And there are some whoppers.

By Wolf Richter for WOLF STREET.

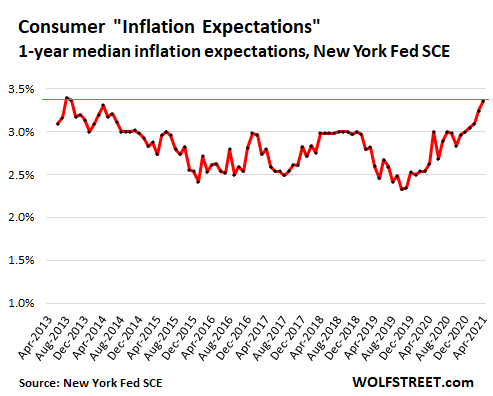

Consumers are picking up on the rise of inflation, and the Fed, which has been trying to heat up inflation, is pleased. The Fed watches “inflation expectations” carefully. The minutes from the March FOMC meeting mention “inflation expectations” 12 times.

The New York Fed’s Survey of Consumer Expectations for April, released today, showed that median inflation expectations for one year from now rose to 3.4%, matching the prior highs in 2013 (the surveys began in June 2013).

But wait… the median earnings growth expectations 12 months from now was only 2.1%, and remains near the low end of the spectrum, a sign that consumers are grappling with consumer price inflation outrunning earnings growth. The whoppers were in the major specific categories.

The whoppers.

So even as consumers expect their earnings to grow by only 2.1% over the next 12 months, and their total household income by only 2.4%, according to the survey, they expect to face these whoppers of price increases:

- Home prices: +5.5%, a new high in the data series

- Rent: +9.5%, fifth month in a row of increases and new high in the data series

- Food prices: +5.8%

- Gasoline prices: +9.2%

- Healthcare costs: +9.1%

- College education: +5.9%.

Sadly, the Fed doesn’t ask consumers about their expectations for new and used vehicle prices, which are now in the process of spiraling into the stratosphere. It would have been amusing to see what consumers expect those prices to do over the next 12 months.

So consumers expect to pay for these price increases with their earnings that they expect to increase at only a fraction of those price increases. In other words, consumers expect that the purchasing power of their labor will be crushed over the next 12 months.

Higher inflation expectations are associated with consumers being more willing to pay for price increases, rather than go on buyers’ strike. And by not going on buyers’ strike when prices rise, they allow companies to jack up prices, and thereby they allow inflation to run higher, in theory at least, and that is why the Fed is watching inflation expectations so carefully. In theory, they open the door to actual inflation.

Never in my life has the Fed ever been so explicit about purposefully firing up consumer price inflation, and thereby crushing the purchasing power of labor that has to pay for these surging consumer prices. But that’s the Fed we got now, and consumers – though they might not see the Fed or know what it does – are starting to expect these price increases too.

The bizarre phenomenon of companies complaining about “labor shortages” amid dropping job applicants, while 9.8 million people are “unemployed,” and 16.2 million people claim unemployment benefits. Read… Unemployment Crisis, “Labor Shortage,” or Out-of-Whack Labor Market – Which Is It?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Funny how these consumers are not saying “we are going to cut way back and consume way less and fix things and make do and do without…”

Oh but at least some of them will cut on expending more so as the government subsides dry up, because they are not gonna last forever. In fact Wolf has pointed out they are using some of that extra cash to pay debt.

That is exactly what I am doing

its sort of what ive been doing as i’m not buying anything but essentials now and i’ve been buying these essentials in large quantities to offset rising costs. Someone is due to inherit a lot of toilet/kitchen roll and tinned foods if something happens to me.

If consumers live paycheck to paycheck as most of these surveys claim then they’ll have no choice but to cut back once all the financial stimulus packages end.

it feels like I live paycheck to paycheck

but I’m ramping up for new summer vacay time

sold cabin last fall(for to little)

and now that RE is totally out of whack I’m in RV world

1 week to take off – but now I’m mobile and we’ll see new lands out west

2 more days of work – it’s brutal hot at 95 already

heard carly simone song today which describes it correctly

ANTICIPATION

Maybe consumers actually actually WILL say “we are going to cut way back”, which it seems that the bottom 70% MUST say, because where are they going to get the money to pay more?

Then will sellers be shocked when they find sales volume lower and that their revenue hasn’t jumped, but with input their prices higher, making less profit than before but with fewer sales? Will they still be able to be willing to pay the input prices?

I’m curious about what will happen. Some who thought they were going to make a smart killing by purchasing commodities with quick inflation with prices going up for a wonderful profit may be surprised that it’s a no go.

We will soon see. Yes, I certainly realize I could be wrong!

.

Print!! Baby print more dollars!! The only thing the FED Knows how to do well for Wallconstreet and cronies ..

Well if you expect your wages to grow less than inflation, you may reasonably develop an eat, drink and be merry for tomorrow we die type of attitude.

Personally, I think most of this inflation is temporary, unless the dollar crashes against other currencies, the economy does actually collapse, or just like the productivity gains from the last 40 years the plutocrats end up taking a larger portion of the pie. Otherwise it’s all going to equilibrate.

I think the consumers are saying “Uncle Sam’s gonna cover the spread between earnings growth and inflation”…

Once expectations of perpetual stimulus checks get entrenched, Wolf’s logic “consumers expect to pay for these price increases with their earnings” breaks down.

IF “consumers expect that the purchasing power of their labor will be crushed over the next 12 months” BUT ALSO THAT “Uncle Sam will cover the gap”, well… there’s no reason to go on a buyers’ strike.

Also keep in mind that ~half the population will spend whatever they earn with no thought for tomorrow, because that’s how they’re wired. So long as they’re getting stimulus above/beyond their earnings (or prior earnings), the consumption boom will roll.

Surprised that wage demands haven’t kicked in yet. Inflation expected or not, people like to maintain their cost of living…ie Kepp their standard of living. We may have a rough 1-2 years ahead if people bounce from job to job looking for higher wages.

Good article. It’s a real “catch 22” kind of situation for the lower 90-95%, it seems to me. Above that, I think they can all get pretty much what they want/need when they want/need regardless of price, due to large net wealth.

Excluding 200 ft Yachts, big jets, private islands, and 10M+ homes, of course…the might have to do a little thinking/budgeting maybe even “worrying” for those wants.

So if you got scared last year and put 100k in T-Bills for safety during the pandemic, and decided to buy something with your money this year:

– You would lose 16k to price of lumber.

– Probably 50k if you were to purchase a house this year.

– 10% or more to copper and other construction materials.

– And much more to Cryptos and other things.

So who would still be foolish enough to buy any government debt?

I am sitting on a high percentage of short term government debt because there are no assets that I want to own now. Like I said yesterday when dividend on SP500 is 1.37% I will sit the party out and hope to buy at better prices. Assets to GDP must be close to 7:1 by now.

Old school,

Do you have a favorite site that you like to pull metrics from (quickly/easily)…

FRED is great but so huge as to occasionally be unwieldy.

I like multpl because it tends to be quick and dirty…if limited.

Cas1

My favorite macro data site is Investment Advisers started by Doug Short.

My favorite single stock data site is Guru Focus.

Both free although Guru has a paywall for additional info.

Those that buy long dated gov’t debt (20 and 30 yr) probably believe that rates will drop to .50 (that’s one half of one percent – from the low 2 percent where they currently stand). If they are correct, they will look pretty good. We could be very well moving toward a deflationary crash. Abbott and Costello in DC will then react to “save” the problem they have created in the first place. This action will probably then lead to the serious inflation. The idea would be to sell those long dated treasuries right before Abbott and Costello get involved. We shall see.

Forgot to mention I was replying to John A’s comment. Thank you.

John A,

Thanks for pointing this out. Holding out on buying something essential was a mistake in retrospect. However, if it is not essential, then holding off until this craziness subsides is a better plan.

I always think short term and long term.

ie.

Long term:

If you bought a house in 2006, 15 years ago at the peak, and have happily lived in it, according to Wolf’s data, you are likely up 20-30% today and you may have a paid off home to enjoy for the rest of your life. It would be a safe bet to buy a house today as long as you are planning on living there for the long term and you have enough cash/TBills for 1-2 years of mortgage payments so you don’t lose it like many people did in 2008.

