As the market continues to come unglued stock by stock.

By Wolf Richter for WOLF STREET.

On today’s menu of imploded stocks are two extra-specials:

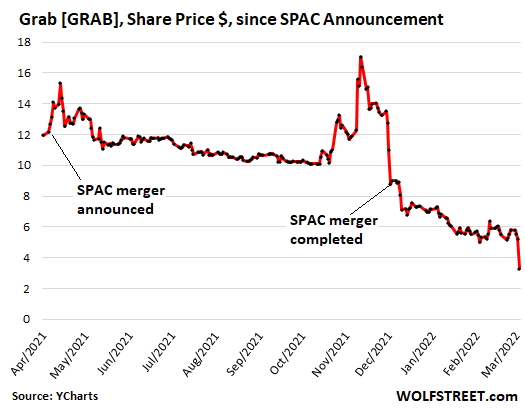

- The biggest SPAC ever, ride-hailing and food delivery app Grab Holdings, crashed by 37% today, bringing the collapse to 81% in the four months since going public;

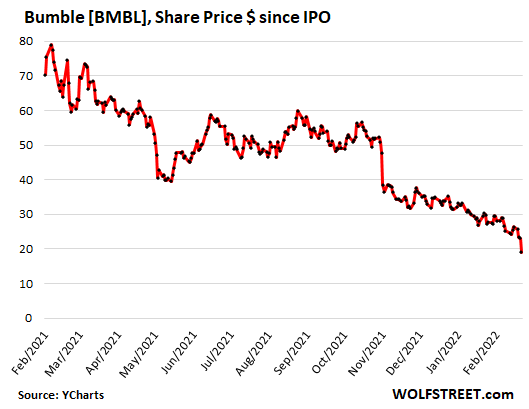

- Dating IPO stock Bumble crashed 16% today bringing its total collapse to 77% since its high just after its IPO in February 2021, the now infamous month when the highfliers started coming unglued, stock by stock.

SoftBank-backed Grab, the largest ride-hailing and food-delivery app in Southeast Asia, is headquartered in Singapore and went public via merger with a SPAC in the US and is trading on the Nasdaq.

The SPAC merger was announced in April 2021 and was approved by SPAC shareholders on November 30, 2021. The deal valued the company at $40 billion, making it the biggest SPAC deal ever.

The SPAC’s shares, which had been trading on the Nasdaq before the merger under a different ticker, started to trade under [GRAB] on December 2, 2021.

Today, Grab reported earnings for the first time as a publicly traded company, namely a colossal loss of $1.06 billion for Q4, nearly double the loss from a year ago. For the whole year, Grab lost an inexplicable $3.45 billion, up from a loss of $2.61 billion in the prior year.

How can you lose $6.1 billion in two years by delivering food and driving people around? That was a rhetorical question.

Revenues plunged by 44% to $122 million in Q4; and for the full year by 44% to $675 million. As you’d expect, there’s a big yada-yada-yada story to make this fiasco sound better, including that the company spent a huge amount on incentives, discounts, and promotions to get consumers to use its services and to get drivers to do the work. These incentives are deducted from revenues.

Upon the news of exploding losses, shares crashed 37% today and are down by 81% from their high on November 12, 2021, just before the SPAC merger was finalized. The boom in SPACs that started in 2020 has, as everyone knew it would, turned into one of the great scams (data via YCharts):

Dating app Bumble [BMBL] went public via IPO in February 2021 amid enormous hoopla. The IPO price was set at $43 a share. The first trade out the gate on February 11 was at $76 a share. Shares rose to $79.60 intraday and closed at $70.31. On the second day of trading, February 12, shares spiked to a high of $84.80 intraday, giving it a market cap approaching $10 billion. And that was it. Shares have dropped ever since.

Today, shares plunged another 15.7% during regular trading and 2.5% afterhours to $19.00. Shares are now down 78% from the high on the day after the IPO. Bumble didn’t even report earnings.

