But shipment volume, though strong, is not at record levels.

By Wolf Richter for WOLF STREET.

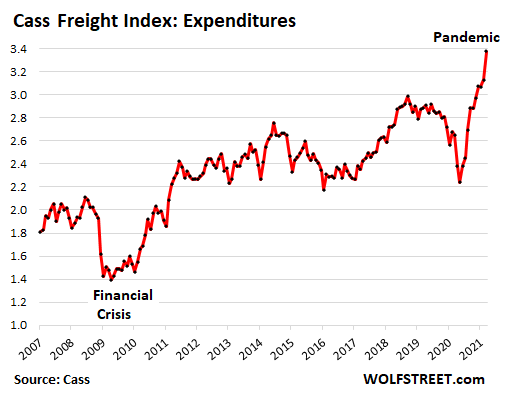

Manufacturers, importers, distributors, retailers, and others have been groaning under surging shipping expenses as freight companies have raised rates, amid bottlenecks and strong demand. The amount these shippers spent in March on shipping goods to their customers spiked by 17% from February, by far the biggest month-to-month spike in the data going back to 1990, according to the Cass Freight Index for Expenditures. But February had already been a record month for freight expenditures. Compared to March last year, just before the sharp decline set in, the Expenditures Index spiked by 27.5%.

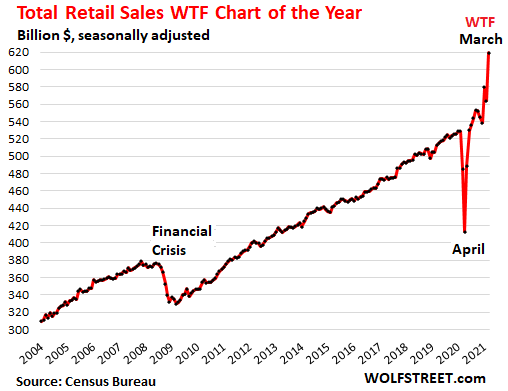

This spike in March was driven by the stimulus-fed boom in consumer spending on durable goods, thereby increasing freight volume, thereby producing the worst ever trade deficit because a lot of the goods are imported, and entailing freight rates that have shot higher, particularly in trucking.

The Cass Freight Index covers all modes of transportation, but it is heavily focused on trucking, with truckload shipments representing over half of the dollar amounts, and less-than-truckload (LTL) shipments in third place, behind rail. It also tracks parcel services and others, but does not cover bulk commodities.

Trucking is under capacity pressure, rates soar.

The average national spot rate for van-type trailers in March jumped by 10% from February and by 41% from a year ago to $2.65 a mile, according to DAT Freight & Analysis. The average national contract rate for vans jumped by 6% from February and by 25% year-over-year, to $2.61 per mile.

In terms of flatbed trailers (hauling heavy equipment, construction materials, and the like), the average national spot rate in March jumped by 8% from February and by 26% year-over-year to $2.76 per mile. The contract rate jumped 6% for the month and 14% year-over-year to $2.85 a mile.

More broadly, Cass reported that the freight rates embedded in the components of the Cass indexes accelerated by 15.8% year-over-year, after having jumped by 12.3% year-over-year in February. “We still expect this trend to press higher near-term, as strong freight demand meets shortages of both drivers and trucks,” the report said.

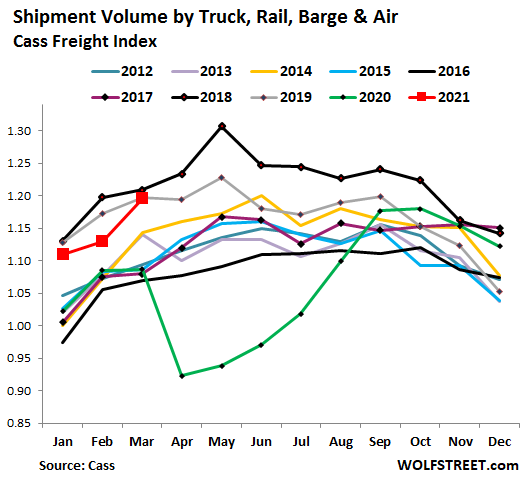

Shipment volume is strong, but not at record levels.

Shipment volume in March (red line and squares in the chart below) jumped 5.6% from February and 10% year-over-year, according to the Cass Freight Index for Shipments.

But it didn’t set records for March; the index for shipment volume matched March 2019 and was slightly below the record March 2018 during the shipments boom at the time, triggered by efforts to front-run the tariffs and piling up inventories, rather than strong demand by end users.

