Trading of Luckin shares now halted. Wall Street banks, which get big-fat fees, are all too happy to sell this stuff to the American public.

By Wolf Richter for WOLF STREET.

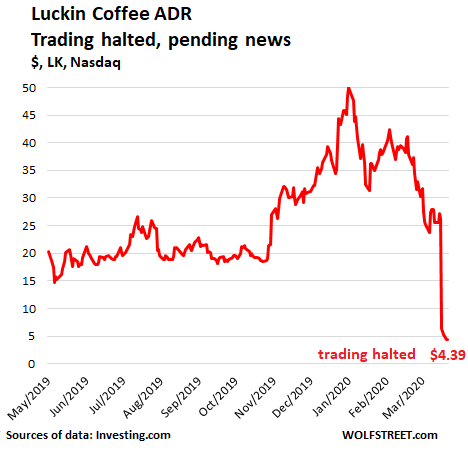

Luckin Coffee is a Chinese coffee chain, founded in 2017, that had sold American Depositary Shares (ADS) to the US public in an IPO in May 2019, thereby extracting $561 million from US investors. Each of those ADS represents eight actual shares. At the peak, on January 17, the market capitalization of the Luckin American Depositary Receipt (ADR) exceeded $12.6 billion. Then it went downhill, and last week, the price collapsed entirely, and this week, on Monday, shares fell another 18%, having now collapsed 91% from the peak in January. And this morning, trading was halted, pending news (update: as 5:45 p.m. Eastern Time, there is still no discernible news, and trading remains halted):

The big 82% single-day plunge was on April 2 when the company finally admitted that it had fabricated $310 million (RMB2.2 billion) in revenues for 2019, thereby inflating its revenues to a fake $732 million. It said that “beginning in the second quarter of 2019, Mr. Jian Liu, the chief operating officer and a director of the Company, and several employees reporting to him, had engaged in certain misconduct, including fabricating certain transactions.” Of course, Q2 2019 was the period of the IPO, and it was important to pump up the share price.

Allegations of revenue fakery had been floating around since February, and the shares [LK] had taken a beating already, though Luckin had denied those allegations vehemently until last week.

Yesterday, the Luckin ADS collapsed further, even as the rest of the market soared, after Goldman Sachs told clients in a note, reported by Reuters, that the company’s Chairman Charles Zhengyao Lu and CEO Jenny Zhiya Qian had surrendered their shares – the actual shares, not the ADS – to a group of lenders, including Goldman Sachs, after another entity controlled by Lu’s family had defaulted on a $518 million margin loan issued by that group of lenders.

Goldman, which is acting as a “disposal agent,” is now proposing a sale of at least some of those shares. The $518 million margin loan was secured by 515.4 million class B shares and 95.5 million class A shares of Luckin. This includes shares pledged by the family trust of Qian. According to the note, the class B shares would be converted into ADSs and sold as such.

In terms of votes, Goldman said that if the share sale goes through, Chairman Lu’s voting interest in Luckin would not decrease, while CEO Qian’s beneficial and voting interests would fall significantly, though Goldman did not quantify it further.

And there is a sideshow here: Chairman Lu is also the largest holder of Chinese car service provider Ucar, with a 10% stake. Trading in Ucar shares, which are listed China’s New Third Board equity market, were halted on Monday. The company said they would resume trading no later than May 6. This followed the revelation that the National Equities Exchange and Quotations (NEEQ), which operates the New Third Board, had asked Ucar to explain the impact on Ucar of the fraud probe at Luckin.

OK, a Chinese company lists on a US stock exchange and via the IPO extracts hundreds of millions of dollars from US investors, including institutional investors befuddled with Chinese miracle companies, and then, it fakes its revenues. Short-sellers start sniffing around and make announcements, which the company vehemently denies. Shares head lower. And when it finally has to admit to the fakery, shares collapse.

This is like the oldest game on Wall Street. And Wall Street investment banks that underwrite the IPO don’t really care because they already extracted their fees. Now some Wall Street lenders are stuck with a loan that is backed by collapsed shares as collateral. And our thoughts go out to them.

Mid-2019, the White House floated the idea that it might ban Chinese companies from listing their shares in the US. Due to the US-China trade disputes that at the time were making – quaintly it now seems – the headlines, IPOs in the US by Chinese companies had already slowed down. Last year, 25 Chinese companies listed their shares in the US, extracting $3.5 billion. One of them was Luckin. This was down from 35 deals for $9 billion in 2018. But as long as US investors gobble up this stuff, Wall Street and Chinese companies are going to happily feed it to them.

