Commercial bankruptcy filings drop to lows last seen in the loosey-goosey days just before the Financial Crisis.

By Wolf Richter for WOLF STREET.

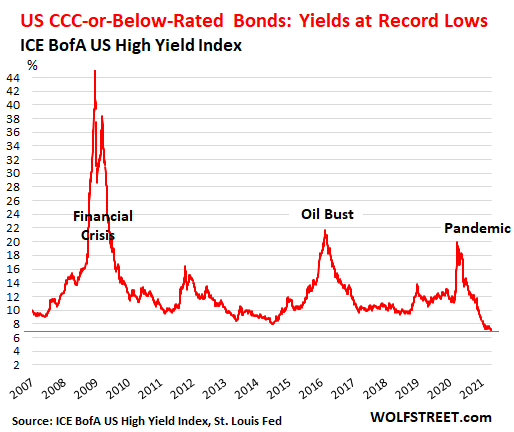

The yields of the riskiest category of junk bonds – those rated CCC or below, which range from “substantial risk” to “default imminent with little prospect for recovery,” according to my cheat sheet of corporate bond ratings – have dropped to record lows, despite the enormous operational issues these companies face and despite the high probability that they will default and restructure their debts or liquidate, thereby offering investors a great opportunity to get crushed.

The average CCC-or-below rated junk bonds have yielded between 7.09% and 7.16% over the past two weeks, a new all-time record low. During a crisis, these companies are among the first to default. They have negative cash flows and fund their operations by issuing ever more debt, and when investors stop throwing money at these companies, it’s over, which happens massively during a crisis. But not this time. What crisis?

When bond yields fall, the prices of those bonds surge, and investors that bought those bonds in the market at the current yields paid a premium over face value.

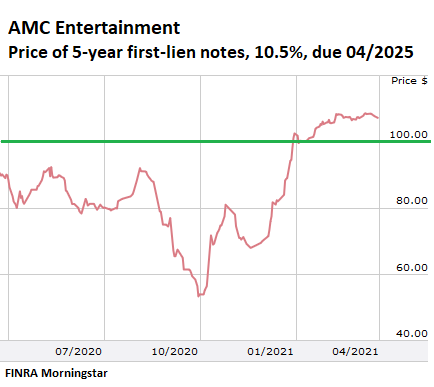

For example, AMC Entertainment, that has been talking about how it is trying to stave off a bankruptcy filing, issued $500 million of secured notes in April 2020 to give it more cash to burn, as its theaters were shut down, and as its revenues were collapsing. The bonds, rated CCC by S&P, have a coupon interest rate of 10.5% and are due in April 2025.

The bonds immediately took a beating, prices fell, and the yield rose, reaching 30% in October last year, with the bonds trading at 54 cents on the dollar, as a bankruptcy filing was being discussed. In Q4, revenues collapsed by nearly 90% from a year earlier.

But then investors shoveled more fresh money at the company that it could burn, and they chased after its existing bonds too, and the prices of the bonds surged and the yields fell.

Today, these bonds trade at 107 cents on the dollar, a premium of 7% over face value. The yield fell to 7.8%. When the bonds are redeemed in April 2025, if AMC doesn’t default beforehand, they will be redeemed at face value. Whoever bought them today at 107 cents on the dollar will get 100 cents on the dollar four years from now. That’s the best-case scenario. This is the price chart of the bond (via FINRA Morningstar):

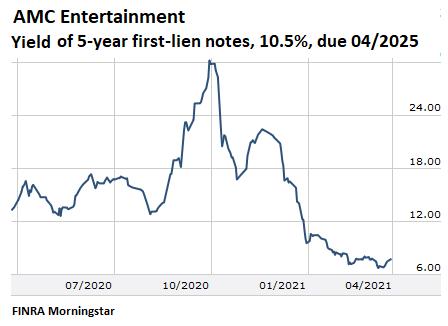

And this is the yield chart of the bond (via FINRA Morningstar):

This fresh money being shoveled at these deeply trouble companies, by investors that are engaged in a raging chase for yield, gives these companies more cash to burn. As long as a company has plenty of cash to burn, and plenty of fresh money from new investors to pay off existing investors, everything is hunky-dory even if revenues are near zero, and losses are sky-high.

