Amid record surge in luxury house sales.

By Wolf Richter for WOLF STREET.

The San Francisco market is dominated by condos. Over the past few decades, nearly all residential construction was for multifamily buildings – apartments and condos – and almost no single-family houses were built, which makes sense for a city that is boxed in by water on three sides.

In terms of condos over the past four months, sales hovered around 450 units per month, not including sales of new condos that are handled directly by the sales offices of the developers and not reported to the MLS. House sales were in the 300 unit per month range. So that’s the size of the market, with condo sales being generally higher than house sales. And this market has totally split in two.

Over the past four months, culminating in June, there has been a historic surge in sales of luxury houses in San Francisco. Luxury in San Francisco starts at $3 million. In June, according to Compass, 70 luxury house sales closed, nearly double the prior peaks.

A good part of this spike in luxury house sales has to do with the fact that the wealthy got immensely wealthier in this pandemic, thanks to the asset price inflation strategy the Fed has pursued – going for the infamous “Wealth Effect” – and some of them bought luxury houses.

Median prices are sensitive to changes in mix. And this record number of luxury house sales that closed over the past four months altered the mix of total house sales and skewed the median price upward (a sharp decline in the number of luxury sales in future months would unwind some of that price spike).

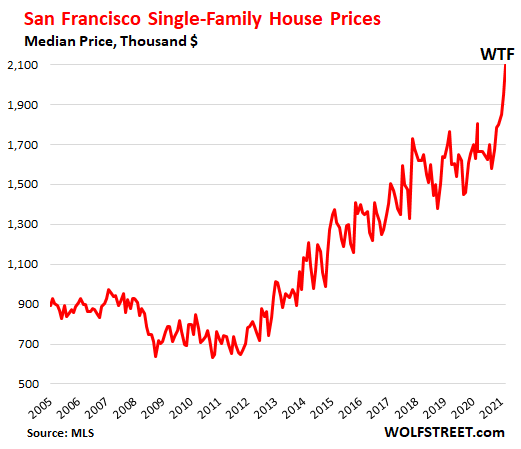

And so, according to MLS data provided by Thomas Stone, a retired real estate broker in Sonoma County, the median price of single family houses in June spiked to $2.1 million, having tripled since 2012, for a beautiful WTF moment:

But condos beg to differ.

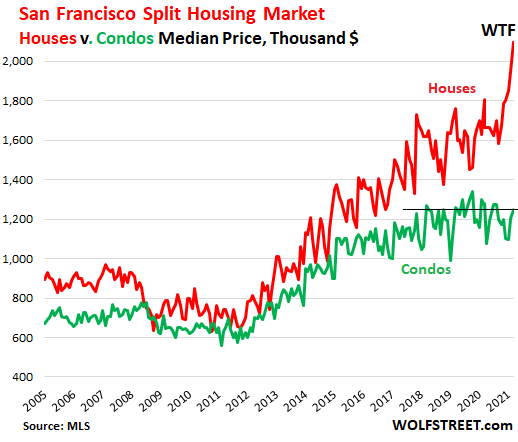

While the median price of condos has been volatile, bouncing up and down as median prices do, it has gone nowhere for over three years.

In June, the median price of condos was $1.28 million, about where it had first been in March 2018. While the median house price tripled since 2012, the median condo price only doubled since then. OK, that sounds kind of funny, something that “only doubled” in nine years, I mean, what kind of rinky-dink market is San Francisco?

Condos had their share of crazy price increases, but before March 2018. Since then, the median price bounced up and down but essentially went nowhere. And there has for years been a large number of condos on the market, with new ones being put on the market all the time.

During the housing bust, the median condo price and the median house price were not that far apart; but since 2015, the spread started widening, and now the median house price is $900,000 higher than the median condo price:

“All of the markets are fear-driven, and none of them are rational,” said Thomas Stone, the retired real estate broker, regarding this situation (he’ll be happy to send readers an MLS-generated housing-trends report for any of the Northern California counties, free; you can find his email here).

Similar situation in the broader Bay Area.

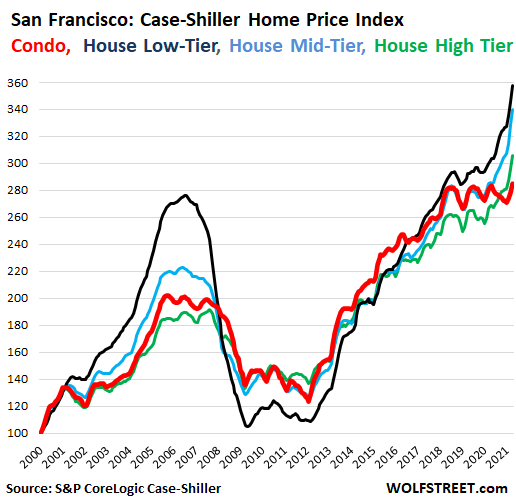

In the five-county Bay Area that the Case-Shiller Home Price Index covers – San Francisco, San Mateo, Alameda, Contra Costa, and Marin – similar trends are playing out. But the Case-Shiller methodology avoids the problem of a change in mix skewing the median price because it doesn’t use median price; it uses the “sales pairs” method, where the sales price of a home in the current month is compared to the sales price of the same home when it sold previously. That’s a big advantage.

The disadvantage is that it lags about four months behind the point when the actual deals were made, compared to the median price index which lags roughly one month behind the actual deals.

This chart shows house-price indexes by price tiers and the condo price index (red) in the five-county Bay Area. San Francisco is the most expensive housing market among the five counties, but it also has the largest share of condos.

House prices in all price tiers started spiking last year, while condo prices continued to go nowhere. The last reading of the condo price index (“April”) was where it had first been in mid-2018:

The San Francisco Bay Area entered the pandemic with a flat housing market. According to the Case-Shiller Indexes, in all of 2019, house prices had been slightly down or slightly up year-over-year, depending on the month. Median prices showed similar trends. Condo prices were down a little year-over-year in 2019.

What changed everything in terms of house prices was the pandemic – the Wealth Effect – and house prices suddenly exploded. But the pandemic didn’t change condo prices much.

Food for idle thought: condo prices, as per the Case-Shiller chart above, had also flattened in the years before the Housing Bust hit the San Francisco Bay Area.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

FOMO

The Fed has made it such that you CAN NOT SAVE YOUR MONEY or they will punish you with their promoted inflation and zero interest rates.

Therefore, you must buy stocks or real estate…things the oligarchs, hedge funds, and the connected bought just before this Fed policy was implemented….

Timing is everything. Inside info helps the timing.

Yep, can’t get no interest on my CDs anymore. They are all rolling over after 1 year and the rate is now 37 basis points on a 1 year CD. To add insult to injury, this little bit of interest pushes me into the next tax bracket which when you add everything up is is about 42% vs 32%. The government is not only giving me no interest, inflating away my principal, but taxing me 42% and pushing all future income into that new bracket. That’s 3 strikes. In baseball, 3 strikes and you’re out. Looks like I done struck out.

You don’t understand tax brackets.

How the rich get richer and the poor get poorer…

“A good part of this spike in luxury house sales has to do with the fact that the wealthy got immensely wealthier in this pandemic, thanks to the asset price inflation strategy the Fed has pursued – going for the infamous “Wealth Effect” – and some of them bought luxury houses.”

The Fed is STILL buying MBSs……with mortgage rates well below inflation….and half the rate they should be

It is clear who benefits from Fed policy….and does Powell really think what he is doing is benefiting “main street”?

