Euro’s 20th birthday after dreams of “Dollar Parity” put on ice during Euro Debt Crisis. Central banks still leery of Chinese renminbi.

By Wolf Richter for WOLF STREET.

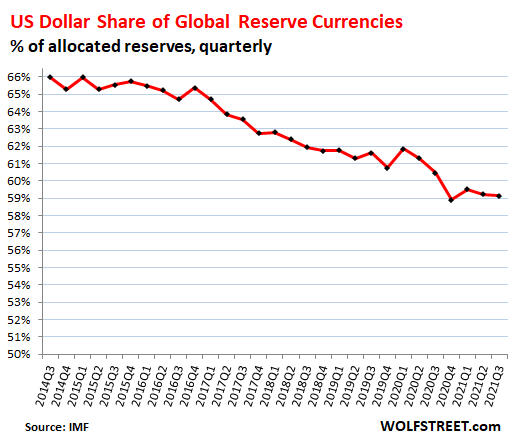

The global share of US-dollar-denominated exchange reserves declined to 59.15% in the third quarter, from 59.23% in the second quarter, hobbling along a 26-year low for the past four quarters, according to the IMF’s COFER data released today. Dollar-denominated foreign exchange reserves are Treasury securities, US corporate bonds, US mortgage-backed securities, and other USD-denominated assets that are held by foreign central banks.

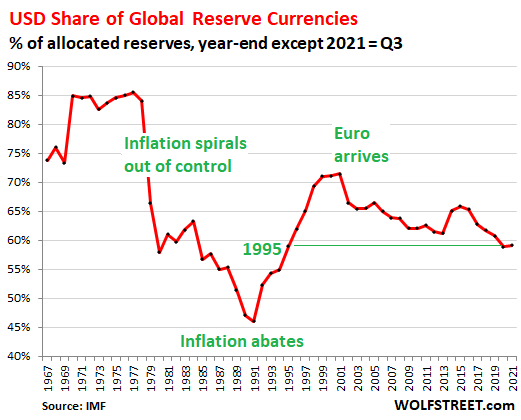

In 2001 – the moment just before the euro officially arrived as bank notes and coins – the dollar’s share was 71.5%. Since then, it has dropped by 12.3 percentage points.

In 1977, when inflation was raging in the US, the dollar’s share was 85%. And when it looked like the Fed wasn’t doing anything about inflation that was threatening to spiral out of control, foreign central banks began dumping USD-denominated assets, and the dollar’s share collapsed.

The plunge of the dollar’s share bottomed out in 1991, after the inflation crackdown in the early 1980s caused inflation to abate. As confidence grew that the Fed would keep inflation more or less under control, the dollar’s share then surged by 25 percentage points until 2000 when the euro arrived.

Since then, over those 20 years, other central banks have been gradually diversifying away from US dollar holdings (year-end data, except for 2021 = Q3):

Not included in global foreign exchange reserves are the assets held by a central bank in its own currency, such as the Fed’s holdings of dollar-denominated assets, the ECB’s holdings of euro-denominated assets, or the Bank of Japan’s holdings of yen-denominated assets.

Impact of exchange rates on exchange reserves.

The exchange rates between the US dollar and other currencies impact the dollar-value of non-dollar reserves. So for example, the value of China’s holdings of euro-denominated bonds is expressed in USD to make it compatible with all the other holdings. All holdings that are denominated in non-dollar currencies are expressed in USD, and those USD-entries for non-USD assets move also with the exchange rates.

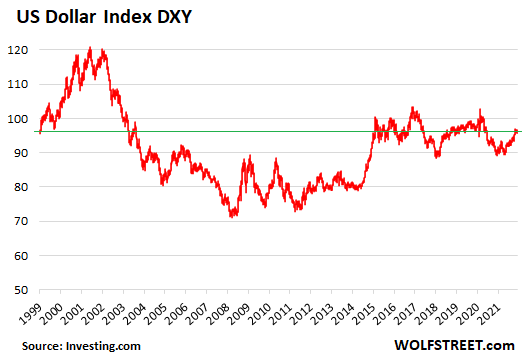

But the exchange rates of the major currency pairs have been remarkably stable over the past two-decades-plus, despite swings in between, as seen by the Dollar Index (DXY), that is now back where it had been in 1999.

So, exchange rates had little or no impact on the substantial decline of the dollar’s share of foreign exchange reserves.

That decline was mostly due to central banks diversifying away from dollar-denominated holdings in favor of non-dollar holdings – getting perhaps a little nervous about the twin deficits int he US – but they’re doing so very slowly to avoid toppling this whole house of cards.

Euro’s 20th Birthday.

On January 1, 2022, euro bank notes and coins will celebrate their 20th birthday. I still have my “Starter Kit” in its original plastic bag because the introduction of the euro at the time in a handful of countries was a huge event in the history of currencies and took decades to prepare for. Now the Eurozone encompasses 19 countries with a population of 340 million people.

The idea of the euro was sold to the inhabitants of the EU with the stated and often expressed goal of “parity” with the dollar: parity as global reserve currency, as trading currency, and as financing currency.

When the euro was formed, local-currency debt and equity instruments, previously issued in local currency, were converted to euro-denominated assets, and coupon interest and dividends were then paid in euros, etc. The currencies that went into the euro, such as the Deutsche mark, had already been reserve currencies. As these assets were converted to euros, so were central-bank holdings of German government bonds and the like. So as a reserve currency, the euro didn’t start from zero. It picked up where the members’ currencies left off.

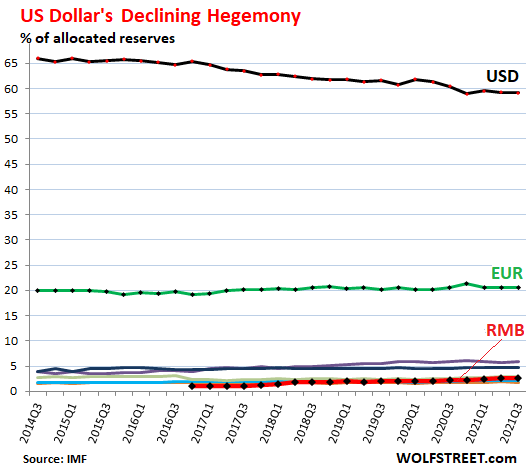

Since the Euro Debt Crisis, the euro’s share of global reserve currencies has been stuck at around 20%, and the dream of “dollar parity” has vanished. But it is the undisputed second largest reserve currency.

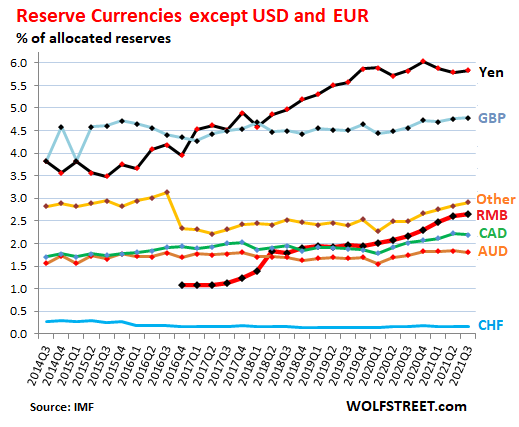

The rest of the reserve currencies are minor entries at the bottom in the chart, including the Chinese renminbi, the bold red line:

The minor reserve currencies:

To see what they’re doing at the bottom of the chart, I magnified the left-hand scale to the range of 0% to 6%.

The yen, the third largest reserve currency, surged from 2015 and hit a share of 6.0% in Q4 2020. Despite the hoopla around Brexit, the share of the British pound (GBP), the fourth largest reserve currency, has remained roughly stable.

The share of the Chinese renminbi (RMB) has been growing in baby steps and in Q3 reached a share of 2.66%, tiny compared to the global trade prowess of China’s economy. The IMF elevated the renminbi to an official global reserve currency in October 2016 by including it in the basket of currencies that back the Special Drawing Rights (SDRs). But the RMB, while freely convertible for trade purposes, is still not freely convertible under China’s capital account. And central banks remain leery of it.

Over the past four years, the share of the RMB has grown by 1.54 percentage points. At that rate, it would take the RMB over 50 years to reach a share of 25%.

Reserve currencies and trade deficits and surpluses.

