In the bizarre machinery of an economy that depends on consumer spending funded by stimulus and “extend and pretend.”

By Wolf Richter for WOLF STREET.

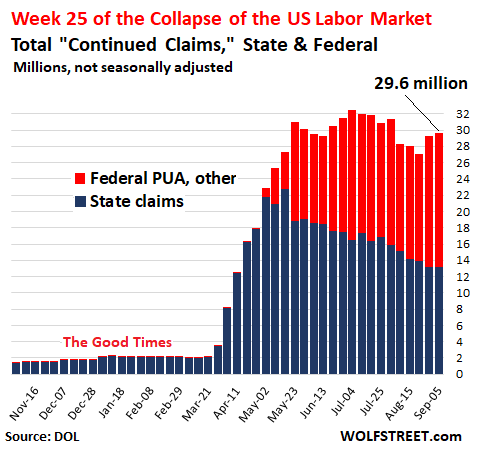

OK, get this: At a time when there are 29.6 million people claiming state or federal unemployment insurance because they lost their work in the worst economy of a lifetime, subprime auto-loan delinquencies, which in the past had spiked during much smaller labor market downturns, are doing the opposite: they’re dropping. Meaning, since April, people with subprime credit ratings are defaulting a lot less on their auto loans than they did during the Good Times.

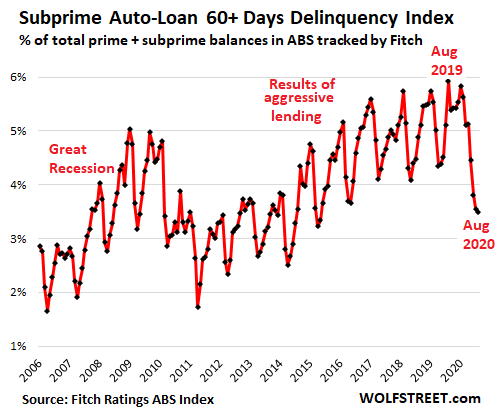

In August, delinquencies of 60 days and over of subprime auto loans that have been securitized into auto-loan Asset-Backed Securities dropped to 3.49% of total auto loans (prime and subprime), the lowest delinquency rate for any August in seven years, according to the Auto Loan Delinquency Index by Fitch Ratings. That was down 2.44 percentage points from August 2019, when the delinquency rate was 5.93%:

The 60-day-plus delinquencies started dropping in May. And given that May’s 60-day delinquencies were 30-day delinquencies in April, when tens of millions of people lost their jobs, it makes for a curious phenomenon.

This is particularly curious because from 2014 on, private-equity firms piled into the subprime auto-loan space, the lending became very aggressive, underwriting standards went to heck, and delinquencies surged as a result. But interest rates charged on those loans were so high – well into the double digits – that the game could go on, with defaults ballooning to levels far higher than during the peak of the Great Recession, and those were the Good Times.

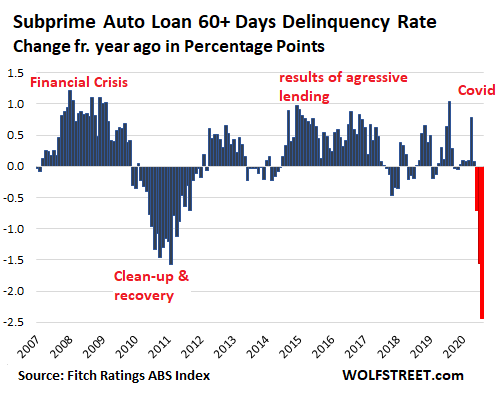

Then we get the biggest unemployment crisis in a lifetime, and the delinquency rates should have spiked from these highs into the sky. But the opposite happened – as shown by the three red columns in the chart below, marking the change in percentage points of the delinquency rate compared to the same month in a year earlier:

So what’s going on here.

Stimulus payments and the extra $600 a week in unemployment insurance. With these funds, many strapped households had more money than they did while working. A study by the Becker Friedman Institute for Economics at the University of Chicago found that two-thirds of the people who received unemployment insurance, including the extra $600 a week, made more from UI than from working, with about 20% of them doubling their pay. And they could make their car payments, even if they had trouble making them before.

The extra $600 a week expired in July, but these are 60-day delinquencies as of the end of August – so they were 30-day delinquencies in July and transitioned into delinquency in June. And during those months, the $600 was still available. And the stimulus payments of $1,200 per adult, or $2,400 per household of two adults – and more when there are kids in the household – started going out in April and went a long way in helping make car payments over the next few months.

The $600-a-week program has now been replaced by $300 a week, and the first lump-sum catch-up checks, covering several weeks, already went out. This program is going to run out of funds in September. But for now, it’s doing its magic.

Loan deferrals – no payment, no problem. When a borrower cannot make the car payment and becomes delinquent, a lender has a choice: Either work with the customer, or repossess the car, sell it at auction, use the proceeds to cover part of the outstanding loan, and write off the rest of the loan. That can get costly.

The cheaper-for-now route is to work with the customer by putting the loan – whether it’s already delinquent or getting ready to be delinquent – into a deferral program. This kicks the can down the road.

Deferral means that borrowers are allowed to not make payments for now, but will have to make payments later, including those payments that had been missed. It’s not a free ride.