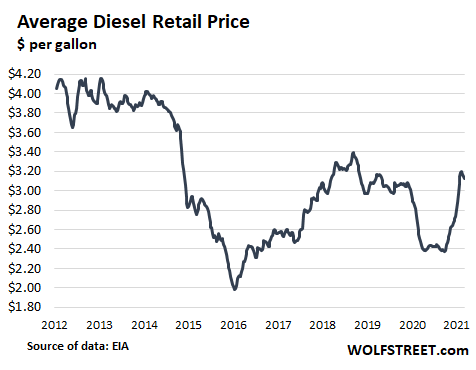

Truckers grapple with diesel prices.

Retail prices of diesel started to rise in November last year after having plunged when the price of crude oil collapsed in the spring. The national average price of No. 2 diesel, according to the EIA, has jumped by 31% since November, or by $0.74 per gallon, to $3.13 per gallon.

Higher fuel prices put upward pressure on freight expenditures. But diesel prices remain relatively subdued compared to the pre-oil-bust years of 2014 and before. So still higher diesel prices could be another thing to worry about, if crude oil prices recover anywhere near to those pre-oil-bust levels, which at the moment is hard to imagine:

What everyone in the transportation business now wants to know is what happens to consumer demand for goods, when the stimmies that triggered an epic spike in retail sales, are spent…

… and when consumer spending swivels back from goods that need to be transported, to discretionary services such as vacation bookings, concerts, ballgames, gyms, hair and nail salons, and the like, that don’t need to be transported.

Consumer spending on services was still down 5.2% from a year ago, largely due to the plunge in spending on discretionary services. But spending on these discretionary services is coming back. And some consumer spending, what’s left after the stimmies have faded, will swivel from goods that need to be transported, to services that do not need to be transported.

And I suspect that the mind-boggling distortions in the economy, driven by historic monetary and fiscal stimulus including direct payments of “free money” to businesses and consumers, are going to serve up many more headaches and price pressures.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Speechless. In a way, those charts look like a capitalists dream.

I’m sorry but what part of the free market capitalism course teaches manipulate interest rate artificially low while printing trillions of money for consumers’ spending?? You know so we can buy junks we don’t need, with money we don’t have, to impress people we don’t like. Was that in chapter 5 of the Adam Smith’s book? Maybe I was asleep during this class.

Free markets and capitalism are mutually exclusive. Capitalism is merely the modern form of feudalism: a small elite corrupts governing authorities to use their monopolies on violence in order to allow the elite to extract value and to ward off any external challenges to their power.

The Chinese have proved the great truth of the old Soviet adage, “A capitalist will sell you the rope you hang him with.”

Short-sighted, bottom-line-only corporations bribe (campaign donate) government officials (of BOTH parties) to allow jobs to be shipped overseas to a communist country to take advantage of cheap labor and in the foolish hope that the manufacturing base they build there won’t be replaced by native Chinese industries using stolen IP… as it will be.

Then, suddenly, after their actions have built up China to be a technological giant, they see and warn about a growing military adversary which their own actions have created.

What a racket…

And, meanwhile, US consumers create shipping logjams due to their continued purchases of “rope” [“Hey, do you have the latest made in China laptop, HDTV, smart phone, etc. to replace the ones you already own that still work?] despite a US economy destroying reaction to a virus from China that has killed 569,475 Americans.

Hedonistic, games and circuses addicted fools…

sure…thats why it produced a middle class and widespread ownership class…that really sounds like feudalism…./s

Haaaaaaaaaaaaaa!!! “Buy junk we don’t need with money we don’t have to impress people we don’t like.” Ain’t it the truth. Go Instagram!

I don’t consider my recumbent exercise bike to be junk. Too bad it had to come all the way from China. The delivery period in the summer of 2020 was about 2 months. But if it had been manufactured in the US from US made parts, it would have been a lot more expensive.

After us will come the deluge.

Fyi. That ain’t capitalism.

“And I suspect that the mind-boggling distortions in the economy, driven by historic monetary and fiscal stimulus including direct payments of “free money” to businesses and consumers, are going to serve up many more headaches and price pressures.”

But if it should drive the price of things up please remember that it’s not inflation because the shipping is like SOOOO much better than before. ;) Hedonics, baby!

Good backup career choice after you serve your time. Ended up washing out of what I went to college for when I hit a non-existent job market and went otr for a while. Pay was awful for how much you work and the industry is just a disaster for drivers hence the “shortage.”

