Getting massacred on the edge of the stock market.

By Wolf Richter for WOLF STREET.

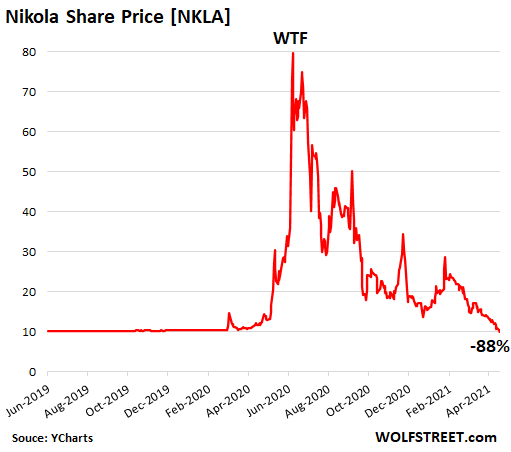

Nikola, one of the most prominent startups in the EV space, went public amid immense hoopla when it was acquired by a publicly traded SPAC in early 2020. Its shares then multiplied by eight in no time at all, to $80 a share, to form one of the most infamous WTF charts of the crisis.

But today, shares fell below the $10 level at which it had been acquired, having now completely unwound that infamous WTF spike. As of today, shares have plunged 88% from that spike and closed at $9.65 (data via YCharts):

With all these SPACs, there has been enormous hype, often involving celebrities. But when the SPAC hype-boom coalesced with the EV startup hype-boom, the fireworks were spectacular, such as with Nikola which collapsed amid a variety of allegations of “deception.” In its aftermath, GM scaled back its super-hyped deal with Nikola, and the whole thing now looks like a mirage.

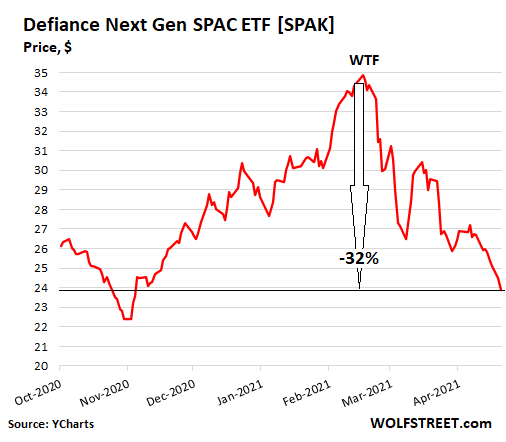

The SPAC boom has been unwinding more broadly, thereby unwinding another spectacular WTF chart of the crisis, the Defiance Next Gen SPAC ETF [SPAK], which tracks SPACs before and after they merge with a target company. The ETF has plunged 32% since February 16, and has now fallen below where it had been when it was launched in October 2020:

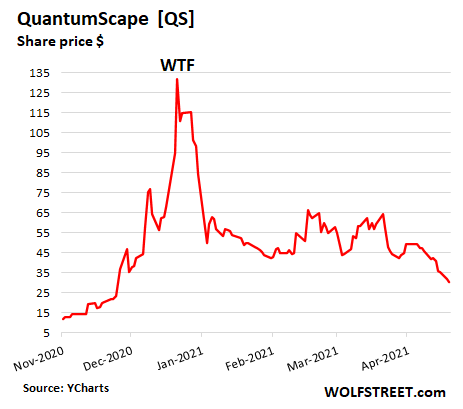

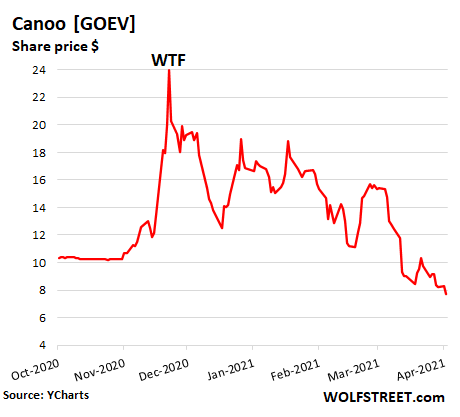

The EV startup hype-boom greased by the SPAC hype-boom produced these spectacular results:

QuantumScape [QS], which develops batteries for EVs, was acquired by a SPAC in August last year, and shares skyrocketed to the WTF moment of $132, before collapsing by 77% to $30.60 today.

Canoo, an EV startup that was acquired by a SPAC and now trades as [GOEV] has collapsed by 69% from its WTF spike in December that had reached an intraday high of $24.90. Today it closed at $7.65.

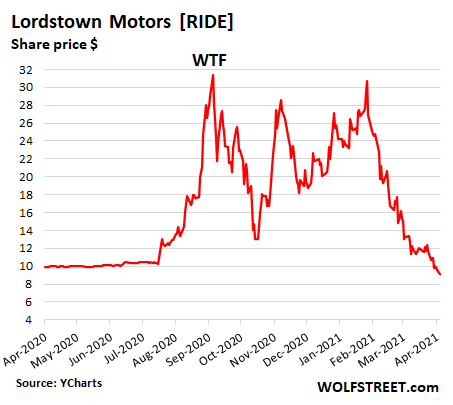

EV startup Lordstown Motors [RIDE], which was acquired by a SPAC in the summer of 2020, is another WTF chart gone awry, with shares having collapsed by 71% from the peak in September, to $9.20 today, below the price at which the SPAC traded before it acquired Lordstwon.

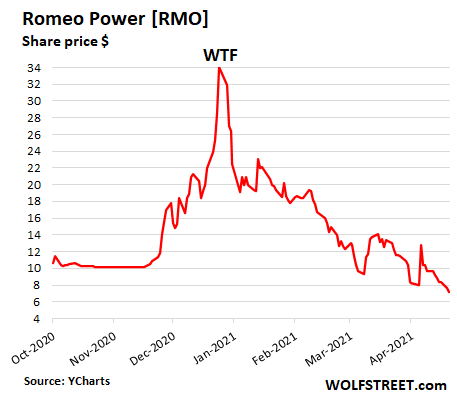

Romeo Power [RMO], which is developing batteries for EVs, collapsed by 81% from its WTF spike in December, to close today at $7.21 a share. The company is now entangled in a securities fraud lawsuit seeking class-action status.

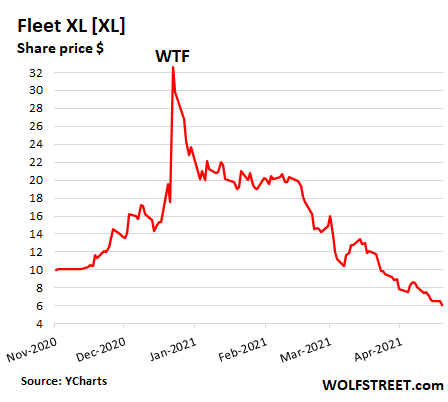

XL Fleet [XL], which is developing EV drive systems for fleets, was acquired by a SPAC late last year and then soared to a WTF peak of $35 before collapsing by 82%, to $6.13 today.

