“Some forced selling is highly likely.”

By Nick Corbishley, for WOLF STREET:

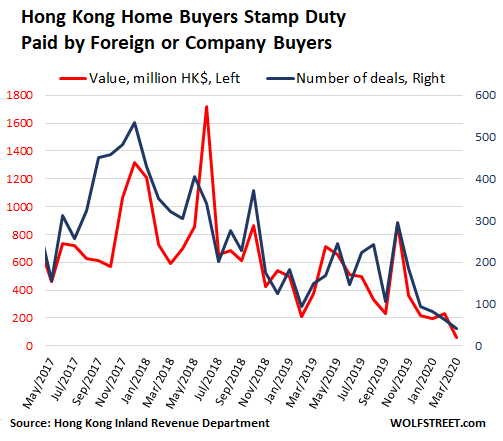

Mainland Chinese buyers, who largely drove the luxury real estate boom in Hong Kong, the world’s most expensive housing market in terms of affordability, have stopped buying. The number of homes eligible for buyer’s stamp duty, which is only paid by overseas or company buyers, mostly from the Mainland, plunged to an unprecedented low of just 42 homes in March, from a record monthly high of 534 in December 2017, according to the city’s Inland Revenue Department:

Sales of Hong Kong property to mainland investors have been trending downwards for the past two years or so, largely due to the Chinese government’s decision, in late 2017, to crack down on money laundering and illicit capital flows from mainland China to other countries. One of the main targets of that crackdown was money used to fund real estate projects in booming global cities with lax money laundering controls.

Since then, the combined toll of the US-China trade war, Hong Kong’s political crisis, and recently Covid-19 has decimated property investor sentiment.

In addition, many Mainland investors are desperately trying to sell those residential properties they have already bought as rental income in Hong Kong slumps and appetite for outbound investment all but vanishes in China. Many of these investors are willing to sell at a sharp discount to offload their property as quickly as possible.

Pummeled by weaker market sentiment, a lack of new launches due to the virus outbreak, and the evaporation of demand from mainland investors, luxury transaction volumes on Hong Kong island tumbled by 44% Q-o-Q in Q1/2020, following a modest rebound in Q4/2019, according to data published by Savills. In Kowloon and the New Territories, which were particularly popular districts among mainland investors, transaction volumes plunged by 50%.

Prices follow transaction volumes.

“With Covid-19 coming at a time of trade tensions, some forced selling is highly likely,” said Simon Smith, senior director of research and consultancy at Savills Hong Kong. “Some mainland vendors whose businesses face cash flow issues, and landlords of properties with multiple mortgages, will be prepared to consider offers [at deep discounts] on a selective basis.”

Here are a couple of choice examples courtesy of South China Morning Post:

- One mainland investor sold a 639 sq ft flat at Century Link in Tung Chung for HK$7.6 million (US$980,550). “The homeowner was pessimistic about market prospects, so he did not hesitate to cash in,” said Dennis Wong, branch manager at Centaline Property Agency. “As the homeowner is a mainlander, he had to pay the buyer’s stamp duty when he entered the market. His exit actually cost him about HK$2 million.”

- A 2,047 sq ft villa at The Beverly Hills in Tai Po that was bought for HK$28.5 million 10 years ago ($3.7 million) went for HK$20 million ($2.6 million) this month.

Weaker sales are translating into lower prices. Luxury home prices in Kowloon and the New Territories fell by 4.5% Q-o-Q in the first quarter. In areas such as Kowloon Station and Kowloon Tong the drop was even steeper, at 6.9% and 4.9%, respectively, from the previous quarter. Luxury apartment prices on Hong Kong Island declined by 3% in Q1/2020.

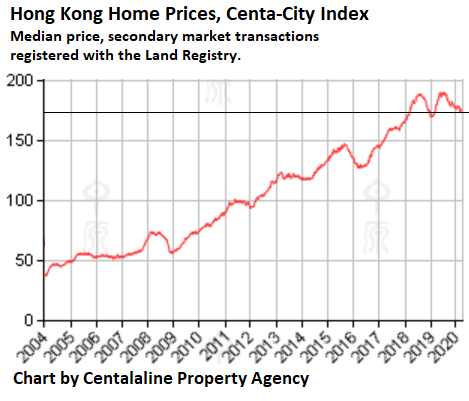

Prices have also fallen in the mass property market. According to Centalaline Property Agency’s Centa-City Index, which is based on all transaction records in the secondary market registered with the Land Registry, the median price fell 1.4% in March from February and about 9% from the double peaks in mid-2019 and mid-2018, and is back where it had first been in January and February 2018:

Prices will have to fall a heck of a lot further before most local residents with incomes that are even above the median can start dreaming about buying a home. Hong Kong is far and away the world’s most expensive housing market in terms of affordability for a median-income household, outdistancing even cities like Vancouver, Sydney and London, which have been through mind-boggling housing bubbles as well. By Nick Corbishley, for WOLF STREET.

Sales at luxury goods stores, once the largest category, collapsed by 86% since their peak in 2013-2014. Read... A Word About Hong Kong’s Retail Sales Collapse: It’s a Mess

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

will this influence decisions in other countries where money was off shored?

Panic first is probably a good idea here.

Other counties also have other buyers besides China, but yes.

Buying and renting is being affected all over the world thanks to the Coronavirus so is a really bad time to be selling a house.

My advice is to keep the property if you can, even if you will have to reduce the rent, and wait until next year to see what happens.

I think whats more this time is that people are seeing the importance of saving. Too many people have maxed their spending at the expense of saving and I expect that to change.

Paying huge portions of your budget on real estate isn’t going to be fashionable in a declining market. Especially if stocks are on sale.

Stocks have to fall a-lot more though, before, they are reasonably priced. Unlike Real Estate, stocks have a much easier to define value and have no maintenance costs.