The Fed has shot housing prices away from most people, and ALL PEOPLE have been denied the ability to SAVE their money. (Zero return and 5% inflation)

Really helping out … right Jay Powell? What are your handlers telling you?

Powell is an economic terrorist who, when history is written, will go down as one of the most reckless bankers to ever live.

He’ll also go down as the most hated in history at least the present history. It could be worse in the future but without a doubt Powell will always be remembered as the man who sunk the entire country.

Too many Americans seemingly shut their eyes to the evidence presented to them every day and do not want to believe that the bankster-owned “Federal” Reserve is clearly, intentionally benefitting its billionaire owners and their cronies on purpose and not fulfilling its mandates, which were imposed on it by a corrupt or gullible congress. They are like the people that believe in Santa Claus or Peter Pan or magic.

The truly astonishing thing is how many Americans now are opposed to the estate tax, corporate, and capital gains tax increases on the bankster-billionaires that have not paid US taxes for years due to the US federal income tax exemption by transferring their factories and US jobs to China, etc. See Fortune’s “Commentary: Apple Avoided $40 Billion in Taxes. Now It Wants a Gold Star?”

Due to their ability to deduct their corporate condos, corporate cars, beautiful, corporate “personal” assistants, etc., even for ordinary, US earnings, the rich can pay a much smaller fraction of their earnings as taxes and only when they wish to pay such. See “Why Does Billionaire Warren Buffett Pay a Lower Tax Rate Than His Secretary?” in msn d o t c o m: “Why do the wealthy pay such little tax? In a 2007 interview, Buffett explained that he took a survey of his employees and compared their tax rates to his. All told, he found that while he paid a total tax rate of 17.7%, the average tax rate for people in his office was 32.9%.”

Most corporations now do not pay dividends, because the rich would have to pay taxes on those dividends. If they just hold their very valuable shares, and those shares do not pay dividends, they do not have to pay taxes until the shares are sold or they die, and then they are taxed at lower capital gains rates or not taxed at all if they are within the enormous $11.7 million estate tax exemption. See Forbes’ “IRS Announces Higher Estate And Gift Tax Limits For 2021:”

QUOTE FROM ARTICLE:

“The Internal Revenue Service announced today the official estate and gift tax limits for 2021: The estate and gift tax exemption is $11.7 million per individual, up from $11.58 million in 2020. That means an individual could leave $11.7 million to heirs and pay no federal estate or gift tax, while a married couple could shield $23.4 million.”

By gifting their funds little by little during their lives, e.g., to a trust, the rich can effectively have a massively larger, effective exemption from taxes. See same article: “The annual gift exclusion amount for 2021 stays the same at $15,000, according to the IRS announcement. What that means is that you can give away $15,000 to as many individuals—your kids, grandkids, their spouses—as you’d like with no federal gift tax consequences. A husband and wife can each make $15,000 gifts, doubling the impact. Separately, you can make unlimited direct payments for medical and tuition expenses.”

Too many Americans are like battered spouses, who keep getting hit but keep covering for and denying that their abusers are scmbgs.

K-somewhat begging the ‘why doesn’t more of the working class raise themselves by their own bootstraps the good ol’ ‘American’ way?’ question. (Hey, it’s GREAT to be born on third base, but don’t confuse it with your own ‘work’…).

may we all find a better day.

I was following you until you suggested *another* tax.

I encourage everyone to read John Hussman’s June commentary. It’s the best explanation of the US economic and financial system I have ever read It’s so much stuff in there that I read it about once a week to let it sink in. I am amazed he gives it away for free.

It’d have been helpful if you have posted a gist of what he says provided you yourself have understood it

Sorry about that.. It probably can be summarized as how the financial system really works.

It’s all Magic.

Hussman writes a lot of interesting stuff. Look at the performance of his mutual funds, it gives insight to his ground game. He is a perma bear. Follow him and one misses out on a lot of upside although i am of the opinion that equities now have more risk and downside. Part of good investing is knowing when to buy and when not to buy however market timing is virtually impossible to do. We are nearing the point when the music will stop but is that point a few months or years away. Some will take some off the table to lock in gains. Some will let it ride and perceive themselves to be wealthy and spend like they are until they are not. This time is different, we have massive debt, Fed buying up everything, aging population and unprecidented debt. They are trying to inflate their wayout. 10 is dropping and while some say its because of shorting, not sure I buy that thesis.

Hussman messed up by underestimating Zirp. You really should judge your performance over full economic cycle peak to peak or trough to trough.

If you average the three best long term valuation metrics you get that sp500 should be around 1550. That’s what Fed is fighting, but I don’t think they will be successful.

Been watching as many past bubble videos as I can find. It seems all the signs of mania are here today.

“Hussman messed up by underestimating Zirp.”

Most people underestimated ZIRP and the effects of multi-trillions in stimulus and QE. There is so much money sloshing around right now that this thing could run another couple years.

I didn’t underestimate the effects of ZIRP or QE; what I underestimated was their sociopathic, maniacal commitment to it, after it was clear how destructive it was.

“Follow him and one misses out on a lot of upside”

You types always miss the point, or you think you’re a wonder gambler. Let us know how well you time the market, unless for the first time in recorded history the stock market permanently disconnects from reality.

Could u send a link,pls.But i remember he was very

always bearish.

Google Hussman Funds Market Commentary dated June 2021.

Instead of John Hussman, I would encourage people to read Mark Hanson who just published his first update in nearly a year (mhanson dot com) and Chris Ciovacco who publishes a free weekly Youtube video. The reason is that these individuals have shown that they can be flexible and open-minded. Hanson made the mistake of being persistently bearish on US housing after 2009. Instead of sticking to his bearish thesis, he changed his mind. You’ll notice that he’s now bullish on US housing. Ciovacco realizes that equity valuations are high, but he is open to the idea that instead of a reversion to the mean (as Hussman expects), the correct economic model may be one in which valuations gradually increase over time.

Hussman doesn’t even discuss real estate or only barely. He isn’t bearish on the stock market all the time either if you actually read his commentary. He isn’t short and presumably has a low allocation (not clear in his comments) but that’s different.

He tells his readers how ridiculously overpriced this stock market is which is contrary to what many or most want to believe. He is correct with this description, despite that those who disagree with are or might be getting away with buying into the most overpriced market in US history.

While I agree that to educate onesself it is essential to gather all pertinant info as pertains to avenues explored, all these guys are, and alway have been, making speculations based on past history. Nobody knows, though some will be by chance correct.

Tough to make predictions, and be correct, especially about the future.

Another one is Doug Nolan’s Credit Bubble Bulletin. His aim is to track this unprecedented historic mania in real time. Most commentary is US focused but also quite a bit on China.

Truly excellent read

Just read an article by Michael Bloomberg preaching about the action needed to be taken on climate change. This from a guy that owns somewhere between 10 – 20 large homes scattered throughout the world. He must create 1000 times more than the average peon.

Hypocrisy is the cornerstone of the Left.

Ignorance is the cornerstone of the Right.

Bloomberg is NOT left, I can assure you.

He’s an oligarch.

Wait a second…George W Bush’s administration’s BIG LIE (Iraq has WMDs “Don’t let the smoking gun be a mushroom cloud.”) and his massive tax cuts were a disaster.

The “policies” of W’s puppeteers crashed the US economy (and 6/8 yrs of GOP controlled Congress).

DJT’s BIG LIE (the election was stolen) led to a violent insurrection at the US Capitol (with more violence to come.

DJT’s incompetence (It’s a Democratic hoax; etc) led to an unnecessary 400K Covid deaths. And his massive corporate / 1% tax cuts were disastrous for the average American.

