable alternative investment, he will flea from equities.

An alternative appears when nominal US Treasury yields exceed expected inflation.

As happened in 1987 when treasuries rose from 6’s to almost 10%.

Perhaps something to look forward to!

A reminder that the dummies at the Fed were still doing QE less than 60 days ago.

The idiots at the ECB are STILL doing QE, plus negative rates. This stuff is just incomprehensible.

They’re looting the countries, Wolf. It’s treason.

Yep, but who’s going to stop them?

Our ‘elected’ officials just cheer them on.

Musk, obviously.

Wonder when he will marry into the Royal Family?

The debasing of the dollar since the Federal Reserves inception, has left the dollar with almost none of the original value. They are now going for any stored or future ability to receive value.

Why has Europe done negative rates while the US hasn’t?

rates are relative. What are you comparing them to?

The Fed will never do negative rates. Why? Because the 12 regional Federal Reserve Banks are owned by the financial institutions in their districts, and those FRBs care about their owners (banks) and their stock prices. And negative rates are terrible for banks and bank stocks. Look at the 30-year chart of European and Japanese bank stocks. A horror show. Then compare to US bank stocks.

The ECB doesn’t care about banks as long as they survive. It cares about keeping the Eurozone glued together, and for a lot of overindebted governments – which don’t control their own currency and cannot print themselves out of trouble – negative interest rates lowered their debt burden. It caused a lot of harm to the economies but kept the political Eurozone glued together.

May be because there will no ECB otherwise given that without these there would be a debt crisis and no EU. They are still at “whatever it takes” and waiting for the day when Draghi is right when he said it will be sufficient.

Inflation is an unexpected and rather unwelcome guest at the ECB party.

13 months in a row of negative real wages. No wonder people are unhappy.

Yet spending like drunken sailors, and feeling rich with an inflated stock and housing market. But the end is nigh.

What about the CPI-W, which measures the inflation rate for many Americans?

8.9 %…

COLA/SSI baked in at 6% with 5 months to go…

Swimmer,

8.9%

Fiat dollar is heading toward its intrinsic value of Zero. It’s an old true story.

DR Doom

The US $ losing purchasing power continuously. It’s (1913 dollar) is now around 3 cents or less!

Inflation even if it is 1%, one loses the purchasing power of the $

But there is NO other global currency ready to replace US $ b/c no one wants run deficit along with imports. Some trading is going between Countries out side the SWIFT but NOT threaten US $!

What good is FED “forward guidance” when it isn’t worth the paper it’s printed on?

June, 2020

“FED: No rate hikes through 2022″

“We’re not thinking about raising rates,” Fed Chairman Jerome Powell said in a press conference. “We’re not even thinking about thinking about raising rates.”

He did say he wasn’t thinking. Credit where credit is due.

Actually, what he meant is “were not thinking at all”.

Jokers! However “the arsonists” are data dependent and act when the fire gets going come in the guise of “firefighters” and if they manage to put out the fire claim to have the “courage to act” and saved the world.

Hopefully the fire of inflation will engulf these “arsonists and firefighters” this time.

Start investing in good shoes and boots, because you’re not going to be able to afford to drive a car very soon.

Aside from saving money, walking would be one of the best things you can do for your health. But if the commute is 30 miles one way, that’s kind of a tough proposition :-]

Agree with you wholeheartedly, Wolf. People need to exercise more.

Homes/apartments near light rail in Phx Metro are selling quickly for still higher and higher prices.

Gas prices are driving some real estate values higher yet.

Do these higher prices imply higher reported profits?

Avraam Jack Dectis,

No, though they might in some cases.

Higher prices imply higher reported revenues, if sales volume remains the same despite the higher prices. This is not always the case, and then we’re talking about “demand destruction,” when higher prices generate a buyers’ strike, and people buy less.

Higher prices also mean higher costs for companies, including higher material and component costs, and higher labor costs, and that’s a squeeze on profits. Some precarious companies may not be able to deal with the higher costs because they cannot pass it on via higher prices, and then companies fail. We just had one of those bankruptcy filings.

High inflation is a double-edged sword for companies.

1) Since Paul Volcker Dec 1979, inflation trend is down.

2) Those shooting star multi CPI coming out from the bottom might drop all the way down, leaving behind a large selling tail.

3) It is a sign of weakness, a stopping action.

4) It stopped the deflation only temporarily.

5) JP might run out of RRP liquidity.

