Free money whipped consumers into a rollicking eight-month splurge on goods. There’s nothing “pent up.” And services are not a shoo-in for “pent-up demand.”

By Wolf Richter for WOLF STREET.

Give Americans some free money, and tell them it’s their duty to buy some stuff with it, preferable stuff imported from other countries, and they’ll buy some stuff with it, big and expensive stuff too, and they did buy a lot of stuff with it, more than they’d ever bought before, and their homes are full of stuff they bought in this eight-month long record rollicking free-money spending spree.

And it happened again in January: Free money from the stimulus payments kicked in and consumers further boosted their spending on goods from already high levels.

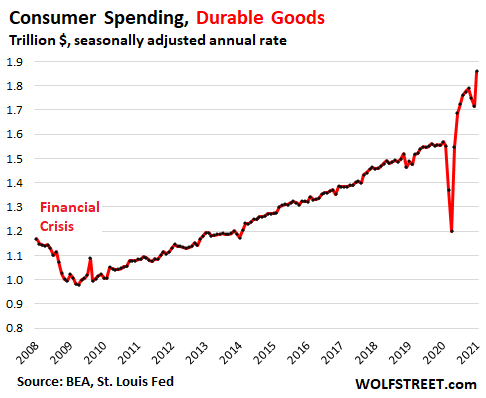

In January, spending on durable goods spiked by a stunning 18.6% from a year ago, according the Bureau of Economic Analysis today, to a seasonally adjusted annual rate of $1.86 trillion. The spending spree has been going on since June:

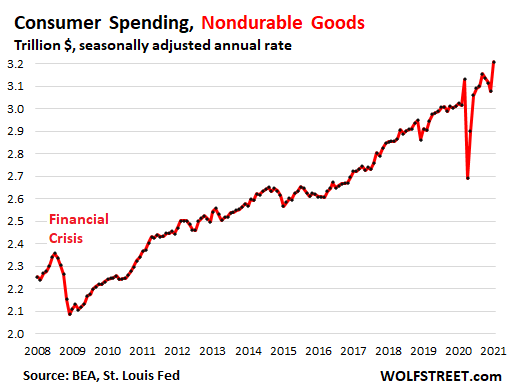

And spending on nondurable goods – which includes food and gasoline whose prices have jumped recently – rose by 6.1% from a year ago to a record of $3.21 trillion (annual rate):

This is an entirely different scenario than what consumers went through in any prior crisis. During the Financial Crisis, consumers suddenly cut their purchases of durable goods and nondurable goods, which you can see in the charts above.

Spending on durable goods plunged by 19% from the peak in October 2007 to the trough in April 2009. This plunge in spending did create some pent-up demand during the recovery.

Nondurable goods during the Financial Crisis dropped by 10% from the peak in July 2008 to the trough in March 2009. Some of this drop in spending had to do with the collapse in the price of gasoline, and also the reduced driving because people were out of work. Prices of food and other items too fell for a few months during this time, which, though welcome by consumers, caused a dip in the dollars spent on these items. This kind of drop in spending on nondurable goods creates only moderate pent-up demand, if any.

But during the Pandemic, the opposite happened.

People got lots of free money from the stimulus and extra unemployment programs. The most recent $600 stimulus payments started showing up in consumers’ bank accounts at the end of December, and massively arrived in January.

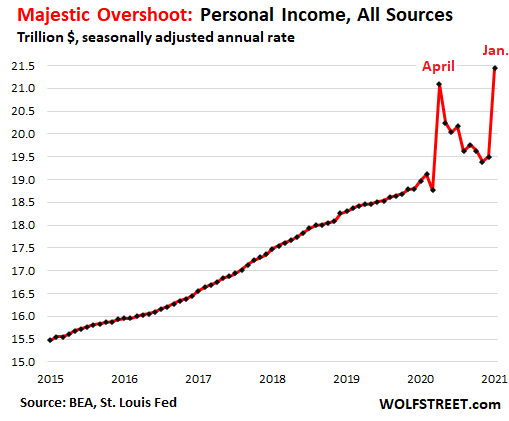

Income from wages and salaries in January, at $9.7 trillion (seasonally adjusted annual rate), was up 1.1% from a year ago. But income from unemployment benefits, stimulus checks, and other government support payments exploded to $2.9 trillion (seasonally adjusted annual rate).

Along with income from interest, dividends, rental properties, farm income, income from Social Security and other transfer payments, total income in January, all together, jumped by 13% from a year ago to a record $21.5 trillion (seasonally adjusted annual rate). These stimulus payments made for a majestic free-money-based overshoot:

In addition to the free money…

Millions of homeowners didn’t have to make their mortgage payments because they’d entered their mortgages into forbearance programs. At one point, 4.3 million mortgages were in forbearance, according to the Mortgage Bankers Association. Currently, 2.6 million mortgages are still in forbearance. Federal student loans were automatically entered into forbearance programs, and borrowers didn’t have to make payments. Eviction bans allowed strung-out households to spend some money on things other than rent.

There was a huge boom across the financial markets, and those with assets felt a lot richer and might have spent more; and to top it off, a cash-out refinancing boom, driven by record low mortgage rates and surging home prices, turned homes once again into ATMs.

All of these factors – and others too – contributed to the record amount of spending on durable and nondurable goods, and now people have this stuff around the house.

Demand for consumer goods wasn’t “pent up.” It was all let out.

This time around, households didn’t go through two years of cutting back on goods purchases, as they’d done during the Financial Crisis.

This time around, there is a shortage of supply, including the now infamous semiconductor shortage, due to the surge in spending on goods, and inventories are tight, amid production snags and supply-chain problems. And given this demand, and the supply issues, prices of goods are rising.

Consumers have been awash with this money they didn’t need to work for. And they paid down credit card debts with it. And they spent part of it on goods.

Now another stimulus package with more free money is being prepared in Congress. If it passes, more free money will rain on consumers over the next two or three months.

What will come when this crisis settles down, and when this free money fades, is a scenario where consumers have bought all the goods they wanted to buy. That’s the opposite of pent-up demand.

Spending on services is still a drag.

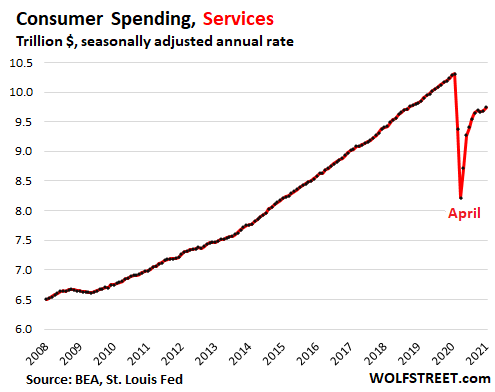

In the Good Times, services accounted for nearly 70% of consumer spending. Services include rents, mortgage interest payments, health care, education, insurance, hotel bookings, plane tickets, cellphone services, broadband, streaming services, the electricity bill, haircuts, plus a million other services.

Spending on some of those services has boomed during the Pandemic. But other services, such as hotel bookings, tours, cruises, flights, tickets to ballgames or entertainment venues, have gotten crushed, and total spending on services in January was still down 5.3% from a year ago, and at $9.75 trillion (annual rate), has seen little improvement over the past five months:

But when this crisis settles down, and when the free money fades, how many additional vacation trips are people going to take to make up for the three trips they missed? How many additional haircuts are they going to get to make up for the missed haircuts? How many additional ballgames are they going to attend to make up for the ones they’d missed?

Surely, there will be some pent-up demand in services. But that’s the issue with services: Unlike durable goods, they don’t lend themselves to massive bouts of pent-up demand. And as the free money fades, consumers return to the customary zero-sum game: money spent on services cannot also be spent on goods.

What all this free money has accomplished is that it overstimulated spending on consumer goods. And once consumers can spend money on vacations and ballgames again, I would expect their spending on goods to sag from the historically high levels, creating the opposite effect of pent-up demand for goods, while services, if lucky, might just wobble back to trend.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

At Costco I saw a woman buying enough dishwashing powder, detergent, aluminum foil, ziplock bags etc, Three carts worth, pushed and pulled by her son and her, to last for a couple of years at least.