But for now, it doesn’t matter how impossible it will be for the borrower to catch up later. Because the loan is in a deferral program, the lender can mark it as “performing,” and accrue the interest income though the borrower is not making payments, and the lender can thereby “cure” a delinquency already on its books, or avoid one. The customer doesn’t have to make payments while the loan is in deferral. And everyone is happy.

Bank regulators normally frown on deferral programs, but this is a pandemic, and now regulators encourage deferral programs.

The finance divisions of the automakers, such as Ford Motor Credit or Chrysler Capital, most banks and credit unions, and specialized auto lenders with a big percentage of subprime customers, such as Ally and Santander Consumer USA, have been offering large-scale deferral programs to existing borrowers.

If a borrower falls behind on a payment, there is now a lender on the other side, eager to kick that can down the road and move this loan from the delinquency basket into the deferral basket – and thereby “curing” the delinquency and turning it into a performing loan.

And then what?

Well, OK, that’s a little bit of a problem. When these policies were implemented in March and April, the expectation was that by summer most of those people would be back at work, that this was a temporary blip. Many people were in fact able to go back to work, but other people have since lost their jobs, and the number of people claiming state and federal unemployment insurance has hovered near 30 million for months:

In other words, this unemployment crisis has settled in. Most of those initial deferral programs were for three months. But they can be extended to six months or whatever – the classic “extend and pretend,” but on a massive national scale.

The only thing that’s hard about “extend and pretend?” Getting out of it. But this is now an essential cog in the bizarre machinery of an economy that depends on consumer spending funded by stimulus money and by consumer debt that is not being paid.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So an interesting insight from this is that if we ever got the Gini co-efficient in the US back to something more sensible (i.e. pre 1980s levels) by restoring middle class incomes and benefits, then there would be a huge boost to the economy overall.

In other words what this shows is that the billionaires hoarding all the wealth actually makes the economy run worse (and the pie smaller for everyone, including them), than if things were a bit more balanced between the ‘regular people’ and the extremely rich.

Fascinating..

Yes, none of this is a surprise. John Kenneth Galbraith already argued in his famous 1955 book “The Great Crash, 1929” that wealth disparity was one of the main causes of The Great Depression.

So it’s not that economists don’t understand how the economy works. It’s just that is goes against vested interests to implement the right policies.

YuShan- I honestly think there are huge numbers of economists who do not know how the “real” economy works. They know how the “monetary system” and the “financial economy” work. (They are basically indoctrinated, not educated in critical thought at this point.)

Wealth (income probably the root cause) inequality is truly a disaster when it gets this big.

It is caused by the lack of “fair markets” in labor, as was designed in the globalization system. It is impossible for US labor in the semi-low skilled labor market to compete because of the costs imposed in the developed economies vs. the emerging economies.

I lived and worked in an emerging economy country for several years. I have seen this first hand in both types of economies/countries.

I would say most of the “top” economists in America get indoctrinated at university (ivy league business schools and the like), if they weren’t already indoctrinated growing up. They simply get the good jobs at the right places, learn not to ask questions and then never really learn how to properly run things. This is the standard practice for all “top” business people as well, there are alot of America’s major corporations that have become less intrinsically valuable over the last 20 years. Just like AT&T executives they only care about themselves, they probably don’t even know how to properly run that company, so AT&T despite being an oligopoly has $150 billion in debt. That money went to such lovely things as stock buybacks which also give that executives a bonus. I really doubt those guys know how the economy works. I’m sure some “top” economists in the country do know how it all works, but, they are so corrupt that it really doesn’t matter. The rest could meaningless string together stuff they’ve heard, but, wouldn’t know anything.

The only way to grow a developed economy long term is through technological advances. Automaton, new discoveries, inventions, advancements, and the like. AT&T’s bell labs used to a major hub of such ideas, but, spending money on more far off things, didn’t benefit executives only concerned with their next quarter paychecks. Allowing offshoring of jobs prevented automaton and many other tech advances. In general the rich hoarding wealth is a big obstacle to tech advancement. The rich given too much power will also screw up the economy, causing there to be less money for future tech advancements.

“I honestly think there are huge numbers of economists who do not know how the “real” economy works. They know how the “monetary system” and the “financial economy” work. (They are basically indoctrinated, not educated in critical thought at this point.)”

One example of this i can give you. We have a professor in economics in The Netherlands, who regularly appears on national TV to tell us that state debt is a money making machine. He doesn’t explain it only works for the state and it means impoverishing the people (now and in the future), it creates a state planned economy and enslaves the people in doing what the state prescribes as being (for) the good. He sees the state and the people as one while in practice it isn’t. The state has privileges that individuals have not. The decision making is entirely different too. The state will always exist in some form, while a person may get sick or die by a bad decision. Imho this man is teaching our future regulators that bad is good. Until it isn’t. But the latter he isn’t aware off so it seams.

Chapter 4: In Goldman Sachs We Trust

It’s encouraging that some things don’t change.

and all I see on streets are paper tags – ie they just bought vehicle

guess we have new crop of non-payers coming soon

This is not at all the consensus. The proximate cause was overvalued aasets and then a deflationary environment made worse by Fed policy.

“Wealth inequality” is synonymous with “overvalued assets” and “deflationary environment”… if you think about it.

