Global market share of 1%. But market cap equals combined total of Toyota, Volkswagen (VW, Audi, Porsche, etc.), Daimler, GM, BMW, Honda, and Ford. Raised $10 billion in three months by selling shares.

By Wolf Richter for WOLF STREET.

Tesla is going to replace Apartment Investment and Management in the S&P 500 Index, S&P Dow Jones Indices announced Friday evening, fleshing out its initial announcement of November 16 that Tesla would be added to the index. The switch will become effective before the start of trading on Monday, December 21. Over $100 billion are estimated to flow in different directions as index funds have to unload Aimco and add Tesla. But they’ll position themselves ahead of time so they don’t have to all go out next Friday and buy or dump those shares in one day. In terms of Tesla shares, the index funds had a month to prepare.

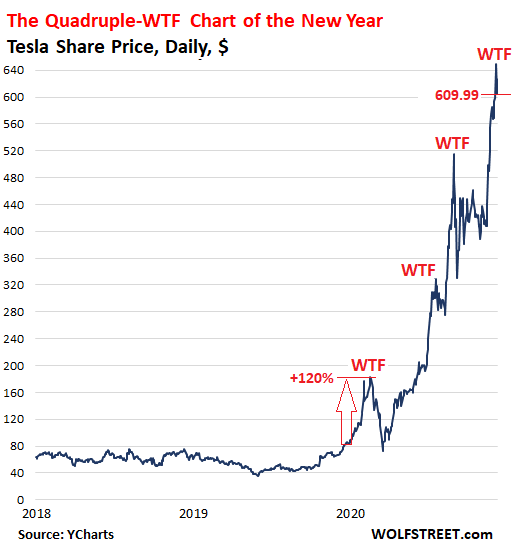

The expectation that Tesla would be included in the S&P 500 index, and all the hype surrounding it, has been powering the last spike in my Quadruple WTF chart of the Year, which blew away and annihilated my Triple-WTF Chart of the Year of August 31, and my Double-WTF Chart of the Year of July 1, and my original WTF-Chart of the Year of February 4, which depicted the puny little 120% jump in one month, as noted in the chart below. Each of the prior three WTF points has been duly followed by a plunge (stock prices via YCharts):

All put together, Tesla shares soared 677% from the beginning of this year ($83.66) to the closing high on December 8 ($649.88). On Friday, TSLA fell $17 to close at $609.99.

Aimco dropped 4.4% Friday afterhours upon the news, after having plunged 37% so far this year.

With earnings per share of $0.50 over the past four quarters, Tesla has a PE ratio – if we’re still allowed to look at anything as antediluvian as a PE ratio – of 1,220 times earnings, when 10 to 20 is more typical for profitable automakers.

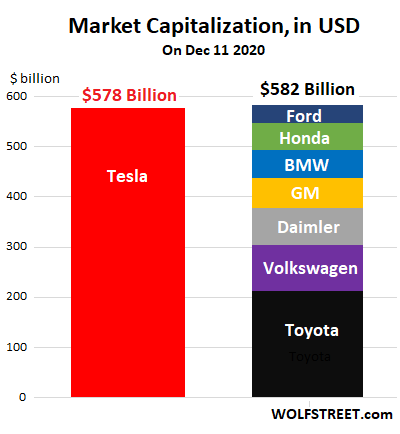

Based on its market capitalization, at the moment $578 billion, Tesla would be the sixth largest company in the S&P 500 behind Apple, Microsoft, Amazon, Google, and Facebook. And it would weigh over 1% of the S&P 500 index. This massive market cap is turning the otherwise fairly routine event of rejiggering the S&P 500 index into a global spectacle.

But Tesla has a market share of the global passenger vehicle market of about 1%. It’s just a small automaker. But Tesla’s market cap ($578 billion) is now about equal to the combined market cap ($582 billion) of Toyota (Toyota and Lexus), Volkswagen (VW, Audi, Porsche, and many other brands), Daimler, GM, BMW, Honda, and Ford – an amazing sight:

And Tesla has taken advantage of this situation: It has extracted $12.3 billion in new funds from investors via three stock sales this year — of which $10 billion in three months.

The latest stock sale, a $5 billion offering, was announced on December 8. And by December 9, it had sold all $5 billion worth of shares. This followed a similar $5 billion offering three months ago. And in March it had sold $2.3 billion of shares. This total of $12.3 billion come on top of the $20 billion or so it had raised since its IPO.

The inclusion in the S&P 500 has created a lot of demand for Tesla shares, and Tesla was more than happy to sell them into this demand at this huge big-fat share price. Now Tesla is swimming in investor cash, and it’s going to have to spend it.

Over the past four quarters combined, Tesla generated $28 billion in revenues, including “regulatory credits” – cashing in on government tax benefits has always been an essential part of Tesla’s business model. But it also had a huge amount of expenses and investments in plants and equipment, and it had to borrow money from Chinese state entities to build the Shanghai Gigafactory. That’s all part of the sordid business of being an automaker.

But in the third quarter, Tesla sold $5 billion in shares, with nearly no expenses attached to the cash, and in the fourth quarter so far it sold another $5 billion in shares, similarly with nearly no expenses attached to them (just a 0.25% fee to the investment banks that handled the sale). In other words, this is pure cash for Tesla.

At its net income rate over the past four quarters (around $500 million), it would take Tesla about 10 years to earn enough money from operations to equate one quarter’s worth of share sales. And you already know where I’m going with this…

At this rate, Tesla would be far better off just giving up on the sordid cash-consuming business of making cars and building factories and dealing with warranty issues and regulators and recalls and investigations into faulty suspensions and Autopilot fatalities and whatnot, and just focus on what it does best and pulls off flawlessly each time: Selling shares at hugely inflated prices.

It could sell them once a quarter on Autopilot, and no one would get killed, and it could shut down all its factories, and shed its people, and be done with pesky regulators and expenses. And investors, the way things stand, would love Tesla for it, no?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

PT Barnum could takes lessons.

It will be fun to see fanboys averaging all the way down.

For now Tesla shuts down hi-end cars production in CA for 18 days. That news alone may push the stock to $1000 ($5000 pre-split).

Because Musk!

I am surprised that nobody see an obvious subsidies through the stock price to avoid mistakes made with Boeing-Airbus.

And of course must be painted as super hero so everyone would forget failed projects like power wall, solar roof, boring tunnel, hyper tunnel, tesla truck, cyber truck.

I don’t know. I’m still looking forward to landing on Mars.

Andy, anyone can land on Mars…..it’s leaving that’s tough to do.

Boring tunnel is the only project he has ownership of that’s failed, in concept.

Hyper loop is his idea but that’s it.

Power wall and solar roof you can buy right now..

Truck and semi are still in development but you guys said tHe 3 wIlL nEvEr mAKe iT tO pROduCtiON, Yet I see tons of them on the road.

Stock overvalued? Absolutely, however your comment is factually incorrect.

Should Tesla crater to the $90 a share value that JPMorgan considers is the real value of Tesla shares, the effect would be disastrous. Like the effect of the collapse of tulip prices in 1637 in the Netherlands. Within less than a year, from 1636 to 1637, “Tulipomania” saw the price skyrocket over 3 months, then go into free fall. Good times.

If Tesla stock collapses, I suspect lots of other new EV companies (high fliers) would go down with it. But, then again, I am an old guy, and really don’t know nuttin’.

EV startups would survive without Tesla, because, most developed countries in the world have little to no oil and don’t want to depend on unstable suppliers or deal with geopolitical energy politics. Also, if deglobalization does pick up, many small developed countries will want to produce their own cars and EV’s are hugely simplerer to design and produce to modern standards.

Tesla’s connection to SpaceX will likely keep it going. Also if Tesla ends up being one of the first licensers of self-driving car tech (or just themselves produce a lot of these at inflated prices for businesses) that will bring in huge money.

“if Tesla ends up being one of the first licensers of self-driving car tech”

That’s a big “if”. There are other self-driving tech currently more advanced (already deployed in some cities) and they are “pure plays”, not a company that competes directly with car manufacturers.

“Tesla’s connection to SpaceX will likely keep it going. ”

Please elaborate how SpaceX would “keep” Tesla going?

