Bailouts, please!

By Nick Corbishley, for WOLF STREET:

Australia’s construction industry, which accounts for 13% of Australia’s GDP and one in ten jobs, is unsustainable and on the brink of collapse, according to Joe Barr, the CEO of John Holland, one of Australia’s biggest infrastructure firms and a wholly owned subsidiary of China Communications Construction Company (CCCC).

“I won’t sugar coat it,” he told The Australian Financial Review. “Tier one contractors in Australia are not making any money, and governments across Australia keep having successive project cost blowouts.”

The underlying message was not exactly subtle: Unless the government recognizes the pressures the industry is under and allows construction companies to renegotiate contracts that are either behind schedule or beset with cost overruns, companies could begin dropping like flies. Bailouts, while not explicitly mentioned in the interview, may also be on the docket.

It’s a message that has been conveyed by captains of all kinds of industry in all kinds of countries since Financial Crisis 2 began. As the economy freezes, companies suddenly see their revenues and earnings drop precipitously. Out of force of habit, they then ask the government to make up the difference.

In the case of Australia’s construction industry, it was already in trouble before the virus crisis hit. By the tail-end of last year, a multi-year boom had begun to turn to bust. And companies in the sector are now beginning to panic.

“We are in the midst of Australia’s biggest infrastructure boom, but as an industry, we are teetering on the brink of collapse,” Barr said. “While [the government has] projects worth hundreds of billions in planning along the east coast, it is unclear if there will be an industry left to build them.”

John Holland posted a A$60 million loss for 2019 after multiple margin write-downs on specific projects. Its biggest headache is the A$6.7 billion (US$3.9 billion) West Gate Tunnel project in Melbourne, which has been suspended for months following a dispute over who should pay the extra costs of dealing with huge volumes of contaminated soil at one stretch of the tunnel: the builders (John Holland and CIMIC, Australia’s largest construction company) or roadtoll company Transurban.

CIMIC and John Holland already terminated a contract to build the new tunnel in January, arguing they were not responsible for the unexpected cost and difficulty of disposing of the soil, which contains dangerously high levels of PFAS (per- and polyfluoroalkyl substances). Neither the government nor Transurban wants to stump up the cash either. The longer the dispute simmers, the more likely it is to scupper the project altogether.

That is the last thing that either John Holland or CIMIC needs right now. Both companies were in the red for 2019 — CIMIC to the tune of $1 billion. The loss came from the company’s decision to book a A$1.8 billion (US$1.2 billion) charge-off after failing to recover debts owed for projects built (or in some cases, barely built at all) at the tail end of Dubai’s property bubble. These project failures have cost the company billions in losses.

CIMIC’s stock has plunged by 60% since April 2019, wiping around A$9 billion in market value. Even before the arrival of Financial Crisis 2, the shares had plunged 40%. The initial trigger was a report that accused CIMIC of using reverse factoring agreements to create the illusion of cash flow, reduce the appearance of debt, and lower its leverage ratios — a charge the company has since admitted. Like other companies in the sector, CIMIC appears to have been making liberal use of supply chain finance techniques like reverse factoring to mask its cash flow issues.

And then the virus crisis began. While Australia, currently in early autumn, has not been as affected by the virus as many countries in the northern hemisphere, the number of Covid-19 cases down under is rising, recently surpassing 1,000. The virus has also hit Australia’s production and supply chains which are heavily dependent on Asia, in particular China, Australia’s largest trading partner. For CIMIC, the recent market turmoil could end up scuppering the sale of its massive mining services unit, Thiess, which was supposed to help stabilize its finances.

The market response was brutal. Last Thursday, CIMIC’s shares crashed by 31% to their lowest level since 2005. Then, on Friday, the shares bounced back 51%, but only after CIMIC’s majority shareholder, German construction giant Hochtief, signaled that it was buying 4.3 million new shares. That was enough to reassure investors, at least for one day. But concerns are rising, both at CIMIC and the industry at large.