Similarly, an S&P 500 index fund is up 2.5X from the value in 2007.

Bogleheads have plenty of data showing a stupid index fund will on average, outperforms a paid investment advisor with fees. Short term, the S&P crashed 50% in 2008. It may happen again. Don’t touch it until it regains some value over the long term.

Long term means don’t sell for at least 10-15 years and don’t sell at a low. Never be forced to sell a long term investment so have short term investments.

Short term:

Less than 3-5 years. Currently about half my net worth (including IRAs and 401K with bond exposure, TIPs, date funds which could be considered long term – ie conservative funds not making much money today and didn’t drop much for long in 2008 )

The stock/housing/Bitcoin market could crash and you could lose your job/income at any point. – Murphy

1) Having money in short term government debt is nearly the safest thing you can do. It pays below inflation but you won’t likely lose 50% when you need it.

2) Having 6 months – 1 year of cash has a lower interest rate than short term government debt but serves as an emergency fund that won’t lose any value overnight.

IMHO, The goal is to keep your assets during any crash/recession like we saw in 2008. Have safe liquid assets is insurance that you won’t lose the house that you built with expensive lumber if it falls to half price like people did in 2008. Or the car you need to get to work. And you can afford to feed and clothe yourself.

Short term safe investing is like insurance. If you do not have homeowners, medical, auto insurance today, you are saving money but if something bad happens, you may be losing a lot more.

Oh, one more thing.

I have Fun(Mad) Money that is about 5% of my savings to keep me from getting too bored with investments.

I put it all in Lumber Futures, Tesla. Bitcoin, NASDAQ ETFs, and lottery tickets in early 2020. I have a mild gambling habit.

No I didn’t ,but if I had, I would have almost doubled my entire net worth just from these investments today. Who knows, next year it may drop to half. At least I won’t lose my house and car.

My crystal ball broke in the 1994 Northridge quake and since then, I gained the most with the boring investment strategy above.

john A,

Exactly. That’s why nothing “self-catalyzes” quite like inflation does…

That would be Foolish Me. Some I-Bonds…..best effort, eh?

And completely useless to rich folks, as there is a $10K/yr limit.

Its like the 70’s again but without an intact industrial base, a cogent foreign policy, the space shuttle, good music, low national debt affordable higher education and competent state and local leadership. Let the good times roll.

Wow. Excellent comment.

Back in the 70s at least we knew the cost of money. Now even that’s gone.

Also, sex, drugs and rock n roll.

The last economic war will be bought with pet rocks!

And hey, before the war you could put those pet rocks together with your Bitcoin collection.

Once the buyers simply don’t earn enough to pay for luxuries such as food and housing, the crash will hit.

It’s the old “you can’t squeeze blood out of a rock” economic law.

The crash will hit the moment people realize there isn’t another $2000 stimulus check arriving in August.

CA is talking about giving people more stimulus money.

Nancy’s nephew prob things it’ll help with his recent “recall”

Buying votes using tax payers money

If CA is doing so well why are they receiving money from the FEDs.

Rcohn,

All states are receiving money from the Feds, based on population. This is an equal opportunity give-away. It’s just that that the money Texas gets isn’t talked about much in these quarters here.

Where is CA going to get the money from?

(This is always the most fundamental of all questions when the G starts up with the brass band bullsh*t…it is also historically the most unasked by MSM D*ldos for Democrats).

In ye olde media oligopoly days, it was *never* asked, G money was just assumed to exist, like manna or Santa Claus.

Re: Texas (Wolf’s reference), taxes and inflation…the dirty little secret, at least in Austin, Texas …property taxes. I have a 1,000square foot cottage in an admittedly good area and pay close to $14,000 a year in property taxes so I’m no longer eating out, going to bars, buying a new car to replace my 11 year old Kia, not buying clothes or going to concerts. Is that deflationary? I spend part of the year in Mexico and I’m thinking of just staying there because I can afford the corruption in Mexico but can no longer afford the corruption in the USA.

This to Wolf: I so appreciate your site as so many others I’ve gone to in the past are so lopsided to the right I just cannot wrap my head around the willful ignorance.

You guys are forgetting the child universal basic income starting in July. I got 3 kids and I’m getting $800 a month forever basically. That money is going to support higher prices of food and commodities as I do not want more cash in the bank.

It’s not forever. It’s for 2021 only.

What! Where can I learn more of this? If it’s true then that might be all I need to decide not to return to the People’s Republic of California.

I thought that was just a child tax credit paid in advance, meaning iyou have to pay into the tax system in order to get it. That is far different than UBI.

I read you have to make less than $30k a year to qualify.

If You make less than $30k, have kids & live in Cali…you need all the help you can’t get. It doesn’t bother me much.

$10mil to a lawyers office via PPP loan that is forgiven….bothers the F$$k out of me.

And when they have to start paying their mortgage or rent again.

Why is it always the ones living off of a fixed income that are so worried inflation and about “the buying power” of the working class as a matter of justice in this rigged game?

And then they never go on to make a case for increased minimum wage, or not off-shoring every possible job, or possibly subsidizing education opportunities, or minimizing the amount of debt that’s necessary to be a functional adult in America?

You know, all things that other countries do to give the working class the opportunity to earn more buying power.

Really, really, classy.

Missed unionizing in your comment but agree with the rest. In 1979 I organised an airline I worked for. Pilots voted 100% to join Teamsters. It took almost 18 months to achieve our first contract with all the legal shenanigans to thwart it. The owners (2 individuals and a very large logging contractor) didn’t give a rat’s ass that we were falling behind every month. They listened after that.

Sometimes that is what it takes, because by definition and especially in tough times or in an inflationary period, employees have absolutely no bargaining power or ability to effect change. At the very least wages should rise by COLA.

Paulo:

One of the unionized small airline carriers on Vancouver Island that went bankrupt?

I get the impression Paulo flew mostly float planes, taking loggers to camp, maybe some rich guys to hunting lodges, and just misc “equipment delivery, minor injury/sick errands”. Could be all wrong.

But I had one logger friend take me down to the coast and say. “Here is where I start work”, 21 days at camp, 7 days at home. Lot’s of Beavers, Otters, twin Otters, etc, and all floating. Comax was generally the commercial “airline carrier” airport I flew into from Vancouver (in Dash-8) when I didn’t drive up…part military, I think

Oyster Bay, IIRC ?

Yea davie, obviously it makes sense to go beg the people who created the problems by printing $$ and giving to their friends and making war, go beg those same people for some morsels – like a little increase in minimum wage, or a few bucks for college, or limits on interest rates credit card companies can charge.

Those sexxed up, drugged, power drunk democrat and republican sociopaths who burned the economy to the ground while stuffing their own accounts with legal bribes, and the corrupt insiders who paid the bribes will really take care of you with some of the programs you are asking for.

Yeah. I’m with RepubAnon.

It’s not a Buyers’ Strike. We’re not striking, nor righteously making some statement about refusing to pay the higher prices. We’re just broke. We cannot afford the higher prices. That’s why we won’t be paying them (at least, not paying them for everything). We are forced to make choices.

Yesterday I drove from Charlotte, NC to Minneapolis, MN and fueled up a few times along the way with the highest octane containing no ethanol I could find. Almost everywhere it was a few pennies under four bucks a gallon. That is certainly inflated.

Is this in anyway due to the cyber attack on Colonial Pipeline? Or is it simply supply/demand cost of oil to refine and refining capacity?

Paid $2.74 for regular yesterday at Costco Kenosha, Wi.

Paid $2.34 last Friday for 89 octane at Costco.

Dan, highest octane (100) with no ethanol is essentially reserved for watercraft engines. No wonder you paid so much. If you bought in PA, that state has outrageous gasoline tax.

In CA and driving my wife to the SFO airport yerterday. Filled up in Milpitas and it was 4.04 per gallon regular 87.

Anthony A,

Shit, I need to find some 100 octane for my Italian V4 motorbike!

No, my ’16 BMW M4 wants 91 or higher, and preferably no ethanol. 10 is the max allowed. A few places had Shell’s V-Max 93, which is the recommended fuel. It is not available in the Twin Cities. The best I can easily find locally is 91 non-oxy.