Concur completely. Also, Musk is one of the few really innovative thinking doers in our country anymore. Everyone else has submitted to the discount chains, monopolies, and private equity guys. This is amazing in itself they haven’t taken him out and subdued him/ bought him like they do everyone and everything else. This guy is old school innovator like we used too have! Let the guy create and think he’s awesome! I own stock in him, and I’ll go down with him unless he totally sells out to the above mentioned status quo guys.

intosh,

America’s space program and part of the future plans of its military is beginning to be dependent on SpaceX. This gives Musk a lot of political connections and leverage, this means as long as Elon pushes for Tesla; Tesla will receive government assistance whether in the form of bailouts, EV credits, direct funding, or other ways that can keep Tesla going. Manufacturing in states with no other car manufacturers, also means they might receive assistance from those states.

As for self driving competitors, no one else has demonstrated the confidence to put them in average people’s hands. All Tesla self driving cars have the necessary pieces for full autonomy and are being updated over time to increase autonomy. They are the only one that gathers and improves the self driving cars with the general population driving in everyday situations. There are however, some very limited and controlled trials by other companies. So I have seen no proof anyone is ahead of them in self driving cars. Tesla making cars themselves, wouldn’t hurt their ability to license self driving car tech.

Thomas Roberts,

Waymo has self-driving taxis in service right now.

Tesla’s Auto Pilot is no way compares to Waymo’s self driving taxis. In a Tesla you have to keep your hands on the wheel and pay attention. Waymo’s vehicles do the actual driving themselves. Big difference.

Intosh, all the other self driving cars use very expensive hardware and are geo-fenced since they need extremely accurate maps. Only Tesla is using vision (cameras) based neutral network logic, just like you and I except Teslas have eight “eyes” vs our two.

David Stein,

It matters little because self-driving tech’s target market is the “car as a service” market, where auto-makers + tech companies would have feets of self-driving taxis and trucks. So the cost is less a problem because the vehicle generates revenue; besides, volume will lower the cost.

intosh,

That is not correct,

First of all Waymo’s cars are restricted to a small area and may have special rules programmed in for how to drive in specific areas. This is very different from Tesla, the data gathered by having everyday people drive and have their vehicle self drive in everyday situations all across america is very valuable. As a safety measure, yes, Tesla wants people to be able to takeover just in case; this is temporary, as their cars become, more autonomous, this will become unnecessary. As someone who did study computer science, i can easily say that the waymo approach is a useful start, but, a deadend. The only way to have actually fully autonomous vehicles that are safe and available to the public, is to do what Tesla is doing. Tesla’s approach is the best way and while in the end someone else may succeed, Tesla is doing it the exact way it should be done and are years ahead in doing it the correct way. It is possible Waymo might lease 1000s of cars out to general public and eventually surpass Tesla, but, for now everyone is behind Tesla.

As for the target market, taxis and the like, are the ideal market, however, the vast bulk of self driving cars will be owned by the public. If you own the self driving car tech and the cars and don’t sell the tech, you might make a lot of money (from owning things like a self driving car network). If you license the tech, you are going to make money on volume, but, mostly from general public. As they will buy most of the cars.

Waymo will probably try to be a taxi service who owns their cars and tech and doesn’t license it out (at first). Tesla could do different things, it might just license the tech, meaning GM and Ford could offer it as an add-on in their cars. GM, Ford and others might have multiple options available for self driving car tech. Or keep it to itself and sell more cars. Tesla licensing it, is probably the best option for them. Tesla might also be able to force businesses like taxi services to share profits from the use of their self driving tech. That is the probable best outcome.

It’s still anybodies race, but, Tesla is in the lead right now. As for other self driving tech companies, if you haven’t shown anything or put them on the road yet, you could still win, but, are very far behind.

JP Moron has a low target price because they are the #1 funder of fossil fools.

Tesla is disrupting all that. With huge disruption to come.

I see a fanboy has clocked in.

Please note the site commenting rules; try to keep your comments to under 5% of the total comments. Right now there are 25 comments; so 5% would be 1 – 2 comments, and you already have 4

To your point: a “low” target price of 90 is still 180x earnings, still fairly stratospheric compared to industry peers.

The industry peers of Tesla are irrelevant to their share price. If any of to anti-Tesla people, like yourself, truly understood why Tesla is worth what it is, we wouldn’t see all of these comparisons that really mean nothing. You can count this as post number one, since you are keeping track.

Low earnings because they’re heavily investing in expansion, in synch with their corporate mission of accelerating the world’s transition to sustainable energy.

Thank you for the info. I know all along the 100yr old coal/oil/gas dirty industries and nations (Russia and Trump) finance all the Tesla sorts to kill it.

Tesla could soar over 300%, to $2,500, in the next three years, the venture capitalist and veteran tech analyst Gene Munster told CNBC on Monday

But really there’s no substance competition – again, they’re going to evolve outside of cars longer-term, he said of Tesla.

Disruption means providing a product that is inferior to current market offerings but at a much lower cost. While Tesla does provide an inferior product, it is higher cost. Thus it is not disruptive.

The disruption can be seen in the statistics and i’m not pleased with it.

My portfolio analyser tells me that automotive has been growing hugely over the year, with only Tesla to ‘thank’ for it. All auto makers haven’t grown in market cap. The mania in Tesla has scewed all trends. It’s better to exclude it from analyses together with the FAANG’s to get a better picture of what’s really going on in the market. Although that remaining market is scewed by the central banks. But at least is gives us a picture of what they are doing and where it is going.

To me Tesla is just as disruptive as a fly in my soup.

I’m with you on that, these fumbling folks actually believe Tesla is valued under 100.00 REALLY lol-I say much more for me later. Only a complete clown would take the risk and get rid of all their TESLA. Bad call again like the previous Naysayers ….When will the Tesla haters learn SMH

Actually a truly disruptive product is vastly superior and cheaper than its competitors which makes them obsolete. Have you actually driven a Tesla? I have driven a Model S and ridden in a Model 3 and I used to own an L-82 Corvette. Both Teslas would blow the doors off the Vette! When the 4680 cell is ramped up (happening now) and incorporated the ICE vehicles will not be able to compete.

I’m long TPL best of the best. Oil ain’t going anywhere for many many years and collapse of US shale by selling the lightest sweetest product on the earth for a trillion dollar loss is a national security disaster. Net energy/co2/pollution cost cradle to grave probably equal or less with GPM. Now if we could only learn to make small nukes with no moving parts that produce +/- 60 Mw like Nucor dreams of, from already “spent” fuel, that would flip the chessboard. Change my mind.

I think we are going to see more of this. Tesla is a going concern because of government policy of subsidizing EVs, Fed zero rate policy and huge Federal deficits. It’s a big market intervention that allowed cars to be made that otherwise would not have been. As with nearly all market interventions there are winners and losers.

Winner: Elon Musk, early investors

Losers: Taxpayers, whoever is holding the stock if (when) the bubble bursts

An English sailor ate a rare bulb thinking it was an onion and was sent to jail.

At the end faced with the collapse of the economy, the Dutch govt passed a law cancelling tulip bulb debts.

@Nick

Thanks for sharing that historical nugget that the Dutch wisely cancelled tulip debts after the bubble collapsed.

Or govt needs to follow that example for housing and student debt immediately!

I hope you are kidding. Student debt for example. School provided services. Student consumed services. Is it moral to force a third-party to pay the bill?

Housing debt. Builder provided goods. Homeowner consumed goods. Is it moral to have a third party pay the bill?

Old School,

“I hope you are kidding.”

To confirm your hopes, read the commenter’s alias again but in one breath ?

Let them go bankrupt, #Moralhazard just like GM Bondholders

Tesla is the “Black Tulip”

Not a good comparison. Who is the genius behind tulips.

Tesla has Musk. Tulips don’t have mega ev car factories In China and Germany. Tulips don’t have mega battery makers.

Tulips don’t have short sellers like James Chanos and Michael Burry.

Tesla will drop but it has assets.

Fun to read article. What times we live in….

As I said this decade is going to be a 100% change

Transportation

Energy Production

Agriculture

If you know what to look for you can see the changes coming.

RethinkX

Add Repossessions and Suicides to your already listed travails in the Transportation, Energy and Agriculture sectors and you end up with:

TEARS.

You were there in 1999 what Pets.com and all the other .coms weren’t making a penny and all crashed and burned.. I know it.

“Pets.com”

Whenever I miss the sock puppet, I just have to turn on the MSM news…

Here in Germany there are quite a few Tesla’s. I have one. I have to say it is ogled wherever I go. And they have a reasonable charging network. I think the network might be their long term strong spot. Instead of the car I should have bought the stock.

The foolish are talking s#%* again about the number 3 car manufacturer on the planet.

There they go again the herd mentality Connoisseur’s pretending to be leaders again in the investment world.

