Kissing share buybacks and dividends goodbye.

By Wolf Richter for WOLF STREET:

What an ugly day in the stock market, just after analysts and the financial media proclaimed that the Fed had succeeded with its immense bailout shenanigans to “calm the markets.” It did manage to calm the markets for a day-and-a-half, from Thursday morning through Friday 11 a.m. But then it all came unglued.

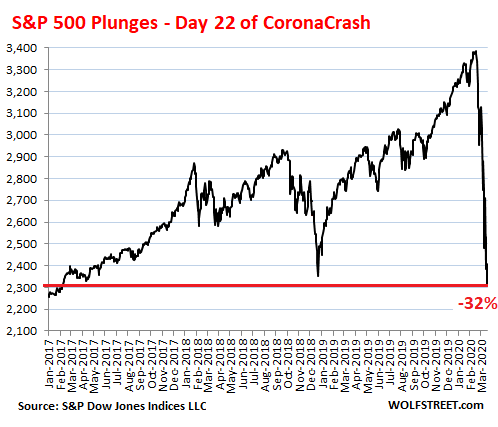

By the close on Friday, the S&P 500 was down 4.3%, the Dow Jones Industrial Average was down 4.5%, and the Nasdaq was down 3.8%. All of them carved out new multi-year lows. From the intraday high to the close, the S&P 500 plunged nearly 6%. Over the past 22 trading days, it has plunged 31.9%:

This move put the S&P 500 back where it had first been on February 9, 2017. Over three years of gains gone up in smoke in less than a month.

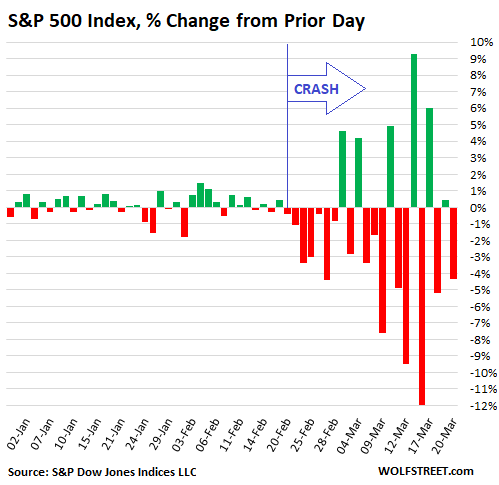

However, the crazy volatility of the past two weeks seems to have lessened, with the S&P 500 index now not having had a move over 4.3% in a whopping two entire full days (not counting intraday moves).

The prior eight trading days had all been moves, up and down, in the range of 4.9% to 12%, which amounted to historic volatility. So a drop of 4.3%, which would have been a major nerve-rattler until February 20, is practically routine now:

The rug is getting pulled out from under stocks by numerous factors. On top of the list is the simple fact that the historic stock market bubble and the most exuberant stock market euphoria in my lifetime, when stocks are the most precarious, collided with the coronavirus.

After this started to wreak havoc and stocks began to crash, two other huge factors came into play: One, share buybacks have mostly come to a halt as companies are now struggling for liquidity in an effort to survive this. And two, for the same reasons, dividends are getting cut brutally, all around.

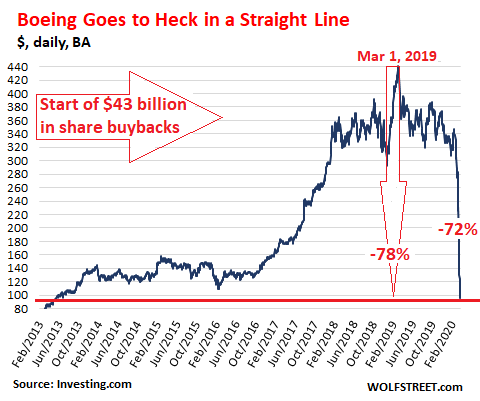

The latest to announce suspending its dividend “until further notice” was Boeing. This came as a surprise to no one; the company is in an existential crisis. Boeing made the announcement on Friday evening to keep it as far away from stock trading as possible.

“Boeing is drawing on all of its resources to sustain operations, support its workforce and customers, and maintain supply chain continuity through the COVID-19 crisis and for the long term,” Boeing said, after it had blown, wasted, and incinerated $43 billion in cash since 2012 by buying back its own shares.

This is what Boeing’s shares [BA] have accomplished – and that was before the dividend cut could have any impact: They have plunged 78% from their peak on March 1, 2019, and 72% over the past five weeks, to the lowest level since February 2013.

By the looks of it, Boeing shares are willfully violating the dictum eternalized on our WOLF STREET beer mugs, “Nothing Goes to Heck in a Straight Line”:

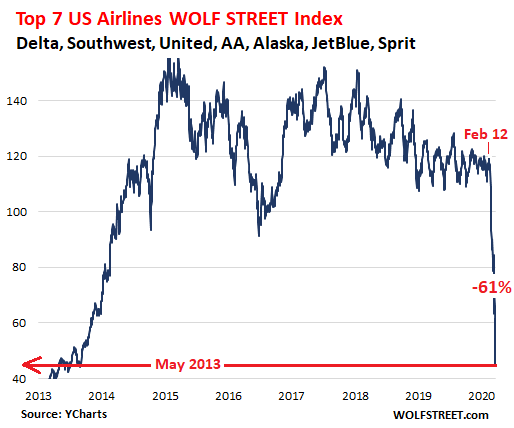

The top US-based airlines are also in an existential struggle, with many routes cancelled. For this period of the shutdown of the travel industry – if it lasts six more weeks or six months – revenues are going to collapse, while many expenses, such as aircraft leases and staff that haven’t been furloughed, continue.

Shares of the seven largest US airlines – Delta, Southwest, United, AA, Alaska, JetBlue, and Spirit – have plunged 61% in combined market value since February 12 this year, and are back where they’d been in May 2013, also violating with apparent impunity our WOLF STREET Beer Mug dictum that “Nothing Goes to Heck in a Straight Line” (data via YCharts):

And like Boeing and much of the rest of Corporate America, Delta, United, American, and Southwest blew, wasted, and incinerated together $44 billion in cash on share buybacks since 2012 to manipulate up their share prices. Now, these share buyback queens, just like Boeing and many others, are asking for billions of dollars each, or tens of billions of dollars each, in taxpayer money to bail out their shareholders. Just say no. Chapter 11 bankruptcy restructuring that bails in shareholders and some creditors is the solution.

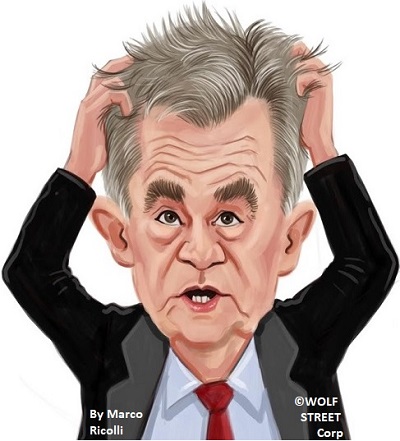

Here is Fed Chair Jerome Powell, upon seeing the market coming unglued again, after he’d already been credited with having succeeded in calming the markets, as envisioned by cartoonist Marco Ricolli, for WOLF STREET:

The bond market too is showing the biggest stress since the days of the Lehman bankruptcy, as yield spreads are blowing out in the $3.3-trillion category of BBB-rated bonds, which are just above junk bonds, and in the $1.3-trillion junk bond universe. Read… Junk-Bond Spreads & BBB-Bond Spreads Blow Out Past Lehman-Bankruptcy Levels

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The economic damage of this corona-crash will be so large that the government will have to step in on a Roosevelt New-Deal scale if the economy is to survive . It will eventually come to an end and have to be paid for with massive taxes and inflation. Who’d have thought that?

It’s actually funny watching CNBC when all the pundits and hedge fund manager become full-blown communists, begging for the government to do X, wanting the government to guarantee Y, etc.

Two months ago, everyone scoffed at the idea of a universal basic income or a federal jobs guarantee, and yet we’re almost there. The covid stimulus FJG is particularly frustrating because these industries beg for the bailouts to guarantee the jobs, yet they keep the benefit of the labor and not the public.

