Is this spread heading to what happened in the 1970s and 1980s when the Fed battled blow-out inflation?

By Wolf Richter for WOLF STREET.

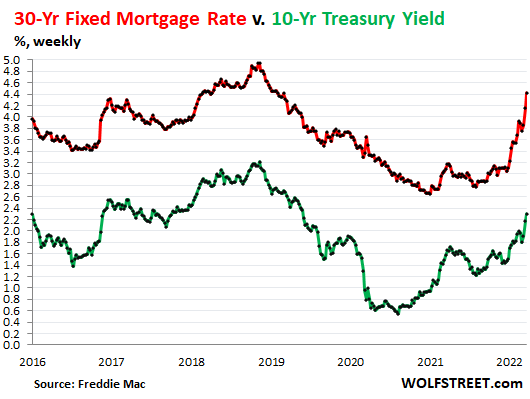

The average 30-year fixed mortgage rate tracks the 10-year Treasury yield, running roughly in parallel but higher. It tracks the 10-year yield because the average 30-year mortgage gets paid off in just under 10 years, either through the sale of the home, or through a refi. But they don’t move in lockstep, and the difference between the two – the spread – has been widening sharply, with mortgage rates suddenly rising much faster than the 10-year yield.

The US Treasury 10-year yield has shot up since the Fed made its infamous “pivot” in the fall of 2021, from willfully ignoring and assiduously brushing off the incredibly spiking inflation to actually acknowledging, even if tepidly at first, its existence and persistence.

Back in August 2021, the 10-year yield was still at around 1.3%. Today it’s 2.34%, having gained 1.03 percentage points in seven months. Over the same period, the average 30-year fixed mortgage rate, as tracked by Freddie Mac, jumped by 1.55 percentage points, from 2.87% to 4.42%:

The chart above shows what happened during the March 2020 chaos, when the Fed cut its policy rates to near 0% and announced a huge QE program which caused the 10-year Treasury yield (green line) to plunge, while mortgage rates just continued their methodical decline that lasted through December 2020.

That decline in mortgage rates was kicked off in late November 2018, when Powell, getting hammered on a daily basis by Trump, caved and communicated that the Fed would soon stop tightening.

At the time, inflation was below the Fed’s target, and the Fed was hiking rates that were already above CPI and it was reducing its balance sheet at a rate of about $50 billion a month (QT). Housing was getting hit, and stocks were tanking, and Trump, who’d taken ownership of the Dow, had had it.

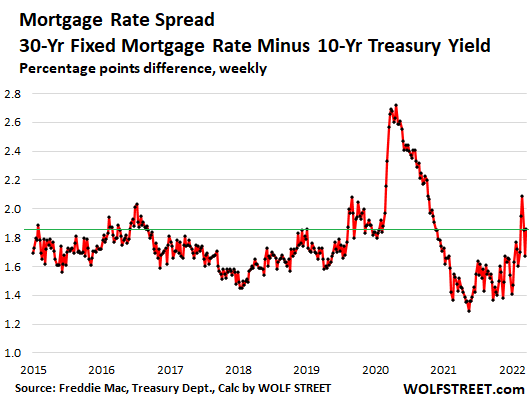

The fact that the 10-year yield plunged in March 2020 while mortgage rates were only slowly declining caused the spread between the two to blow out. It maxed out at the end of April at 2.73 percentage points.

The average 30-year fixed mortgage rate continued to drop until it hit a historic low in December 2020 of 2.66%.

But the 10-year Treasury yield had started rising four months before mortgage rates started rising, bouncing off its historic low of 0.55% in August, causing the spread between the two to narrow. By December 2020, when mortgage rates had hit their low point, the 10-year Treasury yield had risen to 0.9%. And the spread continued to narrow into 2021.

Part of what contributed to the very low mortgage rates in 2021 was the narrow spread between the 10-year Treasury yield and the 30-year mortgage rates. At the time, it ran in the range between about 1.3 percentage points and 1.6 percentage points.

But in January 2022, the spread suddenly started widening, with mortgage rates rising much faster than Treasury yields. As of the latest weekly mortgage rate, the spread has reached 1.81 percentage points, after having hit 2.09 percentage points in early March. Note the increasing volatility of the spread:

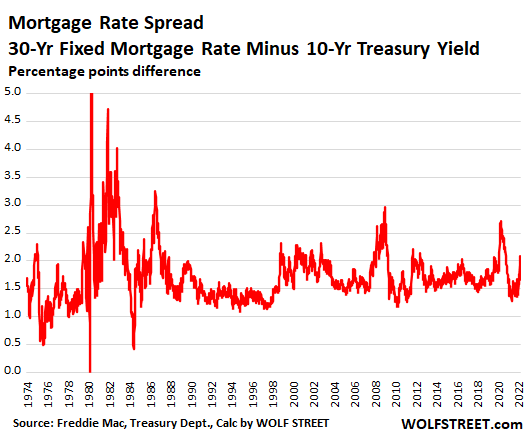

Long-term patterns show just how much the spread can widen. The massive widening in March 2020 and during the Financial Crisis occurred because the Fed aggressively pushed down Treasury yields while mortgage rates lagged.

But in era between the mid-1970s and the mid-1980s, the Fed was aggressively pushing up Treasury yields to battle the markets with massive rate hikes. And mortgage rates in 1980 — like today — were running ahead of the 10-year Treasury yield as lenders were trying to deal with inflation. Eventually, Treasuries caught up, and then there were massive rate cuts, followed by more massive rate hikes, followed by massive rate cuts, and the spread blew out and shrank with huge volatility:

The current situation – an incredibly spiking inflation that the Fed is belatedly getting serious about – is much closer to the scenario of the 1970s and 1980s, than it is to the Financial Crisis and the March 2020 crisis. During the latter two, spreads widened because the Fed pushed down Treasury yields while mortgage rates lagged. Now the spread is widening because mortgage rates are running ahead and are rising faster than the 10-year yield. It’s likely that the spread will be very volatile, and potentially very wide for certain periods, with mortgage rates potentially outpacing Treasury yields by a wide margin during these periods, before Treasury yields catch up or mortgage rates back off.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I thing it’s reflecting that MBS tightening will be bigger than T-bond one in QT.

Meanwhile total Fed assets rose again by $8 billion this week after rising by $44 billion last week. So here we are speculating on QT in face of blatant money printing despite the untrustworthy Fed saying that it “MAY” consider QT in “FUTURE”.

All Jawboning with little actual action : 0.25% rate hike to control 8% inflation is a joke. Not to mention that inflation is measured by BLS with significant effort to misrepresent the real number that runs > 15%. God bless America.

Raj,

Garbage. I get so sick and tired of this ignorant, idiotic, or manipulative — you pick — BS.

1. For the week, total assets increased by $8 billion. For the entire 4-week period, the total amount of increase was $34 billion, or $8 billion a week. Why didn’t you show up and post this when the balance fell? Too painful, hahahaha?

2. The Fed buys securities to replace maturing securities. If it stops buying securities altogether, its balance sheet will decline, and that will be “Quantitative Tightening.” Coming soon.

3. You’re freaking clueless about the MBS, though I have pointed this out a gazillion times.

The Fed buys MBS in the To Be Announced (TBA) market, and the purchases take 2-3 months to settle, which is when the Fed books the purchases, so that what we see added to the balance sheet during the week was bought 2-3 months ago, so Nov-Jan. MBS come off the balance sheet via pass-through principal payments when mortgages are paid off or are paid down, and these pass-through principal payments speed up when rates fall, and they shrink when rates rise (fewer refis, like right now); but the Fed has to replace them, but they’re impossible to predict. And that’s why you see the jagged line in the balance sheet.

So he doesn’t understand how MBS works in pure terms, so what? His overall point is that the FED is clueless which you would seem to agree with having said a gazillion times the “most irresponsible, reckless FED ever”.

As you well know, from late 2019 – Sept 2019, the FED’s balance sheet dropped less than $700B. During that same period, MND shows that the average 30YFRM went from 4% to 5%.