Here is another shining Chinese company traded in Hong Kong. Despite my assurances that “Nothing Goes to Heck in a Straight Line,” it did. Read... Chinese Stock Collapses 98% in Hours After MSCI Flip-Flops: How Index Providers Saddle US Pension Funds with Stock Scams

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But they’re fraudulent, right? Cooked the books?

Precisely.

It was a Ponzi scheme. An addition to your story, Wolf, is that Lukin not only IPO’d to take money from greedy westerners. But they also did a SECONDARY round in December.

This was a pump & dump scheme where the original Chinese investors offloaded their shares to “evil Western capitalists” and probably would have gotten away with it if not for the Coronavirus outbreak resulting in the cash crunch that imploded the whole Ponzi scheme.

All I can say is if you’re a Westerner trying to invest in china you are a mark.

The Chinese have learnt from their US teachers how to defraud investors from their money, turning the table. So far it has been the other way around, Europepan and Asians losing billions in the US markets.

A

You are correct.

The vast VAST majority of Westerners do not understand thousands of years of Chinese business customs: Chinese consider it honorable to outfox their opponents in business.

Westerners consider many of these log-standing practices to be fraud.

Westerners doing business in China expecting they are playing by western customs & rules are simple dupes and easy victims.

Don’t think the US market is unique. The AIM & main markets in the UK were plagued by Chinese & Indian IPOs which nearly all ended badly. Several were taken private for a fraction of the asset value, other went bust…..e.g. Naibu. The lesson – do not touch them with a barge pole, they are mostly scams.

Well luckin shops are open in china now and selling coffee,tea and what ever else they sell. Now that the fraud is out & the culprits are caught & out the stores just keep on selling their products, eventually the company can make money and come out of the hole with proper accounting

Amen. This company was just the tip of an iceberg of corrupt, legally insolvent, Chinese communist controlled companies.

The amazing thing is that the US financial markets are providing a life line to the debt ridden, corrupt Chinese communist controlled companies in China, which have been used in the past and will be used in future to make weapons against us or our allies in the future. We used to have the common sense not to help the companies of and thereby arm the Soviets.

This administration has correctly pointed out the danger posed by China’s tyrannical commies, which is why I am not so enthusiastic about another candidate now, after discovering his weak positions as to the Chinese communists. However, while it is correct as to the danger, it has foolishly not taken the clear action required against the Chinese communists: ban the Chinese companies from accessing US capital unless there is extensive opening and auditing of their books.

I suppose that so many US companies now have Enron-style accounting that this administration may be afraid to start a trend. US companies have so much dirty laundry that will now come out into public knowledge absent massive bailouts that it is dangerous for those who are allied to and supported by the guilty rich in America to start such a trend.

Wall Street banksters are pushers, not only of Chinese companies.

Recently you wrote on weed companies that lost 70-90 % and I can remember plenty baloney companies in The dot-com bubble.

It’s worse than that, according to Chinese law, foreigners aren’t allowed to own any shares of these companies to begin with. What they actually sell you on US stock market for Chinese companies is always a some ridiculous hodgepodge thing saying you get a share of their profits, it can even involve shell companies, but even this is actually against Chinese law. According to the CCP’s laws, you don’t own anything.

Also, all of them lie about their financials.

Thomas Roberts informed us:

> According to the CCP’s laws,

> you don’t own anything.

> Also, all of them lie about their financials.

Interesting, thanks for the info.

Investing in North Korea, Cuba,

Argentina, and/or Venezuela

is probably a bad idea too.

This is why I have never invested in a Chinese company and never will. Many other markets out there to choose from.

The most major financial news websites skirt around it, though they do make vague references to the question of validity of foreigners owning Chinese shares. Here’s one example from a midsize website.

At any time your shares could be ripped from you.

https://thediplomat.com/2014/09/no-one-who-bought-alibaba-stock-actually-owns-alibaba/

Well, not quite. We know Yahoo owned a bunch of original shares, as did Softbank. They were both early investors before the Alibaba went public.

The laws in China are unclear. But, they are heavily against foreigners, especially for ownership of things in China, and foreigners would automatically lose in court in China for certain things, like this and anything involving ownership or money. This is on top of CCP’s willingness to change laws at their wim. China is one of those countries where laws are often not concrete and are interpreted and changed by any official presiding over the matter, unless someone higher up overrules them. But, it can also be random at any time. Add in the anti foreigner sentiments that pop up in cyclical time periods and alot of corruption.