But if you can tolerate running for bottom feeder mega carriers like swift and jb hunt you can escape to a union job that is paid hourly and is forced to treat you like a human being. Hopefully the crash destroys the megas and the industry has a vacuum of no drivers at all to move freight. Maybe then we’ll get some much needed worker’s rights in that God forsaken industry. Most people can’t hack it being a slave for the 2 years insurance companies are requiring before non-self insured decent carriers can hire drivers.

Would absolutely love to see the trucking industry burn to the ground and get reformed. Couldn’t be worse than it is now for new drivers. Most people aren’t going to live in a truck with someone for 6+ months grossing 600 a week getting 3-4 days off after working every single day for 3 months at a time. Only to then get out solo and be insolvent in a couple months from predatory leasing contracts or be a “company man” for a pathetic 2000 miles a week at ~.40 cents per mile gross income and work 60-70 hours a week and be treated like a criminal by the DOT for just trying to do their job.

I’ve been in too many truck stops to be woken up by a single gunshot and a coroner dragging some young kid out with a hole in his head. Seen it personally on 3 different cr england drivers. The megas will survive the crash and small ops will get squeezed out as usual but a man can dream I guess. It is a great career though if you can weasel into a teamsters gig and have it nearly the way it was before deregulation. Minus the good pay.

I’m sure “kindly Uncle Warren” Buffett approves. So long as he pads his billions, some brain splatter here and there just adds a little texture to the landscape. Cannon fodder.

What a terrible state of affairs for what used to be a ticket to a middle class lifestyle.

There is no middle class lifestyle anymore. Get over it.

What about you, SC? What is your economic situation like?

I have 2 nephews, early 30’s. Both purchased homes. Both attended a state university while living at home, which minimized their student load debt load. One married a hard working immigrant who got a JD from an Ivy League law school and is doing well. (Yes, student loans.) He is an engineer, doing well. The other nephew works in academic research with a Masters’s degree. Doing well.

My nephew’s parents – mom high school educated, no college, school lunch lady. Dad – mailman.

It seems that many blog comments sections become a forum for folks to kvetch, in this case, thankfully not about their bunions or myalgias. Maybe bored with too much time on their hands?

And so I think it can be helpful to hear from folks in whose small circle of friends and family things seem to be going well, to balance things out. Although I am swimming against the tide in this comments section, I do occassionally try.

You are my hero, Crush. I look forward to your bleatings about how well off you are with bated breath and the joy of reading about your good fortune makes my day. Happy now?

I’m still middle class, barely. A vanishing breed. Hangin by our fingernails. Standard of living has been dropping since 1999. Haven’t been on a vacation in the last 5 years. I haven’t even left the Washington DC metro area since the end of 2018. Spend my free time reading the Wolf Street Report and reading History Books on WWI, and feeding birds & squirrels, and playing a round of golf twice a week.

I get it Fat Chewer. No one gets their rocks off on good news. Many blogsters, as well as the MSM, recognize this market, and serve up their own brand of heroin. What can be said about this way to earn a living or to go through life? IMHO, it is a pathology, easily served by the internet and the electronic media in general.

I’m lookin at the posting times. 1AM, 2AM, 3AM, 4AM??? What’s going on here?

Wolf reported a while ago that times on here are Eastern Standard Time,, the time of his server on east coast of USA.

Comments come in from all over the world is my understanding, but always register on EST.

As I commented a couple articles ago, removed for being off topic on that one,,, I am really looking forward to the all electric semi and other large trucks taking over the trucking industry,,, and IMHO many of them will be able to be mostly if not totally self driving.

The weight of the batteries kills all cost savings. This is one area where Elon is definitely an idiot and fuel cells are going to dominate because compressed hydrogen doesn’t add appreciable weight. They do want self driving trucks though. The goal is that a single tank of hydrogen will be able to take an automated semi coast to coast without stopping to tank up.

VintageVNvet,

None of your comments was removed. But it may have been in reply to a comment somewhere further up that was removed, and yours and all others attached to that removed comment would have disappeared along with it.

There will not be self-driving trucks in your or my lifetime. I hope I have 35 years left.

Solution to the battery problem is energized overhead at various places along the highway. Trucks draw power and recharge while traveling. Demo projects exist near ports in LA/LB, Germany, and I think Sweden.

It was 10:58 pm my time when I posted.

I’m in Australia. My evening is your pre dawn.

self driven trucks

Self driven trucks ?

Not in our lifetimes….or our children’s either.

Sorry tech bros….you aren’t smart enough to invent this.

40-ton drones?

:)

FAA is about to kill drones for trasport of cargo.

Dont’ worry, pretty soon Musk will have his fleet of electric driverless big rig trucks on the highways. And they won’t have to overnight in a truck stop! Zoom…zoom…zoom!

