The hype-and-hoopla era was just so much fun while it lasted.

By Wolf Richter for WOLF STREET.

Look, I have a BBQ grill made by one of the grill and griddle makers here, and some of the companies here have been around since dirt was young, and others are startups, and so they all rode up the lockdown boom, and now it turns out that the boom didn’t last. And that’s OK.

What’s not OK is that these companies, at the very end of the lockdown boom in the second half last year, when everyone already knew that this lockdown boom was ending, decided to go public at mega valuations amid huge hype-and-hoopla spread by Wall Street banks and their minions that all made a gazillion bucks on these deals.

What’s not OK is that these shares were sold to retail investors directly or indirectly and then, after a quick spurt, the shares collapsed as everyone knew they would, because by that time, countless stocks had already collapsed, following the infamous February 2021.

So here we go again.

Traeger Inc. [COOK], which makes wood-pellet-fired outdoor grills and sells wood pellets, reported earnings this evening. The original company was founded years ago and was sold to PE firms in 2014. In 2017, the company was “recapitalized” by a new majority control shareholder, AEA Investors in partnership with Ontario Teachers’ Pension Plan. The company, as it says now, “entered the BBQ category because it’s ripe for disruption, and our strategy is already working. We are winning with disruptive product, sales and marketing…”

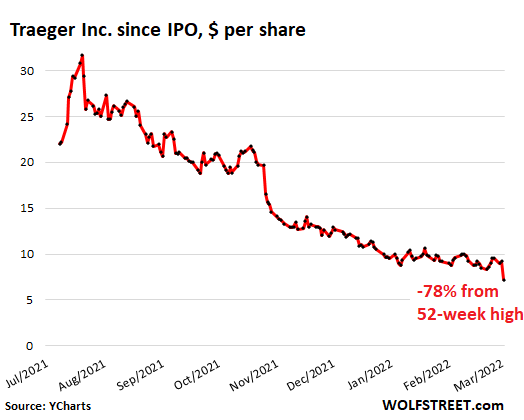

Yup, disruptive. And so this evening, upon the earnings release, shares tanked another 18% to $7.20 a share in afterhours trading, down 78% from their high on August 9, 2021, and down 60% from the IPO price of $18 on July 29, 2021. This was one heck of a “disruption” for the folks that bought the Wall Street hype-and-hoopla, premediated by Wall Street. They knew what would come, a massive wealth transfer (data via YCharts):

Traeger reported today that it lost $33.6 million in Q4, ended December 31, up ten-fold from a year ago, and it lost $89 million for the year 2021. In the year 2020, before the company went public, but during the maximum lockdown boom, it made a profit of $31.6 million. In 2019, it had lost $30 million.

In its earnings release, the company guided for lower sales; “we are projecting lower than typical growth in 2022,” it said. And it mentioned “near-term headwinds,” and costs were going up everywhere in its operations, and its gross margin were getting squeezed.

In terms of Q4, sales jumped 30.8%, but gross profit rose less than that, +28%. Operating expenses spiked by 78%. And so the net loss multiplied by 10, to $33.7 million.

The operating and cost issues aren’t the problem – all companies face this inflation nightmare. And companies that benefited from the lockdown boom, are now having to say goodbye to it. The problem is that the shares were sold with huge hype and hoopla at ridiculous valuations to unsuspecting retail investors that are now getting cleaned out. Hype-and-hoopla booms have that effect.

Other grill and griddle makers too.