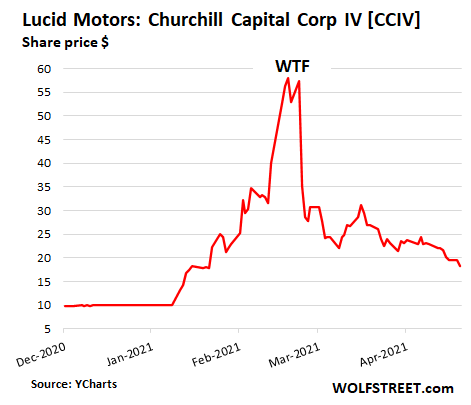

Lucid Motors, which is going public via a merger with the SPAC Churchill Capital Corp IV, trades under the SPAC’s ticker [CCIV]. Those shares have now collapsed by 71% from the WTF peak in February this year.

There are a number of other EV startups being currently hyped to the public while they’re being acquired by SPACs.

Faraday Future is the most infamous one of them. The company was founded in 2014 by a Chinese entrepreneur who filed for bankruptcy in 2019 in the US to deal with $3 billion in debts. The company, which has failed in everything and never sold a single car, plans to go public by being acquired by the SPAC Property Solutions Acquisition Corp, at a $3.4 billion valuation.

Faraday is now being hyped all over the place. But buying those shares is only attractive if you know that they’re going to be whipped to another silly WTF moment, which is the moment to dump the shares into the lap of some befuddled greater fool that thinks that the share price could multiply again before it’s time to dump them.

But Faraday would be a great opportunity for potential investors to dig in their heels and go on buyers’ strike, and let someone else get crushed trying to bail out the current investors, promoters, and creditors. Let them eat cake.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Got to make that money..cook the books, keep people in their chosen career paths, you know?

There is a natural rate of return, markets are intelligent, doing something counts, even if that something, is less than nothing.

This is the fate of every asset that fails to eventually deliver an income stream. It might take 5, 10 or 20 years, but eventually it’s going to have to deliver income or it will crash and burn.

We’re hoping we will live long enough to see how the internal conflicts of the Elites finally meet their destructive habits.

It could be the rise of China,Asia, Russia, parts of the Middle East & Latin America in their trading powers will chink the armor of the Elites one too many times

– or- it could be unforeseen forces that shall cause such intense inner conflict wherein we will witness “how hard the mighty do fall.”

Elites these days don’t have internal conflicts. They have nothing inside. The conflicts have turned into echo chambers.

Many blue-chip stocks are no better then these crap SPAC companies, only share buybacks drive up the value. ZeroHedge had a story on how major communications companies like ViacomCBS, Comcast and AT&T hadn’t made a dime in profits over 5 years if you subtracted the corporate debt they loaded on to finance share buybacks against their net profits. AT&T’s massive investment in DirecTV is pretty much worthless. On March 26, 2021, ViacomCBS shares dropped 27% because Archegos Capital had bought that company’s shares with money it borrowed and couldn’t pay back. That is just about what Bernie Madoff did, but from duped individual investors, not financial institutions. In one form or another, the stoick market really is a Ponzi scheme now, backed by the Rothschild Rockefeller Cabal’s control of the Federal Reserve Bank. Good times for the insiders.

An “asset” that fails to have a positive net present value of future income is more properly classified as a “liability.”

Seems like the #1 mistake people have made in the early 2020s is the ability to properly define the word “asset.” We see this in spades in crypto-currency tomfoolery.

I LOVE the famous phrase…

If you are at the Poker Table..

And you Don’t know who the Patsy is…

It is YOU.

Watch..

Like clockwork at some point. on the way back down

In this massive PONZICONOMY (TM)

The Chumps will all start SCREAMING for Government Bail Outs!!!

“How could we have known”?

“We are victims”

etc etc…

Rinse.. repeat…

IOW…the US tax mules (payers) are the chumps.

As an avid WTF spotter..glad to see another WTF article this week, let’s keep the two or more WTF article momentum going. Given how nuts things are going, shouldn’t be hard to do. Too bad Wolf, your middle initial isn’t T and last name starts with F, would make a great punt if that’s the case.

Interesting all these SPACs are blowing up and not much mentioned in MSM, not surprising since they’re still busy sucking off their favor EV god Musk. I did see something on MSM interviewing Chamath Palihapitiya talking about how much tougher it has gotten with the SPAC environment, perhaps that’s why these overhyped deals are starting to deflat.

I don’t understand the vitriolic hatred for Elon Musk. He is just doing a job. A critically important, very difficult job.

In America, the religion is that: “Government” is stupid, corrupt, useless, wasteful and incompetent, therefore nothing good can ever be done by “Government”. Everything of value can, as an article of Faith, only come from “Swashbuckling Private Entrepreneurship ™”.

This of course leaves Government with the problem of How to bring about a strategic change and, more importantly, How to sell it to the country.

The practical Solution chosen by America is to use Religion, A.K.A., “Swashbuckling Private Entrepreneurs ™” to foment the societal changes and new technologies that Government needs performed, in order to not have America go the same desolate way as the USSR.

Elon Musk is, I.O.W., just “the face” of Americas transformation to the next century’s electrical technologies. And this should happen rather before China and the EU gets there, because, the ones who holds the best batteries, motors, power converters, solar cells, wind mills, “power to X”-processes, and so on, they are going to be taking the other kids lunch money in license fees or in competitiveness.

In the case of the USA, this is very literally what could happen: The only reason to suffer the many inconveniences of using USD, is to pay for Oil.

Elon Musk is simply the appointed “Hero of The American People ™”. If he fails, they will appoint another one. Perhaps a less entertaining one. It will be done.

I personally hope that Elon Musk doesn’t end up like Howard Hughes, the “Swash … et.c. ™” that was tasked with building the American aviation industry. Probably lots of people back then thought he was a dickhead too, but he did what They asked!

Superb comment fajensen.

I’m not taking sides here: that’s what i love about reading Wolf. Fresh takes on big deal world stories.

Howard Hughes? Looking him up right now…

Patterns are everywhere and everything.

Thanks

My friend you need to get more sleep. Looking at pot-head Musk or dope-addled Hughes as exemplars of the American capitalist dream is just weird….

Elon made a lucky bet ($1.5 billion) with PayPal; Howard had the drill bits invented by his father. Everything after that is just play money…..

The trouble with the inventor/genius theory of progress is that it ignores the thousands of hard working engineers and craftsmen who actually design and build all the whiz-bangs, some of which turn out to be transformative, and some of which turn out like the Spruce Goose.

Irony of irony, Hughes became became recluse because assistances sheltered him as they protected their livelihoods, but his need/enjoyment for opioids shortened his days, so with all his wealth his aids only brought codine with acetaminophen. He died of chronic liver disease brought on by acetaminophen poisoning

The entire American culture is based on the miracle of the private enterprise by the self-made genius (with the government doing all it can to make said genius’ life hard). A crude example is Tony Stark.