With all this failure and blood, you think flapping your lips about “The Left” (of which Oligarch Bloomberg isn’t a member) is really wise?

You might want to go find a mirror and take a long hard look in it before you blather about ‘hypocrisy’.

Outside, what is it that the Right is so ignorant of?

Jeff

What is the Left so hypocrital of ?

“Bloomberg is NOT left, I can assure you. He’s an oligarch.”

Most of the oligarchs are liberal globalists. Where are you getting your information?

historicus,

There are no bigger hypocrites than Republicans jabbering about the deficit.

Who ever said that the left and liberal elites are the same thing? They are very different, DC. You’ve been brainwashed by the media. You want it both ways and got neither. What exactly does an occupy protester have in common with an oligarch like Bloomberg? Very little. I think you’d agree if you weren’t so brainwashed.

“You’ve been brainwashed by the media.”

I don’t even watch the news. WTF are you talking about? Wake up.

Republicans have been bad on the deficit as well, but that’s because there’s no way to stay in office without promising people free goodies for votes. Our seeds of destruction were set after the passage of the 19th Amendment. It was only a matter of time.

Sure are a lot of people living for free around here in RVs, tents, shanties, tarps, and whatever. They are unaffected by these prices.

Some of those people said to themselves “Instead of paying the 15% rent increase my landlord wants, how’s about I give myself a 100% rent reduction.”

Karl Schwab of Davos said last year, that in ten years you will have nothing but you will be happy, too bad he has not specified who will be happy.

You never know for sure, but I have read that about 10 years is all the can kicking that can be done with the current financial system.

Heard yesterday when Japan went Zirp nine of top ten biggest life ensures went bankrupt. Can’t run Zirp without consequences.

I worry about inflation. Some chartists are stuck in studying pre-1970 patterns. In 1971 the dollar was no longer convertible to gold.

I recall a term called stagflation. It is when a sluggish economy does not produce lower prices, because inflation reflates the prices.

Wall Street is expecting companies to report increased earnings for 2021 Q2. Like the 1990’s.

When my dad was in the Vietnam War in the 60’s, a Hershey bar cost 5 cents. I have seen them for sale from 85 cents to $1.50. Later they might cost $5.00.

I also fear a crash is coming. I saw a young white man with a bicycle by a dumpster looking for aluminum cans to sell in 2012. A small Florida condo in a not so nice neighborhood was sold for $50k. They had built too many houses. Home prices crashed. Home builders laid off construction workers. Mortgage bankers were bankrupted. Office workers lost their jobs. They were ordered to clean out their desks. A police officer was there to make sure they left the building within fifteen minutes. The stock market panicked.

Karl Schwab…

The most universally quoted man in comment sections anywhere and everywhere !!!

It’s Klaus Schwab.

Aha !

I stand corrected !

But I DO know his favorite qoute !

The one that gets repeated over and over and over and over…..anywhere and everywhere.

People who hold his words as gospel….

Sigh….so sad how many take his words to heart.

New tent prices are going ballistic!

With the average Joe moving out of SF, soon they’ll be nothing but millionaires living there. I jest but can’t see this ending well for many.

What’s the maintenance on a condo in earthquake country? I think Miami is dead and maybe SF is on the same path. LA looks pretty dead too.

Condos are sold primarily to people who can get by with less space in exchange for being close to downtown. The pandemic pushed work from home to adoption, so people need more space. For SF, condos are typically small, so more space means a house – this means demand spikes and house prices get bid up.

The Florida experience may be coloring people’s thinking – but most of the condos are in newer buildings built to earthquake standards. Older buildings survived the 1989 quake, so probably safe. There’s still the inadequate reserves problem, though.

Interestingly CNN had an article a few days ago entitled “Surfside catastrophe raises concerns about San Francisco’s sinking Millennium Tower” given that the tower already sank 18 inches since being built and is tilting. The retrofit of tying the foundation to bedrock is in progress and won’t be done until next year. I wouldn’t feel too good living there until that is done. But I feel that other buildings that are up to code should be fine. I wouldn’t buy the older buildings in Miami but I am sure the newer ones are also fine.

As an aside, I recently read an article that stated that in Japan houses are expected to only be used for 30 years and after that they are torn down to make way for a new house. I’m not sure how true that is. In some places like Miami where the condo boards aren’t doing the necessary maintenance, it might be a good idea to implement something like that. At some point the costs on maintenance outweighs the benefits and people who buy after the 30 year mark may not understand what they are getting themselves into so having a “useful life” or other metric might be helpful.

Josh,

yes, that 30-year concept is a long tradition in Japan (coming from the era when buildings were made out of “wood and paper”). It survived into the post-WW2 period.

For example, the house my in-laws built in the 70s is long past the 30-year line, and it shows it. It will be torn down by the next owner. It cannot be remodeled. The value is in the land.

In the 70s, most houses were still built with a 30-year lifespan in mind. And they have already been or will be replaced. High-rise buildings built in the 90s are likely to be around for a lot longer. And even today’s single-family houses are likely to look good for longer than 30 years.

But post-WW2 mid-rise buildings, including condos, have been getting torn down everywhere in whole city blocks, with “urban renewal” even modernizing the street grid.

In 1996, I lived in one of those areas in Tokyo that was built in the 1950s and 1960s. It was really drab, but also kind of fun. When I looked at it again in 2004, the entire area was gone, and replaced with brand-spanking new buildings, and a new subway line (which was under construction when I was there) went through it, and gleaming new subway stations dotted the main street (Mejiro-dori). They took out all the tiny alleys and changed the entire grid of the neighborhood. The entire area was a perfect example of Japanese “urban renewal.”

In reference to your comment about Japan, I am currently a resident and it’s mostly true along the coastal areas of Japan. I can’t be sure with every town however.

The rain coupled with the salt water in the air pretty much wrecks the steel reinforcing in the concrete in serious structural ways that renders the buildings uninhabitable.

In houses here that are around the 20-30 year mark, you can see the red rust stains just oozing out of the ever increasing cracks in the concrete.

Josh,

CNN is worthless. Why quote anything they said. Ratings down 75%. You may the only person on the planet still tuning into the garbage they put on their network.

Then they’ll build a giant dome around it and call it Zardoz.

“average Joe moving out of SF”

Wealthy parasites won’t like cleaning their own toilets or maintaining their mansions. Their solution will be to allow more tent cities occupied by average joes hired to take care of the rich.

But, but…

Who’s going to serve the lattes?

“The Fed is now buying all the net Treasury

issuance, so there is no real treasury market. They now own 25% of all Treasury

issuance. China and Japan own another $2 trillion equal to 10%. It is a whale

swallowing up all available bonds. If the Fed were not the buyer at the levels they

are, the ten year would very likely be much higher to reflect inflation.”

Wolf, what do you think of this comment from another analyst?

They can’t let the debt float. My guess is 25-30% is the real market rate.

When Greece, Portugal and Spain’s sovereign debt was blowing out to 7% Draghi had to do whatever it took to get the debt financed down to near zero.

Same for USA. Debt so high, you can’t pay a positive real rate. The problem then becomes politicians have a zero interest credit card and destroy real economy with hair brained schemes.

I don’t think gold is especially cheap, but close to it’s long term average of 216 oz to buy median home. Worse places to put your money.

Gold/silver is the most under valued asset at the moment. What are you talking about?

Gold is historically overpriced versus practically all commodities. Not cheap versus most other goods either. Compare how many ounces it takes to buy anything over time. As one example, anyone can buy a much better car now for the same amount of gold as they could in the late 1920’s.