Elon is on his way to prove them wrong again, face it change is a coming.

Buy Tesla and relax folks and you anti Tesla nimrods get a life.

Edward Broussard,

“… about the number 3 car manufacturer on the planet.”

#3, that would be GM, #1 and #2 being Toyota and Volkswagen. Tesla isn’t even in the top 10.

The internet was revolutionary to the world. Yet we still had the dot com crash. Don’t doubt Tesla’s industry. But they are about a decade early for actually making money on their product. If they, like Amazon, can hang on for another ten years, Tesla will do well. But more likely than not, the stock will get destroyed in any sustained market downtrend.

I say by the end of this decade more people will be walking, riding bicycle while the few that manage to remain wealthy will have their electric non tesla cars.

My brother bought Tesla stock a few months back when it took a big dip. You cannot talk to these investors about Tesla financials (or lack thereof), as they are nearly rabid over the “genius” of Musk. As your article points out however, his genius is not so much as a technological leader in the car manufacturing industry as much as it is as a snake oil salesman. “A fool and his money are soon separated “!

1 auto company increased sales in Q2. And they made money, unlike the others.

1 man out of 350M people got the people to the ISS.

A list too long to mention of the “impossibilities” that Elon has accomplished.

Look at the huge debt that the other auto makers are in. Soon Tesla will have 0 debt.

LOL! “his genius is not so much as a technological leader in the car manufacturing industry”

Are you blind? Have you REALLY compared cars?

And building factories. He was claimed to be a “fraud” when he said that he was going to produce cars in a year. That said it would take more than 2 years. It took him 10 months from muddy field to building 1st car.

Look at his mega casting. Nobody does that.

Better do your homework.

You sound like the guy in highschool that was in love with the girl he could never get. Except now it’s Elon instead of a girl.

“1 man out of 350M people got the people to the ISS.”

Cute but no. A team of engineers and professionals did that.

“Have you REALLY compared cars?”

My brother recently bought a Model 3. Sat in it and drove it. Acceleration was fun but fun won’t last. Build quality is below average (loose rubber seal; faulty sound isolation; tiny rattles).

Of course, since it’s an expensive toy, few will admit they’ve made a bad purchase. And friends and family aren’t cruel enough to tell them that either. So we are all just playing along.

Tesla’s customer satisfaction is very high. Cool story, but it is just anecdotal and not relevant in the big picture. Those minor problems are made up for by all of the much bigger positives including performance, OTA updates, and all of the good things about driving electric.

What he has accomplished is impressive no doubt. Building anything and having real products out there people can use (like cars) isn’t easy. Just remember: He didn’t invent electric cars, not was he even the founder of Tesla. He didn’t invent rockets that can land and be reused either – all those concepts came long before and he stood in the shoulders of giants (Nasa etc). However, he is good at seeing where opportunity lies hence Tesla ‘success’. The stock is total WTF but then so is the entire global economy. BTW, Everyone is saying electric is the future – sure, it probably is but at what cost? Do the EV fans really believe all the environmentally friendly and zero emissions marketing? Just take a quick Google look at lithium mines. I laugh everything i see that image of the ‘LOL OIL’ registration plate on a tesla. Where does the owner think all the plastic in the car and his clothes and all the parts for a billion products come from? Everything has a cost.

Mark…

Who issued the carbon credits…and why does he get to sell them?

“SolarCity gained more than $2.5 billion in incentives, with the largest portion estimated at $1.5 billion from the federal 30 percent tax credit for solar installations. The state of New York also provided more than $1 billion in the form of subsidies for a solar manufacturing facility in New York and property tax exemptions.”

“Elon Musk’s SpaceX won $885.5 million in subsidies from the Federal Communications Commission Monday to provide rural areas with high-speed internet”

“By 2015, Tesla Motors had received more than $2.4 billion in subsidies and tax incentives”

“Tesla also received about $1.4 billion from the state of California in tax breaks for electric car production”

He has a genius all right….for tapping into the biggest money pot in the world…the US government.

Have you noticed the subsidies for fossil fuels? They dwarf anything given to EVs.

The regulatory credit system is you buying a fossil fuel car subsidizing an EV (Eg: Ford pays Tesla). That si the way it should be. Great system.

Soon EVs will be cheaper than ICE cars, and they cost less to run.

Don’t understand the hate for Tesla. Doing great stuff and though the stock price may be nuts … can we talk about Amazon … which doesn’t make anything, and is bent on destroying the world..

No doubt Musk is a genius

He made evs cool again

Tesla is a good company making sexy cars

But the right question is : is it this valuable ?

I don’t think so

Wait a year or two when more companies are making evs…

I want to buy ev but teslas don’t fancy me and I’d wait for alternatives

Same here. EV is the future but I wouldn’t get a Tesla because I am simply not impressed by the build quality — it’s subpar compared to, say, Japanese cars.

Musk and actual innovation/business impact…more than Trump…less than Edison.

But…that’s a helluva spread.

Sometimes I take the other side of the argument and think maybe they have a genuine, global first-mover advantage in EVs, and the world is all about mindshare now. Or, maybe this is about converting the car into an iPhone. Or, maybe they solved cold fusion and achieved quantum supremacy simultaneously and it’s been slowly leaking out.

But most days I just get an Enron vibe.

But, then

In China, Tesla is not a big deal. I can go all day traveling around the city and only see one or no Tesla vehicles. They were a fad with the rich trendoids a few years ago, but they have moved on. On the other hand, I see SEVERAL Chinese EV’s A MINUTE on any busy street. All the large car companies and the foreign companies in partnerships are quietly making and selling huge quantities of EV’s.

And those EV’s are mostly powered by Coal. What do you make of that?

Ted,

SO????? Why can someone buy a 1-ton diesel pickup and not give a crap about what powers it, and an EV buyer has to go figure out what powers it and then feel bad about it or what? What kind of hypocrisy is this? People buy EVs because that’s what they WANT, and people buy diesel pickups because that’s what they WANT.

Your EV is powered by the same thing as your smartphone and your AC.

The problem Wolf is that people who drive diesels dont virtue signal about being environmentally responsible.

People on the left got upset about Michael Moore’s documentary (not even sure if YouTube still has it) Planet of the Humans when it challenged these outlandish claims about green energy.

Raymond Rogers,

Quite a few diesel drivers have a very high opinion of themselves and try to act like they are tough and drive irresponsiblely, because, they are in a bigger vehicle than you. I’d easily prefer to share the road with or be in the same room as a Tesla driver.

People got “upset” (that is, critiqued) Moore’s film because it was “deceptive and misleading, not to mention way out of date”.

In some places, grid electricity is as much as 50% from clean sources. But the important point is that it is getting better and better over time. So that EV will be cleaner in 5, 10, 15 years. That diesel won’t.

Ted,

“And those EV’s are mostly powered by Coal.”

That may be the case in China. But it’s not the case in the US, where coal is down to about 25%, and in California, there are no more coal power plants at all. And Texas has become the largest wind power producer in the US.

“People on the left got upset about Michael Moore’s documentary (not even sure if YouTube still has it) Planet of the Humans when it challenged these outlandish claims about green energy.”

These outlandish claims about green energy?

“The CleanTechnica Answer Box (Renewable Energy & Electric Vehicle Answers To Common Myths)”

https://cleantechnica.com/2016/09/02/renewable-energy-facts-electric-vehicle-facts-answers/

Air pollution in Chinese cities is a huge problem and EVs help lessen that burden. While EVs in China are mainly powered by fossil fuels (coal) the plants can be moved away from the dense urban centers. A couple years ago I spent Spring Festival with my wife’s family in Shenzhen and was able to enjoy some terrific blue sky days. This was not as common in earlier years. There were a couple of Teslas on the streets, but this was a part of town where you could also see super cars and one guy with a fully tricked out F150 pickup. The vast majority of EVa on the street were produced by BYD and looked like regular sedans, except for the special green license plate.

This is what I make of it:

Musk (substantially) jump-started the EV industry.

The rapid consumer acceptance of EVs has accelerated the timetable of the shift from fuels to electricity, but it would have happened anyway because of climate change.

We need more and better solar panels, more and better batteries, bi-directional electricity distribution grid, and progressively fewer and shorter car-trips.

And, in fairness, a lot of that has been happening over the past several years.

It’s a spot of good news. A welcome diversion, right?

Wolf,

Whoa, Wolf.

An absolutely integral part of Tesla’s marketing push/appeal is that you are saving the planet/something of a higher life form by driving a Tesla.