Few knows that Tesla was initially funded by the gouvernment, at a time when no VC dared to come near it, not to mention that the fundamental technologies likely came from research funded by public money.

Not a Musk Fan but you have to give credit to him that he made EV sxy again. Teslas are one of the best EVs out there.

If people are willing to pay $700 for Tesla’s shares, it’s not Musk’s fault.

I think Tesla’s shares are hugely over-valued and competition is heating up

Look back at 1935 and check out the H-1 racer Howard conceived & Richard Palmer designed to see a transformative breakthrough in aviation.

The fighter planes of WW II all copied what Howard did.

I would like to drive the new BMW i4, but the companies Wolf mentions haven’t done much yet; have they?

Actually f, what HH is most famous for in USA are two other notable events:

1. The invention of the type of bra that Jane Russell, the femme fatale, wore in his film, “The Outlaw.”

2. Proving to the complete satisfaction of every thinking person that all the money in the world could not keep a person ”well” in the face of extreme use of synthetic pharmaceutical drugs.

That he also got the ”Spruce Goose” airborne is, of course, a very notable event also, but most folks either don’t remember that, or never heard of it.

There is also the ”theory” first promulgated in USA by JP Morgan, that JP, Henry Ford, HH, and maybe a few others ( Ike ?) were ”born to save humanity.”

USA enjoys such theories, that’s for damn sure, eh?

Howard Hughes’ “twin boom” bra never made it anywhere. There are current conspiracy theories that say that Hughes’ death was fabricated, that he did not die in 1976 a skeletal 90 pbs with broken hypodermic needles sticking out of his veins but lived another 15 years. What is fact is that Hughes pretty much wrecked any business he had direct control over. He took over the RKO Radio studio in 1948, laid off 700 workers and RKO virtually ceased making movies in short order. When he ran TWA, he got forced out, but not before making $500 million selling his stock in the company (tremendous money in the 1950s). His “Spuce Goose” was a money pit, a total write-off that is more conceptual art than a plane. When he bought most of the casinos in Las Vegas, and control of the local TV station, all it seems he did was order the station to continually play “Ice Station Zebra” after midnight. What Hughes was really good at was wrecking the lives of workers in companies he took over. A bean counter who thought only of himself.

At least Musk is bringing real innovation to the table. The google boys never got trashed for rehashing old code from the 1960’s.

Tesla is not innovation. It uses 20 year old Li-Ion battery tech to drive electric motors using 100 year old tech. The only new thing is the battery management system that routinely sets the cars on fire. Musk makes his money whipping fanboyz into a frenzy to buy Tulip Mania stock and selling taxpayer-supplied credits.

Tesla has never made a real profit (GAAP) since it opened its doors in 2003.

Check out the news related to the bore he bored in boring Las Vegas. Total fake.

Check out Elon’s company Starlink. Internet to where ever you are.

He is about to break the monopoly of Comcast, AT&T, etc.

Imagine if he decides to sell unfettered internet access in China or North Korea?

Musk’s real innovation is that he managed to convince most people that selling EV (good for environment) and hyping bitcoin/crypto (bad for environment) is not an irony.

“…when an immense coal mine in Xinjiang flooded and shut down over the weekend of April 17–18 … The blackout halted no less than one-third of all of Bitcoin’s global computing power. ‘We’d seen estimates that high, but this shutdown confirms them,’ says Alex de Vries, an economist who runs the website Digiconomist, which tracks Bitcoin’s energy consumption.” Fortune mag, 4/20/21

If Elon Musk tries to sell unfettered internet access in either China or North Korea he’ll be dead man walking.

roddy6667

One of the many problems with comments like roddy6667’s is his seriously insubstantial familiarity with accurate facts (AKA: has no idea what he’s talking about); roddy6667 just makes stuff up.

Examples:

o “Tesla has never made a real profit (GAAP) since it opened its doors in 2003” – RESPONSE: nonsense; Tesla’s 2020 GAAP profit was $690million. Several individual quarters have also shown GAAP profits.

o “…that routinely sets the cars on fire” – RESPONSE: (see link at bottom) ICE cars have about 55 fires/billion miles driven; Tesla has 5 fires/billion miles driven. ICE CAR FIRES ARE 10-11 MORE FREQUENT THAN TESLA CARS PER BILLION MILES DRIVEN.

I’m not a Tesla “fan boy” my ride is a fire-breathing ICE BMW M8), but even so, roddy667’s stuff is strongly redolent of Eau de Merd.

LINK: https://money.cnn.com/2018/05/17/news/companies/electric-car-fire-risk/index.html

Good comment, fajensen.

I am also amazed at the vitriol directed at Musk. The guy is and has presided over several structural changes of key industries: payments, autos, rockets and space exploration, and space commercialization using internet infrastructure as the initial product.

I can’t think of anyone except possibly Edison that’s had this much impact in this number of very diverse industries.

Lately I’ve been reading about the difference in industrial policy and strategic economic development of China .vs. the U.S., and the topic seems to center on the subject of capital allocation by “free market” .vs. centralized gov’t policy-makers.

China is currently winning that game, and convincingly. If we’re going to maintain our current std of living, we’re going to have up our innovation and capital allocation game.

Musk is one of the very few people who are able to marshal the immense amounts of capital necessary to overcome the huge inertia that face any such large-scale endeavors. I don’t care if he smokes pot. I don’t care about his personality. I want results, and in the U.S., as the game is played here, he’s a trail-blazer.

Of course Musk couldn’t possibly do what he does without a wonderful team of engineers and creative types. If you read about Edison, you’ll discover that he was one of the first people to systematically manage innovation. He had (for his time) huge teams of people developing permutations of designs in order to tease out the one design of many that actually works. Edison’s most compelling genius was his ability to manage and learn from failure. That’s what the whole 1% inspiration 99% perspiration comment was based upon.

Musk has learned his lessons well. He is exemplary at getting the maximum learning out of each failure. That’s one of major reasons his designs evolve so quickly.

Go Musk. Keep doing what you’re doing.

And…for the haters and back-biters and detractors of the world….

There are two ways to address the discomfort of being compared to an exemplar like Musk. You can tear him down so you don’t feel so inadequate, or you can build yourself up so you compete better.

One method delivers much better results than the other. Choose accordingly.

Tom Pfotzer

“…reading about the difference in industrial policy and strategic economic development of China .vs. the U.S…topic seems to center on…capital allocation by “free market” .vs. centralized gov’t…[and] China is currently winning that game, and convincingly”.

The ROI for investment by a massively poor nation (China) in remedial health & industrial infrastructure (drinkable water, safe air, paved roads, etc) will appear to outstrip an advanced economy (USA) simply because the USA has substantially harvested the low hanging fruit.

Coastal China (yes, I’ve been there) is making terrific progress from its abysmally low starting point; the remaining 60% of China…not so much.

Doesn’t Musk use Panasonic batteries?