The recent, rapid increase of the 30FRM is directly due to the FED ending MBS purchases (aka FAKE DEMAND) over the last 3-4 months. With rates pushing past ear 4.5%, the last QT tightening data fully supports, at a minimum, a 1% increase in the 30FRM by the end of the year. This assumes that after 2-3 months of MBS QT, the FED is forced to accelerate its overall tightening. And with real inflation running > 10% due to the FED’s reckless under-reporting of rents & OER, we could see the whole scenario accelerated by a factor of 2 by this fall, when the whole shebang comes home to roost.

Personally, I want to see what the reverse REPO market does after 3-6 months of QT. My guess it will drop from its current $1.7T to something notably lower. This nearly $2T in FAKE liquidity needs to go away ASAP.

And the real question is how much of a stomach does the FED and Congress have for > 5.5% mortgages? We can clearly see that the REFI business will literally end by the time we get to 5% rates. But rest assumed, I’ll keep getting those “everything is rosy” news feed alerts from NAMB.

As we all know, the FED is doing everything it can to slow poke mindbogglingly QT.

Jay,

Look, the Fed is bad enough as it is. When people here just make up stuff that readers here then take seriously, they get misinformed in some silly way that then distracts from the real problems with the Fed.

In terms of the $1.8 trillion in RRPs: if the Fed does $100 billion a month in QT, it will take about 18 months to burn through the $1.8 billion in RRPs. So I don’t think QT will blow up anything until after the RRPs are gone, PLUS SOME. Maybe another $500 billion or $1 trillion after the RRPs before serious fireworks erupt. Maybe.

What is the FED waiting for right now, Wolf? They are deliberately stalling in the face of the worst inflation in half a century. They have a raging casino going on in all risk assets and they ignore it.

“”Garbage. I get so sick and tired of this ignorant, idiotic, or manipulative — you pick — BS.”

I don’t like to read such reactions. Seeing a lot of those from you lately. For me it makes it harder to read your pieces without thinking of an angry man writing it. It gives a bad ‘colouring’ to the normally excellent info.

Just saying.

People need to stop abusing my site to spread willful manipulative BS. There are other sites that encourage that.

If you don’t know and are puzzled about the Fed’s balance sheet, ask a question. And that is perfectly fine. But don’t try to manipulate readers here with BS.

You are funny.

On the one hand you wonder, why mortgage rates go through the roof if the Fed only announces they might think about reducing their MBS purchases some time soon, on the other hand you still maintain QT – should it ever arrive – will be not a problem and everything will be just hunky dory. As soon as the Fed lets the market be a market again, it will blow up. Simple as that.

How about those MBS on the Fed’s balance sheet that are now deep underwater with the raising mortgage rates, because noone is going to refinance at these higher rates ? Easy: They will have to hold them or roll them over for ever on their face value, because marking them to market would bankrupt the Fed. Think Lehman Brothers with the brothers now being Powell and Yellen.

Once you go socialist there’s no way back other than a collapse of the system.

Franz Beckenbauer,

Thank you for calling me “funny.” I do have that vein in me.

“How about those MBS on the Fed’s balance sheet that are now deep underwater with the raising mortgage rates…”

The Fed has two ways of getting rid of MBS:

1. By not replacing the passthrough principal payments that come in from the underlying mortgages via regular mortgage payments and mortgage payoffs either when the home is sold or when it is refinanced. This is a large stream every month, even if it is smaller than it was before. People are still buying homes and doing refis, just somewhat less at higher rates than at lower rates, and they’re still making mortgage payments. There are NO losses for the Fed here.

2. By selling them outright. If it loses a little bit selling MBS, well fine. The Fed made $122 billion (with a B) in interest income in 2021. And it continues to make interest income in 2022. So what it has a loss against its interest income?

“When people here just make up stuff that readers here then take seriously, they get misinformed in some silly way that then distracts from the real problems with the Fed.”

And, in the end, it just doesn’t matter (thanks Bill Murray) because even the real problems of the Fed will NEVER be fixed short of an economic collapse because those “problems” are actually “features” of the system for those who benefit from it and who are also the only people in powerful enough positions to demand it be “fixed.” “Fixing” it would be against their interests.

As far as central banks are concerned we’re proles along for their ride.

However, I actually do agree with your point as I’d prefer an ACCURATE idea about how I’m being screwed in ways I can do absolutely nothing about as it at least allows more accurate guesses for investment purposes.

“The Fed made $122 billion (with a B) in interest income in 2021. And it continues to make interest income in 2022. So what it has a loss against its interest income?”

That’s an interesting question I was meaning to ask. Depending on how fast the Fed wants to tighten, it may end up needing to sell securities. Since most of what it will likely sell are long-dated securities, and these are the most affected by interest rate changes, the chances of taking a loss on their sale is quite high.

$122bil in interest income over a year is not much when we’re looking at draining several hundred billion if not perhaps a trillion from the markets over the same timeline.

While unlikely, it’s interesting to speculate what happens if the Fed books a net loss for the year? The Fed has no retained earnings: whatever profit it earns each year, it passes on to the Treasury. So technically, it has no cushion against losses. It’s never needed one because it’s never taken losses before (always held to maturity). But what if it were to book a net loss this year? Would it simply carry a negative equity or book value but otherwise still be able to carry on like before? Or would it technically be bankrupt? And what does it mean for a central bank to go bankrupt, when it can print the currency it needs to pay any creditor?

It would definitely be uncharted territory (I’m assuming, though I don’t know the full history of central banking), and interesting to speculate about what it would mean from a practical standpoint.

Lune,

So let’s ballpark some numbers here, just for fun.

1. The cash flow to the Fed from maturing Treasury securities and passthrough principal payments from MBS is likely in excess of $100 billion a month. Last year, it was a lot more per month. So at $100 billion a month, the Fed would reduce its balance sheet by $1.2 trillion in a year, and it would not lose money on those.

2. If the Fed wanted to speed up QT and outright sell $50 billion a month in MBS (I doubt it, but just for fun), that would be an additional $600 billion a year. If it loses 15% on those sales (this seems high, but we’ll run with it), it would then lose $90 billion on those sales.

But wait…

The current portfolio includes a big pile of securities that the Fed bought years ago when yields were higher than now, and the Fed would make a profit selling those.

The Fed also owns a big pile of TIPS and the principal value of TIPS rises with CPI, and the Fed would make a profit selling its TIPS.

In addition, the Fed would continue to earn a large amount of interest on the current portfolio.

The one thing that will happen for sure, the remittances to the Treasury Department will plunge. That happened during the last QT, and it will happen again. They might go away entirely, if the Fed doesn’t make a profit.

Wolf, I empathize with your sentiment. Unlike a lot of fellow commetators here, If anything, I feel you are far too patient in repeatedly clarifying such nonsense.

One suggestion would be to create a running “BS Destroyer” post, where you debunk these ONCE and then can just post a reference say

“BS#14 Debunked.” followed by link to the post.

This would save some effort, and keeps your BS counters within in the comments discussion to maintain the accuracy of information being discussed.

Hi everyone,

Who say that FED always wants to stabilize the market?

Apparently they want to wait until the balloon is pumped enough so the boom 💥 will be heard in other galaxies too (purposefully ) .

Why? Who knows? Maybe they have agenda and you will learn much much later.

I bet I will spend and will buy Wolf’s famous mug if I am wrong 😑. LOL

Have a greate weekend

Annnd, now US mortgages are essentially at 5%! Wow! Drama, and history in the making

That is absolutely amazing how quickly we got to 5%.

For 30yr FRM we were less than 3% last summer! And now basically nine months later we are basically at 5%.

MND published that their survey average came in at 4.95%

This is a good thing. Let’s hope it continues indefinitely.

I agree. Increase in rates will bring back some sanity to home prices in the real estate markets.

…or maybe not? Perhaps more and more people will start to hoard housing as a hedge against fiat?

It is the funds that are buying residential because it is so much better than commercial.

REITs are buying because Real estate yielded >17% over treasuries last year and still gives atleast >3.5% over cash thanks to Raging inflation (8% as measured by govt), and artificially low interest rates (0.25%) and artificially lowered mortgage rates (4.5%). It has nothing to do with commercial real estate.

Corporate buyers may step up their buying as prices wobble.

They finance their acquisitions outside of conventional mortgage channels.

What you see in the headlines is about huge investors selling rental properties for billions of dollars to each other, with some trying to get out at the peak, and with others jumping with other people’s money.

Corporate buyers/REITS/funds are NOT buying individual houses that homeowners are trying to sell.