Tesla Semi…Tesla Package delivery service…Tesla Taxi…Tesla Mars shuttle…Cybertruck…drug test anyone? I think the Cybertruck should have a “photon torpedo”.

In the 2020 Tesla 10K there was mention that the “company” planned to spend $1.5 billion on Bitcoin. Page 42 for any students who are lost. It reads Bitcoin defined is an indefinite – lived intangible asset under applicable accounting rules. What is the roulette wheel considered under accounting rules?

If I am involved in selling widgets to the public as a vocation or a publicly traded corporation…I would invest the $1.5 billion into the process of manufacturing the widgets.

I bet the Union Pacific, BNSF, SwiftKnight and other legit companies are not investing shareholder equity (cough cough) into bitcoin?

It seems like just yesterday, Wolfe was saying nobody was buying new trucks due to a lack of shipping demand!

That was a year ago :-]

If you were to order a truck or trailer right now. They wait time is 9 months, all of the slots are sold for this year. Volvo trucks might be more, their workers in Dublin VA went on strike.

We make truck parts, and the turnaround from last April has been absolutely wild. Last year at this time, we couldn’t get enough orders in the door to stay afloat. Now this year we can barely enter orders quick enough.

Despite being swamped, it’s still tough to turn a profit now because we can’t find enough people to build what is on the backlog, plus shortages and price increases are now the theme of the day.

Another sector with record prices, but without record demand… I’m sensing a pattern.

Seems as if the economies of scale “savings” from industry consolidation don’t actually get passed on to the consumer, despite what the Bork et al consumer welfare proponent keep claiming.

antitrust, antitrust, antitrust.

A more likely explanation is just that these are supply shocks.

Wolf, can you help me figure out what is being said by Bloomberg “Intelligence” and amped up by Kitco about the article titled ‘Severe deflation’: Everything depends on rising stock market, even commodities?

What is their reason for pushing a deflation narrative when you would have to be Blind Freddy to not see inflation in the economy?

I’d love to hear people’s take on this too!

I agree with the article, but am heavily invested in commodities.

There are massive deflectionary forces in markets, but are they going to be over run by money printing… the $64 million dollar question?

I think try to read a lot on this. Seems like the smart people say the high debt load and demographics means real economic growth is going to be slow. Government has basically been running stimulus for 20 years which helps in short run but hurts in long run. Covid was an excuse to pump 6 – 7 times more to lower income folks than actual damage.

We will soon turn to how to pay for it. Dalio says it’s going to be about half from taxes and half from money printing. In real terms it’s going to be a tough retirement for people who just retired as 1% real growth and financial repression on savings eat you slowing. Going to be tough to get a low single digit real return in my opinion even with stocks in portfolio.

I agree. The common mantra that “stocks eventually go up over time and provide a secure retirement” assumes that the economy is actually growing, as it did for most of the 20th century. For the last 5 or so, it’s been clear that any stock gains will be from multiple expansion, as the economy is no longer growing. Eventually, people realize it and are no longer willing to be the greater fool, which is basically what happened in Japan when they realized that an investment in the Nikkei was not an investment in growth, but in a bubble.

Money printing can work for a long time. Look at Japan. The key is to print just the right amount of money to offset deflationary forces. Print too much, you have high inflation. Print too little, you have deflation. This is modern monetary theory (MMT) in action. Japan has implemented it very well.

As the US heads down the MMT path, I wouldn’t count on sustained inflation or deflation, but I suspect there will be a lot of volatility in inflation rates and asset prices as the federal spending outlook changes. This is one wildcard that could disrupt the MMT spigot. They need consistent federal deficits to make it work.

Also, they need other large countries to implement MMT to avoid currency problems. They seem to be acting in coordinated fashion so far (i.e., US, Europe, Japan, Australia, Canada, etc.).

The problem is – NOBODY VOTED FOR MMT! It’s a massive takeover of our economy and pricing system by an unelected body (the Fed). Key economy decisions that impact our way of life should receive public approval. MMT is a major step away from capitalism towards a socialist way of thinking. The connections between work, competition, and reward are severely eroded.

I pray the public becomes aware of this massive shift and forces political candidates to comment on MMT, so the public has some say in the matter. This may be too much to hope for.

For many years ahead, I predict the wealthy will keep growing their wealth, unimpeded by competitive forces. The poor will continue to get free money. The hard-working productive people in the middle will continue to suffer, as they are fed distractions that mask the real causes of their problems.

Japan is losing 400,000 people a year to low fertility rates. People abandoned isolated rural areas and moved to more affluent areas. Less GDP was spent on building new homes, more on robotics research and development as an aging population automated.

