And refinance mortgage applications plunged by over half from spike last year.

By Wolf Richter for WOLF STREET.

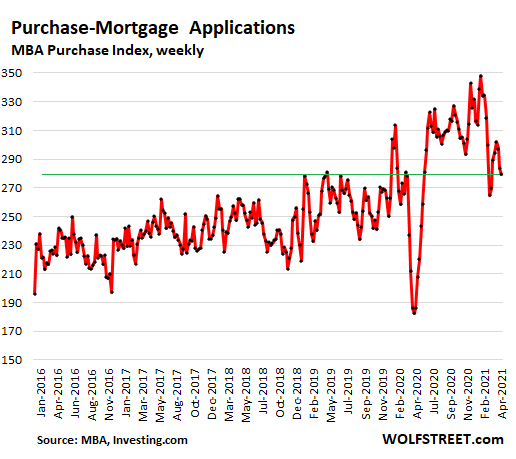

The index for mortgage applications to purchase a home in the week ended April 9 fell by 3.7% for the week, and by 20% from peak-frenzy in January this year, and thereby edged below the same week in April 2019 for the first time since this Pandemic housing boom started, according to the Mortgage Bankers Association (the big drop in February was during snowmageddon; data via Investing.com):

Despite a few click-bait stories in the media that are then endlessly propagated in the make-you-crazy social media about a ridiculous bidding war leading to a ludicrous amount paid over asking price, there have been signs that higher mortgage rates, exploding home prices, and other factors have put a damper on demand.

This has been seen in various metrics, including in the high-frequency metric of weekly mortgage applications and in sharply dropping monthly home sales.

“The third straight week of declining purchase activity is a sign that rising home prices and tight supply are constraining home sales – especially in the lower price tiers,” the MBA’s report said.

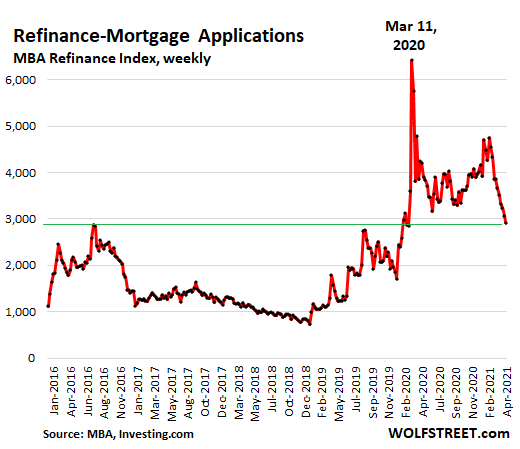

The MBA’s mortgage refinance index fell by 5% for the week ended April 9, and has plunged by over half from the spike in March 2020 to the lowest level since February 2020.

“Many borrowers have either already refinanced at lower rates or are unwilling – or unable – to refinance at current rates,” the MBA said.

The mortgage refinance index is still double the level compared to two years ago, April 2019, when mortgage rates were in the 4%-range:

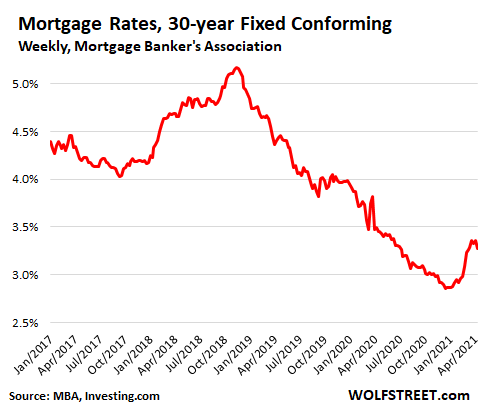

That 4% range in April 2019 was unthinkably high late last year when folks were talking about below-2% mortgage rates. But now that 4% mortgage rate is becoming more thinkable.

In the week ended April 9, the average 30-year fixed rate for mortgages with conforming balances declined to 3.27%, according to the MBA. They have now vacillated in the same tight range for six weeks, after the initial 40 basis-point surge from 2.85% in mid-December (data via Investing.com):

So even this relatively small increase in mortgage rates, from the historically low levels last year to still very low levels currently – in conjunction with sky-high and still ballooning home prices – is starting to sap housing demand from retail buyers.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A crash is baked into the cake.

As a responsible saver who is ready to buy, I sure hope you are right but I really don’t see a crash coming. There is still so much demand that I can’t see this market truly crashing unless the entire system implodes. “Starter” homes in my area (Concord, CA) in the $650-700k range are still as hot as ever. Listings go pending within 3-7 days at 5-10% above asking price. I don’t deny Wolf’s statistics, but I’m not seeing it affect my local market yet. Trying my best to keep the faith and to be patient.

That’s exactly what everybody said before the last crash. And Wolf just showed that there isn’t “so much demand,” despite what shills try to portray.

This is a bit different. Last time I calculated that from 2004 to 2008 home builders built about 700k more homes per year than required based on population growth. Thus there were almost 4 million excess homes.

I remember reading in 2007 that there were 50k building building permits issued for Miami over 3 years. The norm growth was 2500 units a year. Basically the builders in Miami were about to build enough units in 3 years that would supply Miami for 20 years of population growth.

This time there is no excess but prices have outpaced income as during the housing bust but this time low interest rates actually make some of the purchases affordable.

I am still trying to figure this housing thing out.

I have 1 rental home and I am getting calls, text, and letters in the mail at least 3 or 4 times a week.

Crazy. Who are all these people looking to buy.

One of the calls I mistakenly answered was definitely from a call center from a different country. It was a young foreign speaking girl with that call center background noise.

Ru83,

“One of the calls I mistakenly answered was definitely from a call center from a different country. It was a young foreign speaking girl with that call center background noise.”

That’s interesting… Yeah, a LOT of us would love to know who all these people are. I suspect pension funds, private hedge funds, politicians, a Nigerian prince or 2, people who scammed ppp and unemployment and global stock investors are in the mix.

He showed what?

I believe the numbers & graphs.

Sometimes you have to show the full story.

It is remarkable that the numbers are not worse.

Compare those numbers with the inventory.

Inventory #’s are easy to find.

Take that graph, and you truly see how crazy it is

out here. Applications should already be down

to the GFC levels.

RE:83 Agree. New construction is nil compared to pre housing crisis. This market is 180 on supply, with no subprime overhang. The bulge in lending is REFI for people who don’t need it. Average consumer is stocked up equity and lower consumer, CC debt rates. Materials costs are front running the recovery and that will slow things down on the supply side. The fact that sellers are taking houses off the market should tell you something.

I don’t know what “so much demand” means, but Wolf’s charts show demand has declined over the last three months, so if you can measure demand, it will be smaller than it was in January, but it does not say much about the overall level of demand.

I mean, How bigs baby, SO BIG!

Anyhow, I agree it does look like a moment of transition that could force salespeople to find a new narrative, time will tell.

Also, this is demand from buyers who use mortgages — so largely regular folks. Institutional buyers don’t use mortgages like that. They borrow at the institutional level.

I don’t see a crash coming either. If there are any signs of a crash coming, the Fed will pull *yet* another trick. **Negative interest rates** Jerome will go down as perhaps the greatest magician in the history of the world.

Actually it is true

I vividly remember last crash in Southern California

The exuberance was really crazy before the market cooled down

It’s important to distinguish between sales volume and sales prices. You can have fewer sales at higher prices, but I wouldn’t call it a market crash until prices themselves fell out of bed. I could be wrong, but it sounds like Wolf is suggesting that declining volumes foreshadow declining prices, or at least a decline in the rate of increase. I don’t know why that would have to be the case, especially if sales volume is being suppressed by tight supply, but maybe someone can explain it.

Unless the plan is to let the market crash and buy it up on the cheap I know, tin foil hat stuff but does anybody really think they won’t do it?