Under these circumstances, these Chinese IPO’s shouldn’t be allowed in non Chinese stock markets.

lol, you don’t own anything either without the government saying so. Amazing people still don’t get that. At least China is honest on how that works. So yeah, I bet some Chinese do think they “own” it.

China isn’t honest about it.

Huh? Yes you do. Your shares in a listed company are a portion of ownership?

Then the Securities and Exchange Commission, by allowing them on the stock market, seems to be an accomplice …? No?

cb

You are absolutely correct.

It’s one thing to make a mistake, it’s another thing to promulgate the same damn mistake for years.

Chinese law is irrelevant in America.

It should be according to American Law — if not in compliance with American law it should not be listed. If not incorporated and do not have headquarters in America should not be listed.

Thomas Roberts

You are partially right about this.

Foreign investors are not allowed to invest in Companies in some key areas like high-tech, agribusiness, telecom, finance etc. according to Chinese Law (there is a list of restricted sectors but generally the restriction has been loosen up recently).

Those Chinese companies get listed through VIE structure to overcome the restriction. Basically, western investors do own the shares of the Listco, the tricky part is the Listco only controls the entity which conducts the actual business in China through a set of contracts (VIE structure).

So, in a word, yes you do own the shares but not the shares of the company what you think is.

At all times though, it’s at the wims of the CCP, which doesn’t respect foreign governments, foreign property ownership, foreign intellectual property, or even the property of lower class and working class Chinese.

Considering what you actually own, is part of some ridiculous agreement, it’s not worth touching.

Just like all ridiculous investments that can be easily bought and sold, it’s possible to make a lot of money before it crashes.

But Alibaba is fine. Am I right.

Maybe you are right

Here in Qingdao I saw Luckin locations popping up everywhere. I read that they wanted to beat Starbucks. I am retired and spend a lot of time walking around. I questioned the rate that they were opening locations. Too many too soon. And the sites they chose were questionable, IMHO. I drink a lot of coffee and I didn’t think a lot of those stores would get much business. They didn’t have the foot traffic or the convenience to do well.

Are they wholly owned or franchise? Or franchise owned by those who control the company?

I think they are company owned locations. They operate off a phone app for order and payment. That way they company can try to sell them other products or sell their information. That’s the idea, anyway. Doesn’t seem to be working. Too many other people with coffeehouses that have no gimmicks.

The personal lines of credit that they could personally take out on their shares from private lenders may also have been in play.

Many under the table deals…

Many Trojan/Sino Horses inside the USA.

We are being out played by the Dictatorship.

Death by a Thousand Cuts.

Why doesn’t GS have any fiduciary responsibilities and consequences?

Audits? Skin the game? Reporting of fraud and GAAP violations?

Hello SEC? Perp walks do wonders.

“Goldman, which is acting as a “disposal agent,”

Consequences of reducing gubmint regulation, tax cuts and underfunding regulators, removal of regulations on self-dealing by bureaucrats. Basically 40 years of Reaganism.

And yet the government has done nothing but grow in size and scope and take more resources for the last 40 years by all metrics.

More government bureaucrats.

More tax revenue.

More spending.

More debt.

More government programs.

Government takes a higher percentage of GDP than anytime since WWII.

Where does it all go?

And as a FYI.

1980 percentage of defense spending – 6% GDP

2018 percentage of defense spending – 3% GDP

2banana,

The budget of the DOD is only part of defense spending. So now add the VA, plus the portion of the DOE that houses the nuclear weapons program, plus portions of the Dept of Homeland Security that houses the Coast Guard and a number of intelligence agencies, plus the undisclosed budgets of the NSA and the CIA, plus, plus, plus… The end result is quite a bit larger than what you think.

During the Iraq war they said that probably half the DOD budget was black contracts.

It was Clinton who did away with Glass Steagall happily supported by both parties and their bankers.

Regulations don’t deter criminal activity for the most part, good auditing should. And as always caveat emptor with IPOs.

Well if you over turn the regulation the activity is no longer criminal and deterrence is zero.

It have NOTHING to do with reduction of government regulations it has EVERYTHING to do with regulation not being enforced OR the regulations are complete crap. Have more in NOT necessarily better. The regulations need TEETH or they need to be rewritten to be effective.

Kent

You’re claiming So you’re claiming “…removal of regulations on self-dealing by bureaucrats…”:

o What regulations have been removed?

o What regulators have been caught self-dealing?

NOTE: Congressmen & Senators ARE NOT REGULATORS. I absolutely agree some of them are engaging in insider trading.

Consequences of reducing gubmint regulation, tax cuts and underfunding regulators,

IPO underwriters do have some statutory and regulatory responsibilities, but without looking up the caselaw it is hard to tell how well enforced those are in practice.