I have nothing but antipathy towards these hedge funds

I laughed out loud when Ray Dalio stated “cash is trash” at the end of January. To be honest it was just like every other bubble, when ‘this time is different’ creeps into the media everywhere

This is tracking the Great Depression almost precisely and will probably wipe most hedge funds out

“This is tracking the Great Depression almost precisely and will probably wipe most hedge funds out”

That is of no use meaning to say we will get more of the same. These shameless beggars or their shameless bethrens will rise like phoenix when they get the whiff of the money being thrown at them by the Fed.

I hope this gets us a new financial system with a limited Fed mandate (lender of last resort).

I have nothing but antipathy towards these hedge funds

Hedge funds and PE firms could see what was coming. You could suppose that’s why they started liquidating companies well before the crash, grabbing while the grabbing was good.

This is tracking the Great Depression almost precisely . . .

It’s worse than the 1929 crash, faster, with bigger bubbles, and more of them, plus bigger debt, plus a pandemic. The world has changed a lot in the last 90 years.

It’s worse than the 2008 crash, which was never really resolved. It was just papered over with debt, and that will make the present meltdown that much worse. The Fed did try to raise interest rates, to put on the brakes, but were blackmailed into dropping them again by an ambitious politician. Not that it would have mattered much, because by then it was too little, too late. But I think the Fed did see it coming. Most commenters here did.

. . . and will probably wipe most hedge funds out

That’s a good guess, but there’s no way of knowing how they might be backstopped by the shadow banking sector, if at all. Much is hidden. PE firms could survive by bankrupting more companies. I’ve already warned about the likelihood of a binge of hostile takeovers, and those are sure to be destructive.

here we go again, its starting per reuters:

Goldman injects $1 billion into own money-market funds after heavy withdrawals.

The bank repurchased securities from its two funds on Thursday after investors withdrew a net $8.1 billion from them during a four-day stretch, according to the disclosure.

Weekly liquidity levels at the nearly $18 billion Goldman Sachs Fund Square Money Market Fund dropped to 34% on Thursday.

SEC rules on weekly liquidity dictate that funds have to keep at least 30% of their portfolios in securities that can be converted to cash in five business days.

Bank of New York Mellon Corp also stepped in twice this week with a total of $2.1 billion to prop up Dreyfus Cash Management.

somebody is going to break the buck just like lehman…who will it be? does deutsche bank run its own money funds?

https://fundsus.dws.com/us/en-us/products/money-market-funds.html

I still scoff at universal basic income. It will never work long term. Never. Unless manufacturing is moved back to the US, it will create disasterous inflation. Universal income at that point will buy cat food.

Fred: (and others)

Will we have another “Great Transformation” (Karl Polanyi) And, what will it look like.

Some hints may come from how the globe handles both the coming (occurring) financial crash along with a humongous medical crisis.

Will there emerge new priorities for both society and business?

Already thousands of businesses are taking long, hard looks at how they function now and what the present operating restrictions are forcing them to do.

Those same restrictions will also work on those who will lose their jobs and those who might retain them but will be asked to function in entirely different modes.

The globe is rumbling……like a volcano!

your lack of imagination paints a picture of intellectual inertia; my humble suggestion would be to start seeing the box and then to try to force yourself out of it, I say that as one who wakes up in a box everyday.

Fred, I agree. UBI & SS will approximate the old Soviet Pension post USSR.

We’re about to enter a new paradigm.

The worst suffering though is going to be in China- just wait and see. A top down command economy with vast amounts of debt and a lot of it in USD

UBI = socialism for capitalism’s sake. “Let’s take money from the middle class and to give to people who don’t/can’t save. That way we can pretend capitalism is still functional.

It’s pretty easy to get rich if you are going to get bailed out. Excessive leverage is the ticket to building wealth fast, but you go to zero in a recession. If you socialize that wipe out back to taxpayers it’s just very immoral.

This may just wipe out taxpayers..

Can you imagine 6 months, a year or maybe 18 months of little to no taxes collected by not only the federal government but worse by the states?

Yep, greedy always. They’ll support whatever is best for themselves while giving everyone else the middle finger whenever they feel secure, not even an ounce of principle to keep it in check. The hallmarks of true assholes.

The NY fed was already bailing out PE and hedgefunds for months before 1 single case of COVID-19 showed up in Italy/Europe/UK/USA.

According to Hedge Fund Research, 1200+ hedge funds have shut down since 2018 and somewhere around $100 billion was pulled out of these operations in 2019. A mad scramble for cash some 10-12 months before COVID-19 was even a disease.

Just this past December 2019, in one month, before the COVID-19 pandemic outbreak, York Capital Management and Southpaw Asset Management both limited and/or ended withdrawals and this was on top of Woodford Equity Income Fund in London being liquidated.

Also in December of 2019, after $1.2 billion in withdrawals M&G Property Portfolio fund based also in London, suspended its operations citing a lock-up in commercial real estate markets.

All of this was BEFORE 1 single case of COVID-19 had reached the west.

And yet, even before the outbreak and months before the global shutdown, the New York fed was funneling money to PE and hedge funds and other non-banking entities through primary dealers via its repo market operations which now includes counterparties and units outside the US, hence the extension of dollar swaps lines.

Less than 2 weeks after the September 17th, 2019 Repo market lock up,

which kicked off FinCrrash2.0,

on 1 October 2019, Financial Times quoted a CFO of a top money-center bank:

“We have plenty of liquidity. We are just choosing not to lend it out overnight to hedge funds.”

CNBC keeps saying that, Blackstone, KKR, Bain, and cash is trash dalio et al, will be positioned to come in and buy price-cheap stocks once the shares markets bottom…

it makes you wonder why the fed is taking stocks as collateral, if these guys have all this dry powder and are waiting for bargains;

AA has to get to sub5? DB is already a $5 dollar stock…

Less than a year before JPM kicked-off FinCrash2.0 on 9/17/2019 by pulling out nearly 60% of its reserves from the NY Fed to buy back its own stock in a bull market (and 14 months before covid19) the biggest bank in the US was desperately reaching for cash.

On August 30 2018, Bloomberg News reported that JPMorgan Chase’s asset management division liquidated

“a $1 billion credit hedge fund” known as the Palm Lane Credit Opportunities Fund.

SEC records show that this Hedge fund owned by JPMorgan Chase was set up in 2012,

a full two years AFTER the Volcker Rule outlawed such ownership by money-center banks.

This JMPChase fund operated in CLOs, Credit Default Swaps and

“credit correlation, illiquids and leveraged loan markets”

Exactly the same type of black-box fasb-157 unquantifiable risk profile products that brought down the economy in 2008 and got bailed out.

I’m willing to bet other the top money center banks also violated the law by operating hedge funds.

and since we havent heard Citi, DB, BAC etc closing hedge funds they own as JMPchase did, we can assume THIS is what the fed is deathly afraid of.

They know if this blows up the economy again, there will be blood on wall street. real blood. this explains the feds panic.

derivatives are like nuclear reactor cores needing a constant flow of water over them or they will blow up; stupid way to boil water, stupider way to ‘make money’.

“universal basic income”

—-

this policy plays out in the first couple books/TV seasons of “Expanse.” Lack of opportunity leads to overpopulation, chemical abuse and general mischief.

Maybe as a short term band aid but we’ve seen how that works in government…

Many have written that FDR’s “New Deal” made that contraction worse.

I agree.

Also, the concepts in the New Deal were mainly governments responding to the natural forces of a post-bubble contraction.

Haskell’s “The New Deal in Old Rome” describes that Roman policymakers used the same tools when responding to contractions.

The book can be read in the internet.

Bob Hoye:

“Many have written that FDR’s “New Deal” made that contraction worse.”

Really?

Don’t know how old you are but I was born at the beginning and remember the 1930’s as miseration.

NO recession after the GP even came remotely near what happened back then.

Most politicians were doing nothing. At least the Roosevelt admin tried to do many things. Some certainly failed and some succeeded.

The GP was starting to wane in around ’35-’36 but the retraction of some of the successful programs plunged the country back into another GP in 1937.

Only those still alive like me have the historical memory of how bad things can get.

We’re not there yet but we are rapidly deflating into the conditions that prevailed back then. Beware.

Pardon my apparent ignorance but, what exactly is GP? Or are your comments directed at those only “in the know?”

Sierra 7: My earliest and continuing memories of growing up was how we were affected in Appalachia. I warned my friends that what you put in your plate you had better eat it all . My grandfather was an imposing character and you would find out if you did that. His basic answer for all things economic was simple: Neither a lender nor a borrower you be. It was Mr Roosevelt in our house , not FDR. His simple answer has served me well. Most have never seen what hopeless looks like. I was spared and I don’t want to see .