There may now be some hand-wringing and fretting among trading-app jockeys and algos that Bumble’s exposure to Russia and the Ukraine – it’s not huge: J.P. Morgan estimated that they may account for 3% to 4% of Bumble’s revenue – may cause the company to issue potentially reduced guidance when it reports earnings on March 8.

This is the kind of chart where the crazy stock market hype over the past two years comes home to roost:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Do we have the ability to see the benchmark of before Covid for average gains and losses? For example, what would the S&P 500 have to crash, percentage wise, to equate to the crash of 2008?

Thanks for your awesome blog!

The S&P 500 dropped over 50% in both 2000-2002 and in 2008-2009. The Nasdaq dropped 78% in 2000-2002. Many other stock markets globally are still below their various bubble highs decades ago.

That’s what most people fail to understand. Most world stock indexes are where they were pre year 2000 and they are the ones who have tried QE and all these stimulus tricks. US markets will suffer the same fate when this bubble finishes popping.

That tells the truth about post-2000 real growth: it’s zero. Everything else is the government spending mirage and CB bubbles.

2000-2002 was a massacre for QQQ.

March 2000 – 115 – Peak

May 2000 – 88 – local minimum – down 24% – Buy the dip!

August 2000 – 98 – Dead cat bounce

Sept 2002 – 23 – The bottom. Down 80% from the peak.

Recovery:

Nov 2015 – 114 – Recovered to previous high.

Will history repeat itself? Looking at the history of QQQ, we could extrapolate to today. The shape of the curves on the chart are similar.

Where are we today:

December 2021 – 408 – Peak

We are here:

March 2022 – 339 – Local minimum – down 17% – Buy the dip??

June 2022- 375? – Dead Cat bounce?

July 2024 – 82? The bottom? Down 80% from the peak?

August 2037 – 408? Recovery?

Will history repeat itself? Or will it closely rhyme?

OMG. From Nov 15 to Dec 21 it more than tripled? The steep elevation climb may indicate that the plunge reaches the bottom even before 2 years are up.

When the next 50-80% drop happens and the FED drops rates to 0%, then yes there’s a pretty good chance there’s a recovery but probably not anywhere near previous peaks. The potential to substantial social unrest in the next 10 years is rising dramatically each year. The reality is that the FED will struggle to get the funds rate close to 2% by the time the whole thing rolls over.

And, China will be have largest GDP by 2030, and its CBDC will be well on its way to pushing aside the dollar as the world’s reserve currency.

“How did you go bankrupt?”

Two ways. Gradually(most of 2000), then suddenly (2001-2002).”

― Ernest Hemingway, The Sun Also Rises

How long will investors stick with QQQ stocks when they are down 17% today and staying flat to decreasing before they all leave en-masse?

QQQ is paying a 0.5% dividend.

SPY (S&P500) is paying 1.3% dividend

DIA (Dow) is paying a 1.7% dividend.

iBonds are paying 7.1% interest.

The previous market collapses were deflationary collapses. We are in a highly inflationary period. I suspect your Powell will not be able to raise rates very much or suspend QE for very long. Some Fed members will want to keep inflation running hot. If QE is suspended then we will see how flexible US markets are. I anticipate stocks holding their own as Powell keeps, as Wolf would say, his foot on the gas. It is quite possible for stocks to trade sideways but because of inflation, earnings lose value in real terms. This makes shorting much more risky than in previous market collapses.

The Fed does not want to really fight inflation, that is so clear you would have to be blind not to see it. By shorting this markets you are claiming that the Fed wants to fight inflation.

I think the biggest wipeout of hundreds of billions of dollars so far were the Chinese “tech” companies. Their amazons and the googles. Well, our “tech” will wipe out trillions of fantasy dollars. And there is nothing central bank can do about it.

I remember when people thought it was impossible to knock down Mike Tyson. Then, along came a guy by the name of Buster Douglas, out of nowhere, who finally dazed Tyson and knocked him to the ground. It took a LOT of punches to Tyson’s rock, but it happened. Tyson’s lost a lot of aura that day, as reality struck. I say that, knowing Tyson may be the greatest fighter of all time.