Dan, Sunoco sells racing fuel which will be good for the V4 I would imagine. I don’t know where you could get it, though.

Getting ethanol free gasoline or less than 10% ethanol is getting harder to find.

When I had my older 330 Ci BMW I used 91 octane gasoline from suppliers that sold what’s called “Top Tier” fuel. But that was a good while ago.

Bah, you got nothing on CA, here we expect to be taxing the oxygen you breath soon.

re: “… I used 91 octane gasoline from suppliers that sold what’s called “Top Tier” fuel.”

Most name brand fuels–inc. Costco–are Top Tier. I’d post a link but, you know (just google it). It just means the fuels have a higher than the bare minimum detergents and other additives. Most fuel brands blend from the same base stock, only the additive package varies (Techron, etc.).

$6 a gallon in Germany, even more in Holland.

100 octane is av-gas, last I heard.

20 hrs solo in 152, $22/hr wet in 1980 (instructor’s plane)

Dan, glad you said V-4….if your toy collection included an MV Augusta, like Agostini rode, I couldn’t take the envy….;)

Regular, meaning 87 octane? Yeah, the cheap stuff that works in low compression ICE is just that: cheap stuff.

My 15 year old Chevy V6 Silverado 1/2 ton truck will burn that (if I wanted to use it), but my performance car & motorbike will not. I won’t put that stuff in my lawnmower or rototiller.

Ted, what is the price of 92 or 93 octane non-oxygenated gas at the Costco, if I may ask? If I recall, the 91 octane non-oxy was $3.79.9 in Tomah, WI last evening.

You are quite right that there’s a fair difference of price depending on octane and blend ratio.

My Mustang GT with a 12:1 calculated compression ratio and both direct and port injection will run fine on 87 (minus a few HP). Modern engines can change cam and ignition on the fly to deal with whatever fuel you feed them (except diesel, which has an effective octane rating of zero).

California Bob,

From my owner’s manual:

“BMW recommends AKI 93. Minimum fuel grade BMW recommends is AKI 91.”

“Fuel that does not comply with the minimum quality can compromise engine function or cause engine damage.”

“The use of poor-quality fuels may result in harmful engine deposits or damage.”

I wanted and used each and every pony that the twin turbo inline six could make as I was driving through a few of the twisty sections on US 25 between I-40 & I-75. (Sunday morning, perfect conditions and no traffic)

By the way the gentleman who so kindly stored my M4 in his garage for me after he drove it back to his home in Charlotte from Minneapolis last November was the race engineer for the Rahal Letterman Lanigan BMW IMSA team. They won the American LeMans GT Series in 2010 & 2011. And he worked at BMW Motorsport in Munich in 2009 to develop the 2009 M3 GTR.

So yeah, I put the best grade of gasoline into my M4 that I can find. The best man at my wedding would expect nothing less, eh? I certainly hope that you do the same for your Mustang GT Bob.

And to Wolf’s suggestion, I have driven through Cali in the past, but only around San Diego with my dad on our way to Yuma for our off-season wheat nursery – not too exciting. I’d love to drive through the twisty roads that you get to enjoy. But the only thing left for me to get the most out of my M4 now, after Sunday’s drive, would be to suit up with helmet and take it to the absolute limit on the Brainerd International Raceway in central Minnesota.

Dan, as someone who has worked at a bmw speed shop and tunes BMW TT motors for my hobby, the bmw I6 TT motors (from the n54 on up) absolutely love ethanol with a mild tune, if your fueling can support it, huge horsepower gains, as you are getting a much greater cooling effect = more timing.

Merchant M,

My neighbor two houses down from me is a technician/mechanic at the Penske BMW dealership, and I am aware about how to tune, with an adjustable engine map, the BMW I6.

His is a 2008 335i that can kick out 600 hp! And you’re right, when tuned, more ethanol is needed for more the power. To max out his ride, he would need 60% ethanol. “I just keep it at 500 hp. It’s easier to drive in the city.” He’s got a remote control device to code in the fuel map when he wants to change it up. Technology, eh?

I have the third fastest, but most comfortable BMW on the block. My neighbor and his buds are kind of bummed I declined their offer to modify my stock M4 and, “get at least 600 … easy!”

To take it to BIR, having 600 hp instead of just 425 would be fun on the long straightaway. At very high speed the extra power matters proportionately more than it does under 100 mph.

Last comment I promise: 91 octane & no ethanol at my station in St Paul was $3.40 just now.

I paid $4.09/89 octane gallon yesterday in southern California… and that was with my $0.20/gallon Vons rewards discount.

Whatya gonna do?

Dan,

Bring your M4 out to California. Lots of fun windy roads through the mountains and along the coast. Average price of “premium” = $4.30, says the EIA. I see higher prices locally. And California is cut off from the rest of the US in terms of gasoline and crude oil supply, so the Colonial Pipeline issue has no real impact.

we buy regular, and it’s still below $4.

Yep. Did MANY Sonoma/Mendo SERIOUS “Sunday morning rides” early 70’s, got away with murder, and nobody crashed real bad. Yeah, I know we should have been at Sears Point, but it was just too easy to organize, and we were real kids then, not the older ones that “know better”…. ;)

Possibly there are reports of some localized gas runs in responce to reduced supply because of the hack.

Reports this morning that mid single digit per cent of all SE states gas stations are out of gas.

Mostly due, we can assume, from stupid folks rushing to fill up so they can use 10% of their tank before the next filling of the station pumps occurs.

OTOH, this event certainly does illustrate, once again, the vast fragility of the vast majority of the vast ”infrastructure” WE the Peons have been led to and forced to become part of.

OTOH, WE peons can certainly make a choice to grow all our own and neighbors food,,, and only use either ”shank’s mare”,, a bicycle, or some other form of self abuse to get around,,, get, get get around,, eh?

VVN…you don’t need pipelines….until you do! Thirty years working with Big Oil and I have heard and seen it all.

S Rosa Chevron Super, $4.70, Ukiah $4.99. Both North CA. I don’t use much so I get the best, (new rigs really lean that mix out) also a Techron fan since ’10-’13 senior auto shop instructor was.

I hate the “Ethanol from corn (FOOD) mid-west pork program…1;1, 1;2 ROE stupidity” and I’m sure all racers would run methanol for 13:1 high compression w/o detonation if they could, like they all used to.

But IIRC Indy and Nascar have to run ethanol to help make that “pork program” fly better?

When stimulus runs out part,s over

what if the stimulus keeps coming for next few more years

USD is a reserve currency and they can print as much as they want

Fed can buy as much bonds as possible to keep the rates low.

As long as they keep paying people to sit home, and sending out stimulus checks to every house, they can probably continue to overheat the economy. But that’s the only way to do it. Stop paying people and it crashed. And is the rest of the world going to continue to want the US dollar as the deficit grows to $40 trillion and beyond, and the FED’s balance sheet approaches $15 trillion? There is an end to this, and it ain’t pretty no matter what the outcome.

Nobody wanted to pull off the band-aid to put antiseptic on the wound and feel a little pinch so now we have a festering boil that nobody wants to address because now we have to go to the hospital and have no other choices. We’re just arguing at this point on who is going to drive.

Pshawwww, you are only saying that because your state didn’t vote in a genius like Gavin. He is giving out a stimulus to average Californian of $600. And let me tell you, he doesn’t have a bottomless pit of money and he is trying so hard.

You should wish for a jackass as a governor, cause no dumbos are that nice to their constituents, all this wanting us to work is just unAmerican.

No it ain’t pretty. The IMF/CB’s are transitioning the economic system from private ownership to a rent-seeking system that is rigged by a federal/big tech pharma conglomerate. This will push many of us back to local feudalism as people start to realize their are more benefits in decentralizing federal control through local legislation and localizing more production capacity.

The rest of the world holds a ton of US Dollars. They expect some devaluation but not a rapid one.

The end will not be pretty for … someone. For others, they get to score the trade of the millennium, the “bankruptcy” of the United States. John Paulson scored 30 Billion shorting mortgages the last time around. Someone will score a trillion at least this time around.