Root Farmer and others……

GP=Great Depression

I apologize.

My Dad, born n 1911, operated a filling station on the highway between San Angelo and San Antonio in 1931. When I used to question the wisdom of the FFR programs, my Dad’s response was “You were not here! In the store on the highway, I fed a hobo in the morning and I fed another one in the afternoon. Hopeless people walking along the road. If FDR hadn’t gotten in there and done something, there would have been a war right here!”

I did not dispute his statements, as he said: “You were not there.”

Dad was always truthful and factual with no embellishments or hyperbole. So I studied the history of the time and found the details of the “Bonus Army “ protest of summer 1932 when Hoover ordered MacArthur to disperse the peaceful protesters that were camped near the White House with 500 Infantry, 500 Calvary, 6 tanks and 800 policemen. See: https://en.m.wikipedia.org/wiki/File:Bonus_marchers_05510_2004_001_a.gif

I then understood the war that that Dad was talking about.

It is the bad choices that we make in good times that bring us the unfortunate choices that we have now.

You know, I have to admit I always scoffed at AOC’s Green New Deal, this is now much more likely to become reality. If this crisis lasts much longer GND (cause I am too lazy to type it out) is going to gain real traction and then take off.

That moment is almost here. The only question is what industry is going to be eliminated in the process.

Me too MCH, and I will continue to scoff:

Not because all of the GND ideas are bad, even though some clearly are bad; mostly because as a life long capitalist, starting at single digit age selling newspapers in the streets, then advancing to delivering 125 every morning on my bike, mowing lawns on flat rate/contract, and loving every minute up to my last days as a ”consultant” billing by the hour, IMO THE best thing about USA, and the reason SO many want to come here is the promise of capitalism, if not lately the same as it had been since for ever.

I hope, for the benefit of all people of USA, rich and poor, and pray that this event will be a trigger/catalyst for major changes I note below, and as specified in many other comments on this site:

IMHO, if oligarchy does not use this opportunity to level the field once and for all, including: term limits; only public financing of all elections, from starting sort to final, with all interested folks able to start with only a simple verbal declaration, written and oral completely free to make, and free to anyone to access on net, and simple process to proceed from that to final election; all and every law to apply to everyone equally, including all elected and appointed public servant, etc., and on the financial economy side, an equally fair to all and applied to all process that will clearly include getting rid of many of the esoteric financial instruments currently being used to transfer wealth, etc., etc.

Without significant changes and relatively soon, similar to the significance of the Magna Carta, USA is going to go down as did Rome, and so many other ”beacons on the hill” over the last couple of centuries.

This plague is the green new deal. Fuel consumption way down. Fewer planes flying. No cruise ships sailing. CO2 emissions down. It was blue skies in China when they were in their lockdown. Too bad it didn’t last. AOC’s green new deal is liberal foolishness that would be rejected as a junior high school science project. Why would this crisis suggest a green new deal? Global warming didn’t cause this virus.

I am not sure I agree completely…

Back in the depression era, FDR’s new deal was probably a crazy idea when it first came up, likely smacked of socialism and such, but one can’t argue with the results. Well, ok, they also had a shock effect from WWII.

Just because she doesn’t have any realistic details other than the government spending itself into oblivion. It doesn’t mean that there isn’t a path to doing the GND that is potentially realistic and can be useful. After all, if the current strategy doesn’t work, and we’re already spending money like drunk sailors, may be it is time for a more radical approach.

All I’m saying is, as much as I like to make fun of AOC and the GND, there is a merit to an intellectual debate and review to see how it can work, who knows… May be it is the right thing to do. But we’ll never get anywhere, if we just shot those ideas down from the start.

Imagine if Einstein was constantly bombarded with criticism about relativity when he was in the post office… would he have been able to make it happen? Well, ok, in that case, probably, because you know… he was Albert.

MCH:. The GND is great as long as you are willing to put more energy in and settle for less energy out.

For my GND project, I volunteer AOC to input the greater energy required so I can harvest the lesser energy output!

Two things: First, “tax and spend” is being replaced with “borrow and spend.” How is that better?

Second, will Donald Trump become the most socialist president, surpassing FDR and the New Deal, and eclipsing LBJ and the Great Society?

Tax cut and spend has been the basis for Republican voodoo economics since Reagan. It was on his watch that share buy backs were reintroduced.

Gert-check and double-check the point of the intellectual abandonment of governmental financial conservatism, traditionally touted as a pillar and mission of the Republican party.

May we all find a better day.

Price inflation is the only politically palatable tax option but enormously destructive to human society, as evidenced by the long history of such collapses.

Resolving four decades of financial excess/monetary distortion will be profoundly painful.

Amen. It will be magnified, because only some states have competent governors and there is no competent US leadership. Without a nationwide lock down, the infections will bounce around like a ball in an old fashioned pinball machine: one state may lock down and burn down its infections bur since once state cannot close its borders to the next, the locked down state will eventually get re-infected by another state that never locked down.

Everybody, fasten your seat belts! We are in an economic roller coaster and it has just barely started plunging down. Where it will stop, only god knows.

DJT != FDR

With dropping share prices, reducing dividends, job losses and no income from interest rates, what happens when people don’t feel rich any more? Surely there will have to be deflationary pressures where prices will have to chase diminishing demand. But I’ve read that there will be inflationary pressures (maybe price gouging?). I don’t understand. Do I have to go to MBA school? I’ve overheard conversations where people are fretting about how to pay the rent. Normal people are already hurting, they ain’t feeling in the mood to spend at all.

Food and medicine prices won’t go down. Luxury goods price will most likely fall. Car sales? Hahaha, what car sales?

Might be a good time to stop the boomer jokes and be nice to relatives over 65. I live under poverty level moneywise, but am already helping family…even though I made a resolve to help nobody with smart phones and IPads!!

What the heck, it’s Lent!

“Might be a good time to stop the boomer jokes and be nice to relatives over 65. ”

I think there is a general hope/expectation from the boomer-joke-makers that the Corona virus will just flush out all the boomers from society and leave behind inheritances.

i hope there is an app that will tell them where the boating accident occurred…

If you’re under poverty level, then you’re not the type of boomer that younger folks are mad at. Although I’d like to point out that the opportunity cost of a smart phone or tablet was never a modest house.

As a dirt guy at heart, especially after watching the stock market since the early 1950s era with an elder, and actually participating in that market until the 1980s, but never since, stopping when he died, and I realized I had never made much money in SM without allegedly insider information, I have watched the boom and bust nature of real estate as closely as I could, and conclude this one too, just like all the others that I know of, including the depression (formerly known as great, apparently soon to be eclipsed by this one,) will end with all markets, including dirt, way down, and then, gradually come back up again.

Uncle went around CA in the early 1930s buying RE for cash for pennies on the dollar while selling bank supplies he made in his garage; cousin owned dozens of millions of that RE 40+ years later, and sold what he could, (due to guv mint takings, etc.) gave the rest away.

House we bought in fall of 2015 HAD almost tripled, but will now likely go below the price we paid then; no matter, it’s likely our final home, not intended as investment, and I can only hope others our age are similarly situated with our entire ”nut” approx 1/2 of our SS.

I can hardly wait to see the bargains in all markets in the near future!

Wolf, Wolf, wake up!

Where’s you DELETE BUTTON?

People think inflation is result of “printing money”. It’s not. It’s the result of wages growing faster than productivity. The Fed can print as much as they want. People will just hoard it in savings out of fear, and no one is going to be increasing wages. Deflation coming, except in healthcare.

Kent,

There are different kinds of inflation and they move in different directions: consumer price inflation, asset price inflation (including home price inflation), wage inflation, etc. They’re all tracked separately. “Printing money” has definitely created asset price inflation including home price inflation. But it has created no wage inflation.

I have to disagree with this. Printing money, does not cause inflation, borrowing at interest does. The Fed can print all the money in the world, but if no one borrows it, it is inert, and has no effect.

This is the deflating of a giant debt bubble, and as more and more debt defaults, it will continue to drive deflation.

agree w jdog 100%; commoditized dollars dont cause inflation, in fact they induce deflation, because there is NEVER enough of it for the REAL economy, because ghost-dollars circulate in the financial economy.

wrap your head around that. cut out the fed. let the treasury issue a 23 trillion dollar coin. neo-chartalism ftw!