Why are you buying so much, I asked?

Her paraphrased answer distilled from several aisle encounters;

“There’s a movement among people to overbuy everything they might possibly need for a long time so as to avoid shortages and inflation that’s coming with the trillions being handed out. Money in the bank earns zero interest, so why not buy what we’ll use sooner or later?”

With all that stuff that’s been bought, except for fresh food, retail sales are going to have to crater.

At least that I understand the argument for, and that stuff isn’t going to go bad, and will eventually be used. It’s the buying of huge TVs for each room, new furniture, boats, cars, and all sorts of other splurges that I don’t get.

In times of stress like a pandemic and when you’re locked down and you have thousands of dollars saved from vacations you couldn’t take, what are you going to do with that money? Retail therapy of course…

Easy, people look at the fancy vacation homes they rent for 3 or 4 hundred a night when on vacation, and realize it would not take that much to make their home that way.

The downside to that is once your home is all souped up, you look at fancy vacation homes as being just ordinary, or even a step down, and it kills your desire to spend a bunch of money on them…

just got quote to snake sewer drain – $250

ie no extra cash anymore

I got a huge TV a couple of years ago because I couldn’t read the crawlers or type all over the screen. I didn’t want to spend the money, I just wanted to be able to read the screen. People always complain about big TVs for other people while enjoy their own big TV. I didn’t steal the money I spent and it’s nobody’s business what I buy anyway.

BTW, I can’t wait to get my stimulus check, it’s going to buy a new mattress to replace the old one which is over 12 years old.

No one is complaining about big TVs specifically. It’s an example of people who constantly claim poverty and that they need government support when every dollar they ever get goes to frivolities.

Yeah, it’s quite the in thing. These people cheat at welfare and then use the money to live almost better than poor old hard working you did/does. Really makes ya mad, don’t it? They not only have extra TVs and boats, but big SUVs and Benzes you see can outside their free section 8 houses.

PS: When making your sociological observations, don’t give them them any behavioral slack by saying you “don’t get it”. What’s not to understand? These are simply disgusting people you see, right?

For the first time in my life, I have a fully stocked pantry…I’ve never even had a pantry before! My parents always had one.

It’s the opposite in my case. I sold my house and moved to one that is 30% smaller. No place to store extra stuff like large packs of paper towels. I installed a bidet to cut down on TP, use washable rags in my kitchen and have figured out how to do without many things I used and stocked in my previous house. I also have no cable for 12 years and the old TV is used to watch movies from the library.

My previous house had a walk in pantry, this one doesn’t. I am growing tons of spinach, kale and other stuff in the snow with a “greenhouse” made from aluminum pipe tubing and plastic tarps. One of my closets is a greenhouse with LED lights as well. We grow microgreens year round.

Zero regrets.

my 1st roma tomatoes ripening now

1st run of my hydroponic system

been plucking tender lettuce and have 3 cabbages forming nice heads

still developing it and got late start – thanksgiving

will have to shut down end may when I go to mountains

You are inspirational

I think the day i am truly minimalist and learn to live simple and on less things

Being away from internet etc etc

I truly would be a wealthy and free person

I am making efforts to be one .. making slow progress

A bidet ruins a man. Even the finest public bathroom feels like a porta potty forever after.

Same with me Jon. But at least we can read about good role models here.

Kudos to you and that’s inspirational.

It makes perfect sense to buy items that won’t degrade over time, today, to avoid perceived future shortages and inflation. That was one smart mom – as long as she has the space to store all that stuff. I know our basement is full!

Heff,

I agree. We’re stocking up for the next crisis. We have plenty of room in the insulated and sealed crawl space under the house. People might think that we’re paranoid…but we think it is a very reasonable course of action.

The people who don’t do it are the real nuts.

If 2020 didn’t wake people up to the fragility of supply chains, one can do nothing for them.

Goods that will be used, durable clothes, and, of course, weapons……

Don’tcha know that hording preppers are to be excoriated, shunned, and droned!!! … where, in our new equity world, Everyone shall rent 1 roll of TP .. and will use and like it!

The best thing about being stocked up is that it gives you the flexibility to only by things when they are on sale. Most food and household items are about half their usual retail cost when they go on sale.

The result is that you can save huge sums of money, and still always buy the best of everything.

In addition, in the event of a serious emergency, it puts you in the position of helping friends or family if you choose to…

I wonder how many searches Google has had for “Shelf life of…..” ? ;)

We are still eating Y2K spaghetti. Bought a couple hundred pounds of it at Whole Foods with a caseload discount back in 1999. Stored them vertically in in their cellophane sleeves in plastic five gallon buckets with Gamma Seal snap on rings that accept a threaded lid.

Cold, dark and reasonably dry basement.

Can taste no difference between the 1999 pasta and brand new. No, we don’t have Covid.

Tried the white rice poured directly into the buckets a generation ago. Tasted OK, with a little plasticky overtone, but since they were food grade buckets we had picked up for free at a restaurant, a great source for same, figured it was ok.

As George Bush Jr. said “Money is just a bunch of numbers written down on a piece of paper.”

Things that your family must have to survive, like food, cleaning supplies, warm clothing and other supplies that may only be a dream in the future, those are real.

The New York Times story about plumbers in Texas being unable to repair potable water systems, bathing facilities and other fixtures, because of a lack of plumbing parts, is a harbinger of what’s ahead. Hoarders might have the last laugh after all.

What is truly pathetic is that the government does not spend money on upgrading and “what if” scenarious. Goes to show you what they think of the peasants regardless whose in office.

I got two fridges, and a pantry packed with food. I always bought extra TP, paper towels, soaps, etc at Costco or other places so I was loaded up. They always have sales on this stuff. Not so much TP or towels anymore. When things really started getting crazy with the pandemic awhile back, I didn’t really sweat it, but it was pretty interesting to see how people were grabbing at things. Fortunately, they don’t care for fish much. lol I eat it regularly so there was plenty in the stores, but I did notice people catching onto that food source.

“I figure to stock up before the damned hoarders get it all”.

(old joke)

That totally happened…

Costco is such a depressing place!

Idiocracy showing Costco for what it really is truly cracked me up.

I concur to seeing the same things around here. The shelves are once again bare with people stocking up. So now the rest of us get to battle it out for some TP. Humans are weird.

True,services in NYC are dropped a lot.Most are just scared of letting anybody in their houses and just want to save the money.Services were booming during 2008_-2009 crash.

Don’t need to look that good when your face is half covered and you’re not going anywhere anyway.

Yeah, when I hear the “pent up demand” argument, I know I’m not dealing with a serious person.

The idea that people are going to rush out to buy stuff in stores that they could have (and DID) buy online all of this time is just idiocy.

And while it is true that some people are dying to go on vacation again or go back to restaurants, that isn’t going to last. Human nature and reversion to the mean are a thing.

So yes, while people who previously ate out 2 nights a week might go out 4 nights a week, INITIALLY, just because they can, after a month of that or so, they’ll get tired of it and revert back to their old ways. And there are other people who are so used to not going to restaurants that they will continue eating at home.

It’s almost as though the “pent up demand” meme is a way to rationalize to oneself the absurdity that is today’s public markets, more than a sincere belief.

Spot on. It’s rationalization more than anything and merely a way to convince yourself that the services sector, the lifeblood of the people’s economy, will recover against all odds. As Wolf said, you can splurge on gadgets but not on haircuts.

I think it’s also a narrative the financial/corporate media has been pushing as a great forthcoming effect of the Fed’s actions (profligacy). I just don’t see it coming.

I am not sure. Consumers did quite a bit of deleveraging right? If they were to releverage back up, then total spending might not be a zero sum game.

American consumers never get exhausted from buying things. They only stop when they’ve run out of money. Free money might be gone, but if consumers were to get optimistic, and banks are still willing to lend, it’s off to the races again.

And they have a lot of money right now.

I bought a new trash can at a popular big box home goods store. The selection was exactly two cans, one black and one steel. Stores have cut back drastically on selection. The last time I bought a trash can from this store, the selection seemed massive, easily over 10 choices.