I read the article. The argument there is a stock market decline would precipitate a decline in M2. Since M2 money supply has been doing the heavy lifting compensating for commodity weakness, the article claims deflation would follow.

I didn’t read the article, but am old enough to remember the 1970’s, when the stock market had been dead for a decade and inflation was taking off. It was a deflationary period because incomes were stagnant.

The key is incomes and with an aging population staring at retirement those constraints are real. What kicked off the recovery in NYC, back then, were subsidies to builders and the creation of the junk bond market. Good paying jobs became more plentiful.

It would have to come down to jobs and innovation. If the current ZIRP/QE only removes the slack from the labor market and doesn’t spur growth (protip, it won’t), then we’re back to the deflationary forces that caused the contraction in 08-09.

No one wants dollars, they want assets. A liquidity trap happens when there is no one on the Bid. What happens when no one wants to sell their assets? No one on the ask? The value of things drops according to the value of the dollar, and nobody wants to sell, and accept payment in a depreciating currency. No black swan needed, however when we pass the reversal point, the shrinking the dollar no longer raises asset prices, (more dollars to buy a share). Now the Treasury is going to reduce the size of their offering and that should take pressure off yields, keep your eye on that. If rising yields continue through reduced supply at auction that would be the first sign of real deflation.

Can’t know for sure, but fears of price inflation might cause Fed to try to tighten causing people to flee all the zombie stocks out there. A lot of companies went down 70 – 80% in 2020 but Fed and Congress stopped it dead in its tracks. Can they repeat that? Hard to say.

Fat Chewer,

In terms of consumer prices, there are always some folks who push the deflation monster, with an agenda to agitate for lower interest rates and more QE. This BS has been going on forever. In my entire life, there were only a few quarters of consumer price deflation, and it was so mild it wasn’t even noticeable, amid all the inflation coming before and after.

If they’re worried about deflating asset prices, they have a point, they should deflate. They’re ridiculously high.

Commodity prices are very volatile, if you look at a 25-year chart, and they tend to come down after a spike. That’s just how it happens. That’s not necessarily inflation or deflation but just volatility.

If someone drags out demographics to explain deflation “later this year” or “next year,” they lost all credibility and I stop reading. Demographics play out over decades, not this year or next year. And the millennial generation is huge, and they’re now moving into their prime time.

Wolf-thank you (as always, thank you!) for pointing out one of the great mental conundrums of our age-that demographics (just one among many planetary forces) play out over decades while current economic beliefs/actions appear to squeeze most things-economic or not-through the lens of a next quarter’s share value…

may we all find a better day.

The millennial generation is mostly still living at home, around the world, not just here. They seem prosperous because they live at home, but most don’t make enough to move out. This and the retirement issue is the pressure towards deflation.

Just yesterday, someone told me about someone he knows, who bought an old school bus to live in, which he is parking on family land. The guy has a good enough job but doesn’t want to be house poor. These are becoming common stories.

Which is generally illegal, by the way. Most counties have adopted the same codes, which make residing in anything but an approved building with an occupancy permit against the law. One call from the neighbor and no more school bus living on that property.

DC,

In the south you don’t have to go too far out of town to be in the sticks. Besides, even in California, they have passed new laws allowing other dwellings to be built or placed on single family house lots.

The guy with the school bus is putting it on a multi acre lot owned by his family, nobody will care or notice.

Saw the Wall Street shills at 6 AM on CNBC this morning just for laughs. They said CEO pay actually went up during the pandemic. The “peasants with pitchforks” are going to get mighty restless when they find this out. Right now they are busy spending their stimulus checks on something to keep them happy and solvent for another month or so, until it runs out.

March annual inflation was 2.6% surpassing a previous Fed target of 2% annual inflation. Annual food inflation was reported as 3.5%. Energy costs rose by 13%. Transportation services were down -1.6%. Apparel was down -2.5%. Used cars and trucks up 13%. Medical care services rose 2.7%.

See also the U.S. Bureau of Labor Statistics Consumer Price Index Summary.

Shipping cost to deliver blu ray movies from Amazon UK/Germany to USA:

Pre Covid Shipping charges

1 blu ray – 3 pounds / 3 euros

2 blu ray – 4 pounds / 4 euros

Now

1 blu ray – 13 pounds /19 euros

2 blu ray – 19 pounds / 24 euros

It’s not inflation. It’s an investment.

postage from uk to the usa using royal mail went from £14 to £19 during the pandemic so someone is on a winner there. The amount of missing items went up about 400%

This is only indirectly related to Wolf’s story, but it’s related to supply and demand and trucking costs for sure.