As with any asset price inflation is determined by the supply of and demand for the currency in question (drop in price of currency in goods and services terms).

Note, demand can fall very suddenly with a loss of confidence in fiat, which is bound to happen at some point…probably in the not too distant future. The Fed will be mystified. They think employment rates drive inflation (a very popular academic fantasy).

Cruiser – “The Fed will be mystified. They think employment rates drive inflation (a very popular academic fantasy).”

No, they don’t. But they do use “employment rates” as a way to keep interest rates low for longer. It’s an “excuse”.

The Fed manipulates interest rates, inflation, the Consumer Price Index, etc.

The Fed should be called the “Visible Hand” because they’ve got their hand in absolutely everything. As Wolf says, they have engineered all of the bubbles that have been created.

To manipulate things, to engineer them takes a “knowing”. One thing, or maybe even two, might be caused by an accident, a coincidence, but to end up with bubble after bubble takes diligence, manufacturing, steering.

If you think the Fed doesn’t know what it’s doing, then you are the one living in a fantasy.

The Fed is never mystified; they know exactly what they’re doing.

You are absolutely correct. In the short term, deflationary. The real problems start when commodity prices start to rise. The solar minimum may have a say on that.

The only role the FED has and has had and was born to do:

Save the rich from the pitchforks of the general citizenry when the economy goes into the toilet.

This time the FED has overdone everything.

All the “natural” functions of the markets are hugely distorted.

Somebody is gonna pay and I hope it isn’t me, but I know it will be my children and grandchildren and everybody else’s’ unless you are of the super wealthy. That’s how the game has been played since the advent of the FED. It just gets worse each time we have a downturn.

The FED is the drunkard; the politicians and the moguls of the financial world are the “enablers.” You can also turn that phrase around; it works both ways!

my children and grandchildren will not be on the hook. not because i am wealthy, but because i had the foresight to spare them this fate by not having them in the first place.

today was actually a really nice day. i didn’t go anywhere. i put the final touches on the garden, played with the dogs, had a couple afternoon beers (thanks wolf, kitten and ripp for the mug!). the sooner i am not allowed to go to the office, and get more free time to putter about the yard, the better as far as i am concerned.

Geez. I was gonna comment, but you said it better than me.

Thanks.

How many of us are there?

It’s called a hyper-inflationary depression.

No, it’s not – demand getting crushed unleashes *deflationary* pressures, as it did in 2008-9, when a bunch of “Weimar! Zimbabwe!!”-invoking twits like Peter Schiff were making exactly the same claim, that the dollar would collapse. Against what? I recall using the *rise* of the $US back then against the other leading currencies to buy a case of fine Islay single-malt directly from Scotland on the cheap. Currency collapses are inherently always more political events rather than monetary-printing phenomena – it’s when the world loses confidence in the backer of said currency. And see Wolf’s point about the crucial distinction between wage and asset-price inflation. The Fed has for decades been busy crushing the former while promoting the latter – that’s why just about everything keeps getting less affordable for the bottom 90%. It’s not that “there are too many dollars getting printed”, it’s that those dollars are going to the wrong side of the types-of-inflation ledger, to the financial sector so it can enrich itself by blowing one asset-price bubble after another, each of which boom/bust cycles magically leaves the rich richer and the poor poorer.

In terms of supply and demand, if lack of wage inflation for the bottom 90% is the case, then we’d have to say the value of work by people in the bottom 90% is not very high. The people at the top have more and more money with which to more affordably hire other people to do whatever it is they want (this includes any indirect means necessary to obtaining a good or service) however they don’t, choosing rather to accumulate rather than spend. What does this indicate? They don’t really need us in order to have enough, and the Fed can’t generate inflation because the relative value of human labor by people in the bottom 90% has been decreasing. Either the proles need to figure out how to do higher value work or if they actually want inflation, then more cash handouts will be necessary (otherwise inflation will stick to assets prone to being accumulated by the rich).

I see where the price of dog food has gone up. BTW, anyone who gets their dog food at Costco should know this: Costco’s dog food is made by Diamond Pet Food. You can find that available at chewy.com. Costco says “out of stock” in their online store.

In some ways the Fed conned people into thinking an asset price is wealth, but real wealth is the future income stream which for the sp500 was $58 with a long term future growth rate of low to mid single digits. Now it looks pretty foolish to have paid $3400 for $58 of income. Probably fair value would probably be at max 30 times dividend which is around $1750.

One definition of inflation is too much money chasing too few goods. How much would you pay for a nice restaurant meal in NY tonight? In NY in 6 months time when most restaurants are bankrupt?

New York has had the problem of having way too many restaurants for decades. Every crisis they get hit hard and yet a few years later idiots are convinced to invest in a restaurant.

Don’t worry, New York can survive with a third of the restaurants it already has.

General price inflation is, by definition, a currency price drop in goods and services terms (price of currency lower in goods and services terms). As with any asset the price of the currency is determined by supply and demand.

Demand for fiat will drop quickly with loss of confidence, which it the only factor supporting the value of fiat currency (literally IOUnothings). The debasement we will see is bound to result in a drop in confidence at some point.

This is wrong. We are entering a period of deflation.

Inflation is caused by the borrowing of money at interest. If a widget costs $100 and you finance it at 10% the actual cost of the widget is $110. Since the money to buy the widget is created at the point when you sign the loan paper, you just created inflation by creating $110 of debt for a $100 widget.

Deflation happens as a result of you defaulting on the debt you incurred to purchase the widget. The $110 you created to purchase the widget, disappears at the moment you default.

When deflation happens on a mass scale, money disappears on a mass scale increasing the demand for money. The demand for money necessitates the sale of assets, which lowers the value of the assets as their supply and their sales increase.

Even with massive printing by the Fed, the destruction of money outpaces the creation. This is why every asset class including gold and silver are devalued by the deflation created by the mass default of debt.

Stay tuned and we’ll see what actually happens as central banks massively debase currencies in an attempt to paper over all the bad financial paper. Supply will increase, despite systemic deleveraging, and at some point confidence in fiat will collapse. This isn’t the first time in human history such a scenario has played out.

The Fed is against a wall due to the zero bound. They can’t foment another financial mania without pushing nominal short rates lower than the last cycle (the “avoid hangovers stay drunk” strategy is over). We should anticipate an inflationary secular financial decline, likely over the next ten years or more.

It may start out deflationary but if the FED starts giving companies trillions of dollars and helicoptering individuals billions it will end in inflation. If the world loses confidence in the our fiat currency the US Dollar it will end in hyper inflation.

How do you explain Venezuela?

“Potential causes of the hyperinflation include heavy money-printing and deficit spending.”

https://en.wikipedia.org/wiki/Hyperinflation_in_Venezuela

My god, I just saw where Las Vegas is going dark for at least the next 28 days! In the months to come we are going to see some of the most massive apps of the law of unintended consequences ever. There are going to be financial and emotional fallout from these shutdowns that we can’t even think of. BTW, has anyone else seen the “War of the Worlds” analogy where something that looked invincible, the markets, some politicians, or whatever are going to be brought down by this virus?

Anyone else waking up at night? 5:38am this morning and just finished a 2 hour talk with my wife. Started at 3:00am. And we’re actually doing okay. Instead, like Deanna said above, thinking about what we can do for family members, how the kids are faring, etc. I have one more town run to do just to get my van out of lockdown. I had a weird fuel gauge problem and the day my van was taken into the shop the place went down in quarantine until the staff could be tested for the virus. (All three of them exposed to a customer ). Luckily, we actually have testing in Canada. I should get it back Monday. Anyway, the only store stop will be the liquor store to pick up a few bottles of hard stuff, actually.

I have Stock Market friends freaking out. Plus, we get the usual calls like “You guys are doing good where your are” (through this pandemic). My reply is to remind them we built gardens and infrastructure while they were in the Maldives or Cabo. They thought it would never end. Like I have said a zillion times on WS, when working guys are flying to tropical paradise locations for all inclusive weddings, the end is nigh because it is foolish and unsustainable. And it was.

This upheaval is just the beginning and it is never going back to the levels of wasteful opulence my friends thought was normal western life. Sharpen your pencils and write down some planning steps, imho…..maybe on a calendar if you can get one that goes to 2022. Then, we’ll see how this is going down.