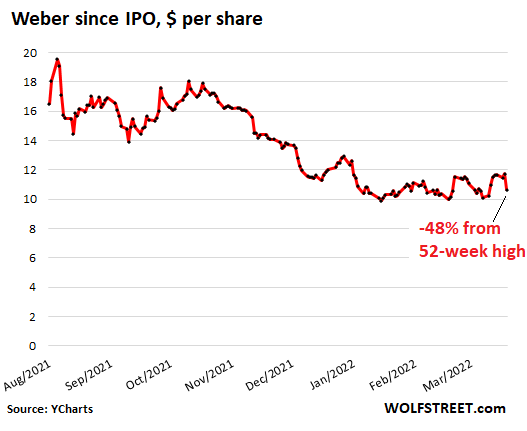

Weber [WEBR], the grill maker that has been around since dirt was young and made money over the last three years before it went public, had its IPO right at the end of the lockdown boom, on August 5, 2021, at the IPO price of $14 a share. Shares then spiked 50% to $20.44 by August 10, and then the whole thing came unglued.

In 2021, it lost money, and it’s just a grill maker that has been making grills for decades, and the lockdown boom is over.

By mid-January, the stock price was down to about $10 a share, where it has been bouncing along ever since. In afterhours trading today, the stock fell to $10.65, down 48% from its high and down 24% from its IPO price (data via YCharts):

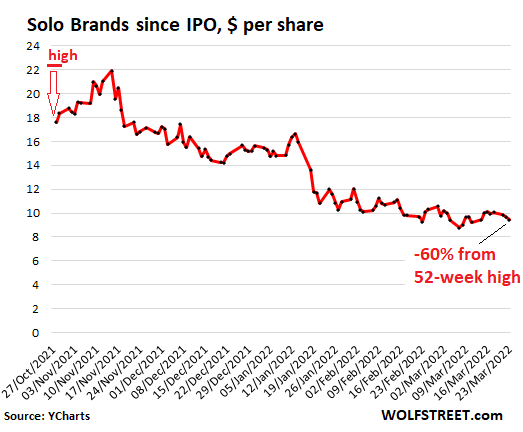

Solo Brands [DTC] – its Solo Stove brand of firepit cooking systems and grills makes up about 90% of its revenues, and three companies it hastily bought just before the IPO make up the other 10% – went public on October 28, 2021, at the IPO price of $17 a share.

The first trade out the gate was at $22.36, valuing the company at over $2 billion. Minutes later, it traded at $23.39, before shares fell. Today, shares closed at $9.45, down 60% from its high on the first day, and down 44% from its IPO price (data via YCharts):

Eagerly awaiting the Blackstone Products SPAC.

This isn’t over yet. Blackstone Products, which has been making BBQ griddles for over 15 years, announced on December 23, 2021, that it would merge with a SPAC and that the merger would likely close in Q2.

The SPAC minus Blackstone Products is currently trading under the ticker ACKIU. The merger, when completed, will make Blackstone Products a publicly traded company. Unlike companies that go public via classic IPOs, there are not a lot of hoops to jump through and not a lot of things to disclose, and pretty much anything flies. Many of the stocks of companies that went public via SPAC since 2020 have collapsed by 70%, 80% and 90%, and I have covered some of them, such as the EV SPACS and Grab, the biggest SPAC ever. So I’m eagerly looking forward to this latest SPAC miracle.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Zing

Disruption = we do not make a profit, we will never make a profit and will burn through investor funding as long as it lasts, hopefully until at least the lockout period ends so we can sell our shares and become wealthy.

“As it says, it “entered the BBQ category because it’s ripe for disruption, and our strategy is already working. We are winning with disruptive product, sales and marketing…”

More “……dogs with fleas!”

Amazing financial engineering and all the investors get grilled. 🤣🤑🤣🤑

These “investors” are “self-basting!”

Investors are getting raked over the coals.

and undercooked – medium rare anyone?

To be frank, they were a bunch of wieners with too much money

I bought a bbq yesterday for $59.00

Works good . Was on sale .

A few years back I went through something like 7 grills in 4 years… in FL, I use them all year round… great for a little while, but all fell apart rapidly with use…

About 5 years ago I got a Big Green Egg… never looked back… best grill I ever bought…it will outlive me with relatively zero care…

My kids will fight over it when I die…

COWG… everyone that I know who bought a Big Green Egg says the same thing you do. But weirdly, I rarely see them actually grilling. Make of that what you will.