The US dollar’s status as the dominant global reserve currency has enabled the huge twin-deficits that are displayed in all their glory by the US government’s ballooning public debt, now close to $30 trillion, and by Corporate America’s relentless offshoring of production leading to the monstrous and ever-growing US trade deficits.

But the Eurozone has had a large trade surplus with the rest of the world in recent years – particularly with the US, including a trade surplus of $183 billion in 2020. The Eurozone’s trade surplus demonstrates in reality that an economic area with a large trade surplus can also have one of the top reserve currencies, debunking old theories that a large reserve currency must be associated with a large trade deficit. But as the US situation makes amply clear: Having the dominant reserve currency enables and encourages the US to run up its twin deficits.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

While the share is declining, the gap between US dollar and the next biggest currency, the Euro is massive. This article is actually telling me that the dollar remains the foundation of the global system, and will for a long time.

Higher interest rates are coming and that will strengthen the US dollar versus the Euro, where the ECB is even behind the Fed in fighting inflation. As global investors look to buy higher yield Treasuries, they will need to exchange for dollars. This will also happen because our Treasury now needs to issue a ton of new Treasury debt, which will increase demand for dollars.

Sometime this year, I see the dollar hitting parity (1 for 1) with the Euro.

I know FX traders are extraordinarily short sighted… Central banks not so much.

With Russia looking to destabilize the US… China working to maneuver into being the dominant super power and introduce the first central banked backed blockchain digital currency… and the GOP willing to do anything to undermine Biden up to and including insurrection…

There is ample reason to think the US reserve currency status is at risk.

Why would anyone hold TBills at effective negative interest rates?

The world knows the FED is cornered. The US debt is so high it is reaching the point where revenue cannot cover the interest on the debt… before raising interest rates at all. Congress is incapable or raising taxes significantly, and is spending like a new money lottery winner…

So why would central banks continue to hold an asset with a negative return, with no hope in site of a turn around… When there are stronger alternatives? Who wants to be the last one holding a toxic asset. When the market agrees on an alternative… USD is going to break down fast.

WyleeEconomist,

“Why would anyone hold TBills at effective negative interest rates?”

Lots of people hold T-bills now, and lots of people will hold them at 3% or 5%, which beats by a mile what we have now. Yield fixes demand problems all day long. The Fed only holds a small-ish portion of T-bills ($326 billion, unchanged since Feb 2020).

Watch what markets will do when they figure out that the Fed, despite all these theories about being “cornered,” is in fact not cornered.

Wolf,

“despite all these theories about being “cornered,” is in fact not cornered.”

How does DC get around the monstrously self-created problem of the huge accumulated Federal debt?

If DC stops printing money (which creates citizen inflation), then Treasury interest rates rise fast (not too many true – non gvt -buyers want to hold low-to-no yielding paper issued by a debtor with debt-to-GDP ratio well above 100%).

But…if DC stops gaming the Treasuries mkt (by buying its own debt using new printed money) and Treasury rates accordingly rise…then annual interest payments on the huge DC debt could double (if 10 yr ZIRP rate of 1.5% goes to still pathetic 3%…and up until the mid 90’s, Treasury rates had rarely been below **7%** for decades…).

So where does DC get hundreds of billions each yr to pay for lowered-ZIRP annual deficits?

Printing (more long term poison), taxes, and spending cuts are the only possibilities.

But the whole political point of the 20 yr ZIRP grand theft was to *avoid* tax increases and spending cuts (read, loss of DC power).

Unless somebody can point out DC’s hidden magic, it looks like the DC Degeneracy has driven the US economy into an inescapable kill box.

There’s also the US sanctions issue: if a US President gets irritated with some other country, US sanctions get imposed. As long as the global financial markets are dominated by US banks and US dollars, everyone else has to bow down.

The Chinese have started showing that there are alternatives – and the rest of the world is starting to notice. Once the US can no longer borrow in its own currency, things will get – interesting.

Cornered, I guess, bc they don’t want to raise rates but people are pushing bc of inflation, which the fed can’t do much about bc it’s about shortages… their only option is to ctush demand with recession, really best to wait.

My thought re your post is that cent banks hold only part of fx recerves, and that other holders may have different preferences.

A guy in Argentina not trusting his own currency will keep something else in his mattress. What does he pick? Overwhelmingly it’s dollars. And he has to sell us stuff to get $. Imo this is how the us trade deficit is financed.

In fact, they can’t hold many euros even if they want to; either euros are being drained from ROW as euro land runs trade surplus, or ECB funds the trade by buying fx, motivated by the desire to keep the euro from appreciating. As do the Swiss.

Foreigners desire to save in a foreign currency creates a demand for whatever the saver trusts most and is available, which has been $ since ww2. Granted we’ve been mismanaged for decades, foreign wars, massive corruption etc… why trust $ in these times? It’s bc it’s still the most desirable and available currency for savers. It’s not that our shirt is clean, a dirty one is better than nothing at all.

It won’t end until there’s something better.

Let’s not forget that the U S is willing to bomb anyone for money. From throwing 2 nuclear bombs over civilians in Japan to lying (is it really a lie if everyone know the truth) about WMD in irak to bomb them, the message is clear. Guns and brutality are directly connected to American wealth.

1. When the system locks up, you better have cash and for a company that means t-bills. Don’t you remember GE and Goldman having to borrow cash from Berkshire at 10% so as not to go under.

2. Even though t-bills seem like the worst investment now, if the stock market returns to normal price to sales valuations that’s about a 75% loss and makes losing 6% per year in t-bills a relatively good investment.

In reality, we have to match our needed income to our time horizon. If you are thirty, it’s a whole different ball game to someone retired needed secure funds coming in.

Butcher baker candlestick maker not part of 5 arrow ? What happened to honest pay for honest work

yet it’s a race to bottom

and winners – THOSE BUYING HARD ASSETS with their worthless fiat $dollars, euro’s and yen

that would be senor PUTIN and XI(got like 18 months of food stored)

much less continual buying of gold at bargain basement prices

“Xi (got like 18 months of food stored)”

He may be a bit overweight, but 18 months? Come on.

Yes use your soon worthless fiat money as much as you can,,,buy silvercoins,,travel, stay in hotels etc all that will be much more expensive ….

“Higher interest rates are coming and that will strengthen the US dollar”

ROFL, that’s a good one. Be it known, fed fund rates in the USA can NEVER increase past 2% or the USA economy will collapse. NEVER. Pick your poison, and it will be inflation over rate increases. The rich love inflation, they get so much more richer.

I will be surprised if they get through taper and get to 1%. I would assume mortgage rates going up to 4.25% will tank housing market.

This is the disconnect I see with the belief that rates will rise.

They can’t rise while housing stays up!!

“The rich love inflation”

Yes they do until it reaches the point that the creditors start hiding from their debtors who want to pay them off in vastly devalued currency.

” I will gladly pay you Tuesday for a Hamburger today” – Wimpy

The euro is a fictitious currency with no basis. The problem is that the world is gaming the Bretton-Woods protocol. The exchange rate is codified and vulnerable to scamming by Europe and Japan and China.

Printing money has been the go to strategy for every one whose currency is correlated, by calculation, with the reserve currency.

There is a game being played with our lives that we have no information about what is going on. Like the actions of the US Federal Reserve. Mysterious to us, logical to their owners and masters.

The Fed should be abolished along with their sacrade private banking system. It seems to me to be indefensible.

The U.S. Fed will lose tens of trillions of dollars or more on their long bond purchases to push down long term rates once inflation turns to hyperinflation. I can see anyone wanting to hold or buy U.S. dollars outside of America. Powell’s monetary policies will turn the U.S. to worthless garbage.

John kissinger already explained this to you — the $USD is the first choice of flight capital, foreign oligarchs squirrelling away cash in boltholes and other criminal enterprises around the world. There is plenty of demand for it.

Treasury’s that the FED buys if the FED truly stops buying Treasury’s the dollar is dirt. It’s dirt already in my book. Its been dirt since 1971. The definition of money is a store of value. If i work today and make $200 that $200 should buy the same thing tomorrow or a year from now. The dollar does not fit that description. The fiat currency system was designed for a wealth transfer it’s only good for those who have access to easy money with low interest rates. Its a faith based system that has run its course. And the world is fleeing it’s mighty grip it’s had on commerce for the past 5 decades. Its days are number and it will soon follow the path of Zimbabwe, Venezuela. But you keep that faith.