This is the BS the financial media is feeding you. Corporate America is creating jobs, nobody wants to work, boo hoo. Bartiroma is the goddess of this agitprop empire, (when it was MSNBC) a shill in the extreme. Cramer is their demigod. You all know this and you still suck it up like it is nectar from olympus. The monetary regime is out, the fiscal regime is in. Maybe working people will catch a break and maybe they will reinstitute slavery.

Very eloquent and well said AB. All true, and if they re-instituted “slavery proper”, at least they would have to feed and house us.

MCH is getting annoyingly (red/blue) repetitious, but you are right, he just ignores what he choses to, and guzzles his favorite nectar.

This is part of the reset plan….they will roll stimulus it into UBI under a new digital currency with some limited purchasing parameters/capitol controls, and if you don’t use it, you loose it.

The FED is too powerful now. The digital currency will make their power absolute.

“USD is a reserve currency”.

Is, with hyperinflation, soon to become

“was”.

Agreed, except the petrodollar gives the USD valuable. Oil-exporting countries get USD for their oil, not their own currency.

The crash always happens when the last greater fool (therefore the greatest fool) has bought. Right now there are lots of them who believe in the power of the almighty Fed. I constantly read comments that the Fed will never, ever let it happen so party on.

I believe once the next big one hits and the Fed won’t be able to come to the rescue then the real collapse will begin.

You know, I’ve been hearing that “the Fed has been painting itself into a corner” since the GFC.

Looks to me like the floor paint job is done, and they have devices for clinging to the walls and painting them, too.

Maricopa can set off a deflationary nuke on a CONUS crisis.

Food bill is up 25% over the last two years, on top of the increases from previous years. The stimulus checks and a decrease in car insurance from covid helped to cover the increases, but it’s getting scary going to the supermarket. Income is barely up at all in the last 5 years. We can’t even imagine how we can ever retire.

Food prices in some towns and cities are absurd. I was visiting Robbinsville, NC last month and was flabbergasted at the food costs at the regular chain grocery store. It was more than Whole Foods or on par. I couldn’t believe it, in a town where many are low-middle class. The first thing I said was how the heck do ppl afford this? If I lived there Id go broke.

One gallon of laundry bleach in Walmart is $2.99. Before the pandemic, it was $0.99/gallon. I could go on, but….

Covid elixir usage is causing some supply/demand issues? Stable Genius, ya know?

Sure looked live those huge mental gears were seriously turning to me….don’t buy “joking” narrative at all.

I do all the food shopping for my family. Not only are prices up but now there are fewer real sales like a few years ago. At most there are only 1 or 2 actually items on sale any given week. Also Walmart cancelled their price matching program. So now I have to go to 3 or 4 different stores to get the sale items I want.

need to live near an ALDI. I was up there in Feb and March. Great prices. Mostly their branded stuff but ok quality.

Here in Costa Rica not seeing much inflation at all on local stuff. Fruits and veggies and chicken etc about the same as last year.

Of course I am not enjoying 15% inflation on my house.

No stimmys here

Eat less

Eat smart.

Afraid to disclose my 6 item once a day, daily diet for years now (and 2 are a multi vitamin and 1000mg vit C) for fear of price increase.

“Excellent health” per Doc after 1 year old very complete testing workup, (even echo cardiogram), except for trashed back…don’t count Tramadol pills….weak, but from the 60’s.

Simple, you won’t. And if you have any money, you need to be taxed out of your boots to ensure equity and equality.

We will be turning into a Japan-like civilization where the children take in the elders when they go broke.

I think many children are already living with their parents!

They are both going broke together!

Asian families are used to having multiple generations living together under one roof.

Wes, that’s not a comforting thought.

I’m retired. My wife neglects her health and is probably headed for expensive nursing home care at some point. I would hate to have to ask my daughter to take me in. Sure hope it doesn’t come to that.

The nuclear family was a post-WWII aberration.

How are the children going to take in their parents when they don’t own homes themselves and are in more debt than their parents?

No, you’re thinking about Asian culture, where there is still some reverence and belief in one’s elders, and respect for wisdom. The kids today know it all, the Boomers are just in the way and taking up precious resource. At least, that’s how they feel if they ever got out of mom and dad’s basement.

MCH is confused. B00omers were the anti-elder OGs. They ruined our society, our culture, our norms. Look at the pigsty they bequeathed! There is no wisdom within the B00omers.

MCH,

I’m with Brinda…hard to revere someone who…

1) If they didn’t abort you

2) Indentured you

3) While LOUDLY proclaiming their moral superiority.

The only people who are are going to welcome the Boomers with open arms are the Soylent Green people.

@Brinda/Cas

You know I just don’t think the boomers are that bad as everyone make them out to be. Did they really wreck the country? If you were to say that, then you could point to each preceding generation and bitch about them too.

In terms of respect, I was referring to Asian culture, not US. Although I’d have to say, some of the Chinese Millennials are every bit as bad as the ones here. Spoiled rotten by their parents, especially the ones who were born after 1990s. But I think there is still a respect for their elders. If not, there is always the bamboo rule to whack their hands with

After read some of the above posts, I’m glad I’m not a Boomer. I’m in the group before that. You know, the invisible ones.

I stayed a “hippy boomer”.

WE tried to warn ya about senseless consumption, but we were too busy having fun to organize much. Still were able to blow the “sex and other normal bodily functions are dirty and not to be mentioned at all” thing all to hell.

You’re welcome.

What supermarket do you go to? I have an Albertson’s across the street and I’m always surprised by how the meat prices are lower than they’ve ever been before. They’ve had boneless skinless chicken on sale about 12-15 times over the last year for 99 cents a pound. I never saw it below $1.67/lb over the previous two decades. $1.99 used to be the low price, now it seems like it’s the high price. For eggs, I pay an average of 99 cents a dozen. Boneless pork loin chops $1.99/lb. London broil, $2.49-2.99/lb. How do they even produce it that cheap? What happened to all the shortages? Meat is supposed to be more expensive than the grains, since you have to feed the grains to the animals first. The vegetables are expensive, but Winco has them much cheaper than Albertson’s, so I just go there.

Hmm…IDK…Albertson’s is notorious for having old stores in old parts of towns (pdt of multiple LBO rinse repeats), where they can jack prices because of a lack of competition/transport.

Occasionally, seasonal factors (and supply derangements…see Covid) can lead to better protein prices…but as a general rule, zooming Chinese demand is driving up protein prices around the world.

My guess is that if you average meat prices for full yr, Albertson’s comes out looking bad.

The way to shop is to let food stamp recipients, who tend to be price-insensitive, pay the high price. When Albertson’s does its “buy 1 get 3 free” deal, I stock up on the meat at low prices. I am getting subsidized by the food stamp people who, in turn, are subsidized by me, the tax payer. It goes full circle.

OI,

We eat so much chicken we joke we will grow feathers. This Mother’s Day my gift was 2 lbs of veal. My husband wouldn’t tell me how much it cost so I could enjoy it.

Some surprise coming from you Pet,,,

Seriously folks, if you have a large family, in one house or many, the very best way to buy meat is ”on the hoof”…

Many small and medium and family farms will absolutely sell you, direct, a steer or hog, or whatever, and connect you to the best field processor and the best local packing house to finish the cutting up and wrapping of the products.

You can also get the hide and all the ”by products” at your option/choice, especially if you or an elder of the family know how to make them into valued finished products.

If you are ”faint of heart” about taking some time to explore your local farmers and their products to get your meats direct, there continue to be,, and in some places growing numbers of, very good local butcher shops who usually have better local products at better prices.

You can see the ”national” prices for all meats on the hoof on the commodity markets every day, and it’s very easy to compare those with the prices at the supermarcado, or wherever you usually shop.

Back in the day, some of WE peons would combine with some of the neighbors in the hood to do this, and we were getting very good meats at a lot less than half of the store prices.

@VV – I guess I’m too modern. I hate tripe and I hate sweetbreads. Always have, always will. And yes, to be polite I have eaten both. Enjoy your haggis, you can have mine.

Yep. What was formerly 60quatloo grocery bag is now approaching 80+q. Pretty soon we’ll all be sitting down wasting away, resigned at staring up into the sky .. looking at wishful points of light, whilst that Fed slave-collar ratchets ever tighter!