Musk’s engineers design and build the battery packs, cooling system and battery management software for the packs. Panasonic provides the LION cells. Many others make the LION cells (LG, etc).

The Southwest including parts of CA are in severe drought conditions with reservoirs getting so low that electricity generation may decline dramatically by 2022. Who is going to supply electricity for EVs in those states?

Rcohn, plenty of elec coming from the nuke plant west of Phx.

Hughes liked planes, knew a lot about them and bought many but was not personally a designer, engineer or aviation innovator. He happened to have a great deal of money via his father’s invention of the oil drill bit and Hughes Machine and Tool spent a lot of it pursuing his record flights, movies and starlets.

Hughes biggest and final involvement in aviation was negative: he ordered a huge fleet (90 ?) of piston engine airliners from Convair, a commitment financial beyond even Hughes Machine and Tool. After many months, Hughes did arrange bank financing via telephone, but this fell through when, well into his reclusive stage, he refused to meet the bank’s CEO. Desperate for delay, he physically seized the first Convair as it approached completion, his men just hooked on to it and wheeled it out of the hanger. While all this distraction for Convair was happening, the rest of the industry was moving on to jets.

EV promoters are fighting the last war. Our 75 year old president is setting policy beyond the personal automobile. Space X has revolutionized rocket payload technology, but is that the future of space flight? What I’ve said about Musk all along, he is implementing futuristic technologies that were publicized in the 1950s on the covers of Popular Science/Mechanics. He’s living in somebody elses future. He might as well be selling cornflakes as cars. HH had to face critics who asked what is all this guff about aviation? Different problem altogether.

AB

Spot on.

I read all these Mags in the 50’s. Did you?

It took so long because so few of the dreams worked from a financial point of view.

Has Musk mastered the ‘money’ problem?

FYI: Biden is 78; whether he’s setting policy is a different question..

You memories of Popular Mechanics perfectly captures the difference between someone painting a magazine cover, and someone actually delivering a viable product.

The former are usually not billionaires; the later frequently are.

I consider Musk to be a contemporary P. T. Barnum. I have no problem with him–and appreciate what he’s done with SpaceX more than appropriating someone else’s idea (Tesla)–but his fanbois are the ones with the vitriol. Recently, a writer for Jalopnik compared Ford’s Mustang Mach-E favorably to the Tesla 3–which he also owned–and received death threats from the ‘bois. That is unacceptable.

Maybe the bois like Musk because they see his success as paving the way for theirs, both largely unearned.

And wouldn’t Moderna have a similar chart had not the scamdemic come along? Enjoy you’re side effects bois!

California Bob

Hard to understand your heartache about Elon “appropriating” Nicola Tesla’s electric car ideas.

Billions of people have had the opportunity to do that since Nikola died in 1943 (78 years ago). In the interim, thousands have used his concepts in an attempt to build a commercially viable EV, but Elon is one of the very few to make it a reality.

Elon never claimed he “invented the EV” de novo; he only claims to have actually built an EV product that appeals to thousands of buyers.

Why aren’t you also upset that Elon “appropriated” rocket technology form a bunch of bad guys in WWII?

I believe you & I could agree on the genius of Elon’s invention of “short” shorts.

Javert Chip,

Electric cars go WAY back (they were popular well before ICE cars). I was referring to:

“Founded as Tesla Motors, Tesla was incorporated on July 1, 2003, by Martin Eberhard and Marc Tarpenning.”

– Wikipedia; see “Tesla, Inc.”

Musk did contribute early funding, but the car was someone else’s idea. Musk did found SpaceX, however, so gets full credit for that.

California Bob

Got it.

My problem with your claim Elon “…appropriating someone else’s idea …” is based on 2 things:

1) The common definition of “appropriate” is to take without permission or consent; seize; expropriate; to steal, especially to commit petty theft.

2) Musk never did any of what you’re accusing him of having done.

JC,

Point taken (‘appropriate’ was a poor choice of words). Musk didn’t create Tesla Motors, but a lot of people don’t realize that. Some maintain Musk forced the original founders out of the company.

Note the first (crude) electric car was built circa 1832; Nikola Tesla was born in 1856. BEVs run on batteries–all batteries are DC–and Nikola Tesla absolutely LOATHED DC power; it was the main issue in his lifelong feud with Thomas Edison–who Musk resembles more than Barnum in some ways–along with Edison cheating him out of significant monies he was owed by Edison for work Tesla did for him (Edison went so far as to electrocute an elephant with Tesla’s beloved AC power to prove how ‘dangerous’ it was). So, Tesla Motors naming itself after Nikola Tesla is a stretch; Nikola Tesla was a lifelong champion of AC power, and even attempted to transmit AC power through the Earth so that it would be available to all. GM made an electric car a couple decades before Tesla stuffed a bunch of laptop batteries into a small British roadster, but didn’t have the conviction to make a viable product out of it.

Also note my issue is mostly with Tesla fanbois, who issued death threats to someone who dared to favorably compare another car to their idol’s. Musk is a showman, and a good one at that.

I agree and while Musk has been acting a bit strange at times I love that he has been pushing the country in this direction. It’s amazing to me that people still don’t understand that we need renewable power and have to put an end to fossil fuel usage …and not only is it going to happen no matter what we do, it may be the only thing that could truly support our economy with tons of jobs, new tech and the side benefit of bankrupting all the oil nations…mostly our enemies. The only question is are we going to lead and be the ones getting rich selling the tech to the rest of the world while we transform our economy … or will we decline while letting the oil majors and Kochs squeeze out a few more years and just have our few remaining rich people buy things from China?

Bh

Don’t give up on big V8’s yet.

Check out super-white paint which is a US innovation and could be a deal changer.

Unless the projections for future Chinese CO2 generation are wrong, then it does not really matter how fast the US and Europe decreases CO2 emissions.

In US, money and/or fame equals power. If you strip billions associated with Musk, Gates, Zuck and Dorsey, put them in a room to solve a trivial problem, you are going to wait decades to see a sensible solution.

They are not geniuses as the abundance of money makes them appear to be.

AGREE,,, SO much y,,,

In spite of, or perhaps because of all the hype and such extensive nonsense surrounding the folks you mention, some of us older folks see nothing other than the latest ”fad” that our mom warned us about when we cut the belt loops off our Levis in the later part of the 1950s. LOL, bet no one on here relates to that OLD news…

Not much has really change since then as far as we see today,,, except for the vast and wonderful expansion of communication possibilities/potentials on account of the now ubiquitous world wide web/internet.

WE the PEEDONs can at least continue to hope for the outcomes the IWW folks and subsequent equals were willing to and did die for in the early 1900s, mostly at the hands of the same kind of corporate bullies that appear to be springing into action today.

In any case, WE can continue to hope and work as we are able to expand personal freedoms of all kinds.

No doubt at all that WE will eventually succeed.

Ding ding ding! We have a winner.

And even in this era of ultra cheap debt, Tesla had to sell out to China in order to survive.