6) The downturn might cont all the way to the bottom.

7) LT CPI : down from 5.6% in July 2008 to (-)2.1% in July 2009. Up to 3.9% in Sept 2011, before floating slightly above zero in May 2020. The vertical rise to 8.5% was next.

8) It’s not sustainable. It will come all the way to the bottom, before “hammering”, breaching 2009 low.

9) Where might it stop : between minus (-)10.70 in July 1932 and 2009 low.

10) Can the Nasdaq bounce back up next week : yes !

ME

Can the Nasdaq bounce back up next week : yes !

Then puts will become a bit cheaper and I can buy more SQQQ ++

Bear trap ‘rally’ sucking dip buiyers, now for the 6th continues days!

Without EASY-PEASY money ( Fed’s put) mkts lack direction but hammered by inflation, potential rate hikes, supply chain squeeze and the oncoming QT!

Why any would buy any stock/etf/or MFund, unless they are programmed to against the mkt! STOCKS do GO DOWN. The ZOOM up played for the last 13 yrs will be in the opposite direction!

There were some greedy players and fools, but I feel really bad for reasonable and innocent folks who are at the wrong end of this.

But the political branches of government just seem like frozen deer, or blustering ad men. So much finger-pointing. The financial system needs reform. A new book, The Fed Unbound, takes it apart intelligently and makes some suggestions. Maybe that’s the easy part, but folks need to start somewhere. Because the problems so treacherous in ’08 have not been solved.

Let me guess? The author didn’t recommend getting rid of monetary policy, did they?

There is no reform or sound “macro prudential regulation” for government created moral hazard.

Problem with the financial system is that it is designed to fail, most just do not know it.

Because debt defaults at any scale are not permitted and the economics profession has been infected by its own hubris (by somehow getting the idea that an economic contraction can be avoided forever), financial system requires permanent debt expansion or it collapses. That’s why the FRB’s balance sheet also has to permanently expand whether by increasing the “money” supply or QE. Add reckless private sector speculation and then QE + FRB “put” + ZIRP become “necessary”.

Then add more government moral hazard in the form of an alphabet soup of government guarantees, like deposit insurance and mortgages.

The cheery on the top is manic market psychology.

phleep

‘The financial system needs reform’

?

It was long overdue in 2009 but instead, Fed covered the problems with insane credit creation! GFC will look like a walk in the park, by the time this bear hits the slough!

Most of the retail investors will end up, holding the bag, just like 2000 and 2008!

First you couldn’t afford a house so you had to rent. Then you couldn’t afford rent so you had to resort to an RV. Then you couldn’t afford an RV so you started to live out of your car. Then you could no longer afford a car and you’re on the streets. What a great f***ing country, huh?

” … In America, if you don’t have a dollar you have a right to choose between sleeping in a house or on the pavement. …” (Khruschev, “kitchen debate” with Nixon)

We got a “Gas Station from Hell” in Glen Echo MD, two blocks from where I used to live. The Exxon station just busted the $499 price for regular. Now posting $539/gallon for regular, $599 for premium. This gas station is the same one I used during the Carter gas line era, where I used to get up at 3AM and park my 78 ford mustang piece of crap at the front of the line. Then I walked back home went back to sleep and came back at 7AM when they opened. This worked like a charm back then.

I remember, not too long ago, when it was $0.10/gallon more per grade step. It rapidly went from $0.10 to $0.20 to $0.30 to $0.40, then to $0.60. Can anyone explain that?

Inflation.

We get the massive sucking sound of inflation, and the ka-thummmp of the tech darlings falling.

yeah but at year 2000 purchasing power of $100 was 97 percent less than in 1914

Below, data from the last housing bust in the U.S., not seasonally adjusted, of the twenty cities monitored by Case-Shiller. Home price indexes only, including the U.S. National Home Price index, for reference. The list is sorted by first local market to peak, to last. Percent change from market top to bottom, for each market is included.

Boston September 2005 -20.1%

San Diego November 2005 -42.3%

Detroit December 2005 -49.2%

Denver March, 2006 -14.3%

Los Angeles April 2006 -41.9%

San Fransisco May 2006 -46.1%

DC May 2006 -33.9%

New York June 2006 -27.1%

Phoenix June 2006 -56.0%

N.P. Index July 2006 -27.4%

Cleveland July 2006 -23.7%

Tampa July 2006 -48.0%

Las Vegas August 2006 -61.5%

Minneapolis September 2006 -38.1%

Miami December 2006 -51.1%

Chicago March 2007 -39.1%

Portland April 2007 -30.1%

Dallas June 2007 -11.3%

Atlanta July 2007 -40.0%

Seattle July 2007 -33.0%

Charlotte August 2007 -17.8%

In Seattle, another 33% loss would wipe out only a year or two of price gains. That might mean we are looking at the possibility of a 50% loss this time around.