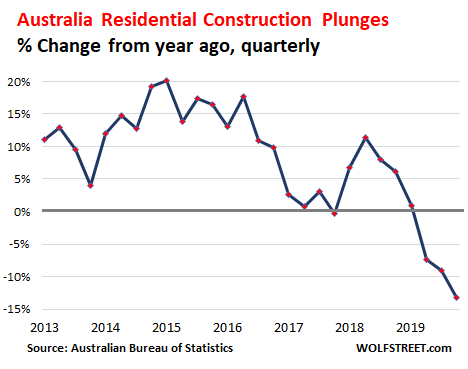

Even before COVID-19 struck, disrupting the sector’s supply chains and halting activity on a few projects, Australia’s construction industry was already in the doldrums. In the fourth quarter of 2019, activity in the sector slumped by 7.4% year on year. The residential building segment bore the brunt of the downturn, with a 12.6% year-over-year drop in the fourth quarter. This was largely a result of the housing bust that swept through Australia’s core markets from late 2017 through mid-2019. The disruptions from last year’s bushfires then added to it:

Also in the dumps is the “engineering construction” segment — a category that includes the design and delivery of industrial plant, such as the construction of structures for the oil and gas industries, power generation, processing, mining and manufacturing industries, roads, water and environmental works. According to ABS data, the volume of engineering construction work performed during the fourth quarter of 2019 dropped by 8% year on year.

These sorts of projects are bread and butter for companies like CIMIC and John Holland. Now there’s less of them, industry representatives are clamoring for the government to lend a helping hand.

The government has already unveiled a A$6.7 billion stimulus package for small businesses while the Reserve Bank of Australia has made extra funds available to banks and non-bank lenders so that they can provide support to companies. It’s a welcome step in the right direction, says Rebecca Casson, CEO of industry group Master Builders Victoria, but not enough. Casson urged all levels of government to approve reasonable requests for time extensions even if the contracts do not technically allow them.

Industry groups are also calling on the government to launch a new public infrastructure maintenance program across Eastern Australia, to provide fresh work for companies in the sector. But fulfilling that work might be easier said than done given the growing problems companies are facing getting hold of basic raw materials, many of which are sourced from South East Asia, where countries such as Malaysia are already beginning to shut down their economies. By Nick Corbishley, for WOLF STREET.

The bushfires were just the latest problem: The slump started well before them and also affects states unaffected by them. Read… Epic Construction Downturn Grips Australia

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I would say that the construction industry is in

good condition. Their machinery work as

intended, the workers are qualified and eager to

work.

The construction industry is not to be blamed of

the coming collapse.

Australian workers eager to work,on what planet?

Experience totally not valued anymore.

Labour hire companies with no idea of what is really required.

Nepotism and chroneism the predominant drivers of who gets a job and who does not.I can only hope this “adjustment ” might put all that in the past.

Some time ago Sydney real estate ranked high on a list of global property bubbles. Now the bubble is bursting.

Hong Kong used to be the greatest property speculation bubble on earth. Hong Kong is in a recession. Their wealthy went to the pawnshops to pawn jewelry.

Hong Kong is a very unique example though, because of the troubles over the 2 systems 1 country system. And the CCP’s early forced attempts at integration of Hong Hong with the Chinese mainland. For those who don’t know; When England gave Hong Kong back to China in 1997, Hong Kong was supposed to be for 50 years able to mostly rule itself like an independent country. But, the CCP is trying to undermine the arrangement.

Snap, and locus too…

John Holland was sold the the Chinese….same Ponzi scheme employed, same tactics.

Will the the Australian have to bail out a Chinese builders “Cash for Clunkers?”

The great Australian real estate bubble has been a Ponzi scheme from the start dependent upon uncontrolled immigration and real-estate lending to non-citizens and non-residents.

Ship the PFAS contamination to an office park in Saint Paul, Mn.

It’s not just 3M. DuPont and its subsidiaries also manufactured the stuff.

The aquifers in the Twin Cities, especially near 3M’s facility in Cottage Grove, have all kinds of perfluoroalkyl acids.

But there’s also a lot of sulfamethoxazole in the ground water. This is an antibiotic. Humans have done quite a bit of messing up Mother Earth over the years.