I know a fellow who needs to relocate his family from LA to northern Idaho and the one-way rate for a UHaul truck (I don’t know what size, but probably a larger one) is $7000.

A serious ouch!

UHaul truck rates are affected by destination….. “Everyone” wants to move to Idaho… or Texas…. and, as a result, the inventory ends up where people want to go, not where they want to leave. This leads to higher rates to the destinations in demand and lower rates to those locales where people are leaving. This helps UHaul reposition their inventory by renting the same truck for a move from ID to LA for $500.

To give you an example: When I moved my Mom out of FL to IL several years ago, I rented UHaul’s largest truck (not that I needed it – that’s what they gave me… I had rented a smaller unit and they “upgraded me”) with a car transport for…… $350. To go the other way would have been $3,500 for the truck alone.

Yup, I’ve had the same thing happen with cars. I was driving from a place that had too many rental cars to a place with too few, got a one way rental for like $24 before taxes and fees.

Our neighbors just moved from central California to Nashville. They found it much more economical to [fly or drive] to Arizona and rent a U Haul truck, drive it to California then on to Tennessee. ‘Demand pricing,’ I guess.

You could buy a secondhand straight truck and resell it in Idaho for less.

The Fed greenlighted (legalized) inflation. To what degree is that just being used as an excuse in many sectors to follow up and increase (tax) prices and boost profits?

Ok, purchasing power of the dollar rapidly dropping, bottlenecks, pandemic shifts, stimulus booms, front running tariffs, negative real rates, hedonics are contributing to but seem to leave plenty of room for greed to be inserted into the stinging swarm of sticker price shocks.

With this surge in shipping and all these trucks rolling along the superhighways its time to stop paying people not to work, and tell the freeloaders to get off their sorry a$ses and take one of these truck driver positions that I see advertised on nearly every truck that passes by.

In fairness, I don’t trust the average freeloader to sweep floors, much less drive a truck that weighs 200,000 pounds (with the trailer).

I see enough of these idiots driving like maniacs in a car, I shudder to think what it would be like if they were driving trucks.

I agree with you.

In the US, OTR trucks are limited to roughly 80,000 pounds, including trailer and cargo. Still a lot to put in the hands of someone of questionable trustworthiness.

Heavy hauls take a lot of permitting, and those drivers are MUCH more experienced.

Senor Mike,

Preface; I vaguely comprehend transportation logistics (driving bizjets is my forte).

Here (Pacific NW) it’s common to see 105k lb. placarded trucks that have mucho more than eighteen wheels. A series of air engaged suspension (& air bagged) wheels available to augment load dispersal.

Most aggregates haulers (gravel, sand, and cement mixing on demand rigs) are multi wheel (between ft axel & drive wheels) augmented.

“Takeoff’s are optional, landings are mandatory. Plan accordingly”. – unknown

Yep, that’s the thing that I don’t think a lot of people understand when calling for WPA type projects for our unemployed today. The men of the 1930s and the “men” of the 2020s are not the same, not in trustworthiness, not in work ethic, not in honor, and not in skill.

SC

You are talking about C-Suite types and the board of directors no doubt.

Also all those lazy shareholders who refuse to get jobs !

Always remember….investing isn’t really work !!!

Everybody must work !!! No exceptions !!!

US labor participation rate has been declining for decades and is now is at about 61.5%.

Labor force participation is defined as “the sum of total number of employed persons and unemployed persons looking for work in the United States as a percentage of the working age population.”

Upshot is that nearly 40% of people of working age are not presently working (and this excludes homemakers, retired, or students).

Pandemic and $trillions in stimulus and handouts have of course worsened the labor force participation rate.

Many people are doing quite well these days without a job what with mortgage/rent/student loan moratoriums, unemployment cash, stimmy checks, etc.

Employers report that it is in many cases difficult to get laid off employees to return to work, or to hire new workers.

I heard anecdotally that whereas pre-pandemic Uber/Lyft drivers were plentiful, today there are long waits (of course depends on locale) to hire one of their cars.

When increasing numbers of people say “take this job and shove it”, or think they can replace a productive regular job by day trading or speculating in Bitcoin (or simply snoozing on couch courtesy of entitlements) then we are screwed.

Services in future will likely be spotty or not available, and goods are not going to be supplied to meet demands– whittled down work force is not up to demands.

This can be both inflationary and ruinous to the economy.

Yeah….well maybe the wage slaves have had enough.

Maybe folks are not going to work themselves to the bone so others can have a cheap cheap cheap hamburger or cheap cheap cheap ride.