My guess is that the underwriters will definitely get sued but we’ve seen this all before (and not that long ago – there was a wave of Chinese IPO fraud in 2009 – 2012).

Besides very careful individual due diligence by potential investors, broad diversification is still the great safeguard.

Ironically, though, the very risk reduction that indexing/diversification makes possible can also lead to a slacking off in due diligence…encouraging these kinds of frauds.

It is impossible to do due diligence with fraudulent numbers.

Which is why these numbers are audited and certified for American companies.

But a foriegn company can just publish outright fraud and there are no repercussions for the American agent who takes a cut of every stock sale?

Actually, I’m fairly sure that a foreign company offering ADS/ADRs into the American market has to have an American accounting firm certify their financials (but you have to read the Accountants’ Opinion to see if there is weasel room on the numbers – that is part of due diligence).

It is also due diligence to evaluate the reputation of the accounting firm – in the earlier crap IPO wave from China, many obscure US accounting firms were used – knowing that is due diligence too.

None of this excuses sh*try underwriters or accountants – but they are very useful tools for avoiding problems in the first place…which if used, help avoid a multi-year fight to claw back a fraction of your invt.

Ditto with diversification – sinking a large fraction of your savings into *any* single stock is unwise…and has been widely known as such for quite awhile.

After a couple of busts, you could also make an argument that almost every underwriter (GS included) is pretty much good for nothing.

And yet institutional investors keep buying in reliance on their long-tattered reputations.

2banana

My response to you assumes your term “foreign companies” refers to “American Depository Receipts” (ADRs). ADRs ARE NOT SHARES, even though the casual observer could certainly easily make that incorrect assumption. When you buy an ADR, YOU DO NOT ACTUALLY OWN THE STOCK OF A FOREIGN COMPANY (you own the American Depository receipt).

The SEC regulates 3 classes of ADRs:

o Level 1 & 2 ADRs: allow selling of ADRs, but no new capital raising – THESE LEVELS DO NOT HAVE THE AUDIT & REPORTING REQUIREMENTS THAT ALL PUBLIC DOMESTIC FIRMS ARE REQUIRED TO MEET.

o Level 3 ADRs: allow selling of ADRs and raising of capital – THIS LEVEL HAS MUCH HIGHER FINANCIAL REPORTING REQUIREMENTS, BUT STILL NOT AS HIGH AS THAT IMPOSED ON DOMESTIC FIRMS.

The buyer of an ADR has a much higher personal responsibility to perform due diligence on the foreign firm in its “home” environment.

There is absolutely is no doubt Chinese companies have seriously gamed LEVEL 1 & 2 ADRs; you are undoubtedly correct that some of this abuse is ought right fraud.

Muddy Waters nailed them, and got the usual hate for it. They do take a position and make money on their shorts.

The other guys make money on fees for flogging this stuff. Pick your side

Elliott Spitzer conducted a few perp walks. Would have liked to see him do a lot more. Instead he ended up in jail for dealing with ladies of the night.

Many a fraudster breathed a sigh of relief.

I kept wondering if Spitzer would ever slip the cuffs on Clown Cramer, just for being obnoxious, if nothing else.

GAAP? GAAP?

We don’t need no steenkin’ GAAP?

When was the last time an American company used true GAAP numbers?

Maybe this The Producers gambit. Set up a phony company, draw Goldman and US institutional investors into the IPO, then short your own company and extract the money from them?

Speaking of which: I see WeWork is suing SoftBank for pulling its offer.

Confession of a Wolf Street reader… I work for a Softbank funded company that just failed to get another round of funding. Watched them lay off nearly everyone a week and a half ago. It’s been a crazy ride. I still work here, and am not directly employed by them so I should survive job wise. Sea of empty desks. Kind of a bummer because the project was neat, but Softbank ran from investment right as the market tanked due to Covid.

Currently, the value of SoftBank’s corporate shares materially lag the value of their gargantuan portfolio investments. Said another way: the total value of all SoftBanks pre-IPO investments is 33% greater than the corporate value of SoftBank. That’s a HUGE gap.

A discount this large seriously concerns SoftBank investors (among them: Saudi Arabia’s Investment fund), and is hard evidence they lack confidence in SoftBank management, or at least management’s current practices.

This is the price investors pay for believing in voodoo venture capital. As SoftBank responds to investor concerns, changing SoftBank management practices will unfortunately and undoubtedly do damage to some of their pre-IPO companies.

Insufficient gall has never been WeWork’s problem.

Softbank would be pulling this kind of trick even if they have no chance of success.