We spent some Benjamin’s on new window blinds for the domicile, seeing as the really cheap minies finally wore out after 15 years of constant use. Not a ‘frivolity by any stretch. That was our entire ‘In the time of Covid’ consumer splurge to date. Otherwise, we often buy in quantity .. as space allows, for essentials – food, household items – as we’ve done since the GFC of 2008.

Oh, and a question to all .. what is this “vacation” thing everyone speaketh of ??

The also have a ton of debt to service. Cheap interest rates on mountains of debt don’t help one pay off the principal which is in every monthly payment for everything. How many re-fi’s are going to be underwater when the ridiculous housing market comes back to earth? With a thud!!

It will be 2008 all over again, this time for a different reason.

Would have to agree with “buying things” comment. My anecdotal evidence? In my neck of the woods I have seen 4 self storage units built (all within a 5 mile radius) over the last 3 years.

Whenever the government intervenes in the economy, like lockdowns, free money, etc., it creates distortions.

The only “pent up demand” I see is for more free money!

joe will get blamed for the 2nd, 3rd, 4th, etc. harmonics!

Well America is indeed back ….. at firing missiles at other countries it seems.

Free money for consumers? NOOOOOOOO. MMT will bankrupt the country, etc, etc.

New base at Northern Syria? Are you sure 1 Trillion is enough? Why not take two?

What an f’ed up country I live in.

MonkeyBusiness,

We have a new base with more boots on ground than Iraq and Afghanistan combined… in Washington DC.

On topic, I do have pent up desire to take some vacations, not much else.

“The only “pent up demand” I see is for more free money!”

WES, that’s an instant classic. Gonna purloin that from you some day :-]

You would pay him a royalty, should you do so, no??

.. or at the very least, a beer mug!

RIGHT ON, WE DESERVE IT!

This ‘distortion’ is there in hopes that the first ‘distortion’–a pandemic infused recession–can be papered over. I’m still in the Michael Hudson camp. We have been and will continue to be in a debt deflation environment.

If the vaccines are successful ( a very big if) I think there is every indication the US population will spend like there is no tomorrow on at least vacations and road trips as well as restaurants. So hotels will be booked and flights crammed.

I can say this with near 95% certainty because most Americans never took (or were forced to take) COVID seriously. In areas where masks are optional I see 1/10 people wearing masks. They think the threat is overblown or that it’s all a conspiracy or other such nonsense. Many actually believe in that ridiculous 6 ft rule. They won’t hesitate to travel on packed airplanes once the government tells them it’s OK.

P.S -After the black plague swept Europe during the mid 1300s, the survivors went on a spending binge.

What you failed to mention is the following:

1. The Black Plague killed 1/3 of the continent’s population..

2. As a result of 1, there was a worker shortage so wages went up. That’s how people were able to spend more. But I doubt that total spending was actually up.

When 1/3 of the population died, it concentrated the wealth, making the survivors richer.

The Black Death has a modern relevance. Most workers were enslaved, indentured, or in some other way restricted in movement by their masters. They could only move jobs or masters with their original master’s permission, and thus there was no real wage competition. Furthermore, the overlords were not subject to the usual laws applied to the peasantry. The key aspect of the situation is that the overlords started “stealing” workers from each other. Financial and other inducements were made to do this – wage inflation. The important point is that once you have a group of people who have put themselves above the law, how do you then apply the law to them? You can’t, and the only determinant of being right become might.

There’s also a side point about journeymen. These arose because highly skilled workers could insist on being paid daily, and thus avoid all the usual tricks employers use to either retain and/or underpay workers. At worst, the journeyman could walk off the job and lose at most a day’s wages.

Rodddy6667 got it right on the concentration of wealth, but you’re also correct about the wage inflation.

I just watched a Great Courses on the Roku channel about the Black Death and the professor said as much as 50% of the population eventually died and it re-occurred every decade for another 100 years keeping the population from growing back to previous levels. That the disruption to the feudal system with worker shortages changed western civilization in ways that would not have happened if not for the plague.

The history of plagues and catastrophes like this is that they change societies and people’s lives. Sure some will try and go back to the previous normal but most won’t. My perception is that people will be cautious for years, maybe decades to come. That they will save and hoard because they felt that they were caught totally unprepared this time and don’t want to be caught unprepared again.

That makes little sense to me. If people never took it seriously to begin with, they have been traveling all along. Very few places have been “locked down” (despite the nonsense you hear about economies being “closed”) since May or so. If you wanted to travel, no one was stopping you for the past 8 months.

In the States….That is why the infection and mortality rates are what they are…the worst in the World.

Show me the death rate of under 30 in the US, and then tell me why we locked them down.

The death rate is massively in the old. How much were they spending on goods and services versus those massively locked down?

I think you’ll find that the UK holds this title based on population.

whatever, you will believe what you want but the facts show that at least 30% of those infected have what they call Long Hauler’s Syndrome and which is serious debilitating side effects. These are not hospitalized nor dead, just people who got the virus.. So you can minimize this in your mind if you want but the facts say this virus has been expensive and disruptive.

US is not worst in cases or deaths per capita, other countries in Western Europe and the UK hold that distinction.

And to reply to someone else, the “long haul” thing is a tiny fraction of people who have had COVID-19, really not a factor from a public health standpoint.

Economicminor-

Here is the best general paper I’ve found yet on what you refer to as “Long Hauler’s Syndrome”.

It can get a bit technical, but is at least worth scanning through, and especially under the “Time and Virus” heading (IIRC), where it makes a comparison to the 1918 Flu and cases of what was then called “encephalitis lethargica” and seen for years later and finally vanished.

Not saying this one is that bad, nor are the authors, but nobody will know for a long time. This thing may be no joke for a long time. And at over 1/2 million dead in the US alone already isn’t.

Anyone who doesn’t wear a mask in crowded public places is stupid and inconsiderate. This crapp about “freedom” is equally stupid. Try walking around naked and see how much of this so-called “freedom” you quickly lose. Probably wind up a sex offender, too.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7511585/

“Worst in the World?”

Source???

Florida’s infection rate is the same as California’s.

May want to get your facts straight first before spewing official narrative propaganda.

Yeah, if you want to be in lock down for 7 days when you arrive.

“If people never took it seriously to begin with, they have been traveling all along. ”

You’re forgetting that you have to quarantine for two weeks entering some states and then returning to your state. It’s a major hassle to travel now. I’m not even mentioning Europe, which is very strict.

Who wants to splurge on an expensive vacation when your hotel might let you in if you’re showing a slight fever. Or maybe a new lock-down order coming out of the blue? California has been on lock-down until recently. Do a search for ‘quarantine restrictions for each state.’

Just one example of the hassle factor below- Now try doing this with 3 kids.

From the AARP website-

“• Hawaii: Gov. David Ige (D) mandated that people arriving in Hawaii from out of state must show a negative COVID-19 test result obtained within 72 hours pre-travel or self-quarantine for 10 days. Some islands require a second test, post-arrival. “

I know tons of people who have flouted those stupid rules for domestic travel. There’s really no enforcement mechanism, outside of Hawaii

not true rnyr:

Some states had and some ”areas” still have road blocks, or did a couple days ago when I checked to see if USA was ready for me to go where ever the heck I want to go once again… answer is still NO.

But definitely looking better by the week, so beginning to prep up the truck with bed in the truck bed over storage of camping gear, food and water, etc…

OK, maybe most of the initial early actual roadblocks have gone away so making your 8 months accurate,,, but the scary part is that they were put up in the first place,,, just one more indication of the slow and continuing slide into whatever is the opposite of positive anarchy; you know, that kind of anarchy where folks are educated to act in their own long term self interest rather than only, repeat only their short term ”apparent self interest” per brainwashing known and accepted as advertising,,, as is now the case at almost every level of every society.

Used to feel sorry for the generation of my grandchildren losing SO many of the freedoms I had as a kid, not to mention their many other non kid freedoms now going down the sewer of ever increasing guv mint control of every aspect of our lives,,,

now beginning to think even the generation of my kids are going to go through the same ”heck.”

I call BS on the roadblocks. Havent seen one and I drive all over the country every week, have been for 30 years.