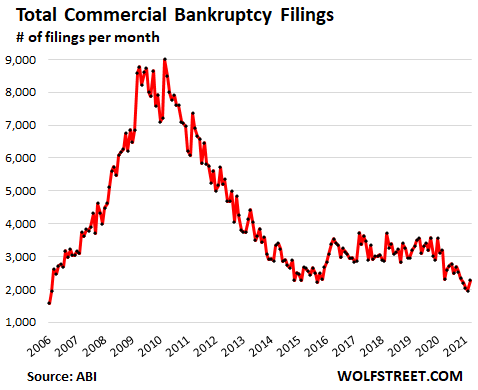

This is showing up in the amazing bankruptcy trends. Since the crisis began last March, as the Fed poured over $3 trillion into the markets and repressed interest rates all around, investors have piled into risk to get some yield, and they have doused companies with fresh money, amid ravenous demand for junk-rated debt, and bankruptcy filings during the crisis have dropped.

Total commercial bankruptcy filings under all chapters of the bankruptcy code fell to lows not seen since the loosey-goosey Good Times in 2005 and early 2006, just before the Financial Crisis. In March, there were 2,275 commercial bankruptcy filings, according to the American Bankruptcy Institute, down 29% year-over-year – after having been down 37% year-over-year in February, and 42% year-over-year in January:

Bad deals are made in good times, the old adage goes. And these are the best of times to make bad deals. The Fed has seen to it that this is so. The Fed has whipped investors into foaming-at-the-mouth yield-chase frenzy.

The risks turns into reality afterwards, when these companies, now saddled with records amounts of debt, suddenly find investors to be a little more circumspect and unwilling to take those risks at those yields, which turns off the money-spigot.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s Clown World, Wolf.

and yet I’m in process of doing 12% 1st position loan with 20%+ down

ON FLIPPER HOUSE

default = PLEASE I can make 20%+ then

What’s worse than a dumpster fire? A dumpster fire burning inside of a dumpster fire. When does this stop?

The only thing I can say about the bond market, and the crypto market, and the stock market, and the housing market in 2021 is that I have absolutely no idea what’s going on or what to expect next. I’m gonna stick to the liquor market where I can still count on the good old reliability of The Belvenie to be there for me.

Sir, I like the way you think.

No rate, no risk, no competition, bo bankruptcy,, tradable tokens that only gain value, unlimited spending, and unlimited profits. Thank our overlords for crafting such a perfect present.

I enjoy the Lagavulin as well as the Balvenie.

Hey, apparently some of the lowest volatility investments you can make is in buying stuff like proper whiskey and wine and putting them in a cellar. They pay neat returns along a nicely predictable curve.

I would probably just end up scarfing the lot, myself.

Where else do you get 40% and if you do it moderately you wont even get a headache

Hey char, up in the mountains I never get a headache from drinking, so store it low and drink it high must be the moral of the story.

TS & ex-Marcus

Kudos gentlemen.

I am sitting here with a Marnoch surrounded by the most important production units (distilleries) in the world and I can assure you there is enough product in store to supply any future needs you could ever possibly have, staying alive that is.

Slange!

What don’t people understand about the word ‘Junk’?

I assume you mean the consumer liquor market, not the funds-that-invest-in-whiskey market because in that case i would suggest you stick with AMC and ponzicoins

I thought I had read, right after the Robinhood/GME hoopla, that AMC used it’s new equity capital to upgrade the theaters and retire their bonds.

Petunia, that is correct. The stock sale will be used to buy back bonds and pay [unpaid] rent on idle movie theaters. AMC equity mania spilled over into the bond market via a capital raise.

Bondholders depend on the kindness of strangers, (stock buyers), the horse before the cart, so if stock buyers sell, there is no bond yield high enough to keep the company solvent?

Ambrose, I’m not sure I follow. The shares in the capital raise were already sold. AMC can do whatever it thinks is best for the comapny with the proceeds. Paying off debt seems reasonable.

What happens to shares outstanding is only important if and when AMC becomes profitable again, or is swallowed up by a streaming service company like Disney (shareholders’ best hope).