So…if not so much, then…not so much.

It is completely legit to very closely examine Tesla’s bona fides.

Ford ain’t selling F150s on the basis that driving them makes you Captain Planet.

Tesla is.

Whoa, Cas127.

You’re twisting the argument. We’re talking about car BUYERS (consumers) — and why they buy. You’re talking about one segment of the company’s spiel. Totally different things.

Tesla is number 2 in sales in China. That is a big deal.

BS

Not even in top ten

Ron Baron vs Jim Chanos. Sooner or later Chanos wins big.

“Tesla is a canvas upon which investors’ hopes and dreams now are being painted,” he said, drawing comparisons between investor optimism for Tesla and investors’ view of AOL as “a symbol in 1999 of everything you think the future will hold.”

Warren Buffet has pretty good method for buying stocks which is only buy stocks that you can do a reasonable forecast of earnings for the next 20 years or so and calculate if the return is substantially better than what you can get on a safe bond. Everything else is speculation/gambling on a stock price.

Experience shows it’s much more profitable to rely on the government than do silly calculations. Think of how much time Warren has wasted over his life calculating things. He could have been so much richer just investing in companies blessed by direct government investment, like TSLA.

This stream in hilarious. BTW what diesel truck ONLY weighs a ton??? I have one for my own reasons and it’s a monster. Way over 2 tons…

Volkswagen Rabbit Pickup

Pickup trucks are rated by Payload capacity, not total weight. A 1 ton pickup can carry 2000lb (907 kg) of cargo.

Ed,

You should look at the specs for any new pickup truck if you think that’s accurate. Things are different now…

Tom,

No one said anything about “weighs.” But there is a gap in your knowledge about pickup truck categories.

A “one-ton” truck is a designation for pickups just below the “medium duty” category. “One-ton” trucks are the largest pickups sold at regular car dealerships. Anything larger would be a commercial vehicle. These are “one-ton” pickups: Ford F-350, Ram 3500, Silverado 3500, and GMC Sierra 3500. By contrast, a Ford F-250 is a “three-quarter ton” truck. These designations are not based not the weight of the vehicle. Many, many decades ago when the term originated, “one-ton” (2,000 pounds) was based on the payload of trucks. But now the payload capacity of modern trucks is far higher. But we still use the term.

Volkswagen Rabbit payload capacity = 500 lbs = 1/4 ton.

It’s a quarter ton diesel pickup.

Perfect.

Wolf,

What do think will happen with the stock on December 21 through the rest of the year?

I see this as a good time to unload the shares. And I think a lot of people see this too.

There it is Wolf, the quadruple WTF I thought would from a few weeks ago. Do you think we have enough left in the gas tank in 2020 for a quintuple WTF chart? I suppose for that to happen, TSLA would have to rally to $1000 per share. Right… how about if it gets to $900 before year end you have a quintuple post?

Cause $1000/sh would take a miracle… although, it’s Christmas, it’s the time of Miracles… (do you remember where that last line came from?)

@MCH, you are right on the money. Read my post above

Santa has replaced his sled with a Tesla, so there’s that.

Pets.com at least had a puppet mascot.

I found it funny that Petco is getting ready to IPO soon…

What stops Tesla from buying out other automakers. He acquires the factories and the logistics he needs? The Covid recession may linger enough to force these automakers to seek a buyout? Making yourself a buyout candidate begins with adding debt. No problem in this economy. Musk is moving to Texas, so far his plants remain in Calfornia, and not sure if he wants to get into the secessionist movement. Perhaps he doesn’t like the business of “regulations”, and looks forward to the nation of Texas providing him with the desired post China business destination; sans règlement, transparency or oversight.

There are no regulations in Texas?

Who knew?

Here is a hint. More and more regulations usually doesn’t make things better.

And the corollary: fewer and fewer regulations usually makes things worse.

So a middle ground between no regulations and California?

Kinda like Texas?

Middle ground between Texas and the USSR.

Makes what worse?

5 years to go from permit to building in CA doesn’t help anyone or anything, including the environment.

Happy1,

See big banks, big tech, big pharma, etc…

Or he’s trying to work the regulators. The state of Texas disallows people from buying a Tesla car straight from a gallery. I mean people can still buy a Tesla car online, but maybe Musk is trying to change this.

You raise an interesting point, which I’ve thought about. Tesla’s market cap gets big enough and the stock sales easy enough that it eliminates all the competition by buying them out.

Some problems though. Not likely able to buy the Chinese or Japanese companies for nationalistic reasons. Same with the German companies.

Could buy out Ford and/or GM. With Ford it depends on what the family wants to do with the company. Based on the history of Ford not likely to sell. GM is interesting. If the price is right Tesla could buy it. Of course there is the issue of the UAW and numerous Democrat politicians as well as warranties.

The automotive future could be real interesting. Of course, the stock price could collapse. Then just an interesting discussion.

Thanks for the post;

Last year one of those off Wall St analysts said Apple might buy Tesla. At what point is it the other way around? You think of Musk as someone who would fill the role of Steve Jobs, it makes as much sense as anything.

Those companies have totally different ethos. They don’t match. One is more niche, design, buy as much from outsiders. The other is the whole market, function and we should make our own toilet paper for our workers

Seriously, all things considered, Musk has done more on the tech side in the last two decades than Jobs could have ever hoped to accomplish. I would put him in that category at this point.

Tesla stock price notwithstanding, I’m in awe of this guy, I mean he literally reinvented two industries at this point. EV, and space. One would say that he really reinvigorated both, sure there was EV around, and people landed on the moon before he was born. But looking at what he has done with SpaceX, it’s nothing short of a miracle what he accomplished in two decades.

No, he didn’t invent the light bulb, or the EV, or rockets. But decades from now, his name will be synonymous with both industries.

Buying out national champions is difficult (read only possible when they or their nation hit the wall or with crazy money) Tesla has money but not crazy money and Japan, Germany or Korea is doing alright (for Covid time) Renault is state controlled. Ford is a future VW brand. That leaves GM and Fiat. Europe is the West prime EV market and GM is not there so useless to buy. Fiat is on deathwatch because they stopped introducing new cars. They have factories but building a paint-shop is expensive but not that expensive

ps. They could buy smaller players like Jaguar or the Daf factory but building a new EV factory is cheaper than getting an old ICE factory to build EV. Or maybe Nissan is in play. But do you want Nissan with their UK and Renault problems

– “What stops Tesla from buying out other automakers”

Tesla’s business model is not scalable to the point of major automaker. in the sens that beyond a certain critical threshold the state subsidies will go into oblivion.

Also, it certain that Tesla is a marketing and stock miracle, but a very US local one.

In Europe EV is not significant (but that could change thanks to the agressive ICE bashing), and Asia clearly belongs to other rising stars.

You have many more WTFs coming. Many of the companies on the right stack are going bankrupt. We have a $20B cash hoard to grow more.

2025 there will be no more ICE sales.

You have to look much deeper than charts and numbers to understand why.

I love the confused looks of the people on cnBS every time Tesla moves up.

You have to do your homework.

Buckle up! The 2020’s are going to be shocking to most of the population.

So many huge changes coming. History proves innovation wins.

Tony Seba/RethinkX and Sandy Munro is a great place to start.

That is why I’m up 1100%.

The Singularity isn’t scheduled until 2045.

“2025 there will be no more ICE sales”…………..really? Where? What are you smoking? LOL

ICE cars and hybrids will be sold and driven for decades to come.

2025 is wrong, decades is also wrong. By 2025 it will be clear to all that ICE is a legacy product without a future

I will lay a sizable wager to the contrary

Exactly! By 2025 everyone still in the hinterlands will move to cities surrounded by windmills. Electric tractors and combines will plant and harvest all the food.

You are only up 1100% if you sell now, otherwise it is just a paper gain. People like you drive Tesla stock higher and I’m fine with that. But Tesla is just a car company and it’s car are good but not exceptional.

I love the idea of electric cars but I won’t be looking at a Tesla when I’m in the market for my next car. Why – because I research major purchases and I know all about Tesla atrocious quality control.

They are not just a car company. And they have had some quality issues, but overall they are minor compared to what you get. Keep waiting for those other EVs. The other companies are starting to make them, but in such low quantities they sell out in a few days. And mostly their specs for range, price etc don’t come near to matching Tesla. That will change….at some point.