Unequal wealth means the “haves” are overbidding for scarce assets — it’s why they’re overvalued. It also means the “have-nots” are unable to pay for basic necessities, hence no backstop to halt a credit/debt-default deflation.

Hi Rosebud,

Could you explain more about this? First I heard of it, but then again, I was born in ’57.

Thanks

YuShan: The wealth disparity was the effect. What was the actual cause of the wealth disparity?

And if you or anyone else feels like swinging for the fences:

In what way is the cause of the wealth disparity of the 1920s (lead-up to Great Depression) similar to, and different from, the cause of wealth disparity now (and for approx the past 25 yrs) ?

Well, for one thing, in the Twenties they had Prohibition in the US which was a wonderful stimulus to small businesses and independent entrepreneurs. Today it is the opposite, the US is taking the pot business from independent vendors and delivering it to government monopolies. ;-)

Tax reform act of 1984. The ultimate root cause. Why?

That is when executive comp switched to stock based comp. No comp over $1M was allowed for tax purposes unless performance based (stock price was how performance was measured). Bases dropped and Stock Options arrived in mass.

Once Executives got a taste of just how lucrative options were, the race was on.

This is why policies based on emotions are never a good thing and the almost certain unintended consequences are worst that the disease. (kind of like a certain lockdown policy).

You really can’t fix stupid.

No better proof that US workers are long overdue for a pay raise.

A raise ? How about the Working Class owning and controlling the means of production to prevent future catastrophes ? Prove me wrong.

See: Marx, Lenin, Stalin, USSR, Cuba, NK, almost all of Africa, Argentina, Zimbabwe, and on and on.

This is the only sensible approach as everybody knows.

Lee here taking a leave of absence from basic rules of sound use of reason.

If by that you mean they own stock and have a voice in the company they work for, then fine.

As for the means of production, those mostly belong to China now, thanks for the fish though. But thankfully, in the PRC, through its rigorous enforcement of party rules, the workers do in fact own the means of production.

Otherwise, the means of production in the US are now mostly service jobs, and has been decreed by many as good way forward and better than low paying manufacturing work.

Sound familiar?

After all, what does Starbucks or Amazon really produce in the US anyway? Today, even Apple doesn’t own the means of production.

Exactly! But first the Bolsheviks need to control everything and get it organized before they turn control over to the the Working Class. Unfortunately, the Bolsheviks are still working on the control and organize part.

Lee, if you think the working class own[s]ed and control[s]led the means of production in those countries, I have a bridge to China to sell you. USSR, Cuba, NK, Africa, Argentina, Zimbabwe…?? You missed Venezuela, how come they’re not on your list?

The working class usually doesn’t know how to pay their own taxes let alone “control” modern technological systems. As long as government is truly democratic and has the power of eminent domain, that’s the closest you’ll get to working class ownership without creating a worse beareaucratic hellhole. Now if only the people realized the benefits of competition in an economy and demanded the government start to aggressively pass and enforce antitrust laws. Prices down, wages up, income inequality shrinking, innovation up, profits down, efficiency up, more job openings and opportunities to give your shitty boss the bird. Sounds beautiful to me. All it takes is a pro capitalist anti Reagan attitude.

“No better proof that US workers are long overdue for a pay raise.”

— just get rid of taxes on wages. Done.

It shows nothing of the kind. It shows that many people prudently use a financial windfall to pay off debt. The middle class in the US has been clobbered by globalization of low value and low skill work, and is about to be further hit by AI and globalization in higher skill areas. People with high value skills have done incredibly well the last 30 years.

What fascinates me is that most people don’t seem to get this and they keep up the MINDLESS consumption, which only feeds and perpetuates this out of balance system. Only when the people take responsibilty in large numbers and actually start to make good choices and lead, will the leaders then follow. Until that day, nothing will change. So, knowing this, I simply try to protect myself so I take on as little “taint” as possible for this situation that only grows more insane by the day.

This. The first knee-jerk reaction is to blame “wealth inequality”, when most of the problems you see are the result of wanton consumption.

A co-worker yesterday asked me what he could do to be able to retire in ten years. I asked him what vehicles he has. He has a car, a truck, and a motorcycle. I asked him what vehicles he needs. He said all of them. I said “need”. Same response.

When the average person buys a house, the first thing you hear is about all the upgrades they want to do. How about paying it off before those upgrades are done? The thought of saving hundreds of thousands in long term interest payments doesnt even make it on the radar.

Personally I prefer my wonton consumed lightly fried with teriyaki sauce. Tying up money in illiquid excessive home equity is not prudent when there are more critical options.

In this housing market I can either:

#1. Save 10,000 dollars cash this year, and if I am lucky plow it into a mutual fund and make 5-10%.

#2. Plow 10,000 dollars into your house and make at least double that when you sell it.

Which one is the rational choice?

Lisa and Kurtis,

My point was not that paying off home debt is a better alternative than than some investments. My point was that mindless consumption is making life much harder than it needs to be.

Paying off debt is much more prudent than jumping into greater debt.

Mr Creature….where are all these Nouveau-Middle Classers going to WORK>>? lolol

The multi-billionaires don’t want more money in absolute terms. They already have much more than they could possibly spend. They just want to maximize their take in relative terms, so they can own the world.

After a certain point, money doesn’t get them off. They seek power.