Petunia,

AMC has over $11 billion in debt. They’re drowning in debt. In January, they raised a measly $300 million in a stock sale. That covers their cash burn for a few months, and that’s it.

I have no idea how they will ever be able to deal with their $11 billion in debt.

Executives have been huge sellers of their AMC shares while they were high.

Now they’re hyping a future share sale, for which they’re trying to get shareholder approval in May. While executives are sellers of their own shares, they’re now hyping that share sale to the public. If AMC can sell 500 million shares at $8 a share, it would be $4 billion.

AMC lost $4.5 billion pre-tax in 2020. So that $4 billion in share sale won’t even cover last year’s hole, and that hole is getting deeper this year by the day.

In the four years before the Pandemic, 2016-2019, AMC lost $400 million combined. And post-Pandemic, the losses are much bigger. The proceeds from that share sale will be needed to feed their losses.

Well, and as part of the share sale hype, they announced they’d buy back their bonds at a discount. Hahahahaha… those bonds are now trading at a premium. But if the share sale fails, those bonds will suddenly trade at a discount, but then AMC won’t have the cash to buy them back.

BTW, buying back your own bonds below face value is considered a default and a debt restructuring and requires creditor approvals.

AMC is owned by a Chinese company.

Dalian Wanda purchased a majority stake in AMC for $2.6 billion, making AMC the largest theater operator at the time, according to a report from Reuters.

Chinese billionaire and businessman Wang Jianlin, who is a member of the Chinese Communist Party, is the owner of Dalian Wanda and is one of the country’s richest men.

I keep wondering if the CCP will bail AMC out or just let the U.S. investors in AMC take the loss in bankruptcy reorganization and then the CCP will loan AMC some money right when things are finally turning around in the world as covid subsides.

That is the long term plan that could be in works. lol

ru82,

Time to update your knowledge. Dalian Wanda has been dumping its shares, and its stake in AMC is down to 6.8%.

https://www.sec.gov/Archives/edgar/data/1411579/000110465921048386/tm2112373d1_sc13da.htm

Wolf,

Excellent incremental info…people really need to go step by step through transactions sometimes, in order to fully appreciate the madness implied.

Which raises the ancient question, “Who buys this sh*t?”

Maybe a 10.5% coupon looks good in a 2% world…but for a company with likely zero revenues for a yr (foreseeable even in April 2020)?

With $10 billion plus in accumulated debt?

And a wholly unknown pace of recovery once reopened?

Picking up dimes in front of a steamroller is just stupid.

Doing it blind folded is insane.

So insane that you always have to wonder if the G is involved somehow on the buyside in these kind of situations.

That makes perfect sense!! How that makes sense, I have no f’ing clue. Apparently it doesn’t matter because dogecoin is up 49, 000,000%. Why would anybody get up of their work-from-home, fat asses and pay ridiculous prices to watch another sequel of a rendition in a room of obnoxious people? The Fed just created the biggest f#ck up of all times…

BAC daily : Mar 18 high and Mar 25 low might be BAC backbone.

Anyone who buys this crap deserves to lose their entire investment. I unloaded all my junk bonds 5 years ago. Lost money every time I ventured into this territory. I got greedy. Bad for taxes. You wind up with a lot of short term income which is taxed at the max rate, and long term capital losses. You have to do your homework very carefully and find a company that is heavily discounted but has some good underlying fundamentals. I don’t have the time for that BS.

For anyone actively buying these, I’d agree. But, at least some poor SOB’s are getting these shoved into their 401k’s and/or pensions, without their knowledge. Gotta love derivatives and the like.

You need to review the holdings of your fund. Requires some homework. I review my BNY Mellon holdings once a year. If they start buying junk then I will unload the fund. Good ides to check their investment profile from one year to the next. Red flags are high level of redemptions, high turnover rate, high management fees.

I do agree, but, many probably most people are simply not capable of auditing their own investments (even if taught how). If they do notice a red flag, whoever they would talk to about it, might be able to slick talk them. Alternatively, their fund manager might claim it’s temporary and that temporarily it’s worth owning, but leave it in much longer until it bursts.

“Whoever bought them today at 107 cents on the dollar will get 100 cents on the dollar four years from now.”