I would love to see EUR/USD parity (again). 20% cheaper RE in Europe? Yes, please.

The current status quo is held by a thing hair like the sword of damocles. The falling economy is subsidized by the foreign debt and common agreements with EU, Britain and Japan to keep the control over the global financial system. The reserve currency chart in this post indicates that the collapse of USSR saved the dollar. However, the current developments may indicate that the US economy is on the brink of the epic failure.

more likely a new civil war. we are a balkanized society with no shared ethos or culture. wait until people are hungry in an environment like that

We know what happens, Bosnia 1992-5, as Balkanized is exactly right.

Jake,

Every time I grocery shop, like again this morning, I’m blown away by how much more expensive everything is.

I fear that people will start going hungry very soon; or at least not be able to buy healthy food.

part of me is giddy with excitement about it. i know there’ll be a lot of pain for good people, but i have faith that the good people will end up on top in the end, and the evil will end up having to face their maker.

Healthy food is cheaper, but you have to cook it yourself.

Really. I track grocery prices. Inflation for processed foods and ready meals is way higher than raw ingredients.

It’s even cheaper if you grow it yourself.

I hear a lot of whining about food prices. I agree with the Truckman. If you stay away from junk food, and processed food and red meat the prices have not gone up that much. I’ve tracked the prices over the last 15 months and have the receipts. The receipts don’t lie.

OK, my receipt: Cat food, cat litter, naval oranges, bananas, yellow chili pepper (hot banana pepper), broccoli. pineapple, apples, telera rolls, parmesan wedge, shaved turkey breast, sliced ham (both on sale from deli @ $6.99/lb), cheese tortellini & vanilla yogurt.

Moderate amounts of all items and house brand on parma & tortellini. $50 two months ago. $70 today. I am a person of routine & very detail oriented.

Left from the garden: raspberries in the freezer & squash in the cellar. I got a nice gas-powered tiller for my two gardens & have three apple trees in the front yard. 51 foot by 126 foot lot in south Minneapolis, and I use as much of it as I can to grow food.

The only thing I don’t “grow my own” is cannabis. Maybe I will soon, but I ain’t holding my breath to be able to do so as long as the GOP has a majority in the Minnesota Senate.

I agree that food is still affordable. Prices of unprocessed food and produce have increased dramatically, but still relatively cheap in absolute terms. (Those who say prices haven’t increased much: I don’t know where they live or what they buy. Even the NYT recently published an article about meat prices.)

Besides, in rich countries, there is a lot of food wasted. Eating less and a reduction in quantity bought and to portions in restaurants may be a good thing.

Also, look at the growth of online food delivery services. This means lots of people still don’t mind paying more for the same food.

Wolf, while in moderation, I figured I’d list my items since Peanut Gallery inquired about eating well & this is my diet.

Not sure why your comment ended up in moderation. Weirder things have happened here.

Dan Romig

“I fear that people will start going hungry very soon; or at least not be able to buy healthy food.”

I was out at a far out suburban shopping center the other day to kill time while Ms Swamp was getting her hair done at her hairdressers residence.

I noticed about 75% of the people walking around the outdoor shopping center were overweight. If we had such a problem with food prices and availability, why is this the case?

When you get closer to the city of Washington D.C. you notice people in much better overall physical shape. I think the second part of your statement may be partially correct. It has to do with education (nutritional) and affordablity.

U can buy beef[ up only 30%] or chicken,Turkey [up 10%] and do cooking yourself.Do not forget,u got your stimmy checks and your salary is up 3-6% also.And your assets are UP also.SO DO NOT COMPLAIN.Millenials and Gen Z are f…d.And they will unvote corrupt boomers pensions in the future.

The single biggest factor making the US anything close to cohesive is bribery through unprecedented deficit spending and artificially cheap money. People are a lot more inclined to pretend to like each other and get along as long as they believe their living standards will be adequate.

The US in in better shape than the Eurozone (which is firstly an elite project) but there is no common culture here either.

yes, i agree with that 100%. diversity requires a level of prosperity. in this case, we don’t have the prosperity, we just have an illusion of it. it’s going to be a really scary time when the illusion falls apart.

“more likely a new civil war”

Nah. It’s primarily a war of words on the smarter-than-they-are-phones of our hedonistic, games and circuses addicted idiocracy, phones purchased by same to replace previous, still functioning models as thanks to the source of the wonderful forever bug which has caused 824,339 US deaths to date, more deaths than the total of all US military deaths from WWI onward.

I don’t think the next play in this act has much to do with the U.S. economy. Wolf hints at it in this sentence… “But the RMB, while freely convertible for trade purposes, is still not freely convertible under China’s capital account. And central banks remain leery of it.”

With the largest export economy in the world, China’s RMB would move up the Reserve Currency ladder pretty quickly if the leadership of China made the RMB freely convertible. But there may be political reasons that they cannot do that. Moreover, their constant beating of the war drums will put a cap on how much Chinese currency the other Central Banks want to hold in their own vaults.

Spencer G

‘if the leadership of China made the RMB freely convertible’

Only if, right?

They just cannot afford to unplug away from US$! their export dependent Economy will collapse!

They want to control the out flow of capital at their wish, but want foreigners to invest in China! Look what happened to Jack Ma!

Their rich want to get away, if they could, with their wealth! But most of them including top CCCP members have one foot in the west via RE and their family+relatives in US Universities!

No rule of law or property rights! Their action on HK proved who really they are!

Those who think otherwise are in a wishful delusional world.

What happened to Jack Ma has nothing to do with capital outflow.

“Unplugging away” from USD is like bringing your own chips to a casino and expect players to start using them instead of the House’s. Absurd.

China has a better chance just by waiting it out while the US destroy their own USD hegemony with cryptocurrencies.

That is the case with much of the world actually. I think the Chinese elites are somewhat like the Middle Eastern elites of the 1970s and 80s or Russian oligarchs of the 90s and early 2000s… they cannot “unplug” their economies from the Western world (since that is what is providing them with their sudden great wealth) but they also want to have an exit strategy so they can escape to the West with as much of that wealth as possible if it all goes belly-up.

UNLIKE the Middle Eastern oil despots, African potentates, or Latin American coup leaders of the last century… the CCP leadership is actually pushing back on that “escape hatch” instinct a bit. It is a pretty curious balancing act to watch them try to perform.

We recently saw the Crown Prince of Saudi Arabia do much the same thing to HIS fellow Saudi elites in the past five years when he was having difficulties managing the challenges posed by the frackers and Iran. Invite the other princes home, hold them in a gilded cage, make them sign over large portions of their wealth to the government, and let them go with a warning to stay quiet about what just happened. Basically he made it clear to them that “there is a new sheriff in town” and their job is to support him as he runs the nation. Like with China we will see how well this works over the long term.

As you say… national leaders of these places tend to view the nation’s wealth as belonging to the nation (and thus to them since they run that nation) rather than being the “property” of the people who currently possess it.

I don’t understand the RMB, is it still pegged? With so many (EM) nations rolling out crypto, how is that going to play out?

That may explain why China is restricting/banning crypto.

China is prepping to launch it’s own blockchain backed central currency… They don’t want the competition.

The Central Bank Digital Currencies (such as Mexico is planning and China is experimenting with) have no impact on any of this since they will be just digital forms of the existing local currency, 1:1, and will be used as a payments platform (free & near-instantaneously, I would hope), which is useful for people who don’t have bank accounts (Mexico).

Correct Wolf, CBDC should have little to no impact on reserve currency mix, but… it will have a gigantic impact on banking in the respective countries where CBDC is introduced.

Will CBDC not destroy the entire banking system in the countries that introduce it?

Peanut Gallery,

If the CBDC is just for transactions, it could destroy dedicated payments systems such as PayPal, money orders, and others that charge hefty fees for transactions, which includes bank wire transfers.

Banks don’t make all that much of their income from processing payments but from lending (interest and fees), including credit cards, mortgages, industrial loans, etc. And banks will still be involved with CBDCs because those funds will in the end come from bank accounts and go to bank accounts though some of the people using them might not have bank accounts.

So if this new payments system is made available for payments, banks are going to miss out on some fees, but it’s not the end of the world for them.

But if the central bank decides to use this CBDC to lend money, and thus become the lender in the country, it would crush banks. I have not seen proposals to this effect. The Fed is keenly aware of the risk to banks if a CBDC pulls the central bank into lending, thus replacing private sector lenders. I just haven’t seen proposals by any major country to that effect.