The “WFH/Rona” correction in the big city Condo market is done now – that was the crash. There will be price flattening in sand state markets (CA AZ TX FL NV) if rates bump a little more, but no crash. If you need a place to live, pricing won’t change much and rates won’t get much better (or worse). Wages will be going up soon also, therefore making the monthly nut on an over-priced SFH more tenable.

Wages will be going up soon? Really from ten to twelve dollars an hour Hardly future homebuyer material With outsourcing, increased immigration and robotics/ AI it wouldn’t seem to be the case

I agree with you – no big home real estate crash unless Mr Market is tamed and required to fall substantially as in a permanent correction then the intravenous feeding tube that goes to directly form the Fed is separated, and the Go Big Team stops/reduces QE and normalizes rates.

My neighborhood index:

Today there are 106 home listings in realtor.com! That is up form 70-ish at any given time, and the rise has happened in a short 2 week or so span. Have not seen it that high in several months or more!

And the 500 sq ft plywood shack with no clear access to public road has been reduced from $200 to $180. A steal!

In CA, through Feb at least, the interest gutting frenzy was more powerful than prudence/wisdom/foresight…homes sales volumes are up about 50% (no C19 impact on given months).

Enough buyers are still being duped into believing that historically low mtg rates justify hugely inflated prices…so they rush blindly to buy and drive prices further up.

Never asking what happens when they try to sell…at rates 1% to 5% higher than today.

(Even as rates are rising off floor).

Short answer…huge hits to home price.

But immediate affordability turns buyers into mindless ZIRP zombies.

Left off source for CA volumes (I was too enraptured by my rant)

https://journal.firsttuesday.us/home-sales-volume-and-price-peaks/692/

I see a lot of listings in FL that are roughly $100K over priced.

I also see a lot of listings where folks are trying to dump those way overpriced homes they bought before the GFC. You’ll see prices slightly below or slightly above the prices they paid in 2005-06.

It’s a telling sign…..they held on through the bottom of 2010-11 and finally see an opportunity to get the albatross off their necks.

I feel bad for the waterfront sellers in Tampa Bay, Pinellas Co. Manatee River, Sarasota, etc. as the algae blooms/fish kills have started and most folks don’t want to spend big bucks with the odor of rotting fish in the air.

A few hundred millions gallons of phosphate waste (radioactive isotopes, heavy metals, etc.) dumped out at Piney Point will do that. It’s an ecological / tourism nightmare decades in the making.

Hoping for the best, expecting the worst.

Yep. Husband and I are moving back into the area in a few months. People, and the commissioners willing to sell land to developers, forget how delicate the ecosystem is. Its been ruined over the last decade due to the last governor’s policies. Soon, the whole state will be ruined and transplants/retirees/flippers will go on to the next location and ruin that place as well.

The hook and book homes being sold are ridiculously overpriced. From what I have seen on realtor sites, flippers are starting to cut prices to sell these homes now. It sucks that we have to pay overpay to live in the state that we both grew up in but Florida’s real estate market is Boom and Bust and it will eventually bust.

The elephant in the room question is left unanswered and hope that Wolf will address that one as well:

Why is there a buying frenzy and why is there demand?

Once you answer that question, crash or mini crash or continued increase becomes an easy answer.

My thoughts on what is going on:

(1) Rates and Inflation

Lenders/Underwriters are dragging their feed (e.g. scrutiny through the roof; jumbo loans are an absolute rarity even for borrowers with assets multiple of the loan amount; no longer for 2nd homes).

(2) No Capital Gains taxes on first 250k/500k with homes

Capital Gains tax are go up if Biden gets his way and will dampen stock market; Capital Gains tax on homes however starts after the 250k or 500k gain. Those that are in homes that have appreciated over this amount need to ‘reset’ by switching to a new home.

Why?

Gutted interest rates create short term affordability (monthly mtg pmt) and create frenzy induced price spikes.

Then 1 to 3 yrs later, interest rates rise (even a small amount) and the affordability of these inflated prices collapses, destroying demand and creating a bust.

We’ve all seen this gvt porno before.

From my perspective there are three basic groups pushing current buyer statistics; corporate buyers who will in tern lease or rent the property, flippers (many acting as part of a co-op or limited partnership), and those individuals who are looking for a home.

The corporations are buying assets with no interest loans, and therefore have the wherewithal (provided by the Gov’t) to capture the majority of the market. This alone causes a shortage for those individual who are actual home buyers as they cannot compete on price. What I find fascinating are the “flippers” who have made this into a profession and seem to be betting this won’t fall apart and leave them exposed.

Better yet. Corporate buyers bundle the loans into MBS, get the GSEs to guaranteed them, and then sell them to investors.

So the cooperate buyers really have not skin in the game. They make selling the MBS and servicing the rental homes. But no worries if the about making payments on the loans if the renter leave.

I had a feeling when the got the GSE to guarantee the loans, we were going to see a housing bubble as we had a new force in the housing market that was never there before and they have unlimited capital an no risk.

One could also ask why has supply been so weak during all of this.

Yes that is a good pt.

One observation.

Traditional lenders are in a decent position to throttle incremental supply by tightening underwriting requirements for new construction.

They might do so in order to protect/inflate *existing* investment in/exposure to real estate.

But, then, where are the new lenders?

We put in every appraisal report, “Home affordability has peaked due to the combination of high sale prices and increasing mortgage interest rates.”

So far no lender nor the VA has disputed this statement.

It’s so freakin’ fragile right now Elon announcing a gender reveal party might crash the markets…

He is human, isn’t he?

To avoid missing out, people need to immediately rush out and catch a falling house!

Didn’t that kill the Wicked Witch of the East?

No, she is Secretary of the Treasury now.

Or the Speaker of the haunted House. SecTreas reminds me of the evil twin of Dora the Explorer

It might sap housing demand from retail but is it enough to cause the next crash? I have my doubts but I sure do hope so and I honestly hope that the next crash will be more violent than last time so regular joe can have a little bit more fair chance in the game. My fear is that with cheap money from FED and around the world, hedge funds, pension funds, foreign investors will keep this market super inflated regardless of what retail demand is like. Also if market is expecting the next stock bubble to pop, where else are they going to park their money other than hard asset like real estate?

On the other hand, just for fun, I did a search on what some people were saying back in 03-07 before the last crash and there’s striking similarities to the narratives back then to now. Everything is fine, soft landing at worst, price will continue to be strong forever…etc. Since I can’t link articles here, google these titles and you can read all about it and compare then and now with some hindsight benefit.

Read Between All Those For-Sale Signs – NY times

No Housing Bubble Trouble – Cato Institute

Who Saw The Housing Bubble Coming? – Forbes

Also, I know MSM loves to talk about how this time is different and last time it was all because of those evil subprime loans that caused the crash but if you do a little bit more research, such as study by economist Antoinette Schoar, subprime was 20% of the market and it wasn’t the primary cause of the last bust. The main culprit was middle and upper middle class taking on more debt, which strike another parallel to what’s going on today.

Phoenix:

Well we know about 14% of recent mortgages were for second homes. Somebody is stretched. Plus many second home buyers are sitting on an unsold first home. What could possible go wrong?

Why are they sitting on an unsold home? Just couriuos. I live in a town of 160k and there are only 160 homes for sale. 100 are new construction. 44 are condos. 16 are single detached homes.

So only 16 homes for a city of 160k in spring time. This is 90% lower than normal for sale inventory. This city has averaged about population growth per year the past 10 years.

A friend is looking to buy a house and the relator said he needs to offer at least 5% or 10% over asking to for the seller to even open the bid.

The city averages 2000 population growth per year. There is just now inventory.

“Vacant homes” not coming on the market as buyers are not selling their old, now vacant homes but hold it for investment gains. Here’s part of the story:

https://wolfstreet.com/2021/04/01/the-explosive-surge-of-mortgages-for-second-homes-housing-bubble-math/

“This is 90% lower than normal for sale inventory.”