Big Tech will likely fall much the same way. They’ll get knocked down and the aura will rub off, but they’ll come back in an environment of lowered expectations.

Same thing when Ali beat Foreman. And look how long it took Big George to come back.

Many multi-national companies are losing millions- billions and our stock market keeps going up ,this will be ugly

Outsourced fast food delivery is proof that investors are nuts. Hiring high school kids to deliver works well enough. There is no need for some tech company to impose themselves and take a cut.

I’ve seen the numbers. The restaurant loses money on each sale. The customer pays more than the food is worth.

I used it once, Uber Eats with a free coupon where I did not pay for delivery. It cost about 50% more than going myself, $50 versus $30+.

Never again

It’s a business that might be viable on a limited scale in high density urban areas but that’s a big maybe.

Somewhat like grocery delivery but I infer a lot more people are willing to pay a premium for this convenience. I have never used it but could see myself doing so when I am noticeably older.

maybe a TON older, as in non ambulatory AF

SO FAR, it’s an enjoyable experience to go to the grocery store and chat with all the young and younger folks working there these days, as I did when first allowed to when turned age 14 many moons ago…

These days, working conditions MUCH better than 70+ years ago, and neighbor kids tell me they are treated well and enjoy the work at Publix. (Publix not yet in small towns in SW FL when I was that age. )

I worked in a grocery store for eight years (Kroger) through high school and university in the 80’s but the one I go to now is a ghost town with very few employees. The main thing I liked about it was interacting with my co-workers.

I would hate working there now. Virtually no one to interact with.

just don’t be the older man who flirts with the young cashier, holding up everyone behind. it’s very annoying.

I agree.

I love Publix, when I have the time to walk every aisle, look at the new stuff, relax, and turn routine shopping into a walk with A/C.

I need to measure the distance that I walk when I walk all the aisles, and perimeter.

When I am in a hurry, want no choices, and the wife is at home, putting diner on hold till I get there with that ONE DAMN INGREDIENT WE DON”T NEED…..then it is Aldi…..and it is even better when I find a cart with the Quarter still in it.

Another interesting observation. People who shop at Publix are different from those who shop at Wal-Mart who, in turn, differ from those at Aldi. The Germans in my area love Publix. Wal-Mart is screaming families, and Aldi appears to be single women, aged 29-39.

I know…get a life….

Oh one more thing to make this an “economic” comment.

Prices vary greatly and one can not assume ALDI has the best prices. So far, the Publix Buy-One-Get-One (BOGO) seems the best. Wal-Mart seems the best for cheese since they sell the biggest “bricks”, thus price per ounce is the best.

When I was working and then back to college at the same time, Uber saved me in order to study because there was no food between the two. It’s that niche it makes it’s money. Students pooling delivery fees. Cheaper then universities having on site cafeterias apparently.

I dare say those charts are identical!

Oops. Thanks. Fixed.

It seem anything softbank touches get cursed

Soft bank comes in and blows your cap table out of the water typically making it uninvestable for other VCs or private capital. If you don’t want soft banks money, they are going to fund your competitor intentionally. At this point you’re locked in to public or bust. IPOs presumably weren’t fast enough for softbank to cash out, so SPACs became a necessary tool. Soft bank is a distortion in the early stage start up world that pushes too many companies too quickly to IPO.

I really REALLY have to start wondering if the infamous February 2021 start of the demise of high-flyer stocks is somehow related to the natural gas pricing disasters in Oklahoma and Texas when those states had their deadly cold snap during that time.

Some nat. gas spot futures apparently were priced as high as 100x normal that month, so it leads me to wonder if there was a liquidation ripple effect taking place behind the scenes which was commodity-based?

The GRAB plot appears to be a repeat of the BMBL plot and needs to be corrected.

Thanks. Fixed.

It looks like people are indeed R-ingTGDFAs

Yes, lots of them actually.