Re: Gates. you obviously don’t know the history of microcomputing. The problems he and a few others solved are why you are able to comment.

When Gates then less than 20, first became involved with the microprocessor, all instructions had to be in the only language they understand: machine language or 0s and 1s, i.e. on and off.

Around 1974 kit computer outfit Altair, whose only customers were nerds, decided it would be nice if regular folks could use them. So they put out a requirement for an interpreter program that would translate machine language into the BASIC computer language. When Gates and crew showed up for the demo, Altair’s secretary thought they were the kids of the engineers who must have slipped by her into the boardroom.

For the first demo, an exec typed in 2+2 and when 4 appeared they all smiled. No one had seen the machine do anything before.

But the really big break did involve some luck. IBM wanted a disc operating system for their microcomputer and hired Gates and co. Them IMB lost interest in ‘toy computers’ and GAVE Gates the program. DOS formed the foundation for the future.

Gates came from a comfortable but not wealthy family and family money was not a factor (unlike Hughes).

Of course, for input the interpreter program is from BASIC to machine language.

re: “… IBM wanted a disc operating system for their microcomputer and hired Gates and co….”

You’re missing some of the history. IBM wanted to use Digital Research’s ‘DR-DOS,’ but when the IBM suits came calling the company’s founder–one Gary Kildall–was pursuing his favorite pastime (flying). He left his wife and the company lawyer to deal with the suits, but they balked at IBM’s stack of paperwork and requirements. The suits went to Microsoft, who didn’t have a PC operating system, but were able to (legally) reverse engineer DR-DOS into ‘MS-DOS.’ And the rest, as they say, is history.

“I don’t understand the vitriolic hatred for Elon Musk. He is just doing a job.”

His job? Like tweeting false news or rumours? Or blatantly lying? Or bullying people who dare question him or his company?

Why do you think some people seem to “hate” him more than practically any other CEOs?

Me, I don’t understand the unconditional love for Elon Musk.

Personally, I think Musk is jerk, but..

I agree Musk is just doing his job, and I actually think he is pretty good at it, but his job seems to me to be less of a manufacturer or developer of EVs and more of a mascot. In that sense, I think he pretends to be the face of American innovation more than he is.

My feelings are he is doing something thats inevitable. You can only sell that first mover vision thing for so long. I mean, I saw a commercial for the VW ID.4 yesterday, I had not seen it before. The very presence of this advertisement from a company that really knows the automotive business completely reframed the world of Tesla for me.

Remember it was only a few years ago people said that legacy automakers did not know what they were doing and only needed someone from “tech” to disrupt them, it seems to me Musk’s style or method was effected to give them their comeuppance: Give me your money, and I’ll show them how its done, you can have the future today! But people don’t say that about the auto business anymore, and I think Tesla is the reason for it.

This is only my opinion, I admire Musk greatly as an innovator. And I don’t think Tesla is about the cars or the batteries, both old technologies, as someone above pointed out.

What people are missing is the software and power station businesses. All these cars have unique software and he is building a network of charging station around the country. This is the real money maker for Tesla. The software that takes the drivers to his power stations. And then there is StarLink….

I think Elon is the greatest innovator of our time.

He has single-handedly(with much VC money), the development for the first popular EV. He has also pushed the start-up launching of vehicles into orbit successfully, AND is pushing manned missions to the Moon and Mars. He will succeed.

The closest mythological analogy I can think of is Zefram Cochrane of the Star Trek mythos who invented the warp drive which changed humanity. Elon is the Zefram Cochrane of our time. There are many similarities in the Star Trek mythology.

I realize we have problems at home that need to be solved.

People like Elon are the innovators pushing us to where no man has gone before.

Humanity needs this.

“I don’t understand the vitriolic hatred for Elon Musk.”

Because some of us aren’t taken with charlatans who amass obscene wealth via the US taxpayer, and flout the law while running companies which couldn’t turn a profit if their livelihoods depended upon it. It’s good, old-fashioned corruption with a bunch of sycophants cheering on a narcissist.

Let me correct you fajenson…In the bought and paid for Republican version of America , the religion is that: “Government” is stupid, corrupt, useless, wasteful and incompetent, therefore nothing good can ever be done by “Government”.

You need to be a little skeptical. When I was young the promise of nuclear power was that it was going to be a nearly free source of energy.

You can’t even finance a nuclear plant in US right now. They are financial money pits.

Musk has destroyed about $6 in real capital last time I looked. That’s $6 billion of capital that will not be used for something better, but with Powell conjuring $120 billion a month it’s small potatoes.

Too late Faj, China is there already.

To believe that the American Government works in the interest of the American People…..

I don’t know what to say.

Good review of compulsive market action.

When I first set out to buy stocks, late 1960’s, all companies were trammelled by the same rules, where by far the majority were first capitalised by their local communities, and our discovery process always involved our local Stock Broker. From that starting point, every applicant for a national listing on the stock market involved a very structured process. All Public Offerings required that the company had to show at the very least, three full years of stable profit, alongside a detailed scrutiny of the entire start up process from day one. Quality of management; quality of initial investors; a complete clean bill of health . . . all of which was a sign of the dedicated involvement of the primary savings institutional management; who would both buy shares for their own holdings; as well as set out the viability of any such “New Entrant” as a safe investment for anyone to buy for their own personal holdings.

We are now all well aware that the present trend for stock markets has created an expectation for a major collapse of confidence, which, when that occurs, there are several associated events that must follow. The original concept of what were once described as Savings Institutions, must be re-introduced. To achieve that, the drive for all such to be trammelled by rules demanding delivery of the majority of their customers savings as lending to government; must be rolled back to where they were at the early 1960’s . . . which will then throw the entire responsibility for re-creating the successful rule structures operating at that time; back onto the management of the savings institutions. All major national stock markets were pillars of full responsibility for the adequacy of the rules that made such investment safe for the majority; those structures must be re-introduced. The sooner the better.

The mentality driving “The Markets” has changed, irreversibly, I think.

Everything is being “compacted” from “The Future” and into Now. We have suffered reform after reform with pensions leaving the effective planning of retirement savings with having a time horizon of maybe 5 years. Careers!? Pah, we migrate from oasis to oasis harvesting what is there before trekking on! Or dropping out, one can live well enough on the margins.

“The Markets” were always suspect, but, now they are no longer seen as a place for making long term investments any more than horse-racing is.

Securities are only Tokens, they don’t represent or convey anything in particular except “Flows” of data and money, and, for the serious or bored players, there are also a whole cornucopia of ETF’s and synthetic derivatives – freely available to “Retail”, as long as one signs an online form claiming competence and understanding.

The “old times” are gone and they are not coming back!

Would agree here with fajensen.

It’s structurally broken. On the levels of what the Roman Empire was after Constantine, etc. Not going back to Julius Caesar. Going to a new era.