The proposals I have seen so far just want to build a near-instantaneous free payments system that is easy to use even for people who are unbanked. And I think that’s a good idea. Also, if the CBDC can be used fee-free for international payments, that would be a big benefit for small vendors and for individuals.

My understanding of the “special relationship ” with China is this. When a German producer gets dollars they exchange them for Euro’s to pay vendors workers etc. China on the other hand inflates or prints their currency to do the same. Dollars are churned through the debt instruments of the US government. This is how the US has exported its inflation. This has kept the RMB at less than 3% of Forex. China is slowly and methodically ending this “special relationship” and wants to take its place in the exchange system that equates how China sees itself on the world stage. . If you think it has been about cheap shit at Wall-Mart think again.The Petro dollar for oil that churns US debt is another leg of support for dollar reserve currency. The producing world is getting weary of financing our huge military and consumption and the weaponizing of the dollar to dictate policy. We are not the only freedom loving people on the planet. So far the US has kept all the plates spinning. It is not certain the US can keep them spinning. Inflating the reserve currency is a treacherous game. Question is ,are our leaders detached from reality and really do not give a shit? They already got their cut of the wealth of the Empire.

it’s all still “money” and the majority of folks in the Euro are still as poor as the majority of folks in the GBP or the USD.

But more evidence of the systemic issues we face. Great article. Thanks x

Where are cryptocurrencies on the charts?

😄

LOL… keep making snarky comments like that and the Teacher is going to put you in timeout.

Wolf’s “graft” scales are not big enough to show crpyto curriencies!

Because they don’t exist.

They are an electrical charge in-on a storage device.

My question is: Why isn’t GOLD the reserve currency. Directly and Indirectly every currency is linked, whether they like it or not, to GOLD, so why not just say “GOLD”.

Price all Trade in grams, or micro-grams, of GOLD.

Speaking of Crypto, I am buying the latest and best of the Coins. The “Semper Augustus” coin. Beautiful coin. After it’s introduction, the site will sell the “Viceroy” coin.

For those with no internet access, these coins will be traded at your local Beer Hall/Pub using nice hand-painted pictures.

Unlike present Crypto Coins, the Semper Augustus and Viceroy can be bought with Future Contracts.

Q: “Why isn’t GOLD the reserve currency.”

A: The last time that was being seriously tried, it hit a little stumbling block called Great Depression and World War 2. Gold is ridiculously inelastic in terms of a money supply, which means when stressed, the system breaks, bigtime. People readily start starving and mass-murdering each other.

Holding precious metals as an investment or speculation is an entirely different matter. As long as they is some sentiment, some demand, i.e., people value it psychologically, it can have some (market) value. But no intrinsic value, apart from a few industrial applications. How are people going to go to the gas station with slivers of gold and, balancing their handheld weapons when SHTF, trade it for something? Won’t happen. It must be spot verified which is ridiculously impractical, especially in the dire conditions many gold-bugs expect..

phleep, gold’s value is more insurance for if the financial system collapses. it’ll have some value in whatever new system takes its place. as you noted, it’s not particularly good for bartering.

1. Gold was valuable before there was money.

2. History teaches us at least since first central banker John Law that it is prudent to have some real silver and gold for when a central banker’s plans don’t work out.

3. In North America 1oz. American Eagle or Canadian Maple Leaf are standard and easily traded.

Gold is inelastic but Fiat is infinitely elastic. So Fiat solves short term problems, but long term Fiat digs it’s own grave.

Money of every description is a Political construct. FDR banning gold, at a time when gold was held as a personal asset/backstop tells you everything you never learned in your Money and Banking classes.

Agree with Phleep’s comment about the lack of currency characteristics of gold. It will not and cannot be used as currency since it isn’t an effective instrument for trade. How can you spot check every single transaction the validity of the gold you receive? I mean are you going to freaking mail a bar of gold to Amazon in order to buy your iPad? Like hell I am going to allow my local UPS driver to carry my precious metal (if I had any).

Remember that effective currency must be a means of trade AND a storage of value. Gold does the latter but not the former (anymore).

Ridiculous inelasticity is what makes a hard currency a hard currency. We are currently witnessing ridiculous elasticity, are we not. No one gets the “privilege” of printing gold, so at least in that sense, a gold backed system is more fair.

phleep,

Gold is not the reserve currency because there isn’t enough of it to cover the productivity that is traded. It is also not infinitely divisible like fiat.

Plus, even though some countries hold a great deal of gold, it is out of necessity, because they are not considered trustworthy trading partners. Now that Evergrande and others have defaulted on its debt to the west, China is going to need all the gold they have to do business.

Gold is the best reserve currency in an honest system. Reserve and trading are not identical. Silver and copper and even paper work as trading currencies, provided credit abuse is not tolerated. It is not the gold standard that causes wars, it is war that causes credit abuse, which renders gold inoperable. Dishonest people need dishonest money.

“Gold is the best reserve currency in an honest system”

“…In an honest system.”

Hell of a qualifier.

I think you will see them under the gold and silver lines, but you have to enlarge the graph and look at it under purple light.

Not sure if you are putting precious metals in the same negative category as cryptos but quality PM coins are in demand. Coins that were plentiful from just two years ago are going for almost double metal value and increasing.

Premiums for Morgan silver dollars are skyrocketing. Silver Eagles are in huge demand, the mint cannot keep up. A date set starting 1986 forward is a solid investment and will soon be impossible to assemble.

You can buy cheap-ass silver rounds and bars for about $4 over spot, but you missed the boat if you started assembling a decent collection just one year ago in 2020. The good stuff is gone and hoarded away since the beginning of the pandemic.

Don’t watch the futures market precious metal pricing, watch the sold prices on Ebay. Physical silver and gold prices are heading for silly mode.

No, I don’t mean to put precious metals in the same category as crypto at all. I was just putting crypto in it’s lowly place.

I have a good stash of U.S. Mint purchased silver Eagle coins I have accumulated over the years. I also have a hoard of standing liberty silver halves my dad gave me in the early 1980’s when silver went nuts for a while. This is stuff I plan to leave to my only daughter some day.

Brant Lee. Don’t confuse a “collectible” with PM.

Sure, you can pay $300 for a slabbed 2021-cc restrike on Ebay. But when (not “if”) it goes to the smelter, it still has only $18 worth of PM in it.

Remembering all the way back into the 1950’s. Buying something sold as a collectible is a sure way to lose your shirt.

Hi Wolf,

There’s been an increasing amount of media speculation that the Federal Reserve won’t be able to hit its 2% inflation target in the near future, and will instead raise its target to 2.5% or even 3% PCE (~4% headline CPI) to avoid upsetting the markets with rate increases.

Do you think this is likely? Do you think this will fly with congressional Republicans & moderate Democrats, whose approvals are needed for incoming FOMC governor appointments (but after they’re in, they can safely pivot?)

Jackson Y,

The Fed won’t raise its target range. This is just billionaires like Paulson — the crybabies on Wall Street — trying to manipulate markets and talking their book to make another billion. I have no idea why any publication still gives them a platform to talk their book on.

Consumers are bitching about inflation. Biden is catching heat over it (as he should). Republicans are making hay with it (as they should). Presidents lose elections over inflation. And this inflation isn’t going away just by changing the Fed’s target. And if the Fed changed its target to meet the surge in inflation, what’s left of its credibility will be flushed down the john, and the Fed knows this.

Wolf,

In isolation, at what rate (or rate range) would the FED have to be to correct for inflation at this point?

Next question, what rate do you think they will achieve, or how high do you actually think they will really go?

I ask because I feel like the ship has left the harbor at this point and the FED is unable and or unwilling to do the right thing

Dave,

Generally, to crack down on inflation, short-term interest rates have to be above the rate of inflation, and long-term interest rates have to be way above the rate of inflation, and the inflationary mindset has to change, to where people and businesses resist price increases. This is very hard to do for a central bank and may require drastic action. There is nothing automatic about it.

@D

It is wrong IMO to see inflation control solely in terms of interest rates. What really counts in the short run is the amount of money in people’s pockets relative to the supply of things to buy. It is pretty obvious on this score how we got here.

If wages keep falling behind inflation people will run out of money very quickly and will have to cut their spending which will knock back prices pretty quickly. The Fed is driving in the rear view mirror and the fact they are still QE-ing says they still see low demand problems ahead. If they were worried about wages they would have taken much more cash out of the economy via RR’s IMO.