They’re buying entire portfolios of hundreds or thousands of already rented-out rental properties, for billions of dollars at a time, such as entire “build to rent” developments, or other massive portfolios of rental properties that are already rented out. They’re buying them from the homebuilders that built the build-to-rent developments (this is a HUGE thing now), and they’re buying portfolios of thousands of already-rented-out houses from big investors that are trying to get out.

Investor purchases in of individual homes have been roughly flat: In February, “all-cash” sales, which includes institutional investors that can fund the purchases at the institutional level, remained in the same range, accounting for 25% of the transactions in February, down from 27% in January but up from 22% in February 2021.

https://wolfstreet.com/2022/03/18/as-mortgage-rates-surge-home-sales-drop-for-7th-month-and-suddenly-new-listings-jump/

Wolf:

That may be true, in the main part, today, but the fact was that our competition as a cash buyer in the saintly part of the tpa bay area in late summer of 2015 WAS the hedgies, etc.

We were fortunate to hook up with a realtor whose sign was on the house we wanted, and she told us it had been bought by a hedgie, and they was able to sort through a dozen or so more appropriate houses for us, most of which were not sold, but were being held by the banks to be able to sell to the hedgies — and these houses were spread all over the area.

Finally found one, fully trashed, that the ”bird dog” for the hedge fund (s) had not properly researched before they bought it, and was able to close in 10 days and rehab it enough to move into in 30 days after that.

Mortgage rates at 4.42%

whoopie

I’m putting my WORTH LESS CASH to use buying HOMES for RENT

made 4.42% this week instead of banksters grifting my $$

On the bottom chart.

Looks like mortgage rate spreads at about 2.5% is gonna tank the market.

What is the significance of a 2.5 spread?

Lending party ended and GFC.

The feds sell MBS during QT, bond prices fall and rates go up. They are trying to drive rates up for a change.

The equity line that I had for years before I recently consolidated during a refinance was also tied to the 10-year yield. The loan couldn’t go below 4 percent, however there was no limit up.

Due to the low rates it stayed at 4 most of the time, but every once in it would go briefly over 4%.

Probably starting to happen right now for those equity line variable rates. I would imagine it will cause problems for those stuck with variable rate loans.

If a line was drawn for those type of loans it would be between the 10 and the 30 of the first Wolf chart with the same variability.

4%

Long way to go.

The Fed continues to pump. Bought $28,000 million mortgage backed securities this week.

“The beat goes on!”

b

Watching the money flows, the walk doesn’t even match the talk.

Brewski,

I get so sick and tired of this ignorant, idiotic, or manipulative — you pick — BS.

And, Ambrose Bierce, if you agree with Breski’s BS, you’re in the same ballpark.

1. For the week, total assets increased by $8 billion. For the entire 4-week period, the total amount of increase was $34 billion, or $8 billion a week. Why didn’t you show up and post this when the balance fell? Too painful, hahahaha?

2. The Fed buys securities to replace maturing securities. If it stops buying securities altogether, its balance sheet will decline, and that will be “Quantitative Tightening.” Coming soon.

3. You’re freaking clueless about the MBS, though I have pointed this out a gazillion times.

The Fed buys MBS in the To Be Announced (TBA) market, and the purchases take 2-3 months to settle, which is when the Fed books the purchases, so that what we see added to the balance sheet during the week was bought 2-3 months ago, so Nov-Jan. MBS come off the balance sheet via pass-through principal payments when mortgages are paid off or are paid down, and these pass-through principal payments speed up when rates fall, and they shrink when rates rise (fewer refis, like right now); but the Fed has to replace them, but they’re impossible to predict. And that’s why you see the jagged line in the balance sheet.

I am not a brilliant economist like you but can the explanation not be much much much simpler?

The driving force behind the mortgages are banks and lenders who want to make a buck. So any excuse to have the rate higher will be used immediately and when there is reason for lower rates, they will walk it slowly. We see the same thing with the gas-at-the-pump prices.

The driving force for the Fed and government is to spend as little as possible on interest . If rates are high, those bonds are sold and interest need to be payed to a third party. If rates are low, nobody except the Fed will buy them so all money stays in the system. And whatever the treasury has to pay the coupon clippers of the Fed does not matter since that money , the profit of the Fed, is returned to the treasury.

The simple version of Wolf’s comment is that the Federal Reserve HAS stopped buying MBS, it’s just that the transaction accounting lags behind by a couple of months. So the paperwork on the final purchases is still being reported out.

This cycle was pumped egregiously on the front end. Now they repent at their leisure. Up until now the Fed has done a great job in a stressful situation. I also thought they should have raised rates first, and that was the correct assumption. Until they actually start cancelling signature only bond buys they are pumping the money supply in ways that benefit wall street. The supply chain debacle is no more evident than it is in the bond market. They over monetized (non existent spending bills), supply is down and prices are falling, yields spike. (Is it Treasuries fault?) We’re probably at peak money supply here, so buckle up.

The exact numbers don’t really matter, we don’t need details, we need insights. Fed’s intent is clear – more inflation. The war on inflation is like the war on drugs, the more the government fights it, the more people die from overdose/worse-living-standards/etc. $ 34 B increase in asset “purchases” isn’t “fighting inflation”, that much is absolutely, and indisputably true. It’s the starting point.

WIN – “Whip Inflation Now” – was a Nixon era campaign to subtly blame the people for what the Gov/Fed were doing. Eat more lentils, buy less stuff and inflation will go away… not true.

Tom Bond,

“…exact numbers don’t really matter,” and “Fed’s intent is clear – more inflation.”

Hahahaha, yes, “exact numbers don’t really matter” if they contradict some wishful thinking. Keep dreaming. Even markets don’t buy it anymore, and they bought everything and anything before.

Average 30-year fixed mortgage rate today 4.95% already. And the Fed heads are STILL out there talking about 50-basis-point hikes this year (plural), rather than walking them back. This ship has sailed. The Fed is now actually trying (still too little too late) to crack down on inflation because this inflation is threatening the wealth of their constituents and the viability of the dollar. This is now serious!

“The Fed is now actually trying (still too little too late) to crack down on inflation because this inflation is threatening the wealth of their constituents and the viability of the dollar. This is now serious!”

Wolf, with all due respect, I disagree with this. I believe the FED is trying to PRETEND they are cracking down on inflation while not really cracking down on inflation. Why do I believe this? Because they stood up there and told us they were “going to let it run hot,” and then that’s what they did and are STILL doing.

A 25 basis point rate hike to supposedly combat 8% inflation is a joke. Everybody knows it. Even if they raise by 25 basis points every meeting this year and for the next 3 years, they wouldn’t catch up to inflation. Somebody mentioned they were asked about the FFR being so out of whack with inflation and Powell just mumbled or something, didn’t even really answer.

I believe this is intentional. They wanted this inflation and they are secretly reveling in it. Otherwise, they would treat it like an emergency and take swift, forceful action. Instead, they chose not to.

If .25% rate increase to combat 8% Inflation is a joke, then what is .25% rate increase to combat the real inflation rate which is running 15 to 20%??

Wolf,

BIG QUESTION HERE:

With the massive 0.24% spike per MND showing that the 30 YRM has jumped up to 4.95%, what’s driving these big increases in the last two weeks?

Is the market right sizing lower prices / higher yields with what they expect in the coming weeks as the FED starts to QT its MBS portfolio?

Does this mean the FED is signaling they plan to sell MBS vs just letting them roll off as they mature? If so, this could cause the mortgage industry demand to move rates / yields closer to what the current MBS on the FED’s books may sell for.

These jumps lately are so significant, I can’t imagine it’s just the mortgage industry reacting to the ending of MBS purchases alone.

My goodness, 6% mortgages by the time the FED starts QT in May is starting to look likely. And what happens if the FED jumps a 50 basis point rise in the funds rate for April? Yikes!

Thanks!

Jay,

I have to admit, the market reaction is going a lot faster than I had thought. This is really fast-moving now.

Not sure I have a good answer for “what’s driving these big increases in the last two weeks?” other than that the mortgage market is buying the Fed’s projections of much higher short-term interest rates and massive QT amid rampant inflation.