My drinking water comes from the Mississippi river, and by Minnesota state law, it must have between .9 & 1.5 ppm of fluoride. My State Representative, Jim Davnie, is happy to have a neurotoxin in our tap water because, “My kids have fewer cavities than I did.”

First law of toxicology: “The dose makes the poison”.

Example: Selenium is quite toxic but is also an “essential mineral”. Too much: you die of toxicity, too little: you have miscarriages and heart disease.

Fluoride is not a neurotoxin at 0.9 or 1.5ppm in your water.

e.g.: https://www.fsai.ie/news_centre/tds_fluoride_30042018.html

Search for “3M Dr. Richard Purdy Resignation Letter”, which he copied to the environmental regulators in 2000, and popped up during plaintiff discovery file search. Those rats knew about it way before then. Yes, DuPont, too, that’s why they created Chemours, born to be bankrupt, sort of like the Monsanto – Solutia trick.

Corporations are people, my friends!

Skilling and Fastow at Enron never poisoned anybody, but they went to prison, really last big corp names. For further info see book, The Chickens-t Club. Complete Regulatory capture since about 2005.

wkevinw:

Thank you for that link.

“Black tea was found to be the most important dietary contributor to fluoride intake in adults, …” That makes me re-think having a glass of ice (black) tea as my usual beverage with dinner.

Illegal “ creative” accounting by these accounting

firms and their executives should not be

tolerated. Let the CFO’s & CEO’s from both parties who initiated the misrepresentation of their financials serve some time in prison. Only

then will you see a change. Otherwise, it is just

a “cost of doing business”.

Oh mate, they are going to be a lot of collapses. For those of you who are long term watchers, this is the longed awaited economic collapse covered by the ‘Corona Virus.’ It was inevitable, virus or no virus. Here in FL, the idiot Governor has the state shut down – in a state that vastly depends on revenue from the tourism industry. If the quarantine ends in a few weeks, FL may be able to recover, but if it goes on a few months, there will be insufficient revenue to support the state’s essential infrastructure. The grocery stores that I have been in here look like pre-hurricane. Interestingly, the fresh produce departments are the least effected. The supply chains here are rapidly diminishing. As a very healthy 60 something, I am not at all worried about the ‘corona virus.’ I am, however, extremely fearful of a country that has willingly destroyed supply chains and local economies. We are going to vastly need local economies to recover from what is transpiring in the financial markets. Prepare my friends, if not physically, psychologically for the new normal.

Stephen, I don’t think it would have mattered whether or not your governor shut down the state or not. This year’s tourist season isn’t going to happen. People won’t be going anywhere including going to work.

I didn’t do a demographic check but I think FL has a large elderly population that if this virus got loose in the retirement communities in FL it would kill many more than the damage one year’s lost season is going to do.

I live in WA but have family in Maine, also a big tourist state, and also with a big elderly population, which isn’t going to have any tourist season either.. and Maine hasn’t shut down.

For years many of us waited for that one pin to pop the 1st bubble expecting all of them would pop eventually but never thought it was going to be a disease that brought down the house and all at once.

With the economy running into a wall, Q2 will look beautiful.

Consider what that will do to 401(k)s and other forms of pension systems

This is apparently The Greatest Depression making itself felt.

For 401k’s, if you have seen the collapse of other pensions. The most likely scenario is that those currently receiving the pension will continue to withdraw their full promised amount “sometimes a partial reduction” even as that depletes the pension into collapse. This could last past the recession, as I don’t see the stock market going back up anywhere near previous highs. How long it takes for each 401k plan to collapse “if that particular one does collapse, most eventually will” will vary dramatically and many of them will continue to collapse past the recession. New entrants into 401k’s will plummet, thus continuing the stock market downfall.

Funny how countries, having seen what is happening in China and then Italy, did NOT immediately go to Defcon 1.

Nope.

Here in NZ they locked out Chinese tourists about a month ago but continued to let everyone else in until just last weekend.

The obvious thing to do given this country comprises two large islands, would have been to immediately deploy the most restrictive policies and lock down everything down immediately.

We are going to end up completely locked down ANYWAY! (see Italy)

There are calls from the medical community to do that asap but now is too late. The virus is on the loose and the damage is being done. Epic layoffs… communal infections.