Ive always tried to explain it by asking “Whats better for the economy? A millionaire buying a Bentley, or ten Joe Schmoes making $100k/year and buying a Ford or Chevrolet?”

(Of course, it would help even more if the cars were designed, engineered and built in the USA)

And dont give me this crap about “rich people drive Toyotas” Ive worked 20 plus years fixing bizjets. Ive seen what the 1%ers are driving to the airport to get on their planes…….S class Mercedes, Rolls, Bentleys, Ferraris, AMGs/Alpina, Porsche. The only US stuff is the occasional Suburban or Tahoe, or monstrosities like the new $100k Shelby F-150

The one percent is not the average millionaire.

The one percent are worth many millions. A while back Reader’s Digest did a profile of average millionaires ( net worth) They had usually inherited little except sometimes a share of a small family business: e.g: plumbing or HVAC or family farm. Or,if you are a reasonably prudent cop or firefighter hired in yr 20’s, it’s very likely have this net worth by retirement.

According to the survey. their vehicles averaged 11 years old.

Re: Rolls, Bentley, Ferrari: I will bet that TOTAL US regs are less than one percent of one percent: i.e. less than one American in ten thousand owns any of them.

Clarification: less than one in ten thousand US registrations.

In the US, the average vehicle is 12 years old.

Right. That’s why they are millionaires and the average person buying new, or worse. leasing every year isn’t.

@Nick yep, to paraphrase: the best way to get (save, accumulate) money is to live like you don’t have any. Frugality! If you can “afford” a Mercedes S-class, then ask yourself if paying three or so times a quality vehicle purchase (honda accord, toyota camry, etc) is “worth” it – especially since as soon as the ink dries on the paperwork the value starts depreciating…

Low paid is using “millionaire” in the sense of “million $/year income”, not “million dollars in net worth”.

Nick is right that your average person with reasonably high net worth was most likely a frugal saver with a moderate income.

Low paid is right that if we had more such people, national wealth would be higher. Ten good people earning $100K/year beats one bankster earning $1,000,000/year.

These games of “extend and pretend” are simply causing more and more pressure to build in the magma chamber of the “financial volcano” and, when this thing blows, heaven help us.

The question is not so much what is happening now, but what will happen when the government subsidies end.

What’s happening now is that when people have the money most of them will pay their bills unlike the bullshit deadbeat welfare-queen myth we’ve been fed for forty years.

To me this whole period feels like a massive waste of time. Many of these jobs are not coming back. So let’s get it over with. New jobs in new sectors will eventually emerge.

In the UK the schemes end by end of October. Even the Bank of England agrees with this. It will be interesting to see how that works out.

The BOE doesn’t print the world’s reserve currency and lately the pound has been taking a hit. The UK is not self- sufficient in food, it has to buy it with pounds which are converted to euros if buying from EU or US$ from US.

The BOE has no choice but to taper benefits or see a possible pound collapse. This has happened before, requiring an emergency IMF loan, the conditions including cuts in exactly this kind of social spending.

No doubt the same applies to the US$ if it continues at this rate ( 3 trillion in approx 3 months) but that reckoning is further in the future.

Surprised to hear that the food supply was so accurately depicted I feel that most people are in denial to the true state of existence

Nick: yes, the U.S. is on the same trajectory…but the reserve status and the political leverage we still have extend the flight time for .. a while yet.

The U.K. has been through this already, and that may turn out to be an advantage: you’ve taken the medicine before, and lived to tell about it.

For us, it’s new turf. I hope we decide to be emotionally tough, and work as a team.

I was always impressed by the “Keep Calm and Carry On” ethos of Britain. I am not much taken by Churchill and the rest of the upper crust posers.

But I do like courage in a people. That’s the determinant of a nation’s spine. Wish that was some sort of elixir you guys could add to your export beer. I would buy it toot sweet. And not just for the altrusim of a fine purchase decision.

:)

Right along those lines…the best beer I’ve ever had was at some roadside joint down near Southampton. Whole rack of local-brew barrels, at room temp, along the wall. Barkeep walked the rail, and you’d point to the one you wanted. Never had such good stuff, and each one so different from the next.

Good times.

I have always been impressed by the British “Don’t Panic” and “Carry a Towel.”

Yeah, the new jobs will emerge. Paying half of what the previous job did.

The “shortage of skilled workers” is total BS. Its more like ” a shortage of skilled workers that will work for what the “market” is willing to pay”

The joke around here is that employers are looking for the 3o year old, with 20 years of experience, that will work for $20/hour

Or, just letting the project go to hell, then hire a contractor/1099 just long enough to clean up the mess. This works well in flyover, where there are a lot more contractors than there are jobs.

The problem is that employers can leave the position open a lot longer than the typical unemployed person can keep his financial head above water. This gets to be a downward spiral for the wretched refuse as well

“Free Market” LOL My opinion is that business/rich people are actively suppressing wages, with the direct help of government, and pocketing the difference. See “ofshoring” and “outsourcing”

I recall a job posting for a Java developer with a minimum 5 years Java experience the year after Sun released Java.

YuShan: Are you sure that new jobs in new sectors will actually emerge?

If they could / would, don’t you think some of that would have happened already? There’s no shortage of capital to fund these emerging sectors.

What’s in the way?

What will happen when half the country is hungry and facing eviction will be revolution. The government has a tiger by the tail, whether they know it or not. The D Party wants to hold on. The R Party wants to let go. The end result will be the same.