As for real estate though, you either buy a house to live in or as an investment. In most of the country, houses are almost entirely for living in yourself and the price is dictated mainly by how nice is that house, that area, and how much money do those who want it have/how big a loan they can get to buy it. Limiting the size of loans people can get, will lower housing prices in most of the country “in very cheap areas, it would also shrink the size of new houses”. The loan size the average person can get will dictate housing prices, in most of the country, but, in major cities the housing market can be pumped up by investors.

For real estate as investment, this includes all houses, commercial RE, and apartment buildings as well, where you aren’t living there yourself “usually”, but, are using it to make more money. But, the price no longer has a practical price ceiling. The problem is that if you have excess money and want to invest it to make more money or safeguard it, once you have enough savings, you gotta put your money somewhere and the world never has enough safe easy investments with a high yield and so people “with enough money” keep causing bubbles in housing markets, stocks, and other areas, because, they have nowhere, better to stick their money and are unsatisfied with it growing slowly or not at all.

So the question is where do you stick your money, or do you keep moving it around?

A-lot of countries have already or are considering limiting foreign investors in RE. Chinese buyers have pushed up RE prices in many places across the world.

For Hong Kong specifically, the political issues with Beijing, are not to be underestimated “that have arisen over the last couple of years, especially” and only those living in Hong Kong, should, be buying property there, in most situations.

As usual I have a different take. I believe the one with access to money want real estate and land prices to fall so they can scoop it at a lower price.

If you have lived in Asia, you know what I mean.

Isn’t that what most people reading this blog, want to happen in the US?

Hopefully out of need to find shelter rather than to speculate.

Just Some Random Guy,

“Isn’t that what most people reading this blog, want to happen in the US?”

There is a common misconception here about websites with comments.

WOLF STREET had 628,000 “users” over the past 28 days, majority of them “new users” — meaning they were on this site only once during the 28-day period per device as per Google Analytics. So there is some duplication as some “new users” can include some more or less regular users that Google fails to identify as such); many “new users” came via search, Google News (where some of my articles run), etc. But there are only a few hundred active commenters.

So the percentage of readers who comment is minuscule (as it is with all sites).

Commenters are authors. My job is to encourage as many readers as possible to read these authors’ comments. And the number of readers on my site who also read the comments, or only read the comments, is fairly large.

Many people who read this site are in the RE industry. Others work on Wall Street. There are hedge funders and people at trading houses that read this site. There are truckers and truck dealers that read this site. And financial advisors and bankers, etc. There are people at the Fed that read this site (I know).

You’re extrapolating from what you read in the comments to the overall readership, but commenters are not representative of the overall readership – this is valid for just about all sites.

BTW, the number of comments are not indicative of the number of readers. Some kinds of topics stimulate a lot of discussion. And so you get 300 comments by 150 people. But that article may only have been read 10,000 times. Another article with over 10 times as many reads might only get 150 comments.

That’s just how websites work.

@Wolf

Love the comments section here! Thanks!

We should really use the comments here to discuss how important i is for the government to continue to support high home prices and the people who bought them. Homes and the mortgages on them are the #1 asset in the USA and most people don’t realize the Federal govt actually takes the risk away by buying the mortgages so the banks can focus on doing what they do best.

Obviously we all need to pull together at a time like this to ensure home prices do not go down. And other countries, like Hong Kong, ought to emulate the US system. Perhaps even the IMF could start buying out mortgage securities internationally so that no one gets hurt by global real estate prices going down. Actions like this might encourage the mainland Chinese not to sell their Hong Kong properties.

Impact of the virus has been bad enough, last thing we need now is real estate prices going down all over the globe.

“Commenters are authors.”

See. kids, stop laughing.

Wolf says I’m an author, so there!

Mr, Richter, it’s good to know that you are getting attention from the Federal Reserve. I would take that as a compliment!

@Pro-Establishment

Thats actually what I need to happen, to get a reasonable deal on my first home. I hope RE craters.

Are Hong Kong residents under the same Capital restrictions as Mainline Chinese? I’m familiar with the Hong Kong diaspora that preceded the Mainland China takeover in 1997. Some of those from HK ended up in the Bay Area. Would be interesting to know if more monied Hong Kongers are anxious to emigrate elsewhere as Hong Kong deteriorates.

@Young Buck

I would encourage you to focus on increasing your earnings and savings so you can purchase a valuable home. This is a win-win strategy. And it works globally.

Waiting for home prices to go down, which would cause financial destruction & chaos to others, is not a good strategy.

@Pro- Elitist- Establishment

We are obviously at another reset and until prices drop on everything we will never bounce back. Sorry bud, but the Fed and Treasury have lost control. The market will pick the winners and losers now.

Fair enough. I should have said people who comment here on a regular basis.

You keep using that word. I do not think it means what you think it means.

Thanks,

I usually read and rarely write comments. The rate probably is 30 to 1.

@Pro-Establishment

Can you explain how house prices going down will cause financial destruction to others?

stemmer det..jeg leser..er fra norge..

I would like to humbly suggest a Morty Mc Mort Bailout Package, Providing Massive Liquidity Events to said Mc Mort. One Half Billion USA Pesos..errrrhh sorry Dollars, should be a good first installment – Funds to be used for immediate stimulation of Self, and Economy in General, but not limited to: Resort Properties, Massage Parlors, Pharmaceutical Groups etc. If this Stimulus Package works, as well as I believe it may.. we will extend the program to benefit all Americans – Thank you!

@ pro-Establishment

‘..how important it is for the government to continue to support high home prices and the people who bought them’

Wow!

WHY?

Is that written in our constitution?

Isn’t housing just a one section of our Economy? Why favor one industry over the other to the extent of creating NOT one Housing bubble but # 2 is on the way!

The bubble made the disconnect between the median price of house vs median income of a middle class American family. Many residents( nurses, Firemen, police etc) of big metros couldn’t afford to stay at or near by where they work! This is a distortion made possible by Fed by easy-peasy money/CREDIT policies accessible to those who have EASY ACCESS! No wonder they are the prime reason for increasing INEQUALITY in Income & WEALTH in America!