And I’m using unpaid labor to proofread my articles :-]

This isn’t my first rodeo. The nasdac is leading the way down as it always does…that top is something to behold…

Hussman always talks about dispersion as a indicator of the top. In heat of a bull market everything is going up. Now a lot things are heading down, just a few things at near all time highs.

We’ve had dispersion for a long time. We are finding out things in this market cannot be explained or predicted. The weird destructive behaviors seem to last a lot longer than they should because central banks are sponsoring them.

Central banks have completely untethered the markets and expelled nearly all common sense. The wrong thing to do has become the right thing to do. Perhaps a political revolution will have to arise before any type of mean reversion occurs. But since Reps and Dems are on the same page, in terms of inflation, a political revolution won’t result from a mere change in leadership from one party to another. You have to wonder what it will take to end the financial profligacy, given that the average person has zero representation in government.

Communism

National Socialism

Coronal Mass Ejection AKA Carrington Event

Match (MTCH) started it’s decline around October-November 2021. I bought it pre-covid for about $55. During the lockdown/mask period it went ballistic, up to about $160, now down to $100.

Strange price action for a dating app when you couldn’t date. It acted more like a pandemic stock.

BMBL went public at the peak of MTCH’s price action. Coincidentally, it had a major drop around when MTCH started its long slow decline 6 months later.

Dating sites are harder to understand than dating.

Out here in Oz, I have never heard of Grab. Amid the plethora of other delivery companies, it has not even registered it’s existence. I suspect that it has more to do with the fact that advertising would take a huge chunk out of their l̶o̶o̶t̶ p̶r̶o̶f̶i̶t̶s “losses”.

I don’t think Grab is in Oz. It’s the largest such app in Southeast Asia (Vietnam, Cambodia, Thailand, etc.)

My wife, trapped in Chiang Mai by exploding COVID numbers, advises that Grab is fighting massive competition. Large numbers of desperate unemployed are either setting up mini delivery services or freelancing for restaurants. Most delivery is via motor bike. Although E-85 costs nearly $4.00 a gallon, the official Thai minimum wage is being raised to $15 a day, so many are able to undercut formal delivery services.

If the US continues to push Russia out of international trade and freezes the Russian CB dollar assets, which will seriously damage confidence in the dollar everywhere outside of the NATO countries, and that is a lot of the world, think China & India, then I think that the US economy is going to see some very serious inflation and outrigh shortages of many things over the next year or two.

This is not longer a parochial US issue, I suspect that Biden has leaned way too far out of the window on this one.

It is just speeding up the progress of the Belt And Road Initiative. The West is shooting itself in the foot. Again.

China, I understand.

But WTF is India’s problem? Why do they have a skin in the Russia/Ukraine game?

Pnut-defense infrastructure heavily invested in Russian equipment…

may we all find a better day.

1stCav,

India produces military equipment / munitions?

And they sell to Russia?

I thought they just did IT work……

Pnut-apologies, i was unclear-India’s defense infrastructure is stocked primarily with Russian equipment and has been for decades-investment and training on different stuff not easily accomplished overnight, especially given the ongoing and precarious India/China border situation…

may we all find a better day.

food – lots of wheat from Russia also fertilizer – huge amounts. Real danger of big food shortages this year.

I can guarantee you right now China is thinking: WTF just happened to our new geo-political super- hero bestie? Floored in a week! Collapsed ruble, stock exchange closed, economy to contract 35%? International pariah, FIFA calls of Petersburg match!!! This may be the biggest sanction lol. Or maybe it’s the oligarch yachts fleeing for that hub, the Maldives.

If anyone is so delusional they interpret China’s UN abstain vote as support, they need to do some research. or at least read China’s follow up remarks about the need to not change borders by force.

These aren’t just US sanctions, they are those of the West. China’s number one fear now is being included. The only upside for China now is a price cut on Russian energy. They will get that anyway. But as a partner to take on the West? Better to try India.

“ How can you lose $6.1 billion in two years by delivering food and driving people around? That was a rhetorical question.”

One way – if you can find a lot of stupid people to step up and provide the $$$ to enable you to.