Yeah, I go to bed early and usually up by 4:30am, but lately I have been popping awake at 1am or 2am.

Yeah me too I’m curious just what insanity is going on in the markets around the world and it’s making me a night owl lately

“I have one more town run to do just to get my van out of lockdown. I had a weird fuel gauge problem … ”

Hey Paulo, you’re a practical guy and I have a practical tip for you: Use the odometer instead of the fuel gauge. Been doing that with my ’95 pickup, for years. 300 miles, fill the tank.

Good start RD, and, I too used the same technique for many years with my 84 chevy 3/4T pickup that I finally passed last year to a couple of younger brothers who gave me $$ I asked.

How some ever, IMO, it’s best to drive always, or at least as much as possible, on the ”top half” of the gas tank. I learned this the hard way with my first car, a ’56 Triumph TR-3 that, literally, conked out on me somewhere in SoCal every time the tank got below about 1/4; finally found an older English mech, who promply took out the tank and ”boiled” it clean.

Top half of the tank almost always has less ”stuff” in it to clog and disrupt, no matter how many filters twixt tank and engine.

I was using the odometer for sure. But it was still freaking me out as we go into the back country. I spent too many years flying for a living and even though I only have about 3 gauges in the beast, I constantly do a scan and listen to all noises. The fuel gauge, I just can’t get past it flopping around. I changed the sending unit and it’s not that. Some weird ground problem the tech thinks.

I woke up at 4:00 this morning and what should pop into my brain but an idea, a good one, about my Thrift Savings Plan (the name for the federal government’s 401(k)). Not something to do immediately, but later this year and next; specifically, taking distributions two years before the Required Minimum Distribution year (2022, in my case) so as to take advantage of the 0% capital gains rate. (Thanks, btw, to GWB in 2008.) My other funds certainly won’t be generating capital gains for at least the next couple of years. The tax savings will offset some of the paper loss.

0% applies to capital gains and qualified dividends, not distributions from a Thrift/IRA/410K

“This upheaval is just the beginning and it is never going back to the levels of wasteful opulence”

It’s gonna be a cruel lesson, particularly for those we classify as “collateral damage”, but it’s a necessary one. Joe Blow office drone with four leveraged condo apartments may finally meet his day of reckoning when his AirBnB revenu dries up.

Never happen again eh? So far there are no signs of humans learning anything from history. Yes it’ll happen again after the next big boom. Might take awhile tho.

Good question Paulo: this old boy, having learned to be waiting on the corner where my newspapers were thrown out of the truck at 0330 about sixtyfive years ago, so that I could get finished by 0530 or so, go fishing, and then get home and washed up and at school on time, has been awake about that time every since… Now, I call it, ”work mode” and, yes, been in that last week or so, but mainly, because of fascination with current events.

Wolf helps the fascination, as I think I am getting the real news here, and not some pablum predigested propaganda.

With no disrespect intended , are you going to take another “test” after the visit and exposure to the liquor store?

Yeah, even though not official, there won’t be a World Series of Poker this year. How could there be? Not a big time player but that used to be an annual pilgrimage for me to play in a small event or two. I also can’t / won’t play in any local poker tournaments. This plague is a real bummer and I don’t face any immediate financial threats.

Read a good book on risk a long time ago. Supposedly booming construction of casinos means you are in the final quarter of the risk ballgame as capital flows to the stupid games of gambling your wealth away. When the bust hits and people are scrambling to pay the electricity bill the casino towns get hit the hardest.

“Kissing share buybacks and dividends goodbye.”

That is only till these shameless beggars get the alms…

They may be brazen and shameless (and lazy), but there’s quite a lot of publicity ATM about corporates who have been spending cash on buybacks – step forward the airlines – it’s certainly something that’s entered the mainstream. So the C-suite may realize it’s not good for the corporate image to be seen to be doing it.

And let’s face it – the fact it makes them look bad is the only thing that’s ever going to stop them..!

Crikey they may actually have to invest in product and people development instead! Quelle horreur!

Did you know that American Airlines CEO Doug Parker gave up his salary and got paid in stock instead. This was a couple of years ago.

The wall street crybabies are cowards when it comes to publicly advocating their bailouts. Not the two unnamed “sources”, supplicants featured in this article:

https://www.reuters.com/article/us-health-coronavirus-fed-lending/u-s-treasury-panel-wants-fed-to-expand-purchases-revive-crisis-era-credit-facility-sources-idUSKBN2173IS?il=0

“Not” should be NOTE.

No, sadly, just the fact that ‘it looks bad’ will not change behavior. They are truly shameless criminals and bullies. The only thing that will change C-level behavior is … criminal charges and/or civil litigation naming them individually as defendants.

+1

I only follow 3 or 4 companies that I am pretty certain have long term shareholders as a top priority. I am sure there are many more, but it takes some effort to dig this out. Giving your money to someone and expecting them to look out for it like you would will probably be a disappointment.

They have no honor…sin verguenza…the great Spanish insult.

We’ll see if the public takes it lying down.

I’m waiting to see Richard Burr and the blonde bandit be publicly tarred and feathered. The crook is trying to get out in front of it, but they are finished. Maybe they can hide out at a ________ property with Devin Nunes?

Haha “the blond bandit” should be thrown out of Senate and take up pole dancing at one of those new drive-through “joints”.

Really a great time for these scumbags to reveal themselves.

Paulo,

Hate to burst your bubble but it turns out that Dianne Feinstein also is also in that category. So maybe they can all hideout together, Oh I forgot her Husband sold the stock!

KPL: even the most profitable airlines such as British Airways and Ryanair can be killed in a matter of months by lack of cashflow because air transport is a business with extremely high fixed costs. That’s why everybody right now is scrambling to put aircraft in storage and crews on leave.

If you think everybody will be bailed out, I have my serious doubts: China is presently putting together a massive consolidation plan of their air transport industry. They may have declared victory over Covid-19, but the troubles are just starting, and on top of that they have to deal with HNA Group.

Dozens of airlines owned by local governments and private concerns will be forced to merge or they will be quietly dissolved, their assets and routes taken over by somebody else. That’s what is coming to Europe and the US as well: the era of making everybody a winner is over.

MC01 – what do you think the prognosis of the airline leasing companies is likely to be? Toast?

ACMI (“wet”) lease companies right now are exactly in the same boat as airlines: unless they are freighter-focused, in which case they are making a bundle, fixed costs will eat them alive in no time if they don’t send aircraft into storage and crews into leave.

Dry lease companies have a better chance of survival because their fixed costs are somehow lower, but they still need to “pay the bills”, chiefly servicing their debt.

The civil aviation industry will be heavily restructured after this, or perhaps even as this crisis unfolds: mergers and acquisitions will become very commonplace.

As restrictions will be progressively lifted air travel will pick up again very quickly, perhaps more quickly than many of us would like, and the advantage will go to those who have restructured first and more efficiently.

As for me I plan to do my bit for the industry as soon as this thing is over by finally going visit two places I have put off in favor of more work for over a decade now. ;-)

I agree. But then the companies that will get the goodies are the favoured ones (by the ed and the government) like TBTF bails in 2008. So well run banks were allowed to go under if they were caught in the storm. This is exactly what this crony capitalism is all about. It does not go the deserving but the unscrupulous.

Why not look at something like this which will help most people (which is exactly why it will be dumped) if you want to help companies

1. See their track record (in terms of C-compensation, dividend, buyback) and only help those companies that deserve it (meaning to say – C-compensation does not gobble up the cash flow, dividend does not need to add debt, there have been no buyback in the last 5 years (or has been when the company has been undervalued)

2. Let everybody bear the pain – Take the median compensation and those below get say 85%, just above get 75% and so on with the top management getting 10%. The logic is the top management have been hogging all along. It will be more just.

3. Since anyway you are making losses, let some of the top heavy weights furloughed or sacked.

I assume something on these lines can be done based on payroll data.

Instead any form of bailout will be subjective and will benefit the favoured unscrupulous few. This is what you get when you have a bunch of unscrupulous few (senators front-running the selling of stocks) running the show for another bunch of unscrupulous few (United, Boeing) in cohorts with a powerful unscrupulous few (the Fed) instead of a system for the people and by the people. Unless there is a way to break this cabal it will be a case of rinse repeat.

In China more generally, GDP just better than doubled (+115% real) between 2008 and 2018, but debt almost quadrupled (+290% real) to enable this to happen.