People will sit on unlisted homes while Covid is still a thing (who wants to get infected at a showing?) but once vaccinations hit a high enough level (August?) that backed up inventory may hit the mkt.

Maybe just about the time the Fed lets rates return to pre Covid highs.

So hiked supply meets drained demand…and prices fall.

Maybe 3 or 4 months from now.

CAS127 > I think Sept is when most of the stimulus runs out. Also some forbearance and rent moratoriums.. So the FED is caught in a trap. The juice ends (unless extended?) and the US pandemic should be on the down side..

So we’ll just have to see whether the FED is able to *normalize* rates ever.. I think we are in for long term negative rates and Stagflation going into year end.

50% or more of the VA homes we inspect are vacant. I believe what I see with my own eyes, not bull s$it from the government or the Real Estate Industry, or shills like Lawrence Yum. The Tax Cut & Jobs act of 2017 along with easy fed policies, incentified holding second home for speculative purposes. That’s what is happening. Its as simple as that. When the interest rates rise, and moritoriums end which they will it will be game over. I don’t want to hear all the whining and complaining when it happens. I don’t a rat’s a$s about home flippers and home speculators.

In a market where homes sell in 3- 7 days and purchasing a new home is challenging, there is an incentive to buy a new home before you sell your existing home. I’d be curious to see how long these second homes are actually being held.

Just like 2007-2009, the spigots will open up. The Fed can not allow dropping prices on assets. It’s game over and vain people are in control. We are going to bop till we drop.

If the FED is so powerful, why did the stock market fall last spring? Why did we have a housing crash in 2008? Why did the tech bubble melt down? Why didn’t the FED prevent all of that? Sounds like you maybe have a financial interest in asset prices not falling?

Depth Charge. I have no debts and have owned my home free and clear for 30 years. I hope I wake up one morning and everything I own is worth 50% less and I can earn 3% above inflation on my savings. I own no stocks. The generations behind me need deflation. I want sound money to help me live not to get rich.F?&k the Fed. N’est-Ce Pas?

We don’t need deflation. Please keep your deflation.

Jacklynhunter,

What is so bad about deflation? Here are some scenarios that idiots like Chairman JPOO say would happen with deflation:

1) Oh the refrigerator went out. I’m going to go 12 months without a fridge to keep food fresh in my kitchen because if I wait I can save 2-5% next year on a new fridge!

2) The car needs new brakes and tires but I think I can stretch it out for 18 months because this deflation will make it cost $10 less by then. Oops I spun out in the snow and totalled the car, but I’ll just walk 20 miles to work every day in the snow for the next year to save 3% on a car.

That is what they say people do during deflation and why deflation is so terrible. The truth is that deflation is bad for debtors and the biggest debtor in the history of the world is uncle sam.

Because the rich sellout first average joe holds the bag

If I learned anything from the GFC re: Real Estate:

1) Get on a chair BEFORE the music stops. Early =OK; Late = You’re screwed

2) Don’t buy at top of market (patience is golden)

3) You cannot trust any bank reps (especially on the phone)

4) RE agents will lie their asses off in search of a commission

In Socal beach cities and in metro Boston, the market has never been hotter. From what I see, it it picking up steam. Many offers on most homes. I see bidding wars on homes in the worst locations. This will last for a while. When it is over, I am sure the last in will take a hit, but we are a ways off from that event.

You didn’t learn much from the last meltdown, did you REALTOR?

Depth Charge,

When this housing rally is over, I am sure there will be a substantial tradeoff … there always is.

But, you have to look at the policy makers at the FED. Any sign of a slowdown, and they will push rates lower and lower. I would guess this will be the strategy at least until the 2022 election cycle.

However, every real estate cycle ends with pain. And, the pain will ruin some lives. Such is life.

You can’t push rates “lower and lower” when they’re already at zero. Nice try.

You don’t have to push short term rates negative. The alternative is yield curve control. At some point we will see it but that point is still far. Before that happens some serious pain points would have to be reached such as 30 year above 5, housing down by 15% or stockmarket down by 30%. The questions is, even if the FED stays out of the game for a while, is any of that happening even possible at this point after M0 quadrupled over the last year while supply and productivity crashed or will we continue to see ripple on effects of that.

Ycc isn’t GAAP. Ycc will kill bonds not save them this time around.

@DepthCharge

We can go to Negative Rates. There are several countries in Europe that still have NIRP.

As crazy as it sounds, in some cases people are actually paid interest on their home loans. The bank usually would not pay them the interest they owed. It has been going on 6 or 7 years with NIRP in Europe I think.

When few if any people can afford the houses that are being built or the ones on the secondary market then you’ve reached the top of the market. Couple that with interest rates going up and you have the makings of real meltdown. The Fed can’t do much about any of this. Real Estate agents are the last ones you should be listening to. I have quote from the 2007 issue of magazine from the National Association of Realtors “This has never been a better time to buy a home” People like Lawrence Yun are financial hucksters of the highest order. He’s on our local radio station WMAL (Real Estate Today) here in the Swamp. We are putting in all our appraisal reports, that “Housing affordability has topped out”

“Buy now or be priced out forever” was my favorite from 2007.

In other words, “Buy an expensive house that you probably don’t love so I can get a fat commission (not my problem if you end up under water).”

Things that no realtor will ever say, in any market, ever……..

“It’s not really a good time to sell”

“It’s not really a good time to buy”

We sold in 1999, and bought in 1999.

It was both a good time to sell, and a good time to buy.

When it comes to housing, I only trust two people.

1. Lawrence Yun.

2. SocalJim.

I don’t know about Lawrence Yun, but I’ve heard SocalJim is legendary!!

We can have bidding wars and lower number of mortgage applications (purchase, refi) both at the same time.

Inventory being low and rates being up from the historical lows can contribute to the lower number of applications. I don’t think it’s an indication of either a lack of interest or competition in buying a new house.

From Wikipedia. Lawrence Yun is a Chief Economist and Senior Vice President of Research at the National Association of Realtors.

If SocalJim is legendary, then Lawrence might as well be a god. At the very least, he has a bigger microphone.

haha Lawrence Yun….gotta love that guy the biggest cheerleader in the RE industry. I remember him from before 2008 repeating the same thing. Who knows, if this is the new normal he might be right but I sure am tired of his supply is forever low and right now it’s the best time. I am sure that will be his narrative when the world is ending and we experience an event like the movie Independence day..I am sure then he will still be saying, best time to buy now, supply will be low and Aliens are snatching up the property market.

Don’t forget HousingWire. Their site’s always worth a giggle. I wonder if it’s owned by Lawrence Yun.

What about Sam Zell?

He’s too inconsistent. I’d trust SocalJim’s record more than Sam’s!!! ;)

You forgot the /S. You can’t trust salesmen? Who would have thought.

I actually laughed out loud. Thanks.

SocalJim

I tend to agree. Builders are not punching out thousands of new homes like in 2004-2007 which led to the GFC. Supply was endless at that time AND the $$$ was cheap – not so this time (supply). The number of “overpriced” homes being purchased with cheap $$ is less than 15 years ago. Moreover, many are the same Buyers and they learned their lesson or they know someone who got whacked on leverage. The exodus will be tapered and there will be some bag-holders, but a more likely scenario is price flattening overall with minor corrective drops in traditionally volatile markets (sand states) where most of the activity is centered.

That’s what they said about tulips until February of 1637.

Definitely agree on the hot so cal beach city markets. My parents house is almost 1.2 million. Just a few years back like 2016-2017 it was 950k comps all day. It’s pretty crazy. They have a great neighborhood but not 1.2 million great. But at the same time I got my home in Camarillo for 625k and now it’s 850 maybe even 900k on a good day. Everywhere is hot and SF valley people are actively defecting to the Conejo valley.