Must be a lot of MSFT and AMZN employees in the Seatle metro that are or were worth 7+ figures from equity awards.

A crash in both stocks should help housing affordability.

It hasn’t happened yet.

This is the only site I have found that breaks it down to this level. Thank you!

Otherwise I have to pick apart what little other sites post and get past the BS headline…e.g. oh yoy we’re doing a little better, but mom core CPI is headed in the wrong direction. And inflation was much hotter last April than March so the April 22 yoy number is quite bad.

Jefferies analyst believes 0.75% rate cut has to be on the table now. We’ll see. J Pow was probably hoping he could wait till after the midterms, but the way this is headed the ultimate damage could be way worse if they keep this slow pace.

Until companies stop hiring and start firing and people spend down savings and put their wallets away I don’t see how inflation goes down with the other global factors.

Watch that core CPI. It will continue to drop more and more each month all year.

That’s because we are still comparing depressed, recession prices from a year ago with prices that have recovered.

According to BLS, prices have recovered to the 2019 Q4 baseline, plus 3.5%.

That means that prices in April 2022 are what they WOULD HAVE BEEN in April 2021 IF there was no recession and we had normal inflation in 2020.

But the baselines you are using for this article are the still-depressed prices from April 2021, so of course the inflation numbers are off and making a false alarm case that prices are elevated way above the baseline.

I’m not the only one who thinks so. Chuck Jones just did an article about this in Forbes.

The ONLY thing that remains a wild card is oil and fuel. Housing, cars, groceries, etc, all priced in and not above the true baseline. Large producers of vegetables may pass on some costs later, but that will be offset by a great year for local small producers.

Core CPI dropped to 6.1, from 6.6 in March. That reflects the very small price recovery that began in April 2021 and continued all last year. The price recovery was larger every month. The inflation scare is a phantom that doesn’t represent a real problem.

People are paying 2019 prices with 2022 wages. Even if you price in the 3.5% extra for 2020, people have still been ahead and will be breaking even in May. After that the inflation numbers keep going down and wages will keep going up.

Add to that the strong dollar against all other currencies and the US economy leading all other economies into recovery

No matter what scare stories are getting spammed, we are heading into a boom, not a recession. Two thirds of investors are not listening to the doomsayers.

1. There is a typo: “Core CPI dropped to 6.1, from 6.6 in March.” No. I dropped from 6.4% in March. Much smaller drop.

2. Close 42% of core CPI are the shelter CPIs, including the rent CPIs. And they’re spiking. They were still lower than core CPI, so they still held down core CPI in April, but they’re spiking, and in a few months, they will higher than core CPI and they will push up core CPI mercilessly.

3. Other services are prominent too in core CPI, and they’re spiking too. Core CPI is going to dish up some nasty surprises.

Inflation is now bending Jerome Powell over a barrel while whispering in his ear: “How do you like me now, b!tch?”

Small local producers of vegetables, like the ones that I shop at in the Twin Cities’ farmers markets, are well behind schedule due to a wet and cold April. In Minnesota, the growing season is not that long, but this year it will be even tighter from a late start.

The bulk of my grocery store bill is from the produce section. Now, I do most of my produce shopping at Trader Joe’s instead of Cub Foods. I have been a loyal Cub customer for over a decade, but it’s time to adapt and go where the better produce and price is.

Target stores with large grocery sections are also quite competitive. The ‘Red Card’ gives a 5% discount as well.

Local Safeway Just raised Lamb Chops shoulder cut from$7.49 Lb to $9.49 LB Humm

Is that Not like all of a sudden in one day Gas going from$7.49 to $9.49 a Gallon ? as both are under $10 yes ?

Pandemic and Inflation are a common denominator it seems for at least Inflation wise .

The Fed Jacks short Term make that tickles not Jacks but no increase from in interest rates from Banks or credit unions or just a Insult type increase . Alliant CU went from APY 0.55 to APY of 0.60 after the Fed did a 1/4Point increase and nothing after the 1/2 point Fed increase

So central Banking tied right in with the Fed agenda by Not Responding ?