What will happen when half the country is hungry and facing eviction? The government has a tiger by the tail, whether they know it or not. The D Party wants to hold on. The R Party wants to let go. The end result will be the same.

The auto insurance companies also lowered the insurance rates during this time. We got a $40 per month decrease for a few months.

Off-topic but most of the car insurance premium is for liability – healthcare coverage for the policyholder or the person they injure. Obamacare rebate checks are in the mail now if your insurer didn’t spend enough money paying claims. How many times over do we have to pay for healthcare insurance until they are satisfied?

Ha—wait ’til you get your renewal notice.

My premium is now higher than before.

It might have something to do with miles

I received $15 once. Just had to renew the policy at the same high rate.

Bout damn time we swept the shareowners-take-all mentality into the dustbin of history. Milton Friedman is spinning in his grave on the 50th anniversary of his manifesto on shareholder capitalism.

Big refutation of Uncle Miltie’s ‘philosophy’ in the NYT today (Sunday).

Full Disclosure: His son lived down the street from me in San Jose.

Funny how horrible and false ideas that happen to benefit the wealthiest get so much more traction in the US political system. Why, it’s almost as if the ‘marketplace of ideas’ has a double standard.

A clown is a clown is a clown. He sure made oligarchs and corporate stooges laugh. What say the betting markets about him still being in his grave ten years from now?

More taxpayer money in the form of enhanced employment benefits going to predatory lenders that should not exist on top of what Wolf already pointed out, purchases of goods made overseas makes this mess even more painful to watch.

The lack of another stimulus bill seemed morally bankrupt at first, but nows seems not so bad. Why not send out Food stamps instead of money? Isn’t it suppose to be about shelter and food so people can get back to a working life without the stress of being homeless?

Govt benefits are notoriously difficult to obtain, even if you are dead broke. Food stamps are rarely given to working age adults who don’t have minor children in their care. When they do give those people benefits they are limited to a few months, and its peanuts, actually it’s to little to buy peanuts.

That’s it. People who complain about the lazy bums on welfare have never been exposed to the system. It’s lots of work to qualify, and stay qualified.

Yes. The Hoops of Discouragement spin far and wide .. unless your a 3-piece Ferengi bearing a Raked Acquisition.

I work with the poor, and it’s true that UI is difficult to access.

But not food stamps. For people with children it is ridiculously easy and there is very significant fraud (selling food for cash to buy other items food stamps doesn’t cover). This is well documented fact.

I have found that poor people and wealthy people are both susceptible to economic incentive. The benefit “cliffs” are a strong disincentive for full time work for people with children. If you lose Medicaid at a certain number, many people will stay just below that number. Same thing applies for part time work for those receiving social security. These are real disincentives for woand cannot be underestimated.

My other experience is that there are people, both rich and poor, who want something for nothing. Disability program is rife with fraud and should be drastically curtailed, there are far more people I work with who have essentially fake disability than otherwise. Wealthy people seek the same something for nothing but by different means, just as toxic and dangerous.

Happy1,

The War on Poverty was a jobs program for people like you. You know better than most that it’s your job to keep them poor while not letting them starve or die. It’s a perverse system.

The endless humiliating application processes for any kind of benefits are designed to Delay, Deny, and Hope They Die.

The message is clear: Useless Eaters should die, preferably today, out of sight, and not too messy. A Useless Eater is anyone is is not rich and has no more money, labor, or blood for the parasites to extract

US peons are learning for themselves how miserable it is to be a refugee like the people forced to live in the burned-out concentration camp on Lesbos.

Here is one good reason for auto loan deferral: it’s gonna be hard to evict people from their repossessed cars.

Yes the ‘reserve army’, an essential facet of capital to keep labour subdued.

Fraud not just in food stamps. Food banks constantly advertise for donations yet hand out food with no screening — to my wealthy mother-in-law for example. She picks through the good stuff and gives the rest to us.

That said, food is dirt cheap. Compared to medical fraud, grocery fraud amounts to pennies, who cares.

I mentioned food stamps as a more efficient mechanism to get money to people in need as a result of the pandemic and have those people spend in on true necessities, food. They are already sheltered from evictions.

Also if most of the food on the shelves is domestically sourced the velocity of money is maintained a little longer instead of toyota camry’s assembled in the US.

Send the money to the states to subsidize their food stamp programs and loosen the requirements for the short term.

Nothing is more efficient than giving money directly to the people. You are talking about the citizens of the most democratic and powerful nation in human history. It’s their god*** money, not the state’s money.

The US is not the most democratic nation in the world, not by a long shot, but I agree with Petunia that cash disbursements are best. They let people meet whatever their needs are – maybe it’s long overdue medical care, maybe it’s car repairs, maybe it’s clothes for the kids. This preference for food stamps over cash is basically a kind of paternalism.

I’ve spoken to folks that work for DES here in AZ and they say that UI claims are fraudulent 50-60% of the time right now. The easy money is just flowing too freely for these folks not to try, even if they risk prosecution. This Fed fiasco has even managed to turn this continuous dumpster fire upside down while it continues burning.

You forgot iPhone, Netflix subscription, and a big screen TV from Somewhere. Surely all essential.

?