All hypothesis of course but we’ll see.

@ Auldyin:

If wages keep falling behind inflation people will run out of money very quickly and will have to cut their spending, which not necessarily will knock back prices. Prices may stay high, people consume less and suppliers adjusting to a lower volume.

An expensive car is not cheaper in a third world country even if very few can afford a car. Same for a lot of other consumer goods.

@S

You are right, of course, in principle but when it comes to essentials like food it is very difficult to cut volume of purchases.

Discretionary purchases are only a proportion of overall spending so my point to a degree holds I think.

i agree that biden should catch heat, as his $2 trillion bill in march 2021 was totally unnecessary. but a lot of the inflationary pressure came from the first cares act, much of which was unnecessary, and the fed’s deranged printing in march and april of 2020, both of which the republicans largely supported. so my point is, while you’re right that republicans should make hay over it, it’s a little insincere if they don’t acknowledge their own culpability over it.

Reserve currencies have an innate quality of the country they represent. Most anyone would love to have dollars and live in the US. Europe, Britain and Japan not far behind. But the Chinese currency will never approach the western cultures in that aspect. Who would ever want to live in China where anyone that displeases the communist party can disappear or wind up in a gulag. Same for Russia and any other totalitarian society. So yes the dollar could conceivably drop like a rock, but doubtful that the RNB would ever approach the other current reserve currencies.

Disappear…like being banned and censored from all forms of social media for not having the correct group thought?

And having your business destroyed or fired from.your job?

Digital currency central bankers are sharpening up their “kill” skills by practicing on twitter!

Chinese leaders say they have “capitalism with Chinese characteristics”.

I say we in the US are moving towards “democracy with Chinese characteristics”.

A key feature of creeping authoritarianism/technocracy is that there is never an obvious time to stand up, unify, and fight.

Great one:

” Democracy with Chinese characteristics ”

Coin it!

Happy New Year to Wolf Richter and all his readers!

@I

“an obvious time to stand up, unify, and fight”.

How about like now I ?

This is why you want to have an account in another currency. The other country doesn’t care what you are doing over here.

The optimum financial strategy is to have a second passport and have as much of your assets outside of your government’s direct reach.

For those who can afford it, live in a country that isn’t where your passport is issued and have your assets in a third.

Every country to one extent or other views its citizenry as just another resource to be plundered. Look at the FRB’s monetary policy now.

Really???Have an acc or bullion in Uruguay.When u really need it,the local police or crooks will get it for themselves.And U can not sue them like in USA.Savings are NOT guaranteed to retain the value in difficult times.

No, disappear like “Mafia” disappear….like not ever seen again or something like that.

the modern u.s. isn’t that much better. sure, you won’t wind up in the gulag, but you can be effectively “canceled” from public life for saying something that goes against the zeitgeist

Well, freedom of movement is still in place – the CDC is not planning to mandate vaccines for air travel “for now”.

That’s total horsesh*t.

And the “woke” movement is destroying this country, right?

Indeed they are. Professorship and also grant applications (NIH, NSF) now require DEI (diversity, equity, inclusion) statements. It’s no longer enough to just be good at science. You must bow down politically or choose another career path.

Intosh, the takeover is complete, your side won – rejoice!

jake W . . . Yes! You are absolutely correct. Like witnessing a classic CIA line of black cars, people walking each side of the street looking over every hedge including where I was staying in France, then off, for my second invitation to the OECD Paris conference centre and finding myself marched out with two Heavy’s on each side; letter arrived UK telling me they did not like my asking so many questions and never to attempt to attend again. And why? Seemingly because earlier that year I had stood up during the introduction of the new European Commissioner for Science, at the Royal Society in London; and warned everyone attending of the potential for possible leakage of technology from Europe via the Defence Trade Cooperation Treaty signed between the UK, (also Australia) and the US. I must add, that the treaty has made the UK an intellectual colony of the US, and signing it was, both the last action by Tony Blair before he handed his Premiership to Gordon Brown; and IMHO, the greatest act of treason since the concept of treason was first invented. It is interesting to watch a US Central institution destroy the credibility of their own nation as a free nation. Then top that off with the recent article in Foreign Affairs about the vast levels of corruption stemming from the US leadership in Afghanistan . . . Afghanistan’s Corruption Was Made in America Sept 3, 2021. Very sad state of affairs as history keeps demonstrating; all Empires eventually decline into oblivion.

In general I agree with you. The two Canadians who were seized and held for three years on trumped up charges by the Chinese leadership in response to the arrest of Haiwai’s technology executive is no doubt causing companies to reevaluate their operations there. It is not like China is admitting fault there… far from it. China’s foreign ministry said Canada should “draw lessons” from the incident. That China may not like the lessons others draw doesn’t seem to have crossed its leadership’s minds.

But currency is a medium of exchange. THAT is its primary function. Since China is the largest exporter of goods in the world, it complicates trade to a large degree to have to engage in it with other currencies. So what is holding China’s RMB back isn’t the quality of life there… it is that people aren’t sure that the RMBs they hold today will have any value tomorrow. Just like the seizing of the Canadian executive, a single unexplained decision in the bowels of Beijing can wipe out much of the value of your holdings.

Until the RMB is freely convertible it won’t gain much traction as a Reserve Currency. There is just too much “political risk” in doing so.

I see language barrier as a more practical obstacle.

It also depends upon the person’s economic status. I still rate the US as the best place to make a living for those who need to work but if you are already rich, the tax system is a huge negative. If I were rich, I’d rather have citizenship in other countries like Canada or Switzerland.

Apparently, 10% of the population of Taiwan voluntarily lives in China. It must be a truly awful place.

You need to get out more. There are tons of countries with a low cost of living and high quality of life than the few you named.

You should spend some time in China and Russia before you talk about how bad it is to live there. I have spent the last 7 1/2 half years retired in Qingdao. During my first visit to China in 2009, it took me exactly 3 days to realize that 95% of everything I “knew” about the country was blatent propaganda. I was mad at myself for being duped, and mad at the Western media for being nothing but propaganda.

Propaganda IS EXACTLY what the USA ”mainstream media” IS all about r2/3,,,

But that has been true for many many years. My first clear perceptions of that was reading the propaganda by the NYT and the SF Chronicle regarding the demonstrations in the streets of Berzerkeley in the late ’60s/early 70s period after taking part on the streets after being beat up by the cops trespassing in my building.

Lies, Damn Lies, and Statistics ”ain’t in it” ,,, it was all made up to cover up the police being out of control.

Never trusted a single source since,,, and now, bless the internet, am able to read news sources from all over the world that, combined, collated, and thoroughly edited tell at least most of the story.

I support Wolf with money at least twice a year to honor his work as THE best source of econ news, and am intending to add a couple others if they prove out after extensive consideration.

1 January 1973: Time Magazine cover “Men Of The Year Triumph and Trial” Henry Kissinger and President Richard Nixon.

When that Time magazine hit the news stand, Dad explained a few things to his ten year old kid.

Two years prior, Dad was the first person to shake Dr. Norm Borlaug’s hand to congratulate the doctor’s winning of the Nobel Peace Prize. They were working together in a wheat nursery outside of Mexico City when Norm’s wife rushed out to tell her husband the news of, and acknowledgement of, the value that his life’s work had earned.

Amazingly, Henry Kissinger would soon share the win of the Nobel Peace Prize.

My high school teachers did not like having me convince the social-studies class, and back up with examples of, the how and why Time magazine was nothing more than a CIA propaganda leaflet. Not much has changed in 45 years I reckon.

V VNvet, likewise on supporting Wolf twice a year. And it is an honor to be able to comment in his site. Thank you Mr. Richter!

May 2022 bring good health and good cheer to all.

@DR

Nobel prizes are not what they used to be.

Some ‘green’ climate ‘scientist’ who got a prize

(forgotten his name, don’t want to remember.) admitted he couldn’t hack it in physics so he changed to climate and ‘bingo’ a Nobel prize.

It’s known as being on the right (WEF) narrative.

Roddy

Why not start a discussion group on why Dear Leader Xi is yelling so loud at Taiwan?