WeWork is a death company with corona. They are the kind of company who’s client can do home office for a lot of what WeWork offers. And this even without the whole economy crashing, WeWork being a overpriced idea.

Our Dear Leader Wolf has always used Regus as a counter example to Weworks. I wonder how they are going to weather this Covid-19 lockdown. Only one man I know out there can tell me, and that’s Dear Leader Wolf. :)

I have always puzzled as to why the fastest growing countries have typically produced sub-par equity returns in their indexes, compared to their GDP. 10 years ago, I put a good chunk of my money in VWO thinking that if a lot of these countries were growing at up to 8-10%, it would blow away VTI, but my net return after inflation has been about zero. Think about that. After 10 years in the hottest countries, and I would have been better off buying treasuries or stuffing money in a suitcase.

I can’t help but think some of the “growth” was hype, such as Luckin, and some was related to currency risk, but I have learned that I am through buying individual stocks, predicting the future, and straying from my original asset allocation. Fortunately, I did not buy Luckin, but my friend did, citing their blistering growth rate, and how Chinese people were going to give up centuries of tea, for coffee, and Starbucks was toast. I jokingly told him in January that the CFO for Luckin was a Mr. Mee Fuk Yoo, and the growth numbers were made up, but we laughed, not realizing the numbers were indeed made up.

I am also going to try to tone down my opinions on this forum, since I have been humbled, not only by biology, but also economics.

Stay safe my friends.

There are currency variables to consider.

The dollar v world currencies has been on a tear since about 2012.

If/when it reverses – emerging “fast growing” markets will look as amazing returns to an American investor.

Wendy,

I don’t think you are wrong about economics, only on how the game is played, and on that subject I will have to defer to our host . It is clearly above my pay grade.

Emerging markets, like China, have been good at growing revenues — but not profit. Many firms made losses for decades, and even now only eke out low-single-digit margins.

Yeah, but revenues are where the game is at. Without it, down sales go. That would trigger a massive correction that would threaten market economy as supply lines and diminished food capacity would begin.

R2D2

Unfortunately, governments in many developing countries are some combination of corrupt, totalitarian, socialist or communist. These bad actors have a habit of very efficiently sucking profits out of what appear to outsiders to be rapidly growing businesses.

Money is looted by sheer corruption and/or government policy (taxes).

Examples:

o Pemex in Mexico

o PDVSA in Venezuela

o Russia’s entire oil industry

o Nigerian oil industry

o Ukraine oil industry

o Cuban army owns/operates most large Cuban commercial enterprises

o Chinese army owns/operates large segments of Chinese commercial enterprise

In neoclassical economic theory, profits shouldn’t theoretically exist because competing businesses will compete for market share by lowering prices in response to each other until they marginally cannot cut price any further and revenue is effectively balanced with costs. However, there is this thing called intellectual property, which allows some companies to be quite profitable. China is known to abuse it quite heavily, and I assume Chinese firms probably cannibalize each other in this way as well. It would be expected that profits are razor thin. That also indicates to me that Chinese companies have yet to figure out how to lobby their government effectively.

There are many reasons why that is. But an important one is that the CEO/biggest owner is with those companies the same so they are running the company for success maximization, not profit. and they likely are skimming the profit to their own pockets. The really successfull companies are also still run by the founder so why sell if you have your own money printer.

I am a Vanguard flagship customer. I understand your pain. But I never believed even Boggles koolaid on ETFs or more exactly mutual funds.

Sunburns from dotcom to 2013 are enough to soften a man. Since I am retired and a stroke survivor, I cannot see how I have time to recoup anything, so even my Vanguard funds are in Treasuries. Since they don’t have auto rollover, I also have Treasury Direct and I find those very helpful for the family. Hope this helps.

>>I have learned that I am through buying individual stocks, predicting the future…<<

It's almost a rite of passage for an individual, self thinking, investor. What can hopefully save someone is to be diversified. Early on I invested in a small, conservative software company in the medical area. All of management passed the smell test. Then they announced that their sales were essentially imaginary.

LOLLOLOLOL…. Goldman Sachs ??

“And our thoughts go out to them.”

**snort**

“Thoughts and prayers” would have been even better…

Where have you gone, Arthur Andersen?

Now they just Accenture-ate the positive.

I’ll show myself out.

I was wondering myself which US accounting firm rubber-stamped the financials for the IPO. For a fee of course.

Just for fun, I went to my Fidelity Brokerage account and put in an

order for 1 share at market for LK.

A note said that ask was $4.39 and that the price could be higher or lower.