The best explanation for the relative value versus housing now is that real estate is bought on margin and it’s artificially inflated by government policy.

Measuring exact relative value is somewhat an apples to oranges comparison since newer houses are generally larger with better amenities but with less land. Other factors such as relative proximity change the relative value proposition too. A house in the city where I live which would have been considered far or not close to the core in 1975 is now considered “centrally located”.

Old…

“you can’t pay a positive real rate.”

Here is where the MMT folks disappear.

If the creation of debt is a great catalyst for the economy, as the MMTers say, then why isnt more debt floated to pay a “positive rate” not good also?

The answer is..

New government debt created to be then spent by the government is good, they say.

New government debt to service pre existing debt and to be paid out in interest is not good. Reason? The government doesnt get to decide HOW those interest payments are spent…the holder of the debt does.

But dont those interest payments end up in the economy too, which should be good according to MMT?

It’s all about who controls the money created by the new debt. That point needs more sunlight.

1. I don’t know why I have to deal with the what some analyst regurgitates.

2. “Available bonds”: There is no such thing. There are marketable and non-marketable Treasuries. The Fed holds marketable Treasuries, but they’re not “available.”

3. The numbers are wrong. Total debt = $28.2 trillion. China and Japan combined hold 8.3% of it.

4. The Fed holds 18% of it.

5. “… likely be much higher to reflect inflation.” Yes, that’s how it should be. If CPI is 5%, the 10-year yield should be 7%. That’s what the market would do if it were allowed to operate as a market. But there is no market. The Fed controls it.

” I don’t know why I have to deal with the what some analyst regurgitates.”

You don’t. But I thought you would have some good input, and you did. Thanks.

“Yes, that’s how it should be. If CPI is 5%, the 10-year yield should be 7%. That’s what the market would do if it were allowed to operate as a market. But there is no market. The Fed controls it.”

Why T F is the FED doing this? Why do they have to wage decades long wars on savers? Making grandma eat cat food and forcing the poor to live on the street is despicable.

DC

Thats’ been the plan. Now the second part of the plan is they want everyone who has suffered a loss in principle on their savings over the last decade to plunge into the stock market right at the top. The rich big guys will use this spike in buying to get out take their profits and go into cash. The late comers to the stock market will get crushed.

I think it means that they have ran bad monetary policy in the past and they have to continue bad policy today, because of high levels of debt. Hard money or conservative monetary policy doesn’t allow excessive debt.

CT shoreline of New Haven suburbs folks are getting 20% over last year selling to doctors. Problem is local taxes which rise dramatically along with higher RE valuations. $30,000-$100,000. property taxes are not that uncommon these days. Local government is getting to be a real growth story; beautiful new vehicles, free health and dental; like many municipalities it’s a family business with retirement pensions after 20yrs times 2 for second 20yrs at another department, and many add another $3K for disability pay.

Amazing. No rising sea levels affecting coastal prices here…

“CT shoreline of New Haven suburbs folks are getting 20% over last year selling to doctors.”

That 18 percent of the GNP goes to health care, half of which is unnecessary, helps. Joe has certainly helped the health insurance industry with billions. That drag alone makes the US essentially uncompetitive in manufacturing. How will it end?

How many Democrats and Climate Change proponents bought ocean side properties lately?

AOC’s prediction has about 7 years to go.

Every Climate prediction for the last 40+ years has been wrong, starting with the coming ice-age in 1979 lol

I thought Al Gore buying a beach property was perhaps the best….

I thought AOC’s prediction was end of the world in 2012. Why would anyone listen to any more of her predictions? She ain’t got the gift .

Indeed – I fail to see how these steeply rising property taxes aren’t going to lead to lowered stability – sure maybe you can afford the $1M house, but when you realize you’re paying $1K/month property tax, in perpetuity, you may want to downsize.

I think this is the weak foundation of the whole system. Assume total carry cost of home is 6% (interest, taxes, maintenance, insurance). Assume you are leveraged at 10:1. Only way it’s a good long term investment is if prices are going up at a positive rate. You are going in the hole real fast in a down market.

Wolf would know. Did Cali pass a law that said property taxes should be based only on the initial sales price, if the original buyer still lives there? I like that idea. The elderly could sell and take out the cash, of course, but should that be their only option?

You are probably talking about Proposition 13, passed by the voters in 1978. The assessed value is allowed to increase no more than 2% per year. Then there are flat rate parcel taxes, most of which have to be voter approved and and general obligation bonds which are tied to assessed valuations and also have to be voter approved. Overall, Proposition 13 has made it more difficult for local governments to raise property taxes. When the elderly sell and take out the cash, they are subject to steep capital gains taxes (State and Federal).

What nobody ever talks about is that every property sold, residential or commercial is taxed on the sale price, market value. This means that the thousands and thousands (yes, thousands) of propertis sold in each county each year results in an incredible astronomical amount of new revenue to the counties.

So local governments do indeed raise property taxes, and they do it thousands of times a year.

My sister is a doctor in San Francisco and is looking to buy a house there. She will not be a happy camper about this.

She can wait. SF is boom and bust, and everyone knows this :-]

What would a bust look like for SF or other upcoming tech city , Seattle ?

Tech is entrenched in every days life, unlike 2000 dotcom bust .

In SF: Declining population, declining rents and home prices, declining jobs, budgets go red, services get cut, traffic congestion lightens up, everyone prays for more tourists…

Well, SF sure has a nice baseball stadium right on the water. Saw the game yesterday on a HD screen at my local sports bar. Good aerial photography of the stadium and adjacent areas. SF really cleaned our clock. 8 to zip in the 3rd inning, including dropped fly balls, booted ground balls. The Nationals looked like a minor league team against SF.

Seattle is probably safer than SF from that standpoint. Seattle also has a lot going for itself in terms of outdoor activities and there’s increasing population still. Seattle is like if SF and Denver had a baby.

CA still has about 2-3x the population density of the rest of the country. So, even though it’s a huge state, there has always been pent up demand for any housing bust.

When I left, I feared that the whole economy was building up a bunch of “too big to fail” institutions. One kind of which is a “failing state” (see NY, IL, NJ, and others). As we have seen, the federal govt will trying anything to keep these voting blocs afloat including giving them sweet bailout/stimmie packages.

Anyway, I could see another long period where residential RE continues to be at nosebleed levels, but commercial RE tanks. In cities that might be conversion to residential.

I don’t see how these states survive without the artificial economic flotation of low rates, bubbly stocks, etc. It’s been going on for decades now.

That’s what I told her to do. But there may be a time limit based on when they sold their properties in North Carolina. I will ask her when I see her next month.

PS: I also told her to read WolfStreet!!!

Wolf,

The one difference if I really think about SFH vs condo is the fact that you own rights to the land. A condo or a townhome, you don’t actually own a lot of land, only the structure, and there is a limit to what you can do with condo where as a SFH, you could tear the place down and do with it as you please.

Being that this is the bay area, the situation is skewed, because when even condos are going for between $750K to $1M, skewing more toward $1M than $750K. It’s hard for people to afford anything unless you’re in the right part of the labor market. It’s no wonder that a lot of people are finding ways to move out, but there will not be a shortage of fortune seekers to the bay area.

MCH,

I owned a condo (a nice big one, 1,800 square feet, with gorgeous views), and I will never ever own another condo. They can be a political and financial nightmare. I came out OK, but I was lucky.

If you think about this with respect to prop 13, one wonders how much of an impact this has to the overall tax base. If I look back at the parcel history over the last 10 years, the taxes have gone from just over $6k to just over $8k.