Shoot, I use mine all the time…

Beer can chicken last Sat… got the bird a $.63 a pound… actually got two…

Ribeye last night…

“About 5 years ago I got a Big Green Egg”

COWG,

Bought our first one in…1956…on Okinawa. They were a common cooking device used by the indigenous.

I’m still using the Weber Kettle Charcoal grill my kids bought for me for Father’s Day in 1998.

My previous Weber was a the same model that was purchased by my parents in the early 1970’s. The real wood handles deteriorated. They went to a type of phenolic handles on the 1990’s models. We’ll see if they last.

I prefer charcoal to LP gas.

Why did these companies, which have good products, wait so long to IPO? Did they think the increased use of their products due to lockdowns, would continue? Did they just take advantage of the situation, greed, or just plain lack of foresight?

Propagation and Dispersion of Ideas. New ideas and concepts are spread out in waves, through different media, with varying properties.

There are some “fast” companies who are always going to be “up front with the very latest”, then many more “unimaginative” companies who are firmly welded to “best industry practice” defined by others, and then there are all of the “stale” backwaters.

The first wave of a New Thing, maybe the hardest effort and using the best salespeople with F1 tickets and the sharpest consultants, goes into the “up with the latest” crowd.

If that succeeds, whatever that lot are up to eventually appears in industry magasines, “all the big guys are doing it, it is best practice”. This generates the long tail of very profitable “bread and butter” con-slutting work amongst the large “best practice”-copycat crowd.

Finally, we hit the backwaters. The more suspect and commission-driven salespeople will be trawling those, maybe competing with someone that has copied the original idea, thus creating the final wave, where the costs of “the solution” is also dropping to make sales.

BBQ manufacturers are definitively way out in the backwaters.

Interesting post.

….sounds a lot like Cantillon’s propagation and dispersion of manufactured money!

Last second correct,plus 8 trillion $ ,simple ,smart

Prime retail investors, not prime rib, being grilled ?

Sincere question about SPACs: if I buy their shares while they’re still an empty shell, before they merge, then can I still redeem them for $10/share if I don’t agree with their merger? Or is that put option only available to the early, private investors and not people who but the SPAC in the public market?

Pretty sure the “put back” option in SPACs is supposed to be open to all shareholders of the same class (in general, SEC statutes and regs don’t like differential treatment of same class shareholders…but note *two class* jiggery pokery that some mega techs use to maintain absolute corp control).

That said, the wise course is to *always* read the prospectus in depth to understand what actual rights come with your shares…the SEC loves the “contractarian/caveat emptor” view even more – there are only a few inalienable corporate shareholder rights that can’t ultimately be contracted around by a halfway decent securities lawyer.

But the jiggery-pokery *does* have to be disclosed in the prospectus.

Yeah, that jiggery pokery was what I was curious about :) so many companies these days IPO with different classes of stock between the founders, the initial private investors, and what’s offered publicly to the sheeple that I was curious whether the put still existed.

The last 2 years have been a money grab of historic proportions. Now, we get to pay for it.

You think? Wait till MMT arrives. Every family will get a minimum of 2 BBQ grills dumped on their front yards.

… with 3 new kinds of tax bills, and incompetent “helpers” on the employment program, meddling in it all.

In the movie Brazil, I think it was DeNiro, who played a rebel outlaw plumber, who showed up spontaneously and actually efficiently fixed things.

A real MMT in the US would end the USD’s role as global reserve currency.

The Empire will never be sacrificed to do that.

“the shares collapsed as everyone knew they would”

Not everyone apparently. You’ve got to give the sellers credit for their cunning ways to always find investors, … ehm … gamblers, who fall for their sales pitches.

It’s sort of a free world. Nobody is forced to buy into these stocks/stories.

But it does amaze me that there are still so many believers/gamblers to be found.