My fav trait about Elon is he really is not into “rich-people” stuff and does not blow much of his money very often. So in the end if a bunch of EV fanatics and Robinhooders want to give their every dime to one of his companies, it is going to charity via the Gates Foundation Pledge in the end.

So smile every tiime you see TSLA go up 5% as 20% of those fanatical fanboy driven gains go to charity someday…

Plus one reason Elon got rich because it wasn’t about the money, it was about changing the world and he has done that by forcing the world to consider EV vehicles sooner than later. I have a few friends who became extremely wealthy in a similar ways. Those types tend to “create stuff” (entrepreneurs) vs “take stuff” (financial parasites). And most of them don’t even enjoy spending the money, as they have purpose beyond perpetual consumption and impressing people they don’t know with things they don’t want or need in a world that is addicted to never ending materialism…

Yort

Interesting observation.

One question for you or Mr. Musk (I don’t personally know him): if he doesn’t care about wealth, why did he demand such generous payouts from the board? Those terms were hammered out when he was already rich.

Way to go, Yort.

Young people: this short essay captures some of reasons the U.S. became economically “great” back in the day.

And forgetting this is why we frittered it away so quickly.

After the current Stupid Train finally wrecks, re-remembering this will help you and subsequent generation(s) put it back together.

Elon is clearly a world shaper.

Nothing evil or bad about it. Inspires a respect.

A great person of a great talent.

That is also his fate.

A not so funny thing – condemned to the emotonal solitude by rarity of his species and a certain sadness – all his brightness is unsifficient to walk around the laws of biophysics.

“…to walk around the laws of biophysics”

I’m guessing that’s why he wants to go to Mars. Not to change the laws of physics, but to re-shuffle the deck, and play a very different game.

But I worry about how well this will really work. Wherever we humans go, we take us along.

Mars is a support for a juicy dream factory that could last decades.

It is much cheaper and safer to inhabit the floor of the Earth’s oceans than to terra-form Mars.

Or we could just change how we behave with respect to the surface of Earth. That would be the “cheapest” solution of all.

That would require addressing some key aspects of human motivation. We’d have to change ourselves.

That’s why I said “wherever we go, we take us with us”.

Blame the damn Fed for this circus. Jerome Powell blew a huge bubble and he knows it, yet he is staying quiet about it

There’re periods in the market where fundamentals don’t matter, it becomes a number game, excessive capitals chasing the higher returns one after another, like the classic tulip bubble. You cannot argue with facts when it isn’t based on facts, until it suddenly does. The reality is fed opened the floodgates, no one can see who’s swimming naked until the fed takes it back, and it won’t. If it crashes again, it will be either fed planned it, or something else few saw it coming.

Plenty…and I mean plenty of people “see it coming” and “know why”.

We just don’t know the timing.

Tesla is really like a SPAC if it’s thinking of doing an acquisition. It just happens to sell cars on the side.

Every retiree is a bag-holder now.

Great system we have where our last year’s on earth are tied to whether a business sells enough cars or not.

Definitely a perfect system and wouldn’t want the govenment to do anything to help people out, oh no that’s socialism! Instead, this Tesla thing looks like such a safer way to organize society! And no way it will end badly for you.

Frankly, I’m waiting to see the quintuple surprise.

Tesla charging stations have been blowing fuses in older homes. They will need beaucoup natural gas to generate electricity to power the car. That will cause sea level rise the through melting of glaciers and the thermal expansion of the ocean. New hydroelectric dam sites are scarce. The Fukushima disaster doused hopes for new nuclear power plants. Coal is dirty. Solar panels were installed on the White House in 1979, but are uncommon in my area.

Tesla batteries may last 300,000 – 500,000 miles. The electric motor is easier to maintain than the gasoline or diesel internal combustion engine. It lessens pollution in the city. Vehicle emissions are responsible for health problems.

David Hall,

The “Solar Panels” installed at the White House in 1979 by Carter provided HOT WATER for the White House, not electricity. The technology for manufacturing large electricity producing solar panels was simply not there in 1979.

The Solar water heaters of that era were leaky and prone to malfunction. In the 1990s, when I lived in Ventura, the Ondulando swim and tennis club near where we lived had Solar water heaters on the roof of the clubhouse – it had to be repaired frequently, and I think they finally took them out. Then the hillside fires of 2017 burned the club down.

Buy, Sell, or Crash? Fed Warns on Stocks and Look what Happens

by Wolf Richter • Apr 10, 2017

“Thus it’s unlikely that stocks can actually crash all in one fell swoop, as they did during the Financial Crisis. It’s more likely that, once they decide to head south, they’ll work their way down gradually, frustratingly, and nervously, spread over years, not because of the Fed’s warning, but because of the myriad reasons lurking around every corner, such as the ludicrously stretched valuations, the Fed’s tightening including the unwinding of QE starting later this year, and the bitter end of the credit cycle.”

… and here we are …

Exactly. The Fed has outlawed stock market declines through the application of MMT for “investment”. I don’t understand what part of that isn’t understand.

Yes, the Fed threw $3 trillion at the market in two months to reverse this type of scenario as it was playing out.

Good article, absolute STARSHIP title!!

Hello Wolf,

I was just reading around the interwebs recently, and I’ve got to tell you that the amount of adulation of Elon Musk is starting to turn into something else. I’m starting to worry that something much bigger (and scary) might be developing with that guy.

Okay, so Musk becomes the first U.S. President to openly smoke pot. I get it. I’m okay with that. At this point voting for him would make no less sense than voting for any other candidate they’ve been putting up in the last two decades.

Agree with your comment, especially the last sentence SC.

Seems to this old boy who has been voting every election since 1966 that the POTUS candidates since then have either been incompetent, complete crooks, or both.

Had lots of hopium in 2008 until he signed off on the nukes in the carolinas that certainly earned him at least the nominal 1% ”commission.” Paid as always either as campaign contribution or to his wife’s aunt’s uncles brothers etc., etc.

I think it’s about time that candidates are vetted for both honesty and competence, hopefully by some kind of service such as governor, etc. But at this point, Musk and some of the women are the only likely possibilities.

BTW, I dealt with SpaceX people on some bids for them a few years ago,,, and found them to be uniformly competent and very clear with their pre bid communications.

Thx for input, VVNvet. Interesting.

I’m ready for someone at the top that’s actually technically competent, and maybe holds a few patents.

China’s Xi is a chemical engineer, and appears to be emotionally highly developed as well.

I want people that can DO things.

Musk can smoke all the pot he wants if he can continue to deliver the results he’s been getting lately.

Wolf, any sense as to what extent the more recent – since pandemic start – crazy valuation spikes of corps like TSLA and DASH may be getting driven by the Robinhooders? [Matt Taibbi’s latest “pandemic villains” series piece is on that: https://taibbi.substack.com/p/pandemic-villains-robinhood%5D I mean, these are exactly the kind of companies the hordes of investing-as-a-form-of-gaming-addiction youngsters piling into that platform would be bidding to the moon.

Tesla 5Y weekly log, take a pencil and measure :

the horizontal distance to the left, at the bottom, to June 2017 is equal to the diagonal rise from the jump.

TSLA is boomerang.

Wolf,

WTF is not strong enough for Tesla. You need to step up to the next level. How about WTF+1?

Have readers come up with a more superlative acronym!

WTF++

I’d go with WTF squared

FUBAR

W5TF. It’s not just What. It’s also Why, Where, Who, When.

If you add How, then it’s W5HTF.

What The Musk (WTM)?

I like mine better. If you take W off W5HTF the later becomes 5HTF i.e. S*** Hitting The Fan

Wolf could go Irish with a Jesus Wept chart.

Elon Musk and his Tesla brainchild may be studied by future economic historians as one of the more remarkable Ponzi-like corporate schemes of early 21st Century.

Tesla’s ability to keep luring in new investors and pumping up its stock is based not on intrinsic fundamentals of his business but on Tesla’s early lead in electric vehicle production and a charisma con with name recognition/reputation.

In a sane economic landscape Tesla wouldn’t get away with runaway stock performance like it can in Wolf’s Weirdest Economy Ever.

It will end in tears and wailing, but not until the Fat Lady sings. I understand she is doing her vocal warm ups off stage now.

Just wait until all the mom-and-pop 401k index investors are saddled with Tesla though the S&P500.

Then you will hear the fat lady wail her sad song.

When (if?) Tesla stock stops rising, and especially if it falls, Tesla is going to have a real issue with employee compensation. From what I can see, Tesla offers new engineers the choice of RSUs (restricted stock units, basically grants of stock) or 3x the number in options (with a call price equal to the closing price of TSLA on the grant date).

