The New Regime at the US Treasury Department.

By Wolf Richter for WOLF STREET.

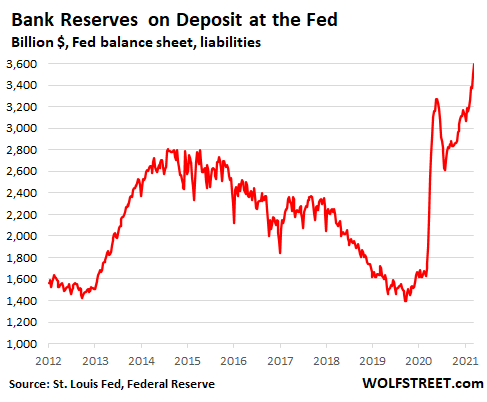

The reserve balances that commercial banks have on deposit at the Fed have spiked by $1 trillion since July, and by $333 billion over the past four weeks, including $89 billion in the week through Wednesday, to a new record of $3.6 trillion. These are liabilities on the Fed’s balance sheet – money that the Fed owes the banks – and the Fed currently pays the banks 0.1% interest on those reserves. What’s behind this huge spike?

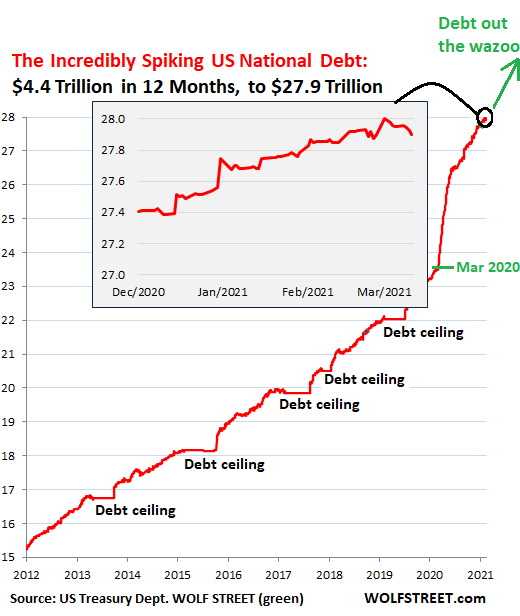

Since March last year, the US government debt – Treasury securities outstanding – has ballooned by $4.4 trillion, to $27.9 trillion currently. The government sold these Treasury securities to borrow the funds it expected it would need to cover the deficits and stimulus packages. But it hasn’t spent all $4.4 trillion.

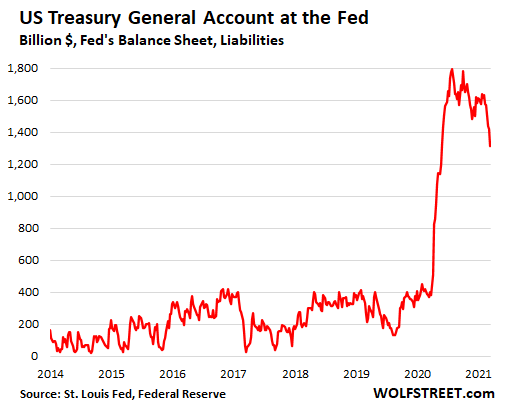

Some of it is still sitting in its vast checking account at its bank, the Federal Reserve, specifically the New York Fed. The balance in this “Treasury General Account” (TGA) spiked from around $400 billion in January and February 2020 to $1.79 trillion at the end of July 2020, as the funds raised from the enormous debt sales at the time weren’t spent as fast as they came in.

The New Regime inherited the TGA with $1.6 trillion in it. And it decided to draw down this balance to around $500 billion by the end of June, thereby reducing the balance in its checking account by $1.1 trillion. And so the government has reduced the amounts of Treasury securities to be sold at the scheduled auctions.

Over the past four weeks, the balance in the TGA account has already dropped by $266 billion, including a massive $110 billion in the week ended Wednesday:

The Fed, as any bank, carries customer deposits as a liability on its balance sheet. By contrast, the QE events – the purchases of Treasury securities and MBS, the repos, swaps, and SPV loans – are happening on the asset site of the balance sheet. But the TGA is on the liability side, money that the Fed owes the government.

So the government is using the funds in the TGA to pay for its deficit spending, including the $600 stimulus checks that were sent out starting at the end of December.

Drawing down TGA makes sense. The government doesn’t need to have all this much liquidity sitting in its checking account, while at the same time carrying this huge debt.

As a result, the government’s debt has declined since March 1, to be roughly flat with mid-February; and in January, it has risen more slowly than the horrendous spike that started in March, despite the red-hot pace of spending.

The insert in my Debt-out-the-Wazoo chart shows the details over the past three months. Obviously, drawing down the TGA balance represents just a minor and temporary slowdown in the incredibly spiking US National Debt:

The Treasury Department is reducing its checking account balance by spending this money faster than it is raising funds through new debt sales. When the government sends out a tax refund check or a stimulus check or pays for a contract, these checks or electronic transfers arrive at the recipients account at a commercial bank. The bank then presents them to the Fed for payment from the TGA.

The bank can then choose to add those funds temporarily to its reserves on deposit at the Fed. In this situation, the funds are effectively moved from the TGA account (money the Fed owes the government, a liability on the Fed’s balance sheet) to the Reserves account (money the Fed owes the banks, also a liability).

And you guessed it, as the balance in the TGA has plunged, the reserve balances on deposit at the Fed have spiked to a new record of $3.6 trillion. See the first chart above.

So this process of reducing the government’s TGA account balances has the roundabout effect of replacing Treasury securities on the banks’ balance sheets with reserves – sheer outright liquidity.

But there are all kinds of side effects, with so much Fed-created liquidity washing through the system, and changing hands, creating these massive distortions.

The current turmoil in the repo market is part of those side effects. This time around, the turmoil is the opposite of what it was in late 2019. Back then, repo rates had panic-spiked to 5%, 6%, and higher as lenders had pulled away, and forced borrowers were getting desperate. The Fed stepped in as lender of last resort to bail out these forced borrowers — such as hedge funds and mortgage REITS — which calmed down the repo market.

But last week, repo rates, particularly those of recently issued 10-year Treasury securities, dropped deeply into the negative.

A repo is a repurchase agreement, whereby one party lends cash in exchange for securities as collateral; and the counterparty borrows this cash and posts the securities as collateral. When the repo matures, the transaction reverses. The lender gets the cash back plus a little interest, and returns the securities to the borrower.

What happened last week was that there was so much demand in the repo market – not for cash, as in the fall of 2019 – but for these recently issued 10-year Treasuries. Participants (effectively the lenders) bid up the price of the Treasuries so high that their yield turned negative to -4.5% for them. In other words, they had to have the Treasuries, and didn’t care about how much they had to pay to get them.

Borrowers who supplied those Treasuries as collateral then – instead of paying interest on the amount of cash they borrowed, as normal – were paid 4.5% to take the cash and post the Treasuries as collateral.

If the Fed had wanted to step into the repo market this time, it would have had to sell Treasury securities into the market to create more supply, effectively borrowing from the repo market (reverse repo), to bring rates back up into the positive – rather than lending to the market by buying Treasury securities as it had done in the fall of 2019 when the rates blew out.

And that sudden selling by the Fed of its Treasury securities, ladies and gentlemen, would have been a hoot to behold. And so the Fed did nothing and let things play out.

The deeply negative repo rates on 10-year Treasuries have raised concerns in certain corners of Wall Street that otherwise clamor for more QE that the Fed has pushed QE too far, and that some aspects of the markets are starting to malfunction.