0.1% have more than bottom 80% of America! Top 1% have more than 50% of wall st wealth and those in top 10% over 90% and the rest less than 7%!

No wonder you want the status quo to continue, favoring the establishment!

Wow!

I am glad this surreal mkt including the Housing bubble is NOW is going to come down to reality on the ground! Wall St wealth was built on NOTHING but on debt on debt, unlike any bull mkt before ’09, is a Mirage fading off. Good riddance!

Been in the mkt since ’82

@sunny129

You do realize that anyone with an income of about $32000 a year is in the top 1% of income earners globally, right? Many people who complain about inequality fall into this bucket.

So before you go complaining about inequality you ought to look at yourself and follow the example of great people, other global 1 percenters, like Bill Gates and Al Gore, and start re-distributing your income to the less fortunate.

Meanwhile if you want to get Constitutional about should the govt support housing you ought to actually read the Constitution – when the states wrote it, right on the top they said “GENERAL WELFARE”- obviously people’s welfare and spirits go up when they have a nice place to live!

Do not trust your analytics, I can appear as a new user every minute. One minute I can come from Netherlands, another one from Emirates, another from Japan, another from USA. How is that possible if there is travel ban? How can I move so fast around the globe? Seems you are missing basics in tech and/or security area, and you are in the mercy of big giant tech companies.

Most of the people are capable of protecting themselves from creepy tracking companies, their analytics and marketing malpractices. Secure e-mails, secured VPN, secured browsing, secured wallets, secured tracking, secured privacy, secured advertisement, masked phones, masked cards, etc.

Every single time I can read and comment on your site with a new IP and new generated masked e-mail from different domain from a new location, that you will never be able to track back to me. And I am not alone. Your statistics are erroneous and they will get worse over time. But pat yourself on the back on how many new users you are getting while being deceived by erroneous statistics from creepy giants.

Secured identity,

Yeah, I know what VPNs do with IP addresses. I see it on my site. For example, you’re using an IP address in Amsterdam. So this might be just the IP address of a VPN server, when in fact, you’re in Ontario or wherever. But percentage-wise, the number of people browsing the internet on VPNs is not huge. Most people don’t jump through these kinds of hoops to cover up their tracks in order to read their news.

Also, about 60% of the readers read this site on mobile devices (mostly smartphones). And that’s a different ballgame altogether. If you’re using an Android device, you’re not going to be able to fool Google Analytics, or Google ads, or Google in general, no matter what. That was the whole purpose of giving away Android :-]

I think many that read and comment on WS are interested in ‘both sides of the coin’. Of course we all have our own interests on the subject at hand, but we value the input in forming the ‘total picture’ that these articles and comments provide.

I some here to shake up my perspective, I appreciate it.

Ditto DawnsEarlyLight…guess I’m an author now…”A man has got to know his limitations” Clint Eastwood from the movie Magnum Force.

The FED can print all the cash they want. But, they can not print quality real estate. Why would anyone sell quality real estate just to get cash when the FED is printing it as fast as they can? The smart money is being moved into hard assets and away from cash. But, you do need enough cash to protect your hard assets and to eat. But no more. Cash is trash.

Quality RE at what Price and who can afford it?

Not a housing bubble artificially created by Fed by lowering the price of capital, with 4 QES and ZRP + suspension of Mkt to mkt accounting standard!

That House of cards is blowing away. A karmic backlash to their insane credit creation!

I don’t think people realize the distorting effect Chinese property buyers (and money-launders) has had on proping up the housing bubble.

In major cities, prices reflect each other. So when a Chinese billionaire buys up property at 1,000 sq/ft in Hong Kong; then Tokyo, NY, and London adjust to try and sell at that price too. Then 2nd tier cities adjust to fit where the suburbs of NY adjust their prices based on Manhattan real estate.

So much is a worldwide bubble driven by the Chinese buying things at any price to get their money out of the country so it can’t get siezed by the CCP.

Legally, annually, you can take 50,000USD out of the country, no questions asked. If you want to transfer over that sum, you have to go thru SAFE-https://en.wikipedia.org/wiki/State_Administration_of_Foreign_Exchange

Depending how corrupt you are, based on your intentions, and then of course the CCP, if you want to transact legally, you are able to. China’s policy is to keep money in China, and clamping down on corruption. There’s really nothing wrong with the theory, and the ideals.

It’s not much different than the US. In fact the corruption to get Chinese into the US, and their money has probably been pushed and supported more by corruption within the US and globally than just from motivations, and options in China.

The big question is who is supporting the most corruption globally? And, it is not really the Chinese, although they’re probably as guilty as any state, and especially global players. The real transaction money trails are those that have increased the black markets globally since the 80’s.

Globally, everyone should support transparency, and legal monetary transactions, and not the black market, under-the-table deals, which are where the untracked, and real money plays are performed contrary to all national, and international legal process.

50k, Are you serious? Have you seen Chinese bet in a casino? I’ve seen them bet around 1 mil per round at the high stakes baccarat table

Gave me a headache.

Here in the UK, bookmakers always try to open up in any local Chinatown… lol

Corruption is pretty rampant especially casinos anywhere. AND, if you get permission from SAFE, you get whatever you want if you have the power and access.

If all you support is corruption, then over time, all you get is the chaos that we’ve got right now. Too many folks are promoting the “deal”. Dealing has it’s real consequences, especially when you pretend that it doesn’t. Operating out of legal boundaries creates a garbage dump. So, what we have is the biggest garbage dump imaginable based on “nothing”. Garbage in and garbage out. Depends who you want to play with, and whether you follow any rules at all. The game on right now, is there are absolutely no rules. So, you get chaos. Enjoy. Have a swig of beer in between the next rounds of cyclical, strategized, loser and winner national sell-offs. Hopefully, your timing will be right on. Right now it may certain areas of the China. In 6 months it may be certain areas of Brazil. In about 9 months it may be certain areas of the US, etc.