Perhaps this is a ‘globalization warming’ effect, i.e.: it allows naked emperors to wander around longer and (for an indeterminate time) avoid the chills from the odd Price Discovery Vortex…

may we all find a better day.

“Price Discovery Vortex”…nice….I have an image of a blizzard of paper swirling around stock and commodity exchanges when it all “escapes” at once. All previous participants could indeed walk down the street stark naked and not be noticed at all.

This site is starting to remind of FuckedCompany back in the dotcom days.

Aha! Somebody else remembers the FuckedCompany days. Revive that site!

I’d like to see another dot.com bust. It’d clean things up a bit.

That future is already here, it’s just not widely acknowledged (or evenly distributed) yet…

I totally forgot about that site! Thank you for the hit of nostalgia.

Wolf, thanks for another article!

Could you please, as a side note, explain why is Über always losing money, badly, and people are resorted to accept it as the fact to just go along with the stock as something normal? Investors (one of my friends is a former employee owning the stock) included.

I can’t wrap my head around this.

Rudolf,

I suggest reading the multi-part series of articles which Hubert Horan has written. They were originally published on Naked Capitalism.

Long story short: ride share rides have been subsidized since the get go.

it’s very simple. mania and psychology. no one cares that it makes money because they’re not buying it for its profit stream. they are convinced they can always sell the shares to someone else later for a higher amount. it’s the greater fool theory in overdrive.

at one point, i thought that it was the unwavering belief of investors that these companies would one day make money. now i don’t think they ever will, and i don’t think investors care.

Uber will lose money until it runs out of money to lose. Uber can make money, but it needs to cut its costs (it has already done a lot of that), raise its prices (has done that), and reduce the share it pays its drivers (done). Uber will be more expensive to use and less attractive to work for, and then it will be just like another taxi company and plod along making some money and not growing. Its stock will be priced accordingly.

I kid you not. My nephew works for Uber (WFH) as a recruiter, makes $200k a year and might work five hours a week.

Yes, they need to get their costs under control. I got one idea how…

“makes $200k a year and might work five hours a week.”

I feel like such a chump sometimes. Where did I go wrong?

Wolf-could never figure out why more folks didn’t deduce that since traditional taxi services were originally unregulated (by legal or market forces), that it was only going to be a matter of time before ridesharing services encountered that market’s same historic issues and constraints…

may we all find a better day.

Actually, ride share cost basis is higher than taxis.

While both ride share and taxis have the same unpaid journey to pickup problem – Seattle data showed taxis economize much more than ride share during peak hours.

Taxis averaged 5 rides an hour during peak periods while ride share bumps along at 2 rides an hour pretty much all the time.

I don’t use Uber but I noticed that some of the big influencers on utube don’t use them anymore. They are pushing another car service that is more upscale and employs the drivers directly.

I see. So, basically, the same kind of pump&dump but within information field boundaries :)

Son from SoftBank hit a home run with Ali Baba. It seems as if he tries for a home run every time he swings (invests). Just like baseball, when you swing for a home run every time you strike out a lot. I’m surprised by the billions others have given him to invest. Amazons and Facebooks and Ali Babas are rarities.

Both companies should be worth zero, and many others should be too.

Bumble…what a great name! Prescient.

Are Ukrainian women on any of these apps?

Headline: If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock

Sanctions have shown that currency reserves accumulated by central banks can be taken away. With China taking note, this may reshape geopolitics, economic management and even the international role of the U.S. dollar.

— Wall Street Journal

My comments either get removed or shit on for being “Russian propaganda” when I post ideas like this, but now we have it direct from the WSJ. I guess the Russian propaganda is everywhere.

Reminds me of Shakespearean sonnet by Kenneth Boulding sonnet written in 1960’s: What IS money?

We must have a good definition of Money,

For if we do not, then what have we got,

But a Quantity Theory of no-one knows what,

And that would be almost to true to be funny.

Now, Banks secrete something, like bees secrete honey;

(It sticks to their fingers some even when hot!),

But what things are liquid and what things are not,

Rests on whether the climate for business is sunny.