To let some hot air out of the markets? As long as it isn’t “disorderly.” Read… Yellen Coddles Up to Powell on Rising Long-Term Yields as a Welcome Sign of Recovery. Wall Street Crybabies Not Amused

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The country was never supposed to run on the distorted beck & call of the Central Bank. Yet here we are…

so sorry you have not listened to WOODROW WILSON

he would disagree

then again he never met GREENSPAN, BERNAKE, YELLOWEN and now JAKY POWELL

they are LEGENDS IN THEIR OWN MINDS

and leading us ALL(100%) into debacle of unknown consequences

The banks never met a repo they didn’t like. The truth is the Fed, a de facto extension of the US Treasury, can cover everything with QE.

Joan,

Thanks for cutting to the bottom line.

Although the incremental operational steps are important (and have ancillary effects that are also important) sometimes their level of detail serves to obscure the fundamental truth that all the subsequent steps ultimately depend upon:

1) The Fed has the power (legal right?) to print USD at will/in any amount.

2) No assets directly back any USD. USD are implicitly backed by the G’s power (legal right?) to take any real asset at will/in any amount.

3) In practice, newly printed USD are placed at the direct/indirect disposal of the US government/Treasury (see, armored divisions).

4) At the moment of their creation, these additional printed funds do not add a single iota of incremental increase to the existent, aggregate base of real assets priced in USD – ie, printing doesn’t magically conjure real assets into existence.

5) Accordingly, at the moment of their creation, the ratio of USD to aggregate real assets must increase (inflation…the dilution of value in pre-print dollars).

6) DC faithful assert the arguments that a) those newly printed USD will be spent by the G in wiser/more intelligent/more productive ways than the USD in the now diluted pre-print pool would have been and b) by increasing the pool of aggregate USD (and therefore dropping interest rates, due to increased supply of dollars) more overall future activity will be undertaken.

All that precedes the more obscure operational details that Wolf has laid out.

Those details are important and have follow-on implications/distributional consequences.

But they aren’t as important or consequential as the printing steps that precede them.

If the FED is so omnipotent and clever then why are we in this mess for over 15 years, with things getting worse? The truth is, QE is a failure, and so is the FED. These economic terrorists should be arrested for what they’ve done to the quality of life in this country.

Depth, the people are to blame too. Everyone wants everything (look at the percent of people that approve of this ridiculous COVID “relief” bill) but they don’t want to pay taxes to pay for anything. So the only solution is to borrow. Since the government can’t feasibly pay the interest rates it would take to borrow in the open market, the Fed playing games is the only way for it to work.

I agree the Fed should have held firm and been the adult. But it never was. It just made it worse and enabled Congress.

Dano, think about the positive. Would you rather spend your summers chopping back weeds in a potato patch, no earbuds, just to have moldy bug eaten potatoes to eat all winter? And poop in an outhouse. That’s what life was like in the USA before we went on the central bank system. Nobody had any money they just had a little patch of earth they could starve on. Oh a few people did well, but they only lived to age 40 back then.

Nowadays all you have to do is set up a bank account and the government drops electronic dollars in there! Then you can buy ANYTHING you want! I’m getting some new earbuds think how much that stimulates the economy. Someone had to design them, make them etc. Do I want those earbud makers to have to go live on a potato patch like in the old days? No I LOVE my earbuds!

Now there is quite a bit of banking and govt stuff that has to be managed for this system to work, and Wolf does a great job explaining it here, but instead of worrying about the details- leave that hard work to the bankers and elected officials- they’ll figure it out. It’s not distortion it’s how you get your money! Just enjoy your stimulus check, bro! And this is just the beginning! I bet soon they’ll get the monthly checks working better so I don’t have to do the unemployment thing and we’ll all be equal!

Absur Ditty:

Central Banks conjuring money out of thin air is the catalyst for innovation?

I think you are stuck in the Brick Outhouse.

I think the post was clever satire. But Poe’s Law, after all.

Oh do you really think Absur is just writing clever satire?

The “problem” is that our ability to produce stuff has become so amazing that soon it will only take a few dozen or so people in the entire world to manage the robots to design and produce everything the rest of us need to buy. Those few will be incredibly rich.

But no one left to buy them.

The Fed will come to the rescue. Everyone will get hired Directly by the Fed for $1200/week.

Job description “twiddle your thumbs and cash your checks.”

If that sounds too boring, Keynes in the 1930’s suggested hiring half to dig the ditches, and the other half to fill them up.

I have come to the conclusion that most people only have enough IQ points to twaddle their thumbs. The cheques are cashed electronically now. Luckily, smart phones allow us to use our twaddling thumbs far more productively now. Like writing needless comments on Wolf Street for example.

Your ‘problem’ shouldn’t be seen as a problem in reality. It’s our political/economic system that’s the real problem insofar as it can’t accept and adapt to the truth you’ve expounded. It’s stuck in Keynes’s 30’s.

Keynes was a great ‘joker’. He said in the long run we are all dead. He is, but I’m still here with the debt mess his kind brought on us all.

The main solution is to simply keep reducing the number of hours a year a person is allowed to work. Simply dividing up real jobs among more people as things get more automated. This of course means implementing a number to start with and making sure companies don’t simply switch to “independent contractors” among many things, such as controlled protectionism (what does and doesn’t have to made in America/tarriffs). I really don’t see any other way to keep everything going well.

“soon it will only take a few dozen or so people in the entire world to manage the robots to design and produce everything”

Sorry. Could not help thinking about WALL-E.

All you need to know is that the stock market hit bottom not when congress passed the first stimulus, but when the FED announced 4 trillion in “special facilities.”

The Federal Reserve is, without hyperbole, a 4th branch of government who is more powerful than congress.

‘The Federal Reserve is, without hyperbole, a 4th branch of government who is more powerful than congress’

and UNACCOUNTABLE to no one! No outrage. Just enjoy the free lunch with MMT – More Money Today!

Uh unaccountable to no one means accountable to everyone. Calm down, it will probably be all right. Or not. Is there really any gold in Ft.Knox?

Reply to Cas127

Read the following two links to the US Code defining a dollar and a Federal Reserve Note. You’ll know more about our monetary system than 99.9% of the populace…you can do it all at no charge and take you less than 1 minute…

See paragraph (e) for a dollar defined:

https://www.law.cornell.edu/uscode/text/31/5112

Federal Reserve Note defined in US Code:

https://www.law.cornell.edu/uscode/text/12/411

Aaron,

Read them…but you’ll need to clarify the point you are trying to make.

Precious metal content of coins?

A dollar is defined as a 1 oz silver coin, and the Fed does not create them.

A Federal Reserve Note is a debt instrument. The Fed doesn’t create the physical ones, they are issued to the Fed. The banking system creates credits with the same purchasing power as the physical ones.

This article is all about the banking system creating credit. The banking system doesn’t create dollars…it creates credit, which has the same purchasing power as dollars.

When the credit is in jeopardy of contracting, that potentially creates significant issues as the collateral is largely securities whose value will also decline…hence debt and QE out the wazoo.

It has been sonce the dollar scam started. Why not replace gold by some pieces of paper, what could go wrong?

The Fed has been coloring outside the lines since 2008.

Even Bernanke, who began this scourge called QE, promised that all would roll off and be undone when things returned to normal. 6.5% unemployment or lower would begin the process. Unemployment went to 3.5% and QE increased!!

The Fed is the well spring now for progressive projects such as package misnomers like COVID relief, Heroes Bill, Green New Deal, and Reparations.

And who is to complain? Congress? Not likely.

We will have to have a PUNISHING inflation and a public outrage before any criticism is laid on the Fed.