Italy was the perfect example because of the transparency — THIS is what is coming for you if you do not go extreme immediately – doing so later is futile.

But nobody took notice, or did not want to take notice.

When you look at the UK and US it almost looks as if they put out the welcome wagon for the Wuhan Plague.

Or perhaps they just know that whatever measures are taken, it is futile?

That trying to fight the virus is like screaming into a hurricane ‘STOP’.

Yet they are progressing towards total lockdowns anyway???

Roughly half the world is expected to be infected in the next few years. The goal is to prevent mass-outbreaks that overwhelms medical infrastructure, so getting people to shelter in place to stem the otherwise-parabolic increase in infections is a small price to pay. All industries will be affected – especially those that rely on discretionary spending (like Public Works projects/housing/commercial etc). Either governments engage in mass bailouts or we get to see what a 2020 Great Depression feels like.

‘ Either governments engage in mass bailouts or we get to see what a 2020 Great Depression feels like.’

It may not be binary…I suspect both of those will occur.

The now deceased doctor who first noticed Cov 19 was a healthy 34 year old.

Lead poisoning I think!

The same fate as the 29 yr old doctor? Look kids, there are NON-CCP sources (WHO, CDC etc. ) who will tell you the virus is at least 10-20 times as deadly as flu and there are young people infected.

Read the stuff from Wisdom Seeker and take these conspiracy theories to ZH. (Actually even ZH is starting to thin out ‘it’s just the flu stuff)

The CCP has issued a very rare apology to the doc, who was never arrested but briefly detained and told not to be alarmist, i.e, they repeated your message. There are innumerable

photos of him on the ventilator which wouldn’t do much good if he was full of holes.

Latest stat from US CDC: 20 % of hospital cases with Cov 19 are aged between 20 and 44

If you want to pen novels make them realistic. Of course the CCP gets rid of enemies. Some with show trials, some just disappear. State sponsored deniable ‘wet work’ is not a body full of bullets. Even in China that raises eyebrows. Privately owned guns are very rare, so… who dunn-it?

Next script, try the fall from a balcony, or maybe an overdose of opiates, a occupational hazard of doctors everywhere.

Doesn’t surprise me that fresh food isn’t being sold. They could be loading up on that and freezing what they don’t eat. It can last for months in the freezer. I live rural and haven’t been “to town” for over 2 weeks. I have a good week’s supply before I need to venture out. My biggest concern is not TP, but almond milk for my tea I drink while reading online… but then I realized I have 2 big bags of almonds I can use to make homemade almond milk. I’m doing my part in the social distancing!

Question, I want to move to FL within 6 months… what would your advice be on that since you seem worried about the state? Do’s/don’ts? Opportunities, i.e. lower rents in certain markets? Thanks.

Re move to FL: wait at least a few months after bottom of SM, while watching on the various websites the prices where you want to move to, including CL… I remember seeing a brochure on a bud’s desk for a house on a canal on the north side of the Manatee river for sale for $850K in 06, and told him in no uncertain times not to buy it because i had heard a convenience store clerk tell how he had flipped a condo the day before, making $100K by buying it early in the morning and selling it that evening, the absolute clue to the bubble nearing it’s bust point.

Six months later, same house for auction with start price $200K.

I’m glad there is someone not worried about Covid-19. I would be interested to hear your opinion in 2-3 weeks, Stephen.

Tourism might be a good industry for resort owners and tax collectors. It’s the shits for workers. Next thing you know Floridians will be selling chicklets on the street corners like PV or Melaque. Surely there is a better way to earn a living and share in the wealth of a nation.

regards

I am not worried either. Call it a fatalistic attitude: I did everything I could to avoid catching the thing and spreading it to others. I’ve done my part and I have a clean coscience.

But I am very worried about the consequences of the leadership failure I have seen. Like China or not their government was planning about a return to normal at the height of the epidemic already. Many sectors of their economy are cautiously getting back to work.

But our governments are behaving like we are all dead already: sure, the US government has done a ton of mistakes (like everybody else) but at least they seem to think the country will pull through.