For both Stores of Value and Means of Exchange

Include, among Assets, a very wide range,

So your definition’s no better than mine.

Still, with credit-card-clever computers it’s clear,

That money as such will some day disappear,

Then, what isn’t there we won’t have to define.

i.e. – money is money, until it ain’t.

It’s not just currency reserves and it won’t just be China. The UK also did the same thing with Venezuela’s gold reserves.

What about the individuals being sanctioned now? What business is it of any foreign government if someone gained funds “illegally” elsewhere?

This is also no different than the unconstitutional US asset forfeiture laws where property is confiscated without due process, whether citizen or otherwise.

Just wait and see the potential for expanding this concept when the asset mania collapses and desperate broke governments are looking to find new revenue sources.

It’s obvious these governments were at least somewhat aware of how the recently sanctioned individuals came into their wealth, yet they did nothing previously. The decision was entirely political expediency and malice which will make many question the future integrity of private property rights in these countries.

Indeed – private property rights. Lets see what happens in the US and UK regarding the large numbers of valuable properties owned by Russians. IF they are confiscated like the yachts then I suspect that we will se large scale selling of property in the US by the Chinese.

Doesn’t matter if you are Russian, Chinese, or American – if the government/corporate complex wants your stuff, they take your stuff – civil forfeiture, condemnation, taxes, fines, retroactively made illegal, foreclosure on forced debt, and now “sanctions on individuals”. Sanctions are country to country; e.g., central bank or officials in official capacity. This country against the private individual property of the citizen of a foreign country is new and potentially unbounded like piracy.

Investment expectation value used to be weighed toward a country with robust private property laws. Which one is that now?

You will own nothing and be happy.

ivanislav,

The WSJ headline/article you cited is braindead because EVERYONE (except you and the author apparently) has known this forever, at least ever since the takeover of the US embassy in Iran in the 1970s, when the US did just that with Iranian assets. Duh.

Russia assumed as much in 2014 when it moved most of its US Treasury holdings (part of its reserves) from the Fed to Euroclear — the huge fiduciary in Belgium. I covered this at the time.

https://wolfstreet.com/2014/05/15/russia-dumping-us-treasuries-but-why-the-heck-in-belgium-2/

So far the result is a scramble for dollars and a big bump in its value.

“ How can you lose $6.1 billion in two years by delivering food and driving people around? That was a rhetorical question.”

Apparently, it’s pretty damn easy…

There were these touts on this site, mocking those who didn’t “get it.” This was Enron’s scornful phrase, the last time around.

If this liquidity drain continues, I think we might see somewhat more “stable,” “established” names with selloffs and maybe even scandal headlines. These surface as accounting scandals, fraud, embezzlement, etc. The stresses lead to, and then expose, extreme and desperate behavior by insiders.

How, I wonder, can softbank survive? Who is still bankrolling it? Does it have huge whales with big investor lock-ins like Long term Capital did?

phleep

Madeoff uncovered in the December of 2008!

According to Dominos, these delivery services take the money from their bottom line. Then Dominos started paying people (with coupons) to pick up their own pizza. Then the pandemic waned, so not hard to see what happened here. Albertsons is still pushing their Fresh Pass,and Walmart has their + delivery service which is 100 a year. (You might get a lot more use out of it than PRIME) If you want consumer staples that’s pretty much the only way you order them at Walmart. Otherwise their delivery charges are exorbitant. I am thinking of using both services. Then I need a service to take me out once a week, and blow off the cobwebs.

Pretty easy to just make a list of what you get most of the time every week or two; order it online, deleting some things adding others, have them bag it, and bring it out to your car for free.

We tried that once … we got lousy produce, missed out on various deals on near-match items that weren’t strictly on our list (but we could have swapped for in a heartbeat), and had various items forgotten that were on the list. Most groceries aren’t truly commodities.

There’s a lot of serendipity in shopping for personal-taste / personal-fit items like food and clothing. Inside a store you’ll often find something interesting that you hadn’t anticipated. Online loses most of that.