Now the value of the parcel has increased by about 80%, or if I am generous and take it actually from 2011, we are looking at 100% increase. A sale would adjust that base to something about $11k range, so I am sure that the local government is pushing constantly for churn in the residential real estate with prop 13, i wonder how much the base will readjust if another crash comes along.

There’s one in a nice area of DC Swamp that we appraised about a year ago. The condo fees were over $1,000/month for a 2 BR that sold for about $400K. There was a notice on the bulletin board with a list of all the owners that hadn’t paid their condo fees. The list was long, about 50 entries. I told the seller that it wasn’t a very good idea to have that information posted right in front of everyone that walked into the building. Who in their right mind would buy a condo in a building where 50 or more of the owners were deadbeats. She had nothing to say.

When you read the news, California and areas like SF, are cess pits of drugs, crime, murder, homelessness and that’s just in the good bits. House prices, however, tell a different tale. Maybe the homeless are just near millionaires who can’t afford to buy??????

Anthony,

Yeah, the “news” love to hate San Francisco and California. It’s very reliable clickbait. But if that’s all you know about those places, you’re misinformed.

I agree with Wolf, but Anthony ain’t wrong either……

Well, it all depends on which parts of the city you look at. A nice crime map will show you the areas you want to avoid.

Then there are all sorts of maps on income level in an area which provides another level of understanding.

I found this funny little site called Justice map recently. Easy to use, but does make me wonder about the accuracy of the data. Wish I had time to check it against the US census info.

I can show you four blocks in the Tenderloin and a few blocks South of Market that are good to avoid. That’s what most of those news stories are all about. Stuff that happens in a few blocks. But the city is 7×7 miles, and a few blocks don’t make up the city. It’s one of the most gorgeous cities in the world.

The homicide rate in SF is lower than in most other cities in the US. And most of those homicides are concentrated in three small areas.

The rest of the city is fairly clean and fairly safe.

Wolf,

You get no argument from me on this, but the problem is the media. But also the cities themselves.

Ignore the stuff from National, just look at local news. Headline just now on KTVU, shooting in Oakland.

Let’s say you live in the Bay Area, and say you live on the peninsula, you read a headline like that. Would you go into Oakland? Never mind that it’s isolated to one location. Why take the risk. Oakland has some fantastically rich neighborhoods, but the image is a city busy defunding police, resulting in lawlessness and have periodic riots due to ineffective government who is more interested in equity than enforcing the law.

You get bombarded with enough of the local news, and SF starts to seem like a hellhole. You and I might know the truth is different. But that lawless image is tough to shake, do you tell the local media not to report the news? And it doesn’t really help that the image of the city in terms of law and order is not Harry Callaghan, it’s George Gascone and Chesa something or other.

I go up to the city about once a month, don’t like it because of parking and traffic, but stuff like this is always in the back of your mind.

Consider the headlines in SF just the last few weeks, Target closing early, 6pm instead of 9 pm. Smash and grab at Norman Marcus, Walgreens closing down however many stores due to unrestricted shoplifting, DA Chesa let’s someone else go because he doesn’t want to prosecute, cause you know, the person who did X was mentally ill or was desperate to feed his family. London’s response to Target, they need to hire more people to keep stores open, not cops and prosecutors need to enforce the law.

Think about the tourist coming in, when he sees this sort of stuff on the news, what is he to think? He isn’t going to know the Tenderloin is the problem, the whole city gets painted with that brush.

MCH,

The thing is there are REAL problems in SF, starting with decades of corruption at the City government. And people rather focus on some thefts at a Walgreens. That’s what gets me.

Fairly clean and fairly safe. Is that like mostly peaceful? Because we know how that works.

@DougP

Wolf is not wrong. There is are certain areas that are trouble magnets, go down to the area around Tendrloin, and it reminds you of places like Baltimore.

Most of SF is not like that. The residential neighborhoods which dominates a majority of the city is not bad at all. But go around the Mission or parts of Market, or around Embarcadaro, then it gets kinda dodgy in places. Not all, but certain parts doesn’t look very good.

Again, you get no argument from me on your comments. Effective local government needs long term foresight. Let’s face it, SF is all about image, politicians are concerned with their image and appearing progressive in this state rather than doing real work for the cities. Why, they’re looking for the next job rather than doing the current one well.

The thefts at Walgreen, the shootings on the street, the Neiman Marcus episode, the Target early closures, all of these are a symptom. But what do you expect with a city that has the likes of Gavin Newsom, London Breed, and DAs like Gascone and Chesa running the place. All concerned with how they look to the press and busy trying to find their next job more than anything else.

Effective long term thinking is what you get with places like Sunnyvale, example, it’s one of the few cities in this country that has a department of public safety that is dual trained, meaning the cops are also fire fighters, and vice versa. The city put in the effort back in the 50s or 60s, a ton of money to invest, but they did it, and Sunnyvale as a city benefited from it. Such foresight is completely lacking in most other places. You just have to consider the current homeless problem, it is difficult to be sure, but SF solution of throwing money at the problem without accountability seem to be just insane.

MCH, I was perfectly safe in the safe neighborhoods when on two separate occasions I had my widows broken in the middle of the day in broad daylight with people around watching. Nothing showing, no items in view, nothing taken, just a sport I guess.

Nice clean cultural neighborhoods, very safe. Golden Gate Park, Presidio, Marina, Lombard street. all nice areas but don’t stand around with nice cameras or purses.

Come to find out there are over 150 car break-ins a day in safe SF.

Not to mention muggings, stores in safe areas ransacked etc.

I love SF and used to go there often for all of the wonderful and very different areas, but no more.

@DougP

I take your point, you can never be too careful, being aware of your surroundings is something I try to keep in mind all the time.

But, you do need to take precautions. I would never ever leave my stuff in my car in SF, not something visible or even remotely valuable. In my part of the bay area, I have seen over the recent years a rise in complaints about people breaking into cars to steal whatever is available. Even into contractor’s trucks just to steal their toolbox. I mean how sick can you get.

You can only take reasonable precautions, and remember, your local politician is too busy catering to the loudest idiot that wants to defund the police, they don’t give a crap. Recently saw a note from the city asking how 4th of July fireworks mitigation efforts turned out. 90% of people said it didn’t work at all. It’s like the lyrics from Dr. Feelgood.

“Cops on the corner always ignore

Somebody’s getting paid

Jimmy’s got it wired, law’s for hire

Got it make in the shade”

Except this time, it’s not the cops,and there is no Jimmy. It’s the damned politicians who wants to go easy on property crime. It would be nice if those same politicians receive the same pain their constituents saw.

I’m trying to comes to grips with US residential RE terminology. Is the following correct?

… there are SFHs and there are Apartments.

… the latter are either Condos or Co-Ops (which in Oz we refer to formally as Strata Title or Company Title apartments)

Are condos always multi-storey, or can they be single storey (our Town Houses) ?

Are Multi-Family Buildings merely any residential structure that is not SFH?

Thanks

You’re pretty much spot on. Condos can be single story interconnected buildings, or partitioned single story buildings, but they are usually referred to as town homes at that point.

In reference to the case shiller, they don’t specifically mention what qualifies as a “condominium” but I think it essentially mirrors the Aussie version of strata title apartments for all intents and purposes.

As for multi-family, they are usually referring to duplex, triplex houses, or small apartments, which from the outside can look like a larger version of a SFH but it’s partitioned for different families.

It really I’m the end comes down to zoning laws. However, real estate agents will make up some wazoo terms when selling houses. In Seattle, the city sold an old fire station as a SFH… Which they later tried to repo as it wasn’t zoned as a SFH and couldn’t be legally occupied.