I guess it is a feature, not a bug. We the public have the opportunity to take a flyer on something that might work out. Or not. The government is helpfully there to pre-screen the pitches, and help police fraud.

If it works out, we get to keep the upside (net of taxes, to pay for said government). If not, we should rightfully take the loss.

This does not apply to people having kids, in the welfare state. If that works out, the parents keep the upside. But if the parents are incompetent at life, they will be bailed out, and the bills get forwarded to me and you.

> it does amaze me that there are still so many believers/gamblers to be found.

A bug, perhaps, in evolution. Each new generation has to learn life all over again from scratch (barring a few inherited instincts and other traits). To some, though, this is a marvelous arbitrage opportunity.

I think Ray Kurzweil has complained about this feature/bug, as an argument for individual life extension.

“But it does amaze me that there are still so many believers/gamblers to be found”

Agreed…the apparently endless supply of suckers with money is *amazing*.

(I mean, who really gets all hot and bothered by a “disruptive BBQ tech” pitch for chrissakes…and who is also too imprudent to not Google around a bit to see if it is a good idea.)

Based upon semi-recent history, I would say that 95%+ of IPOs have to raise 25 mil at a minimum in order to go off (yielding $1.5 mil to invt bank hawking/pushing the IPO).

That is $25 mil *cash* for actual shares sold (likely just 20% to 25% of total float, yielding post IPO mkt caps of $100 to $125 million).

That is $25 mil in actual walking around money that has to be cajoled out of semi-sentient human beings who worked for that money (or who are rich enough to pay for “professional advice”).

Now imagine dozens and dozens of similar (or much larger) IPOs.

(On a semi-related note, ultra long-shot biotech IPOs are a *huge*, multi-decade phenomenon…but at least there I assumed it was well-heeled, financially inattentive Drs. shoveling money into the IPO furnace).

“When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done,” declared Keynes in The General Theory of Employment, Interest, and Money.

Ok, but 20 years of ZIRP central mgt of the economy by the Fed has done a pretty crappy job too.

Somehow, interest rate gutting (via money printing) has managed to explode asset valuations (including leverage-centric housing) far beyond reason, while managing to leave underemployment/pay stagnant or (much) worse.

At least when some idiot overpays for a stock, everyone else isn’t dragged into his nightmare.

Can’t say the same when DC uses our incomes/currency to cover for its f-ups.

Dollar has collapsed 99% in 100 years. Read Eustace Mullins. His most descriptive was “The Secrets of the Federal Reserve- the creature from Jekyll Island”. Caution. The effects of understanding the contents will not may alter your view that can damage your ability to sleep contentedly, hence my post in the madrugada.

Opposite problem is banking crises and a lack of sufficient currency, that has plagued societies through history also.

No, it’s always excess debt and leverage from imprudent lending. There is never a “shortage” of money.

Persistent inflation is evident but the full consequences of unsound money and unsound banking (what actually exists now contrary to what most believe) aren’t evident yet because that’s coming in the future, in the form of lower or much lower national living standards.

Instead of the periodic monetary panics prior to the FR’s creation and post-WWII recessions up to 1991, we’re destined for an eventual “fail tail” catastrophic systemic collapse from the accumulated build-up of debt and leverage.

No, the current philosophy of “printing” and borrowing on the front-end supposedly managed through “macro-prudential” regulation on the back-end will not succeed in regulating moral hazard because there is no free lunch in life.

@ Chase –

Amen. I haven’t slept well since 2005. For me, awareness came gradually, but in time to dodge most of the 2008 crisis.

Today’s bubble is much worse, and the government is less competent to deal with it. A Cat-5+ economic hurricane is coming.

When I can’t sleep, I try to find “the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference”. That’s one reason I chose the nickname “Wisdom Seeker”.

Kinda like why I chose the moniker Lisa_Hooker.

Money can’t buy happiness, but enough money can rent it.

🤣

How about an clean oil type drum and a torch…..DIY

Those pellets are expensive….and half the fun of grilling is tending to the fire. …no automation.