We were seeing a lot of signs of severe financial weakness there, well before this happened – defaults (including SOEs), creit rating abnormalities, the collapse of P2P lending, tumbling sales of cars, phones, chips, components, and so on.

Those who (rightly) describe Western economies as financial Ponzis need to look hard at China.

Beijing’s primary political concern (which is urban unrest) has pushed them to prioritize volume (= jobs) over profitability (and it’s possible that an understanding of this weakness helped inform Mr Trump’s trade policy towards China). Creating excess capacity has driven RoC below cost of capital.

Nobody should understate the impact of the virus, but China was getting near the end of a credit-fueled, volume-driven bubble anyway.

If this means that they fly less, drive less, and pull back from overseas investment, that would be consistent with a failing credit bubble.

Tim, your timeline of 2008 to 2018 has more context.

Wolf the S&P 500 graph above just shows the Everest summit of 3,327.

Using a 30 year contextual span, the current 2,398 will drop to rest around 1,500.

If it goes below that, likely heading for a global financial reset.

Gossip or Fact? Whilst the public spaces are empty, quiet 5G installations under the guise of cleaning companies ordered.

Isn’t the bankruptcy code all but designed for airlines?

Airlines are usually the ones that use BK habitually to shed bad airplane leases and pension costs. Several airlines have filed 2 and 3 times over their history. I would think they’ll all line up for a quick dip into BK like they have in the past.

The government bailing out the airlines seems like a bad use of funds. Also, every American has complained ad nauseam about how airline service has gone downhill – maybe this is the perfect time to redesign the industry. Do we really need to save Spirit and Allegiant, or Ryanair who has said they would make people stand up on board if they could?

If you want better service you’ll have to pay more. What you are proposing sounds like forcing people to pay higher prices for services that they actually don’t want to pay for (if they wanted those services they would have been paying for them already).

“ the era of making everybody a winner is over.”

Love this line. Looks like the rigged monopoly game is being interrupted by a mosquito.

Nodak,

I know. I can’t believe it how corrupt it is.

They call it public service.

MCO1,

I thought the function of the air lease companies was to offload a lot/some of the risk from the airlines proper…by owning the hugely expensive aircraft and just leasing them to the airlines for set periods.

Thereby lowering the airlines’ fixed costs in a very major category (the planes).

If this is the case, what are the fixed costs eating up the airlines? The people can be furloughed when aircraft are not flying, fuel isn’t used, etc. There may be some contractual obligation usage for such categories, but I can’t believe the airlines would have negotiated much flexibility away.

So which are the killer fixed costs?

Leasing is in most cases nothing more than financial fiction: a typical case is XYZ Airlines ordering 10 aircraft from Boeing but immediately selling them off to ABC Leasing and dry-leasing them back.

This means the airline doesn’t have to open a line credit or seek other forms of financing to buy the aircraft themselves and only has to pay lease costs, which are often further broken down in airframe, engines, APU (Auxiliary Power Unit) etc.

But XYZ Airlines still has to pay the crew, maintenance, insurance etc like they owned the aircraft outright. These are the killer costs, on top of the regular lease payments. Remember: with dry leasing you only get an aircraft.

To make matters worse for all legal purposes XYZ Airlines doesn’t own their 10 brand new Boeing. This means they cannot be used as loan collaterals, sold to raise quick cash or even subleased unless the contract allows them.

Dry leasing is basically all the pains of de facto ownership without de jure ownership.

So why do airlines fall in the trap? When cashflow is strong, leasing makes sense. It’s just like paying bond coupons without having to issue bonds. One less liability. But when cashflow is drying up, or when the company faces any sort of financial issue it does go to Heck in straight line.

Alitalia runs such massive deficits because they have been flying for years an almost entirely leased fleet: they have even sold the aircraft they owned outright (such as the 777’s) and leased them back.

Oh, and don’t think you can skip a lease payment: leasing companies can and will repossess their aircraft pretty much the instant the contract allows it, as Jet Airways of India found out.

“That is only till these shameless beggars get the alms”

You bet….. the 1% War Party Of The Rich takes care of itself, big time.

They’ll sweep a few crumbs off their plate for the rest of us.

Like they always do…..

Winning

Dont blame the companies for the share buy backs, blame the Fed.

What are the companies supposed to do when interest rates are zero.

re: “What are the companies supposed to do when interest rates are zero.”

Um, maybe borrow a couple billion $$$ to finance design, engineering and marketing of a new short-haul, single-aisle, twin-engine aircraft from a ‘clean sheet,’ instead of slapping a couple large turbofans and some software patches on a 30-year-old aircraft that is well past its prime?

Where are the down grades staying ?

GF,

Good question…a useful doc would be the most recent list of BBBs…or the equities down the most YTD (a lotta overlap in those lists)

1) The Wuhan virus main victims are the elderly with chronic disease.

2) Instead of dying within 5Y, at tax payers expense, they die within a week.

3) For 3.5Y US indulged itself in the pleasure of building up a strong defense.

4) The Wuhan war is a new type of war DOD cannot fight, or win.

5) After raising US gov debt buying planes, tanks and paying troops & vets,

US gov debt rise vertically in the unexpected Wuhan emergency. Our debt is accelerating to save the elderly.

6) Extreme measures to stop the spread of virus will destroy the fragile health of the aging US economy. It kill our country.

7) If the Wuhan battle will end up as an attrition war or lost, US

will plunge into a prolong depression.

8) The bottom line is : death to US vs 100K senior citizens saved.

9) The epicenter is the east and west coasts, the impeachment hot spot.

9) Ca leaders will always mock and complain in order to squeeze more.

They will blame for political gains. Saving sinking Ca is “sunk ” effort.

The more fluid u give them, the more they will hate u get.

Normally I can’t comprehend what you are getting at in your comments. This time I could though and found it pretty disturbing.

Agree with you Lance that ME can get pretty ”dense” in many of his comments/posts on this site; however, I have found that if I will take the time to interpret/translate, whatever, he does make some really good points most of the time.

This one, more accessible than usual, especially good points, except that not by any metric is this so called ”Boomer Remover” only deadly to older folks, and IMO we will see this very clearly as a result of the spring breakers taking it back to their homes now that most colleges have shut down dorms, etc.

I am older than the boomers, so am always on guard for health related challenges, and began taking increased ”maintenance” dose of Vitamin C in Jan when it became apparent it was horrible, and am prepared to follow the clearly reported findings of Linus Pauling re ”remedial” dose if it becomes necessary, meanwhile, STAY HOME!!

If I’m reading Denninger’s post recent post correctly then the Spring Breakers and similar conducting normal life activity may actually save the day on this. That is if the otherwise young and healthy get the virus and spread it amongst like healthy people in the general population, then this thing will burn itself out sooner rather than later. A virus generally wants to spread, not kill. The more and faster it spreads amongst the healthy the faster this process, and those who get it and recover have built up the immune antibodies. This is like a vacillation from Mother Nature to build herd immunity. The old, infirm, unhealthily, diabetics need to be sheltered / separated however. We can get this done in 90 days, but if this course is not taken then it will run rampantly for 2 years, ultimately kill more people, and destroy whats left of the real economy. The priority should be a test to see if a person already has the antibodies, likely shrugged a brief spell of sickness off thinking it was “the flu” or a bad cold at the time.

Shiloh1

“ That is if the otherwise young and healthy get the virus and spread it amongst like healthy people in the general population, then this thing will burn itself out sooner rather than later. A virus generally wants to spread, not kill. The more and faster it spreads amongst the healthy the faster this process, and those who get it and recover have built up the immune antibodies.”

Such a flawed and dangerous reasoning. First of all, you can’t choose who to “give” the virus to. Second of all, healthy people may still need treatment and visit the hospital. This will tax the already overloaded healthcare system. Didn’t you hear about “the flattening of the curve” yet?

Sounds like a ‘Putin Puppet’.

You know, sowing discord and such?

I’ve seen a lot of this sort of stuff and have realized there is the disinformation spread by a hostile state which then ferments it more within non hostile state attitudes (haters will hate.

Fox News began sowing discord and hate about three years before Vladimir Putin became PM of Russia.

agree

The only exception to the elderly on many medications already seems to be the party animal celebs and royals and such….fascinatin’, ain’t it?

Michael Engel,

It disturbs me that you seem to be very concerned with the elderly and chronically ill being unwilling to die quickly and quietly so you can get on with your life.