Thank you SE

Condominium is a legal term. You don’t own the land beneath. Real estate refers to the land. You own the land. All the way to the center of the earth. Townhouse is real estate. Townhome is a condo with the architecture of a townhouse. Condos collectively own the land thru HOA’s.

In the US, condominium means that owners own two things: the inside of their home, including inside walls; and a percentage of the “common area,” which includes the remaining building sections (outside walls, foundation, roof, garage, common water heater, hallways, lobby, etc.) and the land. So if you own a 2,000 square foot condo in a condo tower with 200,000 square feet of condos, you also own 1% of the common area, including 1% of the land.

Having visited SF recently, whatever charm the city once had has long since gone? Homelessness, rampant crime, filth and crumbling infrastructure seem to be pervasive in many areas of the city. The far left Democrat cabal that controls the city seem to be running the city into the ground? If sales prices of luxury homes in the city are rapidly rising, fools and their money are easily parted?

Same situation in Sunny San Diego..

Clarion, pray tell where you hail from…

may we all find a better day.

We used to live in SF and saw it sadly degrade over the years. We now live in the Sierra Nevada foothills off I-80 going towards Lake Tahoe but may soon move to the Nevada side for tax reasons. We rarely visit SF anymore since there are so many issues there now that it’s not worth the hassle. The City is sort of like Madonna who was once different and exciting back in the day but now is old, tired, decrepit, and delusional.

Clarion-thank you. Good luck in your journey.

may we all find a better day.

Every place has its undesirable aspects. Here in central Wisconsin you would say its a little boring. And I’ve always wondered if there’s something in the water that produces the likes of Ed Gein and Jeffrey Dahmer.

I’m sure this would give nightmares to some people but I sleep fine tyvm.

We’ve driven from Minneapolis to Chicago through Wisconsin. The countryside in Wisconsin was stunning with rolling hills and well kept farms. On the other hand, Milwaukie and Madison seem to suffer from the same undesirable aspects that plague all cities controlled by liberal Democrats?

You betcha! The northern half of the state is God’s country. The best kept secret in the nation. But you better like winter. This last winter was a mild one. But the year before the thermometer on my front porch said -35 F. My old bones can only handle -5 to -10 F. I step outside in -35 F I get bone chilled in 10 minutes. Just going back inside doesn’t warm me back up. Takes a day or two.

The name Wisconsin is Chippewa for a red place that a river runs through. This is referring to the red sandstone along the Wisconsin river. Visit Wisconsin Dells sometime. It’s a tourist trap but the natural beauty is stunning.

You are right about Milwaukee and Madison. I worked in Madison and Milwaukee for 30 years. Within 6 weeks of retiring is was back up in central Wisconsin. Milwaukee’s population has been going down ever since I left it. I think of it as 20 years behind bankrupt Detroit. Madison is unbelievably liberal.

People don’t realize how liberal Madison is. It could easily be gay capital of the country. There’s a reason Cheney’s gay daughter lived there. Paul Ryan was from Janesville just a few miles south. I always chuckled when people referred to his core conservative values. He couldn’t be elected from that area unless he was liberal.

P.S.

You mentioned the rolling hills. I took a motor coach tour of central Europe back in the 90s. One on the places we visited was Bavaria. I felt right at home because of the rolling hills. No wonder German immigrants settled in Wisconsin.

1) SF RE regime change.

2) There are several bubbles and they all rumble under the surface.

3) The gov warned MM Funds, institutions and banks about a controlled

deflation.

4) Traders know that the time is near, are full of fear. Their failed attempts to short the markets cluster together. Value investors salivate.

5) The US economy was subjected to three bubbles busts, rising inflation,

cyber attacks, shortages… by our main enemies shorting us like hedge funds.

6) US consolidate and counter attack, because our enemies are more

fragile than we are.

7) The wealth people are cashing in, buying luxurious homes, expensive toys, or flying out of space, because they don’t care.

” San Francisco House Prices do Holy-Moly Spike, Condo Prices Flat for 3 Years ”

Same thing is happening here in the Swamp. If you did a graph it would be identical to the one in SF.

San Francisco is the land of the UltraRich & UltraPoor; &

it’s growing like never before, on top of the world,

looking down on us mere mortals, trying to eke out a meager living.

Seattle basically becoming SF North though.

Good news bad news? Condos are entry level homes and the price is almost affordable. Bad news the wealth gap is spreading. Is this generations public housing going to be even larger than last and will it turn out to be a bigger ghetto. Those awful boomers and their public housing projects. Mils are piling into condo and apartment “projects”, only now it is the “ownership society”. One thing for sure they have desegregated public housing. Now everybody is poor.

If affordability means $1M+ condo in SF, then it gets to be a challenge for someone earning say $100k without rights to the land.

The median income is about $120k is SF, so it tracks well with Wolf’s chart, the real tangible aspect is the quality of life, city traffic, safety, etc, it really depends on the individual.

1) SF condos rumble in high frequencies, in moderate pendulum amplitude. They cluster together.

2) SF condos osc on the fault line for the big one.

3) Earthquakes risk are rising when seismographs goes crazy.

4) We cannot prevent earthquakes, but the gov can abort anti bubbles

collapse if redemption are minimal and by ignoring regulations, allowing

large value buyers buy convertible bonds, a hybrid of equity and debt, with

C/C rates.

Mr. Engel-

The fragility of CA seems pretty large. i have had family there for more than a century. Now it seems to be just another over-hyped city-state whose best days are behind her. Walking around SF and going to coffee or whatever, is a thin gruel compared to what it used to be. Between ~1945-1985 it had its ups and downs but may have been peak civilization in my lifetime. My parents and I were lucky enough to live it.

Big risks for CA (but the rest of the US will bail them out, which is unethical): earthquakes/tsunamis, droughts, floods, fires, mismanagement of the economy (rampant poverty), no socio=politico-econo- way out via average joe business or education for the masses).

California used to provide a way out of these risks. No more.

People who live there with no family/children or interest in the building of the future of such= part of the problem. It’s the same as always, but CA is like a poster child.

Here’s an exact quote from my Annual Report to shareholders from my BNY MELLON tax free muni bond fund.

“Progressive tax regimes proved advantageous because higher-earning, white collar workers were largely unaffected by the pandemic”.

In other words the pandemic increased the wealth inequality that was already in existence. Congratulations to all that made this possible. Lets have more of it. Let the poor slobs pay all the taxes and get hit with the inflation tax. The rich can put their liquid assets into muni bonds and pay no taxes. Welcome to America.

“…poor slobs pay all the taxes…”

I understand that rhetoric, and empathize with the frustration. But you need to be aware of the numbers.

Bottom 50% pays less than 5% of taxes.

Whereas top 1% pays nearly 40% and top 10% pays 70% of taxes.

‘the rich’ pay higher portion of taxes and at a higher tax rate. ‘the rich’ get excluded out of stimmy checks, child credits and other goodies. ‘the rich’ pay extra taxes like the medicare surcharge.

The reason rich are doing well is not lack of taxes. It’s the Fed policies that have pumped up the asset classes ‘the rich’ usually own.

Bring it up with your 1 percenter congressperson.

Inflation (expansion of the money supply) is a tax, and it is disproportionately a burden on those last in line to spend the freshly-printed money. The establishment works very hard to insure that people don’t see the Fed as the tax collector it is, and the underlying causse of increasing wealth disparity it is.

This is total BS

The rich have the best accountants money can buy. They make sure their income does not show up on the bottom line. I could do it and I’m just an amature accountant. Maybe you can help me pay my property tax bill this year to fund a bunch of schoolteachers who won’t show up for work, or county services that are practically non-existent.