Food bill is about the same. This is a budget constraint. However, the quality/quantity is down ~20-25%. Why am I not losing weight? Oh, poorer quality food.

I’ve live in the GTA (Toronto) and I manufacture building products. My raw material costs of steel, stainless, copper and wood have mostly doubled, but cement powders are behind the curve, only 10% increase so far. The real inflation of goods is much higher than gov’t stats show. I do not expect prices to come down. The cost of consumption looks like it will double across the board. What’s next?….UBI digital currency and negative interest rates?

Stoneweapon,

I’ve posted this before but it bears repeating, because of your comments. My son is a self-employed independent electrician. His wholesaler used to update price sheets every six months. Now it’s weekly. That is scary!

I don’t know about digital currency but we already have and have had for some time, negative interest rates. Inflation eats enough of cash and banks pay so little interest, if any, that negative rates have been here for some time, but most people just don’t know it.

Next stop stagflation.

I don’t think you realize how true your statement is!

Joe needs to get inflation well established before the economy stagnates and deflationary pressures set in.

The Fed is very worried about what comes after this stimme boom comes to an end.

The government desperately needs inflation to reduce the size of the debt.

There are afterall only 2 possible outcomes; inflation or deflation.

Inflation is their choice because it keeps the government strong and the people weak.

Deflation would weaken the government.9

+1

Where is Paul Volker when you need him?

Paul Volker was a disaster – The operation was a success but the patient deid.

Disagree. Volker had stones….the patient did very well from 1982 on…didnt it?

1982 is when the deficit spending began…

Volker was the last honest Fed chairman. He called inflation accurately and dealt with it properly. And deficit spending started way before 1982. Democrats destroyed the Dollar with the massive spending of the Vietnam War and The Great Society combined with the U.S. space program, forcing the US off the the international gold standard in 1971, which opened the door for the Fed to print and borrow money to infinite.

Thank you Harrold. Sort of a very neglected and IMPORTANT point, I kinda think, even without taking Econ 101.

BTW, why does everyone say that instead of Econ 1A-1B. Wouldn’t 101 be “bonehead Econ”, or is it just a CA colleges thing?

Thanks if I get an answer way back here….in WS time….the front is just too crazy for me.

Let’s face it, it’s all about the Mexicanization of the American economy, a hollowed out fortress, bristling with armaments, while most of the population is gently reduced to peonage. Those oligarchs have big plans with no strong government to impede them. Is this simplistic?

“Those oligarchs have big plans with no strong government to impede them. Is this simplistic?” Agree most are weak. A few have had it with us – China, Rus. And did you see that clip floating around of Armenian Prez giving a flabbergasted BBC “journalist” a turn of the tables bringing up her nation’s censorship of Assange? She was knocked down badly by him. Even the little guys are turning on the West. I jumped for joy watching it.

Divide and plunder.

Yup, I’m waiting to be blacklisted because I refuse the vaccine.

MiTurn:

No, you are just part of the control group!

Well, the Fed is not going to be an impediment here, the J team has everything well in hand.

It’s so well in hand in fact that others without the J in their name wants to join the party. Like our genius governor Gavin, who wants to indulge Californians with an extra $600 per person, +$500 per child.

I didn’t realize there was an opening on the J team, but Gavin is auditioning. May be he ought to change his name to Javin.

Nothing like a little good ol fashion vote buying.

?

Isn’t Gavin facing recall?

Why do you think he’s giving people money? If he gets recalled, his political career is probably finished, but then again I thought he was finished the last time around

Warning, Off Topic:

Monkey Spunk:

Didn’t you say you were leaving the country at the end of the year? Why not leave now, you POS lawyer. The United States of America could use one less POS lawyer. The world could use one less POS lawyer. And when you leave, you will not be allowed back in the country, ever. Leave now, you f’n coward. We need men who will stand up and fight, not pussies like you wanting to flee in the face of adversity.

Woah, Take it easy drunk uncle…

Uncle Salty,

Sir…this is a Wendy’s…

Ahh! …. but will the replacement .. should this total recall happen, be any better? That’s the rub.

To my mind, California is but a reduced version of the country to which it is apart .. too big to NOT fail!

Replaced by that idiot who walks around with a REAL BIG alive BEAR (as his “totem”, I guess). Even Trump wouldn’t pull a PR stunt that nuts! Surrounded by bikers or getting in a big rig was about it for his “tough guy image” props. The rest he just did with huge padded suits and facial expressions.

That much stimmi money in Ca will get you a couple of runs through In N Out burger.

say what you like, but In and Out makes decent enough burgers for a chain. And still reasonably priced too. I figure at $600, you can get at least 100 double double.

I hear they opened one in Texas (where I am). When I lived in Ventura County, they were my go to burger chain!

Gas prices are not a measure of whether we are experiencing inflation. Gas prices today, even with the recent rise, are well below where they were in the 2010 – 2014 range. So by that measure, we are experiencing deflation.

And gas prices always rise this time of year, at least in some areas due to the switchover to ethanol blends.

Gasoline prices at the pump can vary considerably over the years, as we all know.

But it is instructive to note that gas prices when adjusted for inflation (not the nominal price listed on pump) have been remarkably consistent for decades, staying generally less than $2.50/gal (in 2020 inflation adjusted dollars, not nominal prices).

For example, gas prices in 1978 were about 65 cents/gal. Adjusted for inflation, in 2020 dollars that would be about $2.46/gal. (Info from US Inflation Calculator).

If Wolf is right, and consumers don’t go on buyer’s strike but rather pay up for what sellers are asking– it would embolden manufacturers and retailers to up the ante and keep raising prices anyway to pad their bottom lines.

So, if consumers are already expecting inflation to continue it turns into a self-fulfilling prophecy.

As Ronald Reagan was quoted:

“Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hit man.”

And the Fed is the crime gang leader.

I’ve been on a buyer’s strike since 2008, it’s called being broke. Inflation is hitting me on my fixed overhead, the rest I do without. There is also a lot of substitution in our shopping.

Inflation won’t get us to spend because prices are rising. We only spend money we have on items we need, mostly on sale. The stimulus money did induce us to spend on a few full price items.

You know what savings buy you?…time to Google around for better deals…the main reason why the Fed is elevating inflation to sex goddess status…

Say, do you think I can buy CDS (credit default swaps) on the US?

Wolf,

A post on Credit Default Swaps would be great…in an era of overvalued everything, CDS should be an area of major focus…

Unfortunately, there have been more than a few cases of CDS welshing, using tortured legal game playing…sometimes by the alleged referees…

Who was the journalist that asked me why I was still buying MBS the other day??!!! This means there are actually TWO journalists still working in this country!!! TWO journalists whose brains haven’t completely rotted!!!! This guy!!!! And that pesky Wolf character!!!!!!! I won’t have any more of it!!!!!!!! No one questions me!!!

No worries! I disinvited these two pests from future Fed news conferences!

EXCELLENT!!!!

(Buffett’s) mistake (in Barrons) analyzing inflation (expectations) arises when conflates relative prices with substantial inflation. This is the old “Core” inflation, [not hysteria-n’-flation]. Powell has the view inflation is dead, and the package, wages and prices, is transitory. Economists who are pressing MMT believe inflation is caused by higher interest rates (as do I) and maybe so does Pow-Yellen who are content to let yields rise (they only control the short end anyway) He wants the data (there is no Fed policy other than the F word). Inflation remains “transitory” while the push-pull is asymmetric. Powell wants inflation, (he heads the new regime) while Buffett and others, fear we are getting the same inflation we had under the old monetary policy. There is no pull without corporate hiring, and higher wages. Greenspan, placed emphasis on consumer demand, the pull, hence his interest rate policies were sometimes called pushing on a string. Now consumers get the push, (stimmies) and higher yields provide the pull. Got a job? Have some money anyway. The next round of stimmies might be a zero interest loan while the corporate bond market has a lot of slack. Screw treasuries, fixed income junkies want high grade paper. One way or another corporate America will have to pull their share, and debt consuming companies go on a diet. This is the new era economy with an inflationary bias. Inflation is pushed out to the EM, which sends us deflation, lower priced export goods. This may be the huge mistake, while China’s currency rises against the dollar. In the 70’s inflation came through energy (imports) and maybe the US is less energy dependent, and maybe it doesn’t matter, just ride your magic carpet solar panel to work or just WFH-(it)…. Then again maybe the pipeline hack caused this bulletproof stock market to drop? All dressed up (normalized yields) and nowhere to go?