I was just thinking about all those stories about houses getting bid up 5 or 10 percent above asking price by desperate cash rich buyers. A few years ago the story was that these “overbidders” were all foreign buyers. But since the pandemic these buyers have dropped out of the market, But the stories continue. I have heard from people who say the got outbid, or from sellers boasting about how their house got bid up to the sky. But I have never met, heard from or read comments from anyone who will admit to bidding a house way above asking. Do these clown really exist? I want to actually meet or hear from one of these impatient jerks that RE pumpers claim are everywhere.

As we all know, real estate is local, but in my area these stories are very real. Here’s just one example of a house I initially wanted to make an offer on. I can’t post links here, but if you want to search Redfin for proof, have at it.

1724 5th St, Concord, CA

3 bed 1 bath

1280 sq feet

Asking price on 03/10/21: $649,000.

Pending on 03/17/21.

Sell price $800,000.

Fingers crossed that the data that Wolf if reporting leads to a slow down on the next few months.

Everyone always talks about these “overbidders” from a third person view. I want to see what one of these impatient clowns looks and sounds like in the first person. Come on, you are supposed to be out there, step up and tell your story.

My personal story is that I put aggressive offers on two houses last summer/fall. The first house we were one of the top three offers. The owner asked for best and final offers from the top 3. We went up $45k which was about 5.5% over asking, we held one contingency, and we came in 2nd. One other offer was $50k over my offer and they waived all contingencies.

The 2nd house was 4 doors down from the house I currently rent. We loved that house so we put our initial offer in 5% over asking but we held the inspection contingency due to the foundation needing to potentially be replaced (100 year old house). The owner counter offered and wanted us to come up $10k on our offer and be willing to pay up to $40k out of pocket in case the house didn’t appraise for the offer price. We countered that we would go up $10k on our offer and go $20k out of pocket if it didn’t appraise. Then an investor swooped in at the last minute and matched our offer price, all cash, no contingencies. The owner took the cash as ran. Now the house is a rental property.

After that my agent encouraged us to wait until 2021 to see if the buying frenzy would calm down. We decided to wait and now things are completely insane and I’m priced out of my target neighborhoods. I’m sitting on the sidelines, inflation eating away at my downpayment, waiting for the mania to calm down. Good times.

Rumple,

Your story is what I suspected, the mega landlords are the ones bidding up the houses. Nobody in their right mind would pay, 800K for a 1200sf house, except a REIT spending other people’s pension money.

That’s what real home buyers are competing with and the agents know it.

It’s not a person. It’s real estate hedge funds making cash offers and over-bidding real estate.

Spot on. I agree that a lot of this is due to institutional investors outbidding retail buyers. But we are 30 miles east of San Francisco so we are likely also getting hit with the tech WFH exodus. Big stock options = big down payments. Double whammy.

I’m hoping and praying that Wolf’s statistics start to manifest in my local market because I just want to plant roots in the city where I’m from. I’ve been a huge housing bear since 2015, waiting for the market to come back to earth. Oops. It’s only about 18 months ago that I finally gave up and started to accept that the Fed would never let asset prices deflate again. Who knows.

Rumple, I’m in a very similar situation here in Ontario Canada. Sold my place in the early fall for what seemed like more money than it was worth in order to move closer to family in a less expense part of the province. Low supply and a couple unsuccessful bids, and now prices in the less desirable area are above my sell price. I saw one house listed the other week in a very sketchy part of town, with all the windows boarded up, description said it was to keep out a former tenant who has broken into the place a few times. Had a good chuckle at the insane asking price. It sold for 90k over asking at nearly 500k.

Presumably all cash. Everyone knows it’s completely nuts, yet it doesn’t stop… I hope it absolutely craters, these fools would deserve to lose everything. Yet I fear that is just wishful thinking on my part.

re: “… Nobody in their right mind would pay, 800K for a 1200sf house …”

I sold my 1,140sf, 3br house in San Jose three years ago this month for $1.305M, about $100K over asking.

I read a story pre-covid in Businessweek. It was how the Wall Street firms like America4Homes were outbidding a lot of buyers.

All the distressed inventory was gone but they wanted to continue to grow. So they were willing to outbid everyone homes in good neighborhoods with good schools. They said everyone wants to live in these neighborhoods so they will not have any problems renting.

Now I think they are building homes now that the good neighborhood inventory is gone too.

Shirley, everyone realizes that pension fund buyers of home are much more likely to be bailed out (one way or another) than us peasants buying homes?

We all know what Mr Saint President did in 2008, right? Bailed out Wall Street and threw peasant home owners under the bus.

My point: Don’t assume a real estate crash especially not that we are moving towards corporate ownership of homes. D.C. let the peasant go under in 2008 because it doesn’t care about us peasants. It does care about Wall Street, financiers, etc and is much more likely to bail the out.

Consider yourself lucky for not getting in a bidding war for that eyesore. $800K for 1300 sq ft and 1 bath in a marginal part of the East Bay. That’s a mania buy for sure. Another 15-30 min of driving east, your money will go =]much further (like in Brentwood, CA or even Tracy, CA). Sure, commute to SF from Concord is better than commute from, say, Tracy, but it’s still a beast from Concord. My god the last guy bought at $560K in 2018, just pocketed $240K on this sale. Do you think the economy is in better shape now, in 2021, than it was in 2018?

Same general boat as you but a different neck of the woods. Saved a lot for down payment over several years while I thought the market was overpriced anyway. Just watched it go by at 100mph. Now close to priced out of the neighborhoods we prefer. The market is definitely more vulnerable now regardless of what the media says. Demand changes with the times. I know of at least one guy qualified up to $800k on a $120k salary… How’s that responsible lending? I don’t know that it’ll crash and inclined to think it won’t. But if enough people are overextending themselves this could end poorly. I have no idea what’s gonna happen. Unfortunately it’s the right time for me to buy with a young family. After working hard and saving pennies I just watched the Fed inflate it away.

Keep your chin up and try to hang tough. Wait till the young people with young kids, one income and a house they overpaid for get laid off. Not being cruel, just realistic. All that stimulus is going to be gone in a few months, then we start to see what the post covid economy looks like with massive tech spend and even more automation. It may not be this month, or next or not even in the fall but something will come out of left field and shut this down abruptly. Berkshire annual meeting coming early May. Charlie will be on the call this year. Worth you time to listen. Without fanfare or drama, they will give some good insights as to what will happen.

BTW, that went pending a month ago.

Understood. The purchase price was finally published on Redfin two days ago so I used it as recent example in my response to Seneca. I will be very interested in seeing the data a month from now. Thanks, Wolf.

This is just my experience – wife and I locked down a home in a new development in a suburb near Los Angeles back in early fall at $925k.

While we’ve been watching our house get built, that same exact home model in later phases is at $1.25M now.

My neighbor where I live now is a realtor and told me that his client bid on a home in that city (Whittier) and had 40 bids come in on the same house, while a person at the developer office said that a different home in Whittier had 70 bids come in.

This screams classic manic phase behavior to me, but with so much money being pumped into the economy, who knows when and were it will all end up.

A Realtor friend of mine listed a residential lot here in the PNW 5 days ago for $150K. It was placed in escrow today at $180K. I don’t know the “clown’s” name, but this is real. Furthermore, this is the norm here, not the exception and there are no signs of things slowing here.

My wife’s good friend sold her house 3 months ago? for a bid 10% over asking. She doubled her money in 4 years. Today she said she wishes she had never sold. Not only can she NOT find a smaller home to purchase in a similar price range, she can not even find anything to rent after she vacates for the new buyers. She is pounding the drums for a rental, but may be forced to live in a borrowed RV. The problem is, all the local RV parks and campgrounds are full of Covid staycationers. There is no sense of a slowdown in our area.

Exactly the stories I hear. Now we will also have a big influx on illegal or legal aliens coming across the boarder. Where will they live?

Many are trying to get here to get in the next amnestry. Also think about the 15 or 20 million illegals living in the U.S. and if they are given the green light for citizenship. Many will be looking to buy a house? We could see a lot of demand for a year or two. Not sure if prices will keep going up if interest rates rise but if feels like inventory is an issue unless people are sitting on a lot of 2nd vacation homes?