Options are a better deal only if the stock rises 50%. If the stock is flat or falls, the options are worthless, whereas the RSUs retain some value. But if the price falls precipitously, even those become basically worthless.

At that point, employee morale will be in the toilet and management will feel pressure to grant additional stock options at the new, lower strike price. But then if the stock keeps dropping, those will become worthless in their turn.

The idea up above for Tesla to buy GM is not a bad one. Although it reminds me of the AOL-Time Warner deal back in the day.

Happened to me with a major telecom corporation 2008-2010. Thousands and thousands of my RSUs and options evaporated to worthlessness.

I sincerely hope that Tesla is successful. I’m sick and tired of the Germans, Japanese, and others coming over here and taking over the luxury car market (although they did it fair and square). Be nice to have a national Champion go kick some ass. But I hate battery cars and will not buy one.

Tesla is a global corporation. It’s more and more Chinese every day, and less and less “American”. Chinese funds saved it from collapse a year ago.

Tesla is writing the book on pump and dump: 2020 edition.

They combine low free share float (i.e. shares which actually trade) with Robinhood herd pumping to achieve amazing short squeezes.

What is interesting is that supposedly bitcoin is embarking on such a short squeeze. Will that suck enough market oxygen away from Tesla for the wizard behind the curtain to finally be revealed?

See the several articles on Adventuresincapitalism.com for details on the Grayscale enabled BTC push.

This is bigger than Tesla this the endless money of the Fed making sure everyone gets the message. Don’t fight the Fed on EV, money or war.

Well, yes Tessla’s real and successful business are selling tax credits and stock, but they can’t give up on the cars, because that is the “entry fee” for getting the tax credits and fooling people into buying the stock at ludicris levels. The car business is sortid difficult and unprofitable, but it is the foundation for the fun, profitable, and easy businesses of selling tax credits and stock, so it is necessary to maintain and even grow for the real source of profits.

The investment banks seem to be pumping TSLA hard right now, as Barrons and others seem to be de-hyping the top China based EV companies. So basically buy over-priced TSLA, but do not buy over-priced EV companies located on any other continent? Strange indeed…not only can no American auto company compete because “Because…duh”, nobody in our universe can compete with TSLA either???

Barrons last Friday:

NIO, Xpeng, and Li Auto Are Not the Next Tesla. Why It’s Time to Unplug From Chinese EV Stocks

CNBC December 2nd:

Goldman Sachs upgrades Tesla, says the stock has massive upside of over 30%

You cannot reason with Tesla fanboys, any more than you can tell a religious person that his god is an idol.

For them, it’s a matter of faith. They worship Musk like a deity, and no facts, valuations, numbers, or anything else will ever change their minds.

On the one hand you have enthusiasts who really like an existing product that you can actually buy. On the other you have haters who make unfounded claims about other people’s motives. I know which camp I find repulsive.

Can you buy them? I’ve known people who have waited many months on a waitlist because of supply issues. Further, I don’t HATE Tesla. I just find it’s CEO and it’s fanboys annoying

Wolf is it our friends the Swiss printing funny money and buying Tesla shares?

Maybe people consider Tesla more real than the Fed’s money?

Maybe they are exchanging the Fed’s false illusion for Musķ’s illusion?

I’m trying to figure out when Musk will be the next Fed chairman. Very similar M.O. – sell paper backed by nonsense.

“It is a great art to know how to sell wind”. — The Art of Worldly Wisdom, Baltasar Gracián

It’s a good thing I don’t have to worry about this investing crap much longer. I am so bad at it.

Whatever I buy goes down. Whatever I don’t buy goes up.

I do much better in the real world.

Do you mind sharing your stock picks with us? ;-)

joe2

Luck, like most things in life, plays a huge role in how well one does in the current Fed corrupted market casino structure.

For example, Jason Collins is a behavioral economist who ran a recent simulation where 10,000 people each flipped a coin 100 times. Each player started with $100 wealth, and any heads flip of the coin increased their wealth 50%, and any tails flip of the coin decreased their wealth 40%. Now “ON AVERAGE”, the game pays out $16,000 to players, so a good bet for a totally logical human, right (sarcasm)? Yet knowing “Averages” can often be “Mean” (pun intended), one super lucky player ends up with $117 million of wealth (70% of the players group wealth…think Elon Musk via the Tesla game). And for over half the players in this game of wealth/luck, they end up with less than $1 after 100 flips of the coin. Thus in the stock market “game”, people usually act irrationally when gambling with real money, and change their willingness to take risks when circumstances change in ways that create an excess of emotional thinking, such as fear of further losses or fear of missing out. Now add in thousands of further complexities and Fed manipulations that are part of the current “stock market game”, and really nobody can predict anything with high level confidence…so yes, in such an environment, luck can play a huge role versus “the real world”. Yet I’m sure the person who got famous by making $117 million in 100 coin flips is pure genius and I should buy anything they produce without utilizing critical thinking skills (sarcasm)…

Seriously though, to force retires and conservative individuals to play the current stock market casino is cruel beyond a reasonable doubt. So I applaud anyone strong enough to ignore the fear of missing out…

You are describing Martingale, the red/black roulette method by which profits are taken off the table and losses double down. This is basic Fed policy. There are two prohibitions to the game, one you must have unlimited capital, and two, the casino cannot reduce the bet limit. The part you may not have noticed, is the Fed is the player, and the taxpayer is the casino. either way the money to cover the Fed bets arrives on time. As long as the game goes on the casino stays in business. The third rule is the player cannot leave the game. The casino has a slight edge, green 0 and 00, in which case the Fed goes bust, asset prices fall, and casino workers enjoy a bonus, unless they were betting along with the Fed, in which case they go bust as well.

Yort, you may be right that to force retirees to play the stock market is cruel. Conservative individuals are scared when they see the price going up and down, and being scared is ok, I am scared all the time, there is a voice telling me that going broke is a bad idea. On the other side, when you keep cash or equivalent, you are going to be broke for sure. Take a dollar saved in 1971, you have about 3 cents now. You have to beat inflation or central banks are going to kill you. Look at Warren Buffet portfolio: he has Coca-cola stocks for a long time now. Look at the price of a bottle: they succeed raising prices to match inflation. That’s important. To stop losing money you have to stop measuring your wealth in fiat currency, that’s my best advice. Measure your wealth in gold, coca-cola stocks, square foot value of your house, choose yours. Currency is used for payments, like a credit card, do you want to keep hundreds of credit cards? If you want to keep wealth, you have to do something else. I wish I knew that when I was 20.

“Bear Skin Rugs Sold Here…”

You all come from a generation of workers, bosses, investors and retirees, who see only fundamentals, price per unit sale, earnings per share and may be future potential of a company.

Now an entire generation of traders, speculators and investors from 2009 onward who know nothing but, “BFTD”, “Dont fight the fed”, “AI trading” and “Robing good”. Modern monetary theory is in full swing. No body cares about the old world paradigms. Earnings and sales do not matter!

All the short sellers this year got roasted. Dow is 30K+ and growing. So is NASDAQ and SPY. Did I mentioned Vaccine will be here any moment and all Americans would be standing in line (with social distancing and masks) to get it?

Get ready to enter the new world where all your text book concepts will be burned like in Russian revolution.

You may be right, bit like the dot come days again. But this time it’s different.

The end is neigh. Keep blowing the horns.

Gas is under $2 in my area.

Tesla began when gas was $4 …

Cheap gas has to be a negative for Tesla….but somehow isnt.

Who gifted the carbon credits? and why?

Clean Air Act for starters, then certain state’s air emission programs (bubble emissions for manufacturers). It’s complicated, but Tesla sells “emission credits” so other manufacturers can stay within permitted levels for their manufacturing plants capacities.

Gasoline taxes will be the donkey that they pile on to fund other socially derived policy ideas. You can count on the price to rise considerably.

@Anthony A

It isn’t the Clean Air Act (Federal) that nets Tesla so much “emission credits”.

It is the CARB – California Air Resource Board.

CARB mandates x% of all vehicles sold by each manufacturer be “carbon neutral” – which forces big manufacturers to buy credits from Tesla. CARB is also responsible for fundamentally higher gas prices in CA due to “different” fuel mixes, and any number of other limousine liberal enviro-machinations.

Which makes Elon’s move to Texas all the more ironic…

Exactly! Look at the real world: Weimar Republic, Zimbabwe, Venezuela, Brazil, Yugoslavia, Argentina, &c. But this is America and this time it is different. More Money Today!