Birds of a feather comes to mind .

The Charts are great and tell the obvious story of our Dilemma

So currently raising Rates has slowed the markets but not increased Saving rates to speak of as Banks and CU’s seem to be keeping the Money in house like hoarders

Sri Lanka coming to America soon

I asked the butcher at my local supermarket if they had any veal cutlets this past weekend. He said they haven’t carried them for the last 2 years. I hadn’t realized it because we usually can’t afford it. The veal would have been my mother’s day gift. But the economy is doing great!

Petunia,

Anyone still eating veal at home in the US? I thought if you want to go upscale, you go to free-range grass-fed beef. Or maybe the opposite, Wagyu beef. But veal?

It’s useful for some things, where tenderness is important, especially Italian. For example pounded super thin (scallopine) rolled with stuffing. It’s much better than using tougher cuts of mature beef. Although that is done, too, and similarly with things like swordfish (primarily in Sicily).

Veal cutlet parmigiana with spaghetti and garlic bread. One of my favorites.

Was simply amazed at the price of groceries this afternoon. Many things at Kroger seemed to go up 20% this past week!

Just bought some yard mulch for Spring clean up. It’s at least 30% higher than last year, and they say it’s on sale!

I do not understand mulch. Each year you have to put a lot more mulch down (and it smells bad too). I use rocks from my local landscape place. Place once and done every 5 years or so I get a minimal amount to top it off(settling).

Much cheaper to maintain, upkeep is minimal.

Did you use a weed mat? Or spray during the growing season?

For every new-/newish- neighborhood I’ve lived in, the builder stripped & sold all the topsoil before building. A wood mulch will decay & breakdown, forming a layer that supports beneficial insects, worms and the like. Rocks may help to prevent weeds, but if you have plantings, you’ll need to use more fertilizer than if you mulched using organic materials.

I’m glad I like peanut butter and jam. When jam gets too pricey I’ll change to jelly.

You know how they’re made right? Powell carefully chew each strawberry and spit into a jar for the jelly, or squeeze them between his toes for the jam. Umm I don’t think you want to know about the peanut butter…

Rocks are about the same cost as mulch. I was afraid they would load up with leaves etc., but they don’t seem to. Good mat underneath, and thick layer of rocks, and no weeds so far.

Great report Wolf! Please send a copy to Jerome Powell at the FED In Washington DC and request he fire all of his it’s only “transitory” economists. I also suggest that the Fed funds rate always = the previous months CPI rate.

Agriculture production is in a decline from a double-barreled combination of human actions and Mother Nature. This will be a problem that makes a lot of other inflation issues seem less important. For many, the cumulative toll will be pushing them, and their families, to the breaking point.

I hope that I am wrong.

Time is running out in the Red River Valley of the North.

Dan R.-whether the RedRiver Valley, Lakes Powell/Mead, et al, too many still firmly believe air comes from the sky, water comes from a tap, and food from the supermarket…

may we all find a better day.

So the C-Suite in my top fortune 100 company is reporting more then 500 million in loss, in Q3, due to inflation and supply chain problems. This is okay because we are sitting on massive reserves of cash and cash is king (their words). I take it from this chart – they are wrong. I wonder if labor cuts are coming soon and they are doing their best not to scare the labor force. After all, they plan to cut near a billion in their budget over the next 5 years.

I’m Fortune 500 but the CEO was very concerned about client sentiment this week.

We won’t record losses for a very long time but our clients will. Luckily I’m on a team that should be fine but for most depts who do… something? They should be worried. 2500 carvana Emps showed up yesterday to their shit already packed in a box.

It doesn’t matter how much liquidity a company has, it’s the Street’s earnings estimates that matter.

Got to “beat the Street” consistently or the pink slips will be coming anyway.

Look for a lot of pink slips in the near future if the stock market doesn’t recover with a noticeably better advance/decline line.

Ugh, wife bought a can of Spam for $4 after tax… I understand substitution but $4 for a can of spam!?!

Phone rings.

Mr. Halibut?

Who did you call?

We called you.

Ok. Well, I’m me.

What would your house rent for?

Depends on what you want it for.

It’s a poll Mr. Halibut.

Huh? Like a stripper pole?

No, just doing a poll.

You got gals that want to do something with a pole? In my house?

No, it’s just a poll.

You wanna rent my house, bring in a stripper pole, and you ain’t got no gals? You wanna bring in squirrel monkeys to swing on a pole in my house? Is that it?