10 more years on Wolf Street and I MIGHT understand this whole Treas-Fed-Banks-Repo merry-go-round. Read the article twice and I understand why bank reserves are high – but making 4.5% by borrowing – I got lost. I will get there someday !! :-)

“…but making 4.5% by borrowing – I got lost. I will get there someday !! :-)”

Everyone gets lost with distorted absurdities like this :-]

Yes, it definitely would have been a hoot if it went the other way…

Wolf,

(Just my, inflated away, 2 cents…)

You do fine explainers but sometimes you mash too many concepts/educational goals into a single post…at least for easy consumption.

Since most of the operational details of the Fed/Treasury/Banking systems are alien to financial civilians’ personal experience, it is very easy to get lost in the weeds of new concepts.

For me, it helps when you more slowly step (in more incremental detail) through fewer concepts across more posts.

Also, such “spreading” allows more time/space to tease out the implications of gvt policies/operations…and that process itself helps the non-insiders to understand what is really being said in the first place.

I think these Fed/Treasury explainers are some of the most important posts that you do…that is why I would like for the maximum number of your readers to fully grasp them.

Thank you for putting in all the hard work that these posts (and your blog) require.

As recent discussions of ad CPMs indicate, you can’t be doing it for the money alone.

Yep. Need Money-and-Banking 101?

I am not an economist or banker,but it seems like the Fed would rather owe commercial banks than the government because they are the Head of the multi-tentacled,vampire octopus and if they want,they can create other crazy special rules or so-called assets to suit their private purposes.Why did the lenders Have to have the number of Treasuries at that particular time is what I want to know?Also,last weeks fiasco seems like a paenshop scam to me! :-)

At least this was a short article albeit a rehash of common knowledge.

The group of families (inbred and acquired) that comprises the banking / ownership cartel won’t stop the scam until they say it’s over or they are defeated on the battle field.

The scam is to create debt.

These way the cartel banking family and the billionaire class will have complete control over every aspect of this earth and it’s daily revolution.

These control freaks not only dislike the majority of earths inhabitants the dislike the millionaire class as well.

Every now and then we hear one or two of these billionaire names. Odd that they are the same old same old names?

Do you suppose they bank at Wells Fargo?

Perhaps the billionaire cartel keeps its cash stash at BOA or BOE?

My observation leads me to suspect that the multi-billionaire class banks only and exclusively with and by the Federal Reserve Bank New York USA.

But it is all by plan and it is very sad for me to see the peoples world wide in peril financially, medically, morally year after year.

Beardawg, I had to reread that same paragraph. It says lenders were willing to pay 4.5% (rather than earn) and borrowers could earn 4.5% (rather than pay). That’s what makes it negative. Hope this helps.

Beardawg and others,

I have now added an explanation about the repo market to this section, which made the section longer, but I think it’s clearer why and how this happened. You might want to give it a try to see if it makes more sense.

The repo market is peculiar creature!

WOLF

Thanks so much for taking the extra time to do this!

I echo cas127’s comments as well. Us Streeters often hang on your every word, and sometimes have to read 2 or 3X to get it to sink in. That is not a problem, because it promotes learning, but some if this high finance S*** really does require a meticulous road map.

Thanks for all you do in this forum !!

So it is

There has to be a “edge”

somewhere within these comments.

Perhaps the Repo Market of a decade ago?

I’m not going to scratch the bottom of the barrel,

Not yet.

Let that play out next week, the early results on the stimulus are in, its arriving with hyperbole, being spent in the consumer market (as it is designed for)

also completely screwed up logistics in the import trade.

Careful how to proceed.

This may look easy peasy still dig deeper.

It’s only money Woofers.

The supply doesn’t meet demand. The rise in yields is considered temporary, and the suggestion is the banks will break the contract and keep those securities.

> banks will break the contract and keep those securities.

Yup… very low liquidity now in long dated UST futs and cash suggest someones right now is just in a corner trying to raise cash… ~23 bps spread between 10y and IG with a avg mat of 12y after fees and tax asof EOD friday. Ones that goes negative, there will be no incentive to buy IG hedged over long dated UST hedged… a no bid kind of situation where any FRBNY buying of IG would just make things worse… any frbny buying of more UST would just leave less HQLA for the system…

So basically the last time around there were too many 10 year bonds in the market so the Fed had to swoop in and buy a bunch whereas now it’s the other way around, there’s too few of these things and the Fed should indeed sell some therefore raising interest rate in the process.

What I am interested in knowing is how these bonds are being used by the lenders? Presumably as collateral as well? For what?

On the run [0], off the run [1], maturity mismatch [2], basis risk [3], and rehypothication [4]… The are the terms that will help us all on the path of eurodollar enlightenment.

Wolf briefly alluded to [0] (“recently issued”).

I doubt this post of Wolf’s will get as much interest as those that invite everyone to opine on the kabuki theater from those who never sat on a trading desk… there’s a lot to unpack here that will get to the heart of neutron bomb going off right now in plain sight for those not yet driven deaf/blind/and dumb from televised performances of prepared remarks of monetary onanism.

Remember LCTM. They loved doing that spread trade between on the run and off the run T Bills/Bonds, etc. I don’t think this is what’s happening though.

4.5% is YUGE.

You only zoomed in on 2/4 briefly… gotta go deeper.

PBOC balance sheet, usd/cnh, 10-30 year yields, 1 year f/ndf’s/etc, cross asset correlation since march ’20 of them… where there’s smoke…

I don’t know if it’s that simple. I realize that picking up yield overseas is not a new thing. Heck even foreign exchange exposure can be hedged away, but 4.5% is still YUGE ….

I am guessing there’s probably some sort of margin call somewhere.

4.5% for the option to fail to return the collateral to the other bank on other side of the trade might wish they had at any moments notice rather than the cash…

Is “Flight to safety” really a thing?

More like “flight to raise cash because I got bills to pay”

There’s potentially just as much interest, some of us are just reading the comments trying to figure it out.

It’s being driven by short interest. Hedge funds (et al.) want to short the bond market, but they need bonds to do that.

The stuff in this article is precisely why they are so eager to short Treasuries — banks have been allowed to exclude Treasuries and Fed reserves (chart #1) from their asset calculations since last March, which has lowered their capital requirements and allowed them to make more lucrative loans. That exemption expires March 31, and if it isn’t extended they have to sell off Treasuries even faster. All that money coming out of the TGA only squeezes them further.

Watch what happens next Tues and Wed after the FOMC meeting. If they say the SLR exemption gets extended, bonds should calm down. If they confirm it is ending or if they don’t say anything rates could go even higher.

>Hedge funds (et al.) want to short the bond market, but they need bonds to do that.

You dont need UST in order to sell cash settled ZBM1…

Offshore UST low volume liquidation is behind this move… eurodollar squeeze

Is this spike in reserves the same as Total Borrowings of Depository Institutions from the Federal Reserve [BORROW]?

I have noticed when Borrowings spike up, generally very bad things happen to the stock market within a few months.

Your last comment made me think of 1883

‘ I say, chaps, did anyone just hear a bang….’

Wolf’s last comment I mean.

What happened in 1883?

silver?

Krakatoa blew a tizzie. (Besides Life Magazine, Civil Service, and 1st state to enact anti-trust laws.)

Yup. Krakatoa.

“Since March last year, the US government debt – Treasury securities outstanding – has ballooned by $4.4 trillion…”

Must be a typo. $4.4 trillion wasn’t inflationary Oct 30 2020, but suddenly $1.9 trillion November 2020 is. Because it’s never been done before yesterday.