It also showed 4/6/20 close at $4.39.

Didn’t place the trade, but curious why I might have been able to do it?

Cheers

Wolf

With all the money the fed has printed and the BBB bonds they have bought, is it reasonable to just buy stocks? Certain stocks.

On a much smaller scale, us peons are getting scammed by Chinese merchants on Amazon.

A recent grocery item order of mine was reported lost in transit by an email written in non-ideomatic English, ostensibly by a female with a common American name. Profuse apologies were offered, along with a refund of the purchase price.

The items reappeared on Amazon at a price 40% higher by a “new” dealer.

If you buy from Amazon, make sure the seller is in USA.

Not practical – too many needed items are only available from China, these days.

Yeah, if it wasn’t, you wouldn’t be buying it. That is the point. Less sales, less consumerism, people start losing “faith”.

I don’t understand why folks turn to Amazon. Why not just buy direct from the manufacturer or retailer? Amazon is just a glorified app with jacked mark-up.

Here’s a nice story for you RD,

My new motorbike needed a rear stand to support it when adjusting the chain. I saw a nice looking one, for a good price on Amazon, but couldn’t tell what it was made of or where it was manufactured. I did look up the brand on the internet, and sent them an email to try and find out.

Fast response: “I’m Linda from Ruedamann Ramp. Our motorcycle stand is made of aluminum and are manufactured in China.”

Nope – don’t want aluminum or Chinese made. A nice USA made stand is $165 plus sales tax.

It took a few hours, but I made my own out of 1″ square steel tubing using my drill press, chop saw and TIG welder. Not quite a total victory though as the 3″ heavy duty castor wheels I got @ Home Depot are, you guessed it, “Made in China.” Oh well.

The bike is made in Italy. The stand in south Minneapolis.

Way to go, Dan.

Kudos to all you people that make stuff for yourselves.

Few actions deliver more satisfaction than using something you built a while back…and saying “ya know, I enjoyed building it, but I like using it even more”.

It’s a good groove to get back into.

How much was your drill press, chop saw, TIG welder, garage, and time worth? Trying to figure out if you really came out ahead on this one or not.

Good points Beck.

As I was winding down my bicycle racing in 1991 and 1992, I apprenticed under a steel frame custom builder to learn how to work with steel. So, I have a metal shop in my basement which is both a hobby, a way to make furniture and it was used when my dad and I ran an agricultural business.

All the equipment has been ready to use for decades, and I have plenty of steel on hand.

Out of pocket cost: $15 for wheels, $10 for stainless steel bolts, washers and nuts & $5 for a can of Rustoleum. It took about four hours.

I decided that it was a toss up to pay $180 for a US made stand or build my own. No way would I buy a Chinese made stand. But when the paint dried yesterday, I was proud to have done it myself. I saved $150; so I guess my time is worth $37.50 an hour.

Luckin lucked out…

Wouldn’t wanna be in their shoes. China executes employers and employees for mega fraud!

“China executes employers and employees who get caught for mega fraud!”

I fixed your statement.

Not before they harvest their organs.

Are these Chinese crooks going to get prosecuted for the fraud?

Would it not depend on if they are party members, or well-connect to local party bosses?

Add to the fact that their is a run on Luckin for a free coffee! So now they have increasing costs, whats that going to do to the earnings LOL

BEIJING / HONG KONG (Reuters) – Luckin Coffee’s app has rocketed to become the second most popular in China as consumers rushed to claim a free drink that it has long offered for downloading, worried the chain might collapse after it said much of its sales last year were fabricated.

Wolf

didn’t you write an article last year some time about how there were a number of IPO’s of chinese firms that were blocked by the Chinese regulator for similar fraud concerns?

I wrote about about Chinese companies listed in China blowing up due to fake cash and fake accounting, plus some other things like that. This is a real disease with Chinese companies. Here are some of the stories I could dig up quickly:

https://wolfstreet.com/2018/09/09/implosion-of-chinas-p2p-lending-boom-hits-consumer-spending/

https://wolfstreet.com/2018/08/20/how-china-struggles-to-contain-its-corporate-bond-morass/

https://wolfstreet.com/2019/07/29/spooked-by-fake-accounting-fake-cash-chinese-regulators-suddenly-halt-46-ipos-and-bond-offerings/

https://wolfstreet.com/2019/01/23/record-defaults-by-chinese-companies-fake-cash-fake-accounting/

https://wolfstreet.com/2018/12/27/chinas-startup-bubble-runs-aground/

And you still believe the stock market???

I guess they can fool you x times.

I think I’ll IPO my fortune cookie.