But Europe… all we miss is being sent a cyanide capsule to hasten our demise.

I don’t know if we have reached the turning point already, but in Italy new cases and deaths have been declining all weekend long while healed patients (sent home with a clean bill of health) have jumped 20%.

It’s about time we have a plan for the not-so-distant future, but nobody bothered with that plan. “The end is nigh” mentality is still rampant at the top but intriguingly not at the bottom. Lions led by donkeys indeed.

We may throw insults at the Chinese leadership all day, and rightly so, but they have been quick enough to seize the advantage of being the first who would return to normal.

Italy could seize that advantage, but she needs to be quick: her advantage over other European countries will be measured in weeks, not for years. With the EU in shambles and ready to rubberstamp pretty much anything this is a true once in a lifetime opportunity.

And I have wasted enough opportunities in my youth to have learned they never ever come back.

so true!!!!!! people wake UP.

This is the redirect from wilf’s site i keep getting.

Covid-19 is a PAUSE button in the neoliberal globalism political economy of the past 40 years. What replaces it, or if it’s business as usual, will be determined by the governmental response of the next few months.

For government response, refer to Shock Doctrine. Also, Bailout Party to make the GFC bailouts look like a kindergarten raffle.

Yes

I can’t help but notice parallels between the current handling of COVID-19 by the major powers and the handling of the Chernobyl disaster by the USSR. They’re so obsessed with looking good they’re willing to sacrifice potentially tens of thousands, if not HUNDREDS of thousands (or god forbid, millions) of lives to preserve their image. China suppressed every scrap of info about the outbreak in December and is probably still fudging the numbers (I mean, they might NOT be, but who in their right mind trusts an authoritarian power to do anything but lie?). Trump and his Republican cohorts followed suit by denying the problem until it had metastasized into the fudge-storm we are now seeing.

Personally, I find it unlikely that the results of this infection will be the same as Chernobyl was for the USSR, for either China or the US. However, it really does have the air of something you’d read in a history book, under the header ‘Events leading up to X’, where X is an even bigger calamity that brings everything that came before it into perspective.

Why don’t you wreck your economy with a real estate boom and bust?

World leaders can’t resist it.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan, Philippines, Thailand

2000s – Iceland, Dubai, US (2008), Vietnam

2010s – Ireland, Spain, Greece, India

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

What’s that noise?

Zzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzz ……………………………………..

Our guardian of financial stability, in independent central banks, are fast asleep and haven’t noticed the dangers of real estate booms and busts to financial stability.

In the last several days, I have watched 15% of beach listings being taken off the market. In 2008, the opposite happened. Clearly, the hands holding these properties are much stronger than they were in 2008.

Agreed, the hands holding properties are in stronger shape, at least in the wealthiest areas. I am less sure the further out you go into working class suburbs. The average downpayment size now is lower than 2006. The wealthy can and will weather the storm, and we’ve never had a pandemic like this in modern housing market history. No reason to list your home right now unless you need out. No disrespect to anyone, but the laid off waiters and such aren’t holding $1.2m+ coastal real estate. Not sure the same will be true with the $300k-$600k ranges of splits, capes, colonials, etc…

Issues will come with re-listing in the fall. Where you and I probably disagree is that I expect some level of price discovery to occur, mostly on second tier areas. Many stock-driven down payments are gone, and a shocking number of well paying, white collar jobs are seeing layoffs. Prime buyers will rush into now slower hot areas, which will likely plateau for a bit, and prices will fall in “up and coming” areas.

The impact to housing will be collateral damage from the size of this thing (as I’ve said for a while, housing will get hit as a bystander to the next recession).