If you want your shopping done right, you have to do it yourself.

Not so fast WS:

My first grocery store job, when I reached minimum required age 14 in mid ’50s, was delivering groceries with my bicycle with big basket(s) also used to deliver 125 morning papers.

These were usually regular customers, some for decades, and the bosses/owner(s) picked out the products, knowing full well the tastes and preferences of their customers, and the feedback they would get from any deficiency;;;

same exact process is going strong these days locally in the saintly part of the tpa bay area, at least at the ”boutique natural food store” I frequent that also happens to have the best local prices on the wine they carry (and an impressive collection of fancy beer and such.)

This concierge service was available but seldom used prior to the pandemic hysteria, increased dramatically including delivery or just loading into customer vehicles — all arranged by email, etc., and has continued as people came to realize the efficiency, etc.

Food delivery just baffles me. The restaurants “wholesale” prices for food are not what most people think. Restaurants pay almost as much as you do at the grocery for most items. They save a decent bit on some items in bulk, but overall, they pay a lot. That, plus the rest of overhead, is why you can eat a lot cheaper at home. Now, when you add a delivery fee (including $ for the driver and $ for the company) and a tip (you DO tip, right?) on top of all that, you’re spending in crazy land. I can see a few people paying that, but not many, and even then, only in the best of times. Also, I suspect most of these customers can’t truly afford it. “Well to do” folks are “well to do”, in part, because they don’t waste money like that.

this is why americans are so overweight on average. not only are people too lazy to prepare their own food, but they need it delivered straight to their door as well.

and no, i’m not talking about the truly disabled. i’m talking about people who are just lazy.

Of course, there’s a lot of laziness out there, but I think that “I deserve it” syndrome is more prevalent. This causes people who work hard and make decent money to make poor decisions. “I worked so hard this week, and I’m so tired that I deserve [fill_in_the_blank_for_stupid_way_to_waste_money]”.

Many are afflicted by this syndrome throughout their careers and, sure enough, they wake up one day with the retirement funds that they “deserve”.

I hope they enjoy the food delivery.

A person like any living thing is a reward system. It is one’s own responsibility to manage and develop one’s own reward systems to stay out of trouble and decay.

It is complex because so many do not foresee the stuck places their own choices point ahead to. They trap themselves and then compound it with bad “rewards.”

Correct, but the political problem is that the majority of the population doesn’t believe in accountability for financial incompetence. The taxpayer and currency holders (through inflation) are responsible covering any shortfall from this irresponsibility.

There’s a few answers I’m sure.

* I deserve it

* Lazy

* Some people don’t know how

I used to know a couple who had dinner delivered or takeout every night. This was 10 years ago, so not a recent thing. They both had really good jobs and made a ton of money. The killer though is that they had this incredible kitchen – granite counters, top of the line appliances, Viking gas range that was like $10k when I priced one out of curiosity, and I’m sure that they never used it except to maybe heat up the pizza. My ex went to a party the wife threw and she came back and said that the wife needed help to figure out how to use the oven.

Incredible as it may seem, there are people out there like this. They’re qualified to manage hundreds of people but they can’t feed themselves.

RockHard, I think you went to my brother-in-laws house. $65 K kitchen upgrade 10 years ago and his wife doesn’t know how to use the $5,000 stove to this day. But it looks nice!

You can’t spell American without including ramen.

There is an often forgotten syndrome called food insecurity. There are entire generation(s) of poor people that never had food growing up. They tend to get a head in life and finally can buy and eat food. There is a scary battle within that even the slightest shift in market causes hoarding food and overeating. My Great Grandma lost a lot of weight and almost died during the Great Depression. That psychological implication passes on to generations. It’s not always lazy. People did die during the Great Depression and Recessions for a long time in America. It unfortunately still a reality of children not getting food at home during summer break and holidays. The struggle is real.

Interesting news.

Wonder how that WeWork thing is doing? Wasn’t Softbank in for 65%?

Must be reaping huge profits by now.