All we have for any market is strategized sell-offs. Now, it’s follow the Fed and their front-runner team. The sell-offs aren’t even real sales, because the Fed buy everything up, and rotates any business brand-name to be recycled by the back-up teams. Rinse, and Repeat.

The only way is UP, and then sell at exactly the right time. Follow the lead team, which right now is Mnuchin’s buddies. You gotta be selected, and invited to be on the team. You know it, if you are a member of the winning team. You know it, if you are on the losing team. There are a whole lot more losers than winners. That keeps everything interesting for everyone, wherever we are, or aren’t.

(P.S. I guess I’m bored, but you didn’t give me a headache. It was kind of fun actually to write this. Have a sunny day!)

At Happy Valley Racetrack last time I was there, $60million HK bet on the last race oncourse. I think we all just emptied our pockets and went home. On a related note, if I steal $10million HK , buy property, and then sell it for $5million HK, there is a whole school of thought that says rather than losing $5million, I have just washed $5million and can now use this clean money as I see fit.

I keep hearing this about rampant Chinese money laundering, or individuals trying escape the clutches of the CCP as the reason for all the Chinese buyers. Perhaps that’s true, but the more fundamental reality is that while China fixes its exchange rate and runs perpetual trade surpluses, it accumulates ever more foreign cash that it needs to stuff somewhere useful in the host country. Once you’ve loaded up on a few hundred billion of ZIRP treasuries, buying some ridiculously overpriced real estate is nothing more than a light diversification strategy.

Unless Covid spells the end of the Chinese neo-mercantalist trade arrangement with the rest of the world (and it might), there will still be lots of Chinese owed USD that needs to go somewhere each week. That doesn’t mean real estate prices won’t crash, but in my opinion, whether Chinese buyers dry up in the medium term is much more dependent on whether a new international trade order is established, rather than the fortunes of international money launderers.

Unless Covid spells the end of the Chinese neo-mercantalist trade arrangement with the rest of the world (and it might), there will still be lots of Chinese owed USD that needs to go somewhere each week. That doesn’t mean real estate prices won’t crash, but in my opinion, whether Chinese buyers dry up in the medium term is much more dependent on whether a new international trade order is established, rather than the fortunes of international money launderers.

Jon W , my take . The China story is over . All money spent on the OBOR program is wasted . All money loaned to deadbeat countries like Venezuela etc is down a black hole . The virus was a KO blow to an already staggering boxer . Now China ( make it CCP)has only three things to do (1) CCP must retain power (2) it must feed its people (3) it must further spend money on the public health system .Why ?(a) The legitimacy of the CCP is in question ,of the way it handled the virus.(b) swine flu and bird flu has killed 300 million pigs and a million poultry , prices have shot up (c) China(CCP) now knows that there might be other viruses behind the curtain that might emerge and cause havoc . There is a lot of talk of Wuhan/China ^opening up^ , there is a difference between ^opening up ^ and ^restarting ^ . Opening up only means that you are not beaten up or arrested for being on the street . So when will China restart ? Look for the following indicators (a) the schools must reopen (b) North Korea,Russia borders must reopen (c) the annual CCP meeting which was to be held on 3rd March but cancelled must be convened . The meeting is very important to show to the Chinese people that CCP is incharge and Xi is the undisputed leader .

j

The Chinese real estate buyer is NOT the CCP. Affluent Chinese dude has as much to do with Xi as rich liberal tech guy in Silicoln Valley has to do with Trump.

Affluent Chinese dude knows he’s in a china bubble. Affluent Chinese dude knows the Shanghai stock market is rigged. Affluent Chinese dude knows the CCP can take all his money out of his bank account any time Chairman Xi wants to.

So affluent Chinese dude wants to do two things:

1) buy a real investment, something tangible

2) buy something that’s legally guaranteed in a place where the CCP can’t take it from him.

So the “smart move” was for all the affluent Chinese to go find some property to buy. Good safe property in a western country.

But if the China bubble bursts and there’s a lot fewer affluent Chinese dudes – then there’s less Chinese dudes who want to buy property. And that is the pin prick that’s going to pop the housing bubble and topple this set of dominos.

Agree with you that that not all affluent chinese are the CCP and also am aware that the affluent have been moving their money overseas for several years to not only HongKong but to other metropolitan cities in the world as insurance for an implosion in China . My comment was to point that this will now be a trickle ,so a return to high prices in HongKong will be difficult .

well said ! I am more fascinated by what happens with real estate in mainland china and the beneficiaries of chinese buyers -vancouver- nyc-sf- then any other investment class in the coronavirus crisis

Back in the day, Canadian politicians almost always brought up human rights abuses by China…now, they really go out of their way to encourage be nice to China. Considering how this country was the backdoor to China’s cheap goods to slip into the US. Cheap goods that are bad quality and over the decades become cheaper and poorer.

The US based MNE, are the real players to establish the squeeze plays to keep pushing quality to the zero-line, same with the USD. Any negative effects in the US has been accomplished at the behest and corporate development process starting at the top of the Federal seats of power, and all through the under-the-table deals to increase the “TAKE-AWAYS”. That process is NOT capitalism at it’s finest. Most of the take-away that has left the US a wasteland over the last 60 years has gone right to Dubai. Check a view videos on Youtube- NYC looks like the slums, no wonder. Initially, more development occurred under direction of the great construction conglomerates from the US, using global, essentially slave labor. Some of Canada has prospered because Canadian government does not allow total loss to internal small and individual producers, compared to the US. Canada has been more unified as a nation with some common-sense focus for land based population.

None of our politicians will allow us to actually vote on anything sensible or meaningful for decades now. They all do what is best for themselves and not the country.

Joe, your comment is so all encompassing it just sounds like conspiracy. You vote for general policy in the large federal venue, and details that effect your everyday life in local politics, even provincial politics. I often hear similar complaints from folks who then go on to say that is why they never vote.