That’s what we’re doing now: creating the underpinnings for a new era. Quite unsure what it’ll look like, how fast it’ll come. Stuff always changes, like the river (Heraclitus). It seems we’re wrapping up the Enlightenment rather quickly nowadays…

For what it’s worth

The comparison of the USA to Constantine’s new Roman empire centered in Constantinople (modern Istanbul) ‘could’ be a good one.

He went east where the money was, consolidated the empire around the new strategic capitol, made long lasting military and governance reforms and popularized Christianity. What followed, the long lasting Byzantine empire, flourished under these reforms but eventually contracted under the weight of it’s dogmatic and excessive ‘Byzantine’ rules and procedures.

No longer nimble and flexible, its shrinking empire slowly collapsed and was invaded.

The US has great potential still but without the power to enact visionary reforms, ala Constantine, yes, it will most certainly go to where the money is but will instead, I fear, remain mired in and captive to its already dogmatic and Byzantine structures.

“…weight of it’s…”

should be “weight of its”.

faj,

The invisible handle of free markets has been replaced with algos designed to push prices ever higher. They function until they test the unimaginable boundary and break. Then the losses are rolled back for the big players, the code patched, and the beast unleashed once again. These are the financial markets now.

I agree that the financial markets’ mentality has irreversibly “tilted”. The game’s destabilized.

Our decrepit and sclerotic rent-extraction-blighted system is not long for this world. It’s failing rapidly; that’s what the stimmies and rackets (health care, defense, finance, etc.) are telling us every day. The decline is rapidly accelerating.

Once the big crash actually happens, and if we don’t devolve into war, then the results-based allocation will resume.

It bears noticing that capital allocation is alive and well in other parts of the world. It’s just hit a rough patch here in the U.S. and in the Anglosphere in general.

So if fin-tech directed or gov’t directed capital allocation isn’t your cup of tea, what might be some alternatives?

Until interest rates become sensible again Faj.

Read ‘Where are the customers’ yachts?” Your description of the stock markets is more than a tad too benign.

I suspect pendulum will swing and people will only want to own companies making money and paying a decent dividend. No more pie in the sky b.s. When you need cash flow a unicorn is going to be worth anything.

Yes the 1960s investment environment was low-risk, but that also meant low returns and low innovation. This is well illustrated by the story of the founding of Fairchild Semiconductor in 1957. While attempting to raise startup capital, the founders were turned down by just about everyone in the mainstream financial industry. It took another self-made entrepreneur, Sherman Fairchild, to recognize the potential and take the risk.

I don’t believe a reversion to 1960s era environment is the solution. If 1960s is viewed as one end of the risk spectrum, and today is the opposite end, there must be something in the middle that can reduce the craziness but still provide opportunities for appropriate risk and innovation.

Ross

Interest rate again.

The ‘hurdle’ rate in the sixties was higher therefore returns had to be shown to be worth more to take the risk. 2% is easy to beat, so anything goes.

Everything is about interest rates!

Four months seems an awfully short time for such spikes and plummets… or “pump and dumps” if you prefer.

Are these shares broadly traded? Perhaps low volume is accounting for this movement??? Also, isn’t there a lock-up period in which the SPAC buyers cannot sell their shares?

Are SPACs in the money cremation business?

SPACS might be doing a public service cremating the money, given the windfall new trillions that have congealed out of electronic energy in the Fed computer.

In my view, there are 3 “audiences surrounding SPACS:

1) The SPAC insiders – the guys who stand up and register an empty “Special Purpose” company; these guys make out like crazy when they finally take a target company public.

2) Managers, employees and early private investors in private target companies: their company may or not be viable, but for a brief period, they can unload their stock options.

3) The retail market (AKA the greater fools) – these are the schlubs that end up buying SPAC garbage…because…well, other than pure uninformed greed, nobody is quite sure why greater fools behave like this.

I just checked with the kids on my block to be sure.

Most never got in this hype.

Those that did saw EV Europa

European for you lagging Cal State kids, just smoke um.

Blast it must hurt to get such losses?

-Shandy

While I am thinking about it… I cannot wait to see the SEC Commissioner squirm when Elizabeth Warren gets him in the hot seat over this. Break out the popcorn!

Warren is a Wall Street lawyer. She will yell at them in front of the cameras, then crickets.

Academics who are millionaires are jealous of capitalistic billionaires.

Nothing really concrete ever comes from any of that showmanship.

Her political grandstanding is about as genuine as WWE wrestling.

She needs one of those outrageous outfits with spandex. I’m getting tired of her pantsuits.

SPACs have been around for decades, a.k.a “blank check companies” which seems a more fitting name for them.

Maybe SPAC sounds less risky than a “blank check”?

Rename them Spac-stics

Elon is busy this week. Something bout a car, with no one behind the wheel, crashing and burning . Re Quantumscape…take a look at the board members and management team ????.

That happened in my neighborhood. Wow, you wouldn’t believe the intensity of that fire. Those guys in the car were mere lumps of charcoal and put into bags when the fire was out.

At least, they contributed to science: the data will (hopefully) improve the beta software Tesla is selling to its fans.

You used to end up a statistic, now you end up a datum. I love the smell of data in the morning.

Factoid:

Elon has pointed out the car’s owner didn’t have the $10,000 Tesla FSD (Full self Driving)) option, making it improbable FSD was piloting car at the time it “…rapidly thermally disassembled…”.

This looks like a Darwin Award nominee, if not outright winner.

If Elon said it, it must be true.

In any case, whether FSD was enabled or not, the fact remains that data is being collected by Tesla. And that data is supposedly used to improve its self-driving algo. This is largely the reason for Tesla’s hype: the supposedly enormous amount of data it collects gives it an edge in the race to fully autonomous vehicle.

Just read an article on it. The fire chief said it took four hours and 30,000 gallons of water to extinguish it.

Yikes.

Every time the firemen thought the fire was out, the remaining batteries fired up again. In the early part of the fire, the flames were scorching the tops of 20 foot tall trees. The wreckers, cop cars and fire trucks blocked our streets for 4 hours. What a mess.

Thus explaining why Lithium ION batteries are not supposed to be in airline checked luggage.

Imagine a pileup of EVs…

Apparently, Musk recommends to just let it burn out. Where is his innovative brain when we need it?

Come on….

This would happen to any car going at a high rate of speed without a driver.

It is not unique to a Tesla who warns you that you need a driver like any other car.

I do like the feature in my Ford that automatically brakes while on cruise control if you are approaching a car too quickly. However, I would not crawl into the backseat for a nap during this time.

Or say “Hold my beer and watch this” like these unfortunate Tesla owners.

Could this be a sign that market exuberance is finally waning? That reality may be setting in on the retail investor? I worked at a failed self driving car startup . . .that technology is unbelievably complex, as are electric cars. These companies will go belly up.

John,

Are electric cars that complex?

My two year old motorbike and five year old sports car have some fancy technology in them. But in theory, a basic EV is pretty straightforward I would think.