The BBQ and “must use our pellets” is the old Kodak camera free, and here is what the film will cost you…game.

Just another example of investors forced to chase things they shouldnt because there is no fair return on the dollar, which disappears in a savings account. Nice job Fed.

Also why Gillette virtually gave safety razors away.

Expensive is relative.

A 40 lb bag of wood pellets (Mesquite, Hickory or Oak) is like $6 at big box store and lasts a couple of months with almost daily normal grilling.

Meme stocks are roaring back this week.

GameStop $78 to $141 in a week despite reporting losses during its holiday quarter (how is this possible?)

AMC Theatres $13 to $21.

Tesla from $750 to $1000 on no news.

Jackson Y,

“Meme stocks are roaring back this week.”

Typo. Should be “were”

At the moment, GME -9%, AMC -8%, only TSLA is edging up today, and TSLA isn’t a meme stock.

I have a page from Ladies Home Journal of August, 1929, titled “Everybody Ought to be Rich, an Interview with John J. Raskob.” It says most anyone might be a millionaire with stocks. Raskob was a key player in putting up the Empire State Building, just as the crash proceeded. Great building projects to some are indicators of such turning points. This time, various flashy “disruptors” too, eh?

I saw that same Rascob ad, and was also intrigued by the public naivety it displayed.

Appealing to the “get rich quick” crowd has been a mainstay of both the press and the stock “plungers” forever. (Read Niel Stephenson’s Baroque Cycle, or David Liss’ Conspiracy of Paper, for depiction of stock scamming in prior centuries).

I know this will be controversial here, but why is it immoral for an entrepreneur to start a company, build up it’s sales, and then sell their holdings at the top, but OK for a naive investor to try to get in on the party buy buying in at what he thinks is a low price. Both are hoping for possible (but not guaranteed!) company profits.

It takes two to tango, and the buyer of shares, looking for a quick buck, is no more moral than the entrepreneur, imo.

I guess you could make an argument that one is smart (more informed) and one is stupid (less info AND naive, to boot). But if so, then most of us fall into the immoral camp!

Analogies: grand larceny and petty larceny, first degree murder and second degree murder

I think more to the point a gambler and a casino. Not the same moral category, unless one or the other actually cheats (commits fraud). We have no evidence of fraud here.

Animal instincts. I don’t think intelligence figures into it. Newton lost his shirt in the South Sea bubble after he reentered because people around him were making so much money.

Intelligence comes in different flavors, I guess.

Look at Bernie Sanders and Donald Trump. Both highly successful — and both intelligent in different ways, IMO.

But this thread is talking about wealth-building and wealth preserving intelligence. Just to clarify, that’s what I meant by my “smart” and “stupid” comment.

“why is it immoral for an entrepreneur to start a company, build up it’s sales, and then sell their holdings at the top, but OK for a naive investor to try to get in on the party buy buying in at what he thinks is a low price. Both are hoping for possible (but not guaranteed!) company profits.”

It’s not immoral to do the IPO. Lying or misrepresenting the company’s prospects is wrong.

As for the “investor”, it’s their money but just plain dumb to believe that a BBQ grill maker is likely to grow noticeably.

It’s a mature market where unit growth is only likely to occur due to selling a junk product that need’s frequent replacement. Are there really that many people who want one but don’t have it now? For an individual company, by taking market share from another one.

It’s the type of company that in normal times would sell for a P/E of less than 10 to low double digits and require a dividend yield of at least 4%. This is assuming they are actually consistently profitable.

I checked the financial summary for three of the companies in this article. Despite the declines, all sell for “stupid money” prices and it’s because we are in a mania.

I wonder how many people invested their stimmies in these companies. YOLO.

“YOLO”

But Wall Street can bend you over an infinite number of times.

I think the last 20 years pretty much justify removing “reputational risk” as a thing in economics textbooks.