…….crickets……crickets

Another Chinese propaganda.Some of my friends live in constant fear in their 2-3 mln$ Rublevka mansions, Moscow suburbs for the rich.They would like to move to USA.And no one rich in Russia wants to move to China.My neighbor is HK chinese,got a 600k house plus renovation,New York,no mortgage. He has no intention to live in China.

Nice bag, but today we require an ingredients list. That would be 999.9 parts “German Silver” (ie cheap white metal) and 0.1 parts sugar coating (like tin foil wrappers)? Where’s the beef?! You can fool some of the people all of the time, but, you can only fool all of the people some of the time. Clocks may be running down, and that Bundesturkey might well taste like crow by suppertime. Plastic forks anyone?

I wouldn’t really recommend eating plastic knives and forks.

If you really want to eat some plastic, try eating the kraft single slice cheese. I heard it is just one ingredient short of being plastic!

But it never goes bad; bacteria won’t it it.

“But it never goes bad; bacteria won’t it it.”

Andy,

Another indicator is if flies will land on it…they won’t

Even my dog won’t eat that plastic cheese, and he will eat cat poop.

I always wondered if Robert Kraft eats any of “his” food that made him so wealthy.

LOL.

There are aside from political incentives, monetary rewards in being the dominant reserve currency if I recall from past dealings into this.

And of course there remain the Iraqi dinar and vietnamese dong dialogues.

Revaluation of other currencies that the West currently outsource much of its consumer making would surely have a huge inflationary push unless there were some counterbalance efforts?

Eventually, currency valuation mostly mirrors economic production. There are exceptions for small low population countries functioning as financial and tax havens but not otherwise.

The US and other countries like Britain aren’t going to keep the USD or GBP where it is now by perpetually overconsuming and exporting debt.

@AF

We’ve managed it for years by selling grossly overpriced London flats to Russian oligarchs, Saudi princes, anybody with money really.

Apparently they like to come here for the ‘security’ of a country which has managed to keep a ‘Royal’ family in power for longer than anyone else.

It’s quite possible I’m missing something here.

So do you think that at some point central banks will begin dumping US dollar denominated assets because of inflation? The US dollar has been strengthening since bond prices (not yields) have been falling.

Was it the inflation that caused them to dump dollars or the rise in yields? Is inflation relevant if the Fed keeps suppressing interest rates? Bond prices can’t fall too far.

In 1977 the ten year treasury yield was above 7%. By that metric there is a long way to go before central banks start dumping dollars.

I’m not sure how central bank reserves effect the average Joe, since exchange rates for the dollar are still strong.

No mention of T Lira in this post. Someone on Yahoo snapped at me when I suggested Erdogens latest intervention was meant to plug a hole in foreign investment outflows. Inflation is the culprit and Turkey’s low interest rate policy, like that of the US, is based on Sharia law :) and the US Feds mullah is preferred. (They are the ones who open the dollar swap lines) Yes central banks are “leery of it”, after the last potus suggested nationalizing China’s reserves in a Covid fund. That guy hasn’t gone away. The problem in my ltd view is the spread between the domestic dollar, the sweat dollar, and the investment, digital dollar. When Av-Joe takes up arms to defend the US$, he wants to know, what am I defending? Leverage coupons for Wall St, or disappearing ink on recycled paper?

but that’s only the exchange rate against other currencies being debased as well. the concern is not other central banks, dumping dollars, but foreigners themselves dumping dollars in exchange for our real assets.

You are missing a key piece in 1977 the FED was not using QE to keep treasury yields low by manipulating bonds. No one who knows economics trusts what the FED has their fingers in.

TINA is over with blockchain in my opinion. The exorbitant privilege enjoyed by any country whose liabilities are regarded as reserve assets ends up increasing resentment towards that country and sub-optimal allocation of resources.

The flip side to the composition of the globe’s reserves assets is the relative dominance of each country’s GDP in global GDP. USA’s is in decline as the planet becomes wealthier and, ceteris paribus, would argue for further diversification of a country’s reserves.

Adjustment will be painful for those overweight the current reserve asset, imo.

“Corporate America’s relentless offshoring of production…”

This is, to me, huge and utterly demoralizing. It is impossible anymore to buy moderately-priced mechanical things made in the USA. And I intentionally try. My last three small-engine machines are branded with American brands — a Craftsman tiller a Craftsman snowblower, and a Coleman mini bike — but all have engines made in China. They have all worked just fine; no complaints there.

At best it seems the most you can get is “assembled in the US with globally-sourced part” or maybe “designed in the US” but built anywhere but here.

The US has become too expensive for most manufacturing. Very high profit margin speciality items, maybe, Consumer goods, the horse is out of the barn.

Yep. If you look at new factories being built in USA it’s usually about $1 million capital spend per job.

Fortunately, I’m well-diversified into NFTs, cryptos and Beanie Baby futures so no worries about the Dollar as reserve currency!

You’ve been listening to Bob Moriarty..:)

Why did the EUR fall against the USD so much in 2014?

IMO the dollar is in big trouble. Short term….I suspect rates will be going nowhere. The hospitals are full, more cases every day. The antiviral pill takes 5 months to make. A good percent of the US is so arrogant that they refuse to take the free vaccine. The argument being…..I’am not letting anyone tell me what to do. We might get to herd immunity but there is just as likely the case that another variant will emerge.

The fed does not understand the solution. Its not a demand issue……its a supply issue. They are focused on creating demand in the face of a world that cannot supply the goods demanded.

Somebody once said….Generals are always prepared to fight the last war. These dudes are fighting 1929…….in the face of a supply shortage.

The trade and governmental deficits are exploding with no attempt to control either. Having little to do with Covid. The inflation rate is exploding with little effort to control it. If we do get a slowdown with inflation the admin will probably pass an adjusted social infrastructure bill inflaming the deficits and inflation. Again…..a 1929 solution.

So….gold is emerging right now out of a 19 month base.

Nations across the world may accelerate their dollar avoidance.

In 1992 Clinton started the era of smaller government with nearly balanced budgets… Talk was no government debt instruments would be available for purchase……so the dollar gained international stature. Today…..neither party has an intent to address either deficit. Trade or government.

Bottom line…..we’ve trained our people to expect a standard of living we can’t afford……good luck retraining them to take less.

Nobody wants to face the social upheaval that would occur by saying no.

So…..its spend spend spend and print print print.

Until….the international banks say no. Its in their best interest to wait until the emperor has no clothes. By then it will be too late.

Short of a street riot…….the US is headed to the shoals with a group of admirals that are drunk and stupid at the wheel. Inherited money eventually ends up putting the dumbest in charge. Good luck finding FDR in this group.

“Its not a demand issue……its a supply issue.”

hahahahaha, Demand for goods is out the wazoo due to excessive monetary and fiscal stimulus, and you’re just going to ignore it? And the costs of services are spiking, and that’s where you’re whole “it’s a supply issue” theory collapses totally.

And then in the third paragraph, you agree, yes, it’s a demand issue, you say, too much stimulus, at least too much fiscal stimulus — “governmental deficits are exploding with no attempt to control either”…

And yes, I agree, we got ourselves into a heap of trouble.

Its actually both……but either way…….thank you for letting me have my say…….as always I enjoy the site.

Lets hope they raise rates, stop the crazy spending and protect our markets from wages we can’t compete against before our wealth is gone.

i’ve been screaming that for over a year to anyone who will listen. there’s no such thing as a “demand” or “supply” issue independent of the other. houses are only in short supply right now because there is tons of cheap money to buy them with and fewer people who want to sell, given current inflation. it would only take interest rates on 30 year fixeds going to 5% and an end to qe to cause the housing market to go from short supply to a glut.

On CNBC this morning the analysts were saying that there is so much money on the sidelines that the only way for the stock market to go is up. If that is so, why is the Fed still printing money like there is no tomorrow? And why are they continuing to buy MBSs when housing is already unaffordable and going higher? Why are they ripping off savers with 7% inflation (really 13.6%) and zero returns on their savings accounts? When the history books are written, I wonder what they will say about this insanity.

“Money on the sidelines” is a myth. All this money is invested in something, including so-called “cash.” And every share that is bought HAS to be sold by someone else. Money just flows. It’s not sitting anywhere (except the Fed’s RRP account). The only thing that changes in the market is buying or selling pressure.

You’re about 18 months behind Lyn Alden in catching on.

Adrian,

Just because you didn’t read it doesn’t mean I didn’t write it. I have been reporting on the IMF’s cofer data near-quarterly for YEARS!