Dan, they are lot more complicated than most people are led to believe. The drive system(s) contain a gearbox (drive reduction unit), electric motor(s) axle assemblies, oil bath for the gearbox (with oil filter), a power inverter that has a separate cooling system than the battery cooling system, and other associated electrical and mechanical components.

The EV cars have a traditional suspension system exactly like a conventional auto (steering gearing, tie rods, shocks and struts, coil springs, control arms, etc). Braking systems are the same except these EV’s are usually equipped with a system to generate a small amount of electrical power on braking.

The rest of the car is the same as non ev’s except that provision is made for battery storage, typically in the underneath area of the car.

There are videos on UTube that go into disassembly of the drives. Please don’t believe these cars are a simple as a box with 4 wheels and an electric motor…they are pretty complicated and it takes a trained specialist to fix them in a lot of cases.

Also, the lithium ion batteries are hard to extinguish in the case of a fire.

AA

When I was young we used to strip out absolutely everything even the door cards because all we wanted was ultimate ‘oomph’.

Driving used to be terrific fun now it’s an utterly sterile over-regulated, over-expensive and boring experience. Why wouldn’t you go by bus or train like I do now, because I can’t stand being reminded of how things used to be. Just sayin’

Anthony A,

Thank you for the reply. I was thinking that a battery system and electric motors are the basic outline of an EV.

Sadly, Dr. William Varner of the Woodlands Medical Center and another person with him passed away in the Tesla crash near you.

Auldyin,

I disagree with you that newer cars are boring and sterile, although until recently, I was in that camp. From driving and auto-crossing hopped up 240Zs and carbureted 280Zs, to driving a few Lexus SC 400s with modified brakes and suspension, I thought simple was better.

But a year ago when I got behind the wheel of a newer and good condition BMW M4, I was blown away. Of course, I bought it. You can set the ‘Stability Control Systems’ in numerous ways, but to get the most fun when driving it, the ‘M Drive 2’ mode gives the best of computer help and driver input combined = really high performance & peace of mind that it’s under control at the same time.

As I got older, the 280Z gave way to the SC 400 for safety’s sake. But the SC 400 gave way to the M4 because the M4 kicks its ass in both performance and safety!

Personally own one SPAC. Small position. More as a reminder of greater things to come I guess?

And what is that greater thing? A huuuuugr greenhouse in SoCal for growing weed.

Hopefully it doesn’t go…

…up in smoke.

;-)

1) Yesterday the DOW was down, but Barrick and Pan America Silver were up.

2) For two days in a row SPX was down, because there was room to go. DM18 was completed successfully and a new count started.

3) SPX is good to go for at least until May, or longer, unless DM will be cancelled.

4) Yesterday, in mid day, energy and banks stock were down over 3%,

because they had targets on their back.

5) Market makers left brain almost got a heart attack when the sold one AAPL for 4 Wells Fargo, or one AMZN for 130 Schlumberger.

6) WTIC is up 6% w/w ==> that’s why SLB had to be down 5% yesterday.

7) That’s doesn’t mean that AAPL and AMZN will be down in the future, but SLB:AMAZ trend will rise higher.

8)

The worst companies are the last to rise and the first to fall in a bust. So it will be interesting to watch which stocks are next to drop and if everything will go according to the script.

Some say bitcoin is going to be the signal. When it crashes the stock market will not be far behind.

Many thanks for yet more great illumination Wolf…..and thanks to the learned contributors.

Reference Chamath Palihapitiya for all of your SPAC needs. One only needs to look at his track record of pump and dumps to see the mania in the SPAC market.

Everything he touches drops at least 50 percent from it’s highs, all in the last 3 months or so. It all works out though because he is a billionaire venture capitalist. As in, he ventures in, and ventures out with a massive profit, and retail investors are getting wiped out one by one.

Also makes 20% to sponsor

1) THE EV SPAC is down along with bk applications chart.

2) There is not much difference between compounding 3% – 4% and

compounding loans with zero interest, if it preserve bank’s total assets.

3) Most people pay their loans, period. Some don’t because they can’t, or because they speculate on SPAC.

4) The banks avoid a war with their customers by helping them to survive and avoid bk.

5) The banks will do whatever it takes to avoid sending loans to the dumpsters, NPL, by offering their customers with several options.

6) Making zero profit is better than losing $10M loans, or $500K bank’s asset or $20K c/c loan in bankruptcies.

7) If a cease fire declared between banks and borrowers, with

an attractive option of zero percent, zero penalties, but no reduction in assets value, both sides benefit. Assets doing nothing for several month signal future losses, that must be avoided.

8) A loan can liquidate itself to zero, by going in a linear line to zero,

with an option of divided the total loan value by several months or several years.

9) It’s give and take. Options of providing less profit, zero profit or even a small loss, are much better than a total loss.

10) By willing to bend, by not pretending that the big shots banks are powerful and strong, ==>

the banks are becoming stronger, at least for a while.

You divided by zero. Your equation is wrong.

Divide 10,000 loan by 60 month (5Y) = $167/ m.

This loan will liquidate it self by the end of 60 months.

If the customer agree, both should be happy.

Watched Becky Quick on CNBC yesterday talking about the stock market bubble and other bubbles in the financial system. When the Wall Street shills on CNBC start talking about a the bubble then you know we must be in one hell of a bubble.

There is so much liquidity that the DOW could probably go to 50,000. The FED and .gov really, really screwed things up with their profligate money printing scam.

Turn Out The Lights The Party Is Over

This is a fantastic collection of well-reasoned, every-day DD. Thank you Wolf for so accurately laying out the landscape and facilitating consistently cogent observations. It is damned refreshing. Ordering my mug today!!!

Fed’s easy money policy has pushed nearly everyone out a few spots up the risk curve. Will be a stampede to safety at some point.

The Only Way to Get Ahead Now Is Crazy-Risky Speculation

April 21, 2021

It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles.

-oftwominds (charlesH Smith)

Look like classic ‘pump & dumps’ to me.

Micheal Engel: I’m having a great day! I understood everything you said. Seriously. In fact, the sun just came out. Thanks for posting.

Yesterday the stock market was down, but few wrinkled market

makers, who many years ago went to Texaco with an empty suitcase to fill the tank, were celebrating a total victory, along with previous victories, but are losing the war, because their power is shrinking among their peers…

I am in negotiations with Goldman Sachs on a new investment vehicle that I think WolfStreeters will be interested in- I call it a Wealth Transformation Fund, or WTF for short.

Wealth Transfer Fund?

?

There’s already an ETF like that, actually more than one–from ARK invest.

11) The banks are playing defense, before the next recession start, before things will get worse.

12) They cut branches, they operate on WFH mode for over a year, solve troubled assets, stop NPL losses, before losses start piling up, before it’s too late for the banks.