The people who already live here, already live in either houses or apartments. So they can only switch to a different place, or they can spread out, looking for larger homes with fewer people in them. The net effect on the overall housing market (renting and buying) by people already in this country is relatively small, but there are shifts within the market. New people coming into the country add new demand over time, though lots of times and for years, they’re staying in homes that are already occupied by others.

Some of those “staycationers” are more than likely living full time in their RVs, Paulo. A lot of them, just like in the US. Essentially homeless. It will get old.

I try to use a lot of models for valuation of stocks. I think the bottom line is:

1. All major asset values including stocks, bonds and real estate are at highest levels ever based on real earnings.

2. All current asset values are dependent on Fed not raising interest rates for a very, very long time

Anyone overpaying for a lot at this point in time is definitely a “clown”. Because either they will have to build on it quickly before the coming collapse in RE and face ridiculous prices for building material, or hold on to it and find the market collapses around them and the new “overbid” lot only has a use as a place to park a broken down “clown car”.

There are never signs of a balloon bursting…… until it does.

Lemmings will never learn…

“A few years ago the story was that these “overbidders” were all foreign buyers. “

This is an interesting point. What’s going on today with foreign buyers? While it might be possible to buy a house sight unseen on the internet can someone from Hong Kong or Great Britain easily fly in to do some home shopping? Probably not. This suggests that the current demand for homes is lower than it would normally be and that more price appreciation can be expected once the restrictions on entering the country have been lifted.

Unless the restrictions on entering the USA are all hot air.

What are you talking about, currently every house is sold at least 10% above asking price. Ask me how I know.

Try hiring a contractor of any sort, or buying lumber, appliances etc. IF YOU CAN FIND stuff, you’re gonna pay top dollar. It’s bound to slow down a bit, but there’s still SO many people who have BIG money (in MA) at least.

I was checking the rates in France this week : 1%. One percent.

And prices, as a result are astronomical despite a weak economy ( France has been destroyed by insane lockdowns).

My bet? coming to a US neighborhood near you.

No crash. Just relentlessly higher prices.

House sales out here on the Olympic peninsula has slowed considerably. Last summer and fall it was hot , hot with flee sales. Now it’s maybe two pendings a day and 90 percent are building lots and property. It’s like it’s hit a wall. Interesting

Y’all just listen to yourselves. Ain’t good to buy during a panic. Just chill. I’m priced out of my own neighborhood too. But this too shall pass. The end of the world ain’t here yet. And of course no one will admit to buying way over the list price. Everyone would laugh at them.

Lots of FOMO, “it’s different this time” and “new paradigms” right on this thread. I remember the same thing last time. All of those people disappeared like a fart in the wind once the worm turned. It’s never “different this time.”

Depth Charge,

You are absolutely right. There is a ton of FOMO out there from people who are buying into the hype, who aren’t interested in economics and aren’t aware of the historical rises and falls of real estate cycles, who don’t know about the Fed’s manipulation of asset prices, who are making foolhardy decisions and rushing into an insane property market….

And then there are responsible, educated, financially conservative people like me who find themselves with a growing family and a recently widowed mother (with escalating health issues and a rapidly shrinking retirement account) that I will need to care for in the very near future, all while living in a market where rent would be as much or more than a mortgage payment for an equivalent house. People like me who don’t give a flip about keeping up with the Joneses or having the biggest and nicest things, who simply need a modest house to be able to care for their family, but they find themselves running out of time waiting for the housing market to crash and not knowing how far this Fed will go to keep asset prices inflated.

I have felt the exact same way as you about the housing market for years. I have been a huge housing bear since 2015, but real life circumstances change and sometimes we have to make difficult financial decisions. I would just encourage you to be careful about being so smart and so arrogant to assume that anyone thinking about buying a house right now is a FOMO fool.

My sense is this is another ‘flight to the suburbs,’ 1950s-style. Big cities can be fun and exciting, but not in a pandemic. You can expect this to endure for a couple decades, at least.

Rumple,

I find it odd that your rent payment would be the same as a mortgage payment (including RE tax and insurance). I’m in a high priced attractive area that is in high demand. The house I’m renting is half what the mortgage payment would be if I owned the property. Take another look at the rent v. buy analysis. I think renting would be a good choice in your case.

“Take another look at the rent v. buy analysis. I think renting would be a good choice in your case.”

But then he wouldn’t be able to enjoy any of that sweet negative equity.

You have my sympathy as I am in the same boat as you. Everyday I feel like I am the crazy guy in Time Square holding that sign “The end is near!” While everyone else around me is thinking they are financial genius by sitting on paper gain of rocketing home prices. Housing affordability should have never been like this, unrealistic and disgusting level of greed off the back of next generation or people didn’t time the market just right. But given the track record of a culture of NIMBYism and F you as long as I get mine mentality, it’s par for course for our society. Below excerpt sums it up pretty well.

From The Herald:

“We were all corrupted by the housing boom, to some extent. People talked endlessly about how their houses were earning more than they did, never asking where all this free money was coming from. Well the truth is that it was being stolen from the next generation. Houses price increases don’t produce wealth, they merely transfer it from the young to the old – from the coming generation of families who have to burden themselves with colossal debts if they want to own, to the baby boomers who are about to retire and live on the cash they make when they downsize.”

House price inflation has been very unfair to new families, especially those with children. It is foolish for them to buy at current high prices, yet government leaders never talk about how lower house prices are good for American families, instead preferring to sacrifice the young and poor to benefit the old and rich, and to make sure bankers have plenty of debt to earn interest on. Your debt is their wealth. Every “affordability” program drives prices higher by pushing buyers deeper into debt. Increased debt is not affordability, it’s just pushing the reckoning into the future. To really help Americans, Fannie Mae and Freddie Mac and the FHA should be completely eliminated. Even more important is eliminating the mortgage-interest deduction, which costs the government $400 billion per year in tax revenue. The mortgage interest deduction directly harms all buyers by keeping prices higher than they would otherwise be, costing buyers more in extra purchase cost than they save on taxes. The $8,000 buyer tax credit cost each buyer in Massachusetts an extra $39,000 in purchase price. Subsidies just make the subsidized item more expensive. Buyers should be rioting in the streets, demanding an end to all mortgage subsidies. Canada and Australia have no mortgage-interest deduction for owner-occupied housing. It can be done.

Bobber & Depth Charge,

To give a real life example, 2425 Gehringer Dr, Concord, CA just sold in my area for $635,000. 3 bed, 2 bath, 1160 sq ft. The new owner immediately put it up for rent (posted on Zillow now) for $3,200/month. This would be considered one of the lower tier neighborhoods in Concord. School ratings absolutely suck.

If we only look at up front monthly costs… if I bought this house on a 30 year fixed 3.3% with 10% down, the monthly payment with taxes, insurance, and PMI would be around $3,600. $3,300 when the PMI drops off. Rent is $3,200.

Using the NY Times Rent vs. Buy calculator: assuming a 30 year fixed mortgage at 3.3% with 10% down, owning the house for a conservative 7 years, with $9,500/year maintenance costs, equal annual rent & house escalation… renting would only be better if the monthly rent is $2,577/month or less.

If I use the NerdWallet RvB calculator using the same terms, renting @ $3,200/month is only better if I own the house for 5 years or less.

At this point my assumption is that mortgage forbearance is a new tool to be used in any future downturn so housing will never correct. If pension funds are essentially buying houses to turn into rentals the federal government is probably also going to do anything to keep that propped up. As someone on the outside looking in it’s very frustrating. My very young daughter and her generation may never be able to afford a home at this rate.