The bottom line is not “death to the US vs 100K senior citizens saved.”, and BTW, the number is a crap-ton bigger than 100K using the herd-immunity route. This is about keeping Medical Services from being overwhelmed and collapsing. See what’s going on in Italy right now for more information. That’s where the US will be shortly if there’s an immediate return to life as usual.

Some waterfall effects from the medical system being overwhelmed will be:

1. Shortages of necessary medical supplies.

2. Shortages of medical professionals. When the overworked and stressed medical professionals become ill, less is definitely not more.

3. Triage for all incoming patients. Not just Covid-19 patients. There may be no ventilators left for that emergency appendectomy you desperately need. Just sayin.

All that and more is what will be coming to a neighborhood near you if this lockdown effort fails.

So yes, life is hard right now. It may get much worse. But we’ll get through this together, or probably not at all. So get a heart tin man.

FWIW I live in Pennsylvania so I’m in a lockdown state. I like my older relatives and neighbors. I enjoy their company, and I want their children and grandchildren to have the pleasure of their company for however many years they have left.

Thanks…I learned a lot from my grandparents about the depression and getting along on much less. Now at 72 I can pass it on, if the Starbucksers want to listen!!

Yes, my father talked about the good old days he said that weren’t so good. He lived it. Our bones have forgotten the difficulty of the early 1900s. A reminder may be coming for the early 2000s.

Brant Lee:.

The quickest way to get into my Father’s bad graces, was to talk about how wonderful the “good old days” were!

He would tell you they “weren’t so good”!

Starting with central heating and indoor plumbing!

When I was about 7 or so, I was reading a history book that showed an illustration of an Egyptian pharioh sitting on his throne, being cooled by two men waving palm branches.

I made the mistake of saying to my Father, “It must have been wonderful to have lived in those times!”

My Father shot back. “Son, you would have been born a slave!”

Suddenly, I was now the one waving the palm branches!

Great comment 2Geek.

From one oldster to another: Thank you.

It used to be a truism: “Our elderly built the country”.

That’s not heard much anymore – probably just as well: I’d hate to take the blame for the excesses I see everywhere in the country today.

Pretty much true, the Boomers built nothing so much as the pre-C19 debt.

Someone hasn’t really been paying attention to the reality of this situation! “death to US vs 100K senior citizens saved”, naive to say the least ( and I presume you’re NOT a senior citizen)!

Michael,

Kindly crawl back into your hole while the rest of us try to react to this situation with wisdom, grit, and compassion.

re: “Kindly crawl back into your hole while the rest of us try to react to this situation with wisdom, grit, and compassion.”

And, hopefully, with humor.

Using that logic, Mr. Engel, you may want to have obese people ineligible for medical insurance (unless they pay an exorbitant premium) due to their massive consumption of sugary soft drinks, people who have heart disease due to eating sh*t from fast-food vendors, people who have lung disease due to smoking, and people suffering from depression since we’d all be better off financially if they just killed themselves. And, by the way, you may want to stop using the software, technology, defense capabilities of the U S military, numerous vaccines, health remedies, and more, because they were developed by some of the elderly that you have no compunction about doing-away-with. I imagine that you’re a member of a Master Race because there are many of us who are flawed and may not survive this pandemic and may not qualify for membership in that race.

I dont know if I would agree with your logic.

One of the reasons we are in those dire straits is that we dont talk anymore about individual responsibility , saving for a rainy day, etc. Instead have created a “victim” society where our problems are always someone else’s fault.

If you are obese, there is a 90% chance that your need to change your lifestyle, exercise and EAT LESS. If you have lung problems, STOP SMOKING.

People who advocate for the government to give free stuff, do that simply because in their mind its someone else footing the bill and it makes them feel good.

In fact they wont never buy a lunch to a homeless person with their own money.

I propose we call it the “Vail Virus” or “Italian virus”

A particularly anti-Mexican person I know was ranting (again) about how f——-g Mexico had not shut down its borders to people from China when I showed her this news story about how the LARGEST currently known cohort of corona virus infections in Mexico started with two charter flights of the richest people in Mexico (including the CEO of Jose Cuervo tequila) who had gone skiing in VAIL, COLORADO and got the virus there, bringing it back to the Mexican state of Jalisco. A subgroup of these same people then proceeded to a beach resort in the state of Nayarit.

The Vail pandemic is being blamed on Italian tourists.

Rich Italians love to ski on America’s mountains. When I was in Reno, during ski season, I saw a head to toe CT scan of one older Italian man who had been helicoptered in off the Lake Tahoe ski slopes because of a ski accident. The good news – not a single broken bone in his body. The bad news – a big fungating lung cancer! Those Europeans still love to smoke!

The new official name for the Wuhan Coronavirus is “the CCP Coronavirus” or “CCP virus” for short.

Just wondering – when comparing current stock price to the stock price 7 years ago (like in the airlines chart), should the net reduction in total share outstanding from buybacks be factored in when making the cost comparison?

PGibby,

To answer your question: No. My airline index chart is not based on stock prices but on market capitalization. It reflects the dollar amount these companies are worth in the market on each day.

Gotcha – comparing market cap vice share price over time makes it apples to apples. I should have seen that was what you were doing. Thanks.

10) This little Dr. at the top and his troops put US economy in a coma.

11) We know how many people die from car accidents,

drugs overdose, but this is something else.

12) US health bureaucrats and researchers put US in the surgery room in order to know the unknown.

13) US will stay comatose until we know.

13) US will stay comatose until we know.

Yeah, sounds like you haven’t been around too long nor have you spent any time in a real battlefield. The U.S. PEOPLE have a lot of resolve and will come together and get by this bad time. We’ve done it before.

Absolutely.

People here in Italy are behaving magnificently and are putting our so called leadership to shame: instead of threatening to shoot people in the streets or play the blame game our chattering class should bow down in front of the people and work hard to mitigate the effects of this lockdown. It’s a classic case of lions being led by donkeys.

I have zero doubts the US people (and everybody else) will behave just as admirably during and after the crisis.

The US is on track to have the largest death toll from this pandemic; it’s not looking good. But it may be a cathartic moment in US history.

Thank you Anthony A., for the sensible and logical commentary in an otherwise doom and gloom blogspot. Wake up folks, opportunity abounds if you can think outside your self-imposed prison cell, recall history and realize this too will pass. There will be, “I shoulda, woulda, coulda” moment with this crisis too.

Based on this poster’s grammar, I’d wager he is not a native English speaker. Michael Engel – where do you live?

Mars?

ME never, ever replies to comments. I really can’t understand the mindset of someone who posts like he does but clearly has no interest in engaging in discussion.

China

Michael Engel,

Seems you don’t understand human nature, or the resilience of Americans. Americans routinely go through hurricanes, tornadoes, earthquakes, floods, droughts, wildfires, etc. And we get through each one of them and we rebuild and go on. That’s how we do things in America.

We’re in this together, and we’re going to get through this together, and we’re going to get out of it together.

ME sure has some acerbic and dry commentary. Clearly majority of readers here don’t understand him. I often don’t.

No need for people to gang up on him because what he’s saying is not plausible or pleasant.

Freedom of expression and that stuff.

From lockdown UK

Meanwhile, we will experience what Russians went through in the 1990s and get a new life challenge.

I love to chat and my town is 60% southern black people…they have the “another day at the office” attitude. Circulate, folks…smile. Perspective is almost everything.

I mean circulate 10 feet apart, of course!

Is it time to consider what we’ll do if our national situation continues to degrade?

A plan B might be worth developing now. It may not be necessary to implement plan B yet, but the likelihood of needing a plan B is increasing.

Selected elements of my plan B:

instituted “social distance”. Getting rather serious about that one.

pre-bought most of the materials I need for this summer’s work now, while the supply chains are functioning

stocked up on non-perishable food

Installed generator. Stocked in fuel enough to last months (1 hr a day usage)

Bigger garden. Seeds in-hand. Soil’s already up to snuff. Got tools.

There are other steps done as well, but that’s enough to give you the flavor. Of course what’s possible/works for me probably isn’t right for you.

I’m just reporting this to indicate that I’ve decided to act on this incoming threat.

Please keep in mind that maneuvering room diminishes as things start breaking.

Reading the tea leaves, it doesn’t look like we’re not going to get a functioning economy top-down (e.g. from our “leaders”).

That leaves….us. Got ideas?