“Economists who are pressing MMT believe inflation is caused by higher interest rates (as do I) …”

Well, and I’m sure you and your economists believe in rainbow-pooping unicorns as well. If that belief were true then Fed Chairman Volker hiking interest rates to the moon to stop inflation (in early 1980s) would have only caused scary high inflation of that time to shoot higher. Instead, inflation was tamed.

“In the 70’s inflation came through energy (imports) …”

Sorry to disillusion you, but the Arab oil embargo and high gas prices were only contributing factors to 70’s raging inflation. The actual causes were many and debatable even today.

According to one view (from Investopedia): central bank policy (easy money), Nixon shutting the gold window (and eliminating what was left of ‘gold standard’), Keynesian economic policy mistakes, and market psychology all contributed to 70s decade of high inflation.

Lest we forget the early 70’s was also the first time that the large unions forced big COLA adjustment into their contract renewals. Automatic inflation. Pay me more because it costs more, so now it costs more so pay me more, which makes things cost more so pay me more, ad infinitum…

Maf is dephkult.

The Great American Consumer Army marches on, even in the face of a 100 year storm. Give them stimmies, increased credit lines and low interest rates and watch them go!

I’m expecting the current Fed’s incessant efforts to increase consumer price inflation will ultimately result in one of the most regrettable “Careful what you wish for…” scenarios experienced in this country in past four decades.

As a self-employed manufacturer I have never in my 30 years experienced raw materials double in over a few months. I have no doubt the IMF cabal is responsible for financial engineering massive inflation across the board with their corrupt political/corporate conglomerate. I expect everything tangible we need to buy will eventually double in price by the end of this year. The cost of consumption is forcing more people to be dependent on federal/state financial assistance programs. IMO, this will set the stage for the IMF to roll out their UBI Marxist digital economic system through the central banks. The IMF controls the money supply and the legal debt obligations. They really have the upper hand/leverage over the masses. Our political systems have no financial independence to control our money outside of the IMF…..just a warning shot!

stoneweapon,

That’s an interesting and possible truth regarding the IMF and engineered inflation. As the world binges to the extreme on nation debt and business debt, what is the end-game solution?

1) Inflate away the debt load and keep the ball rolling.

2) Stop taking on more debt and pay off what is owed.

3) Do not make payments and default.

MMT folks would say just keep making more money and spending it. Kind of like a financial version of a perpetual motion machine.

Read John Perkins’ writings on the IMF and World Bank cabal to see who is behind the curtain pulling the strings.

Or Stiglitz, he finally couldn’t take any more IMF crapp and quit.

I haven’t gotten a raise since I started my job 2 years ago. Not planning to get one. For a working man, this economy sucks.

In 2002 I used to work as a machinist for £8 an hour. In 2020 i worked as a senior research officer which is a phd position for £13 an hour. Using the bank of england inflation calculatory it shows that £8 an hour in 2002 is equivalent to £13.53 as of 2021!

I think its safe to say that it is actually much worse than people think.

Inflation is out of control already. Noticed my favorite restaurant just shrunk the lamb portions from 3 to 2 chops on my salad. That’s shrinkflation, to the tune of a 33% reduction in portion size. Gas is going over 3$/gallon everywhere. BlueCross/BlueShield hiked their premiums by 10%. Grocery bill for April was $1150 vs $1050 the previous month. I don’t know how a family feeds their children. I believe we are already in double digit inflation.

We’re buying a primal cut of beef from a local butcher and portioning it up ourselves. A bit if work, but a third off the cost of retail. Freezing and canning.

A Primal Cut !! What does he use to slice it off with .. a big chipped flint? Talk about artisan meat ..

Do you save the bones for megafauna soup, too??

‘;]

I don’t disagree with your general statement, but Blue Cross Blue Sheild has hiked their premiums by about 10% every year I have had their coverage, so that is a bad example.

Nat

Not true. End of story

Is it really that hard to cut social security, Medicare and Medicaid? I’m going to be getting these things pretty soon and I’d rather just have them reduced to save us from the Fed’s crazy inflation scheme. I mean the over-60 vote is relatively even politics-wise nowadays. Can’t some bipartisan politicians team up to propose this? Yeah I know they can’t. They only care about themselves. Remember when people knew that the path of least resistance was a bad thing? That sure ended fast. And go ahead and tax the rich and cut military spending too. Who cares. Sad.

Covid is already helping the SS Trust Fund. Both current and future beneficiaries are dying off.

This is exactly the sort of thing, the kind of people who usually end up running gvts, think about and plan about, all day, every day.

We’re just here to build DC’s pyramids.

Zero population growth keeps going in and out of style.

Fewer old people to support? Yay. Fewer people being born to support old people in the future? Boo.

This was a problem around the world pre-covid. In China it was self-inflicted. In Italy it was due to economic conditions. Even before covid you could buy entire towns in Italy due to negative population growth.

Now US cities are offering incentives to move there.

And with all this alleged global warming we won’t even be able to put our old people on ice flows to drift away and die.

Pardon my cynicism but I’ve lived through enough of these Goldilocks analyses to believe the outcome is predictable.

Peak water plus Peak food production plus High cost of renewable energy plus too many people = BIG PROBLEMS

The River Test

On a fine day in the Spring everyone in the Village goes down to the freshening river. All the folks over 60 swim to the far shore and back. Some don’t make it back. Problem solved.

“I’m Not Dead, Yet!” …

They tried that – Simpson-Bowles. Obama rejected it. Don’t worry they will resurrect Greenspan at some point with his anti-“entitlement” screed.

“I’m going to be getting these things pretty soon..”

Good for you. My generation isn’t planning on getting anything at this rate.

Give it time…your generation will start planning…to get even.

That attitude is really the best one rising bird.

Never planned on getting one dime from any of the socialistic programs when in my young working days, and really didn’t give a damn one way or another…

So planned out my investments, mostly investing in becoming more and more educated, first in a trade, after college,,, , next in a professional niche that at the time required decades of field experience.

Both trade and profession worked out well, with premium pay for trade work in the SF bay area, and, eventually, premium pay for professional expertise — mostly working from home or in offices of clients when must be there — for decades as an older worker into my middle 70s.

Invest in yourself first and foremost, especially when you are young and able, ready, and willing to work and study long hours.

And enjoy all the benefits of every age,,, YOLO far shore!

VVNV-an addendum, which i have found occurring in my (large) in-law family, wherein most seem to be spending an inordinate amount of time scheming and maneuvering to acquire the assets of the most-seniors as they pass away. The more i look around, the more of this i see in general society. Again, i think this raises the need for a serious discussion in the zeitgeist of estate taxes vs. an American iconography of ‘bootstrap success’ (for the record, told my folks and relatives, to keep their potential inheritance monies in exchange for staying a truly respectable distance out of my life-things worked out okay in my case, no regrets, ymmv…).

may we all find a better day.

91B20-

Isn’t it pleasant being way back here in “WS Time”, where you can read “dead” comments, with most of the red/blue back and forth crapp deleted by Wolf, and put in your 2 cents at your leisure?

And yeah, like you, I may not have much but I’m totally out of the inheritance loops, but I can still get info and verbal help if I ask for it, which is free. I know the fighting is going on, but everyone gets the fact I’m not much of a consumer, and never have been.

So it’s easy for me to be for very high estate taxes, as this class warfare thing is OBVIOUSLY trashing our attempt at democratic government.

91B20-

Heres an article on a (maybe newer?) concept you might like, on something I’ve struggled to explain/understand most all my life. It reads sorta like the same attempt I have been making to understand, and maybe justifies my own “innate” bias? No concrete “answers”, but a weakness in our (maybe all modern) cultures.

Hope Wolf will let me post it……would be difficult for most of the red/blue soundbyte/buzzword set to honestly respond to.

https://en.wikipedia.org/wiki/Managerialism

Just read the Feds are paying over $11,000 per month to care for each child who crossed the border. I think think they can print a $1000/ month for grandma’s social security that she paid taxes for.