I mean if IPO underwriting invt banks are still able to shovel people into BBQ “disruptors” in the era of the internet…

I think by the time these companies had their IPOs in the second half of 2021, most of the stimmies were already gone. Hence the near-instant downdraft.

It’s amazing the number of products or services touted as “disruptive” — from electric vehicles to BBQ grills. I get at least one call a month from brokers trying to sell shares in a company that will “disrupt the industry.” One key to being disruptive is nobody knows it. It’s a product that has a bad reputation among industry experts. A piece of junk that sells significantly below market prices. For example PCs being derided as “toys” by the technology industry in the late 1970s.

Every new startup aspire to be DISRUPTIVE and the cool place to work for with their open office concept 🤣

Wonder how much energy was consumed by all these BBQ grillers?

I’m sure there was a lot of human energy consumed protecting themselves, walking away with millions, and dumping the burnt burgers on low tier investors.

They were not selling grills, they were using grills to sell stocks. This CONcept is not new. Since dirt was young made my nematodes twitter.

“ They were not selling grills, they were using grills to sell stocks”

Otis,

One fine comment…

Should be the question that gets answered before you put money into anything…

1) Zero interest rates promote dividends and buyback.

2) The FANG and other big tech absorbed thousands of small innovative

co. Big oil and wall street M&A guys are targeting the energy sector.

3) Higher rates protect small co from attacks. The higher the rates the more innovations.

4) Since 2009, with zero rates, many co CEO cannibalized their co with

buyback and dividends.

5) SPX & NDX have many co with share holders equities < 20% of total assets. The rest is debt. Rising rates cleanse the zombies zoo.

6) A global zombie zoo.

7) The zombies swim with the sharks. The first bite Invite. In their trading rooms sharks smell the blood.

8) JP will provide steel cages to the best and the most important. He will have to chose : who will live, who will die. Why me, Why me. Can we do something with the gov …

Real interest rates are still below zero. Already these IPO firms are wobbling and falling like zombies, bursting like popcorn. I can’t wait to see the next leg of interest hikes. Popcorn ready!

I wonder how much retirement savings and pensions are resting (perhaps indirectly) on these wonderful assets and markets.

Everyone can’t be a Wal Mart greeter.

#6 is a gem… we are indeed in a global “Zombie Zoo”!

Agent K: “What a gullible breed.”

Darwin: “Shh! I’ve got this.”

Wolf,

“The company was founded in 2017”?

You mean “went public”?

I think Traeger has been around a lot longer than that (???)

I see you said IPO was 2021, but I think the company has been around for quite a while.

1985?

That was very sloppily said on my part. The company was “recapitalized” in 2017. The original people (the Traegers) sold it to PE firms in 2014. And it seems, that didn’t work out. Then new owners with new capital took over in 2017. I updated that section.

Sometimes a firm can be around a long time, before finally hopping on a bandwagon that promptly goes off a cliff.

That happened to the most conservative and respected savings & loan here in San Diego, in the 80s. It finally decided to get racy, and promptly built and lost its shiny flagship headquarters building, as it went bust.

My understanding is that Traeger was a family owned company in Oregon. Their pellet grills simplified smoking meats to an amazing degree. No need to tend the fire every 20 minutes. Smoking can take up to 20+ hours, so that is a big advantage. The family sold out and the new owners moved production to China. Patent expired and the rest is history.

Barings Bank, PLC (1762 – 1995) was another great example.

I have one piece of advice: do not try to make a grilled cheese sandwich on a George Foreman grill.

Or at least, have first sold the debt on it via a stock offering or securitization to a bunch of fools.

I went for the Joe Frazier grill.

Office Humor.

Especially not on the floor on the side of the bed.

Rolling out of bed after the alarm can be dangerous.

Seems to be rotation into quality. Berkshire is selling at 1.5 X book. A recession usually takes everybody down including Berkshire. The past 20 years bottom is just under 1.0 book for Berkshire and top is close to 1.6 book as people flee to quality. Might be different this time, but I doubt it.