Maybe some free rides are over.

Does the workforce participation rate include the self employed or full time gig workers on contracts?

Self Driving Trucks???? No way. One of the great security threats after 911 was for a terrorist to take control of an 18 wheeler fill it with gasoline and plow into a traffic backup on the local Beltway. And now you’re going to allow self driving trucks???? Who are you kidding???!

Good point! “Better” than a drone. An 18-wheeler cruise missile.

Money poured into something can get almost anything done. If government decides to pump a trillion into self driving infrastructure they probably can make it happen. Maybe not everywhere, but say 90% of the easy locations. Backwoods locations might still need a driver.

Stock Market crashing today. I wonder why???

Sure it is…..

I’m hoping for a drop to 5k.

Now THAT is my kind of crash !

Chauvin verdict due tomorrow AM

Rev. (Jessie) Jackson is MIA.

Al (Sharpton), Maxine (Waters), BLM (and other grifters

will profit either way.

“Never waste a good crises”. – Machiavelli

“The urge to save humanity is almost always

a false front for the urge to rule”. – H L Mencken

i don’t know why Mr Jessie is MIA but it’s all kinda beneath him now and what he dedicated his entire LIFE to. i wonder if sharing a stage with BLM would make his lunch come back up because as a life long wanna-be radical lefty, i’m completely OUT of this shtick. it’s disgusting how sisters are emulating the white feminists and using the bodies of our brothers to get more crap in america.

it’s why i go back to loving the brothers i can one at a time, even if it remains in the 5D. i heal where/when/how i can. nowadays all it takes is being genuinely NICE to a brother and he crumples and gets confused.

i recant EVERYTHING.

i’m not saying Mr Jessie did that. i’m saying: I UNDERSTAND WHY, if he did sit it all out on purpose.

it’s grotesque and blood thirsty, not to mention manipulative and exploitative.

x

Sam-as long as you’re at it, another (paraphrased) aphorism:

“…tyranny stems from an overabundance of virtue…”

-thos. jefferson

(But then again, ref: the great Mencken, do we not all quote aphorisms from a place of our own perceived virtue?).

may we all find a better day.

KL,

The poverty pimps are not MIA, they are pimping more than ever, and it has never been easier. Corporate America, pull your skirt down.

but PETUNIA-

that’s my recent horrifying epiphany:

the entire SYSTEM is now ONLY about pimping its increasing poverty and “investing in its own distressed properties” to make a buck on the breakdown, taking a growing cut, or buying back own shares (drinking own urine/eating own gangrenous foot for nourishment).

but what started out as a gangrenous toe with poverty, has fully spread to our entire raison d’être: the private equity / investing in distressed property idea of “disaster capitalism” making money off its own downsides and social decay, existential fears (climate change or germs and dying in general), and internal spreading cancerous rot (opiods and the reason camels are getting through eyes of needles easier than the entire Sackler family will enter heaven).

basically, none of us are clean. to paraphrase our beloved Vonnegut who is always here with us with his “…and so it goes,” he also said people who survive often do horrible things to survive, and doesn’t that make you question who’s left next beside you and if they’ll ultimately eat you if it comes to it?

so we’re all suspect, i figure. i have plenty to atone for now/can’t worry about the cleanliness, or lack thereof, of anyone else right now.

x

Yet Dogecoin is now worth more than Ford. You can’t make this up.

Cue up; “Money for nothing.” – Dire Straits

“The video was one of the first uses of computer-animated human characters and was considered ground-breaking at the time of its release.” – Wikipedia

Cutting edge concept adapting to a new medium (MTV)

What is “cutting edge” about Dogecoin?

I think I’ll take the day off working tomorrow in the DC Swamp. Getting my Covid-19 vaccine tomorrow in Haggerstown Maryland . I’ll be 60 miles from DC. Good timing. I’ll be out of dodge.

MEANWHILE BACK AT THE RANCH:

today Wolf is meeting my dearest friends today, Corky and Basul, and Our New Underground is officially beginning. now that the former underground of San Francisco freaks has gone completely Hollywood and are now the ones obsessively following the rules and dutifully canceling the 420 celebration at Hippie Hill so we can all be eternally Safe, this New Underground being born is a group of outsider white guy businessmen, and myself.

stay tuned for the continuing adventures…

(insert maniacal cackling laugh here)

who KNEW???