@Petunia – Well, it would be even more efficient to cut out the middle men and not take as much money from the people in the first place. But I surely approve of the point you make. The problem is with the US Congress “managing” the disbursement.

JC..dont mean to be caustic,however…what about the Morally Bankrupt and Predatory Defense..Pharmaceutical..et al Industries as well as most Politicians thrown in for good measure..? Besides you cant buy sex,drugs n rock n roll w/food stamps..lol aloha

You can’t buy soap, tampons, or kids cough syrup either.

“subprime auto loans that have been securitized into auto-loan Asset-Backed Securities”. How much of that number reflects aid at the corporate level? How much of that aid is being used against organized labor? Red bars UI claims represent unvetted workers, and a rise in these claims means they are getting some help. Corporate America has a vested interest in bailing out gig workers. Uber is backing prop 22 in CA. (Never waste a crisis) Joe Subprime defers his loan, and he can drive twenty hours a week without government interference. Pre-Covid that was never going to happen.

@AB

Exactly !

Same here Petunia. Interestingly, the costs of our new 6 month contracts, startiing the middle of this and the next month, have gone up almost the total amount that we ‘saved’ from the reductions.

My take on those insurance refunds was it was a ploy to get people to not suspend or cancel their policies. “Gee, I’m not driving, why should I pay for insurance.” “Gee, isn’t my insurance company fair?” I’ve been without a car for the last six months. (I realize this is not an option for everyone.)

Seems like a clever test run of UBI

Nice to know that Congress is not wasting more money with additional stimulus.

Well, all of this is going to eventually lead to UBI. This is not your daddy’s (Andrew Yang’s) version of UBI, but the full blown thing where people are given money by the government without thought to consequence, coupled with emergency pandemic type government regulations. Go ahead, make Andrew proud.

All we have to do to get there is to vote… correctly… in November. Then a miracle will happen. Helicoptered money for everyone, it’s better than the Soviet style promise that there will be food on the shelves available for everyone. Because, when there is money, people will naturally be ready to produce more goods and services right? Free money means more for everyone…

Oh man, I can’t say that without laughing my ass off.

Here in lockdown/curfew Melbourne the State of Victoria just announced another help package for business to the tune of $3 billion.

Don’t know where in the world the money is coming from as they don’t have any cash and huge debts. Years ago the State Labor government here raided every trust fund they could and increased the amount they could legally borrow. Looks like they are going to have to increase the amount they can borrow again.

The state government here is probably going to be rated as a junk borrower pretty soon.

The only good thing about the situation is that states here have very limited power to tax people which means they can NOT implement a state income tax or other such taxes.

Several articles ago when talking about security deposits for rentals people were talking about the amount of the deposits.

Here in the Socialist People’s Republic of Victoria we have a ‘neat’ system regarding security deposits for rentals.

The correct term is ‘bond’, not ‘deposit’ and renter pays a ‘bond’ which is usually limited to one month’s rental. The RE agent collects the money and then forwards it to the State of Victoria who holds the money in a trust account.

Neither the RE agent managing the property or the landlord gets their grubby little hands on it. The money sits in the trust fund accumulating interest for the State.

Of course in order to have a system like this you have to hire a huge number of people to run it. (More employment provided by the state for their supporters.)

So after years and years of the system accumulating hundreds of millions of dollars in excess funds, the State Labor government took the excess and applied it to the budget one year and all of the sudden: a huge reduction in the deficit for that year. They also did this with other trust fund accounts as well so no more where that came from.

Voting?

Our next election is two years or so away. The local left wing rag has an article on a poll which indicated that the current imbecile has a 70% approaval rating. Another center-right publication had a similar poll, but that one showed Labor here losing in landslide………..

Right………….

Brings new meaning to the words “trust account.”

“As I think of this bill, and the fact that the more progress we make the deeper we go into the hole, I am reminded of a group of men who were working on a street. They had dug quite a number of holes. When they got through, they failed to puddle or tamp the earth when it was returned to the hole, and they had a nice little mound, which was quite a traffic hazard.

“Not knowing what to do with it, they sat down on the curb and had a conference. After a while, one of the fellows snapped his fingers and said, ‘I have it. I know how we will get rid of that overriding earth and remove the hazard. We will just dig the hole deeper.”

– US senator Dirksen [Congressional Record, June 16, 1965, p. 13884].

Time for a stiff drink, or three.Right wing left wing dont be fooled ,support is one thing obeisance is an other ,support is for humans obeisance is for dogs.

Wow, great and informative article.

Regarding: ‘most thought the unemployment was a temporary blip’….that is beyond hard to believe. This is a pandemic. The ‘blip’ will probably last until next summer and by then so much will have changed in attitudes, and buying habits. As said in an above comment, many of these jobs will not come back. Furthermore, when the times were good our clueless leaders ran up debt for political reasons. There is no rainy day fund left. (all countries).

I expect most people will become poorer with the top tier reaping more wealth. A country like mine, Canada, will use this period to implement change in supports, and is planning right now a proposed restructuring for better education access and opportunities for regular citizens. I would expect the US will start devolving into more polarization and violence after the election in November.

If a pandemic can’t bring a country together and unite everyone for general health and well being, if even basic scientific facts cannot be agreed upon, nay lied about by leaders, is there any chance of improvement, whatsoever? With the economy? Debt levels? Lending practices? Wealth disparity and opportunity? Not likely.