They are both inflationary, and it cometh pronto.

Of course it is hugely inflationary. Just not CPI inflation. Look at asset prices.

The opposite can also happen: deflation in asset prices while having the CPI running hot. Imagine the panic when that happens! Central banks would be forced to raise rates to prevent people from rioting while asset prices plunge.

You touched on something no one is talking about…

the inflation that raised stocks and housing will now trickle to the working families of this nation….and pound them, grind them down…

to your “people rioting” mension….

There will be a hue and cry…..for inflation relief…

and the central bankers will mostly ignore it….

then …what will happen?

As you probably know, high inflation has been a trigger or at least a major factor in many revolutions in history.

I also believe that much of the anger that we see nowadays is an indirect effect of monetary policies. People know they are getting screwed somehow, but they cannot put a finger on what exactly is causing it. So people are pulling down statues and plundering shops instead of storming the Eccles Building.

It’s not inflation that causes revolutions as much as it is taxes.

Of course to the extent that inflation is a hidden tax it fits in there too!

1.9t is the additional stimulus just passed by Congress. This is added to the previously projected deficit of 2.3t to arrive at a 2021 deficit of ~ 4.2t , similar to 2020.

You are not the only one who does not understand how 4.4 T in additional debt in 2020 is not inflationary ,

I am trying to find the code for ‘The reserve balances that commercial banks have on deposit at the Fed’. Does anyone know? Thanks.

I believe it is WRBWFRBL?

here is the PDF of the Fed’s balance sheet. Go to page 2, bottom line of the table, in bold, “Wednesday level”: “Reserve balances with Federal Reserve Banks”

https://www.federalreserve.gov/releases/h41/current/h41.pdf

You can get the same thing in html format here:

https://www.federalreserve.gov/releases/h41/current/

You can download the data (and all other balance sheet data) here:

https://www.federalreserve.gov/datadownload/Choose.aspx?rel=H41

I guess the net effect is that the Fed gets themselves into tight spots from which they can not extricate themselves.

As in Physics, for every action there is an equal and opposite reaction in this complicated network.

Somewhere along the line, the free market got lost.

The Fed has gone from its initial function of providing banking liquidity in times on necessity to funding government programs with digital minting.

The CB’s make such strange and unprecedented moves, the markets need time to figure out what appropriate opposite action to make. And when it has got the clue, de CB’s change something again to dodge that counter action. But the markets learn from the moves. There is a limited amount of moves possible. And some day the markets will be in charge again by pre-emptive strike. That’s when the CB’s will be put in their cages again. I hope to live to see that day.

CRV

In the 70s when the prime was jumping each Friday by as much as .5%…the Fed would FOLLOW.

The banks would announce their new prime rate on Friday, and banks like Merchants out of St Louis were leading the market…

Those were the days when the Fed didnt control every tick in the markets…..and still stuck to their THREE mandates, and original purpose.

No more. Now the Fed is the piggy bank for government programs….

Cave quid optes.

What so many people don’t seem to understand is that if you create more currency, every dollar MUST be held by somebody.

Therefore, all the talk about “these new dollars flow into…bla bla bla” really gives the wrong picture. If somebody buys stock or bitcoin or whatever, this only changes WHO holds these dollars afterwards.

Can’t wait to see when the Feds start arresting bankers for laundering money via Bitcoin.

As I understand it, there is quite a lot of legislation in the pipeline.

Total crypto market cap is now 1.8T. That is no small fry anymore. It could actually hurt a lot of people when that bubble pops, especially now that institutions are getting suckered into this. It may become a system risk at some point.

I was just checking the market caps of crypto. There are now 77 (!) cryptos with a market cap over $1 Billion. The fast majority you have never heard of and most will eventually go to zero, even if BTC survives.

“It may become a system risk at some point.”

Another few yrs of DC performing the way it has for decades and…the USD will be the systemic risk for crypto…not the other way around.

Funny that with the search for the creator of Dreamcoin, no one seems to think the Fed itself might be behind the whole scheme. Monetary devaluation is the stick to drive us in a direction away from measurable standards of dollars. Perhaps BC is the test carrot. Once you get moved into this world, they simply remove the name and replace it with something more easily divisible into units so small you’ll never know how you’re getting pinched in milli-seconds. Average Joe can spot 1/100’s disappearing with a thief in the night, but how many are watching as 1/10,000 evaporates. All they see now is BC inflating, but it is also capable of dividing into infinite units of whatever it becomes when the word dollars is eliminated. When the say “Redemption”, it won’t have a darn thing to do with saving souls. It’s about selling ’em.

“no one seems to think the Fed itself might be behind the whole scheme.”

Trust me, people think about.

When you realize just how central unbacked money creation is to DC’s ability to govern (poorly), you cannot witness the rise of crypto without wondering what scheme DC has in store (counter productive scheming being the last product of a failed gvt).

Simple guess as to why DC “allows” BetterCoin…if you are a Keynesian, then private savings are often viewed as an enemy of your idealized system of levers and pulleys through which you control the economy (so perfectly…).

If the economy is failing, it *obviously* isn’t caused by the failure of the State religion (Keynesianism) upon which your personal power rests.

It is *clearly* the fault of all those dirty little savings hoarders.

And what better way to extinguish illegitimate savings than to wait for BetterCoin to flourish.

And then (try to) bring the hammer down.

Zeroing out BetterCoin savings serves your Keynesian objectives…while the expropriation serves the same purpose as summary executions…they are a high profile object lesson in who is the Ruler and who are the Ruled.

Why not throw laundering money via real estate in too?

Apparently that’s the easiest way to launder $ in the US.

But since 9/11, white collar crime has largely been ignored for the boogeyman of “terrorism”. Convenient!

The empire has a history of stomping around the world destroying as it goes with endless wars because it thinks it knows best.

So too it stomps around within its borders with policies that leave no aspect of life untouched.

And also in the financial world, stomping on every aspect of money so that not one person is unaffected.

“So too it stomps around within its borders”

This.

There is something about the kind of people that DC attracts…the more they clearly fail, the more shrilly arrogant they become in refusing to course correct.

And so, drowning Men draw more and more innocent men down with them.

Getting paid to borrow is all perfectly normal, the Fed really does have everything under control and it does make sense because plenty of media outlets wouldn’t dare tell you otherwise. At least Joe Biden has all his marbles about him.

WAtch out for end of year when stimulus ends along with free rent student loans and all other boondoggle,s me thinks China will ruin America financially because of corporate greed they really run this country globalization ruined this country for corporations to get richer leaving worker,s behind examples apple whirlpool caterpillar if manufacturing doesn’t,t come home we’re doomed but we still have largest army in the world every citizen has the right to bear arms equality works in mysterious ways

Yes, I’m also curious what happens when stimulus stops and people need to pay rent again.

My guess is…(drumroll)…. another multi-trillion stimulus package! They’ll just keep doing this until something breaks.

Seen a couple local TV news reports of mom and pop type landlords dumping rentals because renters not paying rent for months now. One guy in Seattle owed $30k, no way to evict tenet. No relief for him only a big increase in property tax. Sold at $70k discount. A lot of clicks in this Rubix Cube economic disaster yet to fall into place.

I almost paid my tenant to leave. Fortunately she allowed me to guilt her into leaving.

My friend (at least by FL’s rules) has the answer: She’s only been renting month to month for years.

Folks on month to month leases can be evicted in FL. It’s a tough terrain for LLs for sure.

Remember when Cheney/Bush and 6 yrs of GOP controlled Congress crashed the economy at the end of ’08?