What is even more interesting is that the Fed talking heads are now all warning of faster and more and front-loaded rate hikes (50 basis point hikes, plural) DESPITE the surge in mortgage rates. A year ago, we had a flareup in mortgage rates, and the Fed heads then started walking back some of their verbiage. Now they’re INCREASING their verbiage despite the exploding mortgage rates.

Jay, seems to me that Depth Charge and some others WANT the FED to wreck the economy. Their fantasy is to then scrounge through the economic rubble and grift assets from the impoverished.

The FED is definitely trying to stop and reverse the higher rate of inflation. For D.Charge and others, they’d like to see rates jump 8%, right out of the box, to match inflation. It’s a good thing that America doesn’t have one of these ninnies in charge of the central bank.

“The Fed buys MBS in the To Be Announced (TBA) market, and the purchases take 2-3 months to settle, which is when the Fed books the purchases, so that what we see added to the balance sheet during the week was bought 2-3 months ago, so Nov-Jan.”

I feel bad for Wolf to have to keep repeating this mantra without people reading (and understanding) it. My guess is the at the real fireworks will start this summer when the rug is pulled from under the MBS market. We are at 5% already. The ones buying now are what Wall Street calls “dumb money.”

The Fed is so far beyond clueless that it smells like a mobster setup for the 1% elite at the expense of everyone else.

You should visit an ENT dr. The “mobster setup” is a pretty infantile conspiracy theory. Something much less than “theory”, really. If enough people on this website keep saying it, though, do ya think it’ll become real?

Our friend XiXi can’t wait to see how this is all going to end I’m telling ya.

IF he wants to displace the US…….and he probably does (Thucydidies Trap)…THE he would also want his currency to be THE CURRENCY.

The negative rates courtesy of the Fed may just be what turns the WORLD off on the dollar.

If you have read prior articles on the subject here which I assume you have, then you will know that “real” rates are also negative in much of the world, not just the US.

How much it matters varies on who holds USD.

It’s most important to anyone who uses the USD as their currency of reference, like US based corporations and individuals because their income and expenses are also in USD.

It’s essentially irrelevant to any central bank, because “they” have different motives for holding the USD (as FX reserves) and the “they” isn’t an actual person, so it isn’t actually anyone’s money.

For foreign based corporations, it’s changes in FX rates that matter most, as that’s what affects their P&L the most directly. Inflation elsewhere impacts their costs indirectly but doesn’t have 1:1 correlation to the change in the FX rate.

For foreign individuals, it’s also more about changes in FX rates, except that I would say it’s more important to them than other foreign entities because it’s their wealth.

“real rates are also negative in much of the world, not just the US.”

“Much” is not all, just the West… and it most definitely doesn’t include the country we’re discussing – China. The *real interest rate* in China is well above 3%. it’s about (-13%) in the US. Much difference, no?

historicus,

Sanctions are already turning the world off the dollar. Reserve currencies – typically don’t play nicely with capital controls.

Of course, China also wants to exercise its own capital controls – so the path to making the YMB the world’s reserve currency is tricky.

Up North-

Doesn’t Xi have an RE skeleton in his own closet? The slow motion train wreck in Chinese housing development is truly gargantuan, and is allegedly 30% of China’s alleged GDP, though with China who really knows what the real numbers are….

As if you know the real numbers here.

Point taken!

Better check there company financials,they robbed the world with two sets of books ,until we made them do honest accounting

Let’s see what wonders The FED pull out of their massive bag of tricks.

Will it work though?

They will pull.. wait for it.. a 0.25% rate increase. Then promptly print another $Trillion.

Reminds me of a Batman with Jack Nickolson as Joker. He says to his side kicks “Where does he get those wonderful toys?” Then not actioning him he says “No really go find out!”

I wait for what the FED will roll out next

Yeah, don’t they call this Build Back Better? Don’t worry, be happy. Everything you have experienced the past 2 years is just “Transitory”.

If this is aimed at a certain political party then let me also remind you that In 2020 the government flooded the economy with $4,000,000,000,000 to anyone and everyone

Although, I will not let either party off the hook since both unilaterally voted for the move

So if the fed buys the MBS how is the spread set? Other buyers? Jumbos? I have no idea myself.

The market decides at what prices these MBS get bought (at what price do I want to buy those MBS?). Price determines yield. If they pay higher prices for those MBS, yields are lower. If they pay lower prices for those MBS (right now), yields are higher. Higher yields mean falling prices of MBS. In other words, MBS prices are falling faster than Treasury prices.

Which means the FED will potentially lose billions of dollars, if by some miracle, the eliminate their entire portfolio of MBS while yields are rising / prices falling, NO? Because when the economy tanks, Lord knows the FED is going to jump right back into buying up MBS, right?

Jokingly: Does the FED get to remit those losses back to the treasury?

They have made a huge amount of money on these so far. So yes, they might give up some of their gains going forward.

The Fed received $122.4 billion in interest on its holdings of securities. That interest income will continue in 2022. And against it, it might have some capital losses. In total, the Fed made $108 billion in “net income” last year. And they might make less this year and next year. But this isn’t on my worry list.

Here are the remittances back to the Treasury Dept:

https://wolfstreet.com/2022/01/15/the-fed-released-its-preliminary-financial-statement-for-2021/

Th only thing Powell is serious about is creating hyperinflation which will spread to the rest of the world.

No doubt there will be ripples in the system after massive

pandemic spending and the inflationary blow back, and then the giant rug pull on spending due next fall. The 1800s were cattle, land and gold. Crypto is Beyond Gold, and Beyond Meat obsolesces cattle, and there are NFTs you can live in, virtually? Wonder what the mortgage spreads are?

I can’t wait for crypto gamblers like you to be completely wiped out.

Crypto is one big SCAM and PONZI SCHEME.

I remember when Bitcoin was US$100 in 2013, and I tried to buy it with my allowance, and when I used my dad’s credit card, the bank froze his card and he had to call them because his subscription payments were being rejected.

But when Bitcoin was at US$70,000 and rising, the banks suddenly found a way to allow payments?!

Long-term – yes.

In the shorter term it’s going to be finding uses as a possible way to circumvent sanctions. This will bid the prices higher.

Digital currencies are, perhaps, the way of the future. But there will be no anonymity in their use.

Cattle should be obsolesced, not completely, just insofar as it’s food for the masses.

No worries, the latest soundbite from the FED today was “FED reserve official doesn’t think housing is headed for a crash.” These people are desperately trying to keep house prices and rents out of reach of the young, the working class, the poor and the elderly. Since when was the FED’s mandate to actively promote inflation?

When they have to come out and officially deny something, that often means it’s either true or about to happen… trying to forestall panic.

If there wasn’t a legitimate reason to worry, the question would be ludicrous and they wouldn’t need to say anything.

Do you give much thought to this stuff: “These people are desperately trying to keep house prices and rents out of reach of the young, the working class, the poor and the elderly”, or do you just need to see a proctologist?

It’s a legitimate perspective and one you won’t see in the corporate-funded media.

High housing prices and high rents are a bane, not a boon, to most of the population.

We don’t celebrate high car prices, high mobile phone prices, or high food prices. Yet housing is also one of life’s necessities, so why do people act like high costs of housing are a good thing?

Wall Street has convinced people of a number of things that aren’t true when you look into them, including the notion that “credit” = capital, that “short-term credit” = cash, and that housing is an “asset” not an expense.

The damaging effects of high prices, etc., are one thing. But believing that this is being done intentionally, to impoverish certain classes, is conspiratorial b.s.

The policy of inflating asset prices (the Fed calls it “the Wealth Effect”) is certainly intentional.

The effect of impoverishing the young, creating historically unprecedented wealth inequality, is well documented.

It’s a damning indictment of the Fed that they’re either doing this intentionally OR totally blind to the real-world effects of their policies.

It shows you how little they really know, about what they imagine they can control.

That much power should not be wielded by anyone so unaware.

As Henry Ford once put it, if people really understood how money works in this country, there would be a revolution by morning.

In Canada I can get a 3 year 3.4% GIC, fully CDIC insured, guaranteed up to $100,000 principal and interest. I would not buy bonds at these low rates.

Canada? Is it insured against Government seizure for misbehaving or thought crimes?

is it insured against currency risks when a foreign buyers(Americans) try to convert their principal and interest earned back into dollars?