Anyone who believes a word coming from a Chinese govt official or Chinese business rep (who are usually one and the same) deserves to lose a lot of money.

Yes. What astounds me is that this keeps happening.

Same reason ponzi schemes still work.

The promise of massive gains and nobody ever thinks they’ll be the one holding the bags.

I dunno, my BABA shares were a solid double 2016- 2019.

There are a few examples, BABA among them, that everyone touts in order to sell dozens of other stocks that are frauds.

Im invested in luckin…did I just lose all my money??

Jimmy,

Probably not all. The shares will eventually trade again. Not sure about the price though.

Do you feel Luckin, punk?

I made a boatload shorting Lukin. You can go back and see me talking about it in the comments in January.

It started out as a short against the Coronavirus outbreak in China. But then a funny thing happened – despite lockdowns across the country their sales were unimpacted. Strange, almost like they sales were completely made up! So I followed the Muddy Waters report and stayed short until BOOM Thursday was a good day!!!

Good job! Did you cover your short before the trading halt today?

Yeah I played it short by buying June expiration put options. I sold the options to the next guy on Thursday when the stock price was in the $6s.

Guilty as charged. I received an email from The Motley Fool listing Lukn as a buy and I fell for it.

Well, they do use Fool in the title of their company, so you were warned about what kind of analysts they are.

I was able to place a market sell order via Robinhood app, but not sure what will follow… it is just sitting there…

1) The white gates house will start media furlough.

2) The media will operate at 30% – 50% capacity. They will be sucked into a vacuum from which they will never recover.

3) The invincible media cooked their brains with high debt, they are mouth piece swimming naked.

4) They hook us on their opioid killing drugs : junk food & news, alcohol, sport, and sex.

5) The sport networks sunk on us Michael Jordan slam dunks from the 80’s instead of live Messi.

6) ESPN have lost possession of the ball.

7) The media radiate and transmit hate.

8) They are radical nerds who came from broken places that no

longer exist.

9) Sending them away to the streets is against the law. Freedom of the press is more important than breaking the walls surrounding the white gates house.

10) Wuhan round II will solve their problems. Deep in debt they will go

BK, lose their power and be transferred to the strong hands.

Greed on both sides of the transaction? Say it ain’t so! A match made in heck- how romantic.

TAL and PDD may follow in the foot steps of LK.

Never bet against USA! This was a lesson I learned as a puppy from my elders.

All we here from the sell outs Ray Dalio likes of the world China is the future bet on China. I wonder if Hillary won and we were here today would she say bow to CHINA they are the leaders of tomorrow? Give them the run way..

Listen the biggest mistake we made was allowing the Renminbi into the IMF basket of currency allowing the CCP to extend credit from their credit to other nations throughout the globe allowing the path for modern day colonialism

I cant erase from my memory (you can youtube it) BTW Wolf miss your youtube videos I use to play them in my office on Mondays and people would give me that what the hell is he listening to now look? Now they are requesting enlightenment…

It was a Larry king interview regarding Nafta with the then presidential candidate Ross Perot and Vice president save the planet but ship jobs to china to poison the rivers Al Gore who claimed with a smirk non the less that we would gain even more employment and Ross is like no way no way so fast forward today rest is history

But c’mon folks I guess like the factory owners in China I dealt with years ago – we started a sourcing coming early 2000’s and my partner (who was from Hong Kong but a US citizen) the Chinese factory owners couldn’t buy the truth we were partners (I’m not Chinese) and we couldn’t get any of that crack credit and I said you know lets do what they do stop telling the truth and lie instead – tell them you are my translator and I’m a rich American and lets see what happens next… Well guess what we were extended crack credit! (staples button) “WOW that was easy”, what else can you get away with here? Child labor, prison labor sadly all offered over snake dinner made me sick but people don’t want to hear the truth they want to hear the lies and believe the man in the suit represents their best interests.

Never bet against USA!

So, the China People are good but the China CCP Group Bad – Wake Up

Exactly why I prefer real estate. I know … it is boaring and takes decades to build wealth. And, it is work. Too many chase IPOs where you can’t even verify cash flows and balance sheets as well as earnings growth prospects. Too many also chase established companies with big trailing PEs and terrible forward PEs. I refuse to increase my allocation to stocks until SP gets to 2K. Trailing PEs north of 20 are a total joke. Better off in real estate. As far as IPOs, just a game.

Socaljim

Thanks for that monologue. I have really never been able to explain the uneasiness and inexplicable vulnerability I have always felt when I pull the trigger on an individual stock trade. I too am about 85% in real estate. I agree, it is boring, plodding and relatively predictable, but it is tangible and you hold the keys to the front AND back door.