Baby Bush the Lesser said “Wall Street got drunk…..” The problem as far as I can tell it that the bar never really closed. Some temporary fixes, yes, but the underlying issues were never addressed.

Hence, we find ourselves on the same precipice, staring down into the abyss….

No, the left crashed the economy in 2008 by encouraging banks to underwrite mortgages to non-qualified borrowers, starting in the late 70s.

@ RightNYer –

spoken like a political shill – with a selective grasp of history

____________________________

Bush Jr had “to save Capitalism from itself”, after Cheney said “deficits don’t matter.” That alone ought shame one from being a Republican.

There are many ways to make non paying renters life miserable at the property. For starters they could have made hvac system non functioning. Hard to stay in a house that has no heat or A/C.

Historically, judges have hammered down hard on such eviction tactics.

In all probability, they will hammer down *harder* during/shortly after a G declared pandemic.

The judges will say…try to work out a pmt plan to make up rent arrears over years…before you come back and complain to the Court.

It isn’t particularly fair…but it is more likely.

I actually rent to a really good guy who would die of embarrassment before he missed rent payment. Nevertheless, when I built the place I kept Hydro in my name. We pay his bill online and I just get reimbursed every 2 months. This setup is for future tenants in case they turn dodgy. And if? I’ll just pull the meter about 2 days before I visit with some ‘friends’.

If they want to go the court route good luck. If the place gets wrecked they’ll have to leave the area. People won’t stand for it.

China authorized a ”standing” army of 8 million a few years ago R, so don’t know where you are getting the idea we have largest army??

Please provide reference.

Thank you.

Every citizen in America is armed not hard to figure out

Ron,

That would be a militia, not a standing army.

Would we rather the FED be the piggy bank for TBTF banks or the piggy bank for the Us government? #HelicopterMoney

The arbitrary Rube Goldberg nature of the financial apparatus discussed in this post yields the same result as in a mechanical apparatus. Nothing. At any point an arbitrary component can be replaced with another which will confuse the observer briefly but still the end product is Nothing. The opportunity to siphon off skim is available to a Catillion Oligarchy which is the reason for the Goldberg design of the financial apparatus.

Full of Sound and Fury,

Signifying

Nothing.

People were concerned we were on the way to becoming Japan. Instead we are becoming Argentina, where financial chaos perpetually reins.

Feeling confident? Me neither.

The Japanese scenario is actually not that bad, at least for now. Inflation is low. So is their “growth”. But their population is shrinking, so growth per capita isn’t all that bad. And who needs growth anyway. The country is wealthy.

The main problem is that their massive and growing government debt cannot be sustained forever. Though they can probably solve it by introducing the mother of all inheritance taxes, since their debt is internal! (Japan as a nation is actually the biggest net creditor on earth).

Except, the Japanese scenario was never real in the first place. There is NO Japanese scenario for the US.

People have been betting on the demise of the Japanese economy for years, and a lot of those people have been carried out in body bags. On top of that, Warren Buffet last year started investing in some Japanese companies.

From my point of view, it’s the US that will tumble first. Too many crazy people here.

BOJ owns most of their bonds and only trader, out there. They also buy their own equity ETFs!

10y Jap bond yields 0.016%.. Their economy barely out of recession.

10 y US bond 1.629% comared to 16T at NRP in Europe!

Thanks Wolf. That was clear as mud. Just the way the insiders like it. WhyTF does all this have to be so complicated? Wait, don’t tell me.

I think it has to be so complex because markets are complex and if you try to manage them, then management is going to be complex.

We all make financial decisions everyday and the government would love to carrot and stick us on each one. At least there are gray markets, barter, favors between friends and family, trusts, gold and silver, flee markets, yard sales, cash stashed in hiding, and small cash transactions to give us a little freedom and make their job harder.

Actually, I don’t think it really is all that complex as much as it is…alien.

Markets (for loans or anything else) are all about supply and demand, intersecting to yield price (called interest rates, in markets for various types of loans).

The confusion comes in because almost all citizen civilians have no normal reason to understand the players/practices that translate broad (dysfunctional) gvt policies into private economy effects.

So when more knowledgeable types like Wolf whip through more obscure lingo/players…on the way to making a main point…they tend to leave some of us in the tall grass, laboring to catch up…piecing together sped-through asides and assumptions that we really aren’t completely familiar with.

I just try to focus on the fact that these are all mkts and try to back into who the parties are and what their motivations/perspectives might be. And what the mkt results seem to be telling us about the past, present, and future.

Cas, you’ve done yeoman service in these past few posts. I appreciate your efforts to educate us.

Tom,

Thank you.

Wolf is doing 99.9% of the heavy lifting…sometimes I just try to restate/embroider/occasionally mutilate the points he is making, so that less “insidery” readers can appreciate the mechanisms being impacted by gvt policy and how those impacts might affect the public now and in the future.

A lot of the seeming obscurity can fade once you think about what is actually being traded in a given market, by which parties, and to what purpose.

It has to be complex because the perpetrators are trying to steal legally and lie truthfully.

So where do we go from here as the Fed sits on its hands as the 10yr rate rises?

Currently, the markets seem fine with the 10yr jumping on 3/12. They do nothing. Next week and weeks thereafter the 10yr will continue to climb and at some point, the markets will start going down. At what point will the Fed jump in to try and control the rate? Will they jump in?

The 10 yr at 2%? 3%? 4%?

Could the Fed let the market be a market and let rates rise to their natural levels? If they do will the everything bubble pop and will the Fed will lose credibility and the people’s confidence? Or will they rely on some sort of yield control to put the flames out of inflation they, and their CPI says doesn’t exist?

If I own US Treasuries and I see the US printing money like a drunken sailor, do I hold onto them or do I sell? And if I sell, who will be the buyer of the last (only?) resort? The Fed? If the Fed prints to buy these bonds how far south will the dollar go?

So I guess when Nixon “temporarily” removed gold from the dollar in 1971 was when the can was first kicked. Now… 50 years later that poor dented can not have much more road left to be kicked.

Maybe the last question we have to answer in this half-century monetary experiment is “Will the US government let rates rise and default on their debt? (and pop the everything bubble) or will the US inflate its way out of debt and sacrifice the almighty dollar?”

Either way, it should be interesting.

Murray Rothbard

‘Could the Fed let the market be a market and let rates rise to their natural levels?

Wonder why they started QE 2 when QE1 failed ( then QE3 and now QE4++) besides twist?

Remember Mkts couldn’t handle the rate of 2.5% in late 2018, and had to trace back!

Trapped in their own karma! Deficit spending Congress is also complicit!

So is BLS in understating inflation!

Has there any nation in human history which has prospered by spending debt on debt?

Some bond guru says they are going to keep the short end pegged at zero and let the long end rise, because it does too much damage to banks, insurance companies, pensions and savers to keep entire curve nailed to floor forever.

He also said he believes there’s going to be high inflation because that’s a tax on everybody and politicians don’t have to get their hands dirty raising taxes.

There is a third option

We could nationalize all the Treasuries as the AH dude did in 1939 wiping the debt clean, and say

“We thank all you patriots for your donations to the Fatherland”

“The 10 yr at 2%? 3%? 4%?”

There is no better indicator of America’s political and resultant economic degradation than the fact that 8% rates were completely normal during the 80’s and 90’s – when much, much healthier US economies existed.

If the Fed didn’t commit forgery on a global scale, printing to drive interest rates down, and rates rose anywhere near 8%…the US economy would implode and DC collapse overnight.

For decades and decades, DC has borrowed to avoid ever having to make any semi-difficult decisions and the disease ridden day of reckoning is ever closer.