VintageVNvet,

There are no actual “road blocks” — if you meant it literally. But there are quarantine requirements in some places.

Americans have ALREADY gone on a massive historic huge spending binge on goods, and if they spend more money on services in the future — and surely they’ll spend more on vacations, etc. — spending on goods will decline.

Best Buy has already confirmed that. A couple of days ago, it predicted that the burst it had seen will fade or is already fading. Shares dropped 13% in two days.

So there won’t be pent-up demand spending on goods. On the contrary. But there will be some on services. But most people cannot take four vacation trips in a row, when they normally take two in a year. That’s the limiting factor with services in terms of pent-up demand.

I said that exact thing to a friend of mine who keeps insisting on this pent-up demand nonsense. He said that he and so many people are so eager to travel that he’ll take more vacations than he did in the past.

I looked at him and said “Yeah, and what are you planning on doing about work?”

No response.

I don’t think I took any vacation in 2020 so I have more vacation this year so I may go on more vacation this year or next. However, after that I agree that I will go back to normal. I don’t understand how the hospitality stocks are doing so well. How did Marriott (MAR) go from $60 in Feb 2020 to $148 today? These companies took on more debt, have fewer hotels (due to bankruptcies) and still no timeline for mass reopenings yet they are close to all time highs?!?

I took a *vacation* from March to December of 2020. It was called no clients and no billable hours. I actually enjoyed it a lot. Though I did travel to a remote wilderness location in

Idaho to camp out for 3 nights in August.

Other than that it was mostly staying in the house. Doing ham radio projects and replacing the stairs to the second floor.

Typically I take the last 3 months of the year off, so in 2020 the *vacation* just started earlier. (If you go into October without a contract lined up you might as well just wait until Jan/Feb when budgets are set and people are starting the new year.)

If we stay fully booked through 2021 I will be spending *less*. Mostly because I’ll be working with no down time. (We raised our hourly rates 20% last year, when things came back in Nov/Dec, and clients didn’t even blink. After listening to our US clients whine about our hourly rates for going on two decades now, that was a first.)

First, in order to travel outside this country, once we are vaccinated and the virus has receded here, the rest of the world needs to get vaccinated.

How long will that take? This vaccine doesn’t prevent you from still getting the virus, just minimizes the effects and reduces/ maybe eliminates hospital stays.. BUT it doesn’t prevent the Long Hauler Syndrome.. Or you still spreading it..

2nd/ This isn’t the only virus out there that mankind doesn’t have a vaccine for.. I just read a piece about a new Bird Flu that has popped up in Russia. So Once Bitten, Twice Shy! Things may not return to the old normal for a long time, if ever.

And none of this return to *normal* is considering the underlying economy or the still crazy political instability.

Best Buy announced Thursday, 25 Feb., that they are moving to a new business model which they term “Digital-First.”

CEO Corie Bary, “We know the customer has completely changed the way that they are thinking about shopping, and with that big of a digital shift happening in that short of a period of time, we can adjust to the new reality.”

“Digital sales increased about 90% to $6.7 billion during the fourth quarter over the same period a year ago – a record for for the period that includes holiday sales. But there was a 15% reduction in traffic to stores.”

Friday’s Minneapolis Star Tribune has a report on this written by Nicole Norfleet. I won’t leave a link to it, but those who’re interested may find it worth a read.

Yes, I’ve covered Best Buy’s ecommerce strategy many times, including most recently on Feb 23. They’re doing a good job with it. But their brick and mortar stores are dead. They’re now using them essentially as warehouses and pick-up lockers, but that’s expensive. When the lease is up, they close the store. So each time a lease comes up for renewal (these are long-term commercial leases), they close the store.

Wolf, I suspect this is due to the advent of reliable online reviews, at Amazon and elsewhere. People used to need the physical BestBuy stores to use it as a “showroom,” to see what TV they wanted to buy. But these days, you can just read a few reviews from Consumer Reports or whomever, check out Amazon reviews, and be pretty confident in your decision.

Plus, the main advantage stores have (like Walmart and Target) is that they cater to people who need the stuff RIGHT then. But most people don’t want the hassle of trying to fit a large TV in their cars anyway (assuming they even have one), so even if they do go to Best Buy to check it out in person, they’re still going to order it for delivery.

Expensive rents, utilities and labor costs for a glorified showroom is not a sustainable model.

So basically there will be deflation in prices of goods which are currently seeing inflation?

Durable goods CPI is almost always negative the way it is figured and doctored. But right now it has jumped. And it could return to negative again.

But actual prices of durable goods on average are heading higher as they usually do.

Credit card balances are at record lows and its said American household’s are sitting on over $1.5 trillion in cash.What are they gonna do with it? Its not in America’s DNA to save. This money will be spent somewhere.

RES,

Credit card balances are not at all-time lows. Far from it. But they were paid down by 10.8%, to $970 billion:

“American household’s are sitting on over $1.5 trillion in cash”…

Households were sitting on $10 trillion in actual bank savings deposits before the crisis. Now, a year later, they sit on $10.9 trillion. So actual savings rose by 9%.

People also sit on stocks and homes and all kinds of other assets. These people that have these assets have had money all along and could keep spending at their normal clip, with or without stimulus.

Don’t confuse the “savings rate” – a seasonally adjusted annual rate resulting from the calculation of total consumer income minus total consumer spending in that month, roughly multiplied by 12 – with actual savings in the bank. Two completely different animals.

It is unfortunate that the “savings rate,” released as part of consumer spending, is cited in the media in these misleading terms.

The people that change their spending patterns when they get stimulus payments are people with few savings and few assets.

That comes to about $28K per household, and it is a deceiving statistic. The vast majority of that 10 trillion is sitting in the bank accounts of the top 5%.

The bottom 50% of the population have in the area of less than $1000. Probably less now.

Most household worth is predicted on the insanely inflated value of assets which are very subjective.

The Roaring Twenties was a period in history of dramatic social and political change. For the first time, more Americans lived in cities than on farms. The nation’s total wealth more than doubled between 1920 and 1929, and this economic growth swept many Americans into an affluent but unfamiliar “consumer society.”

The forgotten depression of 1920-21 is a great chapter in history to learn how to deal with economic downturn.

No government intervention, no keynesian experiments, no new deals, no Fed adventures. Things bounced back on their own.

Unlike its famous cousin of the 1930s.

You surely can’t be suggesting that the Fed did anything about the Depression? Even Warren Harding described it as a ‘weak reed’ in times of trouble. Keynesianism, or the idea that the govt could go into debt, hadn’t been invented. The fiscal response to the slow down was to cut govt spending to achieve the grail: a balanced budget. So things got worse.

To repeat: Keynes advocated govt spending in recessions using the SURPLUS accumulated in the good times. It was politicians who prostituted the idea. This began with Reagan. When he took office, after running on lower taxes and smaller govt, the total debt of the US was one trillion dollars. He cut taxes: easy. Then time to cut spending: pork, ag subsidies, ear marks, etc. etc. Not so easy. Result: the debt incurred over 200 years doubled in 4 years. To cut Reagan some slack, he was functionally innumerate and in the opinion of his OMB director, a young David Stockman, simply did not understand. Normally a gentle person, when Stockman was presenting budget options, (now reduced to one sheet of paper, in a pie chart) he almost yelled at Stockman: ‘the problem isn’t govt spending, it’s deficit financing!’

This began the modern era of US politics: deficits don’t matter. The only brief surplus happened under Clinton.

This is not to justify the Fed’s wild actions NOW, but in the Depression it sat on the sidelines.

nick kelly,

I am talking in general about the ‘help’ provided to ‘fix’ the situation.

1920-21 is the proof that it’s possible to recover from a deep recession without ‘help’.

It’s true Fed was in the sidelines post black Friday, but it is very much to blame for creating the bubble in the 1920s.

Fed facilitated huge credit expansion and easy money with lower rates, much like what it’s doing right now.

Now it’s creating bubbles and solving the resulting crisis with bigger bubbles.

Fed initially hadn’t realized it can interfere directly and not have repurcusions. Perhaps Fed even feared that it will be abolished after 1929. But due to sheer stupidity and ignorance of politicians and the public it survived and with each crisis got stronger and stronger.