The world is full of fools and most fools tend to believe others being the greatest fool.

Someday…..in my dreams……the US planned economy will realize that having cosmetics, lawnmowers, jewelry, hankies, ties etc made in China is great. Technology, medical items, anything connected to our defense etc. should all be made in the USA.

Of course there was a time when the above stated paragraph would have been considered common sense. A generation of highly paid morons……the same ones that created our vulnerable economy has now run up a 26 trillion dollar debt and thinks it is all meaningless.

We will see how that turns out.

Fred: I’d love to agree entirely with your comment.

But then I remember that it took 350 million people buying Chinese production by the double-fistful every day for the last 20 years to create this glorious situation we’re in.

We have done this to ourselves. Each and every one of us is involved.

Sorry for the generalization, but there might be – maybe – 12 people in the U.S. who are not complicit.

:)

We reg’lr merkin turtles have an enormous stupid pill to .. um, “eject”.

And one really great way to get back into the saddle is to start making stuff for ourselves again. Build or buy, build or buy….

There is no actual legal system in the US when GS can peddle shares in a company that doesn’t own anything but is a promise to pay based on some foreign companies performance that can’t be tracked via any trustworthy accounting practices. GS KNOWS its a scam but those corrupt people just don’t care as long as they can line their pockets.

I’ll play the Devil’s Advocate here: Goldman Sachs, together with other lenders that include Credit Suisse, has seized over 75 million Luckin Coffee ADS which had been posted as collaterals of a $500+ million margin loan facility by Haode Investment, a major Luckin shareholder.

Instead of paying up Haode defaulted on the loan and the lenders seized part of the ADS that had been posted as collaterals.

Now Goldman Sachs and Credit Suisse are stuck with a big pile of ADS they could legally and technically sell but whose trade has been halted.

This is not a scam: the lenders got their collaterals and now are desperate to dump them as quickly as possible to cut their losses.

It’s absolutely normal in the world of bankruptcies: to give you an example there’s a famous auction house in Vienna called Dorotheum. They specialize in discreetly selling artworks coming from bankruptcies procedures all over Europe, chiefly stuff that was posted as collaterals and seized by creditors upon defaults.

Most creditors don’t care about owning a still life painting or shares in a Chinese coffee company: they just want the cash. That includes Goldman Sachs and Credit Suisse.

Rather than compare a Luckin ADS to artwork, would it be more accurate to compare them to forged artwork? And should Goldman, in the case of Luckin, be considered a dealer of artwork or a dealer of garbage?

A huge (and I am not exaggerating) part of the art and antique trade worldwide is composed of partial or even complete forgeries: I seem to recall every year more pieces of “Regency Era” furniture are sold worldwide than were manufactured in the 30 years Regency fashion lasted.

Expertises (certificates attesting a painting, a statue, a sword etc are really what they are purpoted to be) have long been looked upon with suspicion and lawsuits flying in all directions are the norm, not the exception.

So what’s the difference here? :-D

After attending an antiques auction, I fell into conversation with an elderly gent in a coffee shop.

At one point, I said “you seem to know a lot about antiques”

“I should do”, he replied – “I’ve made enough of ’em!”

He went on to tell me some of the tricks of his trade – absolutely eye-opening.

Lucking must have studied the Fed. They created sales out of thin air.

I thought I remembered something about LK:

https://www.cnbc.com/2019/09/11/your-first-trade-for-wednesday-september-11.html

I like listening to Guy and his calls are generally sound, but he bit the big one on LK.

The stock market in China is not the same thing as it is in the US. Only 10% of Chinese are in the market, and you can be sure that this is just their “casino money” They probably have no debt, 2 or more houses with no mortgage, and little or no debt. It’s strictly a long-shot gamble, not an investment.

Surely the point of this article is not that a Chinese co did it but that investors bought it. They’re not investors though, they’re gamblers. Win some, lose some – but mostly lose.

It’s hard enough “trusting” North American companies which have executives that are incented to push shares higher and higher by any means necessary (BAMN)! Why would you be foolish enough to entrust your money to foreign entities that you know are even worse?

Most stock manipulators and corporate chefs (Book Cookers) don’t go to jail in North America so don’t expect them to be punished in China. You can’t even get upset about it. You need a hard kick if you bought those ADRS. They are as fake as a Chinese Rolex!

Greed and Corruption don’t discriminate.

Tell me I’m wrong!

Nobody cares about Coffee in China, they care about Milk Tea.

Starbucks doing pretty well.