Cas127

When 10y yoeld reaches 1.75%, you will see the reaction of the Bond & Equity mkts!

Cannot wait to see the turmoil!?

I don’t understand this stuff (or calculus, so this is no criticism of WR’s explanation) Only thought from here is: isn’t it time to abandon the term ‘debt ceiling’?

There has never been a debt ceiling because every time they reach a spending limit they get together and increase it. It’s all a big show that is getting really old.

The Debt Ceiling is a joint Kabuki Production between Washington and Tokyo.

Forget Broadway musicals. Those are for wannabes.

This does help explain the alarm a few weeks ago, BoA analysts saw the upcoming transfer of Treasury’s balance, held at the Fed, to charter bank reserves might trigger a melt up in stocks. (gasp) The solution is the stimulus bill passed and the banks will write checks on that balance. The Fed has to go to yield curve control to satisfy demand in the 10yr, and if they monetize the debt at shorter maturities how does that play out? Only if the Fed goes full Japan will YCC work, and that means they are already targeting lower interest rates for the rollover date (or they have the kind of inflation they don’t want – see what JP said about inflation) If Fed does repress interest rates they are guaranteeing another decade of subpar growth. If they allow rates to normalize now, we could get that 70’s inflation show. Global rates are key. US CB must provide positive benefit to foreign buyers of US debt, and the dollar index busts 120. So far even Treasury is not defending the dollar. Foreign interest in the latest debt auction was off substantially. Rates in Yuan are competitive and China wants a reserve currency. Global competition for investment dollars heats up as monetary base shrinks. (sigh) The global monetary potlatch… You were witness to it, this week, peak monetary stimulus.

‘China wants a reserve currency’

Are you sure?

Only country with trade deficit can afford to be a global currency like US $!

Yuan is share 2% vs 60% of US $ in the global commerce.

How many trust Yuan vs US $?

You can use yuan to buy chinese goods. What do we sell, real estate that no longer produces income and paper based investments. Soon even the paper won’t exist, it will all be digital assets and fairy dust based tokens.

Petunia,

“You can use yuan to buy chinese goods. What do we sell, real estate that no longer produces income and paper based investments. ”

Bravo!

This is the crux of everything and I’m glad to see other people boiling it down and pointing it out.

With some additional assistance, we could probably refine it further – as comparatively degraded as US productive capacity has become, there are sectors where the US is not getting its ass as thoroughly kicked by China as others…those might be the places to focus on for an American reboot.

Alternatively, perhaps we should focus on the industries where the US is being most decisively slaughtered (computers, cell phones, etc.) because weakness in the highest value add industries likely leaves us most vulnerable.

Some industries might be so far gone in the US (relative to wage/cost of living structures so inflexible in US) that the best we can hope for is to diversify away the foreign source supply risk (ie, anybody but China, even if it costs some more).

Looking at semi-detailed intl trade stats is useful in this regard (to identify hopeful industries and potential source countries other than China).

A good place to start might be asking why China is able to assemble advanced smartphones and the US cannot any longer.

It isn’t just lower wages (smartphone production is highly automated/component driven anywhere) and it isn’t just the increasingly awful American educational system (self motivated students tend to survive it) – it would be nice to know the details of American defeat in this area from someone involved first hand.

The issue was ‘YUAN as a reserve global currency’ NOT if one cab buy with it!!

Don’t confuse the issue!

What’s the true value YUAN vs US$ ‘off shore vs on shore’?

Any currency pegged to US$ is declaring that it is worth is NOT as an independent floating currency! Even a 3rd world country India floats it’s currency RUPEE as US$!

Cas127 – this question of “what is the basis for our sustainable economic advantage” has been answered well already.

“There isn’t one”.

There might be a sustainable basis for a well-disciplined society like Japan, maybe even Germany (just to name two that come readily to mind).

But the U.S. isn’t politically coherent anymore. We’ve fractured, we’ve let our conception of who we are, and what our interests are become diffused and manipulated by the “cleverly unwise”.

“Clever enough to do it, too stupid not to”.

========

Playing as a team well enough to define and execute a national competitive strategy is not currently possible here in the U.S.

Much pain has to be borne in order for us to wake from the slumber.

Till then, the inflation and transfer payments (less considerable skim) will continue.

THere is an article today on describing how some hedge fund managers are now buying Chinese bonds.

As the US keeps on running giant deficits the dollar will weaken and fewer transactions will be done in dollars .

Drunkenmiller has a big position on China (bonds?) and a big short on the dollar. A more moderate trader might have hedged one with the other. China is changing the rules, and nobody seems to be picking up on it. I just wonder how long they will sell durable goods at the current price with $4 copper??

No wonder BC hit 60K today. Most of the new stimmy (1.9T) checks may go towards purchasing crypto!?

Gold going no where! 10 y is 1.629%

Brazilian mutant (P1) found at Dublin check point.

( Another Brazilian E484k mutation is more deadly that evades antibodies and high levels of contagion)

More upheaval on Monday!

When the crypto bubble pops, it’s going to be the most magnificent crash in the history of asset price bubbles. It’s literally a bunch of greedheads buying and selling nothing to each other.

Crypto is heading toward $2 T. Stocks, bonds and loans and rest of financial products is $525 T.

Zombie companies stocks and bonds going to zero would make Crypto look like loose change. Throw in a housing collapse and you really have problems. Looks like government is going to try to dump so much cash in the economy that it’s going to try to turn zombies into living companies.

Stocks, bonds and housing have intrinsic value. Crypto does not. It’s a Ponzi scheme.

I read that $152.7 billion was cashed out in home equity last year, up 42% from 2019. It wouldn’t surprise me at all if some of that was used to buy BTC and Tesla.

There will be a lot of tears once again when the housing, stocks, bonds, crypto bubble bursts. Powell and Yellen will say: “nobody could see this coming”, just like last time.

Old school

TSLA bought BC when it was 33K, today it is 58K. More & more businesses are lining up!

—

“Bitcoin is a hole …in a burning building

I had the thought that Bitcoin is like a hole in the wall of a burning building. The burning building is the petrodollar. The Bitcoin hole in the wall doesn’t meet any standard definition of a door. It wouldn’t pass a building inspection and it may not last long. It will most certainly be replaced by something else in the long run. But in the short term, no one inside that burning building really cares about any of that and the ones that first smelled smoke are already pouring through it. Many more will follow and some, sadly, will die in the fire. There are other exits from the building too, some may be safer than others, but the most important thing is getting out of the burning building as quickly as possible.”

zh 2017

Depth Charge

“Tree Rings, analyst Luke Gromen looked at the startling similarities in the volatility of gold in Weimar Germany and bitcoin today. His conclusion? Bitcoin isn’t so much a bubble as “the last functioning fire alarm” warning us of some very big geopolitical changes ahead.”

BC is a reflection of what’s happening to Fiat currencies all over the world including US $! Gold is down but BCoins are up! BC has a store value just like a painting, a rare coin or a old clock!

Perhaps lost amidst the bitcoin bluster is the fact that mining names have returned massive sums, in excess that of bitcoin. Marathon and Riot both surpassed 7,600% gains for the year as of March 12

I concur. BTC is a foil on the dollar – a mirror.

Not entirely – a lot of the BTC appeal is simple greed. But a lot of it, at the outset certainly – was as an escape from / alt to the problems of fiat and the related tax regime.

We want out. We realize it’s stupid, unstable, wasteful and a lie.

Just Watch the price of BC vs the yield on 10y bond!

Nothing else can explain or matters!