Rumple,

If the rent equals the home owner’s payment, it’s a no-brainer. Buy the house with FHA financing with 3.5% down. Most of the mortgage insurance is tacked onto the loan principal. If the market continues to rise, you win. If the market drops, you walk and FHA loses (i.e., they’ll get jingle mail). This is the incentive system the FHA has set up, so don’t feel bad about using it.

The house you referenced above should be well under the FHA loan limit for that area.

I strongly suspect this is being fueled by the stock market melt-up. A lot of people have made a lot of money (or are at least sitting on huge paper profits) in the last few years, enabling them to put down a big down payment or even pay cash, and these are also often the kind of people who can work remote while the pandemic lasts, and have moved out of cities, but may be holding on to the home they moved from because they know they may be forced to stop working remote when the pandemic ends. A bursting of the stock bubble may have serious knock-on effects in the housing market. Some big winners in the stock market may be using margin loans for down payments, to avoid having to sell their stocks (in some cases perhaps to avoid the tax on their gains). With interest rates already near zero, and huge government financing demand on the way, the Fed may not be able to rescue the stock and housing markets after the next crash.

Yep. There is definitely a wealth affect for certain segments of the market. Let’s.do easy math for a top 10% retiree with index fund as SP500 goes from 666 bottom to 4100.

Let’s say bottom for him was $660,000 and now value is $4,100,000. Dividends have averaged 2% per year plus say he was taking another 2% per year to give him his 4% withdrawal. He probably still has $3,500,000 with 10 less years to plan for. He has got to be thinking why am I going to die with all this money. I might as well put some of it into something real.

Noting also re the post above by Rumple comparing rent vs buy for a $635k home with 10% down, I think it misses the fact that the $63,500 down payment could be invested now in ATT or MMP for very secure 7% dividends ($370 per month).

And no risk that when selling years in the future interest rates have not risen. Buying a home with 10% down in a market where interest rates are setting the price is essentially like making a 10:1 leveraged bet on Treasury bonds.

Nope, the top 0% own 80% of equities. So the vast majority of buyers don’t have that cash

I expect many of us sympathize with Rumple’s dilemma, that ordinarily prudent conduct is leading to failure. In my opinion, those who are able to understand this evil have the burden of responsibility to oppose it.

For Rumple I would point out that a common response to the dilemma is to allocate a modest portion of capital to investments in real things which are still undervalued; admittedly that is easier said than done. But eventually those should rise in value and will partially remedy your shortfall due to monetary inflation.

Lol, name one asset “undervalued”

Buying at the peak ends up with an upside down mortgage for many people. It’s a terrible situation to be in. Happened to me. In your daily travels you see homes like yours in nice neighborhoods for 30-50% less than you owe the bank. And you see much larger and nicer homes for what you owe the bank. If you are offered a career advancement in a different city or state, you can’t take it because your house is like a millstone around your neck. It really sucks, but you can’t make the lemmings that are buying houses today see the situation.

Yep. I remember in 2011 talking to a sales rep who was so depressed he could barely function at work. He and his wife’s house was worth 1/2 of what they owed, and their neighbor sent the home into foreclosure on purpose and bought a beautiful house in an upscale neighborhood for less than the sales rep owed in the crappy neighborhood. All he could talk about was what a horrible decision buying that house was. His marriage was falling apart. We’ll be hearing the same stories again when the Rumples of the world are losing everything because they just had to buy a house due to FOMO.

FOMO is really the main “tool” in the Fed toolbox. History’s verdict on the central bankers is not going to be favourable.

If I have to guess he is definitely not going to post on the gram how wonderful his house is or how joyful it is to live the American dream. I think I lose count on how many of those posts I see on FB and Gram lately…look at my new crappy house that I overpay but oh how I made it..

I wonder how many people re-mortgaged their house to buy Tesla and Bitcoin.

Hopefully A LOT. I love the smell of burnt speculators.

Me too. I’ve been saying all along I would rather the foolish Robinhooders learn their (relatively inexpensive) expensive lesson now, in their 20s and early 30s, than 20 years down the road when it’s too late.

Would you be surprised to hear that I know a 70 something year old who is “all in” on crypto?

Honestly, why not? He has seen that the America he lives in is not the one he grew up in, and that no one has to take responsibility for his bad behavior. So if he loses it all, he can get “free” everything from the government.

Could it be that the pool of houses on offer gets smaller? That also would explain purchases going down.

I always watch the things that change suddenly.

In my knack of the woods ING is informing clients it might be better to put savings in another bank. ABN-Amro has started a campaign to urge people to take out extra mortgages on the excess value of their properties.

Banks want clients to shift from savings to loans. In my opinion they want that because they feel/know that savings will be inflated away or even confiscated (for bail-ins) and its better to have currency in bricks and let clients take care of it. Prices might go down, but clients will have to work to pay back the mortgages.

Being a contrarian, i think it’s time to pay off that mortgage. It is the bag they want you to hold.

No supply.

People looking to sell cant find where to go…

so they pull

Also, look at the house you are in…and think of replacing it with the lumber, copper and other prices of today…

1) ZI, Silver futures ==> Boston creme.

2) Aug 6/7 produced an Engulf pattern and Aug 7/10 produced a Harami.

3) The big drop on Aug 11 was followed by a small H+S pattern.

4) When ZI crossed the neckline, ZI produced the Sept 21/22 Harami. Sept 24 low produced a nice triangle.

5) After a lower low on Nov 30, a SOW, ZI jumped to test the upper Harami, the Aug 7/10 Harami, on Feb1st 2021.

6) Mar 31 low produced another nice triangle.

7) Get ready for the silver baby.

Bobber.

1) Your landlord wouldn’t sell because he doesn’t trust the crooked stock markets, the banks, or the gov. Your monthly cash flow is better & safer than dividends.

2) Your landlord, who probably own his property for a long time, survived recessions, ==> don’t have steam in his brain during the boom times.

3) He trust u Bobber, inside his $1M property. He wouldn’t trust a $1M in stock market.

4) He rather have a good tenant on reduce rates, because things change, and his property will not be vacant.

5) A vacant space in recessions, is a curse.

No supply

and construction costs too high.

Rampant inflation in materials….

and interest rates below inflation

Every happen before?

World upside down….courtesy of J Powell.

Fed had made a simple mistake. US had low growth and low inflation scenario due to globalization, demographics and technological advances. The economy was not going to run at a 5% nominal rate or even a 4%.

By juicing the economy trying to get it to desired rate, they didn’t help the real economy and distorted it by pushing wealth to leveraged asset holders and speculators. The Fed had shown no interest in letting leveraged assets holders gett wiped out in a downturns but continues to fuel the leverage monster.

Ok, I barely have two neurons to rub together, so maybe I am missing something here. Why wouldn’t home prices stay out and/or increase if you live in a nice suburban area with good schools? By me, there is no land left to develop, so anyone looking for a nice, new McMansion has no choice but to tear down and rebuild. That takes some serious stacks on deck to accomplish. Otherwise, they either have to buy an existing home or move further out. While the “further out” areas may eventually get developed, have better schools and amenities, shopping centers, employment, etc., that will take 10, 20, 30 years in most cases.

So, with no land left to develop and build new homes in a given area, how would demand on existing homes begin to drop outside of the neighborhood somehow becoming less desirable? Also, who wants new builds? All of these builders are buying plots of land and dividing them into insultingly small parcels to build some cheaply manufactured monstrosity. Who wants a .10 acre lot where you can shake your neighbor’s hand outside of your bedroom window?

REITs should be illegal. All speculation in residential real estate should be illegal.

Would you outlaw mortgage securitization?

Absolutely. If banks had to hold the mortgages on their own books, they’d be more discerning in their underwriting process, and less likely to lead to excessive speculation/leverage.