I’ve got some cash in car and I’m concerned.

The Canadian “economy” is heavily reliant on increasing house prices.

It’s not only the “wealth effect” from increasing house prices…it’s also that high assessment values generate healthy property tax revenue for cities and towns.

So what are the chances that home supply starts ratcheting up with supply chain issues easing and the pandemic winding down with construction finally starting to complete work while interest rates start skyrocketing.

Another 2013 housing trough in a few years?

Wolf’s article on unfinished new homes that are about to hit the market is a good one.

When the panic selling starts, everyone will be running for the exits. Just wait it out.

Anthony A.

You’re assuming it will be a deflationary crash…

…It’s an inflationary one this time around.

I am trying to analyze some of this housing data.

Wolf sees the new home just finished and unfinished supply of home increasing. He has plenty of informative charts and articles. IMHO…Most new homes are very expensive I think. Inflation of input costs.

Existing homes that are below $300k are being bought up left and right. These are the 2 and 3 bedroom homes from the pre-90s because nobody builds starters anymore. Maybe they will now? But this sector is very tight on inventory. These are starter homes but also the coveted homes investors like to buy and rent.

Prices are certainly bubblicious. Look at almost any chart like Case-Shiller or Wolfstreet charts or Doug Short charts. There is a lot of zombie (empty house with no specific reason) inventory, but is there enough for population growth?

If you look at some of Doug Shorts new housing starts normalized against population growth, there should not be big a big surplus.

In reading housing reports for my area (which tend to be 3 to 6 months behind), there are not enough affordable houses but builders are building a lot of house but they are the unaffordable ($500k and up). People could afford the payments on these when mortgage rates were 3% but not at 4.5% or higher.

But when I look at inventory for sale in my area. It is still historically low. But I live in flyover land and listening to Jim Puplava, there has been what he calls an inward migration. People are moving from the expensive coasts to cheaper places in the center of the U.S. or to states with no state taxes.

Who then can continually keep buying homes that are priced out of reach of buyers?

ru82, take a look at what’s now happened to publicly traded companies in the housing sector. They’re all approaching, or are at, 52-week lows and are trading at P/Es of 6, give or take. The market adjusts very, very quickly to what is anticipated, and housing investments are being anticipated to be dead money. Nobody rings a bell at the top, and there’s no thud at the bottom.

Incidentally, don’t get too excited about those low P/Es. They could go N/A when quarterly profits go negative.

Wolf, do mortgage rates really follow the 10 year anymore, or just car payments? It seem to me that mortgages are tied to MBS manipulations (and CMBS) since the mortgage market is tied to MBS now unlike the 70s and 80s. It seems to me that the Fed support for MBS was the key in recent years in keeping the rates low for so long.

Look at the first chart.

It’s not that one “follows” the other. It’s that they’re running roughly in parallel (similar maturities, different structure, different risks). And there is a spread between them. And that spread is changing.

I wonder if the market is pricing in an expectation that rates won’t be back down below 4% anytime soon– thus fewer refis in the future and a longer average holding period than 10 years. Perhaps 30 year morgages will, on average, be paid back in something more like 20 years (if higher mortgage rates lead people to not move around so much).

also imagining that higher mortgage rates in the future might lead people to refinance mortgages less frequently.

Shells,

The spread indicates risk between a risk free investment ( 10 yr treasury) and in this case , a mortgage…

In an environment where the lenders think there is more risk of a buyer default, the more spread between the two rates…

Shells-

I always heard this referred to as “extension” risk.

Extension risk played a big part in the 1990’s with the unexpected fluctuations on mortgage prices. Several bond funds and many pensions and other institutions (including Orange County California, and some municipal pensions in Iceland and the Nordic countries) were forced onto the rocky shoals of a volatile bond market.

Exciting times, perhaps to be repeated?

@ Wolf –

How is the thirty year mortgage rate set? What are the determinants of it?

Lenders decide.

It’s always perplexed me that a prudent lender would commit their money to a 30 year fixed rate. Of course if you can create money from nothing to loan and earn interest on, that changes the calculus. Add to that all the government guarantees. Then the ability to package loans and securitize them. And interest rate suppression and manipulation and asset support (at the expense of others) from your protector, the FED,,,,,, maybe there is no need to be perplexed.

Most of the mortgages are securitized and sold to investors (MBS). Banks have some mortgages on their balance sheet, but the amounts are pretty small, given the size of the banks. So the “lenders” — meaning the entity that originates the mortgage, such as a bank — make money off the fees. Investors get the interest income and the risk.

In addition, the majority of the MBS are government guaranteed. So investors don’t have any credit risk.

@ Wolf –

Excellent explanation. Thank you. And with that I will suggest that it not Lenders who set rates, so much as Government guarantees in conjunction with a dose of influence from a debt supporting,, interest suppressing FED.

Wolf is right. Most lenders sell their loans and book a “gain on sale” when sold.

So they don’t have a long term interest in the loan itself, unless for some reason it can’t be sold. In which case then they would have to portfolio the loan.

Imagine a world where banks could NOT sell loans and had to portfolio every mortgage they originated. That would be a very different housing market.

One reason you may be perplexed is because it isn’t actually prudent lending.

What Wolf is describing is another example of moral hazard.

In an actual sound financial system, no one would be able to borrow at fixed rates for 30 years in an unsound currency (all fiat currencies), at such low rates, on such inflated and overpriced collateral, and with such low credit quality standards.

US mortgage standards are weak and farcical, not strict.

Government loan guarantees and rising real estate prices due to inflation have provided the illusion of safety for most of the time since this model was introduced in the 1930’s.

It worked until 2006 right before the GFC. It appears to be working again thanks to the fake economy and the asset mania which also makes borrowers appear to be much better credit risks than they really are.

It’s part of the debt mania, the biggest component of the asset mania, which is waiting to detonate with another supposed “black swan”. (The GFC was not a black swan event.)

I’m not sure how many if any other countries have similar mortgages. The only one I ever heard of (anecdotally) is Japan but never read up on it.

Augustus Frost, can you or someone explain to me in simple terms how mortgages function in other countries?

Canada’s system seems even stranger to me. If you have to get a new loan with new terms and rate every 5 years or so, how do you know the rate won’t explode beyond affordability at one of those times? It seems that system forces rates to be stable or ever decreasing. I probably don’t know what I’m talking about here.

Peanut Gallery said: “Imagine a world where banks could NOT sell loans and had to portfolio every mortgage they originated. That would be a very different housing market.”

============================

at one time, before the securitization of real estate that was the case.

I will contend prices were cheaper and it was better for the working American

Augustus Frost said: “It’s part of the debt mania, the biggest component of the asset mania”

—————————————

Agreed. Thanks for the response. Thoughtful and well written.

This may be incredible, but I got it from a respected economist at a major university: In the early 1990s, and possibly earlier, there were no long-term mortgages. Those loans were paid monthly! There were some restraints for lenders, so they couldn’t jack up rates and confiscate the property. So, prior to govt. guaranteed loans, home ownership was scarce, bank panics were frequent – when recessions hit, and the middle class was almost non-existent.

Whoops! That should have read, “In the early 1900s…”, not 1990s.

Here in Canada, one can get a “two year mortgage” for 1.50% interest. Meanwhile, the savings rate at the Big 6 is on average 0.10% interest.

Lol, what’s the point of a two year mortgage?

In Canada, how does capital gains taxation work? Is it similar to the US, where if you live in a home for two years as a primary residence, you can exclude capital gains taxes?

RE: The Fed belatedly following the newfound reality of higher inflation

It is in the nature of governmental institutions to be conservative with their public “faces” and pronouncements. What does it benefit the Fed to agree that inflation is here? If it tip-toes behind, it can still look wise and perspicacious even though it’s really benefiting from 20/20 hindsight.

“Is this spread heading to what happened in the 1970s and 1980s when the Fed battled blow-out inflation?”

Very possible. The likelihood will increase if inflation continues to increase, which is also likely.

The Fed appears to be hoping inflation will get under control with only modest intervention. That’s unlikely. And hope can be such a cruel, cruel thing.

Goldfinger has popped the credit bubble: “Mr. Bond, I expect you to die.”

No one’s talking about it in these terms, but the bond market is basically crashing. Just ask any 401K owner about their “total bond fund” or “total international bond fund”. Both are approaching 10% drawdowns from the Peak of the Everything Bubble.