If one knows the relationship of Bonds vs stocks and int rate, one should realize that the BOND (credit) mkt is the ‘foundation’ upond which stock/equity mkt is built. Bond reacts acutely to int rate compared to stock.

At the same time, Bond mkt is very essential to raise money for Fed/CBers (sovreign bonds) to keep the spigot of deficit spending of a trillion or more each year, here afterwards.

How long this kabukee circus can go on, is any one’s guess.

I know the answer Wolf!!! The Fed needs the bonds to bootstrap the NFT market!!!

Apparently, according to your chart, you can get Debt-out-the-Wazoo in a fairly straight line!

It feels like the Fed is being forced to take ever more radical actions to correct for the imbalances, like a driver fishtailing down the road with each successive slide being more out of control.

Has the Fed and government passed the point of no return and now we need a good financial collapse in order to set straight who has been swimming with no trunks?

This is what happens when politicians must pander for votes from a citizenry that is completely uneducated in financial literacy. The profession of economics, dominated by liberals has created theories that are so out of touch with reality.

The only thing saving the US is our incredible domination of technology and innovation in certain areas.

Think how great the economy would run if the government was as good as our private sector at performing the functions it is supposed to perform.

Lawrence:

My late Father used to complain about how incompetent governments were. Then he realized we should be grateful they are indeed so incompetent!

Those damned liberal economists!

Finally somebody has really nailed down the problem.

Thank you!!

Everything the FED does just goes straight into crypto now.

So more US bonds have been issued than ever before, yet somehow there is a shortage of US bonds available to buy?

In the repo market US bonds are more valuable than cash? Nobody on the repo merry-go-round wants to be left holding the “bag of cash” when the music stops?

Seems like weare liveing in a very strange world!

Not strange at all, if negative interest rates are just around the corner!

What does the US government need the most at the moment?

The US government needs it’s future borrowing costs to drop permanently going forward, so it is free to spend as much money as it wants.

Only the 8th wonder of the world, the power of “negative” compounding is up to the job!

WES,

Part of it is that a lot of funds are trying to short these bonds, so they have to borrow the bonds — not buy them — so that they can short-sell them, and they’re borrowing the bonds in the repo market. The repo market is used in many cases to support complex highly leveraged trades.

There is no shortage of the bonds in the regular market. On the contrary.

Wolf, I am a big fan of your posts.

Everytime I had questions, I tried to understand by mysefl.

but this time, I am trying to ask.

If there is no shortage in the regular market, why the fund should burrow only in the repo market to short the bond in regular market?

and why would the fed sell the bond into the regular market to bring back the repo rates positive even though there is no shortage in the regular one?

What’s the relation between recent yield rising and negative repo rates?

I’m going to address your #2 question:

#2. The Fed wouldn’t sell bonds in the regular market to deal with this. It would go through the repo market, as I indicated, and this would take the form of “reverse repos.”

Why did they have to keep going back to re-do QE. Is it a matter of size does matter. In the past 15 years they have gone from attempted patchwork fixes to outright market manipulation on a grand scale. What is left to do in the next round?

They’re just printing money. That’s it. They come up with all sorts of cute names and programs and things, but it’s just money printing. That’s all they’ve got.

Yep. They keep it mechanically complicated so people roll their eyes and move onto the sports page.

Yep. They are just replacing longer term treasuries in the market place with zero interest hot potato money that’s tough to for a person to hold when everything is going up. Shows deflation is cryptonite to a central banker.

Central bank being bad cop to steal your savings allows Congress to be good cop and have welfare/warfare state without honest funding through taxes.

The more and more people who realize that, “at bottom, it is all just printing”…the more and more it looks like DC has run through its bag of tricks.

Just about the same time the MSM’s favorite new phrase becomes “domestic terrorists”…after decades of MSM pearl clutching about profiling.

Ben Bernanke…WSJ, July 2009.

Here come Quantitative Easing, here’s how it works and here’s how we will exit the strategy. In short he said that when things returned to normal, normal being unemployment under 6.5%, the rolling off of the purchased securities would begin, and eventually the QE move would quietly expire.

Was that a lie? You decide.

historicus

Bernake was asked to explain how does QE actually work? He said he cannot explain in theory but in practice, they do work! Go Figure!/

Also there was a rumor that he had to call Hedge fund managers to explain to him what Derivativies are?

Yellen is no different! God save America!

Wonder why did he has to start QE2 (later QE3 +4) when QE1 failed to do it’s job!?

So you can hold cash and get 4.5% vs a ‘safe’ treasury.

Yeah that sounds a bit broken to me.

ahhh. finally that long promised new normal has arrived. just not for us poors. meet the new boss…

“These are liabilities on the Fed’s balance sheet – money that the Fed owes the banks”

The Fed owing money hasnt been a problem…..for the Fed. Digital Minting is their game.

This is Doug Nolands take, which I don’t get.

“As new QE-generated Federal Reserve “IOUs” (“reserves”) are funneled to the banking system in exchange for deposits, the upshot has been an unprecedented expansion in Bank Deposit Liabilities. Total (Checking and Time & Savings) Deposits jumped $651 billion during Q4 to $18.866 TN. For 2020, Total Deposits surged an unprecedented $3.344 TN, or 21.5% (vs. 2020’s $3.220 TN gain in Fed Assets). The previous record annual gain in Bank Deposit growth was 2019’s $855 billion. “

just remember that it’s “all about the banks”. The fed only cares about the banks. Rising long rates helps the banks. The government can borrow short and let long rates rise and when the wheels fall off all of their buddies( private equity) can then swoop in and buy up real assets for cents on the dollar. ” it’s a big club and you ain’t in it”

Without BANKs aka Primary dealers, Fed cannot rise sovereign funds needed to continue deficit spening Congress!

If it comes to that again, I have NO doubt that there will be another

BANK bailouts!

Well, if the hedgies need cash, the fed will intervene.

If the hedgies are getting paid to lend, the fed does nothing.

If wsb needs collateral to trade gme, the fed does nothing.

Iow, the fed only rewards those who make their retirement worth millions in speaking fees.

Ok, got it.

In normal times wouldn’t this situation set up an arbitrage. Buy 10-year bonds in the market at higher rates (cheaper) and repo them to buyers at negative rates (more expensive). My guess is there is a fear of counterparty default permeating the repo market. Some hedge fund strategies must be coming unglued. We may see a LTCM situation with a huge fund starting to wobble. Or the Fed could extend its loosened liquidity requirements next week and solve the problem. Of course, then the banks will continue to push against the loosened liquidity measures, further structurally weakening the financial system, but that’s a problem for another day.

Any super genius firm hypothecating their customer’s T bonds will be in a world of hurt if any large swaps break(bonds not returned). Just one scenario which can cascade into a disaster, depending on the size of the broken swap and the speed of the cascade.

one can always hope.

The more negative comments on BC & Cryptos, more rise in their value!

BC is nothing more a RARE ‘ (non-Funfible assets like) stamp, coin, PAINTING’ furniture, baseball card. It has a store value and NOTHING else!

—

-Modigliani nude sells for $170.4 million, second highest auction price for art ever (WSJ 2015)

-Last week, a 1986 sculpture by Jeff Koons sold for $91.1 million at Christie’s, setting a new record for the most expensive work sold by a living artist. The sculpture, a large, silver reflective rabbit(vox)

The first virtual Non-Fungible Token (NFT) artwork to be sold at a major auction house closed at $69,346,250 during an online auction by Christie’s on Thursday. An NFT, or Non-Fungible Token, is a digital one-of-a-kind asset verified using blockchain technology

-Buyer of $69 million crypto art revealed as mysterious founder of NFT fund, who says the artwork is ‘worth $1 billion’

-JPG File Sells for $69 Million, as ‘NFT Mania’ Gathers Pace

“Everydays — The First 5000 Days,” by the artist known as Beeple, set a record for a digital artwork in a sale at Christie’s.