I once got an illegal river bank modification made by the local fish and game club stopped dead by contacting our NDP MP directly. The MP was not even in Govt. One call from the MP to the Fisheries biologist had immediate results, when they just ‘blew me off’ for several months. The f&g club hired a backhoe to put in a boat ramp for flyfishing tourist operators to pull their boats out. It had been done without permit, public notification, or approval. I have property downstream that would have been negatively affected during flood season. The result was no more boat ramp and complete river bank restoration.

If you contact govt representatives with both a problem and suggested solution you will get results has been my experience. Govt reps are terrified of bad press. Well, most of them are. Some are happy to get their name in print anyway they can.

regards

Prime Real estate still more stable than stocks.

Maybe only in US where REITs can receive bailout $$. Unclear if those bailouts include REITs in other countries.

Oh dear. In many countries you get a bailout or “loan” because you are politically connected. You don’t need a REIT.

Iamafan,

I am glad that doesn’t happen here in the U.S.

Many HK buyers also purchase with 100% finance.

Developers, lenders, and family members all contribute to the purchase of a “home” due to the “history” of ever rising prices.

Home is a liability.

CCP is a liability.

The HK people are are in danger.

The new world “re-order” is in effect.

@nicko2

Real estate numbers always lag by 6+ months. Let’s look at the numbers in November.

But remember real estate is a slow moving truck!

Distortion will always accompany a fiat currency especially a foreign reserve one. Get used to it.

However, it does not guarantee they will make money. Just ask the Japanese when they bought Rockefeller center.

With the remarkable Nikkei Bubble of 1989, Japanese speculators were aggressively buying “Trophy” properties around the world.

The guy who sensationally bought the Pebble Beach Golf Course was broke in about six months.

Losing something like $95,000 per hole.

Global real estate prices could suffer a long post-bubble bear market.

Pebble Beach was actually bought by Minoru Isutani in 1990, after the Japanese economy had already started imploding.

Quite the character this Isutani: in 1986 Japanese authorities took him to court over a complex scandal involving one of his golf course companies and an organized crime family. Apparently the mob helped Isutani hide big financial losses through a fictious land sale deal. It was big news because Isutani at the time was riding high on 80’s Japanese executives’ golf craze and he was always in the news, shaking hands and posing for pictures with the gotha of Corporate Japan.

In those years Japanese persecutors only took people to court if they were at least 90% sure to get a conviction, so it was a further scandal that Isutani got away with it. One of his business associates however got a long prison sentence: most likely a fall guy.

Isutani, hounded by massive debts officially racked up with Sumitomo Bank and Sumisho, sold Pebble Beach in 1992 to a “group of Japanese investors”, who were widely suspected of being a front for an organized crime cartel.

Isutani kept the numbers close to his chest but it’s known he paid Pebble Beach an absolutely mind-boggling $850 million in 1990 dollars. He sold it just two years later for a rumored $450-500 million, again in contemporary dollars.

What really went on behind closed doors is unknown but it’s sure Isutani lost at very least a third of his money in just two years.

Isutani needed the cash, and needed it quick, so he sold Pebble Beach at a deep discount, but at least he found a buyer.

This is a luxury many sellers won’t have as soon as they are allowed to exit the house to go to the realtor.

Does this mean that Mainland China is less interested in the pro-democracy movement? In China politics is always at the service of good economic policy.

An article in the Greenwitch (CT) Times this morning highlights China’s sharply tightening of the screws on Hong Kong, So China’s interest in destroying the pro-democracy movement is apparently increasing, which may be contributing to the mainland Chinese citizens’ motivation to bail out.

Unfortunately, that’s my local paper since many nearby towns here are part of the CTInsider group owned by the Hearst Corp.., so they all look alike. While there are some Chinese buyers around, these speculators are not quite welcomed here like the West Coast.

But what caught my attention was this headline.

‘Reopen CT’ protesters hit streets – mostly in cars.

The maddening continues … This time with millionaires.

PS. the town is spelled Greenwich. No witches here. Just extremely toney.

All the witches are up the coast in Salem

People say the Chinese feel rich when property prices are going up and obviously feel poor when the drop.( same in England) Now that property prices are dropping, the very fact that they are dropping will be a further spur to drops in consumerism, so much so, that they become self perpetuating. This, on top of everything else, make you see how depressions start…..

Real Estate is priced at the margin.

On the way up, and the way down.

We just had the longest up cycle of my lifetime in Sonoma County, with the huge economic hit caused by Covid 19 that is over, done, finis.

If you need to sell sometime in the next few years you would be well advised to do so as soon as possible and price your property 10% below the latest Comp.

Better a small gain now than a large loss later.

– But, but, but, mortgage rates are so low in HK !!!! Great time to buy !!!!

/Sarcasm off.

1) HK will divorce the US dollar and be pegged to Yuan.

2) HK RE price collapse will hurt Chineses + HK banks.

3) HSBC @ $24.61 is testing the 2009(L). Its a waterfall collapse that will

breach the previous low.

4) HK RE supply is high, but demand is low. Prices will find equilibrium at much lower levels, in deflated RMB, few years from now.

5) HK is the canary in the coal mine of many high end crowded metropolitan cities.

6) Covid-19 accelerate this trend. Its too risky to live inside a big city.

7) Their middle class is dwindling, leaving behind few elite dots and the rest on gov support/ salaries.

8) Their “leaders” will enforce strict discipline to fight renegades and

crime.

9) HK used to be an opium bridgehead, is constantly changing its

character and its behavior. From port & mfg ctr, to RE, finance & service to Shenzen, Macau & HK metropolitan city. There will be nothing unique about HK.

10) HK is no longer a dissected part of China.

I believe the number one economic grievance of the Hong Kong protesters/rioters is high housing/real estate costs. Why aren’t they out in the streets celebrating the collapse in real estate prices?

Before speculation became the norm…

Properties and houses were valued at how rundown houses actually depreciated.

Iamafan,

I am glad that doesn’t happen here in the U.S.