Again, talk to your 1 percenter congress person to close the tax loopholes. Or as some here propose, have a flat tax and no deductions.

“..I could do it and I’m just an amature accountant”… If you know of legal ways, can you please share it here?

Btw are you still saying “poor slobs pay all the taxes”? What’s your definition of “poor slobs”? What math are you using to say they are paying all the taxes?

Oh this argument again. Look, the fact of the matter is that the rich got there the good old fashion way, usually it involves some degree of work up front. Sure, there are a few that were born into it, they hit the real genetic lottery. But the first generation, Buffet, Zuck, Gates, Dell, Bezos, Musk, Thiel, they all worked their way to their money, nobody just gave it to them. Yes, they accelerated their wealth once they had some by leveraging harder to use loop holes, but they managed it. Did they have help, some of them sure did, most of these guys were born to middle or upper middle class families. But to get their billions, they worked for it. Let’s not pretend otherwise.

Of course, they are going to have the best accountants money can buy, they aren’t stupid.

In the end, no matter which phrase you use, the path to becoming rich is the same. You get rich by working hard, having some luck (without the former, you really don’t have the capability to take advantage of the latter), and then leveraging smarter people than you to enhance and protect your assets. That Joe blow can’t do this is mostly a product of not having enough education or not being able to take advantage of the luck that came by.

You know, the thing with Thiel comes to mind again, what he did with Roth IRA is open to everyone, he wasn’t a billionaire when he used that loop hole. He was smart enough to take a risk, and lucky enough that Paypal paid off. If peopled whined less about how he got there and did more to find their own path, they’d be better off.

MCH wrote: “ Look, the fact of the matter is that the rich got there the good old fashion way […] But to get their billions, they worked for it. Let’s not pretend otherwise.”

In a free market economy, entrepreneurs get rich by figuring out better ways to provide people with services and commodities people are willing to pay for voluntarily. This is the “good old fashion way.” Unfortunately, we don’t enjoy a free market economy. A whole lot of people get rich by selling stuff like weapons and mortgage-backed-securities and carbon credits to the government, which pays for them via taxation and money creation. We should not be celebrating these particular billionaires.

Many got rich just because they had purchased an expensive house. Many tech investors got rich because of the Fed induced malinvestment. Many, as you say by getting on the government gravy train.

Some of them avoid taxes by donating to their own charities, having shell companies, etc.

But all this should take nothing away from people who worked hard to get there. Often times employing hundreds of people and paying all the taxes while doing so.

Overgeneralizing the term ‘the rich’ and associating everything evil with it is plain wrong. “the rich stole from us”, “the rich are greedy”, “the rich are killing the country”.

@SL

Lots of ways for people to get rich. There a lots of famous rich people too, do any one here really begrudge, Buffet, Gates, Musk, Bezoes, Zuck, Thiel, etc? I should hope not, none of those inherited their money, all of them worked for it, and did it taking advantage of the opportunity, and I would not say they were in the least bit scummy about it.

But how about Stanley O’Neal, Angelo Mozilo, Brad Morrice, Al Gore, etc. I agree there are always going to be those who screw over other people, these are executors and enablers of some of the worst excesses around. But you don’t hear people bashing Barney Franks or Chuck Schumer or Bush Jr or Greenspan for their role in the financial crisis, but each of them were equally responsible. They get a free pass. Yet the media deems it right to go after the former group (in the first paragraph), much less so the latter. Because they are successful, and they did it by doing real work. Not playing golf while totally clueless that Merrill Lynch was going down the tubes by packaging subprime MBS and holding it on their books.

Nacho Libre

” If you know of legal ways, can you please share it here?”

I do what the rich people do. I buy mini bond funds, producing tax free income.

I buy a lot of computers and write them off as business expenses every year.

I do a lot of other things which I cannot disclose. Sorry

@swamp

Cognitive bias is showing again.

“I do what the rich people do.”

Small correction – “I do what *I think* the rich people do.”

As long as you keep it all legal, good for you.

Also glad that you are getting rich off investing in munis.

Well, SF sure has a nice baseball stadium right on the water. Saw the game yesterday on a HD screen at my local sports bar. Good aerial photography of the stadium and adjacent areas. SF really cleaned our clock. 8 to zip in the 3rd inning, including dropped fly balls, booted ground balls. The Nationals looked like a minor league team against SF.

In the land of the super rich & the super poor,

Seattle loves small businesses the way Harambe loved toddlers.

Nixon divorced gold and Ford deleted fixed currency rates, adopted

Milton Friedman floating currencies rates, F,,, Bretton Woods in the

ass, after 30 years of volatility that replaced what was supposed to be stability, especially after saint JFK & LBJ acts, in the sixties.

Washington Post article headline 7-10-21:

“Rent prices are soaring as Americans flock back to cities”

From the article:

“Her rent was going up nearly $400 a month, the note said, a 33 percent increase.

… four days to decide whether to commit to stay or leave”

This. This is why people will pay almost any price to own land + house. It is the only way to be free of scumbag landlords and condo associations, to have some sense of security, to not be thrown out onto the street.

David Hall,

BS headline paid for by landlords.

Here is the real story and the real data (I understand you don’t read my articles, but before you spread BS headlines on my site, you should read my articles):

https://wolfstreet.com/2021/06/24/are-the-exodus-triggered-plunges-spikes-of-rents-reversing-mmmm-maybe/

And since we’re talking about San Fransisco, here are SF asking rents, down 25% — but do make sure to read my article linked just above:

SF is a microcosm. You may not see nationwide trends from limited data about the SF – San Jose area. Your chart shows a two month rebound; very rapid short term rent growth coinciding with vaccinations. I remember cities were witnessing a pandemic exodus. Now they are seeing people returning.

I remember Washington, D.C. had terrible rush hour gridlock when I lived there. The bridges over the Potomac were jammed with commuters. People wanted to live in neighborhoods close to their jobs to avoid hours in heavy traffic. During the pandemic, apartment towers were potential death traps. Now they are desirable real estate again.

It has some of the highest price to rent ratios

DH

Many people are are still wearing masks around here even outside. Apartment towers are still out of favor. It will be a long time before they come back. Townhouses will do well, as well as two unit properties. I just switched Dentists to one who works out of a suburban single family property vs a commercial property that got infected with Covid.

☺☺☺

Imagine by how much GDP increased because of that back-and-forth flocking…

BTW the misdemeanor charge of “startling the livestock” is still on the books in Western States.

Before railroads the cattle was transported by means of cattle drives,usually from the collection point in KC to Chicago slaughterhouses.

Usually in Missouri smart operators caused cattle drive to stampede then offered to gather it for $5 per head.Those were the days…

I predict yet another ultra-vicious Covid19 Double Delta Strain to appear soon.It is time to flock back to the suburbs.

“Nun jetzt wird wieder in die Hände gespuckt

Wir steigern das Bruttosozialproduct !!! ”

(Geier Sturzflug,1984)

Dh

“Washington Post article headline 7-10-21:”

The Washington Post is worthless rag of a newspaper that would be bankrupt if it were not for Jeff Bezos bailing them out. Why quote anything from them. They are bought and paid for by their adverisers.

Rent prices are not soaring. My kid owns a Condo in a good area of DC Swamp near the Dupont Circle area. Her rent that she gets for her unit fell about 15% in the last year alone. Same across most of DC.

WTOP TV news did a story in March about DC metro apartment rents rising, even though there were large rent drops during the pandemic. I used to have a condo in Falls Church, inside the Beltway. I sold out in 2012.