Just finished doing a 1.4 million refinance appraisal on a condo 2 unit property 1 block from the Shaw neighborhood in the heart of the DC swamp. That’s 1 block from where the 1968 riots took place. Looks like things have recovered after 50 years. The only problem is the value came in at 1.2 million, 200K below the requested loan amount. The phone is ringing off the hook. Some people are very unhappy. I couldn’t care less. The only thing I have to say, what is the VA getting involved in and facilitating this rampant Real estate speculation? Why are taxpayers on the hook for these guarantee’s and insured loans? Someone ought to look at this.

Swamp Creature,

Maybe you explained this before, but I can’t remember. Are you concentrated on doing VA appraisals? Is the VA paying you for those appraisals? In other words, if your appraisals come in too low long enough, can you lose your client (the VA)?

Wolf,

“Are you concentrated on doing VA appraisals? ”

We do only VA appraisals for now. We are swamped with work, 18 hours and day 7 days a week. Don’t need any more work. There is a shortage of competent appraisers in the DC Swamp. A lot have quit or retired because of the horrendous working conditions, DC crime rate, and low pay.

To answer the other question:

“if your appraisals come in too low long enough, can you lose your client (the VA)?”

No. That is not now nor has been the problem

Here is the root of the problem and all goes back to the Fed. We get paid by the lender. VA insures the loan. If it defaults, the taxpayers are on the hook for any loses through foreclosure or short sale. The loss to the taxpayer is the insured portion of the loan. The loses could even be larger for the investors that wound up buying the paper. The VA doesn’t normally have a lot of defaults or foreclosures, because an active duty military person will get a bad fitness report from their boss and that will hurt their careers. Also their credit rating is trashed. Non active duty military personnel don’t face the same consequenses, They are playing the RE speculation game along with everyone else. The whole VA loan program has morphed into one gigantic speculative orgy and fraud and its getting uglier every day. The Fed encouraged this bad behavior with its near zero interest rates. This is a 5th level spinoff from bad Fed policies.

While there are no direct threats from the VA or the underwriters to hit a particular value, there are subtle ones, like e-mail flame wars, harassing phone calls, appraisal audits and reviews. A whole bunch of people stand to lose money if a deal falls through. The Loan Officer, the Real Estate agent, the RE Broker, the underwriter, the VA funding fee, State transfer tax etc. Also the buyer and sellers are not happy. That’s a lot of people against you. That’s all part of the job. I don’t mind that. I’ve gotten used to the fact that whole Real Estate industry here is corrupt from top to bottom including most of the people that work in it (sorry for you realtors and brokers that may be reading this post, just my opinion).

What is new is the level of defaults which you showed in your recent chart, 7.2% or higher when forbearance is included. Also, what is new is the number of lenders that DON’T PAY THEIR BILLS!!!! Our receivables are piling up because lenders are pocketing the escrow money for as long as they can and getting away with it. WE SPEND 50% OF OUR TIME TRYING TO COLLECT MONEY OWED TO US FROM THESE CORRUPT LENDING INSTITUTIONS) Appraisers have no union representation and are taken advantage of.

All these things mentioned above have essentially ruined what was supposed to be a second career and a thriving family business. I don’t know how much longer we can put up with this.

Thanks and wow.

I am not your typical home buyer. I bought my mom’s home from her estate 3 years ago when she died. This is the first time I have bought a home. And I’m 72 years old. I could have bought If I had been so moved anytime over the last 40 years. But I didn’t because of confusion.

And I’m still confused. For example, I’m willing to concede demand is going to the moon and prices along with it. But why are sellers so willing to sell? They both can’t be right can they? Are the sellers telling me it’s a good time to cut and run?

I got burned in the GFC Global Financial Crisis.

I sold and am renting a friend’s 1940s era cottage.

Looking to buy when prices get reasonable again.

There’s some risk. I could be wrong. But if I’m not….I’ll be paying cash for my home and can hold my middle finger up to the banks.

Owning a home outright is a wonderful feeling!

RedRaider,

I think some are taking profits at what they consider a peak.

Others have to relocate (different area, nursing home, heaven)

Others want to upsize or downsize and can’t carry 2 houses. (Wolf’s prior article says some are financially well-off that they can afford 2 homes. At least for now.)

All of my neighbors aren’t selling.

The schools are good here.

The neighborhood is safe.

Nobody wants potentially Covid-ridden people marching through their houses. This may explain the lack of supply.

Nobody wants to upsize or downsize at this time of their lives.

The last 2 homes sold in our neighborhood were due to the owner passing away. This was over the last 3 years.

It is possible some neighbors are in mortgage forbearance and are waiting to see how that turns out.

I never want to move again since moving with a family is a HUGE costly pain.

Maybe this phenomenon is happening on a macro level, but not here in San Diego. I’m sure there’s a mortgage slowdown here, but not because buyers are backing off; the plain and simple fact is that there’s no supply. During the last bubble, buyers were local and had no business buying, but were and were in droves. This time around money is pouring in from out of the county in droves, and it’s real money, not imaginary NINJA loan money. Folks from the bay area seem to be coming down here and considering a million dollar place to be a bargain compared to up there.

Wolf, you may remember last year in May I mentioned a house at 5454 Siesta Dr, 92115 that sold for what I considered a stupid high price, well Redfin now shows it at almost 871k…it closed last august at 759k. I guarantee if it went on the market today it would get overbid to over 900k. The folks who bought it were from Virginia and this was when the heating market was barley getting going. Look at what San Diego did in the 70’s. Houses that sold for 20,000 mid 60’s we’re going for 100k 15 years later. That’s five times more. Take the bottom value in 2012 and 9 years later things may have doubled (the house above sold for 445 in 2014 for instance).

Things correct as they always do but anyone in San Diego waiting for a 30% correction will be sadly disappointed. FOMO is legit here and something that needs to be taken very seriously. Big money is moving here and moving here fast.

The money is “fake” money too. It’s money borrowed against their stock portfolios, or using cash they are only using because of the paper stock gains. If those stock gains evaporate, so does this money.

The only homes listed in my neighborhood are pending. A real estate agent told me the two listed as for sale not pending are actually under contract.

Retail sales are surging. Jobless claims are dropping like a rock

Haven’t new weekly claims been over 700 thousand for a year now? Keep bidding up the prices of pogs, it’ll pay off some day! The economy that many of us have been waiting for to crumble since 2008 did in late 2019. The people at the top are freaking desperate, so yeah now is the best time to buy a home!

The tide hasn’t gone out yet, the tsunami crashed into shore last year, but what will be revealed when the tide recedes?

And folk’s haven’t had to pay for mortgage or rent for more than a year now. Everything is just dandy.

Retail sales “surged” because we printed money and gave it to people to spend on durable goods. Why is anyone surprised?

1) WTI might breach the previous high @$68.

2) Iran barter oil for Chinese trinkets, at 30%- 40% Brent.

3) US gov will offer Iran to switch from the costly, aggressive option – to hang Israel and dominate the Suni world, – to a peaceful and profitable option ==> to trade with western world, sell at Brent and break the Suni Israeli connection….

4) Iran might to choose the profitable option and start a global charm offensive, in Europe and US, but especially with France and Germany.

5) The Chinese discount will be deleted.

6) Putin might follow up, due to a huge demand from China and Europe.

7) Less trinkets and stupid gadgets. Less troubles in the Red Sea, between Bab el Mandeb and the Straits of Hormuz, between the Arabian Sea and Indian Ocean.

8) Higher energy cost for China, might encourage the enslaved nation to

turn their back on China, for the same reasons.

9) The last Olympics projected China as a peaceful thriving nation.

10) The next will paralyze any aggressive Chines option on Taiwan, Vietnam….

There wont be any slowdown in price increases until we start having inventory build up.

This is the simple truth.

No other explanations needed for the crazy frenzy.

Don’t forget we are still losing more than 500k jobs a week which is depression levels stuff, eviction and mortgage moratorium still in place till end of June, I will say this depression hasn’t started yet.

Houses will come down and assets will deflate unless the adults that run this country have decided to destroy the currency which will be their own destruction and I am sure they understand the process and will back away at the brink.