Finally with regards to Reagan, you hit the nail on the head – he cut taxes, got higher revenue, but just couldn’t shake off pork and ran up deficits. Bad compromise with Congress. And yes, what he said is timeless – the most terrifying words in English language are “I am from the government and I am here to help”.

‘Harding’ should be Hoover.

Nacho-Lunacy

So, I’m sure that when the national guard or FEMA or even firefighters show up to “help” with disasters this internalized “great” Reagan quote of yours always leads you to tell them to, “Go away, I hate government help”.

You are another lazy binary thinker (like 91B20 talks about), incapable of grasping the concepts of equilibrium or balance.

Or just a troll, in which case you have won, you got a response.

What a civilized response!!

Government was created and given power for very narrow set of situations – defense, disasters, protection from harm and such.

Rest is just overreach – do you really want your government running your retirement? Is social security paying minimum living wage right now? Heck, no. Is medicare covering healthcare? Promises made, promises broken.

Back on topic, you are seeing the result of Fed intervention and hubris right now and yet you pretend you don’t see it.

Before the Fed we had boom and bust cycles and things got back on their own. Now the cycles are way longer, bubbles are much bigger and farther from ground reality.

“Protection from harm and such”. Can’t you grasp that your “overreach” may be someone else’s “protection from harm”?

Like I said, balance and equilibrium……or in the vernacular…..”sharing both wealth and hardships as equally as possible”.

The extremes of wealth inequality CLEARLY show we are dismal failures at Government of the people, by the people, for the people.

Granted it is difficult, but internalizing things like that idiotic Reagan slogan DO NOT help to make government work reasonably well for all.

And sorry for ad hominem, but that particular example of “bumper sticker thinking” really sets me off, I can tolerate most of the other examples of it.

And don’t think for a second you aren’t on the menu of the main oligarch promoters of it.

I can see you have a lot of pent up anger. May be try some yoga?

Your comments also show poor understanding of government’s role and it’s track record. Government (politicians and bureaucracy) essentially thinks they can ‘fix’ things, they can ‘help’ people. But they vastly overestimate their abilities and vastly underestimate the destruction they cause.

Only binary thinkers like you who are driven by rage and driven by “government good, free market evil” continue supporting the failed policies over and over at everyone’s peril.

I gave you three examples of the most prominent government ‘helps’. Each of which originated with good intentions, but also with vast overestimation of abilities – retirement, healthcare and delegation of power to the Fed. Instead of shooting the messenger, you should try to address why those three are failing.

Best you just chalk it up to TDS, another bumper sticker “thought process”, which I don’t mind being diagnosed with at all.

It was a period of rampant debt. The booming economy was driven by the production of new products associated with electricity and the ability to travel by automobiles. These new products were purchased mostly with debt for the first time.

We all know how that ended.

That argument doesn’t make sense if you just think about it. Do you eat twice the food you normally eat if you haven’t eaten for a while?

And if they implement Covid travel passports, which is a very real possibility now, that’s bound to decrease air travel and may even backfire in the long-term. I don’t see a rainbow at the end of this road.

Last July I saw a lot of people in LA and Las Vegas that were having a longer than normal vacation. They lived in tents and boxes on the sidewalks.

Covid “Passports” are likely nothing more than another scheme to fleece the populace by extracting more “fees”….. just like the “Known Traveler” and “Global Entry” for those of us who are too impatient to wait in endless lines.

It’s unlikely I’ll get one…. and I can fly for next to nothing.

The keepers of livestock are always devising new ways to keep that livestock contained and controlled…..

Well, effectively you won’t not be able to travel internationally without one, just like with regular passport. So, it’s not like you have a choice…

I usually have to pay 10-20€ for 1000m international flight in Europe.

Right now, that’s 10-20€ for airfare, plus 240€ for double tests and I still get to quarantine for 10 days on arrival.

I expect that Covid passport will take all of that away.

Of course if you don’t want to get vaccinated – you will still be able to do your travel the old fashioned way – with 1000% cost premium through PCR tests and mandatory, enforced quarantine.

But let’s stay attuned to the variants that may be coming to a village near you and me. Coronaviruses are notorious for mutating over time and geography, and there are several out there already that still have no vaccine. Consumer behavior regarding certain risky activities like NFL stadiums and coast-to-coast flights is probably permanently changed in America. We have a lot of hand washing ahead of us, not to mention the handwringing from the state our State is in.

The fact that you fail to mention is that the vast majority of those mutations make viruses less virulent and less contagious, not more. This is exactly why they mutate themselves out of existence and are replaced with new ones…

The reaction to Covid 19 has been hysteria, and not fact based analysis…

You don’t understand Covid travel passports.

Right now, effectively, you cannot airtravel travel for leisure AT ALL.

Living in your little bubble called USA might mislead you into thinking all is ok, but try to fly to another continent, I dare you. 10 days in quarantine at best (which is a total deal breaker for any holidays), with many countries outright banning travel (hi Japan!).

Add to that regulations that change daily and are very country specific, going on international holidays is nigh on impossible nightmare right now.

Covid passports aim to fix all of that – get vaccine/test in your home country (which is very easy – compare how easy it is for you to figure out how to get tested in your home city, vs getting tested in Barcelona) and you are cleared to go anywhere, like in old good times.

Complaining that covid passport are hassle is like complaining that having to have a regural passport is a hassle. In a way it is, but minimal and not really a something that drives a lot of people away from travelling.

I agree with that to a large extent. I’m not “anti-vaxx” or anti-science. Everyone in my family, myself included are fully vaccinated. I take pharmaceutical drugs all the time for various ailments.

But you say anything against the rushed and experimental Covid vaccines and the undue influence of Big Pharma on politicians and you’re branded a closed-minded neanderthal and worse, a Trump supporter. :)

Well said hopefully people do what you suggest BUT I doubt it .

What about the J & J vaccine? Same affects?

Maybe we just need a more powerful boomer remover like the kids call COVID.

I of course bought canned goods to help with inflation also canned meats but America has best food chain in the world everything else is just stuff we should use food as a weapon raise prices to international community get fair prices instead of farm welfare but it’s all welfare sorry for my rant

Yeah, now that inflation is ramping up, we are running out to eat three dinners a night to catch up with all those dinners we didn’t go out for during the past year. Pent up demand, NOT!

I bought extra toilet paper for all of the bathroom trips I’ve been holding back.

Haha.

I’ll pinch that if you don’t mind!

:). Be my guest.

When these ‘forbearance programs’ are finally found illegal, and beyond the governments control, then watch out Nellie!

Yeah, how legally binding contracts can be abrogated and modified at the whim of a bunch of bureaucrats in State capitals and in the Swamp is a case for all the Perry Masons of the world. It is blatantly Unconstitutional to say the least, and the National Emergency expediency has no historical precedent in America that I can think of. There will eventually be Soup Kitchens for bankers and landlords, stay tuned.

Doesn’t make sense to do all this stimulus and house bubble stuff. Must be part of some bigger plan. This must somehow be a takedown of China.

That is kinda clever if you war game it out. We gorge our domestic need for foreign products and goods. Get nice and happy with a TV in every car, room and patio. Then we have a period where we wouldn’t be so dependent on a China like importer. We would starve them of exports for whatever reason. Just kidding we love to shop and spend every single last penny we can manage to borrow. Rinse and repeat until we get paid again and can make minimum monthly payments to all the debt we happily traded for….

That’s what happens when you work for debt notes not money.

Money is debt notes — a zero coupon bond.

It’s also a tax credit.

There is a double effect. The Chinese expand their businesses to meet the increased demand, then there are even more unhappy, unemployed citizens when demand craters.

I always though this should be the way to bring down communism in China.

However, whilst we now have a bunch of rulers who aren’t interested in destroying communism, surges in spending followed by droughts all caused by financial instability may end up having the same effect.

I feel slightly sick every year as I drive down the street after X-Mas (the real spirit of “Christmas” was sold off years ago in exchange for blatant consumerism) and see huge garbage cans overflowing with the packaging from the “holiday”.