Outside of the 2008 and 2020 market panics, this is unheard-of since at least 1994.

Lots of people who thought those were “safe” investments will be pretty damn unhappy when they read their quarterly statements in a few weeks.

It will not be fun when they lose a lot of money thinking they were buying bonds instead of a piece of a fund that traded bonds…

If the bond bull market from 1981 is over, rates will ultimately blow past that prior peak. Fundamentals and credit quality are far worse now than in 1981.

It won’t be a straight unidirectional movement, but the losses are only beginning.

I don’t follow the logic of why rates ultimately have to exceed the prior peak?

W.S. – the logic is that “Fundamentals and credit quality are worse than in 1981”. But… butt… if inflation actually peaks soon, the dire predictions won’t happen. No point in cutting off a leg when some physical therapy may be the neeeded fix. Hope springs eternal!

@HowNow & Augustus – Hmm. I suspect you have it backwards? I agree fundamentals and credit quality are worse.

Back in the 1960s-1970s debt levels were much lower, and people were more averse to excess debt. But that would also mean that it would take a strong change in interest rates to affect economic behavior.

So I think that means the economy is now far more sensitive to interest rate changes. The bond market seems to be thinking that inflation will subside quickly, that the current small increase in rates will unleash enormous “creative destruction”. Otherwise long-term rates would be higher.

I have 2 doubts about this scenario.

The first one is that the government policy response seems to be to try to print-and-spend to mitigate the effects of the inflation. The same mindset driving the current extreme leverage and low credit quality is driving the government policy response. It may take a lot of bitter medicine to change that mindset.

The second one is that I’ve been studying the Treasury interest rates (yield curves) from the 1960s and 1970s, and the longer-term bonds back then ALSO didn’t react – the bond market back then also didn’t believe it would take 20% interest rates to stop inflation.

Love to hear your further thoughts!

W.S., as I remember, the cost of money (interest rates) were generally higher in the period that preceded the twin recessions of ’74 & ’82. I was in Los Angeles then. During the ’82 recession, the local news stations included a session on teaching the public more about the effects of interest rates and on the subject of debt, featuring an economist. I could hardly believe it! People back then were indebted, big time, on credit cards. NPR had a one-hour program on the subject – I bought the cassette for that broadcast to give to my prodigal sister who was always in debt.

When the EU moved to the Euro, people in Greece, who were used to 14%+ interest rates on home and personal loans, were elated that the rates for interest went down to under 6%, give or take. That’s what fueled the indebtedness that brought the country to insolvency. This is what I think A.F. is talking about – that right now, we are sooo far removed from reasonable interest rates and levels of debt, that he thinks the blow-back or normalization (if it can be called that) will be even more punishing than those earlier busts.

unamused…..

the April inflation numbers with the Ukraine effect in full play to date…..will be mind blowing IMO.

J Powell is going to have his “Bridge Over the River Kwai” moment….

“What have I done?”

I hope Wolf allows this picture

https://a.ltrbxd.com/resized/sm/upload/4t/5e/sn/dq/the-bridge-on-river-kwai-120-1200-1200-675-675-crop-000000.jpg?k=4d39fe5a0e

“Madness!”

great financial report. thanks!

Not only is the spread blowing out (risk premium?), but SFH affordability is crashing to 2008 lows, and may end up tying with 2007 bubble high.

Below is a snip from an insightful article from another outling that. WOuld be great if Wolf expanded on, and dug deeper on this bad trend. Seems like a 2008 pre crash inflation scenario cooking…

===============

After a massive surge in housing prices during the pandemic and recovery, the sticker price of housing has soared. Now, with the Federal Reserve starting to raise interest rates and bond markets creaking under the stress, mortgage rates are up to 4.5% and are nearing the highest levels in over a decade. The result is that the cost of occupying a home (that is, monthly payment needed to cover the cost of a house) has soared. As shown in the chart below, the mortgage payment required to cover the median existing home price at the national average mortgage rate is up nearly 30% over the past year, the fastest advance since at least 1987.

Fastest increase in basic homeownership costs

Of course, affordability is also a function of income. If wages are rising rapidly, higher mortgage rates and home prices might be offset by more income to cover those payments. To account for this, we convert the monthly payment implied by the median existing home price and the national average mortgage rate into hours, dividing it by the average hourly earnings of non-managerial workers. As shown in the chart below, at the average hourly wage today, a worker would have to work 51.1 hours to cover a monthly mortgage payment. That’s the highest since August of 2008, and shows that the combination of higher home prices and mortgage rates means that housing is increasingly outpacing incomes. Of course, with supply still tight, demand could fall quite a bit without a big hit to home prices. But the housing market is getting harder and harder to buy in to for most Americans. That also doesn’t include the fact that down payments are rising rapidly. The median existing home required 2,756 hours’ worth of average hourly earnings assuming 20% down in February; that’s only been surpassed by the blow-off top for home prices in the mid-2000s. Assuming 5% down, which many first-time buyers are eligible for, the numbers look less scary with 689 hours’ worth of wages needed. But that’s still rising rapidly. Bottom line: housing prices are rapidly outpacing incomes, and that will suppress demand, even if it might not be enough to make up for record low inventories.

In this rising interest-rate environment, the way a home becomes more affordable is that the price goes down. Why is this so hard to understand or accept? That’s how it happened in 2006-2012, following the rate hikes into 2006.

The Fed is now constantly mentioning housing costs. The Fed is trying to put a lid on them by raising rates. House prices are going to come down when rates are rising this fast this far (they’ve got further to rise).

“In this rising interest-rate environment, the way a home becomes more affordable is that the price goes down. Why is this so hard to understand or accept?”

Of course this is unacceptable. Without the bubble in stocks and real estate the perceived wealth effect would evaporate, and along with it the collateral to borrow more.

Exactly. The “wealth effect” is more aptly named the “leverage effect”, or the “asset bubble effect” but those name are too accurate and honest to be palpable.

Sorry… palatable. It’s been a long day.

“palpable” works, too.

Funny the home builders we are talking to just sent out a mass email that supply issues are causing them to raise the base price of every house $35K. Now every builder, subdivision or build on your lot, will not build a house under $500,000. In 2019, the same house was $380K and came with finished basement and patios. We are back to 2006, in which you pay for the lightbulbs to be installed or install them yourself. Disgusting! If history repeats itself we have two more years of this!

It will go faster this time, for at least 3 reasons:

1) The bond market is moving much much faster than in 2006.

2) Market participants know what happened in 2006 and many don’t want to get burned again. In 2006 most people were much more naive.

3) Corporate participation is much greater and they don’t sit on their hands when the market turns. Ask Zillow.

So lumber prices down 22%, means this hasn’t worked through the system. these houses were built with expensive lumber, (bad business decision?) or indeed supply of housing is tight, and somebody wants to make a whole bunch of money?

re “the way a home becomes more affordable is that the price goes down. Why is this so hard to understand or accept? ”

Outside of the GFC, which was a liquidity crisis, that has never really been true in urban metros like San Francisco. I expect this time is very different any how, b/c the past 10 years was under building SFHs against population, and NIMBYs block nearly all affordable construction nationally, and mega money hedge funds/Wallstreet prop up SFH prices to make more on renting SFHs the worse the affordability of SFHs get.

So, who say SFHs ever have to become affordable? So, long as NIMBYs constrain inventory of affordable multifamily housing, rents will soar, which will prop/push up SFH prices ever higher.

So, tt might end up looking nationally like SF has been for the past 30 years, where people have to rent, hyper-roomate, and save up until the 50s to buy a house, b/c prices never drop to be affordable.

Isaac S.,

“Outside of the GFC, which was a liquidity crisis, that has never really been true in urban metros like San Francisco.”

There have been many many cities with sharp and long home price declines – in some cities home prices collapsed and stayed down (Detroit, Tulsa, many others). Home prices in Tulsa became and remain affordable.

The thing is there haven’t been many SIMULTANEOUS housing market downturns to where the nationwide average prices tanked. That happened in the Financial Crisis. And that across-the-US simultaneity is rare.

For example, in San Francisco, home price peaked in Apr 1990 and then declined until 1996, when the dotcom bubble started taking off. Over these six years, home prices fell 11% (data from Case-Shiller).