How anyone could hope this was a bit of a blip is beyond me? There is little economy left beyond debt and financialization. Lots of upheaval going forward, imho. (I hope I’m wrong). We don’t need any more chaos.

“A country like mine, Canada, will use this period to implement change in supports, and is planning right now a proposed restructuring for better education access and opportunities for regular citizens. I would expect the US will start devolving into more polarization and violence after the election in November.”

Is this all just an educated guess? Or do you routinely predict the future?

Some things are as easy to predict as Wile E. Coyote running off a cliff. What do you predict will happen next?

Generally speaking, if stocks collapse, the very wealthy also don’t do that well, although people who need to work for a living do worse. Gini coefficients drop most during depressions.

Glad to hear Canada’s government is so forward thinking and lacking in corruption and self dealing. I’m sure the Trudeau’s fake charity is part of this plan to improve Canada?

Canada has the normal and historical amount of graft and corruption whereas more advanced countries like the US have imagineered whole new methods and magnitudes. Trudeau and the Liberals will steal 5% and hand out most of the rest to the sweated masses, who will continue to vote for them. Also, since the bulk of the relief has gone to those who will spend it, the overall economic hit has been quite muted.

All these extend and pretend games will only increase the pressure on the “financial volcano” that will blow sky high soon and heaven help us. This is what happens when reality and living within ones means becomes “optional”.

Looks like negative futures on oil several earlier this year.

Curious but in no way significant.

Our civilization in currently in “cyclone eye”.

Wait several months.

Many of the losses, missed payments, and so on, are inside murky asset backed securities. I believe that asset (automobiles) backed loans that provide the underlying financing for leases and purchases are without recourse and do not mature at the same time as the intertwined repossessions and related events. These loans are packages of auto loans with a better than average interest rate wrapped around to attract investors. Even on maturity it is easy to imagine a rewrap.

Prediction: Trump will win by comfortable margin and over the next 2-3 yrs implement corporate centered national socialism like we’ve never seen:

Additional tax cuts – mostly capital gains – rich get richer

$2-3+ trillion recurring annual deficits toward the un/ under employed and small bus. Permanent cut in payroll tax for workers. All borrowed at 50 basis points.

Everyone is bailed out and receives a form of UBI – Economy booms. Trumps ego is finally sated

Wolf – assuming this comes to fruition, how should one invest?

Don’t know about Wolf, I would sell all my gold and buy Tesla stock

if productivity increases over the last 30 years had gone equally to labor instead of just manly to capital then the minimum wage would be 20.00 or so. Of course capital says it’s our money so we should get more. But then the money comes from the fed and the fed gins it up out of thin air. Maybe if we had legislation that required capital and labor to share equally in productivity gains the wealth inequality wouldn’t be so bad and society would benefit.

The wealthy are treated as “deserving”. Everyone else, not so much.

I think you just described Communism.

Not even close. Communism is a system where the means of production are owned by the state.

The state doesnt exist. Remember, “communism” is french.

The CAPITAL always wins over LABOR all the time especially after globalization where there was labor wage arbtrage and the American workers lost!

No, China didn’t steal our jobs or factories but US mult-nationals GAVE THEM AWAY. Trump blaming China for job loss is hilarious!

Our jobs and factories got overshipped ( to China and other Countries)with the FULL consent and complicit of Congress and the elites of both parties and the wall ST since 2000. Exploit cheap labor and more profit and why NOT!?

This is the biggest SNOW JOB perpeterated on the American public by our leadrs and policy makers and the American sheeple are so dumb even today to NOT to realize this scandal!

Get ready more ‘SNOW JOBS’ on the way

Absolutely correct. This needs to get repeated widely and often. The American middle class got sold down the river.

And, to tell the full story: As the canoe went down the river, it was sped along by 300MM active middle-class paddlers who sold themselves out even more by buying those goods made in Asia.

Because they were cheaper.

We forgot to remember that “cheap isn’t always better. Value is better”

The Chinese negotiated and then presided over the greatest transfer of technology ever. Not a shot was fired. Absolutely masterful statescraft.

We have done this to ourselves. Let’s learn from our mistakes, and do better next time.

Once upon a time the Spanish said they would do better next time. And in turn the French. And the British. Where are they now?

Do we get a next time?

Tom,

You forgot to include the various and extensive politicians of all stripes and colors who expedited the movement of the good manufacturing jobs that had supported SO many cities to China for gazillions of dollars of bribes, etc., etc.

Some of us had high amounts of hopium for the bammy mammy/nanny until he signed off on the new nukes in the Carolinas, one of the first actions he took to confirm he was willing to play along, and most likely received the usual ”honorarium” paid world wide for such signings.

Don’t want to sound like I am picking on one side of the aisle; almost everyone of them are in somebodies pocket, from smallest municipality up to the top of the political chain.

”CLEAN HOUSE, SENATE TOO!!!”

Unfortunately unless more housing is made available for people to actually live in, rather than empty investment units, then it wouldn’t matter. If wages go up then rents will go up etc.

@paul c

Perhaps there is some fraud. But, in the context of this post, he’s citing the payouts to show how they have stalled defaults on sub prime auto loans.

In addition, there are also many people who have been denied payments due to inadequate – willful or otherwise – government administration of the policies.