1) AMZN reached a bubble peak on Apr 16 @ 2,261.

2) US opening will prick AMZN bubble.

3) AMZN might fall on the cloud flatbed.

4) MSFT peaked on Apr 17, but today MSFT is big red supply bar. Today, Bill Gates can accumulate the whole energy sector, but not tomorrow.

5) Zul FB butt head with the cloud, breaking his neck.

6) QQQ is gliding on a cloud cliff.

7) If the wind is friendly it might circulate above the cloud flatbed like an eagle, building a cause for few weeks.

Or, in a downdraft dive to close the Apr 3/ 6 gap.

8) The Nasdaq100 lower high on Apr 17 might be the last high investors will see for several years.

9) Apr 2020 might be the month that the markdown started.

> 5) Zul FB butt head with the cloud, breaking his neck.

Wat.

I think many people should realize that these expensive flats or condos are mainly bought for speculative purposes. Many time, their owners don’t live in them or don’t even bother to have a real tenant (who has some rights).

A lot of them are vacant and don’t even bother with AirBnB.

Many of the new buildings are even sold by floor to rich folks who can afford multiple units.

This can’t be called “housing”.

They use a thing called a buy-to-hold mortage, in London it is common to see blocks of appartments with very few lights on at night…

Absolutely. Net rental yields in central London luxury flats are around 2%, possibly around 1% depending on wear and tear (they are pretty shoddily constructed) and void periods. What is the point of renting it? If you take it off the market, local rents go up (backstopped by govt in-work housing benefit), and the capitalised value of those increases at ultra low interest rates makes you at least 2% a year anyway.

Same light at night test can be used in almost any Asian metro city.

Somehow they are encouraged by their gov’ts.

Well this just caught my attention, Sorry for the quotes.

“https://www.bloomberg.com/news/articles/2020-04-21/well-heeled-mortgage-borrowers-face-cold-shoulder-from-lenders”

The wealthiest, most-reliable mortgage borrowers in the U.S. are hearing an unfamiliar word from lenders: No.

So the carnage ain’t just overseas. Now who said Cash was Trash?

Yes, I covered that right here in detail and charts on Apr 12:

https://wolfstreet.com/2020/04/12/going-to-be-tougher-for-lots-of-people-to-even-get-a-mortgage/

Maybe not so reliable?

The 60 year old is five years from retirement and owes $700K on a mortgage on a likely not-that-impressive house that will tumble in value over the next several years.

Guess he won’t be retiring after all.

Why would someone go so deeply into debt with retirement staring them in the face? It is financial suicide.

So far in my ‘burg there is no discounting of any significance. I saw one house listed for $897 which reduced the asking price all the way down to….wait for it….$892K. I chuckled. I realize they did that just to get on the “price reduced” searches. But still it’s kind of funny.

I know a couple looking for property with the intention to build. They made an offer last week, 10% below asking. Offer was straight up turned down, seller didn’t even counter.

All those mythical 50% off fire sales everyone is dreaming of, don’t exist in reality. And why would they? The govt has signalled they will do endless bailouts. Sellers know there is a never ending stream of money available and there is no reason to sell cheap.

Just wait for few months to a year. This charade can’t continue for ever. I still vividly remember 2008-2009. May be this time is really different :-)

This Covid19 created a perfect storm. No worse time than this to hit the economy

One thing different this time is Congress has backstopped ALL(?) mortgage holders with the 12 month no-penalty forbearance. In 08 HAMP and other case-by-case programs were largely ineffective.

To the best of my knowledge the CARES Act extends forbearance to mortgages backed by the Federal government, meaning insured by the FHA, VA, DA etc for up to 180 days. This may be then extended for an extra 180 days, but only on particular cases. Federally-insured landlords (5 or more units) can request forbearance up to 30 days , and can then apply for up to two extra 30 days extensions.

Sounds great isn’t it?

However one here needs to remember only slightly over half the mortgages in the US are insured by the Federal government. All the others are not covered by the CARES Act so there’s no government-guaranteed forbearance for these folks: they can only work with their creditors and hope for the best.

There’s another problem here. Everybody seems to be 100% sure the lump sum owed at the end of the forbearance period will be simply forgiven. It won’t be.

It’s very likely there will be additional assistance offered, most likely under several different plans but not debt forgiveness, too much of a hot political potato. This is a crisis that will blow off in 4-5 months.

Jon,

Yes it is different. Everyone who wants it, gets a 12 month pause on mortgage payments via forbearance. And let’s be real, nobody will ever pay back those 12 months. In a year from now, who knows? But for the foreseeable future there will be no foreclosures or fire sales, and hence no price decreases.

During last GFC it took 3 plus years for housing to hit bottom

I’d say let’s wait for a year atleast

A 12 month pause on payments won’t prevent a price decline.

Banks and other lenders will be unwilling to lend in an environment where anyone can just stop paying for a year. Mortgages will dry up or be severely restricted.

Sellers will have to sell for cash or highly restricted mortgage prices… at a massive discount.

Or they’ll have to hold for 5 or 10 years and pray the market comes back.

The ones who are broke — otherwise known as Typical Overconsuming Americans With No Savings — will have to short-sell or foreclose.

It is early yet, and a lot of would-be sellers have opted to sit out of the market during the crisis.

Wait another couple of months as layoffs pile up, unemployment soars, mortgage requirements tighten and a flood of held-back properties hit the market.

Add in a massively shrunken buyer pool with severely-curtailed buying power and things start to look rather different.

How many buyers in six months will have $190K in cold hard cash as a down payment and closing costs for the “reduced” $890K property?

A lot fewer than the 5% down world of pre-COVID.

How many will have their lender decide to walk away or demand a significant cut in the sale price of the property in a declining market? Lots and lots.

Stick together a dearth of buyers, a glut of property, a host of restrictions on buyers from banks, and a constant steady stream of foreclosures from laid-off households, and LOOK OUT BELOW!