Real estate in socal is special

Come what may it would never go down

Just forget what happened in 2009 and other price crashes before this

This time is different and we are special

sc7, personally, I have changed my opinion on negative rates. Until several weeks ago, I never thought the US would see them. Now, I think it is possible we may see negative rates in UST and MBS. My new opinion is the FED may back MBS such that they are easy to refinance into … and they will have negative rates. They will be paying people who own mortgaged homes. I now think the odds of such an event is 1/4th.

top 5 money center banks have lost on avg 45% of common equity up until now; makes you wonder if there is cds out on them and the spreads

“JPMorgan Chase has exposure to $1.2 trillion in Credit Default Swaps while Citibank has exposure to $1.76 trillion for a combined total of $2.96 trillion as of September 30, 2019.”

https://wallstreetonparade.com/2020/03/jpmorgan-chase-and-citibank-have-2-96-trillion-in-exposure-to-credit-default-swaps/

https://www.savings.com.au/savings-accounts/what-happens-if-your-bank-or-lender-goes-bust

SocalJim,

We’ll see. Rents are starting to soften and will even more when layoffs hit. How many times have you seen a seller pass on the first offer essentially at or near the ask price and they follow the market down stair-stepping the asking price lower and lower all the while lamenting that he would take an offer at that first level if he could get it. Depends how long this lasts. I’m not sure if you were talking about income property or homeowners. Maybe some peeps were looking to trade up and now are leery of taking on more debt. On the income side, LT holders should be strong hands; IRs have been going down for decades, so as long as they didnt cashout every refi, they are in good shape.

Like I predicted.

Speakeasy restaurants and bars within a week.

How does one “crackdown” when no law exists?

“N.J. Gov. ‘really damned unhappy’ about people violating coronavirus lockdown. Expect crackdown.”

From today’s NJ dot com

2banana,

Sure some people violate common rules designed to protect everyone. Some people run red lights or drive while intoxicated. So is that reason to abandon those rules that are designed to (1) keep people from getting hurt or killed, and (2) keep people from hurting or killing others? I didn’t think so.

Yes, I wasn’t surprised that uber-Libertarian “Guvmint Not Going To Tell ME What To Do” Rand Paul was the first Senator to get COVID-19

Why do asymptomatic Libertarians run to get tested for “hoaxes” while first responders cannot get tests?

Also, please stop piling on 2banana, people.

His/her right-wing parody posts are extremely well done.

If Rand Paul had gotten his test in South Korea, China, Japan, Taiwan, Singapore…he be locked in a cell in quarantine for oh I don’t know…the next 2 weeks?

I too am disappointed in Rand Paul. He should have been working closely with colleagues on the other side of aisle, Mnuchin, empty suit criminals at Boeing, Jamie Dimon and Lloyd Blankfein all weekend.

Jefferson on the tree of liberty and blood of patriots and …

@Gandalf – you sound happy about this development. Wishing COVID-19 on anyone is disappointing at best.

Idaho – I believe that all members of Congress were tested. And I don’t believe he ever referred to it as a “hoax.”

Yes, I’m thinking that for a local indp coffee shop by me, they have back alley entrance. I went to bank for packs of new fives and ones for that purpose. They have lost their business from the old goats who used to sit inside thanks to billionaire JB Pritzker.

Hey watch it, I represent some of those goats

Our ‘Builders Labourers (Union)’ (CFMMEU) deserve all the hurt that they get. Been holding the construction companies to ransom for decades and more.

Our jails are not big enough!

Well said Old Codger , also any company should do research I. E.testing ground before committing to a project to think that, that particular area was not contaminated really ?????

Been analyzing and estimating construction since 68, including tons of public work from municipal to hush hush and huge federal – up to $4BB ROM; here in USA at least ALL hazmat discovery, identification and removal is either T&M, or completely excluded from General Contractor and all other non hazmat contractor scope of work.

Obviously, there is frequently hazmat removal IN a specific contract, so GCs get a special rider on their liability umbrella to cover the risk if that removal is included in the general contract. Lately, the removals and final clearance done by specialist prior to general contract signing.

1) $1K bail from jail, but not for a young assistance chef,

the off the books illegal guy , who cook 10 – 12 hours/ day in a

restaurant nearby, but now he is home, without food and a good paying job, because the restaurant is closed.

2) The top 0.01% of Pareto chart, the Effendis guys have a different type of problem. They might tempt to liquidate now, instead of B&H, because FDN sudden waterfall chart caused a lot of pain.

3) FDN is the big internet index ETF.