The answer and solution is the election in November….if the US makes it that far.

I think people are overly critical of leadership. After all, he’s quite the expert when it comes to bankruptcies.

It does not change a thing. We are still on the road to bankruptcy. I don’t think debt solves anything.

Do you ever notice that both parties embrace money printing by the Fed and bigger deficits? It’s just assumed that easy money is the solution to every problem. It seems we are in such a fix when the only solution to too much debt is more debt.

Don’t I wish!

Once again, we appear to be heading for a national election where the leading candidates, so far, the same as 2016, give us a choice between two clearly identified crooks.

After studying them both as an ”always voting always independent,” I could not and did not vote for either in 2016, and, if the current trend continues, I will not vote for either this time.

We need some real leaders to step up, but, unfortunately, most real leaders that I have known in military and civilian life have been intelligent people, and know full well how horribly they would be treated these days, so far.

May the Great Spirits Bless us all!

I could not and did not vote for either in 2016

You can always vote for the meteor as a write-in, even though cov-19 is the current favorite.

May the Great Spirits Bless us all!

A priest, a rabbi, and an imam walked into a bar. I looked up at them and asked “What is this? A joke?”

We’re projecting 6k DJIA and $10/bbl oil before the end of planting season. After that, things start to get ugly.

It’s going to take time for things to get weird ugly. Rome wasn’t built in a day. In point of fact, it was never actually finished.

You must vote. Even for the lesser of two. That is the one and only way to maintain a rule of law.

After the election, insist that the 100 Senators and 435 members of the House give us a full Congress of 535 paid representatives. PAID REPRESENTATIVES. We do not need to hand over the country to the last man standing of those two.

Grayce-you may be familiar with U.S. Congressional history. There is an interesting long-term effect of the number of House members being limited to 435 in the 1920’s (in the interests of, for lack of a better word, ‘efficiency’). The Constitution limits the population of a Congressional district to 30,000, but, THERE IS NO UPPER LIMIT. Given that the national population in the ’20’s was approximately 150 million, and now is well north of 300 million, the arithmetic indicates a steep discount of the average voter’s actual voice in Congress over that time (Note states that have lost all but the mandated one of their House reps). The ramifications have been many, the most important, imho, the huge ascension of party over local politics (and the concomitant limiting of target outlets for special-interest monies to affect national policies and budgets…).

May we all find a better day.

15. Systematic “gutting” of public services and governmental agencies, as a continued scheme to sow mistrust in the public sector.

Have you seen the “Cycle of Civilization”?*

The average civilization lives about 200 years. They progress through stages: From bondage to spiritual faith

From spiritual faith to great courage

From great courage to liberty

From liberty to abundance

From abundance to selfishness

From selfishness to complacency

From complacency to apathy

From apathy to dependency

From dependency back again into bondage

The USA has already had its bicentennial, but the cycle is not inevitable. It depends on every American to open their eyes.

*Credited to HW Prentis, Jr.

Yup, got my 150 cc front tine tiller fueled up and ready to go, and will plant a bigger garden this year.

Tom,

Like your list and approach. I asked my wife this morning if we should just leave the elk gate closed from now on? (Elk come in a terrorize our gardens). She doesn’t think we’re there, yet.

Anyway, we live in a rural valley on the stormy coast and your list is pretty much SOP for long time residents. To add to your list you might consider communications. In any real emergency the first thing to fail is the cell phone network. The internet only has a few different hubs. A couple years ago I obtained my Ham radio certification that allows me to build and maintain my own equipment and operate 2250 watts ssb, which is powerful enough to talk to anywhere in the world. For $400 I bought two used hf radios and use one for a home base station and one is portable I keep in a pelican case. The antenna is made from lengths of old speaker wire. I also have a portable Chinese radio which I can program in any frequencies in any band. I can even send text messages by radio from this computer, if I so choose. Fantastic unit. Is this necessary? No. No more necessary than having a generator and gas, tools, or a bigger garden. Plus, keep cash around, at least $1,000 in twenties and smaller bills. The value of peace of mind? priceless. :-) Plus, it was satisfying to learn about radios, and while my skills are pretty basic compared to a commercial or military trained operator, I can at least communicate with others if need be.

regards

Paulo, I’ve got a bunch of communications stuff in a Faraday cage, against the day, but I’m going to look into ham radio. At least a good research project during lockdown.

Paulo:

10-4 on the comm suggestion, and thanks. Been considering it…you may have wobbled me over the line of decision-making.

:)

And to Unamused: That’s a tough list; I’ve been watching that come together for some time. This is what worries me 2nd-most about Mr. Trump – for all his protestations re: Deep State, he’s helped move the list along nicely.

MC01: the positive, affirmative confidence you display toward your fellow-persons is both well-advised and admirable. I am trying to follow your example.

Paulo – Serious question – HOW will you use your HAM equipment? I got a license a couple of years ago and worked hard at trying to figure out how it would help in an emergency. The local police and fire have no equipment or interest. I’m not sure how worldwide contact is helpful. There is a local HAM group, and I spent a bunch of time with them, but ended up thinking it’s a solution in search of a problem. I finally gave everything away…

Actually our family plan “B” was begun during the Cuban missile crisis – get out of town. But I don’t believe waiting is wise – get out now.

yep, ready here as much as you can be. Enough solar panels w/ battery back up to run my water pumps and refrigerators and freezers. Large garden area fenced with 21 large raised beds. Drip irrigation. Been getting ready for a long time.

The real honest truth is that something always breaks and every year I have to replace something. Also I don’t have animals so I have to get fertilizer from somewhere else. There is no way to be prepared for what might be coming. Seeds go bad. Many are hybred and have to be bought new each year.

The unfortunate reality is that we are all in this together and if the internal supply lines break down we are all in serious trouble.

Then there are things that really don’t help like a neighbor cutting down a very old bee tree a year ago. Now there are way fewer bees to pollinate my fruit trees. Another neighbor bought some bee hives but bee husbandry is an art/skill and so far I still haven’t seen many bees around. And you really can’t do it all yourself. Especially as you get older.

You can keep seeds for a long time if you save them properly. I have many seeds that are more than 10 years old that still germinate 50%. The most important thing is to keep them dry. Buy a bag of indicating silica gel desiccant, some small muslin bags (4″), some metalized mylar bags (large ones, I use empty splenda and stevia bags). Fill a small bag with the desiccant and put it in a ziplock bag with your seed packets, collect a number such filled ziplocks and put them in a metalized mylar bag along with another desiccant bag and seal it up. Keep the bags in the coolest room in the house or in the fridge or freezer. Inspect the bags every year and replace the desiccant bags if needed. You can reactivate the desiccant. You need the mylar bag as plastic bags are too permeable to moisture to use for long term storage, if you put one of your desiccant bags in one and leave it out you will the desiccant indicate moisture in just a couple months.

Good Luck

Thank you for that suggestion, have been pondering seed-saving recently.

This is very solid advice Charles. We started a farmstead in 99, and soon found out about and contacted Seed Savers Exchange to begin using only heritage and other non hybrid seeds.

We learned how easy it is to save all vegetable seeds each year, and still have many 5 years later, saved similar to your advice, though I think your method is better.

Thank you.

Wolf: Your first sentence, “… the financial media proclaimed that the Fed had succeed,” may have meant “had success.”

As a professional writer, I recommend the free version of “grammarly” which is an easy download. You don’t need the paid version.

“I may not be a professional writer, but I did stay in a Holiday Inn once”.

Quit being so smug. I for one appreciate the great service Wolf provides. Unlike math, language is just a bunch of rules made up by people in ivy towers looking down their noses at the rest of us. The gall. (I know-not a complete sentence). If you don’t like it, don’t read it. And when you need to change a lightbulb or fix a plumbing problem, don’t call me.

Ron in Ohio,

Thanks. But don’t let this stuff get to you. I got up at 5 a.m., and I worked all day, and I finished this article (#2 for the day) at midnight my time, and I posted it and passed out. I was so tired I couldn’t even see the letters on the screen anymore. I appreciate it when readers point out typos. Happens all the time. I appreciate it even more when they’re being funny about it.

I personally appreciate your writings typos or not. I could not keep up the pace or quality.

I hate the grammar police. Everybody knows it was a typo.

Please contribute more relevantly.

Sorry Wolf,

My comment was meant for you know who up above.

We often stay at “We R Inn” in Davao City and when we leave we R out.