The crashing train does not stop immediately. At present it has one bogey off one rail and is starting to wobble and make a wee bit of noise. It still has a lot of chronological distance, measured in months, or a year or two, to travel. Then we will look back at it and say, “that was quite a train wreck.” But not for quite some time yet.

Four people died of coronavirus in Hong Kong. China closed its borders. Months earlier pro-democracy riots tipped Hong Kong towards recession. A few years ago Hong Kong was in a property buying frenzy. The excitement has abated.

Having rented my entire life in San Francisco and given up hope of every buying anything decades ago, I laugh at the economic, not human, costs of this “crisis.”

Chinese buyers scooped up everything for sale starting fifty years ago, slapped up gates on the stoops and turned their back on everything but their family, raising rents to ridiculous levels, if they even rented to a round eye. Then came the Yuppies, buying up what was left and further driving up rents. Next AirBnB pushed remaining rents to the stratosphere by removing rentals from the market.

All of them are now trying to get the same high rents as last January. I gleefully chortle as I watch the double digit days that listings remain on Craigslist. Can’t wait for the foreclosures, rent plunges and gnashing of landlord teeth.

Yes, I am in a rent controlled studio apartment.

A reliable way to buy real estate is to value it at 10X grosss rent.

Basically you get your money back in 10 years.That formula has

not worked for a while in most cities but still does in flyover country.

If you presented that to a bank good chance you get your loan.

Gold is pretty but useless, Fiat depreciates faster than a

heartbeat after you know.Don’t let this event deter you from

homestead ownership,

A great irony is that homestead prices have been depressed and operating at 20-30 years lows. I moved from ChiRaq to ten acres and my property tax alone is 1/10th of a condo box. Quality of life is 10x greater.

We are entering a Reset and no one knows for certain how things will look on the other side. But being away from cities and being more self-sufficient is about the only guaranteed `investment’ I would recommend right now.

A lot of players just got roasted alive by buying dips in the oil market. More to come unfortunately.

Gold is pretty but useless? That is the most absurd statement I’ve read in awhile It sure is NOT useless It preserves your wealth and has done so for thousands of years Can’t call that useless And good luck finding rental property to buy at 10x rent roll That ain’t gonna happen in my world anyway

The “gold is magical” thing is one of the more interesting postmodern religions. Its adherents have been skinned alive for decades, but are convinced that the Great Judgment is ahead and they will be vindicated.

Gold is just an element. It has no magical store of value properties any more so than any other commodity.

In my old city it was 8 years gross rent equals house price. Over 20 years it went to 18. Now stable.

HongKongers are not subject to the same capital restrictions as mainlanders. This is in response to a question @Boomer brought up. Can’t seem to “reply” to comments that are nested a couple levels deep today.

I moved to Hong Kong a couple years ago for work. There is free capital movement and the currency board management of the Hong Kong dollar in a tight range against the US dollar really helps with predictability. Also makes the Hong Kong exchange a draw as a listing venue for mainland companies.

Are some HongKongers looking to move due to the events of the past year? Yes, and that’s been covered a fair bit in the South China Morning Post. However, bear in mind these folks have had to do some strategic residency planning for decades (in view of the 1997 handover), so many of means already have a second residency or foreign passport. They may continue to operate businesses in and live at least part of the year in Hong Kong.

If ever there were a generational gap in property ownership, together with holding power from years of capital appreciation, you’d find it in Hong Kong. There are younger white collar professional couples who struggle to cough up a downpayment, not unlike what others have written here on Wolf Street in terms of Bay Area housing. And then there are folks like one nice older dude I nearly rented from two years back. A retired engineer formerly with the local subway system (MTR). Owns… wait for it… 20 rental properties :) He started accumulating in the 80s…

Bingo, it’s funny if you talk to some of those old timers they will tell you real estate is the key to wealth because it has worked out so well for them and pretty much most of Boomer generation. The moment you mention the fact that white collar workers now can’t afford a decent place without being in debt forever or spending over 50% income just on a mortgage to get a place to raise their family (with the exception of maybe mom and dad help with a giant down payment), they just look at you and tell you to work harder and fail to grasp the financial system failure that benefit them so much and leave the future generation holding the bag. The disconnect is unreal, these are the same people that will also argue with you to no end about how stock market is so much riskier than housing, completely fail to understand housing market have the same level of risk but lower return over time.

Kyle Bass had a good blog about Hong Kong at Zero Hedge 2 days ago. According to his numbers, the city/state of HK will be bankrupt before the end of the year. Read it.

Yes, that was a great article. One has to realize that the CCP and their corrupt minions should not be allowed to partake in civilized society. Period.

They need to be quarantined or dissolved as their corruption and ineptness have now infected the world via not only their immoral behaviour but their CCP virus.

NewGuy,can you please post the link .

Sorry Ravi,,I looked but can’t find it now.

Yeah, Kyle Bass and Zerohedge, two impeccable sources of Truth.

That will also be the case for many cities and states in the US. Check them out!

Oh yea,,,and they will all expect a federal bailout. Haha. I think this is the day of reckoning for a lot of muni pensions unfortunately.

Interesting – is there an article, chart, or heat-map? I love those things.

Don’t states need to be bailed out by proxy since it can’t be done by direct transfer?

States’ rights include the right to make a complete hash of their fiscal position. Apparently there is no concomitant States’ Responsibility to fix it.

C

Illinois’ and it’s subdivisions claiming virus caused their pension and budget crisis, which was actually 40 years in the making.

All they need is a phone call by jailbird x-governor stating “this virus is golden!”.

The broke states in the USA are also the productive ones who provide most of the key economic output.

They are broke because the “low tax red states” are welfare queens.

Illinois pays an enormously large amount more to the feds than it receives in federal spending– between $12 billion and $20 billion a year. Welfare recipients like neighboring Indiana get far more back than they pay.

So the Illinois resident has to pay not only for himself but also for Indiana, Florida and other welfare queen states. And the insult gets added to injury when DC hands Illinois taxpayer dollars to Indiana to build new train lines into Chicago and entice more people to leave.