The more we understand shadow leverage, the more attention we pay to collapsing fringe markets the closer the endgame gets to the NYSE. As Doug Noland says, these things start at the periphery and move to the core. The collapse in oil FUTURES last year is one clue. The futures market can reprice stocks without any buying or selling in the underlying. Oil futures went negative, while spot remained at $11. Disconnects do happen. In a market in which visibility and Fed’s “forward guidance,” (haven’t heard that term lately) is somewhat lacking. This may be the reset they are talking about. If you are a big bank and you aren’t going to sell stocks, and the futures drop sharply, then you are behind the eight ball. If you step in early (see banks in competitive dumping of Archegos holding) and “hedge” your rather large stock position, (and I think the banks are holding a sizeable piece of this last rally) you create a disconnect. So you sell forward futures contracts, and that becomes a self fulfilling prophecy. It was always thus, in overheated markets. The issue here is shadow leverage, and cross border investments, and investors. China is trying to tighten credit, sending ripples through private/family hedge fund operators with money in the global markets.

AB – the Fed went from “outlook – ie ‘forward guidance” or looking forward to “outcomes” or backward looking to make decisions. Wolf might want to start tracking Jerome’s speeches seeing how many times JP mentions outcomes vs outlooks.

I remember 1999. The Internet was new. We had dial up modems. AOL was a growth stock. There was no WIFI. Global Crossing was laying fiber optics cable building an information highway. Digital cameras were too expensive. People were buying any stock associated with the Internet. Companies had sales growth, but no earnings. There was a bear market from about 2000 – 2003. The NASDAQ went down further than the S&P 500. Once high flying companies were bankrupted.

GFC-Nasdaq tanked almost 90% loss and the S&P nearly 60%!

All mkt indicators are way crazy above all the records in the past! In coming months (10-12) when Economy fails to catch up with overvalued mkts, the the beginning of the DOWN cycle, will begin. Secular Bear – Lower of the highs and lower of lows, sucking dip buyers until they get the message. It will be the BEAR mkt of a life time for many, as Jim Rogers predicts!

When it comes for the final chapter, Fed will be more interested in saving the Banks than saving the Mkts.

Now we just need crypto to crash spectacularly say 80% to get the real party going.

Or does crypto become the only remaining store of value?

Unlikely. Too much infrastructure required. Just look at Myanmar, the junta is turning the internet on and off at will.

When things really go to hell, you need the simplest thing that work. What that is still needs to be decided, but it’s not going to be crypto.

Even if Crypto could survive as a means of exchange for the younger set, could it be a store of value? (That was a serious question.)

The bulk of the Bitcoin servers are in China … so your mileage may vary, as they say.

Looks like an easy put-call spread. Buy short dated ITM calls and long dated far OTM puts? Assuming that it will pop when the merger is executed, then grind steadily lower over the following 6 months.

It’s nice to know there are some limits to the nonsense we see today.

I saw Peyton Manning trying to sell NFT digital art junk on CNBC yesterday. I’ll be surprised if NFTs ever get off the ground.

Along with marginal debt this is great news for stocks and housing prices!! buy buy buy S&P to the moon 6000 and beyond!!!

I am not so sure we will not get there. That would drop SP500 to just under 1%. I will pass on it though. I say it’s worth about $1000, $2000 max.

Oops. Drop dividend to just under 1%. Nothing like paying 100 times current dividend for a great investment.

1) Option #1 : Supply & demand : chips shortages constricted the 2021/ 22 cars production. Demand is growing since the pandemic, because people avoid subways, or any other form of public transportation, at any cost.

2) Option #2 : dealers expect economic troubles ahead constrict their orders from cars mfg, especially orders of expensive pickup trucks. Instead they buy used cars, liquidate leased cars, buy from rental companies, buying low, making higher profit on sales & service (more visits to the mechanics), while reducing inventory, especially of brand new cars ==> reducing debt and total obligations, before a new recession start..

3) Option #3 : a combination of both #1 and #2.

Not buying it. Miles driven are way, way, WAY down.

What is a SPAC . It is an investment vehicle which raises funds by selling shares to the public. But it does NOT own any businesses ; it just promises to acquire them in the future . It is incentivized to overpay for businesses in order to quickly become an operating company.

It’s sponsors often get warrants to sell shares at the offering price in case the SPAC does not acquire any such businesses, so at worst the sponsors are guaranteed to be able to sell at least at the offering price.

BINGO!

Dear WTF street readers,

In any business “theatrics” and media spin is necessary. Elon Musk is doing that part right. However, company is not still profitable. A Cool kid every girl loves but got no skills. Other companies who IPO the shares at first knew these shares are simply worthless. They did it purposefully to raise capitol for doing nothing. Even the stock market players know the stocks are worthless. Still they played because lets make money out of the euphoria. They know we know. Responsible adults stayed out of these stocks even if they loose the opportunity to make money. If most of the stocks are like this, then the future losses in pension funds and retirement portfolios is very concerning. Raising tides lift all boats so does the lowering tides. Unlike the day-trader reddit kids, pension funds are very slow to act.

‘ If most of the stocks are like this, then the future losses in pension funds and retirement portfolios is very concerning’

The Mkt cap to GDP is over 200%!

All the future demand has been brought forward and already baked in the price. By NOT discounting the future cash flow, those who are buying into the mkt are already paying excess premium. This will be obvious in retrospect.

We are already in the hole by keep buying or being stay invested in this surreal mkt. Btw Mr Mkt never accomodates the majority.

(been in the mkt since ’82)

Saw SPAC, thought WTF, is this actually something new under the Sun for once?

Put on history specs.

Nope! In the 1860’s ‘Railway Mania’ in UK, railways were the big fad of the future and grannies wanted ‘in’. Some smart guys floated companies raising money ‘to invest in a railway somewhere (to be decided later). The big crash came before many of them had nothing to invest in. When the punters asked for their money back in many cases it was gone and they had to build more prisons to house all the ‘felons’. Just sayin’

oops! for ‘nothing’ read ‘anything’ sorry.

Yep, there really is nothing new under the Sun. It is hubris that we believe our ancestors weren’t just as clever, devious, and even stupid as we are today.

Wolf

you’ve got to let me reply to Dan Romig on cars!

Dan

I said I traveled on the bus, I didn’t say I sold my cars.

I’ve got a 78 260z an 84 280z an 89 300z a 97 BMW Z3

and to crown them all a 67 British(real) Rover P6. Nothing to stop me looking at them out of the bus.

Cheers.

When there is no reply button, go up to the next comment that has a reply button and reply to it. This puts your comment just below Dan Romig’s comment.

Thanks again W

Nice!

I saw a misleading piece on Lithium in the Mojave on MSM. If Jerome can keep all the fiat balls in the air we may see a major pivot to Lithi-Mania. If the Miner’s get in the act they have the experience that can remove your shorts will your pants are on.

Since this is a WTF thread, I just saw a Toyota dealer who changed all of their new car prices to ABOVE msrp.

Time for people to go on a buyer’s strike.

After yesterday´s (Apr 21st) session , isn´t it “WTFing” again ?

Sorry Wolf I am late on my readings .

I mean, yeah, it looks bad if you measure the prices in USD. But if you measure them in Dogecoin they are going up.