Americans are brainwashed into buying a ton of plastic crap every year from China. In reality, it’s just a massive waste of time, money and resources.

From under the X-mas tree to the overflowing landfill in a few years. Baby Bush the Lesser told people to “go shopping” after 9/11. I guess the Dead Kennedy’s were right: “Give me convenience or give me death!”

And Carter tried to explain that this behavior would result in death, and was promptly replaced with a puppet handled by the consumption rentiers.

While we all cry about why it “isn’t working” 40 years later, and ask Alexa to re-order our anxiety pills.

I don’t see the “free” money ending. It is now a right to get UBI which is what “free money” has become. Money printer gonna keep going Brrrrrrrrrr………. untill the rest of the world quits giving us it’s productivity for our non-productive debt.

Agreed, a fundamental change in expectation. Everyone is a victim now…

We lived in a nation of ‘victims’ LONG before the pandemic.

Talk to any random person (or your family and friends)…everybody has a tale of woe. Two things you’ll never hear from an American:

1) I made mistakes that put me in this situation, it’s my fault.

2) I don’t know enough about that to have an informed opinion.

The other issue is that in the past, people saw the “free money” as “taxpayer money,” so there was some pushback against making other people pay for other people.

Now that there is this (obviously mistaken) belief that we can print money with no consequences, there’ll be demands for more of it. No longer are people requiring OTHERS to pay. It’s merely a money tree. Like magic!

There will come a time when there is no one left to purchase all this increased debt. It isn’t exactly a money printing machine. The FED has to purchase debt from its member banks OR from US government agencies. The FED takes the debt and turns it into bank reserves. So the banks have to have deposits, someone has to purchase the debt on their books in order for the FED to *buy* it.

So this requires new and larger mortgages or big commercial loans or lots of deposits.. YET when there is no incentive i.e. no ROI.. no interest rates.. people start buying commodities or something of value.. even BTC… This becomes like that ole serpent eating its own tail to survive. It drives up the cost of everything and slows down consumption.

What I’m saying is there is no Free Lunch. Everything affects everything else and the government spending money that was never earned will not last. It will cause a shortage of capital which will cause interest rates to rise and consumption to fall.. The best solution to high prices are high prices. People are way smarter than the government.

Well, it might be credit

It might be barter

But they always find a way

To make you pay (Pay), pay (Pay), pay

“There Ain’t No Free” – NRBQ

Almost none of this is correct.

Ask yourself this… How does UBI benefit the wealthy in the long run…..

It may be of use to them in the short run to implement the changes without opposition, but in the long run it would be only a burden…..

A not quite parallel set of figures:

“Personal Income increased 10.0% in January, Spending increased 2.4%

The BEA released the Personal Income and Outlays report for January:

Personal income increased $1,954.7 billion (10.0 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $1,963.2 billion (11.4 percent) and personal consumption expenditures (PCE) increased $340.9 billion (2.4 percent).

Real DPI increased 11.0 percent in January and Real PCE increased 2.0 percent; goods increased 5.1 percent and services increased 0.5 percent. The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index also increased 0.3 percent.”

I am behaving differently. I overpay credit cards

as a saving vehicle. Now saving for trips as well but don’t know if

I will go cause saving has become addictive. Also, points earned on my credit card I now hoard. I’m sure I’ll snap out of it . Crazy town for sure.

Too many easy innuendos. Not going there.

In nominal dollars, there will be a lot more spending. In real dollars, spending will not be so robust. People will spend more because they are aware of inflation … buy now or pay more later.

My base case is inflation with less than moderate growth. This means the stock market should stall while the prices of hard assets go higher. I have been saying this for weeks … it looks like the equity and bond market is showing early signs of this pattern.

If we hit stagflation, which is possible but not my base case, the stock market will head moderately lower while hard assets go higher.

have you looked at King Copper lately?

Oil is the mother of all inputs. WTI up about 50 % since March 2020.

And the weak link in Civilization.

The Green New Production And Conservation of Energy Program should have been put on a war footing yesterday, like any of the other much smaller “Natural Disasters” we have had recently.

On services:

Doctors and dentists must be hurting a bit. Did my annual checkup with a visit to the Doctor, who was unusually not in a hurry to conclude my appointment because he shared with me a personal story (as he usually does) that not only dragged on to the point I had to repeatedly hint to excuse myself to return to work, but it’s subject content was a loser unless you like bowel movement humor from a Doctor which because of their clinical background can be a bit not pleasant.

On Goods and Regarding Best Buy:

The BB in my city is closing this Sunday with the sign reading “It’s not goodbye, it’s see you later.”

Anyway, I plan to tell Massachusetts I’m not paying fines for not having health insurance in 2020, because I could not use it as my doctor wasn’t taking appointments and then when he finally was it was hard to get them.

This:

Massachusetts Governor wants to raise gas tax to pay for free public transportation, to encourage folks not to drive and clog the roads, but instead wear masks and commute on pubic T to get to work.

My response:

Tax Amazon Massachusetts, which clogs the roads with deliveries. Don’t tax poor working folks, tax Jeff Bezos and The Rich for living high on the hog sucking off the roads we taxpayer built for him to get rich on his business that wouldn’t exist w/o taxpayer funded roads.

“Taxachusetts”.

Full disclosure…it’s a Republican Governor proposing raising the state gas tax to pay for free T rides…and it’s working folk ME proposing to instead tax billionaire Jeff Bezos Amazon living high off the hog clogging tax payer created public roads we working folk need to get to work, and we working folk paid for.

One giant powderkeg and 50 clowns striking matches…shall we start a pool on which idiot is the going to be the one that ignites it all?

So, we’re talking Purple Pliestocene-rHinos (regardless of whose affiliation they party with) .. all of whom are staring avariciously at the last dandelion !

You over simplify and generalize. Our gov. may be rep. But this is totally dem.run state. The T is not free, parking is expensive at the T lots as well. I take it everyday, even during covid. However, your suggestion to tax delivery companies may have merit

Candyman, no oversimplification intended. Just a full disclosure…as I wrote. Both teams are vile in my book…and THAT is simplification (but not overly so) :-)

Other name for elite?

“Hedge-hogs”

Much of the problem lies in the fact that so many folks in the US are simply not healthy. I read that 94% of those that died had about 2.5 underlying conditions. No secret we are an obese country…that is one of those conditions. Diabetes and other issues go with that. Most folks don’t recognize healthy food. Most people unwrap their food obtained from a drive up window at a junk food establishment. So sad what has been done to food and, the country is worse off for it. Generally speaking, healthy people don’t die from these viruses…there are always exceptions.

You can have hypertension and diabetes while being thin and stylish. You’ll have to pardon my math skills but by far and large it appears to me that the biggest correlate is age. If you have diabetes or hypertension and you’re 60+ you’re much more likely to die. But even then the likelyhood, is to me, relatively low. Like if you factor in all the potential means of death you encounter on a daily basis this is a drop in the bucket, especially for anyone below 50. And you can’t vaccinate yourself from a broadside by a bus on ice or and exploding boiler. The hysteria surrounding all of this is purely political grandstanding and fear porn to get people to watch more news. The results are probably going to be pretty tremendous, we’ve perpetuated the world economy and the world’s largest consumer economy and nobody is capable of accurately predicting the outcomes, I suspect they will be adverse, but I’m hoping time will prove me wrong.

Having underlying conditions doesn’t mean that you are going to die soon. Most people live a decade or two with them. Nobody dies in perfect health.

Apparently, travel is the activity americans missing the most. When international travel will be back, everyone will rush to book a trip. Hotels will be running hot.

After first lock down in April, bowling alley in Georgia was fully booked for weeks, wich never happened before. That’s what Pent Up Demand looks like. People rushing to movies, bars, restaurants, spa etc.

Consumers will shift from goods to services.

Personally, hoping for correction in Big Tech, when demand will decline.

Drunk Gambler,

“When international travel will be back, everyone will rush to book a trip. Hotels will be running hot.”

Yes, indeed, Americans are going to spend their stimulus money and savings in Mexico and Spain and Thailand. But the money they spend in other countries is considered an “import” for GDP purposes, and like all imports, it gets deducted from GDP. Spending money overseas is a negative for the US economy.