4) Since Feb 2016(L) @ 57 up 100 to 156. Down 50 within x4 weeks to

105. Mar 2020 < Dec 2018(L). Going up a $1B/ day is not too bad, nice. Yes. Going down $1B/ day is bad, x2 times scary.

5) There is a hope that FDN from this point will popup to 220 within few years.

6) There is also chance that FDN will cont its downthrust to 80 or below, wiping out almost 80% of the wave up from 2016, leaving Billy boy with peanuts.

7) What will u do if your name is Billy ?

Universally, and as demonstrated here…

The central bankers just cant keep borrowing from the future to pay for the present…because someday the future shows up. And here it is!

Central bankers everywhere kept fluffing the pillow, when the pillow was all fluffed out.

Now the world must retrench and reset.

The shame of it all is that the perpetrators (CENTRAL BANKERS) will accrue more power, they will micro manage more, and not learn a thing from the experience. Off into retirement with inflation protected pensions they will go, and off to the lecture circuit.

There is a wisdom to the Feds THIRD unmentioned mandate, the one never mentioned but always ignored…

“promote moderate long term interest rates.”

This ensures a balance between borrower and lender.

This ensures NO inverted yield curve.

Moderate means, by definition, NOT EXTREME. And record low rates, rates pounded below inflation and into historical lows ARE EXTREMELY LOW.

Critics will say the Fed only controls short rates. But I will point out that with a 4.5 Trillion balance sheet, and with a Treasury that can move debt auctions out to the long end, there is plenty of ammo to sway long rates.

Providing endless REPO money to REITs who in turn buy mortgages puts pressure on the long end rates.

Interesting article and a few comments:

1. In Victoria the State Labor government has never been able to deliver a major contruction project on time and under budget since they have been in government. Every project undertaken has resulted in huge cost blow outs and this runs from the Myki ticketing system which ended up costing over A$1.5 billion to the cancelled “West Gate” project for which the costs were about the same (hidden from the public, of course) even though Daniel Andrews promised that it wouldn’t cost Victorian taxpayers a cent during the election.

Other famous projects that ran (are running) over budget were/are the Desal Plant, the North/South Pipeline, Federation Square, Southern Cross Station, and the current railway crossing removals across Melbourne. I think the track duplication from Bendigo to Melbourne ran way over budget and never accomplished the speeds or number of trains either.

The Monash Freeway upgrade(s) are still ongoing and who knows how much that will blow out.

Union people that work in these projects pull down some of the highest incomes in the state for unskilled manual labor. The Desal Plant had people pulling in over A$150,000 a year. The tunnel projects had people holding up signs making A$125,000 a year.

And as far as the real estate bubble in Australia I don’t know what is going on there in detail other than what I see in the newspapers.

This article had some information on current prices:

“Over the full year, Sydney’s house prices were up by 3.8 per cent. In Melbourne, the increase for 2019 was 4.3 per cent.” (Data from the Australia Bureau of Statistics)

https://www.theage.com.au/politics/federal/sydney-melbourne-house-prices-growing-at-fastest-rate-in-three-years-before-virus-outbreak-20200317-p54awk.html

It sounds like bad management at play for the entire construction industry to have been in so much trouble even before the recent complications. Did they take on too much debt? Too many buy-outs to grow giant companies with even more giant debt to service? Was there too much competition and therefore jobs bid too low?

After joining as CEO, Joe Barr announced an ambitious plan to double revenues by 2020 by moving the company beyond D&C work. What followed was successful bidding in a large number of large development projects.

I suspect such over-ambitious growth came at the expense of margin and operating discipline.

So yes, Aqualech, right here is your poster boy for bad management.

In USA 30-40 years ago or so, Skanska and other huge European/international players came through and ”rolled up” many of the mid to upper level regional GCs to make their presence known here.

The C suite of most of the regionals were smart folks, and knowing what was happening, some may have cooked their books so that the big boys usually paid double or more for what they bought, and had to go desperately low to get every project they could.

Working for a very lean small company, I was second low for a bid against Skanska, then interviewed the local chief estimator when my former company, too lean as it were, fell apart a few months later; he said they had taken the job at zero just for the cash flow, as they were making their money on the overnight interest, and did not need to make a profit.