Berkshire (aka Kurobuta) is a fabulous, well-marbled heritage breed. It’s my favorite pork to BBQ ;-)

I have a weber 25 yrs plus. The owner was throwing it out.

You can still get parts for it. I might buy some shares.

On the other hand, how can you make money when things last

so long.

I am an expert on the subject. I got 1 cord supply of Apple and Hickory Wood seasoned to perfection,3 shoulders , rubbed, wrapped and ready to hit the smoker this weekend. My smoker is an IPO smoker. I-Paid-O for it. It’s a barrel smoker/grill / gas or wood with detachable wood box and/or pellet feeder. Cheap to build with hillbilly engineering skills that I and my ilk have mastered. Hillbilly Engineers can be found in West Texas and West Chester. It’s the American Way. Do it your self and if you can’t someone will teach you. For the record vinegar based down east N.C. style smoked hog is the best. I dearly love the Lone Star State and its people but we need to get together on the nomenclature. Over a keg of course setting in a trash can cooler

How long does it take to smoke investors?

So to speak.

You don’t measure by time; you measure by internal temperature. It’s different for each investor.

LOL! I love the screams as you insert the meat thermometer.

I love a good NC pig-pickin’. When I lived in NC I always went to Hillsborough Hog Day. Still have the hat.

For brisket and ribs, it’s Texas, no question.

1) The British Royal Mint will recycle cell phones and computers junk into gold, using a small Canadian innovative co patent.

2) Currently only 20% of 50 millions tons of electronic junk are recycled, mostly in the far east.

3) The Royal Mint will melt 300K tons British electronic junk, producing hundreds of pure 24K kg gold annually.

4) Does it matter to this co if interest rates are 2% or 15%.

5) Did it matter when disruptive co approached Michael Milken knowing that he will charged 15% – 20% to cover his risk.

1) Will the Fed raise interest rates by 0.50% : Yes !

2) When.

3) The Fed threats might be good enough to send SPY to 380, beaching Feb 24 low.

4) If the Fed raise interest rates moderately, SPY will popup to a lower high, near the top, or slightly above.

5) The new “inflation normalization” will force JP to be more aggressive.

6)

Disruption my @ss. Watch Silicon Valley series to see how moronically devious these scumbags are that cook up these IPO valuations. And if the PE firms and whoever else loses their shirts using their own money I have no problem. But when the bloody “money manager” at my 401k firm or the jackass that manages my kids 529 gets in cahoots with these scumbags and loses my money they need to be taken out to the woods. My kids 529 is down 7% YTD. Over all its 6% up, thinking about stopping contributions to the 529 as well as 401k.

Now Wolf.. it IS rather difficult to grill insects without succumbing to total carbonization, now that we’re incessently being told by our betters to nosh on – as per all condescension of ‘substitutional’ Fedspeak ..

… unless of course, it is in reference to WEFian, Bank$ter/Market ferengi .. or most of the assorted squirming politicial ‘maggots’ that abound!

Then it’s “down the hatch” regardless. I’m sure some enterprising startup could repurpose a grill with a chili basket .. to cook such delectable ‘treats’.

Cheers ‘;]

I’ve been using Webber Grills for 20 years. Just got a new one last year which has a unit to boil water attached. This comes in handy during the frequent power outages from our useless Power Company Pepco, which has transformers from the 1930s and refuses to update their infrastructure. I noticed that the whole Grill is not made in the USA like advertised.

“The bold print give-ith and the fine print take-ith away”

If you look hard enough, which I did, I found out the the entire grill in MADE IN CHINA.

The wheels on my Weber Sprint Series 300 grill bought four years ago went out first. The plastic wheels just crumbled into little pieces. Next, the electronic igniter quit. I replaced the wheels and igniter buying the parts on Amazon. You are right…..all Chinese and losing the old Weber quality.