Only the cheapo flight with a US airline out of and back into the US would be a positive. The rest of US consumer spending on vacations in Mexico, Spain, and Thailand, is a positive for those countries, and a negative for the US. So you need to take US consumers’ “international travel” off your list of pent-up demand.

Now, if people go to San Francisco (please don’t, it’s terrible here), and spend a ton of money in SF, that would add to US GDP. But they can do that already. The roads and bridges are open, the airport is open, plenty of hotels are open.

One thing will happen: capacity has been reduced in the airline, cruise, and lodging industries, and when travel demand takes off, prices will surge. Get ready for that.

This morning (in BC Canada) a TV ad came on showing folks on the beach. It was courtesy of ‘Florida and Air Canada’.

I guess the ad was planned and paid for pre-covid but still…

Dear Air Canada: even if we could get there we can’t come back without quarantining for 2 weeks.

I say international airline travel will go back to what it was in the 1970’s – mostly wealthy traveling by air and those that must see family overseas. Flying is going to become way to expensive for the ‘casual’ tourist’. I also suspect that the truly wealthy will never fly commercial again…

I agree with the pent-up demand not materializing itself.

We have to remember that when more normal times occur then the rent moratorium, and payments on loans etc. are going to resume, so that will take care of any feeling of wealth.

I also think we need to think of this as a two-sector economy.

70% -low income, precarious work

30% -middle to upper class

Their responses and ability to consume will be quite different

I am not seeing pent-up demand, but I am seeing demand changing to different sectors. Becoming more prepared and self sufficient requires a certain amount of investment, although it is a one time expenditure and should in theory cause less spending in the future….

“If Trump had quashed this virus in the bud”

This is humor, right?

Auto insurance companies should have had huge profits in 2020. I know I drove 75% fewer miles last year, a large drop in liability to my insurer. I don’t seem to be getting any discounts on my rates, I suppose even the insurance companies are forecasting pent-up demand, just in case?

Pay Less When You Drive Less

Is your car spending more time in the garage than on the road? You may be able to reduce your auto insurance payments.

By Paul Stenquist / New York Times / Jan. 23, 2021

He mentions Metromile, SmartMiles, and others. I haven’t checked any of this out, I merely copied the article for future reference. Maybe one of these deals would appeal to you.

Some ambulance chaser filed a class action lawsuit in Nevada over this very topic (insurance rates)….. should be interesting to see the outcome of that

Where to start. There is a big difference between this scenario where huge numbers of people are stuck at home and facing the prospect of working from home indefinitely. It’s hardly a surprise that these folks might wish to upgrade their environment based on the fact they are going to be spending a lot of time in it.

Secondly, I seem to remember a previous Wolf article stating that a lot of the early rounds of covid relief money was used to pay down consumer debt. Sounds downright prudent.

I notice a lot of folks on this site are getting torqued out about the newest round of relief money. While I would agree that it could be better targeted (i.e. based not just on income but on current employment status also) but given the trillions that have been passed out to people who don’t need it I find it hard to get too worked up about. The ship of “sound money” has sailed. Be it 1987, 1995, 2008, whenever you want to peg it, that has happened and that genie is not going be into the bottle until there is a painful reset.

We’re worked up because we know it’ll not end here, and that it’ll ultimately destroy the country.

If we can print money to give everyone $2,000, why not print more to give everyone $50,000? $5,000,000? There’s only a difference in degree, not kind.

The country was destroyed in that manner in 2008 at the latest.

The slippery slope of handouts is never a problem until it goes to the bottom instead of the top.

No, it’s been a problem all along, and I’m really getting tired of the stupid argument from liberals thinking they have a “Aha, gotcha!” with the “But you had no issue with the rounds of QE and the bailouts for the banks or tax cuts for corporations!”

Actually, most of us on this forum and elsewhere DID have an issue with it.

Well, I agree that many did have issue with it. But it happened anyway. And it happened because of greed and fraud, not because of a natural disaster that is this virus.

We would probably both agree that many people should have wound up in jail after 2008 but that didn’t happen. And we probably both agree that the printing of money cannot go on forever without consequence.

Where we probably do not agree is that this “bailout” is somehow as bad as the one in 2008.

Quit saying money printing… Money is created thru debt.. Debt has to be created thru lending. Laws would have to be changed to actually Print and that isn’t going to happen soon or easily. There is already a liquidity issue as new loans are slowing down. This is not going to end well.

economicminor,

The Fed creates money and buys assets with this newly created money, thereby creating artificial demand for those assets and transferring this newly created money into the markets. That’s what is called “money printing.”

Debt creation by the economy itself is not “money printing.”

Bring all tax rates back to pre 1970. Plenty of money…

Good, let ’em hand it out. Then use it to pay off your debt or buy a ounce of gold. That’s why I’d like to do. I think it would be quite funny to take some fiat and buy some gold.

There is no such thing as a free lunch. When someone offers you something “free” be very wary… It is almost always a way to rob you blind.

I am not worked up… In fact I am at the point now where I realize it will take a major Federal budget crisis before common sense and any sense of fiscal responsibility returns.

The fiscal irresponsibility we are seeing now is simply accelerating the process. In the mean time, I am simply using the “free money” to supplement my preparations for what is coming because it is not going to be pretty…..

“If Trump had quashed this virus in the bud, the worldwide pandemic might have been averted. That is his legacy.”

I am no fan of Trump, but that is just ignorant. It was China’s coverup that allowed it to spread internationally. That is INTERNATIONALLY recognized. The cover-up involved lying about KNOWN human-to-human transmission and banning flights internally, but allowing international flights to continue. When, early on, Trump banned Chinese flights into the US, he was derided by the Dems as being xenophobic. Remember that? Apparently not.

And as far as how hard it hit here, there were 370,000 Chinese students in the US in 2019 and the earliest case of COVID-19 in China is believed to have been in October or November of 2019. Think many of those Chinese students visited home over the US school holidays? A bunch of those kids of the age where they are typically asymptomatic then spread it throughout the US to many more partying, saliva and other bodily fluid sharing college students. We also have the so many other Chinese nationals who preferentially visited here… because this is such a terrible, racist place. [/sarc]

How does this compare to a pie chart of all spending prior to and post Pandemic. A comparison would be valuable.

Personally we’re buying less in general but at 60 we are not large retail consumers.

Here are the charts for comparison by retailer category for “all spending prior to and post Pandemic”: grocery stores, auto dealers, electronic stores, restaurants, etc., In fact, they go back far beyond the pre-Pandemic year, they go back to 2004, so you can compare the Pandemic spending to the Financial Crisis spending, through January data:

https://wolfstreet.com/2021/02/17/whats-hiding-behind-the-massive-seasonal-adjustments-in-january-retail-sales/

Inflation!

Raise rates. Anything but rampant inflation.

Then deflation!

Lower rates and print money! Anything but rampant deflation.

Isn’t this the modus operandi of every market correction?

Now the have a reason to justify raising rates to ‘normal’ to drop them again 12 months later.

Gonna be rough times ahead but I have faith my cash savings won’t disappear in taxes etc, given zirp and money printing are far more effective mechanisms.

5pc bitcoin and 95pc cash seems to give solid positive yields with almost 100% isolation from the generally broken economic world.

I remember back in 2010 there was a thought circulating around London and NYC that we faced a lost decade but the economy would turn up again around 2020 as boomers would be retired and still healthy enough to spend money on fun stuff and millennials would be ramping up house hold formation. I still think these two things are tail winds but the question is how much growth was borrowed from the “roaring 20s” to subsidize the 2010s? Bernanke spoke about this “borrowing” previously.

Wolf is making a good point. Some savings might have accumulated in the past year but many people spent money on durables etc… instead of services. With another round of free money and restrictions being lifted I expect an increase in spending but don’t have a guess as to what degree????

The M2 chart looks frightening but velocity matters also. In the 70s looks like inflation and velocity moved in tandem. As if inflation forced money out of the sidelines and into the economy. I am starting to think we will see that later in the year, inflationary scares kick velocity back into life and this weird feedback loop is created where inflation drives spending and spending drives inflation. So maybe this scenario drives spending much higher as opposed to pent up demand.