(Yahoo/news)

Either one gets it or NOT!

What I get is the guy who bought the digital asset runs the blockchain recording the transaction. Frankly, it stinks. The auction house should have known better than to allow this to happen.

you are missing the point!

Blockchain technology is much more than just BC or crypto currency!

It’s application in financial industry is barely starting.

Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system.

A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger. The decentralised database managed by multiple participants is known as Distributed Ledger Technology (DLT).

Blockchain is a type of DLT in which transactions are recorded with an immutable cryptographic signature called a hash.

As I said, either one gets it or NOT!

I think you are missing the point. I won’t get into why or how ciphers are broken, except they can be broken. And distributing a virus to do it isn’t that hard either. That’s a discussion for another time.

The real point is that any fraudulent transaction doesn’t become legal or ethical just because it is transparent. Real estate brokers trading homes with each other and recording the transactions on a blockchain is still unethical and maybe illegal in some places. Recording the sales on a blockchain, that manipulate a market, doesn’t make the transactions right.

There is a difference between an original Rembrandt and a digital file containing a hash.

Either one gets it or NOT!

Petunia

Just b/c you cannot comprehend, doesn’t mean it is fradulent!

Did you foresee what ‘www’ means in ’95?

—

And Ethereum, despite almost no one understanding what it is, now races toward becoming the foundation of a rearchitected global financial system.

“I didn’t see this coming,” remarked Beeple, now the world’s 3rd most expensive living artist. Such is the pace of change, that not even our artists can see beyond the horizon. We now live in a world where a Beeple can produce a virtual image, tokenized into an NFT, and purchased in a virtual auction by a Metakovan for 38,382 ether, settled on the Ethereum network, instantly, securely, all in the cloud, without the need for a legacy bank, or a single dollar.

Hedge Fund CIO: “Ethereum Now Races Toward Becoming The Foundation Of A New Global Financial System”

zh

Pretty sure that was painting the tape by Metakovan.

Got millions and millions of free press for NFT.

I’ll give you 100 imperial quataloons for all your bitcoins.

@ sunny129 –

Are you certain that you comprehend it?

What people don’t get is that fine art at really outrageous prices is often money laundering.

With ‘everything Bubble’ is being blown still bigger by Trillions created out of thin air by FEd/CBers, the question EVERY one should be asking, but afraid to ask:

Has there any nation in human history which has prospered by spending debt on debt?

The repo problem will be solved when the massive bond shorts

cover. Should be fun to watch

If they can’t cover the shorts because of hypothecation it won’t be fun to watch.

The shorts will be covered at a price that brings in real selling.

Maybe not so fun for the shorts but fun for the longs and to trade

The 3rd largest EVER, everything bubble, supported NOTHING by insane credit (fiat curency)b creation by Fed/CBers, will be challeged by BitCoin/Crypto currency/ Block chain technology/revolution.

As some said ‘It is a “the last functioning fire alarm” warning us of some very big geopolitical changes ahead.”

Some are able to comprehend the coming changes and some just cannot!

I hope you can get out with a profit before cryptos blows up too.

Petunia

I have been in the mkt since ’82! I am retired since 2005.

I have achived my financial freedom LONG TIME ago. My kids are grown up and independent. No need for me to prove anything.

I am in 50% cash assured for my livelihood for the next 10-15 yrs! I am dabbling the rest in this SURREAL mkt of my life time. Profits are NOT my main concern but surviving the stupidity of CBers, who think spending debt on debt will bring prosperity. So many ‘young’ investors appear to believe in it!

I went thru and survived ’87 crash, 2000 and again in 2008 (GFC). My option trading came handy during all those times, until free mkt capitalism was put to death by the Fed! Those newbies at 45y or younger are the ‘hotty ones with more confidence’ think they know the mkt. Wait for the next down turn, when the tide goes down!

Investing is a hobby even before I retired! It is pure entertainment at my age. So don’t take me seriously. Life is too short for it!

My two-cents:

HFTs and PTFs (proprietary trading firms) are the largest-volume traders of cash Treasury bonds.

The 4 largest PTFs trade 2/3 of daily T-bond volume thru various arb strategies, mostly arbitraging futures against cash.

When prices move futures ALWAYS lead spot.

Violent or sustained price moves can create arb opportunities: If selling becomes intense, it shrinks “the basis” (the difference in price) between spot & futures, incenting arbs to “buy the basis” (buy the futures contract, sell the spot/cash bond).

If buying become too intense the process works in reverse: the algo “sells the basis” (sells futures, buys spot.)

Lately, T-bonds have been weak or declining, so market-making algos are long futures and short cash bonds; the algos are “long the basis,” long the spread.

Someday, when T-bond bond futures rip higher, even if only briefly, the algos will sell the futures and simultaneously buy back cash T-bonds.

Right now, cash bond owners are receiving a slightly better interest rate than usual for lending their bonds to prime-brokers who in turn lend them to HFT/PTFs.

But those cash bond owners have probably suffered a paper loss in the price of their bonds.

If the Fed sold some of its T-bond inventory into the cash market, that would hurt the market-making algos who would have to absorb more selling by selling more futures, crushing the basis spread they’re already long too much of.

I think it’s more likely that the Fed intervenes to BUY cash treasury bonds, giving the algos a chance to shrink their positions, clear the decks, so that they (algo market makers) can reabsorb another/future round of selling pressure.

The worst outcome for a T-bond market maker is when the basis changes more quickly than one can unload one’s money-losing position—like March 9, 2020, when the 30-year T-bond rose 11 full points in one trading session!!

Shortly thereafter Ben Bernanke and Janet Yellen wrote an op-ed in the Financial Times (Mar. 18, 2020) advising J. Powell to intervene on behalf of T-bond market-makers, like their employer Citadel Securities.

What is a cash Treasury bond?

@ Wolf – Wolf said: “By contrast, the QE events – the purchases of Treasury securities and MBS, the repos, swaps, and SPV loans – are happening on the asset site of the balance sheet.”

_________________________________________

Is it not true that the QE events take place on both sides of the balance sheet? Purchasing power is digitized and recorded on the liability side of the balance sheet, then the purchased items are shown as assets on the asset side of the balance sheet.

My sentence says exactly how it is on the asset side.

In terms of how the money (credit) flows: The Fed creates the money (credits) to buy assets. It sends that money to the primary dealers’ accounts which then sell the bonds to the Fed. The primary dealers (like all banks) have deposit accounts at the Fed (reserves, liabilities for the Fed), and the Fed credits the newly created money to those deposit accounts, from where primary dealers can then withdraw it and do whatever they want to.

Wolf said: “So this process of reducing the government’s TGA account balances has the roundabout effect of replacing Treasury securities on the banks’ balance sheets with reserves – sheer outright liquidity.”

_________________________________________

Where did those replaced Treasury securities go? I think the reduced TGA accounts went to the accounts of the entities that received those funds. No displacement of Treasuries necessary.

And as for reserves —– what do reserves consist of? either digital dollars or Treasuries? Aren’t they both very liquid?

Wolf said: “Participants (effectively the lenders) bid up the price of the Treasuries so high that their yield turned negative to -4.5% for them. In other words, they had to have the Treasuries, and didn’t care about how much they had to pay to get them.”

____________________________________

Why would they have to trade cash for treasuries, particularly in an overnight, or very short term, repo operation? Cash is the ultimate liquidity and collateral.