x

I put in 45 years as a truckdriver 1964-2009. REading this, the tought occurred to me, I don’t think I’d want a truckdriver career these days. 30 of those years as an owner/operator. I think the ELD killed that career. We used to put in 16 hour days routinely and you learned quickly how to fudge log books and avoid scales and the DOT. My last 20 years was as a city driver, lots of store deliveries, but I always enjoyed physical work. Started out with prep school and then college, but I dropped out because I thought I’d like truck driving, which I did. My family never did approved, but the early years were great fun, the camaraderie, the adventure of seeing the country and being my own boss many years had great appeal. We were “living the dream” as they say. I didn’t want to work in an office. Nowadays the fun has long gone, it’s all too serious and regulated. You can still make good money if you’re experienced and have a good record, a younger buddy of mine makes great money at Fed Ex, sold his truck. Got a lot of stories I can share with my fellow old timers, boy, did we work hard. I think that’s all gone now, I wouldn’t advise my sons to do what I did. They don’t have the slightest interest in truck driving.I wouldn’t advise myself to do it either even though many of those years I thoroughly enjoyed my job.

Thanks for an insider view of trucking industry as a career and your view on today’s truck driving scene, and why you wouldn’t want your sons to follow in your footsteps.

That said, if there are more young prospective truckers out there that are turned off by the prospects of hard and demanding work in a controlled and regulated industry then we looking at potentially severe shortages of qualified drivers to schlep and deliver all the goods that people want and need.

When public and companies get more worried about supply chain shortages and dislocations and high shipping costs, then I suspect trucking industry will move mountains to make automated trucks work in a larger scale.

H b Sober – Funny, I can say almost exactly the same thing about a career in hardware/software design. It was a lot of fun and hard work. Now it looks like it sucks.

Dogecoin is a lapdog compared to Wolfcoin!

And actually, it seems you can make this stuff up. Satoshi n did. And see it attain high moronic appeal and dollar value. I knew some guys in Dallas who started a self-described “bogus cult” in 1979 as a joke. It spread all over the place and is still around and profitable for them, somebody’s not working very hard for their money to be blowing it on this crap. Great parties though. Who knows how long people will buy dogecoin? A few years ago bitcoin was a couple of thousand bucks and looking moribund, after a big run up. And may again. But some secondary and tertiary crypto products will likely flourish. I’ll do a small amount for the feeling of not being old and stupid and set in my ways, keep on stacking for the same reason, one or another has to be right. It’s better than casinos, which are for tourists. Just leave your cards at home and prelose the cash in your pocket. And you can win, sometimes. There’s ultimately nothing to stop the development of drone delivery trucks, nor reason to believe that they wouldn’t be much safer than organically piloted tractors. Interactive speed control with neighboring drones could ameliorate the bad effects of inattentive and unpredictable four wheelers.

Interactive navigational flight control equipment is a recent FAA upgrade requirement for general aviation aircraft, expensive but trending cheaper and an equivalent ground based system would only have to operate in two dimensions. The description of real life trucking conditions above from grungy is horrifying. Somebody starting out sounds bad, like those regional air carrier copilots sleeping in lounges because they couldn’t afford a room between flying days a few years back. The one time I drove a tractor trailer I was praying that all other traffic chose other places to be and that I would never have to turn or maneuver. It was harder than flying a plane and i suck at that too. If the trucking companies aren’t careful they’ll suffer a labor backlash, and they are a vital industry that begs for government oversight in any democratic administration. A few recent republican ones too, not much difference anymore. The Fed can monetize debt, but it can’t grow cabbages or get them to market. The government can, by proxy. When voters get hungry, bureaucrats will tell food companies to send the goodies, and if they roll in on automated trucks so much the better.

April 20th, 2021 Fed Inflation articles:

Reuters article – Fed Powell has sent a letter to Sen. Rick Scott (Fla R), states “Too low-inflation harms American families and businesses.”

CNBC article – Procter & Gamble will raise prices in September to fight higher commodity costs

CNBC article – Coca-Cola CEO says company will raise prices to offset higher commodity costs

Yahoo finance article – They aren’t the only consumer-product manufacturers to warn of price hikes. J.M. Smucker has done the same. And as The Wall Street Journal reported last month, Kimberly-Clark, maker of Huggies diapers and Scott paper products, said it plans to raise prices across much of its North America consumer-products business to help counter rising raw-material costs. Cheerios maker General Mills also said it will raise prices to help offset higher freight and manufacturing costs in addition to rising commodity prices.

Monday, Forbes reported that the monthly producer price index issued by the Bureau of Labor Statistics shows prices rising increasing at multiyear highs. The index for processed goods increased 4% in March — the biggest gain since August 1974. For the 12-month period, unprocessed goods climbed nearly 42%, which was the biggest increase since July 2008.

“We’re raising prices because the other guys are raising prices.” — That’s how it starts.