I would assume that AMC bonds are being packaged into CDOs. No sane investor would buy this hollow shell of a company for his personal portfolio.

If they default I can’t imagine there are any assets to liquidate, unless they are getting in on the NFT craze.

You can rent out an entire movie theater in LA for $100 if watching something older, or $200 for a first run film.

That’s as good as it gets currently for an industry that was dying before Covid came calling.

Investors in 1995

Fundamentals, PE ratio, price, growth, market, intrest rates and DD

Investors in 2021

Apes buy AMC. Guarantee bananas. Buy lambo. Stonks…Go…Up only.

Don’t forget howzing. It only goes up too.

And cryptos!

I just came back from Stonestown in Daly City. Guess what’s opening soon? A new Regal cinema.

Weren’t bridges the hot thing just a few years ago?

The Century theater nearby is also renovating. It’s insane out there.

It might make sense. Renovate and build as much as you can. Either way most existing theatre chains will have to default. Rather than repossessing a building that can serve no other purpose on usually B grade or less commercial land, that has fallen in price (the land), they might get their debts cancelled and keep everything. Many theatere chains might end up with little to no debt and a renovated building. After that we’ll see if they can stay afloat.

I haven’t seen the inside of a movie theater in 20 years. Almost forget what they’re like.

MiTurn, really good films should be enjoyed in a proper arena, I would claim, to get the full effect. E.g. something like ‘1917’, released shortly before the lockdown.

Yeah. I mean, what would a movie be without the slob behind you loudly crackling the wrapper of his high fructose corn syrup laden snacks, made worse by his obnoxious smacking and honking as he gorges himself? Or the talking from the kids whose parent(s), for reasons unknown to mankind, thought it a good idea to bring them to an R-rated film? Think I’ll pass….forever….

DC, my own experiences are not similar to those you relate.

Saw that movie”1917″. I’m a WWI buff. loved that movie. Last movie I went to.

Mt

40’s movies had great stories, great actors, great scripts. Lousy sets, lousy colours, lousy special E’s.

20’s movies have got great special E’s.

Just sayin’

The Fed thinks it can encourage people and business to take out more debt if it reduces interest rates. But that hasn’t worked. The Fed should instead find ways to increase wages for working folk and dramaticlly reduce corporate profits back to historically normal levels. If it succeeded in doing that, demand for debt would rise…ZIRP or not. In fact ZIRP itself is preventing wages from rising and profits from falling.

What are you talking about? Businesses are taking on more debt and investors are willing to take on more risk as demonstrated by this article.

There’s crazy demand out there which is why yields are at a record low.

Bank lending is down, no? I’m going off Mish chart. And borrowing for buy backs isn’t lending for investment like a normal lower profits company might have to do to expand and actually do invest for real..it’s financial engineering. Am I figuring wrong?

Bank lending is just one source of funding though. Borrowing for buybacks is still borrowing.

I mean, there’s a reason why these companies decided to tap the capital market as opposed to their bank credit lines.

timbers,

“bank lending is down”

The big 4 banks — which is what this report was about — represent only a small part of total credit. For example, the biggest mortgage lenders are the shadow banks, Quicken Loans on top, and they don’t hold the mortgages, they sell them to the GSEs, as do banks, and none of them are included in these figures.

All banks sell loans: mortgages to the GSEs; auto loans and credit card loans are securitized into ABS. Corporate loans are securitized into CLOs or CDOs or are sold to loan funds. In addition there was a huge boom in bond issuance, where companies used the proceeds from these bond sales to pay down their bank debt. The Fed has been buying PPP loans. Etc. Etc.

The only thing you can gingerly conclude from the big 4 loan data is that the banks decided to derisk their balance sheet by capping the amounts of loans they hold, and by allowing deposits to build up.

In addition, commercial and industrial loans spiked early on in the crisis as companies took out huge amounts of cash so that the bank couldn’t cut them off. Most of this was done on their revolving lines of credit. These companies have since paid down those lines of credit since they didn’t need that cash.