Another factor, Isaac, is that some cities. by statute, will not increase supply, unless they allow vertical development. There are coastal cities that will absolutely not increase the housing supply (all lots are developed) or allow increasing the square footage of existing homes! These are typically in highly affluent areas where demand is still substantial while new supply is suppressed.

Wolf, re “There have been many many cities with sharp and long home price declines”

those are almost always places where the local/regional instustry engine dies/fails.

re ” in San Francisco, home price peaked in Apr 1990 and then declined until 1996, ”

I doubt that will ever repeat again. SF Bay Area housing prices are closely tied to the stock market, and the Fed world has changed since the 90s, where the Fed must always keep the stock market growing much faster than CPI so that pension funds do not go bust and crash the economy. Also, in the 90s, there was very little Euro$ hot money from EMs looking for a safe-heaven home. Going forward, China (for CA & LV) and Russia (For NY) will also keep those housing markets pumped up, even in down stock markets, like they do in Canada, London, etc. Also, in the 90s was before NIMBY ordinances were passed that blocked all affordable housing construction, and most all new housing. So, the fix is in on all fronts in SF Bay, prices only go up or stay flat for a short time (like 2017).

Isaac S.

“I doubt that will ever repeat again.”

What the heck are you talking about? It already DID repeat and much much worse, during the Housing Bust. Home prices in San Francisco plunged by 43% from June 2006 to Feb 2012 (Case-Shiller).

I didn’t mention it in my comment because I took for granted that you knew it from having seen the below chart in one of my gazillion articles on this topic.

In other words, it happened TWICE in SF in a 20-year period (1990 – 2011). And it’s going to happen again. Last year, 4,000 housing unites were completed in SF, while the population declined by 6% (Census). Every year, 2,000 to 4,500 housing units are completed in SF. Nobody counted on a declining population. Rents are down 22% from the peak in July 2019 (Zumper)

From my last “Most Splendid Housing Bubbles Series”

https://wolfstreet.com/2022/02/22/the-most-splendid-housing-bubbles-in-america-february-update-from-raging-mania-in-phoenix-to-cooling-condos-in-san-francisco/

Wolf,

Of course I know about the 90s and GFC1 housing price crashes!

re “In other words, it happened TWICE in SF in a 20-year period (1990 – 2011). And it’s going to happen again. ”

Apparently, you did not read my post that explained why I don’t expect that can/will repeat again, or if it did, it would not last long or go nearly as deep. This post GFC 1 world is too financialized w/ a global CB/Fed Put like never before. The Fed cannot ever reduce its balance sheet, incl. MBS, in addition to all my other points made.

re “Last year, 4,000 housing unites were completed in SF, while the population declined by 6% (Census). ”

you are wrong to expect that is the trend. population is quickly returning to the urban core and places are reopening and rehiring fast.

re “Every year, 2,000 to 4,500 housing units are completed in SF. Nobody counted on a declining population. Rents are down 22% from the peak in July 2019 (Zumper)”

you are talking about the high end (condos). hardly any SFHs are built in SF. There was an oversupply of high end condos in SF since 2017, and who cares if they have to lower prices, does not affect SFH prices much. If you chop off the over built high end condos/apts, I strongly expect that 1 bdrm rents in SF are nearly back to pre-COVID levels, esp, at the lower half of the market. are their any charts about this?

Issac said: “at the average hourly wage today, a worker would have to work 51.1 hours to cover a monthly mortgage payment.”

———————————————–

Calculation? Sounds on the low side.

@cb, well that does sounds reasonable to me. I got it of a Seeking Alpha article, but Wolf doesn’t let me post evidential article links.

I would figure an affordable mortgage payment is 33% of monthly wages income at 40hrs/wk. So, 51 hrs to pay mortgage, would be ~1.3 times longer work , or ~42% of income to housing, which is deemed unaffordable by most metrics. That forces descretionary demand destruction, esp. if food and energy prices soar at the same time.

@ Issac –

thinking out loud ………….

40 hrs in a work week

4.3 weeks in a month

40 * 4.3 = 172 work hours in a month

article said 51.1 hours to cover mortgage

51.1/172 = .2965

30% of monthly gross earnings to cover mortgage

cb

Calculation:

avg. hourly earnings = $31.58

51.1 hours x $31.58 = $1,613 mortgage payment

30 year fixed at 4.5% at $1,613 monthly payment = $318,000 mortgage.

Median price of existing home = $357,000 (NAR)

minus 10% down: -35,700

= to be financed amount: $321,300

But that’s not how it works because if you earn $31.58 gross, you might only take home $26 (assuming 20% total withholding), and you have to make the mortgage payment from the take-home pay.

So it’s a lot tougher if we do that same calculation at $26/hr:

51.1 hours x $26 = $1,328 mortgage payment

30 year fixed at 4.5% at $1,328 monthly payment = $262,000 mortgage.

That’s not going to buy a median house outside of some cities such as Tulsa maybe. It’s not going to buy even a doghouse in more expensive cities.

In mentioning Tulsa, I remembered that Tulsa is even offering $ 10k for people to move there. Surprisingly, there still are affordable cities in the US. and some will pay you to move there.

———–

Tulsa Remote is a 1-year program that gives selected applicants, among other incentives, $10,000 in cash or toward a home purchase. Since its inception in 2018, the program has received more than 50,000 applicants and accepted around 1,200 people

Yes, they would pay me to move there since I’d bring my own work-at-

home-media-mogul-empire-headquarters job with me. Bringing your own job with you is a requirement to get the $10K. They’re pretty desperate. Nice city though. Lived there for many years.Wolf, great reminder re taxes. I knew the housing burdon was at least 40% pre-COVID so I think I shortened the work week to help boost my calc to get there.

BTW, I track Essex (ESS) Con Calls to follow the pulse of the West Coast, esp. SF Bay & So. Cal. There last CC did not dissapoint. it is all a good read, but I think you and your followers will particularly find the below snips interesting, esp. the part about So Cal. rent affordablility trend getting much worse, but SF Bay is much better (likely b/c job recovery still lags). SF is coming back fast, incl. tourism, so I expect that nicer rent affordability will get much worse by end ’22.

ESS CC snips:

Yes. This is Mike, and maybe Angela may have a comment too here. But generally speaking, the good news is that incomes are moving and that affects us in terms of our guidance, but it also helps us charge more rent or allows us to have higher rent levels and helps us much more than what it cost us on the operating expense side. So we’re pleased with higher income levels, and we’re seeing that throughout our portfolio. And in terms of numbers, so Southern California, for example, has a rent to median income. This is the median – this is not our data, this is a general data that comes from our data vendors, but using median rents and median incomes, we’re currently at 26.9% rent to income in Southern California versus the long-term average of 22.3%, so well in excess of that average. And then conversely, in Northern California, we’re currently at 22.1% rent to income versus a long-term average of 23.1%, so well below in that regard. Seattle is a little bit different. It’s at 21.1% versus 18.7%, respectively. So it suggests that it’s higher in the rent to income versus the long-term average, although that market has changed pretty dramatically in terms of it going from being a lower cost to a higher cost or higher rent market over the last 10 years or so. So I’d say, it’s fundamentally changed its nature. Does that help answer your question?

…

For example, in Los Angeles County, Downtown LA net effective rents are flat from pre-COVID levels, while suburban areas, such as Long Beach and Santa Clarita are up 15% to 20%. We attribute the underperformance of the urban core to the damaging lockdowns in 2020, which resulted in severe job losses in restaurants and the service sectors. More broadly, recoveries in the urban core and major tech companies have been slowed by ongoing government restrictions, worker shortages and delayed return to office plans. While the large tech companies generally did not experience job losses, their hiring slowed during the pandemic and many employees relocated in the initial phase of the pandemic due to citywide shutdowns.

As of December 2021, the U.S. has recovered about 96% of jobs lost in the pandemic compared to only 78% for the Essex markets. Obviously, we are disappointed that many tech employers pushed back their office re-openings during the surge of the Omicron variant over the holidays. However, the data indicates that most large tech employers will adopt a hybrid office environment and therefore, the return to office should be a significant catalyst for housing demand in our poorest performing markets. With job growth now exceeding the U.S. average, we believe that our recovery is well underway and several observations support our positive outlook.