Eventually some accident will start to turn the pendulum to the other side and people will find out that debt is never a way to prosperity, hard work and savings is.

Meanwhile enjoy the ride.

Agree with most of your comment eb, but IMO there is an internal contradiction: The delta between ” Eventually some accident will start to turn the pendulum…” and your first sentence re inventory.

One AND/OR the other can and will do the damage to the ””’image”” AKA imagination of folks,,, been there done that more than once in my long time investing in the RE mkt before and after getting OUT of the SM as an investment in the 1980s when I realized that I had not made serious money other than with what is now referred to as insider trading,,,

Now illegal, of course,,, for all of WE the PEEDONs,,, while still totally legal for apparently ALL of our corrupt crony politicians,,, as well as our masters in fact,,, the rich and richer oligarchs, as always has been the case,,,

Had this premonition (some time back) that Gold would go to $800 and there would be none to buy, a wrinkle on the currency reset. At peak monetary stimulus (NOW!) the dollar will begin to lose value and the money supply will shrink. Negative money velocity takes over, money leaving the economy just as fast as they print it. Once pension funds are fully vested they do not want to buy more stock, and you have the second shoe drop, the negative oil futures crash only this time in the stock market. No place for the supply to go. Right now the competition for shares is fierce. What happens at the moment there are no sellers? Quite obviously if you sell your shares today, your chance of buying them back at a lower price is thin. No one wants the money, they only want the shares, when that happens the money is free to collapse. Once the money begins to drop, then no one is willing to take money in payment. The Fed has cooked up a catastrophe they will not understand in the least. That’s when I believe the true nature of bitcoin will become evident, a form of electronic barter. The only transaction that would exist then is the exchange of assets. The people owning bitcoin don’t hold any assets however, the product can only provide a service.

Just saw this headline on Marketwatch “How do you compete with home buyers who can pay in all cash? Skip inspections and appraisals”

Man, you got to love the new “normal”… all buyers are turning into the mantra “Just shut up and take my money!…You want my first born as part of the deal? You got it!…..”

That’s one of the most irresponsible headlines I’ve ever heard of. But it’s Marketwatch, so I’m not surprised. They’re just a bunch of market pumpers and leftist liars who silenced all of the commenters who had differing opinions, not unlike Twitter.

Yep. I got banned there years ago for writing that most of our problems started when we gave women the right to vote.

RightNYer,

Yes, you’ll get banned here too if you write that. Now if had said that most of the problems started when we gave men the right to vote — which started, I believe, in Greece a few thousand years ago — we’d have something to talk about, over a beer, but not here :-]

Has anyone noticed that major realty sites like zillow, realtor . com, etc have removed previous purchase price history and no longer show sold prices?

I know its public record if you really want to dig, but thats pretty telling to me.

The flippers lobbied them to hide old prices (or at least that’s what I heard). Nobody’s gonna get a warm fuzzy spending 900k on a flip that sold four months ago for 600k. Maybe someone can confirm this.

Also, I heard that realtors are relisting a house for close to the overbid while in escrow to fool appraisers into raising the appraised value to help with LTV requirements.

And another thing I heard is some banks are lending cash sums to a-plus clients so they can go in with all cash and compete for these overpriced places, then they need to convert it to a conventional loan secured by the house.

Strange times

The Bob who Cried Wolf

“Also, I heard that realtors are relisting a house for close to the overbid while in escrow to fool appraisers into raising the appraised value to help with LTV requirements”

If it is true then list your source. Don’t say “you heard”. An appraiser cannot use a sale as a comparable until it closed., and cannot never use the same property as a comparable, period!. An appraiser who did that could lose their license. Why would they do that! For what gain. If they are that dumb then and were “fooled” they should not be practicing in this profession. I believe this is fake news.

No. I read Zillow every day and study various houses listed. The sales and property tax history is always displayed.

There is nothing new under the Sun.

In 36 years of investing in RE, stocks and commodities, I have listened to (and as a younger man, myself espoused) much detailed analysis of precisely why market values were spiking, why they were flat, why they were tanking, what was going to happen and why, etc. Lots of smart talk.

Other than the dot.com bubble, I can’t remember such intense adjectives being used when describing market price inflation as are being used regarding today’s RE market in my SoCal location. Including during the RE runup in ”03-’06.

I know, I know, but it’s different this time. So the facts may be different but the emotions at play are the same and the history of significant value deflation (if not an outright crash) after every insane value spike will probably be the same this time as well. I’ve come to learn I’m not smart enough to see all the cards. I’m missing something. So were most “investors” during the inflation of prior market bubbles.

RE values up 40% in 24 months in some SoCal locations? 30, 40 bids per property? $50K, $100K, $150K over LP? Appraisal waivers by lenders? Ok, sounds reasonable LOL. Warren would say “great time to invest”, do you think?

I’ve been (and am) a long-term bull on SoCal coastal RE, but now would not seem to be a great time to be a buyer. Maybe the hottest seller’s market I have seen.

Can’t wait to see how this phenomenon turns out. Same with the stock market. Major value inflations usually head in the other direction, and in a big way.

Where I live , you cant sell because there is nothing for sale to move to.

This market is as messed up as all the markets..

The reason?

The Fed has inverted reality.

They lend (QE) to the Treasury well under the inflation rate…

Mortgages are under the REAL inflation rate and people know it…

and construction costs are so inflated that building will cease…

which will be another reason for Jerome Powell to keep money loose..

Idiocy.

This housing bubble is similar to the one in 2006/2007 with a different root cause. Back then it was Liar loans, bad subprime underwriting, etc. Now’s it’s root cause is the 2017 Tax Cut and Jobs act which led to a housing listing shortage (people holding onto homes for rental instead of selling) , and Fed zero interest rate policies, which led to residential home speculation, and FOMO mania. In either case the results are going to be the same. We’re going to have a meltdown similar to or worse than 2006/2007. You’ll see this begin once the long term Bond market collapses. Unfortunately, as in the last crisis, (Alt-A Mortgages, for example) it will sweep innocent people up into the conflagration, people who just wanted a home to raise their families and a roof over their heads.

There is a mad scramble every time a entry level house goes up for sale in the West Michigan area.170,000 to 250,000 House goes for sale and 3 or 4 days later bids must be in. And probably 20 or 30 bids or more if the house is decent at all.

In many of the real estate forums I am engaged with on a national level the issue seems to be a simple supply and demand issue…..the only explanation for the ridiculous overbidding going on. And many sellers are going off the market; why sell if there is nothing to buy, nothing to “move up” to? New construction is pricing itself out over material cost increases; they are beginning to have a tough time competing with even the limited amount of resale homes available. Sure, mortgage apps are down when there is little inventory to apply for……and the refi “boom” is being diminished by (even marginally) rising interest rates.

The only possible short term solution is the pent-up number of foreclosures and distressed sales bound to show up in large numbers as foreclosure and forbearance programs wind down.

As for the crash mongers, I’m over the screaming comparisons to 06-08. We were giving ARM loans to borrowers with 480 credit scores….what the hell did everyone think would happen? Now the low end is a 580 score with compensating factors…..somewhat better; and no ARM loans. I think we’ll be ok if Covid gets in the rear-view and we stop providing extensions of unemployment benefits without the job search requirements…..that is one of the bigger problems now, particularly for many small businesses I am familiar with……..

UK background/comparisons Q1

Mortgage lenders claimed a post-lockdown surge in mortgage applications. Time limited duty holidays.

80% of homes sold in small SW coastal holiday town best performer.

15% of homes sold in Birmingham 2nd biggest city worst performer.

Homes +8.5% on year. Cpi + 0.7% on year

Say no more.

Here in Orange County CA, in April 2021, the homes available are very, very over-priced; just shacks some of them. It seems that sellers are taking advantage of the situation and trying to unload their POS properties so they move out of state where their money can buy a much better home. I was considering buying but the selection is over priced and mostly crap. I pass.