So C&I lending now is UP 8% from February 2020 before the crisis, but is down from April and May during the peak of the spike during crisis. Folks need to quit misleading folks about this:

This is where the banks got caught in GFC, holding pass through mortgage loans? When you’re the middle man in anything, you get cut out of the deal. Does Quicken sell directly to GSEs? Makes you wonder what is the future of these banks, besides frontrunning the muppets, and the future of the Fed. Banks no longer originate loans? They underwrite stock deals. Isn’t that the issue?

Ambrose Bierce,

Yes, Quicken and the other non-bank mortgage lenders sell directly to the GSEs, same as deposit-taking banks. And they securitize mortgages that they cannot sell to the GSEs and sell them to investors. They all make their money off fees, not interest earned.

T

Low interest means loads and loads of easy money floating about.

It’s got to go somewhere, anywhere, please, find me a return, any return for G’s sake.

The interest rate is everything in money.

It’s the same with countries and businesses only they’ve got so much they need to dump it anywhere safe and what’s safer than US treasuries.

Bump up rates and the whole world will change for everybody.

LOL! Wow. Those AMC bonds won’t be worth 50 cents on the dollar a year from now.

“drop to lows last seen in the loosey-goosey days just before the Financial Crisis.”

Prescience?

Since I haven’t been buying any of these virtual things, like Tesla, AMC, bitcoin, dogecoin, and making money hand over fist, but instead holding only real things and continuously losing money, clearly I am the one who needs to be classified as insane.

WES, you need to spend some quality time on Stocktwits and Wallstreetbets. That will help you see the light…

Another good data point to support the market bubble prediction with all the makings of the next great collapse in front of us, the unknown quantity will just be timing at this point.

However, with that said…all the action that FED has put in motion and continue to support down the road with almost no consequences or accountability, certainly not from our politicians or POS Jay Powell. Calling or thinking about the next downturn or crash is like betting against GOD, or feels like it. How do you predict or try to understand something in a sane logic when the dominating force march to the beat of its own drums and create its own reality? Case in point, market start crashing again now, what would stop the FED from printing and flushing the market with another $3T – $5T? That straight line upon their balance sheet is comical enough but doesn’t seem to have any caveat for their action.

Agreed 1,000,000%. Seriously what is stopping the FED from just going HUGE rather than largess (literally). What debt ceiling? Gov’t being the buyer and seller of government debt. What is stopping them from just building a bridge from one financial crisis to the next etc… Or as Wolf would say the next WTF. I believe the swag name for the team is the plunge protection team. The US government will not allow another stock market meltdown

The Overton window of financial acceptability has shifted so far into Neverland even from 2008, no one flinch at the Trillions when at one point billions was such a big number. Remember how adorable it was back in 08 when $800B to “rescue” the market was considered once in a lifetime that came with plenty of pearl clinching, not to mention this was handed out over years. Nowadays, FED has adopted the never ending hold my beer strategy…last time we’re into the B over years? This time, trillions in weeks, next time quadrillion in matter of minutes.

ND

Masters of the Universe, indeed.

Unless it could be proven in court that Quantitative Easing might be an illegal procedure, in which case, people could end up in jail like any other crooks. The charge might be “colluding to deceive” and it could apply to specific individuals involved in the process. If there were any ‘hot’ investigative journalists around nowadays, they could possibly make a case. Like the Watergate guys

Now wouldn’t that be mega-fun.

The Mkt cap to GDP is now over 200% record! Margin debt is at record. So is the the M2 supply but velocity of money is record low. velocity of money towards assets is high!

When the Economy fails to catch up with overvalued, over hyped and over bought mkts probably with 10-12 months, the DOWN cycle will start. Covid 19 is here to stay along with break through infections with multiple variants!

I am raising ( by reducing my stock portfolio) cash but still invested in Div paying ETfs+ Stocks. I have calls mixed with some puts to ride with this ‘surreal’ mania.

I’m really upset ZH is featuring a real estate listing of an Uninhabitable Bay Area Shack Listed For $575k.

Because the Uninhabitable Bay Area Shack in my city is only $180K (reduced from $199K).

Try harder, I guess.