Working women in america get the least money out of social security because of their low wages. Most receive benefits below the poverty level and still have to pay for their medicare. If they were on welfare or il..legals they would do much better. Disgusting.

Can we take a vacation in Mexico and return as an illegal?

Seniors on fixed incomes suffer grievously from galloping inflation. Inflation is highly efficient at de-wealthing them.

But you never see them organizing marches on DC to make their grievances known, or pressuring their lobbying arm (AARP– crickets only about this matter) to wake up and sound the alarm.

Heinz

That’s the plan. Steal all the money from the little old lady with $300K in the bank. She has no voice.

Cutting MediCare will automatically reduce SS expenditures.

“Is it really that hard to cut social security, Medicare and Medicaid? ”

How about we cut the US defense budget and expand Medicare and Medicaide.

Most people in this country are poor SERDI. They have no assets to keep inflated.

Geez, what’s with the plans to leave old folks to due along the side of the road? Why not just cut a lot of unnecessary defense spending? (Do we really need billion dollar tanks when the biggest foreign attack threats are most likely cyber in nature?) And why don’t we actually force the largest corporations to actually pay more taxes. And don’t give me excuses on how they already more taxes than the lower 50% of the population combined; most of these large companies pay essentially a tax rate of 6% or less while the average Joe is paying around 25% with the combination of federal and state income taxes, FICA taxes (Social Security, Medicare), sales tax, property tax, gas taxes, and other fees.

Seems like the government has just lost faith in claiming to be broke. Debt ceilings proved to be as fake as $50 New York Rolex. After all these years of stating we will not have the funds to cover the government programs and that they will have to be reduced we all know that is was political maneuvering. Never will I believe that they can’t just automatically or auto-magically create more funds for these or all the future programs that are critical to the well being of the nation or their party

If Government Debt into Citizen Inflation is magic, it is black magic.

“My fellow Americans, trickle-down economics has never worked. It’s time to grow the economy from the bottom up and middle out,” J Biden April 28

My fellow Wolfinghams, draw an inverted pyramid. Place Tom Cruises’ three returned Golden Globes at each vertex… Submerge in a gas for buoyancy.

There goes the sub, diving.. 5 trillion inside.. Down, down, down…it goes

So this old cadaver is announcing that trickle-down economics doesn’t work, yet he’s got Jerome Powell making it rain for the billionaire oligarchs? If he meant what he was saying, Powell would be removed yesterday.

Who’s gonna do that?? His buds in crime?

‘No Way, No How – THEY be commin for Your Cow!

He would claim Jay-Pow is making it rain for the commoners as well, but on close inspection that kind of rain is yellow.

With nominal interest rates at or near zero the “avoid hangovers stay drunk” strategy central banks have been pursuing for decades is over. They can’t foment another mania with a new low in nominal rates so come the next financial collapse they can either allow decades of monetary distortion to be wrung from the system via global secular deflationary collapse (they won’t) or conjure oceans of new currency out of thin air to attempt to paper over oceans of junky paper floating around out there. But debasement won’t work, raging inflation will be the only result. Tangible assets offer refuge. Crypto…we’ll see.

There is no example of a country or nation/state inflating its way to stability with the debt the US has. What does happen is collapse and violence. The Fed is not only delusional but is cruel and evil if it attempts to de-base the currency via inflation in its attempt to fix what only bankruptcy and default will cure. Bankruptcy and default will be orderly with sound money . Painful, but orderly. De-basement will breed havoc and the cry will be loud to release the dogs of war.

Oh my god, prices are going up.

People cant afford to buy anything because there isnt enough money, lets print some more and send checks to everyone, that will take care of high prices.

The facts rather conflict with the fantasy, no? All this inflation and stimulus is supposed to make us better off. Well, someone must be better off, but it doesn’t seem like it’s the average American. And that’s according to the folks who should be in the best position to know.

Government response to every crisis from tech bubble to now seems to be to double down on stupid. I heard the best explanation by Marc Faber stating that private sector nearly always does things more efficient than government and when government starts approaching 50% of economy long term growth is going to flatline.

That’s where we are and where we are going to stay. Just a lot of fighting over the same size pie now.

Gas Lines

Soaring Inflation

Terrible Jobs Report

Boats Shooting At Each Other In The Middle East

It is almost like Jimmy Carter is in office.

Trump handed this mess to Jimmy Carter four months ago :-]

Jimmy Carter could read a teleprompter. Must be someone else. And although Trump was a loose cannon, the seeds of this mess were sown a long time ago.

Back when Obama was president and people wanted to get rid of him ( some by political means, some by violent means) I told everyone who would listen that they wanted to hope for Obama’s health and well-being.

When they asked me why I replied “Two words: President Biden”.

*yawn*

Joe inherited a relatively peaceful middle east (ISIS toasted, 3 peace treaties between Israel, Arab countries), peaceful Korean peninsula and no new wars.

Joe inherited operation warp speed, which developed the vaccines. Joe himself got vaccinated under Trump administration.

Solid economic boom shut down by blue state governors.

Joe spent 4 trillion dollars to send 0.4 trillion dollars in stimulus checks.

And utterly failing in leadership by not making vaccine IP widely available.

Nacho Libre,

Your last line is total BS. How stupid do you think we are? Now the problem is that many people don’t WANT the vaccine, and it sits unused. I read that half of the Republican-leaning folks refuse to get the vaccine. There are vaccine appointments available all over the place, including at Walgreens and CVS. Some mass vaccination sites have shut down because there isn’t any demand… How can the government talk these anti-vaxxers into getting vaccinated? They shoulda called it the “Trump vaccine.”

I do call them Trump vaccines and it’s a miracle how fast they were developed.

I am talking about making the vaccine IP available to the world. So that the vaccine can be manufactured at scale and delivered to anyone anywhere who needs it.

US is the exception where we have more vaccines available than in demand. Rest of the world, not so much. They have many years to go before getting vaccinated.

Nacho Libre

You are partially correct about the vaccine not being widely available but before posting BS on this site, if I were you I would invest in a good calender.

Here are the facts

Vaccines opened up at CVS in mid April. Before that you had trouble finding any place to get vaccinated. I was on the Internet searching at Safeway, Walgreens, Giant with no luck. I even wound up booking an apt in Deleware 100 miles away, then switched it to Haggerstown, MD 120 miles round trip.

Now they are widely available. I’m (and Ms Swamp) are getting second Moderna shots next week at CVS, 3 miles from my house.

I don’t what you are on about.

You don’t get vaccines at CVS if it’s not researched and developed first.

As I made clear in the following post, I am specifically calling out Joe for not taking any leadership or responsibility in sharing the vaccine IP with the world, where thousands are dying everyday.

All the points I made in my first post are correct on what was handed down to Joe and what he has done with that.

And perhaps it’s Joe who needs a calendar. He got vaccinated in December, yet claims there was no vaccine when he took office.

SocalJim

You are stealing my thunder!!

In a recent post I listed how this administration was repeating every blunder that Jimmy Carter made and then some.

Let me repeat. This is Jimmy Carter 2.0 on stroeids

END OF STORY

Why not just raise wages instead of across the board stimmies? Why not just tell us the real rate of inflation rather than actively push up a deliberately lowered CPI? Pull on these two strings and watch the black helicopters arrive to take you to “the Island”.

Not sure how they actually define “expectations”. If you asked me what I thought inflation was going to do I would give an answer. This does not imply that I will not try to counteract that inflation by making different choices or doing without because my “expectations” of a wage rise are limited. Seems like another measure totally divorced from real life bit like the jobs numbers.

Voters are not going to be happy at the 2022 midterm elections if the current admin allows the Fed Inflation Hustle to continue for another 1.5 years. The White House has been sweating stimmy induced inflation over the last year, and I’m guessing they will get desperate and remove some tariffs and perhaps even throw in some price controls, etc if it gets worse before midterms. What the entire media complex seems to avoid discussing is that inflation dynamics take many months to work through the system, thus why every Fed, except for our current risk taking Evel-Knievel-J-Pow, has reduced liquidity and increase the price of money many months before inflation has gotten out of control. J-Pow is a Fed “tool” to think any “Fed tool” will stop inflation in accelerated short order, yet not also crush the economy in the process.