Home prices have risen faster than incomes or rents. Buying houses at these prices is risky.

WTOP is another source of fake news

Target will shut its San Francisco stores at 6 p.m. to curb an ‘alarming rise’ in shoplifting.

Best city on Earth.

Residents living in Russian Hill, Marina, Cow Hollow and Pacific Heights have nothing to fear. Think of them as the Beverly Hills of SF. Pretty soon they’ll have their own private security force. Heck the whole area will probably become its own gated community in the future.

Two of those Target stores are in the business district — in the Financial District and South of Market. Those high-rise office buildings are still dead. What few people are there, disappear after 6 pm. Those stores are nearly always empty, and are totally empty after six. That’s why they closed those stores at 6pm. When the lease ends, they’ll close those stores entirely. And they’ll blame god knows what for it, rather than admitting that the stores are hopelessly losing money.

I don’t know about the other two stores.

Walgreens pulled the same kind of crap. It announced in 2019 that it would close 200 stores nationwide. It has dozens of stores in San Francisco. There were like 5 stores within a 10-minute walk from our place. This is totally nuts. So they closed some stores in San Francisco as part of the 200 stores which they preannounced, and then they find some pretext for it.

And all this stuff sure makes great clickbait for people who are clueless about these retailers and the locations of their stores, and it just fits their narrative.

Something like 20,000 stores were closed in 2020 in the US overall. No one is talking about that. It’s just when Target or Walgreens create some kind of clickbait that everyone suddenly becomes an expert.

All this crap about theft stores in SF is all over the news here, non-stop. Don’t these local news reporters have anything better to talk about than this. We’ve got murders and robberies here almost daily, and the body count is piling up and they want to talk about some petty theft at Walgreens in SF. Frankly, I couldn’t give a s%it.

We get it in our local news too in the bay area. It’s a non-stop drip. Except, the local news gets a bit more nuanced. It’s either that these days or vaccine rates are still way too low. cause you know, the Dumbos hate their neighbors and are just self absorbed.

Billionaire Gordon Getty lives in his mansion on the corner of Broadway and Divisadero streets in Pacific Heights. It doesn’t get any tonier than that in SF. But walk a few blocks south down the hill and the neighborhood changes a lot if you know what I mean.

Meanwhile in Frisco, TX, nothing at Target is under lock and key and 3,000 square foot homes are still half the price of a 2 bedroom SF condo. Employees of former California corporations rejoice!

Detroit send brand new 2021 pickup trucks to Manheim for auction, because dealers lots are half empty, accumulating bad items that

don’t move. They cannot afford Detroit exaggerated prices, due to chip shortages, fancy stuff and “Chinese inflation” .

Oh god. I keep waiting for it to fall, and it keeps going up. How many more months, years, decades….

Why would you want to look for a house in San Francisco? You should look for a house further away in something resembling suburbs.

If you look for a condo in San Francisco, prices haven’t moved in three years, and there is all kinds of inventory available for sale.

Two units are doing real well here in the Swamp. They are following the Case Shiller index of 13 to14% appreciation year over year. Did one last week in a bad neighborhood on the wrong side of the tracts and it was in good condition and the price was 14% over last year. Having one unit to rent out is a big plus.

So…Cali is basically W Bush’s ownership society, at least for the successful. But my life MO for living arrangements, since growing up, has been “why buy when you can rent”? Which is very odd for a now 57 yo IT pro career guy. But..I’m odd!

Rents will have to eventually follow these soaring home prices. I suspect landlords, both Mom/Pop and Corp, are gonna be in the crosshairs of community activist groups and politicians for rent control.

OR

In the current environment, gubments simply subsidize everyone’s rent with OPM – that’s prolly more likely since you can. print it and then give it away – everyone will vote for you !!

Keep in mind that Markets are not rational.

Because Humans are rationalizing animals rather than rational animals.

Have fun finding a rational reason for irrational behavior, that search has entertained many for many thousands of years.

Watch your six and enjoy the show.

As opposed to mainland Chinese companies, which can be sheared of their assets and ordered to bail out a CCP Linked or state owned company at any time so they both become legally insolvent, even those few that are not already insolvent P ONZI schemes like Lukin Coffee, Japanese and other, Asian countries may be good places to park savings against the accelerating inflation that the US bankster’s privately owned but deceptively named “Federal” Reserve cartel creates by printing US legal tender to gift to its banksters. I know some Japanese companies are very conservative in limiting their risk taking and well run.

Their nation’s economy may have been put under pressure in the past to enable international banks and financiers to control it, by creating many huge economic bubbles, but many Japanese companies are very well run and have great futures. The extent to which the foreign financiers now control Japan is not clear.

I bring up Japan, because the banksters probably bribed persons in the Bank of Japan to create the many, economic bubbles that then enabled the banksters to control large parts of its financial sector and economy. Could the banksters have audatiously created the US bubbles in the whole US economy to similarity take over even more of the US economy?

It’s simple, people don’t want to die screaming as the earthquake hits, at least until tons of concrete crush their lungs like a heel on a cockroach, a-la-Surfside condo collapse.

Those towers built south of Market on landfill? Forget it, even if left standing, the special repair assessment will be in the millions, they’ll probably become vertical homeless warehouses first.

Another danger, older “Non Ductile Concrete”, that’s your search term, 1930-1960ish buildings, all over the city, e.g. Green/Jones or in the Financial.

Finally, there’s the bad welds in steel framed. high rises built before 1991.

That is why single family home prices are on the rise. People want the ground within jumping distance. Condo prices are barely keeping up with inflation.

I think there are two highrises in the whole country with issues right now? And I seem to recall a 7.0 in Seattle that killed one person (heart attack).

The lack of earthquake insurance is a problem, though. People in Tornado Alley have hail/tornado coverage built-in but in CA you have to buy separate? I did the math and doesn’t seem like a CA policy with earthquake would cost much more.

Why is it standard to accept the exposure? Oh, wait – maybe it’s because disposable income in California is worse than Alabama. Wait for it… “But if you’re in tech…”

Never underestimate the value of even a little bit of yard. SFHs in Seattle have small lots (4000 sqft), but that little bit of land is bliss. You can grow your own meadow garden, your own vegetables. You can fence it out and have your kids roam around to increase your living space (especially true in places with mild weather like SF and Seattle). Also enough land for a deck to have guests over. It’s worth a lot more and should be worth a lot more than a condo.

Nice ideal, however, upwards of four houses, or apartment building, are being built in Seattle, no more zoning, on single family lots, turning an entire generation into renters.

“The MHA program “upzones” parts of Seattle, allowing residential and commercial developers to build larger buildings that, in theory, provide a more profitable return on their investment. In exchange for that increased density, those developers must either build affordable housing into their project or pay into the city’s affordable housing fund, which will be used to develop affordable housing elsewhere.”

From Crosscut.

In California, anti-local zoning control, anti-suburban single-family living, and pro-unfettered private, for-profit, real estate development (i.e., trickle-down economics) legislation is currently reaching a thunderous crescendo in Sacramento, all in the name of the environment and housing affordability, despite the fact that each new law passed further dismantles protections under the California Environmental Quality Act (CEQA) and has so far created a negligible amount of affordable housing. In fact, recently proposed legislation, like SB10, doesn’t require any affordable housing at all.

Legislators in California just don’t get it. Regulation never makes housing more affordable. And there is virtually nothing they can do to make it more affordable in California because a) Earthquakes and b) weather. They don’t help by “trying”; they just make it worse.

But whatever, California more than most places is due for a colossal correction in housing. I’ll call it Revenge of the Savers.