Tesla, hell, the stock market, junk bonds (OK high yield), housing (FOMO, right?), and all this other assorted madness happens at tops. It’ll break, that’s for sure. It’s the timing that’s not for sure.

Now that it’s in the S&P500, your short is probably even more in the red now Wolf. But on the bright side, when this bad boy deflates, it’ll take the index down with it. :)

There’s gonna be lotsa fireworks, or maybe just fire. I’m 65, so I’ve heard “This Time It’s Different” about a half dozen times.

Maybe this time it really is different, in that by the time it’s over, Federal Reserve Notes will be as valuable as Confederate Currency.

I’d be interested to know how much Tesla and other over-achievers stock is held by public employee pension funds. Those unions are yet to be crushed completely, along with their much-hated (by Dear Leaders) defined benefit pension plans.

The next crash, coming soon to an economy near everyone, should finish them off quite nicely, along with the enforced austerity being imposed on state and municipal governments.

The thing to keep in mind is that the existing “value” pool – which US Government printing dilutes – is far larger than just the US economy and assets.

World trade: 60% in dollars.

Swift transactions: 40% in dollars.

By GDP, the US is about 14% of world GDP – to put the above in context.

If anything, the reasons this bubble of USD strength hasn’t popped is:

1) The other nations are printing too

2) There is no alternative to the USD right now. EU won’t run the big deficits; China can’t open up the RMB without having a lot of it flee abroad; no one else is big enough.

The thing to look at is the Nixon closing of Bretton Woods 1/gold window. The US was running huge deficits for years prior to Nixon – JFK then LBJ were busy bees. But it took France and eventually, the Vietnam war to finally crack the Gold for dollars arrangement.

China has already “signed out” of the dollar – they’re not buying any more Treasuries and haven’t since 2012. But it still will require some alternative to get the ball rolling in unwinding all those foreigners assets held in USD.

Maybe it will be China creating a China-controlled crypto-RMB – that is perhaps the only way China can “open” up the RMB without simultaneously letting all of its internal oligarchs flee with their profits. The last time China opened up the RMB a bit – $1T left the country. It is no coincidence that the peak in the West Coast (and other) housing bubbles and the startup market was that year…

Right now, Tesla has goodwill value related to the first mover advantage. They’ll keep a loyal following. Future growth will, however, have to come from new customers, and with all the other automakers transitioning fast to EVs, I think growth will be hard to come by, especially if the new EVs by other automakers qualify for tax incentives and Teslas do not.

The only other thing of perceived value is the self-driving technology. Tesla fans are using that to sell Tesla as an IP company, like Google, Apple, MS, FB, etc. The problem there is that EVs and self-driving capability are two different things. Most people will want an EV without self-driving capability, because 1) driving is fun and 2) the technology won’t be viewed as superior to one’s physical capability, at least for the next 20 years.

Bloomberg eloquently explained Tesla valuation today (Perhaps they read Wolf Street…HA)

Per Bloomberg:

“Are Tesla’s Shares Worth $90 or $780? Wall Street Can’t Decide”

It’s a Schrodinger stock!!!

Spooky activity at a distance.

We are living in the world of “Printer Money” by all major central banks around the world, flooding the market with excess liquidity. I guess those TESLA investors aware that putting money into this casino has the higher probability and turn profit easily. Antediluvian matrix like PE ratio is no longer practical when the whole market already turning into a gigantic casino.

And I thought $83/share was nuts.

The only way that Tesla is worth more than all the rest of the automakers combined, is if the internal combustion engine is banned, and Tesla is the only automaker left standing.

Producing cars for the 20 million or so people who can afford them, after the 280 million or thereabouts members of the wretched refuse get to play some kind of horrific blend of Zombieland, Escape from New York, and the Hunger Games.

I always find it interesting to read the comments on sites like this. Sometimes it’s even funny. Inevitably I find a bunch of people who really know nothing about electric vehicles, trying to figure out how to make money on what they think they know.

Let me help you out. I’ve been driving a EV since May 2011. Not a Tesla, but a Nissan Leaf. Great car by the way. However, for the right model and the right price I’d drop Nissan like a hot potato and switch in a heartbeat. That said, I’ve frequently talked with other EV drivers at various public charging stations while charging or waiting to charge. It doesn’t’ matter the make or model they are driving, with few exceptions, they also would also switch to Tesla if they could. So for all of you mystified by Tesla’s popularity, let me explain.

Tesla vehicles consistently have the best range of any EV in the respective model’s class. Tesla batteries also don’t degrade as quickly as other EV manufacturer’s batteries. That means the expected range isn’t just better out of the box, it’s consistently that good for years to come.

Tesla has the best charging network in the world. Period. The charging network has been well planned out and deployed. It is also well maintained and convenient to use. All other EV drivers have to contend with chargers that are generally poorly located, hard to find, often not working and have competing standards. Tesla also includes a J-1772 (Level-2) adapter just in case the Tesla driver can’t find a convenient Tesla destination charger. Tesla drivers can also purchase a CCS (Level-3) adapter so they can use most of the Electrify America (VW), EV-Go, ChargePoint, Blink, etc. DC-Fast-Charging network stations. This translates into ZERO range anxiety. When a Tesla driver needs to charge, they can do so far more easily than other EV drivers.

Tesla for a long time had the only over-the-air (OTA) software update system. EVs are still so new that in most cases when you buy one, it’s technology is already out of date. Not so with Tesla. I know Porsche and Audi now offer OTA updates, but Tesla is years ahead of them in seamless deployment. Tesla can also temporarily unlock vehicle features when necessary for customers in an emergency which no one else has yet demonstrated. Tesla gave drivers fleeing incoming hurricanes more range and rumor has it they enabled the usually optional weather feed as well. All done remotely without having to visit a dealership.

Tesla has the best EV brand recognition and so the best resale value retention of any EV. Walk up to any random stranger on the street, or anywhere else, and ask them to give you the name of an electric car. The answer will be Tesla.

Yes, Tesla has experienced some growing pains that have annoyed customers. Mostly fit and finish issues, but everything generally under warranty. That is improving or will improve over time. I personally know several Tesla drivers. Most have had no problems at all. The few who have tell me the annoyances aren’t a deal breaker for them. My wife and I are close friends with a couple who bought a Model-X and a Model-3 (after driving our Leaf). They were on vacation in Florida when they were involved in a car accident in their Model-X. The vehicle was full of family members when a teen driver in his mommy’s SUV pulled out in front of them. They T-boned the SUV at 45 miles per hour. All the airbags deployed, but everyone walked away without a scratch. Unfortunately the teen and his vehicle didn’t fare so well, but he eventually recovered. My friends had to wait 3 months to get their car back and were thrilled by Tesla’s service people.

We LOVE our Leaf. You wouldn’t believe all the stuff we haul in our Leaf. But, if Tesla comes out with a Model-3 hatchback in the same price range, we would be stupid not to trade. The one thing we know for sure is we are never going back to a internal combustion engine (ICE) vehicle as our primary transport. Our Leafs have been our only vehicles since February 2015.

Totally agree with all the points but let wait for few years for others to bring their own evs.

Other manufacturers are catching up with TESLA range for sure

TESLA makes great cars but question is.. is their market cap worth it ?

” …let wait for few years for others to bring their own evs. Other manufacturers are catching up with TESLA range for sure…”

Purely subjective observations from my part of Europe:

Every day, I see at least one EV, not only cars but also vans. Mostly Nisan, Renalut and recently more and more often WV and Skoda. I’ve seen Tesla once, maybe twice this year.

If Tesla had the advantage of the first move, she wasted it long ago.

The point of my earlier rambling was there is a huge pent up demand specifically for Teslas. From the perspective of people who don’t yet drive EVs, Tesla is the only company seriously making an effort for the long term sustainability of building and selling EVs. Unlike legacy automakers who’ve been talking EVs with little to show for their supposed ‘commitment’. For non-Tesla EV drivers like me, we can’t wait to upgrade as Tesla prices will eventually become more affordable.

The only real possible threat I see to Tesla over the next several years is VW. The problem is the VW engineers and marketing people haven’t yet fully sold their board of directors on changing course. So, VW isn’t likely to challenge Tesla any time soon.

However, if VW flips the switch their experience and charging network could make Tesla toast. Since modern EVs could easily do 150 miles range daily the contest is no longer about range, it’s about convenient, reliable charging infrastructure. Tesla is still the king, but VW/E-A could easily steal that crown should they decide to.