No. I don’t have gals or monkeys.

But you got a pole? Ok. Good talk, Russ. I gotta go.

A useless statistic can still be useful as long as it is used on a consistent basis.

BLS are experts at that.

Halibut,

I know you’re trying to be funny, but that’s not how the surveys are done (except in your imagination).

And if you were trying to make a serious statement, you made a silly statement instead. Go read up on how the surveys are done. Quite interesting. And they’re huge.

When the stock market started melting down in 2020, the FED showed up on the scene in a day to hammer rates to zero and promise to support the whole thing, so the wealthy didn’t have to suffer some uncomfortable paper losses in their portfolios. Fast forward a few years to the middle class and the poor getting absolutely annihilated, and the FED slowpokes their way around, talking sh!t and stalling.

Inflation is a non-issue, even at multiples of the current situation.

At least in comparison to zero availability of the things you need to make your own products.

We have now had two suppliers tell us, sorry, can’t get parts, can’t redesign,, can’t hire anyone to make these things, no more soup for you, your money is no good, no matter how much you have.

Today I was trying to buy 3/16″ female spade connectors. About 90% of such items are zero stock at all the big distributors, with only the highest priced, odd application, inconveniently packaged types available.

Tiny stamped metal pieces, zero stock.

Has everyone quit making everything?

Are we somehow using things up at a ridiculous rate?

All of these items are made in CHINA, and China is f*cking us on purpose.

Easier to stomach than your own back yard doing it.

Has everyone forgotten that the government is going to be pumping $10 billion a month into infrastructure projects?

Each one of those dollars is going to create DOUBLE the stimulus in the private sector AND interest rates are still low AND the Fed is going to be flush with cash to lend since they are not rolling over a trillion in corporate bonds to prop up the financial sector bubble this year.

Infrastructure spending doesn’t get squirrelled away into multi million dollar paintings or yatchs or useless bitcoin wallets (Unless you live in Russia). It pays actual people, here in the US, good wages to increase our standard of living across the board.

Someone is going to earn some of that money creating a supply chain for whatever widget is needed. Crybaby losers will sit on their hands and throw tantrums. Capitalists will roll up their sleeves and get it done.

“$10 billion a month” WOW! Huge. $30 billion a quarter. That’s what Apple earned in net income in Q1, hahahaha. Dude, you’ve got to keep a sense of proportion. The US economy is $24 trillion with a T. $10 billion a month with a B isn’t even a rounding error.

RTGDFA

Services inflation.

At what price do you suggest by sp500 etf? 3200, 3500 or 3800

None of the above.

“the trend is your friend” – retracement of S&P to 2990 is POSSIBLE easily in this deleveraging scenario. look at 2008 ( a different type of crisis) but this is turning into one SLOWLY. reversion to the mean is expected. Wolf has clearly explained how a contraction of the “dollars created” is needed to cool inflation which will then allow for normal and orderly growth. PS. Carvana is still overvalued, lots of used cars at high prices moving slowly. NOT a bear just used the excellent reporting here to hedge 2008 to dec 2021 market gains.

“The average hotel price in the US right now is around $147, per The Washington Post, citing travel research firm STR. That’s $42 higher than last year and $15 higher than 2020.”

Only on a few occasions in the last 50 years have I paid more than average.

Unfortunately, when in the US recently, I couldn’t fall back on my technique of buying some good quality alcohol and sleeping in a car or other low cost alternative. Having a wife alters my cheapskate personality.

Not easy to get around these days for people on a tight budget.

How’s that crypto inflation hedge workin’ out? The carnage – it burns. One of those “stablecoins” crashed 99% in a day. LMFAO. There are 35% losses in many of the “major names.” T’was fun while it lasted, huh you reckeless, degenerate gamblers?

“$1 Trillion Crypto Meltdown—Huge Crash Wipes Out The Price Of Bitcoin, Ethereum, BNB, XRP, Cardano, Solana, Terra’s Luna And Avalanche”

I wonder if part of the rent spike is because the forced “rent moratorium ” on landlords of the last couple years? Landlords are saying I have to make up for all the money I lost because my renter skipped town after the rent moratorium ended? Or before the government limits my future rent increases?

All those “free” government Covid checks you will pay back in the end with inflation. Nothings free people!

Many moratorium rent deferrals are being paid by the government. Residential income property owners are assisting the renters and getting back rent. So the landlords aren’t hurting unless they’re unable to figure out how to get that reimbursement.