Yeah, follow Softbank’s every shrewd move.

WeWork went public via SPAC in Oct 2021. The shares [WE] hit a peak on their first day of trading under the ticker WE on October 21 of $14.97, and have since plunged 60% to $5.70, including today’s 6%+ drop.

Wolf,

The tech world formula of conning the world:

1. Creating an idea out of thin air, in the name of solving the world hunger.

2. VCs and friends and family (all one happy money stealing gang) invest as early investors/insiders.

3. Hire the same set of engineers from the last startup and from established tech companies (they know the con job and make some money too).

4. Rebuild a product that either already exists or is no really needed. All this in the same of advancing the world.

5. Lie through the teeth, lose gobs of money but report unreal growth numbers.

Now there are two paths based on if product completely fails or succeeds marginally.

6a. If product fails completely, get acquired by a big tech with insider connections in the name of replacing the big tech’s exiting tech with a better tech. Wow, its the same engineers who left the big tech who built it, meaning the big tech was sitting of its butt not building the improved tech that the startup built. Its like be intentionally being irresponsible and make tons of money in the process.

6b. Once acquired, rinse and repeat with new set of people who did it last time. The net effect: money stolen from general shareholders of big tech.

7a. If the product marginally succeeds, then lie through the teeth and project unreal growth numbers, do some magic accounting to maximize revenue, growth in a year and go IPO.

7b. Once all insiders cash out post IPO, leave the company, and rinse and repeat. Company is dead in the water when they leave or will be dead once the same folks in the gang make something to replace it. The new effect: money stolen from general shareholders of the IPO.

There are very few exceptions to this, 99% of “successful” startups follow this formula and the general investors (not the insider investors) keep getting conned again and again.

Yes. And what we’re seeing today is a much bigger version of what we saw during the dotcom bubble. The numbers are much bigger. The principles are the same, as you pointed out.

Loading my groceries in the car yesterday, there was one of the “Kroger Shoppers” bringing a cartload of “shopped” stuff to a Ford F350 dually with a dirt bike in the back.

They must have been all tuckered out from a day on the trails to drag themselves through the store to shop.

Well if the store starts charging $50 for the service, maybe they will find their energy again.

Pets.com, take two.

Eyes on DWAC (Truth Social SPAC). Its price is up around 900 percent still, levitating on its central figure’s aura. But he hasn’t posted there aftr his first sentence 2 weeks ago, and many are stuck on waitlists.

AMZ could piggyback on the postal system and other delivery infrastructure until it got built out. This is a whole different game. Inflation might get these weed-munchies-streaming TV couch potatoes up off their backsides.

If the government has anything to say(do) about it, I sincerely doubt it.

I really wish I can afford personal financial mistake at the magnitude like Softbank or Masayoshi Son and still be deem by everyone as a competent investor/leader and not suffer any major repercussion at least for now. WeWork fiasco and now this along with countless other loser unicorn they have a big part in.

Here I am crying over couple of thousand worth loss from put option..

The names these tech companies use show them to be managed by cartoon kiddies. “Bumble” means screw up. “Snowflake” is a perjorative term for young people educated a certain way. “Grab” is what a shoplifter does.

How do initial investors spend millions and not insist the companies come up with a serious business plan and name?

Harrold-languages change with the succession of generations, for good or ill, depending on if you’re younger or older. I’ve no doubt the Bard would look on the current state of the English tongue in horror (not to mention, on Broadway stage more recently, Prof. Henry Higgins…). You might lift the occasional bridge, but you won’t lower that river…

may we all find a better day.

I didn’t get around to reading this until Mar 8, which happens to be the day the article said Bumble would report earnings. So I went and checked the press release and found out the stock was “rocketing” up in after hours trading after they reported strong user growth – not earnings, just users. Shades of the dot com and “eyeballs”. Still losing money. Stock closed today even lower than when the article was written, now $16.66.

Wolf asked rhetorically how you can lose so much money delivering food and giving rides. I agree with those who say it’s all by design. Simple pump and dump, just over a longer time frame.