To find my articles going back years, google: wolfstreet cofer

Next time you just wake up, at least don’t let the entire world know that you missed everything for years. Sheesh.

Wolf, do you read Michael Pettis?

It would be good if you were to, and also suggest your readers read his essays at Carnegie’s “China Financial Markets”. They’re very relevant to the topic of your post

jim,

NO ONE here is talking about “trade wars” — the way he is. That is total bullshit. We’re talking taxing imports by all countries. Governments tax labor and property and retail sales and motor vehicles. And they tax some products more than others (alcohol, cannabis, etc.). They should shift some of the taxation to imports. Pettis needs to STFU.

While a lot of you all are beating up on the Fed for insider trading you forgot speaker Nancy Pelosi’s latest trades, the California Democrat purchased millions worth of call options in companies from Alphabet, to Micron, to Roblox, Salesforce and Walt Disney. She’s said that it is her right as well as anyone in Congress to day trade.

A big crash would do Congress a lot of good. There’s nothing like negative corruption returns.

Does anyone remember 6.75% “Carter bonds” denominated in DM & SF ???

They were issued when demand for UST & $$$ plummeted to zero.

Lets take a trip down the memory lane…

This is Time Mag article-now in public domain at Web Archive Wayback Machine:

“Shrinking Role for U.S. Money”

Monday, Oct. 15, 1979

Last paragraph:

“The long-playing saga of the declining dollar has demonstrated —that a weakening currency fosters a vicious circle. The dollar’s decline not only causes more inflation in the U.S. but also gives OPEC an excuse to push petroleum costs still higher, because oil prices are set in dollars. As the latest run on the dollar continued to lose momentum, officials in Bonn and Washington recalled that in the battle of the buck the next round of speculation has always come more quickly and been more ferocious than the last.”

I personally have a nagging suspicion that Fed Ponzi will go on forever…

Its worth considering that when the UK started losing reserve currency status to the US, that the situation was different. The UK was under a strict rationing system for consumption, had a militarised economy, was in control of many other countries policy decisions because of the tail end of Empire, and finally had a friendly relationship with the US to manage the transfer.

So when British currency was supplanted by USD in 1955 (yes that late) as main reserve this had been a -managed process- with essentially help from the US, and even then there was a considerable danger of a collapse in sterling if there had been a rush to the doors, because the UK could only allow redemptions to sterling holders slowly. Basically the transition was slow and internationally coordinated, the UK wanted out and nobody wanted a sterling collapse.

Leaving aside the choice of alternative reserve currencies, I would not say the US is in a position for an orderly runoff of reserve currency status and Powell should be aware that periods of major inflation, whether for the US in 1979 as shown in the graph, and in fact the same happened to UK global reserve share around 1970 with out major inflationary period pre-Thatcher, the global reserve share dropped by about 20% making matters worse. The US has essentially abused its position running trade deficits and the current US administration could be seen as not fiscally responsible.

But having said all that, as this article points out, for today and the immediate future, the dollar is still the main global reserve currency and for that reason I do think it is at least possible that there will be a global increase in demand for dollars as international trade reprices with domestic US inflation and that therefore Powell is in fact right about current high US inflation being transitory.

Great points!

LordSunbeamTheThird

‘Powell is in fact right about current high US inflation being transitory’

I won’t bet my last dollar on it!

Former FOMC member Mr. Hoenig has a lot say about it, since he experienced that during 70s, the only lone member voted NO for further QEs in 2010 (and then resigned?/quit)

The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed. Thomas Hoenig knew what quantitative easing and record-low interest rates would bring ( 3days ago in an online article)

Excellent article, find it on politico. Surely Wolf and many commenters here have also read it. Would be curious to know if people agree with the implications. I’m short the indexes right now, waiting patiently. This is fantasy land. When does reality show up?

How did you size the short? Do you have a stop-loss in mind or set?

Great article. However I don’t think that means to short the market. Don’t bet against the FED. I can’t believe we keep touching ATH weekly either. However they are levitating entire economies with their bag of tricks. Only they know their end game. I have watched and watched and laughed when people said it is priced in. No matter what event the world throws at the FED the markets and RE keep going one direction

i’ll never cease to be amazed at people’s faith in the fed to right all wrongs in the world. the collapse we’re going to have, economically and socially, when the jig is up is going to be downright scary.

I saw that article on Politico. It was impressive.

“‘Powell is in fact right about current high US inflation being transitory’”

He’s wrong already. Clever he doesnt define his terms. An old game…and no hard questioning…..

*How long before transitory doesnt apply?

*Transitory, you mean the inflated prices tacked on will retreat to where we were? To flatten inflation still leaves the 7-9% price increases, doesnt it? And if that inflation doesnt retrace, what exactly is transitory about tacking on 7-9% in prices that become permanent, permanent as in non transitory?

@LSTT

Nice history.

Fair to add, I think, that two major Wars put paid to any prospect of UK maintaining any sort of ‘position’ in the World.

Maybe this should be brought to the attention of all those rattling swords at China and Russia at the moment.

This is the FED’s fault, with some help by Biden.

With all due respect, i think you have not quite grasped the meaning of the term “reserve currency”. There is only one “reserve currency” today, and that is – still – the US$. It’s called a “reserve currency” because everybody that wants to trade internationally has to hold reserves in that currency because most of the global trade is done in said currency (by the way – one rather awkward consequence is that financial institutions outside the U.S. can create dollars out of thin air that are not under the control of the FED – the eurodollar market, which is the FED’s worst nightmare). You also imply this by stating that “All holdings that are denominated in non-dollar currencies are expressed in USD, and those USD-entries for non-USD assets move also with the exchange rates.” Why is that ? Because the dollar is the only “reserve currency” in existence and all “reserves” are measured in dollars for reasons of comparison and rating. Some might say the “reserve currency” is the one that the global price of oil is measured in. Or Gold. And of course you need an extremely liquid, deep bond market to have the “global reserve currency”, which today is only the case for the U.S. But the point about a “global reserve currency” is that there can be only one by definition. That makes your point about the EU running a trade deficit with the US in spite of having a “reserve currency” moot because the Euro is no “reserve currency”.

There have been attempts to make the IMF’s SDR’s the new “reserve currency”, but they failed because the SDR’s are not backed by a nation with the military means to force other nations to use their currency, like in the case of the U.S. And of course for most of human history, the “reserve currenciy” was gold – which all central banks hold today, just like US$.

The world can do without a global “reserve currency” just fine – it did for most of history – , but it would be a completely different system of trade and international relations from the one we have now. And it sure would be a very painful process for the U.S.

“A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy.”

In short, a reserve currency is ANY foreign currency HELD IN SIGNIFICANT QUANTITIES.

“For nearly a century, the United States dollar has served as the world’s premier reserve currency…”

But that does not rule out the possibility that there may be two competing premier reserve currencies.

If it’s a ‘convertible currency’. Most aren’t. You can’t buy anything with a bunch of African currencies outside their countries and barter is preferred within them. Barter for their products if any also occurs outside them. Significant quantities? The quantity doesn’t matter. Their value outside the country is zero.

‘The reserve currency can be used in international transactions, international investments and all aspects of the global economy.’

Although a notch above the African ones the ruble can’t be used for any of these.

Try buying oil from the saudis with euros.

Good luck.

Franz Beckenbauer,

Oil is “priced” in dollars but can be bought (paid for) in any currency the two parties agree to, at USD-EUR exchange rates that both parties agree to. The euro has reached roughly parity with the dollar as an international trading currency. You keep confusing “reserve currency” with “trading currency.”

USD is still the global reserve currency because foreigners still prefer to own US treasury bonds.

Until EU create their own European treasuy bonds priced in Euros, for foreigners, then Euros will be the number two global reserve currency.

Major foreign holders of U.S. treasury securities as of September 2021(in billion U.S. dollars)

https://wolfstreet.com/2021/08/17/who-bought-the-5-trillion-piled-on-top-of-the-monstrous-us-national-debt-in-15-months/

Franz Beckenbauer,

YOU do not get to define what a “reserve currency” is. That definition is set by the IMF and central banks. So your whole diatribe is already garbage from get-go. Then you confuse “reserve currency” with “trading currency.” Two different things, as I pointed out in the article. There is also the role as a “financing currency.” And then you ladle more home-made garbage on to it. And I stopped reading.