Of course, when it all comes apart, the red states will be crying in their beer. Without New England, NY, NJ, IL, CA and WA to pay the bills, the federal money spigot for largesse in FL, AL, MS, SC, etc. gets turned off.

C-pointer-no different than the Founder’s not forseeing that ‘A bill of Responsibilities’ next to the Bill of Rights might have been a good add to the Constitution regarding our population and its ethics in general. (Of course, the long-term decline of long-term teaching of Civics in our education system, once our nation was no longer a shiny and hopeful new kid on the world block, hasn’t helped).

May we all find a better day.

I love the fire in that man’s belly, but you gotta admit his calls are a mixed bag.

He was right about gold, and earlier about housing (Michael Lewis had a chapter about Bass in _The Big Short_ and cut it at the last minute.

Still, I’d vote Bass for president. The guy’s head is in the right place.

Great comments, as always. Would be helpful to know which commenter is a realtor as there are quite a few here, based on comments.

Sorry, but grossly overvalued property based on bubbles in r/e and debt need to be burst. Otherwise their contagion spreads.

Let alone the impact they have on the average young person looking to buy a home.

A good blowoff of 50% would help the moral order.

One of them is Thomas Stone who just commented.

Looks like Pro-Establishment is one too

Wolf,

Some of my biggest frustrations is listening to economists who really have no clue what they are saying. I think it is on purpose so that they can be published.

It becomes everyone’s fault for their own debt as they never include inflation of currency constantly to crush your purchasing power as prices increase. Also, every excuse to add another tax or fee into the government coffers.

Adding laws that make it impossible for you to make an item and yet they import them through other countries that don’t have these laws.

I’m amazed at the number of commenters here that consider “homes” as just another “asset” to plunder!

Owned and sold three homes over my lifetime of being single/married/large family now grown and never once considered that sale a “sale of an asset”. Yes, the “profit” if any did have huge consideration regarding what I would subsequently buy or where to buy especially the last.

Our home was always considered just that….a “home” for ourselves and our children (7).

Focusing so much on “asset value” kind of restricts your choices when maybe finding another area of the country (or the world) to live in.

If you are an investor then that’s a different ball game.

My opinion of what is going to occur in our immediate and medium term future is that there will certainly be a fairly good deflation of home prices even in the most sought after areas like the Greater Bay Area…..then just a long “flat line” of price adjustments.

For those who have families, make your home, really “your home”.

Too much “home sales and flight” destroys the commons.

That is not what we need. Especially now.

Thank you for saying this and I agree but sadly the mentality with most Hong Kongers don’t feed into this mindset. Most of them see housing as some kind of sure fire investment opportunity even if they only own one single unit. RE has become a perception game especially for people that are not paying close attention to how the bigger financial system works. Over the last 2 decades this narrative has shifted towards mainstream in the US as well. Compare how people see RE back in the 60s and 70s to now, you’ll see a stark contrast of seeing a house as a necessity back then more than you’ll see now.

My home is my castle. And vice versa.

I just come here for the play-by-play on the end game and to make snarky comments about how the rich are destroying civilization because they just can’t help themselves. They get plenty of help from people who don’t know any better.

People take everything for granted. The pandemic is merely the latest example, but there will be a few more.

Announcement today from Fannie/Freddie. They will start buying loans in forbearance, from lenders. Which means, the payments missed will never have to be paid back. No way a govt agency will make anyone pay those back, it would look horrible making poor Mr. And Mrs. HardWorking American Homeowner have to pay thousands of dollars in back payments. And how much you wanna bet te 3 month plans will be extended to 6 then 9 then 12 then 24 months?

If you’re renting right now, you might as well stop paying rent, because chances are pretty good your landlord stopped already.

Just Some Random Guy

OK, Wait a minute.

Fannie and Freddie always buy mortgages. That’s their business. And then they turn those into MBS. When those mortgages default, they go through the steps that eventually lead to a foreclosure. That’s just routine. That’s part of their business model.

If the homeowner doesn’t stick to the forbearance agreement, and doesn’t make the payments afterwards, it’s a default. And it’s treated like a default.

What’s new here is a reversal of a prior decision to give a helping hand to the shadow banks so that they won’t collapse.

It’s just a reversal of a decision announced recently. Fannie and Freddie recently announced that they would NO LONGER buy mortgages in forbearance, which caused an uproar among the shadow banks which faced a liquidity crisis as they could no longer sell those mortgages that they had planned on selling. So this announcement would reverse the prior decision and go back to where it had been before.

So this has no impact how defaults on mortgages in forbearance are treated.

But I agree with you that this forbearance issue will be – and already is – a HUGE mess all around because trillions of $ of MBS are backed by these mortgages, and suddenly there are no pass-through principal payments and no interest payments, and the whole thing is up in the air.

Not to mention that new mortgages will be scarce, expensive and with high down payments in a world filled with “forbearance.”

That will send housing prices into the gutter, fast.

China has always used vast amounts of money printing to support it’s economy with much of that going into real estate bubbles across the country, HK and beyond. For example, by 2013 China’s excess money supply totaled 110 trillion yuan or 17 plus trillion dollars. As of 2020, the People Bank of China’s current money supply stands at a staggering 208 trillion yuan or 29 trillion dollars. Where is all this money going and what is it doing to inflation?

“In the past 30 years,” explained a government economist, Wu Xiaoling, in 2011, “we have used excessive money supply to rapidly advance our economy.” At the end of 2013, the excess of money supply totaled 110.65 trillion yuan ($17.77 trillion), four times more than 10 years earlier – a clear sign that the government is printing money faster than the economy is expanding.

I was in Hong Kong for three weeks at the beginning of this year. Stayed in a four star hotel for $48 a night. It is one of the world’s great cities, maybe the greatest of them all – I haven’t been to Singapore yet.

When a home stopped being the place to raise a family in a community, and became an “investment” societies began to implode. Everyone has lost their senses.