As far as idiots go, your post is pockmarked with grammar, spelling and punctuation errors.

It’s going to be perfect storm very soon.

NOT until after Dec ’20 when all the deferrals of payments and ‘extend & pretend’ plans end!

Mkts will be volatile and in chaos with ‘fake and real’ news everday!

Make sure you have ‘tail’ insurance to stay invested in this mkt for the next 3 months!

1) Zoom Zoom, Boom Boom.

2) Those with good technical skills who misbehave & and those that

behaved, but lack good technical skills, were let go half a year ago.

3) There were no calls by future employers to check their referrals in the last 6M. Those people have families & children.

4) Kick the can down didn’t work for them. They couldn’t escape CV-19.

5) Overseas employees with 25% pyramid cost above them, relative to US employee, are still around.

6) The next Qt 35% GDP increase, will not boost hiring.

7) A minus 20% GDP, if GDP from $21.7 to $17T while debt is rising, ==> will boost firing.

8) Where are the orders, in repetition, like in 1932, will purge good labor to the bones.

What does #8 mean?

Many seriously delinquent borrowers who were almost certain repos also paid off their entire loans when they got their big dump of unemployment money. People didn’t really get an extra $600.00 per week federal they got nothing for quite a while then usually $10k or more all at once.

You forgot to mention evictions and foreclosures are not allowed. If shelter is free, pay the loan on the pickup truck first. Then buy some phones and TVs. Splurge on what ever you like.

When the bill comes do just go somewhere else. That’s how poor people think.

Max out your cards on gold/silver. When the bill comes do just stiff the bank. The fed will bail them out for free. That’s how formerly poor people think.

How on earth do you know what poor people think? I think you are projecting. I think you confuse an individual personality trait with class.

First reaction: “When you get evicted and move into your car, car payments suddenly assume a much higher priority.”

But also makes sense that deferrals are magically converting “delinquents” to “performing.”

Good article with keen insight. Only one solution I can see – a debt jubilee.

No chance. A debt jubilee is where they forgive your debt – and take back your home and cars.

You are confusing bankruptcy and debt jubilee. Read Steve Keen on a modern debt jubilee.

Bankruptcy works just fine. What doesn’t work is for central banks to hand out free money so companies and consumers can avoid bankruptcy but then get stuck with even more debts that way. A big wave of debt restructuring in bankruptcy court would go a long way toward clearing out the issues.

I’ve been following Dr. Keen since I bought his book in 2008.

Yet another example of how success is punished and failure is rewarded. People who have value and weren’t fired got nothing. People with no value who were let go were rewarded with $2500/mo in federal welfare, plus of course the state UE benefits.

The message is clear to Americans. Working is for suckers.

And think of all those folks who got to keep their jobs with a 10 or 20% pay cut. They’ve got to be seething.

“Working is for suckers.”

You sound like the President!

I remember when interest income and disposable income was an economic engine. No more.

Wolf, who gooses the stock market each night if the Fed isnt?

The New Robin Hood. They take from the poor to give to the rich.

Just for fun and to show people how screwed up the situation in Victoria is with the lockdown and restrictions.

I am waiting for a purchase from a suburb 9 miles from where I live. As we have a lockdown I can’t drive there and pick it up so it has to be mailed.

The package left the business 12 days ago and went to New South Wales for processing which is a distance of 574 miles. It has been sitting there now for 9 days.

To get delivered it will have to be put on some vehicle and driven back another 574 miles. So a round trip of over 1150 miles in order to get to me from an original distance of 9 miles.

Absurd to say the least.

And for more absurdity, a politician here in Oz who likes to rile up things sent a bunch of beer holders to a group of people in lockdown. The stuff was sent as junk mail and intercepted by the local city government who then promptly opened the packages and refused to deliver them once they found out what was inside.

So not only do we have delays to mail, but local governments, in violation of Australian Federal law, opening mail, deciding what people can receive, and then basically bragging about it.

Free money means nobody has to pay anymore. Forget the idea of an actual “negative” interest rate – where you get PAID to borrow (That’s Bizarro world thinking.), BUT zero rates mean the cost of NOT getting paid is also near zero.

So with 29.6 million people collecting unemployment benefits, how is it possible the unemployment rate only 8.4 percent?

It’s not possible :-]

8.4% is called election year lying.

Where is my smoking candle and that darn mirror?

RE: Thomas Roberts- “I really doubt those guys know how the economy works.” AND could care less, a nice way of saying the nasty alternative!

The deferal programs are a great idea. It saves the vehicle owner from having to scramble without a vehicle. It saves the lender from having to physically repossess it and it saves the credit of the consumer and the balance sheet of the lender.

The only thing is, unlike a house, a car depreciates and deteriorates. What’s going to happen in the worst case scenarios where someone is able to defer for say several years and the vehicle breaks down? A mortgage deferred for several years isn’t too big a deal because the house is probably continuing to appreciate. A vehicle that’s worthless, undrivable, and has a loan that still has 48 months of payments on it….?

It is really very simple – debtors and speculators rewarded and bailed out. The whole economy runs on debt. The balanced accounting will continue but-

All debt that is set to go bad will be monetized, PERIOD.

This country is Toast (in the longer run). In the short run, it will boom like nothing before – free money, debt suspension, etc..

Better buy stuff while you still can – including stawks