Sounds like something similar happening in Australia.

Skanska are extremely good at writing contracts. Much better than they are at building.

Their latest business model is to bid low, screw up the requirements, then make profits on the change requests – all 100% according to the contract and “above board”.

Eventually they will meet someone who is willing to blow up his/her project and take them to court, but, so far so good.

P.S.

Skanska is fucked. They were not making that much profit in 2019, in the most golden of all times for building.

Possibly there is a risk with having people willing to do “whatever” to make the numbers, namely that they will cheat and lie to make their own numbers too.

Futures just hit limit down… that didn’t take long.

Airlines: “If loans and or loan guarantees are enacted, equaling at least $29 billion, participating passenger and cargo air carriers commit to placing limits on executive compensation; eliminating stock buybacks over the life of the loans and eliminating stock dividends for the life of the loans.”

So is it possible to say that if do not get bailouts they will continue the bad business practices?

This is a bit crazy, actually.

The taxpayer needs to have a say on who runs these places; as in current executives need to go, if govt. bailouts happen.

Incredible.

Is the Prime Minister of Australia a SuperDork ? After the Biblical Bush Fires the Construction Industry should be busy on Reconstruction, funded by Canberra. No wonder the Chinese own so much. Aussie Rulers should be shipped off to their Queensland Indian Coal Mines.

An article on Wolf Street ought to happen, on the historical use of debt jubilees throughout history from ancient biblical times to WW1 and WW2 and their phenomenal success at avoiding and curing economic depressions.

It’s what we need as policy now, instead of more debt as D.C. and the Fed is proposing.

timbers,

You still don’t get it, regardless of how many times I’ve said it here: one entity’s debt is another entity’s asset. With this debt jubilee BS, you’re talking about the destruction of the financial system; forget buying groceries or receiving a paycheck. It’ll be all gone. This entire economy is based on “credit” — meaning, one entity’s debt (credit) = another entity’s asset. People just can’t seem to get their brains wrapped around this concept.

However, we already have a form of debt forgiveness: bankruptcy! That’s what needs to happen. And forget this infantile debt jubilee BS.

I think the concept is not as far-fetched as it may seem at first glance. It has happened in the past, and not just in biblical times. The London Debt Agreement of 1953 comes to mind.

I certainly am not going to say who does or does not deserve a write-off. It’s a question that cannot be addressed in any way without considering the deep moral and ethical aspects of it. Who decides to write-off the debt, how much, for whom, etc. However, in this world of extreme capitalism, fiat currency and debt as a way of life (and death), there aren’t many ways to move away from or rectify many of the ills of the modern system without resorting to things as drastic as the gold standard and/or debt write-offs, among other things.

Ideas such as these can be dismissed only in the short-term but then they just loom larger in the background, never to go away.

Debt jubilee Everybody with overbearing debt is running around espousing that Maybe personal responsibility would be a better approach Trouble is the government and too big to fail arent very good role models for society

When I was building houses I had colleagues who were greedy and always had 4 or more projects going at once They did much better than me as long as everything held up but the minute there was a recession they were bankrupted I hardly even knew what a recession was as I was always low cost, do it myself builder and never had any trouble selling my homes

It should be pointed out to the Jubilee crowd that bonds are debt. Municipal, corporate, Federal, etc. Will all the individuals and entities invested in bonds for low risk security be instantly robbed of their savings?

Your savings in a bank are the liability of the bank. Will these savings be wiped-out during a jubilee?

Chuckc,

The entire bank will be zeroed out because none of its assets (loans, Treasuries, etc.) are assets anymore. They’re just gone in a jubilee. There won’t be any payroll or paychecks, there won’t be anything, no groceries either, because no one can pay for anything, not even the store to pay suppliers. Maybe we can do barter, like, I’ll trade you my car which is now useless because there is no gasoline, for a truckload of apples which cannot be delivered because there is no diesel.

Fed will bail out all bonds. Even Illinois.

Note: you have already been robbed.

Australians are ignoring the decline of their dollar. The internet prices for their stuff still expect parity. Delusional. Just like when I was there years ago and they would not accept US dollars for exchange.