Isn’t it time to start all over from the beginning again? Forgive all debts (treasuries, student loans, mortgages etc…). Issue a new currency, call it American Pound if you will. And no, the dollar can’t be exchanged for the new Pound or anything else for that matter. Have the currency devalued in such a way that all manufacturing jobs will come back to the U.S. You know, “cheap American labor”. Then it will all be jobs jobs jobs…sure some people will loose wealth but it sure won’t be the 40% of Americans who can’t afford a $400 emergency. I’m also sure the 60% are not the ones who will be rioting in the streets (i.e. retired grandma, grandpa, tech bro, wallstreet bankster, gov bureaucrat etc…) . This seems to me the easiest and most peaceful way to this avert this nightmare that everyone knows is coming.

I don’t think you need issue a new currency. The financial markets are going to collapse anyway, it doesn’t much matter when, so lots of wealth will disappear then. Put in progressive taxes to take more wealth off the top rungs crowd. Create a national jobs program and achieve full employment. Intellectually, the path forward is fairly simple to understand. We’re still in the ‘greed’ mode. But when fear enters the room and turns the lights off, panic selling ensues, demand drops and so too do prices. Hudson’s debt deflation model right in your face.

Why are junk bonds yield so low?

Simple, the stocks of the underlying companies are selling at prices that are beyond imagination; thus, selling stock is a cheaper alternative to raise money than selling more debt.

Now if AMC ‘s stock was selling at 1 instead of 11, the possibility of stock secondaries would be closed and its junk bonds would be yielding double digits or more . But this is very unlikely considering that the stock of Hertz was trading above 2 even in the final stages of bankruptcy .

Junk bond yields will soar when and if the stocks of zombie and super overpriced companies correct to realistic levels. History has taught investors that this will eventually happen, the question is just when.

Wolf,

I urge you to continue to do these sort of posts (corp borrowing interest rates by bond rating) even though they are relatively under appreciated (to judge by number of comments).

These posts are crucial because,

1) They provide a look at the most marginal of corporate borrowers, who will be impacted first and most dramatically when the ZIRP madness subsides even a little, therefore providing…

2) An early warning system for the rest of the mkts.

3) Also, discussion of highly distressed companies provides an insight into the mechanics of bankruptcy restructuring, which too few people really understand. But will become a topic of massive importance with the end of ZIRP madness.

I just ordered “When Money Dies” from Amazon. Need to put some more money in J Bezos pocket, to make up for the fact that I’m no longer shopping at Whole Foods, nor reading that rag of a newspaper he owns the WP. Want to make sure he continues to live in the life style he is accustomed to.

Wolf,

Excellent article and has given me a much better perspective of the precarious financial situation the country faces, and also to world markets who are buying these junk bonds too, and buying these stocks at unreal levels.

I can’t reconcile what top financial experts like Jamie Dimon, CEO of JPMorgan and many others say about a economic boom when I read your posts, and hear of all these crazed stories of crypto-mania, irrational exuberance of buying stocks on any news, WallstreetBets insanity, Fed spending sprees, etc, etc.

“Dimon says vaccine rollouts, deficit spending, post-pandemic euphoria and a dovish Fed will provide an economic ‘boom’ that may last until 2023. … Spent wisely, it will create more economic opportunity for everyone.”

They all seem to indicate that the infrastructure bill passing will create a immense boom like we never seen before, like FDR did for the Great Depression.

I’m asking if anybody here if they can reconcile these beliefs that the economy is recovering, while all these unseen underlying transactions occur? – especially a feeling that these 4 variants of COVID will cause a 4th wave of destruction.

Too me it seems you can’t have it both ways, a continuing Fed backstop, and the promise of a economic boom when 40% can’t make $400 dollar emergency.

I see today as more unreal circus of events like 1999 and 2008, and how in the heck can institutions begin to accept made up crypto currency backed by “popularity or air” make such a economic boom possible?

Am I missing something? – being in computers all my life makes my mind say – the “abort module” is about to rolled in, and all will collapse, very hard.

It seems like Warren Buffett is raising more cash, buying back shares and positioning for a crash.

All opinions are welcome.

Excellent article, Wolf.

Your article accurately crystallises how dead companies are being kept artificially alive.

The search for yield, sustainable yield, is extremely difficult in these times.

So investors are prepared to risk investing in junk rated companies which in normal times would be bankrupt and kaput.