I fail to see how raising the price of everything is worth creating a few million minumum wage jobs, which do not even begine to pay enough living wage in such a high inflationary environment. Seems like a cruel joke on the poor, doesn’t it? The Fed pretends to help them, and then crushes them via a stealth inflation tax, which only makes the top 1% even more uber wealthy. Yet when the stealth tax is on “everything” and thus extremely obvious, it isnt’ so stealty anymore.

I suspect J-Pow is also clueless on how big the political fallout will be once the “Transitory” phase turns into years, for his theoretical human inflation experiment he has unleashed on the entire world. Perhaps it all works smoothly in the Fed’s simulation models, yet humans are too emotional and thus unpredictable to model accurately when attempting to control the time value and/or price of money.

The greatest experiement in decades at Fermilab recently showed that muons did not behave as predicted, and thus the known laws of particulate physics will most likely need to be re-written. Yet we trust one man to re-write the know laws of economics, running the greatest monetary experiment of all times, across the entire planet, without any definable and/or provable theories of “transitory inflation” based reasoning? When did Fed based economics become a faith based religion verus a data driven pseudoscience? How ironic to miss the good-ole-days of economic pseudoscience…

The FEDs track record is perfect. Wrong every time.

“Seems like a cruel joke on the poor, doesn’t it?”

We live in a dumbed down, easily propagandized idiocracy that doesn’t even get that joke or any of the others.

I just raised the prices of my software and no-one has batted an eyelid. Normally when I increase prices I expect to see a slight fall in volume for a while. Not this time.

Yup. We have increased prices three times this year to cover rising commodities.

Another one probably coming as we are now being quoted over $1/pound on core steel products with poor availability. This is up from the mid $0.40’s range late last year. Still getting battered left and right on healthcare expenses too.

This price inflation. It’s not the same as money supply inflation where money expansion exceeds productivity growth.

The Fed has been engaged in inflation for over a decade. The problem is that they can pull the trigger but not aim the gun, so the inflation went into things rich people buy, like stocks, bonds, art, etc. Remember the old discussions about pushing on a string? The recent discussions about wealth disparity?

This is a different animal. There’s plenty of oil, copper, whatever, but getting it out of the ground to market is the chokepoint. That’s not a monetary problem.

IMHO if the government and the Fed will just leave everything alone it will resolve on its own. Contrary to Friedman and his monetarist followers, expansion of the money supply did not produce widespread inflation and monetary policy will not fix it.

Covid was a black swan event. Like the Black Death it caused huge economic disruptions but those disruptions had long term positive outcomes such as the end of serfdom and the rise of independent towns. OTOH a third of Europe was killed.

There is no fast or easy way out. We have a collision between a crackup boom busting and a Black Swan event. This is gonna hurt.

MG,

You are behind the curve of financial innovation. You can now buy paper gold that is un-mined. The miners are now selling you allocated veins of gold in their mines. What black swan, what crackup, what bust…place your bets.

Allocated veins of gold? Citation please? I can’t find anything online. Tell us about the mechanics. What happens to your allocated veins of gold if the miner decides not to extract from it? What happens if the mine closes?

It sounds like buying an allocated assembly line from GM.

I heard it a couple of times on a podcast out of Canada. They talk about housing, investing, and politics. I’m pretty sure they were referring to a Canadian mining company, whose name I don’t recall.

I am still flabbergasted that the Chairman of the Fed can stand on a podium and say they have a 2-2.5% inflation target.

The Fed is INSTRUCTED per their mandates to “stable prices”, ie FIGHT INFLATION.

2-2.5% inflation rips 22-28% off the dollar in ten years. And we are running well ahead of that right now…in real numbers.

Fed Funds will likely sit more than 3% below the Wed CPI reading….

ever happen before?

The population is waking to the Fed’s mismanagement…and the inflation just might get a politician or two to question what the Fed is doing.

The Walls St Journal editorial finally put in print what many have been thinking…..why the emergency measures from the Fed when the “emergency” has passed.

One can point to the recent COVID emergency, but did the Fed ever back down after the 2008 “emergency” measures? QE was to be temporary, said Bernanke. Now $120 Billion a month 12 years later….and $20 Trillion in debt later.

For all the talk of inflation there’s also a good case to be made about deflationary forces kicking in once the economy goes back to a balance. When supply chains are able to catch up, when the stimmys run out and people start scrambling for a job, when AMZN and UBER are able to bring in the ‘bots to their operations and there is little entry level jobs left and when the demographics catch up with the inflated housing mkts. David Rosenberg was bringing up all these points on Friday when the job numbers came out and he was referring to 2009-2010 when there was also a lot of talk about inflation kicking in after the bailouts. Not sure who will be right this time around but I find comfort in thinking that all my savings wont end up in wheelbarrow in the near future… Regardless the transition probably wont be a smooth one.

“…there’s also a good case to be made about deflationary forces kicking in…”

STRONGLY disagree.

If inflation spikes, and it is, and there is a small “back step”, that is not deflation.

Perhaps you recall the era of “deflationary fears” in the Bernanke and Yellen years (and some Powell)….2009 to 2020…

Deflation?

The CPI went from 214 to 254……just short of 20% increase….

I have never seen deflation……and neither have you.

There are periods of retracement of inflation, but never deflation.

To wit:

https://fred.stlouisfed.org/series/CPALCY01USM661N

I know, I know and the CPI is rigged anyways that number is likely higher… All I’m saying is you can take a contrarian approach from time to time.

Everyone says Inflation is here, Weimar republic here and wheelbarrows there. I’m just looking at all the possible outcomes.

While I do think Inflation is the most likely outcome of all this printing, I can also entertain the thought that maybe it will be transitory and once reality sets the numbers might not be out of whack as they’ve been these past few months.

tooshort

“Everyone says Inflation is here, ”

I guess you dont watch Bloomberg and other shows with talking heads and Fed Governors….

You wont want to be a contrarian anymore…

I am thinking the current DC crowd is going to follow MMT thinking and continue to buy votes by doling out money especially in name of diversity, but try to soft land the asset bubble by taxing corps and cap gains. If you are old, middle class and white you are looked at like the aging quarterback. You are not the future. You will be dead soon and you will not vote when in the ground.

Marc Faber is very disturbed with young people embracing socialism, because in the seventies and eighties he used to travel to socialistic hell holes where people had no freedom and poor standard of living.

“people had no freedom and poor standard of living”

in those “hell holes” there were no homeless. Is it better to have freedom but have to live on the street? You can’t have all…

Having been ”un housed” and then ”squatting” in boroughs of London in ’70, and then similarly in other places in what is now EU,, and then CA,,, I can testify it is never fun,,, and almost never even calm enough to sleep well or enough.

Other than those places in those times, ”hell hole” does not apply ”locally” until you are ”rousted” several times per night,,, and forced to move your self and everything you own.

Lots of folks need to get out of their own, and usually own made ”cocoon” and at least try to relate.

Certainly it IS a challenge,,, but I, for one, will testify it is a very stimulating for growth challenge.

May the GREAT SPIRITS bless us all in our attempts!!!

VintageVNvet:

Old school was referring to “socialistic hell holes” – I grew up in one of them and can tell you that I could only see homeless on the news reports from the USA :)

@OS – these folks are not looked upon as “aging quarterbacks.” They are looked upon as a senile great-aunt being forced to sign a power-of-attorney so that lawmakers can loot what the aunt saved up.

In any case, this period has been an opportunity to pay down the bills and get the finances in better order for those who wanted to.

For those using the situation to draw stimulus and jacked up unemployment benefits just to lay around on their ass consuming while falling deeper into debt, third-world life is quickly approaching them.

Who’s going to house and feed all these people? I hope they all have mommas to move in with.

1) Gasoline prices are up 9.2%, higher than health, steaks and the rest. The trend is up.

2) Cyber is a must have infrastructure.

3) Colonial viaduct disruption will be a cause to shove the infrastructure

bill on congress. It’s an emergency.

4) XLE monthly bounced back after reaching Feb 2016 close.

5) When that resistance line will be overcome, XLE might form a

neckline.

Many of these price increases won’t hold UNLESS wages move up. That is what the Fed/Treasury/Biden want to happen and our trying to force.