The world’s true reserve currency has just broken out of an inverse H&S formation and is going much higher.

The one you ” didn’t like at these prices”.

Franz Beckenbauer,

You made that comment that you now referred to on Dec 17, 2:36 PM US central time (link below), and you called it “liftoff,” because gold rose to $1,810.

https://wolfstreet.com/2021/12/15/powell-everythings-moving-much-faster-incl-end-of-qe-balance-sheet-reduction-rate-hikes/#comment-395714

The next thing gold did over the following few days was drop into the $1,780 range. So on Dec 29, when it was as low as $1,790, gold was still below your “liftoff” comment. On Dec 30 and Dec 31, gold jumped to hit $1,830 on New Year’s Eve, meaning after all these gyrations it’s up 1.1% since your Dec 17, liftoff comment, and it includes the big jump into the New Year’s Day holiday weekend. It’s still down 2% from Nov 15, and it’s down 4% from the end of May, and it’s down nearly 7% from a year ago.

Look at the 1-year chart. That’s not what a “breakout” looks like:

Franz,

The SDR basket which includes China, who gives the seal of approval to companies that default on western debt, isn’t worth crap. If it ever had a chance to be a reserve currency for central banks, it doesn’t anymore.

Credit is the coin of the realm in the west. And China doesn’t have any now.

Petunia,

“Credit is the coin of the realm in the west.” Made me re-read some of John Pierpont Morgan’s testimony to the Bank and Currency Committee of the House on 18 & 19 December 1912:

“All the money in all the banks in Christendom cannot control credit.”

“I have given a man a check for a million when I knew he had not a cent in the world.”

“The first thing is character, before money or property or anything else.”

Of course, the most noted quote he made: “Money is gold, and nothing else.”

The last quote listed by the Library of Congress’ “Morgan Epigrams” (a summary of his quotable testimonial statements) would be rendered false in only one year:

“You can get combinations that can control business, but you cannot control money.”

Since China’s reminbi is effectively pegged to the USD, then it is just another share of the USD in the SDR.

I believe that China’s share in the SDR is 11%. China’s constructive default of $300B to the west via Evergrande, effectively makes their share of the SDR worthless. The entire SDR has been devalued by China’s 11% share.

You can kiss the SDR goodbye, along with any other supra governmental currency.

@FB

“the eurodollar market, which is the FED’s worst nightmare).”

I would expand that slightly to say that everything about the EU is everybody’s worst nightmare.

Eurodollars have nothing to do with the EU. The term ” Eurodollar” is used for all dollars in circulation outside the control of the FED. Which are a lot, since the dollar is the world’s reserve currency, and tberefore a lot of’em have to be around everywhere.

Wolf,

Thanks for the info. I’ve read some things on inflation with interest rates low. A couple of times,one was World War One and the second was World War Two. With all the debt and deficits with the US dollar inflation is here and rates will remain low, maybe 2.5 or 2? So higher prices are here. What I don’t understand is how this helps pay off the debt. Could you help me to understand this? Thanks in advance.

There is no evident intent to pay off the debt. If the government is actually attempting to replicate what they did starting in 1946, it’s to inflate nominal incomes and increase tax revenue, thereby making the debt and debt service less onerous as a percent of GDP.

The difference this time is that there isn’t even a hint of an attempt to control spending which means it’s destined to fail.

My reasons for it?

A widespread belief in something for nothing and long-term social decay. Try to substantially reduce non-discretionary spending and the country falls apart. No, gutting the defense budget is nowhere near enough, no matter what anyone claims. It’s basic math.

@AF

Max Keiser made the very interesting point that a government issuing debt with no intention to repay is exactly the same as printing money, so the whole QE shenanigans is a pointess distraction.

1) USD share of global reserve currencies :

2) The Nikkei reached it’s peak in Dec 29 1989.

3) USSR dissolved in Xmas 1991.

4) USD share of…plunge to it’s nadir of 45% in 1990. Thereafter the German mark was USD main competition, until the Euro arrival.

5) In Mar 2008 USD reached it’s nadir @70. USD osc around Jan/ Feb 2015

backbone, – 95.78 high/ 93. 38 low – until the transitory inflation issues will resolve.

6) East & West Germany wanted to united. Two equal eleven. Traumatized by the previous “events” France, UK and Russia forced Helmut Kohl to sign a shotgun marriage.

Which countries in the world today are investing in (and have been doing so) in human capital and technology?

These ones will lead the world in a short decade or two.

The US does a great job of importing the former and creating the latter, but at what point will people switch from going to the US to another country because the prospects are better?

You pay off the public debt by not issuing more and letting the existing debt ‘roll off.’ You reduce private debt by increasing wage incomes and government sponsored social services, like pensions and health care that currently burden corporate budgets. This makes our industry more price competitive. You reduce inflation by raising taxes. You stop QE, which has never worked as advertised. You enforce anti-trust laws. Very little here is new. Just unpopular with the donor class.

You reduce inflation by raising taxes??

Sorry that’s not my understanding of the situation.

Happy new year !

With all the respect to other currencies, USD share of global…. retraced less than 50%, in the last twenty years, since the Euro was born.

The trend is up. The trend is strong. USD share of… is likely

to reach & exceed the previous high of 70%, unless the share of…. cont to decay more the 62%.

US dollar is no longer the cleanest dirty shirt, it is the only dirty shirt. Everyone else is printing to make up for losses.

Wolf did an article on central banks that are tightening. Check it out.

Ambrose Bierce,

BOJ stopped printing in May. BOC stopped printing in October. BOE stopped printing in December. Smaller central banks (New Zealand, etc.) have also ended their asset purchases.

A whole slew of central banks have started jacking up their rates.

On the BLS web site:

January 2022 CPI weight update

Starting in January 2022, weights for the Consumer Price Index will be calculated based on consumer expenditure data from 2019-2020. The BLS considered interventions, but decided to maintain normal procedures.

The drug business is booming so that keeps the $ in demand. Afghanistan Occupation was also good as heroin production skyrocketed there with corrupt generals being made rich. Go long money laundering.

There are many things that determine the worlds reserve currency. These are just a few.

1. The USA has never defaulted on its sovereign debt. Everyone else has. Some countries do it routinely. Highly related the USA has a system of laws that protects this sovereign debt.

2. The USA economy is the largest in the world. It only makes sense international trade would use the USD. Also, it’s the import country’s currency that is key. The exporter doesn’t want to delay sales by making it’s customers convert local currency to exporting country’s currency first. The customer might decide its too much of a hassle.

3. We all decry the 30 trillion dollar federal debt. But that debt is used as a temporary parking place for many large players including governments and international mega corps. Who else comes close to having this size of a parking place? Who else has the wherewithal to build this size even if they wanted to?

On these points alone the USD is likely to remain the world’s reserve currency.

the US has never defaulted on its debt, except for the four time it did.

1862.1933,1968,1971.

Not every country wants its currency used as a reserve by others. Around 2010 Russia announced a plan to add Canadian $ to reserves and did add some. This was unwelcome to BoC and Russia desisted.

Someone on WS commented that the C$ was heading much higher against US$ even beyond parity. The Min of Fi and BoC would do anything to stop that happening with pretty much every exporter to US hounding them.

In one month in 2021 Can ran an 8 billion dollar trade surplus with the US. The equivalent per capita for China would be 240 billion. Canada is quite happy with a C$ around eighty cents US. If other countries accumulated it as reserves it would be harder for BoC to hold it in that range.

In general people have this ‘reserves’ thing on the brain, especially with gold. The weaker a currency, the more its reserves have to be talked up.

How many times do we read: ‘Russia adding gold to reserves’

The German public, private citizens, own more gold than the Russian govt. The ultimate German reserve is German industry, which became very unhappy when people around the world started accumulating D- Marks as their reserves.

Ultimately a currency is only worth what you can buy with it. Since you can only buy something in the country where it is the legal tender, unless you find a sucker inbetween, the Dollar reserve strength indicate that the US has more in form of assets that people want than other countries. And this is mainly real estate backed by solid property rights.

US dollar is the world trade currency. In most countries exporters not only accept US dollar settlements, they prefer it.

On the other sided, buyers may prefer to pay in a different currency. There have been little in the news about it, but China have paid Saudi Arabian oil with Remimbri

The true Reserve Currency of the true financial system (hidden from us public) is Gold. Physical gold.