The problem with that scenario is that the vast majority of boomer wealth is only paper wealth. It is also offset in most cases by large amounts of debt.

Their net worth is figured on the perceived value of over inflated assets, while their debts are actual and set.

In a major correction, where the value of assets drop 40-50% across the board, the majority of boomers would find themselves broke.

The process of “money destruction” is a domino effect, and may have already begun in the commercial real estate market… We will know soon.

My wife and I have been Loving the Lockdown™. We are out there hiking, snowshoeing or biking [depending on season] usually twice a day. Ordering in dinner a couple of times many weeks from various fine restaurants, and supporting the local vineyards [which just had their best vintages EVER in 2020]. We’ve got money to burn, and huge assets, but have discovered that we are doing great, maybe better than usual, and healthier, without much spending. So our assets and income are nice to have, but kind of superfluous to the live we are living. Many friends have made a similar discovery. If we do go travelling, generally it is to do the same things [above] which we enjoy at home. After lockdown we will enjoy more live theater and music, that’s about it.

The pent up demand was at least in part demand for future wealth pulled into the present. Mortgage and rent forbearance didn’t extinguish those expenses they just kicked the can down the road. Today’s spending is tomorrow’s mortgage payment.

What are you gonna use to buy Tuesday’s hamburger Wimpy?

The US has many of the least healthy people on the planet, obese, sedentary and eating horrifying ‘food’.

That’s why.

Unemployment payments is understandable, even extending it during the lock down. But an extra $600 dollars a week, what gives? My sons friends in low wage jobs, got laid off. They do not want to go back to work because they are making more on unemployment checks than real work. Then all this free cash up to $75,000 a person/ $150,000 a couple! I don’t need and extra $1200. Even the Republican’s voted this largess?

They should limit to low income people, Maybe people making $50k or $30k yr per person.

So why so much when we are drowning in debt anyways? Then it struck me, inequality ! The US government is acting just like China, US is trying to placate the masses so they do not revolt!

Why give money to those who don’t need it? So the President and Congress can look good. Like they are doing something. And you can save the money so they FED can have something to put on their balance sheet.. Just a grand circle of feel good stupidity/insanity. And no interest is paid so it doesn’t cost much.. :-)

I didn’t receive any checks last year and do not expect to receive any this year either. I am sure there are income caps.

‘Pent-up demand’ is a tale fools tell to convince themselves they are not going bankrupt.

It’s also what your rulers, and their puppets in the MSM, tell you, to excuse what damage they did with the wholly unnecessary lock-downs.

If we are only getting $1400, I guess I’ll just spend it on a tank of gas. Regular unleaded has officially doubled in price from last March. Thank God there’s no inflation.

If I’m doing my math right, since a year ago spending on durable and nondurable goods increased by about $450 billion according to the charts. Meanwhile spending on services deceased by about the same amount so people aren’t actually spending that much more, and yet personal income has spiked tremendously.

I think there are a lot of people sitting on a lot more cash than they were before. Some of that may have gone to pay down debt, but some are surely under-spending relative to what they were. I’m reminded of a Mauldin chart showing that rich households were more strongly becoming very frugal at the beginning of the pandemic. My guess is that a lot of that “pent up demand” will be showing up at resorts and tropical beaches possibly this summer or next winter.

We already know what robinhood bros bought with the money. Although a financial services guy in my family told me one day that several older clients hiding from the pandemic had normally enjoyed shopping but didn’t want to go to the store and got tired of shopping online, so they told him that their new hobby was “shopping for stocks.”

Jim Rickards has pointed out that there are long-lasting psychological effects from crises such as pandemics. People may lack the confidence to spend much of their income as they may mistrust government, lack job security going forward, or are wary of tax hikes that may be introduced. This may nullify the tendency to spend in an inflationary environment.

So basically, pent up demand is the new cash on the sidelines?

I know skepticism is your brand but, honestly, it worked! The USA (and the world) should currently be in an economic depression right now.

In the bad old days of Clinton, Bush, and Obama the elites would have given trillions to billionaires thinking that would solve the problem and left the rest of us to suffer like 2009.

Instead Pelosi, AOC, Biden, and yes Donald Trump, gave money to the taxpayer, the normal citizen, and it saved our economy.

A,

Important to distinguish:

1. Paying adequate amounts of money to people who have lost their jobs or gigs is crucial.

2. Sending “free money” – it’s not free to society – to people who have kept their jobs and make as much money as before is not crucial. Yes, “it worked” in creating the greatest trade deficit ever, and in creating the biggest fastest jump in government debt ever, and perhaps in artificially boosting stock prices. But in my book, those are negatives.

3. And using taxpayer borrowed money for large scale serial bailouts of shareholders and bondholders of certain industries is a terrible thing.

So I questioned the necessity of the stimulus payments in a few articles. And mostly I’m looking at the effects (including the costs) of those payments. People need to know.

But I reserved my harsh criticism for the corporate bailouts, and I have vituperated against these bailouts of shareholders and bondholders in my articles. For taxpayers to be shanghaied into bailing out investors is a horrible thing. I have called it “taxpayer capitalism.” There is no excuse for it in a country where share buybacks are the rule, and where there is a functional bankruptcy system to undo the effects of those share buybacks.

WE have ‘taxpayer PAID capitalism’ especially for Banks and Corporations bailouts both during GFC and now!

1 in 3 American families depend entirely on govt assistance in various forms.

Also we have TWO American Economies, one for the top 10-20% and the 2nd one for the rest.Their actions, aspirations, expectations and behaveriol economis are entirely different, as consumers.

When I read comments, I am unsure, which one they are really referring to? What applies to one doesn’t apply to other.

Wolf, those last three sentences are spot on!

The fact is that the citizens are simply the middle man in this entire scenario. The government gives the checks to the citizens, who promptly spend them putting the money in the accounts of the corporations.

In most cases, the citizens end up with little or nothing of value to show, except the monstrous debt to pay off.

The corporations end up with all the money. The taxpayers get the debt.

Never let an opportunity to fleece the citizens go to waste….

Actually, it is. It is simply being masked.

I dislike the term “Free” Money. The definition of work is calories burned, unless you are in the laborers union it’s all free money. Thoreau’s quote applies to durable goods, “these are things more easily acquired than gotten rid of..” The anticipated “Pent Up” demand comes when the next wave of AI is implemented. How many consumers buy out of self gratification, rather than self improvement, or autonomy? The term “Free” money is moralizing at the institutional level, which absolves individuals at the consumer level. The consumer like the investor has been stripped of their own moral authority in exercising judgement.”Free” money is a ticket to blame everybody which is a neat trick.

Wolf, don’t forget, international travel brings tourists to US too.

NYC,Miami, Vegas,LA etc. Americans to Europe, Europeans to US, there is your Air Traffic back, plus fuel demand. More importantly, people will spend on Leisure and restaurants. I’ve seen italians loading up their big sports bags with Polo Ralph Lauren in Vegas Outlet Store. Italy has big taxes on imported clothing.

Local Travel will pick up too, when vaccine brings that feeling of safety.

“…don’t forget, international travel brings tourists to US too.”

Yes, but that is not US consumer spending. And we’re talking about US consumer spending here.

Spending by foreign tourists in the US is considered “exports” and has nothing to do with consumer spending. It goes into GDP under “exports.” I discuss spending by foreign tourists in the US in my articles on the trade deficit:

https://wolfstreet.com/2021/02/08/us-trade-deficit-in-2020-worst-since-2008-goods-deficit-worst-ever-despite-first-ever-petroleum-surplus-services-surplus-drops-again/

Look for the underground economy to boom like never before. People are openly bragging about not paying taxes. Hiring workers for cash will be considered a patriotic duty.

Not paying taxes will also be booming all over the country. One dude I knew, moved to Fla and got a bill from NY for a partial income tax owed for the the time he lived there for 3 months or so. He took the bill and ripped it up at the clubhouse in front of 50 people. Everyone gave him a high five.

My old man paid the bill from NY and everyone called him a sucker.

I’m sure that gal that performed that Lewenski at the bus stop didn’t report one nickel of income on her taxes.