I really expected better quality for a grill I spent almost $500 on. The old *no name* Lowes grill I paid less than $200 for years ago lasted quite a long time. The only reason I don’t have that old grill was that I built it in to my patio at my old house and left it there when we moved 5 years ago.

I am confused by how any investors sophisticated enough to be allowed to participate in IPOs are so stupid as to think that the BBQ industry (!) is on the verge of “disruption.” Do the Teachers of Ontario (and/or their fund managers) not eat BBQ? If they eat it… do they not watch how it is cooked?

Where I live on the Gulf Coast, BBQ is as likely to be cooked in an old metal oil drum laying on its side as in anything bought in a store.

You know the saying right? You can’t fix stupid.

Smoke gets in your eyes.

Stand upwind, no?

Why is a Canadian Teachers Pension Plan Ponzi scheming over American citizens?

I still use my 1990 “Texas” Traeger grill. I think I paid $600 for it in 1990. I sand it down and paint it every other year and I’ve had to replace the fan motor once. I did have to convert the firepot to electric start because I had the old liquid gel start. The thing just keeps going and they were made very well back then. If my memory is correct, Traeger sold out to Smith & Wesson and production was moved from Mt. Angel to Tualatin Oregon. They were there for a few years and then switched manufacturing to China. That’s when the quality of their grills imploded. Cheap steel and cheap parts that failed and the grill became disposable. What a shame. I know the founders and they sold out to “the man” but I bet they regret that decision now.

onionpatchkid: In my MBA class we did a case study on Traeger. They had a legacy workforce at the time they were first sold to PE, and things got so ugly that management moved the entire operation to Tulatin to start fresh, with mostly new people. Sounds like it was successful for a short time – they had a top-quality product and charged accordingly. I noticed that gig was up a few years ago when I saw Traeger grills at big-box stores. It made me depressed to think that anytime anything is nice and different, it is wrung completely out for immediate profits, quality/reputation/legacy be damned. Traeger grills were a cool idea, well-engineered and made (in US). They were not ever intended to be a mass-market appliance. They were a top-of-the-line maker of a niche product, now squeezed out and used up.

My wife bought me some Traeger grilling tools for my birthday. Looked at the label and they were made in China. Took them back and found some made in Ohio. Been doing that with everything I buy now.

I grilled a steak over the weekend.

Couldn’t get it to talk.

Disruptive product = Cathy Wood please buy our stock.

You can get a truly disruptive BBQ grill by making it WiFi compatible and cutting out the middleman by using cash bills as fuel. The heat from mining crypto can keep your pea protein, beyond impossible meat warm, and you can receive text notifications whenever you have to flip. Recurring revenues can come from a barbeque SaaS subscription with videos from leading influencers, and everyone’s smoked cannabis recipes and techniques mined and collated on the cloud. It is not just a method of cooking; it is a technology platform.

Sorry but Solo Brands / DTC is a screaming buy at these levels. Company is profitable, sells for 1.2x its 2021 sales, and 75% of revenue comes from its Solo stoves, which grew 170% year to year. Find me another company growing that fast with a forward PE of 9 (yes, 9).

Jeff O.,

Well, not a “screaming buy” today. Plunged 8% today. My charts are already way outdated. Shares are down another 13% from the last price in my chart.

Just a reminder: right before the IPO, the company bought three companies, and that’s where the growth came from on the last financial, which was through Sep 30, 2021. We don’t have Q4 yet. Maybe that’s what you get so excited about?

Yes I posted my comment after close, so I knew it dropped today when I said it was screaming buy. It’s incorrect that acquisitions are primarily driving Solo’s growth. At the ICR conference on Jan 9 the company broke down revenue between Solo and their other brands (and raised guidance for Q4, which had already closed). Solo is 75% of revenue; the three acquisitions combined are only 25%. Solo grew at 170% for the year; the acquisitions are growing at 30-40%. Great growth, high margins, and their smokeless fire-pit is category-defining. Reminds me more of a young Yeti than the BBQ companies.