What if, at the time that Teslas become plentiful and affordable, plenty of EVs from Toyota and Honda are available too?

In any event, I think using the viewpoint of people who already had EVs very early on is going to give you a skewed perspective.

Yeah but RightNYer, being a hater gives you a skewed perspective, so … shrug.

“Huge pent up demand specifically for Teslas”

Where? Everyone who wants an EV in the US has one. It’s a niche market, in which Tesla is the clear winner for now in the US.

A niche market winner in the US doesn’t mean its market value should exceed all other car makers combined.

I don’t know much about the car. I’m a skeptic of the value proposition of EVs generally, but things can change.

Still doesn’t mean this stock is anything but a gigantic bubble.

When someone shows up with a snowplow mounted on a Telsa and they can clear my driveway of three foot drifts at -20F (and a stiff breeze) at night, I will be a believer.

Using an ICE engine, I have done this task with pickups, farm tractors, and even a walk-behind snowblower. Can anyone with an electric road vehicle do this very ordinary task?

Electric is great for the city. No question that less pollution is very good. But in the rest of the country, where the real work of growing, making, and digging stuff is done, battery electric is simply not suitable, just as diesel engines don’t work in subway systems.

Take away our diesel engines and city slickers will be very hungry very soon.

Great Article, Mister Richter.

Looks like we’re near the Tulip-Peaking of TSLA as a Stock and Company.

*TSLA have already dropped to 3rd in BEV Mkt Share in DEU.

*Many Nation-States will be Forcing New Vehicle Sales Out of Gasoline+Diesel ICEs through 2025-2035. Most, if not All AutoMakers, will be Rolling Out Battery, NatGas, and/or Hydrogen Powered Vehicles. TSLA will get lost in the Market Share and their SharePx should reflect Market Share Numbers more closely by then… but don’t hold your breath – ROTFL!

*DEU are planning to introduce Hydrogen as an Energy Source throughout their Infrastructure.

https://m.dw.com/en/germany-and-hydrogen-9-billion-to-spend-as-strategy-is-revealed/a-53719746

..and just so conveniently…

*Nord Stream 2 is able and expected to Pump in up to 70% Hydrogen in a CH3+H2 Combo Stream.

https://globalenergyprize.org/en/2020/12/10/nord-stream-2-can-send-mixture-of-natural-gas-and-hydrogen-german-official/

Diesel and Gasoline ICEs can be Converted to run on Hydrogen/NatGas.

*TM just released their Newest Version of the Mirai HFCV – they added Fuel Capacity which extends the Range to approx. 850Km – or 530Miles-ish. Have your Okusan translate this for you. Link should show the Vid.

トヨタ、燃料電池車「ミライ」新型発売 航続850キロに:日本経済新聞

https://www.nikkei.com/article/DGXZQOFD0863K0Y0A201C2000000/

This should be the First Version of Mirai that should be sold outside of CA here in the USA. I expect East+West Coast Metro and InterStates followed by Coast to Coast InterStates and Metro Areas tied to them.

TSLAs don’t have the Range in Cold Weather and at Highway+ Cruising Speeds.

*Daimler, VOW, BMW, and Audi have had H2+NatGas ICE and FCV Prototypes Speeding the Roads for Years, so they’re ready.

*TM recently teamed up to share HFCV Tech with their CHN Partners, so CHN AutoMakers should Roll FCVs Out Soon.

*We should see more on H2 Infrastructure/Vehicular Applications at the 2021 Tokyo Olympics.

I’m personally leaning towards H2, since Steaming/Hydrolysis/Industrial_Extraction Costs appear to be absorbed/subsidized readily; and Smog can be reduced at the Tailpipe as they replace Gasoline/Diesel as Fuel Sources.

This should be an interesting Decade.

Thanks for making this point. Using hydrogen as a fuel (high-density portable energy storage) is getting a lot of attention around the world, and for good reason.

Electricity has to come from somewhere, and it’s tough to store (batteries). Those are the two big technical hurdles to overcome. Hydrogen as fuel has both the same problems – the energy to create the H2 (doesn’t occur naturally; hydrogen is way too reactive) has to come from somewhere, and storing highly compressed (for “density”) has some cost, risk, and complexity associated with it.

But it does offer a competitive solution to batteries.

May I ask why you said ” [H2] costs appear to be absorbed/subsidized readily.” Why are they more readily absorbed than solar or wind?

Mister Pfotzer,

I can’t answer your question regarding Subsidy Cost Allocations of Solar and Wind Generation in DEU, other recipients of RUS NatGas/H2, and JPN.

However, I’m aware that NatGas are Consumed Directly for Heat, Manufacturing Goods, Electricity Generation, and as Source Matl for H2 Generation. NatGas are Plentiful and a Cheaper Source of H2. Some – especially those who Import NatGas via Pipelines – Consider them as Baseline Energy Sources.

The Sheer Volume and Breadth of their usage make Related Subsidies Palatable. DEU will be getting a good amount of H2 from RUS, which have Govt Owned/Vested Entities Exporting them.

Solar and Wind? Conditional and Surge-Prone. Even with Storage Venues, Capacity and Volume aren’t there yet.

I’ll briefly mention RUS, DEU and JPN Subsidies. RUS and CHN being mixed Public/Private Economies complicate Subsidy Comparisons. CHN already Subsidies Energy Sources for their Residents (Key difference vs for CHN).

RUS/DEU are planning to Pump In H2 – Steamed/Hydrolyzed in RUS. Steaming is used for most Industrial H2 Generation. RUS have plenty of NatGas DEU+Others require; and RUS will add H2 to the Mix.

I expect RUS to do so for CHN and Others willing to Import H2.

RUS have plenty of Nuclear Reactors in Operation as well. Pretty sure they’ll use Reactor Power to Steam/Hydrolyze the H2.

Add the Sanctioned RUS Economy and Devalued Ruble – Both Favor RUS on these H2 Exports.

DEU are planning to distribute H2 throughout their Infrastructure; and that means mostly Pipelines+Trucks which tend to be flexible.

JPN suspended most of their Nuclear Generation to the Reviews imposed after the Great Northeastern Earthquake/Fukushima Plant Disasters, so they’re using more NatGas these Days.

JPN plan to extract H2 from NatGas, Industrial Processes, and other Sources.

I wish there was a good EV I could buy. Seriously! But Leaf’s battery goes way downhill after 7-10 years since it’s not temp controlled. It is effectively “totaled” when you have to replace the battery. Tesla is too expensive and breaks — plus I don’t trust anything that shiny. There’s an affordable German solar EV coming out — Sion — but I think every automaker takes a while to get it right. Remember when Japanese cars were bad in the 70s? Maybe EVs will be easier to perfect? My Accord is the worst one ever made. It needed a new transmission after 76K but has been running since 2002! I may get another ICE ride when it dies. That sorta bums me out. Maybe if I hold out another 2 years and the world collapses, then there will be some deals. I hope the world doesn’t collapse but there is no new normal — this market is gonna bite it. The wolf street realists will be proven right. Anyhow, Wolf is gonna be mad at me for dissing EVs. But I am pretty cheap. Which one is worth the money and will last?

Renault Zoe beat Tesla and VW in EV sales in Europe.

Another one that’s not sold in America. :(

Japanese cars bad in the 70’s? Late year 1978 Toyota Corona Deluxe Wagon w/20R engine & A40 transmission. Low mileage used at 10 years….lasted some 23+years…sold running well at 190+K. Survived the Buicky thing that ran a red and even cut it open like a can opener. Hauled cargo like a covered truck. Crank windows never failed. [Replaced in 2011 by used 2006 Korean. And that replaced with same model new (end of year) 2018.] All I can say about car companies is McDonalds is still flippin’ out burgers while Mr. Steak is just another historical footnote in the Pantheon of production possibilities…build for the working masses and you grow, build for the fattened asses and you get problems. Got salad from Sizzler?

So many are convinced Tesla is overpriced yet no one has the guts to short it.

Are not those two different categories? Overpriced stock of a company in a market economy and a Tulip Bulb within a Central Bank created mania? Serious question.

Michael Burry just came out and said he was short Tesla. So somebody obviously does.

Comment reportedly attributed to Keynes about investing based on fundamentals (what makes rational sense) vs. trends that are detached from reality :

“Market can remain irrational longer than you can remain solvent.”

Because shorting this means trying to call time on when craziness is going to end. Who can do that? The stories of fortunes lost shorting this mother are on par with stories of fortunes made…

People do; and get burned at times.