Wisdom Seeker,

Well said!!

1) We prepared for a kinetic war, but a war with a virus.

2) The winners get inflation. The losers deflate, until they flip.

3) The highest inflation registered was after WWI. Up from minus (-)1%

in 1915 to 19.60% in 2017. Inflation was raging between 1917 and 2020,

rising to the highest level ever, to 23.70% in June 1920, before plunging

to minus (-)15.80% in June 1920, the lowest.

4) In Apr 1942 inflation was 12.60%, testing the lows of the 1917 – 1920,

before plunging to zero in May 1944. The losers deflated. The

WWII winner got 19.70% inflation in Mar 1947. After a failed test of

1917 – 1920 inflation dropped to minus (-)2.90% in July 1947. The DOW

was ready on the launch pad took off, rising from 164 to 1,000 in 1966.

5) After the plunge of 1920 to (-)15.80%, when the comatose Fed got a booster, inflation rose to 3.60% in Aug 1923. Inflation fluctuate between (-)3% and +3% in the 1920’s, until July 1929, plunging from 1.20%

to minus (-)10.70% in Aug 1932.

6) Both inflation and deflation might have either a sharp top or bottom, or a rounded, longer top or bottom. Adam and Eve.

7) We don’t know what will happen next, but the crazy 8.5% inflation isn’t

the max..

8) 1915 to 2022 look like a triangle.

Has a 1930s cyclical feel

8.3% inflation rolling over? The CPI is fully 0.976 of the prior month. It is 4.15x the FED’s 2% target (price stability).

When Paul Volcker made is Oct. 1979 policy pronouncement to target the money supply, it then took c. 26 months to tame inflation.

Who the hell is this Lisa Cook who just got appointed the board of the Fed. She’s is the Woke of the Woke governors. How can anything good come out of the Fed with these kind of people on board? Look more money printing and inflation.

Housing prices are the inverse of that purchasing power graph.

Well, your focus on reality is sobering, killjoy.

I saw they consecrated Jerome Powell to continue another four years of grift. Rescuing the stock market whenever their clients are going to lose too much money. Meanwhile, the grim reality for the 96 % of people in America whose savings income was cut to zero is well zero income on their savings. Funding the top 5 pct.

The whiners on wall street calling for the Fed to save them has reached a crescendo, culminating in the reappointment of the worst Fed chairman, in history. Heck of a job, Brownie.

The turmoil in the stock market is a diversion for the real tragedy of 10 pct inflation. While the wise guys on wall street bemoan a meager 20 pct decline in the 100 pct gain they made borrowing zero pct money to buy stocks.

Meanwhile, their victims became poorer.

While I believe that “Poverty is a fertile bed for kindness and hope”

I prefer a more egalitarian society

Well, I lived through the era of Paul Volcker, Chair Powell, and you sir, are no Paul Volcker.

Your idea of suffering is a loss in the stock market. Your ambivalence about the decline of our society as a direct result of your policies is devastating not only on it’s effect on the American myth but your ignorance of the effect that policies that your ignorance has engendered.

I’m pretty sure you don’t remember the dog faces that insisted on the egalitarian society, best described in FDR’s 1944 second Bill Of Rights.

Among these are:

The right to a useful and remunerative job in the industries or shops or farms or mines of the Nation;

The right to earn enough to provide adequate food and clothing and recreation;

The right of every farmer to raise and sell his products at a return which will give him and his family a decent living;

The right of every businessman, large and small, to trade in an atmosphere of freedom from unfair competition and domination by monopolies at home or abroad;

The right of every family to a decent home;

The right to adequate medical care and the opportunity to achieve and enjoy good health;

The right to adequate protection from the economic fears of old age, sickness, accident, and unemployment;

The right to a good education.

All of these rights spell security. And after this war is won we must be prepared to move forward, in the implementation of these rights, to new goals of human happiness and well-being.

America’s own rightful place in the world depends in large part upon how fully these and similar rights have been carried into practice for our citizens. For unless there is security here at home there cannot be lasting peace in the world.

dang-many will scoff, but what you’ve eloquently recounted was, for a brief moment in time, a vision that truly made our country (to paraphrase Franklin at an earlier point in our world/national/technical evolution) ‘the last great hope for humanity’…

(on a more mundane note, why would anyone think things in general would get better with a constant reduction of people occupying the first four taxpaying points?).

may we all find a better day.