As highlighted on previous earnings calls, there has been many large investments in office space by the large tech companies this past year, contributing to positive net office absorption in 7 of our 8 major markets, representing 4.8 million square feet of space. Available office sublease space has begun to decline in San Francisco, San Jose, Los Angeles and Seattle, which supports our belief that many companies are moving forward with their return to office plans. As expected, there is a resurgence in service and hospitality-related hiring as our cities recover, with year-over-year increases in leisure hospitality employment ranging from about 29% in Ventura to about 56% in San Francisco. Recent immigration policy changes from the White House announced last week should also support the positive momentum that we are seeing in job growth at the higher income levels.

For many years, Santa Clara and San Mateo counties disproportionately benefited from foreign immigration. However, during the COVID pandemic, stricter immigration policies during the previous administration drove net foreign immigration to a 30-year low. We suspect that the recently announced immigration policy changes will contribute to job growth, particularly in the Bay Area. Venture capital investment in the Essex markets continues unabated. In the fourth quarter, approximately $37.5 billion of capital was invested in West Coast-based companies or approximately 40% of the total venture capital deployed in the United States and representing 124% year-over-year increase. The West Coast remains a leader in venture capital, which is a driver of global innovation and in turn local economies and job growth. The top 10 tech employers in our markets continue to seek talent and with open positions listed in California or Washington reaching 47,000 in the fourth quarter, far exceeding the pre-COVID peak by 62%.

@cb, here are links to the charts, if Wolf allows to post it. if correct, they indicate that homes are still more affordable to blue-collar workers than there ever were pre-GFC. I figure the charts are correct b/c interest rates crashed, and inflation rate was relatively lower, so affordability should go up. This is very odd to me, b/c, post GFS , nesters grew to record highs home builders production fell to record lows. Something does not add up for me about that. Maybe the answer is related to gig economy wages not being counted, something like the phony unemployment rate is achieved by not counting the millions of bogus SNAP/disability working age people (losers). Maybe Wolf can do an article explaining this apparent conundrum, b/c he’s always complaining about how housing is more unaffordable than ever.

https://static.seekingalpha.com/uploads/2022/3/24/saupload_032222-Affordability-2.png

https://static.seekingalpha.com/uploads/2022/3/24/saupload_032222-Affordability-1.png

You’re not including dual income earners. Approx. 53% of homebuyers have dual income.

There is an article on CNBC from earlier this week claiming that the median payment has increased 31% based upon the combination of higher rates and prices.

I did not verify the calculation but it sounds ballpark accurate.

Given that prices are set at the margin and how broke most Americans are in actuality, I see no possibility that the marginal homebuyer can afford to pay 31% more.

This calculation did not include changes to insurance, property taxes, utilities and maintenance.

inflationary demand destruction is ever near.

Check this out from Macy’s:

Macy’s Inc. CEO Jeff Gennette recently told WSJ they tried to raise prices on some mattresses and sofas by $100 and were met with fierce consumer push back. Clothing brand Bella Dahl hiked shirt prices by $20 and immediately saw sales crater. “There was a revolt,” said Steven Millman, Bella Dahls’ brand officer. “If we go any higher, we’ll do half the sales.”

Isaac S.,

This is not demand destruction. Consumers should have done this a long time ago and we wouldn’t have this rampant inflation. This is “price competition.”

It’s not that they didn’t buy a mattress (= demand destruction), but that they bought the mattress from another retailer and Macy’s lost the business to that retailer (= price competition), while demand remains the same.

Agreed. It is price destruction. Inept retailers are trying to raise prices beyond what the market will bear, and are harvesting the fruit of their ineptitude. High prices shift demand, or as you pointed out, direct buyers to an alternative elsewhere.

or consumers pullback on spending but overheating the economy almost always leads to that classic economic thing, with an r word.

…what happens when management’s press releases become more attractive reading than analyzing actual balance sheets…

may we all find a better day.

Wolf, good point as to the Macy’s anecdote, but it is not price competition when all competitors have raised their prices, and inventories can be sold at/near current prices. The fact that we’ve hit the “price competition” point on discretionary goods, IMHO, is an early signal that demand destruction, begetting more need for ever lower “price competition” has begun, esp. given the horrible consumer confidence and horrible fuel consumption polls/data I posted. This must mean that as energy, food, and rents inflation will force demand destruction on discretionary energy and discretionary goods, hence stagflation turning into recession. So, one tells us about the other. Why not?

If I recall right, gasoline retail consumption is very correlated with general retail goods consumption.

Earlier they felt so rich by the stimuli to pay any price. This is gone now.

The amount of stimuli are the real reason for all this mess. If people were just compensated of their income loss perhaps the inflation were really just temporary.

So the cost of mortgage credit is increasing, just as it should in a rising interest rate environment. And due to the inflation, we need to be going there. And if the fed hikes too fast, it fears 9I assume), it might cause panic selloffs and recession. It is trying to steer between the rocks of inflation and recession. No conspiracy theory needed.

As in the GFC, it is easy in hindsight to classify the Fed’s moves as foolish. Knaves or fools? I tend to think fools, most often.

The spreads I wildly guess, are maybe a different reading by banks of credit risk between consumers’ expected future mortgage repayment/default rates and treasury total returns? If we have a recession, as one scenario, I imagine default rates will spike. Maybe banks are concerned about this too?

phleep,

Lending standards are set by institution underwriting…

With the Fed backing the housing market, the lending standards were looser than normal…

Without the Fed backstopping housing, the lending standards will be tighter if the loans are to be securitized…

In a world of high house prices, inflation, and rising rates, the mortgage rate will have to reflect the lending risk (borrower) and the possible decline in the collateral ( the house)…

Thus the spread…

The mortgage rate will reflect the lenders risk premium over a 10 year relatively risk free treasury vs issuing a mortgage…

Simply, with the Fed backing housing and the value of housing going up, low mortgage rates…

Without Fed backing, housing will probably decline, high mortgage rates…

I think I got that right but feel to correct me…

Right on phleep

Actually, for so-called conforming loans, i.e. loans that can be sold to Fannie Mae and the other GSEs, the government sets minimum lending standards. The banks follow these standards or else the loan will be ineligible to be sold and securitized.

But technically, the banks can set whatever lending standards they want for non-conforming loans, as long as they either hold the loans themselves or securitize them to private investors (the GSEs won’t buy them). Which is why there were so many crappy loans like NINJA loans and no-money-down loans made pre-2007, and which caused huge losses for private investors.

But the banks learned their lesson. Nowadays, the main source of non-conforming loans are so-called jumbo loans where the amount lent is higher than the GSE limits. And these generally have stricter requirements than conforming loans because investors now generally demand higher quality loans in the packaged securities they buy.

Anyway, I just wanted to point out that while currently, private lending standards are stricter than GSE’s standards, that’s not always the case. In 2005/2006, lending standards for non-conforming loans were significantly lower than the GSE standard. It all depends on what risk appetite private investors have.

“In a world of high house prices, inflation, and rising rates, the mortgage rate will have to reflect the lending risk (borrower) and the possible decline in the collateral ( the house)…”

What you are really describing is any uncertainty that the mortgage guarantee will be honored. It’s “US government guaranteed” and to my recollection more explicitly than pre-GFC though don’t remember if it’s now with “full faith and credit”.

Throw in supply chain problems and there is no upside from my perspective. The US better start making more stuff, and soon…

But how many American politicians in Congress earn rental income from their properties?

The Deputy PM/Minister of Finance (former journalist) OWN RENTAL PROPERTIES. Conflict of interest.

Canada is in such a huge political mess that the Deputy PM stands to become richer from a housing bubble.

They all earn rental income. Either from renting real estate, or renting money (interest on money, and maybe even dividends in todays world of the FED put should be considered interest).

We have become a rentier society. Those at the top are rent receivers and those at the bottom are rent payers. An efficient form of Master and servants.

This is exactly why the FED and BOC are dragging their feet to combat inflation. They are beneficiaries of the real estate and stock bubbles. This should be treasonous to the American & Canadian citizens.

Mr. Richter,

Assuming this analyst is correct in assumption the US equity markets face at least 10 year bear market and possibly longer, I would also assume this would put a pretty huge dent in housing prices right?